Gold World News Flash |

- Welcome to Dystopia with Mogambo Guru: Corruption Always Rampant During End of a Boom

- Former US Mint Director Clueless On Gold In Fort Knox

- US Police More Concerned About "Anti-Government" Domestic Extremists Than Al-Qaeda, Study Finds

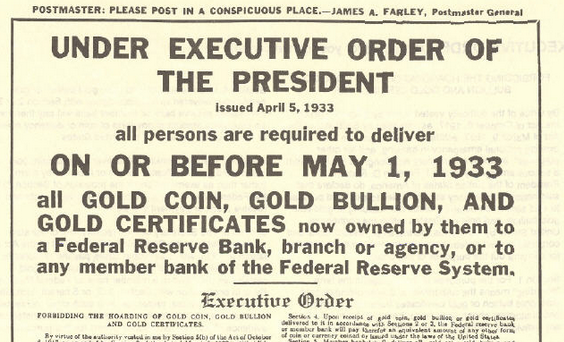

- When Gold is Declared Illegal

- Payrolls Preview: Goldman Expects Jobs Data To Disappoint

- THIS IS THE BANKSTER’S GREATEST FEAR — Harley Schlanger

- A Short History: The Neocon "Clean Break" Grand Design & The "Regime Change" Disasters It Has Fostered

- Mike Kosares: Gold ownership as a lifestyle decision

- Russia Or China - Washington's Conflict Over Who Is Public Enemy #1

- "Heartbreaking" Scene Unfolds At Greek Banks As Pensioners Clamor For Cash

- Gold Price Lost $2.50 and Closed Comex at $1,169.00

- Is gold 'shrugging off Armageddon' or just being shrugged off?

- The Greek Resistance

- Gold Daily and Silver Weekly Charts - Non-Farm Payrolls Tomorrow - Pride, Privilege, Will to Power

- Koos Jansen: Former U.S. Mint director clueless on gold in Fort Knox

- One more book, Mr. Stockman

- China targets counterweight in gold trade with yuan fix

- Gold Stocks Break Below 2008 Low

- Our Spoiled Brat Economy

- Greece Defaults… Here’s What’s Next

- Silver Tunnel Vision 'Experts'

- Gold And Silver - Monthly, Quarterly Ending Analysis

| Welcome to Dystopia with Mogambo Guru: Corruption Always Rampant During End of a Boom Posted: 02 Jul 2015 12:00 AM PDT from WallStForMainSt: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Former US Mint Director Clueless On Gold In Fort Knox Posted: 01 Jul 2015 10:30 PM PDT by Koos Jansen, Bullion Star:

The is post is a sequel to A First Glance At US Official Gold Reserves Audits, Second Thoughts On US Official Gold Reserves Audits and US Government Lost 7 Fort Knox Gold Audit Reports. Also related is Where Did The Gold In Fort Knox Come From? Part One. Recap and Introduction Early 2014 my first post was published about the audits performed on 95 % of US official gold reserves – the 7,628 tonnes stored by the US Mint – this is referred to as Deep Storage gold, 4,583 tonnes is at Fort Knox, 1,364 tonnes in Denver, 1,682 tonnes at West Point. In total US official gold reserves account for the 8,134 tonnes, owned by the US Treasury. My focus has always been the gold at the Fort Knox depository, as this is the largest facility. At the very surface the official story presented by the US government regarding the existence of Deep Storage gold seems credible. However, while investigating we could observe the official story is anything but credible. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Police More Concerned About "Anti-Government" Domestic Extremists Than Al-Qaeda, Study Finds Posted: 01 Jul 2015 08:30 PM PDT Submitted by Mike Krieger via Liberty Blitzkrieg blog,

Since September 11, 2001, the frightened and emotionally pliable American public has gullibly relinquished its civil liberties and free heritage in order to allow the U.S. government to wage unaccountable and unconstitutional war again Al-Qaeda and radical Islamic terrorism across the world. Many of us have warned for years, that preemptively giving up freedoms to protect freedom could only make sense to a propagandized, ignorant public completely clueless of human history. We warned that any totalitarian apparatus implemented to fight an outside enemy, would ultimately be turned around and used upon the public domestically. We already know this is happening with the NSA’s bulk spying and data collection, and we are starting to see a proliferation of the meme that “domestic extremists are more dangerous than Al-Qaeda,” spreading from the mouths of a corrupt and paranoid political class. I’ve covered this topic on several occasions, for example: The “War on Terror” Turns Inward – DHS Report Warns of Right Wing Terror Threat Eric Holder Announces Task Force to Focus on “Domestic Terrorists” Rep. Steve Cohen Calls Tea Party Republicans “Domestic Enemies” on MSNBC It’s Official: The FBI Classifies Peaceful American Protestors as “Terrorists” If all that’s not enough to convince you we’ve got a problem, I bring to you conclusions from the recently released study, “Law Enforcement Assessment of the Violent Extremism Threat.” This study was based on a survey conducted by Charles Kurzman and David Schanzer, who recently penned an op-ed in the New York Times. Here are some excerpts from their article:

Perhaps if the police didn’t harbor such negative thoughts about the general public, there wouldn’t be as many citizens killed by police. The recent tally is up to 463 killed so far in 2015, or an average of 2.5 Americans killed by police every day. Finally, I came across the following excerpt from a recently published National Journal article:

The real enemy of the corrupt corporate state is none other than, “we the people.” | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Jul 2015 08:00 PM PDT by Bill Bonner, Daily Reckoning.com:

Lines to get cash. Lines to buy gas. Lines of people eager to get their hands on something of value. Food. Fuel. Cash. Pity the poor guy who was last in line… …the poor taxi driver, for example, standing behind 300 other people, trying to get 200 lousy euros out of an ATM. Like a tragic nightclub customer… among the last to smell the smoke. By the time he headed for the exit, it was clogged with desperate people, all struggling to get through the same narrow door at the same time. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payrolls Preview: Goldman Expects Jobs Data To Disappoint Posted: 01 Jul 2015 08:00 PM PDT Despite much hopeful banter among the mainstream media, Goldman forecast nonfarm payroll job growth of 220k in June, notably below consensus expectations of 234k.

This is roughly in line with Goldman's expectations for below average job growth over the remainder of 2015. Employment indicators were mixed in June: reported job availability, the employment components of most manufacturing surveys, and ADP employment growth improved, but jobless claims and job cuts both rose slightly and online job ads declined. Overall, the June data point to a gain below the very strong 280k increase in May.

Arguing for a stronger report:

Arguing for a weaker report:

Neutral factors:

We expect the unemployment rate to decline one-tenth to 5.4% in June, from an unrounded 5.508% in May. The headline U3 unemployment rate declined by 0.8pp over the last year and the broader U6 underemployment rate declined by 1.3pp. Looking further ahead, we expect U3 to reach 5% by early 2016 and U6 to reach our 9% estimate of its full employment rate by the end of 2016. We expect a softer 0.1% increase in average hourly earnings for all workers in June as a result of calendar effects. Average hourly earnings for all workers rose 2.3% over the year ending in May, while average hourly earnings for production & nonsupervisory workers rose 2%. We see some preliminary signs of a pickup in wage growth, which we expect to reach about 2.75-3% by year-end, still below our 3.5% estimate of the full employment rate. Source: Goldman Sachs | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THIS IS THE BANKSTER’S GREATEST FEAR — Harley Schlanger Posted: 01 Jul 2015 07:45 PM PDT by SGT, SGT Report.com: Our friend Harley Schlanger, Historian and national spokesman for LaRouchePAC is back with us to process the developments in Greece as it defaults on IMF austerity and usury in favor of a future for its people over the criminal international Banksters. Harley notes, “This is the worst case scenario for these Bankers. The reality is there is something new on the horizon. A new financial system outside of the control of what George Herbert Walker Bush called the New World Order. It’s fragile, but it’s coming into existence. And this is what the Banksters fear more than anything else.” Harley asks a very important question as we approach what is fondly remembered as “Independence Day” on July 4th: “What will the United States do? Where we are under the same captivity of an austerity driven global Bankster domination. Will the American people recognize that the Greeks should be our allies, the BRICS nations should be our allies? Or will we continue to go along with this London-Wall Street DICTATORSHIP?” As we document the collapse for the first day of July, 2015 Harley reminds us that “after the collapse “There is very little that will remain standing. There’s an interconnection, it is a Domino effect.” Thanks for tuning in. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Jul 2015 07:30 PM PDT Submitted by Dan Sanchez via AntiWar.com, To understand today’s crises in Iraq, Syria, Iran, and elsewhere, one must grasp their shared Lebanese connection. This assertion may seem odd. After all, what is the big deal about Lebanon? That little country hasn’t had top headlines since Israel deigned to bomb and invade it in 2006. Yet, to a large extent, the roots of the bloody tangle now enmeshing the Middle East lie in Lebanon: or to be more precise, in the Lebanon policy of Israel. Rewind to the era before the War on Terror. In 1995, Yitzhak Rabin, Israel’s “dovish” Prime Minister, was assassinated by a right-wing zealot. This precipitated an early election in which Rabin’s Labor Party was defeated by the ultra-hawkish Likud, lifting hardliner Benjamin Netanyahu to his first Premiership in 1996. That year, an elite study group produced a policy document for the incipient administration titled, “A Clean Break: A New Strategy for Securing the Realm.” The membership of the Clean Break study group is highly significant, as it included American neoconservatives who would later hold high offices in the Bush Administration and play driving roles in its Middle East policy. “A Clean Break” advised that the new Likud administration adopt a “shake it off” attitude toward the policy of the old Labor administration which, as the authors claimed, assumed national “exhaustion” and allowed national “retreat.” This was the “clean break” from the past that “A Clean Break” envisioned. Regarding Israel’s international policy, this meant:

Pursuit of comprehensive peace with all of Israel’s neighbors was to be abandoned for selective peace with some neighbors (namely Jordan and Turkey) and implacable antagonism toward others (namely Iraq, Syria, and Iran). The weight of its strategic allies would tip the balance of power in favor of Israel, which could then use that leverage to topple the regimes of its strategic adversaries by using covertly managed “proxy forces” and “the principle of preemption.” Through such a “redrawing of the map of the Middle East,” Israel will “shape the regional environment,” and thus, “Israel will not only contain its foes; it will transcend them.” “A Clean Break” was to Israel (and ultimately to the US) what Otto von Bismarck’s “Blood and Iron” speech was to Germany. As he set the German Empire on a warpath that would ultimately set Europe ablaze, Bismarck said:

Before setting Israel and the US on a warpath that would ultimately set the Middle East ablaze, the Clean Break authors were basically saying: Not through peace accords will the great questions of the day be decided?—?that was the great mistake of 1978 (at Camp David) and 1993 (at Oslo)?—?but by “divide and conquer” and regime change. By wars both aggressive (“preemptive”) and “dirty” (covert and proxy). “A Clean Break” slated Saddam Hussein’s Iraq as first up for regime change. This is highly significant, especially since several members of the Clean Break study group played decisive roles in steering and deceiving the United States into invading Iraq and overthrowing Saddam seven years later. The Clean Break study group’s leader, Richard Perle, led the call for Iraqi regime change beginning in the 90s from his perch at the Project for a New American Century and other neocon think tanks. And while serving as chairman of a high level Pentagon advisory committee, Perle helped coordinate the neoconservative takeover of foreign policy in the Bush administration and the final push for war in Iraq. Another Clean Breaker, Douglas Feith, was a Perle protege and a key player in that neocon coup. After 9/11, as Under Secretary of Defense for Policy, Feith created two secret Pentagon offices tasked with cherry-picking, distorting, and repackaging CIA and Pentagon intelligence to help make the case for war. Feith’s “Office of Special Plans” manipulated intelligence to promote the falsehood that Saddam had a secret weapons of mass destruction program that posed an imminent chemical, biological, and even nuclear threat. This lie was the main justification used by the Bush administration for the Iraq War. Feith’s “Counter Terrorism Evaluation Group” trawled through the CIA’s intelligence trash to stitch together far-fetched conspiracy theories linking Saddam Hussein’s Iraq with Osama bin Laden’s Al Qaeda, among other bizarre pairings. Perle put the Group into contact with Ahmed Chalabi, a dodgy anti-Saddam Iraqi exile who would spin even more yarn of this sort. Much of the Group’s grunt work was performed by David Wurmser, another Perle protege and the primary author of “A Clean Break.” Wurmser would go on to serve as an advisor to two key Iraq War proponents in the Bush administration: John Bolton at the State Department and Vice President Dick Cheney. The foregone conclusions generated by these Clean Breaker-led projects faced angry but ineffectual resistance from the Intelligence Community, and are now widely considered scandalously discredited. But they succeeded in helping, perhaps decisively, to overcome both bureaucratic and public resistance to the march to war. The Iraq War that followed put the Clean Break into action by grafting it onto America. The War accomplished the Clean Break objective of regime change in Iraq, thus beginning the “redrawing of the map of the Middle East.” And the attendant “Bush Doctrine” of preemptive war accomplished the Clean Break objective of “reestablishing the principle of preemption” But why did the Netanyahu/Bush Clean Breakers want to regime change Iraq in the first place? While reference is often made to “A Clean Break” as a prologue to the Iraq War, it is often forgotten that the document proposed regime change in Iraq primarily as a “means” of “weakening, containing, and even rolling back Syria.” Overthrowing Saddam in Iraq was merely a stepping stone to “foiling” and ultimately overthrowing Bashar al-Assad in neighboring Syria. As Pat Buchanan put it: “In the Perle-Feith-Wurmser strategy, Israel’s enemy remains Syria, but the road to Damascus runs through Baghdad.” Exactly how this was to work is baffling. As the document admitted, although both were Baathist regimes, Assad and Saddam were far more enemies than allies. “A Clean Break” floated a convoluted pipe dream involving a restored Hashemite monarchy in Iraq (the same US-backed, pro-Israel dynasty that rules Jordan) using its sway over an Iraqi cleric to turn his co-religionists in Syria against Assad. Instead, the neocons ended up settling for a different pipe(line) dream, sold to them by that con-man Chalabi, involving a pro-Israel, Chalabi-dominated Iraq building a pipeline from Mosul to Haifa. One only wonders why he didn’t sweeten the deal by including the Brooklyn Bridge in the sale. As incoherent as it may have been, getting at Syria through Iraq is what the neocons wanted. And this is also highly significant for us today, because the US has now fully embraced the objective of regime change in Syria, even with Barack Obama inhabiting the White House instead of George W. Bush. Washington is pursuing that objective by partnering with Turkey, Jordan, and the Gulf States in supporting the anti-Assad insurgency in Syria’s bloody civil war, and thereby majorly abetting the bin Ladenites (Syrian Al Qaeda and ISIS) leading that insurgency. Obama has virtually become an honorary Clean Breaker by pursuing a Clean Break objective (“rolling back Syria”) using Clean Break strategy (“balance of power” alliances with select Muslim states) and Clean Break tactics (a covert and proxy “dirty war”). Of course the neocons are the loudest voices calling for the continuance and escalation of this policy. And Israel is even directly involving itself by providing medical assistance to Syrian insurgents, including Al Qaeda fighters. Another target identified by “A Clean Break” was Iran. This is highly significant, since while the neocons were still riding high in the Bush administration’s saddle, they came within an inch of launching a US war on Iran over yet another manufactured and phony WMD crisis. While the Obama administration seems on the verge of finalizing a nuclear/peace deal with the Iranian government in Tehran, the neocons and Netanyahu himself (now Prime Minister once again) have pulled out all the stops to scupper it and put the US and Iran back on a collision course. The neocons are also championing ongoing American support for Saudi Arabia’s brutal war in Yemen to restore that country’s US-backed former dictator. Simply because the “Houthi” rebels that overthrew him and took the capital city of Sanaa are Shiites, they are assumed to be a proxy of the Shiite Iranians, and so this is seen by neocons and Saudi theocons alike as a war against Iranian expansion. Baghdad is a pit stop on the road to Damascus, and Sanaa is a pit stop on the road to Tehran. But, according to the Clean Breakers, Damascus and Tehran are themselves merely pit stops on the road to Beirut. According to “A Clean Break,” Israel’s main beef with Assad is that: “Syria challenges Israel on Lebanese soil.” And its great grief with the Ayatollah is that Iran, like Syria, is one of the: “…principal agents of aggression in Lebanon…” All regime change roads lead to Lebanon, it would seem. So this brings us back to our original question. What is the big deal about Lebanon? The answer to this question goes back to Israel’s very beginnings. Its Zionist founding fathers established the bulk of Israel’s territory by dispossessing and ethnically cleansing three-quarters of a million Palestinian Arabs in 1948. Hundreds of thousands of these were driven (sometimes literally in trucks, sometimes force marched with gunshots fired over their heads) into Lebanon, where they were gathered in miserable refugee camps. In Lebanon the Palestinians who had fled suffered an apartheid state almost as rigid as the one Israel imposed on those who stayed behind, because the dominant Maronite Christians there were so protective of their political and economic privileges in Lebanon’s confessional system. In a 1967 war of aggression, Israel conquered the rest of formerly-British Palestine, annexing the West Bank and Gaza Strip, and placing the Palestinians there (many of whom fled there seeking refuge after their homes were taken by the Israelis in 1948) under a brutal, permanent military occupation characterized by continuing dispossession and punctuated by paroxysms of mass murder. This compounding of their tragedy drove the Palestinians to despair and radicalization, and they subsequently lifted Yasser Arafat and his fedayeen (guerrilla) movement to the leadership of the Palestine Liberation Organization (PLO), then headquartered in Jordan. When the king of Jordan massacred and drove out the PLO, Arafat and the remaining members relocated to Lebanon. There they waged cross-border guerrilla warfare to try to drive Israel out of the occupied territories. The PLO drew heavily from the refugee camps in Lebanon for recruits. This drew Israel deeply into Lebanese affairs. In 1976, Israel started militarily supporting the Maronite Christians, helping to fuel a sectarian civil war that had recently begun and would rage until 1990. That same year, Syrian forces entered Lebanon, partook in the war, and began a military occupation of the country. In 1978, Israel invaded Lebanon to drive the PLO back and to recruit a proxy army called the “South Lebanon Army” (SLA). In 1982 Israel launched a full scale war in Lebanon, fighting both Syria and the PLO. Osama bin Laden later claimed that it was seeing the wreckage of tall buildings in Beirut toppled by Israel’s “total war” tactics that inspired him to destroy American buildings like the Twin Towers. In this war, Israel tried to install a group of Christian Fascists called the Phalange in power over Lebanon. This failed when the new Phalangist ruler was assassinated. As a reprisal, the Phalange perpetrated, with Israeli connivance, the massacre of hundreds (perhaps thousands) of Palestinian refugees and Lebanese Shiites. (See Murray Rothbard’s moving contemporary coverage of the atrocity.) Israel’s 1982 war succeeded in driving the PLO out of Lebanon, although not in destroying it. And of course hundreds of thousands of Palestinian refugees still linger in Lebanon’s camps, yearning for their right of return: a fact that cannot have escaped Israel’s notice. The Lebanese Shiites were either ambivalent or welcoming toward being rid of the PLO. But Israel rapidly squandered whatever patience the Shiites had for it by brutally occupying southern Lebanon for years. This led to the creation of Hezbollah, a Shiite militia not particularly concerned with the plight of the Sunni Palestinian refugees, but staunchly dedicated to driving Israel and its proxies (the SLA) completely out of Lebanon. Aided by Syria and Iran, though not nearly to the extent Israel would have us believe, Hezbollah became the chief defensive force directly frustrating Israel’s efforts to dominate and exploit its northern neighbor. In 1993 and again in 1996 (the year of “A Clean Break”), Israel launched still more major military operations in Lebanon, chiefly against Hezbollah, but also bombing Lebanon’s general population and infrastructure, trying to use terrorism to motivate the people and the central government to crack down on Hezbollah. This is the context of “A Clean Break”: Israel’s obsession with crushing Hezbollah and dominating Lebanon, even if it means turning most of the Middle East upside down (regime changing Syria, Iran, and Iraq) to do it. 9/11 paved the way for realizing the Clean Break, using the United States as a gigantic proxy, thanks to the Israel Lobby’s massive influence in Congress and the neocons’ newly won dominance in the Bush Administration. Much to their chagrin, however, its first phase (the Iraq War) did not turn out so well for the Clean Breakers. The blundering American grunts ended up installing the most vehemently pro-Iran Shiite faction in power in Baghdad, and now Iranian troops are even stationed and fighting inside Iraq. Oops. And as it turns out, Chalabi may have been an Iranian agent all along. (But don’t worry, Mr. Perle, I’m sure he’ll eventually come through with that pipeline.) This disastrous outcome has given both Israel and Saudi Arabia nightmares about an emerging “Shia Crescent” arcing from Iran through Iraq into Syria. And now the new Shiite “star” in Yemen completes this menacing “Star and Crescent” picture. The fears of the Sunni Saudis are partially based on sectarianism. But what Israel sees in this picture is a huge potential regional support network for its nemesis Hezbollah.

Israel would have none of it. In 2006, it launched its second full scale war in Lebanon, only to be driven back once again by that damned Hezbollah. It was time to start thinking big and regional again. As mentioned above, the Bush war on Iran didn’t pan out. (This was largely because the CIA got its revenge on the neocons by releasing a report stating plainly that Iran was not anything close to a nuclear threat.) So instead the neocons and the Saudis drew the US into what Seymour Hersh called “the Redirection” in 2007, which involved clandestine “dirty war” support for Sunni jihadists to counter Iran, Syria, and Hezbollah. When the 2011 Arab Spring wave of popular uprisings spread to Syria, the Redirection was put into overdrive. The subsequent US-led dirty war discussed above had the added bonus of drawing Hezbollah into the bloody quagmire to try to save Assad, whose regime now finally seems on the verge of collapse. The Clean Break is back, baby! Assad is going, Saddam is gone, and who knows: the Ayatollah may never get his nuclear deal anyway. But most importantly for “securing the realm,” Hezbollah is on the ropes.

And so what if the Clean Break was rather messy and broke so many bodies and buildings along the way? Maybe it’s like what Lenin said about omelets and eggs: you just can’t make a Clean Break without breaking a few million Arabs and a few thousand Americans. And what about all those fanatics now running rampant throughout large swaths of the world thanks to the Clean Break wars, mass-executing Muslim “apostates” and Christian “infidels” and carrying out terrorist attacks on westerners? Again, the Clean Breakers must remind themselves, keep your eye on the omelet and forget the eggs. Well, dear reader, you and I are the eggs. And if we don’t want to see our world broken any further by the imperial c | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mike Kosares: Gold ownership as a lifestyle decision Posted: 01 Jul 2015 06:44 PM PDT 9:46p ET Wednesday, July 1, 2015 Dear Friend of GATA and Gold: In the July edition of USAGold's News & Views letter, proprietor Mike Kosares describes the serene confidence and gratitude of a now-retired doctor who put a huge amount of his savings into gold coins a little more than a decade ago, taking a long-term approach to capital preservation and perceiving ownership of the monetary metal as a sort of lifestyle decision. Such an outlook is not likely to mollify anyone aggrieved by the ever-more-comprehensive destruction of markets by megalomaniacal central banks, but it's a reminder of the monetary metal's enduring virtue and purpose and of why a free and transparent market in gold is worth contending for. The newsletter's headline, taken from Kosares' commentary, is "Gold Ownership as a Lifestyle Decision" and it's posted at USAGold here: http://www.usagold.com/publications/NewsViewsJuly2015.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 Bullion Star is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. Bullion Star's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in Bullion Star's bullion vault, which is integrated with Bullion Star's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Russia Or China - Washington's Conflict Over Who Is Public Enemy #1 Posted: 01 Jul 2015 06:30 PM PDT Submitted by Michael Klare via TomDispatch.com, America’s grand strategy, its long-term blueprint for advancing national interests and countering major adversaries, is in total disarray. Top officials lurch from crisis to crisis, improvising strategies as they go, but rarely pursuing a consistent set of policies. Some blame this indecisiveness on a lack of resolve at the White House, but the real reason lies deeper. It lurks in a disagreement among foreign policy elites over whether Russia or China constitutes America’s principal great-power adversary. Knowing one’s enemy is usually considered the essence of strategic planning. During the Cold War, enemy number one was, of course, unquestioned: it was the Soviet Union, and everything Washington did was aimed at diminishing Moscow’s reach and power. When the USSR imploded and disappeared, all that was left to challenge U.S. dominance were a few “rogue states.” In the wake of 9/11, however, President Bush declared a “global war on terror,” envisioning a decades-long campaign against Islamic extremists and their allies everywhere on the planet. From then on, with every country said to be either with us or against us, the chaos set in. Invasions, occupations, raids, drone wars ensued -- all of it, in the end, disastrous -- while China used its economic clout to gain new influence abroad and Russia began to menace its neighbors. Among Obama administration policymakers and their Republican opponents, the disarray in strategic thinking is striking. There is general agreement on the need to crush the Islamic State (ISIS), deny Iran the bomb, and give Israel all the weapons it wants, but not much else. There is certainly no agreement on how to allocate America’s strategic resources, including its military ones, even in relation to ISIS and Iran. Most crucially, there is no agreement on the question of whether a resurgent Russia or an ever more self-assured China should head Washington’s enemies list. Lacking such a consensus, it has become increasingly difficult to forge long-term strategic plans. And yet, while it is easy to decry the current lack of consensus on this point, there is no reason to assume that the anointment of a common enemy -- a new Soviet Union -- will make this country and the world any safer than it is today. Choosing the Enemy For some Washington strategists, including many prominent Republicans, Russia under the helm of Vladimir Putin represents the single most potent threat to America’s global interests, and so deserves the focus of U.S. attention. “Who can doubt that Russia will do what it pleases if its aggression goes unanswered?” Jeb Bush asserted on June 9th in Berlin during his first trip abroad as a potential presidential contender. In countering Putin, he noted, “our alliance [NATO], our solidarity, and our actions are essential if we want to preserve the fundamental principles of our international order, an order that free nations have sacrificed so much to build.” For many in the Obama administration, however, it is not Russia but China that poses the greatest threat to American interests. They feel that its containment should take priority over other considerations. If the U.S. fails to enact a new trade pact with its Pacific allies, Obama declared in April, “China, the 800-pound gorilla in Asia, will create its own set of rules,” further enriching Chinese companies and reducing U.S. access “in the fastest-growing, most dynamic economic part of the world.” In the wake of the collapse of the Soviet Union, the military strategists of a seemingly all-powerful United States -- the unchallenged “hyperpower” of the immediate post-Cold War era -- imagined the country being capable of fighting full-scale conflicts on two (or even three fronts) at once. The shock of the twenty-first century in Washington has been the discovery that the U.S. is not all-powerful and that it can’t successfully take on two major adversaries simultaneously (if it ever could). It can, of course, take relatively modest steps to parry the initiatives of both Moscow and Beijing while also fighting ISIS and other localized threats, as the Obama administration is indeed attempting to do. However, it cannot also pursue a consistent, long-range strategy aimed at neutralizing a major adversary as in the Cold War. Hence a decision to focus on either Russia or China as enemy number one would have significant implications for U.S. policy and the general tenor of world affairs. Choosing Russia as the primary enemy, for example, would inevitably result in a further buildup of NATO forces in Eastern Europe and the delivery of major weapons systems to Ukraine. The Obama administration has consistently opposed such deliveries, claiming that they would only inflame the ongoing conflict and sabotage peace talks. For those who view Russia as the greatest threat, however, such reluctance only encourages Putin to escalate his Ukrainian intervention and poses a long-term threat to U.S. interests. In light of Putin’s ruthlessness, said Senator John McCain, chairman of the Senate Armed Services Committee and a major advocate of a Russia-centric posture, the president’s unwillingness to better arm the Ukrainians “is one of the most shameful and dishonorable acts I have seen in my life.” On the other hand, choosing China as America’s principal adversary means a relatively restrained stance on the Ukrainian front coupled with a more vigorous response to Chinese claims and base building in the South China Sea. This was the message delivered to Chinese leaders by Secretary of Defense Ashton Carter in late May at U.S. Pacific Command headquarters in Honolulu. Claiming that Chinese efforts to establish bases in the South China Sea were “out of step” with international norms, he warned of military action in response to any Chinese efforts to impede U.S. operations in the region. “There should be... no mistake about this -- the United States will fly, sail, and operate wherever international law allows.”

The “Pivot” to Asia The Obama administration’s fixation on the “800-pound gorilla” that is China came into focus sometime in 2010-2011. Plans were then being made for what was assumed to be the final withdrawal of U.S. forces from Iraq and the winding down of the American military presence in Afghanistan. At the time, the administration’s top officials conducted a systematic review of America’s long-term strategic interests and came to a consensus that could be summed up in three points: Asia and the Pacific Ocean had become the key global theater of international competition; China had taken advantage of a U.S. preoccupation with Iraq and Afghanistan to bolster its presence there; and to remain the world’s number one power, the United States would have to prevent China from gaining more ground. This posture, spelled out in a series of statements by President Obama, Secretary of State Hillary Clinton, and other top administration officials, was initially called the “pivot to Asia” and has since been relabeled a “rebalancing” to that region. Laying out the new strategy in 2011, Clinton noted, “The Asia-Pacific has become a key driver of global politics. Stretching from the Indian subcontinent to the western shores of the Americas... it boasts almost half of the world’s population [and] includes many of the key engines of the global economy.” As the U.S. withdrew from its wars in the Middle East, “one of the most important tasks of American statecraft over the next decade will therefore be to lock in substantially increased investment -- diplomatic, economic, strategic, and otherwise -- in the Asia-Pacific region.” This strategy, administration officials claimed then and still insist, was never specifically aimed at containing the rise of China, but that, of course, was a diplomatic fig leaf on what was meant to be a full-scale challenge to a rising power. It was obvious that any strengthened American presence in the Pacific would indeed pose a direct challenge to Beijing’s regional aspirations. “My guidance is clear,” Obama told the Australian parliament that same November. “As we plan and budget for the future, we will allocate the resources necessary to maintain our strong military presence in this region. We will preserve our unique ability to project power and deter threats to peace.” Implementation of the pivot, Obama and Clinton explained, would include support for or cooperation with a set of countries that ring China, including increased military aid to Japan and the Philippines, diplomatic outreach to Burma, Indonesia, Malaysia, Vietnam, and other nations in Beijing’s economic orbit, military overtures to India, and the conclusion of a major trade arrangement, the Trans-Pacific Partnership (TPP), that would conveniently include most countries in the region but exclude China. Many in Washington have commented on how much more limited the administration’s actions in the Pacific have proven to be than the initial publicity suggested. Of course, Washington soon found itself re-embroiled in the Greater Middle East and shuttling many of its military resources back into that region, leaving less than expected available for a rebalancing to Asia. Still, the White House continues to pursue a strategic blueprint aimed at bolstering America’s encirclement of China. “No matter how many hotspots emerge elsewhere, we will continue to deepen our enduring commitment to this critical region,” National Security Adviser Susan Rice declared in November 2013. For Obama and his top officials, despite the challenge of ISIS and of disintegrating states like Yemen and Libya wracked with extremist violence, China remains the sole adversary capable of taking over as the world’s top power. (Its economy already officially has.) To them, this translates into a simple message: China must be restrained through all means available. This does not mean, they claim, ignoring Russia and other potential foes. The White House has, for example, signaled that it will begin storing heavy weaponry, including tanks, in Eastern Europe for future use by any U.S. troops rotated into the region to counter Russian pressure against countries that were once part of the Soviet Union. And, of course, the Obama administration is continuing to up the ante against ISIS, most recently dispatching yet more U.S. military advisers to Iraq. They insist, however, that none of these concerns will deflect the administration from the primary task of containing China. Countering the Resurgent Russian Bear Not everyone in Washington shares this China-centric outlook. While most policymakers agree that China poses a potential long-term challenge to U.S. interests, an oppositional crew of them sees that threat as neither acute nor immediate. After all, China remains America’s second-leading trading partner (after Canada) and its largest supplier of imported goods. Many U.S. companies do extensive business in China, and so favor a cooperative relationship. Though the leadership in Beijing is clearly trying to secure what it sees as its interests in Asian waters, its focus remains primarily economic and its leaders seek to maintain friendly relations with the U.S., while regularly engaging in high-level diplomatic exchanges. Its president, Xi Jinping, is expected to visit Washington in September. Vladimir Putin’s Russia, on the other hand, looks far more threatening to many U.S. strategists. Its annexation of Crimea and its ongoing support for separatist forces in eastern Ukraine are viewed as direct and visceral threats on the Eurasian mainland to what they see as a U.S.-dominated world order. President Putin, moreover, has made no secret of his contempt for the West and his determination to pursue Russian national interests wherever they might lead. For many who remember the Cold War era -- and that includes most senior U.S. policymakers -- this looks a lot like the menacing behavior of the former Soviet Union; for them, Russia appears to be posing an existential threat to the U.S. in a way that China does not. Among those who are most representative of this dark, eerily familiar, and retrograde outlook is Senator McCain. Recently, offering an overview of the threats facing America and the West, he put Russia at the top of the list: “In the heart of Europe, we see Russia emboldened by a significant modernization of its military, resurrecting old imperial ambitions, and intent on conquest once again. For the first time in seven decades on this continent, a sovereign nation has been invaded and its territory annexed by force. Worse still, from central Europe to the Caucuses, people sense Russia’s shadow looming larger, and in the darkness, liberal values, democratic sovereignty, and open economies are being undermined.” For McCain and others who share his approach, there is no question about how the U.S. should respond: by bolstering NATO, providing major weapons systems to the Ukrainians, and countering Putin in every conceivable venue. In addition, like many Republicans, McCain favors increased production via hydro-fracking of domestic shale gas for export as liquefied natural gas to reduce the European Union’s reliance on Russian gas supplies. McCain’s views are shared by many of the Republican candidates for president. Jeb Bush, for instance, described Putin as “a ruthless pragmatist who will push until someone pushes back.” Senator Ted Cruz, when asked on Fox News what he would do to counter Putin, typically replied, “One, we need vigorous sanctions… Two, we should immediately reinstate the antiballistic missile batteries in Eastern Europe that President Obama canceled in 2009 in an effort to appease Russia. And three, we need to open up the export of liquid natural gas, which will help liberate Ukraine and Eastern Europe.” Similar comments from other candidates and potential candidates are commonplace. As the 2016 election season looms, expect the anti-Russian rhetoric to heat up. Many of the Republican candidates are likely to attack Hillary Clinton, the presumed Democratic candidate, for her role in the Obama administration’s 2009 “reset” of ties with Moscow, an attempted warming of relations that is now largely considered a failure. “She’s the one that literally brought the reset button to the Kremlin,” said former Texas Governor Rick Perry in April. If any of the Republican candidates other than Paul prevails in 2016, anti-Russianism is likely to become the centerpiece of foreign policy with far-reaching consequences. “No leader abroad draws more Republican criticism than Putin does,” a conservative website noted in June. “The candidates’ message is clear: If any of them are elected president, U.S. relations with Russia will turn even more negative.” The Long View Whoever wins in 2016, what Yale historian Paul Kennedy has termed “imperial overstretch” will surely continu | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| "Heartbreaking" Scene Unfolds At Greek Banks As Pensioners Clamor For Cash Posted: 01 Jul 2015 05:41 PM PDT 1,000 Greek bank branches chanced a stampede in order to open their doors to the country's retirees on Wednesday. The scene was somewhat chaotic as pensioners formed long lines and the country's elderly attempted to squeeze through the doors in order to access pension payments. As Bloomberg reports, payouts were rationed and disbursals were limited according to last name. Here's more:

AFP has more color:

Here's a look at the scene at National Bank in Athens courtesy of The Telegraph: As we outlined in detail earlier this morning, the latest polls show a slim majority of Greeks plan to vote "no" in the upcoming referendum (which, as far as we know, will still go on). Many analysts and commentators say a "oxi" vote would likely lead to a euro exit and with it, far more pain for the country's retirees. Indeed, as we noted on Tuesday in "For Greeks, The Nightmare Is Just Beginning: Here Come The Depositor Haircuts," Goldman has suggested that only once Syriza's "core constituency of pensioners and public sector employees" sees the cash reserves (to which they have heretofore enjoyed first claim on) run dry, will they "face the direct implications of the liquidity squeeze the political impasse between Greece and its creditors has created. And only then will the alignment of domestic political interests within Greece change to allow a way forward." And so, as sad as it is, the scene that unfolded today in front of the roughly one-third of Greek bank branches which opened their doors to pensioners, may have been preordained by the powers that be in Burssels because as we said yesterday evening, breaking Syriza's voter base may have been necessary in order for the Troika to finally force Tsipras to relent or else risk being driven from office, after capital controls and depositor haircuts force public sector employees to collectively cry "Uncle", beg Europe to take it back, and present Merkel with Tsipras and Varoufakis' heads on a proverbial (and metaphorical, we hope) silver platter. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Lost $2.50 and Closed Comex at $1,169.00 Posted: 01 Jul 2015 04:43 PM PDT

30 Day Silver Price Chart

If boldness and brass does not right now characterize the silver and GOLD PRICE, neither does cringing and cowardice. Hanging over the cliff's edge, both stubbornly refuse to obey gravity. Silver's low yesterday was $15.44, today $15.50. Silver is standing on resistance. One step too big backwards and it tumbles. Gold price is trading in a slightly downsloping channel with the bottom line about $1,165 tomorrow. Maximum downside risk (according to my opinion) is about $1,130. Day after the Greek default the world did not come to a halt. Business continues as normal, or as normal as it can in this utterly abnormal fantasy world of central banking. US stocks took that and rumors of a Greek resolution (O, how long must we listen to such things?) as occasion to rise, up 122.90 (0.7%) for a Dow at 17,742.41. S&P500 also gained 12.,93 (0.63%) to 2,076.04. Give the Dow credit, it did close back above its 200 DMA (17,684). This is not, however, particularly inspiring, like saying the wolfman would be good looking if he weren't growing hair under his eyes and on his forehead. What ought to interest us is the US dollar index rising 85 basis points (0.89%) to 96.51. This brings it back to the 96.50 resistance zone, from which it was slapped silly on Monday. It has come right back. Hard for me to fathom that the Dollar will not rise from here, unless that fits not the schemes and nefarious plans of the central banking criminals. A close tomorrow above 96.50 will mark a breakout. Euro dropped 0.75% today to $1.1054. Sick. Yen lost 0.56% to 81.19. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2015, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is gold 'shrugging off Armageddon' or just being shrugged off? Posted: 01 Jul 2015 02:32 PM PDT 5:33p ET Wednesday, July 1, 2015 Dear Friend of GATA and Gold: Your secretary/treasurer today sent the e-mail below to Bloomberg View columnist Barry Ritholtz in response to his commentary posted today, "Gold Shrugs Off Armageddon," which can be found here: http://www.bloombergview.com/articles/2015-07-01/gold-shrugs-off-armaged... CHRIS POWELL, Secretary/Treasurer * * * Wednesday, July 1, 2015 Dear Mr. Ritholtz: Your commentary today, "Gold Shrugs Off Armageddon" -- http://www.bloombergview.com/articles/2015-07-01/gold-shrugs-off-armaged... -- invites people to e-mail you "explaining how wrong and stupid I am." Instead, may I write you to ask that in future commentary you address a few specific questions of fact and that you review and respond to some documentation about the gold market? Particularly: -- Was the Banque de France's director of market operations, Alexandre Gautier, telling the truth when he told the London Bullion Market Association meeting in Rome in September 2013 that the bank is secretly trading gold for its own account and the accounts of other central banks "nearly on a daily basis"? (See: http://www.gata.org/node/13373.) ... Dispatch continues below ... ADVERTISEMENT We Are Amid the Biggest Financial Bubble in History; With GoldCore you can own allocated -- and most importantly -- segregated coins and bars in Switzerland, Singapore, and Hong Kong. Switzerland, Singapore, and Hong Kong remain extremely safe jurisdictions for storing bullion. Avoid exchange-traded funds and digital gold providers where you are a price taker. Ensure that you are outright legal owner of your bullion. If you do not own segregated bullion that you can visit, inspect, and take delivery of, you are exposed. Crucial guides to storage in Singapore and Switzerland can be read here: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland GoldCore does not report transactions to any authority. Safety, privacy, and confidentiality are paramount when we are entrusted with storage of our clients' precious metals. Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44(0)203-086-9200. U.S.: +1-302-635-1160. International: +353(0)1-632-5010. Visit us at: http://www.goldcore.com -- Is the Bank for International Settlements telling the truth when it maintains in its annual report that it does the same sort of secret trading on behalf of its member central banks, trading not only gold itself but also gold futures, options, and other derivatives? (See: http://www.gata.org/node/12717.) -- Is the BIS sincere when it advertises that it undertakes secret interventions in the gold market for its members? (See http://www.gata.org/node/11012.) -- Was CME Group, which operates the major futures exchanges in the United States, telling the truth last year when it told the U.S. Commodity Futures Trading Commission that it is offering volume trading discounts to central banks for secretly trading all contracts on its exchanges? (See http://www.gata.org/node/14385.) -- Was CME Group telling the truth last year when it told the U.S. Securities and Exchange commission that its customers include governments and central banks? (See http://www.gata.org/node/14411.) -- If central banks are indeed doing so much secret trading in the gold market and other markets, what are their objectives and might this secret trading be intended to manipulate markets, support government currencies and bonds, and deceive and cheat investors who think that markets are free trading? There is a lot more documentation suggesting as much here: http://www.gata.org/node/14839 My organization would welcome an honest exchange with you about these things, as your commentaries about gold seem to overlook the most relevant "narrative" about the monetary metal and ignore a substantial and serious audience quite different from the one you seem to enjoy engaging with. With good wishes. CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

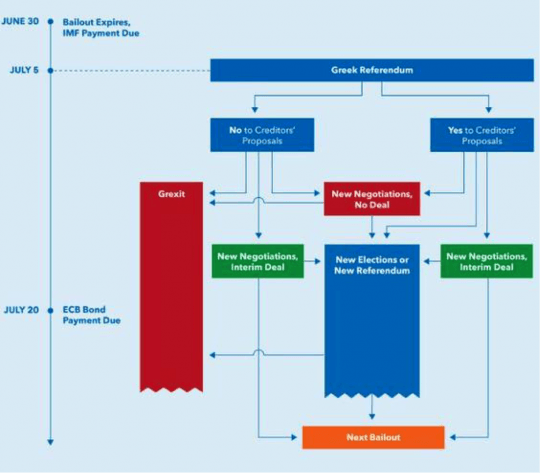

| Posted: 01 Jul 2015 02:13 PM PDT This post The Greek Resistance appeared first on Daily Reckoning. Glimmers of resistance shine from the cracks in the Hellenic Republic. "Greek entrepreneurs," reads one report, "rally together to help Greece's startups through the financial crisis." We'll get to that in a second. But first… stocks were up on the day. Gold's down. Treasury prices are down. And Greece defaulted on its loan from the IMF. At the risk of sounding like a broken record, we repeat Jim Rickards' refrain: "There will be no 'Grexit.'" That said, you can see how 19 EU governments using a single paper currency that none of them is able to print leads to problems. Even better, by watching Europe, you can imagine how financial reckoning day in the U.S. will manifest itself. Case in point: the path forward for Greece over the next month. Just follow the uh… arrows… You'd think they'd just make it a circle and be done with it. As soon as "the euro was introduced, it did not take long for imbalances to develop and accumulate," explained Professor Philipp Bagus to us in 2012. We had the good fortune of making his acquaintance at the Mises Institute in Alabama. A young, thick-accented fellow who hails from Germany, teaches economics in Spain and has authored two books: Deep Freeze: Iceland's Economic Collapse and The Tragedy of the Euro, he's well-versed on EU dynamics. Bagus related how euro creation worked in the Old World pre-2008. As with any paper money system, he who got the new money first benefited most. "But the only way to get new euros," he added, "was for a country like Greece to issue more government bonds and give them to the European Central Bank as collateral." Issue Greece did, its creditworthiness, of course, never in question, as evidenced by this 2007 "Sovereign Borrower of the Year" award: "That led to increased government spending, deficits and debt because of the demand for bonds. A country like Greece benefits by having higher deficits than the other countries." For reference, Greece's budget deficit tripled from 5.2% of GDP in 2006 to 15.7% in 2010. "The wealth redistribution through different rates of money production," ventured Bagus, "brought on a culture of decadence." "Among other things," chronicles James Dale Davidson in his latest Strategic Investment newsletter, Greek politicians used "the proceeds to lavish generous salaries and even more generous pensions on Greek voters. Although Greek wages were mostly lower than those in Germany, Greek pensions were considerably higher. In most cases, it took only 35 years of work to collect a full pension in Greece, as compared to 45 years in Germany. "But Greeks who labored in 'strenuous' occupations," Davidson continues, "could retire after 25 years of work on full pensions at age 55. Among those 'strenuous occupations' — Greek hairdressers. On the whole, Greeks retired earlier than their European colleagues, on pensions that averaged 80% of wages, as compared to 46% in Germany." Hmmnn. That brings us back to the resistance we teased at this reckoning's start… "The bloated public sector," explains a Telegraph article dated June 20, helpfully, "has been in the firing line of the efficiency drives demanded by Greece’s bailout chiefs. "Unlike their parents and grandparents, the current crop of young Greeks no longer have the option to spend their working lives as salaried employees of the state. "Many have chosen to migrate. More than 200,000 have opted for the path of flight in search of better prospects in the European capitals whose governments now stand in the way of a compromise with Greece’s leftists. "Of those who have chosen to stay are a wave of entrepreneurs whose ambitions extend beyond enjoying leisurely office hours and early retirements of yesteryear." One such entrepreneur is Athenian Dimitris Koutsolioutsos. He gave up his preordained gig in his brood's international jewelry outfit to found the Farmers Republic in 2014. It's the nation's first organic farmers market. "We’re a disruptive initiative," related Koutsolioutsos. "When I started, I received death threats from the mafia who have controlled the fruit and vegetable industry for years." A resistance, indeed. The kind that might help a sustainable, productive Greece emerge from the ashes. But "with capital controls in place across the country," reports Tech.eu, "startups are unable to pay for their services in order to stay in business. However, Greek entrepreneurs are coming together to help these companies through this difficult time… "Capital controls restrict the amount and the freedom of how much money you can access or move around," continues the report, "especially internationally, meaning that payments for services such as hosting or developer tools may not be possible for startups to make, as they are considered 'foreign' payments." To help, startup owners from around the globe are raising voluntary donations to help these Greek businesses keep their lights on while the capital controls are in effect. And now you see the problem… "When I think about my granddaughter’s future," one 61-year-old Athenian pensioner, Nikos Athanassiou, told the Telegraph, "I panic. I want her to live in an independent Greece — not a protectorate.” In Greece as in the U.S., wealth will come from innovators, not government. But perhaps more there than in the U.S., Greeks' resistance to the old paradigm stands to be quashed by the paper pushers and mafiosi in power. Which force will dominate? And does it even matter? Our friend Charles Hugh Smith, proprietor of the Of Two Minds blog, offers one sobering outlook, right here. Regards, Peter Coyne P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you're missing. The post The Greek Resistance appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Non-Farm Payrolls Tomorrow - Pride, Privilege, Will to Power Posted: 01 Jul 2015 01:24 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Koos Jansen: Former U.S. Mint director clueless on gold in Fort Knox Posted: 01 Jul 2015 10:17 AM PDT 1:17p ET Wednesday, July 1, 2015 Dear Friend of GATA and Gold: Gold researcher and GATA consultant Koos Jansen today disputes in great detail assurances that have been given over the years by the former director of the U.S. Mint, Edmund C. Moy, about the U.S. gold reserves at Fort Knox. Jansen's commentary is headlined "Former US Mint Director Clueless on Gold in Fort Knox" and it's posted at Bullion Star here: https://www.bullionstar.com/blogs/koos-jansen/former-us-mint-director-cl... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Jul 2015 10:16 AM PDT On March 14 of this year Gary North published "A letter to David Stockman" in which he identified Stockman's popular website as providing the reasons and statistical evidence for why "Keynesian economic policies are going to blow up the world." North goes on to say: You are the lightning rod for all of the establishment economists and senior bureaucrats who are overseeing what is going to become the worst economic disaster of modern times. They don't like the criticism. They fully understand that, if what you're saying is true, they are going to get blamed in the media, the textbooks, and the cultural memory for a comprehensive disaster that they personally engineered, supervised, and took credit for when the going was good. You are likely to become the John Maynard Keynes of this century. You will be remembered as the spokesman who called attention to the fact that the emperors have no clothes. Keynes served as the chief designer of the fabrics which have clothed the emperors ever since 1936. North then suggests that Stockman write a short theoretical work on economic theory, in the spirit of Hazlitt's Economics in One Lesson, which began with an analysis of Bastiat's broken window fallacy. "Central bank policies will shatter a sufficient number of windows to attract the attention of the victims." Stockman's magnum opus, The Great Deformation, while great for its countless historical insights and economic analysis, is a "fat book," North says. Hazlitt wrote his little book for the discouraged troops fighting the Keynesian onslaught. Stockman should do the same for the free market soldiers who will need to provide answers when "the checks stop coming." A free-market primer for today's libertarians I think North has a great suggestion, David Stockman. You should write the book. But I have a suggestion, too: If you do write the book, please reconsider the necessity of a central bank. On March 20, 2014, concluding an interview with Mises Institute, you said: I think the political realities of the situation make the most likely scenario one in which there will be some kind of real financial collapse and disorder that will require a total reconstruction of the system. It's impossible to say how that will be done, and this may be the chance to go back to a gold standard or to a very sharply circumscribed remit for central banks. Gold standards have always been under government control. That's why they were abused, suspended, and ultimately abandoned in favor of a currency that central banks could inflate at will. Central banking has always required a close partnership with government. As Vera Smith pointed out decades ago, central banks are not free market entities. They always require government sponsorship. What would prevent a "sharply circumscribed" Fed from growing to the monstrosity that exists today? Certainly not the politicians, who can always start another war and declare emergency measures that require an unshackled central bank. Certainly not the people who leave it up to the politicians to do the deciding for them. If we are to establish a monetary system that serves the best interests of all market participants, we need currency competition. Let the best currency win. With the Fed established as the monopoly supplier of the nation's money, the door is open for corruption. As you state in your book, In spite of the Fed's design as a passive reactor to the needs of commerce, it got into the public debt business. The 1913 national debt of $1.2 billion "exploded to $260 billion by the end of the Second World War, and rather than 3 percent of GDP it was now 125 percent." [p. 199] Fractional reserve banking is the soft underbelly of central banking. In his monetary primer, What is Money?, North writes: It is not surprising that central banks never get shut down or disestablished, not even after they create nightmare hyperinflations. The victims do not recognize the perpetrator: fractional reserve banking. He adds: The complexity of fractional reserve banking is enormous. Its processes are deliberately shrouded in mystery. This is why the Federal Reserve resists an audit by an independent government agency — independent of the FED. . . To reform central banking is to perpetuate it. To perpetuate it is to accept the fundamental premise of modern economics: money is different. Money is not governed by the same laws of supply and demand that govern the rest of the economy. Money requires experts to administer it. Private contracts are not sufficient. . . . Members of Congress are confident that they can buy votes by spending newly created money. They are not confident that this could continue if the public could redeem digital money for gold. Congress buys votes with fiat money. It would find it far more expensive to buy votes with gold coins. What is true of Congress is true of every legislature on earth. On the issue of central banking I stand with Ron Paul: Get rid of it, and let the market flourish for all participants. Two weeks after writing his letter to you North published the preface of a book he has been busy writing, based on Hazlitt's primer: Christian Economics in One Lesson. Whether he is now following his own suggestion, I can't say, but I hope it doesn't discourage you from writing your own text. North has likened you to the Biblical David in his confrontation with Goliath (paywall) where the role of the giant is represented by Keynes. While there is a sense in which this is accurate, I believe it is also misleading. The Goliath you're confronting is a sham, a purveyor of free lunches, a counterfeiter hiding behind obscurantist jargon. Your opponent has a glass jaw, and you make that abundantly clear in your Contra Corner columns. But as North says, you can't beat something with nothing, and I believe a positive, read-in-one-sitting work from you would be an invaluable resource when the next crisis hits. Please consider it, Mr. Stockman. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China targets counterweight in gold trade with yuan fix Posted: 01 Jul 2015 10:03 AM PDT By A. Ananthalakshmi and Jan Harvey A decade after China kicked off a series of gold market reforms, plans to establish a yuan price fix mark one of Beijing's biggest step so far to capitalise on the country's position as the world's top producer and a leading consumer. While no immediate threat to the gold pricing dominance of London and New York, the benchmark could ultimately give Asia more power over bullion trade, particularly if the yuan becomes fully convertible, industry sources say. The yuan fix is due to launch by the end of 2015 via the Shanghai Gold Exchange, which last year allowed foreign players to trade gold using offshore yuan. "Across the commodity markets as a whole, we're seeing some very significant initiatives by the Chinese authorities," said Nic Brown, head of commodities research at Natixis. ... ... For the remainder of the report: http://www.reuters.com/article/2015/07/01/china-gold-fix-idUSL3N0ZH03O20... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference http://noic2015.eventbrite.com/?aff=gata Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Stocks Break Below 2008 Low Posted: 01 Jul 2015 08:58 AM PDT Briefly: In our opinion, short (half) speculative positions in gold, silver and mining stocks are justified from the risk/reward point of view. Gold and silver declined yesterday, but the really profound action was seen in the precious metals mining stocks. Both key indices for this sector (the HUI and XAU) declined below their respective 2008 lows and managed to close below them. What’s next? Will gold and silver stocks bounce like they did in late 2014? | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 01 Jul 2015 06:43 AM PDT This post Our Spoiled Brat Economy appeared first on Daily Reckoning. By ensuring spoiled brats and vested interests never face the consequences of their actions and choices, we guarantee failure of the entire system. Spoiled brats do not take kindly to being called out as spoiled brats. Since economies are aggregates of individuals, we can anticipate howls of outraged denial at our economy being identified as spoiled rotten. The two essential characteristics of spoiled brats are 1) a complete disregard for the burdens of those paying the bills and 2) a childishly self-absorbed sense of overweening entitlement. Spoiled brats have no sense of fiscal discipline. Indeed, it is their defining characteristic. They want what they want, and they want it now, regardless of the cost to others or the system as a whole. In America’s Spoiled Brat Economy, no vested interest is ever allowed to fail. Lost billions gambling with borrowed money? Just throw a K Street temper tantrum and threaten to close all the ATMs when you go broke, and voila, Mommy and Daddy (the federal government and Federal Reserve) come rushing with trillions of dollars to make all the bad things like well-deserved bankruptcy go away. That tens of millions of savers must be robbed of hundreds of billions of dollars in lost interest to rebuild your banks’ profits and balance sheets — the sacrifices of others are of no concern to spoiled brats. What does not allowing failure bring to mind? How about coddled children who are crippled by helicopter parents who do their homework for them and schools that give everybody passing grades and gold stars? A system that doesn’t allow individuals and enterprises to fail is a system that is simply taking another path to failure. Students who are given gold stars and 9th place ribbons (see the video below) cannot possibly establish a real sense of accomplishment or learn how to make a realistic assessment of their deficiencies or strengths. They are crippled by all the “help” enablers press on them. The same is true of spoiled-brat economies. Enterprises that are never allowed to fail (for example, too big to fail banks, bankrupt cities, counties and states, defense contractors who produce failed weapons systems, healthcare organizations that cheat the government and patients, etc.) become deadwood that saps the vitality of the economy, dragging down the few productive sectors. The “help” lavished on vested interests include sweetheart contracts, direct subsidies, tax credits, lines of credit, zero interest rates and a vast range of other subsidies. The entire point of the vast lobbying machine that funnels federal and Federal Reserve largesse to vested interests is about staving off the very failure that keeps economies from imploding (creative destruction).

By ensuring spoiled brat and/vested interests never face the consequences of their actions, choices and self-absorbed greed, we guarantee failure of the entire system. So by all means, keep passing out subsidies to too big to fail banks and 9th-place ribbons, and give the brats whatever they want as soon as they start wailing, regardless of the cost to the system itself. Regards, Charles Hugh Smith Further Reading: See, The Yellowstone Analogy and The Crisis of Neoliberal Capitalism and Innovation, Risk and the Forest Fire Analogy. P.S. Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible. And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career. You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck. Even the basic concept "getting a job" has changed so radically that jobs–getting and keeping them, and the perceived lack of them–is the number one financial topic among friends, family and for that matter, complete strangers. So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy. It details everything I've verified about employment and the economy, and lays out an action plan to get you employed. I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read.

The post Our Spoiled Brat Economy appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||