Gold World News Flash |

- JAMES TURK – The Fed has Boxed Itself into a Corner and a Silver Divergence has Occured

- Political Conspiracies: 2016 Stuff They Don't Want You To Know - Stuff They Don't Want You To Know

- Glistening Gold & The Rumble In The Ruble - America's "Tribute Scam" Is Unraveling Fast

- Miles Franklin 2016 Silver Outlook Webinar

- A Chinese Banker Explains Why There Is No Way Out

- New Bull Market For Mining Stocks?

- 2016's "Biggest Risk": Markets Will "Need To Panic" To Wake Up "Impotent" Policymakers

- The Chinese Economy Is Sinking, Not Transitioning

- BREAKING 911: Denver Coliseum Multiple People Shot

- Welcome To The Currency War, Part 21: Japan Goes Negative; US To Return Fire In 2016

- Gold And Silver Current Prices Do Not Matter

- Gold Price Potential Upside 2016

- Andrew Napolitano - The Need For Encryption

- Bron Suchecki: LBMA silver 'price' -- a perfect storm of stupidity

- No Change in Outlook for Gold and Silver 2016

- US Mint Gold Bullion Coin Sales

- The Fed’s Normalization and Gold

| JAMES TURK – The Fed has Boxed Itself into a Corner and a Silver Divergence has Occured Posted: 31 Jan 2016 12:00 AM PST from Goldseek Radio: GoldSeek Radio’s Chris Waltzek talks to James Turk of GoldMoney. |

| Political Conspiracies: 2016 Stuff They Don't Want You To Know - Stuff They Don't Want You To Know Posted: 30 Jan 2016 06:55 PM PST Every election season conspiracy theories proliferate across the political spectrum -- and some may be less crazy than others. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Glistening Gold & The Rumble In The Ruble - America's "Tribute Scam" Is Unraveling Fast Posted: 30 Jan 2016 06:00 PM PST Beforer we discuss The Empire of Chaos ongoing attacks on "The Assassin Putin" and The Master of the Universe attempts to topple any challenge to Washington's global hegemony, we thought the following chart may give some much needed context for where the pain really is - the drop in the oil price in local currency terms has been the least of all major nations... for Russia

While a case can be made that for Moscow it would be a tremendous waste of hard-earned foreign exchange to try to counter a rig against their currency they simply cannot beat, as the entire fiat financial power of the US is against them. As Pepe Escobar via DoomsteadDiner.net notes, Russia’s Central Bank by now should be all-out selling rubles for gold, and building Russia’s gold reserves.

So, Russian Central Bank and Finance Ministry, the steaming hot ball is in your court. |

| Miles Franklin 2016 Silver Outlook Webinar Posted: 30 Jan 2016 05:30 PM PST |

| A Chinese Banker Explains Why There Is No Way Out Posted: 30 Jan 2016 05:12 PM PST Over the past year, we have frequently warned that the biggest financial risk (if not social, which in the form of soaring worker unrest is a far greater threat to Chinese civilization) threatening China, is its runaway non-performing loans, which at anywhere between 10 and 20% of total bank assets, mean that China is one chaotic default away from collapsing into the post "Minsky Moment" singlarity where it can no longer rollover its bad debt, leading to a debt supernova and full financial collapse. And as China's total leverage keeps rising, and according to at least one estimate is now a gargantuan 350% of GDP (incidentally the same as the US), the threat of a rollover "glitch" gets exponentially greater. To be sure, in recent months the topic of China's bad debt has gained increasingly more prominence among the mainstream, and notably none other than Kyle Bass has made the bursting of China's credit cycle the basis for his short Yuan trade as noted here previously:

And judging by the surge in recent and increasingly louder calls for a Chinese devaluation, some advocating a major one-off currency debasement, Bass' perspective is certainly prevalent among the trading community. Bank of America goes so far as to speculate that the "upcoming G20 meeting in Shanghai offers an opportunity for policy makers to seize the "expectations" initiative via a one-off China devaluation." It does, however, also add that the "risk is markets need to panic first" before instead of piecemeal devaluation, China follows through with a Plaza Accord-type currency intervention. Friday's adoption of NIRP by Japan, which send the US Dollar soaring, has only made any upcoming future Chinese devaluation even more likely. But whether China devalued or not, one thing is certain: it is next to impossible for China - under the current socio economic and financial regime - to stop the relentless growth in NPLs, which even by conservative estimates at in the trillion(s), accounting for at least 10% of China's GDP. Sure enough, a cursory skimming of news from China reveals that even Chinese bankers now "admit the NPL situation is dire, but will keep on lending" anyway. As the Chiecon blog notes, NPL "ratios might be closer to 10%... supported by revelations in this article, where Chinese bankers complain of missing performance targets, spiraling bad loans, and end of year pay cuts."

But the main reason why China is now trapped, and on one hand is desperate to stabilize its economy and stop growing its levereage at nosebleed levels, while on the other hand it is under pressure to issue more loans while at the same time it is unwilling to write off bad loans, can be found in the following very simple explanation offered by Mr. Zhou, a junior banker at a Chinese commercial bank.

And that, in under 60 words, explains why China finds itself in a no way out situation, and why despite all its recurring posturing, all its promises for reform, all its bluster for deleveraging, China's ruling elite will never be able to achieve an internal devaluation, and why despite its recurring threats to crush, gut and destroy all the evil Yuan shorts, ultimately it will have no choice but to pursue an external devaluation of its economy by way of devaluing its currency presumably some time before its foreign reserves run out (which at a $185 billion a month burn rate may not last for even one year). However, before it does, it will make sure that it also crushes every Yuan short, doing precisely what the Fed has done with equity shorts in the US over the past 7 years. |

| New Bull Market For Mining Stocks? Posted: 30 Jan 2016 05:00 PM PST by Dave Kranzler, Investment Research Dynamics:

Concerning gold and noting that this is Friday, "they"…and we've no idea who "they" are, but we do indeed know that "they" exist… are out there again making mischief as they have tried to do so many times in the past. Fridays "They" wage war on gold. – Dennis Gartman from his Jan 29 "Gartman Letter" With the entire precious metals community is still discussing the fraudulent LBMA a.m. silver fix, I happened to notice that the HUI gold mining stock index quietly is up 20% since January 19. What I find interesting about this is that if this were a stock like AAPL or AMZN, for instance, CNBC/Bloomberg News/Fox Biz would be falling all over themselves with the declaration of a new bull market in those stocks. Instead with regard to mining stocks – crickets.

Perhaps even more interesting is this graph to the left, which shows the performance of the HUI from the inception of the Turning to the quote at the top of the blog, you'll note that until very recently Dennis Gartman habitually used to lift his leg and urinate on the investment community, which he referenced simply as "bugs" (as in "goldbugs"). He used to veto with an iron fist any notion that the precious metals market is manipulated. Wonder what all off a sudden gave him religion? |

| 2016's "Biggest Risk": Markets Will "Need To Panic" To Wake Up "Impotent" Policymakers Posted: 30 Jan 2016 03:40 PM PST On Friday, we brought you the 4 "D's" of deflationary doom from BofA's Michael Hartnett. For those who missed it, Hartnett says the reason "an almost manic monetary policy been so ineffective at generating a broad, sustained economic recovery," is that the following four secular deflationary factors are conspiring to impede a robust recovery:

And so, those are the factors that explain why the DM world is stuck in neutral when it comes to economic activity. As BofA also suggested, the fact that the "recovery" isn't really a recovery goes a long way towards explaining why populist candidates and political parties are polling so well across the developed world. So what, pray tell, can policy makers do to right the ship now that the world appears to have been thoroughly Japanified? Well, to let BofA's Hartnett tell it, there needs to be some manner of "global policy coordination" à la The Plaza Accord to reignite "corporate and household animal spirits" and combat the dreaded 4 "C's": China, commodities, credit, and the consumer. This policy coordination could come at the G20 Finance Ministers and Central Bank meeting in Shanghai next month, Hartnett writes. We've long argued that if you want proof that the Keynesian insanity employed by DM central bankers has demonstrably failed, you needn't look further than global demand and trade, which are both in the doldrums. In short, if you want to resuscitate demand, you need policies that have a real impact on those from whom final demand emanates. Inundating Wall Street with fungible liquidity doesn't accomplish that. It may drive asset prices higher, but Ben Bernanke's fabled "wealth effect" pretty clear doesn't exist. So what's the answer, you ask? Is there any hope for centrally planned markets in the wake of the extreme turbulence that played havoc with equities in January? Can central bankers reclaim the narrative on the way to orchestrating a real recovery? Well, probably not, but BofA says there are 4 points that must be addressed if officials intend to attempt a coordinated policy response to anemic global growth. Below, find commentary on a possible "Shanghai Accord". * * * From BofA In addition to the risk of a deeper profit recession, there is no doubt the recent sell-off has been exacerbated by policy impotence; the sense that policy-makers have little solution for global demand deficiency. A weak, disjointed recovery may also be threatened by the political shift toward capital controls in China, border controls in Europe and the US, as well as more aggressive redistributive taxation at a time of ongoing fiscal austerity. There are some echoes of the period leading up to the 1985 Plaza Accord between the United States, France, West Germany, Japan, and the United Kingdom, which agreed to weaken the US dollar to help the US improve its huge trade deficit and spur economic growth out of the doldrums of the early-1980s. This pro-growth agreement was spurred by weak growth, macro divergence, and interestingly in light of the current political trends, rising protectionism in the US. Leading up to the 1985 accord, interest rates and inflation were low, but macro cycles were out of sync and exchange rates were targeted to induce macro convergence. In addition, West Germany agreed to tax cuts, the UK agreed to reduce its public expenditure and transfer monies to the private sector, while Japan agreed to open its markets to trade, liberalize its internal markets and manage its economy by a true yen exchange rate. All agreed to increase employment. Most important was that the global policy cooperation inspired corporate and household animal spirits. In a similar fashion, we would argue that the upcoming G20 Finance Ministers and Central Bank meeting in Shanghai (Feb 26-27th) offers an opportunity for policy-makers to seize the "expectations" initiative. It's probably too early to expect a Shanghai Accord, and our deep concern is that the macro and the markets may first need to worsen to inspire the correct policy response. But absent a rapid improvement in the 4C's, we believe the investment bulls will need to sit on the sidelines until a G20 meeting announces:

* * * The danger, Hartnett concludes, is that in order for officials to agree on the four measures outlined above, markets will need to collapse first. We close with BofA's simple conclusion:

|

| The Chinese Economy Is Sinking, Not Transitioning Posted: 30 Jan 2016 01:55 PM PST Submitted by Jeffrey Snider via Alhambra Investment Partners, It makes for quite the juxtaposition, though perhaps not so jarring given that global banks are still enormous and disparate operations. On the one hand, Citigroup’s CEO was eminently confident from within the confines of Davos and the status quo:

The question is who is the “we” to which he is referring? It was just a year ago that no bank would even contemplate the possibility of recession entering Janet Yellen’s perfect year, especially as it was setup by “unquestionable” growth in the middle of 2014 (best jobs market in decades). This January, however, while Citi’s CEO downplays recent turmoil, the staff inside his very own bank is thinking very much otherwise:

That’s a lot of slashing in order to be so sanguine. I don’t agree with the premise, namely that this is all or even mostly due to China (the Chinese sell their industrial production to whom?), but the condition of the Chinese economy offers more universal interpretations upon these kinds of circumstances. That starts with the idea that China is slowing but within a more cheering transition to consumer rather than investment-led activity and margins. It is this idea that manufacturing and production matter, but not nearly as much as they used to and thus not enough to make a full recessionary difference right now. After some minor encouragement in December, industrial factors in January have turned (yet again) to the depressively concerning. Today it was industrial profits.

China’s stock market is a small, relative matter; the more troubling imbalances lie and remain elsewhere. This change in production profitability is concerning on three fronts; first in terms of where China’s economy, even in just industry, might actually be at right now. GDP says slowing but rather steady; these figures and many others suggest quite the opposite.

“For the first time in more than a decade” is becoming a consistent qualifier for these sorts of economic indications. A week ago, China reported electrical output and steel production now at just such historical comparison:

Despite these dire results and measurements, there is still this tug of “consumer-led transition” that, as noted in the quote above, remains as a bulwark optimistic sentiment. It can be distilled as if an economy operates in completely discrete and replaceable fashion; as if when industry struggles then services will just continue on that much better until industry no longer matters at all; and if industry really, really struggles, consumption and the service economy should only factor a minor nuisance being so separated. There are no such Chinese walls (pun intended) within an economic system (which extends globally). That brings up the second contradiction noted by persistently decreasing industrial activity in China (and elsewhere). To this point, despite production and output cuts (and to capex and capacity growth) there has yet to be the major transition to across-the-board resource reduction, including and especially labor. In other words, consumption in China might not look as bad as production but only because there are time lags and frictions (as economists call them) that forestall synchronization even in these downward recessionary legs. Once production stalls and contracts long enough, especially in profitability terms, businesses will eventually seek to harmonize production with their resources – the very bad news of total cutbacks, including and especially pay and then labor in full.

And:

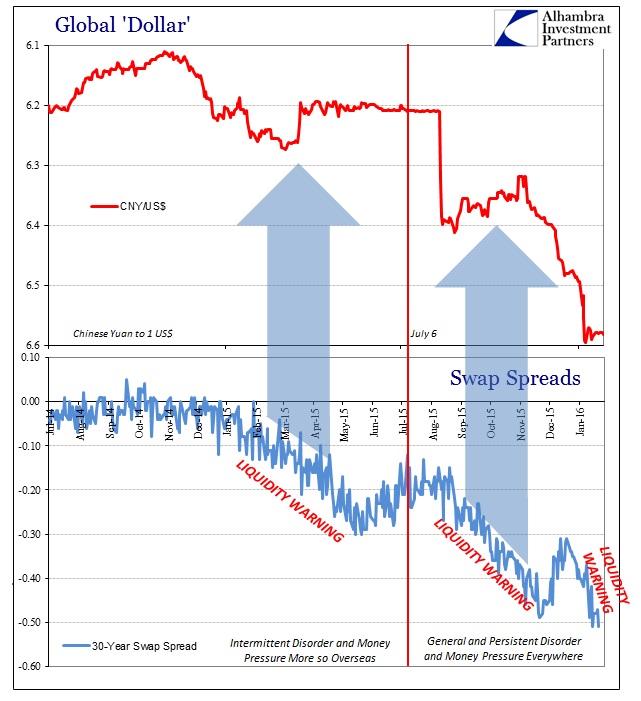

The production decay is only, perhaps, just now starting to impact the wider Chinese economy. It counts not just in resource management and eventual capitulation on those terms, but also financial terms – precisely the problem with China’s “outflows.” This is the third worrisome notice from China’s industrial profitability, namely that defaults or at least perceptions of default risk will only exacerbate an already tenuous position for China’s financial networks; especially its “dollar” short. As the eurodollar standard built China in what looked like “hot money” inflows, that created lending formation and chained liabilities predicated on China being China forever; not China placing all its hopes and dreams on an unproven and hardly-detected consumer transition (that wasn’t really specified until economists started to belatedly recognize “something” was wrong with industry where they were sure nothing ever could be wrong). There are enormous financial implications in the slowdown as it reaches unknowable trigger points, some of which we have undoubtedly already witnessed. If you are a “dollar” provider into China’s banks, as NPL’s rise with this production massacre you are not going to remain statically attached while it all seems to get worse and worse (especially as central bankers and “experts” continue to protest there isn’t anything wrong in the first place that temporary tweaks won’t alleviate).

Economics becomes finance, and finance only furthers those negative economics. Financial distress in and of China both confirms the onrushing economic disaster as it was, while suggesting, because financial imbalance has not yet relented, not even close, much more to come. Our three parts then sum to: China’s industry persists at only getting worse even though it has already reverted to a state not seen in a decade or more; consumer appearances may seem generally optimistic despite all that but only because industrial activity has yet to fully make adjustments through resources and labor; and financial trends are likely already at the stage of self-reinforcement within and without. You can see why China’s problems might trouble Citi’s economists and staff researchers in a way that perhaps the bank’s CEO might rather gloss over and around. “Our” problem is that these trends and analytics are not just for and of China. There are no discrete pockets of fortified economic resolve with which to withstand a global “manufacturing recession.” There are only interconnections between individual economic circumstances that are augmented, amplified and affected by reflexivity in financial markets and conditions. That Citigroup is now recognizing this as a very real possibility, in sharp contrast to last January’s “transitory” commandment, shows how truly far along the economic and financial disease has infiltrated – globally. After all, China’s vast industrial might was built through eurodollars to service “global consumers”, of which Americans account for the bulk; upward as well as downward. |

| BREAKING 911: Denver Coliseum Multiple People Shot Posted: 30 Jan 2016 01:48 PM PST Multiple people shot 1 stabbed at Denver Coliseum in Denver Colorado The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Welcome To The Currency War, Part 21: Japan Goes Negative; US To Return Fire In 2016 Posted: 30 Jan 2016 12:55 PM PST Well that didn’t take long. Two weeks of falling share prices and the European and Japanese central banks go into full panic mode. The ECB promised new stimulus — which the markets liked — and then BoJ upped the ante with negative interest rates — which the markets loved. Here’s a quick summary from Bloomberg:

This is a resounding admission of failure. Over the past seven years the world’s central banks have cut interest rates to levels not seen since the Great Depression and flooded their banking systems with newly-created currency, while national governments have borrowed unprecedented sums (in the US case doubling the federal debt). Yet here we are in the early stages of a global deflationary collapse. Commodity prices have followed interest rates to historic lows, while growth is anemic and may soon be nonexistent. The official response: More extreme versions of what has already failed. Here’s a JP Morgan chart published by Financial Times that shows just how sudden the trend towards negative interest rates has been: Future historians will have a ball psychoanalyzing the people making these decisions, and their conclusion will almost certainly be some variant of the popular definition of insanity as repeating the same behavior while expecting a different result. So what does this new stage of the Money Bubble mean? Many, many bad things. This latest leg down in bond yields presents savers (the forgotten victims of the QE/NIRP experiment) with an even tougher set of choices. Previously they were advised to move out on the risk spectrum by loading up on junk bonds and high-dividend equities. Now, after the past few months’ carnage in those sectors, even the most oblivious retiree is likely to balk. But having said “no thanks” to the demonstrably dangerous options, what’s left? The answer is…very little. There is literally no way remaining for a regular person to generate historically normal levels of low-risk cash income. Meanwhile, a NIRP world presents the US with a problem that perhaps only the Swiss can appreciate: As the other major countries aggressively devalue their currencies (the euro and yen are already down big versus the dollar), another round of lower interest rates and faster money printing will, other things being equal, raise the dollar’s exchange rate even further. For a sense of what that might mean, recall that US corporate profits are already falling because of a too-strong dollar (see Brace for a ‘rare’ recession in corporate profits). Bump the dollar up another 10% versus the euro, yen and yuan, and US corporate profits might fall off a cliff. The inevitable result: Before the end of the year, the US will see no alternative but to open a new front in the currency war with negative interest rates of its own. The big banks, meanwhile, are no longer feeling the central bank love. Where falling interest rates used to be good for lenders because they energized borrowers and widened loan spreads, ultra-low rates are making markets more volatile (and thus harder to profitably manipulate for bank trading desks) without bringing attractive new borrowers through the door. The result: falling profits at BofA, JP Morgan, Goldman, et al and tanking big-bank share prices. As for gold, there are now $5 trillion of bonds and bank accounts that cost about the same amount to own as bullion stored in a super-safe vault — and which cost more than gold and silver coins stored at home. Compared with the 5%-6% cash flow advantage that bonds have traditionally enjoyed versus gold, NIRP can’t help but lead savers and conservative investors to reconsider their options. In other words, what would you rather trust: A bond issued by a government (Japan, the US, Europe — take your pick) that is wildly-overleveraged and acting ever-more-erratically, or a form of money that has never in three thousand years suffered from inflation or counterparty risk? At some point in the process, a critical mass of people will get this. And no discussion of the unfolding financial mess would make complete sense if it left out the geopolitical backdrop. The Middle East is on fire and refugees are flooding the developed world, resurrecting old social pathologies (see Swedes storm occupied Stockholm train station, beat migrant children). Much of Latin America is sinking into chaos (see Caracas named as world’s most violent city and 21 of the 50 most violent cities are in Brazil). Seeing this, who in their right mind would spend thousands of dollars to visit Egypt or Rio or even Paris right now? The answer is far fewer than a decade ago. So the old reliable economic drivers of expanding global trade and enthusiastic tourism are gone for a while, if not for decades. Central banks are, as a result, swimming against a current that is far faster — in water that is far deeper — than anything seen since at least the 1930s. And all they can do is pump a bit more air into their sadly-inadequate water wings. |

| Gold And Silver Current Prices Do Not Matter Posted: 30 Jan 2016 11:17 AM PST Truth be known, short of an uprising or revolution by the masses, which is highly unlikely, the elites have won over the masses, hands down, and the end game is in the final and irreversible stages. Time and again, we have reiterated the elites formulaic strategy of Problem, Reaction, Solution. The most current is the outrageous Mid East refugee situation where European countries are being forced to accept hundreds of thousands of displaced refugees from the war-torn Middle East. It is no secret that the US has been covertly responsible for much of the destruction and strife in that area. Where not covertly involved, the US has provided arms and logistics to Saudi Arabia as the Saudis are destroying helpless Yemenis in the proxy war against Iran. |

| Gold Price Potential Upside 2016 Posted: 30 Jan 2016 11:06 AM PST The most important chart of 2016! Charts in this essay are courtesy Stockcharts.com unless indicated. |

| Andrew Napolitano - The Need For Encryption Posted: 30 Jan 2016 10:57 AM PST Judge Andrew Napolitano discusses the need for encryption. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Bron Suchecki: LBMA silver 'price' -- a perfect storm of stupidity Posted: 30 Jan 2016 06:29 AM PST 9:30a ET Saturday, January 30, 2016 Dear Friend of GATA and Gold: Whatever happened with the new London silver fix last week, the Perth Mint's Bron Suchecki wrote yesterday, it was pretty stupid and invites traders to stop using it by suggesting that there is no mechanism to keep the fix in line with the rest of the silver market. Suchecki's analysis is headlined "LBMA Silver 'Price': A Perfect Storm of Stupidity" and it's posted at the Perth Mint's research page here: http://research.perthmint.com.au/2016/01/29/lbma-silver-price-a-perfect-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Support GATA by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| No Change in Outlook for Gold and Silver 2016 Posted: 29 Jan 2016 11:53 AM PST With each passing rally hope has bloomed that the bear market in precious metals may be over. The long and deep “forever bear” has to end but it hasn’t yet. Under the surface, the bear market is getting weaker and Gold is growing stronger. It’s showing strength against foreign currencies and has broken its downtrend relative to equities. These are very positive developments and a precursor to the birth of a new bull market. However, the weak rebounds in the metals coupled with the potential for a US Dollar breakout advise us to continue to remain patient and cautious. |

| US Mint Gold Bullion Coin Sales Posted: 29 Jan 2016 11:42 AM PST Recent years have seen countless claims that gold and silver prices have to head far lower, implying demand is low or supply is high. But the actual data continues to prove this false, showing precious-metals bearishness is rooted in sentiment and not fundamentals. One fascinating microcosm of gold and silver demand comes in the form of the US Mint’s sales of its popular American Eagle bullion coins. When American investors buy physical gold and silver bullion, it’s often in the form of these American Eagle 1-ounce coins. They have a really interesting history. Back in the early 1980s, foreign national gold coins led by South Africa’s famous Krugerrand were soaring in popularity. The US Congress didn’t want the States to be left out of the prestigious national-gold-coin business, so it finally acted in 1985. |

| The Fed’s Normalization and Gold Posted: 29 Jan 2016 11:36 AM PST The Fed hike is not the end of the world. The U.S. economy experienced many tightening cycles. Actually, many analysts are citing past rate hike environments as a guide to the future. However, three things make this tightening cycle (if there are more hikes at all) unique. First, the U.S. central bank increased interest rates when the economy is actually decelerating and the manufacturing sector is in a recession. This makes new hikes less probable, while increasing the odds for the U.S. recession in the new year. Both effects are fundamentally positive for the gold market. |

| You are subscribed to email updates from Save Your ASSets First. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment