Gold World News Flash |

- As Billionaires Predict Worldwide Defaults, Would You Rather Hold Bonds or Gold

- The Relationship Between The United States And China Is Officially Going Down The Tubes

- Debt Market Meltdown: Here it Comes

- The Next Big Crash Of The U.S. Economy Is Coming, Here’s Why

- National Post mocks gold manipulation without ever questioning a central bank

- Gold Price Lost $38.60 or -3.1% this Week

- G7 Leader Warns Global Economic Crisis Is On Its Way

- Full Speech: Donald Trump Holds Rally in San Diego, CA (5-27-16)

- Bank of America's Winning Excuse: "We Didn't Mean To"

- Another Bubble Has Burst: The Miami Luxury Condo Market Is A "Ticking Timebomb"

- Alex Jones Show (VIDEO Commercial Free) Friday 5/27/16: Tim Kennedy

- The Next Systemic Lehman Event - New Scheiss Dollar & Gold Trade Standard

- Energy and Debt Crisis Point to Much Higher Silver, Metals Prices

- Gold Junior Stocks Q1 2016 Fundamentals

- The World Goes On HIGH ALERT As The US Pushes For WW3 05 06 2016

- Interviews with Maguire, Embry, and Turk

- Gold Juniors’ Q1’16 Fundamentals

- Pope Francis Converts To Islam!

- Donald Trump’s Category 5 Hurricane

- Amerigeddon -- THE MOVIE THEY DON´T WANT YOU TO SEE

- Major story !!! It doesn't get much more serious than this

- Europeans support Donald Trump for president!

- GERALD CELENTE WARNS THE GLOBAL ECONOMY IS BURSTING RIGHT NOW!

- $HUI (Gold Bugs Index) Rally

- The Ugly Truth About Stock Market Manipulation and Gold Prices

- The Global Currency Reset and the Gold Backed Yuan

- Gold Price Looking Vulnerable While Gold Stocks Correct

- A New Golden Bull or Has the Market Gone Too Far Too Fast?

- Breaking News And Best Of The Web

- Eric Hadik: 'Seismic Shift' Coming for US Dollar, Gold Market

- Top Ten Videos — May 27

| As Billionaires Predict Worldwide Defaults, Would You Rather Hold Bonds or Gold Posted: 27 May 2016 11:00 PM PDT from The Daily Bell:

Gold went up by 16 percent in the first quarter of 2016 and kept on moving even afterward for a total of 20%. Investors are nervous about the economy and the first quarter's results reflected those nerves with a rise in gold. Since then it's moved down some 6% as Janet Yellen has counterattacked with vaguely worded suggestions that the Fed might hike rates again. As we pointed out in a recent article, the idea that the US economy is on an upswing seems difficult to believe. The US owes something like $200 TRILLION if one includes Social Security and other outflows going forward. Meanwhile some 100 million individuals including young people and seniors are not working in mainstream jobs or not working at all. Our perspective on the US and the world economy is summed up by a top executive for the Bank for International Settlements, William White. Speaking some months ago, he was quoted by the UK Telegraph as saying that nothing less than a worldwide debt jubilee would bring back global solvency. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Relationship Between The United States And China Is Officially Going Down The Tubes Posted: 27 May 2016 09:05 PM PDT by Michael Snyder, End Of The American Dream:

Let's start with the trade war that has erupted. About a week ago, we learned that the Obama administration had decided to "go nuclear" on China by imposing a 522 percent duty on cold-rolled steel from China that is used in certain kinds of manufacturing…

Subsequently, it was announced that a 450 percent duty will be imposed on corrosion-resistant steel from China…

Needless to say, the Chinese are less than amused, because these "shock and awe" trade duties were clearly designed to punish China. And of course the truth is that China has been abusing us for years, so there is definitely a case to be made that they deserve even harsher treatment. However, we need to keep in mind that the Chinese will retaliate for this. And when they retaliate, it will likely be quite painful for us. But for the moment, they are just issuing vague threats…

Meanwhile, events in the South China Sea continue to push the United States and China toward conflict. Let me summarize a few of the most important things that we have seen over the past month… -In early May, Chinese authorities refused to give permission to the U.S.S. John C. Stennis battle group to make a routine port call at Hong Kong. The Chinese had not turned away a U.S. aircraft carrier in almost a decade, and many believe that this was in direct response to comments that U.S. Defense Secretary Ashton Carter had made regarding China's territorial claims in the South China Sea. -Subsequently, the Obama administration sent the U.S.S. William P. Lawrencesailing within 12 nautical miles of the disputed islands in the South China Sea. This was the third time that Obama has sent naval vessels cruising by those islands, and it provoked an extremely angry response from China. -Just last week, two Chinese fighters and a U.S. spy plane nearly collided in mid-air approximately 50 miles away from Hainan island. This incident made headlines all over the planet. Most Americans seem to believe that the Chinese are our "friends", but in China the perspective is completely different. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt Market Meltdown: Here it Comes Posted: 27 May 2016 08:00 PM PDT from GregoryMannarino: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

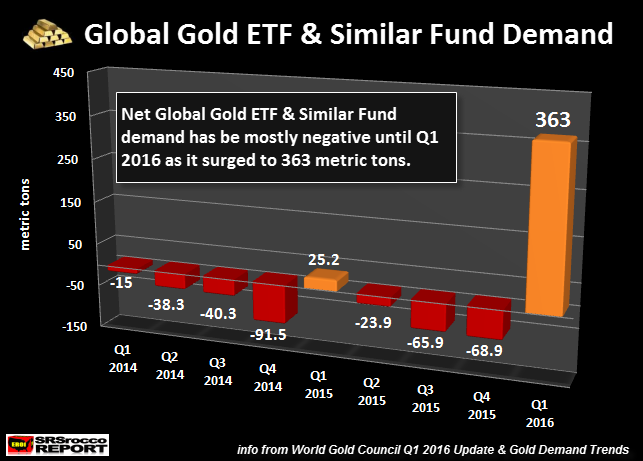

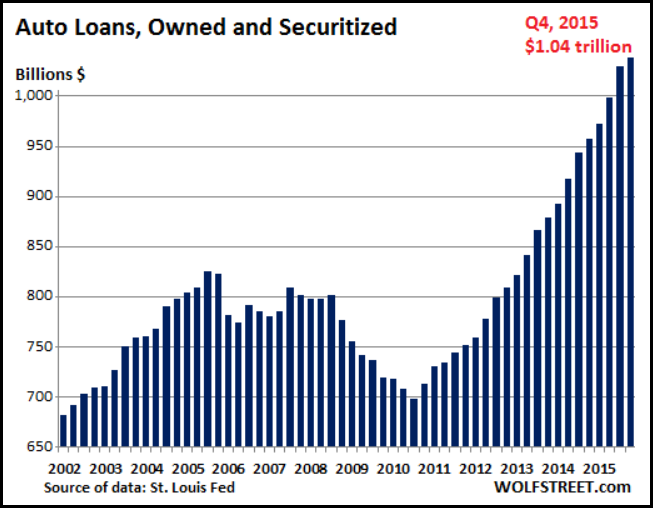

| The Next Big Crash Of The U.S. Economy Is Coming, Here’s Why Posted: 27 May 2016 07:22 PM PDT by Steve St. Angelo, SRSRocco Report:

To get the skinny on the lousy fundamental data, let's first look at the Auto Industry. The next series of charts come from the article, More Warnings–Unsustainable Auto Sales & Stock PE Ratios: Ever since the supposed economic turnaround, the amount of outstanding auto loans has increased dramatically from less that $700 billion in 2010 to over $1 trillion in the fourth quarter of 2015. According to Wolf Richter, quoted in the article:

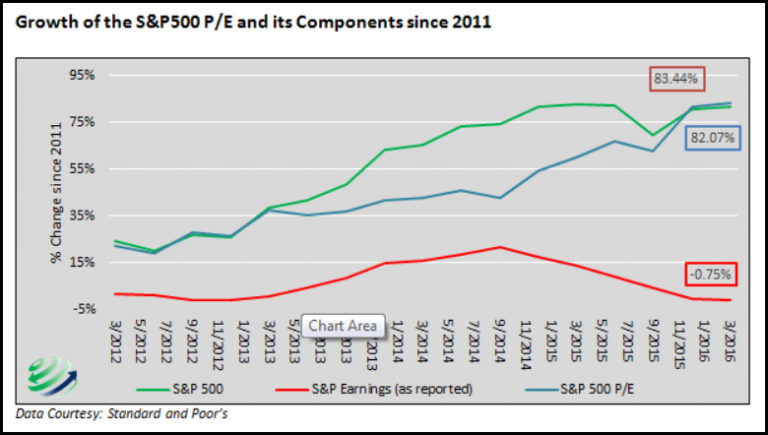

When I was younger, the longest automobile loan an individual could get was 48 months. However, you were considered to be a REAL LOSER if you had to finance an automobile that long. Now, 84 months is becoming the norm….LOL. This is just one factor that shows just how weak the economy has become if Americans have to finance a car for seven years. Here is another chart from the article linked above. It shows just how inflated the S&P 500 index has become:

According to Michael Lebowitz of 720 Global Research (quoted in the article):

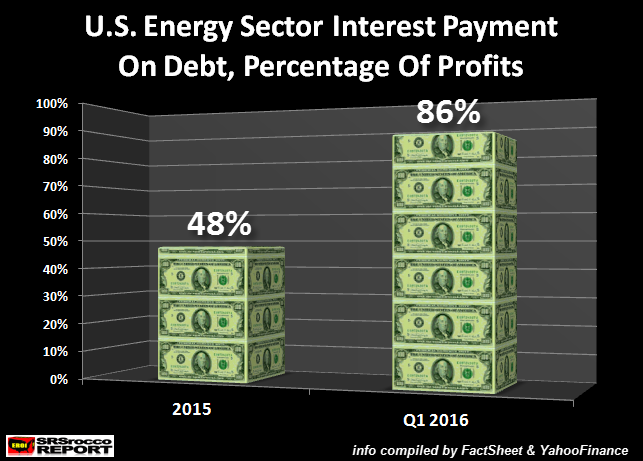

As we can see from the chart, the S &P 500 and earnings have been surviving on HOT AIR, especially since the latter part of 2014. When QE (money printing) and zero interest rates no longer provided enough bounce in the markets, the Fed, Central Banks and the Plunge Protection Team stepped in a BIG WAY to keep the markets from crashing. So, not only do we have a highly over-leveraged automobile financed industry, the broader stock market valuations are in bubble territory. Unfortunately, this is only part of the story. If we look at the disintegrating U.S. Energy Industry, the situation is even more dire. The Coming Collapse Of The U.S. Energy IndustryToday I did an interview with Money Metals Exchange. I will be putting out the interview when it's published. However, I discussed this energy subject matter during the interview. When I first started the interview, I said the precious metals community was guilty of propagating hype and short-term surging price moves that never came true. Thus, we have frustrated a lot of precious metals investors because the COLLAPSE of the Dollar, DEFAULT of the COMEX or much HIGHER gold and silver prices have not yet occurred. So, am I guilty myself by putting out a new a headline that reads, "The Coming Collapse of the U.S. Energy Industry?" No…. here's why. The situation in the U.S. Energy Industry is so AWFUL, I wouldn't be surprised to see half of the industry go bankrupt over the next few years. Of course, the U.S. Government could step in and either bail out or nationalize the energy industry, but this would stop the impending collapse. Let's take a look at this next chart. The U.S. Energy Industry has added so much debt that it took nearly half of all its operating profits to just pay the interest on its debt in 2015:

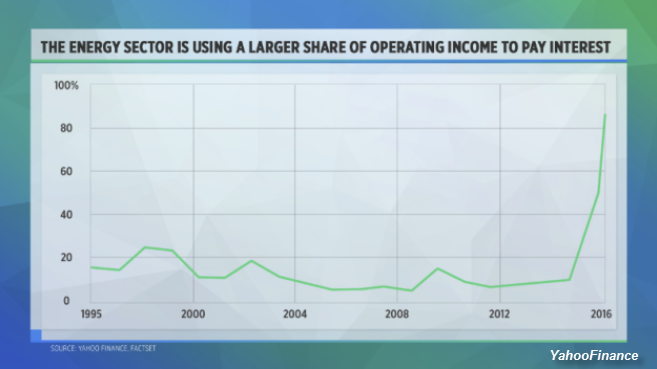

While this was bad, it was even worse in the first quarter of 2016. According to the article, Why Oil & Gas Companies Are Barely Scraping By, the U.S. Energy Sector paid 86% of its total profits just to service the interest on its debt. Can you imagine that? This chart from the article shows the huge change of interest payments on debt of the percentage of operating income in the U.S. Energy Sector:

Since 2000, the U.S. Energy Sector was paying (on average) between 10-15% of its operating income to service its debt. However, that changed significantly in 2014 as the price of oil plunged. The reason this percentage jumped over 20% in 1998 was due to the price of oil falling below $15 compared to $22 in 1996. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| National Post mocks gold manipulation without ever questioning a central bank Posted: 27 May 2016 06:17 PM PDT All any journalist has to do is ask them about gold swaps and leases, but no one dares to do it: http://www.gata.org/node/16341 http://www.gata.org/node/12016 * * * Shine Fades on Scotiabank's Gold Business as Banks Land in Court over Alleged Price Manipulation Barbara Shecter and Peter Koven http://business.financialpost.com/news/fp-street/shine-fades-on-scotiaba... In 2004, Rick Waugh, then Bank of Nova Scotia's chief executive, proudly posed with a gold bar for a photo to tout the Canadian bank's new leadership position among the world's top bullion dealers. In May that year, Scotiabank became the first non-British bank to chair the London Gold Fixing, a twice-daily setting of a key benchmark price for gold. It felt like a landmark moment for the bank. But a little more than a decade later, Waugh's successor Brian Porter found himself in a less pleasant sort of spotlight, as lawsuits began to roll in against Scotia and the other banks involved in setting benchmark prices for precious metals (known as the "fix"): Deutsche Bank Societe Generale, Barclays, and HSBC. ... Dispatch continues below ... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. The allegations at the heart of the proposed class action lawsuits, filed in New York and Ontario, are unproven, but they are serious. The five banks are accused of manipulating the gold market, which is worth trillions of dollars in trading value per year. A smaller subset, including Scotiabank, is accused of manipulating the silver market by rigging the daily Silver Fix. UBS AG, meanwhile, is accused of conspiring to exploit metals prices. In a wrinkle that became public this year, one of the defendants -- Deutsche Bank -- is close to settling and co-operating with the plaintiffs in order to extract itself from the U.S. lawsuit. That puts the remaining defendants in a highly uncomfortable position, even if they have done nothing wrong. A statement of claim in one of the Canadian lawsuits, filed in February, alleges the five banks "conspired" to rig precious metals pricing for their own benefit for nearly 10 years. "Beginning at least as early as 2004 and continuing through to June 30, 2013, the defendants conspired with each other to fix, raise, decrease, maintain, stabilize, control, or enhance unreasonably prices in the gold market," the claim states. "This was accomplished through daily conspiratorial communications under the guise of the arcane fixing process," which, the lawsuit alleges, "provided a veneer of false legitimacy for collusion." The fixing process produced a benchmark price for gold that the lawsuit claims affected the broader market for gold instruments including coins, futures, options, exchange-traded funds and mutual funds. Canadian plaintiffs also filed a silver manipulation suit with similar allegations. Scotiabank declined to comment because the matter is before the courts. Canada's third-largest bank became a big player in bullion dealing in 1997, when it acquired Mocatta Bullion, which had 180 employees in 10 offices around the world. The bank recently closed a small office in Dubai, but said in a statement that "ScotiaMocatta remains an important part" of its global banking and markets business. The controversy over precious metals fixing didn't come out of nowhere. Since the 2008 financial crisis, accusations that global banks have manipulated various benchmark rates have been at the heart of several ongoing legal and regulatory wrangles. Most famously, several of the world's largest banks in 2015 were fined nearly US$6 billion over alleged rigging of the London Interbank Offered Rate (LIBOR). Precious metals price fixing is an archaic process that dates back to the late 19th and early 20th centuries (1897 for silver and 1919 for gold). Somehow, the process didn't undergo a significant change until 2014. Until then, a group of bankers from bullion banks got together daily in London and set a daily benchmark price for the commodity based around their buy and sell orders. (They eventually stopped meeting in person and just did it over the phone). "In effect, they were setting the prices of their own financial instruments," said Daniel Brockett, a lawyer at Quinn Emanuel Urquhart & Sullivan LLP, who is spearheading the U.S. lawsuit. The fix price may seem irrelevant to investors, who trade on the open market, but it is an important benchmarks for companies that buy and sell physical metal on a daily basis, including mining firms, jewelers and refiners. The fixing model created obvious opportunities for abuse, given that competing banks worked together to set the price without any outside oversight. But after the LIBOR scandal rattled Europe's financial sector, regulators and investors began looking at precious metals fixing with greater scrutiny. "The way it worked was completely, in my view, unacceptable," said Rosa Abrantes-Metz, managing director at Global Economics Group, who has identified some questionable trades around the gold fix. "Under any antitrust view, I don't think this kind of direct, private communications among competitors would have been allowed. And as soon as antitrust regulators realized how the fixing worked, they changed it." The very nature of the self-regulated fixing process has over the years outraged gold and silver bugs, who see it as proof of a grand conspiracy to drive down the price. And while that theory has never come close to panning out, the fix has produced some genuine controversy. In 2014, Barclays was fined US$44 million over allegations that a trader tried to manipulate the "fix" price of gold. And earlier this year, silver bulls were livid when the price was repeatedly fixed at levels lower than the spot price the same day. The fixing process has been reformed over the past couple of years. In 2014, Thomson Reuters Corp. and CME Group Inc. assumed independent oversight of the silver fix, eventually installing an electronic, auction-based system. The Intercontinental Exchange (ICE) became the gold fix's administrator the same year, and also adopted an electronic platform. Transparency is now much higher, although regulators are expected to push for more changes. Abrantes-Metz said there are still lingering problems with the system. Most notably, she said, the price continues to be determined at a specific moment in time, when it should be established over several minutes of trading. "In my view, it is still easier than it should be to manipulate prices during the fixing," she said. According to the proposed Canadian gold fixing lawsuit, first filed last December, regulatory probes around precious metals fixing continue in the United States, Switzerland, and the United Kingdom. All but one of the banks embroiled in the U.S. lawsuit went to court in April to try to have the case tossed out. Representatives for Scotiabank, HSBC, Société Générale and Barclays argued that there are simply no facts to back up the claims. But Brockett said he is prepared to build the case and will push ahead with discovery if the presiding judge rejects the motion to dismiss. A decision on the dismissal motion is expected in the next 30 to 90 days. "I think our complaint is very strong," he said. "When you have a circumstance where competitors are getting on the phone, even if they're ostensibly doing it to set a legitimate benchmark, there's a lot of temptation there to be able to coordinate information." Notably absent from the dismissal motion argued in court was Deutsche Bank. According to Brockett, the large German bank is close to reaching a US$60-million settlement. As part of that deal, it will help the plaintiffs with their remaining claims against the other banks. Some media reports have suggested this would mean providing instant messages, emails and other communications. Brockett said he could not disclose the specifics at this point, as the settlement requires the judge's approval, which is still pending. It is unclear how Deutsche Bank's co-operation with U.S. plaintiffs would impact the lawsuits on either side of the border. Experts noted that it doesn't necessarily reflect the strength of the case or the value of potential settlements involving other players. The German bank has good reason to exit this lawsuit, and the move did not come as a big surprise to onlookers. Deutsche Bank has been under greater financial pressure than most of its peers, and has been cutting costs and shedding most of its commodity business -- indeed, Deutsche gave up its seats on the gold and silver fix in 2014 without finding any buyers. Jeffrey Christian, managing partner of CPM Group and a close follower of the gold market, said he doubts the plaintiffs will get anything of value out of Deutsche Bank's co-operation. Although gold bugs hope the bank will lift the veil on some sort of grand conspiracy to suppress gold prices, he said concerns about the fix process involve minor manipulations at best. Christian noted Deutsche has spent more than US$13 billion settling lawsuits in recent years, meaning it clearly wants to eliminate any overhang from legal actions, even if they are just nuisance suits. He also noted that if precious metals fixing was such a good business and there was a lot of money to be made from being an insider, Deutsche wouldn't be so keen to give up on it, even with the heightened regulatory scrutiny of the past couple of years. "If you're in the fix, you have to trade spot physical metal, which is probably one of the least profitable bullion transactions you can make," he said. "And it's very cumbersome and expensive to execute." Peter Griffin, one of Canada's top litigators and a specialist in business and securities law, said it is not unusual to see divergence in cases with multiple defendants, particularly as they work their way through the regulatory process or the courts. "You often have different interests at play amongst the defendants," said Griffin, a partner at Lenczner Slaght in Toronto, who is not involved in the precious metals fixing cases. "So as time goes on, some of the commonality of the defence starts to erode just as people start to look at their own interests." Griffin said there can also be a "first settler advantage," where plaintiffs are willing to accept less money than they'll demand later, partly because a chunk of the initial settlement funds the ongoing lawsuit. "Really, the issue amongst the defendants is who has what stomach for the fight. Often you're going to find that you end up with one or two defendants in these multi-defendant claims who go the distance," he said. "In certain circumstances, you might actually outlast the plaintiff and get a better deal if you're the last person standing." Still, the risks must be balanced. Although there are mechanisms that allow the remaining defendants to limit their liability while others settle, the outcome of a trial cannot be guaranteed. And if damages must be paid -- particularly punitive ones popular in the U.S. -- Griffin said it can be "daunting" for a defendant standing alone. "Trials are an unruly business because it's human beings trying to convince other human beings about a set of facts and a position, and people react differently," he said. "That's just the way trials are. So it's a risk you take if you're the last person." The precious metals price-fixing lawsuits come on the heels of numerous other lawsuits that have accused banks of manipulating interest rates and foreign exchange rates. Brockett was involved in a number of class-action suits that accuse banks of price fixing and manipulation, including one in which a collection of global banks agreed to pay US$1.87 billion to settle claims they limited competition in the credit default swap market. As with a handful of other post-financial crisis cases, the credit default swap issues were resolved through financial settlements in court after regulators either found insufficient proof of wrongdoing by the banks, or declined to take action. Brockett said the financial bar set by Deutsche Bank's proposed settlement in the precious metals class action should not be taken as the price at which other banks could settle. "If we litigate against the other banks," he said, "We're going to be looking for more." Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Lost $38.60 or -3.1% this Week Posted: 27 May 2016 05:11 PM PDT

Tough week for metals, good week for stocks &, at the end, for the US dollar index. The study of history has left me philosophical, not to be bent out of shape when the inevitable doesn't happen for a week or two. Now let it stretch out three weeks, & I get irritable. 'Twas Friday, and had been a nasty week for the Nice Government Men. Try as they might, they just couldn't inject any spine into the US dollar. "Hey! Janet! It's Friday, time for a surprise party. You got a speech scheduled? Yeah, Haaavaad? Go over there an talk that dollar up. Sure, sure, blow hot and cold out of both sides of your mouth like you always do, but blow harder on that interest rate rise. The suckers are beginning to catch on. Say something to kick that dollar up a notch." This, we imagine, the Fly on the Wall at the Fed heard today, for LO! Janet the Bobbling Banker spoke at Harvard & said, "It's appropriate . . For the Fed to gradually & cautiously increase our overnight interest rate over time, and probably in the coming months such a move would be appropriate." Listen, I am not low & mean & ungentlemanly enough to point out to a grown woman, an academic at that, that she not only split but double split an infinitive with two out of place adverbs, or used the word "over" twice too close to each other, or generally foamed at her bureaucratic mouth with a sentence that sayeth nothing much while threatening something. In other words, it was the Nice Government Men at their best, spooking markets. (That image might be a really salable idea, a "Bobble-Janet". Y'all know those dancing hula girls people carry on their dashboards, or bobble=head German dogs in the back window? We could make Bobble Janets and Bobble Baracks and Bobble Hillarys.) Bobbling Janet's late in the day speech took gold as low at $1,206.10 and pushed the dollar index up to a new high for the move. Wall Street has apparently changed its mind, deciding higher interest rates are somehow good for stocks. Meanwhile at the G7 meeting in Tokyo, Japanese prime minister Shinzo Abe warned that the world may be on the brink of a global financial crisis on the scale of Lehman Brothers. Yet Abe failed to get his counterparts to warn about the risk in their wrap up communiqué. They did, however, find time to slap their gums about how horrible Brexit would be, right up there with war, terrorism, and refugees. For the first time in six weeks, stocks ended the week higher. After yesterday's moderate decline, the Dow added 44.93 (0.25%) to 17,873.22. S&P500 rose further, 8.96 (0.43%) to 2,099.06. It's May, the season for stocks to shut down for the summer. Will they buck that powerful pattern & keep rising past last years high? Or bust and take the hopes and tears of millions with them? I haven't got a clue, but I never bet on breaking patterns. It happens, but not often. Thanks to Jaundiced Janet the US dollar index finished 59 basis points (0.62%) higher at 95.75. Did y'all see if Janet broke a sweat pushing that US dollar index through 95.50 resistance? Today's theatrics answered nothing for me. The dollar is unpacking a lethargic, unconvincing rally. Above stands the 200 DMA at 96.63, a likely place to turn down. One sign of the market's skepticism about Janet's rates is the 10 year yield today, which rose only Why does it matter? Only to how fast or slow silver & gold will rise. If the dollar can pierce that 200 dma and climb to 100, it might go higher. That would put concrete galoshes on silver & gold. But so far that's only a possible and not terribly likely outcome. Janet slapped the euro and yen winded today. Euro ended down 0.71% at $1.1113 while the yen dropped 0.49% to 90.66. Last few days gold is getting the hand of this dropping thing. Dropped $6.60 (0.5%) today to $1,213.80 on Comex. When Janet spoke long after Comex had closed, it dropped to $1,206.10, but in the aftermarket clawed its way back to $1,209.50. Hmmm. $1,206.10. My first target for this correction. Chart's here, http://schrts.co/Edby9s Look for gold's struggle to continue next week, but a bottom should come soon. I began buying today near $1,206. Comex silver dropped 9.2¢ (0.6%) to 1624.6¢. In the aftermarket it saw no panic, but backed off to 1619¢. Behold, the chart, http://schrts.co/IP2UXn On silver's chart you see it nearing that 1600¢ level I have been expecting. However, it could also drop as low as 1520¢, the 200 DMA. That latter price is a nest of potential support: the 200 DMA, the uptrending range line from March, and the downtrend line from April 2011. Any of these points would satisfy a correction. But until I see some fear and a lot faster fall in silver, I keep on expecting a shallow rather than a deeper correction, in other words, something around 1550 - 1600¢. Yes, I am anticipating, but I am also following my own advice. I began buying today. I would certainly buy silver around 1600¢. Monday is Memorial Day holiday in the United States when the country honors its fallen soldiers and veterans. Oddly enough, this began in the South, in May 1865 when the ladies in Columbus (some say Georgia, some Mississippi) went to decorate Southern soldiers' graves. Since they were gracious Southern ladies, they honored both their own dead and Northern dead. They understood that death ends all hostilities. In memory of those brave Southerners who fought a Second War for Independence, I will tell y'all the story of the Army of Tennessee's retreat from the Battle of Nashville. General Bedford Forrest was charged with covering the retreat, in bitter December. When he took command, he saw that his shoeless men had bleeding feet, cut by the ice on the puddles. Out of the chaos he commandeered wagons, and put these brave soldiers in them. When they came to a place where they had to stand and fight, they rolled out of the wagons and fought like furies on bleeding feet, then remounted the wagons and rode to the next stand. If you come South and notice on every county's courthouse lawn a statue of a Confederate soldier, that's why. In their honor in Greensboro, Georgia stands this monument: "In honor of the brave who fell defending the right of local self-government." Deo vindice. Y'all enjoy your weekend. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| G7 Leader Warns Global Economic Crisis Is On Its Way Posted: 27 May 2016 04:48 PM PDT UMich hope that surged has now faded in May. GDP has been revised to push the idea that the economy is stable. Gold is being slammed down but central banks are purchasing, Nations are ranked by using gold holdings.G7 leader warns a global economic crisis is on its way but will not push it among the... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full Speech: Donald Trump Holds Rally in San Diego, CA (5-27-16) Posted: 27 May 2016 04:17 PM PDT Friday, May 27, 2016: Full replay of Donald Trump's speech in San Diego, CA at the San Diego Convention Center Corporation. LIVE Stream: Donald Trump Rally in San Diego, CA (5-27-16) The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bank of America's Winning Excuse: "We Didn't Mean To" Posted: 27 May 2016 04:00 PM PDT Authored by Jesse Eisinger via ProPublica.org, Back in the late-housing-bubble period, in 2007, Countrywide Home Loans, which was then the largest mortgage provider in the country, rolled out a new lending program. The bank called it the “high-speed swim lane,” or HSSL, or, even more to the point, “hustle.” Countrywide, like most mortgage lenders, sold its loans to Wall Street banks or Fannie Mae and Freddie Mac, two mortgage giants, which bundled them and, in turn, sold them to investors. Unlike the Wall Street banks, Fannie and Freddie insured the loans, so they demanded only the ones of the highest quality. But by that time, borrowers with high credit scores were getting scarcer, and Countrywide faced the prospect of collapsing revenue and profits. Hence, the hustle program, which “streamlined” Countrywide’s loan origination, cutting out underwriters and putting loan processors, whom the company had previously deemed not qualified to answer borrowers’ questions, in charge of reviewing loan applications. In practice, Countrywide dropped most of the conditions meant to insure that loans would be repaid. The company didn’t tell Fannie or Freddie any of this, however. Lower-level Countrywide executives repeatedly warned top executives that the mortgages did not fulfill the requirements. Employees changed data about the mortgages to make them look better, sometimes increasing the borrower’s income on the forms until the loan looked acceptable. Then, Countrywide sold them to the mortgage giants anyway. At one point, the head of underwriting at Countrywide wrote an alarmed e-mail, with a list of questions from employees, such as, does “the request to move loans mean we no longer care about quality?” The executive in charge of the decision, Rebecca Mairone, replied, “So - it sounds like it may work. Is that what I am hearing?” To federal prosecutors—and to a jury in Manhattan—the hustle sounded like fraud. And in 2013, Bank of America, which had by then taken over Countrywide, was found liable for fraud and later ordered to pay a $1.27 billion judgment to the government. But this week, the 2nd U.S. Circuit Court of Appeals looked at that judgment and asked this question: If a entity (in this case, a bank) enters into a contract pure of heart and only deceives its partners afterward, is that fraud? The three-judge panel’s answer was no. Bank of America is no longer required to pay the judgment. The Bank of America case was a rare outcome in the collapse of the financial system: a firm whose actions had contributed to the crisis was held to account by a court of law. The U.S. Attorney’s Office for the Southern District of New York, which brought the case in 2012, used an ingenious strategy, charging the bank under a law dating from the savings-and-loan crisis of the late 1980s, called Financial Institutions Reform, Recovery and Enforcement Act, or FIRREA. And the government actually identified a human being, Rebecca Mairone, claiming she defrauded Fannie and Freddie. Though it was a civil action, rather than a criminal one, the case actually went to trial—unusual in this day and age—and the jury found Bank of America and Mairone liable. (The 2nd Circuit panel’s ruling reversed a finding of fraud against Mairone and tossed out a million-dollar ruling against Mairone.) The appellate-court panel accepted the main facts as described by the government. It acknowledged that Countrywide intentionally breached its contract but ruled that it had not engaged in fraud. The ruling, written by Richard C. Wesley, a George W. Bush appointee, was unanimous, with another Bush appointee and an Obama appointee voting in favor. “What fraud … turns on, however, is when the representations were made and the intent of the promisor at that time,” Judge Wesley wrote. If the fraud is based on “promises made in a contract, a party claiming fraud must prove fraudulent intent at the time of contract execution; evidence of a subsequent, willful breach cannot sustain the claim.” The government hadn’t set out to prove Countrywide’s intentions—honorable or otherwise—of Countrywide at the moment it signed the contracts with Fannie and Freddie. Consequently, the court ruled that the government had not provided sufficient evidence for its contentions. “The government had zero evidence of affirmative misrepresentations at the time of the bad conduct,” Samuel Buell, a law professor at Duke University and the author of the forthcoming book “Capital Offenses: Business Crime and Punishment in America’s Corporate Age,” says. But to other legal scholars, the ruling seemed nonsensical. “Is the idea that a good state of mind initially can insulate you from fraud later on?” Brandon Garrett, a professor of law at the University of Virginia and the author of “Too Big To Jail: How Prosecutors Compromise with Corporations,” asked. “That would be a very strange and troubling doctrine.” He added, “It almost seems like the 2nd Circuit fell victim to a lawyer’s trick.” For U.S. Attorney Preet Bharara, the court’s ruling is yet another setback in his corporate-crime efforts. In 2014, the 2nd Circuit overturned one of the office’s major insider-trading cases, throwing the law in that area into disarray. It’s tempting to read something personal into these rulings. Courts often view themselves as a check on what they see as prosecutors responding to the pitchfork-wielding mob. In the 1990s, the 2nd Circuit overruled several high-profile Wall Street prosecutions brought in the ’80s by Rudolph Giuliani, who had been the Southern District’s U.S. attorney. Now it is doing the same to Bharara, who (as Jeffrey Toobin wrote in The New Yorker recently) has antagonized the bench, and is viewed by some as overly aggressive and arrogant. The ruling also bolsters the argument, so often heard from prosecutors, that they didn’t bring many big cases after the financial crisis because the laws required an evidentiary standard that couldn’t be met. “We thought it would be unfair to bring it as a criminal case, and therefore properly and fairly used our discretion to bring it as a civil case, but we thought it was clearly fraudulent," one former prosecutor familiar with the case said. The ruling, this person says, is “extraordinary and dispiriting.” The relentless criticism of its post-financial-crisis crackdown has taken a toll on regulators. “This is a perfect example of how everyone thinks it is so easy to bring financial-crisis cases, but it isn’t,” the former prosecutor says. “The Court of Appeals didn’t agree, and now they’ve undone a major, major case tried before a jury. We get criticized for timidity in taking on financial-crisis cases, but the appeals court clearly viewed us as too aggressive. So maybe everyone who rails about the failures to bring financial-crisis cases needs to understand that there is a legal system, and what seems so obvious to them, is in fact not.” The ruling does not affect the many multibillion-dollar settlements that the government has reached with most of the top financial firms for mortgage abuses. The parties entered those settlements voluntarily. Settlements are highly unsatisfying as a matter of justice. Companies and their defense attorneys complain that the government extorts them out of unreasonable sums because they have no choice but to negotiate, while the public feels companies are not held accountable, punished only by being compelled to write checks that have little effect on their bottom line. After this ruling, the government may be even less willing to fight it out in court. Worse, it may have less leverage with companies when trying to extract penalties and fines in settlement negotiations over misconduct allegations. The court has provided companies with a new piece of ammunition: the ability to argue that their deliberate misconduct was not actually fraud. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Another Bubble Has Burst: The Miami Luxury Condo Market Is A "Ticking Timebomb" Posted: 27 May 2016 03:30 PM PDT Last year we warned that the luxury condo market in Miami was cooling down, and we also noted that one of the mail culprits was the fact that foreign buyers (especially Brazilians) were seeing their buying power crushed by the appreciating dollar. Today, the bubble has officially burst and the Miami luxury condo market is a complete trainwreck. There are 3,397 condominiums available in the downtown Miami area, and at current prices it is estimated that it would take 29 months to sell those. A strong US Dollar has continued to force South American investors to unload recently built condos, adding inventory to an area where 8,000 units are under construction and nine towers have already been completed since 2013.

Purchases from January through April fell 25 percent from the same period in 2015, and average prices have fallen 6 percent on a per-square-foot basis according to Bloomberg. And prices will continue to slide... "The problem is that investors are no longer buying, and now they're going to be looking to sell. And what buyers are going to replace those other than vulture buyers looking for deals." said Jack McCabe, a housing consultant based in Deerfield Beach, Florida. During this latest construction boom, projects required cash deposits of as much as 60 percent, and contract cancellation had stiff penalties. Due to this, some investors have been able to cover costs as they wait to sell by renting the condo's out, but that isn't a viable option for everyone either, as apartment vacancies have been on the rise as well. "The ticking time bomb is based on rental rates. When some of the foreign investors sitting on the sidelines have to dig into their pockets and subsidize renters, that's the fuse that will lead to a correction." said Peter Zalewski, owner of real estate development tracker CraneSpotters. Or said another way, will accelerate the current correction. Even billionaires are dumping their property in Miami. Apollo Global Management founder Leon Black, Ken Griffin, and former Saks CEO Stephen Sadove all have units on the market. Sadove has even lowered his asking price by almost 11 percent to $12.95 million - that unit may be there a while. Andrew Stearns of StatFunding.com, which provides residential mortgages for foreign nationals, pointed out that of 14 new Miami towers, the share of resale listings range from 7 percent at MyBrickell tower to 40 percent at 400 Sunny Isles. "The concern is we're in a price-discovery phase, and the prices people are trying to get for their condos is a lot higher than the market will bear." Stearns said. A lot higher indeed. A slide from a recent StatFunding.com presentation shows a snapshot of just how underwater some of these condos are at the present time.

It's also worth noting, that from the same slide deck, Stearns shows that 22% of new units built since 2012 are for sale, and at the current sell-through rates there is a 126+ month supply! * * * The note at the bottom of that last slide from Andrew Stears sums everything up perfectly: As additional resale inventory is added to the market, the market could get frightening. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alex Jones Show (VIDEO Commercial Free) Friday 5/27/16: Tim Kennedy Posted: 27 May 2016 01:37 PM PDT -- Date: May 27, 2016 -- Today on The Alex Jones Show On this Friday, May 27 edition of the Alex Jones Show, we cover Donald Trump's nomination as he crosses the delegate threshold while the left slips into panic mode and Roise O'Donnell hits meltdown stage. We also cover Trump's decision to debate... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Next Systemic Lehman Event - New Scheiss Dollar & Gold Trade Standard Posted: 27 May 2016 01:25 PM PDT The entire Western financial systemic, complete with USDollar-based foundation platforms, is breaking down. The breakdown is in full view, very noticeable, in almost every arena. What happened in 2008 with the Lehman Brothers failure event is currently underway with almost every single financial platform, structural entity, financial market, banking structure, and arena. In response to the Lehman killjob event, where JPMorgan and Goldman Sachs strangled the victim firm (by denying Lehman proceeds on countless asset sales), the entire Western financial system has been lashed together, tied together, and connected among its many member parts. The main parts are the big banks, which use derivative contracts to lash themselves together. They believe there is strength in numbers, which is true to some extent. But the consequence turns out to be that all will fail at the same time in a cascade of insolvent marred by illiquidity while steeped in corruption and market rigging. The breakdown could be described as having begun in full force, in earnest power, at the start of this 2016 year. This is the year of systemic failure, or financial breakdown, and of revelations of important crimes for the last generation or more. The revelations are against the Western power centers for their grand criminal activities. The East, by favoring a Gold Standard, has put the West on notice for exposure, if not prosecution. The gold weapon has power in its arbiter role in commerce, banking, and economies. No nation will be spared from the urgent nasty effects of being forced to achieve trade balance. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Energy and Debt Crisis Point to Much Higher Silver, Metals Prices Posted: 27 May 2016 01:19 PM PDT img src="../images/gold_star.gif" width="82" height="78" align="right">Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason. Coming up we’ll hear from Steve St. Angelo of the SRSrocco Report. Steve shares his top-notch research with our listeners on some alarming trend changes in silver supply and explains how and why the debt bubble is eventually going to burst and why he believes gold and silver will be the assets to own when it all unravels. Don’t miss an incredibly enlightening and eye-opening interview with Steve St. Angelo coming up after this week’s market update. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Junior Stocks Q1 2016 Fundamentals Posted: 27 May 2016 01:06 PM PDT The smaller gold-mining and exploration stocks have enjoyed an amazing year, soaring with gold’s new bull market. Many have more than doubled since mid-January, and some have more than tripled at best in that short span. Are such spectacular gains fundamentally-justified, or merely the result of ephemeral sentiment that could vanish anytime? The gold juniors’ recently-reported Q1’16 results offer great insights. The junior gold miners and explorers play a critical role in the world gold market. They bear the major costs and risks associated with discovering and sometimes developing new economically-viable gold deposits. They painstakingly find the new gold reserves to offset the constant depletion of the world’s existing gold mines, acting as the headwaters feeding the global mined-gold-supply pipeline vital to this industry. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The World Goes On HIGH ALERT As The US Pushes For WW3 05 06 2016 Posted: 27 May 2016 12:59 PM PDT The World Goes On HIGH ALERT As The US Pushes For WW3 05 06 2016 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interviews with Maguire, Embry, and Turk Posted: 27 May 2016 12:39 PM PDT 3:37p ET Friday, May 27, 2016 Dear Friend of GATA and Gold: London metals trader Andrew Maguire tells King World News today that bullion banks and central banks are covering short positions in gold today as speculators are scared out of their longs again, the prerequisite for gold's move back up: http://kingworldnews.com/andrew-maguire-on-the-war-in-the-gold-silver-ma... Sprott Asset Management's John Embry tells the Daily Coin why he expects a big move up in silver: http://thedailycoin.org/2016/05/27/john-embry-explosive-move-in-silver-w... And GoldMoney founder James Turk tells the Daily Coin how GoldMoney and BitGold are remonetizing gold in every practical sense: http://thedailycoin.org/2016/05/24/james-turk-when-you-own-gold-you-own-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Juniors’ Q1’16 Fundamentals Posted: 27 May 2016 10:01 AM PDT Zealllc | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pope Francis Converts To Islam! Posted: 27 May 2016 10:00 AM PDT Alex Jones talks with Infowars reporter Wayne Madsen discusses the openly globalist Pope and how he's helping to push the NWO agenda. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Donald Trump’s Category 5 Hurricane Posted: 27 May 2016 09:00 AM PDT This post Donald Trump's Category 5 Hurricane appeared first on Daily Reckoning. Editor's note: In observance of Memorial Day, we will not be publishing Covel Uncensored on Monday, May 30. We hope you enjoy the holiday! Failed Republican presidential candidate Senator Marco Rubio did some soul-searching this week. In an interview with the Guardian, Rubio was asked why he dropped out of the race… He responded by comparing his campaign to a "really strong building" that was hit by a "category 5 hurricane." And that hurricane was Donald Trump. Trump's ascendancy shocked Rubio and the world. Political scientists will be studying it for decades. But investors should be paying close attention too. Here's why… The Perfect StormDon't believe what anyone says. Nobody saw Trump coming. His odds of becoming the Republican nominee were 80-1. But yesterday, he reached the number of delegates needed to clinch the nomination. Why were so many so wrong about Trump? Well, the world is filled with know-it-alls who have the same fatal flaw. They think they have the ability to somehow corral the innumerable variables in our universe into a model or system that will give them the ability to magically see into the future. But reality is far too complicated for that. And those many variables always come together in a way nobody expects. That's what happened this year when Category 5 Hurricane Trump formed. In his case, crony capitalism run amok, reckless D.C. spending, and political correctness came together to form a perfect storm of voter anger that Trump rode to victory. Investors would be wise to take notice of the lessons in Trump's unforeseen rise… Because our world is dominated by complexity. And no one, no matter how big their ego, can possibly know or understand all that happens within it… much less what all those variables will produce when they come together. Many have tried. And many have failed. Which is why staking your financial future on the forecasts of "clairvoyant" types is a dangerous game. It's a game that the world's most successful trend following traders never play. And neither should you. My Conversation With Jim RickardsJim Rickards knows a lot about complexity and world-altering events. I spoke with Jim on my podcast. He's a fascinating guy. Jim's the author of the bestsellers Currency Wars and The Death of Money. He was also general counsel of Long Term Capital Management when it famously went belly up in 1998. And he's served as a high-level adviser to the Department of Defense and the U. S. intelligence community. Jim's had a bird's-eye view of some of the world's seminal events over the past two decades, including the Asian financial crisis in 1997 and the global financial crisis in 2008. And he gives an insider's account of the earth-shattering crises of the past 20 years that not many can. Here's what you'll learn in today's podcast…

