saveyourassetsfirst3 |

- The Latest COT Report Shows That Gold Longs Are At All-Time Highs So Gold Bulls Need To Be Careful Here

- Nigel Hugill: 'If there were a silver bullet then people would have fired it by now'

- Porn and Bestiality: Moral Relativism Embraces It All

- Gold Price $1300: 3 Taps and Out?

- Breaking News And Best Of The Web

- Bull Markets that Follow Epic Bears

- “Atomic Bomb In the Works for July”: Someone VERY BIG Is Standing For Gold & Silver!

- Derivatives Expert Warns Globalists Ready to SHUT DOWN Entire Financial System!

- Bull Markets that Follow Epic Bears

- Martin Armstrong Warns Gold May Have Just Received A KISS OF DEATH

- Jim Sinclair-Silver Will Be Gold On STEROIDS As Gold Nears Bull Top at $50,000/oz!

- BREAKING: GET READY FOR THE COLLAPSE OF DEUTSCHE BANK!

- Harvey Organ: BANK RUN On COMEX Silver!

| Posted: 18 Jun 2016 09:42 AM PDT |

| Nigel Hugill: 'If there were a silver bullet then people would have fired it by now' Posted: 18 Jun 2016 07:09 AM PDT This posting includes an audio/video/photo media file: Download Now |

| Porn and Bestiality: Moral Relativism Embraces It All Posted: 18 Jun 2016 07:00 AM PDT A society which has lost appreciation of the past is unable to comprehend the present. The sexual depravities of the ancient world – from the Temples of Khajuraho to Babylon, Greece, and thence to Rome's Villa Jovis, Pompeii, and the celebration of the Bacchanalia – were a function of their respective idolatrous cults. These cults […] The post Porn and Bestiality: Moral Relativism Embraces It All appeared first on Silver Doctors. |

| Gold Price $1300: 3 Taps and Out? Posted: 17 Jun 2016 09:01 PM PDT With the Gold Price Hitting A NEW HIGH Above $1308 & Closing the Week at $1300, PM Fund Manager Dave Kranzler Joined the Show Discussing: $1300 Gold: 3 Taps & OUT? “There’s Not Alot of Resistance Between Here and $1800. This Thing Could Turn into a Runaway Freight Train VERY QUICKLY” The Setup is Here For […] The post Gold Price $1300: 3 Taps and Out? appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Breaking News And Best Of The Web Posted: 17 Jun 2016 06:20 PM PDT Fed and BoJ spook the markets. Global stocks fall but US stocks recover after UK assassination temporarily suspends Brexit campaign. US factory output and inflation weak, gold tests $1,300 again. German 10-year bonds go negative and Japanese 10-years go more negative. Can US Treasuries be far behind? China’s debt, as always is causing angst. […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| Bull Markets that Follow Epic Bears Posted: 17 Jun 2016 06:11 PM PDT The Daily Gold |

| “Atomic Bomb In the Works for July”: Someone VERY BIG Is Standing For Gold & Silver! Posted: 17 Jun 2016 02:45 PM PDT Someone very real and VERY BIG is standing for gold. This “someone” would not be bribed to go away last month and does not look like they will go way this month! Who is this long who all of a sudden cannot be bribed to stand down? Looking specifically at silver, we have a true potential atomic […] The post “Atomic Bomb In the Works for July”: Someone VERY BIG Is Standing For Gold & Silver! appeared first on Silver Doctors. |

| Derivatives Expert Warns Globalists Ready to SHUT DOWN Entire Financial System! Posted: 17 Jun 2016 02:11 PM PDT The globalists seem to be running short of time according to derivatives expert Rob Kirby, as he is warning the algorithms that run the financial system may be turned off in the not too distant future. When I say not too distant future I mean before the end of summer… 1 oz Silver Superman S-Shield Intro […] The post Derivatives Expert Warns Globalists Ready to SHUT DOWN Entire Financial System! appeared first on Silver Doctors. |

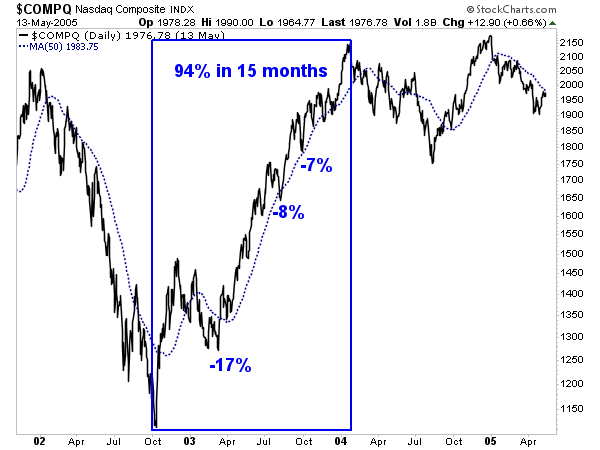

| Bull Markets that Follow Epic Bears Posted: 17 Jun 2016 01:46 PM PDT The gold mining stocks continue to defy any bearish price action or perceived bearish development. Pundits first warned because of the "bearish" CoT data. The commercials are always right and a big decline is coming! Then we heard the miners were too overbought and would have to correct 20%. (I thought this once or twice!) Next we heard Gold was forming a head and shoulders top. Conventional analysis is failing in trying to predict or even explain what is happening and why. A look at history helps explain why the gold mining sector has remained extremely strong and almost immune to any sustained correction. Simply put, history shows that epic bears give birth to bull markets that in their first year do not experience any significant correction or retracement. The Nasdaq, which is comprised of mostly tech stocks crashed 78% during its bear market from 2000 to 2002. That epic bear followed a full blown mania and a strong recovery followed that epic collapse. The Nasdaq rebounded by 94% in 15 months and only endured one significant correction during the recovery. That 17% correction occurred while the market was in a bottoming process. Once the Nasdaq exceeded 1400 it enjoyed smooth sailing to 2100 over the next nine months.

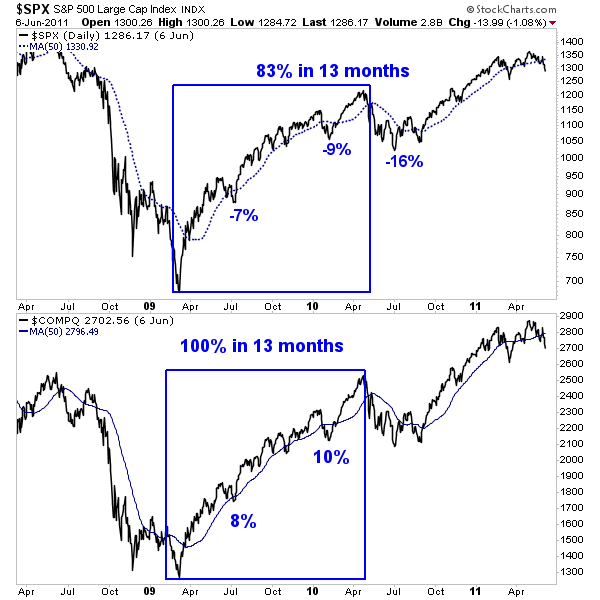

The next chart plots the S&P 500 and the Nasdaq from 2008 to 2011. The bear market in price terms was the worst for the S&P 500 since World War II. Its recovery was equally as spectacular as the index gained 83% in 13 months without correcting more than 9%. During the same period, the Nasdaq doubled and did not shed more than 10%!

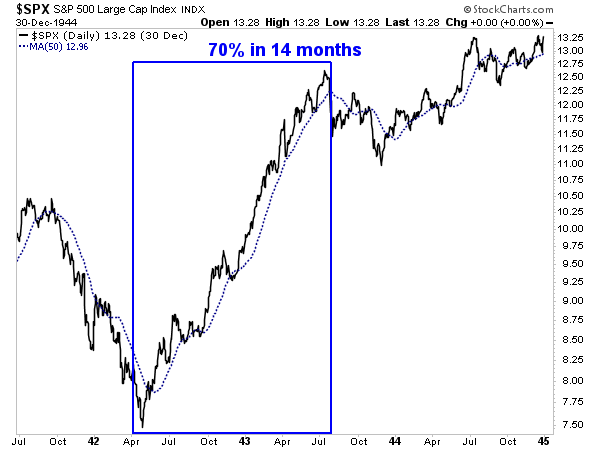

Speaking of World War II, it kicked off the best buying opportunity of all time as the stock market enjoyed fabulous returns over the next year, three years, five years, 10 years and 15 years. The stock market declined 60% over the previous five years. It was the longest bear market in modern times and the second worst in terms of price. During the ensuing recovery, the S&P 500 gained 70% in 14 months and did not correct more than 5%! It also held above its 50-day moving average nearly the entire time!

