saveyourassetsfirst3 |

- Fractal Analysis Shows Coming 70s Style Gold Stocks Rally From Even Cheaper Levels

- Integra Gold Challenge With Rob McEwen, Sean Roosen, Brent Cook, Integra Gold And Top 5 Contestants!

- Never Before Has America Been Hit By So Many Historic Floods In Such a Short Period Of Time

- FOMC today and Gold

- March BoJ Meeting and Gold

- Fed Holds Serve, Gold and Silver Go Vertical

- GOP’s DEMISE Ahead & SOVIET-STYLE ONE Party System | Mike Rivero

- US Credit Card Debt Is Approaching A Trillion Dollars

- World’s Largest Reinsurer Buying Gold To Counter Punishing Negative Rates

- The Rothschild Formula is Complete: The US is Done!

- German bank that almost failed now being paid to borrow money

- Harvey Organ: SLV Adds Monstrous 3.236 M oz of Silver, Yet Prices Smashed!

- The Status Quo Plan – Convince the American Public to Accept Serfdom

- Gold Stocks: Surfing An Institutional Wave – Stewart Thomson

- Precious Metals – Cutting Through Confusion

- Jim Willie Issues Alert: “Systemic Lehman Event Is In Progress”

- We Are Being Killed On Trade – Rapidly Declining Exports Signal A Death Blow For The U.S. Economy

- Gold Stocks Reverse at Resistance Targets

- Kiss the Bear Goodbye (But Wear a Helmet). . .

- The Economic Collapse Of South America Is Well Underway

| Fractal Analysis Shows Coming 70s Style Gold Stocks Rally From Even Cheaper Levels Posted: 16 Mar 2016 12:39 PM PDT Fractal Analysis Shows Coming 70s Style Gold Stocks Rally From Even Cheaper Levels By Hubert Moolman In terms of the gold price, gold stocks are currently at better value than at the beginning of the bull market in 2001. In 2001, at the bottom of the gold bull market, the XAU to Gold ratio was […] |

| Integra Gold Challenge With Rob McEwen, Sean Roosen, Brent Cook, Integra Gold And Top 5 Contestants! Posted: 16 Mar 2016 12:06 PM PDT |

| Never Before Has America Been Hit By So Many Historic Floods In Such a Short Period Of Time Posted: 16 Mar 2016 12:00 PM PDT The United States has never seen anything like this… Submitted by Michael Snyder: The United States has been hit by seven historic floods since the month of September, and the latest one is making headlines all over the planet. This week, nearly two feet of rain triggered record-setting flooding in parts of Texas, Louisiana […] The post Never Before Has America Been Hit By So Many Historic Floods In Such a Short Period Of Time appeared first on Silver Doctors. |

| Posted: 16 Mar 2016 11:16 AM PDT Commodity Trader |

| Posted: 16 Mar 2016 11:16 AM PDT SunshineProfits |

| Fed Holds Serve, Gold and Silver Go Vertical Posted: 16 Mar 2016 11:08 AM PDT The Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent The stance of monetary policy remains accommodative 1 member voted to raise rates to 1/2 – 3/4% Gold and silver go vertical on the release Full FOMC Statement Is Below: Gold: Silver: From the FOMC: […] The post Fed Holds Serve, Gold and Silver Go Vertical appeared first on Silver Doctors. |

| GOP’s DEMISE Ahead & SOVIET-STYLE ONE Party System | Mike Rivero Posted: 16 Mar 2016 11:00 AM PDT Is a Soviet-style ONE party system dead ahead for America? In this interview with Finance and Liberty, Mike Rivero makes the case: The post GOP’s DEMISE Ahead & SOVIET-STYLE ONE Party System | Mike Rivero appeared first on Silver Doctors. |

| US Credit Card Debt Is Approaching A Trillion Dollars Posted: 16 Mar 2016 10:00 AM PDT For the first time ever, total credit card debt in the United States is approaching a trillion dollars. Instead of learning painful lessons from the last recession, Americans continue to make the same horrendous financial mistakes over and over again. In fact, U.S. consumers accumulated more new credit card debt during the 4th quarter of […] The post US Credit Card Debt Is Approaching A Trillion Dollars appeared first on Silver Doctors. |

| World’s Largest Reinsurer Buying Gold To Counter Punishing Negative Rates Posted: 16 Mar 2016 09:01 AM PDT gold.ie |

| The Rothschild Formula is Complete: The US is Done! Posted: 16 Mar 2016 09:00 AM PDT The Rothschild formula of Give me control of a nation's money, and I care not who makes the rules was finally entrenched with the forced passage of the Federal Reserve Act of 1913. The economic dismantling of the United States is a fait accompli. The US is done, beyond economical repair. Submitted by ETP: Political […] The post The Rothschild Formula is Complete: The US is Done! appeared first on Silver Doctors. |

| German bank that almost failed now being paid to borrow money Posted: 16 Mar 2016 08:00 AM PDT This is exactly the same madness we saw ten years ago during the housing bubble and the subsequent financial crisis… Submitted by Simon Black, Sovereign Man: The 12.5 hours spent crossing the Pacific on Qantas flight 27 feels like going through a wormhole. The flight departs Sydney, Australia at 12:50pm and arrives to Santiago, […] The post German bank that almost failed now being paid to borrow money appeared first on Silver Doctors. |

| Harvey Organ: SLV Adds Monstrous 3.236 M oz of Silver, Yet Prices Smashed! Posted: 16 Mar 2016 07:31 AM PDT IN TWO DAYS, SLV ADDED A MONSTROUS 3.236 MILLION OZ AND YET THE PRICE OF SILVER GOES DOWN ON TWO MASSIVE RAID DAYS. GOLD AND SILVER WHACKED AGAIN AS OPEN INTEREST DID NOT DECLINE AS MUCH AS BANKERS DESIRED/CHINA SIGNALS THAT IT MAY INTRODUCE A TAX ON FOREIGN EXCHANGE TRANSACTIONS AS THEY TRY AND […] The post Harvey Organ: SLV Adds Monstrous 3.236 M oz of Silver, Yet Prices Smashed! appeared first on Silver Doctors. |

| The Status Quo Plan – Convince the American Public to Accept Serfdom Posted: 16 Mar 2016 07:00 AM PDT The American public has two clear choices: Fight back, or accept serfdom. Submitted by Michael Krieger, Liberty Blitzkrieg: Earlier today I came across a fantastic article published at Naked Capitalism by a writer known as Gaius Publius. Yves Smith introduces the piece with the following poignant passage: Let us not forget that the […] The post The Status Quo Plan – Convince the American Public to Accept Serfdom appeared first on Silver Doctors. |

| Gold Stocks: Surfing An Institutional Wave – Stewart Thomson Posted: 16 Mar 2016 04:00 AM PDT While anything is possible in any market at any time, including new lows for gold, I think the Western gold community is starting to look pretty good here, given the sizable institutional buying taking place "across the board" in gold stocks. Because a lot of that buying is value-oriented, even if gold did "impossibly" go […] The post Gold Stocks: Surfing An Institutional Wave – Stewart Thomson appeared first on Silver Doctors. |

| Precious Metals – Cutting Through Confusion Posted: 15 Mar 2016 09:07 PM PDT Precious Metals- Cutting Through the Confusion With all of the economic headlines and prognosticators screaming the headline of the minute it's enough to make your head swim. Too much information, rather than helping us sometimes is just throwing up so much smoke it's confusing. Rather than bringing clarity it just's just additional distraction away from what is important. Today at www.preciousmetalsinvesting.com Ted Sudol talks with Paul Mladjenovic about precious metals and the big picture. Paul is the author of Precious Metals Investing For Dummies, Stock Investing for Dummies, and High Level Investing For Dummies. Precious metals have been in a tough market for a while. We assumed the bear market would not last as long as it did. But we firmly believe that the precious metals are headed on their way up. So far in 2016 gold and silver are up in 2016 while the stock market performance in the first quarter of this year has been dreadful. Precious metals and precious metals investments should be a part of the diversification of your portfolio. Remember that gold etf's, gold stocks, etc are still just paper carrying counter party risk. It's important that part of your diversification should be in hard assets - the physical precious metals. The Precious Metals Investing podcast is now on iTunes. Use this link: Precious Metals Investing iTunes listing If you want to find out more about Paul Mladjenovic and the products and services he offers please go to his resource page here on this web site. The post Precious Metals – Cutting Through Confusion appeared first on PreciousMetalsInvesting.com. |

| Jim Willie Issues Alert: “Systemic Lehman Event Is In Progress” Posted: 15 Mar 2016 08:30 PM PDT “A systemic Lehman event is in progress…” Submitted by Jim Willie, GoldenJackass: The current monetary policy is stuck in place. It is highly destructive to banking systems, working capital, and financial markets. Yet it continues ad infinitum, actually until the great collapse. A systemic Lehman event is in progress, as the global financial structure is […] The post Jim Willie Issues Alert: “Systemic Lehman Event Is In Progress” appeared first on Silver Doctors. |

| We Are Being Killed On Trade – Rapidly Declining Exports Signal A Death Blow For The U.S. Economy Posted: 15 Mar 2016 01:17 PM PDT

And this chart does not even show the latest numbers that we have. During the month of January, U.S. exports fell to a five and a half year low…

Because our exports are falling faster than our imports, our trade deficit is blowing out once again. Every year we buy hundreds of billions of dollars more from the rest of the world than they buy from us, and this is systematically wrecking our economy. Over the past several decades, we have lost tens of thousands of manufacturing facilities, millions of good paying manufacturing jobs, and major exporting nations such as China have become exceedingly wealthy at our expense. We are being absolutely killed on trade, and yet very few of our politicians ever want to talk about this. A brand new study that was recently discussed in the New York Times is bringing some renewed attention to these problems. It turns out that the promised “benefits” of merging the U.S. economy into the global economic system simply have not materialized…

Another study conducted by some of the same researchers discovered that 2.4 million American jobs were lost between 1999 and 2011 due to rising Chinese imports. When are we going to finally wake up? The middle class in America is being absolutely shredded, and yet only a few of us seem to care. Meanwhile, global trade as a whole continues to slow down at a very frightening pace. We just learned that the China Containerized Freight Index has now dropped to the lowest level ever recorded. The following comes from Wolf Richter…

How many numbers like this do we have to get before we will all finally admit that we are in the midst of a major global economic meltdown? Here in the United States, the recent rally in the stock market has most people feeling pretty good about things these days. But the truth is that there are ups and downs during any financial crisis, and this recent rally is putting the finishing touches on a very dangerous leaning “W” pattern that could signal a big dive ahead. Harry Dent, the author of “The Demographic Cliff: How to Survive and Prosper During the Great Deflation Ahead“, has shown that this leaning “W” pattern is part of a huge “rounded top” for the S&P 500. The following is a brief excerpt from one of his recent articles…

Now is not the time to relax at all. In fact, now is the time to sound the alarm louder than ever. That is one reason why my wife and I have started up a new television program. It will be airing on Christian television, but it will also be available on YouTube as well… As I have said before, 2016 is the year when everything changes. So don’t be fooled just because the stock market had a couple of good weeks. The truth is that global economic activity is slowing down significantly, geopolitical instability continues to get even worse, and this political season has caused very deep, simmering tensions in the United States to rise to the surface. Let us hope that we have a few more weeks of relative stability like we are currently experiencing so that we can have more time to get prepared, but I certainly wouldn’t count on it. |

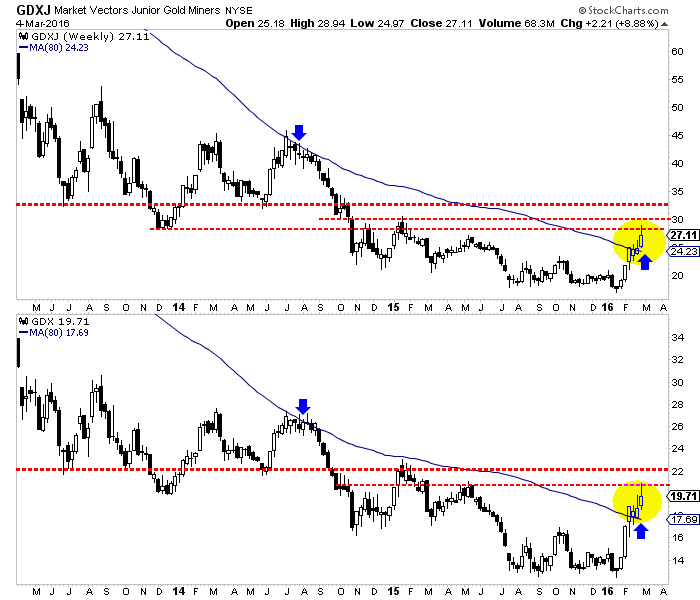

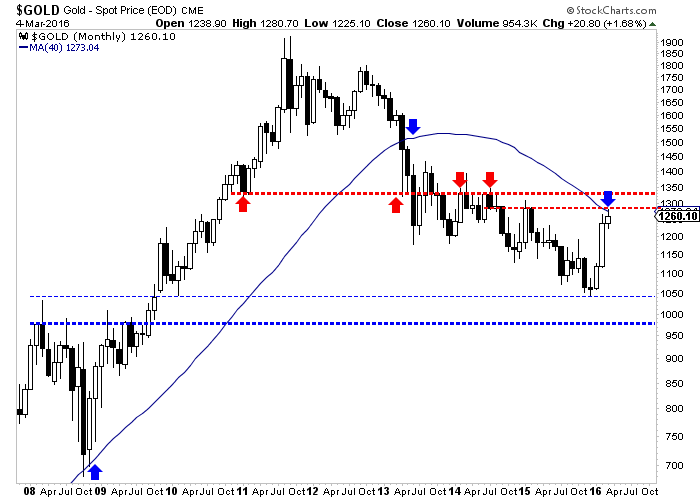

| Gold Stocks Reverse at Resistance Targets Posted: 04 Mar 2016 03:11 PM PST Two weeks ago, regarding the miners we wrote: If it (GDXJ) surpasses its 80-week moving average then its next target is $27-$28. Meanwhile, GDX is holding above previous resistance at $18. Its next strong resistance targets are $21 and $22. Earlier today GDX and GDXJ came within pennies of $21 and $29 respectively while Gold touched $1280 before reversing. While Gold and gold stocks could continue a bit higher, their rebound may have ended Friday morning. A weekly candle chart of GDXJ and GDX is below. The miners over the past six weeks have formed six white candles and taken out their 80-week moving averages, which contained the strongest rallies during the bear market. However, the miners formed a nasty reversal on Friday after touching resistance earlier in the day. The miners could, at the least, test their 80-week moving averages which are now support.  GDXJ, GDX Weekly Candles

The recent rebound was similar to that from the October 2008 lows. Then, GDX rebounded 69% (from low tick to high tick) in five weeks while over the past six weeks GDX surged 68%. Then, GDX corrected 20%. GDX also corrected 29% during that rebound. In recent weeks GDX has not corrected more than 10%. It would not be unreasonable for GDX to correct 20% or even 25% from Friday's high. Meanwhile, Gold reversed course after reaching a confluence of resistance which includes the 40-month moving average. There remains a small chance that Gold could test $1300/oz before correcting. Gold has support at $1240/oz and $1200/oz.

The bearish reversal at resistance coupled with history makes a strong argument that gold stocks could correct recent gains in the days and weeks ahead. A 20% decline would be normal and reasonable given the context. For those of us waiting for a correction, it could be coming. The month of March may provide the best buying opportunity in the miners since December 2015. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

By Jordan Roy-Byrne, CMT

|

| Kiss the Bear Goodbye (But Wear a Helmet). . . Posted: 04 Mar 2016 12:00 AM PST |

| The Economic Collapse Of South America Is Well Underway Posted: 03 Mar 2016 06:46 PM PST

At this point, Brazil is already experiencing its longest economic downturn since the Great Depression of the 1930s, and things are getting worse for ordinary Brazilians every single day. The following comes from CNN…

So how did this happen? Well, there are a couple of factors that are really hurting South American economies. Number one, during the “boom years” governments and businesses in South America absolutely gorged on debt. Unfortunately, many of those loans were denominated in U.S. dollars, and now that the U.S. dollar has appreciated greatly against local South American currencies it is taking far more of those local currencies to service and pay back those debts. Number two, collapsing prices for oil and other commodities have been absolutely brutal for South American economies. They rely very heavily on exporting commodities to the rest of the world, and so at the same time their debt problems are exploding they are getting a lot less money for the oil and industrial commodities that they are trying to sell to North America, Asia and Europe. I want you to pay close attention to the following chart and analysis from Zero Hedge. As you can see, the economic problems in Brazil appear to be greatly accelerating…

And of course Brazil is not the only South American economy that is a basket case right now. In fact, things in Venezuela are far worse. In 2015, the Venezuelan economy shrunk by 10 percent, and the official rate of inflation was a staggering 181 percent. Could you imagine living in an economy with a 181 percent inflation rate? As prices have escalated out of control, citizens have attempted to hoard basic supplies in advance, and this has resulted in food shortages that are absolutely frightening…

Here in the United States, there are still people who doubt that an economic crisis is happening. But in Venezuela and Brazil there is no debate. Unfortunately, what is happening in Venezuela and Brazil is also slowly starting to happen to most of the rest of the planet as well. It is just that they are a little farther down the road. Economic and financial bubbles are bursting all over the world, and I like how author Vikram Mansharamani described this phenomenon during a recent interview with CNBC…

And of course the evidence of what Mansharamani was talking about is all around us. Just this week we found out that Chinese state industries plan to lay off five to six million workers, U.S. factory orders have now fallen for 15 months in a row, and the corporate default rate in the United States has now risen above where it was at when Lehman Brothers collapsed. There are some people that would like to point to the fact that stocks have bounced back a bit over the past couple of weeks as evidence that the crisis is over. If they want to believe that, they should go ahead and believe that. Unfortunately, the truth is that the hard economic numbers that are coming in from all over the world tell us very clearly that global economic activity is slowing down significantly. A new global recession has already begun, and the pain that is already being felt all over the planet is just the beginning of what is coming. |

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment