saveyourassetsfirst3 |

- Don't Jump Into Gold Just Yet

- DOLLAR CRASHES WHILE GOLD AND SILVER SKYROCKET- “RECOVERY” LIE EXPOSED!

- Why Buffett Avoids Gold

- “Terrorized”: Violent California Protesters Play Right Into Donald Trump’s Hand

- FX And Oil Week Ahead: Gold Shines As The Greenback Gets Crushed

- Gold Fever

- Sprott’s Thoughts: Gold Leading Up to the Fed Meeting

- Now A Monstrous 47 Tonnes of Gold Standing For Delivery! – Harvey Organ

- Breaking News And Best Of The Web

- There Was Never Any Intent to Raise Rates – It Was All About Targeting Gold! – Fund Manager

- Are Junior Gold Stocks Following 2008-2009 Recovery?

- The Weimar Republic of Venezuela

- June 4, 1963 - JFK executive Order - Right to issue silver certificates against silver bullion

- “A Very Significant Reversal In Precious Metals” – Eric Sprott

- Are Junior Gold Stocks Following 2008-2009 Recovery?

- Q&A With The Doc: Is Martin Armstrong Right on Sub-$1000 Gold?

- The Scapegoat For the Global Financial Collapse

- A Perfect Storm is Brewing in the Physical Silver Market

- Jim Willie Issues Warning Alert: Immediate Risk of Systemic Lehman Event

- Another 100,000+ Ounces of Gold Get Delivered at 1,209 Yesterday

- Billionaire George Soros Dumps 37% of Stocks To “Buy Up Massive Amounts of Gold” But Why?

- Three Buying Opportunities in a Resurgent Gold Market

| Posted: 04 Jun 2016 12:48 PM PDT |

| DOLLAR CRASHES WHILE GOLD AND SILVER SKYROCKET- “RECOVERY” LIE EXPOSED! Posted: 04 Jun 2016 12:00 PM PDT It's going to be a long weekend for those holding stocks and believing in the "recovery" lie… Numbered Rim, Only 2,500 Minted! Today, the US government released its jobs report and the market was expecting an additional 200,000 jobs in May. Instead, the number came in at a paltry 38,000. One analyst, Naseem Aslam of Think […] The post DOLLAR CRASHES WHILE GOLD AND SILVER SKYROCKET- "RECOVERY" LIE EXPOSED! appeared first on Silver Doctors. |

| Posted: 04 Jun 2016 10:56 AM PDT |

| “Terrorized”: Violent California Protesters Play Right Into Donald Trump’s Hand Posted: 04 Jun 2016 09:05 AM PDT Public perception matters a lot, which is why politicians spend virtually all of their energy managing it. Despite the twisted and corrupt nature of our political system, the fact of the matter remains that there will be an election in November 2016, and Donald Trump will be on the top of the Republican ticket. If your goal […] The post “Terrorized”: Violent California Protesters Play Right Into Donald Trump's Hand appeared first on Silver Doctors. |

| FX And Oil Week Ahead: Gold Shines As The Greenback Gets Crushed Posted: 04 Jun 2016 08:19 AM PDT |

| Posted: 04 Jun 2016 07:55 AM PDT |

| Sprott’s Thoughts: Gold Leading Up to the Fed Meeting Posted: 04 Jun 2016 07:00 AM PDT Everyone in the mining sector, literally everyone, was worried about a correction… From Sprott’s Thoughts: Everyone in the mining sector, literally everyone, is worried about a correction. Fair enough. After five long and dark years, the last thing any of us are is overconfident. So when we look at this year's sharp gains in […] The post Sprott’s Thoughts: Gold Leading Up to the Fed Meeting appeared first on Silver Doctors. |

| Now A Monstrous 47 Tonnes of Gold Standing For Delivery! – Harvey Organ Posted: 04 Jun 2016 05:00 AM PDT AT THE COMEX THE FRONT JUNE CONTRACT ADDS 7800 OZ TO THE AMOUNT STANDING- NOW WE HAVE A MONSTROUS 47.29 TONNES STANDING FOR GOLD DELIVERY!! GLD HAS A MASSIVE 10.71 TONNES ADDED TO ITS INVENTORY (PAPER DEPOSIT) AND SLV ADDS 1,560,000 OZ/AT THE COMEX THE FRONT JUNE CONTRACT ADDS 7800 OZ TO THE AMT STANDING/NOW WE […] The post Now A Monstrous 47 Tonnes of Gold Standing For Delivery! – Harvey Organ appeared first on Silver Doctors. |

| Breaking News And Best Of The Web Posted: 04 Jun 2016 12:00 AM PDT US jobs report misses big, stocks decline, gold soars, odds of interest rate hike fall. Car sales, oil prices, mortgage applications, US construction spending, China and Japan manufacturing all fall hard. Alhambra Partners on why apathy is a bigger risk than stupidity. Charles Hugh Smith on why pension funds (that is, your retirement) are doomed. […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| There Was Never Any Intent to Raise Rates – It Was All About Targeting Gold! – Fund Manager Posted: 03 Jun 2016 07:00 PM PDT With Gold & Silver SCREAMING Higher On the Worst Jobs Report in Half a Decade, PM Fund Manager Dave Kranzler Joined the Show, Discussing: Is the Correction Over? Bullion Buyers “Shellshocked” As Gold & Silver Prices Jump Higher “There Was Never Any Intent to Raise Rates” – It Was All About Targeting Gold! Unprecedented Development […] The post There Was Never Any Intent to Raise Rates – It Was All About Targeting Gold! – Fund Manager appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Are Junior Gold Stocks Following 2008-2009 Recovery? Posted: 03 Jun 2016 06:09 PM PDT The Daily Gold |

| The Weimar Republic of Venezuela Posted: 03 Jun 2016 04:24 PM PDT Why the Western Media and Intelligentsia Whistle Past the Graveyard of Venezuela's Collapse.

|

| June 4, 1963 - JFK executive Order - Right to issue silver certificates against silver bullion Posted: 03 Jun 2016 04:00 PM PDT Executive Orders |

| “A Very Significant Reversal In Precious Metals” – Eric Sprott Posted: 03 Jun 2016 02:26 PM PDT The Admiral of the Silver Market Eric Sprott Breaks Down Today’s HUGE MOVE in Gold and Silver: “A Very Significant Reversal In Precious Metals“… Buy Silver Coins and Silver Bars at SDBullion The post “A Very Significant Reversal In Precious Metals” – Eric Sprott appeared first on Silver Doctors. |

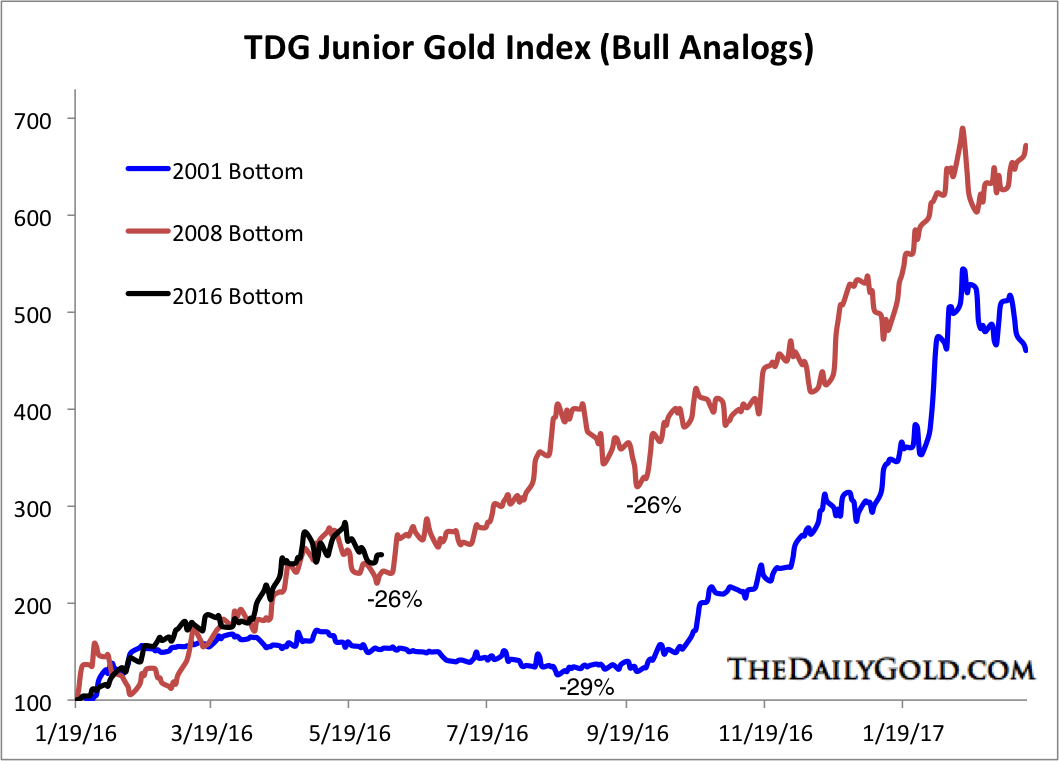

| Are Junior Gold Stocks Following 2008-2009 Recovery? Posted: 03 Jun 2016 02:07 PM PDT Weeks ago precious metals began a correction amid overbought conditions (in the miners) and very bullish sentiment in the metals. The recent Fed minutes helped accelerate the weakness but it lost steam in recent days. A real stinker of a jobs report completely reversed the thought that the Fed would hike rates in the summer and it sent precious metals surging. As a result, the gold stocks and junior gold stocks especially could be back on the path to making new highs before autumn. Below we show our junior gold index bull analog chart. It is a custom index of 18 stocks with a median market cap of roughly $300 Million. We plot the rebounds from 2001, 2008 and January 2016 on the same scale. From high to low the index had corrected 18%, which compares to the 26% at this point in the 2008-2009 rebound. In 2001 the juniors corrected 29% over five months. Given the reaction to the jobs news, the probabilities say the juniors are more likely to follow the red path (2009) or something close to it then the blue path (2001).  Junior Gold Stocks Bull Analog

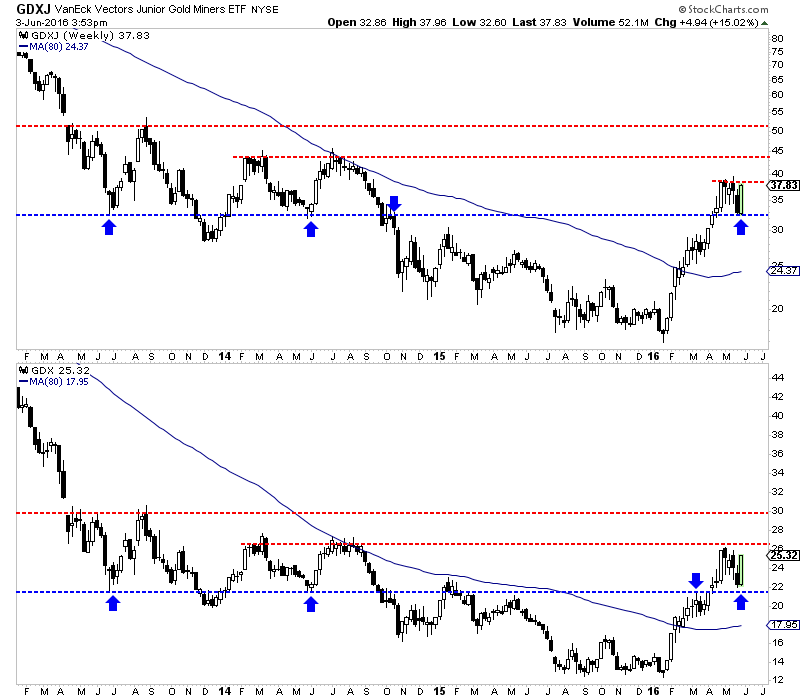

Below are the weekly candle charts for GDXJ and GDX which have now engulfed the bearish candle from the previous week. Note how the miners were able to hold support which includes the 50-day moving averages (not shown). If GDXJ can make a weekly close above $38 then that brings upside targets of $44 and $50 into play. Meanwhile, if GDX can make a weekly close above $26 then it has upside potential to $30 and even $32, the 38% retracement.  GDXJ, GDX Weekly Candles

This was an amazing move in the gold stocks that caught many off guard, including me! The data argued and argues for a bigger and longer correction. My junior index corrected only 18% while the corrections in 2001 and 2009 were 29% and 26%. No one can predict if the correction is over or if gold stocks (and juniors especially) will continue to follow their 2008-2009 path. However, we do know a few things. It is a bull market and prices should move higher in the months and quarters ahead. Finally, we know that a bullish consolidation in the weeks ahead followed by a breakout would be inline with recent history (2008-2009). Hold your positions and take advantage of weakness! Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Jordan Roy-Byrne, CMT Jordan@TheDailyGold.com

|

| Q&A With The Doc: Is Martin Armstrong Right on Sub-$1000 Gold? Posted: 03 Jun 2016 02:00 PM PDT Doc, I want to start by saying thanks for all of your hard work. And I also want to thank you for responding to my notes on occasion. Unlike many people we have everything in silver. The bad news is that we need to sell silver to live of off. Due to health concerns we […] The post Q&A With The Doc: Is Martin Armstrong Right on Sub-$1000 Gold? appeared first on Silver Doctors. |

| The Scapegoat For the Global Financial Collapse Posted: 03 Jun 2016 01:35 PM PDT Let’s face it, the system is coming down. Have you ever wondered “who” would be blamed this time around? Submitted by Bill Holter, JSMineset: To this point, we speak about the “Lehman moment” when we look back at 2008. Of course it was not Lehman’s fault as they were forced, sacrificed or purposely destroyed, […] The post The Scapegoat For the Global Financial Collapse appeared first on Silver Doctors. |

| A Perfect Storm is Brewing in the Physical Silver Market Posted: 03 Jun 2016 01:35 PM PDT The physical silver coin market is ON FIRE with demand. The bullion banking cabal is in trouble… From Rory Hall, The Daily Coin: The physical silver bullion market is seeing a "perfect storm" brewing according to an article replete with some recent videos about the silver market by Rory Hall of the precious metals website, […] The post A Perfect Storm is Brewing in the Physical Silver Market appeared first on Silver Doctors. |

| Jim Willie Issues Warning Alert: Immediate Risk of Systemic Lehman Event Posted: 03 Jun 2016 01:31 PM PDT The reckoning has begun… Submitted by Jim Willie: The entire Western financial systemic, complete with USDollar-based foundation platforms, is breaking down. The breakdown is in full view, very noticeable, in almost every arena. What happened in 2008 with the Lehman Brothers failure event is currently underway with almost every single financial platform, structural entity, […] The post Jim Willie Issues Warning Alert: Immediate Risk of Systemic Lehman Event appeared first on Silver Doctors. |

| Another 100,000+ Ounces of Gold Get Delivered at 1,209 Yesterday Posted: 03 Jun 2016 12:02 PM PDT Le Cafe Américain |

| Billionaire George Soros Dumps 37% of Stocks To “Buy Up Massive Amounts of Gold” But Why? Posted: 03 Jun 2016 07:11 AM PDT ShtfPlan |

| Three Buying Opportunities in a Resurgent Gold Market Posted: 03 Jun 2016 01:00 AM PDT |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment