Gold World News Flash |

- Dumb Debt's Of America , Gold And Silver

- George Soros Buying Gold ETF And Gold Shares In Q1

- Bullion pricing - how it works

- Undeniable Evidence That The Real Economy Is Already In Recession

- Welcome To 1984

- 2016: The Year It All Came Down (ANONYMOUS COLLAPSE – Part 1)

- Silver Prices per Ounce Will Be Determined by These Three Factors in 2016

- Gold Price Closed at $1276.20 up $2.80 or 0.22%

- How Stupid Do You Have To Be, Part 2: 100-Year Bonds

- China’s Largest Bank Is Quietly Cornering The Market For London Physical Gold

- DOLLAR REJECTED WORLDWIDE - PUTIN KILLS PETRO DOLLAR

- TF Metals Report: The epic battle continues

- Shocking Chinese Plan To Start Rationing Food To Americans In 2017

- Gold Daily and Silver Weekly Charts - Opera Buffa

- The Elite’s Master Plan for Global Inflation, Part II

- The Decline and Collapse of Sweden | European Migrant Crisis

- The Long-Buried Secret of Napoleon Bonaparte

- WESTERN VALUES HEADING TOWARD OBLIVION

- Gold Relaxes In $1250 - $1300 Range Trade

- Economic Collapse 2016 Warning : Conspire to KILL THE DOLLAR

- Why Britain should leave the EU - What BBC is not telling you #Brexit

- The Panama Papers: The Putin Connection

- Defense Bill Coming This Week: A Boost for War and Tyranny

- Venezuela "Apocalyptic Collapse" No Food And Crime Waves

- Gold Gets Derailed From The Rally Tracks Again

- 'Audit the Fed' movement is taking a big step forward in Congress this week

- Gold Price Possible $200 Rally

- Armed gangs confound Venezuela's bid to exploit gold mines

- Paulson cut gold bets again as Soros, others rushed back

- University of Michigan to invest in gold, copper mining fund

- Tuesday Morning Links

- Make America gold again: Calls for everyone's favorite standard are back

- Bullion Star's Ronan Manly examines the London platinum and palladium market

- Two Companies Poised to Catch Up to Gold Peer Group

- Breaking News And Best Of The Web — May 18

| Dumb Debt's Of America , Gold And Silver Posted: 18 May 2016 12:51 AM PDT A Solution to this big problem . Assuming everything is manipulated - Stock markets , Gold and Silver paper contracts , treasuries Assuming anyhow this debt cannot be ever repaid by conventional means | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| George Soros Buying Gold ETF And Gold Shares In Q1 Posted: 18 May 2016 12:41 AM PDT George Soros, who once called gold “the ultimate bubble,” has resumed buying the gold ETF and shares after a three-year hiatus. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bullion pricing - how it works Posted: 18 May 2016 12:15 AM PDT Perth Mint Blog. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Undeniable Evidence That The Real Economy Is Already In Recession Posted: 17 May 2016 11:00 PM PDT Submitted by Michael Snyder via The Economic Collapse blog, You are about to see a chart that is undeniable evidence that we have already entered a major economic slowdown.

I know that might sound really basic, but I want everyone to be on the same page as we proceed in this article. Just because stock prices are artificially high right now does not mean that the U.S. economy is in good shape. In fact, there was a stock rally at this exact time of the year in 2008 even though the underlying economic fundamentals were rapidly deteriorating. We all remember what happened later that year, so we should not exactly be rejoicing that precisely the same pattern that we witnessed in 2008 is happening again right in front of our eyes. During the month of April, the Cass Transportation Index was down 4.9 percent on a year over year basis. What this means is that a lot less stuff was bought and sold and shipped around the country in April 2016 when compared to April 2015. The following comes from Wolf Richter…

Of course this was not just a one month fluke. The reality is that we have now seen the Cass Shipping Index decline on a year over year basis for 14 consecutive months. Here is more commentary and a chart from Wolf Richter…

This is undeniable evidence that the “real economy” has been slowing down for more than a year. In 2007-2008 we saw a similar thing happen, but the Federal Reserve and most of the “experts” boldly assured us that there was not going to be a recession. Of course then we immediately proceeded to plunge into the worst economic downturn since the Great Depression of the 1930s. Traditionally, railroad activity has been a key indicator of where the U.S. economy is heading next. Just a few days ago, I wrote about how U.S. rail traffic was down more than 11 percent from a year ago during the month of April, and I included a photo that showed 292 Union Pacific engines sitting in the middle of the Arizona desert doing absolutely nothing. Well, just yesterday one of my readers sent me a photograph of a news article from North Dakota about how a similar thing is happening up there. Hundreds of rail workers are being laid off, and engines are just sitting idle on the tracks because there is literally nothing for them to do… Intuitively, does it seem like this should be happening in a “healthy” economy? Of course not. The reason why this is happening is because businesses have been selling less stuff. Total business sales have now been declining for almost two years, and they are now close to 15 percent lower than they were in late 2014. Because sales are way down, unsold inventories are really starting to pile up. The inventory to sales ratio is now close to the level it was at during the worst moments of the last recession, and many analysts expect it to continue to keep going up. Why can’t people understand what is happening? So far this year, job cut announcements are up 24 percent and the number of commercial bankruptcies is shooting through the roof. Signs that we are in the early chapters of a new economic downturn are all around us, and yet denial is everywhere. For instance, just consider this excerpt from a CNBC article entitled “This key recession signal is broken“…

Treasury yields are very, very clearly telling us that a new recession is here, but because the “experts” don’t want to believe it they are telling us that the signal is “broken”.

For many Americans, all that seems to matter is that the stock market has recovered from the horrible crashes last August and earlier this year. But in the end, I am convinced that those crashes will simply be regarded as “foreshocks” of a much greater crash in our not too distant future. But if you don’t want to believe me, perhaps you will listen to Goldman Sachs. They just came out with six reasons why stocks are about to tumble. Or perhaps you will believe Bank of America. They just came out with nine reasons why a big stock market decline is on the horizon. To me, one of the big developments has been the fact that stock buybacks are really starting to dry up. In fact, announced stock buybacks have declined 38 percent so far this year…

Stock buybacks have been one of the key factors keeping stock prices at artificially inflated levels even though underlying economic conditions have been deteriorating. Now that stock buybacks are drying up, it is going to be difficult for stocks to stay disconnected from economic reality. A lot of people have been asking me recently when the next crisis is going to arrive. I always tell them that it is already here. Just like in early 2008, economic conditions are rapidly deteriorating, but the stock market has not gotten the memo quite yet. And just like in 2008, when the financial markets do finally start catching up with reality it will likely happen very quickly. So don’t take your eyes off of the deteriorating economic fundamentals, because it is inevitable that the financial markets will follow eventually. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 17 May 2016 07:50 PM PDT Authored by Chris Hedges, originally posted at TruthDig.com, The artifice of corporate totalitarianism has been exposed. The citizens, disgusted by the lies and manipulation, have turned on the political establishment. But the game is not over. Corporate power has within its arsenal potent forms of control. It will use them. As the pretense of democracy is unmasked, the naked fist of state repression takes its place. America is about—unless we act quickly—to get ugly.

This moment in American history is what Antonio Gramsci called the “interregnum”—the period when a discredited regime is collapsing but a new one has yet to take its place. There is no guarantee that what comes next will be better. But this space, which will close soon, offers citizens the final chance to embrace a new vision and a new direction. This vision will only be obtained through mass acts of civic mobilization and civil disobedience across the country. Nader, who sees this period in American history as crucial, perhaps the last opportunity to save us from tyranny, is planning to rally the left for three days, from May 23 to May 26 at Constitution Hall in Washington, D.C., in what he is calling “Breaking Through Power” or “Citizen’s Revolutionary Week.” He is bringing to the capital scores of activists and community leaders to speak, organize and attempt to mobilize to halt our slide into despotism.

“Elections have become off-limits to democracy,” he went on. “They have become off-limits to democracy’s fundamental civil community or civil society. When that happens, the very roots shrivel and dry up. Politics is now a sideshow. Politics does not bother corporate power. Whoever wins, they win. Both parties represent Wall Street over Main Street. Wall Street is embedded in the federal government.” Donald Trump, like Hillary Clinton, has no plans to disrupt the corporate machinery, although Wall Street has rallied around Clinton because of her predictability and long service to the financial and military elites. What Trump has done, Nader points out, is channel “the racist, right-wing militants” within the electorate, embodied in large part by the white working poor, into the election process, perhaps for one last time. Much of the left, Nader argues, especially with the Democratic Party’s blatant rigging of the primaries to deny Bernie Sanders the nomination, grasps that change will come only by building mass movements. This gives the left, at least until these protofascist forces also give up on the political process, a window of opportunity. If we do not seize it, he warns, we may be doomed. He despairs over the collapse of the commercial media, now governed by the primacy of corporate profit.

The impoverished national discourse, fostered by a commercial mass media that does not see serious political debate as profitable and focuses on the trivial, the salacious and the inane, has empowered showmen and con artists such as Trump.

The focus on info-entertainment has left not only left the public uninformed and easily manipulated but has locked out the voices that advocate genuine reform and change.

“The system is gamed,” he said. “The only way out of it is to mobilize the civil society.

Nader called on Sanders to join in the building of a nationwide civic mobilization. He said that while Clinton may borrow some of his rhetoric, she and the Democratic Party establishment would not incorporate Sander’s populist appeals against Wall Street into the party platform. If Sanders does not join a civic mobilization, Nader warned, there would be “a complete disintegration of his movement.” Nader also said he was worried that Clinton’s high negativity ratings, along with potential scandals, including the possible release of her highly paid speeches to corporations such as Goldman Sachs, could see Trump win the presidency.

While Nader supports the building of third parties, he cautions that these parties—he singles out the Green Party and the Libertarian Party—will go nowhere without mass mobilization to pressure the centers of power. He called on the left to reach out to the right in a joint campaign to dismantle the corporate state. Sanders could play a large role in this mobilization, Nader said, because “he is in the eye of the mass media. He is building this rumble from the people.”

Nader said that a Clinton presidency would further enflame the right wing and push larger segments of the country toward extremism.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016: The Year It All Came Down (ANONYMOUS COLLAPSE – Part 1) Posted: 17 May 2016 07:00 PM PDT from Silver The Antidote: Note: Any ads you might see are not loaded by me but by 3rd parties claiming copyright and earning off my hard work. To support this channel please watch my other videos and just let the adds run with volume down, to fund me buying better software to present you better content! | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Prices per Ounce Will Be Determined by These Three Factors in 2016 Posted: 17 May 2016 06:40 PM PDT by Peter Krauth, Money Morning:

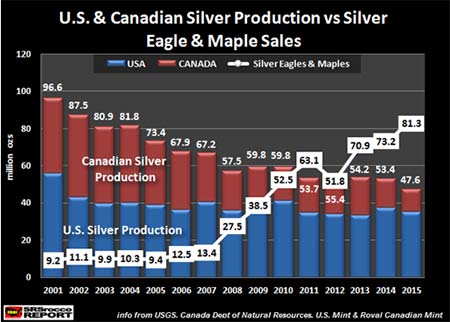

Late last month, we saw the silver price flirt with the $18 level. It has since backed down but has continued to trade in a relatively narrow range between $16.80 and $17.50. But we’ve recently witnessed some strength in the U.S. Dollar Index (DXY), which arguably became somewhat oversold in early May. It’s bounced back 1.7% so far this month. That’s been the biggest headwind facing silver prices right now. And by many accounts, it may not be over yet.

There are a number of drivers that influence the price of silver. Supply and demand are the fundamental forces, but sentiment and technical indicators will also have a notable impact. I’m going to explore some of those with you today. The goal is to see what we can determine about the direction silver prices are headed in the near and longer terms. But first, let’s look at the silver price action last week… The Volatility in Silver Prices per Ounce Last WeekIt was another bouncy ride for the silver price over the past five trading days. Silver kicked off the week with a big sell-off. On Monday, May 9, silver prices per ounce dropped 2.5% to close at $17.09. This coincided with a jump in the U.S. Dollar Index, which gained 0.1% to 94.16 on the day. Silver prices saw little movement the next day. They opened at $17.02 and closed the day fairly flat at $17.09. The DXY added 0.1% to settle at 94.27. But the price of silver received a shot of life on Wednesday. In overnight trading, it climbed to a peak of $17.53. This happened as the dollar trended downward and bottomed at midday around 93.60. However, the DXY reversed and rose modestly towards 93.80. This capped silver’s gains but still gave the metal a 1.8% gain to close at $17.40. To get a better understanding of the dollar’s movement, this chart shows how it trended last week…  On Thursday, May 12, some weakness returned to the silver price thanks to the strengthening dollar. While the DXY gained 0.4% to close at 94.16, silver prices per ounce fell 2.6% to settle at $16.95. To end the week, the price of silver faced some more challenging dollar strength. But despite the 0.5% gain in the DXY, silver managed to post a 1.1% gain on Friday. With that, silver prices saw a weekly decline of 1.8% to $17.13. Although silver lost some ground last week, we see the metal rebounding in 2016 thanks to these three indicators… The First Bullish Factor for Silver Prices per Ounce in 2016The first indicator for silver prices in 2016 is production. You see, the relationship between North American silver production and silver coin sales has undergone a sea change in the last 15 years. And since 2011, the market has been in a growing deficit situation. According to SRSrocco Report, the Royal Canadian Mint’s annual sales of Silver Maple Leaf coins jumped 18% in 2015 from 29.2 million to 34.3 million. If you combine the U.S. Mint’s Silver Eagles sales with the Silver Maple Leaf sales, the 2015 total is 81.3 million ounces. That’s a huge increase from 73.2 million ounces in 2014.  As you can see in the accompanying chart, there was plenty of North American silver production to meet Canadian and U.S. Mint sales between 2001 and 2007. In fact, there was a considerable surplus by this measure. But sales kept growing. In 2008, annual sales of these coins doubled from 13.4 million to 27.5 million. They kept rising, nearly doubling again to 52.5 million in 2010. With combined sales of U.S. and Canadian silver at 63.1 million units in 2011, the market found itself in a deficit. A major reason is the silver supply steadily declined from 2001 onward. And with the exception of 2012, the deficit has been widening ever since. Last year, total sales of Silver Maples and Silver Eagles were 81.3 million ounces. That’s a dramatic difference from the 47.6 million ounces of production in 2015. This begs the question, “How long can we keep importing silver, especially at current prices, to fill the widening gap?” | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1276.20 up $2.80 or 0.22% Posted: 17 May 2016 06:29 PM PDT

When roosters quack & ducks crow, you wonder what's going wrong. When markets don't act right, you wonder what you're not seeing. Dollar index tried one again today to clear its 50 DMA (94.76) and failed second day running. Lost 7 basis points (0.07%) to 94.49. Not fatal, but like a rooster quacking, it makes you ask, "Why?" And moreso because it comes atop a slothful, lethargic rise off the early May low. So far nothing at all about that rally looks like anything more than a routine upward correction in a ruling downtrend. But what do I know? I'm no more'n a one-footed nat'ral born durn fool from Tennessee. Right now if I got into a kicking contest, I'd have to borrow somebody else's foot. Other stinking, scrofulous, scurvy, scabby fiat currencies went nowhere today. How they ALL fell and the dollar index fell, too, I am not quite mathematically certain. I reckon they're falling out of this world backwards! It's tough enough being the only practicing non-communist in the USA, but worse would be owning stocks. Oh, yea, they were a-jubilatin' & a-drinkin' them martinis on Wall Street yesterday when the Dow rose 1%, so today I reckon they're drinking vinegar, ipecac, & milk-of-magnesia because it dropped 1.02%. Yes, lost 180.73 to close at 17,529.98. S&P500 did not disappoint, either, dropping 19.45 (0.94%) to 2,047.21. Today the Dow in fact closed below the neckline of the Head & Shoulders top it has been drawing, & it goes without saying below its 20 & 50 DMAs. http://bit.ly/1YA7s1u That head & shoulders measures to a target of about 17,000, and that right soon. Listen, this is NOT entertainment and I am deadly serious. Mark my words: get out of stocks. Get out. Outlook for next 5-8 years is to lose 50% or more from the 18,312.39 high from last May. In case you're slow with a calculator, that means it will drop to 9,156.20 OR LOWER. Stocks will lose 85% of their present value against silver & gold. If I did nothing more than look at the gold/silver ratio, I would conclude that this metals rally probably has further to run. Rallies take the ratio DOWN, & in spite of correcting for two weeks and more, the rally has not managed to break through the 200 day moving average above or the lower range boundary it broke getting here. Ratio appears set to move further down. Silver rose 9.3¢ to 1723.5¢ and gold added a measly $2.80 to $1,276.20. Both are rattling back & forth, trapped like a tiger and trying to break out. Look first at the gold chart for something new, http://schrts.co/AqN5pJ Blue-dotted line shows an even sided triangle, and gold has traded out into the tight nose cone. Above $1,287.50 gold burst out upside. Below $1,270 gold crashes to the earth. An even-sided triangle says nothing about which way it will break, only that it will break soon. Now look at silver, http://schrts.co/t9IUae Silver has outlined a falling right triangle. As a general rule, these triangles are supposed to break downward, but I have often seen them serve as a consolidation and break out upwards. Odds favor a downside breakout, and momentum has slowed and turned down. Yet for all that I can't shake a reluctance, a trembling in my tongue, to say silver & gold will fall. I'll be delivered shortly, at least. These triangles are swiftly coming to their point. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Stupid Do You Have To Be, Part 2: 100-Year Bonds Posted: 17 May 2016 05:20 PM PDT by John Rubino, Dollar Collapse:

We all make mistakes, but some are bigger than others. An example of a serious one that's both potentially catastrophic and easily avoided is to lend money for long periods during a time of rising debt and financial instability. Who, for instance, would commit capital for 30 years to Italy by buying that country's long-dated government bonds? "No one" is the sane answer, yet those bonds do find buyers. Even higher on the crazy scale is the following:

A few questions And since institutions like pension funds and insurance companies as well as individual retirees have based their plans on projected returns two or three times this high, owning such bonds doesn't make these entities any more viable. So let's go with "who the hell knows?" as the only reasonable answer to the above question. Meanwhile if you're "duration hungry" how does locking in a low rate for a longer time help you match your book — that is, line income streams up with obligations so that when the latter come due the former are guaranteed to be there? What obligations both run for a century and can be predicted with anything other than simple extrapolation (which is to say pure guesswork)? The answer is that there are none. Sure, pension funds and insurance companies might need to pay out benefits in 2116 but they also might have long since been replaced by an artificial intelligence that meets the needs of its human slaves without recourse to archaic concepts like money. So planning for something that distant and nebulous is silly. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China’s Largest Bank Is Quietly Cornering The Market For London Physical Gold Posted: 17 May 2016 04:40 PM PDT from ZeroHedge:

Deutsche Bank’s vault became operational in June 2014 and has a capacity of 1,500 tonnes. It was built and is managed by British security services company G4S. “The figure that was initially talked about may have been around $4 million, but it’s way lower now,” a second source said, without disclosing the figure paid for the vault.

We thought that ICBC would be content with its purchase of one of London’s biggest vaults but that appears to not have been the case. Earlier today, ICBC Standard Bank reported that it was also buying Barclays’ London precious metals vault, giving the Chinese bank the capacity to store gold worth more than US$80bn in the secret location. The vault, which can store 2,000 tons of gold and other precious metals such as silver, platinum, palladium, was opened by Barclays in 2012 and took more than a year to build. The location of the vault is secret, but the lender has said it's within the M25 road that orbits London. “This is an exciting acquisition for the Bank. This enables us to better execute on our strategy to become one of the largest Chinese banks in the precious metals market," Mark Buncombe, head of commodities at ICBC Standard Bank, said in the statement. “The acquisition of a precious metals vault allows us to expand our services in clearing and processing.” Barclays’ decision to exit the business comes as U.S. and European Union regulators investigate whether at least 10 banks, including Barclays, JPMorgan Chase & Co. and Deutsche Bank AG — manipulated prices of precious metals such as silver and gold. Barclays Chief Executive Officer Jes Staley said in January that the bank was assessing "various options” to exit its precious metals business while vowing to speed up disposals from the bank's non-core unit, which houses 51 billion pounds ($73 billion) of toxic and otherwise unwanted assets. As Bloomberg reports, China’s (and the world’s) largest bank expects the purchase of the vaulting business and related contracts to be completed in July, it said in an e-mailed statement Monday. No financial details were given. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| DOLLAR REJECTED WORLDWIDE - PUTIN KILLS PETRO DOLLAR Posted: 17 May 2016 04:36 PM PDT America is fucked. It survives on the petro dollar and weapons sales. So it looks like they are going to ramp up the false flags for further wars and more weapons sales. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| TF Metals Report: The epic battle continues Posted: 17 May 2016 04:30 PM PDT 7:29p ET Tuesday, May 17, 2016 Dear Friend of GATA and Gold: The TF Metals Report's Turd Ferguson shows today how yesterday's seemingly unprovoked smash of gold futures prices was another attack by the bullion banks that have -- or have been lent by central banks -- the power to create infinite amounts of imaginary metal for price suppression. Ferguson writes: "Having the ability to create an endless supply of anything gives you direct control over whatever market you 'make.' And for three years this has provided a stream of easy profits for these bank trading desks. They would simply issue as many new contracts as necessary to wait out the specs. Eventually price would top out and momentum would stall. All it would take was usually one good shove from the banks and down would go price. The specs would all rush for the exits and the banks would use the ensuing selling to buy back and cover nearly all their recently issued shorts." Ferguson's analysis is headlined "The Epic Battle Continues" and it's posted at the TF Metals Report here: http://www.tfmetalsreport.com/blog/7631/epic-battle-continues CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shocking Chinese Plan To Start Rationing Food To Americans In 2017 Posted: 17 May 2016 02:30 PM PDT Shock Over Chinese Plan To Start Rationing Food To American People In 2017. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Opera Buffa Posted: 17 May 2016 02:00 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Elite’s Master Plan for Global Inflation, Part II Posted: 17 May 2016 01:44 PM PDT This post The Elite's Master Plan for Global Inflation, Part II appeared first on Daily Reckoning. The global monetary elites had a conference in Zurich, Switzerland, last week. Among the speakers were William Dudley, president of the Federal Reserve Bank of New York, and Claudio Borio, chief economist of the Bank for International Settlements. The topic of the conference was the prospect of multiple reserve currencies in the international monetary system. The speakers generally agreed that a system with more reserve currencies (such as the Australian dollar, Canadian dollar and possibly certain emerging markets' currencies in addition to the Chinese yuan) would be a desirable one. There's only one problem… It's a zero-sum game. All of the reserve currencies in the world add up to 100% of the reserve currencies. If new currencies have a larger share, then the U.S. dollar must have a smaller share. It's just basic math. That means a long-term process of selling dollars and buying the new reserve currencies. That selling lowers the value of the dollar and imports inflation into the U.S. It also means a higher dollar price for gold. The elites won't tell you that, but it's true. Case in point: It seems George Soros might be subscribing to Rickards' Gold Speculator! According to Bloomberg: "Soros cut his firm's investments in U.S. stocks by more than a third in the first quarter and bought a $264 million stake in the world's biggest bullion producer, Barrick Gold Corp…. "Soros also disclosed owning call options on 1.05 million shares in the SPDR Gold Trust, an exchange-traded fund that tracks the price of gold." These are all signs of a weaker dollar. But it's one thing for famous billionaires and analysts like me to expect a weaker dollar. It's another thing when the guy who prints dollars also says the dollar will weaken. A moment ago, I mentioned William Dudley, head of the New York Fed… Well, when the Fed wants to print dollars, it's the New York Fed that buys bonds from Wall Street primary dealers and pays for them with money that comes from thin air. In a recent interview, Dudley said that "energy prices seem to have stabilized and actually increased a little bit, and the dollar has actually weakened… I am reasonably confident that inflation will get back to our 2% objective over the medium term." So if the guy who prints dollars is looking at a weaker dollar and more inflation, maybe you should too. Yesterday, I explained how the global elite plan to use higher gold prices to unleash inflation. Below, I show you the second part of their plan, which may already be underway. Read on… Gold's trading at around $1,280 this morning. So, if you buy gold today and it goes to $5,000 an ounce or $10,000 an ounce, which I do expect, you'd probably be extremely happy. But that doesn't tell the whole story. Gold will have increased dramatically in nominal terms. If gold goes from $1,000 an ounce to $5,000 an ounce, most people would say that's a 400% increase in the price of gold. But it's really an 80% devaluation of the dollar. That 80% dollar devaluation leads to a world of $5,000 gold. But it also leads to a world of $400 per barrel and $10.00 gas. Yes, you need to own gold in that situation because you'll be protected against inflation. You'll be in a far better position than those who don't. They'll be wiped out. But in many ways you're just keeping up, since everything you buy will be much higher. The key takeaway is that a higher dollar price for gold is just a lower value for the dollar. And that's what the elite's want. It's part of their global inflation plan… How do you get all the major economies in the world to create inflation without relying on destructive currency wars that merely shuffle money around between winners and losers? The answer is very interesting. It's a two-part answer, really. And they're both coming. You could call it a master plan for global inflation… I explained yesterday how the monetary elites are looking to engineer higher gold prices to generate inflation since nothing else has worked. That's the first answer. The evidence is very strong for that hypothesis. The second part of the answer goes by the name of helicopter money. You've probably heard all about it. Helicopter money is different than QE, quantitative easing. It conjures up the image of a helicopter dropping money onto the streets below. Everyone picks up the money, runs down to Walmart and goes on a buying spree. All that extra spending leads to inflation. That's not literally how the process works, but the idea is the same. Let me explain technically how helicopter money does work. It's a combination of monetary policy and fiscal policy. The central bank controls money printing, but it can't control government spending. That's up to the Congress. With helicopter money, the monetary authority and the fiscal authority work together. When Congress wants to spend a lot more money, it produces larger budget deficits. And the Treasury has to cover that deficit by issuing more bonds. The Federal Reserve buys the bonds. And it prints money to buy the bonds. The answer still comes back to money printing. Quantitative easing, which they've been doing for seven years on and off is money printing, but it works differently. With quantitative easing, the Federal Reserve simply buys bonds from a bank. It pays for the bonds with printed money, which goes to the bank. What do the banks do with it? In theory, they're supposed to lend it to businesses and private citizens. But people have been reluctant to spend it and banks don't want to lend it. What do the banks do with that money if there's no lending and spending? They give it back to the Federal Reserve in the form of excess reserves. After all, the Federal Reserve is a bank. It's a bankers bank, essentially. What good does that do anybody? None, really. It just inflates all the balance sheets and props up the banks. It doesn't do the economy any good. Helicopter money is different because Congress spends the money. Helicopter money doesn't give the money directly to people because they might not spend it. But the government will. The government is very good at spending money. The Democrats prefer benefit programs, welfare programs, social spending, education, healthcare, and the like. The Republicans prefer defense, intelligence, corporate subsidies, and so on. The way Democrats and Republicans usually compromise on these things is to do both. Everybody gets something. They can build six new aircraft carriers, offer free tuition, free healthcare, free housing, etc. Then the supposed Keynesian multiplier kicks in to increase consumer spending. The Keynesian multiplier says that if the government spends money to hire people to build a highway, for example, they'll spend it by going to dinner, the movie theater, buying new cars, vacations, etc. And those on the receiving end of that money spend it on other things, in a virtuous cycle. But the Keynesian multiplier might not be nearly as effective as elites suspect. With an economy saturated in debt like ours, you reach the point of diminishing returns. (By the way, if helicopter money fails, plan B is to increase the price of gold, as I explained yesterday. That works every time). The leader on this is House Speaker, Paul Ryan. Last December, Sir Paul Ryan passed Obama's budget and busted the ceiling caps that have been in place since 2011. The Ryan budget of September 2015 busted the cap. (It also refinanced the IMF, which was buried in a 2012 bill, but that's a story for another day). But that budget bill was the tip of the iceberg. The plan now is to have much larger budget deficits. The point is, if people won't spend, the government will. When the government spends and deficit finances it, it will eventually produce inflation. That plan is on the table. It's discussed among the elites. It's being advanced by all the big brains who work for the big think tanks, run by George Soros and the financial elite. These people don't walk around with hoods around their heads. We know who they are. You just have to follow them to see what they're up to. But these elites are actually beyond the stage of calling for helicopter money. That's already been decided. They're now debating what they should spend the helicopter money on. They looking for the best way to reassure the public — meaning lie to the public — about what they're actually up to. I wrote recently in these pages about how the recent climate agreement may have really just been a disguised helicopter money scheme. Spending on emission reduction programs and infrastructure could total about $6 trillion per year, which would be carried out by the IMF through the issue of special drawing rights (SDRs). That's one way the elites could sell their plans to the public. It's inflation masquerading as "saving the planet," "climate justice," or what have you. The bottom line is that helicopter money is coming. I think inflation is too, either through helicopter money or increasing the gold price — or a combination of both. It may not happen overnight, but governments will ultimately get it if they're determined enough. It's true, inflation is low right now. The Fed says it wants 2%. But it secretly wants 3%, which is really not so secret. Troy Evans is the president of the Chicago branch of the Federal Reserve. And he told me he wouldn't mind seeing 3% to 3.5% inflation. His theory is that, if the target is 2% and it's been running at 1%, you need 3% to average the two. And mathematically that's right. But the economy isn't a fine Swiss watch you can tinker with to produce desired outcomes. Deflation has held the upper hand in many ways since the 2008 crisis. But once inflation takes hold, it can't easily be put back in the bottle. Think of the forces of deflation and inflation as two teams battling in a tug of war. Eventually, one side wins. If the elites win the tug of war with deflation, they will eventually get more inflation than they expect. Maybe a lot more. This is one of the shocks that investors have to look out for. Now is the time to buy gold. Regards, Jim Rickards P.S. Another dollar crisis is coming. It's not a question of if, but when. And gold could soar to record levels when it strikes. If you own gold beforehand, you can preserve – and grow – your wealth. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. Don't buy any gold until you read it. We'll send you your report when you sign up for the free daily email edition of The Daily Reckoning. Every day you'll get an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE and claim your special report. The post The Elite's Master Plan for Global Inflation, Part II appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Decline and Collapse of Sweden | European Migrant Crisis Posted: 17 May 2016 01:30 PM PDT Question: "How far or low can Sweden go in accepting Muslim immigrants? I understand to a degree why the government can`t get enough of them - millions of people, highly dependent on the government welfare can probably keep the ruling left in power. But what is wrong with the Swedes? Why are they... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Long-Buried Secret of Napoleon Bonaparte Posted: 17 May 2016 01:16 PM PDT This post The Long-Buried Secret of Napoleon Bonaparte appeared first on Daily Reckoning. DUBLIN – The smart money is getting out while the gettin' is still good. That's the message we get from reading the recent headlines. Here's the Financial Times:

Bloomberg:

Family SecretsMeanwhile, in Paris over the weekend, it seemed as though everyone had cleared out. We dined in a neighborhood brasserie on the Rue La Tour-Maubourg. Brightly lit, with red awnings and polished brass, it is normally full of life, noise, and people. But on Saturday, we were as lonely as a libertarian – the only diner in the place. It was Pentecost weekend – a big holiday in France. "That's not all," a taxi driver told us. "It's been like this since that terrorist attack in November. We live on tourists. And the tourists have stopped coming." There was no line of tourists at the Les Invalides museum complex when we went to visit. The edifice houses a large collection of military paraphernalia. You could spend weeks inside, studying centuries' worth of pompous bungling and grand disasters. But we had a particular destination and a special purpose. We were exploring family secrets… Myths and HeroesEvery nation… every people… needs its myths, narratives, and heroes. For a time, Napoleon Bonaparte seemed to prove that France was the "exceptional nation." It had the world's leading culture… its most advanced government… its best art and architecture… and its nearly-invincible armies, headed by the Hannibal of his time, the great military genius – the Emperor Napoleon I. He managed to recreate the Holy Roman Empire, bringing Europe together under one yolk almost 200 years before the European Union. But after the catastrophe in Russia – he invaded with 400,000 troops; he returned with fewer than 40,000 – France's Grande Armée no longer looked so grand. And its commander no longer appeared to be such a genius. Myths hold nations together. But what holds myths together? Ah, dear reader, we wish we knew. Napoleon's next disaster was at Waterloo, where he was caught between Wellington's anvil and Blücher's heavy hammer. Then his friends and fans deserted him… leaving him to the tender mercies of the British army. Thence he was sent off to a tiny island in the South Atlantic – St. Helena. The nearest major country to St. Helena is South Africa. And from there came a remote cousin's wife… a woman we met years ago, in London, when she was already in her 90s. "After Napoleon died," she explained, "my ancestors – who were with him on that dreadful island – immigrated to South Africa and went into the wine business. They did very well. "My mother's grandfather was the son of Henri Bertrand, Napoleon's favorite general. The general shared everything with the emperor… even his exile." Shared ExileThere is an exhibition at Les Invalides of "Napoleon at St. Helena." Curators have gathered the furniture, books, and personal effects from his time in exile in the South Atlantic. There is also a film showing the island that was his prison and the house the British had prepared for him. Those were more civilized times. St. Helena was no Guantanamo. The house was pleasant, comfortable, and almost elegant. There were gardens and orchards… and a view to the far-off sea. We saw Napoleon's nightclothes, hung neatly over an oriental chair. We saw his books and writing table. We saw his bathtub… and his pool table. Then, we saw what we were looking for. There were a couple of paintings of Napoleon's death. Both show the same scene. A small group has gathered around the emperor on his death bed. Most prominent among them is the only woman in the group, the Comtesse Bertrand, and her children. They are the family of General Bertrand, who is seated next to the bed, his legs crossed and an anguished look upon his face. His wife stands, bending toward the dying man… with two small children by her side. "I may be one of the last ones to know it," the old woman said. "But I'll tell you, since you are family. Over the years, many people wondered why General Bertrand would take his family into exile with Napoleon. He certainly didn't have to. He was not banished. "But my mother told me that General Bertrand shared everything with Napoleon," the old woman looked down. A wry smile crossed her wrinkled lips, "Even his wife. You know the French." Regards, Bill Bonner P.S. Another dollar crisis is coming. It's not a question of if, but when. And gold could soar to record levels when it strikes. If you own gold beforehand, you can preserve – and grow – your wealth. That's why we've produced a FREE special report called The 5 Best Ways to Own Gold. Don't buy any gold until you read it. We'll send you your report when you sign up for the free daily email edition of The Daily Reckoning. Every day you'll get an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE and claim your special report. The post The Long-Buried Secret of Napoleon Bonaparte appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| WESTERN VALUES HEADING TOWARD OBLIVION Posted: 17 May 2016 12:30 PM PDT As soon as Governments disarmed their citizens they dismantled all of their freedoms. One cannot be free without the means to defend their freedoms from government tyranny. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Relaxes In $1250 - $1300 Range Trade Posted: 17 May 2016 11:46 AM PDT Graceland Update | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Economic Collapse 2016 Warning : Conspire to KILL THE DOLLAR Posted: 17 May 2016 11:00 AM PDT Warning: Conspire to KILL THE DOLLAR (Economic Collapse 2016) THIS is why you do NOT get a paper check as your paycheck they put your money that YOU work directly in the bank and IT'S YOUR MONEY and when this happens SAY GOODDDDDDDD BY TO YOUR MONEY IT'S NOT YOUR MONEY ANYMORE . The... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Britain should leave the EU - What BBC is not telling you #Brexit Posted: 17 May 2016 10:19 AM PDT What BBC won't tell you about Brexit: Decline of Britain since 1973 EEC Tony Gosling. Why leave EU? What the BBC won't tell you about #Brexit II Documentary evidence the EEC and EU was designed in 1942 in Berlin by the Nazis The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Panama Papers: The Putin Connection Posted: 17 May 2016 09:07 AM PDT Could Putin and other high profile political leaders and celebrities be using shell accounts to avoid tax? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Defense Bill Coming This Week: A Boost for War and Tyranny Posted: 17 May 2016 08:22 AM PDT This post Defense Bill Coming This Week: A Boost for War and Tyranny appeared first on Daily Reckoning. For many of us concerned with liberty, the letters "NDAA" have come to symbolize Washington's ongoing effort to undermine the US Constitution in the pursuit of constant war overseas. It was the National Defense Authorization Act (NDAA) for 2012 that introduced into law the idea that American citizens could be indefinitely detained without warrant or charge if a government bureaucrat decides they had assisted al-Qaeda or "associated forces that are engaged in hostilities against the United States." No charges, no trial, just disappeared Americans. The National Defense Authorization bill should be a Congressional mechanism to bind the president to spend national defense money in the way Congress wishes. It is the nuts and bolts of the defense budget and as such is an important oversight tool preventing the imperial executive from treating the military as his own private army. Unfortunately that is no longer the case these days. Why am I revisiting the NDAA today? Unfortunately since 2012 these bills have passed the House with less and less scrutiny, and this week the House is going to vote on final passage of yet another Defense Authorization, this time for fiscal year 2017. Once again it is a terrible piece of legislation that does great harm to the United States under the guise of protecting the United States. Unless some last minute changes take place, this latest NDAA will force young women for the first time to register to be drafted into the US military. For the past 36 years, young men have been forced to register with Selective Service when they turn 18 or face felony charges and years in prison. Under a perverted notion of "equality" some people are cheering the idea that this represents an achievement for women. Why cheer when slavery is extended to all? We should be fighting for an end to forced servitude for young men and to prevent it being extended to women. The argument against a draft should appeal to all: you own your own body. No state has the right to force you to kill or be killed against your will. No state has a claim on your life. We are born with freedoms not granted by the state, but by our creator. Only authoritarians seek to take that away from us. Along with extending draft registration to women, the latest NDAA expands the neocons' new "Cold War" with Russia, adding $3.4 billion to put US troops and heavy weapons on Russia's border because as the bill claims, "Russia presents the greatest threat to our national security." This NDAA also includes the military slush fund of nearly $60 billion for the president to spend on wars of his choosing without the need to get Congress involved. Despite all the cries that we need to "rebuild the military,” this year's Defense Authorization bill has a higher base expenditure than last year. There have been no cuts in the military. On the contrary: the budget keeps growing. The Defense Authorization bill should remain notorious. It represents most of what is wrong with Washington. It is welfare for the well-connected defense contractors and warfare on our economy and on the rest of the world. This reckless spending does nothing to defend the United States. It is hastening our total economic collapse. Regards, Ron Paul P.S. What's the latest on gold, oil, the Fed, or the stock market? What's China going to do next? You'll find the answers in the free daily email edition of The Daily Reckoning. It provides an independent, penetrating and irreverent perspective on the worlds of finance and politics. And most importantly, how they fit together. Click here now to sign up for FREE. The post Defense Bill Coming This Week: A Boost for War and Tyranny appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Venezuela "Apocalyptic Collapse" No Food And Crime Waves Posted: 17 May 2016 08:08 AM PDT It has begun the "Apocalyptic Collapse" of the Socialist Nation of Venezuela The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Gets Derailed From The Rally Tracks Again Posted: 17 May 2016 07:40 AM PDT This post Gold Gets Derailed From The Rally Tracks Again appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a Tom terrific Tuesday to you! The soft dollar that began yesterday and the week, carried on throughout the day, and in the overnight sessions as well. The trading range has been narrow, and it appears to me that the currency traders are looking for something to send them in a direction, either way, but a clear, distinct direction, and to quit playing around with this one day dollar up next day dollar down stuff we’ve seen the last couple of weeks. I was writing the Review & Focus which is now available to everyone, and all you have to do to read it is go here and you’ll not only see the May R&F but also the April R&F. OK, getting back to me writing the June R&F. I was making a big thing out of the fact that the so-called Shanghai Accord seems to be fading, and we’re back to yen and renminbi weakness. The euro has range traded since hitting a high of 1.15 a couple of weeks ago, and then fell back to a 1.13 to 1.14 range. So, not so much damage to the euro, but the yen has really lost ground. In April yen was 106, now in May it’s 109 and losing ground every day. So, there you go a little preview of the June R&F, aren’t you now saying to yourself, why haven’t I been reading this letter once a month? There’s not much going on overseas this morning. Sweden’s Riksbank will have a couple of members speaking. In the U.K. they printed their April CPI (consumer inflation) and it was weaker than expected, which was 0.5% and the actual was 0.3% year on year. Just stop there for a minute, and think about what was going on here a year ago. The Bank of England’s Gov. Mark Carney was talking about hiking rates and of course I was laughing my you know what off at that call. But imagine if you will what the U.K. economy would be looking like right now, if he had gone ahead and hiked rates not once but twice as he was suggesting. Things in the Eurozone have seem to gone to play hide and seek. 7,8,9,10, ready or not here I come! Seriously, the Eurozone is as quiet as a church mouse today. And the euro has added a small amount to its value overnight. The Big thing overnight was the release of the Reserve Bank of Australia’s (RBA) meeting minutes from the meeting where they cut rates 25 Basis Point at the beginning of the month. Observers thought that these minutes would be quite dovish given the fact that the RBA did cut rates, when most people thought they wouldn’t. But the minutes proved not to be dovish, and in fact pointed out what a difficult decision the rate cut was, and how at one point it was thought they would wait for more information on the economy before cutting. Well, after seeing these minutes, Aussie dollar (A$) traders took them as an indication that the RBA will not cut rates again in June, and a lot of the short A$ trades had to be reversed, thus propelling the A$ to its best day in a month! I read a lot of research on the data that China printed over the weekend, and I reported to you on yesterday. I guess I’m the only one in the universe that thinks that the China economic prints were solid. No, I even mentioned that they didn’t meet expectations. But when Retail Sales are 10.1% that’s a solid print, I don’t care what anyone says otherwise! But the markets are thinking that China is in trouble again, after a brief respite from the markets putting pressure on them because of their economic slowdown. Again, I’m going to go back to what I told the Daily Reckoning on Friday, and that is how I view the situation in China. China had a nice long run of a boom economy, but after the boom you need a bust, to clean out the excesses of the boom run, and that’s what’s happening in China and will continue to happen in China until the excesses have been cleaned out. Of course it doesn’t help matters that the global economy is circling the bowl right now. The Chinese renminbi was allowed to appreciate again overnight, but at a very small amount. It was as if the People Bank of China (PBOC) said, “we’ll throw the markets a bone here, and see how they react”. So, yesterday, I asked the question to you – did you think that the Fed would hike rates at their June meeting? I’ve gone on record as saying I didn’t think so, and neither do the bond boys, or the Fed Fund Futures guys. But there was a curious thing that occurred yesterday under the cover of darkness. A Janet Yellen speech has been added to the speaking circuit calendar, that will take place on June 6th, which is before the “blackout” that occurs before a Fed meeting, and after the Jobs Jamboree which will be June 3rd. You don’t think this was done so she could see what the May jobs report looked like, and then could formulate her speech around that data? If the data was good, she could be giving the wink and nod for a June rate hike, and if the data was bad, she could be talking about how the Fed still believes that inflation and the economy will rebound this year. I have to say that I find this announcement of a previously unscheduled speech to be very curious. Curious don’t you agree? Not only curious but disturbing to me. I really take Central Banks to the woodshed in the June R&F, you’ll want to make sure you check that out when it gets posted. And not just the Fed. The Bank of Japan, Bank of England, and others, are all rounded up and taken to the woodshed for their insistence in “knowing better” as to what their economies needed. The Bank of Japan (BOJ) is the poster child for Central Bank interference in its economy. It all began over two decades ago. At the time, I was a foreign bond & currency trader for the old Mark Twain Bank. And we all thought that what the BOJ and Japanese government were doing was strange. Their cutting rates so aggressively, and their Budget stimulus measures, were just the beginning. Fifteen years ago, when we took control of the currency deposit book back, I would write about how the Japanese needed to change what they were doing because it wasn’t working. Well, they didn’t listen and now we’re more than 20 years down the road, and they’re still cutting rates, which are now negative, they’re still stimulating the budget. There are problems that Central Banks just can’t, even if they want to with the strongest desire, fix. And either they will figure that out one day, hopefully not too distant in the future, or they will become dinosaurs, and no one will listen to what they say. I think we’re almost there, the big meteor is about to hit. In Asia overnight, Singapore printed their April NODX (non-oil domestic exports) and they were quite weak, falling -7.9% year on year. Not as bad as expected which was -8.4%, but negative is still negative, and that should hurt the Sing dollar (S$). The S$ had been quite perky since March, but recent trading has brought the S$ back and this report should knock the stuffing out of the S$ in the short term. And in Canada, it appears that the wildfires in Alberta aren’t going to be that big of a hit to the Canadian GDP, and that the economic effect should be just a temporary thing. The price of oil rose again in the past 24 hours, but still holds a $47 handle. The Canadian dollar/loonie hasn’t been a HUGE recipient of the rise in the price of oil like the Russian ruble or the Norwegian krone has been. It’s difficult to tell what part of the Brazilian real’s rise is oil-related and what part is impeachment-related. But the real has held its gains so far even though I thought that it would struggle once the impeachment process was complete, for there were no quick fixes to the Brazilian economy. But a rising oil price is a helper! Speaking of oil, I was sent a graph yesterday by a dear reader, that illustrates the problems the U.S. energy companies below investment grade are going to have going forward, even if the price of oil remains stabilized. Next year, no biggie, just $62 billion in bond maturities to deal with. But in 2018, bond maturities rise to $100 billion, and in 2019 to $180 billion, and in 2020 to more than $220 billion. OMG! But I don’t see anything that could go awry here, do you? But then I’ve been talking about the financialization of the oil producers for months now, so none of this should be a surprise to you. Well maybe the size of the problem will be, I’ll give you that! Gold couldn’t hold the $10 gain it held yesterday morning, and ended up losing another $10 on top of that, making its loss on the day $20 in reality, given it has gained $10 in early trading. UGH! This morning, the price of gold is flat, no change at this point of the morning. I was asked a question on the Pfennig website yesterday, that I found interesting. The reader asked me where I saw gold trading in five and ten years. WOW! I’ve never really thought about that, setting an actual price for gold in five or ten years. All I’ve ever thought about is that it would be much stronger than it currently is, because by five years we’ll probably have experienced a currency regime change, with the dollar losing its reserve currency status. So, I was unable to actually answer his question, other than to say that I think it will be much stronger than it currently is. Which is my opinion and could be wrong! If you believe in what James Rickards writes, he says that:

And the Big News overnight night although not market moving was that after 41 years, the Treasury Dept. finally unveil the total Treasury holdings of Saudi Arabia. The Saudis own $116.8 billion in Treasuries. Ok, am I thinking about something else or am I right here that the Saudis threatened to sell $750 billion in Treasuries if the U.S. allowed the citizens to sue Saudi Arabia in the 9/11 lawsuit? Ahem. $117 billion is a far cry from $750 billion. I’m just saying. The U.S. Data Cupboard has a region manufacturing index for us yesterday. The Empire State PMI, showed a steep fall back -9.0 in May thus wiping out the 9.6 gain in April. Hmmm… let’s see in April the dollar was falling daily, and so far in May it has rebounded. Take what you want from that pairing, but it makes abundant sense to me! Today’s Data Cupboard has a piece of real economic data, Industrial Production (IP), which should show nascent growth, nothing of rate hike worthy material. And we’ll get one not so real economic data, in Housing Starts, and one piece of data that I call stupid. The stupid CPI. But let’s play along with the government on this one and pretend we care about CPI, just today, eh? NOT! I’ve got a special treat for you today. The folks at www.Bullionstar.com have put together an illustration of how things work at the COMEX. In this illustration you’ll find out how:

So, if you want to go directly there, simply click here. Chuck again. I found that pretty interesting, and I hope you did too. If you don’t have time to do it now, save this email and don’t just delete it, as my colleague once told a new reader he could do, and then you can come back to it and view it later.. That’s it for today. I hope you have a Tom terrific Tuesday, and be good to yourself! Regards, Chuck Butler P.S. Have you thought about investing in gold but don't know the best way to do it? Then you need to see the FREE special report we've produced called The 5 Best Ways to Own Gold. It answers all the questions you have. We'll send you your report immediately when you sign up for the free daily email edition of The Daily Reckoning. It combines hard-hitting information with charm and wit to bring you a unique perspective on the world. Click here now to sign up for FREE and claim your special report. The post Gold Gets Derailed From The Rally Tracks Again appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 'Audit the Fed' movement is taking a big step forward in Congress this week Posted: 17 May 2016 06:27 AM PDT By Jeff Cox An effort to conduct an unconventional audit of the Federal Reserve is gaining traction in Washington and on its way to a potentially important milestone this week. The Federal Reserve Transparency Act will undergo the markup process this week in the House Oversight and Government Reform Committee. A product of the "Audit the Fed" movement, the bill seeks not a financial exam of the U.S. central bank but rather a peek behind the curtain of how monetary decision-making happens. The markup comes after several failed efforts to move the legislation ahead, and supporters believe there now is enough backing in Congress to go forward. The Fed's policymaking arm, the Federal Open Market Committee, does not meet in public and only communicates its decisions through carefully worded statements at the end of its meetings and through officials' remarks at speaking engagements and through the press. ... ... For the remainder of the report: http://www.cnbc.com/2016/05/16/the-audit-the-fed-movement-is-taking-a-bi... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Possible $200 Rally Posted: 17 May 2016 05:45 AM PDT Gold Rally In my opinion, gold’s Cycle is setup well for a surprise, $200 Gold rally. Gold has reached an interesting crossroads and based on the Cycle position, some significant volatility lies ahead. The Gold sector is doing well, and has held up after impressive gains. It has seen a couple of weeks of price consolidation, but no serious selling. This points to a strong underlying bid, and is reflective of a bull market. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Armed gangs confound Venezuela's bid to exploit gold mines Posted: 17 May 2016 05:45 AM PDT By Anatoly Kurmanaev LA PARAGUA, Venezuela -- Five years after Venezuela nationalized much of its mining industry, President Nicolas Maduro is inviting multinational firms back in to try to revive the country's dying economy. But standing between the companies and the minerals are up to 100,000 illegal miners and armed gangs, some of which evidently enjoy cozy relations with local military commanders. In February, Mr. Maduro unveiled a plan to auction 27 million acres of new concessions in an area he designated as the Orinoco Mining Arc. The government estimates the area holds 7,000 tons of gold, which if certified would make Venezuela's gold deposits second only to Australia's. Mr. Maduro signed deals that month with China's fourth-largest coal miner Yankuang Group, construction giant China CAMC Engineering Co. and Spokane, Washington-based independent miner Gold Reserve Ltd. He said more contracts worth billions of dollars are coming. "This is a magnificent source of wealth that will begin substituting petroleum as our only source of foreign earnings," he said. But at the illegal Arenosa gold mine in the heart of the Orinoco Mining Arc, gang leader Ramon said he had other plans. On a recent day, dozens of his henchmen armed with pistols, shotguns, and machine guns stood guard surrounding the mines. Around them, hundreds of wildcatters dug pits with shovels amid blaring salsa music. ... ... For the remainder of the report: http://www.wsj.com/articles/armed-gangs-confound-venezuelas-bid-to-explo... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Paulson cut gold bets again as Soros, others rushed back Posted: 17 May 2016 05:38 AM PDT By Devika Krishna Kumar Gold bull John Paulson slashed his bets on bullion while billionaire investor George Soros and other big funds returned to the metal for the first time in years, filings showed on Monday, as prices staged their biggest rally in nearly 30 years. New York-based hedge fund Paulson & Co, led by John Paulson, one of the world's most influential gold investors, slashed its investment in SPDR Gold Trust, the world's biggest gold exchanged-traded fund, by 17 percent to 4.8 million shares, U.S. Securities and Exchange Commission filings showed on Monday. It was Paulson's third cut to his SPDR stake in a year and saw him drop to the third largest investor in the fund from second, behind BlackRock and First Eagle Investment Management. "If you were already long, which clearly Paulson was, maybe he's just taking some profits off the table," Mike Dragosits, senior commodities strategist at TD Securities said. ... ... For the remainder of the report: http://www.reuters.com/article/us-investments-funds-gold-idUSKCN0Y72C4 ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| University of Michigan to invest in gold, copper mining fund Posted: 17 May 2016 05:31 AM PDT By Janet Lorin The University of Michigan plans to invest $30 million in a fund that will buy North American gold and copper mines from distressed companies. The school, with a $10 billion endowment as of June 30, plans to make the investment with Waterton Mining Parallel Fund, which is managed by Waterton Global Resources Management in Toronto, according to an agenda for the Board of Regents meeting on May 19. Gold is the best-performing major metal this year after silver amid rising concern over negative rates in Europe and Japan and whether the Federal Reserve will be able to tighten further. "These opportunities arise from the financial distress of mining companies who took on significant amounts of debt for M&A activity prior to the collapse in commodity prices since 2011," Kevin Hegarty, chief financial officer at University of Michigan, wrote in the request for approval. "Now looking to strengthen their balance sheets, these financially distressed companies are selling assets to raise cash and reduce debt levels." ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-05-16/university-of-michigan... ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 17 May 2016 05:20 AM PDT MUST READS ICBC to be first Chinese lender to own London vault – BBC Make America Gold Again: Calls for Gold Standard Are Back – Bloomberg China is Doubling Down on State Directed Growth – Gave Kal Capital BlackRock's Fink Concerned About China's Rising Debt – Bloomberg Raghuram Rajan and the Dangers of Helicopter Money – New Yorker EU referendum: More [...] | ||||||||||||||||||||||||||||||||||||||||||||||||||||