saveyourassetsfirst3 |

- A HUGE 45 Tonnes of Gold Stand For Delivery On First Day! – Harvey Organ

- Alasdair Macleod’s Market Report: Gold and Silver Appear to be Breaking Out

- Gold – Stock Benchmark Battle

- Breaking News And Best Of The Web

- Julian Assange Claims Next Leak Will Lead to Arrest of Hillary Clinton

- Sunshine Minting CEO Tom Power: HUGE Pullback in Physical Demand Once Silver Hit $20

- 5 Best Gold and Silver Junior Mining Stocks in 2016

- Ups and Downs in Oil and Gold

- The Upside Potential in Junior Gold Stocks

- Monetary Metals Closes First Gold Fixed-Income Deal at 5%

- Gold Price - Support is Lower

| A HUGE 45 Tonnes of Gold Stand For Delivery On First Day! – Harvey Organ Posted: 31 Jul 2016 11:00 AM PDT For the August gold contract month, we had a gigantic 5028 notices served upon for 502,800 ounces on first day notices! A HUGE 44.7 TONNES OF GOLD STANDING FOR THE AUGUST CONTRACT MONTH/OI FOR SILVER REMAINS AT LOFTY LEVELS: 222,909 CONTRACTS CLOSE TO RECORD SET YESTERDAY/THURSDAY NIGHT-FRIDAY MORNING TURMOIL IN JAPAN AS THEY DISAPPOINT […] The post A HUGE 45 Tonnes of Gold Stand For Delivery On First Day! – Harvey Organ appeared first on Silver Doctors. |

| Alasdair Macleod’s Market Report: Gold and Silver Appear to be Breaking Out Posted: 31 Jul 2016 09:00 AM PDT It appears that gold and silver have broken out from a month long consolidation: Buy 90% Junk Silver Bags at SD Bullion As Low As $1.49/oz Over Spot! Submitted by Alasdair Macleod, GoldMoney: Gold and silver drifted this week, continuing last Friday's end-of-week profit-taking, until the FOMC announced on Wednesday afternoon EST that there was […] The post Alasdair Macleod’s Market Report: Gold and Silver Appear to be Breaking Out appeared first on Silver Doctors. |

| Posted: 30 Jul 2016 09:01 PM PDT The gold-mining stocks have enjoyed enormous gains in their young bull market this year, trouncing all other sectors. Naturally this radical out-performance has led to surging popular interest in this usually-obscure contrarian sector. New investors are wondering how to best track its performance, about which gold-stock benchmark is the definitive one to use. Something of […] The post Gold – Stock Benchmark Battle appeared first on Silver Doctors. |

| Breaking News And Best Of The Web Posted: 30 Jul 2016 06:44 PM PDT US GDP disappoints. IMF admits it mishandled Greek crisis. Plunging interest rates turning insurance companies into hedge funds. Oil back in technical bear market. Japan considers 50-year bonds. Companies report fake numbers. Money pours into corporate bonds as sovereign yields go negative. Gold and silver jump again. Best Of The Web Jim Grant is […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Julian Assange Claims Next Leak Will Lead to Arrest of Hillary Clinton Posted: 30 Jul 2016 03:00 PM PDT While many are blaming Russia for the Democratic National Committee (DNC) email leak, WikiLeaks founder Julian Assange says there is no evidence to suggest that the DNC was hacked by the Russian government. Furthermore, Assange claims the next leak will lead to the arrest of Hillary Clinton… Buy 90% Junk Silver Bags at SD Bullion […] The post Julian Assange Claims Next Leak Will Lead to Arrest of Hillary Clinton appeared first on Silver Doctors. |

| Sunshine Minting CEO Tom Power: HUGE Pullback in Physical Demand Once Silver Hit $20 Posted: 30 Jul 2016 02:15 PM PDT Sunshine Minting CEO Tom Power Joined the Show For An Exclusive Insider’s Look at the Trends & Mechanics of the Physical Silver Bullion Market. Tom Offered SD Listeners An Invaluable Look into the Silver Investment Demand Market. Is the Retail Silver Shortage Over, or is This the Lull Before an Unprecedented Shortage? Tom Provides a Unique Perspective on the […] The post Sunshine Minting CEO Tom Power: HUGE Pullback in Physical Demand Once Silver Hit $20 appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| 5 Best Gold and Silver Junior Mining Stocks in 2016 Posted: 16 Jul 2016 06:30 AM PDT  The following five junior mining stocks are 10 baggers, through just the first half of the year. These are the best performing junior mining stocks on the Toronto Stock Exchange, as they have posted gains of 1,000% or more over the past six months! These junior gold and silver miners are generating significant wealth for […] The following five junior mining stocks are 10 baggers, through just the first half of the year. These are the best performing junior mining stocks on the Toronto Stock Exchange, as they have posted gains of 1,000% or more over the past six months! These junior gold and silver miners are generating significant wealth for […] |

| Posted: 16 Jul 2016 01:00 AM PDT |

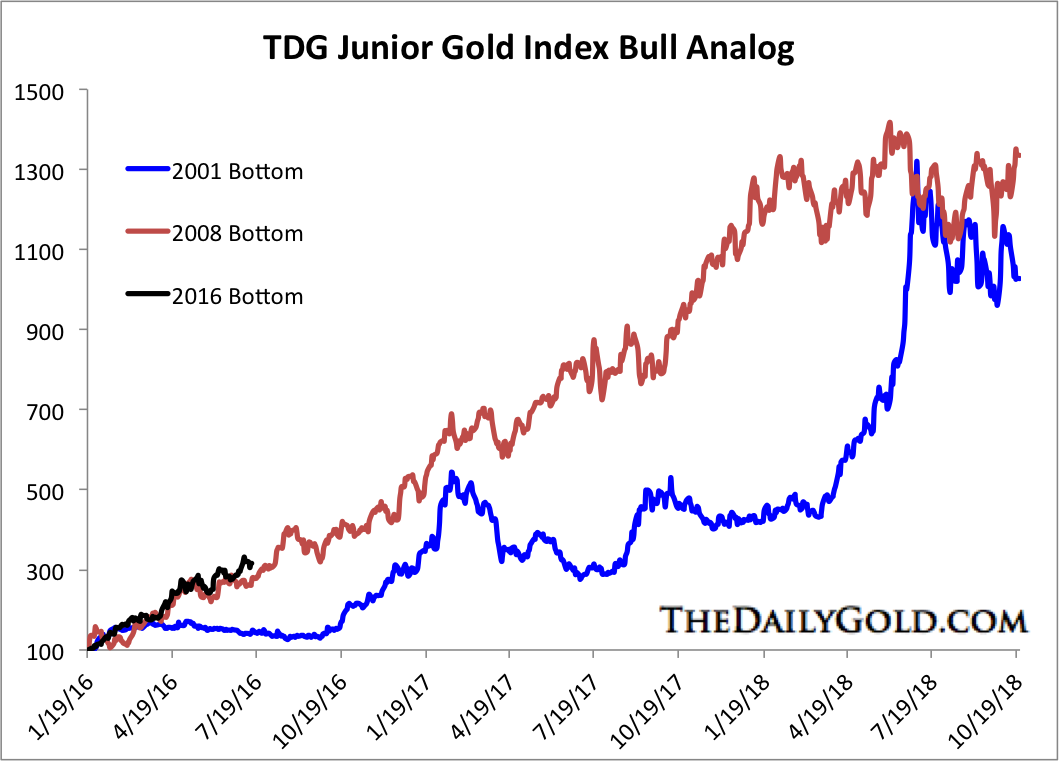

| The Upside Potential in Junior Gold Stocks Posted: 15 Jul 2016 02:19 PM PDT Our research continues to argue that the current, record rebound in gold stocks will continue. Every time we've predicted a correction, the weakness in the sector has been only a fraction of what we expected in both price and time. New bull markets that follow epic bear markets typically show exceptional strength in their first year. This bull has been no different. Thus, we expect the strong performance to continue. Today, we share a few reasons why the junior sector is poised to outperform in nominal and real terms. Juniors typically outperform once the new bull is established and metals prices are trending higher. The large cap miners perform best at the very beginning of the new bull. Later on, their performance in relative terms (against metals and juniors) weakens. Naturally, once the trend is established and sentiment improves, investors take on more risk. That benefits the junior sector. Moreover, that point time is when larger companies have the financial strength and optimism to acquire the smaller or junior companies. That is another positive for juniors. The current rebound in juniors as compared to the past still has plenty of upside potential. Take a look at the bull analog chart below. My junior gold index currently contains 18 companies and has a median market capitalization of ~$350 Million. It has been reconstructed several times dating back to 2000. While the index has already gained 200% in the past six months, if it follows the previous two bull cycles it could potentially double in the next seven months and then double again after that!

Junior Gold Stocks Bull Analog

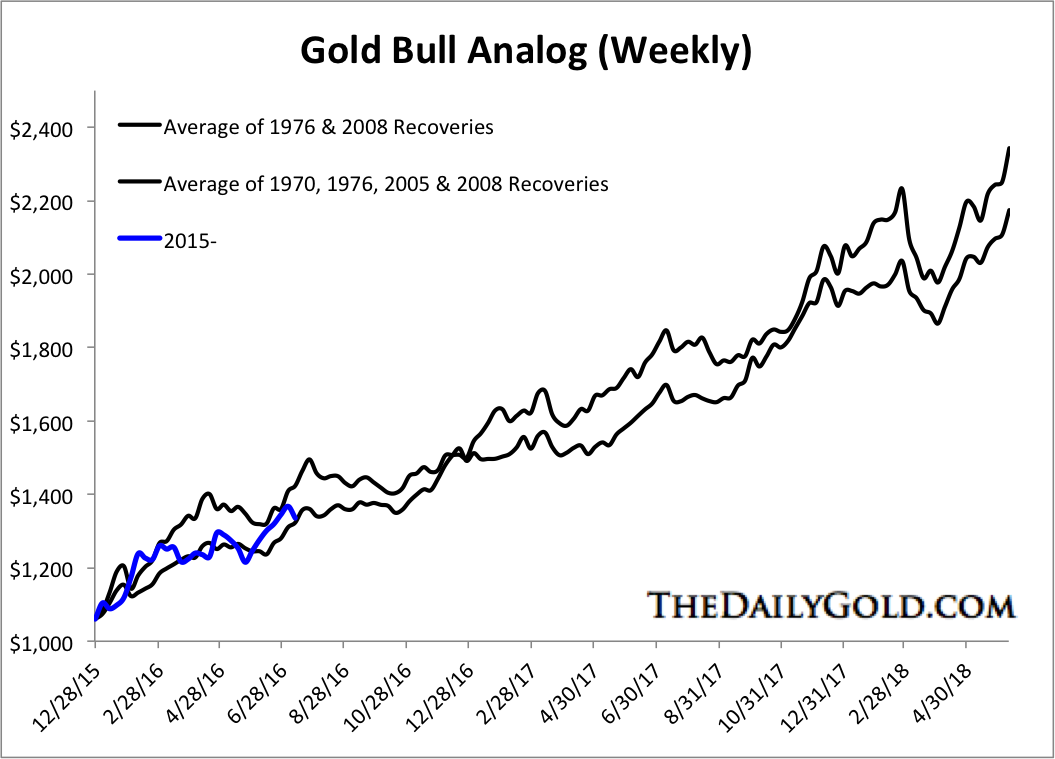

The junior sector should see an increased benefit if $1300-$1400 Gold becomes a floor and Gold continues to rise. The weekly Gold bull analog below shows that Gold's recovery has been following the weaker of the two analogs. If that continues, Gold could retest its all time high by the end of next year!

Gold Bull Analog

Be advised that no one can predict the future and these are projections based on a limited history. That being said, we believe the fundamentals for the junior sector have never been better and there is a strong precedent for the sector to go gangbusters in the years ahead. We did not even mention the full blown mania of the late 1970s and the mini-mania that occurred from 1993 to 1996. In short, we believe the precious metals sector continues to offer upside potential but that the junior space both in real and nominal terms offers the best risk/reward potential. For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT, MFTA

|

| Monetary Metals Closes First Gold Fixed-Income Deal at 5% Posted: 15 Jul 2016 07:04 AM PDT What was that about gold being a sterile asset? FREEDOMFEST LAS VEGAS, Nev., July 15, 2016—At FreedomFest, Monetary Metals announces that it has closed its first gold fixed-income deal, to finance the gold working inventory of Valaurum. The initial amount of gold meets Valaurum's current needs, with room for expansion driven by its growth. The interest rate is 5 percent of the gold, paid in gold. Read more here and check out the revamped Monetary Metals website. |

| Posted: 14 Jul 2016 12:58 PM PDT |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment