Gold World News Flash |

- GUEST POST: Silver Squelchers NINETEEN & Their Interesting Associates — Charles Savoie

- Fed Leaks, Fast Food, Housing & Gold

- Andrew Maguire – A Gold And Silver Tsunami Is Forming As The Shorts Are Now Going To Get Destroyed

- World Gold Council Dismisses Gold Price Plunge

- Gold Daily and Silver Weekly Charts – Rebound – Option Expiration Next Week

- The Shemitah (Full Length Teaching)

- Bible Prophecy: Signs of The End Times

- Corporate Credit Crashing: Waiting On The Rest Of The Herd

- 7 Key Events That Are Going To Happen By The End Of September

- Abenomics End Game: Thousands Protest In Downtown Tokyo, Demand Abe's Resignation As PM Disapproval Soars

- Weekend Update July 24

- Religious or not, this will scare the SHTF out of you!

- In The News Today

- Max Igan -- New World Technocracy

- SHEMITAH EXPOSED: Financial Crisis Planned For September 2015

- Wesley Clark: Internment Camps For Disloyal Americans Needed

- Central Banks and Our Dysfunctional Gold Markets

- Hedge funds are holding first-ever gold net-short position

- Woman Births Alien Hybrid; Warns We Are All About to DIE! (Bizarre Interview)

- Gold and Mining Stocks Bottom is Imminen...

- Major News Networks Have Confirmed Soon Coming US Catastrophe!

- BIS ran attack on gold and short squeeze is imminent, Maguire tells KWN

- Silence from the gold mining industry and timidity from the World Gold Council

- You’re “Dumb” if You Rely on EIA Numbers

- Bron Suchecki: The message behind the Chinese gold reserves announcement

- Gold And Silver - The US Dollar Does Not Exist, Part II

- Protected: Gold – Update

| GUEST POST: Silver Squelchers NINETEEN & Their Interesting Associates — Charles Savoie Posted: 26 Jul 2015 12:05 AM PDT [Note: #19 in the incredible Silver Squelchers research series is 120 pages long. It’s essentially an entire book of its own, offered for FREE to SGT Report readers, courtesy of the one and only Charles Savoie. Please PRINT THESE OUT and save them! ~SGT] Investment Bankers in The Pilgrims Society – Part I by Charles Savoie, Silver Stealers.net, via SGT Report:

1) Miner Hill Warner (1942—; is current president of The Pilgrims Society of the U.S.); second generation member. His info from the 2014 Who's Who in the East, page 1466—

|

| Fed Leaks, Fast Food, Housing & Gold Posted: 25 Jul 2015 10:30 PM PDT from Peter Schiff: |

| Andrew Maguire – A Gold And Silver Tsunami Is Forming As The Shorts Are Now Going To Get Destroyed Posted: 25 Jul 2015 10:00 PM PDT from KingWorldNews:

BIS / Insider Activity Ramps Up In Gold And Silver Markets I have provided analysis of this insider favored setup in prior commentaries, illustrating how this puts US-centric traders at a distinct disadvantage to the BB’s (Bullion Banks) /BIS and all other global players who can continue to trade/hedge in the spot markets in any size while the futures and options markets are frozen. The concurrent OTC (over-the-counter) FX Gold action around these market halts were not picked up by any commentator/analyst and strongly point to BIS/Insider LBMA Bullion Bank activity. |

| World Gold Council Dismisses Gold Price Plunge Posted: 25 Jul 2015 09:30 PM PDT by Chris Powell, GATA:

Dear Friend of GATA and Gold: The World Gold Council yesterday published a fairly involved statement responding to this week’s attack on the gold market, acknowledging the suspiciousness of the trading that began the attack last Sunday night but dismissing it as the doings of speculators and emphasizing what the council considers the favorable fundamentals for gold, as if fundamentals might prevail any time soon against surreptitious trading by central banks. The council’s statement is posted in PDF format at GATA’s Internet site here: http://www.gata.org/files/WorldGoldCouncilStatement-07-23-2015.pdf |

| Gold Daily and Silver Weekly Charts – Rebound – Option Expiration Next Week Posted: 25 Jul 2015 08:30 PM PDT from Jesse's Café Américain:

Now we will see if gold and silver can put in a real bottom here, or something else. Next Tuesday will be the August metals expiration at The Bucket Shop. August is also an active month for gold. I have included the latest ‘owners per ounce’ charts from Nick Laird at sharelynx.com. They were able to knock down the open interest a bit, but could not produce more physical bullion for sale yet. The Fed accidentally leaked its staff projections about rate hikes today. It looks like one for this year and four more next year for about 1.26%. I hope they wait for The Recovery to get on their magic bus. |

| The Shemitah (Full Length Teaching) Posted: 25 Jul 2015 08:00 PM PDT Watch full length teaching on "The Shemitah," and how it applies to the judgment that has come and will come upon the United States. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Bible Prophecy: Signs of The End Times Posted: 25 Jul 2015 07:00 PM PDT Democratic presidential candidate Hillary Clinton says a two-state solution is the 'best outcome' for both Israelis and Palestinians. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

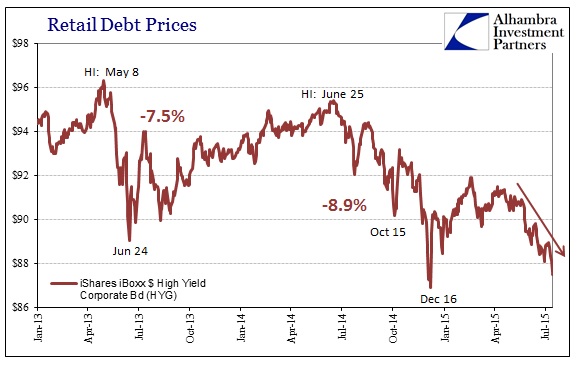

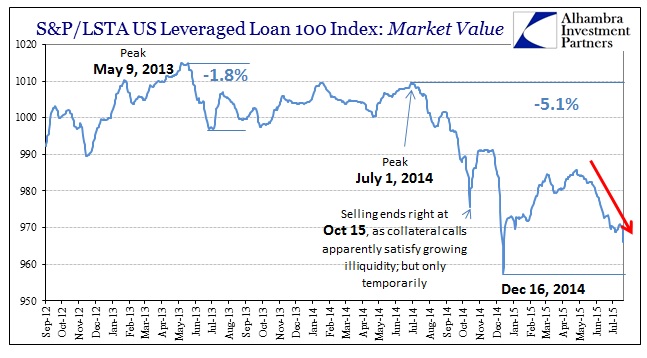

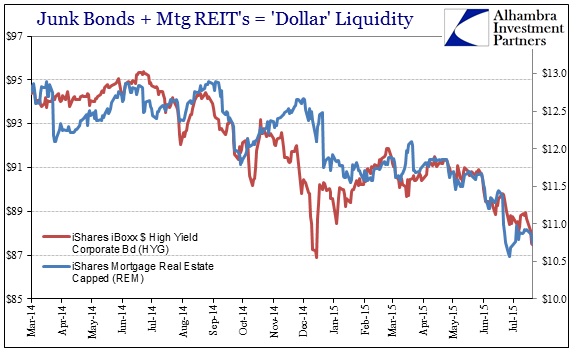

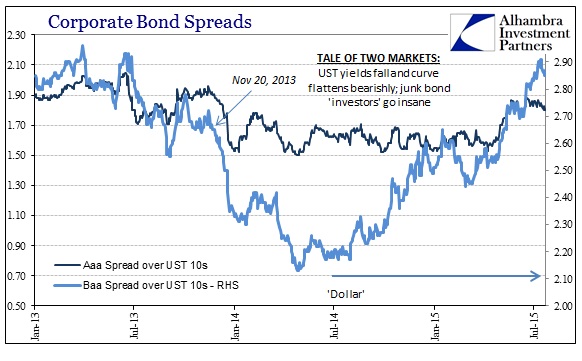

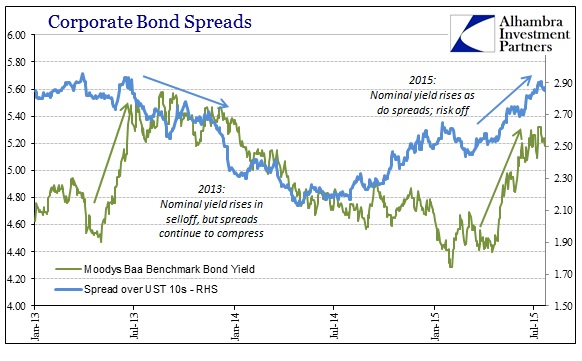

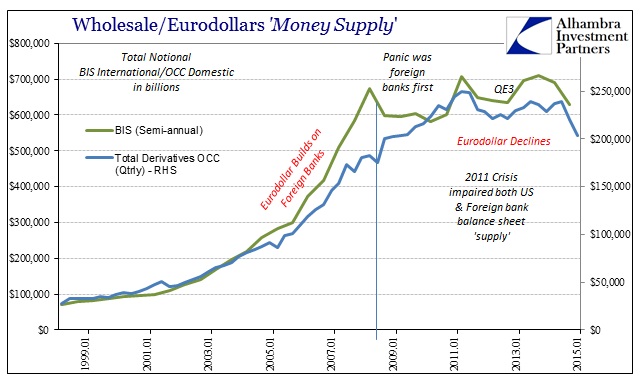

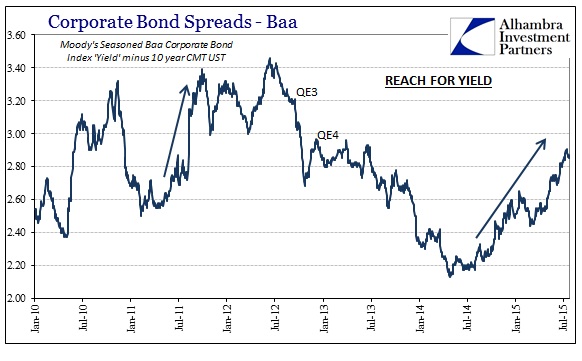

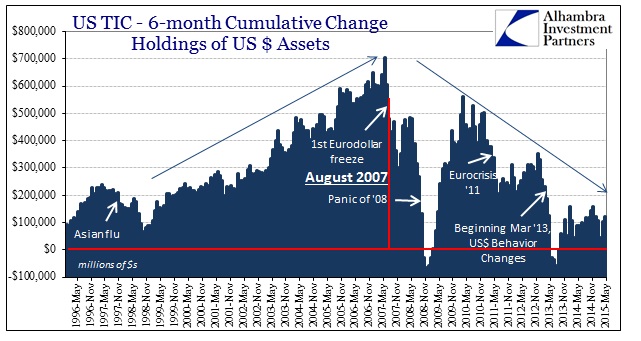

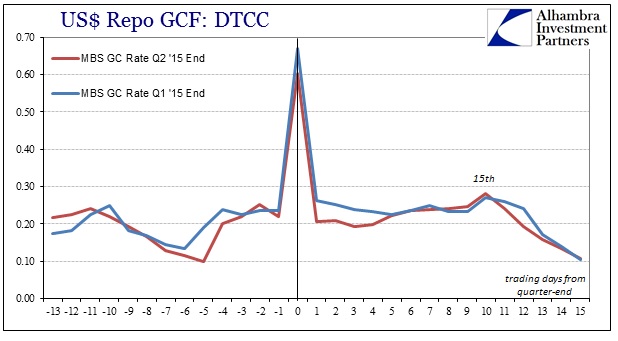

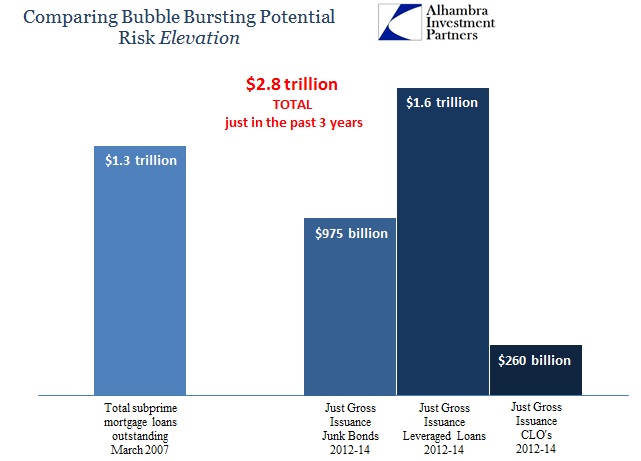

| Corporate Credit Crashing: Waiting On The Rest Of The Herd Posted: 25 Jul 2015 04:40 PM PDT Submitted by Jeffrey Snider via Alhambra Investment Partners, With almost everything turning lower this week under “dollar” pressure, it is imperative to keep in mind the apex asset class. In 2007, it was the ABX indices and various mortgage related structures that signified the how far along everything was; in this cycle it is clearly corporate credit. The disarray starts in the riskiest pieces and then moves inward and eventually, if left unchecked, eroding too much underneath with which to support what was once believed perfectly safe. Once there is no place to hide, the turn really begins. Leveraged loan pricing, among the riskiest of the corporate bubble, had been somewhat tame, even unexpectedly so, as commodities ran aground under the weight of global “dollar” funding. In the past few days, however, leveraged loans (at least what is visible and represented by the index; it is very likely that less liquid issues are faring far more poorly) have been sold as have junk bonds. The market value portion of the S&P/LSTA US Leveraged Loan 100 fell 5 points just in the past two days, all the way to 965. Both junk bonds and leveraged loans are back down to prices far too close to the nadir of the last selloff in mid-December. That would seem to suggest, as UST’s (and the fast again flattening UST curve), that the broad credit and funding environment has turned far more toward that which prevailed in early December than the more benign mid-March to early May “pause.” Undoubtedly, there are