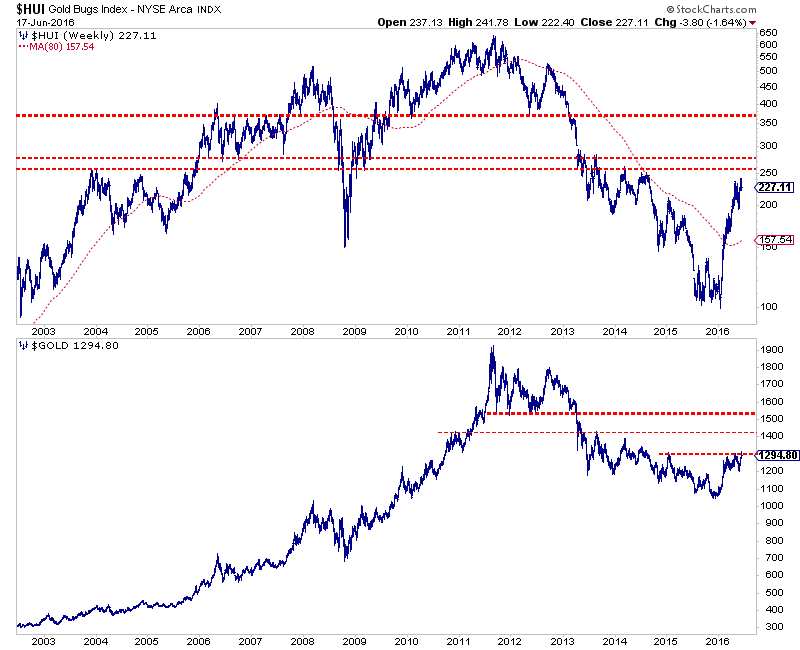

While the gold mining space is a very tiny sector and its own animal compared to the stock market, its current recovery can be accurately depicted in a strikingly similar context. The recovery has been extremely strong in terms of price and the lack of declines. The gold stock indices are up over 100% and have yet to correct even 20%! It makes perfect sense considering gold stocks are following their worst bear market ever and in January were perhaps at their own 1942 moment. The gold stocks are following a history that suggests potentially another six to nine months of steady gains without a major correction or retracement. In looking at both the gold stocks and Gold (chart below), we can see potential six to nine month upside targets of HUI 365 and Gold $1500-$1550. The HUI has overhead resistance to overcome while Gold has $1300 and $1400 to overcome.

We've said it before and we will say it again. It is hard to be bullish when something is so overbought and trading so much higher than in recent months. However, the one time to be bullish amid that context is when the market at hand has emerged from a brutal bear market. The gold mining sector is only five months into this new bull market. The historical pattern that gold stocks are currently following suggests potentially another six to nine months of upside before a major correction or retracement. It is difficult to be bullish or be a buyer here but our research suggests it is the correct posture. As we noted last week, +10% weakness could be a good buying opportunity. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT

|

| Martin Armstrong Warns Gold May Have Just Received A KISS OF DEATH Posted: 17 Jun 2016 01:30 PM PDT A $30 pop, followed by a brutal take-down on rumors next week’s BREXIT vote will be suspended. Did Gold Just Receive the KISS OF DEATH? From Martin Armstrong: QUESTION: Marty; This pop in gold smells like another manipulation. Everyone was saying Soros is selling everything and buying gold. They seem to have gotten the […] The post Martin Armstrong Warns Gold May Have Just Received A KISS OF DEATH appeared first on Silver Doctors. |

| Jim Sinclair-Silver Will Be Gold On STEROIDS As Gold Nears Bull Top at $50,000/oz! Posted: 17 Jun 2016 01:19 PM PDT Legendary gold trader Jim Sinclair (the man who called the top in gold to the very day in the last gold bull market), and who has famously predicted gold will reach $50,000/oz in the current bull– says that when gold hits his $50,000/oz level, Silver will be GOLD ON STEROIDS… From Greg Hunter’s USAWatchdog: Buy Silver […] The post Jim Sinclair-Silver Will Be Gold On STEROIDS As Gold Nears Bull Top at $50,000/oz! appeared first on Silver Doctors. |

| BREAKING: GET READY FOR THE COLLAPSE OF DEUTSCHE BANK! Posted: 17 Jun 2016 12:30 PM PDT The signs were there for Bear Stearns, Lehman, and AIG in 2008. It’s up to you to read the economic warning signals flashing right now… GMO-Free Long Term Food Storage With Organic Superfoods! The post BREAKING: GET READY FOR THE COLLAPSE OF DEUTSCHE BANK! appeared first on Silver Doctors. |

| Harvey Organ: BANK RUN On COMEX Silver! Posted: 17 Jun 2016 12:10 PM PDT IT LOOKS LIKE WE ARE HAVING A BANK RUN AT THE SILVER COMEX! GLD ADDS 2.37 TONNES OF "PAPER "GOLD INTO ITS INVENTORY/SLV ADDS 1.664 MILLION OZ OF "PAPER" SILVER INTO ITS INVENTORY/GOLD RISES BY 11 DOLLARS AS BREXIT FEARS INTENSIFY/SILVER UP ONLY 11 CENTS/JAPANESE LARGE MANUFACTURING LAST MONTH A DISASTER/FITCH LOWERS CREDIT RATING ON […] The post Harvey Organ: BANK RUN On COMEX Silver! appeared first on Silver Doctors. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment