Gold World News Flash |

- Negative Mainstream Media Articles on Gold and Silver Don’t Tell the Truth

- Is The LBMA Running Out of Physical Gold & Silver? — David Jensen

- David Wilcock - Comments on Benjamin Fulford’s Latest Article

- Friday Night Lights - Another Brexit moment for FX

- URGENT: "US Airbase Hold Nukes Still Blocked In Turkey"

- Eric Sprott Weekly Wrap Up w/ TF Metals’ Craig Hemke

- Dexit after Brexit -- MERKEL'S WORST NIGHTMARE

- Illinois Obamacare Co-Op Goes Bust Leaving Tens of Thousands at Risk

- GOD's Final Warnings: Signs In The Heavens And On Earth. END TIMES Pt.16

- Great Numbers! Curious Timing?

- Will Electric Cars Kill Big Oil? Here’s the Answer…

- Newt Gingrich: Deport every Muslim who believes in Sharia

- TURKEY COUP !! • UPRISING IN TURKEY

- Brexit Was Globalist Plan All Along According to 1942 New World Order Map

- #SHTF DOLLAR COLLAPSE Party -- August 8-8-16 potential assassination

- Operation False Flag -- THE GOVERNMENTS SNEAKY WAYS...2016

- Jim Rickards On Financial Reform, Corruption, and Gold

- BREAKING NEWS: Military Coup in Turkey

- The Collapse of The European Banks Is Imminent: Jason Burack

- Full Speech: Donald Trump Announces Mike Pence as Vice Presidential Candidate (7-16-16)

- BREAKING: TURKEY UPDATE - MILITARY COUP AGAINST ERDOGAN GOVERNMENT

- A gold ETF that lets you redeem shares for gold

- 5 Best Gold and Silver Junior Mining Stocks in 2016

- Gold And Silver – NWO-Created Tragedies Will Never End, Seek Truth

- Ups and Downs in Oil and Gold

- Breaking News And Best Of The Web

| Negative Mainstream Media Articles on Gold and Silver Don’t Tell the Truth Posted: 16 Jul 2016 08:00 PM PDT from The Daily Bell:

Silver and gold have had terrific weeks but as we've been showing, the mainstream media, especially the business media, often focuses on the negatives. Meanwhile, the news queues are filled with anti-metals propaganda.

From Yahoo:

Would you ever see this sort of article in response to a stock rally? Far more likely that Yahoo would be presenting an article asking "How high can the Dow go?" |

| Is The LBMA Running Out of Physical Gold & Silver? — David Jensen Posted: 16 Jul 2016 07:00 PM PDT from WallStForMainSt: |

| David Wilcock - Comments on Benjamin Fulford’s Latest Article Posted: 16 Jul 2016 07:00 PM PDT It might be average silver cost, but bigger miners say that is costs around $10-15 to produce silver coin. Can we all, like hurry up with this and get our freedoms. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Friday Night Lights - Another Brexit moment for FX Posted: 16 Jul 2016 06:58 PM PDT It seems that such events are always planned for the weekend. News of the attempted Turkish coup reached FX investors just hours before the close. Turkey's currency is an exotic currency, commonly traded against USD, EUR, and JPY. Near the close, a huge spike in USD/TRY: Just as FX traders were worried about not having another Brexit moment for a few more years, only weeks later here's another. But this time it happened just before Friday's close at 5pm NYT so we'll see how the market opens Sunday night. EUR/USD sold off on the news as well, but only reached its channel lows.

It seems this FX event is a sign, that Europe is going to be full of "Brexit" moments in the coming years, and that FX is going to be the market defining this next epoch of investing. For those who don't understand Forex, the above chart represents the US Dollar against the Turkish Lira, that means when you see a spike UP, it means US Dollar going UP and Turkish Lira going DOWN. So, here's another boost to the good ol' USD, who is now being accused of the coup itself. FX traders patiently wait for markets to open, 24 hours from now. To learn more about Forex, checkout Splitting Pennies - Understanding Forex the book.  |

| URGENT: "US Airbase Hold Nukes Still Blocked In Turkey" Posted: 16 Jul 2016 05:36 PM PDT Urgent as 50-80 American Nukes stored in the Air Base in Turkey has had the power shutoff and all access blocked by Turkey in the "Coup" The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Eric Sprott Weekly Wrap Up w/ TF Metals’ Craig Hemke Posted: 16 Jul 2016 04:30 PM PDT from Sprott Money:

Our Ask The Expert interviewer Craig Hemke began his career in financial services in 1990 but retired in 2008 to focus on family and entrepreneurial opportunities. Since 2010, he has been the editor and publisher of the TF Metals Report found at TFMetalsReport.com, an online community for precious metal investors. Click HERE to Listen |

| Dexit after Brexit -- MERKEL'S WORST NIGHTMARE Posted: 16 Jul 2016 04:00 PM PDT MERKEL'S WORST NIGHTMARE: Germany calls for EU Referendum 'People want to be Free' Germans want Sovereignity - MERKEL'S WORST NIGHTMARE: Germany calls for Referendum as 'People want to be Free of EU' The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Illinois Obamacare Co-Op Goes Bust Leaving Tens of Thousands at Risk Posted: 16 Jul 2016 04:00 PM PDT by Michael Krieger, Liberty Blitzkrieg:

Politicians, particularly those of the Democratic persuasion, love to throw around statistics about how many additional people have healthcare coverage without ever talking about the cost of such coverage, or whether it actually translates into actual access in the real world. While a greater number of Americans having health insurance is a good thing when it comes to protecting against unexpected catastrophic events or extended hospital stays, it doesn't tell you anything about two very important variables: 1) How much does it cost? 2) What kind of access does it provide? As usual, the devil is in the details.

In my opinion, the above situation represents the number one failure of Obamacare, but there are others. Today's piece focuses in on the state of Obamacare co-ops, which were "created under the federal health law to provide cost-effective coverage and competition in state insurance markets." Just like with Obamacare in general, stark reality is not living up to the sales pitch, and 16 of the 23 nonprofit cooperatives created nationwide have now failed. As the Chicago Tribune reports:

Pretty massive concentration for a "free market."

|

| GOD's Final Warnings: Signs In The Heavens And On Earth. END TIMES Pt.16 Posted: 16 Jul 2016 03:30 PM PDT Events are happening on a daily basis that prove we are in the End Times. Time Is Running out, repent before its too late! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Great Numbers! Curious Timing? Posted: 16 Jul 2016 03:15 PM PDT Submitted by John Rubino via DollarCollapse.com, Pretend you’re running a corrupt government and something big and scary happens in another part of the world. Brexit, for instance. You’re quite naturally worried about the impact on your local economy and political system. What do you do? Well, one obvious thing would be to call the statisticians who compile your economic reports and tell them to fudge the next batch of numbers. [ZH:Notice the spike in macro data hit right as Brexit crashed markets... but bonds aren't buying it...] [ZH: And some more context for this sudden ramp in awesome data...]

Since you already do this prior to most major elections, they’re neither surprised by the request nor concerned with how to comply. They simply go into the black boxes that control seasonal adjustments or fabricate things like “hedonic quality” or “imputed rent,” and bump up the near-term levels. Later revisions will lower them to their true range but by that time, hopefully, the danger will have passed and no one will be paying attention. So…Brexit spooks the global markets and — surprise — some big economies report excellent numbers. Among them: China’s GDP growth comes in at 6.7%, slightly better than expected US retail sales pop by 0.6%, versus expectations of just 0.1% US industrial output surges in June, led by autos These are indeed really good numbers, and anyone looking solely at the headlines would have to conclude that the things the major governments have done lately are working. Nothing to see here folks, everything is fine. The experts have it covered. But a clearer, far less rosy picture emerges when you look at the numbers below the headlines, which are either harder to fudge because they’re calculated by private sector entities or are too obscure to be worth fudging. Industrial Production is in the middle of its longest non-recessionary slump in American history...

Business inventories, for instance, are a pretty good indicator of future activity, with high inventories implying slow growth (because factories have already produced plenty of stuff for the months ahead) and low inventories meaning the opposite (because factories will have to resupply their customers shortly). Here’s a chart from Zero Hedge showing “Business Inventories At Highest Level To Sales Since The Crisis”: Autos especially (which you’ll recall led the jump in retail sales) are piling up on lots around the country, implying that auto plants will be running somewhat less than flat-out during the balance of the year. Meanwhile, The Amount Of Stuff Being Bought, Sold And Shipped Around The U.S. Hits The Lowest Level In 6 Years:

And last but not least, Empire State index softens in July:

To sum up, growth is great but…business inventories are spiking, freight shipments are at six-year lows and the most recent regional manufacturing report is as close to no-growth as is possible without actually not growing. Which set of figures should we trust? Time will tell, but human nature being what it is, our money is on the bad ones. |

| Will Electric Cars Kill Big Oil? Here’s the Answer… Posted: 16 Jul 2016 03:00 PM PDT by Marin Katusa, Katusa Research:

In the years that followed, Apple sold over 700 million iPhones, dominated the smartphone market, and became the world's most valuable company. Around the time Apple rolled out the iPhone, Netflix rolled out its streaming movie service. In the years that followed, streaming became a phenomenon. More than 60 million subscribers signed up for the service. Demand was so high that at times, streaming represented more than 35% of Internet traffic. Netflix shares climbed more than 3,200%. There's another side to these success stories. There's always a loser choking on the dust of a winner. Apple's iPhone became a huge hit at the expense of the then-popular BlackBerry phone. The maker of BlackBerry, Research in Motion, suffered a spectacular collapse.

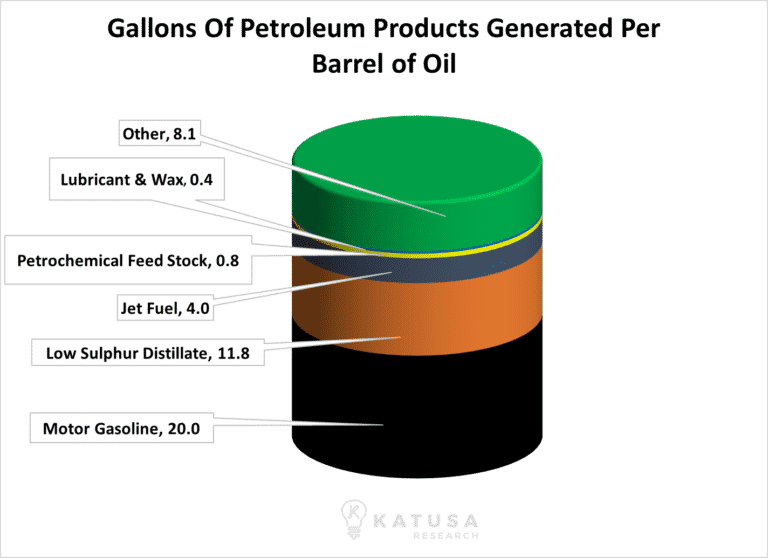

These stories are extremely important for resource investors right now. The success of another innovator, Tesla Motors, has raised some big questions… "Will electric cars eventually make oil worthless? Will they kill 'Big Oil?'" The answer has major economic implications; it has major investment implications. After all, if electric cars explode in popularity, most oil investments will be huge losers. Your shares of ExxonMobil or Chevron could plummet in value. Trillions of dollars of oil deposits could take a 90%+ haircut in value. In this essay, I'll answer the big electric car question…and tell you how to invest in what's coming… Why This Question is Finally Relevant The threat of electric cars is nothing new for the oil industry. People have claimed electricity would replace gasoline for a long time… and they've been wrong for a long time. The reason why is simple economics. The cost of building electric cars and a grid to fuel them was astronomical compared to the cost of sticking with the status quo. But over the past 10 years, electric car technology has radically improved. Battery technology has radically improved. Power efficiency has radically improved. And performance? The Tesla Roadster can go from 0 – 60 mph as fast or faster than any comparable gasoline-fueled sedan. The Tesla Model S was named Motor Trend's Car of the Year in 2013, beating Porsche and BMW products. Meanwhile, electric vehicle costs are plummeting. Batteries make up about a third of the cost of an electric vehicle. They've dropped in price by about 60% in the past five years. They're expected to drop another 55% in the next 10 years–and that is a conservative estimate. In reality, costs will drop much more, much faster. So the EV revolution is real. The EV sector is going to get a lot larger. And it's not just Tesla. Volkswagen, GM, Ford, BMW, and many non-motor companies like Google and Apple are entering the sector in a big way. With all these companies investing in EVs, the technology will continue to improve. But will it kill the need for oil? Will it make oil investments losers? The answer is "NO." In 2016, over 95 million barrels of oil will be consumed every day. Gasoline used in motor vehicles is the largest consumer of that oil; approximately 44.4% of every barrel is used to make gasoline.

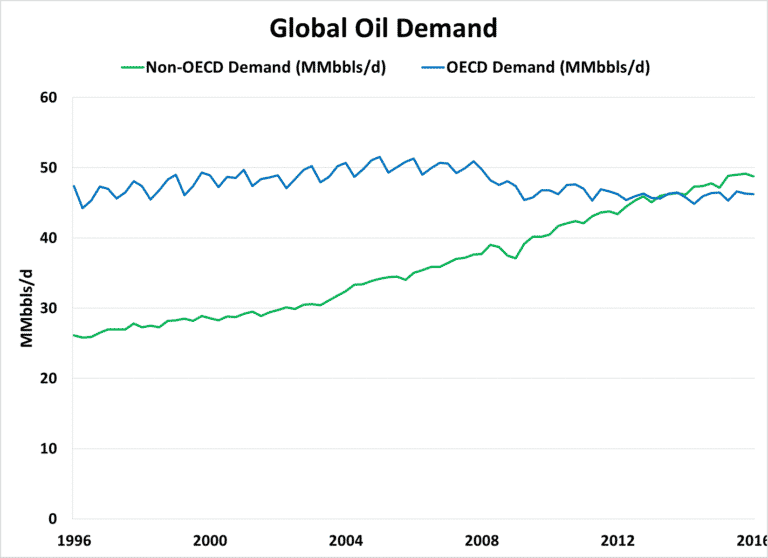

Many people suggest that oil demand has peaked, but I think it's quite the opposite. Forecasters fail to remember that outside of North America and Europe, most societies are relatively poor…but growing rapidly. Economic growth rates in the "BRICS" (Brazil, Russia, India, China, South Africa) countries are double those of the developed world. These expanding economies will drive massive demand for gasoline powered cars, trucks, planes, and boats. They will demand huge quantities of oil. The chart below shows how demand from emerging markets (in green) is steadily rising, while demand from developed markets is slowly declining (blue line).

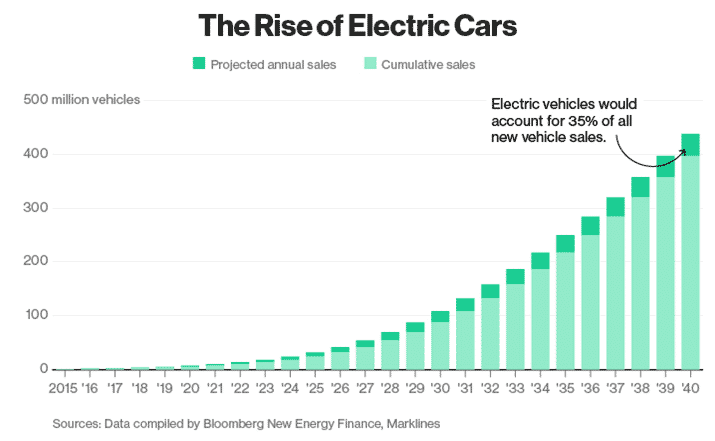

Oil demand in the developed world (OECD in the chart) hasn't changed much in the past 20 years, but demand in the developing world (Non-OECD) has nearly doubled over the same time period. We can expect this trend to continue. Blue collar workers in China and India cannot afford $100,000 Tesla electric vehicles…but they can afford small gas-powered cars that will get them from point A to point B. The point is that EVs are "still" luxury vehicles in the OECD nations, while gas-powered vehicles have become so cheap that a blue collar worker in China can now afford one. This won't change for many decades. In other words, the glass is half full for oil companies, not half empty. Currently, there are 1.1 billion cars on the road. By 2025, there will be 1.5 billion. By 2040, it is expected that there will be 2 billion cars on the road. It's forecasted that by 2040, EV sales will represent 35% of new car sales. The math works out to approximately 40 million new cars and in total about a quarter of all cars on the road will be electric.

This does represent a changing of the guard, so to speak, but by no means does it indicate that EVs will kill oil. |

| Newt Gingrich: Deport every Muslim who believes in Sharia Posted: 16 Jul 2016 03:00 PM PDT Former House speaker outlines his plan for dealing with radical Islam in America on 'Hannity' The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| TURKEY COUP !! • UPRISING IN TURKEY Posted: 16 Jul 2016 02:30 PM PDT TURKEY COUP !! • UPRISING IN TURKEY • MUST SEE !! • NEWS FOOTAGE • Newt Gingrich #donaldtrump #trump The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Brexit Was Globalist Plan All Along According to 1942 New World Order Map Posted: 16 Jul 2016 02:00 PM PDT Brexit is 100% a part of the globalist agenda. Many people seem to interpret the Brexit as a blow against tyranny. But this is an obvious case of divide-and-conquer playing out on all issues. Revolution will emerge as society begins to wobble. The Financial Armageddon Economic Collapse... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| #SHTF DOLLAR COLLAPSE Party -- August 8-8-16 potential assassination Posted: 16 Jul 2016 01:00 PM PDT Jesse Ventura: Establishment VP Pick Could Get Trump Assassinated The former Minnesota governor tells The Daily Beast why he thinks the divisive mogul would be an easy target for a government plot if he picks ... 'Deflated' Trump supporters howl over Pence pick: 'Worst. Season. Finale. Ever.' Raw... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Operation False Flag -- THE GOVERNMENTS SNEAKY WAYS...2016 Posted: 16 Jul 2016 12:10 PM PDT .. The elites have a hatred for the people...H.Liar is actually a Goldwater girl....so our choice is right or extreme right...both profound enemies of the people! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Jim Rickards On Financial Reform, Corruption, and Gold Posted: 16 Jul 2016 12:05 PM PDT |

| BREAKING NEWS: Military Coup in Turkey Posted: 16 Jul 2016 11:35 AM PDT Breaking News just in is that Turkey has just taken over the institutional control over Turkey. Turkey and Erdogan have always had strains and now they have seemed to have of gone to a tension point with this military coup. The Financial Armageddon Economic Collapse Blog tracks trends... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The Collapse of The European Banks Is Imminent: Jason Burack Posted: 16 Jul 2016 11:00 AM PDT The entire system is rigged to collapse, but not because of fraudulent economic theories, but only when the Elite decide when they want to pull the plug(soon, within the next few years). The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Full Speech: Donald Trump Announces Mike Pence as Vice Presidential Candidate (7-16-16) Posted: 16 Jul 2016 10:27 AM PDT Donald J. Trump officially announced Indiana Governor Mike Pence as his Vice Presidential Candidate for the November 2016 today at a press conference in New York City at the New York Hilton Midtown. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| BREAKING: TURKEY UPDATE - MILITARY COUP AGAINST ERDOGAN GOVERNMENT Posted: 16 Jul 2016 10:13 AM PDT Turkish military declares takeover of country (Special coverage) The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| A gold ETF that lets you redeem shares for gold Posted: 16 Jul 2016 07:24 AM PDT There are others, like the Sprott gold and silver ETFs. But it's good that the idea of redeemability for ordinary investors is catching on and that suspicion of "paper gold" is growing. * * * A Gold ETF That Lets You Redeem Shares for Gold By Lewis Braham How much is fear worth? That, in a nutshell, is the difficulty in valuing gold. It's the currency of last resort for those who are afraid that all other assets will eventually become worthless. The greater investors' angst, the higher gold's value. Thus it commands a "fear premium" unlike any other asset. That anxiety can translate into a desire among certain investors to keep physical gold in vaults in their basements, or shoved under their mattresses. If the much-anticipated global financial meltdown or zombie apocalypse occurs, having a bar or two on hand could prove useful -- if not to barter, then to at least bash a zombie over the head. ... ... Dispatch continues below ... ADVERTISEMENT Stacking the Odds for Discovery By Tommy Humphreys Greg Beischer and his team at Millrock Resources (MRO-V) didn't spend the depths of the bear market for exploration juniors bemoaning the awful state of things. Quite the opposite. "The past three years, even though they've been brutal, were really just the perfect time for a generative exploration company," says Beishcher, Millrock president and CEO, in a CEO.ca feature video. "We were able to acquire assets at very, very low costs." Recent acquisitions include a dominant group of claims in B.C.'s Golden Triangle with concessions adjacent to Pretium Resources and its Brucejack gold project. ... ... For the remainder of the report, and the video interview, please visit: https://ceo.ca/@tommy/millrock-stacking-the-odds-for-discovery If you're among the nail-biting set, this year may be the one to buy the VanEck Merk Gold Trust exchange-traded fund (ticker: OUNZ). With Brexit in the rearview mirror and a contentious presidential election on the horizon, there is no shortage of fear. VanEck Merk is up 26.7% year-to-date, a fraction higher than the largest gold ETF, the $41.7 billion SPDR Gold Trust (GLD). Both ETFs have identical 0.4% expense ratios. But VanEck has a unique feature that gives it added appeal. Retail investors can redeem their shares in ounces of physical gold that will be delivered to them for a fee. This made the upstart ETF, which has gathered $156 million since its May 2014 launch, very interesting, even during last year's bear market. It had a 46% growth in investor inflows in 2015, according to Morningstar, while the precious-metals sector saw minus 6.4% in outflows. That's off a small base, but the fact that investors were buying this fund while gold was getting hammered is significant. "Since the launch of SPDR Gold Trust, there have been some in the gold investment community who refer to it in a negative way as 'paper gold,'" says Dave Nadig, FactSet's director of ETFs. "There's a belief system that's somewhat conspiratorial that there's no gold in the vault. Having a sense of physical access to the gold is important to those investors." Indeed, Axel Merk, who as president of Merk Investments designed the new ETF, consulted the doubting Thomases in the gold blogosphere before launching it. "When we structured this ETF, we wanted to offer what SPDR Gold offers and more," he says. "We think we've designed a better product." While Van Eck provides flexibility and added safety, it's not the best option for acquiring physical gold directly, especially for small investments. Share exchanges for coins and bars are cost-prohibitive with small transactions because of the minimum fees. For instance, to exchange ETF shares for Australian bars costs $30 an ounce, but for a minimum fee of $1,200. With gold currently at $1,343, you'd lose almost your entire investment for one ounce. But with a 40-ounce conversion -- or $53,720 currently -- your $1,200 fee is 2.2% of your investment, a reasonable outlay for a secure delivery of gold to anywhere in the U.S. from a London-based vault. So far, only a half-dozen investors have redeemed some 200 total ounces in physical gold, Merk says. "Most people want to keep the ETF but appreciate the functionality," he says. "One delivery we had, the investor said, 'Well, I'm going to take five ounces because I want to test the process in case I want to eventually take more.'" With the geopolitical outlook increasingly uncertain, the ETF's flexibility, despite the exchange costs, may provide just the right level of security that nervous investors need to stay in the game. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| 5 Best Gold and Silver Junior Mining Stocks in 2016 Posted: 16 Jul 2016 07:19 AM PDT Gold Stock Bull |

| Gold And Silver – NWO-Created Tragedies Will Never End, Seek Truth Posted: 16 Jul 2016 05:50 AM PDT Nice, France weighs heavily and brings home the point, tomorrow is promised to no one. The tragic mass-killing of Bastille Day celebrants in Nice, France may not have been a planned terrorist attack, but its consequences are no less extremely sad and equally infuriating. We heard about comments made from neighbors of the truck driver that he was not that religious, was undergoing a divorce and was not handling it very well and apparently snapped. It matters not if that explanation makes sense in the wake of a senseless act of running over a hundred or so people, killing around 84, including children. The man was shot dead by police, so little else will ever be directly known from the Tunisian known mostly for petty criminal acts but no known terrorist affiliations. |

| Posted: 16 Jul 2016 01:00 AM PDT Technical analyst Jack Chan charts a major buy signal in oil and a possible correction in gold. |

| Breaking News And Best Of The Web Posted: 15 Jul 2016 06:44 PM PDT Attempted coup in progress in Turkey. Stocks recover on promise of massive new stimulus from Japan and UK and suspiciously good growth numbers from US and China. Gold corrects and interest rates rise. Banks report pretty good earnings, trucking firms and oil companies not so much. Another big terrorist attack in France. UK Conservative party […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

NEW YORK, July 15 … Hedge funds and money managers again raised their net long positions in COMEX silver futures and options to fresh record highs in the week to July 12, as spot prices hovered near two-year highs, data showed on Friday. As gold's safe-haven appeal waned, speculators cut their record bullish bets for the first time in five weeks and raised their net longs in copper, U.S. Commodity Futures Trading Commission (CFTC) data showed. For silver, it was also the fifth straight week of additions. – Reuters

NEW YORK, July 15 … Hedge funds and money managers again raised their net long positions in COMEX silver futures and options to fresh record highs in the week to July 12, as spot prices hovered near two-year highs, data showed on Friday. As gold's safe-haven appeal waned, speculators cut their record bullish bets for the first time in five weeks and raised their net longs in copper, U.S. Commodity Futures Trading Commission (CFTC) data showed. For silver, it was also the fifth straight week of additions. – Reuters

This week on the Weekly Wrap-Up, Eric Sprott discusses the recent price weakness in gold relative to the continued strong performance of silver and the mining shares.

This week on the Weekly Wrap-Up, Eric Sprott discusses the recent price weakness in gold relative to the continued strong performance of silver and the mining shares. The fact that Obamacare is a gigantic train wreck barreling uncontrollably into a brick wall is pretty much undeniable at this point. I've covered this reality from several angles in 2016, with one of the more popular posts being,

The fact that Obamacare is a gigantic train wreck barreling uncontrollably into a brick wall is pretty much undeniable at this point. I've covered this reality from several angles in 2016, with one of the more popular posts being,

On June 29, 2007, Apple released its now-iconic iPhone for sale in the United States.

On June 29, 2007, Apple released its now-iconic iPhone for sale in the United States.

No comments:

Post a Comment