saveyourassetsfirst3 |

- DOW JONES vs SILVER: Trading Volume Says It All

- Gold Price Floor Might be 1190-1200

- How to Escape the Purgatory of Minimum Wage/Part-Time Jobs

- Silver – A Long-Term Perspective

- Venture Capitalist Says Investors Are Terrified Of Market Volatility And Weak Economy: “They Are Scared And Don’t Know What To Do”

- Wait a Minute–Who’s Fascist?

- Harry Dent Warns: “The Greatest Crash Of Your Life Is Just Ahead…”

- SILVER ALERT: Silver Price Rigging Apparatus Failing Miserably!!

- Calculating The True Cost of Living

- Harvey Organ: A HUGE WHACKING!

- Silver/Oil Correlation, Silver Refining, and Coins

- Protected: Gold & Gold Stocks Comments

- The View Hosts Admit Trump Was Right About Brussels: “I Can’t Believe It, He Seems Reasonable”

- Gold Daily and Silver Weekly Charts - The Dangerous Obsession with Gold

- Silver Price Forecast: Silver Peak Likely Only After Dow Crash & Major Bottom

- China And Fracking: The Pillars Of “The Recovery” Are Crumbling

- Gold Trading Levels are 1180/90, 1307 and 1335/45

| DOW JONES vs SILVER: Trading Volume Says It All Posted: 24 Mar 2016 12:00 PM PDT Trading volume for silver has been increasing in a steady fashion since 2002. Even though silver enjoyed a huge price spike and correction (2010-2013), its overall trend is still higher… so is its trading volume. Thus, the Silver Chart shows a healthy combination of increased price and trading volume. However, the Dow Jones Index […] The post DOW JONES vs SILVER: Trading Volume Says It All appeared first on Silver Doctors. |

| Gold Price Floor Might be 1190-1200 Posted: 24 Mar 2016 11:31 AM PDT |

| How to Escape the Purgatory of Minimum Wage/Part-Time Jobs Posted: 24 Mar 2016 11:00 AM PDT In the age of automation, what’s scarce are problem-solving skills. Submitted by Charles Hugh Smith, Of Two Minds: Readers responded positively to my recent essay on the emerging economy and jobs: A Teachable Moment: to the Young Person Who Complained About Her Job/Pay at Yelp and Was Promptly Fired Many young people are stuck […] The post How to Escape the Purgatory of Minimum Wage/Part-Time Jobs appeared first on Silver Doctors. |

| Silver – A Long-Term Perspective Posted: 24 Mar 2016 10:00 AM PDT We all know silver is volatile. When gold rallies, silver usually rallies faster and farther, particularly after the rally has been well established. Volatility is not a reason to avoid silver. Instead, now is a time to continue stacking. Yes, silver almost certainly will correct many times, but examine the big picture: Submitted by […] The post Silver – A Long-Term Perspective appeared first on Silver Doctors. |

| Posted: 24 Mar 2016 09:00 AM PDT Nobody, not even the central banks, knows how this is going to end… Submitted by Mac Slavo, SHTFPlan: With stocks having rebounded following a major down-swing earlier this year, it's all smooth sailing going forward if you believe the mainstream financial pundits and renowned economists who continue to encourage the general public about the unfettered strength […] The post Venture Capitalist Says Investors Are Terrified Of Market Volatility And Weak Economy: "They Are Scared And Don't Know What To Do" appeared first on Silver Doctors. |

| Posted: 24 Mar 2016 08:00 AM PDT This, ladies and gentlemen, is fascism, and it’s the Establishment’s America… The core belief of the Establishment is the central state should run everything. If you’re an Establishment insider, the mainstream media will give you plenty of column inches and airtime to label Donald Trump a “dangerous” fascist: for example, Democratic insider Robert Reich’s fear-mongering […] The post Wait a Minute–Who’s Fascist? appeared first on Silver Doctors. |

| Harry Dent Warns: “The Greatest Crash Of Your Life Is Just Ahead…” Posted: 24 Mar 2016 07:17 AM PDT Harry Dent, best-selling author and economist, has warned that the stock bubble in the U.S. today is the biggest in history and that the "greatest crash of your life is just ahead…" Submitted by Mark Obyrne: Writing on his website EconomyandMarkets.com, Dent warned that The story on Wall Street and CNBC continues to be […] The post Harry Dent Warns: "The Greatest Crash Of Your Life Is Just Ahead…" appeared first on Silver Doctors. |

| SILVER ALERT: Silver Price Rigging Apparatus Failing Miserably!! Posted: 24 Mar 2016 07:14 AM PDT ARE YOU KIDDING ME?? They have gone from the world's most difficult to understand "Silver Fix" mechanism to an even more contorted and convoluted way to "determine" the price of physical silver! Submitted by Bix Weir, Road to Roota: After totally failing as a price setting exchange in late January, a large portion of […] The post SILVER ALERT: Silver Price Rigging Apparatus Failing Miserably!! appeared first on Silver Doctors. |

| Calculating The True Cost of Living Posted: 24 Mar 2016 07:00 AM PDT Why it’s much higher than we’re told/sold… Submitted by Adam Taggart, Peak Prosperity: Over the past decade, we’ve been told that inflation has been tame — actually below the target the Federal Reserve would like to see. But if that’s true, then why does the average household find it harder and harder to get […] The post Calculating The True Cost of Living appeared first on Silver Doctors. |

| Harvey Organ: A HUGE WHACKING! Posted: 24 Mar 2016 06:32 AM PDT AS EXPECTED A HUGE WHACKING OF GOLD AND SILVER TODAY…. /JAPAN'S YIELD CURVE INVERTS AT FRONT AND BACK OF CURVE/10 YR JAPANESE BOND YIELD -.114%/USA 10 YR AND USA 30 YR BOND YIELDS PLUMMET CAUSING HAVOC AMONG USA BANKS AS SPREAD LOWERS/BRITISH POUND FALTERS AS NEW POLLS PUTS BREXIT AS PROBABLE/CREDIT SUISSE TO FIRE […] The post Harvey Organ: A HUGE WHACKING! appeared first on Silver Doctors. |

| Silver/Oil Correlation, Silver Refining, and Coins Posted: 23 Mar 2016 11:45 PM PDT Charleston Voice |

| Protected: Gold & Gold Stocks Comments Posted: 23 Mar 2016 06:30 PM PDT |

| The View Hosts Admit Trump Was Right About Brussels: “I Can’t Believe It, He Seems Reasonable” Posted: 23 Mar 2016 04:00 PM PDT Is Donald Trump really the voice of reason the day after the attacks in Brussels? Submitted by Mac Slavo, SHTFPlan: Is Donald Trump really the voice of reason the day after the attacks in Brussels? These left-leaning women from The View are besides themselves in having to admit that they agree with The Donald […] The post The View Hosts Admit Trump Was Right About Brussels: "I Can't Believe It, He Seems Reasonable" appeared first on Silver Doctors. |

| Gold Daily and Silver Weekly Charts - The Dangerous Obsession with Gold Posted: 23 Mar 2016 02:03 PM PDT Le Cafe Américain |

| Silver Price Forecast: Silver Peak Likely Only After Dow Crash & Major Bottom Posted: 10 Mar 2016 04:46 AM PST Silver Price Forecast: Silver Peak Likely Only After Dow Crash & Major Bottom Last year, I produced the following chart and commentary (italics) to show how the Dow could crash like it did in 1929: Above, is a fractal comparison between the current period (1998 to 2015) and the 1920/30s, for the Dow (charts from […] |

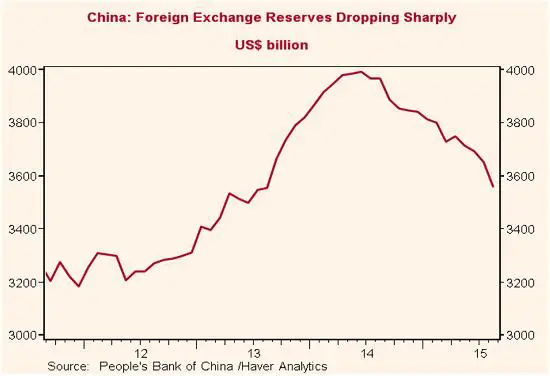

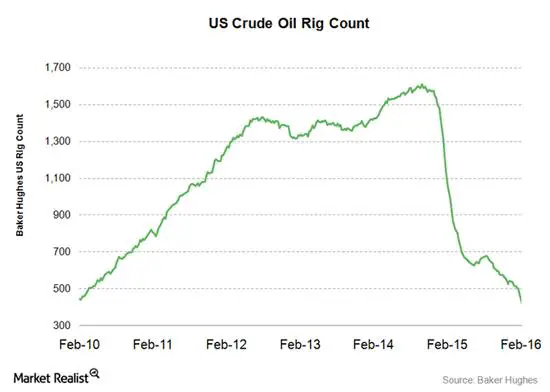

| China And Fracking: The Pillars Of “The Recovery” Are Crumbling Posted: 08 Mar 2016 12:22 PM PST When historians sort out this era of once-a-decade financial bubbles, they’ll marvel at how dissimilar the drivers of each boom were. The junk bonds of the 1980s were essentially leveraged tools for extracting wealth from companies. The dot-coms of the 1990s were vehicles for exotic new technologies and untested business models. The sub-prime mortgages and credit default swaps of the 2000s were semi-fraudulent fee-generation schemes. All, in retrospect, were strange, unsteady foundations on which to build a global economy. But they look positively sane compared to the pillars of the current expansion: China and fracking. As the true extent of China’s debt binge becomes apparent, the only reasonable reaction is awe. To cook the story down to its essence, the world’s biggest developing country decided to become developed in the space of a few years, borrowing nearly as much money as the entire rest of the world and using the proceeds to buy up every conceivable kind of industrial commodity. The result was a natural resources boom that, for a little while, floated the global economy on a rising tide of leverage. For much more detail, see this long Zero Hedge analysis. Then, as all debt binges eventually do, this one ended in a tangle of malinvestment and evaporating cash flows. China’s excess capacity in basic industries like steel and cement is now epic. Mass layoffs are being announced daily. Its velocity of money — a measure of the tempo of economic activity — is the lowest in the world. And external trade is collapsing, with February imports and exports falling 13.8% and 25.4%, respectively. Now in damage control mode, China is spending its foreign exchange reserves in a probably-futile attempt to keep its currency from plunging, while capital is pouring out of the country in search of safe havens and hedge funds are placing billion-dollar bets on a big yuan devaluation. China, in short, has become a drag on the global economy rather than its savior. And much, much worse is coming. Now on to fracking, which involves pumping toxic industrial chemicals into the ground to free up hard-to-reach oil and gas reserves. For a while, this was the Internet of the energy business, captivating bankers and entrepreneurs and igniting a scramble for prime drilling rights. Between 2006 and 2014, US natural gas production rose from 64 billion cubic feet a day to 90 billion while oil production rose from 5 million barrels a day 9 million. Along the way, fracking produced millions of well-paying jobs, lifting whole US regions from bust to boom and generating massive tax windfalls for favored states. But this too was a leveraged mirage. The surge in supply swamped a global market that was already slowing due to China’s bursting credit bubble. The result was a crash in oil and gas prices and a bloodbath in the US oil patch. All those now-idle rigs cost someone a lot of money, much of it borrowed from banks and junk bond investors. So unless oil and gas jump back up to 2011 levels in short order, the year ahead will see a rolling wave of bankruptcies and huge write-offs for lenders, pension funds and yield-seeking retirees. All of which, like China, constitute a drag on growth. In a system that seems incapable of functioning in the absence of bubbles, the question now becomes: What can the monetary authorities convert into the next bubble? And the answer is not at all clear. A case can be made that the rush into negative-coupon German and Japanese bonds is bubble-like. But this doesn’t seem to be generating jobs or income for anyone — just the opposite. Buying a negative interest rate bond is a bet on shrinking capital. In the US, cars were hot for a while but subprime auto lending is already hitting a wall and will likely go the way of China and fracking in the year ahead. Solar power? Maybe, but growth there comes at the expense of coal and natural gas, so it’s a wash in the short run. Finance? Forget it. Negative interest rates are an existential threat to traditional lending, and the big banks are all retrenching. Government funded infrastructure? That’s a liberal politician’s dream, but it sounds a lot like what China just did, and bubbles tend not to repeat in this way. The terrifying conclusion is that other than a major war, there’s nothing out there capable of generating another global bubble. And absent another bubble, there’s nothing between us and the abyss. |

| Gold Trading Levels are 1180/90, 1307 and 1335/45 Posted: 08 Mar 2016 11:18 AM PST |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment