saveyourassetsfirst3 |

- CHARTS – Gold And Silver Price Trending Lower Until Demand Returns

- PM Fund Manager: Cartel Attempting to Do to Gold What They Did in 1974

- Peter Schiff: Gold’s Past And Future 4 Years

- The Soaring Dollar Debate: Good, Bad, Ugly

- Alasdair Macleod’s Market Report: Failing Economies and the Quarter-End

- Will Ebola Mutate To Emoola?

- Gold Has Got To Put Up Or Shut Up

- US dollar top will mark the bottom for gold and silver prices

- Precious Metals to Face More Body Blows

| CHARTS – Gold And Silver Price Trending Lower Until Demand Returns Posted: 05 Oct 2014 12:25 PM PDT goldsilverworlds |

| PM Fund Manager: Cartel Attempting to Do to Gold What They Did in 1974 Posted: 05 Oct 2014 11:50 AM PDT In the back of my mind (going back to 2003/2004) I've always been worried that they might do to gold eventually what they did to it in late 1974 when they took it from $200 back down to $100 by early 1976. Please note that the end of 1974 is when gold futures trading was first introduced […] The post PM Fund Manager: Cartel Attempting to Do to Gold What They Did in 1974 appeared first on Silver Doctors. |

| Peter Schiff: Gold’s Past And Future 4 Years Posted: 05 Oct 2014 10:52 AM PDT This article is written by Peter Schiff. Yesterday, I launched a new website and announced the rebranding of my gold bullion dealer from Euro Pacific Precious Metals to SchiffGold. I started this company four years ago to provide a trustworthy option for my Euro Pacific Capital brokerage clients, but it has since grown to become a major US gold dealer in its own right. This landmark for my company comes in the midst of a historic time for the precious metals. The past four years have had highs and lows. We have been experiencing the inflation of remarkable new asset bubbles, and gold's response has been mixed. But I have reason to believe that over the next four years, gold and silver investors will witness shocking macroeconomic events that put to rest any doubts about the importance of having sound money in every portfolio. Short-Term Memory Lane It's hard to believe that when I started my gold company in the summer of 2010, the Federal Reserve was already finishing its first round of quantitative easing (QE1). Yet even that massive inflationary program was not enough to paper over the fallout from the credit crisis of '07-'08. Because the economy did not "return to normal," Fed Chairman Ben Bernanke had his excuse to begin a second round of QE just a few months later. The government had already started the circular narrative that confuses the markets to this day: "The economy is in genuine recovery, but it still requires ongoing emergency stimulus from the Fed." The announcement of QE2 spurred many of our initial customers to make substantial purchases of gold and silver. The rest of the market soon caught up. In the year following QE2, gold rocketed to its current record-holding high of just over $1900. As QE2 ended, "Operation Twist" began, and before long QE3 was introduced. In order to prevent their currencies from appreciating against a now increasingly worthless US dollar, nations around the world joined the money-printing party. These foreign governments wrongly believed that they were dependent on exporting their goods to the US for dollars, when in fact stronger currencies would have allowed them to keep the fruits of their labor to enjoy at home. This has developed into the ongoing international "currency war," in which countries are racing to see which can impoverish their citizens fastest. The currency war has been a boon to the US dollar, which has appeared fairly stable relative to other currencies. However, just because you and a fellow skydiver both fall in tandem doesn't change the fact that you're both headed toward the ground. Short-sighted speculators have ignored this reality, and the precious metals have taken an undeserved beating. What the Future Holds QE3 has been winding down throughout 2014, and investors are eagerly awaiting news of a rate hike from the Fed. After all, if the economy is as healthy as the government claims, we should no longer be in need of these multiyear emergency measures. Unfortunately, the Fed’s zero interest-rate policy (ZIRP) is the very thing making the economy appear healthy. It has boosted stocks and financed corporate acquisitions. It has also allowed the federal government to continue operating under a crushing debt load. Even a rise in rates to historically average levels could very well bankrupt the federal government and many of America's remaining industrial giants. Neither Fed Chairwoman Janet Yellen nor Washington want to bear responsibility for the painful process of raising rates. Instead, I have long forecast that the Fed will follow QE3 with QE4, and so on. After all, each round of QE is like trying to put out a fire with gasoline, it only makes our economic problems burn hotter. Meanwhile, our creditors will continue to make careful moves to extricate themselves from the US dollar reserve system, like China's recent currency swap deals with other emerging markets or its rapid liberalization of domestic gold markets. This means that a stagnant job market and poorly disguised inflation is the "new normal" for Americans. Forget about sending the kids to college – it's going to be a struggle for many families just to make ends meet. Those who don't own gold and silver will see their dollar savings and quality of life diminish at a faster and faster rate. Helping You Turn Paper Into Gold My new motto for SchiffGold is "Helping you turn paper into gold." This has been our mission for the last four years, and it will only gain urgency in the next four. While the precious metals may have seemed like they were riding a roller coaster recently, serious investors must learn to see past the short-term noise to understand the important fundamental signals. By all accounts, the global dollar reserve system is in its death throes. At the first major crack, we are likely to see the biggest gold rally the world has ever seen. At that point, it will matter less whether you bought in at $600, $1200, or $1900, because those prices will all seem so cheap as to be quaint. Remember $1.20 a gallon gas? That wasn't too long ago, and yet we know that we'll never see that price at the pump again. SchiffGold will continue to help customers redeem as many paper dollars as possible for physical gold and silver – trading a devaluing asset for one that has been on a 12-year uptrend. I am proud of how my gold company has weathered the storm of overwhelming negative sentiment towards precious metals. While doubters abandoned ship, we were the first to introduce innovative new products that increased investor liquidity, like the Valcambi CombiBar and the Silver Barter Bag. When others laid off brokers, we were training passionate new specialists in the intricacies of precious metals investing. The result is that, as I understand it, we have the most loyal customer base of any US gold dealer. We've managed to accomplish this without resorting to selling the high-margin products that make up the bulk of many major dealers' revenue. Soon after forming my company in response to these widespread shady dealings, we launched the Classic Gold Scams educational campaign. In the years since, we have exposed nearly every scam and ripoff imaginable. More recently, several unscrupulous dealers have come under investigation and closed their doors. The years spent growing my gold company from scratch have been exciting, but our greatest work has yet to be done. Our mission will continue as long as the US government remains committed to obliterating the value of the dollar, and investors seek out an honest guide to safety. |

| The Soaring Dollar Debate: Good, Bad, Ugly Posted: 05 Oct 2014 10:38 AM PDT The dollar is on a tear. And the world is scrambling to figure out what it means. Beginning with the always-interesting Martin Armstrong in a recent Financial Sense interview:

Another positive take comes from Monty Guild, also on Financial Sense:

Caroline Valetkevitch at Reuters takes the other side, pointing out that some of those negative effects are already manifesting:

Finally, Automatic Earth’s Raúl Ilargi Meijer goes downright apocalyptic in his recent The US Dollar Is About To Inflict Carnage All Around The Planet, where he quotes some representative reports:

Meijer’s conclusion: “It's going to be carnage out there.” Some thoughts There are clearly benefits to a strong currency. And in recent years a lot of very smart people have made favorable foreign exchange trends a centerpiece of their analysis, generally citing a strong currency as an investment positive. But there seems to be a missing piece to that scenario, which is debt. True, other things being equal a strong currency is a sign of (relative) confidence and generally a good thing for a country that has its financial house in order. Appreciating money makes its citizens’ savings more valuable and its corporations better able to snap up cheap acquisitions abroad. On balance, the strong currency society gets richer. But for an over-indebted country, where local savings are dwarfed by local debt, a strong currency makes the debt burden even heavier, so the net effect is negative. For a real-world test of this thesis, simply look at who had the last batch of strong currencies. Between 2009 and 2013 that would be Japan and Europe, which are now tipping into recessions that threaten to become something much worse. Which is why the dollar is soaring. Europe and Japan — along with nearly-as-over-indebted China — need need weaker currencies not to thrive, but survive. US policymakers, while recognizing the downsides of a soaring dollar, no doubt see taking one for the team (i.e., the global economy) as better than a list of alternatives that includes widespread Depression. Now the question is whether the strong dollar will do to the US what the strong yen and euro did to Japan and Europe. That is, will America in 2015 be an island of stability in a sea of chaos or will it be a yet another deflationary basket case? |

| Alasdair Macleod’s Market Report: Failing Economies and the Quarter-End Posted: 05 Oct 2014 09:00 AM PDT Precious metals have faced adverse weather as evidence mounts that major economies may be sliding into recession. Silver in particular has been badly mauled, slipping to new lows below $17. It now stands at one third of the brief high of nearly $50 achieved in April 2011. Silver is also very oversold as evidenced in the chart below. […] The post Alasdair Macleod’s Market Report: Failing Economies and the Quarter-End appeared first on Silver Doctors. |

| Posted: 05 Oct 2014 05:08 AM PDT With the New York Times reporting that the Ebola virus can live on contaminated surfaces, how long before paper money becomes the culprit for spreading the Emoola virus? Are global electronic forms of money such as Bitcoin the answer to saving the world from viral death by fiat paper money or are robotic hamburger makers the key to a more sanitary monetary theme park experience? Are we reliant on the $15 minimum wage to jump start the economy or is our fast food future survival dependent on automation and the success of the Disney Dollar version 2.0? |

| Gold Has Got To Put Up Or Shut Up Posted: 05 Oct 2014 02:15 AM PDT Precious Metals Stock Review |

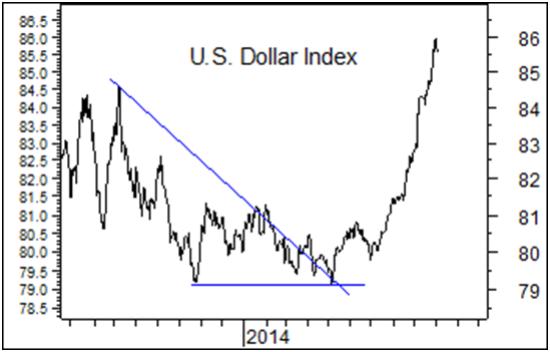

| US dollar top will mark the bottom for gold and silver prices Posted: 04 Oct 2014 09:23 PM PDT In the past 12 weeks the US dollar has soared against the euro which has dropped from $1.36 to $1.26. That’s been great news for US tourists but a shock for precious metal investors on the inverse side of this trade: gold prices fall as the dollar rises. Technical analysts reckon the dollar is now close to the top of its recent rally. Anecdotally everyone is positive on the dollar and any contrarian knows this is a danger signal: the crowd is always wrong because its enthusiasm is unsustainable and you simply run out of buyers. Dollar topping out? If you are feeling brave next week would be a great time to stock up on gold and silver. That’s what the ArabianMoney investment newsletter is telling its paid-for subscribers this month, albeit with its usual twist for insiders only (subscribe here). What that a final capitulation move by the euro at the end of last week? It certainly looked like it: So if the euro is now oversold so is gold and the price will go back up and silver will follow as it almost always does. This may not be the last shock for precious metal investors as financial markets go on a rollercoaster ride this fall. It’s impossible to predict these moves ahead of time, or to time them properly. That’s why long-term exposure to the precious metals makes sense. We are entering a dark phase in financial markets when you have to pick the asset class that may perform least badly rather than the next champion. Buying your protection insurance now in bullion is a very smart move. |

| Precious Metals to Face More Body Blows Posted: 04 Oct 2014 02:15 PM PDT The Daily Gold |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment