saveyourassetsfirst3 |

- Book Review: 'The New Case For Gold'

- Kinross Maricunga Gold Mine Water Problem Has Broader Implications

- April 2016: The Temple Of Baal Will Be Erected In Times Square In New York City

- What to Watch For in Gold and Gold Stocks

- End-of-week top gold stories

- When You Start to See THIS…The World Will WAKE UP to Gold & Silver!

- China’s 7,000 Year Old Strategy Hints That A Massive Move Is Coming : “Largest Gold Rally Of Our Lifetime… It Will Go Ballistic”

- The Establishment Is Preparing For Martial Law And Civil War: “Trump’s Pursuit Of Presidency Will Be The Spark”

- Derivatives & Deutsche Bank: Jim Willie Unleashes Historic Holiday Rant

- What to Watch For in Gold & Gold Stocks

- Coming Bombshell Revelation Will Drive Gold & Silver Dramatically Higher – Rob Kirby

- SILVER ALERT: Silver Price Rigging Apparatus Failing Miserably!!

- Silver Price Will Be the Nuclear Bomb for the Markets to Crash – Bo Polny

- Near-Term Gold Forecast: The Thrill of Victory and the Agony of Indecision. . .

| Book Review: 'The New Case For Gold' Posted: 26 Mar 2016 12:31 PM PDT |

| Kinross Maricunga Gold Mine Water Problem Has Broader Implications Posted: 26 Mar 2016 09:34 AM PDT |

| April 2016: The Temple Of Baal Will Be Erected In Times Square In New York City Posted: 26 Mar 2016 09:00 AM PDT Child sacrifice and bisexual orgies were common practices at the altars of Baal, and now we are putting up a monument of worship to this false god in the heart of our most important city. Submitted by Michael Snyder: I realize that the headline of this article sounds like it must be false, but […] The post April 2016: The Temple Of Baal Will Be Erected In Times Square In New York City appeared first on Silver Doctors. |

| What to Watch For in Gold and Gold Stocks Posted: 25 Mar 2016 04:11 PM PDT The Daily Gold |

| Posted: 25 Mar 2016 03:18 PM PDT USA Gold |

| When You Start to See THIS…The World Will WAKE UP to Gold & Silver! Posted: 25 Mar 2016 02:00 PM PDT With Gold and Silver Hammered Ahead of the Holiday Weekend, Harvey Organ Joined the Show to Break Down All the Action, Discussing: Why A Raid HAD To Come! On the GLD: Someone’s Buying 2 Tons of Gold & the Price Gets Slaughtered!?! “How This Game Ends”: END GAME Will Happen “This Year” China Threatens […] The post When You Start to See THIS…The World Will WAKE UP to Gold & Silver! appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Posted: 25 Mar 2016 01:45 PM PDT The world may well be on its way to the largest gold rally of our lifetime… Submitted by Mac Slavo, SHTFPlan: Up until January, the majority of people assumed that governments and central banks had everything under control. Zero-Interest and Negative-Interest rate policies coupled with unprecedented monetary printing appeared to have stabilized the economy and […] The post China's 7,000 Year Old Strategy Hints That A Massive Move Is Coming : "Largest Gold Rally Of Our Lifetime… It Will Go Ballistic" appeared first on Silver Doctors. |

| Posted: 25 Mar 2016 01:30 PM PDT No matter which direction the GOP nomination goes, there will be violence. There will be widespread violence if he defeats Clinton in the General Election. Submitted by Dave Hodges, The Common Sense Show via SHTFPlan: In the business of uncovering both present and coming events, in an effort to warn the public so they can prepare accordingly, […] The post The Establishment Is Preparing For Martial Law And Civil War: "Trump's Pursuit Of Presidency Will Be The Spark" appeared first on Silver Doctors. |

| Derivatives & Deutsche Bank: Jim Willie Unleashes Historic Holiday Rant Posted: 25 Mar 2016 01:29 PM PDT 2.5 hours of Golden Jackass at his absolute finest: Download Podcast (Right Click + ‘Save As’) The post Derivatives & Deutsche Bank: Jim Willie Unleashes Historic Holiday Rant appeared first on Silver Doctors. |

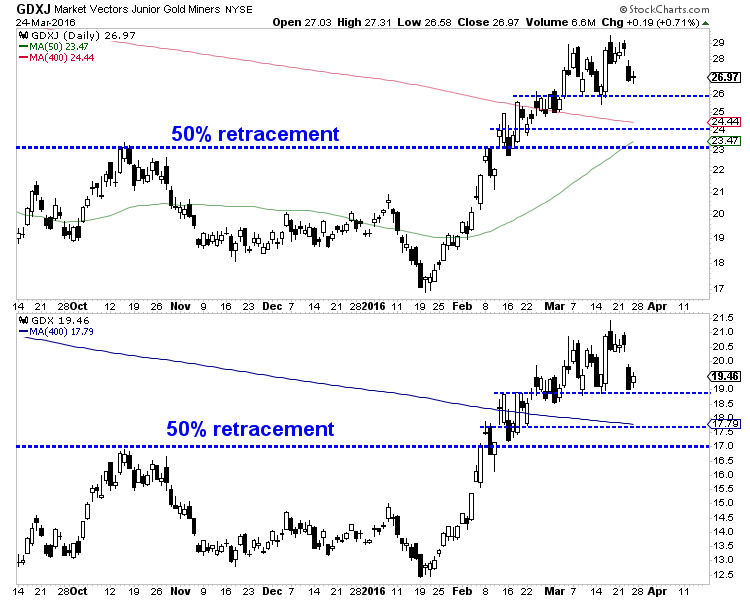

| What to Watch For in Gold & Gold Stocks Posted: 25 Mar 2016 01:12 PM PDT Gold and gold stocks finally showed a bit of weakness during the holiday shortened week. Gold had its biggest weekly loss in months, losing 3% to $1217/oz while the miners (GDX, GDXJ) declined about 5%. Silver lost 4%. If weakness in Gold and gold stocks continues then we should turn our attention to technical support and see if it will hold. Gold and gold stocks are trading above the 400-day moving average which has been key resistance since 2011. Holding that support in the days or weeks ahead would offer confirmation that a new bull has started. The following chart plots the daily candles for GDXJ and GDX. GDXJ, which is showing more strength has initial support at $26 followed by strong support near $24 and $23. Note that the 50-day moving average, 400-day moving average and 38% retracement of the rebound figure to coincide in the low $24s. Meanwhile, GDX has initial support at $19 with strong support in mid $17s and at $17. The confluence of support in GDX is in the mid $17s.

Miners: GDXJ & GDX

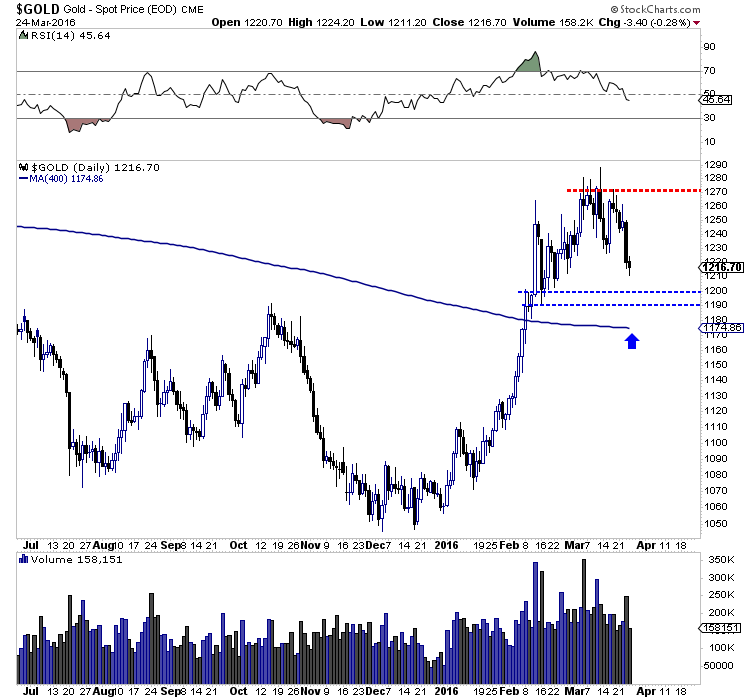

Gold's support is at $1190 to $1200/oz followed by the 400-day moving average at $1175/oz.

Gold

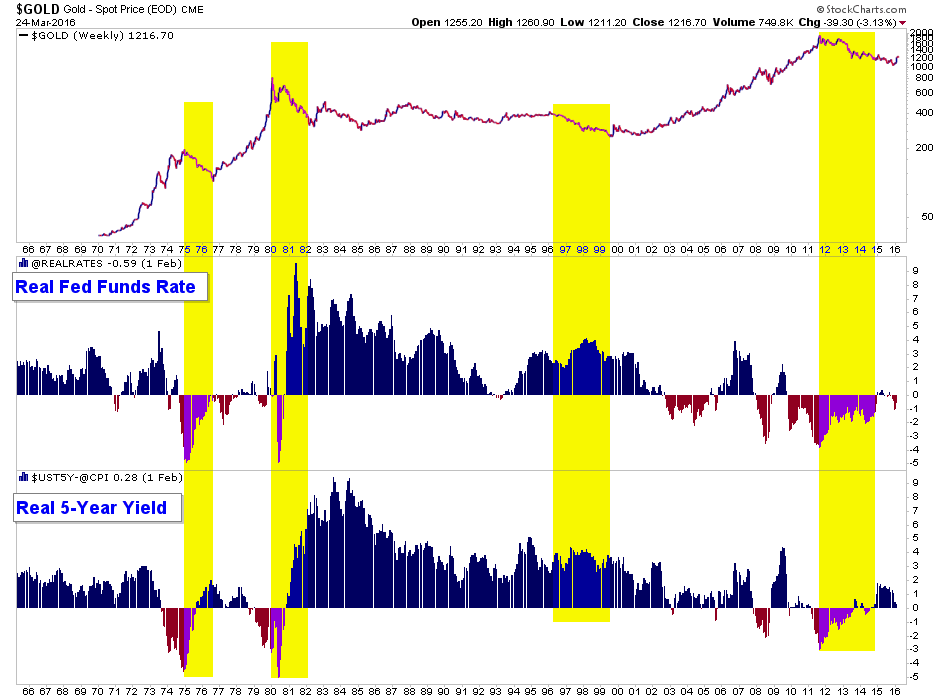

The 400-day moving average is important because it contained every rally in the precious metals complex from 2012 to 2015. During that period GDX tested and failed at the 400-day moving average three times. GDXJ tested and failed there once (in summer 2014). Gold spent a few days above its 400-day moving average in early 2015 but that proved to be an aberration. Silver, which has remained below its 400-day moving average since late 2012 failed to exceed it in recent days. Turning to the fundamental picture, real interest rates (the major driver for Gold) have recently turned in favor of precious metals. As the picture shows, the real fed funds rate is negative again while the real 5-year yield has declined from nearly 2% to near 0%. The fundamental underpinning that precious metals lacked in recent years is now in place.

Gold & Real Rates

With respect to the miners, their fundamentals have been improving for over a year. The energy crash has reduced operating costs for many miners by a considerable margin. Furthermore, weakness in many local currencies has also reduced operating costs. If Gold and gold stocks are in a new bull market then they will hold above their 400-day moving averages and rebound in the weeks ahead. Meanwhile, Silver would vault above its 400-day moving average. Given the forever bear of 2011-2015, there is now widespread fear and consternation about a correction or major rollover in precious metals. It is only natural to feel that after a sharp and persistent downtrend. We would be buyers on pullbacks to the 400-day moving average. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Jordan Roy-Byrne, CMT |

| Coming Bombshell Revelation Will Drive Gold & Silver Dramatically Higher – Rob Kirby Posted: 25 Mar 2016 12:04 PM PDT from Greg Hunter: "There are some revelations that are going to be coming regarding precious metals price suppression, which are going to make the deniers, that this has been occurring, look very silly. This is going to occur in the very, very near future. . . . The reaction to this news is going to be […] The post Coming Bombshell Revelation Will Drive Gold & Silver Dramatically Higher – Rob Kirby appeared first on Silver Doctors. |

| SILVER ALERT: Silver Price Rigging Apparatus Failing Miserably!! Posted: 25 Mar 2016 12:01 PM PDT ARE YOU KIDDING ME?? They have gone from the world's most difficult to understand "Silver Fix" mechanism to an even more contorted and convoluted way to "determine" the price of physical silver! Submitted by Bix Weir, Road to Roota: After totally failing as a price setting exchange in late January, a large portion of […] The post SILVER ALERT: Silver Price Rigging Apparatus Failing Miserably!! appeared first on Silver Doctors. |

| Silver Price Will Be the Nuclear Bomb for the Markets to Crash – Bo Polny Posted: 25 Mar 2016 11:30 AM PDT In the interview below, Bo Polny warns a supernova of Biblical proportions is set to hit gold and silver in 2016… The post Silver Price Will Be the Nuclear Bomb for the Markets to Crash – Bo Polny appeared first on Silver Doctors. |

| Near-Term Gold Forecast: The Thrill of Victory and the Agony of Indecision. . . Posted: 11 Mar 2016 12:00 AM PST |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment