Gold World News Flash |

- Lunar Tiger Gold Coin Set

- SP 500 and NDX Futures Daily Charts – On the Slippery Slopes of Pigmanistan

- Alasdair Macleod: Guessing the future without Say's Law

- Once reviled, gold hedging makes an unexpected return

- Diversify Into Gold As An “Insurance Policy” Against Geopolitical Risk

- Barrick Gold cuts executive chairman's pay 76% after investor criticism

- Barrick Gold to face U.S. group lawsuit over South American mine

- Gold Price Closed at $1221.60 and Lost $32.20 or 2.6% This Week

- Silver $100 When & How – Currency vs Industrial

- Refugee Crisis: Using Chaos To Build Power

- It's 1790 All Over Again - The World Is Sunk By Central Banker Conceit

- "Why We Need To Beat Russia"

- Gold Daily and Silver Weekly Charts - All Things New

- The Dollar Has Been Shanghaied

- Gold and India: A love affair

- The 'Dangerous Obsession' with Gold

- US Dollar Rebound Spells Further Downside for the Kiwi Dollar

- Gold Takes One To The Mid-Section

- MATRIX EXPOSED: Where Television REALLY comes from! (R$E)

- EU was Warned of Global Terror threat Years Ago

- Is the Rally Finally Out of Steam?

- Silver Will Lead The Way To New Highs

- ISIS Exploits Europe's Pre-911 Security Stance

- The Illuminati & Brussels (NWO, False Flag & Order out of Chaos)

- GLX, GLDX, Baby Gold Bull Market Stillborn?

- A Love Affair: India and Gold

- Who Sets the Gold Price?

- Reservoir Minerals Has Many Options to Enhance Value

| Posted: 25 Mar 2016 01:30 AM PDT from SalivateMetal: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SP 500 and NDX Futures Daily Charts – On the Slippery Slopes of Pigmanistan Posted: 25 Mar 2016 12:30 AM PDT from Jesse's Café Américain:

So far this dip we saw today in the wondrously mispriced risks of the US markets is just a pause, merely another day in the dismal lands of Pigmanistan. Let's see if they can keep pumping this pig up to one of the more difficult levels of overhead support. And a pig of a market this is. The 'smart money' has been selling the rallies for the last couple of weeks. I wonder if they will be able to hang on until the end of the first quarter. If allowed to continue, this process will turn the United States into a declining, unfair society with an impoverished, angry, uneducated population under the control of a small, ultrawealthy elite. Such a society would be not only immoral but also eventually unstable, dangerously ripe for religious and political extremism.” Charles Ferguson, Predator Nation, 2012 “Predator Nation demolishes the view that the global financial crisis was merely some sort of freak accident. Charles Ferguson makes a convincing case that the world's banking system was brought to the brink of complete collapse in 2008–09 by a virulent combination of unchecked greed and criminal behavior. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: Guessing the future without Say's Law Posted: 24 Mar 2016 11:41 PM PDT By Alasdair Macleod With Japanese and Eurozone interest rates becoming increasingly negative and the Fed backing off from at least some of the planned increases in the Fed funds rate this year, economists are reassessing the interest rate outlook. Economists lack consensus, with some expecting yet more easing, based on the apparent collapse in cross-border trade last year. That the Bank of Japan and the European Central Bank see fit to pursue increasingly aggressive monetary reflation is taken as evidence of underlying difficulties faced in these key economies. And lingering doubts about the sustainability of China's credit bubble point to a high risk of a credit-induced slump in the world's growth engine. Other economists, citing official US data and relying on the Fed's statements, point out that unemployment levels have more than satisfied the Fed's target, and that core inflation has picked up to the point where the Fed would be fully justified to increase interest rates over the course of this year, or risk overheating in 2017. ... ... For the remainder of the report: https://www.goldmoney.com/research/goldmoney-insights/guessing-the-futur... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Mines and Money Asia http://asia.minesandmoney.com/ Mining Investment Asia http://www.mininginvestmentasia.com/ Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Once reviled, gold hedging makes an unexpected return Posted: 24 Mar 2016 11:24 PM PDT By Peter Kovan New Gold Inc. was braced for a vicious backlash from the investment community when it decided to hedge some gold production earlier this month. After all, hedging is the gold industry's ultimate dirty word. It became such a toxic subject during the last decade that most chief executives decided that even talking about it was off-limits. And New Gold is led by Randall Oliphant, who headed up Barrick Gold Corp. back when it had the biggest -- and most reviled -- hedge book in the business. But the response to New Gold's move wasn't negative. Instead, almost everyone cheered. "We've heard nothing but positive reactions from shareholders, analysts, and media people to what we did," said Oliphant, New Gold's executive chairman. "So that will give other people who want to do this sort of stuff some ammunition." ... ... For the remainder of the report: http://business.financialpost.com/news/mining/once-reviled-gold-hedging-... * * * Australian Gold Miners Are Starting to Embrace Hedging Amid Strong Prices By Peter Ker Once upon a time, Newcrest Mining was adamant that shareholders did not want the company to hedge its gold production. "Our investors are looking for spot price exposure," former chief executive Greg Robinson said in 2013, insisting that shareholders could hedge their own positions by purchasing shares in other companies and commodities. However, with the gold price near record highs in Australian dollar terms, the largest gold miner on the ASX has decided to embrace hedging. Newcrest confirmed on Thursday a portion of the gold produced at the Telfer mine in Western Australia had been hedged until June 2018. ... ... For the remainder of the report: http://www.smh.com.au/business/mining-and-resources/newcrest-mining-chan... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: Mines and Money Asia http://asia.minesandmoney.com/ Mining Investment Asia http://www.mininginvestmentasia.com/ Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Diversify Into Gold As An “Insurance Policy” Against Geopolitical Risk Posted: 24 Mar 2016 11:21 PM PDT "Investors could be forgiven for heading for the hills given the tumultuous start to 2016," so writes Andrew Oxlade in The Telegraph today who advises investors to diversify into gold as an "insurance policy":

The Telegraph, like GoldCore, had warned of such turbulence at the start of the year. John Ficenec, editor of the Questor column, warned of the real risk of volatility and falls in stock markets. We believe that the tragic events in Brussels show the continued very high degree of geopolitical risk and the need for an insurance policy. Further attacks are quite possible, including in the U.S., and this should support gold. Geopolitical risk is frequently underestimated and it would be unwise to discount the risk of a September 11 style attack in the coming months. Intelligence agencies and ISIS themselves are warning of such attacks and investors need to be diversified to hedge this growing risk. It gives us no pleasure to be the bearer of this bad news but it is important that the reality of the real risks of today are considered in order to protect and grow wealth in these uncertain times. Read Telegraph article here

Gold is -2.6% and silver -3.4% this week and markets are in a sea of red as they react to the terrorist attacks in Brussels (See Table).

Gold Prices (LBMA) 24 Mar: USD 1,216.45, EUR 1,088.75 and GBP 861.89 per ounce Silver Prices (LBMA) 24 Mar: USD 15.28, EUR 13.70 and GBP 10.82 per ounce Gold News and Commentary Spot gold targets biggest weekly loss in four months (Reuters) Stock Slide Deepens in Asia as Oil Slumps Amid Resurgent Dollar (Bloomberg) Gold Falls to Lowest in a Month as Dollar Advance Saps Demand (Bloomberg) World's richest Hindu temple wants gold back rather than cash (Reuters) China's vice finance minister denies any secret US-China exchange rate deal (Reuters) Gold Investors Unfazed By Fading Rally – Chart (Bloomberg) Silver Attractive as Gold-Silver Ratio at 2008 Financial Crisis Level – Video (Bloomberg) Technician: Gold Heading Toward $1,450—Here's Why (CNBC) Bonds Best-Bid But Bullion Blasted As Belgium-Bombing-Bounce Is Battered (ZH) Stocks vs. Gold – Money and Investment (Future Money Trends) Read More Here

'7 Real Risks To Your Gold Ownership' – Must Read Gold Guide Here Please share our website with friends, family and colleagues who you think may benefit from it. Thank you | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Barrick Gold cuts executive chairman's pay 76% after investor criticism Posted: 24 Mar 2016 11:10 PM PDT By Doug Alexander Barrick Gold Corp. awarded Executive Chairman John Thornton $3.08 million in total compensation, 76 percent less than last year, after he gave up his bonus in the wake of investor criticism of pay packages at the world's largest gold producer. Thornton, 62, received a salary of $2.5 million, $204,090 in other compensation, and a pension value of $375,000, the Toronto-based miner said Thursday in a regulatory filing. Thornton forfeited $3.4 million of incentives for the year, the company said. The compensation compares with $12.9 million in 2014, which included $9.5 million of incentive pay. Thornton "elected to forfeit all of the incentive compensation earned for 2015 in order to better reflect the experience of our shareholders last year," Barrick said in the filing. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2016-03-24/barrick-gold-cuts-thor... ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: Mines and Money Asia http://asia.minesandmoney.com/ Mining Investment Asia http://www.mininginvestmentasia.com/ Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Barrick Gold to face U.S. group lawsuit over South American mine Posted: 24 Mar 2016 11:04 PM PDT By Amrutha Penumudi A federal judge on Wednesday granted class certification for a U.S. class-action lawsuit filed against Barrick Gold Corp claiming that Barrick misstated facts of its now-halted Pascua-Lama gold-mine project on the border of Argentina and Chile. The class certification means the world's largest gold producer will have to face the U.S. lawsuit. U.S. District Judge Shira Scheindlin in Manhattan said that shareholders who purchased Barrick shares from May 7, 2009, through Nov. 1, 2013 are a part of the class-action lawsuit. Investors who bought Barrick's common stock during this period have said Barrick touted Pascua-Lama as a world-class project even as it became clear that the project would fall short of expectations. ... ... For the remainder of the report: http://www.reuters.com/article/us-barrick-gold-lawsuit-idUSKCN0WQ0E5 ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. Join GATA here: Mines and Money Asia http://asia.minesandmoney.com/ Mining Investment Asia http://www.mininginvestmentasia.com/ Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Closed at $1221.60 and Lost $32.20 or 2.6% This Week Posted: 24 Mar 2016 09:42 PM PDT

THIS WEEK'S MARKETS: The expected precious metals correction showed up this week, hammering all heads. Stocks looked sickly all week, finally ended down, but not as much as they merited. Rally is probably over. US dollar index recovered 1.1%, and fell not into the abyss - yet. Platinum & Palladium want to drop with silver & gold. US DOLLAR INDEX has risen the last 5 days -- not enthusiastically, 'tis true, but risen still. Test will come at the 200 day moving average (97.08) & the 50 DMA (97.40). Dollar is locked in a downtrend, but can't be written off till it closes below 92.50. Euro flatlined today, up 0.1% to 1.1181. Yen dropped 0.44% to 88.59. Both are technically in uptrends, but with gigantic volatility & indecision. Inflation markets have switched to full correction mode. WTIC eased off 0.43% to $39.59/bbl, but it has broken its uptrend line and is fixing to break its rising 20 DMA. Next move down. Copper also has broken its uptrend line, ending today little changed at $2.238, but broke down still. CRB gapped down today, leaving behind what looks like an island reversal. Roll on downhill. Stocks kept on chiseling away their price this week. None of the losses was huge, merely losses, consistent with a market that has lost buying power. Today the Dow gained 13.14 (0.8%), closing 17,515.73. Gain all came very late in the day. Great to have friends in high places, I reckon. S&P500 never quite made it through unchanged. Ended down 0.77 (0.7%) at 2,035.94. Gravity will become vengeful below 17,500 and 2024. At this stage in world history, the Dow in Gold (closed today at 14.40 oz) and the Dow in silver (1,152.35 oz) are aimed higher. DiS barely crossed its 200 DMA today, but soon hits stiffer resistance. http://schrts.co/ohwLZP Silver & gold are just beginning a correction stocks will soon share with more fervor. Till then, the Dow in metals will rise. The Volatility index, which measures fear in the stock market, reached Smugness a few days ago at 13.75. Today it tried to shoot up, but ended the day falling back. When it is rolling up to Terror (around 30) it needs 2 - 4 weeks to make the whole trip. VIX is telling us stocks are near breaking, and will break lustily and large. I remind y'all that both the Dow & S&P500 have built out bearish rising wedges, and broken down from their tips -- not a forerunner of higher prices. Look here, http://schrts.co/Q6KUW0http://schrts.co/Q6KUW0 Gold scraped off another $2.10 (0.1%) on Comex to $1,221.60. Silver backed up 7.2¢ (0.47%) to close at 1519.1¢. Gold/Silver ratio rose again today, up 2.3% in two days. That ratio has indeed bounced off the lower channel boundary, as y'all can see. http://schrts.co/kh9gOy It gapped up yesterday, above the 50 DMA, and ineluctably will push forward toward that top channel boundary, now around 84. In other words, silver will fall faster than gold. Yesterday gold finally began paying the promise of that Bear Flag by plunging. Today it took a breath, but next week it will resume falling. This could last until mid-April, and gold might reach $1,195 or $1,170. Silver is dealing from a weak hand. Today's 1510¢ low approached the 50 DMA (1502¢). Most likely target is the lip of that bowl silver broke skyward from, about 1460¢. However, nothing has changed my mind: silver & gold both bottomed and turned up in December, ending the post-2011 correction. Higher prices coming, after a correction. But I could be wrong. I ain't no more'n a nat'ral born durn fool from Tennessee. I'm from so far back in the woods we have to order sunlight from Sears & Roebuck. Tomorrow is Good Friday so I won't be sending a commentary. May God bless you all at Eastertide and always! Y'all enjoy your weekend. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2016, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver $100 When & How – Currency vs Industrial Posted: 24 Mar 2016 09:40 PM PDT from FreedomForceUSA: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Refugee Crisis: Using Chaos To Build Power Posted: 24 Mar 2016 07:00 PM PDT Submitted by Alex Newman via TheNewAmerica.com, A European Union military force with power to intervene in member states. A new “Marshall Plan” to radically redesign whole regions of the world and impose regional government. A United Nations empowered to manage it all. Christendom under siege. And the end of nationhood as it is understood today. That is where the “refugee crisis” is heading, as the engineered disaster wreaks havoc across Europe and beyond. Despite the appearance of chaos, though, it is all by design, with a series of radical goals in mind. While the establishment’s demands on Europe to accept millions of Middle Eastern refugees have been couched in “humanitarian” rhetoric, the real agenda is nothing of the sort. Rather than helping out their fellow human beings, globalist forces actually created the refugee crisis and the suffering behind it. And they are using it to advance multiple, related agendas — primarily globalism and statism. That the crisis is being exploited to undermine Western culture, national sovereignty, and even nationhood itself is now beyond dispute. Top globalists are openly bragging about it. “I will ask the governments to cooperate, to recognize that sovereignty is an illusion — that sovereignty is an absolute illusion that has to be put behind us,” declared former Goldman Sachs chairman Peter Sutherland, an ex-member of the Bilderberg Steering Committee who currently “serves” as the UN special representative of the secretary-general for international migration. “The days of hiding behind borders and fences are long gone. We have to work together and cooperate together to make a better world. And that means taking on some of the old shibboleths, taking on some of the old historic memories and images of our own country and recognizing that we’re part of humankind.” Billionaire globalist and open-borders zealot George Soros, in denouncing European officials trying to control the human tsunami coming across their borders, similarly declared, “Our plan treats the protection of refugees as the objective and national borders as the obstacle.” In essence, then, the engineered refugee crisis was created and is being used, at least in part, to advance what globalists often refer to in public as “global governance” and their “new world order.” As part of that, even the idea of nationhood is under fire — everybody is just part of “humankind,” as Sutherland put it. And as such, people must be governed by the “Parliament of Humanity,” as UN Secretary-General Ban Ki-moon referred to the dictators club known as the UN last year. Already, the UN manages a global refugee program via the UN High Commissioner for Refugees (UNHCR). This agency decides which refugees will be settled where, including those destined to be settled in the United States at U.S. taxpayer expense. Further clues about the agenda can be found in the fact that the UN refugee outfit was until very recently led by António Guterres, the former president of the powerful global socialist-government-promoting Socialist International, as senior editor William Jasper documented in an October 19, 2015 cover story for this magazine. There are several elements to the globalist plot as it relates to the refugee crisis.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| It's 1790 All Over Again - The World Is Sunk By Central Banker Conceit Posted: 24 Mar 2016 06:00 PM PDT Authored by Hugo Salinas Price via Plata.com, It was 1790 and the revolutionary National Assembly in Paris was worried. Complaints were reaching the Assembly from all over France, that business was stagnant, sales were down, people were without work, and there was a great scarcity of money. This was quite natural, because all business slows down when the prevailing source of Authority is under question. The Bastille prison had been taken the prior year by a revolutionary crowd and all sorts of ugly things were being said about King Louis XVI and his pretty young Queen, Marie Antoinette. But this was the "Age of Reason" and the most educated, intelligent and reasonable people in France were members of the revolutionary National Assembly, which gathered daily in Paris. The Assembly put their highly educated heads together and came to the conclusion that a scarcity of money was quite intolerable and that the Assembly must really do something about it. "What do we have highly educated brains for, if we can't solve the problem of a scarcity of money? Without a doubt, Reason can overcome this problem." So the members of the National Assembly thought about the problem of the scarcity of money, and came up with a splendid idea: "Let us create the necessary money, and things will go swimmingly." Thus was born the "Assignat". Out of the collective wisdom of the Assembly, the Assignat was born as a claim upon the vast extension of lands recently taken by the State of France, from the Catholic Church. What could be more solid than a claim upon the lovely lands of dear France? The Assignats were soon printed up, with various denominations of monetary value in gold Francs. At first, the Assignats circulated alongside gold coin at par value. But soon enough, the exchange value of the Assignats against gold began to fall. Thus began a nightmare episode that lasted seven years. The first issue of Assignats did not relieve the problem of business being in a funk. So a second issue followed the first; and then another, and then more, and thick and fast they came at last, and more and more and more, falling, falling, always falling in value against gold. The highly intelligent gentlemen of the Assembly decided that this fall in value of their Assignat must be the work of wicked, unpatriotic people who should be severely punished. The Assembly decreed that a merchant should be punished by being sent to the galleys or to the guillotine, if he should venture to ask a customer who wanted to know the price of bread, with what money he planned to pay for the bread - whether it was with gold coin or with Assignats? The Assembly created a national net of spies to hunt down the wicked hoarders of gold, confiscate their gold and have them part with their heads with a short, sharp shock on a big, black block. In the meantime, the more intelligent of the citizenry took out enormous debts in Assignats, with the certainty that their value would soon plummet; with borrowed Assignats they purchased all sorts of things of lasting value, such as real estate, art and jewelry. In due course, the value of the Assignat fell to next to nothing and the debts were wiped out. Enormous wealth was transferred from the mass of the ignorant to the few who were able to see what was going on. Eventually, the common people of Paris found that bread was hard to come by. Starvation set in, and the Parisian government had to provide rations of bread for the multitude - rotting, wormy bread. In 1797 Napoleon came to power in France. He put a stop to the very reasonable plans of the highly educated men of the National Assembly, and declared that henceforth, only gold would be money. In the center of the Place Vendome, where today there stands a great column surmounted by a statue of Napoleon, a huge bonfire consumed piles of freshly printed Assignats and the wooden printing machinery which fabricated them. The highly educated and eminently reasonable men of the National Assembly had succeeded - in the mighty work of bringing France to its knees. But not one of those men, responsible for the colossal disaster, was ever known to have said about it: "We were mistaken". 2016: Why is it 1790 all over again? Because just as in France in 1790, today we have a set of conceited men running the world's economic policy on the basis of a flawed intellectual construct. In 1790, the flawed construct was the Assignat. Today, the flawed intellectual construct is the irredeemable dollar and its derivative currencies.In 1790, gold was the enemy of those conceited men, because the depreciation of the Assignat against gold revealed the falsity of the Assignat; so the National Assembly did their best to suppress the use of gold by violence against its owners. Today, gold is once again the enemy of our conceited masters: gold, whose value threatens to expose the falsity of the irredeemable dollar. In 1933, the value of the dollar in gold was 1 1/2 grams. Today, the value of the dollar is only about 2 1/2 hundredths of a gram of gold. Our conceited masters are struggling to keep their intellectual construct, the irredeemable currency which is the dollar, from plunging in value to thousandths and ten-thousandths of a gram. Like the Assignat, which in 1797 fell to a value of zero grams of gold, the dollar faces the same inevitable fate. And since the rest-of-the-world's currencies are derivatives of the dollar, they too will become worthless. The fundamental flaw in the thinking of the conceited members of the National Assembly of France in 1790 was their mistaken idea that they could invent a money more suitable than gold to achieve the prosperity of France. Today, the fundamental flaw in the thinking of our conceited Masters of the Universe is the same as that which blinded the members of the National Assembly in France, in 1790: they are convinced that their intellectual construct, the irredeemable dollar, is far more suitable than gold for use as money. The conceit of the majority of the members of the National Assembly in France in 1790 led to the total prostration of the economy of France in the course of seven years. The conceited Central Bankers of today will without a doubt achieve a world sunk in economic prostration. But don't expect any one of them to ever say "We were mistaken". So that's why It's 1790 All Over Again. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Mar 2016 04:28 PM PDT Submitted by The Saker, authored by Cathal Haughian 250,000 capitalists read the Financial Times, and it has been our undertaking to chronicle our understanding of capitalism via our book The Philosophy of Capitalism. A USA led team has answered the question 'What is The Nature of the Monetary System?' The Monetary system has three layers – the core is Religion and the unconscious mind – as they formed first. The outer layer is operational and intersects with geopolitics, it explains: Why we need to beat Russia We may see Syria as a testing ground for Imperial Power. Russia has tested our influence and shown the World it's wanting, so it's crucial to appreciate why and of what consequence. Our Imperial weapons give definite form to our Empire. And nothing has shaped our Empire more than the FIAT. The deformation began in 1971, when the US imposed her Power to re-define the rules of the monetary system for her sole benefit. The ability to print IOU's in exchange for real value is more clever than theft as we borrow and do not pay back in kind due to inflation. Our enemies, adversaries and vassals must found their financial systems upon the printed dollar which they must purchase with hard earned money. That seizure has financed a vast network of military bases, bribery, assassinations, coup d´états and perpetual war. What's not to like? All that Power without taxing the produce of the American people. So why have we lost in Syria? Let's begin by appreciating that the global "FIAT system" is responsible for our moral crisis and departure from virtue. As we embrace further the gods of greed – listen to the masses cheer for Clinton and Trump – we must recall that virtue is knowledge of what is good. We are getting weak because we have forgotten what is good for us.

No one. That is who. But nonetheless, governments and monarchies throughout the ages have been entrusted to issue wealth by decree. All have failed, because power corrupts, and absolute power corrupts absolutely. So in every FIAT timeline we see the more powerful become wealthier and the wealthy become more powerful, because it is they who control the issuance and distribution of wealth. Inequality of Wealth, therefore, always reaches its peak at the end of the FIAT timeline. As social position offers more favours than purpose and production. What has happened is what always happens – you have a system politicized to such an extent that political access – and not profits from innovative new solutions – Become the core of the incentive structure. Notice how productivity declined after Bretton Woods and later when Bretton Woods was abandoned. One of the problems of easy money, not the only one mind you, is the financialization of the economy. Financialization drains key human capital and generates malinvestment. Nuclear engineers are doing MBA's so that they can work as investment bankers! Trillions of dollars have been invested in real estate developments that provide no productivity gains. Easy money kept fracking companies alive –producing an endless glut of gas that had nowhere to go but heat tar sands in Canada – what waste! This is the real economic evil of our current monetary system – malinvestment – with two insidious effects:

If the common man had a say in all this, he would declare his modest holdings to be the pinnacle of wealth, by his decree. He will offer you his apartment for your mansion, his hot dog for your lobster, his bike for your car and so forth. If this sounds ridiculous, then think how absurd it is to offer stacks of paper for these same items, which (based upon the numbers and signatures printed upon them) you would gladly accept, by decree. We know that paper is just as intrinsically worthless as the electronic digits they represent in a bank account. The issue here is who holds the power of decree. The little people never will. The monied men hold this power – like a parasite feeding upon any who deign to offer value at the marketplace. And that is the cut of the second edge my friends. That is the death blow. The Fiat produced a parasite – the financial sector – that in its greed is killing the real economy. So when we read about absence of opportunity with such empathy, know that the parasite suffers too, as the problem of debt reaches higher toward senior capital. When we see debt piled on debt just to prolong the dying system, take note that a few monied men enjoy the fruits of this easy money for a time before defaulting … and with no collateral to make lenders whole, many walk away with nothing more than an impaired credit rating – into a waiting system where debt is harshly devalued. Monsanto can darken the sunflower harvest in the Ukraine, and Allianz can steal a few tranquil Greek islands, but the ambience is never quite the same as when hard working people had their just rewards, and goodness and charity and kind souls rejoiced – with compassion and cooperation – while loving the narrative of a life written while desiring only the product of their work. The world this Global Reserve Fiat creates is one of misery and strife where evil and greed feeds upon the spirit, and the world becomes an immoral wasteland of modernity. The worker is discriminated against as all pressure and stress is heaped upon his future, as the law discriminates between debts held as an asset vs. debt held as a liability. You see, reader, while we all hold "deposits" at banks, which is an euphemism for bank debt, only the lending class (and I use this term in the broadest sense) get to hold debt on their balance sheets as a wealth asset, whereas the little people hold debt as an obligatory liability. If there is a default, all the better as the law allows them to seize the "secured" assets as collateral. Is there a flaw in my thinking? Let us see… You may say that banks are able to hold debt as an asset because they have the capital to cover that debt – to which I would say, "Really ??!!" As we understand the nature of debt in this modern era of aging debt, and the derivatives that attempt to hedge those obligations, this is simply not the case, as the lessons of Enron, AIG, Lehman, MF Global – ad nauseam – clearly prove. The empire of debt is hallmarked by misery for the masses though this is no accident, for a system cannot discriminate in and of itself. Financial laws are written by and for the hidden agenda of monied men, how can we conclude otherwise? A few of which see war or systemic crisis as an opportunity to rewrite the social contract e.g. the tax payer takes over bank debt, see Ireland, Britain and soon Australia and the Eurozone. Look at the workers as they make their way home on the subway, standing tightly together, neither wanting nor caring to utter a word to one another, their grey features melted by the stress of their "wealth as debt". Their one shot at consciousness ground away while vampire and zombie stories speak to their existence. Look at the once prosperous cities around you, like Detroit, or Camden, crumbling into 3rd world ghettos. Not exactly a world that the 1% wants to live in, but one they deserve – one of their making. They can insulate themselves in the Hamptons for only so long until the sirens sound. It has always been this way, and it will always be this way, until man changes his nature by recognizing what is good for him. Now, the East – China / Russia / India – challenge the Global Reserve Fiat. And when the dollar fails, and it will: For debt is the essence of fiat, and when it defaults, the system defaults with it. Fiat Debt is unstable for two reasons:

As we look at the precarious nature of our faith-based money, we must acknowledge the moral implications of "dishonest money". Seizure by decree, whether judged just by Constituted Power, is immoral. But the fact that dishonest money is so easy to create, control and redistribute helps one understand the wave of immorality that has swept over our world. Paying tribute with labor and exchange rates is not enough for the empire of debt. Rather, its vassals must accept and embrace the ideology of the empire as well – "Wealth as Debt" and Globalism. It's their separation in language which causes the confusion – Globalism and Absolutism – for they are one and the same thing. When Russia and China stockpile honest money, they attack our most potent weapon and father of our decline. Our Imperial weapon will die by both edges of its own sword, one being the contempt with which it is so easily created to bend the will of the world to its bidding, and the other sharp edge which the wicked are blind to recognize: The evil that sound money prohibits. Will Russia and China attack the fiat dollar using overt enemy action? Possible, but not probable: as they can simply undermine "confidence" in the FIAT and wait upon the 2% to bury the blade. The Dynasties of Wealth - Have you ever wondered how we hedge our holdings through turmoil? The top 85 patricians of which own more wealth than the bottom 3.5 billion humans – will move first. The 1%, then 2% and whoever else left standing will be forced to follow through. Only Gold has the history, depth, unique qualities, loyalty of the elite and transitional power to challenge any man, any nation, any system on earth, past, present and future. The Dynasties understand this, because they have both witnessed and authored this axiom across generations of asset accumulation. When they vote, they vote with their ability to make markets, and then reap the profit from the market they make, offering favor to those who protect their interests. They easily control men through greed and are beholden to Gold alone. Gold transitions their wealth recycling system through change. As the sand peters past the last curve of the hour glass the Dynastic hand is clear to see. So the Neo-cons need to beat Russia, and soon, as only Globalism can keep the markets enchained. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - All Things New Posted: 24 Mar 2016 01:57 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Dollar Has Been Shanghaied Posted: 24 Mar 2016 01:42 PM PDT This post The Dollar Has Been Shanghaied appeared first on Daily Reckoning. The U.S. dollar has just been knocked down and forced to serve the interests of the world against the will of the American people. The dollar has been Shanghaied! The term "Shanghaied" refers to the 19th-century practice of sailors forced to serve against their will on vessels bound for Shanghai and other ports in China. Victims were often from West Coast port cities such as San Francisco, Portland and Seattle. Tactics used included kidnapping, beatings and forms of trickery. In the 19th century, trade between the U.S. and China was booming. But there were persistent shortages of able-bodied seamen to sail the cargo vessels. Each vessel had a boarding officer whose job it was to find the crews. Boarding officers were paid by the number of bodies they could round up before the vessel set sail. This pay was called "blood money" for good reason. The law at the time said the once a seamen "signed on" with a vessel, it was illegal to leave the ship until the journey was complete. Jumping ship at any point in the journey would result in imprisonment. A common tactic was to confront a seaman in a dark alley, knock him unconscious, forge his signature on the manifest and drag him aboard. The seamen would regain consciousness after the vessel left port. At that point, there was no choice but to finish the journey or jump ship when he could. Most finished the journey. Next stop — Shanghai! Based on the best information we've been able to obtain, it looks like the dollar has just been Shanghaied by the G-20 (the unelected, unaccountable group of 20 nations that collectively control the world monetary system). This could be the most important financial development of 2016, with enormous implications for you and your portfolio. Once again, the city of Shanghai is the center of attention. This new effort to knock out the dollar was contrived in a secret meeting in Shanghai on Feb. 26. Who attended the meeting? The list of names reads like a rogues' gallery of central planners and currency manipulators. Janet Yellen from the Fed, Christine Lagarde from the IMF, Mario Draghi from the ECB and U.S. Secretary of the Treasury Jack Lew were all there, along with their central bank and finance ministry counterparts from Japan, China and the other BRICS. Here's the "class picture" of those who attended the G-20 conclave, with some of the main players identified. The main meeting of the G-20 finance ministers and central bank governors was no secret. It was conducted with much fanfare and publicity. Thousands of reporters descended on Shanghai to cover the proceedings. A side meeting of a core group consisting of the U.S., Europe, Japan, China and the IMF was a secret. This group really calls the shots. The U.S., Europe, Japan and China together represent over 70% of global GDP. The IMF acts as a kind of facilitator for these secret meetings, and an "enforcer" for whatever agreements are reached behind closed doors. The outcome of this secret side meeting was the biggest dollar take-down operation since the famous Plaza Accord of 1985. The Plaza Accord was orchestrated by James Baker, who was Ronald Reagan's secretary of the Treasury at the time. The dollar had increased almost 50% between 1980–1985, and reached an all-time high that year. The strong dollar was hurting U.S. exports and jobs. The Plaza Accord was a coordinated effort by the U.S., France, West Germany, Japan and the U.K. to weaken the dollar. It worked. The dollar fell 30% over the next three years. The U.S. economy got a second wind, and the long Reagan-Bush expansion continued. Now the dollar is at a 10-year high on major indexes. It's time to trash the dollar again. But the U.S. does not have the same skillful leadership we had in James Baker. This time, the big winner won't be the U.S.; it will be China. The losers will be the same — Japan and Europe. Understanding these backroom machinations of the power elite requires some history and analysis. Here's what you need to know: Currency manipulations are negative-sum games. One country can get a small temporary boost from devaluation, but trading partners are worse off, and the world is worse off. Ultimately, even the country that devalued first is worse off after others retaliate. However, a new theory of currency manipulation was created by Ben Bernanke. This theory says that if every country eases at the same time, everyone gets the benefit of easing, but exchange rates don't change much because of the coordinated timing. Bernanke called this "enrich thy neighbor," in contrast to the original "beggar thy neighbor" name given to currency wars in the 1930s. The concept of cooperation and coordination among the central banks can be carried several steps further. Several countries can ease or tighten at the same time in order to give one country some relative benefit by design. Central banks can give targeted relief to one country if they all cooperate in a secret plan. Central bank policy changes work through expectations as much as actions. In traditional policy, a central bank eases by cutting rates or tightens by raising rates. But it can also ease by raising expectations about a rate increase and then doing nothing. If markets price in a rate increase and the central bank does nothing, markets can rally on the news. This is like an invisible rate cut, based solely on changed expectations. Having multiple central banks manipulate expectations and coordinate policy behind the scenes is complex. These efforts are doomed to fail because of unintended consequences and exogenous shocks. But that won't stop the big brains from trying. This brings us to China's shock devaluation of the yuan last August. Because China had not managed expectations, this shock destabilized the global financial system. The IMF and the Fed were quite upset that China was not playing by the rules of the game. On the other hand, China did not care much about the rules, because their economy was sinking under bad debts and capital outflows. China acted in its best interests regardless of the global impact. With this background and the recent yuan shock in mind, the global financial powers descended on Shanghai in late February. The G-20 central bankers and finance ministers agreed that China needed help. It's the world's second-largest economy and it was falling fast. There was some danger it could take the world down with it. But further yuan devaluation was not possible (in the short run) because it was too destabilizing to markets. The solution is to weaken the yuan on a relative basis by strengthening the currencies of China's major trading partners, Japan and Europe. In other words, if the yen and euro get stronger, that's the same as making the yuan weaker, but without the shock of Chinese devaluation. Since this secret deal was worked out on Feb. 26, the first chance the central bankers had to put their plan into action was mid-March. The ECB met on March 10. The Bank of Japan met on March 15. The Fed met on March 16. All three central banks would be able to implement the secret plan in just five business days. Now it was "game on" for the biggest currency manipulation since 1985. Yet how could Japan and Europe tighten without explicitly raising rates? They did it by raising expectations. Markets thought Draghi's ECB "bazooka" would be long lasting. Markets expected Kuroda of the Bank of Japan to do more aggressive QE. In fact, Draghi did the minimum necessary, and then said he was done doing more. Kuroda did nothing. Both decisions acted like tightening relative to expectations. The euro and yen went up against the dollar immediately. Comparatively, the yuan went down with no explicit devaluation by China. This was the new Shanghai Accord in action. The dollar declined 30% after the coordinated action at the Plaza Accord in 1985. The dollar's recent strength since the all-time low in 2011 is also shown. This is the period leading up to the new Shanghai Accord, also shown. Will the dollar now plunge 30%, as it did after 1985? It might. If that happens, the shock waves will be felt in every market in the world. U.S. stocks will get a lift, Japanese stocks will get crushed and gold will soar. The Shanghai Accord will be a game changer depending on how hard the insiders push their new playbook. The Fed took a slightly different tack in this plan. Markets pay most attention to the yuan/dollar cross-rate; that's the one the Chinese government manipulates. The yuan/euro and yuan/yen cross-rates just go where they go based on the euro/dollar and yen/dollar crosses. The dollar cross-rates are the ones markets pay most attention to. So the Fed weakened the dollar with their dovish comments at the March 16 meeting. (Again, by doing nothing and signaling slower tightening, they changed expectations, which is a form of ease.) With Europe and Japan tightening and the U.S. easing at the same time, nobody noticed that China effectively devalued, because the yuan/dollar cross-rate was unchanged. Neat! Europe is a larger trading partner to China than the U.S., so the yuan/euro cross-rate is actually more important to the Chinese economy. What happened under the Shanghai Accord was a coordinated devaluation that went unnoticed because China took no official action and the yuan/dollar cross-rate was unchanged. It was an invisible devaluation of the yuan. Japan and Europe were the losers in this round of currency manipulations. Japan was the winner in 2013 with Abenomics. Europe was the winner in 2014 with negative rates and Euro QE. Now it was the turn of China and the U.S. to get a lift. The U.S. and China are the world's two largest economies. If they go down, the whole world goes down with them. Both economies were showing signs of weakness. It was time for Europe and Japan to give it up to China and the U.S. That's the legacy of the Shanghai Accord. What's next? There's another secret G-20 meeting on April 16, 2016. This will take place on the sidelines of the IMF spring meeting in Washington, D.C. I'll be in Washington then reporting from the front lines. At the April conclave, I expect the Big Four (Japan, U.S., the eurozone and China) to leave exchange rates alone for the time being. They'll want time to evaluate their work following the Shanghai Accord before taking next steps. The Big Four may later want to run the Shanghai playbook again just to give China more breathing room. The Shanghai Accord seems like a success for the central banks. This means the Big Four will want to try it again to ease financial conditions in the U.S. and China. They won't push it too far, because Japan and Europe are fragile. We'll wait to see the indications and warnings before the April meeting. For now, a stronger yen and stronger euro are both in the cards. The consequences for Asia of a stronger yen and weaker yuan are not difficult to discern. Japanese corporate profits will be hurt two ways. Japanese exporters will be hurt because their products will be more expensive for foreign buyers. Japanese multinationals will be hurt when their overseas earnings are translated back into yen. It's a double-whammy for the Japanese stock market. The Shanghai Accord happened in stealth, but it will go down in history as a major turning point in the international monetary system. Regards, Jim Rickards P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post The Dollar Has Been Shanghaied appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Mar 2016 01:01 PM PDT Resource Investor | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The 'Dangerous Obsession' with Gold Posted: 24 Mar 2016 11:28 AM PDT "Gold has worked down from Alexander's time. When something holds good for two thousand years I do not believe it can be so because of prejudice or mistaken theory." Bernard Baruch "The commerce and industry of the country, however, it must be acknowledged, though they may be somewhat augmented [by paper money], cannot be altogether so secure, when they are thus, as it were, suspended upon the Daedalian wings of paper money, as when they travel about upon the solid ground of gold and silver." Adam Smith, Wealth of Nations, p. 262 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Dollar Rebound Spells Further Downside for the Kiwi Dollar Posted: 24 Mar 2016 11:18 AM PDT With rhetoric for US rates hikes ramping higher while other advanced economies across the globe consider the merits of additional accommodation, the US dollar has found itself on the mend after several weeks of softness. Even though US macroeconomic data has been mixed and at times disappointing, first quarter growth is projected to be strong, paving the way for additional tightening while countries such as New Zealand contemplate lowering benchmark rates even further. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Takes One To The Mid-Section Posted: 24 Mar 2016 10:28 AM PDT This post Gold Takes One To The Mid-Section appeared first on Daily Reckoning. And now… today's Pfennig for your thoughts… Good day, and a tub thumpin’ Thursday to you! This will be short-n-sweet. It seems the dollar, which had the conn yesterday, has carried that on throughout the night, and is grinding higher this morning. Gold really took one to the mid-section yesterday, losing more than $28 on the day. I found that interesting considering the talk this week about the coming end of the short gold paper trades. It was as if the gold traders stuck out their collective tongues and said, “not yet!”. I wasn’t sold on that story about the end of the paper trades, instead it was more of wishful thinking. I just don’t see the reason for the selloff. Nothing fundamentally changed in the world, and there was no real economic data prints to look to. I know what I would put this down as. The Chinese renminbi is the worst performer overnight, as the Chinese pushed the renminbi down by a large margin in the fixing. The rest of the currencies are all down vs. the dollar this morning, some by larger margins and some by tiny margins. The euro, yen and pound sterling are down by such small amounts you could call them “flat on the day”. But like I said above, there’s nothing going on that would move the currencies and metals like they’ve moved in the past two days. The price of oil slipped again yesterday. Two steps forward, one step backward is how this all seems for the price of oil these days. But a $2 drop in the price of oil, has the gas stations all out changing the prices they display for their grades of gas! UGH! Today, we get to see some “real economic data” in the form of February Durable Goods and Capital Goods Orders. Some might like the taste of the Markit PMI for March, but the real focus today is on the “real economic data”, and I’m going to go out on a limb here and say that the Goods Orders will both be disappointing and probably print negative. Again! I came across this article on Bloomberg this morning and it just ticked me off to no end, and then had to make sure I used it here. So, here’s the deal, Lola (Goldman Sachs) is telling the Fed how to deal with their monetary policy. Hmmm… let’s see what Bloomberg says about this:

Chuck again. Are you kidding me? Even in my current state of mind, I have to take issue with this! First of all, I don’t know what schools of economics the boys and girls at Lola went to, but they need to go back and relearn how a currency influences a county’s inflation! And that’s all I’m going to say about that today. I’ll come back to this when I have a clear head, and am loaded for bear! And with that I’ll get out of your hair for today. See? Short-n-sweet as I promised. I hope you have a tub thumping’ Thursday and be good to yourself! Regards, Chuck Butler P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post Gold Takes One To The Mid-Section appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MATRIX EXPOSED: Where Television REALLY comes from! (R$E) Posted: 24 Mar 2016 09:30 AM PDT An Exclusive look into the inner workings of the Alien Matrix Projection that is coming to the earth from the Abyss. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EU was Warned of Global Terror threat Years Ago Posted: 24 Mar 2016 08:30 AM PDT Terror in the heart of EU: global threat demanding global response has been ignored for years. Could the tragic events happening in Europe now been prevented if the EU hadn't been so deaf? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

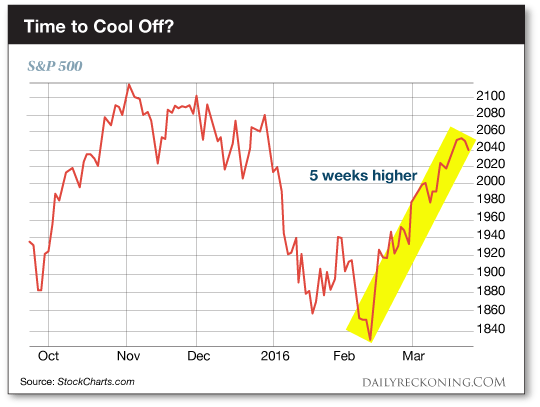

| Is the Rally Finally Out of Steam? Posted: 24 Mar 2016 08:29 AM PDT This post Is the Rally Finally Out of Steam? appeared first on Daily Reckoning. Stocks slumped yesterday. Crude slipped below $40, losing more than 4% on the day. Gold futures dropped a whopping $25. Are markets on the brink once again? Rich Dad thinks so. Robert Kiyosaki of "Rich Dad, Poor Dad" fame says total collapse is upon us. He predicted as much in his book "Rich Dad's Prophecy" way back in 2002. "Fourteen years ago, the author of a series of popular personal-finance books predicted that 2016 would bring about the worst market crash in history, damaging the financial dreams of millions of baby boomers just as they started to depend on that money to fund retirement," MarketWatch reports. "Kiyosaki is convinced: The pullback he predicted is happening." And as Kiyosaki told MarketWatch, we're right on schedule. I'm not sure about Rich Dad's definition of a meltdown-in-action. The S&P 500's barely in the red for the year. Sorry but that just doesn't cut it for me. But I don't make prophecies 14 years in advance. Maybe Rich Dad would have earned more clout if he had mentioned the housing bust and financial crisis back in 2002… To be honest, I'm not the least bit surprised the Rich Dad meltdown prediction is gaining traction right now. It's almost laughable how quickly sentiment has swung bearish after one crappy day. How should we treat yesterday's market action? You'll see in a second… A little perspective is necessary. The S&P 500 just posted five straight weeks of gains. And it did it after the worst start to the year ever for the index. So a little red on the screen shouldn't be unexpected.

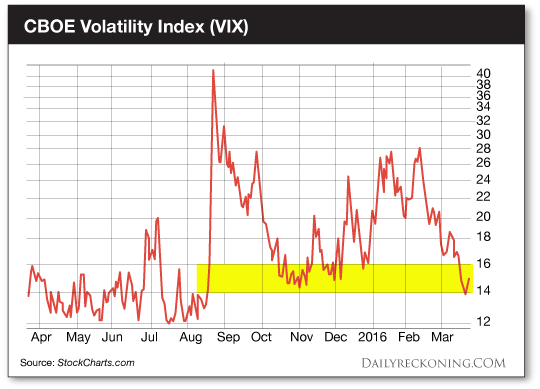

Despite what the past five weeks might have suggested, this is not a favorable market environment. Stocks remain under pressure. And it's obvious investors are rudderless right now. That's how we ended up with the most boring trading week of 2016. Low volume. And barely any movement from the major averages. All the investing class can do is drift along with the tide. So instead of making wild predictions, let's go with what we know… While a majority of stocks have enjoyed short-term bounces since mid-February, most stocks remain below their respective 200-day moving averages. So we're forced to deal with a choppy market since most stocks aren't locked in long-term uptrends. And what about volatility? Are we due for another spike? Maybe… The CBOE Volatility Index (VIX) steadily churned higher to start the year as the market floundered. But volatility was smacked down last month as stocks bottomed out and started climbing. Now the VIX has dropped below 15 to 2016 lows—an area that has triggered some volatility spikes ever since the market started behaving badly last year.

Of course, none of this means we're guaranteed to see another swoon like we saw to start the year. But if this rally is indeed losing significant steam, it's time to take some money off the table. Sincerely, Greg Guenthner P.S. Make money in a falling market–sign up for my Rude Awakening e-letter, for FREE, right here. Stop missing out. Click here now to sign up for FREE. The post Is the Rally Finally Out of Steam? appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Will Lead The Way To New Highs Posted: 24 Mar 2016 08:27 AM PDT Silver Will Lead The Way To New Highs | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ISIS Exploits Europe's Pre-911 Security Stance Posted: 24 Mar 2016 07:30 AM PDT Isis continues to exploit Europe's security stance of pre-9/11 with the open borders the radical Islamic militants continue to plot evil The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Illuminati & Brussels (NWO, False Flag & Order out of Chaos) Posted: 24 Mar 2016 07:00 AM PDT In this video we look at the involvement of the globalist satanic new world order elite and this supposed "terror" attack! Please share this video! God Bless, STAY VIGILANT & FEAR NO EVIL !!! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GLX, GLDX, Baby Gold Bull Market Stillborn? Posted: 24 Mar 2016 06:42 AM PDT Today felt like a short covering rally during the bear market years in the PM complex only in reverse. Days like today can make one think that the rally over the last two months is all she wrote for the new bull market.. Did the baby bull die at birth ? Maybe , but I’ll need to see more proof that the bear market for the precious metals stocks, that ended on January 19th of this year is back. During a bull market it’s nice to see new highs being made even if it’s for the short to intermediate term time frame. Then to confirm a new uptrend we need to see higher highs and higher lows being made. Since the January 19th low we’ve seen the PM stock indexes making higher highs but we’ve not seen a higher low put in yet because the rally has been so strong. Tonight I would like to show you the new bull market for the GLDX, global explores, using horizontal support and resistance lines. You can apply the same principal to the other precious metals stock indexes like the HUI or the GDX. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Mar 2016 06:28 AM PDT India has had a long-standing love affair with gold. At Indian weddings, some of the brides get so much gold jewellery that it weighs them down. There are upwards of 15 million weddings every year in India. According to the World Gold Council, upwards of 50% of Indian demand for gold is destined for weddings. Gold is ingrained in the culture and a part of their belief system. Not only is it integral to weddings, gifts of gold are common for anniversaries, birthdays and religious festivals. Gold jewellery is not regarded solely as adornment. It is a store of wealth. At one time it was widely accepted that women could not own anything except for their gold jewellery. That custom still prevails outside the major cities. Gold has spanned centuries and millennia in India. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 24 Mar 2016 06:21 AM PDT SunshineProfits | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reservoir Minerals Has Many Options to Enhance Value Posted: 24 Mar 2016 01:00 AM PDT Reservoir Minerals Inc. (RMC:TSX.V) has moved up sharply this month—over 50%—after Lundin Mining Corp. (LUX:TSX) made an offer to buy part of Freeport-McMoRan Copper & Gold Inc.'s (FCX:NYSE) interest in its joint venture with Reservoir. But it remains a strong buy. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

We have become so frivolous, so easily distracted, and so wantonly shallow that we are all becoming Tom and Daisy now. We get by, like addicts, on partisan fear and hatred. It is unfortunate but most have nothing to fall back on after the bread and circuses have run their course— no money, no love of anything but themselves, and no firm moral beliefs and principles. Nothing but the abyss.

We have become so frivolous, so easily distracted, and so wantonly shallow that we are all becoming Tom and Daisy now. We get by, like addicts, on partisan fear and hatred. It is unfortunate but most have nothing to fall back on after the bread and circuses have run their course— no money, no love of anything but themselves, and no firm moral beliefs and principles. Nothing but the abyss.

The root of this evil is our love of easy money, or FIAT money, defined by those with power as "wealth by decree" which places an arbitrary value upon "wealth issued by men" such that buying power has no natural governor, as it did when gold was freely traded along currencies in truly free markets. But whom, may we ask, has the power to decree wealth? And with such great power to do so, who can be trusted with such great responsibility?

The root of this evil is our love of easy money, or FIAT money, defined by those with power as "wealth by decree" which places an arbitrary value upon "wealth issued by men" such that buying power has no natural governor, as it did when gold was freely traded along currencies in truly free markets. But whom, may we ask, has the power to decree wealth? And with such great power to do so, who can be trusted with such great responsibility?

No comments:

Post a Comment