Gold World News Flash |

- U.S. Economy Meltdown Has Reached New Level as Greece, Puerto Rico, China Shake Markets

- Andrew Maguire Warns The Price Of Silver Is Set To Skyrocket In A Massive Short Squeeze

- The Complex Nature of Gold

- No Surprise Here: Mortgage Fraud Is Increasing Again

- Does The Illuminati Control The Music Industry?

- BET Awards 2015 Illuminati Chris Brown Performance EXPOSED

- Why The Puerto Rico Debt Crisis Is Such A Huge Threat To The U.S. Financial System

- PHYSICAL Ag Production DECLINING: World’s Largest Silver Producer Down Stunning 12%

- GoldCore's O'Byrne cites gold suppression in interview with Max Keiser

- Potential for short squeeze in silver is greater than ever, Maguire tells KWN

- Greek banks prepare plan to raid deposits to avert collapse

- EXPOSED: The great deception of the mainstream "truth movement".What David Icke DOESN'T tell you!

- Shanghai Gold Exchange Has 46.2 Tonnes of Gold Withdrawn - What Will China Do

- Greece Referendum: A coming Coup? - Joaquin

- Arctic Drilling Future Now Rests On One Well

- Gold Bullion Dealer Unexpectedly "Suspends Operations" Due To "Significant Transactional Delays"

- While the World Watches Greece THIS is Happening

- Predicting impacts of dollar collapse based on Greece implosion

- Red Alert -- Greece Begins To Collapse (Black Horsemen)

- RON PAUL on ECONOMIC COLLAPSE - Collapse of America is Coming U.S. on The Brink

- India considers ending import curbs on gold-silver alloy

- Gold and Silver Subdued

- Gold Stocks Cheap to Buy but Not for Long

| U.S. Economy Meltdown Has Reached New Level as Greece, Puerto Rico, China Shake Markets Posted: 04 Jul 2015 12:00 AM PDT from The Money GPS: |

| Andrew Maguire Warns The Price Of Silver Is Set To Skyrocket In A Massive Short Squeeze Posted: 03 Jul 2015 11:30 PM PDT from KingWorldNews:

Silver started the year at around $16.50 and had an open interest of around 150,000 contracts. Last Friday silver closed at $15.76, with an open interest of around 200,000 contracts. That's a 50,000 increase in open interest. This evidences a large short position that's been built up since we ended 2014. The only question that remains is: Who holds this short position? |

| Posted: 03 Jul 2015 10:00 PM PDT SunshineProfits |

| No Surprise Here: Mortgage Fraud Is Increasing Again Posted: 03 Jul 2015 09:20 PM PDT by Dave Kranzler, Investment Research Dynamics:

Often overlooked is Colorado, which at one point during the last bubble collapse was in the top-5 for foreclosures. For the past year, up until about four weeks ago when the market seems to have stalled, Denver was as hot as any market in country as "investor/flippers" began bidding wars on homes. Wash, rinse, repeat. Just like stock market chasers, the retail home bubble chasers will never learn… |

| Does The Illuminati Control The Music Industry? Posted: 03 Jul 2015 09:00 PM PDT from Alltime Conspiracies : The All-Seeing Eye, Triangle and many other Illuminati symbols run rampant throughout the music industry, whether on album covers, in music videos or in live shows. With outspoken critics of the Illuminati, like Tupac, mysteriously disposed of, is it possible that the billion dollar industry is controlled by the world’s most secret organization? |

| BET Awards 2015 Illuminati Chris Brown Performance EXPOSED Posted: 03 Jul 2015 08:40 PM PDT from Vigilant Christian: At this years 2015 BET awards Chris Brown performed in a giant gold Illuminati pyramid! In this video I share with you how this is a blatant attack against God hidden in plain sight. Orchestrated by a secret satanic cabal! Please share this video! God Bless, STAY VIGILANT & FEAR NO EVIL !!! |

| Why The Puerto Rico Debt Crisis Is Such A Huge Threat To The U.S. Financial System Posted: 03 Jul 2015 08:00 PM PDT by Michael Snyder, The Economic Collapse Blog:

The debt crisis in Puerto Rico could potentially cost financial institutions in the United States tens of billions of dollars in losses. This week, Puerto Rico Governor Alejandro Garcia Padilla publicly announced that Puerto Rico's 73 billion dollar debt is "not payable," and a special adviser that was recently appointed to help straighten out the island's finances said that it is "insolvent" and will totally run out of cash very shortly. At this point, Puerto Rico's debt is approximately 15 times larger than the per capita median debt of the 50 U.S. states. Yes, the Greek debt crisis is larger, as Greece currently owes about $350 billion to the rest of the planet. But only about $14 billion of that total is owed to U.S. financial institutions. But with Puerto Rico, things are very different. Just about the entire 73 billion dollar debt is owed to U.S. financial institutions, and this could potentially cause massive problems for some extremely leveraged Wall Street firms. There is a reason why Puerto Rico is called "America's Greece". In Puerto Rico today, more than 40 percent of the population is living in poverty, the unemployment rate is over 12 percent, and the economy of the small island nation has continually been in recession since 2006. |

| PHYSICAL Ag Production DECLINING: World’s Largest Silver Producer Down Stunning 12% Posted: 03 Jul 2015 07:55 PM PDT by Steve St. Angelo, SRS Rocco Report:

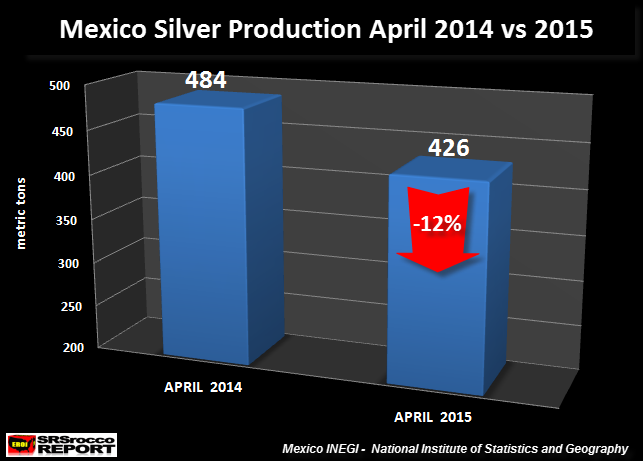

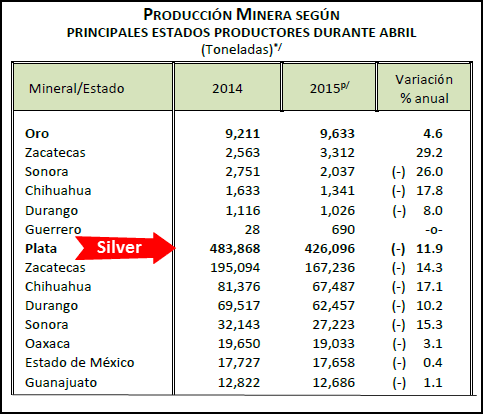

Looking at the chart below, we can see Mexico's silver production declined 58 metric tons (mt), from 484 in April last year down to 426 metric tons in 2015: That's a large decline in just one month. Mexico's total silver production for the first four months of 2015 is down 5% (92 mt) compared to last year. Here is the data: Jan-Apr 2014 = 1,893 mt Jan-Apr 2015 = 1,801 mt. This is the actually data released by Mexico's INEGI:

The table shows silver production in Mexico declined the most in the larger regions such as, Zacatecas, Chihuahau, Durango and Sonara. Two of Mexico's largest silver producing mines are located in Zacatecas… Fresnillo PLC's Fresnillo Mine and GoldCrop's Penasquito Mine. Falling Mexican silver production could cause more stress on an already high-demand silver market this year. With India importing record silver, including elevated imports into the United States, we could see real shortages by the second half of the year if investment demand surges due to a financial contagion stemming from a Greek Exit of the European Union. If you haven't checked on THE SILVER CHART REPORT, there's a great deal of information on the Silver Industry & Market not found in any single publication on the internet. |

| GoldCore's O'Byrne cites gold suppression in interview with Max Keiser Posted: 03 Jul 2015 07:47 PM PDT 10:46p ET Friday, July 3, 2015 Dear Friend of GATA and Gold: GoldCore proprietor Mark O'Byrne this week joined Max Keiser on Russia Today's "Keiser Report," discussing the suppression of gold prices with derivatives, the Texas public university system's plan to repatriate its gold from New York, and the possible restoration of gold as international currency. The interview is summarized and available in video at GoreCore's Internet site here -- http://www.goldcore.com/us/gold-blog/max-keiser-interviews-goldcores-mar... -- with the segment with O'Byrne beginning at the 12:30 mark. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Potential for short squeeze in silver is greater than ever, Maguire tells KWN Posted: 03 Jul 2015 06:49 PM PDT 9:48p ET Friday, July 3, 2015 Dear Friend of GATA and Gold: London metals trader tells Andrew Maguire tells King World News today that the weak hands in the silver market are now so short that the potential for a short squeeze has never been greater. His interview is excerpted at the KWN blog here: http://kingworldnews.com/andrew-maguire-the-price-of-silver-is-set-to-sk... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Greek banks prepare plan to raid deposits to avert collapse Posted: 03 Jul 2015 06:35 PM PDT By Kerin Hope ATHENS, Greece -- Greek banks are preparing contingency plans for a possible "bail-in" of depositors amid fears the country is heading for financial collapse, bankers and businesspeople with knowledge of the measures said on Friday. The plans, which call for a "haircut" of at least 30 per cent on deposits above E8,000, sketch out an increasingly likely scenario for at least one bank, the sources said. A Greek bail-in could resemble the rescue plan agreed by Cyprus in 2013, when customers' funds were seized to shore up the banks, with a haircut imposed on uninsured deposits over E100,000. ... ... For the remainder of the report: http://www.ft.com/intl/cms/s/0/9963b74c-219c-11e5-aa5a-398b2169cf79.html ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| EXPOSED: The great deception of the mainstream "truth movement".What David Icke DOESN'T tell you! Posted: 03 Jul 2015 06:30 PM PDT REAL TRUTH: What David Icke DOESN'T tell you! (R$E) 'All that ever came before me are thieves and robbers: but the sheep did not hear them.' [John 10 v 8] The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Shanghai Gold Exchange Has 46.2 Tonnes of Gold Withdrawn - What Will China Do Posted: 03 Jul 2015 05:45 PM PDT |

| Greece Referendum: A coming Coup? - Joaquin Posted: 03 Jul 2015 03:30 PM PDT Greece: Meaningful Economic Reforms Could Come Through BRICS and Russia? The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Arctic Drilling Future Now Rests On One Well Posted: 03 Jul 2015 03:10 PM PDT Submitted by Charles Kennedy via OilPrice.com, Royal Dutch Shell is nearing a start to drilling in the Arctic, but has run into some hiccups. The U.S. government decided that Shell cannot actually drill both of its wells in the Chukchi Sea as planned. The Interior Department said that doing so would run afoul of its rules that protect marine life. According to those regulations, which were issued in 2013, exploration companies cannot drill two wells within 15 miles of each other. Shell had planned to drill two wells in the Burger prospect within a 9 mile range. Environmental groups hoped that the Interior Department would throw out Shell’s drilling plan altogether, owing to the fact that the environmental assessment the agency conducted was based on the two-well drilling plan, according to Jennifer Dlouhy of Fuel Fix. Environmental groups argued that since the Interior Department didn’t actually conduct an assessment of a drilling plan consisting of just one well, the entire drilling program should be scrapped. Interior didn’t buy these arguments, but still ruled that Shell can only drill one well this summer. Shell reiterated that it would move forward with drilling the lone well in the Arctic this year, having committed around $1 billion for the program. Shell announced that it expects to be able to begin drilling by the third week in July after sea ice has melted sufficiently. Shell is still awaiting one last federal permit before it can begin drilling, and it is also awaiting the arrival of its second drilling rig in Alaska. Separately, several oil companies recently announced that they were putting their Arctic plans on ice. A joint venture between Imperial Oil, ExxonMobil, and BP decided to shelve plans for exploration in the Canadian Arctic. They had permits that will expire in 2019 and 2020, and the group says that they will not be able to drill before then. More research is needed and since the companies are running out of time, they have decided to suspend work and lobby the Canadian government for an extension. Last year Chevron decided to suspend its plans to drill in the Beaufort Sea after the collapse in oil prices made doing so unattractive. The move by Imperial and its partners likely puts any significant drilling in the Canadian Arctic on hold indefinitely. As such, Arctic drilling in North America will come down to Shell’s one well in the Chukchi Sea. |

| Gold Bullion Dealer Unexpectedly "Suspends Operations" Due To "Significant Transactional Delays" Posted: 03 Jul 2015 02:40 PM PDT What makes the current sovereign default episode different from previous ones is the uncanny stability and lack of buying of "fiat remote" assets such as gold and silver, and to a lesser extent, digital currency such as bitcoin. Indeed, all throughout the Greek pre-default escalation and ultimately, sovereign bankruptcy to the IMF, it seemed as if there was an absolute aversion to the peak of Exter's inverted pyramid. What is even more surprising about the lack of any gold price upside is that it is not due to lack of demand. Quite the contrary, because as Bloomberg wrote last week, "European investors are increasing purchases of gold as Greece's turmoil boosts the appeal for an alternative to the euro."

The bullion dealers themselves are enjoying a jump in sales to retail customers:

However, it is the "paper" gold market where things were most perplexing in recent months. Recall that, as Zero Hedge broke and first reported, in the first quarter of the year, or the same time the Syriza government took power, something very dramatic took place in the US derivatives market, where first JPM saw an absolute explosion of its commodity derivative holdings (a broad umbrella which is not broken down further):

... coupled wih Citi's surge in "precious metals" derivatives which soared from $3.9 billion to $42 billion.

But what is most confusing is how even as physical metal demand clearly rose across Europe in the past few months and the price of paper gold actually declined, perhaps facilitated by some "hedged" derivative positions on the short side of precious metals, some bullion dealers have actually found it impossible to survive, and in the last few days at least one major gold bullion dealer, Bullion Direct, greeted customers with the following notice on its website:

Just what are "significant transactional delays" and how bad is the physical gold supply-chain if it can put at least one dealer out of business. Another question: is this a solitary failure by gold vendor due to a one-off problem with working capital, or is something more systemic about to be revealed in the gold bullion sales industry? We look forward to finding out, but in the meantime our advice to buyers of physical precious metals is the same as always: if you purchased it and you can't hold it in your hand, it isn't yours. |

| While the World Watches Greece THIS is Happening Posted: 03 Jul 2015 02:17 PM PDT By Chris at www.CapitalistExploits.at Watching the ongoing Greek saga unfold is enough to make a blind man grimace. Capital controls which could be seen coming down the track like a freight train are but one more notch on the disaster stick called European Monetary Union. Why talk of Greek debt negotiations is even taking place at all is the height of absurdity. It's akin to discussing how large an area of the desert should be dedicated to growing lettuces. The answer which no Eurocrat is prepared to acknowledge is, "Who cares? Nobody should be so daft as to grow lettuces in the desert". Let's all be honest, shall we. What we're talking about here is foreign aid. It's not about debt repayments. Nobody is getting repaid. Anyone still clinging to that hope is simultaneously still waiting for Santa to come down the chimney, the Easter bunny to show up and for "liberating" forces to find weapons of mass destruction in Iraq. Let's just table debt talks, call them what they are, which is foreign aid, and move this thing along. The problem with acknowledging the ugly truth is that German banks would then have to write down those "assets" on their balance sheets: "Jeez, it'd just be so much easier if we could keep them at par value and ensure we pick up that bonus at year end. And so we must endure more saga and carry on this game of pretense". While I could spend time on Greece, what I'm more interested in is what few are paying attention to while this Greek saga unfolds. That is what is going on with the Chinese yuan. We've recently made the argument for a weakening yuan. My friend Brad and I both went up against the yuan late last year and Brad detailed his thinking in October of last year, then again in December, where he delved into the Chinese banking system, and once again in March of this year. That, ladies and gentlemen, is our current bias. We're currently short. It's important to establish one's bias early on in order to attempt to understand any argument, so now you have ours. Often fund managers are selling a product which leads them into making decisions which have more to do with an agenda than with sufficient critical thought. Let me say therefore that we have an opinion right now. But since we are not selling any product, hopefully we can keep our minds open. Let's see where we get to and then I'm going to show you why we have a decent crack at making money without having an opinion either way. By many accounts the yuan is one of (if not THE) most overvalued currencies in the world right now. But there are just as many well thought arguments arguing the opposite saying that it is indeed undervalued. Both sides have credible and well thought out ideas so let me attempt to summarise the most credible I've found. Why the Yuan will Rise Chinese policy makers are unlikely to let anything take place which rocks the yuan exchange rate boat. The yuan fell to 6.28 in early March of this year before the PBOC stepped in and threw $33 billion at the "problem", reversing the decline and sending it back up to where it trades today around 6.21. They have around $4 trillion in reserves so if, like us, you're a speculator looking at firepower this is well worth looking at. Clearly the monetary authority is prepared to dip into their vast currency reserves to offset capital outflows and stabilize the yuan. The IMF discussions around including the yuan into the SDR basket of reserve currencies (currently the dollar, euro, yen and pound) is something which China has long been courting. Right now, the yuan has posted it's biggest monthly advance since December 2011, on the heels of or in anticipation of inclusion in the SDR basket by the IMF. Amongst other things, what is required is for the yuan to be "fairly valued". Wild swings in the yuan - whether up or down - would kill their chances of joining the hallowed ground of the other terrible units of payment. In order to meet their criteria it's essential that the yuan remain stable. Another IMF criteria is that the currency is "freely usable". In other words, free floating. I'll come back to this in a minute as I think it's something overlooked by many observers. Why the Yuan will Fall On the other side of this argument is the fact that China's economy is slowing and is facing increased competition from regional players, such as Japan, who are playing the currency card, devaluing their currencies and sucking up export market share. A weaker exchange rate would help boost exports and while China is certainly moving towards a domestic consumer supported economy, they are not there yet and manufacturing and exporting to the developed world is still their "bread and butter". Remember I mentioned that part of the IMF criteria is that the currency float freely? Well, many believe - and perhaps correctly - that when (or if) the yuan is added and floats freely there will be an almighty rush INTO the yuan. I've seen few who believe that this wouldn't at least in the short-term allow the opposite to happen. Consider for a moment that most Chinese have been going to great lengths to get OUT of the yuan. Does it not make sense that when they are allowed to do so there will not be a decent amount of them quite excited with the prospect of moving out of yuan? In the simplest of terms the question boils down to the following...Upon inclusion into the IMF and a subsequent floating of the yuan, does capital flow into the yuan or out of it? The problem with China is that nobody knows the real numbers. Nobody! What are the insiders doing? They're shoveling their money out of the country so fast it's going to catch fire from the friction. This is what the insiders are doing. That doesn't mean that suckers won't come in the other way and we get a strong yuan rally. It's certainly possible and maybe it's even probable. Fortunately, the market is gifting us an opportunity right now and we don't have to make that decision. I just got off the phone with Brad who told me about me the below pricing of an at the money call option on the yuan (or the offshore yuan, to be more specific). Currently, you're paying 2.5% premium for a 12-month call option.

Now, take a look at the below chart. You'll see that buying a 12-month at the money put we're paying just 0.3%. You can buy 100,000 USD/CNH puts for 12 months at the money and it'll cost you a mere $300!

To break even on the first trade we need the currency pair to move by 2.5% in our favour within 12 months and on the second trade we need the pair to move by just 0.3% to break even. Pardon me for saying so but that is almost as insane as the Eurocrats discussing Greek debt. Buying both is what traders term a "straddle" but don't get hung up on terminology. The point is that for a 2.8% premium (2.5% + 0.3%) we can hold both positions. We don't much care which way it moves but simply that it MOVES! What could make it move? Well, inclusion at the hallowed table of disreputable currencies currently making up SDRs or of course non-inclusion. Either of these events have the potential to create capital flows one way or the other causing the USD/CNH pair to move substantially more than a mere 2.8%. Or any of the reasons we delved into in our USD Bull Market report where we detailed why we are short the yuan. I'd suggest we're likely to see MORE not LESS volatility over the next 12 months and the current lack of volatility being priced into the market is just the sort of golden gift which Brad looks for. - Chris

"Eppur si muove (And yet it moves)." - Galielo Galilei |

| Predicting impacts of dollar collapse based on Greece implosion Posted: 03 Jul 2015 10:50 AM PDT http://www.telegraph.co.uk/finance/ec...Greek banks down to €500m in cash reserves as economy crashesThe daily allowance of cash from many ATM machines has already dropped from €60 to €50, purportedly because €20 notes are running out Greece is sliding into a full-blown national crisis as the... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Red Alert -- Greece Begins To Collapse (Black Horsemen) Posted: 03 Jul 2015 10:43 AM PDT Only 500 Million Euro's left in Reserve Banks as Food and Drugs are beginning to not be shipped into the country The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| RON PAUL on ECONOMIC COLLAPSE - Collapse of America is Coming U.S. on The Brink Posted: 03 Jul 2015 10:22 AM PDT The controlled media tells us that it is a symptom of corporate greed and an accidental occurrence. The truth is that recently released central bank cartel documents show that the entire global financial melt-down in a purposefully engineered consolidation. The following is a transcript of an... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| India considers ending import curbs on gold-silver alloy Posted: 03 Jul 2015 08:54 AM PDT By Neha Dasgupta and Manoj Kumar The Reserve Bank of India and the finance ministry are in talks to scrap bulk import licences for a gold-silver alloy used by domestic refiners, months after relaxing curbs on gold imports, officials with direct knowledge of the discussions told Reuters. Gold is India's second-highest import in value terms, and a jump in imports widened the current account deficit in 2013, sparking the country's worst currency turmoil since a balance of payments crisis in 1991. An alloy of gold and silver, called dore, from which refineries produce pure gold, forms about 150 tonnes of imports each year and attracts a duty of 8.24 percent, which is less than the duty of 10.30 percent on refined gold. The RBI wants to remove all restrictions on refiners while the finance ministry has raised concerns over tax evasion, the sources said. ... ... For the remainder of the report: http://www.reuters.com/article/2015/07/03/india-gold-economy-idUSL3N0ZJ2... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 03 Jul 2015 05:24 AM PDT Gold and silver had a poor week, with no relief from drifting prices after the end of the second quarter. The gold price opened on Monday morning in the Far East at $1187 and fell to a low point at $1158 yesterday. Silver mirrored gold's move falling from $16.05 to $15.50. Both metals rallied yesterday afternoon with gold down slightly but silver up 14 cents. In early European trading this morning there were further small gains. |

| Gold Stocks Cheap to Buy but Not for Long Posted: 03 Jul 2015 01:17 AM PDT Fund Manager Adrian Day believes that the U.S. dollar is fundamentally overvalued and we can expect a devaluation at some point. This is good news for the price of gold. In this interview with The Gold Report, Day adds the even-better news for investors in gold equities is that so many good shares now sell for so little, and he discusses several companies that won't remain bargains for long. The Gold Report: Despite the lack of an economic recovery and the reality of ever-increasing debt, the U.S. dollar and the equity markets remain strong, while gold (as denominated in U.S. funds) remains weak. Do you expect these conditions to change? |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Silver is the big story at this time. And it gives away what the same market-making bullion banks are up to in gold. In almost 40 years of trading I have never seen such a bullish set up in silver. We will look back (and marvel) at this unprecedented inflection point. Since we've started the year, open interest in both gold and silver have increased while prices have declined. Silver is the primary focus because it involves the same actors in a much smaller market and the footprints are much easier to read.

Silver is the big story at this time. And it gives away what the same market-making bullion banks are up to in gold. In almost 40 years of trading I have never seen such a bullish set up in silver. We will look back (and marvel) at this unprecedented inflection point. Since we've started the year, open interest in both gold and silver have increased while prices have declined. Silver is the primary focus because it involves the same actors in a much smaller market and the footprints are much easier to read. It was only a matter of time before the mortgage data started reflecting mortgage fraud again. I have suspected that mortgage application fraud had been rising with the sudden re-emergence of home-flipping and the "get-rich quick – find it, finance it, flip it" seminars proliferating in the larger metropolitan areas. The hot-spot fraud and flip areas the first time around are largely the hot-spot fraud and flip areas now: California, Nevada, Florida and the northeast.

It was only a matter of time before the mortgage data started reflecting mortgage fraud again. I have suspected that mortgage application fraud had been rising with the sudden re-emergence of home-flipping and the "get-rich quick – find it, finance it, flip it" seminars proliferating in the larger metropolitan areas. The hot-spot fraud and flip areas the first time around are largely the hot-spot fraud and flip areas now: California, Nevada, Florida and the northeast.

The World's largest silver producer saw its production decline significantly in April. According to Mexico's INEGI – National Institute of Statistics and Geography, Mexico's silver production dropped a stunning 12% in April compared to the same month last year.

The World's largest silver producer saw its production decline significantly in April. According to Mexico's INEGI – National Institute of Statistics and Geography, Mexico's silver production dropped a stunning 12% in April compared to the same month last year.

No comments:

Post a Comment