saveyourassetsfirst3 |

- Famous Technical Analyst Now Predicting Crash During Jubilee Time Period

- BREXIT Game Changer: Onward Toward Gold Bullion Bank Collapse!

- Massive Gold and Silver Price Manipulation Post BREXIT

- Jim Willie Breaks Down BREXIT Impact On GOLD and SILVER

- BREXIT Domino Effect: COLLAPSE OF EU?

- Sunday Night Open: Moonlight Madness?

- The Real Brexit “Catastrophe”: World’s 400 Richest People Lost $127 Billion Friday!

- Brexit, Gold, Silver and Interest Rates

- Trade Invoicing in Major Currencies in the 1970S-1990S: Lessons for Renminbi Internationalisation

- You Can See it, Feel It, Sense It: Catastrophic Implosion Inevitable – AGXIIK

- THE MAGIC NUMBER 7: BREXIT COLLAPSE FALLS EXACTLY ON SHEMITAH DATE

- BREXIT: The Unanimous Winner Of Six-Sigma Black Swan is GOLD

- Bull Markets that Follow Epic Bears

| Famous Technical Analyst Now Predicting Crash During Jubilee Time Period Posted: 26 Jun 2016 02:00 PM PDT Shemitah 2015 was a special Shemitah. Every 7th Shemitah is a special year called the Super Shemitah or Jubilee. Jubilee 2016 is telling us what's coming; we better be prepared. The flurry of banksters, ex-banksters (Alan Greenspan), insiders (Soros) and billionaires all warning we are on the edge of collapse now continues with a famous technical […] The post Famous Technical Analyst Now Predicting Crash During Jubilee Time Period appeared first on Silver Doctors. |

| BREXIT Game Changer: Onward Toward Gold Bullion Bank Collapse! Posted: 26 Jun 2016 12:42 PM PDT Friday’s Brexit vote truly was a game-changer and the single most important financial event since 2008. That it might accelerate the death throes of the Bullion Bank Paper Derivative Pricing Scheme is not something that is fully appreciated by the global gold “community” – yet… Buy 90% Junk Silver Coins at SD Bullion As […] The post BREXIT Game Changer: Onward Toward Gold Bullion Bank Collapse! appeared first on Silver Doctors. |

| Massive Gold and Silver Price Manipulation Post BREXIT Posted: 26 Jun 2016 12:00 PM PDT Is this some kind of SICK JOKE!?! Buy 90% Junk Silver Coins at SD Bullion As Low As $1.99/oz Over Spot! From Smaulgld: Gold traded in an incredibly tight range today after an initial burst higher in reaction to the Brexit vote. Silver Price Silver's price action was steady as can be in mid Friday […] The post Massive Gold and Silver Price Manipulation Post BREXIT appeared first on Silver Doctors. |

| Jim Willie Breaks Down BREXIT Impact On GOLD and SILVER Posted: 26 Jun 2016 11:18 AM PDT In the gold and silver segment of our exclusive coverage on BREXIT Contagion, Jim Willie warns that if THIS happens next: We're Going to Make A Rather Quick Move Towards $1,900… Gold and Silver Are Moving into 2nd Gear – I Think We're Going to Make A Rather Quick Move Towards $1,900! I Think We […] The post Jim Willie Breaks Down BREXIT Impact On GOLD and SILVER appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| BREXIT Domino Effect: COLLAPSE OF EU? Posted: 26 Jun 2016 11:00 AM PDT France, Netherlands…TEXAS!?! BREXIT has unleashed a tidal wave… Buy Silver Coins and Buy Silver Bars at SD Bullion Jim Willie’s Full BREXIT Analysis & Coverage Latest Market Data, Charts, and Gold and Silver Prices: The post BREXIT Domino Effect: COLLAPSE OF EU? appeared first on Silver Doctors. |

| Sunday Night Open: Moonlight Madness? Posted: 26 Jun 2016 09:00 AM PDT The big question now is whether the sharp drop in the markets can be contained and reversed, or whether this drop marks the start of something much more serious… From The AU Report: Britain has voted to exit the European Union and its prime minister has resigned in the wake of the Brexit vote. The […] The post Sunday Night Open: Moonlight Madness? appeared first on Silver Doctors. |

| The Real Brexit “Catastrophe”: World’s 400 Richest People Lost $127 Billion Friday! Posted: 26 Jun 2016 07:24 AM PDT The world's 400 richest people lost $127.4 billion Friday as global equity markets reeled from the news that British voters elected to leave the European Union. The billionaires lost 3.2 percent of their total net worth, bringing the combined sum to $3.9 trillion. It turns out that when George Soros threatened “The Brexit crash will […] The post The Real Brexit “Catastrophe”: World’s 400 Richest People Lost $127 Billion Friday! appeared first on Silver Doctors. |

| Brexit, Gold, Silver and Interest Rates Posted: 26 Jun 2016 02:19 AM PDT The Daily Gold |

| Trade Invoicing in Major Currencies in the 1970S-1990S: Lessons for Renminbi Internationalisation Posted: 25 Jun 2016 11:25 PM PDT China's authorities have been promoting the renminbi as an international currency for international trade, investment, and finance. This column examines the experiences of the dollar, yen, and deutschmark from the 1970s to the 1990s. As long as China's neighbouring economies keep using the dollar for international trade and financial activities, the rise of the renminbi as a trade invoicing currency may be as fast as the rise of China itself |

| You Can See it, Feel It, Sense It: Catastrophic Implosion Inevitable – AGXIIK Posted: 25 Jun 2016 03:40 PM PDT The damage in the interim is catastrophic. It will produce an IMPLOSION EXPLOSION event. Like a supernova that results when a star runs out of fuel and collapses in on itself, this near infinite quantity of paper printed is does not act as fuel. It does nothing. It’s a drain and drag on the system. And its Implosion is inevitable. You can […] The post You Can See it, Feel It, Sense It: Catastrophic Implosion Inevitable – AGXIIK appeared first on Silver Doctors. |

| THE MAGIC NUMBER 7: BREXIT COLLAPSE FALLS EXACTLY ON SHEMITAH DATE Posted: 25 Jun 2016 03:16 PM PDT The last major market crash occurred on September 29, 2008. On that day, the Dow Jones fell 777 points, of all numbers…. its biggest one day point drop ever. On Friday, in the aftermath of Brexit, the Dow fell over 600 points. What's interesting about Friday's date? Submitted by Jeff Berwick, The Dollar Vigilante: […] The post THE MAGIC NUMBER 7: BREXIT COLLAPSE FALLS EXACTLY ON SHEMITAH DATE appeared first on Silver Doctors. |

| BREXIT: The Unanimous Winner Of Six-Sigma Black Swan is GOLD Posted: 25 Jun 2016 02:57 PM PDT Brexit is being called a six sigma “Black Swan”. The world will wake up Monday morning to all sorts of margin calls. You must understand, the “carry trade” is held on very thin margin. Many “counterparties” were outright blown up today. The unanimous winner in ALL currencies is gold… Submitted by Bill Holter, jsmineset.com: BREXIT! I […] The post BREXIT: The Unanimous Winner Of Six-Sigma Black Swan is GOLD appeared first on Silver Doctors. |

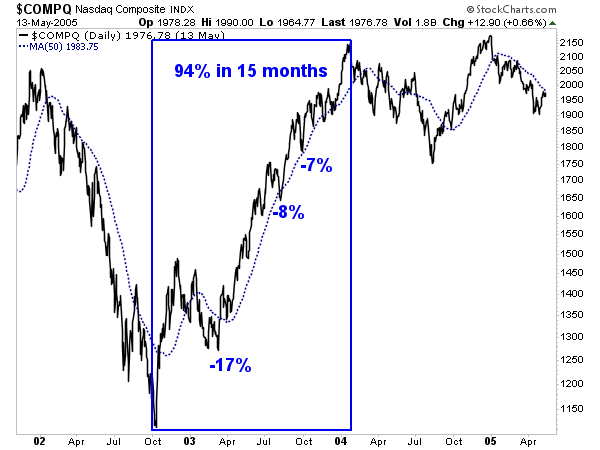

| Bull Markets that Follow Epic Bears Posted: 17 Jun 2016 01:46 PM PDT The gold mining stocks continue to defy any bearish price action or perceived bearish development. Pundits first warned because of the "bearish" CoT data. The commercials are always right and a big decline is coming! Then we heard the miners were too overbought and would have to correct 20%. (I thought this once or twice!) Next we heard Gold was forming a head and shoulders top. Conventional analysis is failing in trying to predict or even explain what is happening and why. A look at history helps explain why the gold mining sector has remained extremely strong and almost immune to any sustained correction. Simply put, history shows that epic bears give birth to bull markets that in their first year do not experience any significant correction or retracement. The Nasdaq, which is comprised of mostly tech stocks crashed 78% during its bear market from 2000 to 2002. That epic bear followed a full blown mania and a strong recovery followed that epic collapse. The Nasdaq rebounded by 94% in 15 months and only endured one significant correction during the recovery. That 17% correction occurred while the market was in a bottoming process. Once the Nasdaq exceeded 1400 it enjoyed smooth sailing to 2100 over the next nine months.

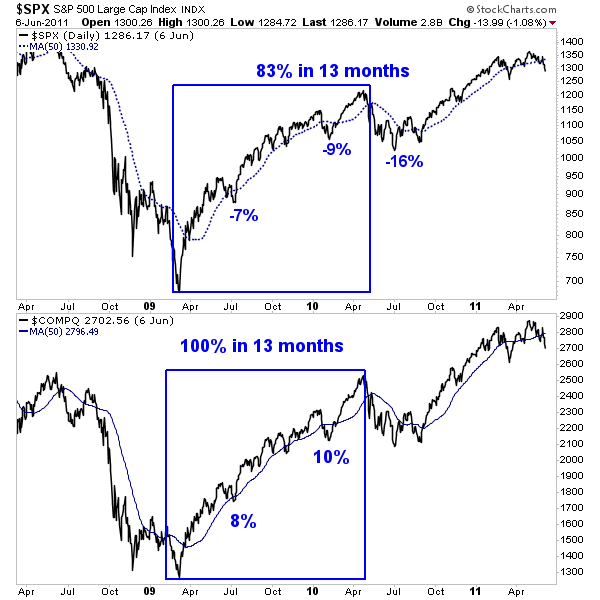

The next chart plots the S&P 500 and the Nasdaq from 2008 to 2011. The bear market in price terms was the worst for the S&P 500 since World War II. Its recovery was equally as spectacular as the index gained 83% in 13 months without correcting more than 9%. During the same period, the Nasdaq doubled and did not shed more than 10%!

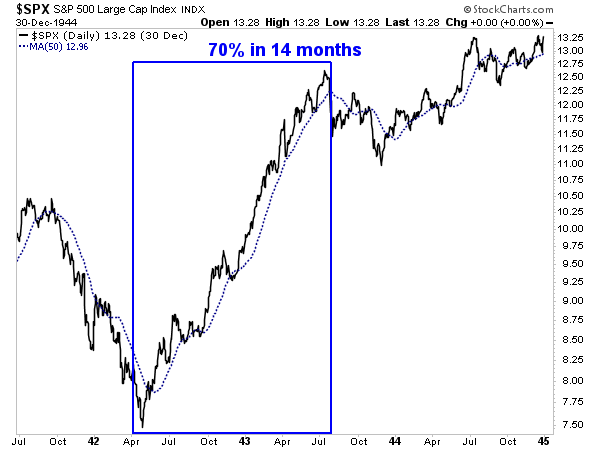

Speaking of World War II, it kicked off the best buying opportunity of all time as the stock market enjoyed fabulous returns over the next year, three years, five years, 10 years and 15 years. The stock market declined 60% over the previous five years. It was the longest bear market in modern times and the second worst in terms of price. During the ensuing recovery, the S&P 500 gained 70% in 14 months and did not correct more than 5%! It also held above its 50-day moving average nearly the entire time!

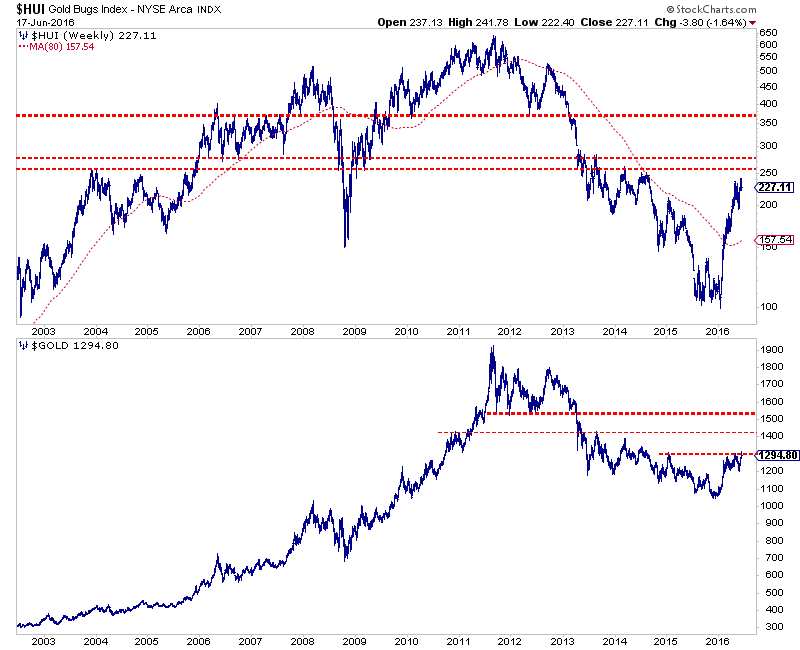

While the gold mining space is a very tiny sector and its own animal compared to the stock market, its current recovery can be accurately depicted in a strikingly similar context. The recovery has been extremely strong in terms of price and the lack of declines. The gold stock indices are up over 100% and have yet to correct even 20%! It makes perfect sense considering gold stocks are following their worst bear market ever and in January were perhaps at their own 1942 moment. The gold stocks are following a history that suggests potentially another six to nine months of steady gains without a major correction or retracement. In looking at both the gold stocks and Gold (chart below), we can see potential six to nine month upside targets of HUI 365 and Gold $1500-$1550. The HUI has overhead resistance to overcome while Gold has $1300 and $1400 to overcome.

We've said it before and we will say it again. It is hard to be bullish when something is so overbought and trading so much higher than in recent months. However, the one time to be bullish amid that context is when the market at hand has emerged from a brutal bear market. The gold mining sector is only five months into this new bull market. The historical pattern that gold stocks are currently following suggests potentially another six to nine months of upside before a major correction or retracement. It is difficult to be bullish or be a buyer here but our research suggests it is the correct posture. As we noted last week, +10% weakness could be a good buying opportunity. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT

|

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment