Gold World News Flash |

- Bill Fleckenstein – Bubblevision Tries To Keep The Dream Alive As The Mainstream Media And Bullion Banks Bash Gold

- Gold, Silver, Equities: Megaphone Patterns

- The Collapse Of The U.S. Retirement Market & Epic Rise In The Price Of Gold

- Legendary Pierre Lassonde: A Spectacular Turn In The Gold Market Is Coming – China And India Will Be The Key

- Forecasting The U.S. Economic Collapse

- Gold and Silver 'Owners Per Ounce' - Free Markets at Work

- A Middle-East Game Of Thrones

- Citi Predicts HYPERINFLATION in Greece by 2017!

- The Price of Gold Closed Down $12 Today Ending at $1,091.40

- China's Record Dumping Of US Treasuries Leaves Goldman Speechless

- Peter Schiff: Currencies Depend On Faith, Gold Doesn't

- What Do Greece and Louisiana Have in Common? The War on Cash

- Currencies Depend on Faith, Gold Doesn’t

- Gold Daily and Silver Weekly Charts - Falling, Coiling - The Slow Blues

- Hackers Can Now take Over Moving Cars Remotely

- Gold Price Hits a 5-Year Low: How to Time the Next MAJOR Bottom

- The Fed’s “Mission Accomplished”

- In The News Today

- Jim’s Mailbox

- The Global Monetary Elites Are Being “Rope-a-doped”

- We Are Now All Prisoners of the Information Age

- Prepare Now for 9.0 Earthquake -- Quick Tips

- Currencies Depend on Faith, Gold Doesnt

- Silver and the Deflation Thesis

- Seth Lipsky in The Wall Street Journal: Fifty years of debasing money

- The JFK UFO Connection - Robert Morningstar

- Currencies Depend on Faith, Gold Doesn't

- Bron Suchecki: What's the spin on the gold smash?

- Gold's plunge sparks retail demand in China, India

- Silver and the Deflation Thesis

- Gold Price Crash - Trend Forecast 2015, Gold Stocks Buying Opportunity?

- US Dollar Breakout

- David Morgan Talks Silver

| Posted: 23 Jul 2015 12:30 AM PDT from KingWorldNews:

The latest earnings season has clearly been no great shakes, and there have been a number of disappointments, but the tape has still been able to hold itself together. Thus, one of the things I wanted to see today was how the overall market responded to the disappointment from Apple, on top of the others we have seen. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, Silver, Equities: Megaphone Patterns Posted: 22 Jul 2015 11:01 PM PDT Examine the 20 year log scale chart of monthly gold. I have drawn lines connecting highs and lows. The result is an expanding channel or megaphone pattern. The increasing prices are exponential... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Collapse Of The U.S. Retirement Market & Epic Rise In The Price Of Gold Posted: 22 Jul 2015 10:00 PM PDT SRSRocco Report | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2015 08:20 PM PDT from Kingworldnews:

It's all about the dollar right now. The U.S. is the only economy in the world that's growing and everybody is fearing the collapse of their currencies, so they are all moving into the dollar. As long as the dollar is 'king,' gold is going to struggle. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Forecasting The U.S. Economic Collapse Posted: 22 Jul 2015 07:40 PM PDT from Fabian4Liberty: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver 'Owners Per Ounce' - Free Markets at Work Posted: 22 Jul 2015 06:46 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2015 06:15 PM PDT Submitted by Patrick J Buchanan, As President Obama’s nuclear deal with Iran is compared to Richard Nixon’s opening to China, Bibi Netanyahu must know how Chiang Kai-shek felt as he watched his old friend Nixon toasting Mao in Peking. The Iran nuclear deal is not on the same geostrategic level. Yet both moves, seen as betrayals by old U.S. allies, were born of a cold assessment in Washington of a need to shift policy to reflect new threats and new opportunities. Several events contributed to the U.S. move toward Tehran. First was the stunning victory in June 2013 of President Hassan Rouhani, who rode to power on the votes of the Green Revolution that had sought unsuccessfully to oust Mahmoud Ahmadinejad in 2009. Rouhani then won the Ayatollah’s authorization to negotiate a cutting and curtailing of Iran’s nuclear program, in return for a U.S.-U.N. lifting of sanctions. As preventing an Iranian bomb had long been a U.S. objective, the Americans could not spurn such an offer. Came then the Islamic State’s seizure of Raqqa in Syria, and Mosul and Anbar in Iraq. Viciously anti-Shiite as well as anti-American, ISIS made the U.S. and Iran de facto allies in preventing the fall of Baghdad. But as U.S. and Iranian interests converged, those of the U.S. and its old allies — Saudi Arabia, Israel and Turkey — were diverging. Turkey, as it sees Bashar Assad’s alliance with Iran as the greater threat, and fears anti-ISIS Kurds in Syria will carve out a second Kurdistan, has been abetting ISIS. Saudi Arabia sees Shiite Iran as a geostrategic rival in the Gulf, allied with Hezbollah in Lebanon, Assad in Damascus, the Shiite regime in Iraq and the Houthis in Yemen. It also sees Iran as a subversive threat in Bahrain and the heavily Shiite oil fields of Saudi Arabia itself. Indeed, Riyadh, with the Sunni challenge of ISIS rising, and the Shiite challenge of Iran growing, and its border states already on fire, does indeed face an existential threat. And, so, too, do the Gulf Arabs. Uneasy lies the head that wears a crown in the Middle East today. The Israelis, too, see Iran as their great enemy and indispensable pillar of Hezbollah. For Bibi, any U.S.-Iran rapprochement is a diplomatic disaster. Which brings us to a fundamental question of the Middle East. Is the U.S.-Iran nuclear deal and our de facto alliance against ISIS a temporary collaboration? Or is it the beginning of a detente between these ideological enemies of 35 years? Is an historic “reversal of alliances” in the Mideast at hand? Clearly the United States and Iran have overlapping interests. Neither wants all-out war with the other. For the Americans, such a war would set the Gulf ablaze, halt the flow of oil, and cause a recession in the West. For Iran, war with the USA could see their country smashed and splintered like Saddam’s Iraq, and the loss of an historic opportunity to achieve hegemony in the Gulf. Also, both Iran and the United States would like to see ISIS not only degraded and defeated, but annihilated. Both thus have a vested interest in preventing a collapse of either the Shiite regime in Baghdad or Assad’s regime in Syria. And, thus, Syria is probably where the next collision is going to come between the United States and its old allies. For Turkey, Saudi Arabia and Israel all want the Assad regime brought down to break up Iran’s Shiite Crescent and inflict a strategic defeat on Tehran. But the United States believes the fall of Assad means the rise of ISIS and al-Qaida, a massacre of Christians, and the coming to power of a Sunni terrorist state implacably hostile to us. Look for the Saudis and Israelis, their agents and lobbies, their think tanks and op-ed writers, to begin beating the drums for the United States to bring down Assad, who has been “killing his own people.” The case will be made that this is the way for America to rejoin its old allies, removing the principal obstacle to our getting together and going after ISIS. Once Assad is gone, the line is already being moved, then we can all go after ISIS. But, first, Assad. What is wrong with this scenario? A U.S. no-fly zone, for example, to stop Assad’s barrel bombs, would entail attacks on Syrian airfields and antiaircraft missiles and guns. These would be acts of war, which would put us into a de facto alliance with the al-Qaida Nusra Front and ISIS, and invite retaliations against Americans by Hezbollah in Beirut, and the Shiite militia in Baghdad. Any U.S.-Iran rapprochement would be dead, and we will have been sucked into a war to achieve the strategic goals of allies that are in conflict with the national interests of the United States. And our interests come first. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Citi Predicts HYPERINFLATION in Greece by 2017! Posted: 22 Jul 2015 05:30 PM PDT Hyperinflation would probably happen with the Drachma. As for the timing, it's hard to tell; within 5 years. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Price of Gold Closed Down $12 Today Ending at $1,091.40 Posted: 22 Jul 2015 04:45 PM PDT

The SILVER PRICE chart diverges from the gold price chart right plainly. First, on the five day chart, silver's low occurred on Monday (before New York Trading). The rest of the week has been flat. Today's high reached $14.86, the low only $14.59. Silver lost 5.5 cents today (0.4%) to a Comex close at $14.714.

Sooner or later, all hidden things are made known. In early (Asian time) trading on 19 July) somebody dumped $2.7 billion in sales orders into the futures market, causing gold's flash crash. Nothing new about this, whether it is simply predatory High Frequency Traders or Nice Government Men. Read about it on Zero Hedge at http://bit.lay/1LDbVMn Remember: these shenanigans only work at the margin, and passingly. Manipulators can't alter primary market trend, and if silver and gold weren't already weak and trending downward, these tricks would hardly work at all. Feels like being in a prison camp. As long as they have you in the camp, you can't hit the guards, but one day, one day, you'll get out. It will be payday someday. Stocks lost ground again. Dow backed up 69.42 (0.39%) while the S&P50 crawfished 5.19 (0.24%) to 2,114.02. That leaves the Dow below its 50 DMA (17974.80) and 20 DMA (17851.04). S&P500 remains above both. Dow Composite never rose as high as the 200 DMA in this recent rally, and turned down 4 days ago. Nasdaq Composite and 100 appear to have turned solidly down. US Dollar Index regained 24 basis points (0.25%) to close at 97.67, but this is like unbreaking eggs. Once you break an uptrend, the correction has to complete itself before another upleg can begin. Two days ain't enough. Dollar Index may rise higher later, but for a few days it will be doing penance for previous pride. I'm not going to talk about the euro and yen, they're just too dull to stand. Euro lost 0.18% to $1.0918 while the yen lost 0.09%. Bonds have been rising the last seven days, so somebody is rolling out of risk and into safety. Listen, y'all, I know it sounds utterly laughable that anybody would seek safety in US dollars, much less US government bonds. I'm not offering the statement for the truth of the matter, but for their state of mind. If, as some say, we are locked in deflation, you couldn't prove it by copper or oil today, since both rose Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China's Record Dumping Of US Treasuries Leaves Goldman Speechless Posted: 22 Jul 2015 04:40 PM PDT On Friday, alongside China's announcement that it had bought over 600 tons of gold in "one month", the PBOC released another very important data point: its total foreign exchange reserves, which declined by $17.3 billion to $3,694 billion.

We then put China's change in FX reserves alongside the total Treasury holdings of China and its "anonymous" offshore Treasury dealer Euroclear (aka "Belgium") as released by TIC, and found that the dramatic relationship which we first discovered back in May, has persisted - namely virtually the entire delta in Chinese FX reserves come via China's US Treasury holdings. As in they are being aggressively sold, to the tune of $107 billion in Treasury sales so far in 2015.

We explained all of his on Friday in "China Dumps Record $143 Billion In US Treasurys In Three Months Via Belgium", and frankly we have been surprised that this extremely important topic has not gotten broader attention. Then, to our relief, first JPM noticed. This is what Nikolaos Panigirtzoglou, author of Flows and Liquidity had to say on the topic of China's dramatic reserve liquidation

JPM conclusion is actually quite stunning:

Incidentally, $520 billion is roughly triple what implied Treasury sales would suggest as China's capital outflow, meaning that China is also liquidating some other USD-denominated asset(s) at a feverish pace. So far we do not know which, but the chart above and the magnitude of the Chinese capital outflow is certainly the biggest story surrounding the world's most populous nation: what is happening in its stock market is just a diversion. At this point JPM goes into a tangent explaining what the practical implications of a massive capital outflow from China are for the global economy. Regular readers, especially those who have read our previous piece on the collapse in the Petrodollar, the plunge in EM capital inflows, and their impact on capital markets and global economies can skip this part. Those for whom the interplay of capital flows and the global economy are new, are urged to read the following:

Summarizing the above as simply as possible: for all those confounded by why not only the US, but the global economy, hit another brick wall in Q1 the answer was neither snow, nor the West Coast strike, nor some other, arbitrary, goal-seeked excuse, but China, and specifically over half a trillion in still largely unexplained Chinese capital outflows. * * * But wait, because it wasn't just JPM whose attention perked up over the weekend. This morning Goldman Sachs itself had a note titled "the Curious Case of China's Capital Outflows":

Granted, this is smaller than JPM's $520 billion number but this also captures a far shorter time period. Annualizing a $224 billion outflow in one quarter would lead to a unprecedented $1 trillion capital outflow out of China for the year. Needless to say, a capital exodus of that pace and magnitude would suggest that something is very, very wrong with not only China's economy, but its capital markets, and last but not least, its capital controls, which prohibit any substantial outbound capital flight (at least for ordinary people, the Politburo is clearly exempt from the regulations for the "common folk"). Back to Goldman:

In other words, for once Goldman is speechless, however it is quick to point out that what traditionally has been a major source of reserve reflow, the Chinese current and capital accounts, is no longer there. It also means that what may have been one of the biggest drivers of DM FX strength in recent years, if only against the pegged Renminbi, is suddenly no longer present. While the implications of this on the global FX scene are profound, they tie in to what we said last November when explaining the death of the petrodollar. For the most part, the country most and first impacted from this capital outflow will be China, something its stock market has already noticed in recent weeks. But what is likely the take home message for non-Chinese readers from all of this, is that while there has been latent speculation over the years that China will dump US treasuries voluntarily because it wants to (as punishment or some other reason), suddenly China is forced to liquidate US Treasury paper even though it does not want to, merely to fund a capital outflow unlike anything it has seen in history. It still has a lot of 10 Year paper, aka FX reserves, left: about $1.3 trillion at last check, however this raises two critical questions: i) what happens to 10 Year rates when whoever has been absorbing China's Treasury dump no longer bids the paper and ii) how much more paper can China sell before the entire world starts paying attention, besides just JPM and Goldman... and this website of course. Finally, if China's selling is only getting started, just what does this mean for future Fed strategy. Because one can easily forget a rate hike if in addition to rising short-term rates, China is about to dump a few hundred billion in paper on a vastly illiquid market. Or let us paraphrase: how soon until QE 4? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peter Schiff: Currencies Depend On Faith, Gold Doesn't Posted: 22 Jul 2015 04:00 PM PDT Submitted by Peter Schiff via Euro Pacific Capital, In his July 17th Blog, Let's Get Real About Gold, author and Wall Street Journal columnist Jason Zweig likened investor interest in gold with the "Pet Rock" craze of the 1970's, when consumers became convinced that a rock in a box would provide continuous companionship, elevate their social standing, and give them something hip to talk about at parties. Zweig asserts that investor faith in gold, which he argues is just another inert mineral with good marketing, is similarly irrational, and has kept people from putting money in the much more lucrative stock market. First off, Zweig's comparison of gold to equities as an investment vehicle sets up a false dichotomy. Gold is not an investment. It is, as Zweig indicates, nothing but a rock. But it is a rock that is extremely scarce, with highly desirable physical properties that have resulted in its being used as money for all of recorded human history. As a result, it should not be compared to stocks or real estate, but to other forms of money, such as any one of a number of fiat currencies now in circulation. Ironically, in a world awash in fiat currencies that are created at an ever increasing pace, and whose value is solely derived from faith in the issuing state, gold is the only form of money whose value does not require a leap of faith. I have no emotional attachment to gold. I don't use it to cover my walls, I don't run my fingers through it and laugh, I don't ask my wife to paint herself with it. What I do know is that before the world moved to a fiat monetary system in the latter half of the 20th Century, gold had become the money of choice for nearly every major culture in every age. This supremacy was based on gold's scarcity, its versatility as a metal, its unique and useful properties, its beauty, and its wide cultural acceptance as a hallmark of love, permanence, wealth and success. There can be little doubt that people will always be willing to desire and accumulate gold...for any of a variety of reasons. The only question is how much they will be willing to pay. On that point, reasonable minds can differ. But to imply that gold has no more intrinsic value than a pet rock, is to recklessly ignore reality. Up until 1971, the U.S. dollar was backed by the faith that the government would redeem its notes in gold. But, since then, that faith has been replaced by a simpler faith that others will always accept U.S. dollars in exchange for goods and services of real value. The transformation put the U.S. dollar in the same basket as all the other fiat currencies in the world whose value stems from the faith in the issuing government. In his piece, Zweigseems to assume that holding currencies is not an act of faith. But clearly this too involves a question of degree. Most investors would certainly prefer gold to Argentine Pesos, Ghanaian Cedis, or Venezuelan Bolivars. In reality, what Zweig is saying is that good fiat currencies (the U.S. dollar being the gold standard of fiat currencies) require no faith to buy and hold. But why is that? But the dollar's strength is supposed to derive from faith that the U.S. government will remain fiscally sound. There is little evidence that this will be the case. All of the traditional factors that determine a currency's value, i.e. trade balances, interest rates, government debt levels, economic growth, etc. should be putting downward pressure on the dollar. The U.S. government has done nothing to solve the nation's long-term debt crisis. Even the Congressional Budget Office admits that the Federal deficit will increase by an average of $35 billion annually until the end of the decade. By 2025, Trillion dollar plus deficits become entrenched (and those projections are based on economic growth assumptions that currently have proven to be far too optimistic.) Despite all this, the dollar has surged close to a 10-year high, based on the Bloomberg Dollar Spot Index. Wall Street has explained the dominance by pointing to troubles in Europe and Asia, saying that the dollar has its problems, but it is the "cleanest dirty shirt in the hamper." Analysts pointed to the expected higher interest rates from the Fed that would under-gird demand for the dollar as other central banks around the world were lowering rates. But that outcome has yet to materialize. At the end of 2014 most investors had assumed that the Fed would begin raising rates in the First Quarter of 2015. But disappointing economic growth has led the Fed to continuously delay lift off. Nevertheless, investors still think that the hikes are just around the corner. In reaching this conclusion, they blindly accept that our economy can survive higher rates when all the objective evidence leads to the conclusion that it can't. In reality, faith in the dollar is based solely on the belief that the U.S. dominance of the global economy will continue indefinitely, no matter how deeply we go into debt, how low our interest rates remain, and how unbalanced our trade becomes. We have seen this movie before. When confidence in the infallibility of central bankers is high,mainstream voices tend to cast aside gold and put their faith in the judgment of man. In 1999, New York Times columnist Floyd Norris penned an article entitled, "Who Needs Gold When We Have Alan Greenspan?" Despite Norris' dismissal, the real answer to that question was "everyone". In the following 12 years, at its high, gold rallied 650%. From my perspective, the markets are now placing more misplaced faith in the wisdom of Janet Yellen than they had in Greenspan. As a result, gold is being shunned as it was back in 1999. Alan Greenspan's penchant for easing monetary policy to prop up financial markets led to the creation of two dangerous bubbles, the first in stocks in 2000, and then in real estate, which finally burst in 2007, leading to the Great Recession. Given that the easing of monetary policy made by Greenspan's successors has been much larger, one can only imagine what may be the enormity ofan economic disaster that looms on the horizon. So yes, in a way my investment decisions are based on faith, but not the same type of faith that the Wall Street Journal assumes. My faith is that governments and central banks will continue to run up debt and debase currencies until a crisis brings the whole experiment to a disastrous conclusion. There is simply no historical precedent to reach any other conclusion. I also have faith that human beings will always prefer a piece of gold to a stack of paper. Separate a paper currency from its perceived value and you just have a stack of paper and ink. However, if they would just print it on softer and absorbent stock and put it on rolls, it might have some intrinsic value if we run out of toilet paper. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What Do Greece and Louisiana Have in Common? The War on Cash Posted: 22 Jul 2015 03:44 PM PDT More and more institutions are trying to make it harder for you to move your money into cash.

Globally, over $5 trillion in debt currently have negative yields in nominal terms, meaning the bond literally has a negative yield when it trades. In the simplest of terms this means that investors are PAYING to own these bonds.

Bonds are not unique in this regard. Switzerland, Denmark and other countries are now charging deposits at their banks. In France and Italy, you are not allowed to make cash transactions above €1,000.

This sounds laughable to most people, but it is a reality in Europe… and in the US, in some regions. Louisiana has made it illegal to purchase second hand goods using cash.

This is just the beginning. The War on Cash will be spreading in the coming weeks. The reasoning is simple. Most large financial entities are insolvent. As a result, if a significant amount of digital money is converted into actual physical cash, the firm would very quickly implode.

This is precisely what happened in 2008…

When the 2008 Crisis hit, one of the biggest problems for the Central Banks was to stop investors from fleeing digital wealth for the comfort of physical cash. Indeed, the actual “thing” that almost caused the financial system to collapse was when depositors attempted to pull $500 billion out of money market funds.

A money market fund takes investors’ cash and plunks it into short-term highly liquid debt and credit securities. These funds are meant to offer investors a return on their cash, while being extremely liquid (meaning investors can pull their money at any time).

This works great in theory… but when $500 billion in money was being pulled (roughly 24% of the entire market) in the span of four weeks, the truth of the financial system was quickly laid bare: that digital money is not in fact safe.

To use a metaphor, when the money market fund and commercial paper markets collapsed, the oil that kept the financial system working dried up. Almost immediately, the gears of the system began to grind to a halt.

When all of this happened, the global Central Banks realized that their worst nightmare could in fact become a reality: that if a significant percentage of investors/ depositors ever tried to convert their “wealth” into cash (particularly physical cash) the whole system would implode.

None of these issues have been resolved. The big banks remain as leveraged as ever and at risk of implosion should a significant percentage of capital get pulled into physical cash.

European banks as a whole are leveraged at 26 to 1. In simple terms, this means they have just €1 in capital for every €26 in assets (bought via borrowed money).

This is why whenever things get messy in Europe, the ECB and EU begin implementing capital controls.

Consider what recently happened in Greece. Depositors began to flee the banks in droves, so they declared a bank holiday. This holiday included safe deposit boxes… so all the bullion or physical cash Greeks had stashed there remained locked up… just like the “digital” money in their savings accounts.

Again, it was impossible to get cash out of the banks… even cash that technically wasn’t “in the system” anymore but sitting in safe deposit banks.

The US financial system isn’t any better. Indeed, the vast majority of it is in digital money. Actual currency is just a little over $1.36 trillion. Bank accounts are $10 trillion. Stocks are $20 trillion and Bonds are $38 trillion.

And at the top of the heap are the derivatives markets, which are over $220 TRILLION.

If you think the banks aren’t terrified of what this market could do to them, consider that JP Morgan managed to get Congress to put the US taxpayer on the hook for it derivatives trades.

Mind you, this is the same bank that is now refusing to let clients store cash in safe deposit boxes.

This is just the tip of the iceberg. As anyone can tell you, it’s all but impossible to move large amounts of money into cash in the US. Even the large banks will routinely ask you for 24 hours notice if you need $10,000 or more in cash. These are banks will TRLLLIONS of dollars worth of assets on their books.

This is just the beginning.

Indeed, we've uncovered a secret document outlining how the Fed plans to incinerate savings.

We detail this paper and outline three investment strategies you can implement right now to protect your capital from the Fed's sinister plan in our Special Report Survive the Fed's War on Cash.

We are making 1,000 copies available for FREE the general public.

To pick up yours, swing by…. http://www.phoenixcapitalmarketing.com/cash.html

Best Regards Phoenix Capital Research

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Currencies Depend on Faith, Gold Doesn’t Posted: 22 Jul 2015 02:53 PM PDT This post Currencies Depend on Faith, Gold Doesn’t appeared first on Daily Reckoning. In his July 17th Blog, Let’s Get Real About Gold, author and Wall Street Journal columnist Jason Zweig likened investor interest in gold with the “Pet Rock” craze of the 1970’s, when consumers became convinced that a rock in a box would provide continuous companionship, elevate their social standing, and give them something hip to talk about at parties. Zweig asserts that investor faith in gold, which he argues is just another inert mineral with good marketing, is similarly irrational, and has kept people from putting money in the much more lucrative stock market. First off, Zweig’s comparison of gold to equities as an investment vehicle sets up a false dichotomy. Gold is not an investment. It is, as Zweig indicates, nothing but a rock. But it is a rock that is extremely scarce, with highly desirable physical properties that have resulted in its being used as money for all of recorded human history. As a result, it should not be compared to stocks or real estate, but to other forms of money, such as any one of a number of fiat currencies now in circulation. Ironically, in a world awash in fiat currencies that are created at an ever increasing pace, and whose value is solely derived from faith in the issuing state, gold is the only form of money whose value does not require a leap of faith. I have no emotional attachment to gold. I don’t use it to cover my walls, I don’t run my fingers through it and laugh, I don’t ask my wife to paint herself with it. What I do know is that before the world moved to a fiat monetary system in the latter half of the 20th Century, gold had become the money of choice for nearly every major culture in every age. This supremacy was based on gold’s scarcity, its versatility as a metal, its unique and useful properties, its beauty, and its wide cultural acceptance as a hallmark of love, permanence, wealth and success. There can be little doubt that people will always be willing to desire and accumulate gold…for any of a variety of reasons. The only question is how much they will be willing to pay. On that point, reasonable minds can differ. But to imply that gold has no more intrinsic value than a pet rock, is to recklessly ignore reality. Up until 1971, the U.S. dollar was backed by the faith that the government would redeem its notes in gold. But, since then, that faith has been replaced by a simpler faith that others will always accept U.S. dollars in exchange for goods and services of real value. The transformation put the U.S. dollar in the same basket as all the other fiat currencies in the world whose value stems from the faith in the issuing government. In his piece, Zweig seems to assume that holding currencies is not an act of faith. But clearly this too involves a question of degree. Most investors would certainly prefer gold to Argentine Pesos, Ghanaian Cedis, or Venezuelan Bolivars. In reality, what Zweig is saying is that good fiat currencies (the U.S. dollar being the gold standard of fiat currencies) require no faith to buy and hold. But why is that? But the dollar’s strength is supposed to derive from faith that the U.S. government will remain fiscally sound. There is little evidence that this will be the case. All of the traditional factors that determine a currency’s value, i.e. trade balances, interest rates, government debt levels, economic growth, etc. should be putting downward pressure on the dollar. The U.S. government has done nothing to solve the nation’s long-term debt crisis. Even the Congressional Budget Office admits that the Federal deficit will increase by an average of $35 billion annually until the end of the decade. By 2025, Trillion dollar plus deficits become entrenched (and those projections are based on economic growth assumptions that currently have proven to be far too optimistic.) Despite all this, the dollar has surged close to a 10-year high, based on the Bloomberg Dollar Spot Index. Wall Street has explained the dominance by pointing to troubles in Europe and Asia, saying that the dollar has its problems, but it is the “cleanest dirty shirt in the hamper.” Analysts pointed to the expected higher interest rates from the Fed that would under-gird demand for the dollar as other central banks around the world were lowering rates. But that outcome has yet to materialize. At the end of 2014 most investors had assumed that the Fed would begin raising rates in the First Quarter of 2015. But disappointing economic growth has led the Fed to continuously delay lift off. Nevertheless, investors still think that the hikes are just around the corner. In reaching this conclusion, they blindly accept that our economy can survive higher rates when all the objective evidence leads to the conclusion that it can’t. In reality, faith in the dollar is based solely on the belief that the U.S. dominance of the global economy will continue indefinitely, no matter how deeply we go into debt, how low our interest rates remain, and how unbalanced our trade becomes. We have seen this movie before. When confidence in the infallibility of central bankers is high,mainstream voices tend to cast aside gold and put their faith in the judgment of man. In 1999, New York Times columnist Floyd Norris penned an article entitled, “Who Needs Gold When We Have Alan Greenspan?” Despite Norris’ dismissal, the real answer to that question was “everyone”. In the following 12 years, at its high, gold rallied 650%. From my perspective, the markets are now placing more misplaced faith in the wisdom of Janet Yellen than they had in Greenspan. As a result, gold is being shunned as it was back in 1999. Alan Greenspan’s penchant for easing monetary policy to prop up financial markets led to the creation of two dangerous bubbles, the first in stocks in 2000, and then in real estate, which finally burst in 2007, leading to the Great Recession. Given that the easing of monetary policy made by Greenspan’s successors has been much larger, one can only imagine what may be the enormity ofan economic disaster that looms on the horizon. So yes, in a way my investment decisions are based on faith, but not the same type of faith that the Wall Street Journal assumes. My faith is that governments and central banks will continue to run up debt and debase currencies until a crisis brings the whole experiment to a disastrous conclusion. There is simply no historical precedent to reach any other conclusion. I also have faith that human beings will always prefer a piece of gold to a stack of paper. Separate a paper currency from its perceived value and you just have a stack of paper and ink. However, if they would just print it on softer and absorbent stock and put it on rolls, it might have some intrinsic value if we run out of toilet paper. Regards, Peter Schiff P.S. This article was originally posted at Euro-Pacific Capital, right here. The post Currencies Depend on Faith, Gold Doesn’t appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Falling, Coiling - The Slow Blues Posted: 22 Jul 2015 01:33 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hackers Can Now take Over Moving Cars Remotely Posted: 22 Jul 2015 01:00 PM PDT Hacking is the least of our worries. What about when the cars get smart enough to become self-aware? Haven't you people seen "Maximum Overdrive"!?! The End is coming!! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Hits a 5-Year Low: How to Time the Next MAJOR Bottom Posted: 22 Jul 2015 12:49 PM PDT See this surprising "central banks indicator" of big reversals in gold prices "In what traders called a 'bear raid,' sellers on Monday dumped an estimated 33 tonnes of gold in just two minutes on exchanges in Shanghai and New York, sending prices on a nearly $50 downward spiral from which they never fully recovered." (Reuters, July 21) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fed’s “Mission Accomplished” Posted: 22 Jul 2015 12:25 PM PDT This post The Fed’s “Mission Accomplished” appeared first on Daily Reckoning. Give the Federal Reserve its due: It's managed to reinflate the housing bubble. Sort of. Sales of existing homes have returned to levels last seen in February 2007, says the National Association of Realtors (NAR) this morning. Heh — we'll pause to note February 2007 was the first time a big bank booked a loss on subprime mortgage securities and the start of the housing meltdown became apparent to anyone with a pulse. In any event, existing home sales rose 3.2% in June, on top of a 4.5% jump in May. The year-over-year gain is 9.6%. So, not bad. A caveat: The National Association of Realtors has a history of fudging this number. We exposed the scandal in real-time during 2011. The NAR did not use MLS listings as its reference point. Nor did it rely on county courthouse filings. Instead of tangible figures like those, it relied on a statistical model keyed to the 2000 Census, making various assumptions about population growth after 2000. A few days before Christmas 2011 — a time when presumably no one would notice — the NAR revised its figures going back to 2007. Existing home sales in every year from 2007-2011 turned out to be at least 11% lower than we were first told. God only knows what they're doing to generate the numbers now. But here's a number that's harder to fudge (we think). The NAR says the average price of an existing home has reached a new all-time high — $236,400. That surpasses the previous record set in July 2006. "Part of the rise in prices," says a Bloomberg summary, "is tied to a lack of distressed sales, at only 8% of June’s total, which is a record low." Wow, not a lot of foreclosures or short sales there. "Tight supply is another factor driving up prices, at 5.0 months at the current sales rate versus 5.1 and 5.2 months in May and April and against 5.5 months last June. There were 2.30 million existing homes for sale on the market in June." "We’re starting to see first-time home buyers re-entering the market," says our income specialist Zach Scheidt — eyeing an instant-income opportunity for his premium subscribers recently. Before the housing market went to hell in 2007-09, first-time buyers usually made up about 40% of the market. By spring of last year, the NAR says that number had sunk to only 27%. But for the last four months, the number has been at or above 30%. At least a few millennials are doing well enough to keep up with their student loans and move out of Mom's basement, it seems. That could be huge, says Zach: "As new families are started, demand for housing leads to construction jobs, along with plenty of ancillary businesses in mortgage servicing, home repair, landscaping, furniture sales and so on. "The pickup in first-time home purchasers is great news for home construction stocks," says Zach — "especially those that build homes that are affordable enough for first-time homebuyers." Regards, Dave Gonigam P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post The Fed’s “Mission Accomplished” appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2015 12:09 PM PDT Russians Buy Gold In June – Another 25 Tonnes By Mark O’Byrne - Russia adds another 800,000 ounces or 25 tonnes to gold reserves in June - Russia's has sixth largest gold reserves in the world - Allocates 13% of FX reserves to gold - Central bank buys all Russian gold production - Other... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2015 12:06 PM PDT Jim, The more articles I see, such as the ones below, the more I come to believe we are at the bottom of gold’s decline. It goes with the old Rothschild quote: "Buy when blood runs thru the streets, sell when everyone is partying." CIGA Wolfgang Rech Dear Wolfgang, The history of markets is on... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

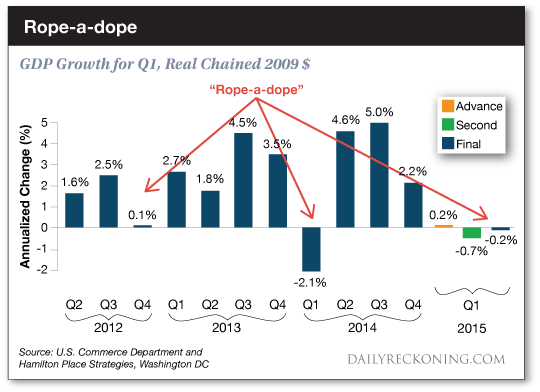

| The Global Monetary Elites Are Being “Rope-a-doped” Posted: 22 Jul 2015 12:02 PM PDT This post The Global Monetary Elites Are Being “Rope-a-doped” appeared first on Daily Reckoning. Muhammad Ali is undoubtedly one of the greatest boxers of all time. He calls himself "the Greatest," but among fans and sportswriters, he is also called "the People's Champion," because of his popularity and ability to connect with everyday citizens around the world. His lifetime record in professional fights was 56-5 with 37 knockouts. Before becoming a pro, he won a gold medal for the U.S. Olympic boxing team in the 1960 Olympics in Rome. Ali did not look like the most intimidating boxer in the ring; others like Sonny Liston and Joe Frazier had fiercer demeanors. But Ali had a combination of smarts, agility and creativity that none of his opponents could match. He declared he could "float like a butterfly and sting like a bee" in the ring. This was a way to capture the combination of his fluid motion and lightning-like knockout punch. Ali also invented a technique he called "rope-a-dope." The idea was simple, but few boxers could pull it off. Ali would lean back on the ropes and absorb punishment from his opponent, even pretending to be weakened. Then he would bounce off the ropes, strike back and inflict a powerful combination of painful blows on his opponent. The point of rope-a-dope was not that it worked once, but that it worked repeatedly. Opponents could not resist the sight of a seemingly weakened Ali leaning on the ropes. The result was always the same — a refreshed Ali would lash out, cause real damage and eventually win the fight. The global economy today can also be understood as an exercise in rope-a-dope by forces of deflation versus the forecasts and policy experiments of central bankers. Deflation is caused by a combination punch of demographics, debt, deleveraging and technology. It weakens real growth, and it reduces nominal growth even more. In recent years, both the U.S. and Japan have periodically shown negative real growth, but nominal growth has been even lower because of the impact of deflation. Real growth makes us richer, but nominal growth is how we pay debt, since debts are nominal — you owe what you owe regardless of the real value. Low real growth is a disaster for social well-being, and low nominal growth puts us on the same path as Greece. The one-two combination is toxic. Meanwhile, the global monetary elites — central bankers, the IMF, finance ministers and professors — keep predicting higher growth, and they keep printing money to get it. They continually expect better growth in the next quarter, the next half or the next year. They act like the opponents of Ali and believe that deflation and weak growth are "on the ropes." One more dose of QE or one more interest rate cut will be all it takes to knock out deflation and win the fight. Yet every time the monetary elites are ready to declare victory, deflation bounces off the ropes, charges to the center of the ring and hits their policies with vicious GDP punches. What is amazing about this pattern is not that it happened at all but that it keeps happening. Monetary elites are like Muhammad Ali's opponents in the ring. They fall for the same trick every time. Ali showed that in order for rope-a-dope to work, you need a "dope" — someone who just doesn't understand what's happening. The monetary elites seem to qualify as those who just don't get it. To illustrate this phenomenon, look at this chart of quarterly GDP growth, shown as an annualized percentage change:

Growth in the third quarter of 2012 was 2.5%, slightly above the post-2008 average. But it collapsed in the fourth quarter and was almost negative. Growth in the third and fourth quarters of 2013 was robust, averaging about 4% over both quarters. Then it collapsed again in the first quarter of 2014 to negative 2.1%. Growth in the second and third quarters of 2014 was the best in this recovery, averaging almost 5%. But then it fell back to trend in the fourth quarter and collapsed in first quarter of 2015, when it was again negative. The pattern is obvious. We can call it deflationary rope-a-dope. Collapses in Q4 2012, Q1 2014 and Q1 2015 show how deflation bounces off the ropes and bloodies the best-laid plans of the central banks. Every time growth picks up due to money printing, interest rates cuts and currency wars, deflation just bides its time. Deflationary and disinflationary tendencies persist because the problem with the global economy is not cyclical, it's structural. This means that monetary remedies can at best produce temporary results but will not permanently fix the problem. A good comparison is the persistence of the Great Depression from 1929-1940. After a brutal decline from 1929-1933, the economy did pick up from 1933-1936, but then collapsed again in 1937. The monetary remedy of devaluing currencies against gold — used by the U.K. in 1931 and the U.S. in 1933 — produced temporary gains but did not permanently fix the problem. Capital was on strike and refused to invest until uncertainty about government policy was resolved. Consumers were also uncertain and saved rather than spend what money they had. It was only when the economy was restructured to a war footing in 1940 that growth resumed. Apart from war, a robust peacetime economy did not reemerge until the Republican tax cuts of 1946. There is some evidence that global monetary elites are waking up to the rope-a-dope effect of deflation. The IMF and Federal Reserve have lowered their respective global and U.S. growth forecasts in recent weeks. But there is still no evidence that the monetary elites understand the cure for global economic malaise. What is needed is not more money but smart infrastructure investment, lower taxes and smart regulation (which means more regulation for banks and less for businesses and entrepreneurs), among other structural remedies. Unfortunately, none of these policies is on the political horizon. The "indications and warnings" on which my newsletter advisories rely have been signaling a global growth slowdown even more pronounced than the monetary elites are willing to admit. The deceleration of growth in China is impossible to ignore. The six-month super-spike in the Shanghai stock index was an effort to solve a credit collapse by issuing equity to millions of unsuspecting first-time investors. Now the stock bubble has collapsed also. With equity and credit markets in distress and no ability to devalue the currency because of the new yuan-dollar peg, growth in China is on a downward spiral. The same is true in Brazil, due to mismanagement and corruption, and in Russia due to sanctions. Commodity producers such as Australia will suffer along with China. Greece is resolved for the moment, but a stronger euro will slow growth in Europe. The U.S. is not immune from this global slowdown — the world is too interconnected. Certain stocks have come down lately in line with this global growth decline. But some have not. The key for investors is to find a stock or sector that is still flying high and seems unaware of the rope-a-dope surprise coming in the second half of 2015. Regards, Jim Rickards P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post The Global Monetary Elites Are Being “Rope-a-doped” appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| We Are Now All Prisoners of the Information Age Posted: 22 Jul 2015 11:31 AM PDT This post We Are Now All Prisoners of the Information Age appeared first on Daily Reckoning. Somewhere in Northern Alberta – "The train will stop for 20 minutes to take on water," said a voice over the loudspeaker. We had been rolling for a day and a half. It would be nice to get out and stretch our legs. And so, we climbed down and wandered around town. In about 10 minutes, we had seen all there was to see – just a few cheap houses, a convenience store, a post office, and a place that billed itself as the Château du Nord – a ramshackle blue house, built of wood that advertised itself as a place for "burgers and shakes." It was closed. Everything was closed. U.S. stocks fell yesterday. The news from the tech sector is bad. IBM sales are down for the 13th straight quarter. Microsoft posted its largest quarterly loss ever on a big write-down related to its purchase of Nokia. And Apple shares plunged 7% in late trading yesterday, following disappointing earnings forecasts. This wiped $50 billion off the market cap of the world's most valuable company. The Dow, meanwhile, lost 181 points – a 1% drop. Taking a long ride on a passenger train must be like an ocean cruise. The difference is that we look at land, not water. Once the TransCanada left the station in Toronto, and the delayed departure was behind us, the trip became very agreeable. The staff are friendly and competent. The accommodations are comfortable. We read. We write. We eat. We drink. We settle down for days of quiet reflection – often out of cellphone range. And when we look out our window, we see trees… rocks… hills… rivers… lakes. And a few shabby houses. Canada's north – Le Grand Nord the French call it – is amazingly empty. Mostly what we see are trees. Maple. Birch. Spruce. Pine. The forests of Northern Ontario seem to have no end. Heading north by northwest, the train rounded Lake Huron and then turned west. It has been lumbering and trundling west ever since, occasionally pulling off onto a sidling to let a freight train go by. Our fellow travelers are a mixed crew. One group – which includes a Chinese woman – speaks Spanish. One of the Spanish speakers – from Lima, Peru – ducked our question when we asked what he was up to. But he asked our opinion on America's economic recovery. "What recovery?" we replied. Several families, apparently on vacation, speak Québécois: French with a heavy New World accent. A tall, elegant African woman is a mystery. There are a few lost souls. One retired man won't stop talking; the other passengers are learning to avoid him. At the upper end – which is at the very back of the train – are a few retired couples from south of the 49th parallel. By no means statistically significant, half of these high-end customers come from Washington, D.C., and have earned their money from the Pentagon. Most have some reason to go to Vancouver, as we do, and thought the train would be an interesting way to get there. Yesterday, we joined them to celebrate an 80th birthday. They formed a jolly group – joking, laughing. Generally, our fellow voyagers seem to enjoy each other's company and spend much of their time together in the club car. One of the books we brought with us to contemplate was George Gilder's Knowledge and Power: The Information Theory of Capitalism and How It Is Revolutionizing Our World. We made fun of Gilder – President Reagan's most quoted living author – years ago in one or our books. He had gotten a little moonstruck in the lunatic glow of the dot-com boom in the late 1990s. Like many of that era, he came to believe that information is more important than matter. Maybe it is in some sense. But never have we sprained an ankle by stepping on an idea. And when 6 o'clock comes, we do not sit down and uncork a thought. In the late 1990s, more and cheaper information was thought to be the ticket to faster economic growth. Gilder believes that information trumps physics, removing the age-old constraints – time, energy, and resources – that hold back progress. "In the beginning was the word," he writes, echoing an earlier bestseller. The word is what makes the thing, not the other way around, he points out. But what word? Most of the words we hear are noise. Most of the ideas they convey are superficial piffle. They don't create wealth or beauty. They get in the way; they confuse; they fill up the cupboards and trash bags of the mind. Then they must be dumped somewhere – blemishing our mental landscape, like the slagheaps of the Industrial Age, for many years. And since it's been more than half a century since Claude Shannon discovered the principles of information theory… and almost two decades since the debut of the World Wide Web… we look around and wonder: Where's the beef? You can get any word you want on the Web – for free. But we don't see how they make us better off. We don't see wealth or prosperity – except in the industries that own the pipes through which these words are transmitted. Google, Apple, and Facebook are building new mega-rich campuses to celebrate their success. But the average man in America saw his wages, in inflation-adjusted terms, peak in the 1970s. Now he can distract himself from his misery with cheap entertainment from Silicon Valley. But he can't support a family. All we see are time-wasters. Most people use the new devices for entertainment; they become less productive thanks to the time they spend browsing dating apps or talking to their refrigerators. We work with words and ideas. The electronic media – with so many ideas and so much information so readily available – has turned us into miners rushing to Sutter's Mill. We have to dig into every hillside, crack open every rock, and send every grain of river-bottom sand through our sluice. We don't know where the gold is; it could be anywhere. The iPhone sends more and more money to Apple. To us it brings more information – to be processed, to be studied, to be stuck in some mental file… thence forgotten… lost forever. Standing in line… in an elevator… in a taxi… waiting for dinner – no minute is spared, neither in thought nor reflection. Instead, every message demands attention – immediately! Yes? No? What do you think? What should you think? Is this important or more time-wasting drivel? Why not just turn the damn iPhone off? Why not dispense with the additional information? Why not "just say no" to more ideas? The answer is simple and obvious: We are now prisoners of the Information Age. We can't say no because we don't know what we are saying no to. Are we saying no to more noise? Or to "The Word"? Ah, yes, that is where we have come to. Now that information is available, we can't resist it. And yet, judged by U.S. GDP, wages, or our own experience, it is a dud. Regards, Bill Bonner P.S. I originally posted this article at The Dairy of a Rogue Economist,right here. The post We Are Now All Prisoners of the Information Age appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prepare Now for 9.0 Earthquake -- Quick Tips Posted: 22 Jul 2015 11:23 AM PDT CNN slip predicts Mega quake Cali This was caught on the today show ticker July 10th... How can that be a mistaken? I mean someone must of typed it in, goes on for a few seconds then pulled. They are obligated to give hints Always The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Currencies Depend on Faith, Gold Doesnt Posted: 22 Jul 2015 10:01 AM PDT Euro Pacific Capital | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and the Deflation Thesis Posted: 22 Jul 2015 08:29 AM PDT Jeffrey Lewis | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Seth Lipsky in The Wall Street Journal: Fifty years of debasing money Posted: 22 Jul 2015 07:39 AM PDT By Seth Lipsky July 23 marks the 50th anniversary of the Coinage Act of 1965, which stripped U.S. coins of silver and made legal tender out of base metal slugs. It's an anniversary that comes at an apt time, as Congress considers monetary reform. This discussion has been quietly taking place in recent months, in the Senate Banking and House Financial Services committees. Rep. Kevin Brady (.-Texas), vice chairman of the Joint Economic Committee, recently reintroduced a proposal for a Centennial Monetary Commission as the Federal Reserve starts its second century. The anniversary of the 1965 Coinage Act is a reminder of why reform is needed. Speaking from the White House Rose Garden, President Lyndon B. Johnson called the law he signed a "very rare and historic occasion." It certainly was; it superseded the coinage act drafted by Alexander Hamilton and passed by Congress in 1792. ... ... For the remainder of the commentary: http://www.wsj.com/articles/fifty-years-of-debasing-money-1437522237 ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The JFK UFO Connection - Robert Morningstar Posted: 22 Jul 2015 06:26 AM PDT Clip from July 8, 2015 - guest Robert Morningstar on the Jeff Rense Program. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Currencies Depend on Faith, Gold Doesn't Posted: 22 Jul 2015 06:23 AM PDT In his July 17th Blog, Let's Get Real About Gold, author and Wall Street Journal columnist Jason Zweig likened investor interest in gold with the "Pet Rock" craze of the 1970s, when consumers became convinced that a rock in a box would provide continuous companionship, elevate their social standing, and give them something hip to talk about at parties. Zweig asserts that investor faith in gold, which he argues is just another inert mineral with good marketing, is similarly irrational, and has kept people from putting money in the much more lucrative stock market. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bron Suchecki: What's the spin on the gold smash? Posted: 22 Jul 2015 05:34 AM PDT 8:30a ET Wednesday, July 22, 2015 Dear Friend of GATA and Gold: Perth Mint research director Bron Suchecki today summarizes what seem to him to be the most sensible comments about Monday's attack on the gold market. "The general view," Suchecki writes, "seems to be that it was a deliberate tactical move to push the price down, trigger stops, and try to get gold down to the technically important level of $1,080, but with the real objective of making money on another derivative position." Suchecki's commentary is headlined "What's the Spin on the Gold Smash?" and it's posted at the Perth Mint's Internet site here: http://research.perthmint.com.au/2015/07/21/whats-the-spin-on-the-gold-s... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold's plunge sparks retail demand in China, India Posted: 22 Jul 2015 05:29 AM PDT By Biman Mukherji, Alice Kantor, and Rhiannon Hoyle HONG KONG -- Gold's plunge to five-year lows this week has prompted a swift rise in demand from jewelry retailers in China and India, the world's top consumers of gold, leading to a doubling of premiums paid on physical gold. At the same time, sales of gold coins from Australia's biggest bullion mint have been rising sharply, likely thanks to some bargain hunting. The increase in demand is expected to provide a cushion to the battering that gold has taken this week, although it may not be enough to offset the bearish outlook on the yellow metal amid growing expectations of a rise in U.S. interest rates and a lack of safe-haven demand. India, together with China, accounts for around half of the global demand. ... ... For the remainder of the report: http://www.wsj.com/articles/golds-plunge-sparks-retail-demand-in-china-i... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and the Deflation Thesis Posted: 22 Jul 2015 03:53 AM PDT 56,859 contracts represents over 284 million ounces of silver in a market with a total of just under 1 billion ounces in open contracts (open interest of 197,092) and a combined warehouse “physical” inventory of just over 180 million ounces. I decided to make public and expand upon one section in my private newsletter weekly commentary. As silver was monkey-hammered once again this week, I got the usual “see that, Harry Dent was right. Silver is going down” response. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Crash - Trend Forecast 2015, Gold Stocks Buying Opportunity? Posted: 22 Jul 2015 12:46 AM PDT The gold price bear market has continued in 2015 since its mid January 2015 peak of $1307 that had fooled many gold bugs into assuming that the preceding multi-year bear market was finally over and that 2015 would see a strong price rally to possibly even new all time highs! However, so far 2015 has seen a series of failed rally's rolling over into downtrends to new lows, punctuated by flash crash days such as that which took place on the 19th of July that saw a series of flash crashes that lasted no more than a couple of seconds that took the gold price to well under $1,100, to a new five year low of $1080 before recovering to currently stand just over $1,100. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Jul 2015 12:03 AM PDT The previous Friday's expected cycle low was successful in starting a rally last week in which the US Dollar had its best week since May. DXY gained 1.89% to close at 97.99 above the June 1 high and printed an engulfing bullish candlestick on the weekly chart. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Jul 2015 08:05 AM PDT Market Analytics |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Today’s big news was obviously the fact that Apple did not sell as many phones as folks expected (more about that below). First, I would like to note that Microsoft’s results were not that great, nor were Linear Technology’s, Yahoo’s, or Caterpillar’s, to name a few. In fact, most of the earnings reports thus far have not been all that spectacular and the one that was celebrated the most, Google, was a function of cost cutting, not revenue growth. (I’m leaving Netflix and Chipotle out because I don’t think their results indicate that much about the economy.)

Today’s big news was obviously the fact that Apple did not sell as many phones as folks expected (more about that below). First, I would like to note that Microsoft’s results were not that great, nor were Linear Technology’s, Yahoo’s, or Caterpillar’s, to name a few. In fact, most of the earnings reports thus far have not been all that spectacular and the one that was celebrated the most, Google, was a function of cost cutting, not revenue growth. (I’m leaving Netflix and Chipotle out because I don’t think their results indicate that much about the economy.) We are in the dog days of summer, but I believe prices are more likely to be higher in September than what we are seeing today. However, if the U.S. dollar is going to stay on a tear, it will be very difficult for the gold market to work its way higher.

We are in the dog days of summer, but I believe prices are more likely to be higher in September than what we are seeing today. However, if the U.S. dollar is going to stay on a tear, it will be very difficult for the gold market to work its way higher.

No comments:

Post a Comment