economic concerns playing a significant part of the selloff but it may be liquidity that is the proximate catalyst (which is just another expression of those economic concerns combined with perceptions about the Fed’s proclivity to make it worse). The combined trend in liquidity and the apparently persistent impulse toward selling is a dangerous combination, as systemic capacity is extremely poor and the incongruence of corporate pricing to actual, non-QE delivered risk is as extreme. The divergence between this heightened form of “reach for yield” and what bearishness that beset the treasury market is beyond remarkable, as if there was open bifurcation in overall credit back in 2013. Dating to right around November 20 that year, all bonds were bid but for very different reasons. Corporate spreads, especially junk, compressed until the middle of last year – what a difference two years makes, as the corporate bubble is belatedly catching the warning of UST trading. The rising “dollar” has meant rising spreads, as the junk “curve” has actually retraced the entire taper euphoria. That is certainly a measure of the ongoing systemic reset for risk perceptions, but in the wider context there is perhaps a long way yet to go. In absolute terms, this move under the “dollar” is almost as severe as that in the middle of 2011... which triggered the renewed eurodollar decay and eventually two new QE’s: in 2011, this measure of risk spreads jumped 90 bps from February 2011 until the end of that September and the Fed’s renewed “dollar” swaps. The current decompression is already 74 bps dating back to July 2014. Again, it is the combination of liquidity (restrained and getting worse) and constant selling that ends up taking the next step. The real danger is if this continues past some unknown critical mass the entire herd will turn and there won’t be much at that point to offer support – the dealers are already out as are banks more generally. As a reminder, the size of the “herd” really escapes imagination: |

| 7 Key Events That Are Going To Happen By The End Of September Posted: 25 Jul 2015 04:00 PM PDT 7 Key Events That Are Going To Happen By The End Of September By: BY THE EVENT CHRONICLE ON JUNE 15, 2015 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 25 Jul 2015 03:21 PM PDT Considering that Shinzo Abe's first reign as prime minister of Japan lasted precisely one year from September 26, 2006 until September 26 of the following year, when he voluntarily resigned due to diarrhea, the fact that he has managed to stay in power for nearly 3 years since ascending to power for the second time in December 2012 and unleashing the currency-crushing and market-surging policy of unprecedented debt and deficit monetization known as "Abenomics" is quite impressive. It also confirms that as long as the stock market keeps going higher politicians have nothing to fear even if it means a total collapse in living standards for the rest of the population.

Yet even with the Nikkei pushing on 18 years highs, it appears that Abe may have reached his rigged market rating benefit cap, because even as the Nikkei was soaring, Abe's approval rating was plunging. As we reported a month ago, "Abe Cabinet's approval rating plunged to 39%, matching a record low, as more than half of voters oppose the new US-sanctioned military/security legislation being debated in the Diet.... As his popularity has waned, Abe has become more and more desperate to keep support and has, for the first time in 70- years, lower the minimum voting age from 21 to 18."

Since then things have gone from bad to worse for Abe, whose popularity rating last week plunged to a record low, while the number of Japanese citizens who disapprove of his policies has finally surpassed 50%, and rose to 52.6% in a Sankei poll, while the 47news.com poll shown below shows approval at just under 38% while dispparoval at 52%.

It spilled over last night when after years of growing resentment to their premier who panders to the rich, to big exporters, to the Japanese military-industrial complex, and of course, to the US government and Goldman Sachs (whose idea Abenomics was from the very beginning) thousands of protestors rallied Friday night in downtown Tokyo in a campaign of "Say no to the Abe government," targeting Japanese Prime Minister Shinzo Abe's "runaway" policy. The protestors gathered at the Hibiya Park, Diet building and the prime minister's official residence, shouting "Abe step down," "definitely oppose war" and "protect constitution." People hold up signs saying "No to the Abe administration" in a gathering at Hibiya Park in Tokyo on July 24, 2015. They expressed opposition to Prime Minister Shinzo Abe's policies on a wide range of issues such as national security bills, the Trans-Pacific Partnership free trade initiative and the planned relocation of a U.S. military base within Okinawa Prefecture.

[Photos: Imagine China] According to CRI, the anger of the Japanese population was sparked ever since the Abe administration started to push forward a series of controversial security-related bills in parliament debates.

Japan's former prime minister Tomiichi Murayama, who delivered a speech Thursday evening during a rally near the Diet, again participated in Friday's demonstration, criticizing Prime Minister Abe for carrying out an autocratic politics and defying Japan's democratic system.

In the immediate aftermath of the forced passage the controversial bills in the lower house Abe's approval rate tumbled 10 percentage points immediately while the disapproval rate surged to over 50 percent. So what happens next? Unless Abe relents and pockets his military expansion ambitions, it is very likely that another massive, and career ending, blast of diarrhea is in the prime minister's immediate future. But first, as we said one month ago, and now as others admit, Abe will do everything in his power to, well, stay in power. Which is quite limited, i.e., print more. As Bloomberg reports, expectations for further BOJ easing may increase amid a falling approval rating of PM Abe's Cabinet, says Daisaku Ueno, Tokyo-based chief currency strategist at Mitsubishi UFJ Morgan Stanley Securities, in an interview. Uen adds that market participants are focusing on whether Cabinet's approval rating can maintain key 30% level amid possible passage by upper house of security bills this summer and ahead of upper house elections in July 2016. His assessment: there is rising risk that BOJ will be pressured to ease policy further in autumn when govt is likely to struggle to find funding sources for its budgets. Which reveals one more important aspect of QE: in addition to being the only catalyst pushing stocks to record highs even as the global economy slides into recession if not outright depression, it has become the new normal politicians' favorite and only means of holding on to power: if ratings plunge, print; if they continue plunging, print some more. By the time Abe is finally booted out of power, peacefully or otherwise, the Yen may well be at 200 which in turn will be the catalyst that finally destroys the already careening Japanese economy. But destroyed cataclysm and demographic disaster aside, at least the Nikkei will have hit all time record highs. |

| Posted: 25 Jul 2015 03:20 PM PDT By Everett Millman, head content writer at Gainesville Coins, a leading gold and silver distributor. ABSTRACT: Amid continued risk-off sentiment in the markets following an easing of... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} |

| Religious or not, this will scare the SHTF out of you! Posted: 25 Jul 2015 03:00 PM PDT War with China over South China sea Spartly islands, War with Russia New currency, North Korea nukes and rocket development, Gold hoarding and Gold theft by US social decay unrest times are real turbulent! WWIII who controls the banking system.GET READY NOW! The Financial Armageddon... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 25 Jul 2015 02:10 PM PDT US Mint Sells Most Physical Gold In Two Years On Same Day Gold Price Hits Five Year Low Tyler Durden on 07/24/2015 20:49 -0400 Three weeks ago, we reported that the US Mint had run out of physical silver on the same day silver plunged to its lowest price in 2015. This happened just days... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. |

| Max Igan -- New World Technocracy Posted: 25 Jul 2015 02:00 PM PDT Max Igan - Surviving the Matrix - Season 5 - Episode 03 The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| SHEMITAH EXPOSED: Financial Crisis Planned For September 2015 Posted: 25 Jul 2015 01:30 PM PDT I've been thinking this September has to be big for a couple of months now. I think the time really is on us finally. Get that silver and gold. Get that food and stock it. Do it. Since Jews invented and established and are in control of the current monetary system, I'm not surprised... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Wesley Clark: Internment Camps For Disloyal Americans Needed Posted: 25 Jul 2015 12:30 PM PDT Advocates life sentence for people who have not committed a crime. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Central Banks and Our Dysfunctional Gold Markets Posted: 25 Jul 2015 12:21 PM PDT Marcia Christoff-Kurapovna writes: Many investors still view gold as a safe-haven investment, but there remains much confusion regarding the extent to which the gold market is vulnerable to manipulation through short-term rigged market trades, and long-arm central bank interventions. First, it remains unclear whether or not much of the gold that is being sold as shares and in certificates actually exists. Second, paper gold can theoretically be printed into infinity just like regular currency — although private-sector paper-gold sellers have considerably less leeway in this regard than central banks. Third, new electronic gold pricing — replacing, as of this past February, the traditional five-bank phone-call of the London Gold Fix in place since 1919 — has not necessarily proved a more trustworthy model. Fourth, there looms the specter of the central bank, particularly in the form of volume trading discounts that commodity exchanges offer them. |

| Hedge funds are holding first-ever gold net-short position Posted: 25 Jul 2015 12:08 PM PDT By Joe Deaux Hedge funds are holding the first ever bet on a decline in gold prices since the U.S. government started collecting the data in 2006. The funds and other speculators shifted to a net-short position of 11,345 contracts in New York futures and options in the week ended July 21, according to figures from the U.S. Commodity Futures Trading Commission. Gold futures on Friday fell to the lowest since 2010 on the Comex, and the short wagers show investors expect the rout to deepen. Bullion has fallen almost every day in July, leaving the metal poised for the biggest monthly decline since June 2013. ... ... For the remainder of the report: http://www.bloomberg.com/news/articles/2015-07-24/hedge-funds-hold-first... ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit: USAGold: Great prices, quick delivery -- all the time. Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Woman Births Alien Hybrid; Warns We Are All About to DIE! (Bizarre Interview) Posted: 25 Jul 2015 11:30 AM PDT One of the most detailed accounts of an alien encounter, pole shift, planet X, Nibiru all in one! This will leave you shaking your head!! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold and Mining Stocks Bottom is Imminen... Posted: 25 Jul 2015 10:53 AM PDT SafeHaven |

| Major News Networks Have Confirmed Soon Coming US Catastrophe! Posted: 25 Jul 2015 10:30 AM PDT Mainstream has Just Issued Catastrophic Warning! Massive Earthquakes and Tsunamis Now Confirmed As All Major News Networks Report of Mega-Quake To Soon Destroy U.S. Pacific Northwest! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| BIS ran attack on gold and short squeeze is imminent, Maguire tells KWN Posted: 25 Jul 2015 09:53 AM PDT 12:50p ET Saturday, July 25, 2015 Dear Friend of GATA and Gold: In commentary posted today at King World News, London metals trader Andrew Maguire provides evidence that last week's attack on the gold price was operated through the Bank for International Settlements, that commercial traders have turned speculators short and gotten themselves long, and that a short squeeze is imminent. Maguire's commentary is posted at KWN here: http://kingworldnews.com/andrew-maguire-a-gold-and-silver-tsunami-is-for... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers: To invest or learn more, please visit: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Silence from the gold mining industry and timidity from the World Gold Council Posted: 25 Jul 2015 08:27 AM PDT 11:33a ET Saturday, July 25, 2015 Dear Friend of GATA and Gold: On Friday your secretary/treasurer sought comment from the World Gold Council and the investor or media relations offices of six large gold mining companies about last Sunday night's attack on the gold market. Only Newmont Mining responded, saying it had no comment. Not responding were the gold council, Barrick Gold, Goldcorp, Kinross, Anglogold Ashanti, and Agnico-Eagle. The gold council's statement about the attack, conveyed to you by GATA Friday evening -- http://www.gata.org/node/15588 -- was discovered by your secretary/treasurer not in the "News and Events" and "Press Releases" section of the council's Internet site -- http://www.gold.org/news-and-events -- but rather in the "Tweets" section -- https://twitter.com/GOLDCOUNCIL -- where it had been almost immediately overshadowed by an item about jewelry purchases in India. One could have gotten the impression that the council was not eager to be seen addressing the issue. ... Dispatch continues below ... ADVERTISEMENT Silver Coins and Rounds with Employee Pricing and Free Shipping Grab your Silver Starter Kit at cost from Money Metals Exchange, the company named "Precious Metals Dealer of the Year" by industry ratings group Bullion Directory. Simply go to MoneyMetals.com and type "GATA" in the radio box at the top of the page. This special silver offer contains 4 ounces of silver coins and rounds in the most popular 1-ounce, half-ounce, and 10th-ounce forms. Claim yours now, because GATA readers get employee pricing and free shipping. So go to -- -- and type "GATA" in the radio box at the top of the page. And yet one GATA supporter was a bit encouraged by the council's statement. He wrote: "This was probably the most interesting statement I've seen the World Gold Council issue. They acknowledged gold as money, something they've been loathe to do. They are acknowledging all our observations about shady activity in the gold market and expressing some rationales, but quietly. It's almost as if they want to protest but someone is keeping them from making a direct protest and this is the best they are permitted to do. If they really wanted to bury this, why issue a statement at all? "I think that in the fullness of time someone in the gold council will rat out what is going on over there. Perhaps the council is dominated by government interests but has some people who are sympathetic to gold as money. Yes, gold investors and mining companies needed a full-throated protest of last week's attack and didn't get it, and yes, the gold council was still a little defensive about the status quo. Yet my expectations for the gold council are so low that the council actually exceeded them for once. I don't admire the council by any means, but I do wonder what they're up to with this statement." Well, here's a guess: The attack on gold was so extreme and so obviously a market manipulation that the council figured that its own relevance would evaporate if it had absolutely nothing to say but that saying anything relevant risked upsetting the market-rigging establishment to which the council is so closely connected. So it said something timid and quickly buried it. But eventually even the World Gold Council may realize that it will be out of business if the gold price is taken down to zero. Then central banks will no longer need the council's help in getting the price down. CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

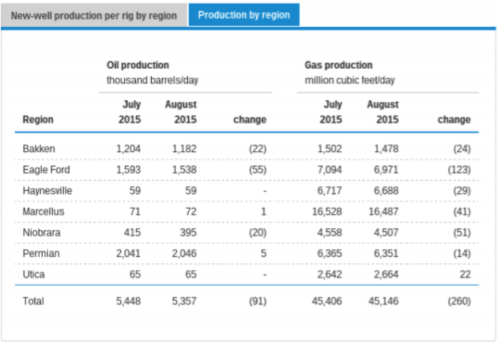

| You’re “Dumb” if You Rely on EIA Numbers Posted: 25 Jul 2015 08:26 AM PDT This post You’re "Dumb" if You Rely on EIA Numbers appeared first on Daily Reckoning. I had to read it twice because I thought I must be seeing things. Last week, the Houston Chronicle had an article that touched on the fact that the quality of real-time oil data is, shall we say… less than superb. The jaw-dropping part of the article involves a direct quote from an U.S. Energy Information Administration (EIA) employed engineer who is directly involved the EIA's data compiling. I have to share it in its entirety (my emphasis added): "'If you're using the weekly production numbers to do trades on Wall Street, you're dumb,' said Gary Long, a petroleum engineer who compiles numbers for the EIA. 'This is not going to work out for you. Don't do that. We've actually had people call us and be very angry with us because they've lost a lot of money.'" So there you have it. The people who actually produce the most widely followed oil production data think that it is so unreliable that you are a fool to make any decisions based off of them. I'm coming to the realization that the whole world is in the dark as to the real-time state of supply and demand in the oil market. I covered the fact that the EIA real-time production data were lacking back on June 17 for our Outstanding Investment subscribers. The core of the EIA's problem is that they themselves don't have access to anything that is real-time, so their reports actually incorporate a lot of estimation, which is notoriously weak when it comes to figuring out turns in the market. I believe that the EIA weekly reports have been slow to figure out that U.S. shale production is now in decline. I also believe that the EIA was underestimating how fast production had been growing prior to the crash. That would make them wrong on both ends of the cycle. Strangely, while the real-time EIA data continue to report U.S. production is not in decline, the EIA's monthly Drilling Productivity Report keeps forecasting that U.S. shale production is now in decline… significant decline. Yes, the EIA is telling us completely different things about the same subject. They should schedule a meeting and get these two departments in the same room to compare notes. Here is the August version of the report, which predicts a 91,000 barrel-per-day decline in U.S. shale production in the month of August based on the number of rigs drilling today.

The publication of this August Drilling Productivity Report means that the last four reports are calling for shale production declines of:

That is a total decline of 325,000 barrels per day of production over just a four-month period. So where to from here? What numbers can we trust? Well, the shale companies that we watch in Outstanding Investments are seeing a decline in production. This drop is a direct result of reduced drilling. I would expect this reflects what is really going on across the industry. Time will tell, of course, and I'm sure the EIA will get its numbers straight in due time. But it's important to realize that even the big data agencies and experts are having trouble keeping up with the fast-moving production stats. Stay tuned. There are, of course, two sides to the oil story. In addition to supply, we must consider demand. For that, I'm going to defer to two pretty well-respected oil market observers. The first is Andrew Hall, whom I've written about before. His oil trading colleagues refer to him simply as "God." Needless to say, they think he knows what he is talking about. Hall has generally been very long-term bullish, but he has also been able to get out of the way of oil price downturns. He is not a one-trick pony; he is a rational thinker. Last fall, he actually made money while oil was plummeting. His viewpoint is more credible than most. In his July 1 letter to his Astenbeck Capital investors, he made the following observation, according to Bloomberg: "Oil's collapse is sending demand in the U.S. and Asia 'on a tear' that will push prices up this year and into 2016." Hall referred to oil demand in the U.S. specifically being up a "whopping" 1.34 million barrels per day over the past four weeks year on year. Another very well-respected oil market strategist, Mike Rothman at Cornerstone Analytics, also believes that demand is very strong and very much underreported by the EIA and IEA. Cornerstone is hard data-driven oil market intelligence firm (they do the onerous barrel counting that nobody else is able to do), and usually we don't get access to their viewpoints. Last week, one of Cornerstone's reports was leaked online. It showed that Cornerstone believes that global oil demand is currently being underreported by an incredible 2.5 million barrels per day. If that is true, the supply and demand fundamentals are much, much tighter than pretty much anyone believes. How do we know whom to believe? Well, what I try to do is independently come up with my own view based on data that I think are reliable. For me, the reliable data are the production guidance from the E&P industry as a whole, not the EIA data. In addition to my own work, I listen to the experienced investors/strategists who have a track record for being right. I try to be aware of confirmation bias (seeking out only the opinions that are in line with mine) while doing this, which is more difficult than it may seem. So what do I think? At this point in time, I feel pretty strongly that the rate of U.S. production decline is going to surprise pretty much everyone. On the demand side of the equation, I'm not entirely sure what to believe, but if I were a betting man, I'd follow the most successful oil trader that I'm aware of, that being Andrew Hall. This last down leg in oil prices has not been a lot of fun, but considering the fact that we have Iranian sanctions lifted, distress over Greece and a rising U.S. dollar, we likely shouldn't be surprised by a short-term dip. Over the long term, I still believe oil prices need to head higher (substantially so), with the most likely near-term catalyst being the EIA real-time data finally catching up to the fact that production is in decline (assuming it is). Keep looking through the windshield, Jody Chudley P.S. The post You’re "Dumb" if You Rely on EIA Numbers appeared first on Daily Reckoning. |

| Bron Suchecki: The message behind the Chinese gold reserves announcement Posted: 25 Jul 2015 07:49 AM PDT 10:48a ET Saturday, July 25, 2015 Dear Friend of GATA and Gold: Perth Mint research director Bron Suchecki has done a spectacular job compiling and analyzing interpretations of China's latest gold reserve announcement, which, he writes, likely was aimed at influencing and even misleading various audiences. In a particularly astute observation, Suchecki writes: Knowing that a lower-than-expectations figure would likely be negative for gold prices, China may well have considered it fortuitous that the gold price was weak at the same time they wanted to encourage people to invest in the stock market. As Jim Rickards tweeted, "China is still buying gold and favors a lower price. So timing the big 'reveal' for when gold prices are weak anyway makes perfect sense," both for the State Administration of Foreign Exchange in terms of acquiring more gold and for discouraging domestic investors from shifting money from the stock market to gold. Suchecki's analysis is headlined "The Message Behind the Chinese Gold Reserves Announcement" and it's posted at the Perth Mint's Internet site here: http://research.perthmint.com.au/2015/07/24/the-message-behind-the-chine... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata The Silver Summit and Resource Expo 2015 http://cambridgehouse.com/event/50/the-silver-summit-and-resource-expo-2... Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold And Silver - The US Dollar Does Not Exist, Part II Posted: 25 Jul 2015 07:15 AM PDT Truth does not exist in the world of politics. It is reasons such as these, below, that drives the importance of owning and holding physical silver and gold. The fundamental reasons everyone already knows exists but do not apply are important, but the power of the elites to rule over all [at least Western] governments, write the laws, deceive everyone, and now with the evidence of how much influence the bankers can exert over the manipulation of PM prices, is why you need to protect yourself from the evil nature of their control. |

| Posted: 25 Jul 2015 02:29 AM PDT There is no excerpt because this is a protected post. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Ivan Obolensky, Pilgrims Society, is identified as an investment banker. However, we are more appropriately placing him in the royalty section which will be number 28 or 29 (or other later number due to ongoing series revision), if that group is in two parts due to too much length as one presentation. Obolensky is a relation of the super rich Astors. In the next installment, Megabankers in the Society (#21 because #20 will be Part II of Investment Bankers), we'll include a profile on globe-straddling titan Sir Peter Sutherland who, though he could fit into this investment bankers presentation due to his strong linkage to Goldman Sachs, has been a director of several megabanks.

Ivan Obolensky, Pilgrims Society, is identified as an investment banker. However, we are more appropriately placing him in the royalty section which will be number 28 or 29 (or other later number due to ongoing series revision), if that group is in two parts due to too much length as one presentation. Obolensky is a relation of the super rich Astors. In the next installment, Megabankers in the Society (#21 because #20 will be Part II of Investment Bankers), we'll include a profile on globe-straddling titan Sir Peter Sutherland who, though he could fit into this investment bankers presentation due to his strong linkage to Goldman Sachs, has been a director of several megabanks.

I will start this week's commentary with a summary of the week's extraordinary action and defer catching up on some exceptionally good member questions to early next week. During the week, in our live sessions, we have looked in granular detail at the footprints that lead into and out of the gold raid that commenced in the early hours of Monday morning and how China was going to be falsely blamed for the selloff (which it subsequently was), yet an analysis of the footprints leads directly to the BIS (Bank for International Settlements) desk. I draw this conclusion because, unusually, the selloff commenced in the OTC (over-the-counter) FX gold market, which concurrently picked up in the Comex tripping off market halts just before China sold. What is missed by all the commentary out there is that while the Comex was halted, the OTC markets continued to operate unencumbered.

I will start this week's commentary with a summary of the week's extraordinary action and defer catching up on some exceptionally good member questions to early next week. During the week, in our live sessions, we have looked in granular detail at the footprints that lead into and out of the gold raid that commenced in the early hours of Monday morning and how China was going to be falsely blamed for the selloff (which it subsequently was), yet an analysis of the footprints leads directly to the BIS (Bank for International Settlements) desk. I draw this conclusion because, unusually, the selloff commenced in the OTC (over-the-counter) FX gold market, which concurrently picked up in the Comex tripping off market halts just before China sold. What is missed by all the commentary out there is that while the Comex was halted, the OTC markets continued to operate unencumbered.

Gold led a stiff rebound off support at 1180 today as it just was not going to go any lower, and the wiseguys grabbed some profits off the table. This was a very obviously short term oversold condition.

Gold led a stiff rebound off support at 1180 today as it just was not going to go any lower, and the wiseguys grabbed some profits off the table. This was a very obviously short term oversold condition.

No comments:

Post a Comment