Gold World News Flash |

- Is the US making the same mistakes as Zimbabwe?

- YOU ARE 100% RIGHT ABOUT SILVER — The Wealth Watchman

- Supply and Demand Report: 5 Oct

- The US Dollar Is About To Inflict Carnage All Around The Planet

- Tocqueville’s Hathaway: China Has it Right About Gold and the Dollar

- Pan American Silver Has The Cash To Survive And Thrive

- Is The US Making The Same Mistakes As Zimbabwe?

- Why the rush to buy gold coins shows the way the gold price will go

- Rob Kirby — Physical Gold & Silver Contracts DEFAULT in 2014

- Gold Slides Near 4-Year-Low In Early Asia Trading

- The US Dollar Is About To Inflict Carnage All Around The Planet

- Technical analysis is little good in manipulated markets, Fitzwilson writes at KWN

- GoldSeek Radio interviews GATA Chairman Murphy

- Violent Currency, Gold & Resource Wars Engulfing The World

- Robin Bromby in The Australian: Shanghai gold surprise in store

- Peter Schiff: Gold’s Past And Future 4 Years

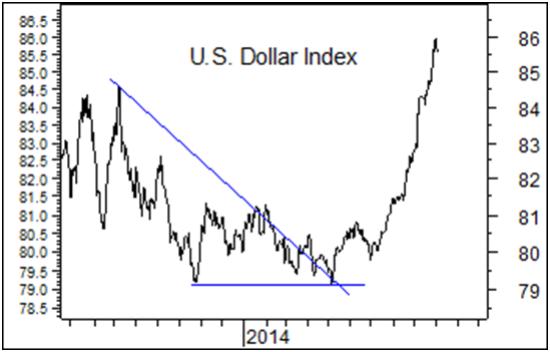

- The Soaring Dollar Debate: Good, Bad, Ugly

- Weekend Update October 3

- Interviewed by KWN, Ing sees 'final panic selling stage' in gold

| Is the US making the same mistakes as Zimbabwe? Posted: 06 Oct 2014 12:00 AM PDT by Patrick Barron, Mises:

| ||||

| YOU ARE 100% RIGHT ABOUT SILVER — The Wealth Watchman Posted: 05 Oct 2014 09:05 PM PDT

As The Wealth Watchman notes, despite the cartel’s vicious, criminal paper games, Silver & Gold demand has EXPLODED and Western demand is back with a vengeance. Judging by the past week of Silver Eagle sales from the US Mint the big players, the smartest guys in the room were busy buying nearly 24 tonnes of silver from the U.S. Mint! So the cartel can continue slaughtering the paper silver market, but they do so at their own peril as the inverse reaction to their criminality is a RUN ON PHYSICAL precious metals in the United States and abroad. | ||||

| Supply and Demand Report: 5 Oct Posted: 05 Oct 2014 09:04 PM PDT by Keith Weiner

How much higher can the dollar go? Betting on the Fed's paper has been one helluva speculation. No doubt the Fed's credit quality has been falling, but powerful forces are driving it up, such as desperate debtors clutching for cash to calm their creditors (sorry, couldn't resist). The dollar was up this week, from 25.5 to 26.1mg gold, or alternatively from 1.76 to 1.86g of silver. Since this move began, the dollar has risen from around 16mg gold, or about 63%. If one prefers to measure value in terms of other currencies, the dollar was up from €0.788 to €0.80. It went up from £0.615 to £0.626. It went up from CAD$1.115 to CAD$1.124, or AUD$1.14 to AUD$1.15. It went up from ?39.14 (Russian rubles) to ?39.98. It went up in Japanese yen, Brazilian reals, Indian rupees, Indonesian rupiahs. You get the picture. In the past year and three quarters, the dollar has gone up about 33% in rubles. Exciting times for Russian speculators, many of whom probably feel they're getting rich. Are they really? Not in our opinion. Looked at the other way—in terms of most readers' favorite paper currency—the prices of the metals fell this week. As usual, this means the price of silver fell in terms of gold as well. The gold to silver ratio made a new high on Thursday of 71.1. Last week, we said the following:

This wasn't quite a premature calling of the top (particularly in light of our silver analysis). But it was not necessary to reach for 70 last week, when this week the market has solidly hit it. What about 80? Read on… First, here is the graph of the metals' prices. The Prices of Gold and Silver We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can't tell them whether the globe, on net, hoarding or dishoarding. One could point out that gold does not, on net, go into or out of anything. Yes, that is Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production can be measured in months. The world just does not keep much inventory in wheat or oil. With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here. Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It rose 2.4% this week. The most likely course is on towards 75. The Ratio of the Gold Price to the Silver Price For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red. Here is the gold graph. The Gold Basis and Cobasis and the Dollar Price The cobasis may have finally broken out of its range since August, though it took a price below $1200 to make this happen. The cobasis is up noticeably on the week, from -0.21% to -0.15%. There is no doubt that lots of physical metal has come to market in this period of falling prices since August. Maybe metal supplied to the market will dry up, and metal demanded will rise at the new, lower price? We prefer to call it as we see it, rather than predict such changes in behavior. Now let's look at silver. The Silver Basis and Cobasis and the Dollar Price The silver price had another breakdown this week, losing 0.81 Federal Reserve Notes. But the cobasis fell. Silver had been in (a small) backwardation at the close of last week. Now the cobasis is 0.0000. Last week, we wrote:

Now we are 81 more cents closer. And the cobasis fell despite this, or because of it. Definitely not an encouraging sign for those looking for an abrupt end to the dollar's relentless rally.

The Gold Standard Institute Presents The Gold Standard: Both Good and Necessary, in Manhattan on Nov 1. There hasn't been a real recovery from the crisis of 2008. The reason is not simply that the Fed has made a particular mistake. The cause of the crisis is the dollar itself. There will not be a recovery until we return to the use of gold as money. Please come to this talk to hear Keith Weiner's diagnosis of the dollar and urgent prescription for gold.

© 2014 Monetary Metals | ||||

| The US Dollar Is About To Inflict Carnage All Around The Planet Posted: 05 Oct 2014 08:37 PM PDT by Raul Ilargi Meijer via The Automatic Earth blog, via ZeroHedge:

There is of course the fact that Abenomics in Japan is living up to its longstanding promise of utter failure. And there is Mario Draghi torn between two lovers, one the one hand the Germany/Austria camp – with France as a surprise third – who don't want the ECB to buy up junk paper, and on the other hand those EU members whose sole road to survival inside the EU is for Draghi to buy up anything that even looks like it was once toilet paper. But Japan and Europe have been in the economic doghouse for a long time. It wasn't until the Fed pulled the trigger on the dollar steamroller that they started paying the real price for it. | ||||

| Tocqueville’s Hathaway: China Has it Right About Gold and the Dollar Posted: 05 Oct 2014 08:00 PM PDT by Chris Powell, GATA:

Tocqueville Gold Fund manager John Hathaway’s third-quarter letter to investors details how the fundamentals for a much stronger gold price remain in place, and he cites many of the developments to which GATA has called attention in recent weeks. Hathaway’s letter concludes: “We take comfort that our positive view of the future dollar gold price is shared by those who understand the difference between synthetic and physical metal and who regard the real substance as a matter of strategic imperative, not as a plaything for macro traders. We believe that China’s negative assessment of the future prospects for the U.S. dollar is correct and that our investment strategy of investing in the shares of value-creating gold miners offers sensible and dynamic exposure to the inevitable repricing of gold in U.S. dollars.” | ||||

| Pan American Silver Has The Cash To Survive And Thrive Posted: 05 Oct 2014 07:56 PM PDT Summary

By Ivan Y. Pan American Silver (NASDAQ:PAAS) is the fourth in a series of articles I am writing on silver stocks. The three stocks I had written about previously were | ||||

| Is The US Making The Same Mistakes As Zimbabwe? Posted: 05 Oct 2014 07:28 PM PDT Submitted by Patrick Barron via Mises Canada, I have started reading a new book about the collapse of the Zimbabwean dollar–When Money Destroys Nations, by Philip Haslam and Russell Lamberti. One of the main causes of the hyperinflation was the decision of the Zimbabwean government to give army veterans of its recent wars a big bonus. The promise was too much for the Zimbabwean economy to manage, so the government printed money... and lots of it. Why is this relevant? Well, look at America. We have been fighting wars around the world for twenty-five years and recently promised universal healthcare to all citizens. The baby boom generation is retiring and will draw unfunded Social Security and Medicare benefits in ever larger amounts. There is no way that these promises can be funded by the American economy. We will print money, too, just like the Zimbabweans. The Zimbabwean economy went into hyperinflation, because the Zim dollar was not held as a reserve anywhere in the world. The US hyperinflation may be delayed, because our money printing is being sopped up by foolish central banks worldwide in order to reward their export industries. In a non-manipulated currency market, the US would have to fund its budget with honest debt and repay it with honest money. But the chickens eventually will come home to roost for the US, just as they did for the poor Zimbabweans. The political pressure to print money is the same everywhere as are the laws of economic science. | ||||

| Why the rush to buy gold coins shows the way the gold price will go Posted: 05 Oct 2014 07:20 PM PDT by Peter Cooper, Arabian Money:

Investment logic: Is this logical? In investment markets most investors are only comfortable about investing after a long uptrend when they can feel really sure about future performance. Sadly that is the madness of crowds speaking and being among the last to invest in an asset class going up is a fatal error. | ||||

| Rob Kirby — Physical Gold & Silver Contracts DEFAULT in 2014 Posted: 05 Oct 2014 07:05 PM PDT from USA Watchdog: Derivative and gold expert Rob Kirby says the U.S. looks a lot like the run up to the fall of Rome more than 1,500 years ago. Kirby explains, "The parallels with what we are experiencing today are so clear and so much like what was happening in Rome as Rome was falling.” “Diversions were the way of the day, anything to divert people's attention from the undermining of the empire. It was largely a financial debasement. Rome fell when they debased the currency. That's the major factor behind the fall of the Roman Empire. It was the debasement of the currency, and we are seeing the same thing today. What's at the heart of all these issues? What's at the heart of all the trouble in the world right now? The world's reserve currency has been debased to the point that it is going to go supernova. This is the whole illusion behind the strength of the dollar. The dollar isn't getting stronger, just like stars aren't going to have longevity when they go supernova. They get brighter and you might think the star is getting more viable when, in reality, the notion of it getting really bright before it goes supernova is exactly the opposite of the illusion of it getting brighter. It's what happens just before it goes black and dies." | ||||

| Gold Slides Near 4-Year-Low In Early Asia Trading Posted: 05 Oct 2014 06:05 PM PDT Same old, same old. Treasury yields are lower (futures prices higher); USDJPY (and thus S&P futures) are higher (though 110.00 is once again offering notable resistance); and gold is getting 'handled' lower. The divergence between stocks and bonds from Friday's jobs number is holding for now but it is gold that has been smacked to $1183 - near a four-year low: $1180.50 6/28/13, then back to Aug 2010). Silver is down 1% to March 2010 lows. Despite US equity exuberance, Asia-Pac stocks (ex-Japan) are down 0.3%.

Stocks and bonds remain divergent from Friday's jobs print

As a reminder, this is what happened last Friday into Sunday night's open...

Gold has been punched lower once again near 4-year lows...

But futures volume is negligible compared to the payrolls dump...

*SPOT SILVER DROPS 1% TO $16.6825/OZ, LOWEST SINCE MARCH 2010

And Bitcoin collapsed to as low as $275 overnight...

Charts: Bloomberg | ||||

| The US Dollar Is About To Inflict Carnage All Around The Planet Posted: 05 Oct 2014 05:39 PM PDT Submitted by Raul Ilargi Meijer via The Automatic Earth blog,  Jack Delano Brakeman Jack Torbet at Atchison, Topeka & Santa Fe Railroad March 1943

As I watch the euro losing another 1.3% against the dollar today, it’s now at $1.25, and down from close to $1.40 recently, it’s getting clearer all the time: the greenback is busy eating currencies and economies alive. There is of course the fact that Abenomics in Japan is living up to its longstanding promise of utter failure. And there is Mario Draghi torn between two lovers, one the one hand the Germany/Austria camp – with France as a surprise third – who don’t want the ECB to buy up junk paper, and on the other hand those EU members whose sole road to survival inside the EU is for Draghi to buy up anything that even looks like it was once toilet paper. But Japan and Europe have been in the economic doghouse for a long time. It wasn’t until the Fed pulled the trigger on the dollar steamroller that they started paying the real price for it. Japan, at least as long as it chooses to cling to the growth fairy, has nowhere to turn but to something in the vein of Abenomics, i.e. huge money and credit expansion. But it’s not the money supply, no matter how it’s defined, that is the problem, it’s that people refuse to spend. And if people don’t spend, no government or central banks has a way to boost inflation. Why they should want to in the first place is another question. Europe has the added problem of disagreement on how to escape the walls that are closing in. And the more they close in, the less comfortable the shared living space on the old continent becomes. With a bit of imagination, you can see different people, different cultures, different languages, and different economies, all forced to live in the same ever shrinking – economic -space. There’s less of everything to go around, and no-one wants to give up what’s theirs. Still, at the same time we already saw that two-thirds of Greeks live at or below the poverty line, and that Naples is even worse than Greece. Where do you personally think that will go? With a dollar that is set to make lots of things, not the least of which is oil and gas, more expensive? It’s not just that for Europe, the growth fairy is evasive, their economies are bound to shrink a lot more still. And then what is Draghi, or his successor, supposed to do? The eurozone, and the EU itself, has already become a straightjacket with a noose attached to it, and that noose will start to tighten as we go forward. Brussels and Frankfurt can spin all they want – and do they ever -, but they can’t squeeze milk out of a deceased goat. No matter what side of which fence you’re sitting on here, you have to give it to the Fed and Wall Street, though: their timing is impeccable. Victim no. 1 of the "Dollar is King"-move are the emerging markets: Emerging Stocks Pummeled as Weak Yen Boosts Japan

And the weak yen has long since stopped boosting Japan in a net, overall, sense: Japanese Stocks Have Crashed Over 1000 Points Since Friday

And: Japan Inc. Begins To Turn Against The Weak Yen

And also: Yen’s Steepest Decline in 20 Months Spreads Unease in Japan

You have to like the suggestion that “The weaker yen puts Japan at risk of recession”. Tokyo may want to pick whatever stats they like, but it should be obvious that Japan, like the EU, is in a recession, not at risk of one. Take a look: What 110 Yen to the Dollar Means for Japan’s Consumers

“Not necessarily all positive”. Now there’s a dead spin. Any country that sees a 7.1% drop in GDP, no matter what sales tax changes, is in very serious trouble. The nation’s largest retailer is down 22% (!) Want to try that on for size at WalMart? And then there’s Europe. Where plenty folk probably think they’re in some lower euro honeymoon still. Today, EU exchanges are up 1% or so. While the euro loses big. I suggest these happy shiny people should check on Japan to see what’s in store. European Stocks Plunge Most In 16 Months As Draghi Disappoints

Draghi’s plan to buy Toilet Paper Backed Securities is dead is a dead in the water as it is on dry land: France’s Noyer Is Third ECB Dissenter Against ABS Buying Plan

And there’s more to that: Mario Draghi’s QE: Too Little For Markets, Too Much For Germany

It’s not just Draghi, the entire EU leadership has a severe credibility problem. With – seemingly – nothing left on the economical front that member nations can agree on, other than there’s a huge and imminent disaster waiting in the wings, what ways forward are available? There’s only one, really: split up the whole caboodle in as amicable a divorce as you can muster, and then try to stay friends. But even that doesn’t seem likely, at all. A split-up of the EU would obviously be grossly costly, and the lion’s share of those costs would have to be borne by the richer north. But the richer north, too, is getting poorer fast. So what campaign slogan do you think will win out in the next election in Germany, France etc? Will it be: let’s pay for Greek debts, so they can have a good life again? Or will it be: let them cook in their own fat, so we can party on for a while longer in Berlin and Paris? I think you know the answer. So does Albert Edwards. And he includes the US, and China, in his dark panorama for good measure. And he’s right of course Albert Edwards Says Watch Japanese Yen and Be Very Afraid

| ||||

| Technical analysis is little good in manipulated markets, Fitzwilson writes at KWN Posted: 05 Oct 2014 04:43 PM PDT 7:40p ET Sunday, October 5, 2014 Dear Friend of GATA and Gold: Fund manager Robert Fitzwilson of the Portola Group, in commentary published at King World News, argues that technical analysis is of little use in markets as manipulated as those of the monetary metals. Fitzwilson also ridicules assertions that there is a glut of oil. His commentary is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/10/5_Vi... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| GoldSeek Radio interviews GATA Chairman Murphy Posted: 05 Oct 2014 04:33 PM PDT 7:35p ET Sunday, October 5, 2014 Dear Friend of GATA and Gold: GATA Chairman Bill Murphy, interviewed by Chris Waltzek for GoldSeek Radio, discusses the possibility that the Ebola virus outbreak in West Africa could obstruct gold mining. He also discusses the strange rise of open interest in the silver futures market as the price falls. The interview is 12 minutes long and starts at the 50-minute mark at GoldSeek Radio here: http://news.goldseek.com/radio/1412568000.php CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Join the Sprott Precious Metals Roundtable on Tuesday, Oct. 7 Sprott Asset Management's Eric Sprott, Rick Rule, and John Embry will get together for an hour at 2 p.m. ET Tuesday, October 7, to discuss the prospects for the precious metals, and you can join them via the Internet. Just register here: https://event.on24.com/eventRegistration/EventLobbyServlet?target=reg20.... Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

| Violent Currency, Gold & Resource Wars Engulfing The World Posted: 05 Oct 2014 02:14 PM PDT  As the world continues to move into uncharted territory, today a 40-year market veteran warned King World News that violent currency, gold, and resource wars are now engulfing the entire world. He also discusses what investors should be doing in this dangerous environment. Below is what Robert Fitzwilson, founder of The Portola Group, had to say in this exclusive piece for King World News. As the world continues to move into uncharted territory, today a 40-year market veteran warned King World News that violent currency, gold, and resource wars are now engulfing the entire world. He also discusses what investors should be doing in this dangerous environment. Below is what Robert Fitzwilson, founder of The Portola Group, had to say in this exclusive piece for King World News.This posting includes an audio/video/photo media file: Download Now | ||||

| Robin Bromby in The Australian: Shanghai gold surprise in store Posted: 05 Oct 2014 11:08 AM PDT By Robin Bromby http://www.theaustralian.com.au/business/opinion/shanghai-gold-surprise-... If you want to know what China will do in the future, it's usually a good thing to look at its past. Don't trust us --- listen to the late Chinese communist leader, Zhou Enlai. "Past experience, if not forgotten, is a guide to the future," he said in 1972. He was talking about the relationship between China and Japan, but let's take another example, this time gold, which tumbled again to close the week at $US1,191 an ounce. Keith Goode, probably Australia's most experienced gold analyst, now running his own outfit at Eagle Research, was struck by what the Chinese are doing in Shanghai. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Putting together his thoughts after attending China's first gold congress -- http://www.gata.org/files/KeithGoodeEagleResearchAdvisory-10-03-2014.pdf -- Goode says the gold bears have trumpeted reduced gold imports through Hong Kong as a clear sign China's gold consumption is falling dramatically. But these same people have failed to realise that, with the new Shanghai free-trade zone, China no longer needs to import through the former British colony. Why Shanghai? Simple, says Goode: It is because Shanghai was once the gold trading centre of the world. Until the fall of the Qing dynasty in 1912, Shanghai accounted for about 60 per cent of all gold traded around the world. Gold trading was revived there in 1921 and lasted until Japan captured the city. Now the Shanghai Gold Exchange is the third largest in the world, after New York and London. Last Monday was the first anniversary of Shanghai's FTZ, where gold trading is backed by the contents of a 1,000-tonne vault. Goode then quotes one Chinese presenter at the congress making the point that his country was the world's leading gold producer (428 tonnes last year), consumed the most (1,100 tonnes), and traded the most Asian gold futures -- then adding: "But yet we have little control over the gold price." A China Gold Association video shown at the congress described the $US200-an-ounce fall in April last year as a "black swan, one in a 2-million-year event." Goode suspects the real meaning of that comment was that China does not intend to allow that to happen again; in April 2013 Shanghai was not trading when Comex in New York was open. Now it is. He believes China is still on course to made the yuan a reserve currency, backed by gold. China last reported its official gold holdings in 2009 at 1,054 tonnes. He thinks the figure may now be around 6,000 tonnes and the Chinese are waiting until they have 9,000 tonnes stored away before they announce they have passed the United States to become the world's biggest holder (a theory Pure Speculation has previously advanced). Goode says Russia is accelerating gold buying (another 7 tonnes in August). "With the increased level of co-operation between Russia and China, does Russia know China's intentions and is adding gold reserves as fast as possible?" he wonders. Kazakhstan is also buying up. Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:

This posting includes an audio/video/photo media file: Download Now | ||||

| Peter Schiff: Gold’s Past And Future 4 Years Posted: 05 Oct 2014 10:52 AM PDT This article is written by Peter Schiff. Yesterday, I launched a new website and announced the rebranding of my gold bullion dealer from Euro Pacific Precious Metals to SchiffGold. I started this company four years ago to provide a trustworthy option for my Euro Pacific Capital brokerage clients, but it has since grown to become a major US gold dealer in its own right. This landmark for my company comes in the midst of a historic time for the precious metals. The past four years have had highs and lows. We have been experiencing the inflation of remarkable new asset bubbles, and gold's response has been mixed. But I have reason to believe that over the next four years, gold and silver investors will witness shocking macroeconomic events that put to rest any doubts about the importance of having sound money in every portfolio. Short-Term Memory Lane It's hard to believe that when I started my gold company in the summer of 2010, the Federal Reserve was already finishing its first round of quantitative easing (QE1). Yet even that massive inflationary program was not enough to paper over the fallout from the credit crisis of '07-'08. Because the economy did not "return to normal," Fed Chairman Ben Bernanke had his excuse to begin a second round of QE just a few months later. The government had already started the circular narrative that confuses the markets to this day: "The economy is in genuine recovery, but it still requires ongoing emergency stimulus from the Fed." The announcement of QE2 spurred many of our initial customers to make substantial purchases of gold and silver. The rest of the market soon caught up. In the year following QE2, gold rocketed to its current record-holding high of just over $1900. As QE2 ended, "Operation Twist" began, and before long QE3 was introduced. In order to prevent their currencies from appreciating against a now increasingly worthless US dollar, nations around the world joined the money-printing party. These foreign governments wrongly believed that they were dependent on exporting their goods to the US for dollars, when in fact stronger currencies would have allowed them to keep the fruits of their labor to enjoy at home. This has developed into the ongoing international "currency war," in which countries are racing to see which can impoverish their citizens fastest. The currency war has been a boon to the US dollar, which has appeared fairly stable relative to other currencies. However, just because you and a fellow skydiver both fall in tandem doesn't change the fact that you're both headed toward the ground. Short-sighted speculators have ignored this reality, and the precious metals have taken an undeserved beating. What the Future Holds QE3 has been winding down throughout 2014, and investors are eagerly awaiting news of a rate hike from the Fed. After all, if the economy is as healthy as the government claims, we should no longer be in need of these multiyear emergency measures. Unfortunately, the Fed’s zero interest-rate policy (ZIRP) is the very thing making the economy appear healthy. It has boosted stocks and financed corporate acquisitions. It has also allowed the federal government to continue operating under a crushing debt load. Even a rise in rates to historically average levels could very well bankrupt the federal government and many of America's remaining industrial giants. Neither Fed Chairwoman Janet Yellen nor Washington want to bear responsibility for the painful process of raising rates. Instead, I have long forecast that the Fed will follow QE3 with QE4, and so on. After all, each round of QE is like trying to put out a fire with gasoline, it only makes our economic problems burn hotter. Meanwhile, our creditors will continue to make careful moves to extricate themselves from the US dollar reserve system, like China's recent currency swap deals with other emerging markets or its rapid liberalization of domestic gold markets. This means that a stagnant job market and poorly disguised inflation is the "new normal" for Americans. Forget about sending the kids to college – it's going to be a struggle for many families just to make ends meet. Those who don't own gold and silver will see their dollar savings and quality of life diminish at a faster and faster rate. Helping You Turn Paper Into Gold My new motto for SchiffGold is "Helping you turn paper into gold." This has been our mission for the last four years, and it will only gain urgency in the next four. While the precious metals may have seemed like they were riding a roller coaster recently, serious investors must learn to see past the short-term noise to understand the important fundamental signals. By all accounts, the global dollar reserve system is in its death throes. At the first major crack, we are likely to see the biggest gold rally the world has ever seen. At that point, it will matter less whether you bought in at $600, $1200, or $1900, because those prices will all seem so cheap as to be quaint. Remember $1.20 a gallon gas? That wasn't too long ago, and yet we know that we'll never see that price at the pump again. SchiffGold will continue to help customers redeem as many paper dollars as possible for physical gold and silver – trading a devaluing asset for one that has been on a 12-year uptrend. I am proud of how my gold company has weathered the storm of overwhelming negative sentiment towards precious metals. While doubters abandoned ship, we were the first to introduce innovative new products that increased investor liquidity, like the Valcambi CombiBar and the Silver Barter Bag. When others laid off brokers, we were training passionate new specialists in the intricacies of precious metals investing. The result is that, as I understand it, we have the most loyal customer base of any US gold dealer. We've managed to accomplish this without resorting to selling the high-margin products that make up the bulk of many major dealers' revenue. Soon after forming my company in response to these widespread shady dealings, we launched the Classic Gold Scams educational campaign. In the years since, we have exposed nearly every scam and ripoff imaginable. More recently, several unscrupulous dealers have come under investigation and closed their doors. The years spent growing my gold company from scratch have been exciting, but our greatest work has yet to be done. Our mission will continue as long as the US government remains committed to obliterating the value of the dollar, and investors seek out an honest guide to safety. | ||||

| The Soaring Dollar Debate: Good, Bad, Ugly Posted: 05 Oct 2014 10:38 AM PDT The dollar is on a tear. And the world is scrambling to figure out what it means. Beginning with the always-interesting Martin Armstrong in a recent Financial Sense interview:

Another positive take comes from Monty Guild, also on Financial Sense:

Caroline Valetkevitch at Reuters takes the other side, pointing out that some of those negative effects are already manifesting:

Finally, Automatic Earth’s Raúl Ilargi Meijer goes downright apocalyptic in his recent The US Dollar Is About To Inflict Carnage All Around The Planet, where he quotes some representative reports:

Meijer’s conclusion: “It's going to be carnage out there.” Some thoughts There are clearly benefits to a strong currency. And in recent years a lot of very smart people have made favorable foreign exchange trends a centerpiece of their analysis, generally citing a strong currency as an investment positive. But there seems to be a missing piece to that scenario, which is debt. True, other things being equal a strong currency is a sign of (relative) confidence and generally a good thing for a country that has its financial house in order. Appreciating money makes its citizens’ savings more valuable and its corporations better able to snap up cheap acquisitions abroad. On balance, the strong currency society gets richer. But for an over-indebted country, where local savings are dwarfed by local debt, a strong currency makes the debt burden even heavier, so the net effect is negative. For a real-world test of this thesis, simply look at who had the last batch of strong currencies. Between 2009 and 2013 that would be Japan and Europe, which are now tipping into recessions that threaten to become something much worse. Which is why the dollar is soaring. Europe and Japan — along with nearly-as-over-indebted China — need need weaker currencies not to thrive, but survive. US policymakers, while recognizing the downsides of a soaring dollar, no doubt see taking one for the team (i.e., the global economy) as better than a list of alternatives that includes widespread Depression. Now the question is whether the strong dollar will do to the US what the strong yen and euro did to Japan and Europe. That is, will America in 2015 be an island of stability in a sea of chaos or will it be a yet another deflationary basket case? | ||||

| Posted: 05 Oct 2014 07:22 AM PDT By Everett Millman, head content writer at Gainesville Coins, a leading gold and silver distributor. ABSTRACT: A rising dollar had the greatest effect on the markets this week, driving most... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | ||||

| Interviewed by KWN, Ing sees 'final panic selling stage' in gold Posted: 05 Oct 2014 06:55 AM PDT 9:55a ET Sunday, October 5, 2014 Dear Friend of GATA and Gold: Technology stock Alibaba is trading at 60 times earnings while successful gold mining companies are trading at less than 20 times earnings, notes John Ing, president of the Maison Placements investment house in Toronto, in an interview with King World News. Ing thinks this indicates a "final panic selling stage" in gold. An excerpt from the interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/10/5_Wa... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

I have started reading a new book about the collapse of the Zimbabwean dollar–

I have started reading a new book about the collapse of the Zimbabwean dollar– from

from

As I watch the euro losing another 1.3% against the dollar today, it's now at $1.25, and down from close to $1.40 recently, it's getting clearer all the time: the greenback is busy eating currencies and economies alive.

As I watch the euro losing another 1.3% against the dollar today, it's now at $1.25, and down from close to $1.40 recently, it's getting clearer all the time: the greenback is busy eating currencies and economies alive. Dear Friend of GATA and Gold:

Dear Friend of GATA and Gold:

There's a rush to buy gold coins and bars all over the world this autumn. Last week coin sales at the US Mint were running at the highest this year with September sales double the August tally. There was a similar surge in sales of coins and minted bars at the Perth Mint to 68,781 ounces last month with Chinese buyers accounting for 80 per cent of business. The super-rich are stocking up on gold. In Perth the biggest seller is the one-kilogram bars, which are worth about $45,000 each at current prices. Buyers tell dealers they are buying gold as an insurance against a market collapse. But the other reason that they are buying gold now is the drop in the price to around $1,200 an ounce.

There's a rush to buy gold coins and bars all over the world this autumn. Last week coin sales at the US Mint were running at the highest this year with September sales double the August tally. There was a similar surge in sales of coins and minted bars at the Perth Mint to 68,781 ounces last month with Chinese buyers accounting for 80 per cent of business. The super-rich are stocking up on gold. In Perth the biggest seller is the one-kilogram bars, which are worth about $45,000 each at current prices. Buyers tell dealers they are buying gold as an insurance against a market collapse. But the other reason that they are buying gold now is the drop in the price to around $1,200 an ounce.

No comments:

Post a Comment