Click here to listen to my conversation with Jim Rickards. Please send me your comments to coveluncensored@agorafinancial.com. Let me know what you think of my talk with Jim. Regards, Michael Covel P.S. Jim Rickards has just released a new report on how to make money from gold. If you have any interest in the metal and gold miners, you should check it out. According to Rickards, this could be a great opportunity to make a fortune from the yellow metal. Click here for more details. The post Donald Trump's Category 5 Hurricane appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amerigeddon -- THE MOVIE THEY DON´T WANT YOU TO SEE Posted: 27 May 2016 09:00 AM PDT The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Major story !!! It doesn't get much more serious than this Posted: 27 May 2016 08:49 AM PDT Federal agent takes his own life, spills the beans in a suicide note. American's !!! you had better do something pretty darn quick, or Obama is going to get those changes, that you all wanted. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europeans support Donald Trump for president! Posted: 27 May 2016 08:00 AM PDT The Political elections and how the situation can change in Europe with a Donald Trump presidency. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GERALD CELENTE WARNS THE GLOBAL ECONOMY IS BURSTING RIGHT NOW! Posted: 27 May 2016 07:30 AM PDT George Soros is buying massive amounts of gold as the Chinese debt bubble threatens the world economy. Gerald Celente makes bold statements with Gary Franchi on the Next News Network. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 May 2016 03:54 AM PDT I said one doesn’t need to chase the rally during the second leg, any gains would not be sustainable and would be given back. At the low yesterday miners had already given back 62% of the second leg gains, and we are not done with the Intermediate Cycle Low yet. The final Intermediate Cycle Low isn’t due until late June or early July. This is why it wasn’t critical to chase the second leg, one was going to get a second shot at it anyway. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Ugly Truth About Stock Market Manipulation and Gold Prices Posted: 27 May 2016 03:50 AM PDT We all know the financial markets move in cycles and I have been a big advocate of using the 200-day moving averages to figure out where you are in a financial market cycle and then to invest accordingly. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Global Currency Reset and the Gold Backed Yuan Posted: 27 May 2016 03:34 AM PDT hi it's Friday May 27th 2016 this is an echo 64 the home of alternative economics and contrarian thinking this morning I'm going to be talking about currency or economic and global reset that these are terms that are especially the last two years of pop pop top on the Internet alternative media even in the mainstream media and also be talking about a gold-backed you want which is something you hear about all the time you know in the alternative media especially not in the are not in the mainstream media and have to go back to like 2015 I think it was April 2015 Christine Lagarde president or head of the IMF made a speech and she said we're facing global economic recession and | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Looking Vulnerable While Gold Stocks Correct Posted: 27 May 2016 01:28 AM PDT Last week we highlighted our gold stocks bull analog chart which showed the gold stocks correcting at least 20% at this point during both the 2008-2009 and 2000-2001 recoveries. We concluded that gold stocks were likely to continue to correct in the days and weeks ahead. While that has played out so far, we should also note that Gold is suddenly looking more vulnerable. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A New Golden Bull or Has the Market Gone Too Far Too Fast? Posted: 27 May 2016 12:59 AM PDT Precious metals expert Michael Ballanger discusses how investors should interpret the recent shifts in gold and silver "market tectonics." | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Breaking News And Best Of The Web Posted: 27 May 2016 12:00 AM PDT US debt becomes an issue. Bill Gross starts shorting corporate bonds. Great interviews with James Rickards and Helen Chaitman. Yesterday’s strong US economic reports are called into question. China plans to borrow even more. Oil stabilizes and gold continues to correct. Look for next week’s COT report to be a lot less bearish. Bitcoin gets […] The post Breaking News And Best Of The Web appeared first on DollarCollapse.com. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Eric Hadik: 'Seismic Shift' Coming for US Dollar, Gold Market Posted: 26 May 2016 05:00 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 26 May 2016 01:00 PM PDT Fascinating look at the criminality of the big banks from Helen Chaitman. Yellen’s folly from McAlvany. Mike Maloney on why negative interest rates equal global bankruptcy. Gordon T. Long on the crumbling of the Shanghai Accord. Marin Katusa predicts $5,000 gold. Rob Kirby sees the dollar falling from here. The post Top Ten Videos — May 27 appeared first on DollarCollapse.com. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Gold on Track for Eighth Losing Session U.S. GDP data revision seen bolstering case for interest-rate increase … Gold prices edged lower Friday, on pace for an eighth straight losing session, amid mounting evidence of improving economic growth in the U.S. that would strengthen the case for an interest-rate increase. –Wall Street Journal

Gold on Track for Eighth Losing Session U.S. GDP data revision seen bolstering case for interest-rate increase … Gold prices edged lower Friday, on pace for an eighth straight losing session, amid mounting evidence of improving economic growth in the U.S. that would strengthen the case for an interest-rate increase. –Wall Street Journal What happens when the two largest economies on the planet start fighting a trade war with one another? Well, we are about to find out. As you will see below, the U.S. has gone "nuclear" on China in a trade dispute over steel, and the Chinese response is likely to be at least as strong. Meanwhile, events in the South China Sea have brought tensions between the Chinese government and the Obama administration to a boiling point. The Obama administration strongly insists that China does not have a legal right to those islands, and in China there is now talk that it may ultimately be necessary to confront the United States militarily in order keep control of them. Most Americans may not realize this, but the relationship between the United States and China is officially going down the tubes, and this is likely to have very significant consequences during the years to come.

What happens when the two largest economies on the planet start fighting a trade war with one another? Well, we are about to find out. As you will see below, the U.S. has gone "nuclear" on China in a trade dispute over steel, and the Chinese response is likely to be at least as strong. Meanwhile, events in the South China Sea have brought tensions between the Chinese government and the Obama administration to a boiling point. The Obama administration strongly insists that China does not have a legal right to those islands, and in China there is now talk that it may ultimately be necessary to confront the United States militarily in order keep control of them. Most Americans may not realize this, but the relationship between the United States and China is officially going down the tubes, and this is likely to have very significant consequences during the years to come. Investors better be prepared as the next crash of the U.S. economy is coming. This is not based on hype or speculation, rather due to the disintegration of the underlying fundamentals. Matter-a-fact, the fundamentals are so completely AWFUL, that the next market crash will make 2008 look quite tame indeed.

Investors better be prepared as the next crash of the U.S. economy is coming. This is not based on hype or speculation, rather due to the disintegration of the underlying fundamentals. Matter-a-fact, the fundamentals are so completely AWFUL, that the next market crash will make 2008 look quite tame indeed.

No comments:

Post a Comment