Gold World News Flash |

- Jim’s Mailbox

- The US Economy Priced in Gold

- The Housing Market Is In A Hyper Bubble And When It Pops The Economy Will Collapse: Fabian Calvo

- Man with Gun Arrested at Trump Rally

- Elizabeth Warren’s War On The Poor

- Japan: A Future Of Stagnation

- Living 'The American Dream' In These Cities Is Not Possible

- Rio Declares State Of "Public Calamity", Warns Of Total Collapse In Security, Health And Transport

- GUN CONTROL,THAT IS WHAT THEY ARE PERPETRATING WITH THIS FALSE FLAG.

- Frustrated Illinois Taxpayers Pay Property Tax With $1 Bills

- We Will Never Again See Gold Prices Below $1,201.50

- Donald Trump: What happened in Orlando is a disgrace

- China Must Follow Japan to Survive

- Sam Harris discusses Islam, Orlando and the reaction from Trump, Clinton and Obama

- China: Heading for a Great Depression?

- Gold Daily and Silver Weekly Charts - Like a Leaf Upon the Water

- The Fed Giveth and the Gold Bullion Banks Taketh Away…

- Gold Stocks Summer Breakout?

- Silver Wildcats - And The Day Futures Died - Part 1

- What Would The #Brexit mean for the Eurozone

- Long-term investment interest in gold is making trouble, Maguire says

- Mike Ballanger: The Fed giveth and the bullion banks taketh away

- BREXIT: This is your last CHANCE #LeaveEU #Brexit

- Silver Wildcats - And The Day Futures Died - Part 1

- How to Use the Gold-to-Silver Ratio?

- Gold-Stock Summer Breakout?

- The Trend Following Guide to Surviving the Apocalypse

- Crude Chewed Up by Another False Breakout…

- Inflation, Deflation & Associated Trading Prospects

- Hints of FX intervention as central banks debate Brexit response

- Gold Price Surges to Highest in Nearly Two Years On Central Bank and Brexit Haven Demand

- Breaking News And Best Of The Web

- Stock Market, Iron Ore, Bitcoin – Is Silver Next for Chinese Momentum Investors?

| Posted: 17 Jun 2016 09:07 PM PDT Larry/Bill, Because Texas teachers wish to be the last teachers standing, are they thereby perpetuating the ability to open carry in class? Jim Why Does the Texas Teachers Retirement Fund Own Gold? Whenever the topic of gold comes up it always seems like to me that there is way too much emotion about it. Mainstream... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 17 Jun 2016 07:20 PM PDT by Gary Christenson, Deviant Investor:

What if we priced national debt in "real money" – actual gold instead of the digital and paper stuff that can be created at the whim of a central banker? I used the annual average of gold prices and heavily smoothed them with a 7 year moving average. Then I divided the national debt by the heavily smoothed gold prices.

The 35 year graph shows that, on average, national debt has increased rapidly, even when priced in gold. This should be cause for alarm – debt is increasing far too rapidly, and gold is underpriced. The current national debt is equal to about 100 times the total value, at current gold prices, of the gold "officially" stored in Fort Knox. This should be cause for alarm. What about transfer payments per the St. Louis Fed (FRED)? According to FRED the total transfers for social benefits in 2015 was about $1.959 trillion – or 10 times the value of the gold officially stored in Fort Knox. A 35 year graph is shown below. Of course transfer payments have steadily increased from $251 billion in 1981 to $1,959 billion in 2015, but even priced in gold the transfer payments have increased. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Housing Market Is In A Hyper Bubble And When It Pops The Economy Will Collapse: Fabian Calvo Posted: 17 Jun 2016 07:00 PM PDT from X22Report Spotlight: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Man with Gun Arrested at Trump Rally Posted: 17 Jun 2016 06:30 PM PDT Mass Shooting at Trump Rally Houston Threats Posted Online The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Elizabeth Warren’s War On The Poor Posted: 17 Jun 2016 05:55 PM PDT Submitted by Patrick Trombly via The Mises Institute, There is no American politician more closely associated with “progressive” economic causes than Massachusetts Senator Elizabeth Warren. The senator is widely regarded by the political Left as an expert on financial issues, is a self-professed champion of the “working poor,” and is a proud, finger-wagging chastiser of the 1 percent and Wall Street. Her cause is to lift up the least powerful and protect them from the most powerful. She appears to genuinely believe in this cause, and has made several policy proposals that she believes will serve it. Because of her position and the public’s association of the senator with this cause, it is assumed that the policies she proposes will in fact serve it, and that anyone who supports the same causes should get on board and support her proposed policies. Senator Warren’s stated objective of helping the least powerful is laudable. The problem is that, though well-intentioned, many of Senator Warren’s proposed policies would actually harm the very people whom she intends to help, while her other proposals represent distractions from the real threats to the least powerful, and thus have the effect of allowing these threats to continue. By occupying the seat of defender of the least powerful while advocating policies that would harm the least powerful, the senator has become a danger to her own cause. Below are three examples.

What does this have to do with Senator Warren? Her position on the Banking Committee gives her an audience with the Chair of the Federal Reserve on a regular basis. Yet she has never taken the opportunity to raise the issue of monetary inflation and its ill effects. Instead she has focused on the Fed’s decisions not to “break up big banks” or “bring bankers to trial” for various misdeeds. Some of these misdeeds are real, but none related to what Senator Warren contends are her main concerns: wage stagnation and income inequality. Indeed, whether most deposits are held and most loans are made by 10 banks or 10,000 banks won’t change income and wealth inequality if the banks are members of a protected cartel that creates money out of thin air and loans it into the financial system. Senator Warren’s efforts in this respect use up attention and energy that could otherwise be devoted to understanding what actually causes the wage stagnation and inequality: the systematic and perpetual wage and savings devaluation, and asset price inflation, conducted by our central bank. We should not quarrel with Senator Warren’s stated goal of protecting the least powerful in society, but we should take issue with many of Senator Warren’s proposed strategies to achieve her stated goal — because they don’t work. If Senator Warren wishes to achieve her stated goals, then she should re-think her policy objectives, become familiar with basic economic principles, and adjust her policy prescriptions accordingly, especially with respect to the central bank. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 17 Jun 2016 04:55 PM PDT Submitted by Charles Hugh-Smith of OfTwoMinds blog, Take a declining population with declining rates of productivity growth and load it up with debt, and you get a triple-whammy recipe for permanent stagnation.

Our friend is planning to move to another more vibrant economy in Asia. She didn't want to spend the rest of her life struggling to keep the business afloat. She wanted to have a family and a business with a future. It was the right decision, not only for her but for her family: get out while there's still some value in the business to sell. I have written a number of entries on Japan's economic downward-spiral and its largely hidden social depression over the past decade, most recently: Global Bellwether: Japan's Social Depression (September 25, 2014) Lessons from Japan: Decades of Decay, Unavoidable Collapse (April 26, 2016) The Keynesian Fantasy is that encouraging people to borrow money to replace what they no longer earn is a policy designed to fail, and fail it has. Borrowing money incurs interest payments, which even at low rates of interest eventually crimps disposable earnings. Banks must loan this money at a profit, so interest rates paid by borrowers can't fall to zero. If they do, banks can't earn enough to pay their operating costs, and they will close their doors. If banks reach for higher income, that requires loaning money to poor credit risks and placing risky bets in financial markets. Once you load them up with enough debt, even businesses and wage earners who were initially good credit risks become poor credit risks. Uncreditworthy borrowers default, costing the banks not just whatever was earned on the risky loans but the banks' capital. The banking system is designed to fail, and fail it does. Japan has played the pretend-and-extend game for decades by extending defaulting borrowers enough new debt to make minimal interest payments, so the non-performing loan can be listed in the "performing" category. Central banks play the game by lowering interest rates so debtors can borrow more. This works like monetary cocaine for a while, boosting spending and giving the economy a false glow of health, but then the interest payments start sapping earnings, and once the borrowed money has been spent/squandered, what's left is the interest payments stretching into the future. Central banks played another game: buying assets to inflate asset bubbles, bubbles that were supposed to spark the wealth effect: once businesses and households see their net worth rise as assets bubble higher, they will be psychologically induced to borrow against that new wealth and spend, spend, spend. The Bank of Japan has played this game to little effect. The BOJ now owns a significant chunk of Japan's stock market, but the real economy continues its long descent into stagnation.

Demographics matter. As the populace ages, older people spend less and sell assets to raise cash for their non-earning retirement years. As young families have fewer children, consumption declines accordingly. Take a declining population with declining rates of productivity growth and load it up with debt, and you get a triple-whammy recipe for permanent stagnation. There are Degrowth strategies that make sense because they're designed to be sustainable, but first the systems that have been designed to fail--Keynesian stimulus policies and the banking system--must be allowed to fail. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Living 'The American Dream' In These Cities Is Not Possible Posted: 17 Jun 2016 04:25 PM PDT Originally posted at TheRedPin.com, "The American Dream is that dream of a land in which life should be better and richer and fuller for everyone, with opportunity for each according to ability or achievement." That idea – and those words, written by James Truslow Adams in 1931 – forms the foundation upon which the country was built. But that foundation has cracked. It’s one thing to fantasize about living the American Dream from regions outside the United States. It’s another to be already living in America and to not be able to attain it. And while the American Dream ensures that no one is legally barred from reaching their full potential, it doesn’t prevent individuals from being held back in other ways. After analyzing the cost of living and median income levels in 74 U.S. cities, we found significant obstacles to obtaining the American Dream across the country. Picture Perfect, American Dream–Style

Imagine it: You own a 1,480-square-foot home with a one-car garage, perfect for your family of four and all your needs, all nicely contained by a manicured front lawn and a white picket fence. You also have the funds for two adults-only dinner dates and one trip to the movies per month. Sounds nice, right? That version of material wealth and comfort will cost you roughly $3,547 per month, or $42,548 per year. The bulk of your expense is not even the mortgage; instead, it’s the monthly groceries. Clearly, you have very hungry mouths to feed. Don’t forget, it will cost you approximately $245,000 to raise a child until the age of 18. And the typical American Dream usually includes at least two children. Getting Ahead, Just by Demographics

Based on three criteria, we can easily divide the 323.5 million people living in the United States into “those who can afford to live on easy street” and “those who cannot” – the “haves” and “have-nots,” a concept that American literature has widely explored and that American citizens experience every day. According to our research, the first required criterion for becoming one of the “haves” is simply to be a man. Despite the fact that women make up nearly half the workforce – and act as the main, or at least equal, breadwinner in 4 out of 10 households – women earn only 79 cents for every dollar that a man makes, according to 2015 figures. That’s a gender wage gap of 21 percentage points. The second criterion for becoming one of the “haves” is to be either white or Asian. And the third criterion is age: those most likely to be “haves” are Asian men between the ages of 35 and 54, and white men between the ages of 35 and 64. The implications of failing to fall into those three categories are staggering, especially when we focus on the 35 to 44 age range. An Asian man in this age range will make $66,318 each year, but his female counterpart won’t even crack $40,000. The same disparity holds true for white women. And many black men and women, as well as Hispanic men and women, sit far below the American Dream line – in some cases, by as much as $20,000, according to median results. Needing Smarts to Succeed

From the first day of kindergarten, and possibly even before, American children learn that an education is the gateway to success. With it, there is nothing they can’t do; but without it, they are destined to fail. To some extent, this maxim proves to be true. Statistically, both men and women with minimal education – a high school diploma, or less – will not head quickly toward the American Dream. Even those with some college education, but without a degree, sit below the required $42,000. However, with a master’s, doctorate, or professional degree, a man’s salary is almost guaranteed to exceed the income required to live comfortably. A man with a professional degree can expect to earn at least six figures, while a woman can expect to earn approximately $63,000. And while this discrepancy is shocking, it pales in comparison to the discrepancy between men and women who have an associate or bachelor’s degree. For women with these degrees, even achieving financial security remains a challenge. Based on median income, a woman who has earned a bachelor’s degree will make $40,033, while a man who has obtained his associate degree will see nearly $44,000. That puts him, but not her, on track toward a white picket fence. It’s a trend that’s echoed in every education increment. Reality Sinks in for Major American Cities

It’s no secret that coastal living is expensive. However, we might go a step further and say that the American Dream is fast becoming a fantasy on the coasts. That statement sharpens the cold, hard facts and puts them into perspective. The good news is that middle America and the Southwest still offer a thriving environment for the American Dream. It’s hard to imagine just how far the dollar can go before moving there, according to Holly Johnson. “For example, when I tell people I bought my 2,000-square-foot Indianapolis home on one-third of an acre for a cool $188,500, they often look at me like I have three heads,” she writes in her article, “A Potentially Easier Way to Get Rich: Move to the Midwest.” “In fact, I’m pretty sure they assume I’m being dishonest somehow, or that my home is actually a giant cardboard refrigerator box. But they’re wrong.” Sure, she admits, the Midwest isn’t nearly as exciting as the East and West Coasts. However, small-town festivals provide entertainment, and open fields and parks (instead of congested, busy streets) are perfect for children. And community theater, while it’s not the Broadway stage, provides a dose of much-needed culture. Depending on your priorities, the Southwest and Midwest could be the answer for your American Dream – at least until more people catch on to the trend. Look No Further for the American Dream

Of these 53 cities where the good life is attainable, the vast majority are inland or comfortably nestled in the Midwest and Southwest– which should come as no surprise. At the top of the list is Fairfax, Virginia, where the median yearly savings add up to roughly $45,500, mostly thanks to the approximately $100,500 median household income and the fact that 91.7 percent of its residents have finished high school. Anchorage, Alaska, boasts a yearly savings of about $32,200, with a median household income of $78,121 and a graduation rate of 92.5 percent. Stamford, Connecticut, rounds out the top three cities, with $28,268 in savings, a $77,221 median household income, and a graduation rate of 87 percent. Zero Dreamers in Sight

New York, New York: It’s a wonderful town – for those with a boatload of disposable income or absolutely zero interest in making it in America. When purchasing the typical 1,480-square-foot home, New Yorkers pay approximately $1,625 per square foot, for a grand total of $2.4 million worth of real estate. The average person needs to earn nearly $90,000 in addition to their income to afford the American Dream in New York. That’s the extreme. In San Francisco, the tune is more like $36,500 in supplemental income, which 25-year-old Peter Berkowitz was simply not willing to pay. Instead, he constructed an 8-foot-long bedroom pod inside his pal’s apartment, so he could live up the street from the beach for a fraction of the rent he would otherwise be paying. Where to Find the American Dream

As shown on the map, the United States comprises pockets of affordability and unaffordability. The states where you are most unlikely to thrive are New York and Massachusetts thanks to housing costs. And while Hawaii offers insurmountable beauty, very few people can afford the American Dream there. Island living is insanely expensive. A minor example that speaks volumes: In Hawaii, a five-pound sack of potatoes will run you $6.48, more than twice the national average. Overall, people living in California, Oregon, Washington, Florida, and much of the East Coast have a harder time building their savings accounts than those in the Southwest and Midwest, due to a larger disparity between income and expenses. Barely Getting By

This past spring, New York Governor Andrew Cuomo signed a law that enacted a statewide $15 minimum wage plan. Portland, Oregon, also bumped up its minimum wage, and the issue of minimum wage looms large in this year’s presidential race – for good reason. In Hawaii, the issue seems most severe. The current minimum wage is $7.75, but in order for Hawaiians to afford the American Dream, minimum wage would need to be raised to $34.49 – nearly 4.5 times higher than what it is now. The pattern continues throughout the U.S. If citizens are to have any hope of reaching the American Dream, the minimum wage in Washington, D.C. – as well as in New York, California, Alaska, and Connecticut – needs to be about three times higher than it currently is, while the minimum wage in Mississippi needs to be about twice as high. For now, the minimum wage debate only focuses on getting Americans above the poverty line. Perhaps focusing on the Dream will come next. ConclusionFor some parts of the country, namely the Southwest and Midwest, the risk of never achieving the American dream is slim. There, the American Dream is alive and well. And while residents give up a certain level of excitement and culture to live in these locations, they get more bang for their buck and live more comfortably. In the coastal areas and big cities, it’s nearly impossible for Americans to live out the ideal picture of the picket-fenced life. For them, the American Dream changes once again, and they must adjust it to fit their mold of what brings them happiness, security and comfort. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rio Declares State Of "Public Calamity", Warns Of Total Collapse In Security, Health And Transport Posted: 17 Jun 2016 04:21 PM PDT Earlier today, the IAAF announced that Russian track and field athletes would be banned from the Rio Oympics due to allegations of systematic doping. Rune Andersen, who heads the IAAF task force overseeing Russia's attempts to reform, said that a "deep-seated culture of tolerance, or worse, appears not to be materially changed". "No athlete will compete in Rio under a Russian flag," he said. Perhaps instead of fighting this decision, Putin's response should be a simple "thanks" because just hours later, and just 49 days before the start of the Olympics, the Rio state government declared a state of "public calamity" (yes, that's the technical term) warning of a risk of total collapse in public security, health, transport and virtually everything else, because as the local government explained, the financial crisis is preventing it from fulfilling its requirements for the Games.

In other words, the money is gone... all gone, and as we jokingly predicted some time ago, as a result of the ongoing economic and now political catastrophe in the country, the 2016 Oympics may never even happen in the country gripped by what may be the worst depression in its history. Oh, and then the whole Zika thing. As Bruce Douglas adds, the Rio state government fears "total collapse in public security, health, education, mobility, education, environment" due to financial crisis, and that Rio de Janeiro "will adopt exceptional necessary measures to rationalize all public services, with the aim of realizing the [Olympic] Games." It was not clear what would happen if the rationalization fails. Finally, by declaring a state of public calamity, the state government of Rio de Janeiro aims to get access to federal cash. The question is whether there is any left. And then, on the background of this dire assessment, some humor:

The silver lining: no matter how bad Brazil's economy gets, it will always remain rich in natural resources | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GUN CONTROL,THAT IS WHAT THEY ARE PERPETRATING WITH THIS FALSE FLAG. Posted: 17 Jun 2016 03:51 PM PDT SOMETHING BIG IS COMING! End Times News Update (Latest Events #69) June, 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Frustrated Illinois Taxpayers Pay Property Tax With $1 Bills Posted: 17 Jun 2016 03:48 PM PDT Jeff McGrath has been fed up about his property taxes going up for years in McHenry County, Illinois. However when McGrath was told that taxes would go up another 26% this year and nobody could provide any explanation for it, he had enough, and decided that a statement needed to be made.

That statement, as it turns out, was to pay the first installment of his commercial and residential property taxes in single dollar bills. McGrath said that by doing so, perhaps someone would relay that to the tax assessor that people are not happy about what's taking place.

McGrath isn't just sitting around waiting for taxes to get magically lower though, he purchased land in Wisconsin and is planning to build a house and a new business there in the future in order to escape the Illinois taxes.

McGrath wasn't the only one to pay taxes this way, Dan Aylward also paid his McHenry County taxes in singles as well. Aylward arrived with neatly bundled packages of singles stacked inside a black suitcase, along with two dimes to pay a bill of $5,734.18. "I gave them the two cents for my opinion" Aylward said. Aylward went on to explain that "the American dream is to own a home. My home is more than the American dream. To me it's part of my family. When I leave this driveway because I'm forced to sell it because I can't afford to pay the taxes anymore, I will cry. I will fight with every breath that I take." McHenry County treasurer Glenda Miller said that as a taxpayer herself, she understands the frustration but paying taxes with loads of cash hurts her employees who are not at fault. "I understand your grief, but I don't know what you are going to prove by putting more burden on my staff in processing your payment" Miller said. * * * To say that Illinois finances are a disaster is an understatement. The state remains without a budget, and as its fiscal year ends soon, it will go into its second year without a plan to address the massive deficit. Residents have already started to leave the state, and as evidenced by McGrath, even more are planning to. The state will continue to lose its tax base, and devolve further and further into complete insolvency - but hey, the Cubs are in first place in the NL Central, so who cares right? Finally, a question: why pay with singles - the much desired currency of choice at every "gentlemen's venue" around the globe - when quarters, nickels and dimes would serve even better? | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| We Will Never Again See Gold Prices Below $1,201.50 Posted: 17 Jun 2016 03:22 PM PDT

Oh, for heaven's sake! Here's the truth. I work by myself, no waiting secretary, & I run like a scalded dog. That means things don't get checked and double checked. So yesterday I sent y'all the wrong link for the Gold Summit. No point in post mortems, I simply erred. So here is the announcement again, with the link corrected. Please forgive my error.. Y'all can follow this link to the Gold Summit, http://bit.ly/1rtAsN5 I tried it and double tried it. It's right. The Gold Summit offers 20 different interviews with 19 different people, and one nat'ral born durn Tennessee fool among 'em. If you are interested in gold and silver investing, better take a look. You can watch them for free June 16 through June 18, or you can buy and download podcasts. Just so y'all know, if you do buy anything, I receive a small commission. Yesterday markets -- dollar, stocks, gold, silver -- reversed with crazy days, large ranges, and small gains or losses at the closes. Today they reversed the reversals. All this reflects spooked markets fearful what sort of egg the Brexit vote might lay. Brexit vote happens on 23 June, next Thursday, so we'll probably be treated to more of this turmoil next week. US dollar index fell 44 basis points (0.44%) today to 94.17. The three day chart makes yesterday look like a freak spike, which gave back the entire gain & resumed the previous trajectory of fall. Another question highlights why this is important: With Brexit looming, why isn't scared money fleeing into the US Dollar? If it's not, what does that say about the "strength" of the dollar? Of course, I leave open the likelihood that central banking criminals are colluding to keep the euro from collapsing & the dollar from soaring. Stocks reversed yesterday's reversal. Dow fell 57.94 (0.33%) to 17,675.16. S&P500 slid 6.77 (0.33%). Bottom line of both days is that stocks couldn't hold on above their 20 & 50 day moving averages, and haven't for five days. Momentum is firmly down, & no up & down jiggering for a day or two will change that. The Gold Price backed off $3.60 (0.3%) to $1,292.50 while silver got serious about dropping, down 19.4¢ (1.1%) to 1740¢. What's happened in gold can't really be shoehorned into a Key Reversal pattern. It always looks sorry when a market breaks to new highs, then closes lower for the day. But a Key reversal needs at least two days reversal, and preferably three. Here gold dropped yesterday as low at $1,278, but came back and today is trading above $1,290 again. It has conquered that first resistance at $1,287. I keep noticing, out of the corner of my mind, that gold & silver keep surprising everyone to the upside. Surprising even me. This typifies markets at the beginning of a bull run. I am beginning to harden in my opinion that the $1,201.50 low was the bottom of Wave 2, and that gold is now in a frantic Wave 3. Sure, I know I might be wrong, and that will be plain if gold drops below $1,272 or even $1,250. But for now my operating theory is that we will never again see gold prices below $1,201.50. Here's the gold chart, http://schrts.co/pI1ZgR Blast this Brexit vote! It throws everything out of focus. Gold's high surge yesterday probably marked the beginning of a correction, UNLESS gold can close higher than $1,308 next week. If you see that, ALL BETS ARE OFF & gold will rocket higher. But y'all haven't yet seen that. Must see it first. Silver's five day chart gives an even stronger impression of a market that has peaked and is beginning to correct. Silver would gainsay that by climbing smartly through 1750¢. Fiddling around below 1750¢ is weakness. Gold/Silver ratio jumped up yesterday as if stuck by a hatpin, but plunged today right back below the 20 & 50 DMAs. Forming a rising wedge, which forecasts another fall. Chart's right here, http://schrts.co/kh9gOy Y'all enjoy your weekend. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Donald Trump: What happened in Orlando is a disgrace Posted: 17 Jun 2016 02:30 PM PDT Donald Trump: What happened in Orlando is a disgrace On 'Hannity,' the presumptive Republican nominee fires back at the Democratic frontrunner and discusses how he plans to protect American citizens from Islamic extremists The Financial Armageddon Economic Collapse Blog tracks trends... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Must Follow Japan to Survive Posted: 17 Jun 2016 01:44 PM PDT This post China Must Follow Japan to Survive appeared first on Daily Reckoning. China has been transformed by a credit-fueled investment boom unlike anything the world has ever seen. A credit-based economy, built around what has effectively been the dollar standard, made it all possible. There's no limit to the amount of credit that can be created under a fiat money system. And the dollar standard created a very large global boom, as U.S. dollars flooded into countries like China. Between 1990 and 2014, investment in China increased a staggering 50-fold. Between 2007 and 2014 alone, investment in China increased by 236%. In the U.S. meanwhile, investment only increased 6% over that same time period. The Chinese are therefore dependent on the dollar standard. If they could have given it up, they would have. But they can’t. They desperately need a trade surplus with the U.S. and the rest of the world to finance their economy and sustain their jobs. Jobs are the main benefit they receive from the dollar standard. China's had an explosion in their population in the last three to four decades. Because of the dollar standard, globalization and the growing U.S. trade deficit with China, they’ve been able to keep those people employed, fed, and increasingly prosperous. China kept the global bubble inflated after the U.S. bubble burst in 2008, through very rapid credit growth and investment growth. But that credit-fueled came into an end sometime in 2014 or 2015. And China faces severe problems as a result. I’m not at all certain China’s economy grew at all last year. Chinese exports used to grow up to 30% a year. Now they're contracting. Last year, for example, Chinese imports contracted 17%. The great export surge from 1990-2014 will not be repeated. There's simply not enough demand in the entire world to permit China's investment-driven economy to grow. The global economy now teeters on recession, if not outright depression. In the past, China was able to export most of its excess production to other countries. But now trade is collapsing and global demand is much too weak to absorb further Chinese exports. Meanwhile, U.S. credit growth is too weak to drive growth, at home or abroad. And my projections don't show those figures changing anytime soon. The bottom line is that China will not be able to sustain its economy through export-led growth. China's investment boom has long since outpaced demand. And with exports contracting, that is now resulting in heavy losses in the banking system. Investment is a net good, but only as long as it creates goods that can be sold for more than they cost to make. When investment is too high relative to demand, prices fall and investment results in losses, rather than profits. That's what China is facing. China realizes it can't continue having such massive levels of investment. That investment has already resulted in far too much excess production capacity. Most of it is already generating losses. And the more they invest now, the more wealth they destroy. Further investment in loss-generating enterprises will only result in more losses. But without continued high rates of investment, the Chinese economy will fall into severe recession. That's the trap. China invests much more than it consumes, which has led to a severely imbalanced economy. And Chinese per capita income is far too low to consume the nation's excess capacity. Median Chinese disposable income, for example, is only $8.13 a day. In the U.S, household consumption accounts for 68% of GDP, and investment 18%. In China, consumption only accounts for 38% of GDP, while investment represents 44%. Perhaps not since the Pharaohs built the pyramids in ancient Egypt with slave labor has investment accounted for so much of a country's GDP, and consumption, so little. Chinese officials have said they'd like to switch from an export-based system to a consumption-driven model since the export model is too vulnerable to a global slowdown. But this will be a major challenge. There’s really no easy way to shift from investment-driven growth to consumption-driven growth, for a number of reasons. If you lay off thousands of steelworkers, for example, those people aren’t going to consume more, they’re going to consume less. If you move those people from manufacturing jobs into service sector jobs, these service sector jobs will pay a lot less than manufacturing sector jobs. To boost consumption, China would need to boost its people's income dramatically. When disposable personal income per capita is $8.13 a day, those people can’t really consume a great deal. On the other hand, if China did manage to increase wages and thus consumption, that presents another problem. At present rates, Chinese factory workers are on track to make about $60 a day within ten years. That sounds like a positive. But before long, Chinese wages aren’t going to be globally competitive anymore. The manufacturing jobs would move out of China into Vietnam, Indonesia, India, and Bangladesh. Exports would plunge and millions of jobs would be lost. There are 100 million Indians that would be happy to work for $5 a day. They haven’t even entered the game, so we're a long way to go before we run out of $5 a day labor. That’s China’s problem. Investment in China is going to decrease. So is consumption. That means Chinese government deficit spending is going to have to increase sharply to keep the country out of depression. In other words, it's going to have to follow the Japanese model of the past 26 years, with soaring debt-to-GDP ratios and much large budget deficits. China's bust may not turn out to be as severe as Japan's, but the threat of a full depression cannot be ruled out if the government doesn't undertake strong measures. And the Chinese government cannot risk that possibility. The Japanese bubble popped in 1990. And today, 26 years later, its economy is no bigger than it was in 1993 in nominal terms. Japan’s now been in an L-shaped recovery for 26 years. In an L-shaped recovery, the economy declines sharply initially, which is then followed by a long period of flat or stagnant growth. 26 years is a long time of flat or stagnant growth. But Japan managed to avoid a full depression because it increased its debt from 60% of GDP to 250%. I expect something quite similar to happen in China. Hopefully, with some luck and skill, China will be able to replay the Japanese scenario. Through very large budget deficits and a very large rapid increase in Chinese central government debt, they can avoid collapsing into a Great Depression. China isn't going to have very much GDP growth to speak of at all, not for a very long time potentially. Its export-fueled growth of the past 25 years has come to an end. And it's attempts to transition to more of a consumption-based economy will not be easy. But if China follows the Japanese model, it can hopefully avoid a depression. A Chinese depression would present a great challenge not just for China, but for the entire world. Regards, Richard Duncan P.S. For my ongoing forecasts on what the Fed will do and where I believe asset prices are headed, please subscribe to my quarterly video newsletter Macro Watch. I've created a coupon code for you as a Daily Reckoning reader — simply enter the coupon "daily" to receive a 50% discount. The post China Must Follow Japan to Survive appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sam Harris discusses Islam, Orlando and the reaction from Trump, Clinton and Obama Posted: 17 Jun 2016 01:28 PM PDT Sam Harris discusses Islam, Orlando and the reaction from Trump, Clinton and Obama The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China: Heading for a Great Depression? Posted: 17 Jun 2016 01:18 PM PDT This post China: Heading for a Great Depression? appeared first on Daily Reckoning. "Capitalism was driven by investment, savings, capital accumulation, reinvestment and capital accumulation… But history got in the way…" In yesterday's reckoning, economist and author Richard Duncan explained "creditism." And how it came to replace good old-fashioned capitalism, now dead beyond recall. World War I forced warring nations off the classical gold standard. The Great Depression and World War II put the final stakes through capitalism. Government spending, based on the expansion of credit-backed money, was the new order of the day. Thus, creditism was born. Creditism scotched the Nazis. It buried the Soviet Union. It also sparked one of the great economic booms in history as it ushered in a new era of globalization. Thus, an economic backwater like China could develop into the world's second-largest economy. But the laws of economics will not be forever conned. Trees don't grow to the sky. Imbalances must be righted. Debts must be paid…. Creditism has produced booms and busts and the devil and all the other disorders to which a credit-based monetary system is prone. "Once the Bretton Woods system broke down, the old rules went out the window," notes Richard. "The world sent America goods, but the world didn't get American goods in return. It got paper dollars. Under the dollar standard, central banks accumulated hundreds of billions, ultimately trillions, of U.S. dollars in this way. The huge inflow of dollars also created investment booms in those countries." But as sure as night follows day…

Or China today. Global recession looms once again, and the world's central banks are running out of tools. The Chinese export-based economic model that creditism birthed is crumbling. And it could drag the rest of the world down with it. In this essay, Richard explains in chilling detail why China could be on the verge of its own Great Depression. And there's only one way out. What is it? Read on, here. Regards, Brian Maher P.S. The Federal Reserve might reduce rates again or launch another round of QE to stimulate the failing economy. And gold should soar on the weaker dollar. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. We'll send it to you when you sign up for the free daily email edition of The Daily Reckoning. We break down the complex worlds of finance, politics and culture to bring you cutting-edge analysis of the day's most important events. Click here now to sign up for FREE and claim your special report. The post China: Heading for a Great Depression? appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Like a Leaf Upon the Water Posted: 17 Jun 2016 01:00 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fed Giveth and the Gold Bullion Banks Taketh Away… Posted: 17 Jun 2016 12:18 PM PDT Precious metal expert Michael Ballanger breaks down the gold price roller coaster surrounding the Fed's decision not to raise interest rates. Janet Yellen just blew all remaining semblances of credibility believed to be still present at the U.S. Federal Reserve Board. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 17 Jun 2016 12:03 PM PDT The red-hot gold stocks surged again this week in an apparent early-summer breakout. This strong buying is defying their seasonally-weak odds this time of year. Investors are flocking back to the miners as gold powers higher on also-counter-seasonal strong investment buying. Such unprecedented gold-stock strength in early June highlights how undervalued the miners remain relative to gold, but is suspect. Summers are usually lackluster times for gold, and thus silver and their miners’ stocks. These summer doldrums exist for a couple reasons. Gold simply enjoys no recurring demand spikes driven by cultural or income-cycle factors in June and July unlike during most of the rest of the year. It’s before the Asian-harvest, Indian-wedding-season, and Christmas gold buying that flares up like clockwork in second halves. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Wildcats - And The Day Futures Died - Part 1 Posted: 17 Jun 2016 12:01 PM PDT Jeffrey Lewis | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What Would The #Brexit mean for the Eurozone Posted: 17 Jun 2016 12:00 PM PDT The Consequences of a #Brexit Stratfor outlines the repercussions a Brexit would have for Britain and Europe in the wake of the June 23 referendum. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term investment interest in gold is making trouble, Maguire says Posted: 17 Jun 2016 11:43 AM PDT 2:43p ET Friday, June 17, 2016 Dear Friend of GATA and Gold: London metals trader Andrew Maguire tells King World News today that long-term investment interest in gold is increasing, making trouble for the "usual price-suppression schemes." His comments are excerpted at KWN here: http://kingworldnews.com/alert-whistleblower-maguire-says-massive-stampe... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mike Ballanger: The Fed giveth and the bullion banks taketh away Posted: 17 Jun 2016 11:32 AM PDT 2:30p ET Friday, June 17, 2016 Dear Friend of GATA and Gold: Market analyst Michael Ballanger remarks today that while the Federal Reserve seems befuddled about interest rates, the gold price remains under the control of the Fed's bullion bank agents. He adds that more respectable analysts increasingly echo your secetary/treasurer's observation from eight years ago -- -- that there are no markets anymore, just interventions. Ballanger's commentary is headlined "The Fed Giveth and the Bullion Banks Taketh Away" and it's posted at Streetwise Reports here: https://www.streetwisereports.com/pub/na/the-fed-giveth-and-the-bullion-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: New Orleans Investment Conference Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREXIT: This is your last CHANCE #LeaveEU #Brexit Posted: 17 Jun 2016 11:31 AM PDT Brexit is coming. Please Upload and share this on Social Media sites everywhere. #LeaveEU #Brexit The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Wildcats - And The Day Futures Died - Part 1 Posted: 17 Jun 2016 10:37 AM PDT From Legends to Bankers Yes, there has always been price manipulation. There will always be price manipulation. From the time of Caesar, through the American Civil War and into the 20th and 21st centuries. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How to Use the Gold-to-Silver Ratio? Posted: 17 Jun 2016 10:33 AM PDT We have debunked the myth that gold-to-silver ratio should revert to its “true” level around 16. The predominant range for the ratio in modern times is rather well between 40 and 80. Moreover, the notion that the gold-to-silver ratio should revert to some historical average makes no sense. The relative valuation between these two precious metals depends on market forces, like the health of the world economy and monetary demand for both metals, or industrial demand for silver. Such factors change over time. For example, gold has nowadays much higher monetary demand compared to silver than in the past, which largely explains why the average ratio in the 21st century was on average higher than earlier. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 17 Jun 2016 10:01 AM PDT Zealllc | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Trend Following Guide to Surviving the Apocalypse Posted: 17 Jun 2016 09:00 AM PDT This post The Trend Following Guide to Surviving the Apocalypse appeared first on Daily Reckoning. Check out this email I received from a subscriber… "I have read the next bubble to implode will make 2008 look like a minor event… I guess building a fast, bulletproof car and watching reruns of Mad Max to gather clues to what is coming is a [good] strategy." Maybe he's right about a coming apocalypse. But that's not a real strategy for the real world. I'm all for preparation. But binge-watching dystopian films and bulletproofing your own Mad Max 1973 Ford Falcon XB GT coupe to prepare for the next economic collapse is not the path. Today, I'm going to show you the best way to find peace and prosperity in a royally ****ed up world. It's All Perverted TheaterLook, don't get me wrong, I understand why millions are on edge lately… We have record levels of worldwide debt… stagnant economies… Brexit fear looming… and massive global instability. And the reckless central bankers who created this mess are more than happy to make it even worse. I wouldn't be surprised at all if a major shock event – a black swan – hit tomorrow and knocked 20% off the S&P in a day. So how come I'm not worried? Well, I have a backstop… a strategy that protects me from market meltdowns. (More on that in a moment.) And, to be honest, I enjoy watching the chaos. It's like watching the clueless in zombie movies… There's "Average Joe," who's been hoodwinked over and over again into investing his hard-earned money into a rigged system… and he's desperately trying to find a way to survive. There's "D-bag Banker," the wealthy financier who's made a killing off the backs of guys like "Average Joe." His desire is to stay out of jail and plan his next swindle–like Axelrod in the TV show "Billions." And then there's "Stormtrooper Janet"… the feckless central banker with the enormous ego that made the entire swindle possible. She wants to control the world… and has it on the brink of chaos at all times. There's fantastic drama on display… so much suspense… and the performances are so compelling. But, I realize not everyone is like me. I have learned to see this as bizarre entertainment. The fact is there are millions of real-life "Average Joes" caught in this all-too-real nightmare. They're holding on to stocks and praying for the best. And all they're trying to do is protect their retirements. They live the stress every day. And they're told by media to worry about the next meltdown literally 24/7. But I'm here to tell you that you don't have to do that to yourself. You don't. There's a much better way to live a life. So just sit back. Take a deep breath. And give a listen to today's podcast… It's about one of best discoveries I've ever made… It's a 1959 article from Time magazine that's one of the first trend following articles to appear in a major American publication. I couldn’t believe what I found inside this magazine. I revealed the details in a podcast I recorded last year… Here's what you'll learn…

Click here to listen to today's podcast. Please send me your comments to coveluncensored@agorafinancial.com. Let me know what you think of today's podcast. Regards, Michael Covel The post The Trend Following Guide to Surviving the Apocalypse appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

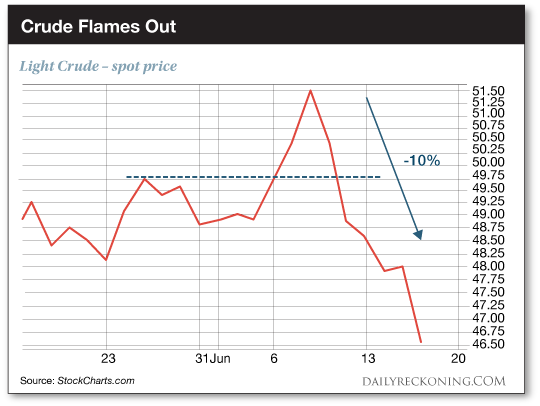

| Crude Chewed Up by Another False Breakout… Posted: 17 Jun 2016 08:37 AM PDT This post Crude Chewed Up by Another False Breakout… appeared first on Daily Reckoning. The stock market is grinding up the bulls every single time it gets within spitting distance of its highs. And tumbling stocks aren't the only culprits that are chewing up portfolios… A handful of nasty false breakouts and breakdowns are creating a treacherous environment for traders and investors alike. Just when you think you have something figured out, the market throws a wrench in your gears. You don't have to search very far to find the effects of these whipsaw moves. Just look at gold futures over the past 24 hours. After launching to two-year highs above $1,318 Thursday morning, gold started to slip. It's lost more than $25 since noon yesterday—and now it's back below $1,300 once again. Oil's another example of whipsaw market action taking its toll. Earlier last week, we told you the oil bears were losing their bite. Oil prices quickly jumped above $50 a barrel last week for the first time in nearly a year. U.S. stockpiles were down and China demand came in stronger than anticipated. Both of these factors helped push oil over the hump. Crude even managed to top $51. But these gains were short lived. As it turns out, the oil bears were just taking a quick nap… "Oil prices fell for a sixth straight day on Thursday, striking the longest bearish run since early 2016, as U.S. crude stocks fell less than expected and concerns over Britain’s future in the EU weighed," CNBC reports. I'm not sure what the Brexit vote has to do with crude. Will Britain stop using oil if it decides to break from the EU? No chance… Still, market jitters continue to wreck havoc on what appear to be the strongest breakouts.

This bearish action is rattling throughout the entire energy sector. Keep in mind that oil services stocks kicked off last week with an insanely strong move right out of the gate. The VanEck Vectors Oil Services ETF jumped 10% on strong volume to new 2016 highs. But after going from laggard to leader in just 48 hours, the oil services sector fell flat on its face. In fact, the entire energy sector is getting smacked around this week. The Energy Select Sector SPDR (NYSE:XLE) is fighting to stay above its 50-day moving average for the first time since oil began its comeback move in early March…

The 50-day moving average will be a critical test for the energy sector. We saw a nice little bounce yesterday afternoon to keep hope alive. But this sector will need some positive follow-through for anything to stick… Along with oil, stocks are a hot mess once again. After a brutal start to the year and an improbable run off its lows, the S&P 500 is once again getting knocked farther from its all-time highs. It doesn't matter if you've bet big on breakouts or breakdowns this year. If you didn't take the money and run, you're right back where you started—or worse. For now, we're combating these painful whipsaw moves by keeping our short-term trading positions to a minimum. The worst thing we can do is force trades that just aren't there. It's best to simply cut our losses as quickly as possible and wait for more favorable market conditions. Don't let the market grind your portfolio to a pulp… Sincerely, Greg Guenthner P.S. Make money in a falling market — sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out on the next big trend. Click here now to sign up for FREE. The post Crude Chewed Up by Another False Breakout… appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inflation, Deflation & Associated Trading Prospects Posted: 17 Jun 2016 07:27 AM PDT Recently I have gotten wordy about the decline in ‘inflation expectations’ beginning on June 2, right on through yesterday’s update of the TIP-TLT ratio and TLT in essence, attaining their targets. The implication would be that the mini deflation whiff is coming to its limits. As often happens at potential limit points, the market’s crosscurrents are strong. As noted yesterday, USD, gold, silver and the gold miners all did in-day reversals as items that had been risk ‘off’ got hammered. ‘What, USD and gold in lockstep? What is the meaning of this?!?’ think inflationists. See yesterday’s in-day post Strange Bedfellows. The meaning is that these items, along with the VIX and US Treasury bonds have been plays for a risk ‘off’ market as it got the jitters over deflation. Gold miners had been, however fleetingly, rising in line with their counter-cyclical fundamentals and this is the mirror image to the reasons why I so often parrot that if you are a gold miner bull, realize that fundamentally at least, the sector is done no favors in an inflationary backdrop (price, for long stretches of time, can be something else all together). | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hints of FX intervention as central banks debate Brexit response Posted: 17 Jun 2016 05:44 AM PDT By Patrick Graham and Anirban Nag LONDON -- Warnings from officials in Japan and Switzerland on Thursday left financial markets wondering about what central banks are planning behind the scenes if Britain votes to leave the European Union next week. It is five years since major monetary authorities waded in to currency markets in a concerted push to quell gains for the yen after a shattering earthquake in Japan. ... Dispatch continues below ... ADVERTISEMENT A Contrarian's Call Option on Gold Sandspring Resources' Toroparu project in Guyana is the fourth-largest gold deposit in South America held by a junior mining company. Experienced backers of Sandspring Resources include Silver Wheaton, the John Adams / Energy Fuels group in Denver, and Frank Giustra's Fiore Group in Vancouver. A 2013 preliminary feasibility study shows strong economics for this large-scale mine at US$1,400 gold. With a current gold price below US$1,300, Sandspring is for investors who believe that gold price suppression will be overcome. For a detailed report on Sandspring Resources by Tommy Humphreys of CEO.CA, please visit: https://ceo.ca/@tommy/a-ten-million-ounce-call-option-on-gold Such coordinated action in the era of floating exchange rates is rare, and central banks have so far restricted themselves to promises to provide any funding banks might need in the event of a stormy aftermath to next Thursday's referendum. Officials told Reuters earlier this week the European Central Bank would pledge to backstop markets in tandem with the Bank of England after a vote to leave. But a raft of official policy statements following four major central bank meetings this week -- and amid evidence that momentum within the British electorate is shifting towards the Brexit camp -- offered hints that policymakers are considering whether they will need to do more. "Sharp fluctuations could occur in the FX market, with the pound depreciating massively amid low liquidity. This could prompt the central banks of the developed countries to conduct joint FX market interventions," said Antje Praefcke, a currency strategist at Commerzbank in Frankfurt. The Swiss National Bank said outright it would be active on the franc and would take steps to counter any Brexit fallout. Chairman Thomas Jordan added central banks were holding intense exchanges on market developments. ... ... For the remainder of the report: http://uk.reuters.com/article/us-britain-eu-intervention-idUKKCN0Z225Y Join GATA here: New Orleans Investment Conference Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Surges to Highest in Nearly Two Years On Central Bank and Brexit Haven Demand Posted: 17 Jun 2016 04:59 AM PDT The gold price surged to their highest level in nearly two years yesterday on BREXIT concerns and deepening concerns that central banks are slowly losing control of the financial and monetary system. Gold subsequently fell quite sharply below the key $1,300 level but remains roughly 1% higher for the week in all currencies and is on track for its third week of gains. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 16 Jun 2016 06:20 PM PDT Fed and BoJ spook the markets. Global stocks fall but US stocks recover after UK assassination temporarily suspends Brexit campaign. US factory output and inflation weak, gold gives up big early gains. German 10-year bonds go negative and Japanese 10-years go more negative. Can US Treasuries be far behind? Best Of The Web Thinking […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock Market, Iron Ore, Bitcoin – Is Silver Next for Chinese Momentum Investors? Posted: 16 Jun 2016 08:41 AM PDT The roulette game all started in the fall of 2014, about 2 years after Chairman Xi Jinping came to power and became the General Secretary of the Communist Party of China. Xi Jinping had campaigned for socialist economic reform, including a sweeping anti-corruption drive, cutting excess production capacity, tightening of housing credit, and clamping down on gaming in Macau. Public feedback was initially positive. However, largely as a result of those policies, Beijing was facing an increasingly grim economic growth outlook which was the worst in more than two decades*. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

We all know the debt load in the US economy is horrendous and unsustainable. The US government runs deficits of approximately $1 Trillion per year, even with interest rates at historical lows. Current official national debt exceeds $19 trillion, of which $13.9 trillion is public debt. Unfunded liabilities are much larger. Even a 7% average interest rate would require nearly $1 trillion per year for interest only debt service, thereby increasing national debt even more rapidly. National debt has increased exponentially for the past 50 years. Expect the exponential increase to continue and accelerate, even with historically low interest rates.

We all know the debt load in the US economy is horrendous and unsustainable. The US government runs deficits of approximately $1 Trillion per year, even with interest rates at historical lows. Current official national debt exceeds $19 trillion, of which $13.9 trillion is public debt. Unfunded liabilities are much larger. Even a 7% average interest rate would require nearly $1 trillion per year for interest only debt service, thereby increasing national debt even more rapidly. National debt has increased exponentially for the past 50 years. Expect the exponential increase to continue and accelerate, even with historically low interest rates.

Crude only had a few hours to savor life above $51. That's when everything started to fall apart. Despite a strong breakout, oil couldn't even hold a fraction of its gains. Since its break to 11-month highs, oil has crashed more than 10%.

Crude only had a few hours to savor life above $51. That's when everything started to fall apart. Despite a strong breakout, oil couldn't even hold a fraction of its gains. Since its break to 11-month highs, oil has crashed more than 10%.

No comments:

Post a Comment