saveyourassetsfirst3 |

- The Important Geopolitical News That You’re Not Being Told

- Silver Wheaton: More Reasons To Go Long

- Illegals Dwarf American Households in Welfare: “Obama Seeking $17K For Every Illegal Minor”

- Legendary Gold Trader Jim Sinclair Says Gold Headed to $50,000/oz! Here’s Why…

- A Heretic: Why Was Warren Buffet Forced to Dump 129 Million Oz of Silver?

- Gold & Silver Demand & A Loss in Confidence in the Dollar

- 5 Charts That Blow Up the Status Quo

- The US Economy Is Rapidly Deteriorating Even As The Stock Market Soars

- Blockbuster Story – How Hedge Funds Invest Heavily in Washington D.C.’s Culture of Corruption

- DEATH By Gold – Jim Willie

- Gold Short term decision arriving for direction into June

- April CPI and Gold

- Silver Smashed Under $17 On COMEX Open

- Legendary Investor George Soros Takes Massive Gold Position, Fears of a Crisis Grow - Nathan McDonald

- Peter Daniels Talks On "Gold" Part 2

- Interview with WallStreetforMainStreet

- Misreading the CoTs, Again

- This Is How Bad It Really Is!

- Gold Price Drifting Lower after Key Reversal

- Puerto Rico Bonds – Is this Only the First Bomb to Drop?

- Gold and Silver Companies with the Potential to Move the Needle

- Rail Traffic Depression: 292 Union Pacific Engines Are Sitting In The Arizona Desert Doing Nothing

- Podcast: Easy Money From China, Japan and Europe Has Failed. What’s Next?

- Gold Takes a Breather; Watch for 1247 Support

- Some of Brien Lundin's Precious Metals Picks Are Up More Than 400%. What Is Next?

| The Important Geopolitical News That You’re Not Being Told Posted: 18 May 2016 12:30 PM PDT There’s something you’re not being told… The post The Important Geopolitical News That You’re Not Being Told appeared first on Silver Doctors. |

| Silver Wheaton: More Reasons To Go Long Posted: 18 May 2016 12:02 PM PDT |

| Illegals Dwarf American Households in Welfare: “Obama Seeking $17K For Every Illegal Minor” Posted: 18 May 2016 12:00 PM PDT For traditional American families, it is a double blow to an economy that has forced many citizens on welfare as well while they watch good jobs slip away. 2016 Silver Shield Silver Trump at SD Bullion Submitted by Mac Slavo: Who exactly is the burdensome, broken and disturbingly unsensible welfare system being run for? […] The post Illegals Dwarf American Households in Welfare: "Obama Seeking $17K For Every Illegal Minor" appeared first on Silver Doctors. |

| Legendary Gold Trader Jim Sinclair Says Gold Headed to $50,000/oz! Here’s Why… Posted: 18 May 2016 11:30 AM PDT According to Legendary gold trader Jim Sinclair, The real gold show is only starting… From Jim Sinclair: Legendary gold trader Jim Sinclair shocked the precious metals community Friday by publicly stating that the US will be Cypruss’d, the current take-down in gold & silver is a last-ditch can kicking attempt by the bullion banking […] The post Legendary Gold Trader Jim Sinclair Says Gold Headed to $50,000/oz! Here’s Why… appeared first on Silver Doctors. |

| A Heretic: Why Was Warren Buffet Forced to Dump 129 Million Oz of Silver? Posted: 18 May 2016 11:01 AM PDT Warren Buffet bought about 129 million oz of silver at $3.50 to $4 an ounce around 2002-2003. JPM helped him with this purchase. He was forced to dishoard at around $6 an ounce and by 2007 silver was up to $17. This forced sale was demanded because he found that he made the same […] The post A Heretic: Why Was Warren Buffet Forced to Dump 129 Million Oz of Silver? appeared first on Silver Doctors. |

| Gold & Silver Demand & A Loss in Confidence in the Dollar Posted: 18 May 2016 11:00 AM PDT We continue to read stories of the "loss of confidence in central banks." We may not know the last detail of what that will look like—when it occurs one day. However, we will wager an ounce of fine gold against a soggy dollar bill that it will not look like today with the market bidding […] The post Gold & Silver Demand & A Loss in Confidence in the Dollar appeared first on Silver Doctors. |

| 5 Charts That Blow Up the Status Quo Posted: 18 May 2016 10:00 AM PDT These 5 Charts absolutely BLOW UP the Status Quo: Buy 2016 Silver Maples Lowest Price Ever! Submitted by Charles Hugh Smith: The promises made when there were 7 workers for every retiree cannot be kept when there are only 2 workers for every retiree. In an auto-mechanic analogy, the Powers That be are […] The post 5 Charts That Blow Up the Status Quo appeared first on Silver Doctors. |

| The US Economy Is Rapidly Deteriorating Even As The Stock Market Soars Posted: 18 May 2016 09:00 AM PDT The market surge in the spring of 2008 was just a mirage, and it masked rapidly declining economic fundamentals. Well, the exact same thing is happening right now: Submitted by Michael Snyder: We have seen this story before, and it never ends well. From mid-March until early May 2008, a vigorous stock market rally […] The post The US Economy Is Rapidly Deteriorating Even As The Stock Market Soars appeared first on Silver Doctors. |

| Blockbuster Story – How Hedge Funds Invest Heavily in Washington D.C.’s Culture of Corruption Posted: 18 May 2016 08:30 AM PDT It's so bad, even the critters in Congress are disgusted by it: Submitted by Michael Krieger: Earlier today, Ryan Grim and Paul Blumenthal published a blockbuster piece in the Huffington Post, titled: The Vultures' Vultures: How A New Hedge-Fund Strategy Is Corrupting Washington. It details the secretive world of the dark money groups representing mercenary hedge […] The post Blockbuster Story – How Hedge Funds Invest Heavily in Washington D.C.'s Culture of Corruption appeared first on Silver Doctors. |

| Posted: 18 May 2016 07:45 AM PDT Will the US Petrodollar end this summer? China is preparing an EXECUTION… Jim Willie joins us for a riveting 90+ minute explosive interview about the implosion of the Western financial empire and the rise of the Eurasian empire. Could the US Petrodollar end this summer? From TruNews: Jim Willie | Dollar Death by Gold Download MP3 […] The post DEATH By Gold – Jim Willie appeared first on Silver Doctors. |

| Gold Short term decision arriving for direction into June Posted: 18 May 2016 07:22 AM PDT Commodity Trader |

| Posted: 18 May 2016 07:21 AM PDT SunshineProfits |

| Silver Smashed Under $17 On COMEX Open Posted: 18 May 2016 06:26 AM PDT The Commercial short position isn’t at all-time record levels for nothing… Silver smashed below $17 as COMEX opens on no news: Gold only down $8 to $1268, but undoubtedly the cartel would love to see the royal metal back below $1250: Yesterday, Our good friend Craig Hemke broke down the EPIC BATTLE on […] The post Silver Smashed Under $17 On COMEX Open appeared first on Silver Doctors. |

| Posted: 17 May 2016 11:00 PM PDT Sprott Money |

| Peter Daniels Talks On "Gold" Part 2 Posted: 17 May 2016 03:00 PM PDT Anglo Far East |

| Interview with WallStreetforMainStreet Posted: 17 May 2016 09:55 AM PDT Today, Jason Burack of WallStforMainSt interviewed us. It was a long interview and we discussed many topics related to Gold and gold stocks.

|

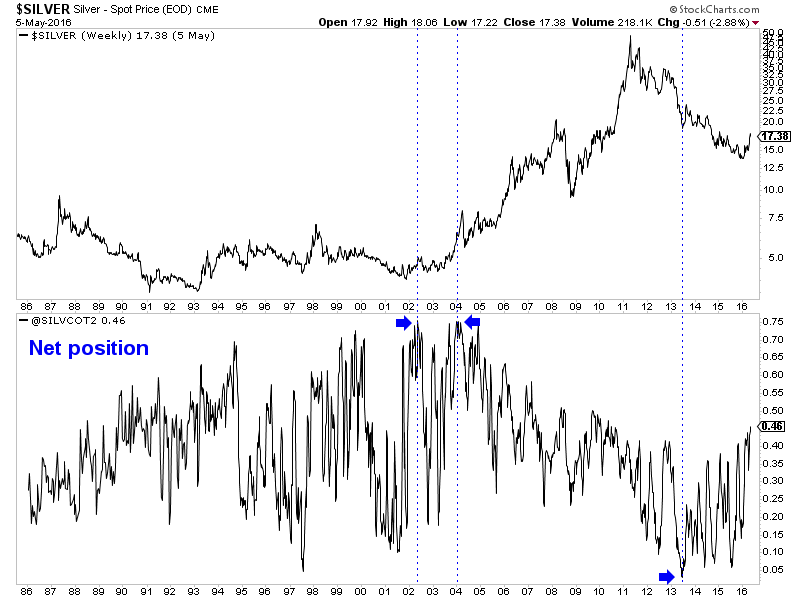

| Posted: 06 May 2016 01:00 PM PDT Nearly two months ago I published a video in which I discussed conventional CoT analysis and the mistake many investors might make assuming Gold and gold stocks would undergo a big correction. The fact is a bull market that follows a nasty bear usually stays very overbought throughout its first year and therefore sentiment indicators remain in bullish territory. As a result of the primary trend change, conventional CoT analysis fails and requires an adjustment. Today we look at the Gold and Silver CoT's while harping on a few of the mistakes people are making. The first mistake people are making (and I've seen this quite a bit recently) is painting the commercial traders as smart money. This completely mischaracterizes that group. Commercial hedgers are the users, producers or consumers of the commodity. They are using the futures market to hedge in some way. As Steve Saville writes in his explanation of the CoTs, the commercials usually do not bet on price direction. Generally speaking they tend to fade the trend while speculators drive or follow the trend. Risk certainly rises for bulls when speculators increase long positions aggressively and we should be aware of that. However, we should look beyond nominal figures to get a better reading of the degree of speculation. The second mistake is looking at the CoT's in only nominal terms and not as a percentage of open interest. The nominal net speculative position in Silver is at an all time high, which sounds scary. However, as a percentage of open interest the net speculative position is nowhere close to an all time high. In the chart below we plot Silver and its speculative position as a percentage of open interest. The current position is 45.7%, which is nowhere near the all-time highs seen in 2002 and 2004 of nearly 75%. Also note how the net speculative position does not tell us anything about the primary or long-term trend. Speculators were most bullish in 2002 and 2004 just after the start of a secular bull market. Speculators were least bullish in 2013. Silver bounced but continued to make new lows for a few more years!  Silver & Silver CoT

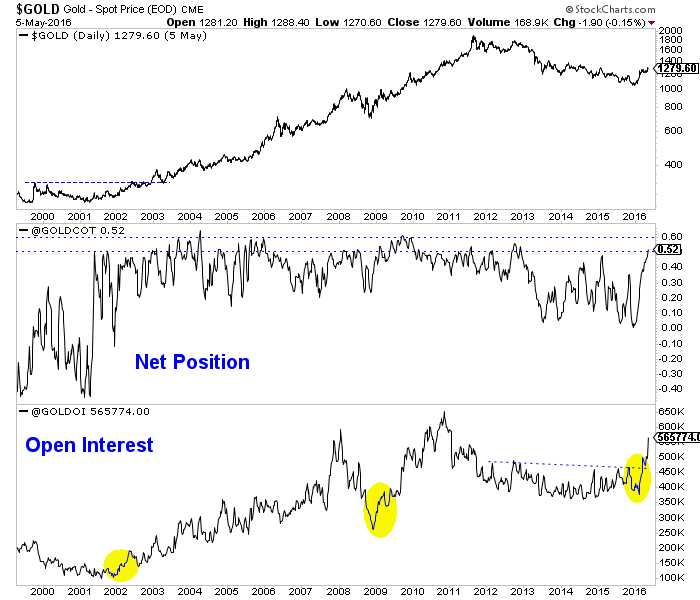

When considering open interest, Gold's primary trend change has been confirmed yet the net speculative position in Gold is much closer to extremes than Silver's. Take a look at the chart below and note the huge increases in open interest that immediately followed the lows in 2001, late 2008 and late 2015. A rise in open interest confirmed the trend change at those points. As of Tuesday, the net speculative position in Gold was 52.1%. Note that from 2003 to 2012 the net speculative position often peaked at 55% to 60%. Keep in mind, we do not know if Gold's next peak will be at 55% or even 70%.  Gold CoT

Overall, the CoT is one of a handful of tools we use and we learned how to interpret and analyze it the hard way. Remember, the speculators drive the trend and it's best to judge their position in terms of open interest. I do not see anything in the CoTs or price action of the metals or the miners that says they are about to endure a large correction. That will change at somepoint but for now weakness or consolidation is a buying opportunity. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Jordan Roy-Byrne, CMT Jordan@TheDailyGold.com

|

| Posted: 06 May 2016 04:35 AM PDT Silver Price Forecast: The 1929 Dow crash marked the start of the infamous Great Depression. We currently have a repeat of the pattern that led to that great crash in 1929. This pattern is basically a huge stock market rally (after a period of stagnation) that is driven by a huge expansion of the money… |

| Gold Price Drifting Lower after Key Reversal Posted: 05 May 2016 04:05 PM PDT |

| Puerto Rico Bonds – Is this Only the First Bomb to Drop? Posted: 05 May 2016 08:10 AM PDT Puerto Rico Bonds - Is this Only the First Bomb to Drop?Puerto Rico Bonds - Is it the first bomb to drop in the Bond Bubble Collapse Michael Pento predicted in an earlier interview here on >www.preciousmetalsinvesting.com. Michael Predicted this in his book "The Coming Bond Market Collapse: How to Survive the Demise of the U.S. Debt Market." Puerto Rico Bond Default - Is it the first bomb to drop in the Bond Bubble Collapse Michael Pento predicted in an earlier interview here on http://www.preciousmetalsinvesting.com. Michael Predicted this in his book "The Coming Bond Market Collapse: How to Survive the Demise of the U.S. Debt Market." The precious Metals Investing podcast is available at Apple iTunes for people who use the ipad and other Apple mobile devices. Precious Metals Investing podcast on iTunes Great news for Android users! The Precious Metals Investing podcast is now also available now on Google Play Music. Precious Metals Investing Podcast at Google Play Music The post Puerto Rico Bonds – Is this Only the First Bomb to Drop? appeared first on PreciousMetalsInvesting.com. |

| Gold and Silver Companies with the Potential to Move the Needle Posted: 05 May 2016 01:00 AM PDT |

| Rail Traffic Depression: 292 Union Pacific Engines Are Sitting In The Arizona Desert Doing Nothing Posted: 04 May 2016 07:35 PM PDT

One of the economic commentators that I have really come to respect is Wolf Richter of WolfStreet.com. He has a really sharp eye for what is really going on in the economy and in the financial world, and I find myself quoting him more and more as time goes by. If you have not checked out his site yet, I very much encourage you to do so. On Wednesday, he posted a very alarming article about what is happening to our rail industry. The kinds of numbers that we have been seeing recently are the kinds of numbers that we would expect if an economic depression was starting. The following is an excerpt from that article…

Because rail traffic is down so dramatically, many operators have large numbers of engines that are just sitting around collecting dust. In his article, Wolf Richter shared photographs from Google Earth that show some of the 292 Union Pacific engines that are sitting in the middle of the Arizona desert doing absolutely nothing. The following is one of those photographs… As Wolf Richter pointed out, it costs a lot of money for these engines to just sit there doing nothing…

All over the world, similar numbers are coming in. For example, the Baltic Dry Index fell 30 more points on Wednesday after falling 21 on Tuesday. Global trade is really, really slowing down during the early portion of 2016. What this means on a practical level is that a lot less stuff is being bought, sold and shipped around the planet. It is becoming increasingly difficult for authorities to deny that a new global recession has begun, and at this moment we are only in the very early chapters of this new crisis. Another thing that I watch very closely is the velocity of money. When an economy is healthy, people feel pretty good about things and money tends to circulate fairly rapidly. For example, I may buy something from you, then you may buy something from someone else, etc. But when times get tough, people tend to hold on to their money more tightly, and that is why the velocity of money goes down when recessions hit. In the chart below, the shaded areas represent recessions, and you can see that the velocity of money has declined during every single recession in the post-World War II era… During the last recession, the velocity of money declined precipitously, and that makes perfect sense. But then a funny thing happened. There was a slight bump up once the recession was over, but then it turned down again and it has kept going down ever since. In fact, the velocity of money has now dropped to an all-time low. The velocity of M2 just recently dipped below 1.5 for the first time ever. This is not a sign of an “economic recovery”. What this tells us is that our economy is very, very sick. And we can see evidence of this sickness all around us. For instance, the Los Angeles Times is reporting that homelessness in Los Angeles increased by 11 percent last year, and this marked the fourth year in a row that homelessness in the city has increased…

Let us also not forget that about half the country is basically flat broke at this point. Just recently, the Federal Reserve found that 47 percent of all Americans could not pay an unexpected $400 emergency room bill without selling something or borrowing the money from somewhere. With numbers such as these being reported, how in the world can anyone possibly claim that the U.S. economy is in good shape? It boggles the mind, and yet there are people out there that would actually have you believe that everything is just fine. The current occupant of the White House is one of them. With each passing month, the real economy is getting even worse. We may not have slipped into a full-blown economic depression just yet, but it is coming. For now, let us be thankful for whatever remains of our debt-fueled prosperity, because we don’t deserve the massively inflated standard of living that we have been enjoying. We have been consuming far more than we produce for decades, but it won’t last for much longer. And when those days are gone for good, we will mourn them bitterly. |

| Podcast: Easy Money From China, Japan and Europe Has Failed. What’s Next? Posted: 04 May 2016 12:33 PM PDT China’s most recent borrowing binge didn’t work. Japanese and European negative interest rates resulted in their currencies going up rather than down. Global growth is slowing. Inflation is nonexistent and debt keeps rising. Only gold and silver are looking strong. Calls are being heard for bigger deficits. The world’s governments are about to panic. This posting includes an audio/video/photo media file: Download Now |

| Gold Takes a Breather; Watch for 1247 Support Posted: 03 May 2016 12:54 PM PDT |

| Some of Brien Lundin's Precious Metals Picks Are Up More Than 400%. What Is Next? Posted: 03 May 2016 01:00 AM PDT |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment