saveyourassetsfirst3 |

- What Do Changes In GLD's Bullion Inventory Tell Us About The Future Gold Price?

- Peter Schiff: Gold is Going to SKYROCKET- People Need to Prepare for That Now!

- Peak Gold And Silver - It's Here!

- Commercials Flee the COMEX: “This is the Sort of Thing You Would Expect to Happen Prior to a COMEX Default”

- Alasdair Macleod’s Market Report: Silver Fixed!

- Silver Buffalo Rounds Just 59 Cents Over Spot, ANY QTY at SD Bullion!

- New Facebook Policy Gunning Against Talk Of Private Gun Sales, Applies To Instagram

- Legendary Investor Eric Sprott Shares the Greatest Financial Lesson He’s Ever Learned

- Impressive US Mint Gold and Silver Bullion Coin Sales

- Harvey Organ: 7 Million Oz of COMEX Silver VAPORIZED!!

- Welcome To The Currency War, Part 21: Japan Goes Negative; US To Return Fire In 2016

- Bullion Wholesaler on Thursday’s Silver Fix Manipulation: “If You Were a Seller Today You Got F*&@#d”

- Gold Could Lose Safe-Haven Bid as Equities Rebound

- Chronicle Of A Debt Foretold

- 2016 Market Meltdown: We Have Never Seen A Year Start Quite Like This…

- Gold Short Term Bullish Channel Forms

- Precious Metals Video Update: Gold Showing Relative Strength

| What Do Changes In GLD's Bullion Inventory Tell Us About The Future Gold Price? Posted: 31 Jan 2016 09:42 AM PST |

| Peter Schiff: Gold is Going to SKYROCKET- People Need to Prepare for That Now! Posted: 31 Jan 2016 09:00 AM PST The admission that the economy is so weak that it needs more QE is going to destroy the narrative that the U.S. economy is in great shape and it's no longer going to be the safe haven for capital around the world…it's going to prick the bubble in the dollar…and people are going to realize […] The post Peter Schiff: Gold is Going to SKYROCKET- People Need to Prepare for That Now! appeared first on Silver Doctors. |

| Peak Gold And Silver - It's Here! Posted: 31 Jan 2016 08:51 AM PST |

| Posted: 31 Jan 2016 08:20 AM PST Are commercials bailing out of the COMEX casino before it burns down? There are several interpretations we could put on it, but the selling is helping to cap the gold price. But this time its not the much-talked-about naked short selling, its just the commercials leaving the market, both long AND short. I’d expect this sort […] The post Commercials Flee the COMEX: “This is the Sort of Thing You Would Expect to Happen Prior to a COMEX Default” appeared first on Silver Doctors. |

| Alasdair Macleod’s Market Report: Silver Fixed! Posted: 31 Jan 2016 08:01 AM PST Ahead of the fix, silver was trading at $14.42, and the fix itself, which took fourteen minutes, was finally settled at $13.58. The circumstantial evidence behind this extraordinary price behavior was there were over-the-counter market options expiring on the fix price. Submitted by Alasdair Macleod, GoldMoney: Gold and silver continued their rise, feeding on the […] The post Alasdair Macleod’s Market Report: Silver Fixed! appeared first on Silver Doctors. |

| Silver Buffalo Rounds Just 59 Cents Over Spot, ANY QTY at SD Bullion! Posted: 31 Jan 2016 07:32 AM PST *.59 Special While supplies last The post Silver Buffalo Rounds Just 59 Cents Over Spot, ANY QTY at SD Bullion! appeared first on Silver Doctors. |

| New Facebook Policy Gunning Against Talk Of Private Gun Sales, Applies To Instagram Posted: 31 Jan 2016 06:53 AM PST Facebook and Instagram have banned users from selling firearms or ammunition. TND News Alert: Facebook and its acquired service, Instagram, no longer allow users to make arrangements to buy or sell firearms, gun parts, or ammunition. The new rule has given users a hot topic to share and post about, whether they "Like" it […] The post New Facebook Policy Gunning Against Talk Of Private Gun Sales, Applies To Instagram appeared first on Silver Doctors. |

| Legendary Investor Eric Sprott Shares the Greatest Financial Lesson He’s Ever Learned Posted: 31 Jan 2016 02:15 AM PST In the wake of Japan announcing negative interest rates and chaos in the silver market with Thursday’s LBMA silver price fix smashed .84 below spot prices by the 6 fixing bullion banks, we welcomed The Admiral of the Silver Market, Eric Sprott himself to help us break down all the action. In Sprott’s words, the sheer […] The post Legendary Investor Eric Sprott Shares the Greatest Financial Lesson He’s Ever Learned appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Impressive US Mint Gold and Silver Bullion Coin Sales Posted: 31 Jan 2016 01:11 AM PST Contrary to Wall Street's assertion that gold and silver demand continue to implode heralding much-lower precious-metals prices, the US Mint says these American Eagle coins are selling like hotcakes. On December 31st it reported that 2015 sales of its gold bullion coins soared 53% above 2014's levels, while silver-bullion-coin sales hit an all-time record! That's […] The post Impressive US Mint Gold and Silver Bullion Coin Sales appeared first on Silver Doctors. |

| Harvey Organ: 7 Million Oz of COMEX Silver VAPORIZED!! Posted: 30 Jan 2016 04:32 PM PST HUGE 7 MILLION OZ TRANSFERRED OUT OF DEALER SILVER/COMEX LEFT WITH ONLY 28 MILLION OZ OF DEALER SILVER!! JAN 29/JAPAN SURPRISES THE WORLD BY INITIATING NEGATIVE INTEREST RATES/EXPECT CURRENCY WARS TO DEVELOP SHORTLY ESPECIALLY WITH CHINA/CHINA FOR THE YEAR HAD 1.6 TRILLION DOLLARS LEAVE ITS COUNTRY/OVER 20 TONNES OF GOLD STANDING ON FIRST DAY […] The post Harvey Organ: 7 Million Oz of COMEX Silver VAPORIZED!! appeared first on Silver Doctors. |

| Welcome To The Currency War, Part 21: Japan Goes Negative; US To Return Fire In 2016 Posted: 30 Jan 2016 12:55 PM PST Well that didn’t take long. Two weeks of falling share prices and the European and Japanese central banks go into full panic mode. The ECB promised new stimulus — which the markets liked — and then BoJ upped the ante with negative interest rates — which the markets loved. Here’s a quick summary from Bloomberg:

This is a resounding admission of failure. Over the past seven years the world’s central banks have cut interest rates to levels not seen since the Great Depression and flooded their banking systems with newly-created currency, while national governments have borrowed unprecedented sums (in the US case doubling the federal debt). Yet here we are in the early stages of a global deflationary collapse. Commodity prices have followed interest rates to historic lows, while growth is anemic and may soon be nonexistent. The official response: More extreme versions of what has already failed. Here’s a JP Morgan chart published by Financial Times that shows just how sudden the trend towards negative interest rates has been: Future historians will have a ball psychoanalyzing the people making these decisions, and their conclusion will almost certainly be some variant of the popular definition of insanity as repeating the same behavior while expecting a different result. So what does this new stage of the Money Bubble mean? Many, many bad things. This latest leg down in bond yields presents savers (the forgotten victims of the QE/NIRP experiment) with an even tougher set of choices. Previously they were advised to move out on the risk spectrum by loading up on junk bonds and high-dividend equities. Now, after the past few months’ carnage in those sectors, even the most oblivious retiree is likely to balk. But having said “no thanks” to the demonstrably dangerous options, what’s left? The answer is…very little. There is literally no way remaining for a regular person to generate historically normal levels of low-risk cash income. Meanwhile, a NIRP world presents the US with a problem that perhaps only the Swiss can appreciate: As the other major countries aggressively devalue their currencies (the euro and yen are already down big versus the dollar), another round of lower interest rates and faster money printing will, other things being equal, raise the dollar’s exchange rate even further. For a sense of what that might mean, recall that US corporate profits are already falling because of a too-strong dollar (see Brace for a ‘rare’ recession in corporate profits). Bump the dollar up another 10% versus the euro, yen and yuan, and US corporate profits might fall off a cliff. The inevitable result: Before the end of the year, the US will see no alternative but to open a new front in the currency war with negative interest rates of its own. The big banks, meanwhile, are no longer feeling the central bank love. Where falling interest rates used to be good for lenders because they energized borrowers and widened loan spreads, ultra-low rates are making markets more volatile (and thus harder to profitably manipulate for bank trading desks) without bringing attractive new borrowers through the door. The result: falling profits at BofA, JP Morgan, Goldman, et al and tanking big-bank share prices. As for gold, there are now $5 trillion of bonds and bank accounts that cost about the same amount to own as bullion stored in a super-safe vault — and which cost more than gold and silver coins stored at home. Compared with the 5%-6% cash flow advantage that bonds have traditionally enjoyed versus gold, NIRP can’t help but lead savers and conservative investors to reconsider their options. In other words, what would you rather trust: A bond issued by a government (Japan, the US, Europe — take your pick) that is wildly-overleveraged and acting ever-more-erratically, or a form of money that has never in three thousand years suffered from inflation or counterparty risk? At some point in the process, a critical mass of people will get this. And no discussion of the unfolding financial mess would make complete sense if it left out the geopolitical backdrop. The Middle East is on fire and refugees are flooding the developed world, resurrecting old social pathologies (see Swedes storm occupied Stockholm train station, beat migrant children). Much of Latin America is sinking into chaos (see Caracas named as world’s most violent city and 21 of the 50 most violent cities are in Brazil). Seeing this, who in their right mind would spend thousands of dollars to visit Egypt or Rio or even Paris right now? The answer is far fewer than a decade ago. So the old reliable economic drivers of expanding global trade and enthusiastic tourism are gone for a while, if not for decades. Central banks are, as a result, swimming against a current that is far faster — in water that is far deeper — than anything seen since at least the 1930s. And all they can do is pump a bit more air into their sadly-inadequate water wings. |

| Posted: 29 Jan 2016 08:13 PM PST “If you were a buyer today you were happy and if you were a seller today you got f*&@#d…“ Participants in the silver bullion market witnessed perhaps the most egregiously blatant occurrence of silver manipulation in history Thursday, when the 6 large fixing bullion banks rigged the London Silver Price down 84 cents (6%) […] The post Bullion Wholesaler on Thursday’s Silver Fix Manipulation: “If You Were a Seller Today You Got F*&@#d” appeared first on Silver Doctors. |

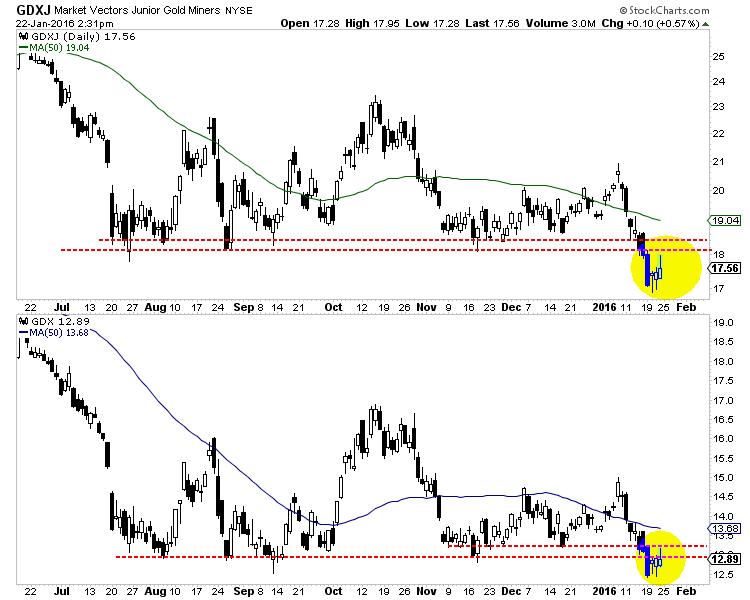

| Gold Could Lose Safe-Haven Bid as Equities Rebound Posted: 22 Jan 2016 12:13 PM PST Gold and Silver have held up well during the recent selloff in equities. From December 28 through Wednesday the broad NYSE lost 10.4% while the S&P 500 lost 9.6%. Precious Metals gained strength during that period. Gold advanced 3.0% while Silver gained 1.7%. Gold relative to the NYSE broke its downtrend and touched an 11-month high. Gold relative to global equities (excluding the US market) reached a 2-year high. Precious metals have clearly benefitted from the equity selloff but therefore figure to lose strength as the equity market begins a relief rally. Equities have become very oversold and are forming a bullish reversal. The weekly candle chart of the S&P 500 is shown below. The market is forming a bullish hammer (reversal candle) right at important support. The week is not over but we expect volume to be sizeable. The last two hammers on big volume came at the October 2014 and August 2014 lows. The market became extremely oversold this week as only 15% of stocks within the NYSE were trading above their 200-day moving average. That is the lowest figure in more than four years. Furthermore, various sentiment indicators are showing extreme pessimism. The AAII survey for example is showing the lowest amount of bulls since 1987.

The S&P 500 could rally as high as 1990 where there is major resistance. Wednesday's low should hold for at least a few months. The recent poor performance of the gold miners is another signal that the metals (Gold and Silver) are at risk of making lower lows. During the aforementioned period when the metals were positive the miners (GDX and GDXJ) lost 9.6% and 12.0%. That relative and nominal weakness is a strong signal that the recent strength in the metals is unlikely to last. GDX and GDXJ are charted below. The miners are recovering in part due to the recovery in the stock market. They are also retesting Tuesday's breakdown to new lows. The rally has been weak as there is strong resistance overhead in the form of recent support ($18 for GDXJ and $13 for GDX) and the 50-day moving averages.

Recent relative weakness in the gold miners along with the bullish reversal in the equity market is a bearish development for precious metals. Gold and surprisingly Silver have held up well amid the decline in equities. They enjoyed a safe-haven bid yet are likely to lose that bid as the equity market begins a relief rally. The gold stocks, while initially following the stock market could resume their decline once metals have resumed their downtrends. Precious metals bulls should wait for an extreme oversold condition amid extreme bearish sentiment before turning bullish. As we navigate the end of this bear market, consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Jordan Roy-Byrne, CMT |

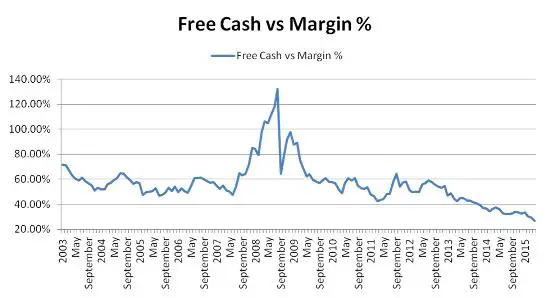

| Posted: 22 Jan 2016 11:09 AM PST Critics of today’s fiat currency/fractional reserve banking world have (for what seems like forever) made the common sense point that when debt rises faster than cash flow, bad things are bound to happen. In every cycle since 1980 this has been dismissed by the vast majority who benefit from inflating bubbles — until the bubble bursts. And here we go again. The following chart from Stock Traders Daily shows the relationship between margin debt (money borrowed by investors against existing stock positions in order to buy more stock) and cash on hand in brokerage accounts. The idea is that when investors hold lots of cash they’re pessimistic, and when they borrow a lot they’re optimisitc. Extremes of either tend to signal changes in market direction. At the end of 2015 investors were even more excited than at the peak of the housing bubble, indicating that there’s not much retail money left to be tossed at US stocks. China, being a little more bubbly than the US, is a good indicator of where US margin debt might be headed: Another red flag is being waved by corporate debt, much of which is being taken on to fund share repurchase programs. These tend to benefit shareholders in the moment but at the cost of higher leverage and less flexibility in the future. Where in the past net debt has tended to track EBITDA (a broad measure of earnings). starting in 2014 the former has soared beyond the latter. Just as a spike in margin debt implies a lack of retail stock buying in the future, soaring corporate debt implies limited borrowing power and a scale-back of share repurchases going forward. Based on both history and common sense, we should expect not just a slowdown, but a cratering of equity demand from both individuals and corporations in the year ahead. What happens then? Either the market crashes and prices go back to levels that attract wiser capital, or a new source of dumb money emerges. And that would be government. Already, the Bank of Japan owns more than half of the Japanese stock market. And now China — displaying its customary cluelessness about what markets are and how they work — is countering the recent bear market with public (which is to say borrowed) funds:

Companies exchanging long term bonds for equities and individuals using equities as collateral to buy more tend to distort equity valuations, but only temporarily, as the players’ finite borrowing capacity is eventually maxed out and the buying has to stop. Governments are a different story, since they can create trillions of dollars with a mouse click. Their ignorance is thus a lot more dangerous because it short-circuits price disclosure on a vast, potentially open-ended scale. When a central bank buys equities, it doesn’t have teams of analysts running valuation studies and creating model portfolios. Presumably it just makes across-the-board purchases, which tends to float all boats. So the wheat doesn’t get separated from the chaff and capital has no idea where to flow. Malinvestment becomes rampant and the result is, well, what we have today: Chinese ghost cities, Japanese zombie companies and US tech unicorns worth billions before generating their first dollar of earnings. And that’s before the Fed and European Central Bank really get going. |

| 2016 Market Meltdown: We Have Never Seen A Year Start Quite Like This… Posted: 21 Jan 2016 03:13 PM PST

The Dow was up just a little bit on Thursday thankfully, but even with that gain we are still in unprecedented territory. According to CNBC, we have never seen a tougher start to the year for the Dow than we have in 2016…

But even with the carnage that we have seen so far, stocks are still wildly overpriced compared to historical averages. In order for stocks to no longer be in a “bubble”, they will still need to decline by about another one-third. The following comes from MarketWatch…

Of course the mainstream media doesn’t seem to understand any of this. They seem to be under the impression that the bubble should have lasted forever, and this latest meltdown has taken them totally by surprise. Ultimately, what is happening should not be a surprise to any of us. The financial markets always catch up with economic reality eventually, and right now evidence continues to mount that economic activity is significantly slowing down. Here is some analysis from Brandon Smith…

In addition, another very troubling sign is the fact that initial jobless claims are starting to surge once again…

Since the last recession, the primary engine for the creation of good jobs in this country has been the energy industry. Unfortunately, the “oil boomtowns” are now going bust, and workers are being laid off in droves. As I mentioned the other day, 42 North American oil companies have filed for bankruptcy and 130,000 good paying energy jobs have been lost in this country since the start of 2015. And as long as the price of oil stays in this neighborhood, the worse things are going to get. A lot of people out there still seem to think that this is just going to be a temporary downturn. Many are convinced that we will just go through another tough recession and then we will come out okay on the other side. What they don’t realize is that a number of long-term trends are now reaching a crescendo. For decades, we have been living wildly beyond our means. The federal government, state and local governments, corporations and consumers have all been going into debt far faster than our economy has been growing. Of course this was never going to be sustainable in the long run, but we had been doing it for so long that many of us had come to believe that our exceedingly reckless debt-fueled prosperity was somehow “normal”. Unfortunately, the truth is that you can’t consume far more than you produce forever. Eventually reality catches up with you. This is a point that Simon Black made extremely well in one of his recent articles…

Sadly, the time for avoiding the consequences of our actions is now past. We are now starting to pay the price for decades of incredibly bone-headed decisions, and anyone that is looking to Barack Obama, the Federal Reserve or anyone else in Washington D.C. to be our savior is going to be bitterly disappointed. And as bad as things have been so far, just wait until you see what happens next. 2016 is the year when everything changes. |

| Gold Short Term Bullish Channel Forms Posted: 21 Jan 2016 01:25 PM PST |

| Precious Metals Video Update: Gold Showing Relative Strength Posted: 21 Jan 2016 11:37 AM PST A look at Gold against Stocks and Foreign Currencies, Silver, and the gold miners GDX and GDXJ.

|

| You are subscribed to email updates from Gold World News Flash 2. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment