Gold World News Flash |

- How Smart Investors Will Play China and Greece’s Collapses

- Global Run On Silver…Shortages On The Horizon! – Steve St. Angelo SRSrocco Interview

- Keynote Speaker Who Addressed Fed, IMF And World Bank Warns China Crash A Warm Up – Global Collapse Coming & It Will Be Devastating

- Syriza Cruel Hoax on Greek People, Led Like Sheep to Economic Collapse Slaughter House

- Price of Gold Today Ended Comex Down $1.30 or 0.11 Percent at $1,157.70

- There’s Something Else Driving Gold, Not Greece & China - CME Group

- Peter Schiff On The Big Picture: The Party's Ending

- How Not to Use a Mobile Credit Card Machine

- No Way to Run a Currency Union

- Paul Craig Roberts Interview about Greece Financial Collapse

- Organized Plunder, a.k.a. The State

- Bohemian Grove’s Secret Speeches Revealed - The Lakeside Talks Exposed!

- Greek Businesses Accept Lira, Lev As Grexit Looms

- JADE HELM 15 - U.S. Preparing for Martial Law & Collapse of America ?

- Alex Jones -- Pope Francis Is A Vatican Coup

- 5 Things To Ponder: "China Rising" Or Not?

- Gold Daily and Silver Weekly Charts - Calm Before the Storm

- Varoufakis' Stunning Accusation: Schauble Wants A Grexit "To Put The Fear Of God" Into The French

- Bill Still Report - Cyber Attack Thursday?

- Mike Kosares: The Shanghai stock crash and China gold demand

- Ron Paul - The United States Is About To Collapse - July 10th, 2015

- BREAKING NEWS -- Chelsea Is Not Bill Clinton's Daughter

- China wants to steal gold market 'reins' from New York and London

- Maintaining the Illusion of Stability Now Requires Extremes

- Gold and Silver Stocks More Weakness Ahead

- Silver at the Mercy of China’s Stock Market

| How Smart Investors Will Play China and Greece’s Collapses Posted: 10 Jul 2015 10:00 PM PDT by Graham Summers, Gold Seek:

1) Hype and hope of a Greek deal 2) China has stopped trading of 49% of stocks and threatened to arrest anyone who is short-selling the market (talk about a backstop!) Regarding Greece, no deal has been made. Greek PM Tsipras has submitted a proposal for a new deal… which is almost EXACTLY the same as the deal that 61% of the Greek population rejected via referendum last week. Tsipras has completely backed himself into a corner. He used up a lot of goodwill with EU officials when he let Greece to default by staging a referendum for Greek voters AFTER the due date on Greece's debt. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Global Run On Silver…Shortages On The Horizon! – Steve St. Angelo SRSrocco Interview Posted: 10 Jul 2015 09:40 PM PDT from victoryindependence: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 10 Jul 2015 09:20 PM PDT from KingWorldNews:

Eric King: "The timing of your last interview at KWN was so amazing in the sense that you had just warned the IMF, World Bank, and the Federal Reserve officials about a coming collapse. You said to me, 'The coming collapse will be more devastating." Is what we just saw unfold in China (the stock market crash) just a preview of things to come?" Nomi Prins: "Yes, it definitely is. It's a question of when and how in terms of the ultimate impact of the cheap liquidity that's been infused into the markets and where that ultimately creates a vacuum that pulls the markets downward…” | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Syriza Cruel Hoax on Greek People, Led Like Sheep to Economic Collapse Slaughter House Posted: 10 Jul 2015 08:08 PM PDT Syriza presents bailout proposals worse than Greece rejected at the 5th July referendum. The Syriza game theory players 6 month long intensifying black mail of the euro-zone that culminated in the NO referendum to the previous bailout package from the 'evil Troika', who according to Syriza were financial terrorists hell bent on the destruction of Greece, to which end only Syriza were the Greek people's saviors who would prevail with no austerity over the evil Troika. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Price of Gold Today Ended Comex Down $1.30 or 0.11 Percent at $1,157.70 Posted: 10 Jul 2015 08:01 PM PDT

Sounds like somebody doesn't want to go home for the weekend without some silver and gold. One item I left out of my discussion of the Dow in Gold and Dow in Silver above. They address my apprehension that silver and gold prices might plunge to the $1,000 or $8.00 some analysts keep thumping for. If stocks moved higher, then the DiG and DiS could only maintain that top Gator Jaw if metals, too, moved up in step with stocks. Being stalled at their highs for eight months whispers loudly that stocks aren't going much higher, at least, not higher against silver and gold. Mathematically it's also possible that stocks might drop while metals drop, too, but then I'll play the metals seasonal low card. That seems to halt that possibility.

I suspect I see the invisible hand of Bogusness in this week's closes. At Comex close both silver and gold prices were down slightly for the week, but in the aftermarket they were up strongly, slightly higher than last week's closes. Nevertheless, the tape is painted with down weeks for both. Likewise the Dow ended with an "up week" by 30.30 points after spending most of the week taking on water and running the bilge pumps. S&P500 finished flat. US dollar index was strong as a garlic milkshake all week, so had to be tempered on Friday. Those Nice Government Men must think we all fell off a turnip truck. Let me brush these hayseeds off my shoulder. The media, who report "all the news that fits," tell us today that stocks rose on hopes of a European deal on Greece's debt this weekend. If so, that's the triumph of hope over experience, as Dr. Johnson said of a man's remarrying soon after the death of a wife to whom he had been unhappily married. The Greeks have the Euros over a barrel now. The Euros over the past few years have shifted the debt from the banks to the taxpayers, and now the taxpayers, through their governments, will take the hit if Greece defaults. Not good for politicians when taxpayers find out how they've been shafted. Anyhow, the Dow rose 211.79 (1.21%) to 17,760.41 while the S&P500 climbed 25.31 (1.48%) to 2,076.52. Today's closes bring both averages back above their 200 DMAs. I talked to my friend Al Thomas today (www.mutualfundmagic.com), author of "If It Doesn't Go Up, Don't Buy It." Al is one of those men you listen carefully to because his knowledge comes from experience. He is expecting one last rise in stocks, and reminded me that the sell signal comes when the market moves through a DOWNTRENDING 200 DMA. The stock index's 200 DMAs are almost flat, but still rising and not yet falling. Yes, yes, Al's book most certainly is worth buying, reading, and studying.

Both charts have been unable to penetrate that top Gator Jaw and advance. Now their 200 DMAs are pushing up on them, leaving little room to fall without strong consequences. Dow in Gold ended today up 0.84% at G$315.66 gold dollars (15.27 troy ounces). Dow in Silver lost 0.16% today to end at $1,474.82 silver dollars (1,140.68 oz). That comes after the DiS pierced the upper Jaw Tuesday with a rise to$1,531.27 silver dollars (1,184.34 oz), a new high punching through that line. It just as quickly fell back within the gator jaws. Why am I so concerned with this? Because the Dow in Gold and Dow in Silver are the most reliable indicator for that shift in investor mood from confidence to lack of confidence in the financial system. And that, dear friends, is what drives silver and gold up. So when the DiG and DiS confirm they have turned down and resumed the bear market for stocks against metals that began in 1999 and 2001, we can be sure that gold and silver nominal prices have turned up. And, of course, pinpoint the time to swap stocks for silver and gold. You there, in the back! I see you dozing! Sit up, pay attention. I'm not a politician, so I have no easy answers.

Euro rose 1.16% to $1.1160. That leaves it still broken down out of an even sided triangle and looking nasty. The Yen's masters slapped it winded today, down 1.21% to 81.42 and once again below that range that held it from December to May.  Bond yields gapped up today, whereas earlier in the week they gapped down. This is some kind of volatility, with the yield closing above the 20 DMA. Since bond prices fall when yields rise, this implies those flighty investors who fled euros and other investments because of Greece had backbone transplants last night. I'm sorry, I just don't buy it. 'Tain't nat'ral. Charts on the left. Bond yields gapped up today, whereas earlier in the week they gapped down. This is some kind of volatility, with the yield closing above the 20 DMA. Since bond prices fall when yields rise, this implies those flighty investors who fled euros and other investments because of Greece had backbone transplants last night. I'm sorry, I just don't buy it. 'Tain't nat'ral. Charts on the left.Both Copper and Crude appear to have turned up after vicious drops earlier in the week. Whether that is lasting or temporary is not yet clear. Y'all enjoy your weekend. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| There’s Something Else Driving Gold, Not Greece & China - CME Group Posted: 10 Jul 2015 05:47 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peter Schiff On The Big Picture: The Party's Ending Posted: 10 Jul 2015 05:00 PM PDT Submitted by Peter Schiff via Euro Pacific Capital, The past four years or so have been extremely frustrating for investors like me who have structured their portfolios around the belief that the current experiments in central bank stimulus, the anti-business drift in Washington, and America's mediocre economy and unresolved debt issues would push down the value of the dollar, push up commodity prices, and favor assets in economies with relatively low debt levels and higher GDP growth. But since the beginning of 2011, the Dow Jones Industrial Average has rallied 67% while the rest of the world has been largely stuck in the mud. This dominance is reminiscent of the four years from the end of 1996 to the end of 2000, when the Dow rallied 54% while overseas markets languished. Although past performance is no guarantee of future results, a casual look back at how the U.S. out-performance trend played out the last time it had occurred should give investors much to think about. The late 1990s was the original "Goldilocks" era of U.S. economic history, one in which all the inputs seemed to offer investors the best of all possible worlds. The Clinton Administration and the first Republican-controlled Congress in a generation had implemented policies that lowered taxes, eased business conditions, and encouraged business investment. But, more importantly, the Federal Reserve was led by Alan Greenspan, whose efforts to orchestrate smooth sailing on Wall Street led many to dub Mr. Greenspan "The Maestro." Towards the end of the 1990's, Greenspan worked hard to insulate the markets from some of the more negative developments in global finance. These included the Asian Debt Crisis of 1997 and the Russian debt default of 1998. But the most telling policy move of the Greenspan Fed in the late 1990's was its response to the rapid demise of hedge fund Long term Capital Management (LTCM), whose strategy of heavily leveraged arbitrage backfired spectacularly in 1998. Greenspan engineered a $3.6 billion bailout and forced sale of LTCM to a consortium of Wall Street firms. The intervention was an enormous relief to LTCM shareholders but, more importantly, it provided a precedent that the Fed had Wall Street's back. Not surprisingly, the 1990s became one of the longest sustained bull markets on record. But in the latter part of the decade the markets really started to climb in an unprecedented trajectory. As the bubble began inflating in earnest Greenspan was reluctant to follow the dictum that the Fed's job was to remove the punch bowl before the party got out of hand. Instead he argued that the Fed shouldn't prevent bubbles from forming, but simply to clean up the mess after they burst. But while U.S. markets were taking off, the rest of the world was languishing, or worse:  Created by EPC using data from Bloomberg All returns are currency-adjusted But then a very funny thing happened. In March 2000, the music stopped and the dotcom bubble finally burst, sending the Nasdaq down nearly 50% by the end of the year, and a staggering 70% by September 2001. When investors got back into the market their values had changed. They now favored low valuations, real revenue growth, understandable business models, high dividends, and low debt. They came to find those features in the non-dollar investments that they had been avoiding. Over the seven years that began at the end of 2000 and lasted until the end of 2007 the S&P 500 inched upwards by just 11%, for an average annual return of only 1.6%. But over that time frame the world index (which includes everything except the U.S.) was up 72%. The emerging markets, which had suffered the most during the four prior years, were up a staggering 273%. See table below:  Created by EPC using data from Bloomberg All returns are currency-adjusted Not surprisingly, the markets and asset classes that had been decimated by the Asian debt and currency crises, delivered stunning results. South Korea, which was only up 10% in the four years prior, was up 312% from 2001-2007. Brazil, which had fallen by 4%, notched a 407% return, and Indonesia, which had fallen by 50%, skyrocketed by 745%. The period was also a great time for gold and gold stocks. The earlier four years had offered nothing but misery for investors like me who had been convinced that the Greenspan policies would undermine the dollar, shake confidence in fiat currency, and drive investors into gold. Instead, gold fell 26% (to a 20-year low), and shares of gold mining companies fell a stunning 65%. But when the gold market turned in 2001, it turned hard. From 2001 - 2007, the dollar retreated by nearly 18% (FRED, FRB St. Louis), while gold shot up by 206%, and shares of gold miners surged 512%. As it turned out, we weren't wrong about the impact of the Fed's easy money, just too early. 2010 - 2014 In recent years, investors who have looked to avoid the dollar and the high-debt developed economies have encountered many of the same frustrations that they encountered in the late 1990s. Foreign markets, energy, commodities and gold have gone nowhere while the dollar and U.S. markets have surged as they did in 1997-2000.  Created by EPC using data from Bloomberg All returns are currency-adjusted It is said history may not repeat, but it often rhymes. If so, there may be a financial sonnet brewing. There are reasons to believe that relative returns globally will turn around now much as they did back in 2000. Perhaps even more decisively. Just as they had back in the late 1990's, investors appear to be ignoring flashing red flags. In its Business and Finance Outlook 2015, the Organization for Economic Cooperation and Development (OECD), a body that could not be characterized as a harbinger of doom, highlighted some of the issues that should be concerning the markets. Reuters provides this summary of the report's conclusions:

While these trends have been occurring around the world, they have become most pronounced in the U.S., making valuations disproportionately high relative to other markets. As we mentioned in a prior newsletter, looking at current valuations through a long term lens provides needed perspective. One of the best ways to do that is with the Cyclically-Adjusted-Price-to-Earnings (CAPE) ratio, which is also known as the Shiller Ratio (named after its developer, the Nobel prize-winning economist Robert Shiller).Using 2014 year-end CAPE ratios that average earnings over a trailing 10-year period, the global valuation imbalances become evident:  As of the end of 2014, the S&P 500 had a CAPE ratio of well over 27, at least 75% higher than the MSCI World Index of around 15. (High valuations are also on evidence in Japan, where similar monetary stimulus programs are underway). On a country by country basis, the U.S. has a CAPE that is at least 40% higher than Canada, 58% higher than Germany, 68% higher than Australia, 90% higher than New Zealand, Finland and Singapore, and well over 100% higher than South Korea and Norway. Yet these markets, despite the strong domestic economic fundamentals that we feel exist, are rarely mentioned as priority investment targets by the mainstream asset management firms. In addition, U.S. stocks currently offer some of the lowest dividend yields to compensate investors for the higher valuations (see chart above). The current estimated 1.87% annual dividend yield for the S&P 500 is far below the current annual dividend yields of Australia, New Zealand, Finland and Norway. If a dramatic shock occurs as it did in 2000, will investors again turn away from high leverage and high valuations to seek more modestly valued investments? Then, as now, we believe those types of assets can more readily be found in non-dollar markets. Another similarity between then and now is the propensity to confuse an asset bubble for genuine economic growth. The dotcom craze of the 1990s painted a false picture of prosperity that was doomed to end badly once market forces corrected for the mal-investments. When that did occur, and stock prices fell sharply, the Fed responded by blowing up an even bigger bubble in real estate. When that larger bubble burst in 2008, the result was not just recession, but the largest financial crisis since the Great Depression. But once again investors have mistaken a bubble for a recovery, only this time the bubble is much larger and the "recovery" much smaller. The middling 2% GDP growth we are currently experiencing is approximately half of what we saw in the late 1990s. In reality, the Fed has prevented market forces from solving acute structural problems while producing the mother of all bubbles in stocks, bonds, and real estate. A return to monetary normalcy is impossible without pricking those bubbles. Soon the markets will be faced with the unpleasant reality that the U.S. economy may now be so addicted to monetary heroine that another round of quantitative easing will be necessary to keep the bubble from deflating. The current rally in U.S. stocks has gone on for nearly four full years without a 10% correction. Given that high asset prices are one of the pillars that support this weak economy, it is likely that the Fed will unleash another round of QE as soon as the market starts to fall in earnest. The realization that the markets are dependent on Fed life support should seal the dollar's fate. Once the dollar turns, a process that in my opinion began in April of this year, so too should the fortunes of U.S. markets relative to foreign markets. If I am right, we may be about to embark on what could become the single most substantial period of out-performance of foreign verses domestic markets. While the party in the 1990s ended badly, the festivities currently underway may end in outright disaster. The party-goers may not just awaken with hangovers, but with missing teeth, no memories, and Mike Tyson's tiger in their hotel room.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

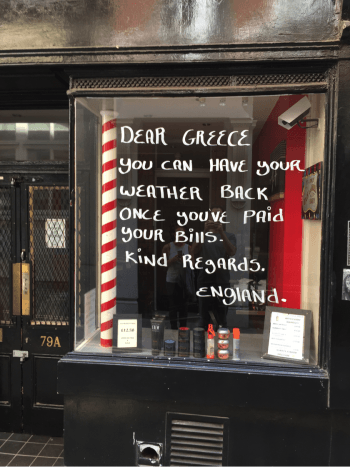

| How Not to Use a Mobile Credit Card Machine Posted: 10 Jul 2015 04:43 PM PDT This post How Not to Use a Mobile Credit Card Machine appeared first on Daily Reckoning. It was time to leave… "Monsieur," the waiter said, handing over what looked like a Game Boy with a slot to enter my credit card. We took it and settled the group's tab, pressing the buttons on the gadget that we guessed were appropriate, given the French prompts were lost on us. Out of the top, a receipt of our bill neatly printed out. We grabbed the paper… gave it a tug… and then a second, herculean tug… until, finally, the Game Boy's back broke open and rolled out a mouse-sized white carpet of receipt paper across the barroom floor. It was such a smooth move, all the waiter could do was take the mess and drape it around our neck: Cashless Society Tip #1: Tear the credit machine receipt toward you, not away… And so, the first casualty in the War on Cash happened on the 3 rue Daunou in Paris at Le Sherwood piano bar. Not three days before, at the currency exchange in Heathrow Airport, we had this very concern. "I won't be here that long. Do you think I'll need some pounds and euros to get by without a problem?" "For $50 worth, I wouldn't," replied the man behind the desk. "It's a cashless society, don't you know? You can buy anything with a debit or credit card here." Uh-huh… "Right now, they're just making it seem convenient," said Jim Rickards when we told him the clerk's response. We were in Europe — two days in London, two days in Paris — because a dedicated group of publishers want to bring Jim's message to the U.K. and France. He continued explaining that the government and banks will say, "'Why carry all that messy cash and change around when you can just use a credit or debit card?' They'll make it seem like it's a matter of convenience, until, eventually, we'll reach the cashless society. At that point, the government can freeze the financial system whenever they need to, like in Greece now." Greek banks are still closed today. By Monday, the government hopes to open them again. The new proposal before the Greek parliament, according to The Wall Street Journal, includes: "changes to Greece's sales tax system"… an "overhaul of the pension system"… increasing "the sales, or value-added, tax on restaurants" plus "corporate taxes to 28% from 26%." They would have to be accepted by the so-called Troika, in order for Greece to receive the bailout funds it needs. And yet the main problem — and not just in Greece — remains. "Until recent times," relates The Daily Reckoning U.K.'s Ben Traynor, "central bankers were traditionally wary of intervening in a crisis. One reason was what's called moral hazard. This is the idea that by bailing out the foolish, they would simply encourage future follies." Ben goes on: "The trouble is that if things get too bad, the central bank may have no choice. If it offers support, it reduces the incentive to exercise discipline in future. "But if it lets nature take its course, as the U.S. authorities did with Lehman Bros. in 2008, the fallout can be so bad that it requires even more support to contain it. This in turn leaves markets confident the central bank would never be so rash as to withdraw support again. "Of course, this leaves the field clear for even more mischief and a bigger mess to clean up down the line. "It's an unenviable decision for ECB President Mario Draghi and his colleagues. "Crisis now? Or bigger crisis later?" Later, it seems. "Markets Rally on Greece Deal Optimism" reports The Wall Street Journal at writing. U.S. stocks are up… commodities like copper are up… and U.S. Treasuries and German bunds have sold off. Happy times are here again. Writing to me in an email, Jim Rickards said, "I expect the Greece situation to be settled by Monday." If he's right, another pat on his back is in order for getting the "There will be no Grexit" call right once again. The parties involved in the deal should hurry, though. The stakes are higher than just people's pensions… bankers' loans… and the future of a monetary union. London's been dangerously sunny, while Greece is gray. We saw an English barbershop Wednesday that explained why: Talk about making an offer they can't refuse… The aforementioned Ben Traynor, who honchos The Daily Reckoning U.K., reports from London. Click here on for his English perspective on the pending Greek deal and what might come afterward… Cheers, Peter Coyne P.S. Here are three more snapshots from the Rickards' European tour…

The post How Not to Use a Mobile Credit Card Machine appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No Way to Run a Currency Union Posted: 10 Jul 2015 04:42 PM PDT This post No Way to Run a Currency Union appeared first on Daily Reckoning. Logistics are important. They can also be a pain in the neck. I say this having spent a portion of today wrestling with the details of getting the U.K. version of Jim Rickards' The Big Drop: How to Grow Your Wealth During the Coming Collapse ready to go to the printers. It felt like an episode of Columbo. There was always just one more thing… It's part of a special project to bring Jim's work over the Atlantic to the U.K. I know it'll be well worth it. As I said to one of my long-suffering colleagues (who has been doing sterling work), at least we're not one of the poor souls working for a eurozone finance ministry who has to assess the latest Greek proposals in a single day. That's no way to run a currency union. Indeed, one of the issues at stake is whether the euro will remain a currency union. What I mean is, there's a big fear that if members can leave, it'll come to be seen as more of a souped-up fixed exchange rate regime. Historically, fixed exchange rate mechanisms have tended to break down sooner or later. That's a big reason why Germany's Angela Merkel has been so keen for so long to keep Greece, an economically tiny member, in the club. This weekend's frenzy of bureaucracy is all about keeping a fundamentally flawed monetary union together. Any solution will be temporary in the extreme. It cannot be anything else – monetary union is incomplete. There's been a lot of ink spilt elsewhere on this aspect of the crisis, so I won't say much about it today. The lack of fiscal union is a major weakness, which everyone knew at the outset. A fascinating article to read from the perspective of 2015 is Wynne Godley's "Maastricht and All That" from 1992, which outlined the eurozone crisis almost two decades before it kicked off. Here's an extract: "It should be frankly recognised that if the depression really were to take a serious turn for the worse — for instance, if the unemployment rate went back permanently to the 20-25% characteristic of the '30s — individual countries would sooner or later exercise their sovereign right to declare the entire movement towards integration a disaster and resort to exchange controls and protection — a siege economy if you will. This would amount to a rerun of the inter-war period." The eurozone's incomplete banking union is another Achilles' heel (can you have more than one Achilles' heel? Can you have more than two?). Indeed, Greece's banks remain closed. They can't stay closed forever without completely destroying the economy. But they can't reopen and start distributing euros again without European Central Bank support. A deal may be cobbled together over the weekend that allows the ECB to come to the rescue once again. If a deal is done though it will be the most hurriedly cobbled together piece of work this crisis has thrown up yet. Here's something to think about. Far from bringing leaders together, this crisis has pushed them apart. Cooperation has been undermined. Political capital is being deployed on an almost constant basis to keep Greece in the euro, by none more so than Angela Merkel. The returns on that capital are hard to discern. If the euro crisis thus far had led to the creation of new institutions and ways of working that could in the future handle something much bigger, it might be a blessing in disguise. It has speeded up the creation of a banking union (whether you agree with this or not is another issue), but overall I suspect it's exhausted Europe's leaders more than it's galvanised them. This may come to matter if we have a fresh and bigger crisis to deal with. Say if another, bigger euro member needs support. Stay tuned… Regards, Ben Traynor Editor’s Note: Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post No Way to Run a Currency Union appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Paul Craig Roberts Interview about Greece Financial Collapse Posted: 10 Jul 2015 04:00 PM PDT My talk with Dr Paul Craig Roberts about the financial situation controlling Greece, and the consequences of the Greeks staying in the Euro or leaving it. Paul explains what, who, has, is, and will be, influencing the situation, and what outcomes we might expect, and how Washington will no doubt be... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Organized Plunder, a.k.a. The State Posted: 10 Jul 2015 03:10 PM PDT Authored by Bill Bonner via Bonner & Partners (annotated by Acting-Man.com's Pater Tenebrarum), Whose Side Are You On?On one side: the Fed… the NSA… the CIA… Fannie Mae… Freddie Mac… the trade unions… Wall Street… the dollar… Obamacare… New York’s taxi system… QE… the wars on terror, poverty, illiteracy, and drugs… Dodd-Frank… the TSA… the ATF… millions of retirees and disability scammers… General Motors… Hillary Clinton… and many, many others…

A widely held and quite erroneous belief … On the other: Airbnb… Uber… cryptocurrencies… “Main Street”… businesses… families… gold… young people… savers… Freemasons… Ron Paul… truck drivers… the Episcopal Church… Elks… entrepreneurs… free markets… and millions of honest people who make their livings and live their lives as best they can without holding a gun to anyone else’s head. Yes, dear reader, maybe it was too much alcohol or too little food. But in the night, a vision came to us. It revealed the big picture in a way we hadn’t seen it. Zombies, you’ll recall, are people and institutions that live at the expense of others. How? Some are freelance criminals. But most depend on government to get the flesh they need. People don’t give up their own blood readily. They run. They hide. They try to protect themselves. But government maintains a territorial monopoly on the one thing that does the trick – violence. So today, we stoop to admire the institution of government. What a beautiful racket! It typically takes 20% to 50% of an economy’s output. It makes the rules. It sets the pace. And woe to anybody or anything that gets in its way…

Murray Rothbard’s concise definition of the State

Everybody Is a CustomerYou can divide an economy into three estates: households, businesses, and government. Of the three, government is in the best position by far. Everybody is a customer of the government, whether he wants to be or not. And when you have control of the government, you set the terms of the deals with the other estates. And you can change the terms whenever you want. That’s why there is so much money in politics – because you can get so much money from politics! A person can go into government with nothing; he comes out with a fortune. Dick Cheney, for example, huffed and puffed almost his entire career in politics, except for a brief stint with a crony defense contractor. Now, he’s said to be worth $80 million.

Dick Cheney – from nada to $80 million – a political career can be quite remunerative. Photo via politicususa.com

Or Hillary Clinton. She has never had a job in the productive economy. She is said to be worth $21 million. Successful politicians get the best parking places… the best offices… and other perks and privileges that no one else gets

Hillary Clinton: never produced anything consumers would voluntarily acquire, and yet, is said to be worth $21 million. Photo credit: Pablo Martinez Monsivais / Associated Press

Members of Congress also routinely exclude themselves from the rules and regulations they’ve made for others. For example, it is illegal for U.S. companies to misstate their financial positions; for government it is business as usual. In the private sector, fraud is a crime; in government it is “just politics.” As to the business community, government has a mixed relationship. Every business is a source of funds. In addition to the money it gets from taxation, confiscations, and other predations, government also gets bribes in various forms. A retired Congressman, for example, can look forward to a career as a lobbyist for the industries he promoted while in office. Or he can make money by giving dull speeches to industry groups. He may choose to do a little consulting, too, or haunt the board of directors.

“Where we are right now”, a public service message sent by Bastiat

Businesses usually begin as productive enterprises. But almost all have zombie tendencies. Once they reach a certain size, they recognize that the best investment they can make is in politics. They hire lobbyists. They pay crony politicians. In return, government enacts rules and regulations to stifle competition. But as with so many of its activities, government succeeds when it fails. As a new industry arises, the money still flows from the cronies, while the feds get a piece of action from the new enterprises, too. And households? They grouse and groan. But the masses usually love government. They think business people are greedy SOBs. But they often hold the fellows who run the government racket in the same exalted category as saints, TV stars, and sports heroes. Don’t believe it? At a recent reception in Baltimore, we noticed people gathered around a familiar face. It wasn’t Baltimore Ravens owner Art Modell; it was former senator Paul Sarbanes. Just look around Washington… or any major city for that matter. Do you find statues of Henry Ford? Where is the marble bust of Alexander Fleming, discoverer of penicillin? Where is the pile honoring Sam Walton? Instead, you find plenty of granite spent to honor scalawags and scoundrels – Lincoln, Wilson, and FDR, to name just a few. And who’s next?

A collection of past scoundrels and scalawags hewn in granite and cast in bronze …

Hillary Is a Terrible Candidate – but is Brain-fog any Better?In politics, as in markets, nobody knows anything. But we were seated at dinner last night next to a seasoned political analyst… “Hillary won’t win the White House,” he confided. “She might not even win the nomination.” We recall that much of what he said was off record, but we can’t remember which parts. So, we will leave his name out of the Diary; he may have spoken more candidly than he had wished. “The trouble with Hillary is that she’s a Clinton without Bill’s charm. And she’s yesterday’s news. She couldn’t even beat Obama. And he’s a terrible politician. “Obama only got elected because of a unique set of circumstances – Hillary and George W. Bush. People were sick of Bush. Hillary is a weak candidate. “So now we’re seeing other candidates come out. Bernie Sanders is showing us how vulnerable she is. Others will be encouraged. One of them will probably get some traction. “Jim Webb is not getting any money from the establishment. But he has real appeal to the voters. “As for the Republicans… Hard to say. I’ve met them all. Rand Paul is smart. But he doesn’t have the funding. Or the political network. He’s too much of an outsider and a maverick to be acceptable. “The trouble with Ted Cruz is that he is inflexible. He’s very smart and right about a lot of things. But you have to be fairly flexible to get elected president. “The one I really like is Rick Perry. I know, he sounds like an idiot. But he’s not. They just caught him at a bad moment, when he was on painkillers from dental surgery, or something. “You remember – he couldn’t recall which department he would abolish if he were elected. It was just a case of brain fog. But it happens to everyone. “He’s actually very smart… and a good campaigner.” We’ve never met Rick Perry, so we can’t say either way…

Modern Zombies: Ms. “Hard Choices” and Mr. Brain-fog… we actually think we would be quite happy with never hearing about either of them again for the rest of our life… | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bohemian Grove’s Secret Speeches Revealed - The Lakeside Talks Exposed! Posted: 10 Jul 2015 03:00 PM PDT Bohemian Grove's Secret Speeches Revealed - The Lakeside Talks Exposed! Check The Bohemian Grove: Facts & Fiction by Mark Dice in paperback on Amazon The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Greek Businesses Accept Lira, Lev As Grexit Looms Posted: 10 Jul 2015 02:35 PM PDT With the Greek drama headed into its final act and Alexis Tsipras stuck between an obstinate Germany and a recalcitrant Left Platform, many wonder if the introduction of an alternative currency in Greece is now a foregone conclusion. Even if Athens and Brussels manage to strike a deal over the weekend, the country still faces an acute cash shortage and a severe credit crunch that threatens to create a scarcity of critical imported goods. Amid the chaos, the Greek Drachma has made two mysterious appearances this week (see here and here), suggesting that the EU is on the verge of forcing the Greek economy into the adoption of a parallel currency and while this week's Drachma "sightings" might properly be called anecdotal, a report from Kathimerini and comments from deposed FinMin Yanis Varoufakis suggest redenomination rumors are not entirely unfounded. Now, with the ECB set to cut Greek banks off from the ELA lifeline on Monday morning in the absence of a deal, some businesses are mitigating the liquidity shortage by accepting foreign currency. FT has more:

Yes, "no reason not to accept." There are however, quite a few reasons for Germany "not to accept" Tsipras' latest proposal and for Greeks "not to accept" a deal that flies in the face of a referendum outcome that's not even a week old. And so as we kick off yet another weekend where all eyes turn nervously to Brussels on Saturday and to Athens on Sunday, the million dollar question seems to be this: what will the preferred payment method be in Greece this time next week? Lira, lev, drachma, or euro? | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JADE HELM 15 - U.S. Preparing for Martial Law & Collapse of America ? Posted: 10 Jul 2015 02:30 PM PDT Jade Helm 15, the controversial Special Operations exercise that spawned a wave of conspiracy theories about a government takeover, will open next week without any media allowed to observe it, a military spokesman said. Jade Helm 15, heavily scrutinized military exercise, to open without media... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alex Jones -- Pope Francis Is A Vatican Coup Posted: 10 Jul 2015 02:00 PM PDT Alex Jones breaks down how the Pope is a part of the globalist plan to destroy the world The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 Things To Ponder: "China Rising" Or Not? Posted: 10 Jul 2015 02:00 PM PDT Submitted by Lance Roberts via STA Wealth Management, Things have certainly changed since I was a child. When I was growing up my father would come outside to give the traditional "dinner whistle." As was often the case, the common response was "Can we play for five more minutes? Please?" Times have certainly changed. Today, my "dinner whistle" is often met with:

My kids are huge fans of the Electronic Arts "Battlefield" series of multiplayer military warfare games. The other night, one of the downloadable content (DLC) maps on which they were playing caught my attention. It was entitled "China Rising." Had it not been for the recent headlines of the Shanghai index, it would have likely gone unnoticed. However, given the collapse in the index of nearly 30% over the last month, and the potential implications for domestic economy and markets, I thought it was most apropos. China Rising? Well, it was. And this last week, we saw what the perils of a leveraged market can be when things go "inevitably wrong."

This weekend's reading list is a collection of analysis as to the potential impact of the deflating of the Chinese bubble. Will the interventions by the Chinese government stem the tide of selling or only postpone it? More importantly, is history set to repeat itself. "China Rising" may have been the sound of the "sound of the bell" being rung for the bull market that begin in 2009. While it is too early to know for certain, at least things are getting a bit more interesting. Let's just try and get to a "save point" first. 1) The Greek Crisis Is Nothing Compared To China by Paul La Monica via CNN Money

Read Also: Goldman Sachs Says There's No China Stock Bubble by Cindy Wang via Bloomberg Business 2) Why Beijing Cannot Let Its Bull Market Die by Craig Stephen via MarketWatch

Read Also: Why This Chinese Bubble Is Different by John Authers via FT Read Also: 5 Reasons Why China Really Matters by Mohammed El-Erian via Bloomberg 3) China's Big Misquided Gamble On Its Stock Market by Minxin Pei via Fortune

Read Also: China And The Delusion Of Control by David Keohane via FT 4) China Or Grexit? What's Driving Markets by Bryce Coward via GaveKal Capital

Read Also: US Stocks: Last Man Standing by Meb Faber via Faber Research 5) China's Stock Market Crash Is Just Beginning by Howard Gold via MarketWatch

Read Also: Chinese Stocks: What's Behind The Great Market Tumble? by Knowledge@Wharton Other Interesting ReadsWhy Momentum Investing Works by Ben Carlson via Wealth Of Common Sense Cyclical Bull, Structural Bear Still by Eric Bush via GaveKal Capital Old Economic Thinking Is The Problem, Says BIS by Yves Smith via Naked Capitalism

Have a great weekend. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Calm Before the Storm Posted: 10 Jul 2015 01:40 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Varoufakis' Stunning Accusation: Schauble Wants A Grexit "To Put The Fear Of God" Into The French Posted: 10 Jul 2015 01:33 PM PDT Earlier we reported that Yanis Varoufakis, seemingly detained by "family reasons" would be unable to join his fellow parliamentarians and personally vote in what is likely the most important vote of Syriza's administration: the one in which he and his party capitulate to the Troika and vote "Yes" to the proposal he and Tsipras urged everyone to reject just one week ago. Subsequently, it was made clear what these family reasons are:

Judgment aside about his decision to take a holiday from a vote that his strategy guided Greece into, it was clear that he has Wifi on the ferry because this afternoon, While V-Fak may well have been in transit, the Guardian released an Op-Ed penned by Varoufakis titled "Germany won't spare Greek pain – it has an interest in breaking us." Readers can read it in its entirety here but here is the punchline:

He does have a point: Recall "Forget Grexit, "Madame Frexit" Says France Is Next: French Presidential Frontrunner Wants Out Of "Failed" Euro." So perhaps making an example of the social collapse that would result from a Eurozone exit, would be seen a good lesson for French voters ahead of the 2017 French presidential elections in Schauble's mind But is Varoufakis right? Perhaps ... but also recall this from the FT in 2014 recalling Europe's first formulation of Plan Z:

Will this time Merkel risk the explosion of the Eurozone with her own actions: her biggest historic legacy? Probably not, and while Schauble has much sway, it is still Merkel's word over his. No, Varoufakis may be right about Greece being made an example of (unless he is merely trying to deflect blame from himself for putting Greece in this position and for conspicuously avoiding voting for a plan he himself derided untilt the end), but the one person who will decide the future of Greece in the Eurozone is neither Schauble nor Merkel but Mario Draghi, also known as Goldman Sachs. Because if Goldman wants more Q€, it will get more Q€. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bill Still Report - Cyber Attack Thursday? Posted: 10 Jul 2015 12:56 PM PDT I'm Still reporting from Washington.With the vast majority of the citizens of the world completely in the dark, as we speak a multi-billion dollar World War is going on – a Cyber War.Yesterday the New York Stock Exchange was knocked out for 3 and a half hours in the middle of a very busy trading... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mike Kosares: The Shanghai stock crash and China gold demand Posted: 10 Jul 2015 10:21 AM PDT 1:20p ET Friday, July 10, 2015 Dear Friend of GATA and Gold: China's stock-market crash likely will encourage Chinese investors to consider the capital-preservation virtues of gold, Mike Kosares of USAGold in Denver writes today, especially since the Chinese government has been encouraging gold ownership and building market mechanisms to facilitate it. Kosares' commentary is headlined "The Shanghai Stock Crash and China Gold Demand" and it's posted at USAGold here: http://www.usagold.com/publications/NewsViewsJuly2015SpecialReport.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ron Paul - The United States Is About To Collapse - July 10th, 2015 Posted: 10 Jul 2015 10:00 AM PDT Ron Paul - The United States Is About To Collapse - July 10th, 2015 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BREAKING NEWS -- Chelsea Is Not Bill Clinton's Daughter Posted: 10 Jul 2015 09:32 AM PDT Clinton insider Larry Nichols reveals and confirms that Bill Clinton is NOT Chelsea's Biological father. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China wants to steal gold market 'reins' from New York and London Posted: 10 Jul 2015 07:50 AM PDT By Myra P. Saefong China has been making it very clear that it wants more control over the global gold market, but it'll have to go through New York and London first. "Given that China is the epicenter of the physical gold market, it does make sense that the Chinese government would want its physical Shanghai gold market to supplant the Comex derivative market (and others) as the primary global price-setting mechanism," said Anthem Blanchard, chief executive officer of online precious-metal retailer Anthem Vault. China is, after all, the world's largest producer and one of the biggest buyers of the metal, often running neck and neck with India as the globe's top consumer. ... ... For the remainder of the report: http://www.marketwatch.com/story/china-wants-to-steal-gold-market-reins-... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Maintaining the Illusion of Stability Now Requires Extremes Posted: 10 Jul 2015 06:41 AM PDT This post Maintaining the Illusion of Stability Now Requires Extremes appeared first on Daily Reckoning. On the surface, everything still looks remarkably stable in the core industrial economies. The stock markets in Japan, Germany and the U.S. are only a few percentage points off their highs, and we’re constantly assured that inflation no longer exists and official unemployment is low. In other words, other than the spot of bother in Greece, life is good. Anyone who signs on the dotted line for easy credit can go to college, buy a car or house or get another credit card. With more credit, everything becomes possible. With unlimited credit, the sky’s the limit, and it shows. Europe is awash with tourists from the U.S., China and elsewhere, and restaurants are jammed in San Francisco and New York City, where small flats now routinely fetch well over $1 million. In politics, the American public is being offered a choice of two calcified, dysfunctional aristocracies in 2016: brittleness is being passed off as stability, not just in politics but in the economy and the cultural zeitgeist. But surface stability is all the status quo can manage at this point, because the machine is shaking itself to pieces just maintaining the brittle illusion of prosperity and order. Consider what happened in Greece beneath the surface theatrics.

Here is the debt in 2009–mostly owed to private banks and bondholders:

Here is the debt in 2015–almost all was shifted onto the backs of Eurozone taxpayers:

This re-set, while painful in the short-term, is the only mechanism available to force reforms on a self-serving kleptocracy and rid the economy of a dependence on unsustainable credit expansion. This much-needed re-set to an economy that serves the many rather than the few is what the Powers That Be are so fearful of, for it is the few who garner most of the gains of a corrupt, fully financialized neofeudal system and it is these few who fund the election campaigns of the politicos who are so desperate to maintain the perquisites of the Financial Nobility. Austerity is meted out to debt-serfs while those at the top transfer tens of billions to their private accounts. There are variations of this basic flow of income from serfs to the nobility, of course; stock market bubbles are inflated by authorities, insiders sell, sell, sell as credulous banana merchants and wage-earners buy, and then when the bubble bursts, these same authorities ban selling by the small-fry bagholders. But this is not real stability; it is a brittle simulacrum of stability, an illusion that has required the status quo to pursue extremes of policy and debt that are intrinsically incapable of yielding stability. In effect, the status quo has greatly increased the system’s vulnerability, fragility and brittleness–the necessary conditions for catastrophic collapse–all in the name of maintaining a completely bogus facade of stability for a few more years. Regards, Charles Hugh Smith P.S. Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible. And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career. You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck. Even the basic concept "getting a job" has changed so radically that jobs–getting and keeping them, and the perceived lack of them–is the number one financial topic among friends, family and for that matter, complete strangers. So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy. It details everything I've verified about employment and the economy, and lays out an action plan to get you employed. I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read. The post Maintaining the Illusion of Stability Now Requires Extremes appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver Stocks More Weakness Ahead Posted: 10 Jul 2015 02:59 AM PDT The precious metals sector is enduring losses for the third straight week. The gold miners and Silver have led the way down, though Silver has rallied over the past two sessions. Gold has also rallied yet remains dangerously close to making a new weekly low for the bear market. While the metals recovered some losses on Wednesday and Thursday, the gold miners failed to generate anything positive and closed near their lows for each session. The inability of the miners to recover to even a small degree augurs badly for the entire sector in the days ahead. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver at the Mercy of China’s Stock Market Posted: 10 Jul 2015 02:44 AM PDT Silver's fate will be determined over the next few weeks by the events unfolding around China's stock market. If their equity markets stabilize, and if it looks as if the worst is over, silver will stabilize as well. If not, then neither will silver. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Stocks are rallying today because of:

Stocks are rallying today because of: Chinese Stock Market Crash Just A Warm Up

Chinese Stock Market Crash Just A Warm Up

Jim and I enjoying Partagas No. 5's on Hotel Raphael's rooftop…

Jim and I enjoying Partagas No. 5's on Hotel Raphael's rooftop…

No comments:

Post a Comment