saveyourassetsfirst3 |

- Protected: Notes on Gold Stocks

- The Next Crash Could Be The Big One: “Don’t Be A Refugee In Your Own Country”

- Governments Worldwide Will Crash the First Week of October… According to 2 Financial Forecasters

- Gold Bullion Liquidation Below $1100 Hits Miners & Retailers

- The Economy Has Never Recovered And The Collapse Is Around The Corner

- SURPRISE! This is the top performing commodity so far in 2015…

- SRSRocco: Key Driver Of The Future Silver Price

- Violent Crime Is Surging In Major U.S. Cities And The Economy Is Not Even Crashing Yet

- Fresnillo raises 2015 Gold production outlook by 6.6%

- These charts explain why gold stocks are crashing

- US Gold output falls 9% Y Y in Mar: USGS

- Debt is the barbarous relic. Not gold.

- Lions, Tigers, and Gold Bears, Oh My!

- Here’s why China ‘probably’ lied about its gold reserves

- Historic Moment in Gold As Commercial Traders Go NET LONG! – Stewart Thomson

- “Bank Lives Matter” – Obama Administration Makes Another Move to Protect Profits of Criminal Mega Banks

- This is your best shot at 500% gains in today’s market

- Gold Downtrend Eyes $1,000 As Euro And FTSE Wobble

- Gold Weakened And Continues To Decline Below Support Level 1096.70

- Where to for Australian gold price

- Russians Buy Gold Again In June – Another 25 Tonnes

- Why Israel Is Going To Bomb Iran

- COMMERZBANK : Gold Seen Going Back to Boring by Chart Watchers

- Commentary: The Gold And Silver Charts

- Gold (XAUUSD) & Silver (XAGUSD) Rebound to Fresh Resistance

- Gold: Breakdown Or Simple Overshoot?

- Is gold’s 50% bull market fall the launchpad for $8,800 an ounce?

- 12 Ways The Economy Is Already In Worse Shape Than It Was During The Depths Of The Last Recession

- Making A Gold Nugget From Electronic Waste

- Gold And Silver Shortages Become Acute – Refiners Desperately Calling Jewelers Looking for Gold or Silver!

- Commodity expert: This copper miner could be about to soar

- No matter what’s in the news, these stocks just keep going higher

- Is Gold a Pet Rock or a Bedrock asset?

| Protected: Notes on Gold Stocks Posted: 22 Jul 2015 12:11 PM PDT The post Protected: Notes on Gold Stocks appeared first on The Daily Gold. | ||

| The Next Crash Could Be The Big One: “Don’t Be A Refugee In Your Own Country” Posted: 22 Jul 2015 12:00 PM PDT All the ammo has been fired… trillions and trillions… we're paper thin away from the whole thing just cracking. Submitted by Mac Slavo, SHTFPlan: Though our political leaders maintain that the contagion from Europe and China won't spread to the United States, our economy is likewise an utter catastrophe. In his latest interview with the […] The post The Next Crash Could Be The Big One: "Don't Be A Refugee In Your Own Country" appeared first on Silver Doctors. | ||

| Governments Worldwide Will Crash the First Week of October… According to 2 Financial Forecasters Posted: 22 Jul 2015 11:30 AM PDT Two well-known financial forecasters claim that virtually all governments worldwide will be hit with a gigantic economic crisis in the first week of October 2015. Both believe that the domino collapse will eventually hit the U.S., and America will end up defaulting on its debts – and falling into financial crisis. From Washington's Blog: […] The post Governments Worldwide Will Crash the First Week of October… According to 2 Financial Forecasters appeared first on Silver Doctors. | ||

| Gold Bullion Liquidation Below $1100 Hits Miners & Retailers Posted: 22 Jul 2015 11:22 AM PDT Bullion Vault | ||

| The Economy Has Never Recovered And The Collapse Is Around The Corner Posted: 22 Jul 2015 11:00 AM PDT The Collapse is Right Around the Corner…. SD Podcast Spotlight: X22Report Spotlight This interview talks about inflation, asset bubbles and what’s going on in the real economy. Possible shortages are discussed along with what bail-ins and civil unrest may mean. How much longer the status quo can continue is also discussed. Click here to […] The post The Economy Has Never Recovered And The Collapse Is Around The Corner appeared first on Silver Doctors. | ||

| SURPRISE! This is the top performing commodity so far in 2015… Posted: 22 Jul 2015 10:08 AM PDT From Frank Holmes, CEO, U.S. Global Investors: Can we really be halfway through the year? That’s what my calendar tells me, which means it’s time for the 2015 commodities halftime report. The periodic table of commodity returns, consistently one of our most popular pieces, has been updated to reflect the first half of 2015. Click on the table for a larger image. If you’d prefer your own copy of the original, simply email us. As an asset class, commodities continue to be a challenging space for investors, as they’ve faced many headwinds lately including lackluster purchasing managers’ index (PMI) numbers and a strong U.S. dollar.

Crude Pulls off Coup but Faces Strong Downward Pressure The widest expansion this year was made by none other than crude oil, the worst-performing commodity of 2014. As of June 30, oil posted gains of over 11 percent, rising to $59.47 per barrel. After falling more than 50 percent since last summer, though, it had little else to go but up. That oil claimed the top spot just highlights the reality that commodities are in a slump right now. Case in point: This week, West Texas Intermediate (WTI) retreated to $50 per barrel, putting it back in the red for the year. This move was largely in response to Greece’s debt dilemma, China’s slowdown and weakening PMI numbers. After the JPMorgan Global Manufacturing & Services PMI was released, showing a continued downtrend in manufacturing activity, oil almost immediately dropped $4. The lifting of sanctions on Iran, if approved by Congress, could also place downward pressure on WTI, with some analysts seeing it returning to the $40s range.

As the 800-pound commodity gorilla, China greatly contributes to the performance of oil. Its own PMI reading remains below the key 50 threshold, indicating that its manufacturing sector is in contraction mode. This has a huge effect on the consumption of oil and other important commodities. The good news is that the projected crude price for the remainder of 2015 should be high enough to support continued production in drilling areas such as the Bakken, Eagle Ford and Permian basins, according to the Energy Information Administration (EIA). The oil rig count, as reported by Baker Hughes, has advanced for the third consecutive week, after 29 straight weeks of declines.

You can read the rest of Frank’s Commodities Halftime Report for free right here | ||

| SRSRocco: Key Driver Of The Future Silver Price Posted: 22 Jul 2015 10:05 AM PDT Silver expert Steve St. Angelo of the SRSRocco Report sat down with Craig Hemke to break down the status of the silver market, and explains the KEY DRIVER of the future silver price in the MUST LISTEN interview below: From the SRSRocco Report: The key driver of the future silver price is discussed in my […] The post SRSRocco: Key Driver Of The Future Silver Price appeared first on Silver Doctors. | ||

| Violent Crime Is Surging In Major U.S. Cities And The Economy Is Not Even Crashing Yet Posted: 22 Jul 2015 10:00 AM PDT From coast to coast, we are witnessing a dramatic increase in violent crime, and the economy is not even crashing yet. So what is going to happen when the next great economic crisis hits us, unemployment skyrockets, and people really start hurting? From End of the American Dream: Don't let anyone tell you that […] The post Violent Crime Is Surging In Major U.S. Cities And The Economy Is Not Even Crashing Yet appeared first on Silver Doctors. | ||

| Fresnillo raises 2015 Gold production outlook by 6.6% Posted: 22 Jul 2015 09:22 AM PDT Silver production for the quarter ended 30 June grew by 2.7% to 11.3 million ounces, while gold production rose 16.8% to 181,985 ounces. | ||

| These charts explain why gold stocks are crashing Posted: 22 Jul 2015 09:05 AM PDT From Bloomberg: If only gold mine operators could flatten their debt mountains as easily as they can the real things. Mining companies built up record borrowings to boost gold output during a 12-year bull market in the metal that stopped dead in 2011. The 42 percent slump in prices since then leaves them effectively servicing the debt with devalued currency.

Output that might have fallen as gold sank has continued on to all-time highs as producers need to generate enough cash from sales at lower prices to keep up payments on what they owe. That’s squeezed profitability and share prices, with a benchmark index of 30 of the biggest precious-metals miners falling to the lowest levels since 2001, when bullion was barely a quarter of its current rate of $1,110 an ounce.

“The industry is in a shocking state,” said Mark Bristow, head of Randgold Resources Ltd., the producer with the best share performance in the past decade. “Everyone is still focused on production and not on profitability.” Growth in output has exacerbated an oversupply that makes a recovery in the bullion price harder to achieve, Bristow said.

Debt held by 15 of the biggest producers including Barrick Gold Corp. and Goldcorp Inc. hit a record $31.5 billion at the end of the first quarter, up from less than $2 billion in 2005, according to data compiled by Bloomberg Intelligence. That was spurred by the dash for growth when prices were rising, including $8.5 billion for Barrick’s mine in the Andes mountains and C$8.2 billion ($6.3 billion) for Kinross Gold Corp.’s bet on Mauritania. In the past decade, world output expanded 24 percent to last year’s 3,114 metric tons. “The whole industry is being encouraged to continue to live on hope,” Bristow said. “The question is how much cash flow do you need to expunge the debt? There’s nothing really left to create value for shareholders.” | ||

| US Gold output falls 9% Y Y in Mar: USGS Posted: 22 Jul 2015 09:00 AM PDT Based on unrounded data, the average daily gold production for U.S. mines was 509 kg in March 2015, 543 kg in February 2015, 541 kg in January 2015, and 577 kg for full-year 2014. | ||

| Debt is the barbarous relic. Not gold. Posted: 22 Jul 2015 09:00 AM PDT Governments and central banks around the world continue to hold gold as part of their official reserves. Owning gold is saving, which by definition is civilized, i.e. NOT barbarous. Debt, on the other hand, is the exact opposite. It is a lack of savings that shows a complete disregard for the future. It is the […] The post Debt is the barbarous relic. Not gold. appeared first on Silver Doctors. | ||

| Lions, Tigers, and Gold Bears, Oh My! Posted: 22 Jul 2015 08:29 AM PDT Monetary Metals | ||

| Here’s why China ‘probably’ lied about its gold reserves Posted: 22 Jul 2015 08:01 AM PDT From Matt Badiali, Editor, Stansberry Resource Report: The gold sector just took a big hit… On Friday, the People’s Bank of China published its gold reserve figure for the first time since 2009. The official announcement said the country has just 53.3 million ounces of gold. That’s less than half of what analysts expected. The news sent the gold price plummeting 16% from its January high. It’s now at a five-year low. But this may be exactly what China wants. So that begs the question: Is China lying about its gold reserves? The short answer is: probably. China is a closed society, so information is tough to get and official numbers aren’t reliable. And there are several reasons why the number should be higher. For example, when China reported its gold reserves back in 2009, it said it held about 33.9 million ounces. In its recent announcement, it said it had about 53.3 million ounces. That means China’s reserves have grown at about 3.2 million ounces per year. At that rate, it would take China until 2079 to reach the same level of gold reserves as the U.S. This is highly unrealistic. I don’t think China wants it to take that long. For starters, the president of the China Gold Association, Song Xin, said in July 2014 that China should accumulate 273 million ounces of gold to help support the renminbi as an international currency. This is more than the U.S. claims to have now. China is also gold crazy. In the past decade, it has ramped up domestic gold production. The country has been the world’s largest gold producer for the past eight years. It should be the largest this year, too. At the end of June, the chairman and secretary general of the China Gold Association, Zhang Bingnan, said the Chinese produced more than 90 million ounces of gold domestically from 2007 to April 2015. And that doesn’t include China’s gold imports. The chairman of the Shanghai Gold Exchange, Xu Luode, said China imported nearly 50 million ounces of gold in 2013. Overall, Bloomberg Intelligence, a market analytics group, believes China has around 112.8 million ounces of gold. Remember, the official announcement said the country has 53.3 million ounces. So nearly 60 million ounces of gold are missing… That’s why I believe China is “sandbagging” the market. In short, by reporting low gold reserves, China has created a lower gold price. This allows the country to import gold more cheaply. We’ve seen this type of move before… The U.S. Treasury has criticized China for years for “significantly” undervaluing its currency. You see, keeping the renminbi weaker makes China’s exports cheaper to the rest of the world. We can’t know for certain how much gold the Chinese hold. But regardless of whether or not China is lying, I still believe gold prices are likely headed higher. As I’ve shown you in these pages before, sentiment toward the metal is terrible– which points toward a bottom. And world banks are printing massive amounts of money right now. Europe, Japan, and China have all followed the U.S.’s lead in adding money to their systems to boost their economies. By doing this, they’re devaluing their currencies. For example, the euro has fallen 20% versus the dollar in the past year. With the world’s governments continuing to print more and more paper money, it will take more and more of it to buy gold. Unlike paper currency, you can’t just print more gold. There’s a finite amount of it in the world. According to market research firm Thomson Reuters’ 2015 GFMS Gold Survey, just 5.9 billion ounces of gold have been produced to date. That’s why I’m using the recent decline in gold prices as an opportunity to build up my personal gold holdings. You might want to do the same. Good investing, Matt Badiali P.S. If you’re interested in resource investing, it’s not too late to join us for the Sprott-Stansberry Vancouver Natural Resource Symposium, starting July 28. We’ve arranged a way for you to watch the entire event LIVE from the comfort of your own home. For a small fraction of the cost to attend in person – and with no more effort than turning on your computer – you’ll have the chance to hear some of the best ideas from the “best of the best” of the resource world… like Eric Sprott, chairman and founder of Sprott Asset Management… famed speculator Doug Casey… Franco-Nevada CEO David Harquail… and many, many more. Click here to see the full lineup and get all the details on how to join us online next week. | ||

| Historic Moment in Gold As Commercial Traders Go NET LONG! – Stewart Thomson Posted: 22 Jul 2015 08:01 AM PDT Gold stocks are trading lower now against gold than when gold was under $300 an ounce! As a group, gold stocks are trading like the entire sector is going "off the board". Is that going to happen? It's my professional opinion that the price and volume action on Friday, Sunday, and Monday has produced a […] The post Historic Moment in Gold As Commercial Traders Go NET LONG! – Stewart Thomson appeared first on Silver Doctors. | ||

| Posted: 22 Jul 2015 08:00 AM PDT When "guilty pleas" threatened to exclude JP Morgan and Citibank from making certain FHA–insured loans, the Department of Housing and Urban Development (HUD) immediately came to the rescue and changed its own documents without telling anyone… Submitted by Michael Krieger, Liberty Blitzkrieg: Three top Democrats are accusing the Department of Housing and Urban Development of […] The post "Bank Lives Matter" – Obama Administration Makes Another Move to Protect Profits of Criminal Mega Banks appeared first on Silver Doctors. | ||

| This is your best shot at 500% gains in today’s market Posted: 22 Jul 2015 07:49 AM PDT From Justin Brill, Editor, Stansberry Digest: There are two ways to get rich in stocks… You either compound your money over long periods of time, or you buy in early to a major bull market. Today, no sane person would say we’re anywhere near the early stages of a bull market in U.S. stocks. The S&P 500 has more than tripled from its March 2009 lows. It has also gone nearly four years – 1,383 days, to be exact – without a decline of more than 10% (an official “correction”). The current winning streak is among the greatest in history. Take a look at this chart from our colleagues at Casey Research…

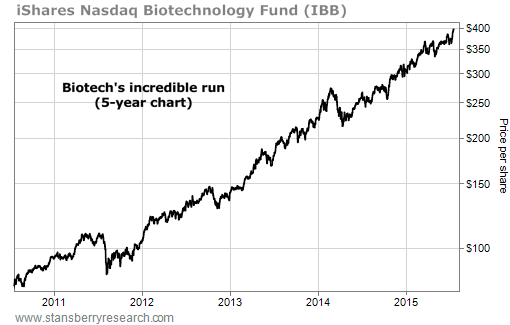

Despite the big gains, we still think there’s big money to be made in some stocks. One sector in particular could triple your money – or even more – if you get in now. Our Editor in Chief Brian Hunt is saying certain investments could soar 500% in the coming years… And longtime readers know he is one of the most conservative investors here at Stansberry Research. Before you dismiss 500% gains as impossible, consider the gains we’ve seen in biotech… Regular Digest readers know what Steve Sjuggerud says about biotech: “If you catch just one biotech bull market in your lifetime, you may never have to work again.” The last few years have proved his point… The iShares Nasdaq Biotechnology Fund (IBB) hit another new all-time high yesterday. It’s up almost 60% over the past year… and nearly 410% over the past five years…

But biotech isn’t the only sector that can gift you with an early retirement. You can also make an absolute fortune catching a major uptrend in the junior resource market. There is no bull market like a junior resource bull market. The junior resource sector consists of small companies that explore for and develop resource deposits. These are the companies that search for the next big oilfield… the next big gold mine… the next great untapped copper or uranium deposit. They often have no revenue or earnings. They are teams of geologists out looking to hit it big. As we’ve said several times in the Digest, when you catch a junior resource bull market, these stocks don’t just double or triple… They can soar thousands of percent. Consider this story from Stansberry Resource Report editor Matt Badiali…

But a run from $0.06 a share to $0.45 was only the beginning for Kaminak. As Matt continued…

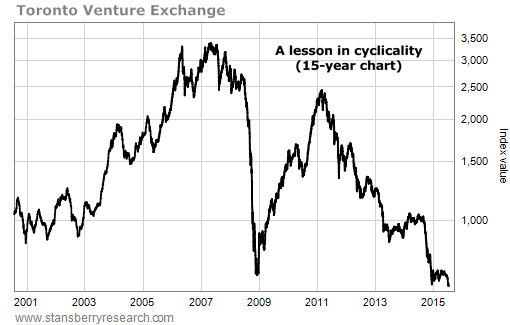

Take a look at this 15-year chart of the TSX Venture Exchange, the bellwether index for junior resource stocks. We’ve written many times about how cyclical resource stocks are. As you can see, the TSX Venture has huge busts followed by equally impressive booms…

And today, junior miners are poised to boom. As Matt explained in his anecdote, buying a sector near the bottom is scary. The news at the bottom is always terrible. Your emotions will be against you. But buying amidst extreme pessimism is how you make the greatest amount of money. Remember, Matt made 27 times his money in about one year. We think we have a similar opportunity today. There is “blood in the streets” in junior resources. It’s only a matter of time before they soar off their lows. But even if it takes more than 12 months, you can still make huge money. Around the office, we often call these companies “stock options that never expire.” As you may know, a stock option is a type of security that offers massive upside. And we’re not talking about “only 100%” upside. Stock options can return 10, 20, even 50 times your original investment. It’s not uncommon for traders to turn $10,000 into $250,000 with well-placed option trades. But while buying options gives you the potential to make giant gains, they come with some negatives, too. The biggest one is that options have finite lifespans. For example, you might buy an option contract in January that expires in June. If the outcome you expect doesn’t happen by June (known as the “expiration date”), the value of your option will be worthless, and you’ll lose 100% of the capital you place in the trade. The best junior mining stocks have the same upside as stock options. It’s not uncommon for professional mining stock investors to turn $10,000 into $250,000 by buying the right junior miner at the right time. However, these junior miners are actual businesses. They don’t “expire” like option contracts do. The right junior miners have plenty of cash on hand to fund their operations… which allows you to hold these stocks for years and get exposure to their incredible upside potential. Because the upside of these “stock options that don’t expire” is so great, placing just a small amount of your portfolio in them can produce incredible gains in a resource bull market. Placing just 1% or 2% of your portfolio in these stocks can result in a huge positive change to your overall net worth. If the global central bank experiment ends badly – and we’re certain it will – the value of paper currencies will continue to plummet. The value of “real money” (gold) will soar. And buying these “stock options that never expire” now, while they are dirt-cheap, will end up looking like a genius move. Again… the nature of the junior resource market makes it difficult for the average investor. These firms typically don’t have earnings. They don’t pay dividends. You can’t screen for the best ones. Instead of earnings or dividend yields, the junior resource sector is all about people. To succeed in this market, you must invest in people with track records of success… people who are working on projects with real potential. Achieving huge returns in this sector isn’t about “what” you know… it’s about “who” you know. If you don’t invest with the right people, you’re guaranteed to lose. And there isn’t another research firm as connected in this business as Casey Research. Led by multimillionaire speculator and best-selling author Doug Casey, Casey Research has decades of experience in this market. They know all the right people. They’ve been to all the most important projects. There might not be anyone on Earth more connected in the junior mining industry than Doug Casey. There’s a saying in the mining industry: “In the room, in the deal.” And no one has been “in the room” as many times as Doug. He has been in the business for 40 years now. Everyone knows him by name. For example, when resource investor Ian Telfer came up with the idea for Silver Wheaton, he called Doug and pitched it to him. If you’re not familiar with the company, Silver Wheaton is the world’s biggest precious-metals streaming company. It’s similar to a royalty company. Silver Wheaton collects money from more than 25 different silver and gold mines around the world. It’s considered by many to be the “Rolls-Royce of silver stocks.” And one of Doug’s biggest personal gains was with a company called Diamond Fields. He made an incredible 59,000% on the trade. He got into the deal because he is friends with a guy named Robert Friedland. If you don’t recognize the name, Friedland is the founder of Ivanhoe Mines. He has an estimated net worth of more than $1 billion. The point is, Doug – now our corporate partner – has built up a huge network of contacts… proven “boots on the ground” insiders who can share insight on these small resource companies… and who can testify that they have sound management teams and enough capital on hand to make money off their deals. Recently, Doug and his staff produced a special report called “The Top 7 Stocks That Will Soar in the Coming Gold Rally.” Right now, this is one of the most valuable lists in the investment world. Large investment funds often pay $10,000, or even $25,000, to get high-level, proprietary research like this report. But for a limited time, you can access it for a tiny fraction of the cost. By taking advantage of this special offer, you will not only get the names and ticker symbols of the elite resource stocks worthy of your capital… you will also get specific instructions on when to buy, whether or not to expect a takeover, and how much of your portfolio you should allocate to these stocks. We believe buying these stocks while prices are down – like they are right now – is one of the best speculations in the world today. If you want to make money in the junior resource space, these are the seven stocks you want to consider first. The report also comes with a subscription to Casey Research’s flagship newsletter, International Speculator. It’s the premier junior resource advisory, read by individual investors and industry insiders alike. Casey Research is about to double the price of this research. To learn more about International Speculator and see the incredible gains you can achieve in the sector (including one stock that returned more than 20,000%), click here. | ||

| Gold Downtrend Eyes $1,000 As Euro And FTSE Wobble Posted: 22 Jul 2015 07:35 AM PDT investing | ||

| Gold Weakened And Continues To Decline Below Support Level 1096.70 Posted: 22 Jul 2015 07:35 AM PDT investing | ||

| Where to for Australian gold price Posted: 22 Jul 2015 05:57 AM PDT I don't know if this is the case in other countries, but here in Australia the TV news and other media report the USD gold price, not the AUD price. The result is that often gold will only appear in the local news when the USD price does something interesting or achieves new lows or highs, when for local investors the gold price may not have changed much or moved in an opposite direction. | ||

| Russians Buy Gold Again In June – Another 25 Tonnes Posted: 22 Jul 2015 05:02 AM PDT gold.ie | ||

| Why Israel Is Going To Bomb Iran Posted: 22 Jul 2015 04:00 AM PDT Thanks to Barack Obama, it is only a matter of time before Israel feels forced to conduct a massive military strike against Iran's nuclear program. When that happens, Iran will strike back, and hundreds if not thousands of missiles will rain down on Israel. This exchange will likely spark a major regional war in the […] The post Why Israel Is Going To Bomb Iran appeared first on Silver Doctors. | ||

| COMMERZBANK : Gold Seen Going Back to Boring by Chart Watchers Posted: 22 Jul 2015 01:40 AM PDT bloomberg | ||

| Commentary: The Gold And Silver Charts Posted: 22 Jul 2015 01:15 AM PDT livetradingnews | ||

| Gold (XAUUSD) & Silver (XAGUSD) Rebound to Fresh Resistance Posted: 22 Jul 2015 12:00 AM PDT cfdtrading | ||

| Gold: Breakdown Or Simple Overshoot? Posted: 22 Jul 2015 12:00 AM PDT investing | ||

| Is gold’s 50% bull market fall the launchpad for $8,800 an ounce? Posted: 21 Jul 2015 09:33 PM PDT Will the author of ‘Hot Commodities’ and the man who spotted the boom in the sector before anybody else, Jim Rogers now start buying gold? He said earlier this year that he would when the bull market showed a 50 per cent retracement. That is to say the gold price had fallen to halfway between the $287 an ounce it was in 2000 to the $1,923 it reached in 2011. Simple logic Mr. Rogers astutely noted that he did not know a commodity market that had not corrected in this way before powering very much higher, and that has now happened. Perhaps he has already been out bargain hunting. After all that’s how this ex-hedge fund manager made another fortune in the 2000s, ahead of everybody else. He parked his money in commodities and went off for a three-year holiday with his then girlfriend and now wife. Mr. Rogers bought when nobody else was interested in commodities. And after the ‘flash crash’ of last weekend the financial columns are full of obituaries on gold. So are we to believe that after more than 5,000 years as a store of value for humanity that gold has finally been replaced by the like of Apple shares? Or has it just become horrendously oversold courtesy of the manipulation of paper derivatives? In Mr. Rogers’ famous book his chapter on gold concludes that one-day gold will have a spectacular blow-off again as mankind loses control of its printing presses. Are we about to see that day? 1975-6 precedent From 1975-6 gold under went a 50 per cent correction of the type Mr. Rogers has been waiting for and it subsequently rose in value by a factor of eight. That would give us a spike to $8,800 an ounce today. What are the alternatives and how likely do they look? Does Wall Street not look a lot like Chinese stocks did a little over a month ago? The US dollar is far too high, and look what just happened in China where the currency is dollar-linked and so also overvalued. And yet all the talk is of pushing the dollar higher with Fed interest rate cuts. Everybody knows what that does to stock market and bond markets and we have bubbles in both. Surely at this point the sane money begins to dump stocks – as Goldman Sachs suggested this week, and moves into precious metals that offer outstanding value at current price levels. Markets do move in cycles and not straight lines. | ||

| 12 Ways The Economy Is Already In Worse Shape Than It Was During The Depths Of The Last Recession Posted: 21 Jul 2015 04:01 PM PDT

#1 Back in 2008, 18 percent of all Americans kids were living in poverty. This week, we learned that number has now risen to 22 percent…

#2 In early 2008, the homeownership rate in the U.S. was hovering around 68 percent. Today, it has plunged below 64 percent. Incredibly, it has not been this low in more than 20 years. Just look at this chart – the homeownership rate has continued to plummet throughout Obama’s “economic recovery”… #3 While Barack Obama has been in the White House, government dependence has skyrocketed to levels that we have never seen before. In 2008, the federal government was spending about 37 billion dollars a year on the federal food stamp program. Today, that number is above 74 billion dollars. If the economy truly is “recovering”, why is government dependence so much higher than it was during the last recession? #4 On the chart below, you can see that the U.S. national debt was sitting at about 9 trillion dollars when we entered the last recession. Since that time, the debt of the federal government has doubled. We are on the exact same path that Greece has gone down, and what you are looking at below is a recipe for national economic suicide… #5 During Obama’s “recovery”, real median household income has actually gone down quite a bit. Just prior to the last recession, it was above $54,000 per year, but now it has dropped to about $52,000 per year… #6 Even though our incomes are stagnating, the cost of living just continues to rise steadily. This is especially true of basic things that we all purchase such as food. As I wrote about earlier this year, the price of ground beef in the United States has doubled since the last recession. #7 In a healthy economy, lots of new businesses are opening and not that many are being forced to shut down. But for each of the past six years, more businesses have closed in the United States than have opened. Prior to 2008, this had never happened before in all of U.S. history. #8 Barack Obama is constantly telling us about how unemployment is “going down”, but the truth is that the percentage of working age Americans that are either working or considered to be looking for work has steadily declined since the end of the last recession… #9 Some have suggested that the decline in the labor force participation rate is due to large numbers of older people retiring. But the reality of the matter is that we have seen a spike in the inactivity rate for Americans in their prime working years. As you can see below, the percentage of males between the ages of 25 and 54 that aren’t working and that aren’t looking for work has surged to record highs since the end of the last recession… #10 A big reason why we don’t have enough jobs for everyone is the fact that millions upon millions of good paying jobs have been shipped overseas. At the end of Barack Obama's first year in office, our yearly trade deficit with China was 226 billion dollars. Last year, it was more than 343 billion dollars. #11 Thanks to all of these factors, the middle class in America is dying. In 2008, 53 percent of all Americans considered themselves to be “middle class”. But by 2014, only 44 percent of all Americans still considered themselves to be “middle class”. When you take a look at our young people, the numbers become even more pronounced. In 2008, 25 percent of all Americans in the 18 to 29-year-old age bracket considered themselves to be “lower class”. But in 2014, an astounding 49 percent of all Americans in that age range considered themselves to be “lower class”. #12 This is something that I have covered before, but it bears repeating. The velocity of money is a very important indicator of the health of an economy. When an economy is functioning smoothly, people generally feel quite good about things and money flows freely through the system. I buy something from you, then you take that money and buy something from someone else, etc. But when an economy is in trouble, the velocity of money tends to go down. As you can see on the chart below, a drop in the velocity of money has been associated with every single recession since 1960. So why has the velocity of money continued to plummet since the end of the last recession?… If you are waiting for an “economic collapse” to happen, you can stop waiting. One is unfolding right now before our very eyes. But what most people really mean when they ask about these things is that they are wondering when the next great financial crisis will happen. And as I discussed yesterday, things are lining up in textbook fashion for one to happen in our very near future. Once the next great financial crisis does strike, all of the numbers that I just discussed above are going to get a whole lot worse. So as bad as things are now, the truth is that this is just the beginning of the pain. This article, 12 Ways The Economy Is Already In Worse Shape Than It Was During The Depths Of The Last Recession, was originally authored by Michael Snyder. He has also written two books - a novel entitled The Beginning Of The End and a new book on how to make preparations for the coming crisis entitled Get Prepared Now! | ||

| Making A Gold Nugget From Electronic Waste Posted: 21 Jul 2015 04:00 PM PDT Perth Mint Blog | ||

| Posted: 21 Jul 2015 02:30 PM PDT A client of mine, a jeweler just called. His refiner called him – looking to buy gold or silver. The refiner has very tight stock. My client buys "shots" to melt and builds into rings etc. His refiner volunteered info on the selling this am – says the system is manipulated, which shocked the client […] The post Gold And Silver Shortages Become Acute – Refiners Desperately Calling Jewelers Looking for Gold or Silver! appeared first on Silver Doctors. | ||

| Commodity expert: This copper miner could be about to soar Posted: 21 Jul 2015 12:02 PM PDT From JT Long, Executive Editor, The Gold Report: Experienced investors know that commodities and equities move in cycles, and understanding where copper, iron ore, nickel, and zinc are in the cycle can result in much smarter decisions than blindly following the pack. In this interview with The Gold Report, Salman Partners Vice President of Commodity Economics Raymond Goldie brings some perspective to the charts and names the junior mining companies that could ride the inevitable waves up.

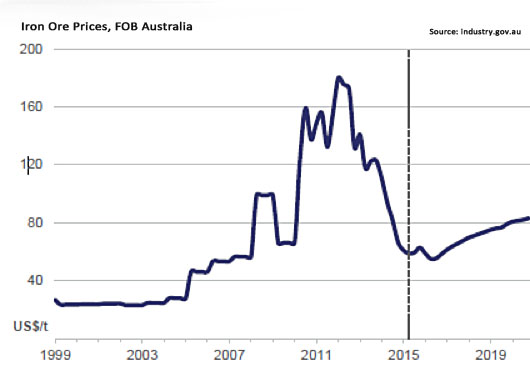

The Gold Report: You recently wrote a paper called “Stagnation: The New Paradigm?” where you put current commodity prices in perspective by showing charts going back to 1999. What happened over the last five years in iron ore and copper and what can we expect going forward? Raymond Goldie: The price of iron ore from 2011 to 2015 dropped more than 70%. If you look at the other great indicator of the mining industry – the price of copper – you find a similar, but smaller, decline over the same time period.

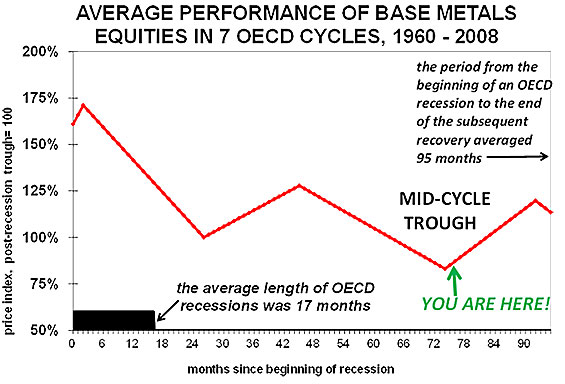

[Copper chart located above. Data: London Metal Exchange.] TGR: What were the fundamentals both behind iron ore and copper’s astronomical moves up going back to 2004 and the subsequent falls? RG: Iron ore prices really started to rise in 2008 because of increasing demand for infrastructure needs globally. Copper received added attention in China as it became seen as money right alongside gold. Chinese bankers started using copper, especially for foreign trade financing, which helped push copper prices up to levels that may not have been sustainable. In both cases, the main reason for the following shift down was that supply had increased faster than demand. Both iron ore prices and copper prices are, even at their relatively depressed levels today, higher than any price that they’d ever seen before 2006. TGR: The continuing trend lines that you have on both iron ore and copper in these charts show slow, steady growth going forward. What prices are you expecting in 2016 and beyond? RG: One of the things I’ve learned is that I’m not particularly good at forecasting prices. The forward strip markets, the futures prices on the London Metal Exchange, incorporate the aggregate of expectations and are better at forecasting prices. That seems to be calling for a steady increase in copper prices over the next 10 years. In the case of iron ore, there is no forward strip market, so I relied on the Australian government forecast. We’re at a pretty flat bottom now and the best estimate is a steady increase in iron ore prices. TGR: What would steadily increasing commodity prices mean for the commodity equities market? RG: That’s a very good question – how strong is the relationship between commodity prices and commodity equities? One of the answers is that stocks of companies that produce copper, like Freeport-McMoRan Copper & Gold Inc. (FCX), the biggest one, and some of the smaller producers – the biggest one in Canada is First Quantum Minerals Ltd. (FM:TSX) – follow the larger equity market closer than the commodity prices. One of the charts that I’ve put together shows the relative performance of the Toronto Stock Exchange diversified mining index against the overall Toronto composite index. It shows seven clear economic cycles since 1960. In every one of those cycles, equities have experienced two peaks and two troughs. One of the peaks happens as you recover from the end of the recession. Then in the middle of each cycle, those equities tend to languish and decline and form a second trough, finally running up to the cycle end peak. I believe we are at the middle of one of these mid-cycle peaks right now.

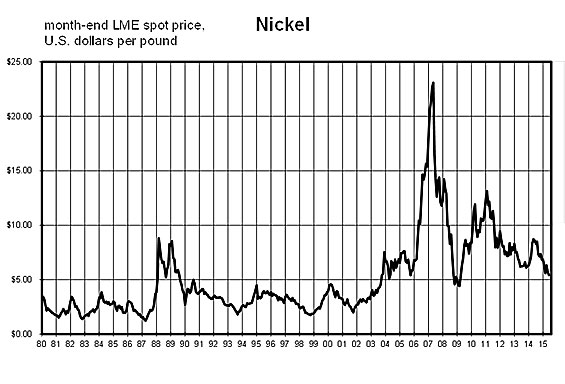

Source: TSX data, analysis by Salman Partners Inc. The index is of non-precious metals equities’ performance relative to that of the TSX Composite, recalculated to 100 being the low point in each cycle immediately after the end of the recession that began each cycle. TGR: Is there anything different about this cycle than the previous cycles? Is it acting as predicted? RG: Many have said we are experiencing uncommon demand, but if we look at the Western world’s demand for base metals in this cycle compared with some of the previous cycles, we find that the trend of the line for demand has been pretty much in the middle of previous cyclical trends. Even China’s export data is, on average, sideways. There may, indeed, be strong growth in China in demand for copper, but there’s also been strong growth in production of copper in China. The net result is that China’s impact on the rest of the world copper market is pretty flat. So it’s not a demand story. I think it’s a supply side story that is resulting in copper prices that are stronger than at any time before 2006. TGR: What is causing the lack of supply and will that continue? RG: At the beginning of every year, copper mining companies publish their production goals, and typically up to 2005, they achieved that. One of the ways they did that is by tucking away some high-grade ore so they could kick up the pounds if needed at the end of the year. But since 2005, the world’s copper industry has consistently produced 7% less copper than planned. One of the reasons we’ve had these shortfalls is that those areas of high-grade ore don’t exist anymore. They’ve been mined out. That is why we have a supply side issue at existing mines. When it comes to building new mines, not only are we not finding sparkling new copper deposits at the rate we used to, but also it takes longer to get mines into production – 12, 15, 20 years – because of new environmental compliance regulations. That is why this isn’t a typical cycle. This is a cycle constrained by government compliance and governmental regulations. TGR: Can the junior companies fill that demand in the coming cycle? RG: Many juniors have superb projects, but they’re lacking financing. Banks generally want to lend to big companies. So the juniors are sitting, waiting to be taken over or engage in a joint venture with a big company. But big company shareholders often do not want to see their companies underwriting big new expansion projects. They’d rather see that cash returned to them. TGR: What are the companies that have some money to move projects ahead? RG: First Quantum has become a big company by growing internally and through the recent takeover of Inmet Mining Corp. That big company interest will allow Cobre Panama to come on stream roughly as planned. NovaCopper Inc. (NCQ) has an equally good project. In fact, it’s smaller and higher grade. It’s in Alaska, which many people would consider to be a more stable jurisdiction than Panama, but it can’t yet get full financing. The project continues to be studied and permitted, but we don’t have the financing to bring it all the way through to production yet. The company has managed to get enough interest from investors that it’s staying alive, but it doesn’t have financing all the way through to production. Nautilus Minerals Inc. (NUS:TSX) is a small company, but it was able to find financing, largely through partnering. One of those partners is the government of Papua New Guinea, which is in for 30% of that project at the bottom of the ocean off the country’s coast. That has provided enough financing to move the project all the way through to production. TGR: Has Nautilus answered the risk question associated with underwater mining and proved it can be economical? RG: Nautilus is merging mining technology and deep ocean oil and gas drilling technology. I have confidence that the engineers have figured out a way to make it work. TGR: Are you following other copper companies? RG: Reservoir Minerals Inc. (RMC:TSX.V) has a joint venture with Freeport-McMoRan, which has named Reservoir’s Timok Project in Serbia as one of its top priorities. This is a country that has been wracked with war; only recently has there been calm. The political instability resulted in a lack of new technology used to explore ore deposits in a seasoned mining area. The Timok project combines a known occurrence of large, high-grade ore deposits with modern exploration methods to find some humdinger resources. The company is working on permitting and engineering in preparation for raising final financing. TGR: Is nickel following the same pinch-point curve™* as copper?

Source: London Metal Exchange RG: Nickel is also in a mid-cycle low, something that occurs well before the end of an economic cycle. As long as economic growth continues, we will see a recovery in the price of commodities that relate to that recovery. Nickel is one of them. In fact, I’m more optimistic about nickel than most other commodities because it is a supply side story. The demand is growing fairly consistently at about 4% or so a year. The supply side issue is that in January of 2014, the government of Indonesia, the Saudi Arabia of nickel, banned exports of raw nickel as part of a move to producing finished nickel. China had been making lots of cheap nickel from this high-grade Indonesian ore and stocked up before the door shut. We’re not quite sure when the Chinese will run out of that ore, but it’s almost certainly before the end of this year. Once that happens, a shortfall of 200,000 or 300,000 tons a year could push the price up from the current $5 a pound ($5/lb) range to something more like $11, 12 or 13/lb. Remember, the price of nickel got into the $20/lb neighborhood in 2007. TGR: What junior companies do you follow in the nickel space? RG: Royal Nickel Corp. (RNX:TSX) and Sherritt International Corp. (S:TSX) are covered by my colleague, Nik Rasskazovskiy. What’s driving the price of both companies is the nickel price. Royal Nickel has a project in Quebec and is looking for a big brother to help develop it. Sherritt is North America’s go-to play on nickel. It has operations in Cuba, Canada and Madagascar and is one of the world’s lowest-cost producers of nickel. Once we see confirmation that the Chinese have run out of Indonesian nickel ore, nickel prices will turn up, and then we could start to see joy in the share prices of Sherritt and Royal Nickel. TGR: Looming supply challenges have been reported in the zinc space. What is your outlook in that market? RG: A few months ago a lot of investors noticed that many of the big world zinc mines are closing down. Some speculated we were running out of zinc and that the price might go from the current $0.91/lb to as high as $2/lb in a couple of years. The problem is that because of that prediction, a lot of production – particularly in China, Peru and at Vedanta Resources Plc’s (VED:LSE) projects in Africa and Asia – ramped up fast. The net result is the price of zinc isn’t $2/lb. It’s about $0.91/lb and likely to stay in that range for the next few years. TGR: Are there junior companies that can still be successful? RG: Trevali Mining Corp. (TV:TSX) is one of the best zinc plays. It has a joint venture with Glencore International Plc (GLEN:LSE), the world’s biggest zinc producer and trader. Also, it has mines in Peru and Canada, so it’s already in production. Better yet, that production is low cost. Zazu Metals Corp. (ZAZ:TSX) is an Alaskan play on a zinc deposit that, fortunately, can make money at $0.94–0.95/lb. But it needs a big brother. TGR: Do you have any words of wisdom that can help investors re-engaging with the market as the summer comes to a close? RG: We have seen the bottom in copper. We are still waiting for the bottom in nickel, and zinc could be a couple of years out. I would focus on copper equities. Start with the big, liquid copper producers. That used to mean Freeport-McMoRan, but it also now has huge interests in oil and gas. I have really no idea what’s going to happen to oil and gas prices in the foreseeable future. So I turn to First Quantum, which is Canada’s go-to copper play. This is probably the best performer among base metals equities between now and the end of this year. Looking out further will be the time for other junior copper plays and then later, nickel, and even later, zinc. TGR: Thank you for your time. *Pinch-point curve™ is a term trademarked by Raymond Goldie. Raymond Goldie, vice president of commodity economics and senior mining analyst at Salman Partners, has extensive experience in the investment business, including more than 20 years as a mining analyst covering non-precious-non-ferrous and precious minerals (gold, silver, PGEs, diamonds) and fertilizer companies. In geology, Goldie holds a Bachelor of Science from Victoria University in Wellington, New Zealand; a Master of Science from McGill University; a PhD from Queens University; and a Diploma in Business Administration from the University of Toronto. | ||

| No matter what’s in the news, these stocks just keep going higher Posted: 21 Jul 2015 10:58 AM PDT From Brian Hunt and Ben Morris, DailyWealth Trader: While Chinese stocks were crashing… While natural resource stocks were hitting fresh multiyear lows… While major stock indexes were selling off hard… One of the world’s strongest uptrends didn’t miss a beat… And DailyWealth Trader readers are making money. If you understand the powerful financial secret behind this trend, you can cash in, too. Below, we cover all of the details… Selling insurance is one of the world’s greatest businesses… And understanding it is one of the world’s great investment secrets. Insurance companies collect premiums from their customers. And if they’re good at what they do, those premiums exceed what they’ll end up paying out in claims. In the meantime, they get to invest all that money. As Porter Stansberry has explained in his Investment Advisory, insurance companies get paid to use capital. “That’s a fantastic way to become very wealthy,” he wrote. Insurance stocks are also a great way to play inflation defense. Insurance companies take in current dollars… and agree to pay out claims in “future dollars.” Should inflation gradually erode the value of the U.S. dollar as some analysts expect, well-managed insurance companies will prosper. And even after more than six years, these stocks still haven’t recovered from the financial crisis. Back in 2008, investors couldn’t sell insurance stocks fast enough. Big names like AIG made promises they couldn’t keep. From its May 2007 peak to its March 2009 low, the iShares Dow Jones U.S. Insurance Fund (IAK) lost 78% of its value. The government stepped in with billions of dollars in bailouts… And insurance stocks soared. Since bottoming in 2009, these stocks are up over 300%… outpacing the S&P 500 Index by nearly 50%. Despite this big run, insurance stocks haven’t gotten even close to recovering. They’re still cheap… And there’s still a lot of upside ahead. IAK holds big-name insurance companies, like MetLife, AIG, and Aflac… It’s a diversified way to invest in insurance stocks… and it’s enjoying a long, steady uptrend. As you can see in the chart below, IAK is up 312% since its March 2009 low. It has far outpaced the S&P 500. IAK has also been impressive in the past few weeks. While the stock market was dropping, IAK was hitting new highs. That’s a major display of strength.

But even after this huge rally, insurance stocks are cheap. Over the past 20 years, the S&P 500 Insurance Index has had an average price-to-book-value (P/B) ratio of 1.65. Today, it has a P/B ratio of 1.12. IAK’s holdings are even cheaper, with an average P/B of just 1.06. (Book value is a rough measure of the liquidation value of a company’s assets. And the P/B ratio is a simple, useful measure of value for financial stocks.) These ratios are exactly where they were five years ago… But shares have doubled. This means that the values of these companies have doubled right along with share prices. So insurance stocks are cheap and they’re in a big uptrend. And shares of IAK would have to increase 56% just to get back to average valuations. If you don’t own insurance stocks yet, it’s a great time to open a position. We recommend using a 15% trailing stop to protect your capital if the trend turns. In sum, insurance is a fantastic business… And insurance stocks are historically cheap. These cheap valuations mean there’s great potential for more upside. So as long as the trend is up, ride it for profits. Regards, Brian Hunt and Ben Morris | ||

| Is Gold a Pet Rock or a Bedrock asset? Posted: 21 Jul 2015 08:20 AM PDT The story that should be investigated is why paper markets are not reflecting rising investment demand for the physical metal. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

_FF5R8ERF1U.png)

No comments:

Post a Comment