saveyourassetsfirst3 |

- Ray Dalio Reveals Whats Coming After QE

- Contagion: Gold Is Signalling A Systemic Catastrophe

- “Atomic Bomb In the Works for July”: Someone VERY BIG Is Standing For Gold & Silver!

- Fake Rally: Analyst Warns Silver Prices Headed to SINGLE DIGITS!

- Legendary Gold Trader Jim Sinclair Says Gold Headed to $50,000/oz! Here’s Why…

- Jim Willie: Unintended Consequences & COLLAPSE

- Gold & Silver Are Cooking! Eric Sprott Metals Update

- Peter Schiff Issues CNBC BIG Warning

- Bilderberg Nazis Detain Luke Rudkowski- “We Don’t Need A Reason. We’re In A Secret Zone”

- Gold Stocks Retreat at Resistance

- June 2016: ZERO HOUR! |Bo Polny

- Gold Medium Term Technical Chart

- Gold rigging will fail as investors see fraud of paper gold, Grant Williams says

- Really Cookin'

- WGC’s June Gold Investor: King about Gold

- If You Didn’t Buy Gold and Silver During the Dip, Buy the Companies That Did!

- Breaking News And Best Of The Web

- The mystery of the Gold Certificates

- How Gold is Produced

- George Soros Is Preparing For Economic Collapse – Does He Know Something That You Don’t?

| Ray Dalio Reveals Whats Coming After QE Posted: 10 Jun 2016 01:17 PM PDT And it’s not what you expect… by Rory, The Daily Coin I have known for some time that our economy is in a lot of trouble. Today, that has been confirmed by someone that runs one of the largest, most well known funds anywhere in the world. We have spent a lot of time on […] The post Ray Dalio Reveals Whats Coming After QE appeared first on Silver Doctors. |

| Contagion: Gold Is Signalling A Systemic Catastrophe Posted: 10 Jun 2016 01:17 PM PDT This is why the price of gold is signalling a systemic collapse: Submitted by PM Fund Manager Dave Kranzler: The media is doing it's part to cover up the unexpectedly bullish trading action in gold and silver. It's a given that the Fed is making an all-out effort to keep a lid on the price gold. […] The post Contagion: Gold Is Signalling A Systemic Catastrophe appeared first on Silver Doctors. |

| “Atomic Bomb In the Works for July”: Someone VERY BIG Is Standing For Gold & Silver! Posted: 10 Jun 2016 01:15 PM PDT Someone very real and VERY BIG is standing for gold. This “someone” would not be bribed to go away last month and does not look like they will go way this month! Who is this long who all of a sudden cannot be bribed to stand down? Looking specifically at silver, we have a true potential atomic […] The post “Atomic Bomb In the Works for July”: Someone VERY BIG Is Standing For Gold & Silver! appeared first on Silver Doctors. |

| Fake Rally: Analyst Warns Silver Prices Headed to SINGLE DIGITS! Posted: 10 Jun 2016 01:14 PM PDT Currently, what's taking place in bullion markets, over the short term, we are in the middle of a fake rally… If you want to crash metals prices and they are already at bargain basement levels then you have to march them up a bit first, if you wanna give them a really good crash. Before […] The post Fake Rally: Analyst Warns Silver Prices Headed to SINGLE DIGITS! appeared first on Silver Doctors. |

| Legendary Gold Trader Jim Sinclair Says Gold Headed to $50,000/oz! Here’s Why… Posted: 10 Jun 2016 01:05 PM PDT According to Legendary gold trader Jim Sinclair, The real gold show is only starting… From Jim Sinclair: Legendary gold trader Jim Sinclair shocked the precious metals community Friday by publicly stating that the US will be Cypruss’d, the current take-down in gold & silver is a last-ditch can kicking attempt by the bullion banking […] The post Legendary Gold Trader Jim Sinclair Says Gold Headed to $50,000/oz! Here’s Why… appeared first on Silver Doctors. |

| Jim Willie: Unintended Consequences & COLLAPSE Posted: 10 Jun 2016 01:05 PM PDT An Economic Collapse and Financial Crisis of historical proportions is rising… Numbered Rim, Only 2,500 Minted! The post Jim Willie: Unintended Consequences & COLLAPSE appeared first on Silver Doctors. |

| Gold & Silver Are Cooking! Eric Sprott Metals Update Posted: 10 Jun 2016 01:01 PM PDT A BIG change in sentiment sent gold and silver to a HUGE week. Is a SIZZLING SUMMER Just Getting Started? 1 oz Silver Superman S-Shield Intro Pricing! The post Gold & Silver Are Cooking! Eric Sprott Metals Update appeared first on Silver Doctors. |

| Peter Schiff Issues CNBC BIG Warning Posted: 10 Jun 2016 01:01 PM PDT Big Banks, BIG Warning. Our favorite Fed basher Peter Schiff has issued the world (via CNBC’s Fast Money no less) a rather large warning… 1 oz Silver Superman S-Shield Intro Pricing! The post Peter Schiff Issues CNBC BIG Warning appeared first on Silver Doctors. |

| Bilderberg Nazis Detain Luke Rudkowski- “We Don’t Need A Reason. We’re In A Secret Zone” Posted: 10 Jun 2016 01:00 PM PDT The police (about eight of them surrounding us) responded, "We don't need a reason. We are in a secret zone." I asked him what that meant, that we were in a secret zone, and he said, "That means I can do whatever I want." Submitted by Jeff Berwick: Bilderberg was founded in 1954 and […] The post Bilderberg Nazis Detain Luke Rudkowski- “We Don’t Need A Reason. We’re In A Secret Zone” appeared first on Silver Doctors. |

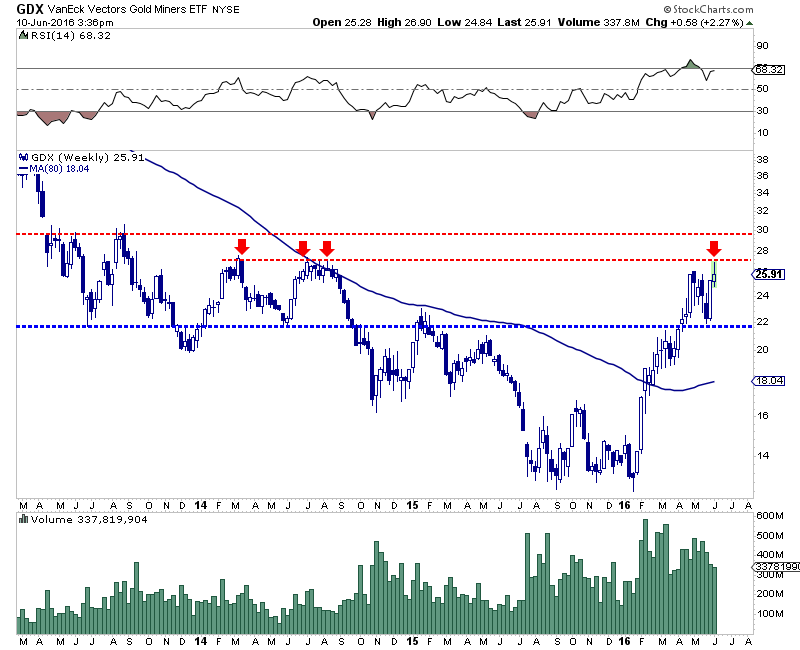

| Gold Stocks Retreat at Resistance Posted: 10 Jun 2016 12:54 PM PDT Over the past two weeks gold stocks have surged more than 20% as the awful jobs report forced the bears to capitulate. That strong of a move in a brief amount of time will naturally slow or correct. Furthermore, gold stocks touched resistance Friday morning which led to a bearish reversal. While the bullish trend remains intact, the odds favor lower prices in the days ahead. The weekly chart below shows that GDX ticked resistance near $27 yet will close off the highs of the week. That is not a surprise considering the market tested resistance amid a very overbought condition. It was unlikely to crack resistance on the first try.  GDX Weekly

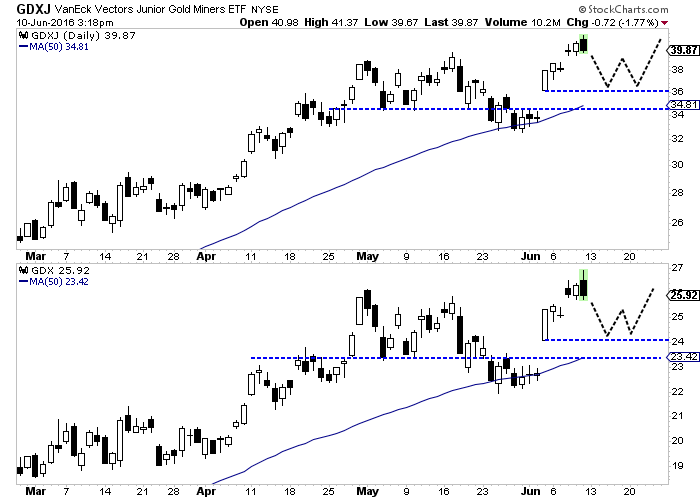

We zoom in on the short term by looking at daily candle charts for both GDX (bottom) and GDXJ. The miners pushed to higher highs but formed a bearish reversal on Friday. I expect Wednesday's gap to fill and the miners to potentially test last Friday's opening prices (GDXJ $36 and GDX $24). We sketch how the correction could evolve with the presumption of a bullish outcome.  GDXJ, GDX Daily Candles

Buying opportunities within this sector have been few and far between and that could remain the case for the time being. However, if the miners correct here as expected then we should get a minor buying opportunity in the days ahead. If GDXJ tests $37 that would mark a 10% decline. Buying +10% weakness has been a profitable, lower risk strategy and we think that will continue to be the case. Hold your positions and take advantage of weakness. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Jordan Roy-Byrne, CMT |

| June 2016: ZERO HOUR! |Bo Polny Posted: 10 Jun 2016 12:45 PM PDT Have we reached The End? Numbered Rim, Only 2,500 Minted! The post June 2016: ZERO HOUR! |Bo Polny appeared first on Silver Doctors. |

| Gold Medium Term Technical Chart Posted: 10 Jun 2016 09:21 AM PDT Commodity Trader |

| Gold rigging will fail as investors see fraud of paper gold, Grant Williams says Posted: 10 Jun 2016 09:03 AM PDT GATA |

| Posted: 10 Jun 2016 07:31 AM PDT Things are really starting to get interesting this morning as global interest rates push to new lows and global equity markets swoon. This has driven gold higher again and the shares are at new 2016 highs, too. Of course the question is, can we hold all of these gains through the day and into the close? |

| WGC’s June Gold Investor: King about Gold Posted: 10 Jun 2016 07:21 AM PDT SunshineProfits |

| If You Didn’t Buy Gold and Silver During the Dip, Buy the Companies That Did! Posted: 10 Jun 2016 06:45 AM PDT  If You Didn’t Buy When Gold and Silver Bottomed, Buy the Companies That Did… Gold bottomed at $1,045 and silver at $13.62 during December of 2015. Although there have been some minor pullbacks, 2016 has been an incredibly strong year for precious metals. Gold rocketed above $1,300 and silver above $18 briefly, before slipping back […] If You Didn’t Buy When Gold and Silver Bottomed, Buy the Companies That Did… Gold bottomed at $1,045 and silver at $13.62 during December of 2015. Although there have been some minor pullbacks, 2016 has been an incredibly strong year for precious metals. Gold rocketed above $1,300 and silver above $18 briefly, before slipping back […] |

| Breaking News And Best Of The Web Posted: 09 Jun 2016 06:20 PM PDT Soros and Gross turn bearish. Stocks fall, gold continues to rise. Debt, as usual, continues to grow. Corporations start selling zero-percent bonds. Clinton wins California, clinches nomination. Major US/China trade war breaking out. Global bond yields still falling, China’s debt still rising. Doug Noland’s latest Credit Bubble Bulletin and David Stockman’s proposal to fix the […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

| The mystery of the Gold Certificates Posted: 09 Jun 2016 04:00 PM PDT Charleston Voice |

| Posted: 09 Jun 2016 04:00 PM PDT GoldCoin |

| George Soros Is Preparing For Economic Collapse – Does He Know Something That You Don’t? Posted: 09 Jun 2016 03:02 PM PDT

The recent trading moves that Soros has made are so big and so bearish that they have even gotten the attention of the Wall Street Journal…

Hmmm – it sounds suspiciously like George Soros and Michael Snyder are on the exact same page as far as what is about to happen to the global economy. You know that it is very late in the game when that starts happening… One thing that George Soros is particularly concerned about that I haven’t been talking a lot about yet is the upcoming Brexit vote. If the United Kingdom leaves the EU (and hopefully they will), the short-term consequences for the European economy could potentially be absolutely catastrophic…

The Brexit vote will be held two weeks from today on June 23rd, and we shall be watching to see what happens. But Soros is not just concerned about a potential Brexit. The economic slowdown in China also has him very worried, and so he has directed his firm to make extremely bearish wagers. According to the Wall Street Journal, the last time Soros made these kinds of bearish moves was back in 2007, and it resulted in more than a billion dollars of gains for his company. Of course Soros is not alone in his bearish outlook. In fact, Goldman Sachs has just warned that “there may be significant risk to the downside for the market”…

Ultimately, George Soros and Goldman Sachs are looking at the same economic data that I share with my readers on a daily basis. As I have been documenting for months, almost every single economic indicator that you can possibly think of says that we are heading into a recession. For instance, just today I was sent a piece by Mike Shedlock that showed that federal and state tax receipts are really slowing down just like they did just prior to the last two recessions…

And online job postings on LinkedIn have now been falling precipitously since February after 73 months in a row of growth…

Last week, the government issued the worst jobs report in nearly six years, and the energy industry continues to bleed good paying middle class jobs at a staggering rate. The following comes from oilprice.com…

At this point it is so obvious that we have entered a new economic downturn that I don’t know how anyone can possibly deny it any longer. Unfortunately, the reality of what is happening has not sunk in with the general population yet. Just like 2008, people are feverishly racking up huge credit card balances even though we stand on the precipice of a major financial crisis…

Will we ever learn? This has got to be one of the worst possible times to be going into credit card debt. Sadly, the “dumb money” will continue to act dumb and the “smart money” (such as George Soros) will continue to quietly position themselves to take advantage of the crisis that is already starting to unfold. We can’t change what is happening to the economy, but we do have control over the choices that we make. So I urge you to please make your choices wisely. *About the author: Michael Snyder is the founder and publisher of The Economic Collapse Blog. Michael's controversial new book about Bible prophecy entitled "The Rapture Verdict" is available in paperback and for the Kindle on Amazon.com.* |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment