Gold World News Flash |

- Silver Trolls Luv Me. Literally!

- Max Igan and Chris Everard - Truth Frequency - Nov 8th 2014

- TRILLIONS of Paper Silver, QUADRILLIONS of Fiat -- Kranzler

- Current Economic Collapse News Brief

- Catalonia Votes for Independence from Spain

- Jig Is Up For West, Historic & Disastrous Transition Upon Us

- Louise Yamada On The War In The Silver Market

- Gold Demand Still Running High so Where’s the Turning Point?

- Who Said It? “Deficit Spending Is A Scheme To Confiscate Wealth. Gold Stands In The Way Of This Insidious Process”

- The System Is Terminally Broken

- Chinese Yuan Fix Drops By Most Since End Of QE1, Strongest Since March

- China Aims For Official Gold Reserves At 8500 Tonnes

- Who Said It? "Deficit Spending Is A Scheme To Confiscate Wealth. Gold Stands In The Way Of This Insidious Process"

- Zionisms Role In END TIME PROPHECY, Freemasonry & E.T. Contact With Mankind

- Clashes in Berlin Germany

- ISIS Sells Oil for $20 Per Barrel

- With gold benchmark fixed, OTC trade eyed as next reform milestone

- Arctic Blast via 'Polar Vortex' to Chill 42 States

- Big Pharma Genocide in The Third World

- In The News Today

- A Major Low in Gold Price?

- Gold Sheeple: Put Your Dogma on a Leash

- Gold & Silver Hit Rock-Bottom. Or Nearly

- The Future of Money and Bitcoin - Max Keiser

- Coast To Coast AM - November 8, 2014 Open Source Everything & Curing Aging

- Fraser Murrell: Permanent gold backwardation means a worldwide financial meltdown

- UBS to settle allegations over precious metals trading

- Fraser Murrell: Permanent gold backwardation means a worldwide financial meltdown

- GATA dollar, euro, pound, or bitcoin?

- Dan Hannan on UK non-deal on EU money demand (07Nov14)

- Why a Strong U.S. Dollar is the Ultimate Economic Stimulus

- US Dollar mid-term top makes Precious Metal and Energy Stocks a Buy

- Gold Price Bounces. Is This A Trend Reversal?

- Weekend Update November 7

| Silver Trolls Luv Me. Literally! Posted: 10 Nov 2014 12:00 AM PST from Silver NewJack: |

| Max Igan and Chris Everard - Truth Frequency - Nov 8th 2014 Posted: 09 Nov 2014 10:51 PM PST Max Igan and Christopher Everard join Chris and Sheree Geo on The Chris Geo Show for a groundbreaking roundtable discussion about Zionism, Freemasonry, and even Extraterrestrial contact throughout the history of mankind. The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| TRILLIONS of Paper Silver, QUADRILLIONS of Fiat -- Kranzler Posted: 09 Nov 2014 10:45 PM PST Dave Kranzler from Investment Research Dynamics joins us to talk about ABN Amro's absurd call for $800 gold in 2015 - and the very real, very powerful PHYSICAL response to the Bankster's paper metals manipulation scheme. Stay tuned for the second half of this dynamic discussion, 'Gold is Currency... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Current Economic Collapse News Brief Posted: 09 Nov 2014 10:30 PM PST from X22Report: |

| Catalonia Votes for Independence from Spain Posted: 09 Nov 2014 09:32 PM PST Catalans hold symbolic vote on breaking away from Spain Early results show more than 80 per cent of Catalans who cast their votes in a symbolic poll, favour independence from Spain. RT's Marina Portnaya follows the vote in Barcelona. The Financial Armageddon Economic Collapse Blog tracks trends... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Jig Is Up For West, Historic & Disastrous Transition Upon Us Posted: 09 Nov 2014 09:01 PM PST  As the world continues to move into uncharted territory, today a 40-year market veteran sent King World News a powerful piece warning that the jig is up for the West and a historic and disastrous transition is now upon us. He also discussed gold, silver, oil, and what investors should be doing in this dangerous environment. Below is what Robert Fitzwilson, founder of The Portola Group, had to say in this exclusive piece for King World News. As the world continues to move into uncharted territory, today a 40-year market veteran sent King World News a powerful piece warning that the jig is up for the West and a historic and disastrous transition is now upon us. He also discussed gold, silver, oil, and what investors should be doing in this dangerous environment. Below is what Robert Fitzwilson, founder of The Portola Group, had to say in this exclusive piece for King World News.This posting includes an audio/video/photo media file: Download Now |

| Louise Yamada On The War In The Silver Market Posted: 09 Nov 2014 08:40 PM PST from KingWorldNews:

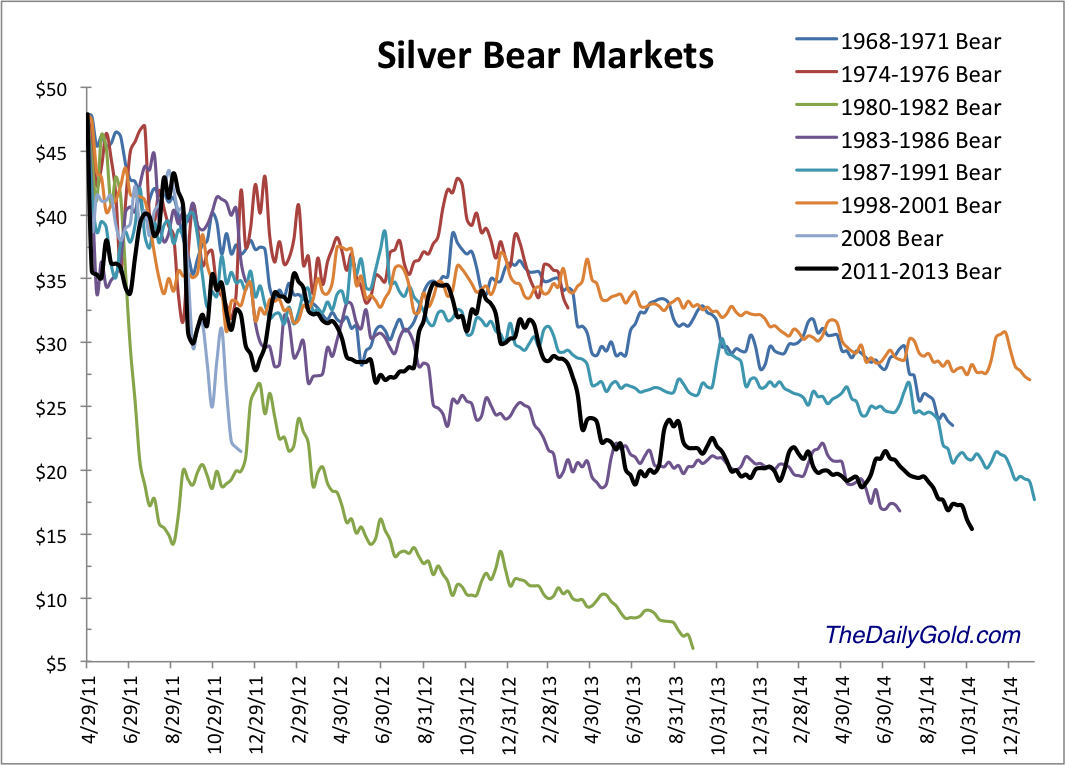

Silver Spot price (SILV-16.16) has fared worse than Gold in that the recent year-long support at 18 was breached and nearly achieved the target at 15 (see Figure 36). The new breakdown suggests testing 15 and 14 at the 2003 uptrend. Resistance now lies at the broken support at 17-18. |

| Gold Demand Still Running High so Where’s the Turning Point? Posted: 09 Nov 2014 07:40 PM PST by Lawrence Williams, MineWeb.com

However, as also seen from the chart, demand obviously dropped sharply from March through July, although it had started the year at an even higher level. Overall monthly demand to date suggests total annual consumption this year of around 2,000 tonnes, around 10% down on last year's total, although if October levels persist the year's total figure could be a little higher. 2014 demand will definitely be well in excess of that for 2012 and years previous though. |

| Posted: 09 Nov 2014 07:13 PM PST from ZeroHedge:

“This is the shabby secret of the welfare statists' tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard.” – Who Said It? |

| The System Is Terminally Broken Posted: 09 Nov 2014 06:56 PM PST Originally posted at Investment Research Dynamics, This is a world where nothing is solved. Someone once told me, ‘Time is a flat circle.’ Everything we’ve ever done or will do, we’re gonna do over and over and over again. - Nic Pizzalotto, “True Detective” The Fed has formally “ended” QE, but it hasn’t really. The Fed will continue reinvesting interest on its portfolio in more bonds and it will rollover maturities. We saw what happens to the stock market a few weeks ago when Fed official James Bullard asserted that the Fed needs to start raising rates: the S&P 500 quickly dropped 8%. Right at the bottom of the drop, the very same Bullard issued a statement suggesting that QE should be extended. This triggered an insanely abrupt “V” move back up to a new record high for the S&P 500. Bullard either did this intentionally or is a complete idiot. The stock market can’t function without Federal Reserve intervention. The stock market lost 8% quickly on just the thought that the Fed might start raising rates. Imagine what would happen if the Fed decided to “experiment” by shutting down its market intervention operations – both verbal and physical – for a month… As for QE, if the Fed has achieved its objective of stimulating the economy, why doesn’t it start removing the $2.6 trillion of liquidity that it has injected into its member banks (LINK)? This was money that was supposed to be directed at the economy. How come it’s sitting on bank balance sheets earning .25% interest? That’s $6.5 billion in free interest the Fed continues to inject into the Too Big To Fail banks. But why? What would happen if the Fed decided to “experiment” by removing this massive dead-pool of money from the banks? The money isn’t really “dead,” it’s keeping the banks from collapsing. I’m interested to watch the Government Treasury bond auctions now that the Fed is not there to soak up anywhere from 50-100% of each issue. I wonder if the banks will be moving their $2.6 trillion in Excess Reserves into new Treasury issuance. Obama is going around broadcasting the lie that the Government’s spending deficit in FY 2014 was something like $600 billion. Yet, the amount of new Treasury bonds issued increased by $1 trillion over the same period. Either Obama is lying or the accountants at the Treasury committed a big typo. Either the Fed has found a way to continue opaquely monetizing new Government debt issuance, or the market is soon going to force U.S. interest rates up much higher. By continuously intervening in all of the markets, the Fed has destroyed the information transmission system that is built into freely trading markets. If the Fed left the gold market alone – instead of hammering away with the naked shorting of Comex paper gold – the price of gold would be significantly higher than where it is now. This would be the market’s signal that our system is indeed terminally broken. Instead, the Fed keeps interest rates artificially low in hopes of stimulating a recovery in consumption and housing. But if this is working, how come the country’s two largest retailers have begun Black Friday shopping discounts on November 3rd (LINK)? And the Fed keeps pushing stocks higher to new record highs in order to “stimulate” confidence and faith in the system. The fact that the stock market craps its pants when the Fed steps away for a split-second tells us just how broken this transmission mechanism is. That 8% drop 4 weeks ago is the real signal that our system is terminally broken. And now it’s emerging that the Q3 GDP report was greatly inflated by a statistical error which erroneously boosted the Government spending component. It was this component that juiced the GDP report because residential investment (housing) and personal expenditures (consumption) both tanked. Imagine that – a statistical error artificially boosted the GDP report right before a national election… A colleague of mine has concluded that the QE infinity policy implemented Friday in Japan is the market’s signal that the entire western fiat system is getting close to imploding. I’m inclined to agree with him. Wall Street, the financial media and politicians are pointing at Europe and Japan as the source of the problems. But the heart and nerve center of the western fiat currency/debt Ponzi scheme is right under our nose in this country. The U.S. financial system is in worse shape than both Japan and Europe. The only difference is that the U.S. officials do a much better job hiding these problems. Time is starting to run out for ability of the U.S. to keep kicking the can of collapse down the road. I really believe that the full-on intensity of the recent intervention in the precious metals market is the most obvious signal of time expiring. China has been accumulating physical gold at a stunning rate and now some research indicates that China’s Central Bank may have accumulated significantly more gold than anyone previously thought (LINK). China has most likely maneuvered itself into owning the world’s largest stock of gold, which is where the U.S. had positioned itself after WW2. China has done this to a large degree by buying massive quantities of western Central Bank gold. We’ve come full circle, only with China in the Midas throne this time around. Eventually the world is going to revert back to a gold-backed currency system. When this happens, the U.S. will be required to demonstrate that it possesses the amount of gold that it reports to own. The only caveat here is that I believe that the U.S. will start WW3 before it’s forced to reveal the truth about its empty gold vault. That’s how broken our system really is… |

| Chinese Yuan Fix Drops By Most Since End Of QE1, Strongest Since March Posted: 09 Nov 2014 05:53 PM PST Following Friday's notable weakness in USDCNY (the biggest drop in the market rate since March and an abrupt change of recent trend), and trade data this weekend, the PBOC appears to have decided to try and put a stop to any weakness and smashed the USDCNY Fix lower by 0.37% - its biggest 'stronger CNY' adjustment since 2010 - when the Fed initially ended QE1 (and 2nd biggest shift since Lehman). Of course, we are sure it is nothing but a storm in a teacup that the largest economy in the world just re-valued its currrency fix by the most in 4 years... just days after the end of QE3 and the BoJ's insanity... but as we warned previously, "we think that for China in particular this latest BoJ action is perceived as an aggressive provocation that must be responded to forcefully." We note also that Japan's Abe and China's Xi are due to meet on Wednesday and perhaps this is a tactical move in that chess game. Biggest strengthening shift in USDCNY fix since the end of QE1

USDCNY was its richest to the fix in 8 months...

Notice the significant meltdown in CNY into the close of Friday's Asia session... and the plunge in USDCNY thanks to tonight's fix...

As Bloomberg reports,

Charts: Bloomberg |

| China Aims For Official Gold Reserves At 8500 Tonnes Posted: 09 Nov 2014 05:17 PM PST Submitted by Koos Jansen via BullionStar.com, China should accumulate 8,500 tonnes in official gold reserves, more than the US, according to Song Xin, President of the China Gold Association, General Manager of the China National Gold Group Corporation and Party Secretary. He wrote this in an opinion editorial published on Sina Finance July 30, 2014. Gold is money par excellence in all circumstances and will help support the renminbi to become an international currency as “gold forms the very material basis for modern fiat currencies”, Song notes. In the short term the Chinese will not back the renminbi with gold (establish a fixed renminbi price for gold), but The previous President of the China Gold Association (CGA), Sun Zhaoxue, was also the General Manager of the China National Gold Group Corporation, these jobs are apparently connected. Song took over from Sun as CGA President and Manager of China National Gold in February 2014. Remarkably, when Sun was in office he wrote equally candid articles (in Chinese) about the importance of gold for China’s economy. Sun’s most renowned article is titled “Building A Strong Economic And Financial Security Barrier For China”, published on August 1, 2012, in Qiushi magazine, the main academic journal of the Chinese Communist Party’s Central Committee (click here for a translated version). From Sun:

Song’s vision is in line with these statements which confirms the strategy of the Communist Party of China to aggressively accumulate official gold reserves and to stimulate individual gold investment in order to strengthen the Chinese economy and protect it from internal and external shocks. Note, Song is the President of the CGA that for political reasons largely understates Chinese gold demand figures in order to conceal China’s true hunger. Though clearly expressing his point of view in the next article, he could not disclose deviant data regarding CGA demand numbers. Actual Chinese wholesale gold demand in 2013 was 2197 tonnes, as is confirmed numerous times. Translated by LK, gold investor from Hong Kong.

Gold Will Support Renminbi As It Moves To Join WorldBy Song Xin, General Manager of the China National Gold Group Corporation, Party Secretary and President of the China Gold Association. 2014-05-06 edition 6 For China, the strategic mission of gold lies in the support of RMB internationalization, and so let China become a world economic power and make sure that the “China Dream” is realized. Gold is the only thing carrying the dual mantels of a commodity as well as a monetary substance. It’s both a very ‘honest’ asset and forms the very material basis for modern fiat currencies. Historically, gold has played an irreplaceable role in responses to financial crises and wars as it comes to protecting a country’s economic security. Because of this, gold carries with it an honored and divine-given strategic mission in the ascend of the Chinese people and the pursuit of the “China Dream”.

The Important Function Of GoldGold is the world’s only monetary asset that has no counter party risk, and is the only cross-nation, cross-language, cross-ethnicity, cross-religion and cross-culture globally recognized monetary asset. Gold is the last protection for a country’s economic security; it safeguards a nations sovereignty in times of crises. A textbook example happened in 1997 during the Asian financial crisis. To work through Korea’s severe debt problem, the IMF’s condition for a rescue package was to sell large enterprises. In the end, the Korean government had no choice but to call on its people to donate gold to settle the foreign debt, and it was only through this act that the chaebols at the center of the country’s economy and independence survived. From our country’s point of view, gold has played an irreplaceable role in the development of our economic society. In the wars during the Revolution [1921-1937] gold provided strong support in the economic development of the liberated zones and achievements in reforms; in the three years of natural disasters, the nation used gold reserves to obtain information on living and production conditions and took actions to alleviate hardship. At the start of the great Reforms (1980’s), gold boosted our foreign reserve levels and helped the promising private sector and it advanced society. After 1989, we suffered economic sanctions from Western countries for a while and the PBOC used our gold reserves to enter into swap agreements to obtain needed foreign currencies. Right now, gold is still serving its functions to protect against economic risks; contributing in ever more important ways to our financial security. For the moment, although in general the international scene is peaceful, conflicts can develop in certain regions. If there should be a blockade or regional war, there could be only one method of payment left: gold.

The strategic Mission Of GoldSince the 18th People Congress, general secretary Xi Jinping brought up the goal to revive our nation, to realize the “Chinese dream “. One important part of this dream is to have a strong economy. Though China is already the world’s second largest economy, there is still a long way to go to become an economic powerhouse. The most critical part to this is that we don’t have enough say in matters such as international finance and matters regarding the monetary system, the most obvious of which is the fact that the RMB hasn’t fully internationalized. Gold is a monetary asset that transcends national sovereignty, is very powerful to settle obligations when everything else fails, hence it’s exactly the basis of a currency moving up in the international arena. When the British Pound and the USD became international currencies, their gold reserve as a share of total world gold reserves was 50% and 60% respectively; when the Euro was introduced, the combined gold reserves of the member countries was more than 10,000 tonnes, more than the US had. If the RMB wants to achieve international status, it must have popular acceptance and a stable value. To this end, other than having assurance from the issuing nation, it is very important to have enough gold as the foundation, raising the ‘gold content’ of the RMB. Therefore, to China, the meaning and mission of gold is to support the RMB to become an internationally accepted currency and make China an economic powerhouse. In this view, our gold reserves are very low, both in terms of a nominal level as well as a percentage of official reserves. From the nominal level, the total official reserves of gold in the world stands at 30,000 tonnes, of which the USA has been occupying the first place at 8133.5 tonnes – 26 % of the world total. Germany has 3387.1 tonnes and Italy and France both hold more than 2,400 tonnes. Ours is 1054 tonnes at the sixths place – only 3.4% of the world total. As a percentage of a country’s total reserves, US gold reserves amount to 71.7 % and European nations have kept their levels between 40% to 70%. The average of the world is about 10%, but for us it’s only 1%. That is why, in order for gold to fulfill its destined mission, we must raise our gold holdings a great deal, and do so with a solid plan. Step one should take us to the 4,000 tonnes mark, more than Germany and become number two in the world, next, we should increase step by step towards 8,500 tonnes, more than the US.

All-round, Multi-channel Increases In Gold Levels. Fulfill Our Part In Enabling Gold To Accomplish Its Strategic Mission.How to achieve growth in our gold reserve? Apart from the PBOC directly buying in the open market, we should use also use the following strategies: 1. Relax gold import controls, grant large scale gold enterprises permits to import gold. In 2013, our gold consumption reached 1176.4 tonnes. Compared to the 426 tonnes of local production, there is a shortage of 750 tonnes. To meet this gap, we presently let the 12 commercial banks with gold-trading rights import standard gold ingots. But these banks lack the ability to refine and assay gold, they can only import standardized gold, missing the large amount of non-standardized gold and wasting the international resources that we could reach. By relaxing import controls, the large-scale gold companies can then obtain this gold and use their own technology to refine it into standard quality gold. This can help meet demand in the market, or turn gold into official reserves as required. 2. Establish a gold reserve building fund. This can be seeded using capital from the State Treasury, and open it for participation by private-sector capital in the public. It should be controlled by the State and used to target diverse off-shore gold resources, acquire mines and raw gold and in so doing, extend our reach beyond our borders and add a layer of opaque reserves to otherwise standard reserve numbers. 3. Establish a Gold bank. We need to establish our gold bank as soon as possible, and enable it to break the barrier between the commodity and monetary world. It can further help us acquire reserves and give us more say and control in the gold market. It may be guided under the PBOC and led by the China Gold Association, involving leading gold industry companies and commercial banks, and it’s business would include: gold pricing (fix), gold financing and leasing, gold-guaranteed payments, gold saving accounts, gold lending, gold production chain financing and issuance and trading of paper gold and other gold investments. This gold bank can then naturally use market-oriented methods to change commodity gold into monetary gold reserves, thus help us increase our strategic gold reserves. |

| Posted: 09 Nov 2014 04:14 PM PST ...by Alan Greenspan Published in Ayn Rand’s “Objectivist” newsletter in 1966, and reprinted in her book, Capitalism: The Unknown Ideal, in 1967. An almost hysterical antagonism toward the gold standard is one issue which unites statists of all persuasions. They seem to sense — perhaps more clearly and subtly than many consistent defenders of laissez-faire — that gold and economic freedom are inseparable, that the gold standard is an instrument of laissez-faire and that each implies and requires the other. In order to understand the source of their antagonism, it is necessary first to understand the specific role of gold in a free society. Money is the common denominator of all economic transactions. It is that commodity which serves as a medium of exchange, is universally acceptable to all participants in an exchange economy as payment for their goods or services, and can, therefore, be used as a standard of market value and as a store of value, i.e., as a means of saving. The existence of such a commodity is a precondition of a division of labor economy. If men did not have some commodity of objective value which was generally acceptable as money, they would have to resort to primitive barter or be forced to live on self-sufficient farms and forgo the inestimable advantages of specialization. If men had no means to store value, i.e., to save, neither long-range planning nor exchange would be possible. What medium of exchange will be acceptable to all participants in an economy is not determined arbitrarily. First, the medium of exchange should be durable. In a primitive society of meager wealth, wheat might be sufficiently durable to serve as a medium, since all exchanges would occur only during and immediately after the harvest, leaving no value-surplus to store. But where store-of-value considerations are important, as they are in richer, more civilized societies, the medium of exchange must be a durable commodity, usually a metal. A metal is generally chosen because it is homogeneous and divisible: every unit is the same as every other and it can be blended or formed in any quantity. Precious jewels, for example, are neither homogeneous nor divisible. More important, the commodity chosen as a medium must be a luxury. Human desires for luxuries are unlimited and, therefore, luxury goods are always in demand and will always be acceptable. Wheat is a luxury in underfed civilizations, but not in a prosperous society. Cigarettes ordinarily would not serve as money, but they did in post-World War II Europe where they were considered a luxury. The term “luxury good” implies scarcity and high unit value. Having a high unit value, such a good is easily portable; for instance, an ounce of gold is worth a half-ton of pig iron. In the early stages of a developing money economy, several media of exchange might be used, since a wide variety of commodities would fulfill the foregoing conditions. However, one of the commodities will gradually displace all others, by being more widely acceptable. Preferences on what to hold as a store of value will shift to the most widely acceptable commodity, which, in turn, will make it still more acceptable. The shift is progressive until that commodity becomes the sole medium of exchange. The use of a single medium is highly advantageous for the same reasons that a money economy is superior to a barter economy: it makes exchanges possible on an incalculably wider scale. Whether the single medium is gold, silver, seashells, cattle, or tobacco is optional, depending on the context and development of a given economy. In fact, all have been employed, at various times, as media of exchange. Even in the present century, two major commodities, gold and silver, have been used as international media of exchange, with gold becoming the predominant one. Gold, having both artistic and functional uses and being relatively scarce, has significant advantages over all other media of exchange. Since the beginning of World War I, it has been virtually the sole international standard of exchange. If all goods and services were to be paid for in gold, large payments would be difficult to execute and this would tend to limit the extent of a society’s divisions of labor and specialization. Thus a logical extension of the creation of a medium of exchange is the development of a banking system and credit instruments (bank notes and deposits) which act as a substitute for, but are convertible into, gold. A free banking system based on gold is able to extend credit and thus to create bank notes (currency) and deposits, according to the production requirements of the economy. Individual owners of gold are induced, by payments of interest, to deposit their gold in a bank (against which they can draw checks). But since it is rarely the case that all depositors want to withdraw all their gold at the same time, the banker need keep only a fraction of his total deposits in gold as reserves. This enables the banker to loan out more than the amount of his gold deposits (which means that he holds claims to gold rather than gold as security of his deposits). But the amount of loans which he can afford to make is not arbitrary: he has to gauge it in relation to his reserves and to the status of his investments. When banks loan money to finance productive and profitable endeavors, the loans are paid off rapidly and bank credit continues to be generally available. But when the business ventures financed by bank credit are less profitable and slow to pay off, bankers soon find that their loans outstanding are excessive relative to their gold reserves, and they begin to curtail new lending, usually by charging higher interest rates. This tends to restrict the financing of new ventures and requires the existing borrowers to improve their profitability before they can obtain credit for further expansion. Thus, under the gold standard, a free banking system stands as the protector of an economy’s stability and balanced growth. When gold is accepted as the medium of exchange by most or all nations, an unhampered free international gold standard serves to foster a world-wide division of labor and the broadest international trade. Even though the units of exchange (the dollar, the pound, the franc, etc.) differ from country to country, when all are defined in terms of gold the economies of the different countries act as one — so long as there are no restraints on trade or on the movement of capital. Credit, interest rates, and prices tend to follow similar patterns in all countries. For example, if banks in one country extend credit too liberally, interest rates in that country will tend to fall, inducing depositors to shift their gold to higher-interest paying banks in other countries. This will immediately cause a shortage of bank reserves in the “easy money” country, inducing tighter credit standards and a return to competitively higher interest rates again. A fully free banking system and fully consistent gold standard have not as yet been achieved. But prior to World War I, the banking system in the United States (and in most of the world) was based on gold and even though governments intervened occasionally, banking was more free than controlled. Periodically, as a result of overly rapid credit expansion, banks became loaned up to the limit of their gold reserves, interest rates rose sharply, new credit was cut off, and the economy went into a sharp, but short-lived recession. (Compared with the depressions of 1920 and 1932, the pre-World War I business declines were mild indeed.) It was limited gold reserves that stopped the unbalanced expansions of business activity, before they could develop into the post-World War I type of disaster. The readjustment periods were short and the economies quickly reestablished a sound basis to resume expansion. But the process of cure was misdiagnosed as the disease: if shortage of bank reserves was causing a business decline — argued economic interventionists — why not find a way of supplying increased reserves to the banks so they never need be short! If banks can continue to loan money indefinitely — it was claimed — there need never be any slumps in business. And so the Federal Reserve System was organized in 1913. It consisted of twelve regional Federal Reserve banks nominally owned by private bankers, but in fact government sponsored, controlled, and supported. Credit extended by these banks is in practice (though not legally) backed by the taxing power of the federal government. Technically, we remained on the gold standard; individuals were still free to own gold, and gold continued to be used as bank reserves. But now, in addition to gold, credit extended by the Federal Reserve banks (“paper reserves”) could serve as legal tender to pay depositors. When business in the United States underwent a mild contraction in 1927, the Federal Reserve created more paper reserves in the hope of forestalling any possible bank reserve shortage. More disastrous, however, was the Federal Reserve’s attempt to assist Great Britain who had been losing gold to us because the Bank of England refused to allow interest rates to rise when market forces dictated (it was politically unpalatable). The reasoning of the authorities involved was as follows: if the Federal Reserve pumped excessive paper reserves into American banks, interest rates in the United States would fall to a level comparable with those in Great Britain; this would act to stop Britain’s gold loss and avoid the political embarrassment of having to raise interest rates. The “Fed” succeeded; it stopped the gold loss, but it nearly destroyed the economies of the world, in the process. The excess credit which the Fed pumped into the economy spilled over into the stock market, triggering a fantastic speculative boom. Belatedly, Federal Reserve officials attempted to sop up the excess reserves and finally succeeded in braking the boom. But it was too late: by 1929 the speculative imbalances had become so overwhelming that the attempt precipitated a sharp retrenching and a consequent demoralizing of business confidence. As a result, the American economy collapsed. Great Britain fared even worse, and rather than absorb the full consequences of her previous folly, she abandoned the gold standard completely in 1931, tearing asunder what remained of the fabric of confidence and inducing a world-wide series of bank failures. The world economies plunged into the Great Depression of the 1930’s. With a logic reminiscent of a generation earlier, statists argued that the gold standard was largely to blame for the credit debacle which led to the Great Depression. If the gold standard had not existed, they argued, Britain’s abandonment of gold payments in 1931 would not have caused the failure of banks all over the world. (The irony was that since 1913, we had been, not on a gold standard, but on what may be termed “a mixed gold standard”; yet it is gold that took the blame.) But the opposition to the gold standard in any form — from a growing number of welfare-state advocates — was prompted by a much subtler insight: the realization that the gold standard is incompatible with chronic deficit spending (the hallmark of the welfare state). Stripped of its academic jargon, the welfare state is nothing more than a mechanism by which governments confiscate the wealth of the productive members of a society to support a wide variety of welfare schemes. A substantial part of the confiscation is effected by taxation. But the welfare statists were quick to recognize that if they wished to retain political power, the amount of taxation had to be limited and they had to resort to programs of massive deficit spending, i.e., they had to borrow money, by issuing government bonds, to finance welfare expenditures on a large scale. Under a gold standard, the amount of credit that an economy can support is determined by the economy’s tangible assets, since every credit instrument is ultimately a claim on some tangible asset. But government bonds are not backed by tangible wealth, only by the government’s promise to pay out of future tax revenues, and cannot easily be absorbed by the financial markets. A large volume of new government bonds can be sold to the public only at progressively higher interest rates. Thus, government deficit spending under a gold standard is severely limited. The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. They have created paper reserves in the form of government bonds which — through a complex series of steps — the banks accept in place of tangible assets and treat as if they were an actual deposit, i.e., as the equivalent of what was formerly a deposit of gold. The holder of a government bond or of a bank deposit created by paper reserves believes that he has a valid claim on a real asset. But the fact is that there are now more claims outstanding than real assets. The law of supply and demand is not to be conned. As the supply of money (of claims) increases relative to the supply of tangible assets in the economy, prices must eventually rise. Thus the earnings saved by the productive members of the society lose value in terms of goods. When the economy’s books are finally balanced, one finds that this loss in value represents the goods purchased by the government for welfare or other purposes with the money proceeds of the government bonds financed by bank credit expansion. In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone decided, for example, to convert all his bank deposits to silver or copper or any other good, and thereafter declined to accept checks as payment for goods, bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves. This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard. * * * Somewhat explains his recent commentary...

|

| Zionisms Role In END TIME PROPHECY, Freemasonry & E.T. Contact With Mankind Posted: 09 Nov 2014 03:48 PM PST Max Igan and Christopher Everard join Chris and Sheree Geo on The Chris Geo Show for a groundbreaking roundtable discussion about Zionism, Freemasonry, and even Extraterrestrial contact throughout the history of mankind. The Financial Armageddon Economic Collapse Blog tracks trends and... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 09 Nov 2014 03:26 PM PST Clashes and arrests marred the anniversary of the fall of the Berlin Wall, as several hundred left-wing activists met far-rights in the city center. The latter were rallying in commemoration of the 1938 Kristallnacht Nazi attacks against Jews. The Financial Armageddon Economic Collapse Blog... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| ISIS Sells Oil for $20 Per Barrel Posted: 09 Nov 2014 02:48 PM PST Islamic State militants, who have seized oil fields and refineries in Kirkuk province in the north of Iraq, are selling the hijacked oil on the black market for a price as low as US $20 per barrel, according to the country's Finance Ministry. The Financial Armageddon Economic Collapse Blog... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| With gold benchmark fixed, OTC trade eyed as next reform milestone Posted: 09 Nov 2014 02:42 PM PST By Clara Denina Calling time on London's century-old gold "fix" could mark the beginning of an even wider industry overhaul that may ultimately dilute the dominance of the highly profitable bilateral over-the-counter trading. London's bullion price benchmarks, or fixes, were transformed in a matter of months this year as regulatory scrutiny and accusations of market manipulation made price-setting among a handful of banks untenable. The overhaul spawned electronic price setting platforms for gold, silver, platinum, and palladium, with gold's fate sealed just last week when Intercontinental Exchange were announced as administrators for the prized bullion benchmark in early 2015. ... More than $5 trillion worth of gold transactions are made over the counter in London every year. The OTC market, where trades are executed via dealer networks as opposed to a centralized exchange, exceeds the trading of gold futures. ... ... For the remainder of the report: http://www.reuters.com/article/2014/11/09/gold-lbma-otc-idUSL6N0SC49J201... ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers. (http://www.gata.org/node/173) To invest or learn more, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Arctic Blast via 'Polar Vortex' to Chill 42 States Posted: 09 Nov 2014 01:44 PM PST As the polar vortex gets displaced to the south, the door will open for arctic air to plunge over the most of the United States as the new week progresses. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Big Pharma Genocide in The Third World Posted: 09 Nov 2014 12:47 PM PST When big pharma blocks essential HIV/AIDS medication to the third world, it is the poor who suffer. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 09 Nov 2014 12:44 PM PST UBS To Settle Gold/Silver Manipulation Activities November 9, 2014 Financial Markets Intrinsic currencies like gold and silver, for example, are acceptable without a 3rd party guarantee. – Alan Greenspan, (LINK) The Financial Times is reporting that UBS has agreed to settle charges against it by the UK's Financial Conduct Authority that it engaged in the... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. |

| Posted: 09 Nov 2014 10:51 AM PST It's been a while since I have written an article on Gold, but the recent price action could well be the very clue we have been looking for. I have been very bearish Gold for a number of years/months, month by month the market has slowly moved towards the $1150 target we have been looking for. |

| Gold Sheeple: Put Your Dogma on a Leash Posted: 09 Nov 2014 10:44 AM PST Yes, today's "risk on" reality is insane. But it is a fact... The PRECIOUS METALS bear market has been all about psychology, writes Gary Tanashian in his Notes from the Rabbit Hole. Every bear or bull market is about psychology, but the intensity of this dynamic – beginning with silver's blow out in early 2011 and the general top in the commodity and 'inflation trade', along with gold's lesser blow out later that summer amidst Euro crisis hysterics – has been something to behold in the gold sector over these last few years. In early 2011 long-term interest rates were rising in response to inflationary pressures. 'Bond King' Bill Gross famously shorted the long bond, while virtual mobs with pitchforks were storming the Fed's castle calling for Ben Bernanke's head. Silver went to $50 an ounce, with calls for $100, $200, etc. All psychology my friends. On the subject of the long bond, our 'Continuum' chart shows that players did not learn 2011's contrarian lesson with respect to yields as they took Wall Street's 'Great Rotation' hype hook, line and sinker in 2013. What did the 30-year yield then do? Why, it hit our long-term limiter (monthly EMA 100, red dotted line) and has dropped ever since.  If market participants are "Sheeple" as many gold bugs believe, then the average gold bug – as evidenced by so many peoples' staunch refusal to give up on the shiny relic – are Sheeple squared, because the gold "community" (right there, a giveaway on group think) has distinct leaders or troubadours who, if the faithful will just hang in there long enough, will be proven right as we are all led to the promised land. Yet the bear market has cruelly put the promised land further and further out on the horizon with each impulse of hope. The gold story is one of righteousness because sound value (and insurance) not beholden to leverage is monetarily righteous. But promoters and/or buffoonish spokespeople have either knowingly or unknowingly used the righteousness of the message to keep people firmly in the grip of dogma all the way down during the bear market. To make matters worse the 'pigs', led by Goldman, JPM and Wall Street in general, have feasted and feasted some more on the propped up paper entity built on what will one day be 'discovered' to have been disastrously insane policy making. That is a double whammy for a gold bug who stands for what is right. But these are the markets. You sit at your computer and I sit at mine. We press buttons and make digital transactions in a system that is functioning just fine for now. Within this, psychology is clustered toward speculation and risk taking and against a "risk off" environment. This is the reality. So I would say to gold bugs that what you must do is "put your dogma on a leash" (quoted from a song by long-ago Boston rock band Volcano Suns), manage risk against your world view and be ready for:

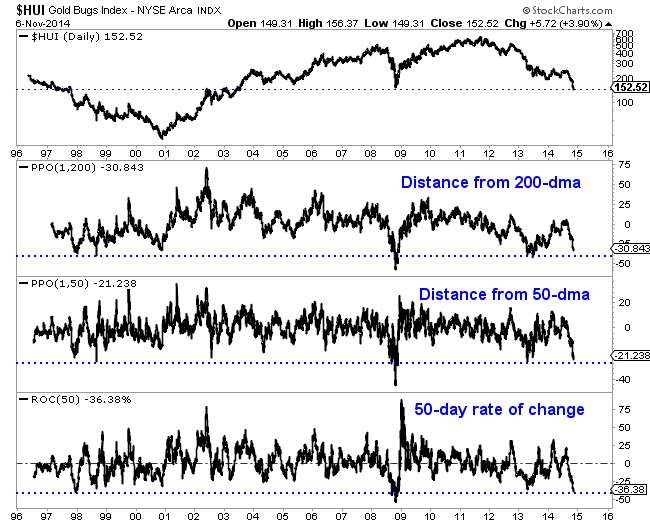

So where are we at? Well, I have a couple pet market writers (un-named and shall remain so) on whom I depend for contrary signals. One just went hyper bearish. With the HUI gold & silver miner stock index now at its 2008 lows, that indicates the potential for a bounce. But the other writer we track for contrary signals is still sounding 100% right, even as he has been bullish all the way down. The fact that he is still apparently tugging at gold bugs' greed impulse is a negative and implies further downside pending any bounce activity that may crop up. In NFTRH we have been managing what we called the 2008 'Fear Gap' for years now. Once gold made its first major support breakdown, we looked at the potential for the entire sordid mess we used to call "Armageddon '08" to be closed out with a fill of the upside gap in gold vs. the US stock market. Well...consider it closing if not closed.  I believe that those who will be bullish on gold and the gold miners from the depths of this bear market are going to well rewarded in both their holdings in real monetary value (gold) in a world gone berserk and in their speculations associated with that value (gold stocks of relative quality). But first you must be intact and that means guarding against your own bias, dogmatic beliefs and even certain truths as you know them. These are the financial markets after all. Be guarded when appropriate and be brave when appropriate. NFTRH has spent all too many years now guarding against bias reinforcement and simply dealing with what look like insane realities. It was too easy to listen to the promoters for many people. That was the easy way out, to have their perceptions reinforced. Gold is not out of the woods, and on coming bounces these promoters will be right back at it. When they are neutered...or more accurately, when the gold bug community's actionable perceptions of them are neutered...the sector will resume its bullish place in a global financial market that is ripe for change where today's pigs will become tomorrow's bewildered sheep and today's bewildered sheep...well, you know. |

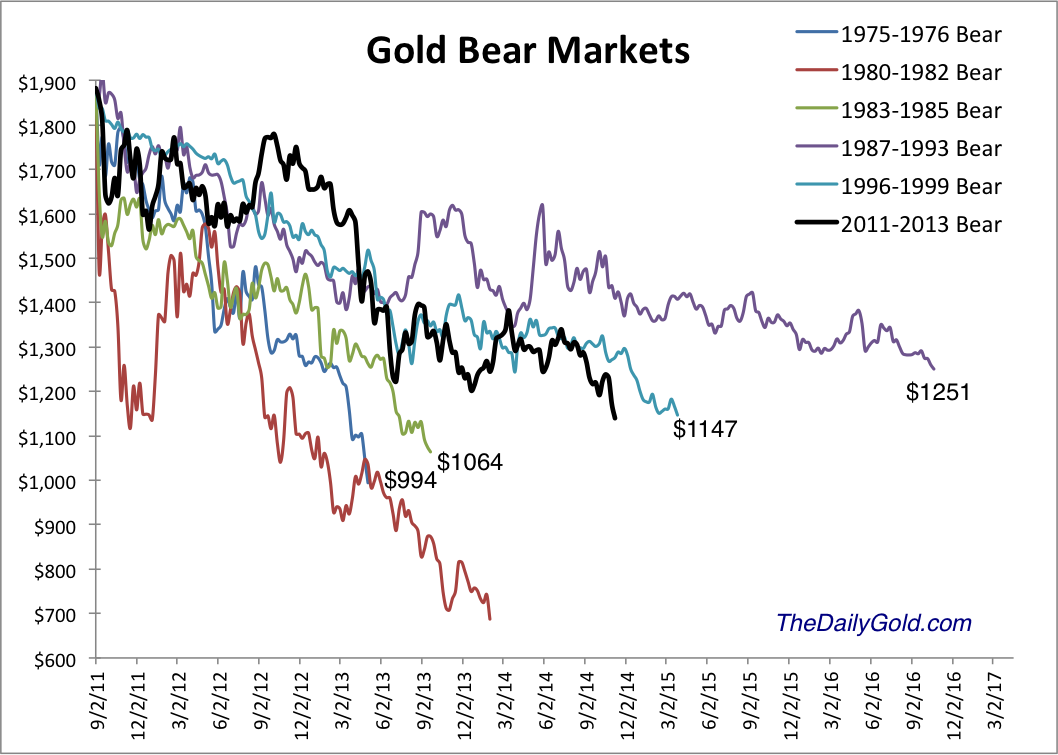

| Gold & Silver Hit Rock-Bottom. Or Nearly Posted: 09 Nov 2014 09:51 AM PST Bear market might not be quite done yet, says this comparison with previous bears... The SELL-OFF in precious metals intensified over the past week, writes Jordan Roy-Byrne at TheDailyGold. Junior gold miner stock index GDXJ declined 25% in seven days while gold bullion plunged below $1180 to $1140 per ounce. Silver plunged below $16 to as low as $15.20. So precious metals are becoming extremely oversold and the bear market is clearly in the 9th inning. Be on alert for a snapback rally to repair the extreme oversold conditions. Although we are likely very close to the bottom in the miners, gold's current position continues to leave me skeptical. Below is the updated bear analog for gold which uses weekly data. Gold has yet to suffer the extreme selling experienced by silver and the mining stocks. It makes sense given that gold peaked months after those assets in 2011.  The chart illustrates how bear markets are a function of price and time. The most severe bears in price are the shortest in time while the longest bears in terms of time are the least severe in terms of price. This bear falls in between. Given that gold went 10 years without a real bear market it makes sense that this bear could bottom very close to the 1983-1985 and 1975-1976 bears but will have lasted quite a bit longer. With respect to gold, another point to consider is the strong supports at $1080 per ounce (50% retracement of the bull market) as well as $1000 per ounce. These downside targets continue to align well with the history depicted in the bear analog chart. Moreover, the fact that gold currently sits well above these support levels is reason to expect more downside. Silver on the other hand figures not to have the same degree of downside. Silver's bear began five months before gold's and the bear analog below makes a strong case that the current bear will end very soon. Other than the epic collapse from 1980-1982, the current bear is the worst ever for silver in terms of price and is the third worst in terms of time.  Similar to silver, the mining stocks which led the bear market are moving from very oversold to extremely oversold. The HUI Gold Bugs Index shown below closed Wednesday at an 11-year low. As far as the HUI's distance from its 50 and 200-day moving averages, it is inches from major extremes. Over the past 50 days the HUI has declined 36.4%. That is its second worst performance over the past 20 years. The picture is even worse for the junior mining sector. GDXJ has declined 43% over the past 50 days. It is trading at the lowest level relative to its 50-day moving average since the creation of the ETF.  The worst bear market ever for gold mining stocks was the more than four and a half year decline following the junior bubble in 1996. That bear did have a 14-month long respite where the indices rallied as much as much as 70% and 80%. That rally was longer and much larger than the one experienced recently. During the 1996-2000 bear, the GDM index (forerunner to GDX) declined 77.5%. Through Wednesday it was down 76% from its latest top. The XAU declined 72.5% between 1996 and 2000. Through Wednesday it was off 74.2%. The Barron's gold Mining Index declined 75% during the late 1990s bear. Through last week it was down 68%. The mining stocks and silver are obviously extremely oversold and very close to the bottom. It could happen any day or any week. However, I'm skeptical because gold is currently trading so far above its potential bottom. Sure, gold figures to be the last to bottom but my view is the window for a bottom in the stocks could come when gold declines below $1080. That being said, we could definitely see a snapback rally of some sort. The mining stocks and silver are extremely oversold and could pop higher in the short-term. In any event, the bear market is very close to its end. The weeks and months ahead figure to be very enticing and exciting for precious metals traders and investors. Expect quite a bit of volatilty as we see some forced liquidation from longtime bulls and as the sector tries to carve out a major bottom. Opportunities are fast approaching so pay attention. Be patient but be disciplined. As winter beckons, we could be looking at a lifetime buying opportunity. I am working hard to prepare DailyGold subscribers. |

| The Future of Money and Bitcoin - Max Keiser Posted: 09 Nov 2014 09:48 AM PST In this episode of the Keiser Report, Max Keiser and Stacy Herbert discuss how fools and their money are soon parted whether shale oil investors losing $1.17 for every dollar gained or housing market participants who seek to help people onto the so-called 'property ladder' and yet, by lowering... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Coast To Coast AM - November 8, 2014 Open Source Everything & Curing Aging Posted: 09 Nov 2014 09:30 AM PST Coast To Coast AM - November 8, 2014 Open Source Everything & Curing Aging The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Fraser Murrell: Permanent gold backwardation means a worldwide financial meltdown Posted: 09 Nov 2014 09:01 AM PST GATA |

| UBS to settle allegations over precious metals trading Posted: 09 Nov 2014 08:34 AM PST Daniel Schäfer and James Shotter http://www.ft.com/intl/cms/s/0/428e1400-6804-11e4-bcd5-00144feabdc0.html UBS is to settle allegations of misconduct at its precious metals trading business alongside a planned agreement between UK and US authorities and seven banks over accusations of foreign exchange market rigging. The Swiss lender is one of a group of banks including Barclays, Citigroup, HSBC, JPMorgan, and Royal Bank of Scotland that are set to announce an agreement of at least L1.5 billion on Wednesday to settle forex rigging allegations with the UK's Financial Conduct Authority. ... Dispatch continues below ... ADVERTISEMENT Own Allocated -- and Most Importantly -- Zurich, Switzerland, remains an extremely safe location for storing coins and bars of the monetary metals. If you do not own segregated physical coins and bars that you can visit, inspect, and take delivery of, you are vulnerable. International diversification remains vital to investors. GoldCore can accomplish this for you. Read GoldCore's "Essential Guide to Gold Storage In Switzerland" here: http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44 (0)203 086 9200 -- U.S.: +1-302-635-1160 -- International: +353 (0)1 632 5010 Several US authorities are also expected to be part of the settlement, including the Office of the Comptroller of the Currency and the Commodity Futures Trading Commission in the US, while Switzerland's Finma may also take part. Bank of America Merrill Lynch is also expected to settle but only with US authorities. UBS is expected to strike a settlement over alleged trader misbehaviour at its precious metals desks with at least one authority as part of a group deal over forex with multiple regulators this week, two people close to the situation said. They cautioned that the timing of a precious metals deal could still slip to a date after the forex agreement. Regulators around the world have alleged that traders at a number of banks colluded and shared information about client orders to manipulate prices in the $5.3 trillion-a-day forex market. UBS has previously disclosed that it launched an internal probe of its precious metals business in addition to its forex investigation. It declined to comment for this article. Unlike at other banks, UBS's precious metals and forex businesses are closely integrated. The business units have joint management and the bank's precious metals staff -- who mainly trade gold and silver -- sit on the same floor as the forex traders. One person familiar with UBS's internal probe said that the bank found a small number of potentially problematic incidents at its precious metals desk. Andre Flotron, the head of UBS's gold desk in Zurich, has been on leave since January for reasons unspecified by the lender. Mr Flotron has not been accused of wrongdoing and has never responded to any requests for comment. He has labelled his professional status on his LinkedIn profile as being "on leave, keen to return in due time." The precious metals market has this year become the latest trading area to be subjected to heavy regulatory scrutiny and allegations of price rigging. The FCA fined Barclays L26 million in May after an options trader was found to have manipulated the London gold fix. BaFin, Germany's financial regulator, has launched a formal investigation into the gold market and is probing Deutsche Bank, one of the former members of a tarnished gold-fix panel that will soon be replaced by an electronic fixing. UBS's top management has pushed hard to speed up its internal forex and precious metals probes. It has sought to get ahead of rivals in securing immunity agreements as it wants to leave behind its legacy problems as soon as possible. In a global forex-rigging probe against at least 15 banks, UBS has the highest numbers of suspended traders -- at least seven -- across London, New York, Singapore, and Zurich. It is said to have fired several forex traders in recent months, some of whom had earlier been suspended. UBS is also in separate talks over a forex settlement with the US Department of Justice's criminal division. It is expected to get leniency from the DoJ's antitrust team in return for handing over information early on and co-operating. Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Fraser Murrell: Permanent gold backwardation means a worldwide financial meltdown Posted: 09 Nov 2014 08:17 AM PST 11:20a ET Sunday, November 9, 2014 Dear Friend of GATA and Gold: Australian scholar Fraser Murrell, a mathmetician and former stockbroker, argues today in commentary posted at MineWeb that, as the economist Antal Fekete has written, permanent backwardation in gold is the great threat to the world financial system, at least as it is now constituted as a fiat money system. "Sooner or later," Murrell writes, "the bullion banks and governments will run out of ammunition and they will be forced to step back and allow the market to do its thing. Which is to repeat the 1970s -- the worst of all economic outcomes -- stagflation. Unfortunately, this is the consequence of all the money printing, and while it can be delayed it cannot be stopped. The gold price will eventually peak in the tens of thousands of dollars and unless the bullion banks unwind their short positions, they will either default or go bankrupt." Murrell's commentary is headlined "Permanent Gold Backwardation = Global Meltdown Ahead" and it's posted at MineWeb here: http://www.mineweb.com/mineweb/content/en/mineweb-gold-news?oid=259165&s... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 BullionStar is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. BullionStar's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in BullionStar's bullion vault, which is integrated with BullionStar's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| GATA dollar, euro, pound, or bitcoin? Posted: 09 Nov 2014 07:56 AM PST 11:04a ET Sunday, November 9, 2014 Dear Friend of GATA and Gold: With the monetary metals mining industry agreeing to die quietly and its investors dying with them, the World Gold Council celebrating watches for plutocrats as its industry dies -- https://twitter.com/GOLDCOUNCIL/status/528214829841264640/photo/1 -- and the Western financial journalism celebrating central bankers instead of questioning them critically, it's getting harder to perceive GATA's constituency in particular beyond humanity generally. ... Dispatch continues below ... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. At least our efforts in North America, dominated by the U.S. government and Wall Street (yes, what's the difference?), produce less and less. Efforts more distant from those financial powers seem more promising, since while in North America the consequence of the gold price suppression scheme is mainly the loss of the market economy, in the rest of the world the consequence is daily financial exploitation. GATA is not unknown outside North America. As noted yesterday -- http://www.gata.org/node/14686 -- your secretary/treasurer will be speaking twice next month at conferences in Europe. And he has been invited to speak at three conferences in Asia in March. But travel over such long distances is expensive and the conference business, especially for conferences connected with mining, is not in a position to cover much of that expense. Further, of course, GATA has never put a lot of effort into fundraising -- not that it would accomplish much, given the radioactivity of our mission: free markets, limited and transparent government, and fair dealing among nations and peoples. Our support has fallen off dramatically over the last year and unless things change just as dramatically soon our operations will be severely curtailed next year; just keeping the flag flying, the Internet site operating, may become a challenge. So, as a practical matter, who is our constituency? Only you 9,562 people who as of this morning belong to our e-mail dispatch list -- and most of you have never contributed to the organization, even as a mere dollar, euro, pound, or tiny fraction of a bitcoin from each of you would give GATA a crucial boost right now. Providing that little bit of support is easily accomplished by credit card or bitcoin code at GATA's Internet site -- -- but please, just new donors this time. We can't keep relying on our most loyal friends. One more reason to help: If this doesn't work, we may have to resort to Soupy Sales methods: https://www.youtube.com/watch?v=a-OGy3Kh7yM CHRIS POWELL, Secretary/Treasurer Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Dan Hannan on UK non-deal on EU money demand (07Nov14) Posted: 09 Nov 2014 05:11 AM PST Conservative MEP Daniel Hannan talks about George Osborne's smoke and mirrors non-deal on the Brussels demand for more money from the UK. Recorded from BBC News Channel HD, 07 November 2014. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Why a Strong U.S. Dollar is the Ultimate Economic Stimulus Posted: 09 Nov 2014 04:53 AM PST Earlier this year commodities prices were fairly buoyant thanks in part to strong demand in Asia. The strength didn’t last long, however, and by summer weakness was evident in Europe and China. Global growth slowed considerably in the months leading up to October, when oil plunged below $90/barrel for the first time since 2012. Apart from weakening global demand and the growth of energy supplies (thanks to fracking), the strengthening U.S. dollar has accelerated this trend. |

| US Dollar mid-term top makes Precious Metal and Energy Stocks a Buy Posted: 09 Nov 2014 04:44 AM PST I decided to do an important update of the US Dollar Index, because Friday’s rise in Gold and gold stocks alongside oil indicated a likely top. I have been extremely bearish on energy and precious metal stocks the past few months because of the upside strength potential in the US Dollar. I still am bullish on the US Dollar, but as this analysis will indicate, a top has been put in place that should see a correction minimally last until early to mid-March 2015. |

| Gold Price Bounces. Is This A Trend Reversal? Posted: 09 Nov 2014 02:13 AM PST Gold was trading sharply higher on Friday after the US monthly jobs report showed fewer jobs were added in the economy than expected. This encouraged traders to take some profit on their long dollar positions, causing buck-denominated assets to rally. But we remain skeptical how high gold can go from here, for the jobs report wasn't that bad. After all, the unemployment rate edged lower to 5.8% thanks to another 200-thousand-plus increase in non-farm employment. Ignoring today's bounce, gold has dropped to a low so far of just under $1132 per troy ounce since reaching $1255 about three weeks ago. To put things into perspective, it has fallen almost 10% during this period, which is obviously a huge move. Most of the losses have been due to the US dollar, which has surged higher following last week's hawkish FOMC statement and increasingly more dovish central banks elsewhere in G10. The Bank of Japan's surprise decision to expand its asset purchases program last week was followed by a dovish European Central Bank meeting on Thursday. At the follow up monthly news conference, Mario Draghi said the ECB is prepared to act more aggressively to combat deflation threats if needed and that the policy makers were unanimous on this view. He also said that the ECB's Governing Council expects the central bank's balance sheet to reach the early 2012 levels, implying an increase of up to €1 trillion. The net effect of the BoJ and ECB announcements has been positive for not only the US dollar, but also the global equity markets. Thus this has weighed on safe-haven demand. But given that gold has also fallen even in euro terms recently, the dollar alone cannot explain its weakness. It seems therefore that investors are not finding any value, at least at these levels, in tying up a significant portion of their capital in gold. What's more, the physical demand for gold has also not been as strong as it had been in recent past. Price pressures remain weak across the globe so there is less need inflation hedging purposes at this moment. On top of this, the world's top gold consumers – China and India – have been purchasing less gold. The Chinese are probably waiting for prices to fall further before increasing their purchases. Perhaps one piece of positive news for gold bugs is that prices are now close to the cost of production levels, therefore miners will be forced to halt production if they fall further and remain depressed. The potential reduction in supply growth could provide support to prices. But in the more near-term outlook, one other positive news is that the falling prices have given rise to bullion coin and bar sales, especially in North America. What's more, the market sentiment is VERY bearish on precious metals and this is should be a warning sign for the bears that the trend may soon end. Gold's breakdown of the key $1180 support level last week has given rise to follow-up technical selling. The yellow metal has already reached both of our targets from last week: the 127.2% and 161.8% Fibonacci extension levels of the last rally that started at the beginning of October, at $1163 and $1138/9 respectively. Therefore Friday's bounce was also driven by profit-taking which is part of the reason why we don't think the rally will be sustained. Even if it does push further higher, it would do really well reach, let alone break, the $1180 level. For as long as it remains below this broken support level, our technical outlook on gold will remain bearish. Meanwhile the 127.2% extension of a separate move, the short-lived rally from the 2013 low comes is at the psychological $1111.1 level. This is our extended bearish target.

You can find more of FOREX.com's research at http://www.forex.com/latest-forex-research.html

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions. Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex and commodity futures, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that FOREX.com is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. FOREX.com is regulated by the Commodity Futures Trading Commission (CFTC) in the US, by the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investment Commission (ASIC) in Australia, and the Financial Services Agency (FSA) in Japan. Please read Characteristics and Risks of Standardized Options.

|

| Posted: 08 Nov 2014 05:29 PM PST By Everett Millman, head content writer at Gainesville Coins, a leading gold and silver distributor. ABSTRACT: The midterm elections in the U.S. this Tuesday saw a sweeping victory for the... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

With the ongoing war in the gold and silver markets continuing to rage, today King World News is pleased to share a piece of legendary technical analyst Louise Yamada's "Technical Perspectives" report. Yamada is without question one of the greatest technical analysts Wall Street has ever seen. This information is not available to the public and we are grateful to Louise for sharing her incredible work with KWN readers globally.

With the ongoing war in the gold and silver markets continuing to rage, today King World News is pleased to share a piece of legendary technical analyst Louise Yamada's "Technical Perspectives" report. Yamada is without question one of the greatest technical analysts Wall Street has ever seen. This information is not available to the public and we are grateful to Louise for sharing her incredible work with KWN readers globally.  As can be seen from Nick Laird's (

As can be seen from Nick Laird's (

No comments:

Post a Comment