saveyourassetsfirst3 |

- Jim Willie Issues Warning Alert: Immediate Risk of Systemic Lehman Event

- Junior Gold Miners Report Surging Operating Profits In First Quarter

- NSA’s Worst Nightmare: Journalists Glenn Greenwald, David Miranda Plan Mass Snowden File Leak

- Interplay Between Interest Rates and Gold

- Fed Hiking Rates in June? Marc Faber Says No, Gold & Stocks Have “Significant Upside Potential This Year”

- Gold And Silver at the 11th Hour

- Eric Sprott’s Market Wrap: Can The Fed Stop A “Totally Crazy” Bull Market In Gold & Silver?

- On the Brink of WWIII? “Geo-Financial War” Between NATO and Russia Is Dangerously Escalating

- Two Overlooked Streaming Stocks with Huge Upside Potential

- Gold Looking Vulnerable While Gold Stocks Correct

- Is THIS The End of the Road?

- “Markets” Are A Total Farce: Stocks Pushed Up – Gold Pushed Down By The Fed

- Breaking News And Best Of The Web

- Gold Looking Vulnerable While Gold Stocks Correct

- Harvey Organ: COMEX Players Are Refusing Fiat & Demanding Only Physical Metal!

- My Favorite Micro-Cap Silver Company

- Top Ten Videos — May 27

| Jim Willie Issues Warning Alert: Immediate Risk of Systemic Lehman Event Posted: 27 May 2016 12:05 PM PDT The reckoning has begun… Submitted by Jim Willie: The entire Western financial systemic, complete with USDollar-based foundation platforms, is breaking down. The breakdown is in full view, very noticeable, in almost every arena. What happened in 2008 with the Lehman Brothers failure event is currently underway with almost every single financial platform, structural entity, […] The post Jim Willie Issues Warning Alert: Immediate Risk of Systemic Lehman Event appeared first on Silver Doctors. |

| Junior Gold Miners Report Surging Operating Profits In First Quarter Posted: 27 May 2016 12:04 PM PDT |

| NSA’s Worst Nightmare: Journalists Glenn Greenwald, David Miranda Plan Mass Snowden File Leak Posted: 27 May 2016 12:00 PM PDT On August 18, 2013, David Miranda's life was turned upside down when he was detained at London's Heathrow Airport for 12 hours under anti-terrorism laws. This came after his partner Glenn Greenwald had published numerous documents released by the former NSA contractor Edward Snowden. Now the Brazilian-born Miranda says the public has the right to […] The post NSA’s Worst Nightmare: Journalists Glenn Greenwald, David Miranda Plan Mass Snowden File Leak appeared first on Silver Doctors. |

| Interplay Between Interest Rates and Gold Posted: 27 May 2016 11:10 AM PDT SunshineProfits |

| Posted: 27 May 2016 11:00 AM PDT “The most attractive assets in my view are gold shares and oil and gas shares. I think they still have significant upside potential this year…“ Marc Faber, editor of the Gloom, Boom & Doom Report, is bullish on gold and oil and gas stocks. Source: The Gold Report: Given the abundant speculation about the […] The post Fed Hiking Rates in June? Marc Faber Says No, Gold & Stocks Have “Significant Upside Potential This Year” appeared first on Silver Doctors. |

| Gold And Silver at the 11th Hour Posted: 27 May 2016 10:00 AM PDT The United States has been in a state of declared national emergency since the elites forced the US into bankruptcy on 9 March 1933. Every president, upon being sworn in, has to formally renew the national emergency. Why? When under a state of national emergency: Submitted by ETP: At the proverbial 11th hour, […] The post Gold And Silver at the 11th Hour appeared first on Silver Doctors. |

| Eric Sprott’s Market Wrap: Can The Fed Stop A “Totally Crazy” Bull Market In Gold & Silver? Posted: 27 May 2016 09:30 AM PDT In this Critical Market Update, the Silver Admiral Eric Sprott discusses the big recent decline in metals prices caused by recent concerns of an imminent Fed rate hike. Can The Fed stop a “Totally Crazy” Bull Market? Take Advantage of Silver's Recent Dip With the Latest 5 oz Silver ATB Release: 2016 Harpers Ferry – […] The post Eric Sprott’s Market Wrap: Can The Fed Stop A “Totally Crazy” Bull Market In Gold & Silver? appeared first on Silver Doctors. |

| On the Brink of WWIII? “Geo-Financial War” Between NATO and Russia Is Dangerously Escalating Posted: 27 May 2016 09:00 AM PDT The threat is all-too real, and a serious provocation, like the false flag attacks that have sparked most of the wars in the past, could be on the horizon. Submitted by Mac Slavo, SHTFPlan: Russia is preparing for war against the West. Putin is being urged to do so because the U.S. and […] The post On the Brink of WWIII? "Geo-Financial War" Between NATO and Russia Is Dangerously Escalating appeared first on Silver Doctors. |

| Two Overlooked Streaming Stocks with Huge Upside Potential Posted: 27 May 2016 08:00 AM PDT Streaming/royalty stocks have been darlings of the commodity investment world with Silver Wheaton leading the pack. In the precious metals sector, this type of company provides financing for mining companies in the form of an upfront cash payment in exchange for a percentage of production or revenues from the mine. Jason Hamlin of Gold Stock […] The post Two Overlooked Streaming Stocks with Huge Upside Potential appeared first on Silver Doctors. |

| Gold Looking Vulnerable While Gold Stocks Correct Posted: 27 May 2016 07:10 AM PDT The Daily Gold |

| Posted: 27 May 2016 07:00 AM PDT This is a major RED WARNING ALERT… Submitted by Chris Vermelean: In May of 2008, there was a very similar stock market 'rally' as compared to today's 'rally'. Investors believed that the 'turmoil' during the latter part of 2007 and the early part of 2008 was permanently over and that we were headed towards […] The post Is THIS The End of the Road? appeared first on Silver Doctors. |

| “Markets” Are A Total Farce: Stocks Pushed Up – Gold Pushed Down By The Fed Posted: 27 May 2016 03:00 AM PDT While days like today may be painful to watch, the truth is that since the Fed began bashing gold with rate-hike drivel starting last Monday, the S&P 500 has not moved higher despite days like today which make it feel like the stock market is poised to hit an all-time high. When the Fed pushes […] The post "Markets" Are A Total Farce: Stocks Pushed Up – Gold Pushed Down By The Fed appeared first on Silver Doctors. |

| Breaking News And Best Of The Web Posted: 27 May 2016 12:00 AM PDT US debt becomes an issue. Bill Gross starts shorting corporate bonds. Great interviews with James Rickards and Helen Chaitman. Yesterday’s strong US economic reports are called into question. China plans to borrow even more. Oil stabilizes and gold continues to correct. Look for next week’s COT report to be a lot less bearish. Bitcoin gets […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. |

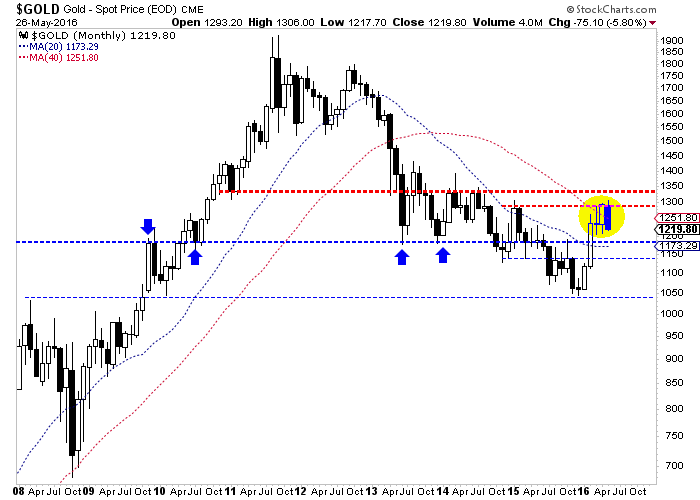

| Gold Looking Vulnerable While Gold Stocks Correct Posted: 26 May 2016 11:40 PM PDT Last week we highlighted our gold stocks bull analog chart which showed the gold stocks correcting at least 20% at this point during both the 2008-2009 and 2000-2001 recoveries. We concluded that gold stocks were likely to continue to correct in the days and weeks ahead. While that has played out so far, we should also note that Gold is suddenly looking more vulnerable. Unless Gold has a big bounce the next two days then its monthly chart will show a bearish engulfing candle for the month of May. That implies weakness in June. Key support levels are $1180 and $1140. The bearish reversal in May takes Gold back below its 40-month moving average at $1252. The 40-month moving average has been an excellent trend indicator for Gold throughout its history and it is the last line of defense for bears. They defended it, now bulls will need to defend $1180 and $1140.  Gold Monthly Candles

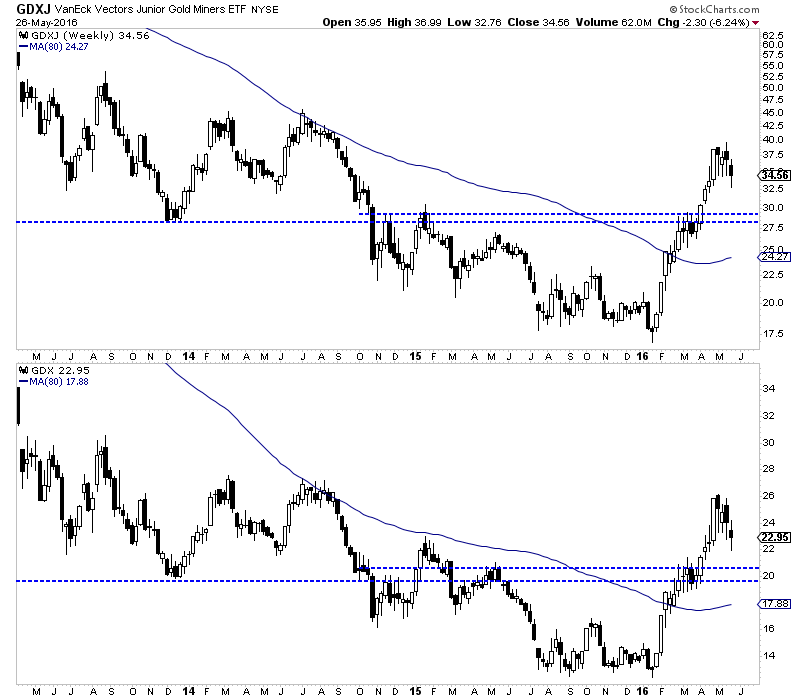

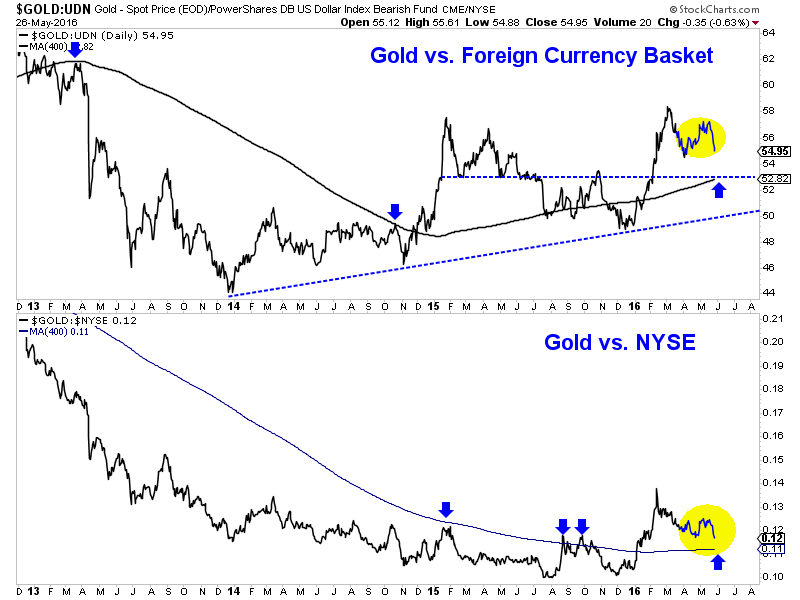

Equally as troubling for bulls, Gold has lost strength in real terms as it is acting poorly against foreign currencies (FC) and the equity market. Since Gold/FC touched a 3-year high in February it has undergone a sustained correction. Meanwhile, Gold/equities has already retraced most of its winter gains. Look for these ratios to continue lower and test their 400-day moving averages. Meanwhile the miners have obviously begun a correction. GDX and GDXJ were already off 16% and 17% respectively at Wednesday's lows. Even though the miners did not reach their 2014 resistance highs they still reached the second most overbought point in the past 20 years. GDX's parent index, $GDM's distance above its 100 and 200-day moving averages was the second greatest in the past 20 years. That leads us to believe that the correction is likely to be greater than the routine 20%. The weekly charts of GDX and GDXJ are shown below with the blue lines showing downside support targets. GDX should find good support around $20 while GDXJ should find support at or below $30. A move just below $20 equates to a 25% correction in GDX.  GDXJ & GDX Weekly Candles

The precious metals sector has begun a sizeable correction and it figures to continue into June. Gold needs to regain strength soon in real terms or it could undergo a deeper and longer retracement of its recent rebound than initially anticipated. We will continue to take first cues from the miners which should continue to lead the sector in the weeks and months ahead. Those who have been waiting for a buying opportunity could have their first chance in the weeks ahead. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Jordan Roy-Byrne, CMT

|

| Harvey Organ: COMEX Players Are Refusing Fiat & Demanding Only Physical Metal! Posted: 26 May 2016 06:53 PM PDT The amount standing for gold at the comex in May is simply outstanding at 6.886 tonnes. The previous May 2015, we had only .08 tonnes standing so you can certainly witness the difference as the demand for gold by investors/sovereigns is on a torrid pace. This makes the excitement for June gold that much more […] The post Harvey Organ: COMEX Players Are Refusing Fiat & Demanding Only Physical Metal! appeared first on Silver Doctors. |

| My Favorite Micro-Cap Silver Company Posted: 26 May 2016 02:22 PM PDT This report was written April 2, 2016. This is the smallest company (by market capitalization) in our model portfolio. We have not been compensated to publish this report publicly. Remember to do your own due diligence, which includes calling the company.

For more information on our premium service:

|

| Posted: 26 May 2016 01:00 PM PDT Fascinating look at the criminality of the big banks from Helen Chaitman. Yellen’s folly from McAlvany. Mike Maloney on why negative interest rates equal global bankruptcy. Gordon T. Long on the crumbling of the Shanghai Accord. Marin Katusa predicts $5,000 gold. Rob Kirby sees the dollar falling from here. The post Top Ten Videos — May 27 appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment