Gold World News Flash |

- Prominent Billionaire Investors Warn of Financial Crash, Quietly Position Themselves

- Are Junior Gold Stocks Following 2008-2009 Recovery?

- LOL – Bloomberg: Gold is “without friends”

- Trump U Is Nothing Compared To Laureate Education

- The Criminal Arrogance of Hillary Clinton -- Jim Fetzer

- Billionaire George Soros Dumps 37% of Stocks To “Buy Up Massive Amounts of Gold” But Why?

- The Recovery Lie Exposed -- Dollar Crashes While Gold and Bitcoin Skyrocket

- Gold Price Closed at $1241.10 up $30.30 or 2.5%

- China putting floor under gold, Maguire tells KWN

- "What If?"

- "We're Hungry And Tired" - Protesters In Venezuela March Toward Presidential Palace Demanding Food

- Full Event: Donald Trump Holds Rally in Sacramento, CA (6-1-16)

- How to Profit From a Higher Euro

- Gold Daily and Silver Weekly Charts - And At Last the Weekend

- Derailed! A June Rate Hike Is Off

- How Free Money Leaves Everyone Poorer

- Fed Fears Create Opportunity for Knowledgeable Gold Buyers

- END OF THE WORLD FEARS: A.I. could Use ALL our Resources & DESTROY Humanity

- Another 100,000+ Ounces of Gold Get 'Delivered' at 1,209 Yesterday

- Donald Trump says Hillary Clinton has to go to JAIL!

- Jon Rappoport "Zika Hoax Created By The World Health Organisation To Destroy Brazil's Economy!"

- FTSE 100 pares gains and gold spikes after dire US jobs data shocks markets

- US Dollar Crashes, Gold And Bitcoin Skyrocket As Economic Recovery Lie Is Exposed

- Trump's Rise: America's Last Hope

- The Structure of Collapse: 2016-2019

- Ronan Manly: LBMA gold and silver data is full of mistakes

- US Dollar Plummets - Good Show!

- Negative-yield debt breaks $10 trillion level for first time

- Smart Money Coming into Clean Energy Sector Should Look at Uranium Lithium Deposits

- Physical Silver Bullion – Perfect Storm Brewing in the Market

- Silver Bullion – Perfect Storm Brewing in the Market

- Sir Philip Green accused of 'lamentable failure' over BHS collapse

- The Super Shemitah, Jubilee and How to Prepare For the Coming Economic Collapse - Video

- Three Buying Opportunities in a Resurgent Gold Market

- Breaking News And Best Of The Web

| Prominent Billionaire Investors Warn of Financial Crash, Quietly Position Themselves Posted: 03 Jun 2016 11:50 PM PDT Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason. Coming up Michael Rivero of WhatReallyHappened.com updates us on some of the key developments in the ongoing attempt by the central planners to bring about a one world government, when and why we’re likely to see a massive inflationary uptick in the not too distant future, and how gold and silver may end up being the key beneficiaries as the masses discover them as the safe haven assets to own. Don’t miss our explosive interview with a man who pulls no punches, Michael Rivero, coming up after this week’s market update. After suffering through a sharp pullback in May, gold and silver markets could be eyeing a bottom in the trading so far in June. Gold touched the $1,200 level on Tuesday and managed a small bounce off that key level. As of this Friday morning recording, gold is surging and is up close to $30 so far on the day with the spot price coming in at $1,241 an ounce now, up 2.2% for the week. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Are Junior Gold Stocks Following 2008-2009 Recovery? Posted: 03 Jun 2016 11:43 PM PDT Weeks ago precious metals began a correction amid overbought conditions (in the miners) and very bullish sentiment in the metals. The recent Fed minutes helped accelerate the weakness but it lost steam in recent days. A real stinker of a jobs report completely reversed the thought that the Fed would hike rates in the summer and it sent precious metals surging. As a result, the gold stocks and junior gold stocks especially could be back on the path to making new highs before autumn. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LOL – Bloomberg: Gold is “without friends” Posted: 03 Jun 2016 11:00 PM PDT by Jeff Nielson, Bullion Bulls:

It’s hard not to be a little smug, since this is precisely the Schttp://www.bullionbullscanada.com/images/avatar/ee577d7ead9b93f28cbf3278.jpgript which I have been outlining for the past four months. Take prices up a token amount, call that “a peak” and then precious metals can be taken down hard (like everything else) when the Next Crash is detonated. And don’t be fooled by today’s sudden pop in the price of gold (and to a lesser extent, silver). It’s more of the Script. Why did the price of gold jump today? Because of the “surprisingly bad” U.S. jobs report.

Understand how convenient this is, with these BLS reports being just about the most-heavily fictionalized “statistic” produced by the U.S. government. The Fed, and especially Janet Yellen, has been “talking tough” about raising interest rates. Yes, all the way up to 0.50%.

Then we get this “surprisingly bad” jobs report from the same Liars who have invented more than 11 MILLION non-existent “jobs” over the past 7 years. They could have written any number they wanted. They were ordered to produce a mediocre number, so that a few days from now, Janet Yellen has an excuse to pull back (yet again) from another pledge to raise to interest rates. Then the day after she doesn’t raise rates, the Liars will go right back to their “tough talk” on raising interest rates, and gold and silver prices will fall — just as we have seen through the last 5+ years of Hostage Markets. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trump U Is Nothing Compared To Laureate Education Posted: 03 Jun 2016 10:00 PM PDT by Kurt Nimmo, Infowars:

The Laureate Education went private in August 2007, in a multi billion dollar, risky, hugely leveraged transaction, closed in the last gasp of the bubble. The leveraged buyout was completed around August 2007 for approximately $3 billion in debt plus equity. The driving force behind the deal is of Friend of Bill (FOB) hedge fund king Steven Cohen, a poster child for bad hedge fund behavior. Henry Kravis and his KKR, Goldman Sachs and many others are in.

After the deal closed, the schools had great financial difficulties and these capital suppliers grew concerned. Bill Clinton's pals were feeling squeezed as a profitable exit seemed less and less likely. To dress the deal up in 2010, Bill Clinton was brought in to serve as "Chancellor," a part-time position for which he was collecting $16 million through early 2015. This extraordinary compensation was never properly disclosed until 2015. Many of those on the hook paid Bill and Hillary big fees for speeches as well. Bill Clinton was thus collecting from both Laureate equity and debt suppliers. The Laureate CEO, Doug Becker, is involved as a Clinton backer, Clinton Global Initiative and Clinton Foundation donor and involved in the International Youth Foundation, a recipient of favors and money from the Clinton-led Department of State To dress the deal up in 2010, Bill Clinton was brought in to serve as "Chancellor," a part-time position for which he was collecting $16 million through early 2015. This extraordinary compensation was never properly disclosed until 2015. Many of those on the hook paid Bill and Hillary big fees for speeches as well. Bill Clinton was thus collecting from both Laureate equity and debt suppliers. The Laureate CEO, Doug Becker, is involved as a Clinton backer, Clinton Global Initiative and Clinton Foundation donor and involved in the International Youth Foundation, a recipient of favors and money from the Clinton-led Department of State. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Criminal Arrogance of Hillary Clinton -- Jim Fetzer Posted: 03 Jun 2016 06:42 PM PDT Jeff Rense & Jim Fetzer - The Criminal Arrogance of Hillary Clinton Clip from January 28, 2014 - guest Jim Fetzer on the Jeff Rense Program. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Billionaire George Soros Dumps 37% of Stocks To “Buy Up Massive Amounts of Gold” But Why? Posted: 03 Jun 2016 06:40 PM PDT by Mac Slavo, SHTFPlan:

Why is George Soros moving billions of dollars out of stocks and into gold assets and other precious metals? Perhaps the point of collapse has arrived. The suggestion seems to be that a point of no return is coming for the stock market system of illusion and usury. The Fed's great bubble is getting ready to burst. It is playing out on a time frame decided, undoubtedly, by those closest to the inside. Worse, the end of the U.S. petrodollar is playing out, with plenty of geopolitical drama as currency wars threaten to undo the foundation that the nation has been resting upon. When the music stops, the economy will shatter and collapse in a devastating wave that will catch the vast majority of Americans off guard. It isn't the first time Soros' positions have served as a stark warning. Soros is shifting towards gold because he understands what is coming, and likely has several tricks up his sleeve. According to the experts, fear of the dollar is driving his gold purchases. via Sputnik News:

Watch this video by the Next News Network: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Recovery Lie Exposed -- Dollar Crashes While Gold and Bitcoin Skyrocket Posted: 03 Jun 2016 06:01 PM PDT The real question is......will Janet Yellen have another nervous breakdown in this next meeting? The ones where she can't read her paper, goes silent, and just stares off into the distance or starts to pass out. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1241.10 up $30.30 or 2.5% Posted: 03 Jun 2016 05:59 PM PDT

Well, my, my! Even a blind hog finds an acorn every now & then, & I reckon this blind hog found his'n yestiddy. I told y'all I'd been thinking wrong about silver & gold, looking at patterns, but identifying not the ones ruling the market. I redrew those yesterday, suspicious that metals were near turning around, & look what happened. Well, I didn't do anything. The Nice Government Men in the Bureau of Labor & Statistics did all the heavy liftin', and disappointed the US dollar market & stocks & interest rates. They just stomped off in a big pout. Silver & gold were tickled to death. Since the Fed has announced that it watches the unemployment rate ("jobs report") as its most important gauge for raising interest rates, watchers hung like buzzards on dead oaks waiting for the report today. If it was good, the Fed might raise the discount rate in June. If vanilla, no information. If it showed much lower unemployment, then the brave Rhode Island Reds at the Fed would not dare raise rates. In the event, the Bureau of Labor Statistics report fell dismally short of estimates. Plus the March & April reports, were as usual, revised downward. The dollar tanked, silver & gold rose. But ponder the fable of government employment statistics. If they measured anything really important, government statisticians would change the scale until they got the rosy number the administration wanted. As it is, they are wholly unreliable, BUT if the terrible employment news even filtered through the governments churchifying statisticians, how bad must it have been IN FACT? Thus the entire week was thrown a-gollywoggle with an unexpected happy ending for metals. First let us ponder, stifling our Schadenfreude, that scurvy tapeworm on the world economy, the US dollar index. We tasted today how much speculation was under it, is always under it, keeping it afloat. Remove the chance of a rate rise, and it sank a magnificent 154 basis points (1.61%). Technically the damage was near fatal. It collapsed from the 95+ resistance area and sliced through the 50 & 20 day moving averages. On the chart this now shows a failure even to reach, let alone breach the 200 DMA (now 96.60). Worse, it broke through the upper range boundary it had only escaped on 23 May. In short, the scrofulous dollar looks sorry as gully dirt. It will need a long spell to recover, if it does. Chart's here, http://schrts.co/OkJ5UT Yen & the Euro took the dollar's tumble as their signal to jubilate. Euro rose 1.82% to $1,1356. Yen rose a whopping 2.1% to 93.74¢ per Y100. Let me preface everything else I say with this: IF CONFIRMED. Today appears to have been the watershed for many markets, but follow through must confirm appearance. I'm not going to keep saying "If Confirmed," so y'all just add it yourselves. Inflation markets did not react uniformly to the dollar's plunge. Oil, which you would have expected to make hay of it, went nowhere, down 0.9% to $48.62. Lo, the chart, http://schrts.co/KvfGnd Still looks like its about to break down. Copper juiced, up 2.23% to $2.113. http://schrts.co/02nSGN CRB rose 0.64%, a.k.a., little or nothin'. Yield on 10 year US Treasury notes fell -- WHOA! -- 5.91% to 1.704%. Mercy, fell all the way to the bottom of the 4 month range. Look at it, http://schrts.co/68TDbQ Stocks are fighting, but not effectively, to remain above their 20 & 50 DMAs. Head & shoulder pattern in both Dow & S&P500 will shortly take 'em down in the Market Elevator: "Basement, please!" Dow lost 31.5 (0.18%) to 17,807.06. S&P500 backed off 0.29% (6.13 points)) to 2,099.13. Okay, pack away that Schadenfreude and gloating, & let's look at the Dow in Gold like adults. Chart's here, http://schrts.co/8Sv0tc The Dow in Gold since march has formed a megaphone reversal. Today it ricocheted off the top boundary of that megaphone, which was almost the 200 DMA, and fell plumb back to the uptrend line form the 2011 low. Turned down today, settled at 14.33 oz. Dow in Silver fell 2.79% today to 1,038.15 oz. Its upward correction never even reached the 200 DMA, today it fell sharply and Monday should fall through its 50 DMA. Why, would y'all LOOK at that! Silver popped up 34.1¢ (2.1%) to 1634.6¢. Gold -- am I reading this right, or does that have one zero too many in it? -- rose $30.30 (2.5%) to $1,240.10. Both of them rose straight up at 9:30 when the employment report was released. Y'all go look at the gold chart first, http://schrts.co/keWFnm That range bounded by the heavy pink lines appears to be ruling gold. It bumped into the bottom line with a $1,201.50 low this week, and today bounced stupendously, clean to the 50 day moving average ($1,247.77). The RSI bounced up, the volume rise confirmed the price rise, momentum turned up, and the rate of change has stopped falling & turned up. Mercy! What do y'all need, an engraved invitation? But gold needs to confirm this performance by improving it, crossing above the 50 & 20 DMAs next week. Since we are entering a weak season for gold (June-July), we may have to endure a lengthy crabwalk. But tuck this away: as long as it stays above $1,201.50, we have seen the low. In a bull market, surprises always come to the upside. Today's surprise said that gold will not revisit the 200 DMA. That also makes sense, looking at the chart. Falling all the way back to that 200 DMA would look weak after that bold, fierce climb out of that bowl in January. Now y'all switch to silver's chart, http://schrts.co/aLdx54 RSI turned up sharply. Silver bounced off lateral support and off that uptrend from January. It touched the 50 DMA (1647¢) & closed not far below it. Volume confirmed the higher price. Momentum (MACD) turned up. Today's performance shouts that the pattern ruling silver is that range marked by the green lines: The uptrend line from the January low bounding the range bottom. Assuming silver can advance next week through the 50 & 20 DMAs & generally behave itself and improve its gains, we will not again in this lifetime see silver below 1600¢. I can't resist saying it once more: IF CONFIRMED. Don't forget the gold/silver ratio, http://schrts.co/fbhoU8 Consistent with my interpretation that silver & gold have completed their correction & bottomed, the ratio remains below the 200 DMA and the lower boundary line it punched through in April. Ratio confirms. Now it needs to drop, or at leas move sideways a while.. Last Wednesday I appeared on David Simpson's True Money Show. He's a talented interviewer. You can download the podcast at http://bit.ly/1Uj0ZEw I have one more week with this K-wire sticking out of my toe. Next Friday it's coming out! I appreciate with all my heart your kind prayers which have sped my recovery. Y'all enjoy your weekend. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China putting floor under gold, Maguire tells KWN Posted: 03 Jun 2016 05:27 PM PDT 8:26p ET Friday, June 3, 2016 Dear Friend of GATA and Gold: As it increasingly encourages its people to buy gold, China is putting a floor under the gold market, London metals trader Andrew Maguire tells King World News today. Maguire adds that he thinks China may be preparing to announce a more accurate tonnage of its gold reserves, compiling gold now hidden among government institutions other than the central bank. An excerpt from the interview is posted at KWN here: http://kingworldnews.com/alert-andrew-maguire-says-china-just-put-huge-f... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Jun 2016 04:00 PM PDT Via ConvergEx's Nick Colas,

What if President John Kennedy had rolled out of Dealey Plaza unharmed? Would he have avoided a larger military entanglement in Vietnam? Or more quickly embraced the civil rights movement than his successor? Would it have been John Jr running for President in 2008, or now? And would Marilyn Monroe ever have become first lady, as she reportedly told Jackie was her goal? The term for that kind of scenario analysis is “Counterfactual thinking” – considering possible alternative events to those that actually occurred. What if you had majored in Classics instead of Business, or married someone besides your current spouse? How would your life be different? Would you be happier? Poorer, but happier? (Yes, that’s a thing.) Today we’ll unpack the current U.S. market through the lens of 5 counterfactuals, all anchored in a prior reality: where the world was 155 days ago, at the end of 2015. Our goal is to highlight what has taken the S&P 500 to its highest point in 2016 and assess the sustainability of current valuations and market dynamics. #1: What if global interest rates were the same as 12/31/2016? Since the start of the year, global long term interest rates have fallen dramatically: · US 10 year Treasuries went from a 2.24% yield to 1.80% today. · German 10 year Bunds yield just 11 basis points now, down from 64% bp on New Year’s. · Japanese 10 year government bonds now sport a negative 11 basis point yield, down from 27 basis points at the start of 2016. The reasons for these declines are largely due to punk economic growth in Europe and Japan combined with central bank bond buying in those regions. This has pulled U.S. rates lower in their wake, even though domestic economic growth is grinding modestly higher. Lower rates make equities look more attractive (at 2.1% the S&P 500 yields more than a 10 year Treasury) and, voila, you have a rally in U.S. stocks. Our Answer: U.S. Equities would likely be down on the year if interest rates were unchanged. The tipping point here relates to economic and corporate earnings growth balanced against nominal interest rates. The central narrative surrounding capital markets is that global growth is very slow for a variety of fundamental reasons. Therefore if global yields were unchanged even with current central bank bond buying, it would be due to an increasing fear of inflation. Good for policymakers and their goals, but likely bad for stocks. #2 – What if crude oil prices were unchanged in 2016? The year began with spot West Texas Intermediate trading at $37/barrel and now trades for $49/barrel, up 32% YTD. The move higher has both lifted large cap energy stocks by 10.8% and reassured capital markets that we are not at the brink of global recession. Many investors look at oil prices as the blood pressure reading of the world economy – you don’t want it too high (inflationary hypertension) or too low (deflationary coma). Our Answer: higher oil prices have been very helpful in reestablishing investor confidence in everything from U.S. economic growth (we are still by far the largest oil consumer country in the world) to Chinese economic expansion (they are #2) to the relative stability of many oil-producing countries. The most easily quantifiable benefit: at 7% of the S&P 500, the energy sector’s 10.8% YTD rally means that oil’s rise is responsible for some 25% of the entire rally this year in large cap U.S. stocks. #3 – What if the dollar hadn’t weakened by 3% this year, but was instead unchanged? Based on the DXY Dollar Index, the U.S. greenback has been on a bit of a wild ride this year, starting at 98.75, dropping to 92, and then bouncing to a close today of 95.6. Put another way – the dollar has been almost as volatile as stocks. At its current level, it suits U.S. monetary policymakers to a “T” – just weak enough to help the earnings of large multinational companies (who might expand and hire due to better earnings) but strong enough of late to confirm that the Fed’s message of a potential rate increase is getting through. Our Answer: this one might not matter much to the current level of U.S. equities. The net change year-to-date, just 3%, still leaves the dollar below where it has traded for much of the time since early 2015. Any dramatic strengthening would likely hurt equities, unless it came with a healthy dose economic growth. #4 – What if tech investors still thought smartphones were a global growth category? Apple may be just one company, but it is still has the largest single weighting in the S&P 500, at 2.97%. Microsoft holds the #2 spot, at 2.28% and the dual classes of Alphabet combine to 2.39%. That means that Apple’s key market – global smartphones – is important to the equity market as whole. Our Answer: As with the dollar, Apple’s move (down 7% for the year) doesn’t overly change general market returns. If Apple were flat on the year, the S&P would only be 0.21% higher. #5 – What if Donald Trump were not the Republican nominee for President? I think if you had asked market participants a year ago “Where would you guess the S&P 500 was trading if I told you that in one year’s time Donald Trump were the Republican Party candidate for President”, the answers would have ranged from 1,000 to 1,500. Surely that kind of unexpected turn of events must have tied to a market meltdown, large geopolitical shock, or both. And yet here we are. The only way to square the circle is to assume that investors think the chance of a Donald Trump presidency is essentially zero, because here we are at 2016 highs. Our Answer: Stocks would likely be exactly where they are now if Mr. Trump were not the nominee. The more important observation is actually “Why are capital markets ignoring the social message that his success (and to a similar degree Senator Sanders’ rise) seems to be delivering to Wall Street’s front door?” Yes, the Electoral College and demographic decks seem stacked against Donald Trump, but that doesn’t negate the reason he got as far as he did. Remember when Jeb Bush was the seeming favorite? It wasn’t that long ago. Our bottom line here is that two of our counterfactuals neatly illuminate why U.S. stocks are working: lower interest rates and stable-to-rising oil prices. The former underpins market valuations, the latter sends soothing signals about global economic growth and supports hopes for an earnings rebound in the energy sector. As for when – or even if – markets get around to pondering what a Trump campaign signals about broader social issues, I doubt we’ll need counterfactuals to illuminate those messages once they come along. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| "We're Hungry And Tired" - Protesters In Venezuela March Toward Presidential Palace Demanding Food Posted: 03 Jun 2016 03:30 PM PDT Last month we showed just how severe the collapse in Venezuela had become, as starving Venezuelans took to looting supermarkets and other food dispensaries in search of whatever food could be found. Despite having the world's biggest oil reserves, Venezuelans are suffering from severe shortages of food and electricity, on top of inflation that makes it difficult to buy anything to begin with. Angry citizens have had enough, and again took to the streets yesterday to march on the presidential palace, Chanting "No more talk. We want food!". Once protesters were within about a half dozen blocks of the palace, police in riot gear blocked the road and began firing tear gas. A protester named Jose Lopez said he and several others were neither government supporters nor opposition members, they just wanted food: "We have needs. We all need to eat" Lopez told journalists. Another protester said "I've been here since 8 in the morning. There's no more food in the shops and supermarkets. We're hungry and tired." As citizens literally starve, Maduro blames the fall in global oil prices and an "economic war" by his foes seeking a coup for the issues his country is facing. "Every day, they bring out violent groups seeking violence in the streets. And every day, the people reject them and expel them." Miguel Perez, the government's top economic official, said "we know this month has been really critical. It's been the month with lowest supply of products. That's why families are anxious. We guarantee things will improve in the next few weeks." Unfortunately, the crisis worsens every day in Venezuela, and people aren't going to wait weeks before they can get enough to feed their families. With the decision whether or not to hold a recall referendum to oust Maduro officially put on hold, the scene is set for the crisis to become even more severe. * * * More From Caracas

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full Event: Donald Trump Holds Rally in Sacramento, CA (6-1-16) Posted: 03 Jun 2016 02:30 PM PDT Wednesday, June 1, 2016: Full replay of the Donald J. Trump for President rally in Sacramento, CA at Sacramento International Jet Center. Full Event: Donald Trump Holds Rally in Sacramento, CA (6-1-16) The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How to Profit From a Higher Euro Posted: 03 Jun 2016 02:00 PM PDT This post How to Profit From a Higher Euro appeared first on Daily Reckoning. The euro's heading higher from its lowest levels in five years. This is part of the secret "Shanghai Accord" struck by the "Big Four" economic powers (China, Japan, U.S. and Europe) on Feb. 26, 2016. Investors who act now will have big gains in the year ahead. Here's a quick refresher on the Shanghai Accord. The Big Four needed to find a way to cheapen the yuan to stimulate the Chinese economy, which is slowing dangerously. The last two times China cheapened the yuan against the dollar (August 2015 and January 2016), the U.S. stock market fell out of bed. There was a borderline stock market collapse both times. The solution they agreed to was to keep the yuan pegged to the dollar and cheapen the dollar. This gave China, and the U.S., some relief. The losers were Japan and Europe, which had to endure a stronger yen and euro, respectively. That's not what Japan and Europe wanted, but too bad. In currency wars, if someone wins (China and the U.S.), then someone else has to lose (Europe and Japan). It can't be any other way. We've recently explored the impact of the Shanghai Accord on three of the four affected currencies: the dollar, yuan and yen. Today, we complete the overview with a look at the euro. By the way, after two months of strength, the euro and yen both weakened recently, and the dollar rallied. This occurred because of fresh talk about a Fed rate hike in June, which makes dollar assets more attractive. (Gold traded down for the same reason.) A lot of commentators asked if the Shanghai Accord was dead (if it ever existed). The Shanghai Accord is alive and well, but it's not a day trade. It's intended to guide currency policy among the major economies for at least a year, possibly two. That's why we gave it the name "Accord," as a tribute to the Plaza Accord of 1985, which guided exchange rates for over 20 years (with a reset at the Louvre Accord, in 1987). That period 1985–2007 was the heyday of King Dollar. It lasted through Republican and Democratic administrations, under Treasury secretaries James Baker and Robert Rubin. We don't have to assume the Shanghai Accord will last that long. We can take the analysis one year at a time. The point is that you don't reach an agreement of that importance in February and tear it up in May. The Shanghai Accord will be a good guide to portfolio allocation for the foreseeable future. We always expected volatility along the way. We'll see what the Fed does later this month. The problem with the hawkish Fed-speak is that markets begin to expect a rate hike, tighten financial conditions, cool off the stock market and put stress on the export sector (because of a stronger dollar). By the time the Fed meeting arrives, the Fed has decided to delay a rate hike because of the tighter conditions. Then markets rally, and the dollar drops again because a no rate hike decision is seen as dovish. Wash, rinse and repeat. The Fed has been playing this circle game with market expectations since May 2013 and the original Bernanke "taper talk." If the Fed does hike rates this month, they'll be playing with fire. Higher rates cause a stronger dollar, which will force China to devalue on its own. We're already seeing some signs of this. In that case, it's back to a January-style stock market collapse. That's one more reason I expect the Fed to delay the rate hike again. Either way, the Shanghai Accord is still alive, and the euro is expected to go significantly higher over the next year, if only to give China the relief it needs. The euro is the currency of the eurozone, a group of 19 countries who are members of the European Union. (There are nine additional members of the European Union that do not use the euro, notably the U.K., which is an EU member but retains the pound sterling.) The European Central Bank, ECB, controls monetary policy in the eurozone using the same techniques the U.S. Federal Reserve uses for the dollar. One technique the ECB has implemented, which the Fed has not yet adopted, is the use of negative interest rate policy, NIRP. As the name implies, NIRP is a policy in which interest is deducted from a bank account instead of added over time. If you deposit €100,000 in a bank account with a negative rate of 0.50% and wait one year, your account balance will be €99,500. NIRP is spreading around the world like a contagious virus. NIRP is already the norm in the eurozone and Japan, two of the four largest economies in the world, alongside the U.S. and China. Other countries with negative interest rates include Denmark, Sweden and Switzerland. Negative interest rates have not hit the U.S. yet, but the possibility is under active consideration by the Federal Reserve. About $4 trillion of sovereign debt, a substantial percentage of all the non-U.S. sovereign debt in the world, now has a negative yield to maturity. Why are central banks including the ECB imposing negative interest rates? What is the point of this policy? One answer is that negative interest rates are a thinly disguised tax on savers. The traditional way of stealing money from savers is with inflation. You may get a positive interest rate of 2% on your money, but if inflation is 3%, then your real return is negative 1%. If we take the same €100,000 bank deposit in the example above and apply a 2% positive interest rate, you would earn €2,000 in interest, leaving an account balance of €102,000 after one year. But after adjusting for 3% inflation, the purchasing power of the €102,000 balance is only €98,940. This leaves the saver worse off than in the negative interest rate example above (assuming no inflation in that case). In the first case, the banks extracted €500 through negative interest rates. In the second case, they extracted €1,060 in lost purchasing power. Any way you look at it, you lose. That's the reality. The second answer is the academic theory behind negative interest rates. In theory, savers will be dissatisfied with NIRP and react by spending their money. Likewise, entrepreneurs will find negative interest rates attractive because they can borrow money and pay back less to the bank. This combination of lending and spending by consumers and entrepreneurs alike will lead to consumption and investment that will stimulate the economy, especially after the famous Keynesian "multipliers" are piled on top. This theory is junk science. The reality is the opposite of what the elite academics project. The reason savers are saving in the first place is to achieve some future goal. It could be for retirement, children's education or medical expenses. When negative rates are imposed, savers don't save less; they save more in order to make up the difference and still meet their goals. The other unintended consequence of NIRP is the signal it sends. Savers rightly conclude that if central banks are using NIRP, they must be worried about deflation. In deflation, prices drop. Consumers defer spending in order to get lower prices in the future. Instead of inducing savers to save less and spend more, NIRP causes savers to save more and spend less. It's a perfect example of the law of unintended consequences. When abstract academic theories are applied in the real world by central bankers with no real-world experience, you get the opposite result of what's intended. These unintended consequences are already appearing in Japan and Europe. Serious doubt has been cast on the ability of central bankers to extend NIRP beyond current levels. However, cross-rates are driven by capital flows much more than trade flows. A strong euro implies that global investors have a preference for euro-denominated assets, such as German government bonds. But why would investors want assets with negative yields? The answer is that yields are not the only way to win on these investments. The other way is capital gains from currency appreciation. This brings up the issue of the numeraire, or the base currency you use to calculate profit and loss. A euro-based investor has no currency gain from a euro-denominated investment. But as a dollar-based investor, you can have huge gains if you invest on an unhedged basis in a currency that is on its way up. Take the following example: You begin with $1 million to invest. You convert to euros at $1.12 (about the current exchange rate). This gives you €892,857 to invest. You buy German bonds with a negative yield of 1%. After a year, your bonds are worth €883,928, a slight loss measured in euros. But if the euro rose to $1.25 in that year, your euro proceeds would be worth $1,104,910. That's a 10.5% profit on essentially risk-free German bonds. So it can make a great deal of sense for U.S. investors to buy euro assets with negative yields. The big question is will the euro go up? Currencies are different from securities. Stocks and bonds can go to zero if the issuer defaults. That's not true with major currencies. They trade up and down in a range, but they never go to zero, except in extreme cases like Venezuela or Zimbabwe. The euro is trading near the bottom of a five-year range. It has tested the $1.05 bottom twice and rebounded both times. This resilience happened before the Shanghai Accord. In the eurozone, further quantitative easing and deeper negative rates are off the table, according to ECB head Mario Draghi. The ECB will keep the current stimulus in place, but not add to it. That's part of the Shanghai Accord. If the euro trades up to the middle of its 2011–15 range, about $1.30, that's a 19% gain for a U.S. dollar investor. And this can be done without the risk of investing in stocks and bonds. Over a year ago, I said the euro would not go to par ($1.00 = €1.00). At the time, Wall Street was certain the euro would trade below par. I called a bottom at $1.05. And that's exactly what happened. As the German bond example above shows, there are many ways to profit from a rising euro even in a negative interest rate environment. And a rising euro is a distinct possibility as the Shanghai Accord plays out. Regards, Jim Rickards P.S. Another dollar crisis is coming. It's not a question of if, but when. And gold could soar to record levels when it strikes. If you own gold beforehand, you can preserve – and grow – your wealth. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. Don't buy any gold until you read it. We'll send you your report when you sign up for the free daily email edition of The Daily Reckoning. Every day you'll get an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE and claim your special report. The post How to Profit From a Higher Euro appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - And At Last the Weekend Posted: 03 Jun 2016 01:53 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Derailed! A June Rate Hike Is Off Posted: 03 Jun 2016 01:34 PM PDT This post Derailed! A June Rate Hike Is Off appeared first on Daily Reckoning. Expecting a rate hike this month? Well… The Labor Department released its latest jobs report this morning. It showed the economy added only 38,000 jobs in May — the lowest number since September 2010. The Dow coughed up about 100 points on the news. It's clawed its way about 70 points higher at writing, but the point was made. Meanwhile, gold soared $30 higher today on the news. It had been dropping for weeks on the talk of a possible rate hike. No longer. If you question the predictive power of economists, give yourself a gold star. These numbers were more than twice as bad as the lowest forecast in a Bloomberg survey of economists. The most pessimistic economist in that survey predicted 90,000 jobs. Cherry atop the sundae: A record 94,708,000 remained outside the U.S. labor force last month — 664,000 more than in April. The labor force participation rate dropped to 62.6%, to a 38-year low. But are the latest jobs numbers a mere one-off, a chance detour on the road to jobs nirvana? After all, all the talk lately has been of the strengthening labor market. "The slowdown in job growth looks pretty pervasive across industries," says Michael Feroli, chief U.S. economist at JPMorgan Chase, as reported in Bloomberg. "It raises some questions about the momentum of growth and about the outlook." Sure does. But everyone wants to know about its effect on a possible rate hike this month. How about it, Mr. Feroli? "The easy thing to say is this takes June off the table for a Fed hike." "That was very disappointing and adds a lot of uncertainty to a market that was gearing up for a summer rate hike from the Fed," adds Allan von Mehren, chief analyst at Danske Bank. The Fed's always blabbing that its decisions are "data dependent." If so, then the latest jobs report appears to rule out this month. But does it necessarily? James Bullard, president of the Federal Reserve Bank of St. Louis, says that a June rate hike could still get the green light because the markets have already baked it into the cake. "But that's flat-out wrong," says Jim Rickards, snapping his fingers at Bullard. "Markets have increased the probability of a rate hike this year, but the expectation is still below 50%. If the Fed hikes rates in June, markets will react sharply to adjust expectations from 50% to 100%, because expectations of future rate hikes will increase also." Bullard isn't looking far enough down the road. A rate hike this month will increase expectations of additional hikes. And what does Jim expect if the Fed does raise? "If last December's 'liftoff' is any guide, the Dow Jones industrial average could crash 2,000 points by the end of July… Bullard is simply incorrect if he thinks a rate hike is priced in." Traders agree with Jim, as they now give a June rate hike dark-horse odds of 6%. Whose eyes will be riveted on the Fed this month? China's. China wants a soft dollar to keep a lid on the yuan. A weak dollar also stems capital outflows that would otherwise seek higher-yielding dollar-denominated assets (further explanation below). The U.S. and China will be holding their annual Strategic and Economic Dialogue (S&ED) in Beijing this coming Monday and Tuesday. And Jim Rickards will be paying close attention: "China's message to the U.S. is to go slow and don't rock the boat with rate hikes right now. So what's China's secret plan to find out the Fed's intentions? They plan just to ask their U.S. counterparts when they're all together in Beijing! We'll see if the U.S. gives them a straight answer and if the Chinese drop any clues afterward. Either way, I'm watching them." Below, Jim shows you how investors who understand the "Shanghai Accord" will see "big gains in the year ahead." But they'll come from a source few investors consider. What is it? Read on… Regards, Brian Maher P.S. The Federal Reserve might reduce rates again or launch another round of QE to stimulate the failing economy. And gold should soar on the weaker dollar. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. We'll send it to you when you sign up for the free daily email edition of The Daily Reckoning. We break down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. Click here now to sign up for FREE and claim your special report. The post Derailed! A June Rate Hike Is Off appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Free Money Leaves Everyone Poorer Posted: 03 Jun 2016 01:19 PM PDT This post How Free Money Leaves Everyone Poorer appeared first on Daily Reckoning. BALTIMORE – A dear reader reminded us of the comment, supposedly made by Groucho Marx: "A free lunch? You can't afford a free lunch." He was responding to yesterday's Diary about the national referendum in Switzerland on Saturday. Voters will decide whether to give all Swiss residents a free lunch – a guaranteed annual income of about $30,000 a year. Destroying LivesThe problem with a guaranteed income (you get it no matter whether you have a job or not) is something we've been writing about for the last 15 years. It is the problem with all frauds… all cockamamie, jackass redistribution programs… and all something-for-nothing schemes. And it is the same whether you are "stimulating" an economy with artificial, phony-baloney "money"… giving aid to foreign dictators… or handing out free lunches to voters at home. The Deep State, in addition to being malignant and entertaining, is incompetent. It fights wars just to lose them. It solves problems and makes them worse. Led by the Yellen Fed, it "improves" the economy and leaves 9 out of 10 people poorer than they were before. Today, we turn to a special war – the War on Poverty. Jesus dismissed it. "The poor you will always have with you," he said. But that didn't stop the feds from launching an attack. Fortunately, they are so clumsy, lame, and incompetent, they spare us a worse disaster. Had they been smarter and better organized, they would have done even more damage. Mission Accomplished!President Lyndon Johnson launched his War on Poverty more than a half-century ago. Since then, the feds have spent more than $16 trillion on anti-poverty campaigns. There are today as many poor people in the U.S. as there were then – about 39 million. Already, we applaud the feds: They didn't make it worse! And they could have. They've spent $16 trillion. That's about $1.7 million for each poor family of four… enough to wipe out poverty for the whole clan. But now, the "good government" conservatives have their calculators out. They say the war could be fought much more efficiently by simply handing each poor family a million bucks. Problem solved! The "poor" would be overnight millionaires. Mission accomplished! And think of the economic stimulus it would bring! Especially to certain segments of the economy. All of a sudden, a tidal wave of buying power would hit the markets like a U.S Navy cruiser plowing into a dockside brothel. Cocaine prices would soar! As for black Escalades with tinted windows… GM wouldn't be able to turn them out fast enough. For a few months, the poverty problem would be solved… and replaced by plenty of other problems. Then, the poor would go back to being poor, and the poverty fighters could pick up their weapons again. The Devil and Idle HandsFree money is a blind menace: It ruins the rich and the poor alike. And the more money you apply to the task… the more people you can ruin. That's why children of rich parents are often more corroded than those of the poor; the rich have more money to spend on them. In Aspen, Colorado, for example – an enclave of wealth – levels of depression and drug use among adolescents are higher than in poor communities. Taking money for nothing is an easy habit to get into… and a hard habit to break. Poor people – in U.S. inner cities and African countries – have few defenses; even a little handout gives a strong rush. Soon, they are hooked. Local industries disappear; they can't compete with free goods and services. Bad habits proliferate; crime and violence rise, as the devil and idle hands find each other. As we hinted in our review of the graduation ceremony at the University of Vermont, it's not caring that causes people to make economic progress. It's need. And it's not the abundance of capital that causes people to want to add more of it; it's the scarcity of it. Take away the need… and you undermine the whole thing. People even stop caring. Honest MoneyOne of the key innovations that built modern civilization was money. It made possible to move wealth through space and time. Money rolled. You could do business with someone you didn't know – from a different tribe… a different language… and a different culture. You didn't care what he thought or what gods he worshipped. His money was as good as anyone else's. This is what allowed people to specialize at doing what they did best. They didn't have to do everything themselves. They could focus on their most productive enterprise and then trade part of the output with others. If they lived in a warm place, they could grow bananas or oranges and trade with people farther north for wheat and other grains. Goods and services began to move around (often with invading armies) carrying with them new ideas and innovations that helped everyone move ahead. It is no surprise that tribes that have been cut off on remote islands or in isolated valleys are usually more primitive than the rest of us. They haven't had the advantage of contact, trade, and exchange. Money permitted wealth to transcend time, too. You build something. You sell it. You hold the money in your purse. Ten years later, you can still spend the wealth you created a decade earlier. Or, borrowing money, you could use someone else's money – based on wealth created long ago – to create future wealth… with which you could pay him back and still have something left over for yourself. Money didn't come from nothing; it came from something. It had to be honest money, not fraudulent money created by central banks or central governments. And it couldn't be stolen. Instead, it had to be earned – from work, investment, trade, commerce, and industry. It was the product… the fruit… of effort. Not of idleness. And it brought with it a whole new spirit, a new ethic, and a new philosophy about how the world worked. "Do unto others as you would have them do unto you" was how Jesus put it in the Sermon on the Mount. And woe to the chiselers: "Every branch in me that beareth not fruit… he taketh away." If you are going to get, in other words, you'll have to give. Remove the need to give as well as to take, and you muck up the whole thing. No need to plant if you don't have to reap. No need to say "please" and "thank you"… or to get up and warm your oven at 4 a.m… if you get a check even without baking a single loaf. And no need to save your money and invest it wisely if you have access to pseudo-savings in unlimited quantity. Free money creates the illusion of wealth – in a family or an economy – and leaves everyone poorer. Regards, Bill Bonner P.S. Another dollar crisis is coming. It's not a question of if, but when. And gold could soar to record levels when it strikes. If you own gold beforehand, you can preserve – and grow – your wealth. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. Don't buy any gold until you read it. We'll send you your report when you sign up for the free daily email edition of The Daily Reckoning. Every day you'll get an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE and claim your special report. The post How Free Money Leaves Everyone Poorer appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fed Fears Create Opportunity for Knowledgeable Gold Buyers Posted: 03 Jun 2016 12:31 PM PDT Guest Post from Goldco Precious Metals Is "Accepted Wisdom" the smart gold buyer's secret weapon? Everybody knows when interest rates go up, gold goes down. It's just common knowledge. Except you... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| END OF THE WORLD FEARS: A.I. could Use ALL our Resources & DESTROY Humanity Posted: 03 Jun 2016 12:28 PM PDT END OF THE WORLD FEARS: AI could use all our resources and DESTROY humanity. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Another 100,000+ Ounces of Gold Get 'Delivered' at 1,209 Yesterday Posted: 03 Jun 2016 11:45 AM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Donald Trump says Hillary Clinton has to go to JAIL! Posted: 03 Jun 2016 11:00 AM PDT Hillary Clinton has to go to jail!': Donald the counter-puncher clobbers his Democratic challenger over her classified emails as he says watching her anti-Trump speech was 'like taking Sominex' The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jon Rappoport "Zika Hoax Created By The World Health Organisation To Destroy Brazil's Economy!" Posted: 03 Jun 2016 10:30 AM PDT Same story, another place...anyone with a memory of over a year or so would recall the 'hysteria' around Sochi, Russia and the 'imminent toothpaste problems' on the airlines....etc etc etc. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FTSE 100 pares gains and gold spikes after dire US jobs data shocks markets Posted: 03 Jun 2016 09:52 AM PDT This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Dollar Crashes, Gold And Bitcoin Skyrocket As Economic Recovery Lie Is Exposed Posted: 03 Jun 2016 09:43 AM PDT It’s going to be a long weekend for those holding stocks and believing in the “recovery” lie. Today, the US government released its jobs report and the market was expecting an additional 200,000 jobs were added in May. Instead, the number came in at a paltry 38,000. One analyst, Naseem Aslam of Think Forex UK said, “The U.S. nonfarm payroll data was crazy and completely unbelievable and this is the last set of important data before the Fed meeting. When you look at the data set, it really boggles your mind because the unemployment rate has ticked lower. The productivity picture is even more confusing as it is not increasing.” | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trump's Rise: America's Last Hope Posted: 03 Jun 2016 09:30 AM PDT We need Donald Trump. Our country is a mess and he is our last hope. I am a first time voter who will be voting Trump. We need to Make America Great Again! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Structure of Collapse: 2016-2019 Posted: 03 Jun 2016 09:29 AM PDT This post The Structure of Collapse: 2016-2019 appeared first on Daily Reckoning. The end-state of unsustainable systems is collapse. Though collapse may appear to be sudden and chaotic, we can discern key structures that guide the processes of collapse. Though the subject is complex enough to justify an entire shelf of books, these six dynamics are sufficient to illuminate the inevitable collapse of the status quo. 1. Doing more of what has failed spectacularly. The leaders of the status quo inevitably keep doing more of what worked in the past, even when it no longer works. Indeed, the failure only increases the leadership's push to new extremes of what has failed spectacularly. At some point, this single-minded pursuit of failed policies speeds the system's collapse. 2. Emergency measures become permanent policies. The status quo's leaders expect the system to right itself once emergency measures stabilize a crisis. But broken systems cannot right themselves, and so the leadership is forced to make temporary emergency measures (such as lowering interest rates to zero) permanent policy. This increases the fragility of the system, as any attempt to end the emergency measures triggers a system-threatening crisis. 3. Diminishing returns on status quo solutions. Back when the economic tree was loaded with low-hanging fruit, solutions such as lowering interest rates had a large multiplier effect. But as the tree is stripped of fruit, the returns on these solutions diminish to zero. 4. Declining social mobility. As the economic pie shrinks, the privileged maintain or increase their share, and the slice left to the disenfranchised shrinks. As the privileged take care of their own class, there are fewer slots open for talented outsiders. The status quo is slowly starved of talent and the ranks of those opposed to the status quo swell with those denied access to the top rungs of the social mobility ladder. 5. The social order loses cohesion and shared purpose as the social-economic classes pull apart. The top of the wealth/power pyramid no longer serves in the armed forces, and withdraws from contact with the lower classes. Lacking a unifying social purpose, each class pursues its self-interests to the detriment of the nation and society as a whole. 6. Strapped for cash as tax revenues decline, the state borrows more money and devalues its currency as a means of maintaining the illusion that it can fulfill all its promises. As the purchasing power of the currency declines, people lose faith in the state's currency. Once faith is lost, the value of the currency declines rapidly and the state's insolvency is revealed. Each of these dynamics is easily visible in the global status quo. As an example of doing more of what has failed spectacularly, consider how financialization inevitably inflates speculative bubbles, which eventually crash with devastating consequences. But since the status quo is dependent on financialization for its income, the only possible response is to increase debt and speculation—the causes of the bubble and its collapse—to inflate another bubble. In other words, do more of what failed spectacularly. This process of doing more of what failed spectacularly appears sustainable for a time, but this superficial success masks the underlying dynamic of diminishing returns: each reflation of the failed system requires greater commitments of capital and debt. Financialization is pushed to new unprecedented extremes, as nothing less will generate the desired bubble. Rising costs narrow the maneuvering room left to system managers. The central bank's suppression of interest rates is an example. As the economy falters, central banks lower interest rates and increase the credit available to the financial system. This stimulus works well in the first downturn, but less well in the second and not at all in the third, for the simple reason that interest rates have been dropped to zero and credit has been increased to near-infinite. The last desperate push to do more of what failed spectacularly is for central banks to lower interest rates to below-zero: it costs depositors money to leave their cash in the bank. This last-ditch policy is now firmly entrenched in Europe, and many expect it to spread around the world as central banks have exhausted less extreme policies. The status quo's primary imperative is self-preservation, and this imperative drives the falsification of data to sell the public on the idea that prosperity is still rising and the elites are doing an excellent job of managing the economy. Since real reform would threaten those at the top of the wealth/power pyramid, fake reforms and fake economic data become the order of the day. Leaders face a no-win dilemma: any change of course will crash the system, but maintaining the current course will also crash the system. Welcome to 2016-2019. Regards, P.S. The most entertaining and informative 15-minute read of your day. That describes the free daily email edition of The Daily Reckoning. It breaks down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. In a way you're sure to find entertaining… even risqué at times. Click here now to sign up for FREE. The post The Structure of Collapse: 2016-2019 appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ronan Manly: LBMA gold and silver data is full of mistakes Posted: 03 Jun 2016 07:45 AM PDT 10:45a ET Friday, June 3, 2016 Dear Friend of GATA and Gold: Monetary metals researcher Ronan Manly shows today how recent statements by the London Bullion Market Association about world gold and silver production are full of mistakes, including the silliest arithmetical errors. Manly's analysis is headlined "Apples and Oranges: An Update on LBMA Refinery Statistics and GFMS" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/ronan-manly/lbma-refinery-statistics-g... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Dollar Plummets - Good Show! Posted: 03 Jun 2016 07:30 AM PDT USD/DXY plummeted to a low of 93.99 this morning. This falls into line with my thesis that lower stock values also means a lower dollar price. USD is now beneath its 50-day Moving Average a 94.62 and is on a sell signal. We may see a bounce at the Cycle Bottom support at 92.92, with one final plunge to its target. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Negative-yield debt breaks $10 trillion level for first time Posted: 03 Jun 2016 07:27 AM PDT By Eric Platt and Mamta Badkar Negative-yielding government debt has risen above $10 trillion for the first time, enveloping an increasingly large part of the financial markets after being fueled by central bank stimulus and a voracious investor appetite for sovereign paper. The amount of sovereign debt trading with a sub-zero yield climbed 5 percent in May from a month earlier to $10.4 trillion, buoyed by rising bond prices in Italy, Japan, Germany, and France, according to rating agency Fitch. Yields fall as the price of the underlying bonds climbs. The ascent of the negative yield, which first affected only the shortest maturing notes from highly rated sovereigns, has encompassed seven-year German Bunds and 10-year Japanese government bonds as both the European Central Bank and Bank of Japan have cut benchmark interest rates and launched bond-buying programmes. On Wednesday the ECB left its main deposit rate for bank reserves unchanged at minus 0.4 percent. ... ... For the remainder of the report: http://www.ft.com/intl/cms/s/0/37eb6964-2908-11e6-8ba3-cdd781d02d89.html ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

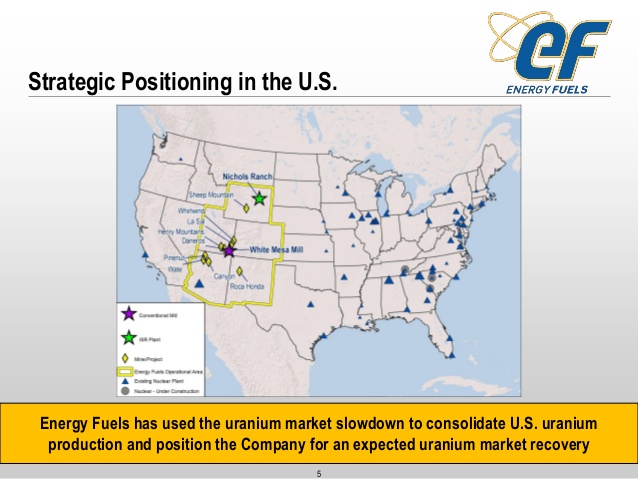

| Smart Money Coming into Clean Energy Sector Should Look at Uranium Lithium Deposits Posted: 03 Jun 2016 06:51 AM PDT (Excerpted from Premium Report 5-31-16) Uranium continues to drop to breathtaking 5 year lows despite being the most crucial clean and carbon free energy source. However, these low prices can be cured quite quickly by a black swan and I am positioned for this sort of move. Attention should be paid to the restructuring of the deal between Cameco and Kazakhstan. Kazakhstan is the world’s largest uranium producing nation but as I have always written is not a secure supplier of this strategic clean energy metal and at any time could make moves to squeeze foreign operators like Cameco or Areva possibly nationalizing their assets. The Government is being hurt by low uranium prices and these producers are cutting back due to the low price. This means Kazakhstan is putting pressure even on the lowest cost producers in the world. Uranium investors must watch developments in Kazakhstan as nationalization fears could spark a major rebound in uranium developers and producer in much safer places such as North America. Keep your eyes on Energy Fuels (UUUU or EFR.TO) which is a pure play American uranium company focussed on conventional and In Situ Recovery. They have contracts in place with major nuclear power companies and is the leading pure play uranium producer in the US. They just announced that they consolidated the Roca Honda Project and now control 100% of one of the largest and highest grade uranium deposits in the US.

Stephen P. Antony, President and CEO of Energy Fuels stated: "…The Roca Honda Project is an important component in our strategy of combining large-scale optionality and leverage to improving uranium markets, with lower cost production from our Nichols Ranch Project, alternate feed materials, certain of our Arizona Strip conventional properties, and our pending acquisition of Mesteña Uranium, LLC…"

See the full news release by clicking on the following link:

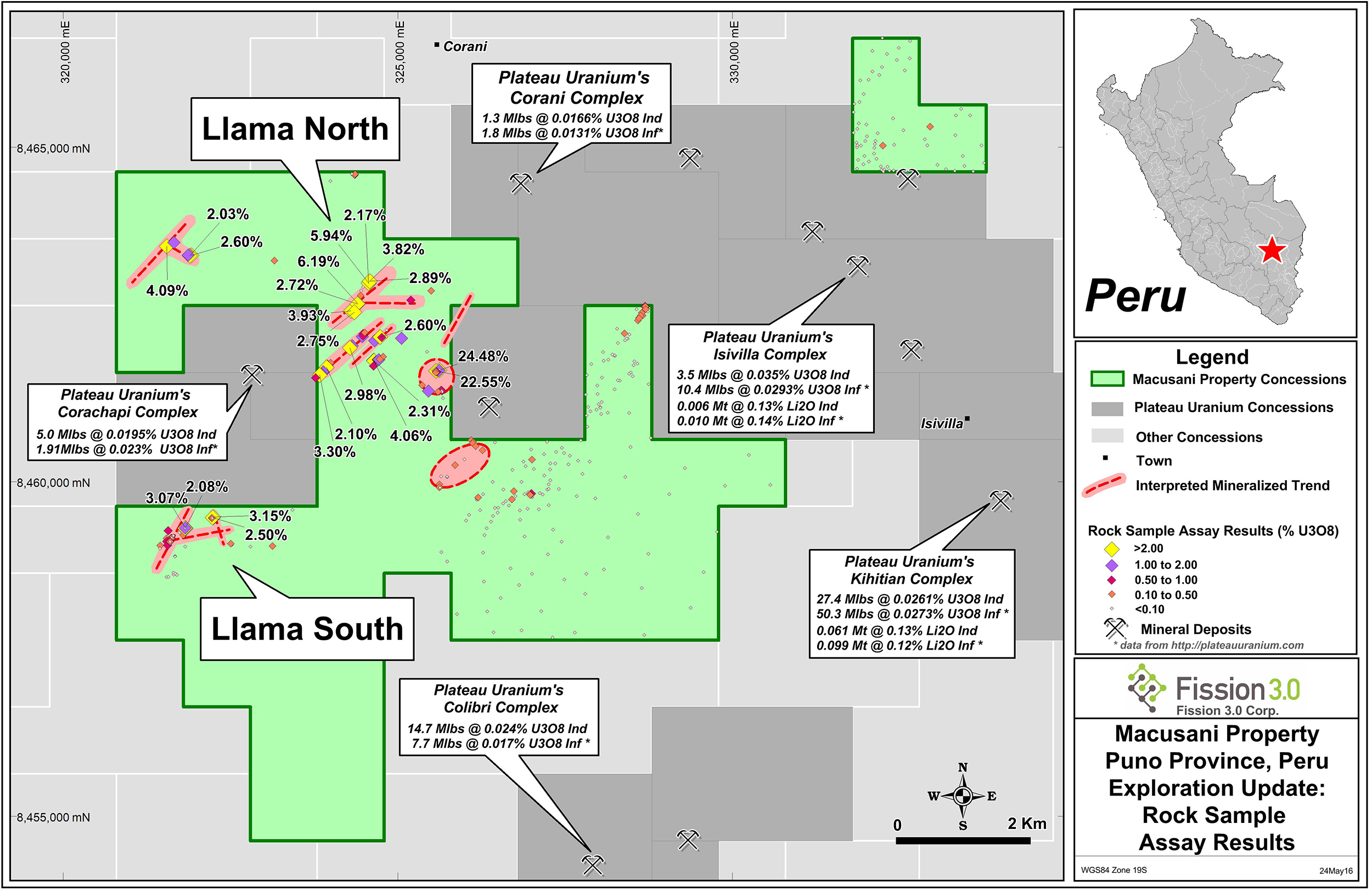

Additionally, I want to revisit a company I highlighted to you a few times called Plateau Uranium (PLU.V or PLUUF) who published a PEA this past year on their big uranium resource on the Macusani Plateau in Peru. The company should maybe now be called Plateau Uranium and Lithium as they published an initial lithium resource after the PEA.

Ted O'Connor, CEO of Plateau Uranium commented: "Although we are a uranium-focused company, recognizing the presence of lithium and establishing this large initial lithium resource within only a small subset of our defined uranium resource base is significant. Lithium has the potential to add substantial value to our already robust uranium project as a prospective by-product following uranium extraction. We have only included lithium resources contained within four of the uranium deposits considered in the PEA…We will be evaluating a program to analyze a number of our other uranium deposits for lithium."

See the full news release by clicking on the following link:

The news from Plateau showing uranium and lithium mineralization has generated additional interest in this area. Fission 3 Corp (FUU.V or FISOF) award winning explorers just announced a summer exploration program on its project which is on the same corridor as Plateau Uranium’s project. The drilling will look for high grade uranium and lithium near surface.

upcoming drill program at Macusani is a very exciting next step and will represent the first drill holes to be drilled on the property. Mapping and prospecting has not only discovered numerous uranium in bedrock anomalies on the Llama trend, with peaks assaying as high as 24.48% U3O8, it has validated the model that the same mineralized trend that hosts shallow-depth uranium and lithium resources on adjacent projects appears to be present on our claims. Our Macusani project represents an important project with high-grade uranium mineralization and excellent drill ready targets in a highly prospective new uranium district in Peru, where the infrastructure is well-established and exploration costs are low.”

See the full news release by clicking on the following link:

I believe these uranium/lithium assets could be quite valuable as these two metals are both critical for clean and carbon free energy. We could see a major transition from fossil fuels to clean energy sources such as nuclear and renewables.

Disclosure: I own securities in these three featured companies Energy Fuels, Plateau, Fission 3 and they are all paid advertising sponsors on my website. This should be considered a conflict of interest as I could benefit from price/volume increase and have been compensated. I have purchased securities in open market and/or private placement. See full disclaimer and current advertising rates by clicking on the following link:

http://goldstocktrades.com/blog/featured-companies-on-gold-stock-trades/

Section 17(b) provides that:

"It shall be unlawful for any person, by the use of any means or instruments of transportation or communication in interstate commerce or by the use of the mails, to publish, give publicity to, or circulate any notice, circular, advertisement, newspaper, article, letter, investment service, or communication, which, though not purporting to offer a security for sale, describes such security for a consideration received or to be received, directly or indirectly, from an issuer, underwriter, or dealer, without fully disclosing the receipt, whether past or prospective, of such consideration and the amount thereof." _______________________________________________________ Sign up for my free newsletter by clicking here… Order premium service by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… To send feedback or to contact me click here… Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. For informational purposes only. This is not investment advice. May contain forward looking statements. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Physical Silver Bullion – Perfect Storm Brewing in the Market Posted: 03 Jun 2016 05:03 AM PDT gold.ie | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Bullion – Perfect Storm Brewing in the Market Posted: 03 Jun 2016 04:44 AM PDT Silver bullion is seeing a “perfect storm” brewing in the physical market according to an article replete with some recent videos about the silver market by Rory Hall of the precious metals website, The Daily Coin. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sir Philip Green accused of 'lamentable failure' over BHS collapse Posted: 03 Jun 2016 04:11 AM PDT This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Super Shemitah, Jubilee and How to Prepare For the Coming Economic Collapse - Video Posted: 03 Jun 2016 03:17 AM PDT I was recently on Truth Frequency Radio with Joe Joseph and we discussed a number of topics including: The discovery of the Shemitah 7 year cycles and the upcoming collapse, the last Shemitah The impact of technology and the internet Elite planning of society The disastrous war on drugs is a war on people Attempts to control the internet The ongoing devaluation of the US dollar US government bankruptcy Creating a new system that makes the old system obsolete | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Buying Opportunities in a Resurgent Gold Market Posted: 03 Jun 2016 01:00 AM PDT After gold nearly reached $1,300/oz in early May, it has been trading lower, but Gwen Preston of Resource Maven is not worried. She sees this as the correction after the big gain and believes the new bull market is intact. In this article for The Gold Report, Preston discusses three companies that offer good opportunities in today's market. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 03 Jun 2016 12:00 AM PDT US jobs report misses big, stock futures plunge, gold soars, odds of interest rate hike fall. Car sales, oil prices, mortgage applications, US construction spending, China and Japan manufacturing all fall hard. Alhambra Partners on why apathy is a bigger risk than stupidity. Charles Hugh Smith on why pension funds (that is, your retirement) are […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Gee, I don’t think I could have put things any better, myself. Just a few weeks ago; the mainstream media was full of “rally” pumpers. Where did they all go? It’s like someone blew a dog-whistle, and summoned them all back to the kennel.

Gee, I don’t think I could have put things any better, myself. Just a few weeks ago; the mainstream media was full of “rally” pumpers. Where did they all go? It’s like someone blew a dog-whistle, and summoned them all back to the kennel. Hillary Clinton is excoriating Donald Trump over Trump University? The Clinton scandal at Laureate Education, a for- profit education chain of schools and colleges operating world-wide, including the United States is much worse. That New York Attorney General Eric Schneiderman is pursuing Trump University while ignoring CGI-University, a shady joint venture of Laureate and the Clinton Global Initiative adds insult to injury.

Hillary Clinton is excoriating Donald Trump over Trump University? The Clinton scandal at Laureate Education, a for- profit education chain of schools and colleges operating world-wide, including the United States is much worse. That New York Attorney General Eric Schneiderman is pursuing Trump University while ignoring CGI-University, a shady joint venture of Laureate and the Clinton Global Initiative adds insult to injury.

No comments:

Post a Comment