Gold World News Flash |

- 5 Things The Media Isn't Telling You About The Olympics

- The Charade Continues: London Gold And Silver Markets Set For Even More Paper Trading

- 23 Health Benefits of Cinnamon

- GLOBAL COLLAPSE ALERT: Bank Of England Suffers Stunning Failure On Second Day Of QE: “Goodness Knows What Happens Next Week”

- THE COMING BREAKDOWN OF U.S. & GLOBAL MARKETS EXPLAINED… What Most Analysts Miss

- Gold, Silver, Stock and Bond Markets

- Everything is Fixed… Not!

- Watch This and Know We are in the End Times! 2016 2017

- Redneck Investin Part 1 - A look from the other side

- Some Olympic Athletes Are Chasing Huge Gold Medal Bonuses

- The DECLINE of American Empire

- No, This Won’t Cause a Gold Shock (Something Else I’ve Just Exposed Will)

- John Stossel - Cronies and Connections

- The Coming Financial Crisis Will Make 2008 A Walk In The Park : John Rubino

- FULL EVENT: Donald Trump Rally in Wilmington, NC 8/9/16

- Gold Daily and Silver Weekly Charts - Dollar Lower, Metals Up, Silver in the Lead - Power Coiling

- Hillary Like a Greek Tragedy

- JIM WILLIE WHAT WILL TRIGGER DOLLAR COLLAPSE NEW INTERVIEW 2016

- Ronan Manly: Charade continues as London metal markets get more paper trading

- END TIMES SIGNS August 9 2016. Signs In The Heavens And On Earth. Prophecy Fulfilled.

- THE ECONOMIC COLLAPSE ALREADY BEGUN? REVEALED BY HARRY DENT

- TF Metals Report: A new wrinkle in the paper gold con game

- London Metal Exchange to launch gold spot, futures contracts

- Peak Gold has Passed, But Patience Is Key For Striking It Rich

- 3 Top Advanced Junior Gold Stocks Breaking into New Highs Outperforming GDXJ

- The Money Bubble Will Collapse, Gold is Real Money - JAMES TURK

- Will the Dow go up 100% and Gold 5,000%?

- Smiths Group set to cash in on stronger dollar

- Gold Standard Ventures' Monster Hole

- Breaking News And Best Of The Web

- Gold Suffers Weakness on Strong U.S. Jobs Numbers, but UK Stimulus to Offer Respite

- Top Silver Mining CEO Makes a Remarkable Price Forecast

- Signs Are Silver Bull Market Is Consolidating

| 5 Things The Media Isn't Telling You About The Olympics Posted: 10 Aug 2016 01:00 AM PDT Submitted by Alice Salles via The AntiMedia.org, This year’s Olympics have a particularly romantic setting: Rio de Janeiro. In the 1950s and 60s, Rio’s most prominent artists were international stars, which made the popularity of “Bossa Nova” the perfect opportunity for Brazilians to share their culture and approach to life with the world. But throughout the following decades, Brazil changed considerably in the eyes of foreigners. It became the land of corruption, misery, police brutality, and a savage drug war, which was partially responsible for over 60,000 homicide cases in 2014, alone. But as athletes from all corners of the globe compete in the Olympic spirit, news outlets forget about the country’s problems. Here’s a rundown of the five most concerning issues facing tourists, athletes, and Brazilians themselves during this year’s leading international sporting event. 1. In Brazil, political protesters are granted very little freedom of speech (that’s why they are threatening to extinguish the Olympic torch)On May 10, 2016, disgraced then-president Dilma Rousseff signed a bill into law that prohibits individuals from holding political protests in publicly-owned stadiums — where all Olympic games are currently being held. While some protesters claim this policy was designed by the interim president, former Vice President Michel Temer, the law is actually a product of Dilma’s time in office. Citing Article 28 from Law 13.284, police officers are now asking protesters to either leave the stadiums or destroy any material they are using to protest politicians while watching the games. Recently, Al Jazeera reported on a group of protesters threatening to blow out the Olympic torch. They are protesting the cost of the games, among many other issues. “In addition to the Games’ $12bn price tag,” Al Jazeera reported, “anti-torch protesters are calling for more accountability from elected officials after a massive corruption scandal focused on the state oil company ensnared dozens of high-level politicians.” A man whose unsuccessfully attempted to extinguish the torch claimed he did so because he is “against the current president, and the ‘coup.’” But according to a group of torch-blowing protesters who used Facebook to organize their events, the idea behind the “prank” is not only focused on Temer. The protesters intend to “show Brazil and the world that we are unhappy with the current political and economic situation in the country, where WE do not want these OLYMPICS. [sic]” 2. Rio is broke and so is BrazilThe state of Rio de Janeiro is expected to have a deficit of BR$19 billion by the end of the year, a projection that prompted the Olympics’ host government to issue an emergency state “decree” in June — nearly two months before the event — publicizing “the abnormal situation” in an official manner. In April of this year, the state had already reported its public deficit equaled 201% of its annual revenue — a much higher rate than what is legally allowed, as reported by Globo, one of Brazil’s most popular news organizations. Despite the financial disaster, the games weren’t canceled. According to Zurich University senior research fellow, Christopher Gaffney, “Rio will be in debt for the next 10 years following the 2014 World Cup and this month’s Olympics.” But Rio’s problem is Brazil’s problem. Moddy’s Investors Service recently cut the country’s investment-grade rating to “junk,” And with an over $706 billion national debt, Moddy’s reports, “progress in fiscal consolidation will be slow, and economic growth anemic, for the next two to three years.” According to Mises Institute’s Leandro Roque, the current negative economic outlook in the country — and more specifically in Rio — has a lot to do with the expansion of easy credit policies. This has given the federal government the power to “print money” out of thin air and make the cost of consumer goods go up, hurting the poor and the middle class. But that’s not all that has hurt members of lower income brackets in the country. During the preparations for the Olympics, hundreds of residents were forcibly removed from their homes simply because they were located near a stadium built for the games. 3. The military police are responsible for Olympics security, but the targets are civilians (and athletes!)In Brazil, there are four main law enforcement organizations. The military police, civil police, federal police, and municipal guard. What many foreigners do not realize is that the military police, not civil, are responsible for “keeping the peace” in the streets. They have the power to patrol cities in search of drug-related criminals and others. They also have the power to pull over drivers for traffic infractions. In order to increase their reach, the Ministry of Justice and Citizenry allowed the National Force of Public Safety (an organization created by the joint cooperation of various Brazilian Public Safety forces; Força Nacional de Segurança Pública or FNSP in Portuguese) to urge inactive military police officers to join the forces as volunteers in light of the Olympics. The request was made in early July. Although no estimate was released, segments of the military police force currently patrolling the streets of Rio are likely working as volunteers. In an attempt to combat soaring crime in the city, the government has also assigned as many as 85,000 members of the armed forces to patrol Rio, including 21,845 members of the Brazilian Navy, Marine, and Air Forces. But patrolling the streets for thieves and potential drug traffickers is not the only thing military police officers are doing in Rio. A jiu-jitsu fighter from New Zealand, Jayson Lee, reached out to the civil police to press charges against military police officers who allegedly kidnapped him before the games began. According to the athlete, he was compelled to give officers BR$2,000 so they would let him go. The man was originally pulled over and told he was not allowed to drive in the city without his passport, even after he presented his car’s documents to the officers. He was then told he had to go to the police department, where he would have to pay a fee. But as the exchange continued, officers told the athlete he could forego the trip by giving them the money directly. As the police escorted the athlete, he withdrew BR$2,000 and handed it to the policemen who had pulled him over. After he complained, the military police opened an investigation, putting two officers allegedly involved in the exchange behind bars. They could be expelled from the force if they are found guilty of extortion. In São Paulo, the military police were involved in an altercation with anti-Olympics protesters a day before the games officially started. About 200 people were reportedly pepper-sprayed and beat up during a demonstration on one of the busiest main streets in downtown São Paulo, Avenida Paulista. The protest was interrupted just 15 minutes after it began, with police officers requesting to see people’s backpacks and handbags while collecting identification numbers. Moments later, the police blocked the street, cornering protesters under the São Paulo Museum of Art. As protesters attempted to leave, officers allegedly attacked them with batons and pepper spray. 4. Rio loves putting lipstick on pigs (seriously, the government claims to be environmentally-conscious — but it’s not)According to the Associated Press, “the waterways of Rio de Janeiro are as filthy as ever, contaminated with raw human sewage teeming with dangerous viruses and bacteria.” The report is the result of a 16-month study commissioned by the news outlet. Nevertheless, during the opening ceremony, the games’ organizers displayed a video narrated by actress Judi Dench that warned about the “problem of global warming and climate change … showing how rapidly the earth’s temperature has spiked over time, how drastically the Antarctic ice sheet has wilted in recent decades and how steadily seas are rising around the globe.” There was no mention of how rapidly Brazil’s environment has deteriorated, especially since the mismanagement of local dams led to one of the worst toxic mud spills in recent history. The incident was due to a dam collapse in an iron ore mine partially owned by Vale (formerly Vale do Rio Doce) — which was founded by the federal government — and Samarco, a company owned by Vale and the English-Australian company BHP Billiton. The Dilma administration took back control of 52.5% of Vale in 2015. So why wasn’t that discussed during the event? 5. Brazil’s plan to “clean” the streets of Rio ahead of the Olympics was responsible for the unlawful arrests of thousands of childrenAccording to official data, police in Rio arrested 5,538 minors between 2015 and the first two months of 2016. While officials remain mum about the records of these arrests, it’s important to note Brazil has the second highest rate of child homicide in the worldl it trails only Nigeria. The United Nations recently claimed street children are being arrested “under unfounded suspicions and being arbitrarily placed in younger offenders institutions.” According to UNICEF, the U.N.’s children’s agency, “the number of children killed by violence in Brazil has doubled in the last two decades. As of 2013, the number of youth homicides in the country hit 10,500 per year.” In Rio in particular, 16 percent of the city’s homicides are committed by police, Amnesty International reports — a concerning fact considering that each year, 10,500 children are killed in Brazil. |

| The Charade Continues: London Gold And Silver Markets Set For Even More Paper Trading Posted: 09 Aug 2016 11:58 PM PDT Submitted by Ronan Manly of Bullionstar Today the London Metal Exchange (LME) and the World Gold Council (WGC) jointly announced (here and here) the launch next year of standardised gold and silver spot and futures contracts which will trade on the LME's electronic platform LMESelect, will clear on the LME central clearing platform LME Clear, and that will be settled 'loco London'. Together these new products will be known as 'LMEprecious' and will launch in the first half of 2017. However, although these contracts are described by the LME as delivery type 'Physical', settlement of trades on these contracts merely consists of unallocated gold or silver being transferred between LME Clear (LMEC) clearing accounts held at London Precious Metals Clearing Limited (LPMCL) member banks (i.e. paper trading via LPMCL's AURUM clearing system).

For example, the contract specs for the LME's planned spot gold trading state that the LME's proposed settlement procedure is one of:

The range of LME contracts for both gold and silver will consist of a trade date + 1 contract (T+1), aptly named TOM, as well as daily futures from T + 2 (equivalent to Spot settlement) out to and including all trade dates to T + 25. Beyond the daily futures, the suite of contracts also includes approximately 36 monthly futures contracts covering each month out to 2 calendar years, and then each March, June, September and December out to 60 calendar months. The LME / WGC press release also mentions plans for options and calendar spread products based on these futures. As well as trading electronically on LMESelect, these precious metals futures will also be tradeable via telephone market (inter-office market). Trading hours for the daily contract (TOM) will be 1am – 4pm London hours, while trading hours for all other contracts will be 1am – 8pm London hours, thereby also covering both Asian and US trading hours. Detailed contract specs for these gold and silver contracts are viewable on the LME website. The trading lot size for the LME gold contracts will be 100 ozs, which is significantly smaller than the conventional lot size of 5000 -10,000 ozs for gold trading in the London OTC market (and conventional OTC minimum of 1000 ozs of gold). The planned lot size for the LME's silver contracts is 5000 ozs, again below the conventional lot size of 100,000 – 200,000 ozs for silver trading in the London OTC market (and conventional OTC minimum of 50,000 ozs of silver). These LME contracts are being pitched as a real alternative to the incumbent over the counter system of gold and silver trading in London which is overseen by the London Bullion Market Association, an association whose most powerful members are the clearing and vaulting banks in London, namely HSBC, JP Morgan, Scotia, and to a lessor extent UBS and Barclays, but increasing ICBC Standard bank as well. But given that the LME's clearing will sit on top of the LPMCL clearing system and use unallocated transfers, the chance of any real change to the incumbent London gold and silver market is non-existent. Nor will the trading of these LME products give any visibility into the amount of physical gold and silver that is held within the London Market, nor the coverage ratio between 'unallocated account' positions and real underlying physical metals. Five Supporting BanksThis new LME / WGC initiative is being supported by 5 other investment banks and a trading entity called OSTC. These bank backers comprise US banks Goldman Sachs and Morgan Stanley, French banks Natixis and Société Générale, and Chinese controlled bank ICBC Standard Bank. According to a Reuters report about the launch, the World Gold Council had approached 30 firms about backing the launch, so with only 5 banks on board that's a 16.6% take-up ratio of parties that were approached, and 83.4% who were not interested. Earlier this year in January, Bloomberg said in a report said that the five interested banks were "ICBC Standard Bank Plc, Citigroup Inc., Morgan Stanley, Goldman Sachs Group Inc. and Societe Generale SA", so somewhere along the line Citigroup looks to have taken itself off the list of interested parties, while Natixis came on board. The World Gold Council's discussions about a proposed gold exchange and its discussions with '5 banks' appear to have begun as early as the 4th quarter of 2014 and were flagged up by the Financial Times on 02 April 2015, when the FT stated that:

Notably, this was around the time that LME found out it had not secured the contracts to run either the LBMA Gold Price or LBMA Silver Price auctions. Note, that all 5 of the LME supporting banks, i.e. Goldman, ICBC Standard, Morgan Stanley, SocGen and Natixis, are members of the London Bullion Market Association (LBMA), with Goldman, Morgan Stanley, ICBC Standard and SocGen being LBMA market members, and Natixis being a full member of the LBMA. Goldman, Morgan Stanley, ICBC Standard and SocGen are also direct participants in the LBMA Gold Price auction operated by ICE Benchmark Administration. None of these 5 banks are direct participants in the LBMA Silver Price auction. Notably, none of these banks except for ICBC Standard is a member of the precious metals clearing group LPMCL. ICBC Standard Bank also recently acquired a precious metals vault in London from Barclays and also joined the LBMA's Physical Committee (see BullionStar recent blog 'Spotlight on LPMCL: London precious MEtals Clearing Limited' for details). Therefore, ICBC Standard seems to have a foot in both camps. Unallocated Balances, Unsecured CreditorsGiven the long build-up to this LME / World Gold Council announcement, and the fact that these LME spot and futures products were supposed to be a genuine alternative to the LBMA bank controlled OTC trading system, the continued use of unallocated settlement and the use of LPMCL accounts by these planned LME contracts underscores that the LME contract do not represent any real change in the London Gold and Silver Markets. As a reminder, the resulting positions following transfers of unallocated gold and silver through the LME Clear accounts of LPMCL members essentially means the following, in the words of none other than the LBMA:

Additional LBMA definitions of unallocated transactions are as follows:

LME bows to LPMCLHowever, it should come as no surprise that these LME spot and futures contracts haven't taken a new departure away from the entrenched monopoly of the London gold and silver clearing and vaulting systems, for the LME specifically stated in quite a recent submission to the LBMA that it will never rock the boat on LPMCL's AURUM platform. When the LME presented to the LBMA in October 2014 in a pitch to win the contract for the LBMA Gold Price auction (which it didn't secure), the pitch said that a centrally cleared solution "would only be introduced with market support and respecting LPMCL settlement". [See right-hand box in below slide]: In the same pitch, the LME also stated that:

[See bottom line in below slide]: Interestingly, following the announcement from the LME and the World Gold Council, the LBMA provided a very short statement that was quoted in the Financial Times, that said:

While that may be true, what the LBMA statement didn't concede is that 5 of its member banks, 4 of which are LBMA market makers, do have a direct involvement in the LME / World Gold Council project. Nor did the LBMA statement acknowledge that settlement of the planned LME gold and silver contracts will use the LPMCL infrastructure, nor that the LPMCL is now in specific scope of the LBMA's remit. Recall that in October 2015, the LBMA announced that:

With the LME contracts planning to use LPMCL, this 'new dawn' view of the LME / World Gold Council initiative is in my view mis-guided. Even COMEX has more TransparencyAnyone familiar with the rudimentary vaulting and delivery procedures for gold and silver deliverable under the COMEX 100 oz gold and 5000 oz silver futures contracts will know that at least that system generates vault facility reports that specify how much eligible gold or silver is being stored in each of the designated New York vaults, the locations of the vaults, and also how much of the eligible gold or silver in storage has warehouse warrants against it (registered positions). The COMEX 'system' also generates data on gold and silver deliveries against contracts traded. However, nothing in the above planned LME contract specs published so far gives any confidence that anyone will be the wiser as to how much gold or silver is in the London vaults backing up the trading of these spot and future contracts, how much gold or silver has been converted post-settlement to allocated positions in the vaults, nor how much gold or silver has been delivered as a consequence of trading in these spot and futures contract, nor importantly, where the actual participating vaults are. This is because the LMPCL system is totally opaque and there is absolutely zero trade reporting by the LBMA or its member banks as to the volumes of gold and silver trading in the London market, and the volumes of physical metals held versus the volumes of 'metal' represented by unallocated account positions. Furthermore, the LBMA's stated goal of introducing trade reporting looks as dead as a dodo, or at least as frozen as as a dodo on ice. LBMA stall on Trade Reporting, LPMCL clear as MudOn 9 October 2015, the LBMA announced that it had launched a Request for Information (RFI) asking financial and technology providers to submit help with formulating solutions to deficiencies which regulators thought the London bullion market such as the need for transparency, and issues such as liquidity that had supposedly been recommended as strategic objectives by consultant EY in its report to the LBMA, a report that incidentally has never been made publicly available. On 25 November 2015, the LBMA then announced that it had received 17 submissions to its RFI from 20 entities spanning "exchange groups, technology firms, brokers and data vendors". On 4 February 2016, the LBMA then issued a statement saying that it was launching a Request for Proposals (rRfP) and inviting 5 of these service providers (a short-list) to submit technical solutions that would address requirements such as an LBMA data warehouse and that would support the introduction of services such as trade reporting in the London bullion market. The RfP statement said that the winning service provider would be chosen in Q2 2016, with a planned implementation in H2 2016. However, no progress was announced by the LBMA about the above RfP during Q2 2016, nor since then. The only coverage of this lack of newsflow came from the Bullion Desk in a 27 May article titled "Frustration Grows over London Gold Market Reform" in which it stated that the 5 solution providers on the short-list were "the LME, CME Group, the Intercontinental Exchange (ICE), Autilla/Cinnobar and Markit/ABS", and that:

A quote within the Bullion Desk article seems to sum up the sentiment about the LBMA's lack of progress in its project:

What could the hold up be? Surely 17 submissions from 20 entities that were whittled down to a short-list of 5 very sophisticated groups should have given the LBMA plenty of choice for nominating a winning entry. Whatever else this lack of progress suggests, it demonstrates that increased transparency in London gold and silver market trading data is not going to happen anytime soon, if ever. Furthermore, the opacity of the London clearing statistics that are generated out of the LPMCL clearing system need no introduction to most, but can be read about here. ConclusionAccording to the LBMA, 'Loco London' "refers to gold and silver bullion that is physically held in London", however, given the secrecy which surrounding trading data in the London gold and silver markets, and the lack of publication by any bank about the proportion of unallocated client balances in gold or silver that it maintains versus the physical gold or silver holdings that it maintains, this 'loco London' term appears to have been abused beyond any reasonable definition, and now predominantly refers to debit and credit entries in the virtual accounting systems of London based bullion banks. Nor, in my opinion, will the LME contracts change any of this. One would therefore be forgiven in thinking that the real underlying inventories of gold and silver in the London market and their associated inverted pyramid unallocated account positions are too 'precious' to divulge to the market. The Bank of England is undoubtedly licking its chops to the continued opacity of the market. |

| 23 Health Benefits of Cinnamon Posted: 09 Aug 2016 11:00 PM PDT by Cindy WIlson, Nutri Inspector:

Among the spices that that give a truly distinctive flavor and aroma cinnamon (Cinnamomum Verum) occupies a unique place. Cinnamon is an excellent source of manganese, iron, calcium, copper and zinc, and experts recommend that you add this spice to coffee, fruit juices, cereals, pastries. I've spent some time to write my research about Cinnamon bellow. The article is rather long, so I advice you to check the table of contents first, and pick out a topic that interests you most:

Where Does Cinnamon Originate From? Sanskrits written 2800 years BC also show that cinnamon is unique. It is certainly one of the oldest spices for which even the ancient Chinese, Egyptians and Phoenicians knew. From the Europeans, it was first discovered by the Portuguese when they occupied Ceylon. The natives of the island took it as a cure for fatigue and for boosting the energy and even smoked it and used is as scented oils. The price of the cinnamon was incredibly high, it was expensive as gold, and the Dutch and the Portuguese led the Hundred Years War to get it. At the end of the 19th-century, cinnamon has ceased to be the England’s exclusive, and it has spread around the world. Where Do Cinnamon Trees Grow?As for the value of the cinnamon, the one that is grown in Madagascar, Ceylon and Seychelles is the most valued. Cinnamon grows wherever there are tropical conditions, so they have it in both India and Indonesia. |

| Posted: 09 Aug 2016 10:24 PM PDT from Zero Hedge:

On the first day of the Bank of England’s resumption of Gilt QE after the central bank had put its monetization of bonds on hiatus in 2012, bondholders were perfectly happy to offload to Mark Carney bonds that matured in 3 to 7 years. In fact, in the first “POMO” in four years, there were 3.63 offers for every bid of the £1.17 billion in bonds the BOE wanted to buy. However, earlier today, when the BOE tried to purchase another £1.17 billion in bonds, this time with a maturity monger than 15 years, something stunning happened: it suffered an unexpected failure which has rarely if ever happened in central bank history: only £1.118 billion worth of sellers showed up, meaning that the BOE’s second open market operation was uncovered by a ratio of 0.96. Simply stated, the Bank of England encountered an offerless market.

What makes this particular failure especially notable – and troubling – is that while technically uncovered sales of government securities happen frequently, and Germany is quite prominent in that regard as numerous Bund auctions have failed to find enough demand in the open market in recent years forcing the “retention” of the offered surplus, when it comes to a central bank’s buying of securities, there should be, at least in practice, full coverage of the operation as the central bank is willing and able to pay any price to sellers to satisfy its quota. For example, in today’s operation, the scarcity led to the BOE accepting all submissions, even as some investors offered prices above the prevailing market. The highest accepted price for the 4 percent bond due in 2060, for example, was 194.00, compared with a weighted average of 192.152, which means that the happy seller obtained a yield well in excess of that implied by the market. And yet, despite having a completely price indiscriminate buyer, some £52 million worth of bond sellers simply refused to sell to the BOE at any price! The QE failure quickly raised alarm signals among the bond buying community. In a Bloomberg TV interview, Luke Hickmore, an Edinburgh-based senior investment manager at Aberdeen Asset Management said that "lots of people are bidding us for bonds — Mark Carney is now bidding me for bonds and he still can't have them. The problem is he was trying to buy 15-year plus bonds today in the gilt market. That's a really difficult area." Needless to say, immediately after the news that not even the BOE can buy all the bonds it needs to buy at any price, yields on 10 and 30-year gilts quickly dropped to new record lows. “Yesterday we saw a 3.63 cover in the short APF so this is a sharp difference that has really caught the market off guard," said Daniela Russell of Legal & General Group in London, cited by Bloomberg. We were surprised they didn’t slide even lower. After all, if even the central bank is met with an offerless market, there is simply no price that is high enough, as ludicrous as that may sound, for longer-maturity gilts because the last marginal seller can demand any price from the BOE and they will get it. As Bloomberg notes, the BOE's failure to reach its target on Tuesday is an early warning of the challenges it may face in expanding its QE plan. A big part of the problem for the central bank is that it already scooped up about a third of the U.K. government bond market as part of a program that started in March 2009. And, with yields already at all time lows, it has just run into the same problem that we warned back in 2014 will haunt the BOJ: a lack of willing sellers. Ironically, even as the BOJ has stumbled from one monetary policy embarrassment to another, it never had a failed POMO. It was up to the Bank of England to demonstrate what a bond shortage really means. But why the lack of sellers? Well, since the BOE paused purchases in 2012, global bond yields have tumbled, meaning investors may be less willing to part with longer-term bonds that tend to offer higher yields than their shorter-dated equivalents. Long-dated U.K. bonds are in particular demand from pension companies that hold the securities to match their liabilities. |

| THE COMING BREAKDOWN OF U.S. & GLOBAL MARKETS EXPLAINED… What Most Analysts Miss Posted: 09 Aug 2016 09:33 PM PDT by Steve St. Angelo, SRS Rocco:

The reason for this upcoming systemic collapse of the U.S. and Global markets is quite simple when you understand the information and are able to CONNECT THE DOTS. While it has taken me years of research to be able to finally put it all together, new information really put it all into perspective.

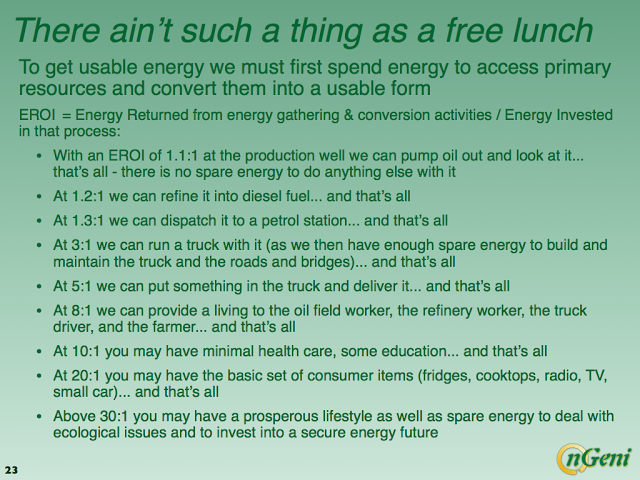

Yes… a HUGE LIGHT BULB went off, but unfortunately the realization is much worse than anything I imagined before. I briefly discussed this in my last article, The Coming Global Silver Production Collapse & Skyrocketing Silver Value. The information discussed in this article makes it abundantly clear that the precious metals will be the GO TO ASSETS in the future. The standard financial practice of investing most of one's assets in stocks, bonds and real estate will no longer be true. What little investment strategies are left in the future will turn to PROTECTING WEALTH, rather than building wealth. The days of acquiring wealth are coming to and end… and fast. So, now I will try to lay out all the details in a way that will make this easy to understand. However, I have a word of warning. Those who are able to connect the dots… it's like taking the RED PILL, you can't unlearn what you now realize. The Collapsing EROI Is Destroying Everything In Its Path & QuicklyAmericans used to enjoy a much better standard of living when it only took one person in the family to provide the income. This was during the late 1940's, 1950's and early 1960's. However, the situation started to change in the 1970's. Not only do both spouses have to earn a living to make it today, health care and college education are becoming unaffordable. I remember back in the 1980's that most health plans had full coverage with little or no premium. Basically, your health care was free, and all you had to do was pay a small deductible when you went to the doctor. Now, more and more Americans can only afford catastrophic coverage, for an expensive monthly premium with a high deductible. Many believe this is all due to the corrupt insurance, healthcare and pharmaceutical companies. While they are partly the blame, the majority of the reason is due to the rapidly falling EROI. Furthermore, the falling EROI is making higher degrees of education less affordable to the public. Before I get into the details here, let me explain the EROI. The EROI stands for Energy Returned On Invested. Basically, its how much profitable energy you get in return from what amount of energy was invested (burned). The EROI has been a guiding principle for humans going back thousands of years when we were hunter gatherers. Here are some simple EROI for human food production: Hunter Gatherer = 10/1 Simple Human Farming = 5/1 Human & Animal Farming = 1-2/1 High Tech Modern Food System = 1/10 Data from Thomas Lough/ Energy Efficiencies (EROI) of food procurement strategies/ (page 4) A typical hunter gatherer only burned 1 calorie of energy to acquire 10 calories of food. You will notice that a hunter gatherer was 100 times more efficient in food production (gathering) thanour modern high-tech food system that devours 10 calories of energy to provide 1 calorie of food on the dinner plate. Our modern food system can waste so much energy growing, harvesting, processing and delivering food because of the high EROI of oil we have enjoyed in the past. Unfortunately, the rapidly falling EROI of U.S. and Global oil will cause serious trouble for food production going forward. Why the Falling EROI is Causing Havoc To Our Modern Way Of LifeIn a recent three-part article by Louis Arnoux, Some Reflections On The Twilight Of The Oil Age, the following chart was posted about the importance of a high EROI for our modern society:

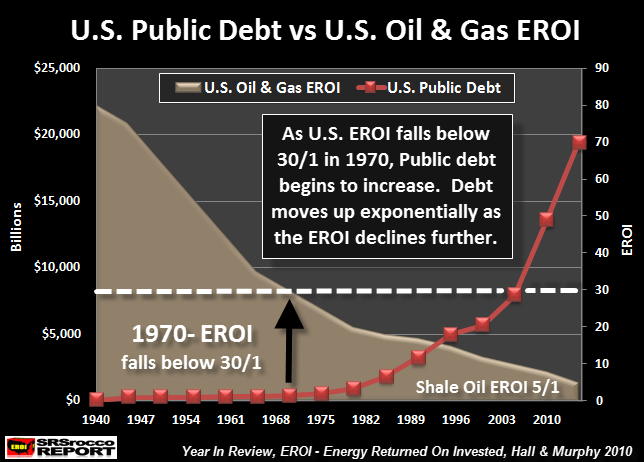

I am going to simply the chart above. EROI 3/1 = Transportation System: Roads, Bridges & Trucks only. EROI 10/1 = Transportation System, Agriculture, minimal Health Care & Education. EROI 20/1 = Transportation System, Agriculture, Basic Living, Health Care & Education along with basic consumer goods EROI 30/1 = Transportation System, Agriculture, Prosperous Living, Heath Care & Education with advanced consumer goods. The important thing to understand from these EROI guidelines, is that a minimum value for a modern society is 20/1. For citizens of an advanced society to enjoy a prosperous living, the EROI of energy needs to be closer to the 30/1 ratio. Well, if we look at the chart below, the U.S. oil and gas industry EROI fell below 30/1 46 years ago (after 1970):

You will notice two important trends in the chart above. When the U.S. EROI was higher than 30/1 prior to 1970, U.S. public debt did not increase all the much. However, this changed after 1970 as the EROI continued to decline, public debt increased in an exponential fashion. |

| Gold, Silver, Stock and Bond Markets Posted: 09 Aug 2016 09:30 PM PDT from GregoryMannarino: |

| Posted: 09 Aug 2016 09:05 PM PDT [Ed. Note: We like Andy but we think he’s vastly under informed if he so firmly believes the “Bilderbergs” and “Rothschild ” Khazarian mafia has NOT actively been “planning our fates” for decades, as he claims in paragraph three. We kindly advise Andy to read Carroll Quigley’s Tragedy and Hope as soon as possible. ~SGT] by Andy Hoffman, Miles Franklin:

To think, just a year ago people were flocking into silver so aggressively, premiums surged and supply dried up, despite no material political or financial crisis. Apparently, the principal reason was fear of the "Shemitah" – which is a great commentary on human nature, in that people are more likely to fear the mystical, than what's actually occurring in front of their eyes.

So far, not a single non-financial theory has panned out – from solar flare occurrences; to biblical prophecies; and the most ridiculous of all – "web bots" – which was so out of leftfield, even I considered it for a second, until it was proven to be a sham like the others. To that end, there are no "good" or "bad" guys planning our fates, nor "guaranteed" correlations between gold and the Yen/dollar exchange rate; or "elites" controlling the world, like the Bildeberg's, Rothschild's, or the ghost of JP Morgan. Sorry if I'm offending anyone, but I call it like I see it – and when it comes to financial market movements, the same factors are in play today as under Wall Street's buttonwood tree in 1792. Not to mention, when Queen Elizabeth I charted the East India Company in 1600, or when cavemen traded beaver pelts for food. Which are, the eternal battles between free market forces and manipulation. Yes, bankers, politicians, and corporate titans have been the focal points of manipulation for time immemorial – and always will be, given their access to the corruptive forces of money and power. However, they rarely, if ever, have plans "grander" than maintaining a status quo that maintains their wealth and power – which at times, requires collusion with others; but usually, doesn't. Once and for all, anyone that tells you they "know" something will happen – let alone, based on conspiratorial, mystical, biblical, or astrological "proof" – should be considered with a boulder-sized grain of salt. As a financial "scientist," I seek actual proof for my conclusions, which none of these people provide, no matter how confident they sound. More importantly, not a single one has been "right," as far as I can see. And definitely not due to the actual unfolding of "predicted" mystical, biblical, astrological, or "web bot" events. Or, for that matter, "proprietary analysis" of any kind, be it fundamental, technical, cyclical, demographic, or otherwise. And by the way, those that claim to be "right," typically hedged their forecasts so they can always claim victory – even if such forecasts were ambiguous, evergreen, or uninvestable. Or better yet, they ignore their failures completely, which typically outnumber their successes by a large margin. Frankly, if someone were so good at unconventional market forecasting, they'd be as rich as Biff in Back to the Future II, who had a sports almanac from the future. Why am I so irritable this morning? Because TPTB have, for the time being, quelled well-justified fears with the most maniacal market manipulations in history. And it's not like they haven't told you what they're doing, even though much of it – like the PPT's blatant, unrelenting monetization of U.S. stocks – is done covertly. And the craziest part is that so much of the load is carried by the U.S., in knowing it can get away with – for the time being – hyperinflating its "reserve currency" more rapidly than any other country. Not to mention, its global domination of high frequency trading, off balance sheet financial engineering, and economic data manipulation. To the contrary, as I discussed this weekend, most overseas stocks are declining. Heck, even here in the States, most stocks are down despite the PPT-supported "Dow Jones Propaganda Average" sitting at an all-time (nominal) high, amidst collapsing GDP and corporate earnings; and record-high P/E, P/CF, and EV/EBITDA valuations. The CRB commodity index is not far from its 2009 spike bottom low; the average currency is at, near, or in many cases well below its previous all-time low; whilst political revolutions are exploding, and Precious Metals have outperformed all asset classes – maniacal Cartel suppression notwithstanding. Other than, that is, sovereign Treasury bonds, care of unprecedented QE and NIRP policies that have some of the world's worst credits trading at or below zero yields. I mean, geez, Spain has not had an operating government for a year; witnessed its wealthiest province, encompassing 25% of its economy, vote to secede last week; and has one of the ugliest financial situations in Europe. And yet, care of ECB QE, Spanish 10-year bond yields plunged below 1% yesterday, for the first time in the nation's 500-year history! For that matter, we're told the BrExit contagion has "passed" because financial market order has been restored. Well, yeah, if you don't consider the European banking stocks at the heart of the issue – like Deutsche Bank, whose bounce to $13.50/share from last week's all-time low of $12.50, remains 91% below its 2007 high. Not to mention, it still has $70+ trillion of toxic derivative exposure; is still hemorrhaging money; and is still on the verge of being downgraded to junk status, amidst a rapidly deteriorating environment of plunging commodities, currencies, and geopolitical stability. In the UK – you know, where the BrExit actually occurred, the Bank of England lowered interest rates and increased QE last week, amidst a dramatic downgrading of its economic outlook. Which of course, will not be a UK-only situation, but a global one – particularly in Europe, where France's "economic emergency" was just extended by six months, setting the stage for the anti-Euro National Front party to take power next year; Italy's anti-Euro "Five Star Movement" will likely take power after Matteo Renzi's "Parliamentary reform" referendum fails in October – or sooner if its banking system fails; Spain is dealing wit the aforementioned, horrific political and economic issues; Portugal's banks, too, are on the brink of collapse; Greece needs another bailout; and Turkey has become the most dangerously volatile nation on the continent, to name but a few of the issues that have decidedly not been "fixed." In Japan, the BOJ has pledged to essentially buy the entire stock market, atop the nearly 100% ownership it has of its "helicopter-like" bond market. China's economic collapse is taking on epic proportions, as it prepares for the massive, inevitable Yuan devaluation that will hit the global economy like a Cat-5 hurricane. Emerging market currencies are being destroyed by plunging commodity prices and accelerating capital flight; while here in the States, amidst the three worst quarters of GDP "growth" since the 2008-09 crisis – "double seasonal adjustments" and all – we are on the cusp of a polarizing, nation-destroying election campaign. On one side, we have 68-year old Hillary Clinton – visibly having seizures on stage – whose treasonous handling of her personal emails, and the Clinton Foundation's "business," makes her one of the most corrupt politicians in U.S. history. And on the other, 70-year old Donald Trump, who yesterday proposed a "supply-side" economic plan estimated to add $10-$12 trillion to the national debt. In other words, not a shred of "bullish" economic, political, or geopolitical news to speak of, on a worldwide basis. This, amidst the final, catastrophic stage of history's largest, most destructive fiat Ponzi scheme – characterized by exploding debt; and collapsing economic activity, commodity prices, and currencies. And no, the Dow is not higher (nor gold lower) due to, LOL, the "falling yen." As, per below, the Yen, following the BOJ's historic equity monetization announcement last week, is essentially at a 52-week high.

So for those of you – and I seriously doubt there are many – who actually believe "everything's fixed" because the PPT, Fed, Exchange Stabilization Fund, gold Cartel, Bureau of Labor Statistics, and a host of other manipulative agencies, overt and covert, have temporarily calmed markets in August's "dog days," I advise you to "snap out of it," and quickly. Whether the world escapes August intact, before the next "BrExit event" arrives to cause mass economic, financial, geopolitical, social, and monetary chaos is up for debate. However, the odds of something really bad arriving shortly thereafter have never been higher – as no matter where one looks, the "rubber" is hitting the "road." Which is why now, more than ever, the urgency to PROTECT YOURSELF while you still can, in as many ways as possible, has never been more urgent. |

| Watch This and Know We are in the End Times! 2016 2017 Posted: 09 Aug 2016 07:34 PM PDT FACTS .. ISRAEL DID 911!! ..and. the BANKER$ ARE THE PROBLEM... meanwhile the answer to my ..GENESIS 6.6.. problem remains unchanged.. GENESIS 6.7.. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Redneck Investin Part 1 - A look from the other side Posted: 09 Aug 2016 07:23 PM PDT While we often get caught up in discussions about QE and gold storage reports, it's easy to forget the realities in life that most humans face on planet Earth. Let's face it - you need spare money to invest. And not a few extra coins - you need real cash. We tried to explain Forex in Splitting Pennies for the common man, as they are the real losers in Forex. We get questions all the time from common folk who don't know about investing. Not all are poor. One great example is a older trust fund baby with $100 Million in a Bank of America Savings account "Ain't nobody touchin' MY MONEY!" he'd say. So, for all of you who are not qualfied investors - here's your practical poor-man's guide to investing. And it's short - only 1 page! This is also a good read for those who want a different outlook, to understand a little about how 'the other side' lives. Rule #1 - If you only have $1,000 to invest, the only reasonable investment is in CANNED FOOD which can be stored for up to 20 years. Because Food inflation, depending on how you calculate it, is about 10% - 20% per year or more. Certain food items can experience a permanent 'adjustment' of 50% - 100% for example due to weather factors or other circumstances. Where else can you get 20% per year returns nearly guaranteed? Plus, if the investment doesn't work out or you get desperate, you can eat it. It's a win-win. The best way to store this food is in large PVC pipes dug deep into the ground, the cans can be connected with duct tape and lowered into the pipes. When you need some money - just pull up your in ground savings account! It will be safe here from the IRS and from pesky hungry neighbors. No capital gains tax here. Redneck Arbitrage Strategies Coin Hoarding A penny is worth more than a penny. Not only in the United States - in Russia too! Take this strategy international! In the US, it's illegal to melt pennies. But that may not always be the case. And if you think this strategy is only for Rednecks, think again. Kyle Bass is a Nickel Hoarder (but, he had to buy them from the Fed due to the large quantity):

Postage Stamp Arbitrage This is illegal and information about this strategy is provided only to demonstrate how ridiculous the financial system is, in its current state and form. FOR EDUCATIONAL PURPOSES ONLY - DO NOT CONSIDER ACTUALLY DOING THIS!!! "Forever" stamps sell at current single stamp value of $.47; they were $.41 in April 2oo7; about a 12% increase. 12% you're thinking - it's nuthin. But it's guaranteed! And people always need stamps. Checkout this site for historical stamp data. Although, investors here should note the value actually DROPPED in last 2 years. But this has been a historical anomaly. Rule #2 - Keep a savings account in heavy metal stored in remote locations. Make regular 'deposits' to this account by spending an afternoon 'scrapping' - collecting unused metal garbage such as appliances, cars, metal frames, railroad tracks (abandoned, of course) and other metal objects. Don't go near electrical wires! They are live and will shock you! Free Money Claims Cash in, on a class - action. Anyone is eligible to get a check. Did you smoke Marlboro cigarettes in the late 90's while living in east Massachusetts? You may be eligible for a big reward. Did you purchase Tom's Toothpaste in the last few years? Sites such as Free Money Claims list class actions that are open for joining. Civil War Treasure Hunting If you've got a lot of time, and if you're poor or on the dole probably you do, and you like the outdoors, nuthin better than a good ol' treasure hunt! Spend some time doing some research, get the gear - and go hunt! You've got nothing to lose. In the worst case, you spend a day or two hiking through the woods and get some good excercise. It's out there:

If you think Redneck investin' is a dead end- you haven't been following CNBC. There's billions in this budding domestic 'emerging market.' The south will rise again!

If you want a quick Forex education, checkout Splitting Pennies - the pocket guide designed to instantly make you a Forex genius! If you want to get started looking at investing, checkout Fortress Capital Forex For financial institutions, checkout Liquid Claims Securities Settlement Serivces.  |

| Some Olympic Athletes Are Chasing Huge Gold Medal Bonuses Posted: 09 Aug 2016 06:55 PM PDT If you're a world-class British athlete, it may well be time to consider emigration to Singapore... judging by the colossal variance in gold medal bonuses on offer by various nations at The Olympics. The glory of winning a gold medal is a massive incentive for athletes competing in Rio but, as Statista's Niall McCarthy reports, the impressive bonuses on offer add another more lucrative dimension to the games. The size of the bonus on offer varies hugely by country. For example, British athletes do not receive bonus for winning a gold medal whereas American competitors get $25,000 for every gold they take home. Successful athletes from Singapore are awarded a prize of $1 million Singapore dollars, not a bad day at the office at all. Singapore has never won a gold medal... Though all eyes will be on Singapore's great medal hope Joseph Schooling who made an impressive start to Rio 2016 with a powerful swim in the 100m freestyle heats on Tuesday. Indonesia offers its successful Olympians around $380,000, according to Fox Sports Australia. The following infographic provides an overview of the biggest estimated cash rewards for gold medal winners in Rio (the values were converted from Australian to U.S. dollars). This chart shows the estimated bonus per gold medal at the Olympic Games in Rio...

So we have four years to move to Singapore, gain citizenship somehow, overdose on PEDs, become a world-class ______[BLANK]______, and ride off into the sunset with our $750,000! Doesn't seem so hard. |

| The DECLINE of American Empire Posted: 09 Aug 2016 05:45 PM PDT Whether you live in the USA or Europe, or elsewhere, now is the time to: - Get armed - Buy some gold and silver - Learn to farm - Network with family so you have a place in the country to go The next 15 years are going to be brutal. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| No, This Won’t Cause a Gold Shock (Something Else I’ve Just Exposed Will) Posted: 09 Aug 2016 03:24 PM PDT This post No, This Won’t Cause a Gold Shock (Something Else I’ve Just Exposed Will) appeared first on Daily Reckoning. The market has the technical setup for the greatest gold shock in history. When it rocks markets, gold will soar — ultimately to $10,000 if my full thesis plays out. But most gold investors won't be happy when it does. In fact, most gold investors will face big losses when gold reaches that price. And most of the people who want to get hold of the physical metal won't be able to. I was recently in Switzerland, where I met with my secret gold contact. I call him "Goldfinger" to protect his identity. He's one of the most plugged-in men in the gold industry. He meets with the heads of the world’s largest refineries… some of the highest-level bankers… finance ministers… gold dealers… and central bankers. He also controls tens of millions of dollars in physical gold. "Goldfinger" knows why this gold shock is coming better than anyone else because of his first-hand knowledge of the gold market. He sees it playing out in front of his eyes. What will trigger this gold shock? First, let me tell you what it won't be… Most people believe the gold shock could start if a large institution with a paper claim for a lot of physical gold, demanded delivery of that gold. The story goes: There's not enough physical gold to back up all of the paper gold. So therefore, if a large player demands enough physical gold, that order won't be filled. And a gold panic would ensue. But the gold shock that's coming will almost certainly not come from any of the large gold market participants. This surprises many people when I tell them that. But consider a hedge fund that's long gold futures. Why would that hedge fund start a buying panic in the physical gold market by taking delivery of physical metal? And if a large hedge funds is thinking of taking a large enough delivery of physical gold to cause a panic, they’ll probably hear from their lawyers. And those lawyers are going to advise against it because it would put the hedge fund in the crosshairs of the Justice Department or a Commodities Future Trading Commission (CFTC) investigation. Smaller market participants can ask for delivery of physical metal if they own gold futures without causing a problem. But if too many request delivery, the powers that be can change the rules very quickly. They could work to make it illegal. The U.S. government can decide they're not a normal gold trader, but a manipulator. Manipulation is illegal. The feds can paint them as a mini-version of the Hunt brothers, who tried to corner the silver market in 1980. That may sound far-fetched because there have been tons of manipulation on the short side of gold. If manipulation is illegal, why doesn't the Justice Department simply go after the gold shorts? The likely answer: Because the biggest gold short is China, and they're beyond our jurisdiction. Nobody thinks the FBI is going to investigate Chinese gold manipulation. China is the second largest economy in the world and a sovereign nation. (And maybe the Fed doesn't mind if the price of gold has a lid on it anyway). So we won't see anti-manipulation enforcement against the gold shorts. Or take another example of a large player in the gold market. A large "local" broker on the floor at major futures exchanges or commodity exchanges makes money every time a gold contract expires. They sell the current month's gold contract, while buying the next month's gold contract. That's called "contango" — which is just a fancy way of saying that the price of gold delivery in the future is higher than the price of gold now. If gold is in contango, a trader can keep executing the same type of trade and profiting over and over again. Now, that broker can use those gains to fund other trading activities. So why on Earth would it want to blow up the gold market by causing a panic? The broker's making money on the gold trade and has every incentive to keep the game going. The paper gold market is comprised banks, local traders at the exchanges, and hedge funds. All three of them are disincentivized to cause a panic in the gold market. The locals are making steady profits, so are the banks, and the hedge funds are being told by the lawyers that they could go to jail if they demand a large gold delivery. No large player in this market is looking to produce chaos. So, if the large players aren't going to cause the coming shock, what will? What will be the snowflake that triggers the avalanche? It could be many things… It could be the bankruptcy of a medium-size commodities broker like MF Global, that went bankrupt in 2011. That type of medium-sized firm could suddenly go bankrupt and fail to make a delivery. (It's one thing if J.P. Morgan and Goldman Sachs want to call a halt to the whole game. But it's another thing if some medium-sized dealer that no one's heard of suddenly can't make a delivery.) Then that firm's customers will all rush at once into the physical market with a massive order. They need to cover the firm's failure to deliver. And that sets off the panic. The trigger could also be a geopolitical shock. It could also be an assassination, a suicide of an important player, or a natural disaster. But aside from these possibilities, I'm eyeing one particular trigger that I believe is most likely to start the avalanche… It's coming very soon. When this trigger is pulled and the gold panic starts, it'll run out of control very quickly. Gold prices will soar to heights no one thought possible just a short time ago. The dollar will plummet against gold. And very few people will be able to get their hands on gold when they need it most. That's why you need to understand what's about to happen so you can prepare. Click here to see my new video project exposing this Great Gold Hoax. Regards, Jim Rickards Ed. Note: Sign up for your FREE subscription to The Daily Reckoning, and you'll start receiving regular offers for specific profit opportunities. By taking advantage now, your ensuring that you'll be financially secure later. Best to start right away.

The post No, This Won’t Cause a Gold Shock (Something Else I’ve Just Exposed Will) appeared first on Daily Reckoning. |

| John Stossel - Cronies and Connections Posted: 09 Aug 2016 02:30 PM PDT Mark Meckler (Founder of Citizens for Self-Government) and Yale law professor John Macey join Stossel to break down the crony connections of Donald Trump and Hillary Clinton. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The Coming Financial Crisis Will Make 2008 A Walk In The Park : John Rubino Posted: 09 Aug 2016 02:00 PM PDT Today's Guest: John RubinoThere Is Financial Crisis Coming That Will Make 2008 A Walk In The Park:John Rubino The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| FULL EVENT: Donald Trump Rally in Wilmington, NC 8/9/16 Posted: 09 Aug 2016 01:30 PM PDT Tuesday, August 9, 2016: Full replay of the Donald Trump rally in Wilmington, NC. at the University of North Carolina - Wilmington. FULL EVENT: Donald Trump Rally in Wilmington, NC 8/9/16 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Daily and Silver Weekly Charts - Dollar Lower, Metals Up, Silver in the Lead - Power Coiling Posted: 09 Aug 2016 01:23 PM PDT |

| Posted: 09 Aug 2016 11:00 AM PDT Hillary Clinton Is Disintegrating Before Our Eyes As Hillary's health worsens her campaign staff are forced to prop her up using any methods possible as she gets closer and closer to the power she has always craved. The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| JIM WILLIE WHAT WILL TRIGGER DOLLAR COLLAPSE NEW INTERVIEW 2016 Posted: 09 Aug 2016 10:23 AM PDT Jim Willie CB Proprietor, GoldenJackass.com Editor, Hat Trick Letter The man behind the name Jim Willie has experience in three important fields of statistical practice in the 23 years following completion of a PhD in Statistics at Carnegie Mellon University. He spent time since 2001 in a private... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Ronan Manly: Charade continues as London metal markets get more paper trading Posted: 09 Aug 2016 10:04 AM PDT By Ronan Manly Today the London Metal Exchange and the World Gold Council jointly jointly announced the launch next year of standardized gold and silver spot and futures contracts that will trade on the LME's electronic platform LMESelect, will clear on the LME central clearing platform LME Clear, and will be settled "loco London." Together these new products will be known as "LMEprecious" and will launch in the first half of 2017. However, although these contracts are described by the LME as delivery type 'physical,' settlement of trades on these contracts merely consists of unallocated gold or silver being transferred between LME Clear clearing accounts held at London Precious Metals Clearing Limited member banks (i.e., paper trading via LPMCL's AURUM clearing system). ... ... For the remainder of the commentary: https://www.bullionstar.com/blogs/ronan-manly/the-charade-continues-lond... ADVERTISEMENT Camino Minerals Receives Approval to Drill Company Announcement Camino Minerals Corp. (COR: TSX-V, CAMZF:OTC) is pleased to announce that it has received regulatory approval to drill at the Lost Cabin project in south-central Oregon. The company has received notice from the U.S. Bureau of Land Management that it has accepted the plan of operation, described in the notice for exploration drilling submitted in September 2015. On February 4, 2015, Camino announced it had optioned the Lost Cabin Project from La Cuesta International Inc.. The company has since completed a field evaluation of the project. Anomalous gold values were returned from grab samples, including 38.0 grams per tonne and 2.8 grams per tonne gold at the western end of the zone, as well as 5.5 gpt and 1.9 gpt gold in the east. The property lies within the Basin and Range Province in southern Oregon and covers a layered dome complex. Moderate to intense argillic alteration is exposed for more than 3 kilometers in a northwest trending valley. Within the exposed alteration are epithermal quartz veins, stock work, and breccias, which have potential to host a low-sulphidation, epithermal gold system. For the complete announcement: http://www.caminominerals.com/s/News.asp?ReportID=759715 Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| END TIMES SIGNS August 9 2016. Signs In The Heavens And On Earth. Prophecy Fulfilled. Posted: 09 Aug 2016 10:00 AM PDT This video is an end times update, showing the latest end times events that occurred on August 8-9 2016. Events are happening on a daily basis that prove we are in the End Times. Time Is Running out, repent before its too late! The Financial Armageddon Economic Collapse Blog tracks trends... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| THE ECONOMIC COLLAPSE ALREADY BEGUN? REVEALED BY HARRY DENT Posted: 09 Aug 2016 08:26 AM PDT The U.S. economy grew at a painfully slow rate of just 1.2 percent in the second quarter after only growing 0.8 percent during the first quarter. And last week we also learned that the homeownership rate in the United States has dropped to the lowest level ever. Has a new economic downturn begun?... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| TF Metals Report: A new wrinkle in the paper gold con game Posted: 09 Aug 2016 08:08 AM PDT 11:10a ET Tuesday, August 9, 2016 Dear Friend of GATA and Gold: The gold futures contracts being planned by the London Metals Exchange and World Gold Council appear to be based only on more "paper gold" derivatives, the TF Metals Report's Turd Ferguson writes today. His analysis is headlined "A New Wrinkle in the Paper Gold Con Game" and it's posted here: http://www.tfmetalsreport.com/blog/7785/new-wrinkle-paper-gold-con-game CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Camino Minerals Receives Approval to Drill Company Announcement Camino Minerals Corp. (COR: TSX-V, CAMZF:OTC) is pleased to announce that it has received regulatory approval to drill at the Lost Cabin project in south-central Oregon. The company has received notice from the U.S. Bureau of Land Management that it has accepted the plan of operation, described in the notice for exploration drilling submitted in September 2015. On February 4, 2015, Camino announced it had optioned the Lost Cabin Project from La Cuesta International Inc.. The company has since completed a field evaluation of the project. Anomalous gold values were returned from grab samples, including 38.0 grams per tonne and 2.8 grams per tonne gold at the western end of the zone, as well as 5.5 gpt and 1.9 gpt gold in the east. The property lies within the Basin and Range Province in southern Oregon and covers a layered dome complex. Moderate to intense argillic alteration is exposed for more than 3 kilometers in a northwest trending valley. Within the exposed alteration are epithermal quartz veins, stock work, and breccias, which have potential to host a low-sulphidation, epithermal gold system. For the complete announcement: http://www.caminominerals.com/s/News.asp?ReportID=759715 Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| London Metal Exchange to launch gold spot, futures contracts Posted: 09 Aug 2016 08:00 AM PDT London Metal Exchange to Launch Gold Spot, Futures Contracts By Clara Denina LONDON -- The London Metal Exchange said today it is planning to launch spot and futures contracts for gold and silver in the first half of 2017, adding to its list of products which includes copper and aluminium. The 139-year-old exchange is working in collaboration with the World Gold Council, an industry body backed by gold mining companies such as Barrick Gold and Goldcorp, and is supported by five banks and proprietary trader OSTC, which have committed to provide liquidity. "The initiative has been driven by the need for greater market transparency, to support and aid ongoing regulatory change, provide additional robustness to the precious metals market, broaden market access," the exchange and its partners said in a statement. ... ... For the remainder of the report: http://www.reuters.com/article/gold-contract-lme-idUSL6N0WR4PI ADVERTISEMENT Camino Minerals Receives Approval to Drill Company Announcement Camino Minerals Corp. (COR: TSX-V, CAMZF:OTC) is pleased to announce that it has received regulatory approval to drill at the Lost Cabin project in south-central Oregon. The company has received notice from the U.S. Bureau of Land Management that it has accepted the plan of operation, described in the notice for exploration drilling submitted in September 2015. On February 4, 2015, Camino announced it had optioned the Lost Cabin Project from La Cuesta International Inc.. The company has since completed a field evaluation of the project. Anomalous gold values were returned from grab samples, including 38.0 grams per tonne and 2.8 grams per tonne gold at the western end of the zone, as well as 5.5 gpt and 1.9 gpt gold in the east. The property lies within the Basin and Range Province in southern Oregon and covers a layered dome complex. Moderate to intense argillic alteration is exposed for more than 3 kilometers in a northwest trending valley. Within the exposed alteration are epithermal quartz veins, stock work, and breccias, which have potential to host a low-sulphidation, epithermal gold system. For the complete announcement: http://www.caminominerals.com/s/News.asp?ReportID=759715 Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

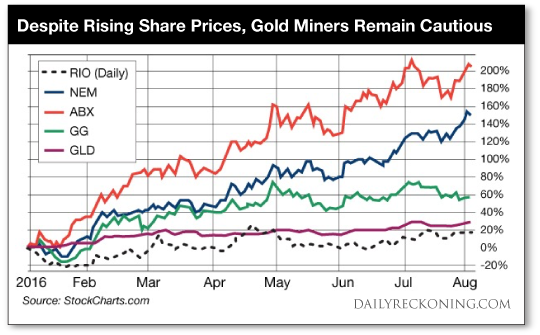

| Peak Gold has Passed, But Patience Is Key For Striking It Rich Posted: 09 Aug 2016 08:00 AM PDT This post Peak Gold has Passed, But Patience Is Key For Striking It Rich appeared first on Daily Reckoning. Lately, I've been watching the iron business, in comparison with what's happening in gold-silver. Along these lines, I just reviewed semiannual results from one of the world's largest iron mining firms, Rio Tinto. Rio is a great old name, mostly focused on iron, as well as aluminum, copper and diamonds. In the first half of 2016, Rio's net cash was down 27% from comparable months in 2015. But the company's net earnings were up by 113%. Higher prices for iron ore in the first six months of this year lifted Rio's profitability, based on a pickup in China's construction industry. To keep Rio's earnings growing, according to company CEO Jean-Sébastien Jacques, the mining giant will continue to clamp down on costs. Management is concerned about volatile commodity prices, certainly for iron. Rio has an aggressive plan to shave billions from operating costs over the next two years. According to a Rio spokesman, "Cost culture is now embedded across the organization." Meanwhile, Rio CEO Jacques recently advised investors not to expect much in the way of M&A. "Before we trigger anything," he said, management will ask "are we going to create value for shareholders?" According to Jacques, "We could be boring (in M&A) for a long time." Let's consider what this kind of thinking might also mean to the gold-silver mining space. After all, whether it's iron mining or gold mining, the fundamental idea always ought to be to "create value for shareholders." Despite Rising Share Prices, Gold Miners Remain CautiousFor this week's data shot, here's a chart showing year-to-date performance of Rio Tinto, compared to performance of gold (represented by GLD). I also included year-to-date share performance for Goldcorp (GG), Newmont (NEM) and Barrick Gold (ABX) for comparison.

Year to date, Rio shares are up by about 20%. In fact, iron miner Rio generally tracked performance in widely celebrated gold (GLD). Now compare GLD/gold and Rio/iron with several big names in the gold mining space. This year, Goldcorp has moved up just under 60%, Newmont is up 150% and Barrick soared over 200%. Obviously, gold and iron are different elements with different uses. As Jim Rickards pointed out in his talk in Vancouver last week, gold is not really a commodity. It's not an input to something else; certainly not in the way that iron is a critical input to steel. So far this year, gold prices have moved up by just under 30%. However, it's hard to escape the idea that these rising prices have climbed one of those proverbial stock market "walls of worry." There's notable sentiment within the investment community that gold prices could tumble. I've encountered sentiment within the mining community that rising gold prices lack strength and longevity. At the same time, there appears to be solid, market-based support for gold prices. New gold supply is contracting, plus, there's continuing demand for yellow metal from China and the West — certainly from the U.S. for investment reasons. There's also demand from Europe, due to uncertainty about the euro, European Union post-Brexit and general sociopolitical problems there. Along with central banks across the globe pursuing low interest policies and "negative rates," which tend to reduce the holding costs for gold. Thus, it's all good for gold. If gold can hold its current price levels then we're about to enter into a "sweet spot" of the industrial-commercial cycle. In the second half of 2016, we should see gold mine cash flow rising, while out in the field companies remain focused on cost cutting and capital discipline. This will lift share prices even more. With higher share prices, companies now have more valuable "currency" with which to do M&A. Right now, many large gold miners are cutting costs and selling gold into a higher-priced market. I expect to see very strong performance on many companies' bottom lines in the next few quarters. When it comes to M&A, though, I expect that management teams at many large companies remain gun-shy about buying new assets, at least until they gauge the continuing strength of the current bull market. One must always beware chasing a rally. Whether it's gold or iron ore, right now, miners that focus on value, versus volume, can outperform the basic price of what they sell. Nobody is in a hurry to make a M&A announcement, and watch their share price tank. Everything will get extra scrutiny. In the medium and long term, Jim and I are very optimistic about where gold prices are heading. We're optimistic about how investors can obtain high leverage to value from well-selected small cap exploration/development/mining plays. Still, the reality is that, just like with Rio Tinto and iron ore, the gold mining M&A space might remain "boring" for a while longer. Don't fret, though… because the hiatus will offer investors more opportunity to buy into great companies ahead of the gold rush to come. Best Wishes, Byron King The post Peak Gold has Passed, But Patience Is Key For Striking It Rich appeared first on Daily Reckoning. |

| 3 Top Advanced Junior Gold Stocks Breaking into New Highs Outperforming GDXJ Posted: 09 Aug 2016 07:58 AM PDT (Originally Published For Premium Subscribers on 8-2-16) After one of the most exhausting and traumatic bear markets in junior Lets visit some of the recent junior gold stories I have been highlighting 1)Treasury Metals (TML.TO) which was pretty much a low volume and 2)MX Gold (MXL.V or DTVMF) is a company which I have been highlighting for 3)I just recorded an interview with Sandspring Resources (SSP.V or SSPXF) Disclosure: I own securities in Treasury, MX Gold, Sandspring. Treasury, MX Gold, Sandspring are current website See my full disclosure by clicking on the following link: http://goldstocktrades.com/blog/featured-companies-on-gold-stock-trades/ Investing in stocks is risky and could result in losing money. Buyer Section 17(b) provides that: "It shall be unlawful for any person, by the use of any means or I am biased towards my sponsors (Featured Companies) and get paid in You must do your own due diligence and realize that small cap stocks is an |

| The Money Bubble Will Collapse, Gold is Real Money - JAMES TURK Posted: 09 Aug 2016 07:34 AM PDT Economic collapse and financial crisis is rising any moment. Getting informed about collapse and crisis may earn you, or prevent to lose money. Do you want to be informed with Max Keiser, Alex Jones, Gerald Celente, Peter Schiff, Marc Faber, Ron Paul,Jim Willie, V Economist, and many specialists... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Will the Dow go up 100% and Gold 5,000%? Posted: 09 Aug 2016 06:25 AM PDT Will the Dow go up 100% and Gold 5,000%? |

| Smiths Group set to cash in on stronger dollar Posted: 09 Aug 2016 02:16 AM PDT This posting includes an audio/video/photo media file: Download Now |

| Gold Standard Ventures' Monster Hole Posted: 09 Aug 2016 01:00 AM PDT Precious metals expert Bob Moriarty discusses Gold Standard Ventures' latest drill results and explains why he has been a fan for a while. |

| Breaking News And Best Of The Web Posted: 08 Aug 2016 06:44 PM PDT US productivity drops for third straight quarter. Oil price jumps on rumors of output cap. Stocks, gold and silver up slightly. China trade data disappoints. US debt now has negative yield for foreign investors. Most Americans worse off today than in 2005. More good earnings reports from precious metals miners. A major bitcoin hack throws […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Gold Suffers Weakness on Strong U.S. Jobs Numbers, but UK Stimulus to Offer Respite Posted: 08 Aug 2016 09:11 AM PDT Gold investors might need to brace up for a potentially disappointing week after strong U.S. employment numbers reduced the allure of the yellow metal. Gold has been on an impressive bullish ride this year and the yellow metal has gained 26% in the year-to-date period to erase the 11% loss that was recorded in full year 2015. In fact, gold has delivered an impressive price gains that outperforms equities and other commodities. |

| Top Silver Mining CEO Makes a Remarkable Price Forecast Posted: 08 Aug 2016 08:56 AM PDT First Majestic's Keith Neumeyer: “Silver Mines & Silver Are Way Rarer Than People Actually Think” Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason. Coming up we’ll hear a fantastic interview with Keith Neumeyer, CEO of First Majestic Silver Corp. Keith gives an insider’s take on the tremendous and unsustainable imbalance that exists between the available mine supply of silver compared to gold and what it likely means for the silver to gold ratio. And you’ll definitely want to hear Keith’s long term price target for the white metal, which may surprise you. Don’t miss my conversation with Keith Neumeyer coming up after this week’s market update. |

| Signs Are Silver Bull Market Is Consolidating Posted: 08 Aug 2016 01:00 AM PDT Having hit a target, silver has formed what is believed to be an intermediate top over the past five weeks or so, which it should soon start to descend from, says technical analyst Clive Maund. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

It started off well enough.

It started off well enough.

The U.S. and world are heading toward an accelerated breakdown of their economic and financial markets. Unfortunately, the overwhelming majority of analysts fail to understand the root cause of this impending calamity. This is also true for the majority of precious metals analysts.