Gold World News Flash |

- Manipulating the Price of Gold and Silver

- 4 Mainstream Media Articles Mocking Gold That Should Make You Think

- Silver Squelchers 20 & Their Interesting Associates

- Insight into Greece and China’s Love of Gold – David Morgan

- 4 Mainstream Media Articles Mocking Gold That Should Make You Think

- Isaac Newton's September 23, 2015 Prophecy; September 24, 2015 100% PROBABILITY of Asteroid

- It is NOW Time to Leave the Cities! September 2015

- Global Economist: Do These 3 Critical Things in a Currency Collapse

- Total Collapse: Greece Reverts To Barter Economy For First Time Since Nazi Occupation

- Canadian False Flag Exposed -- CSIS Ran 'Terror Drills' In Run Up to Ottawa Shooting

- Meanwhile In Venezuela... The Socialist Paradise Has Arrived

- 4 Mainstream Media Articles Mocking Gold That Should Make You Think

- The Price of Gold Closed Down at $1,092.70

- Banned Documentaries - Ep. 2: What really happened at Sandy Hook?

- 5 Things Shills Don't Want You To Know

- False Flag Operations Are Almost Always A Drill To Get Explosives, Actors & Vehicles Into Position

- Jade Helm FEMA Camps: Walmart Founder Sam Walton TRUTH EXPOSED! (Rhema word)

- Gold Daily and Silver Weekly Charts - Gold Is the Statist's and the Con Man's Bête Noire

- In The News Today

- Fukushima Update July 2015 - James Corbett

- Central banks are manipulating 'all' markets, Bill Gross tells CNBC

- Bankers Are The True Criminals

- Why Everyone Is Wrong About Low Interest Rates

- Coming July 31st "Blue Moon" In A Prophetic Time

- Dear Bloomberg News: Central banks manipulate gold prices too

- Are You Prepared For The Coming Collapse

- Economic Collapse 2015 -- The Crisis Is So Dire

- Currency Devaluation: The Crushing Vice of Price

- More Ritholtz on Gold, and Another Response

- Has China Manipulated The Gold Market?

- Bron Suchecki: Gold market liquidity and manipulation

- Why the Energy Sector’s Perfect Storm Is About to Blow Over

- Is the Gold Price Manipulated?

- The Gold - U.S. House Prices Ratio As A Valuation Indicator

- Is it Time to Load Up on Gold?

| Manipulating the Price of Gold and Silver Posted: 29 Jul 2015 11:00 PM PDT LewRockwell | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 Mainstream Media Articles Mocking Gold That Should Make You Think Posted: 29 Jul 2015 10:07 PM PDT from Zero Hedge:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Squelchers 20 & Their Interesting Associates Posted: 29 Jul 2015 10:01 PM PDT [Note: #20 in the incredible Silver Squelchers research series is 135 pages, essentially an entire book of its own, offered for FREE to SGT Report readers courtesy of the one and only Charles Savoie. Please PRINT THESE OUT and save them! ~SGT] Investment Bankers in The Pilgrims Society #2 by Charles Savoie, Silver Stealers.net, via SGT Report:

The December 21, 1907 New York Times, front page headline read, "Ruined Speculator Kills J.H. Oliphant Then Shoots Himself in the Brokerage Office of his Victim Who Dies at 2:00 AM Today, Fortune of $75,000 Gone" we read: "James H. Oliphant, senior member of the Stock Exchange firm of James H. Oliphant Co., and one of the best-known brokers in this city, was shot, and mortally wounded in his office at 20 Broad Street yesterday afternoon by Dr. Charles A. Geiger of Beaufort, S.C., a ruined speculator, who for two years or more had been a customer of the Oliphant firm. Dr. Geiger then turned the revolver on himself and sent the bullet into his brain, dying instantly."

My "Pilgrims meter" tells me that Oliphant was a member, though he wasn't a charter member as of January 1903— The 2005 Who's Who in America, page 3502, shows David Olyphant (note spelling variation) as a member of The Pilgrims. He was a Citibank executive, an officer of the English Speaking Union (direct Pilgrims subsidiary) and involved with the American Trust for the British Library. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Insight into Greece and China’s Love of Gold – David Morgan Posted: 29 Jul 2015 10:00 PM PDT from silver investor.com: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 Mainstream Media Articles Mocking Gold That Should Make You Think Posted: 29 Jul 2015 09:00 PM PDT from Liberty Blitzkrieg:

There are many reasons why I stopped commenting on markets, but the main reason is that I started to recognize I wasn't getting it right. In fact, in some cases I was getting it spectacularly wrong. Whenever this happens, I try to isolate the problem and fix it. In this case there was no fix, because much of why I was no longer getting it right was rooted in the fact that my heart, soul and passion had moved onto other things. My interests had expanded, and I started a blog to express myself on myriad other matters I deemed important. Providing relevant market information needs intense focus, and my focus had shifted elsewhere. I recognized that I wasn't intellectually interested enough in centrally planned markets to provide insightful analysis, and so I stopped. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Isaac Newton's September 23, 2015 Prophecy; September 24, 2015 100% PROBABILITY of Asteroid Posted: 29 Jul 2015 07:30 PM PDT All these links are leading up to September 23rd-24th, 2015. YOM KIPPUR...The Day Of Atonement. No one really knows what exactly will happen this date, it could be spiritual or physical. If you want to know more, then have a watch. The Financial Armageddon Economic Collapse Blog tracks... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| It is NOW Time to Leave the Cities! September 2015 Posted: 29 Jul 2015 06:30 PM PDT Prepare for Strong Discipline to be poured out upon America in particular .... a Nation founded on Godly principles that has literally turned her back on GOD! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Global Economist: Do These 3 Critical Things in a Currency Collapse Posted: 29 Jul 2015 06:23 PM PDT Dear Reader,

Most Americans have no idea what really happens when a currency collapses, let alone how to prepare…

But global economist, multimillionaire businessman, and New York Times best-selling author Doug Casey does. In fact, he might be the single most knowledgeable person in the world on the subject.

Dubbed the ‘International Man,’ roughly 4 decades ago, Casey has not only established residency in nearly a dozen countries, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Collapse: Greece Reverts To Barter Economy For First Time Since Nazi Occupation Posted: 29 Jul 2015 05:43 PM PDT Months ago, when Alexis Tsipras, Yanis Varoufakis, and their Syriza compatriots had just swept to power behind an ambitious anti-austerity platform and bold promises about a brighter future for the beleaguered Greek state, we warned that Greece was one or two vacuous threats away from being "digitally bombed back to barter status." Subsequently, the Greek economy began to deteriorate in the face of increasingly fraught negotiations between Athens and creditors, with Brussels blaming the economic slide on Syriza's unwillingness to implement reforms, while analysts and commentators noted that relentless deposit flight and the weakened state of the Greek banking sector was contributing to a liquidity crisis and severe credit contraction. As of May, 60 businesses were closed and 613 jobs were lost for each business day that the crisis persisted without a resolution. On the heels of Tsipras' referendum call and the imposition of capital controls, the bottom fell out completely as businesses found that supplier credit was increasingly difficult to come by, leaving Greeks to consider the possibility that the country would soon face a shortage of imported goods. On Tuesday, we brought you the latest on the Greek economy when we noted that according to data presented at an extraordinary meeting of the Hellenic Confederation of Commerce and Entrepreneurship, retail sales have fallen 70%, while The Athens Medical Association recently warned that 7,500 doctors have left the country since 2010. Now, the situation has gotten so bad that our prediction from February has come true. That is, Greece is reverting to a barter economy. Reuters has more:

So Greece, the birthplace of Western civilization and democratic governance, is now literally sliding backwards in history. The nation - which has already suffered the humiliation of becoming the first developed country to default to the IMF and which was nearly reduced to accepting "humanitarian aid" from Brussels when a Grexit looked imminent a few weeks back - is now transacting in clover, hay, and cheese. Here's Reuters again:

Yes, "maybe in cheese", but certainly not in euros, especially if the growing divisions within Syriza render Athens unable to pass a third set of prior actions through parliament next week. Should the vote not pass, it's not clear if Greece will be able to obtain the funds it needs to pay €3.2 billion to the ECB on August 20 - a missed payment would endanger the liquidity lifeline that is the only thing keeping any euros at all circulating in the Greek economy. On the bright side, "barter has been a part of everyday life for Greeks for a long time" economist Haris Lambropoulos told Reuters. The only difference is that now, "it is a more structured and organised phenomenon." Maybe so, but this is one "structured and ordered phenomenon" that many Greeks would likely just as soon do without and indeed, the new barter economy is drawing comparisons to a period in Greece's history that has gotten quite a bit of attention over the course of the last few months, and on that note, we'll give the last word to Christos Stamatis, who runs the barter website Mermix:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Canadian False Flag Exposed -- CSIS Ran 'Terror Drills' In Run Up to Ottawa Shooting Posted: 29 Jul 2015 05:30 PM PDT A CBC journalist reports that in the run-up to the Ottawa shooting last October, Canadian intelligence agencies had been running 'terror drills' mimicking such events. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Meanwhile In Venezuela... The Socialist Paradise Has Arrived Posted: 29 Jul 2015 05:19 PM PDT As we recently warned, the hyperinflationary collapse in Venezuala is reaching its terminal phase. With inflation soaring at least 65%, murder rates the 2nd highest in the world, and chronic food (and toilet paper shortages), the following disturbing clip shows what is rapidly becoming major social unrest in the Maduro's socialist paradise... and perhaps more importantly, Venezuela shows us what the end game for every fiat money system looks like (and perhaps Janet and her colleagues should remember that).

As we previously concluded, and seemingly confirmed by the above video,

In developed countries, people believe that the planners have everything in hand, and that their “price stabilization” rules will protect them from such outcomes. However, it should be clear that these rules will simply be abandoned in extremis. The independence of central banks exists only on paper – it will mean nothing in a perceived “emergency”. It is almost comical in this context that gold is being sold while most of the world’s major central banks are seemingly hell-bent on aping John Law’s Banque Générale Privée. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

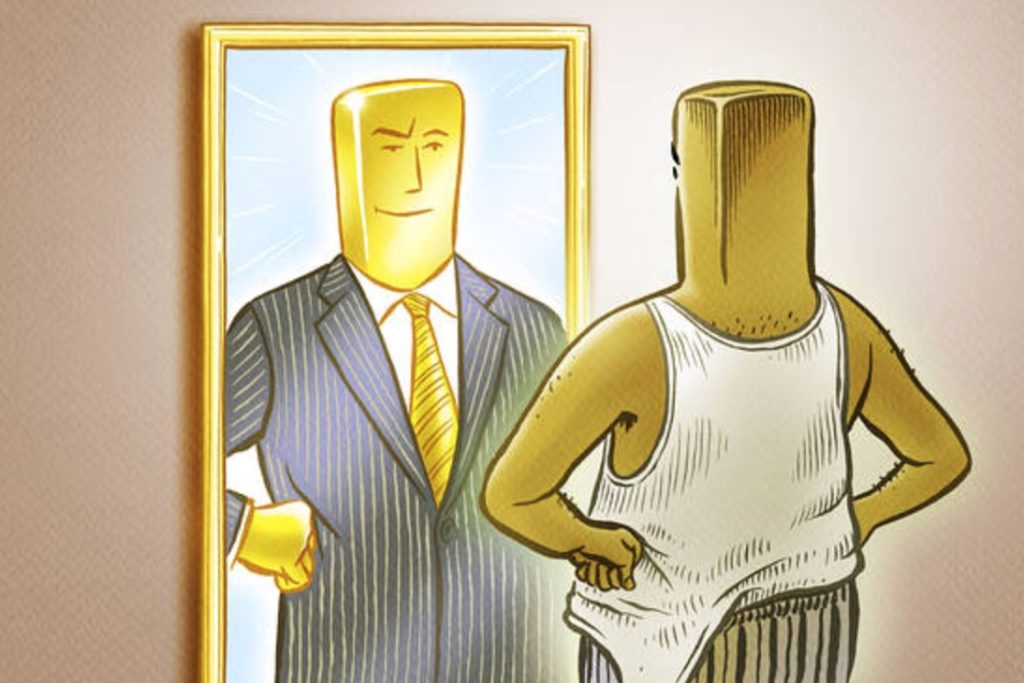

| 4 Mainstream Media Articles Mocking Gold That Should Make You Think Posted: 29 Jul 2015 05:15 PM PDT Submitted by Mike Krieger via Liberty Blitzkrieg blog, For those of you who have been reading my stuff since all the way back to my Wall Street years at Sanford Bernstein, thanks for staying along for the ride. I appreciate your support immensely considering that I essentially no longer write about financial markets at all, and for many of you, that remains your profession and primary area of interest. There are many reasons why I stopped commenting on markets, but the main reason is that I started to recognize I wasn’t getting it right. In fact, in some cases I was getting it spectacularly wrong. Whenever this happens, I try to isolate the problem and fix it. In this case there was no fix, because much of why I was no longer getting it right was rooted in the fact that my heart, soul and passion had moved onto other things. My interests had expanded, and I started a blog to express myself on myriad other matters I deemed important. Providing relevant market information needs intense focus, and my focus had shifted elsewhere. I recognized that I wasn’t intellectually interested enough in centrally planned markets to provide insightful analysis, and so I stopped. This doesn’t mean I won’t start up again. When central planners do lose control, I may indeed become far more interested in opining on such matters. Time will tell. In the interim, financial markets do still play an important role in the bigger picture of social, political and economic trends I passionately care about. The stability and increase in financial assets (stocks and bonds) is of huge importance to the propaganda machine, in particular keeping the non-oligarchic, non-politically connected 1% in line and believing the hype (see: The Stock Market: Food Stamps for the 1%). So while I won’t claim to know when the paradigm shift will begin in earnest, I do rely on people who have gotten macro forecasts right, and there is no one better than Martin Armstrong. Years ago, he was saying that nothing goes up in a straight line and that gold would experience a severe correction before beginning its real bull market. We are seeing his prediction unfold before our very eyes. What he also said is that as gold approached the $1,000 per/oz mark or even below, everyone would proclaim that “gold is dead” and start making comically bearish statements. In a nutshell, negative sentiment would plunge to levels not seen in years, if not more than a decade. We are starting to see this now. Here are four mainstream media articles that provide some evidence we may be approaching a sentiment low. Some of them I’m sure you’ve seen, others perhaps not. What amazes me is how they’ve all come out within the last two weeks. 1) From the Wall Street Journal: Let’s Be Honest About Gold: It’s a Pet Rock Here are a few choice excerpts:

Think about some of the words and phrases used in this WSJ article:

Condescending as the entire article is to gold owners, he even goes so far to quote the Hebrew Bible! Moving on. 2) From the Washington Post: Gold is Doomed

While I agree that many gold bugs do deserve the criticism they get, it’s interesting to see the way in which the Washington Post demonizes them as:

But the purpose of the above article is less about demonizing gold bugs, and more about praising the existing system of crank central planners that no one other than starry eyed pundits and thieving oligarchs actually support (see: “Revolution is Coming” – The Top 20 Responses to Jon Hilsenrath’s Idiotic WSJ Article). Here are some examples:

This story is far from over, as the Fed has yet to raise interest rates. Talk to me about victory when rates normalize. Moving along to the next article: 3) From Bloomberg: Gold Is Only Going to Get Worse

Let’s once again highlight some of the terminology used.

So now it’s magically turned into a human being as opposed to a pet rock.

Finally, for the last article. This one takes on more of the tone from the WSJ article, basically just calling gold buyers imbeciles. 4) From Market Watch: Two Reasons Why Gold May Plunge to $350 an Ounce.

Some choice quotes to think about:

This is pretty much peak condescension, and once again, notice the religious imagery.

I didn’t write this article to “call the bottom in gold” or anything like that. I merely want to flag these four articles due to the hyperbolic nature of some of the statements made (they are exhibiting pretty much exactly the same behavior as the gold bugs they mock do). I do think that something is happening on the sentiment front that warrants we are closer to the bottom that the mid-stages of a bear market. While I certainly accept that gold prices could fall further from here, I don’t think they will go anywhere near $350/oz, or $500/oz. If Claude Erb cares to make a public bet with me on that, he can find me here. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Price of Gold Closed Down at $1,092.70 Posted: 29 Jul 2015 05:00 PM PDT

Welcome to limbo, where nothing is ever resolved and all decisions are avoided and all verbs in the passive so you can't tell who's acting. Still, there was no weakness in today's silver and GOLD PRICE charts, and a spirited defense against an attempt to drive them down about noon. We're stuck at the same place: the price of gold and silver must hold $1,090 and $14.40 and on the upside must hurdle over $1,100 and $15.00 to begin a rally, and $1,140 and $15.50 to prove one. Tomorrow? Do y'all know what a wonderful freedom it is to liberate yourself from hogwash? Think of all the goofs in the world who hang around their TV sets to see what are the latest words that drop like fetid liquid lard from the lips of Janet Yellen, believing their future depends on them. How utterly degrading, and how howlingly ridiculous! Mercy, Janet Yellen couldn't run a Louisiana snow-cone stand at a profit in August! What's the chance she and the rest of those Keynesian midgets will get the whole US economy right, let alone interest rates? Yet the mind control persists. Press conference after press conference, month after month, she says the same thing, and markets react -- for a day or maybe two. Folks, the magic don't work any more. She's just a pitiful, flabby old woman pretending to be a Mistress of the Universe. I have better things to do than listen to that stuff. I've got a sock drawer that needs re-arranging. Dow climbed 121.12 (0.69%) to 17,751.39 on another veinful of government heroin, i.e., the Fed's worn-out promise to raise interest rates some day, but not yet. S&P climbed 15.32 (0.73) to 2,108.57. Wow. Dow almost climbed through its 200 DMA. US dollar index scarfed up 21 basis points and closed at 97.08, barely above the 20 DMA. Euro dropped 0.69% to $1.0985 and the yen 0.23% to 80.68. Nothing happening there, dollar still riding the downdraft, despite today's higher close. Y'all go home tonight and do something really important. Kiss your wife or husband and children and squeeze 'em and enjoy the presence of love and peace -- and ignore blathering, lardy bureaucrats. AN UNUSUAL OPPORTUNITY. The wholesale buy side premium on US 90% silver coin has risen so high that you can swap US 90% silver coin for 100 ounce silver bars and realize an 11% to 12.2% gain in silver ounces. Far as I know this is a "like-kind" exchange and so not taxable, but ask your own tax daddy about that because I don't know sic-'em from come-here about no taxes. Be careful about doing this swap with any other dealer but us. I believe we are the only dealer in the country that charges commission on one side of the swap only, to increase your realized gain. Trade can also be done for one ounce silver rounds, with a slightly smaller gain. Warning: do not swap ALL of your 90% coin. Keep at least some of it because the higher premium may be a permanent structural change and not a transitory one. In other words, it may never get cheaper again. Call to inquire, (888) 218-9226 Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Banned Documentaries - Ep. 2: What really happened at Sandy Hook? Posted: 29 Jul 2015 04:30 PM PDT Here is the most thorough and unbiased documentary catologing every question raised about the "Sandy Hook Massacre" in Newtown Connecticut on December 14, 2012. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 Things Shills Don't Want You To Know Posted: 29 Jul 2015 04:00 PM PDT The internet has revolutionized numerous disciplines, and propaganda is no exception. How can you know who's saying what -- and why -- online? Join Ben, Matt, and special guest Joe to learn more about the future of online manipulation. The Financial Armageddon Economic Collapse Blog... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| False Flag Operations Are Almost Always A Drill To Get Explosives, Actors & Vehicles Into Position Posted: 29 Jul 2015 03:30 PM PDT Ole Dammegard: "False Flag Operations Are Almost Always A Drill Used To Get Explosives, Actors & Vehicles Into Position" The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jade Helm FEMA Camps: Walmart Founder Sam Walton TRUTH EXPOSED! (Rhema word) Posted: 29 Jul 2015 02:30 PM PDT Walmart Jade Helm Martial Law, Fema Camps, the truth about Walmart founder Sam Walton's evil scheme is exposed by almighty God. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Gold Is the Statist's and the Con Man's Bête Noire Posted: 29 Jul 2015 01:47 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 29 Jul 2015 01:36 PM PDT Jim Sinclair’s Commentary Bill is a man after my belief system. His insight is very clear and direct. Can the dollar be made to perform well when it is truly running out of room? $60,000 Gold May Be Laughably Low-Bill Holter By Greg Hunter On May 27, 2015 In Market Analysis Recent Bloomberg analysis says... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fukushima Update July 2015 - James Corbett Posted: 29 Jul 2015 01:00 PM PDT James Corbett from Japan, with Joyce Riley in The Power Hour, July 27th, 2015. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central banks are manipulating 'all' markets, Bill Gross tells CNBC Posted: 29 Jul 2015 12:05 PM PDT 3p ET Wednesday, July 29, 2015 Dear Friend of GATA and Gold: Zero Hedge this afternoon calls attention to comments made on CNBC today by former PIMCO bond buyer Bill Gross, now working for Janus Capital, who says all markets now are artificial, the products of central bank manipulation, and that real market prices cannot be discovered. By "all" markets, one might assume Gross meant to include the market that in mainstream financial journalism must never be associated by manipulation, the gold market. But somehow Gross wasn't wearing a tin-foil hat. Zero Hedge's posting, which includes the CNBC video excerpt, is here: http://www.zerohedge.com/news/2015-07-29/bill-gross-explains-90-seconds-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bankers Are The True Criminals Posted: 29 Jul 2015 12:00 PM PDT PrisonPlanet head writer Paul Joseph Watson explains how banks are able to get away with massive crimes and normal citizens are under the thumb when they make cash withdraws or even visit and ATM. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Everyone Is Wrong About Low Interest Rates Posted: 29 Jul 2015 11:43 AM PDT This post Why Everyone Is Wrong About Low Interest Rates appeared first on Daily Reckoning. VANCOUVER, Canada – Hillary is taking the bull by the horns… and putting the knife between her teeth. She is a "take-charge" candidate and aims to let us know. Yes, earlier his week, she promised to improve capitalism. Now, it's the climate of planet Earth that has her attention. She's going to make it better by decreasing carbon emissions – by force, of course. Next week, presumably, she will vanquish death itself. But let us turn to the markets. Last night as the sun set, things were looking up. From Bloomberg: U.S. stocks rose, ending their longest losing streak since January, amid better-than-forecast earnings and as Chinese equities pulled back from a selloff. Whether the rebound continues… or collapses altogether… we wait to find out. Unlike Ms. Clinton, we are a slave to God and to the markets; we are not their master. As we reported yesterday, Hillary also wants to punish investors who don't hold on to their positions for long enough. She never mentioned that meddlers like herself largely caused the problem of "short-termism" in the stock market. In a free economy, people choose how long to hold on to their stocks, according to what suits them. Some are investing for generations. Some are retiring soon. Some are traders, looking to profit from short-term moves in the market. But 19th-century Swedish economist Knut Wicksell explained that when you push lending rates below their "natural rate" – the rate determined by the return on capital – you get distortions. People can simply borrow as much as they can at a low interest rate and plow it into anything with a higher yield. They can eschew, in other words, the hard work of building capital and learning new businesses. Long-term capital formation and long-term projects give way to the kind of "short-termism" Hillary is so keen to be seen combatting. Nor did Ms. Clinton mention the supposed damage that she and her fellow meddlers have done to poor planet Earth. This only comes up because we were talking to a nice woman at the Sprott-Stansberry Natural Resource Symposium here in Vancouver yesterday. The subject was technology – information technology, to be precise. "In your latest book, Hormegeddon, you suggest that the Internet really hasn't contributed much to the economy," she said, setting us up. "In fact, it seems to have changed everything. As Tesla founder Elon Musk says, 'It has given the world a kind of nervous system, allowing for an instant exchange of information all over the planet.'" "That may be," we replied. "But the context we were talking about was economic growth. The kind of growth you need to pay back your loans. And the Internet seems to have suppressed economic growth, not boosted it." “But… you don’t think that economic growth is all there is, do you?” "No… I don't. I think the whole thing is a fraud." We went on to explain that economists could only measure quantity, not quality. So quantity is all they care about. Naturally, they want more of it. They know only the price of the stuff the economy produces and sells. If the GDP – that is to say the monetary value of all the finished goods and services produced within the U.S. – falls, the economists who run the Fed urge immediate rate cuts to get the assembly lines and checkout counters busy again. More… more… more! Normally, the amount of stuff you can buy is limited by how much money you earn. But when you make EZ money available, the amount of stuff you can afford goes way up (over the short term, at least). And each additional increment of stuff produces more CO2, which is what has given environmentalists – including Hillary – the heebie-jeebies. We don't know whether carbon dioxide is killing the planet. But if it is, as many scientists claim, Hillary has no one to blame but herself. She and her cronies created a corrupt and insatiable economy, pumped up high on cheap credit. The post-1971 phony dollar (not limited by gold)… plus the Fed's slashing of banks' reserve requirements to essentially meaningless levels… allows for an unlimited amount of credit, provided banks are deemed solvent by the regulators. (Once upon a time, banks had to hold liquid reserves to ensure they had sufficient cash to repay their customers' deposits on demand. But by the turn of the new millennium, reserve requirements were so low, they no longer played a role in constraining credit creation.) This allowed for an almost unlimited amount of stuff. Factories in China ran hot trying to keep up with U.S. consumer demand. If credit had been kept to the ratio of GDP that prevailed before the "funny money" system began, China would have fewer smokestacks. And the U.S. would be an $8-trillion economy, not an $18-trillion one. That's trillions of dollars worth of stuff that would never have been made, shipped, or used, this year alone. And since the 1970s, that represents the equivalent of about 9 trillion gallons of gasoline that never would have been burned! But wouldn't that mean we'd all be poorer? Only according to economists. Economists measure stuff. Less stuff to them means less wealth. They can't measure the quality of the stuff… or the quality of our experiences… or the quality of our lives. Going back to my conversation in Vancouver, the Internet doesn't seem to do much for stuff… but it does increase quality. We can now easily find out how to do things. We can check our restaurants and hotels before we go to them. We can learn things… read things… see things that we couldn't before. The Internet spares our most precious resource: time. You can use it to get where you want – by the shortest, most economical route. You can use it to find information that would have otherwise required a trip to the public library. You can order STUFF, too – saving the trouble and expense of a trip to the mall. Most of these activities are probably time-wasters. But they are energy-savers. And for those who wish to spend their time watching porn or kittens – or fighting imaginary battles with people on the other side of the planet – it must be a lifestyle improvement. GDP growth goes down. But quality may go up. Regards, Bill Bonner Originally posted at the Diary of a Rogue Economist, right here. Editor's Note: Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post Why Everyone Is Wrong About Low Interest Rates appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Coming July 31st "Blue Moon" In A Prophetic Time Posted: 29 Jul 2015 11:00 AM PDT It is not as much the "Blue Moon" but the signs of the end times during the 4 "Blood Moon" Season The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dear Bloomberg News: Central banks manipulate gold prices too Posted: 29 Jul 2015 10:03 AM PDT Wednesday, July 29, 2015 Mark Gilbert Dear Mark (if I may): While your commentary today, "True Gold Bugs Care about Value, Not Price" -- http://www.bloombergview.com/articles/2015-07-29/true-gold-bugs-care-abo... -- was excellent for noting that central bank interventions increasingly are determining asset prices, you were in error when you asserted that gold's value "appears to move freely depending on the whims of its buyers and sellers, rather than on the interventions of policy makers." In fact, central bank manipulations encompass gold as well, probably more so than the prices of other assets. ... Dispatch continues below ... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: For 15 years my organization, the Gold Anti-Trust Action Committee, has been documenting the surreptitious intervention in the gold market by Western central banks. By their own admissions, the central banks are surreptitiously intervening in the gold market every day, or nearly so, to control the gold price to prevent it from becoming an accurate measure of other currency values. This is no mere "conspiracy theory," though "conspiracy" is fairly applied when central bankers hold secret meetings to determine and implement a course of policy, as they often do. Rather this is the official record of longstanding Western central bank and government policy, a record drawn from government archives and public statements by central bankers themselves. This intervention is easily confirmed journalistically by reviewing the records and putting the right specific questions to central banks, the Bank for International Settlements, and the International Monetary Fund, among others. No analysis of the gold market is worth much if it fails to address these questions: -- Are central banks in the gold market surreptitiously or not? -- If central banks ARE in the gold market surreptitiously, is it just for fun -- for example, to see which central bank's trading desk can make the most money by cheating the most investors -- or is it for policy purposes? -- If central banks ARE in the gold market for policy purposes, are these the traditional purposes of defeating a potentially competitive world reserve currency, or have these purposes expanded? -- If central banks, creators of infinite money, ARE surreptitiously trading a market, how can it be considered a market at all, and how can any country or the world ever enjoy a market economy again? A summary of the most important documentation developed by GATA over the years, some of it quite recent, complete with links to the documents themselves, is posted at our Internet site here: http://www.gata.org/node/14839 To correct your commentary's error today, please review this documentation and pursue it in future commentary. Of course I'll be glad to provide more information. I'll be grateful for an acknowledgment of this note, which I'm copying to your editor, Mary Duenwald, as a request for Bloomberg News to pursue this documentation as a news story. I'll be hoping to get an acknowledgment from her as well. With good wishes. CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Are You Prepared For The Coming Collapse Posted: 29 Jul 2015 09:00 AM PDT Here is part two of my appearance as a guest with David Kobler on Today's Survival Show. We discuss practical prepping tips and how to be better prepared for the inevitable collapse. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Economic Collapse 2015 -- The Crisis Is So Dire Posted: 29 Jul 2015 08:38 AM PDT The Crisis Is So Dire, What Lies Beneath Is So Dark People Are Going To Be Shocked The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Currency Devaluation: The Crushing Vice of Price Posted: 29 Jul 2015 08:13 AM PDT This post Currency Devaluation: The Crushing Vice of Price appeared first on Daily Reckoning. When stagnation grabs exporting nations by the throat, the universal solution offered is devalue your currency to boost exports. As a currency loses purchasing power relative to the currencies of trading partners, exported goods and services become cheaper to those buying the products with competing currencies. For example, a few years ago, before Japanese authorities moved to devalue the yen, the U.S. dollar bought 78 yen. Now it buys 123 yen–an astonishing 57% increase. Devaluation is a bonanza for exporters’ bottom lines. Back in late 2012, when a Japanese corporation sold a product in the U.S. for $1, the company received 78 yen when the sale was reported in yen. Now the same sale of $1 reaps 123 yen. Same product, same price in dollars, but a 57% increase in revenues when stated in yen. No wonder depreciation is widely viewed as the magic panacea for stagnant revenues and profits. There’s just one tiny little problem with devaluation, which we’ll cover in a moment. One exporter’s depreciation becomes an immediate problem for other exporters: when Japan devalued its currency, the yen, its products became cheaper to those buying Japanese goods with U.S. dollars, Chinese yuan, euros, etc. That negatively impacts other exporters selling into the same markets–for example, South Korea. To remain competitive, South Korea would have to devalue its currency, the won. This is known as competitive devaluation, a.k.a. currency war. As a result of currency wars, the advantages of devaluation are often temporary. But as correspondent Mark G. recently observed, devaluation has a negative consequence few mention: the cost of imports skyrockets. When imports are essential, such as energy and food, the benefits of devaluation (boosting exports) may well be considerably less than the pain caused by rising import costs. Japan is a case in point. The massive devaluation of the yen was designed to boost Japan’s exports and rocket-launch corporate profits, which was then supposed to drive a virtuous cycle of higher wages and increased employment. But the benefits of the massive devaluation have been underwhelming. Some exporters have seen profits soar, helping to push Japan’s stock market to post-1990 highs, but the effect is not universally positive. Consider the plight of companies that must buy soybeans from the U.S. to make their food products. The cost of their raw materials just increased 50%, as a $1 of soybeans now costs 123 yen rather than 78 yen. Given that major exporters of goods and services like China and Japan are importers of oil and food, devaluation is a ticking time bomb in terms of the cost of liquid fuels and food. The looming global recession and over-investment in commodity production–driven by the zero-interest rate policies of the central banks–has created a temporary glut in oil and other commodities. But as marginal producers are driven into bankruptcy or cut production, supply and demand will realign at some point. Somewhere not that far down the line, exporting nations that devalued their currency for the crack-cocaine hit of soaring revenues and profits in their home currencies will find the cost of essential imports will skyrocket while the benefits of their devaluation fade in the currency wars they instigated. Authorities pushing currency devaluation as a cure for their stagnating economies might want to study Frederic Bastiat’s insight into the eventual cost and consequences: “For it almost always happens that when the immediate consequence is favorable, the later consequences are disastrous, and vice versa." Regards, Charles Hugh Smith P.S. Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible. And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career. You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck. Even the basic concept "getting a job" has changed so radically that jobs–getting and keeping them, and the perceived lack of them–is the number one financial topic among friends, family and for that matter, complete strangers. So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy. It details everything I've verified about employment and the economy, and lays out an action plan to get you employed. I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read. The post Currency Devaluation: The Crushing Vice of Price appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| More Ritholtz on Gold, and Another Response Posted: 29 Jul 2015 08:09 AM PDT Anyone who has been bearish on gold for the last 4 years has been right. They have been right in Euros and though the trend appears to have been gently changing over the last year or two, they have been right in Canada & Aussie (i.e. commodity currencies) dollars as well. Certainly, they have been right that gold as measured in most global stock markets has been (and remains) bearish. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Has China Manipulated The Gold Market? Posted: 29 Jul 2015 07:50 AM PDT The financial press and blogosphere are still exploring the topic of Chinese reserves. Recently, some voices have arisen that China supported the recent plunge of the gold price in order to boost its reserves. Are these opinions justified? The disappointment increase in China's reserves led to a heated debate. On Friday, two articles were published (here and here), which suggest that China manipulated the gold market by under-reporting its official reserves to lower the gold price and increase its reserves. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bron Suchecki: Gold market liquidity and manipulation Posted: 29 Jul 2015 05:35 AM PDT 8:34a ET Wednesday, July 29, 2015 Dear Friend of GATA and Gold: Perth Mint research director Bron Suchecki today disputes financial letter writer Clif Droke's assertion yesterday that the gold market is too large to be manipulated. To the contrary, Suchecki writes, the gold market can be moved by strategic trading of just a few tonnes, and, unlike Droke, he cites authority for his assertion. Suchecki's commentary is headlined "Gold Market Liquidity and Manipulation" and it's posted at the Perth Mint's Internet site here: http://research.perthmint.com.au/2015/07/29/gold-market-liquidity-and-ma... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why the Energy Sector’s Perfect Storm Is About to Blow Over Posted: 29 Jul 2015 02:20 AM PDT Dr. Kent Moors wrotes: There is a “perfect storm” brewing in the energy sector. And as storms go, this one has certainly attracted attention. The ongoing concern over supply gluts both in the U.S. and abroad has combined with a Chinese stock collapse to drive down the price of oil. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is the Gold Price Manipulated? Posted: 29 Jul 2015 01:44 AM PDT One of the most commonly held beliefs among gold investors is that the market for gold is heavily manipulated. It has become an article of faith among gold advocates that the price is subject to direct control by government, central banks and other parties who have a vested interest in depressing the gold price. In this commentary we'll explore this belief and try to arrive at a firm conclusion as to its veracity. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold - U.S. House Prices Ratio As A Valuation Indicator Posted: 29 Jul 2015 01:40 AM PDT The Gold/Housing ratio is a quite useful measure for evaluating relative values between real estate and gold, and also has an interesting historical track record for identifying turning points in long-term gold price trends. In light of the commodities rout occurring in the summer of 2015, and the continuing strength in housing – it is worthwhile revisiting this basic measure, because the results aren't at all what most people likely think they are. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is it Time to Load Up on Gold? Posted: 28 Jul 2015 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Religious imagery… peak condescension… everyone proclaiming “gold is dead”… In a nutshell, sentiment has plunged to negative levels not seen in years, if not more than a decade. Here are four mainstream media articles that provide some evidence we may be approaching a sentiment low. Some of them we’re sure you've seen, others perhaps not. What amazes us is how they've all come out within the last two weeks.

Religious imagery… peak condescension… everyone proclaiming “gold is dead”… In a nutshell, sentiment has plunged to negative levels not seen in years, if not more than a decade. Here are four mainstream media articles that provide some evidence we may be approaching a sentiment low. Some of them we’re sure you've seen, others perhaps not. What amazes us is how they've all come out within the last two weeks. 1) John Charles Straton Jr. (1932—: Pilgrims Society as of undetermined) has info in the 2014 Who's Who in the East, pages 1367-1368—

1) John Charles Straton Jr. (1932—: Pilgrims Society as of undetermined) has info in the 2014 Who's Who in the East, pages 1367-1368— For those of you who have been reading my stuff since all the way back to my Wall Street years at Sanford Bernstein, thanks for staying along for the ride. I appreciate your support immensely considering that I essentially no longer write about financial markets at all, and for many of you, that remains your profession and primary area of interest.

For those of you who have been reading my stuff since all the way back to my Wall Street years at Sanford Bernstein, thanks for staying along for the ride. I appreciate your support immensely considering that I essentially no longer write about financial markets at all, and for many of you, that remains your profession and primary area of interest.

No comments:

Post a Comment