saveyourassetsfirst3 |

- Department Of Justice: Militarized Police Tactics Caused Ferguson Riots

- Bare Supermarket Shelves In Greece Should Be A Huge Wake Up Call To Millions Of Clueless Americans

- Gold Price Hits 3rd Lowest Weekly Close Since 2010 as Greek Deal Looms, China Stocks Rally Again

- China Rapidly Changing International Gold Market

- Jim Sinclair: I Think the PPT Knew They Were Going to Be Overwhelmed & Pulled the Plug!

- Was Greece Sacrificed to the Bankster Gods Like Lehman Brothers in 2008?

- Caption Contest Friday

- Silver coin shortages, again

- The Big Picture – Peter Schiff

- Putin’s Top Aid Yury Ushakov: BRICS Bank, Greece & Ukraine Headline BRICS/SCO Summits

- History Repeats as China Faces 1929-Style Crash: “The Parallels with 1920 Are Uncanny”

- Max Keiser: Bail-in Induced Spike in Velocity of Money

- Silver shortages, again

- More Weakness Ahead in Precious Metals Complex

- Bail-Ins Coming – GoldCore Interviewed By Financial Repression Authority

- Silver Forecast July 10, 2015, Technical Analysis

- Gold Gains But Remains Under Pressure

- Greece and China crisis calming down says Jim Rickards

- Gold Prices July 10, 2015, Technical Analysis

- Gold Facing Downside Risk: An Overview

- Gold (XAUUSD) & Silver (XAGUSD) Rebound in Focus

- Comex Gold Futures (GC) Technical Analysis – July 9, 2015 Forecast

- Gold Fails To Stabilize Below 1150.95

- Gold Enters Support Zone

- Gold Trades In Downward Channel

- More Downside Potential in Precious Metals Complex

- European Leaders Promise The Greek Debt Crisis Will Be Resolved One Way Or Another On Sunday

- El-Erian: U.S. investors should be worried about China… Here are 5 things you need to know

- Doc Eifrig: Here are the best ways to fight seasonal allergies this summer

- Military insider: This is the best cyberwarfare stock in the defense sector

| Department Of Justice: Militarized Police Tactics Caused Ferguson Riots Posted: 10 Jul 2015 12:00 PM PDT Police apologists, who have long claimed the violent response by officers to demonstrations in Ferguson was perfectly justified and appropriate, might soon be eating crow. According to a Department of Justice document obtained by the St. Louis Post-Dispatch, the police effort to handle protests with inappropriate, militaristic tactics not only violated constitutional rights, it effectively antagonized and […] The post Department Of Justice: Militarized Police Tactics Caused Ferguson Riots appeared first on Silver Doctors. |

| Bare Supermarket Shelves In Greece Should Be A Huge Wake Up Call To Millions Of Clueless Americans Posted: 10 Jul 2015 11:49 AM PDT This should be a WAKE UP CALL to millions of Clueless Americans… From End of the American Dream: What you are watching unfold in Greece right now is eventually going to come to your own neighborhood. Someday, people living all around you will be storming the supermarkets in a desperate attempt to secure the […] The post Bare Supermarket Shelves In Greece Should Be A Huge Wake Up Call To Millions Of Clueless Americans appeared first on Silver Doctors. |

| Gold Price Hits 3rd Lowest Weekly Close Since 2010 as Greek Deal Looms, China Stocks Rally Again Posted: 10 Jul 2015 11:03 AM PDT Bullion Vault |

| China Rapidly Changing International Gold Market Posted: 10 Jul 2015 11:00 AM PDT Since 2007 China has the largest domestic gold mining output, since 2011 the Shanghai Gold Exchange has been the largest physical gold exchange and in 2013 and 2014 China was the largest importer. Now the Chinese seek to escalate pricing power. Submitted by Koos Jansen, Bullionstar: From the beginning of the liberalization of China's […] The post China Rapidly Changing International Gold Market appeared first on Silver Doctors. |

| Jim Sinclair: I Think the PPT Knew They Were Going to Be Overwhelmed & Pulled the Plug! Posted: 10 Jul 2015 10:27 AM PDT “It’s like if in a casino and everyone starts winning, mysteriously either the lights go out of someone pulls a fire alarm …no more gambling! I think the PPT knew they were going to be overwhelmed, if this were the case and I was the chairman of the NYSE, I would run upstairs and pull […] The post Jim Sinclair: I Think the PPT Knew They Were Going to Be Overwhelmed & Pulled the Plug! appeared first on Silver Doctors. |

| Was Greece Sacrificed to the Bankster Gods Like Lehman Brothers in 2008? Posted: 10 Jul 2015 10:00 AM PDT PM Fund Manager Dave Kranzler weighs in on if Greece has just been sacrificed to the bankster gods like Lehman Brothers was in 2008…and is the $1.4 QUADRILLION derivatives market on the verge of implosion??? SD/TND Podcast Spotlight: Wall Street For Main Street Jason Burack of Wall St for Main St had on returning guest […] The post Was Greece Sacrificed to the Bankster Gods Like Lehman Brothers in 2008? appeared first on Silver Doctors. |

| Posted: 10 Jul 2015 09:30 AM PDT The post Caption Contest Friday appeared first on Silver Doctors. |

| Posted: 10 Jul 2015 09:03 AM PDT Perth Mint |

| The Big Picture – Peter Schiff Posted: 10 Jul 2015 09:00 AM PDT While the party in the 1990s ended badly, the festivities currently underway may end in outright disaster. The party-goers may not just awaken with hangovers, but with missing teeth, no memories, and Mike Tyson’s tiger in their hotel room. SD/TND Guest Contributor: Peter Schiff The past four years or so have been extremely frustrating for investors like me who […] The post The Big Picture – Peter Schiff appeared first on Silver Doctors. |

| Putin’s Top Aid Yury Ushakov: BRICS Bank, Greece & Ukraine Headline BRICS/SCO Summits Posted: 10 Jul 2015 08:30 AM PDT Ahead of the landmark BRICS/SCO summits in Russia's Ufa, Putin’s top aide Yury Ushakov speaks to RT, Vesti and RIA on the key topics of the forums' agendas, including the BRICS New Development Bank, Iran joining SCO, and crises in Greece and Ukraine. Q:Mr. Ushakov, it so happened that there will be two […] The post Putin’s Top Aid Yury Ushakov: BRICS Bank, Greece & Ukraine Headline BRICS/SCO Summits appeared first on Silver Doctors. |

| History Repeats as China Faces 1929-Style Crash: “The Parallels with 1920 Are Uncanny” Posted: 10 Jul 2015 08:00 AM PDT Is China repeating the mistakes and the queasy heights of America's roaring twenties? Submitted by Mac Slavo, SHTFPlan: According to some, Greece has been hogging the limelight, while China is going through ultra dramatic market fails, too. It's excesses are glorious in their potential to plummet in a spectacular thud. Is China repeating the […] The post History Repeats as China Faces 1929-Style Crash: "The Parallels with 1920 Are Uncanny" appeared first on Silver Doctors. |

| Max Keiser: Bail-in Induced Spike in Velocity of Money Posted: 10 Jul 2015 07:00 AM PDT In this episode of the Keiser Report, Max Keiser and Stacy Herbert discuss the Greek referendum results, financial terrorism and bail-in fears induced velocity of money. SD/TND VideoCast Spotlight: Keiser Report In this episode of the Keiser Report, Max Keiser and Stacy Herbert discuss the Greek referendum results, financial terrorism and bail-in fears induced velocity […] The post Max Keiser: Bail-in Induced Spike in Velocity of Money appeared first on Silver Doctors. |

| Posted: 10 Jul 2015 06:22 AM PDT Some thoughts/observations on the US Mint suspending silver eagle sales http://research.perthmint.com.au/2015/07/10/silver-coin-shortages-again/ |

| More Weakness Ahead in Precious Metals Complex Posted: 10 Jul 2015 05:11 AM PDT The Daily Gold |

| Bail-Ins Coming – GoldCore Interviewed By Financial Repression Authority Posted: 10 Jul 2015 05:03 AM PDT gold.ie |

| Silver Forecast July 10, 2015, Technical Analysis Posted: 10 Jul 2015 12:55 AM PDT fxempire |

| Gold Gains But Remains Under Pressure Posted: 10 Jul 2015 12:45 AM PDT dailyforex |

| Greece and China crisis calming down says Jim Rickards Posted: 10 Jul 2015 12:35 AM PDT Hedge fund manager and ‘Currency Wars’ author Jim Rickards is heartened by the news coming out of Greece and China and sees a crisis postponed for another day. Gold, silver, fine art, and land are his tips for a portfolio to hedge the problems still coming in global financial markets in his view… |

| Gold Prices July 10, 2015, Technical Analysis Posted: 09 Jul 2015 11:30 PM PDT fxempire |

| Gold Facing Downside Risk: An Overview Posted: 09 Jul 2015 11:25 PM PDT actionforex |

| Gold (XAUUSD) & Silver (XAGUSD) Rebound in Focus Posted: 09 Jul 2015 11:25 PM PDT cfdtrading |

| Comex Gold Futures (GC) Technical Analysis – July 9, 2015 Forecast Posted: 09 Jul 2015 11:25 PM PDT fxempire |

| Gold Fails To Stabilize Below 1150.95 Posted: 09 Jul 2015 11:25 PM PDT investing |

| Posted: 09 Jul 2015 11:20 PM PDT actionforex |

| Gold Trades In Downward Channel Posted: 09 Jul 2015 11:20 PM PDT investing |

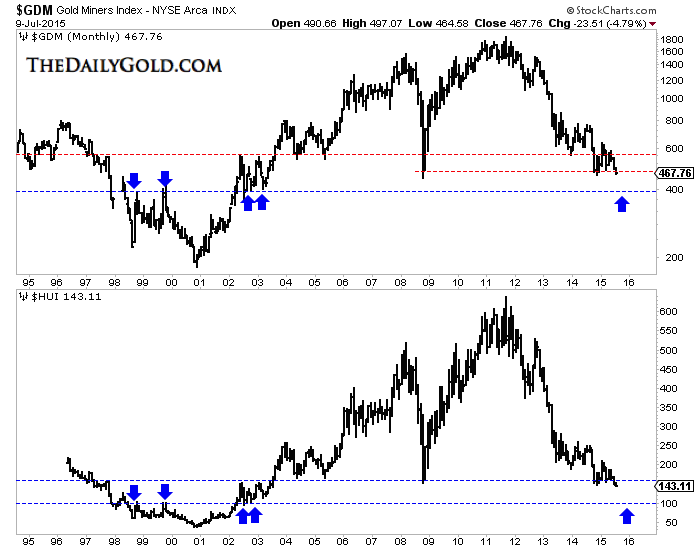

| More Downside Potential in Precious Metals Complex Posted: 09 Jul 2015 09:44 PM PDT The precious metals sector is enduring losses for the third straight week. The gold miners and Silver have led the way down, though Silver has rallied over the past two sessions. Gold has also rallied yet remains dangerously close to making a new weekly low for the bear market. While the metals recovered some losses on Wednesday and Thursday, the gold miners failed to generate anything positive and closed near their lows for each session. The inability of the miners to recover to even a small degree augurs badly for the entire sector in the days ahead. Continued weakness in the miners is not much of a surprise considering they are breaking down from their 2008 and 2014 lows. We plot monthly bars below for GDM (forerunner to GDX) and the HUI. GDM closed at 468 and lacks strong support until 400. The HUI is in full blown breakdown mode and does not have strong support until the low 100s.

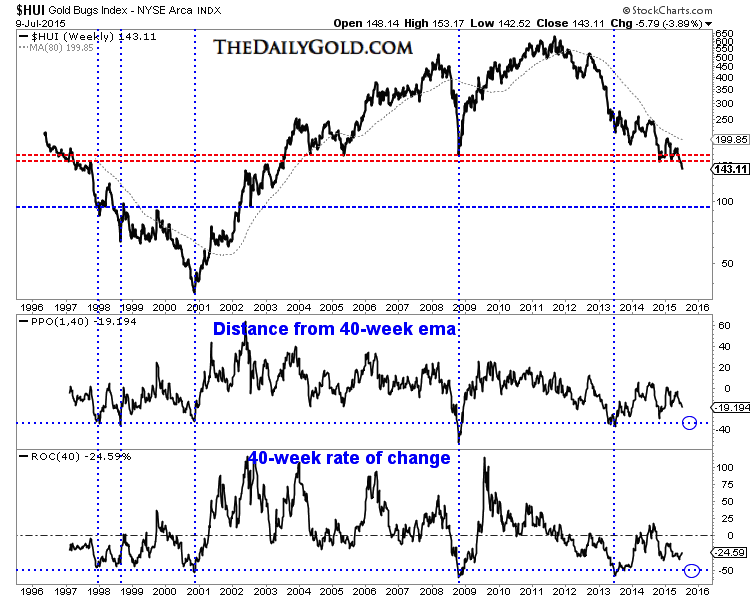

In the chart below we plot the HUI's weekly price going back 20 years and two oscillators which can serve as overbought and oversold indicators. We plot the HUI's distance from its 40-week exponential moving average and its rolling 40-week rate of change. The HUI is certainly oversold but these two oscillators argue the HUI is some distance from reaching the extreme oversold condition seen in spring 2013, late 2008 and late 2000.

Turning to Gold, it appears ripe for a breakdown below $1150/oz in the days ahead. If that comes to pass, then the focus should be on its next strong support around $1000/oz to $1040/oz. The chart below includes the weekly plot of Gold as well as the net speculative position as a percentage of open interest. The net speculative position will be updated Friday and figures to be close to 10%. In our view that needs to go below 5% (the 2013 low) for sentiment to be considered extreme. A reading below 5% would mark a 14-year low.

We appear to be in the early stages of the final act in this precious metals bear market. Gold breaking below $1140-$1150/oz could put us in the middle stages. Our work shows that miners are not yet extremely oversold and have room to fall before reaching strong support. Gold breaking below $1150/oz and then $1100/oz would initiate further losses in the miners and bring them very close to that extreme oversold condition. It is the combination of an extreme oversold condition coupled with strong technical support that creates a very favorable buying opportunity. A few weeks ago we noted that it was potentially a very dangerous time for bulls. It still its. However, the closer the miners get to extremely oversold and the closer Gold is to $1000/oz then the closer we are to risk favoring the bulls. It is always darkest before dawn. At somepoint within a few months, the switch will flip and we could have some epic buying opportunities in the precious metals complex. Consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2015.

Jordan Roy-Byrne, CMT

The post More Downside Potential in Precious Metals Complex appeared first on The Daily Gold. |

| European Leaders Promise The Greek Debt Crisis Will Be Resolved One Way Or Another On Sunday Posted: 09 Jul 2015 04:42 PM PDT

For months, the entire planet has been following this seemingly endless Greek debt saga. Global financial markets have gyrated with every twist and turn of this ongoing drama, and many people have wondered if it would ever come to an end. But now European leaders are promising us that the uncertainty is finally going to be over this weekend…

So what is the general mood of European leaders as they head into this summit? Overall, it does not appear to be overly optimistic. For example, just consider what the head of the Bundesbank is saying…

And even normally upbeat leaders such as ECB President Mario Draghi are sounding quite sullen…

That certainly does not sound promising. It isn’t as if the Greeks are not trying to find a compromise. Their latest offer reportedly contains some very painful austerity measures…

But once again, it appears that pensions may be a major sticking point. The following comes from a Zero Hedge report about the latest Greek proposal…

We shall see what happens on Sunday. I have a feeling that it is all going to come down to what Germany wants to do. At this point, the Greeks owe the Germans approximately 86.7 billion euros. The German people are overwhelmingly against pouring more money down a financial black hole, and German leaders have taken a very hard line with Greece in recent days. If Germany does not like this new Greek proposal, it will almost certainly fail. And if there is no deal, Greek government finances will totally freeze up, the Greek banking system will utterly collapse, and the Greeks will probably be forced to switch back to the drachma. Speaking of the drachma, check out what Bloomberg is reporting…

Could plans to roll out the drachma already be in motion behind the scenes? The next few days promise to be extremely interesting. Meanwhile, there are all sorts of other indications that big economic trouble is ahead for the entire planet. For instance, global commodity prices have been plunging big time…

We witnessed a similar pattern just prior to the financial crisis of 2008. And in addition to the problems that have erupted in China, Greece and Puerto Rico, CNN is reporting that every major economy in Latin America “is slowing down or shrinking”…

Very few people are talking about Latin America right now, but the truth is that the region is in the midst of a slow-motion economic implosion. Here is more from CNN…

Right now, trouble signs are emerging all over the planet. That is why we shouldn’t just focus on Greece. Yes, if Greece is kicked out of the euro that is going to greatly accelerate things. But no matter what happens with Greece, the truth is that we are steamrolling toward another major worldwide financial crisis. Perhaps you didn’t notice, but I purposely did not use the word “Greece” once in my recent article entitled “The Economic Collapse Blog Has Issued A RED ALERT For The Last Six Months Of 2015“. Yes, I am taking what is happening over in Europe very seriously. I believe that we are about to see some things happen over there that we have never seen before. But the Greek crisis is only part of the picture. Everywhere on the globe that you look, red flags are going up. Sadly, just like in 2008, most people have chosen to be willingly blind to what is happening right in front of their eyes. The post European Leaders Promise The Greek Debt Crisis Will Be Resolved One Way Or Another On Sunday appeared first on The Economic Collapse. |

| El-Erian: U.S. investors should be worried about China… Here are 5 things you need to know Posted: 09 Jul 2015 12:33 PM PDT From Mohamed A. El-Erian for Bloomberg: The rebound of Chinese stocks Thursday shouldn’t lull global investors into a false sense of complacency: That country’s equities market isn’t out of the woods quite yet. In addition to stabilizing prices and sustaining a gradual price recovery process, the government must take on the challenge of restoring normal functioning to a market roiled by share suspensions and manipulation. Given the significant economic and financial links between the two countries, what happens in China matters more to U.S. investors than the spillover from the tragic Greek crisis. Here are the five considerations for U.S. investors as they monitor developments in China:

In sum, unlike with Greece, the U.S., and American investors, are much more exposed to the spillover effects from China. An economically damaged China would lower demand for U.S. exports and harm corporate profits. The more China draws on its huge international reserve holdings to support its domestic markets, the greater the risk of pressure on U.S. financial assets that China has invested in. And the bigger the setbacks to market reforms, the longer it will take China to assume its full responsibilities in the global economy. |

| Doc Eifrig: Here are the best ways to fight seasonal allergies this summer Posted: 09 Jul 2015 12:10 PM PDT From Dr. David Eifrig, MD, MBA, Editor, Retirement Millionaire: If you suffer from seasonal allergies, you’re not alone… More than 30% of the U.S. population has seasonal allergies. But you can do a few things to relieve your symptoms… Since I live in the city, I keep an air filter in my bedroom, which has helped with seasonal allergies as well as general stuffiness in the mornings. I clean the filter weekly. One thing to remember when you have allergies is to be careful when blowing your nose. Researchers at the University of Virginia studied the flow of snot and mucous in sick people. They found that blowing your nose with both nostrils clogged creates large pressures in your sinuses. This just pushes the mucous and “bugs” back up into your sinuses and can cause more of an infection. It’s the same story with allergies. Blowing lightly with one nostril at a time restricts airflow less and is the best way to avoid this. Another trick is to try a Neti pot. The Neti pot is an old Hindu device used to wash the sinuses. (Neti means “nasal” in Sanskrit.) You can purchase plastic ones with balanced salt solutions (in packets you mix with water at home) at your local drug stores for about $10. By using gravity and the solution, you can gently rinse your sinuses. When I get tickles in my nose or post-nasal drip and sneezing, I know it’s time to do a rinse once or twice a day… It feels funny at first… But if you’re stuffy from pollen, this is a great way to clean out the areas in your nose that trap the pollens. Be careful… Overuse of the Neti pot (either more than twice a day or for more than a couple weeks) can worsen things, leading to bacterial sinus infections. Also, make sure to follow the instructions… If you don’t use sterilized or distilled water, brain-eating organisms in the water can enter the brain through your sinuses. In late 2011, two deaths in Louisiana were blamed on the improper use of a Neti pot. For itchy eyes, purchase eye drops that “stabilize the mast cells” in your mucous membranes. Mast cells maintain chemicals used to protect the body from infections and parasites. When they are stimulated, they release these chemicals, which increase blood flow and direct immune-modulating cells to migrate to that area. Think of them as the fire alarm in a building. Once released, you start itching, which leads to rubbing, which serves to spread even more of the cells and chemicals around to fight whatever it is that’s bothering the body. If you can prevent the alarm from going off, you can avoid the redness and itching. After all, you know you’re not suffering from an infection or parasites, so why not block it for a couple of weeks and feel better? The drugs require a prescription, so you’ll have to ask your physician to prescribe them. Ask for Patanol or Zatidor, or the generic versions, alocril and crolom. If used at the first sign of itchy eyes, they can help cut your allergy symptoms in half. I use them for about 3-4 weeks to get me through the worst of the season. Foods That Can Control Allergies Without DrugsHowever, if you want to avoid drugs… some alternatives to medicine have been shown to ease symptoms. To start, here are some “hygiene” steps you can take to reduce symptoms…

Also, you should avoid some foods that can exacerbate symptoms… Some people with seasonal allergies also have “oral allergy syndrome” – also called “food-pollen allergy” syndrome. This occurs when your immune system attacks proteins in certain foods like it would pollen. The food you react to can depend on the type of allergy you have. People with weed allergies can react to honeydew, cantaloupe, watermelon, tomatoes, zucchini, and sunflower seeds. Tree allergies are often associated with kiwi, apples, pears, peaches, plums, celery, cherries, carrots, hazelnut, almonds, and parsley. If you have grass allergies, you might have a reaction to peaches, celery, tomatoes, melons, or oranges. Here's to our health, wealth, and a great retirement, Dr. David Eifrig Jr., MD, MBA P.S. This essay is an excerpt from my new Big Book of Retirement Secrets. In it, you can find hundreds of "life hacks" like the ones I’ve mentioned above… things like how to get paid to watch TV and eat potato chips… how to get free silver from the U.S. banking system… and even how to get free healthcare and prescriptions. You can get all the details right here. |

| Military insider: This is the best cyberwarfare stock in the defense sector Posted: 09 Jul 2015 11:11 AM PDT From Byron King, Editor, Military Tech Alert: If you’ve read the news at all lately, you know that the “Fifth Domain of War” is heating up. According to CNN, “Four million current and former federal employees, from nearly every government agency, might have had their personal information stolen by Chinese hackers, U.S. investigators said.” This story from last month is all part of our “Fifth Domain of War” theme — the idea that cyberwarfare and cyberterrorism are going to play a major role in the global military space. And that the U.S. is building a “secret” army of its own cyberwarriors. We’ve done well with our “Fifth Domain of War” recommendations in my Military Tech Alert newsletter, too — booking over a 75% average gain since August 2013. Today, however, I want to share with you a new angle on cyber — and a familiar “Fifth Domain” company that’s in the right spot. Let’s have a look… “What’s the BEST cyber play for the defense sector?” asked one reader in an emailed comment. Great question! But I have to reply along the lines of… what part of defense cyber do you want to cover?

All this and more… And in short, there’s lots of cyber out there. Still, I have in mind one particular company that answers the reader’s question. Since 2007, this firm has bought out fourteen other cyber-related companies. This firm is growing its government cyber business fast — in the order of 20% per year. It’s rapidly becoming a “go to” play for DOD and service cyber procurement offices. The magic secret to success is that this company gets the job done. Period. Indeed, this company is already a DOD household name. Yet, it approaches cyber in sort of a “Silicon Valley” kind of way — very “un-DOD,” to coin a phrase. That is, and unlike the case many other tightly-controlled defense business hierarchies, management at this company understands that it’s necessary to give people freedom to think widely, and indeed to experiment. Top executives and board members not only allow business units to make bets on new technology and approaches, but also to experience failure. The thing is, after all, if you haven’t failed a few times in Silicon Valley, you’re not a success, right? It’s kind of like how things worked long ago with Thomas Edison, who once noted that he didn’t just have to go through nearly 1,000 failures before experiencing success. It’s that he figured out 999 other ways not to do something, until he hit on the right approach. Basically, this company has a culture that supports independent research and development (IRAD) over time. Oftentimes, there’s no clearly defined use for what the scientists and engineers are working on and figuring out. Then again, in our fast-moving world, new tech tends to find its own place when the need arises. One never knows when some item of tech or another can come down off the shelf, and make a big contribution. Part of the process, though, is understanding how to transform new ideas into something that can win in the marketplace. During the Cold War, the DOD could operate on, say, 20- and even 30-year time frames for system development. It was the big, lumbering, U.S. military-industrial-Congressional complex (MICC), versus the big, lumbering Soviet military complex, with all its design bureaus and Five Year Plans. We still see lots of that Cold War approach in the way that DOD operates. (Yes, it’s better than it used to be; but there’s much room for improvement.) Anymore though, the world in which we live doesn’t afford the luxury of lengthy development times. Reminds me of what Napoleon said to his generals during the invasion of Russia. “Ask me for anything, sirs; anything but time.” Today however, a truly successful company can’t get into a 30-year rat race on a traditional developmental treadmill. A company that wants to survive and prosper has to place its IRAD money into play, and have the right instincts to “bet right.” Consider, say, the use of gallium nitride (GaN) in electronic circuits. This was a big idea about 10-15 years ago. Many firms placed money on the table, working on GaN. Specifically, GaN works well in signal processing. It’s fast and delivers phenomenal results. But GaN also has big problems. GaN uses lots of electrical power, in a small volume of material. As you can likely figure out, this leads to heat buildup, and heat leads to what’s called “circuit fatigue,” and eventual equipment failure. Thus many companies gave up on GaN. However, the company that I’m about to show you has managed to make GaN work. The company’s labs installed GaN, and delivered products to government buyers that offered high-power and high efficiencies. Indeed, GaN became a key discriminator in competitions for advanced equipment and systems like Next Generation Jammer, Air and Missile Defense Radar, and the 3D Expeditionary Long-Range Radar. Now, this company is making a major push into cybersecurity. Per management, cyber will pervade everything in years to come. Cybersecurity will have to be embedded into everything, and a key component of all solution sets to all problems; otherwise, even the most sophisticated military systems will be hacked and defeated. Going forward, cybersecurity engineers will be part of everything. They’ll be involved in answering requests for proposals; in design and development; in integration and testing; and certainly in manufacture, production and life cycle. That’s where the defense industry is headed. Which gets back to that initial question. What’s “the BEST cyber play” in the defense sector? Right now, my call is Raytheon (RTN) and its newly formed, fast-growing division called Raytheon Cyber Products. Yes, there are other cyber plays out there, large and small. Some of these plays might even get bought by Raytheon, or bought by some other defense giant that decides to go into cyber in a big way — as opposed to just following a path to irrelevance and oblivion. One way or another, cyber is and will remain a key play for defensive investors. For now, I’m highlighting Raytheon because the company exhibits a truly “out front” approach to making it all work. Regards, Byron King P.S. I recently told my readers about one of my most lucrative insider sources. It’s a little-known government website that can tip you off to the latest big contract coming from inside the beltway. When I'm not meeting directly with a member of the Joint Chiefs of Staff or corresponding with highly placed government officials, this is one source for the latest cash flow to come from Congress' pen. In fact, using this source, I uncovered three big deals coming down that add up to more than $156 billion… and there's more where that came from. Get all the details right here. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment