saveyourassetsfirst3 |

- US Gov’t Promises to Forgive Student Loan Debt… If You Work For Them

- Mining stocks see options action

- Precious Metals to Face More Body Blows

- Head of Russia’s Second Biggest Bank: Russia to Completely Switch to Rubles for Intl Trade in 2-3 Years

- The U.S. economy just set a frightening new 36-year record

- Gold Silver Ratio and Some Thoughts On Markets

- Who Needs Alan Greenspan When You've Got Gold?

- Bullish dollar has negative implication for commodities

- It’s Time to Fight Back!

- “Money Bubble” Predictions Coming True, Part 1: Stock Market Volatility Surges

- Porter Stansberry: What I just discovered about our business will surprise you

- This is HUGE: Chinese Renminbi Becomes Directly Tradable With the Euro

- Gold rebounds in face of geopolitical events, falling stocks

- Ben Bernanke just tried to refinance his house. You won’t believe what happened next.

- Gold drops below $1,200/oz

- New Gold Rush Cometh With Global Bond Market On Edge Of “Cliff”

- This could be the most important takeaway from the Bill Gross/PIMCO divorce

- Jobs Reports Sends Dollar Soaring

- Where are the Stops? Friday, October 3: Gold and Silver

- Metals market update for October 3

- New gold rush after bond bubble bursts

- Gold Stocks: Time to Buy or Will They Get Worse?

- Greenspan hints at a gold backed Yuan in China and considers gold the ‘ultimate’ money

- Gold and Silver Rush Cometh With Global Bond Market On Edge Of “Cliff”

- New Gold Rush Cometh With Global Bond Market On Edge Of “Cliff”

- Gold Coin Demand Up, Silver Relatively Better

- Yamana Gold hits record quarterly production

- Iamgold to sell niobium mine for $500m

- Gold tempts $1,200/oz

- Our obsession with monetary stimulus will end in disaster

- Another Sign Of Gold Moving Back Into The Financial System

- Silver - Technical Report

- Great Panther Silver Announces Filing of Preliminary Base Shelf Prospectus

- Goldcorp makes first gold pour at Eleonore

- African Bank just the start of loan deluge

- China is Hong Kong’s future – not its enemy

- Mecca gold sales down as pilgrims still recovering post Arab Spring

- India Gold imports at 16-month high

- New futures contract to help gold delivery in India

- Gold sales at Perth Mint reach 11-month high as prices retreat

- High-Frequency Trader Indicted for Manipulating Commodities Futures Markets

- Crude Oil, Gold Await Direction Cues as SPX 500 Hits 2-Month Low

- Gold Will Surprise In More Ways Than One

- Gold – Remains Steady Around $1215

- Gold Braces For A Bumpy Ride On NFP, Natural Gas Dives On Storage Data

- Gold Extends Weekly Decline as Platinum Slumps to Five-Year Low

- Silver & Gold Demand Explodes: Western Demand back with a Vengeance!

- October 2/no change in silver inventory at the SLV./ another drop of 1.19 tonnes from the GLD/ gold and silver rise/Updates on Ebola in the USA/Argentina's stock market crashes again/

- Gold Daily and Silver Weekly Charts - The Ritual of Our Existence

- SILVER CRASHES Below $17, What’s Next? |David Morgan

| US Gov’t Promises to Forgive Student Loan Debt… If You Work For Them Posted: 03 Oct 2014 01:00 PM PDT Today in the Land of the Free, everyone is required to pay into the Social Security system, and over 90% of students go to public schools. With the passage of the Affordable Care Act, the state is exerting its control over your medical care. And now with a new bill comes the crown jewel of […] The post US Gov’t Promises to Forgive Student Loan Debt… If You Work For Them appeared first on Silver Doctors. |

| Mining stocks see options action Posted: 03 Oct 2014 11:37 AM PDT Options active on gold miners as price of gold extends decline |

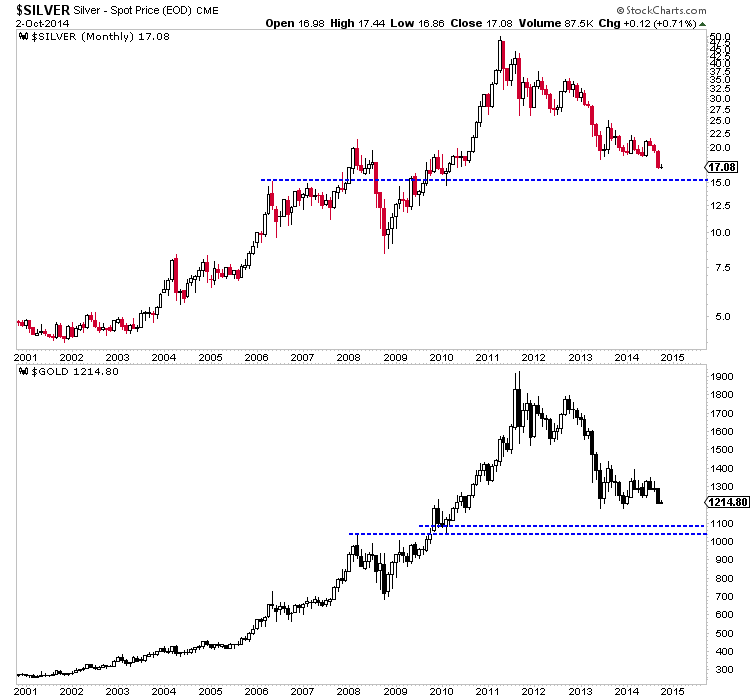

| Precious Metals to Face More Body Blows Posted: 03 Oct 2014 11:35 AM PDT Gold has broken below $1200 this morning in what should begin the final breakdown. In weekly and monthly terms $1200 was the remaining support. Sure Gold could bounce from $1180 but todays breakdown is more significant. Both metals are now in breakdown mode while the mining stocks continue to slide. There is more downside ahead and bulls should continue to stand aside before a favorable buying opportunity emerges. The monthly chart of Gold and Silver is below. We know that Silver has already broken down. It peaked before Gold and could bottom first. Silver is trading at $16.88 as I pen this. The next major monthly support is $15. With Gold trading at $1192, its next monthly support is below $1100. The 50% retracement is at $1080 and more support lies at $1040.

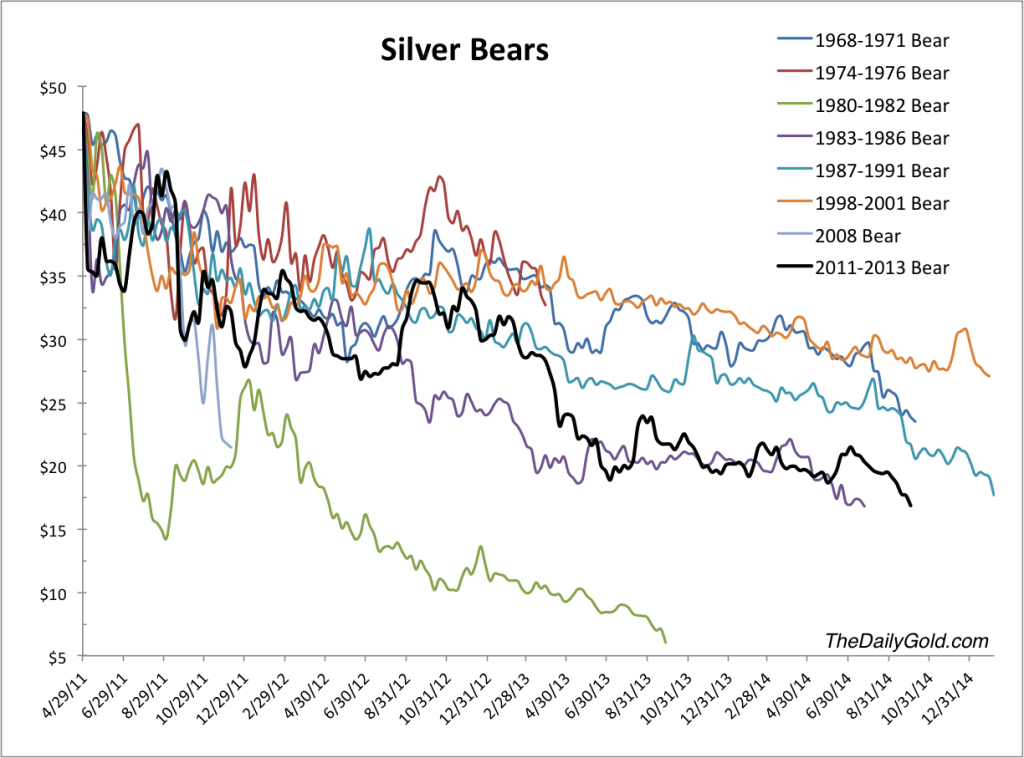

Those downside targets fit well with the bear analog charts. In this Gold specific chart we removed the two extreme bears. We can see how the current bear compares to three other bears.

The bear analog chart for Silver suggests its current bear market will end first and is very close to ending. In price terms this is now the second worst bear market ever for Silver. In terms of time it is close to being the third worst bear ever.

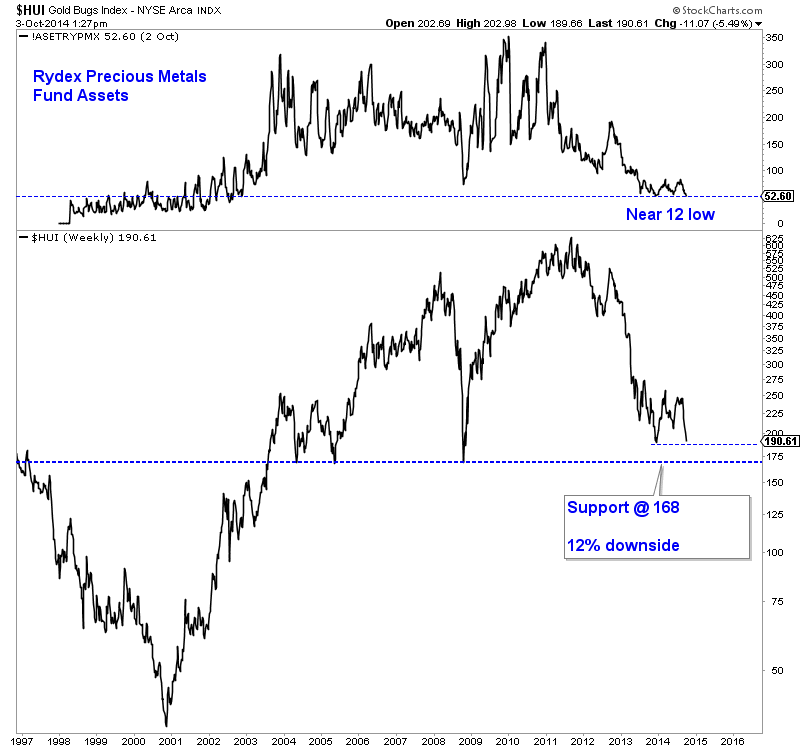

Turning to the miners, the HUI Gold Bugs Index is trading at 190 as we pen this. The weekly line chart shows 168 as very strong multi-year support. That is about 12% downside from current prices.

GDXJ (not shown) has been the strongest of the mining indices. It was the last to break its May low. It has 9% downside to its December low. GDXJ was down 82% at that low. Any breakdown to a new low is very likely to be a false breakdown given the current age and severity of the bear market. We were bullish most of 2014 but quickly changed our tune as the evidence shifted. In our most recent editorial we noted the downside risk but the eventual shift from risk to an amazing opportunity. These charts are a few of the tools we can use to potentially identify the start of that amazing opportunity. For now, Gold and Silver continue to have more downside until very strong support targets. The same goes for the mining stocks. I see a potential lifetime buying opportunity in the weeks and months ahead. We invite you to learn more about our premium service including a report on our top 5 buys at the coming bottom. Good Luck! Jordan Roy-Byrne, CMT The post Precious Metals to Face More Body Blows appeared first on The Daily Gold. |

| Posted: 03 Oct 2014 11:30 AM PDT In an interview published Tuesday in Russia's Izvestia newspaper, the head of Russia’s #2 bank stated that he envisions the country being able to completely switch to the ruble in international settlements with two to three years. Originally Posted at RT.com: Russia's second biggest bank VTB has reduced its US dollar lending, Andrey Kostin […] The post Head of Russia's Second Biggest Bank: Russia to Completely Switch to Rubles for Intl Trade in 2-3 Years appeared first on Silver Doctors. |

| The U.S. economy just set a frightening new 36-year record Posted: 03 Oct 2014 11:14 AM PDT From Zero Hedge: While by now everyone should know the answer, for those curious why the U.S. unemployment rate just slid once more to a meager 5.9% − the lowest print since the summer of 2008 − the answer is the same one we have shown every month since 2010: the collapse in the labor force participation rate, which in September slid from an already three decade low OF 62.8% to 62.7% − the lowest in over 36 years, matching the February 1978 lows. And while according to the Household Survey, 232,000 people found jobs, what is more disturbing is that the people not in the labor force, rose to a new record high, increasing by 315,000 to 92.6 million! And that’s how you get a fresh cycle low in the unemployment rate.

So the next time Obama asks you if you are “better off now than 6 years ago” show him this chart of employment to the overall population: it speaks louder than the president ever could.

|

| Gold Silver Ratio and Some Thoughts On Markets Posted: 03 Oct 2014 11:01 AM PDT Le Cafe Américain |

| Who Needs Alan Greenspan When You've Got Gold? Posted: 03 Oct 2014 10:42 AM PDT China is buying gold, says the celebrity Maestro. Or rather, oh no it isn't... ACCORDING to the internet, Alan Greenspan, former chairman of the Federal Reserve, thinks he know "why China is buying gold," writes Adrian Ash at BullionVault. Cue lots of chatter and praise on the bug-o-sphere. The Maestro speaks! And he says China is buying gold! For all I know, that's true. We're no more privy to Beijing's thinking than anyone else outside the politburo. But Greenspan didn't even know what his own central bank was doing to the US economy when he ran it. So what is clearly false is the idea that anyone should listen to anything Greenspan says about the People's Bank, or anything else, today. In October 2008, as the credit bubble he'd done so much to inflate tried to go bang, Greenspan confessed that...maybe...he had been "wrong" on the economy. Come 2013...eight years after he left the Fed, and 7 years after the US housing bubble began to burst...Greenspan admitted that he "never saw [the crash] coming". But no problem. Greenspan's celebrity as an economic sage...the "ultimate insider" with foresight second only to God...has rolled on regardless. It started in 1950, according to his damning biographer, Fred Sheehan, when the young pretender affected to start smoking a pipe. Now in 2014, Greenspan will even star at this year's New Orleans Investment Conference. Yes, really. The die-hard event for die-hard gold bugs since 1974, it was virtually empty when I attended at the turn of the century. But back then, of course, the Maestro was in charge of the Fed. And amid central-bank gold sales and tech stock bubbles worldwide, "who need[ed] gold when we've got Alan Greenspan?" as the New York Times put it so neatly. Turns out we all did. Yet lots of gold bloggers suddenly think they need Greenspan too, thanks to his new piece of nonsense. The man who brought you the lowest interest rates in history, the "Greenspan put" to support world equities, and the repeal of Washington's Glass-Steagal Act...letting investment and commercial banks play each other's markets, imperilling Joe Public's savings when the crash came...Greenspan has now penned what might pass for a "think piece" about China's gold reserves for Foreign Affairs magazine. But that would have taken some thought. Instead, "If China were to convert a relatively modest part of its $4 trillion foreign exchange reserves into gold," says Greenspan...ever the two-handed economist..."the country's currency could take on unexpected strength in today's international financial system." If? Could? Empty of meaning, that opening forces Foreign Affairs' editors to slap a no-nonsense strapline on Greenspan's short ramble:

Which Greenspan doesn't say it is. Not that he says it isn't. Hey, this is the Maestro. You've got to read the runes, right...?

Nothing ventured and nothing gained by this Greenspan-ese. But again, it must surely mean something. And given the rapture of $5,000 gold which would-be analysts have forecast since the People's Bank last bothered to update the world on its gold holdings in 2009, "China wants to overtake US in gold reserves" is the summary headline slapped on one write-up of Greenspan's wittering today, linked and tweeted the world over...including here. See how it works? Job done for the arch-celebrity. A few hundred words, not even guessing at what's going on, and Greenspan is front and center once more. Not least for his most pliant...and absurd...audience: Gold promoters warning you against the evils of Western central banking. Greenspan long has form here, of course. Back in 1966...when he worried Ayn Rand as a "social climber" like a dog worries sheep...he famously wrote a paper about "Gold and Economic Freedom". US reserves were depleted, and the post-WWII Bretton Woods treaty was fit to collapse. News-worthy stuff then, the essay has proved invaluable for the Janus Greenspan ever since. Because on the one hand he gets to point it out every time he's door-stepped about the Dollar's rampant devaluation. But on the other, he also saddled up his one-trick pony for monetary policy, more than two decades before he got his hands on the levers and dials at the Eccles Building:

Got it? Famously obtuse (because he wasn't in truth saying anything), the Maestro was never so clear...nor, we think, right. In the end, prices will rise thanks to the post-Alan insanity trailing in his wake at the Fed. But even here, on the subject of prices, today's Greenspan is useless, claiming that "if" Beijing moved to buy gold, it would "certainly" boost gold prices "for the rest of the world...but only during the period of accumulation." Gold, on the contrary, has sunk this week back towards 2013's crash lows. Ergo, if Greenspan's "thinking" can be trusted at all, Beijing ain't buying gold at all today. And to think self-declared gold bugs are cheering! Still, I bet he could at least raise a mortgage. Not that he needs to. What a legacy to leave his disciples... |

| Bullish dollar has negative implication for commodities Posted: 03 Oct 2014 10:30 AM PDT The latest thermal coal market trading research note from Marex Spectron on the outlook of the coal market. |

| Posted: 03 Oct 2014 10:15 AM PDT With silver prices going down, down down, now might finally be the time for the "movers and shakers" in the mining and precious metals communities to call a major press conference to make their case and actually defend themselves from the years-long assault on their businesses. Submitted by Bill Rice Jr: As the saying goes, […] The post It’s Time to Fight Back! appeared first on Silver Doctors. |

| “Money Bubble” Predictions Coming True, Part 1: Stock Market Volatility Surges Posted: 03 Oct 2014 10:04 AM PDT In The Money Bubble: What To Do Before It Pops, James Turk and I climb out on a lot of limbs with a series of extreme predictions. This series will track the ones that are (or seem to be) working out, beginning with increasingly wild swings in US equities:

Now consider the US stock market over the past two weeks. The following table lists the daily fluctuations of the Dow Jones Industrial Average where in the space of ten trading days there have been seven triple-digit moves, for an average swing of 132 points. Mr. Market’s mood swings are getting more and more violent. More from The Money Bubble:

So the follow-on prediction is that today’s volatility, like that of 2007, will be resolved to the downside via a market crash and possibly a full-blown financial crisis sometime in the coming year. Stay tuned.

|

| Porter Stansberry: What I just discovered about our business will surprise you Posted: 03 Oct 2014 09:30 AM PDT From Porter Stansberry in The S&A Digest: We’ve been working on a big project behind the scenes here at Stansberry Research… We’ve been conducting an internal audit of our track records – since inception – across all of our newsletters. As longtime readers know, we’ve always insisted on a high level of transparency and accountability from our analysts. We conduct thorough reviews annually – our “Report Card.” We assign grades based on the nominal results achieved, factoring the risks taken and the analyst’s winning percentage. But we’ve long wondered what the multiyear results look like. I bet you’re curious about how we’ve done. And I’ll share some of our results below. I’ll also show you something very surprising about our investing over the years… something that could make you a lot richer in the years ahead. First, though, a word about our methodology. We hired two certified public accountants with audit experience at the “Big Four” accounting firms. We asked them to produce a detailed track record accompanied by the requisite backup information. We have copies of the newsletters we’ve published over the years and we were able to get third-party data from Bloomberg and other data providers to verify the prices of equities as we published them over the years. None of our writers (including me) were involved in auditing our own work. We have completed the audits of both my newsletter (Stansberry’s Investment Advisory) and Steve Sjuggerud’s letter (True Wealth). We started with these because they’re our oldest newsletters and had the longest track records. True Wealth launched in the fall of 2001. The average gain from all of its recommendations through 2013 was 21.9%. The average holding period was 476 days. That produces annualized gains over nearly 12 years of 16.8%. That is an extraordinary performance, almost double what the stock market earned as a whole over the same period. Just as importantly, Steve has only had one year (2008) where his average return from each recommendation made was negative (-2.53%). In every other year, True Wealth earned substantially positive results. Its three best years for annualized gains were 2003 (31%), 2009 (29%), and 2012 (26%). My Investment Advisory launched in the summer of 1999. The average gain from all recommendations through 2013 was 9.6% with an average holding period of 286 days, for annualized gains over roughly 15 years of 12.3%. This beats the market as a whole by around three percentage points annually. Over 14 years, that would make a huge difference in total returns. Still, my results were not nearly as good as Steve’s… or were they? We’ve both done very well for our subscribers, but Steve definitely got a big advantage in long-term results because of timing. We launched his newsletter the week of September 11, 2001. The resulting crisis sent stock prices way down. He was able to recommend a lot of high-quality investments at low prices. I’m not taking anything away from Steve – he had the foresight and the wisdom to make those recommendations. However, he wasn’t writing a newsletter during the terrible bear markets of 2000 and 2001, when my average returns were negative. Those two bad years – the only two bad years of my career – weighed down my overall results significantly. If you look at our results over matching time periods, they are almost identical. Over the past 10 years, I’ve produced annualized gains of 14% for my subscribers. Steve’s returns for the same period are 15.7%. Yes, Steve is still beating me, but the comparison is much closer. And if you measure over the past five years, I beat Steve by a fraction. Steve has produced annualized returns of 18.3% and I’ve done 19.2%. The point is, even though we made completely different recommendations – and even though we follow very different strategies – we’ve produced very similar, excellent results. Why? I think I know the reason. But first, let me show you something else… Here’s the interesting part of what we’ve found. Just like True Wealth, my newsletter’s best results came in 2003, with annualized returns of 62%. And just like True Wealth, my second-best results came in 2009, with annualized returns of 25.7%. And, like True Wealth, my third-best results came in 2012, with annualized results of 22.1%. Here’s my hypothesis. Despite our very different investment styles, both Steve and I are fundamentally conservative investors. We care a lot about buying good values and we almost never overpay for stocks of any kind, no matter how good the story sounds. That’s why our results are so similar. And that’s why we both have done the best during periods (2002, 2009, and 2012) when the stock market was bouncing back from a period of low valuations. Earning the kind of money Steve and I have made for our subscribers over the past decade will make you very rich, even assuming a moderate level of savings. Earning 16% a year in stocks while saving $10,000 per year will create a $1.1 million portfolio in 20 years. And if you want to do even better than our average result, focus on the outstanding values we write about. More importantly… wait for the market as a whole to offer you outstanding value, as it did in 2003, 2009, and 2012. It won’t be long before the market offers us another period of outstanding value. Now… as hard as it is for investors to hold onto cash and wait for great values… I’d also like to urge you to do something even more difficult: take the time and spend the money to join us in Nashville, Tennessee on October 18. It’s our last Stansberry Conference event of the year. I’m going to give a speech unlike any other presentation I’ve ever given… or will ever give again. You’ll want to say you were there. Even if you don’t care about the stunt I’m going to pull, you should come and meet former presidential candidate Dr. Ron Paul. In my view, there isn’t a more clear-thinking voice in American politics. Likewise, my friend and mentor Bill Bonner will be speaking in Nashville. Bill is the founder of Agora Inc., one of the largest and most successful publishing companies in the world. More importantly for our purposes, Bill has been writing about the global economy on a daily basis since 1999. He’s going to share his thoughts on the efficient market hypothesis, a topic he has been noodling about for 40 years. Financial expert Jim Rickards is also going to join us. Perhaps you’ve seen his new book, The Death of Money. It has become an international bestseller – one of the bestselling books ever written about global economics. Jim is convinced (as am I) that the dollar-based global monetary system is on the way out. He’ll explain what’s coming next… But not all of our presentations are “macro” in nature. As we do here in the Friday Digest, our mission at these Stansberry Conference events is to educate first and foremost. Extreme Value editor Dan Ferris is hosting a workshop on Friday (for our VIP members) with legendary hedge-fund manager Carlo Cannell. Both focus on value investing in small-cap stocks, an approach that has long proven to be the safest and most profitable sector in the stock market. And on Saturday, Dan will address the entire conference, sharing the strategies he has learned writing the world’s leading value-oriented financial newsletter since 2002. Sitting down with Dan for an hour could easily prove to be the most valuable hour of your life. I’m not kidding. That’s why I’ll be sitting in the crowd with you, taking notes. DailyWealth Trader editor Amber Lee Mason will be leading another one of our “hands on” presentations. DailyWealth Trader is one of our company’s best trading services. Amber is going to tell you about one of the few real secrets to making consistent, dependable returns in the stock market. It’s a way to make 12% a year with your savings without even trying. Here’s a hint: it has nothing to do with trading. And there’s more… a lot more that I don’t want to give away, like one of the most respected global value managers in the world who is flying in from London… and the most experienced resource financier I know telling us which commodities are buys right now. I already know why you won’t come. Plane tickets are expensive. It’s not fun to sleep in a strange hotel. Sitting in a crowd of 500 strangers is terrifying. But here’s the thing… your life is going to be exactly the same a year from now. You’ll still be making all of the same mistakes. Your investing results aren’t going to magically change. You’ll still be in the exact same rut you’re in now… unless something changes you in a dramatic way. The best ways I’ve found to grow are by meeting new people (with new ideas)… traveling to new places… and reading new books. Our Stansberry Conference events have introduced around 400 people to each other at every meeting. It has taken people to some of the most beautiful and interesting cities in the country: Miami, Dallas, Los Angeles, and up next, Nashville. And it has introduced our audience to a huge array of fascinating ideas – everything from the ethos of big-wave surfing (surfing legend Laird Hamilton) to the real value of freedom (WikiLeaks founder Julian Assange) and the physics of better batteries (Tesla cofounder J.B. Straubel). So… do it. Do it for yourself. Come meet your peers and your friends at Stansberry Research. Come learn with us. Experience a new place. Meet several hundred new friends. It will change your life. Sign up here. Crux note: We couldn’t agree more with Porter… but we also know there are readers who simply can’t attend the Stansberry Conference event this month in Nashville. Fortunately, there’s now another more convenient − and affordable − option available for you… For a small fraction of the cost of a full-priced ticket to the event, you can get your own “online access pass” and watch all the great presentations LIVE from the comfort of home (or anywhere else you choose). Your online access pass also includes free video and transcripts of all the presentations, so you can watch and re-watch them whenever you like… and as often as you’d like… even if you can’t watch the event live on October 18. Even better, if you sign up now, you’ll also receive complimentary access to all the great presentations from this year’s three previous Stansberry Conference events in Miami, Dallas, and Los Angeles. Click here now for all the details. |

| This is HUGE: Chinese Renminbi Becomes Directly Tradable With the Euro Posted: 03 Oct 2014 09:00 AM PDT The Chinese central bank, People's Bank of China, has issued a press release announcing the authorization of direct trading between the renminbi and the euro on the inter-bank foreign exchange market. This is HUGE. Submitted by Simon Black, Sovereign Man: The euro is the second most traded currency in the world, after the US dollar. The European […] The post This is HUGE: Chinese Renminbi Becomes Directly Tradable With the Euro appeared first on Silver Doctors. |

| Gold rebounds in face of geopolitical events, falling stocks Posted: 03 Oct 2014 08:39 AM PDT The U.S. Comex gold futures rebounded 0.38% to $1,215.10 during the first two days of October while the Dollar Index retreated 0.39% to 85.601. |

| Ben Bernanke just tried to refinance his house. You won’t believe what happened next. Posted: 03 Oct 2014 08:20 AM PDT From Mike “Mish” Shedlock at Global Economic Trend Analysis: In the curious news of the day, former Fed Chair Ben Bernanke was turned down in his effort to refinance his mortgage. Bloomberg reports You Know It’s a Tough Market When Ben Bernanke Can’t Refinance. Ben S. Bernanke said the mortgage market is still so tight that he’s having a hard time refinancing his own home loan. The former Federal Reserve chairman, speaking at a conference in Chicago, told moderator Mark Zandi of Moody’s Analytics Inc. − “just between the two of us” − that “I recently tried to refinance my mortgage and I was unsuccessful in doing so.” “The housing area is one area where regulation has not yet got it right,” Bernanke said. “I think the tightness of mortgage credit, lending is still probably excessive.” Questions Abound 1. Given that Bernanke makes $250,000 per speech, why does he even have a mortgage? 2. How big is it? 3. What about Bernanke’s finances? Is Bernanke living beyond his means? 4. Is there any chance Bernanke was turned down on purpose as a publicity stunt to highlight a fictitious need for looser mortgage standards? I cannot quite put my finger on it, but “just between the two of us,” something about this story does not seem exactly as presented. Perhaps I am wrong and Bernanke just firmly believes the dollar is trash and the Fed will inflate his mortgage away… |

| Posted: 03 Oct 2014 07:54 AM PDT What has served as a floor - $1,200/oz gold - opens up today, with gold trading down below. |

| New Gold Rush Cometh With Global Bond Market On Edge Of “Cliff” Posted: 03 Oct 2014 07:45 AM PDT The current U.S. bond market faces a “liquidity cliff” and looks like an asset “bubble” that could burst when interest rates start to rise, according to the senior U.S. securities regulator. This is something we have been warning of in recent months. The consequences of the bursting of the bond bubble would be rising interest […] The post New Gold Rush Cometh With Global Bond Market On Edge Of "Cliff" appeared first on Silver Doctors. |

| This could be the most important takeaway from the Bill Gross/PIMCO divorce Posted: 03 Oct 2014 07:43 AM PDT From Bloomberg: One man shook a $42 trillion bond market last week, highlighting just how vulnerable bond prices are to shocks. Bill Gross’s surprise departure on Friday from Pacific Investment Management Co. sparked selloffs in some of his biggest wagers, such as inflation-protected U.S. government bonds. The most-traded assets quickly recovered after the exit of the star trader, who dominated the $2 trillion asset manager’s investment strategy. But the less-traded ones are still feeling the effects, according to David Leduc, chief investment officer at Standish Mellon Asset Management Co. “What you’re seeing most of is a lack of liquidity in the bond market,” said Christopher Orndorff, a money manager at Western Asset Management Co. “When you get a dislocation like this, it tends to exacerbate price movements maybe more than what you’d have seen 10 years ago.” One person − even a really important person − pushing around borrowing costs for nations and companies worldwide, however briefly, shows the increasing fragility of credit markets that have swelled on the heels of trillions of dollars of central-bank stimulus. Debt still largely changes hands off exchanges, through telephone calls and e-mails. Trading Slump It’s become increasingly difficult to buy and sell debt as new regulations prompt Wall Street banks to curtail their holdings. Average daily trading in the U.S. bond market fell to $809 billion in 2013 from $1.04 trillion in 2008, according to data compiled by the Securities Industry & Financial Markets Association. Banks are less willing to cushion big swings using their own balance sheets and Gross’s exit shows just how little it takes to move the needle in the global bond market, which has ballooned by 48 percent since 2008. The day Gross left Pimco to join Janus Capital Group Inc. (JNS), Mexican government bonds declined 0.3 percent, inflation-protected U.S. bonds lost 0.4 percent and debt of Verizon Communications Inc. (VZ) − one of his bigger company holdings − dropped 0.3 percent. That compares with a 0.05 percent decline on the Bank of America Merrill Lynch Global Broad Market Index. The moves also illustrate the dominance of the world’s biggest bond fund in a market where dealers’ roles are shrinking. While some investment firms, such as Vanguard Group Inc., have closed bond funds to new investors over the past few years when they got too big, Pimco allowed the Total Return fund to swell to as much as $293 billion. Withdrawal Concern “The impact of Total Return (PTTRX)’s size remains a question that Morningstar continues to study and examine,” Morningstar Inc. analysts Eric Jacobson and Bridget Hughes wrote in a Sept. 29 report. While not all the weak spots in the market were due to Gross, investors were concerned that either a new management strategy at the Newport Beach, California, firm, or withdrawals could direct money away from his bigger trades. “Less liquid sectors such as TIPS continued to weaken as a result of Pimco concerns,” Leduc wrote in a Sept. 30 note. “There has not been measurable impact in most liquid sectors.” Almost six years of near-zero interest rates from the Federal Reserve has suppressed volatility in stocks and government notes, yet the values of some of the least-traded securities have started swinging more in the past few months as investors prepare for rising interest rates by shedding riskier debt. Junk Rout Junk bonds, for example, plunged 2.1 percent in September, the most since hysteria mounted in June 2013 that rates would rapidly rise as the Fed curtailed its asset purchases. In August, the securities gained 1.5 percent after tumbling 1.3 percent in July, according to a Bank of America Merrill Lynch index of dollar-denominated debt. Record monetary stimulus has fueled gains of 30 percent on bonds globally since the end of 2008 and concern is mounting about what happens when borrowing costs increase. Flows may reverse, causing losses that spur others to sell, and resulting in a spiraling selloff. The effects of Gross’s departure from Pimco will probably fade away soon enough. The inability to quickly trade in many parts of the debt market is the bigger issue. |

| Jobs Reports Sends Dollar Soaring Posted: 03 Oct 2014 07:17 AM PDT It is quite entertaining reading the barrage of emails that regularly hit my inbox detailing over and over and over, the certain demise of the US Dollar. More often than not, it is the usual gold bug chatter about China buying up all the world's gold to make the yuan the new global reserve currency. If not that, it is the regional trading agreements bypassing the Dollar which are going to certainly knock the greenback from its throne. Such things may or may not happen but the point is we have a huge throng of perma gold bulls who continue hanging on to their gold as they have been told that "any day now it is going to launch higher and one does not want to miss the bull move by not having a position". "Once the Dollar goes", so the chatter states, "gold is going to skyrocket". Based on today's surprisingly strong jobs report, that day is going to be postponed for a while longer. Here is a look at the chart of the US Dollar. Note it has run to the resistance zone I have drawn in on the chart. It is already well past any remaining Fibonacci retracement levels drawn off the June 2010 peak meaning that it is on track for a test of that level up near 89 if it can convincingly clear the 87 level. We'll see if it can manage that but for now, those who have wrongly bet against the Dollar are not looking especially wise at the moment. I wonder what happened to "Mr. Massive Gold buying is taking place". He is especially looking more and more comical with the passing of each week. Please understand those charlatans who keep up with their nonsense have opened themselves up to the scorn that they rightfully deserve among fair-minded and objective people who are trying to read and decipher today's very challenging financial markets. It is one thing to misread a market. We all do that including yours truly as we are all mere mortals at best. However, to persist day after day, week after week, month after month, year after year, with the same utterly discredited rubbish and unverifiable reckless claims, misleading many innocent and sincere people, is simply inexcusable. There comes a time to admit one has been wrong, apologize to those who have been misled and simply go away or close down the various propaganda sites. Maybe then their victims can get on with their lives and try to recoup their losses having learned a valuable, but extremely expensive lesson that they will never forget as long as they live here on this globe. There is an old traders' adage that goes something like this: "The first loss is the best loss". What it means is that once you realize that a trade or an investment has gone sour, you get out - the sooner the better. That first loss, taken early rather than later, leaves a welt but it does not end up obliterating you. Oh that some had learned this lesson and ignored all the "opinions" from the many self-proclaimed experts. Shifting back briefly to the currency front for a moment - it all goes back to interest rate differentials. The strong jobs number has lent further credence to those who are expecting the Fed to move on the interest rate front sometime next year. Yesterday we heard from the ECB and Mr. Draghi that interest rates in the Eurozone are not going anywhere ( except maybe even lower if that is possible) anytime soon. By the way, the notion that the Euro would be higher were it not for the sanctions imposed on Russia is a canard dreamed up by those who cannot read a price chart nor have apparently been listening to Mr. Draghi who has been making it abundantly clear for some time now that Europe wanted a lower currency. Here is the Euro chart. It is falling through chart support levels like a hot knife through butter at this point. There looks to be some mild psychological support near the 1.240 level but more serious support does not materialize until closer to 1.2273 or so. If it goes through that, it is going to 1.2000. more later... busy morning... |

| Where are the Stops? Friday, October 3: Gold and Silver Posted: 03 Oct 2014 07:05 AM PDT kitco |

| Metals market update for October 3 Posted: 03 Oct 2014 06:50 AM PDT Gold fell $0.80 or 0.07% to $1,213.80 per ounce and silver slipped $0.08 or 0.47% to $17.10 per ounce yesterday. |

| New gold rush after bond bubble bursts Posted: 03 Oct 2014 06:46 AM PDT The consequences of the bursting of the bond bubble would be rising interest rates, which would likely impact property and stock markets and benefit safe haven gold bullion, writes Goldcore's O'Byrne. |

| Gold Stocks: Time to Buy or Will They Get Worse? Posted: 03 Oct 2014 06:45 AM PDT Gold has fallen from over $1,300 in mid-August to around $1,200 per ounce as of October 3, dragging many gold-related stocks down with them. Should cautious investors steer clear of the sector for now? Or is this an opportunity to buy gold stocks? Submitted by Henry Bonner, Sprott’s Thoughts: Steve Todoruk joined Rick Rule at Sprott […] The post Gold Stocks: Time to Buy or Will They Get Worse? appeared first on Silver Doctors. |

| Greenspan hints at a gold backed Yuan in China and considers gold the ‘ultimate’ money Posted: 03 Oct 2014 05:59 AM PDT |

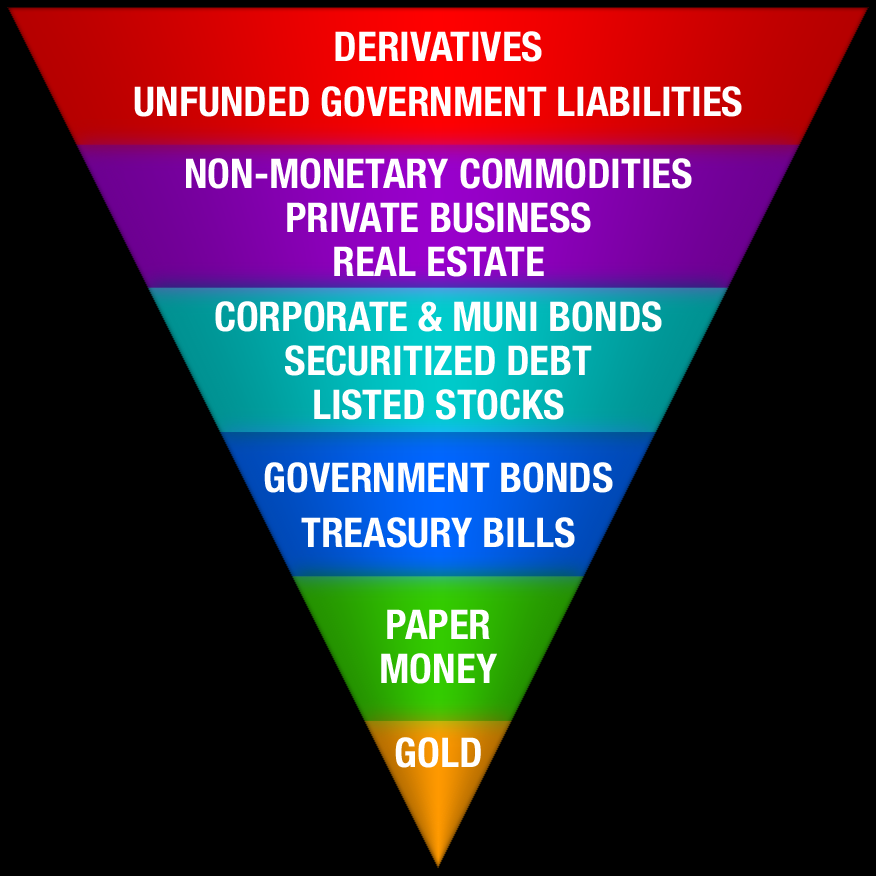

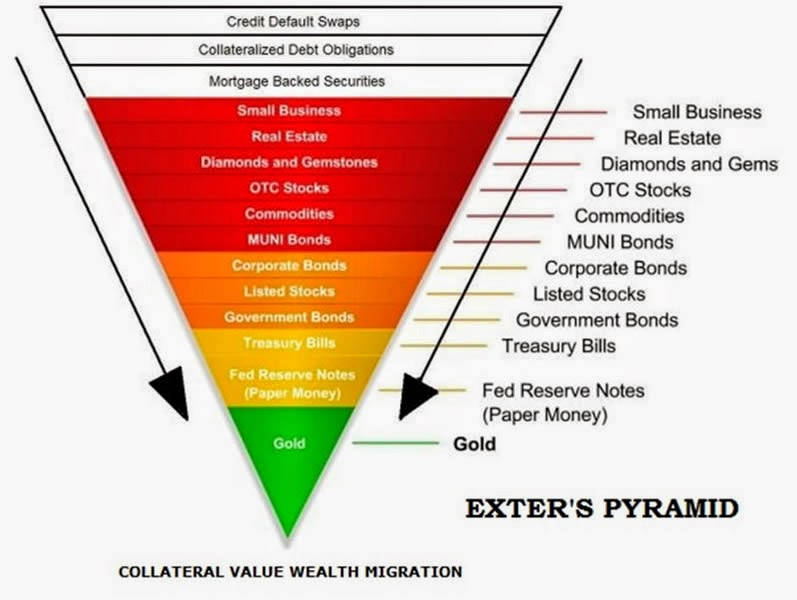

| Gold and Silver Rush Cometh With Global Bond Market On Edge Of “Cliff” Posted: 03 Oct 2014 05:08 AM PDT Bond Market “Armageddon” Cometh. The current U.S. bond market faces a “liquidity cliff” and looks like an asset “bubble” that could burst when interest rates start to rise, according to the senior U.S. securities regulator. Own gold and silver .

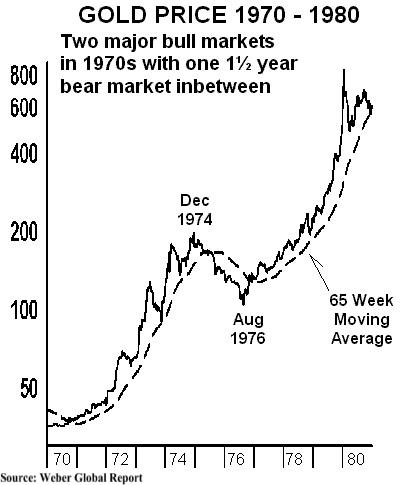

The current U.S. bond market faces a “liquidity cliff” and looks like an asset “bubble” that could burst when interest rates start to rise, according to the senior U.S. securities regulator. This is something we have been warning of in recent months. The consequences of the bursting of the bond bubble would be rising interest rates, which would likely impact property and stock markets and benefit safe haven gold bullion. Securities and Exchange Commission (SEC) Republican member Daniel Gallagher said over a year ago that the $3.7 trillion municipal bond market may suffer”Armageddon” once interest rates climb. The Fed has continued ultra loose monetary policies and debt monetisation for more than six years now. It has kept its benchmark interest rate near zero since December 2008. The Fed already employed three quantitative easing rounds buying up bonds to help stimulate the U.S. economy after the financial crisis. The Fed maintains that the program will end this month and many investors expect the Fed to move to a tighter monetary policy. However, we believe that if the Fed increases rates, it would likely lead to a sharp recession and possibly a Depression. It would also likely lead to serious volatility in markets and the risk of a triple stock, bond and property crash. There has been jitters in bond markets in recent days. PIMCO saw $448 million in fund outflows last Friday. Bill Gross's departure from PIMCO to join Janus Capital Group is being blamed for some of the jitters but it may be that investors internationally are concerned about over valuation in bond markets and heading for the exits – before the stampede begins. Given concerns about the crisis on global bond markets and indeed the wider financial system, it is worth remembering one of the greatest central bankers of the modern era, John Exter and his insightful 'golden pyramid' (see above and below). John Exter is known for creating Exter’s Pyramid, also known as Exter’s Golden Pyramid and Exter’s Inverted Pyramid. John Exter (September 17, 1910 – February 28, 2006) was a highly respected American economist, member of the Board of Governors of the United States Federal Reserve System, and founder of the Central Bank of Sri Lanka. His golden pyramid allowed for the visualisation and the organisation of assets and asset classes in terms of risk and size. Exter rightly believed that gold is the safest asset and therefore gold forms the small base as the most reliable value and the asset classes on progressively higher levels are more risky. The larger size of asset classes at higher levels is representative of the higher total worldwide notional value of those assets. While Exter’s original pyramid placed Third World debt at the top, today derivatives hold this dubious honor. Exter was highly respected for his great intellect and he also had all the mainstream credentials. He was Harvard educated, a Federal Reserve economist, a member of the Council of Foreign Relations and quite unusually among mainstream insiders, Exter believed in gold as money and a store of value. He was a friend of the great Austrian economist, Ludwig von Mises. and debated the inflation versus deflation argument all the time with von Mises. Given the huge levels of government debt throughout the developing and developed world, global bond markets today are multiple times bigger than they were in the 1970s when Exter created his pyramid. In the event of another global financial crisis which we see as quite likely, capital will again flow from the riskier assets at the higher levels of the pyramid into the base of safe haven gold. While bonds were the beneficiary of the last financial crisis, they may be the nexus of the next financial crisis. The stock of assets in the world today is multiple times bigger than it was in the 1970s and thus, gold appears very undervalued. Should we see capital flight from U.S. and global bond markets, gold should see gains on a par with those seen in the second half of bull market in the 1970s. Many said that gold's bubble had burst when it fell from $200 to $100 per ounce from December 1974 to August 1976. "Experts" warned that gold would fall as interest rates rose. The opposite happened and as interest rates rose, gold rose more than 8 times in 3 years and 4 months, to $850 in January 1980. History does not repeat but frequently rhymes. GOLD IN Q4 – CNBC SURVEY This is particularly the case if the bombing campaign leads to a wider military conflict between Syria and Israel, Iran and Israel or a combination thereof. There is also the not inconsiderable risk of terrorism and a major act of terrorism in the UK, U.S. or elsewhere in western world. A “September 11″ style event would quickly make market participants realise the importance of gold as a diversification in a portfolio. This has been forgotten about recently due geopolitics failing to impact on asset markets and due to the outperformance of equities, bonds and property. It is worth remembering that gold was dismissed as a safe haven during a similar bout of "irrational exuberance" at the turn of the century prior to September 11, the potentially never ending war on terrorism and the resumption of history. It is also important to remember that gold was dismissed as a safe haven in the 2005 to 2007 period prior to the collapse of Lehman and the global financial crisis. The penny is slow to drop for more speculative market participants. Has the Russia-Ukraine crisis shown us that gold simply is not the safe-haven that it once was? Focussing on very short time frames and data sets can lead to erroneous conclusions. Do Asian buyers start returning to the market, and do investor ETF inflows start picking up? There is already evidence that demand has picked up significantly in India and China. The world's largest bullion buyer, China imported more gold in September than in the previous month due to demand from retailers stocking up for the current National holiday. In the last month, withdrawals from the SGE have totalled over 170 tonnes – this suggests an annual rate of over 2,200 tonnes. “The physical volumes have been high this month compared to August. I would say imports could be at least 30% higher than last month,” a trader with one of the 15 importing banks in China told Reuters. Meanwhile, demand in India – the second biggest buyer of gold – has also picked up significantly in recent days as the festival and wedding season began in earnest. How strongly correlated will gold be with the dollar in Q4? Before last week's very slight fall, the dollar had risen for 10 weeks in a row, the first time for 40 years. It appears overvalued in the short term and looks ripe for a correction. Gold traditionally has a strong inverse correlation with the dollar. However, there have been bouts of dollar strength coinciding with gold strength which saw gold rise sharply in euros, pounds and other currencies. This is a possibility in the coming months. More likely are competitive currency devaluations and currency wars. Central banks are unlikely to allow one currency to rise too sharply versus another as it creates deflationary risks for the appreciating currencies economy. A resumption of currency wars seems likely either in Q4 or in 2015 and in the coming years. Where does gold average in Q4 vs. Q3? MARKET UPDATE Gold in Singapore ticked lower from $1,214 per ounce to over $1,207 per ounce and gold remains weak and at these levels in late morning trade in London. Gold fell $0.80 or 0.07% to $1,213.80 per ounce and silver slipped $0.08 or 0.47% to $17.10 per ounce yesterday. Gold in Euros – 2 Years (Thomson Reuters) It is important to note that gold's falls continue to be primarily in dollar terms and that gold in euros and pounds has seen only minor falls. Indeed, gold in euros remains nearly 10% higher for the year and has risen from €876 per ounce at the start of the year to over €956 per ounce today. Gold in British pounds has risen from £727 to £750 per ounce for a gain of 3.3%.

Physical demand remains robust in Asia and we are seeing a pick up in western markets now too. Data from the U.S. Mint and Perth Mint show that safe haven bullion coin buying returned in September as western demand increased. The U.S. Mint sold over 50,000 ounces of American Eagle gold coins so far in September, its highest monthly sales since January. The Perth Mint’s sales of gold coins and bars hit their highest in nearly a year in September. Sales of gold bullion coins and minted bars rose to 68,781 ounces in September, their highest since October 2013. The world's largest bullion buyer, China imported more gold in September than in the previous month due to demand from retailers stocking up for the current National holiday. In the last month, withdrawals from the SGE have totalled over 170 tonnes – this suggests an annual rate of over 2,200 tonnes. “The physical volumes have been high this month compared to August. I would say imports could be at least 30% higher than last month,” a trader with one of the 15 importing banks in China told Reuters.

Meanwhile, demand in India – the second biggest buyer of gold – has also picked up significantly in recent days as the festival and wedding season began in earnest. Prithviraj Kothari, vice president of the India Bullion & Jewellers’ Association told the Reuters Global Gold Forum in an interview that there is currently "huge physical demand in India in every sector." Indian demand may be double that of last year, he believes. Gold ETF inflows are likely to resume as silver inflows have already done. Speculators continue to sell paper and electronic gold while prudent buyers in China, India and elsewhere continue to accumulate physical bullion. This dichotomy can only last for so long before the powerful forces of actual physical demand in the small physical gold market lead to higher prices.

|

| New Gold Rush Cometh With Global Bond Market On Edge Of “Cliff” Posted: 03 Oct 2014 05:01 AM PDT gold.ie |

| Gold Coin Demand Up, Silver Relatively Better Posted: 03 Oct 2014 05:00 AM PDT As gold and silver prices are going down, demand for coins are going up. Shouldn’t things be the other way around? Perth Mint announced that gold coin demand has hit the highest point in the last 11 months. Bloomberg reports Gold Sales at Perth Mint Reach 11-Month High as Prices Retreat:

The same article points out that the U.S. Mint, the largest Mint in the world, sold 58,000 ounces of American Eagle gold coins in September from 25,000 ounces in August and 13,000 ounces a year earlier. When look at silver coins it becomes even more interesting. This chart comes from Sharelynx (the most extended resource for data related to the precious metals market). It shows how silver coin sales, expressed in dollar value (not in number of coins sold), is as high as gold coin sales. Why is this an interesting evolution? Because the price of silver has decreased faster than the one of gold, evidenced by the gold to silver ratio standing at 61 early this year and 71 today. The red line is clear: as of 2013, when the futures market has been pushing precious metals prices significantly down, the physical market has been reviving every time again. Although safe haven demand for gold coins has gone up, silver has done even better in relative terms given an increasing gold to silver price ratio.

|

| Yamana Gold hits record quarterly production Posted: 03 Oct 2014 04:55 AM PDT Preliminary third quarter production for Yamana Gold was up 27% year-over year. |

| Iamgold to sell niobium mine for $500m Posted: 03 Oct 2014 04:46 AM PDT Iamgold has said Magris Resources is to buy an asset that has never really fit well in a gold focused company. |

| Posted: 03 Oct 2014 04:35 AM PDT Gold traded under $1,210/oz this morning bumping close to what lately has been a $1,200 floor. |

| Our obsession with monetary stimulus will end in disaster Posted: 03 Oct 2014 03:05 AM PDT |

| Another Sign Of Gold Moving Back Into The Financial System Posted: 03 Oct 2014 03:00 AM PDT This article appeared on Sovereignman.com on October 2nd. We are reprinting this in its entirety because it is a must-read. In 1324, Mansa Musa, the tenth emperor of the Mali Empire, set off from Western Africa on his pilgrimage to Mecca.This was no Spartan journey. He was accompanied on his way by a procession of 60,000 men and 12,000 slaves, each of whom carried up to four pounds in gold bars. Musa is might just have been the richest person of all time, with an accumulated wealth estimated at $400 billion valued in today's increasingly worthless dollars. But it wasn't just kings and emperors who held gold. Gold has been the most widely-used medium of exchange in world history… across all points of the globe. Ibn Battuta was a 14th century traveler and explorer whose famous grand adventure spanned 75,000 miles over the course of 24 years, much like Marco Polo's. Everywhere he traveled– North Africa, Middle East, Central Asia, India, Southeast Asia, China – gold was either the dominant currency or an easily accepted medium of exchange.This barbarous relic has stood the test of time across cultures around the world for millennia as a form of wealth. Most people in the West have completely lost sight of this. They view the value of gold through the lens of paper currency, i.e. an ounce of gold is 'worth' 1,215 US dollars. This is a deeply flawed perspective. Looking at the gold price moving up and down in US dollars is something like sitting in a rowboat on choppy waters believing that it's the beach that's moving up and down. Einstein might say that it's all relative, but only one has any real stability. But perspectives can and do change. There once was a time when most people believed that the entire universe revolved around the Earth. This was flawed (and arrogant) view, and it was eventually corrected. Thinking that the global economy revolves around the US dollar is just as flawed and arrogant. And it will soon be discredited just the same. History tells us that dominant monetary systems invariably have an expiration date. From the Byzantine solidus to the British pound, this is especially true when a superpower enters into decline and plays destructive games with its currency. Today's system where an unelected central banking elite conjures trillions of dollars and euros out of thin air is no different. It has an expiration date too. Change is never easy. People don't like it, and will resist change even if their current situations are terrible. Inertia is the most powerful force in the universe after all. Desirable or not, it's happening. The US dollar's days are numbered. Now, gold, with its millennia-long history is making a comeback. We're not just talking about it as a store of wealth or a speculation, but as a regular form of currency. Moving us back in this direction, Singapore Exchange launched a new arrangement this week where institutional-sized gold contracts will settled not in cash, but in 1kg bars of gold. This means that each of these contracts is intended to deliver and store gold in Singapore on behalf of large financial institutions, central banks, and even governments. Sure, Singapore wants to advance itself as THE gold hub of Asia. We've been writing to our premium members about this for years. But more importantly, it's quite telling that major insiders within the financial system itself are pursuing this contract. They're effectively setting up a new system, in Asia, to afford governments and central bankers the opportunity to trade in their US dollars for something real. Just like yesterday's post about the renminbi / euro convertibility, this is truly a canary in the coalmine moment for the future of the US dollar… as well as gold's emerging role in the financial system of tomorrow. |

| Posted: 03 Oct 2014 02:15 AM PDT investing |

| Great Panther Silver Announces Filing of Preliminary Base Shelf Prospectus Posted: 03 Oct 2014 02:10 AM PDT marketwired |

| Goldcorp makes first gold pour at Eleonore Posted: 03 Oct 2014 12:54 AM PDT Within a three-month period this year Goldcorp has launched two major gold mines on schedule and in line with capital cost guidance. |

| African Bank just the start of loan deluge Posted: 02 Oct 2014 11:16 PM PDT The August collapse of African Bank Investments Ltd. as its loans soured was only the beginning of South Africa’s bad-debt cycle. The country’s four-biggest lenders are preparing for a flood of bad debts as the economy sputters and markets bet the central bank will keep raising interest rates after 75 basis points of increases since January. A gauge showing the percentage of bank loans that might not be fully repaid rose to the highest level in at least four years, according to PricewaterhouseCoopers LLP research last month. “Impairments in the unsecured portfolios have been increasing,” David Hodnett, Barclays Africa Group Ltd.’s chief financial officer, said in an e-mailed response to questions on Oct. 1. “We don’t expect the improvements of the current year to continue next year, because the consumers remain under pressure. We have increased our general provisions.” The nation’s unsecured lending market is being squeezed between growth at the weakest level since the 2009 recession and rising rates as inflation feeds off a 6.3 percent drop in the rand this year. In the six months through June, banks recorded an average increase of 1.2 percent in non-performing loans compared with a year earlier, according to PwC’s local unit. The firm’s measure of loans by the four biggest banks that may not be repaid rose to 43.2 percent by end-June. This Bloomberg article appeared on the South African website moneyweb.co.za very early Friday morning local time---and I thank California reader Ray Wiberg for bringing it to our attention. |

| China is Hong Kong’s future – not its enemy Posted: 02 Oct 2014 11:16 PM PDT The upheaval sweeping Hong Kong is more complicated than on the surface it might appear. Protests have erupted over direct elections to be held in three years’ time; democracy activists claim that China’s plans will allow it to screen out the candidates it doesn’t want. It should be remembered, however, that for 155 years until its handover to China in 1997, Hong Kong was a British colony, forcibly taken from China at the end of the first opium war. All its 28 subsequent governors were appointed by the British government. Although Hong Kong came, over time, to enjoy the rule of law and the right to protest, under the British it never enjoyed even a semblance of democracy. It was ruled from 6,000 miles away in London. The idea of any kind of democracy was first introduced by the Chinese government. In 1990 the latter adopted the Basic Law, which included the commitment that in 2017 the territory’s chief executive would be elected by universal suffrage; it also spelt out that the nomination of candidates would be a matter for a nominating committee. This proposal should be seen in the context of what was a highly innovative – and, to westerners, completely unfamiliar – constitutional approach by the Chinese. The idea of “one country, two systems” under which Hong Kong would maintain its distinctive legal and political system for 50 years. Hong Kong would, in these respects, remain singularly different from the rest of China, while at the same time being subject to Chinese sovereignty. In contrast, the western view has always embraced the principle of “one country, one system” – as, for example, in German unification. But China is more a civilisation-state than a nation-state: historically it would have been impossible to hold together such a vast country without allowing much greater flexibility. Its thinking – “one civilisation, many systems” – was shaped by its very different history. This very interesting opinion piece was posted on theguardian.com Internet site at 7:45 p.m. BST on Tuesday evening---and my thanks go out to reader B.V. for bringing it to my attention---and now to yours. It's worth reading if you have the time---and the interest. But regardless of whether you read this article or not, the link to the First Opium War [and its effect on the silver market] in the first paragraph falls into the absolute must read category. |

| Mecca gold sales down as pilgrims still recovering post Arab Spring Posted: 02 Oct 2014 11:16 PM PDT Saudi Arabia's retail gold merchants used to look forward to brisk sales during the annual hajj pilgrimage to Mecca but lingering economic hardships since the Arab Spring have left shops eerily empty this year, retailers said. Traditionally, Arab visitors to the Muslim holy city generated the bulk of jewellery sales during the hajj period, buying necklaces, rings and bracelets as gifts to take home. But jewellery shops just outside the Grand Mosque, Islam's holiest site, were almost completely empty on Thursday, a day before the official start of the pilgrimage on Friday. Salesman sipped tea and read newspapers behind their counters, but there were few customers to be seen. This Reuters article, filed from Mecca, appeared on their Internet site at 5:53 a.m. EDT yesterday morning---and I thank Manitoba reader U.M. for finding it for us. |

| India Gold imports at 16-month high Posted: 02 Oct 2014 11:16 PM PDT The festive season rejuvenated the otherwise dull business of the Pitrupaksh period last month as the state saw its highest gold imports in the last 16 months in September - over 20 metric tonnes (MT). A relaxation in import curbs by the NDA government, fall in international gold prices and high demand have led to record imports in the state. For the second month, gold imports crossed double-digits since June last year when restrictions on gold imports were imposed by the Central government. According to the latest figures, 20.8 MT of gold was imported in September 2014 compared to 0.153 MT in the same period in 2013. In June this year, 17.311 MT of gold was imported following Reserve Bank of India's (RBI) decision to provide conditional relief in gold import restrictions by allowing STAR trading houses to import gold. In 2013-14, only 92 MT of gold were imported in comparison to 193 MT in 2012-13, making it the lowest amount in the past five years."India is one of the biggest consumers of gold in the world and after restrictions were imposed, imports fell to record lows leading to a correction in international gold prices. From $1,300 per ounce (31.99 ounce= 1kg), gold prices in the international market came down to $1,207 per ounce," said Monal Thakkar, president, Amrapali Industries. |

| New futures contract to help gold delivery in India Posted: 02 Oct 2014 11:16 PM PDT Multi Commodity Exchange (MCX), India's leading commodity exchange, has launched fresh futures contracts in bullion, base metals and farm commodities for the 2015 calendar year, on October 1. The Forward Markets Commission, the regulator, has granted permission to the bourse to launch the new futures contracts for next year. New contracts in commodities such as gold, silver, aluminium, lead, nickel, zinc, copper, crude oil, crude palm oil, and other farm products has been launched. Traders said the commodity bourse could see a sizeable quantity of gold delivery early this month, with jewellers still encountering some difficulty in procuring the precious metal from banks. A sharp jump in warehouse stock position of gold was noticed on the MCX from 59 kilograms on September 27, to 594 kilograms on September 29. The MCX futures contract for gold expires on October 5. This gold-related news item, filed from Mumbai, was posted on the mineweb.com Internet site yesterday---and it's the second contribution in a row from reader U.M. |

| Gold sales at Perth Mint reach 11-month high as prices retreat Posted: 02 Oct 2014 11:16 PM PDT Gold sales from Australia's Perth Mint, which refines all the bullion output in the world's second-biggest producer, climbed 89 percent in September to the highest level in almost a year as prices declined. Sales of gold coins and minted bars rose to 68,781 ounces from 36,369 ounces in August and the most since October 2013, according to data from the mint compiled by Bloomberg News. Sales were about 68,487 ounces in September 2013, data show. This very brief news item, filed from Melbourne, was posted on the Bloomberg website at 12:50 a.m. Mountain Daylight Time yesterday---and I found it over at the gata.org Internet site. Bron Suchecki over at The Perth Mint had a short comment and chart on September sales figures---and that is linked here. |

| High-Frequency Trader Indicted for Manipulating Commodities Futures Markets Posted: 02 Oct 2014 11:16 PM PDT "Once again the HFT boyz are really sticking it platinum" ¤ Yesterday In Gold & SilverThe gold price rallied almost from time that New York opened on Wednesday evening, but shortly after 11 a.m. on their Thursday morning in Hong Kong, the price showed signs of getting carried away to the upside---and as I mentioned in The Wrap yesterday, it appeared that someone hit the "Buy the dollar index/sell the precious metals" button---and that was that. The low of the day came shortly after 1 p.m. BST in London---and about fifteen minutes before the Comex open. The price chopped higher from there---and was obviously running into resistance at just about every up tick, with the New York high comings shortly after 12 o'clock noon EDT. That rally got sold down until shortly before 1 p.m. -----and the price traded pretty flat from there into the 5:15 p.m. electronic close. The high and low were recorded by the CME Group as $1,224.00 and $1,209.10 in the December contract. Gold finished the Thursday session at $1,214.30 spot, up only $1.30 on the day---and obviously well of its high. Net volume was around 143,000 contracts, about the same volume as Wednesday. After the down tick at the open in New York on Wednesday evening, silver's high of the day came at the same time as gold's, just minutes after 11 a.m. Hong Kong time, with the low of the day coming at, or just after, the London p.m. silver fix. The subsequent rally didn't amount to much---and from there, the price traded sideways into the 5:15 p.m. close. The high and low ticks were reported as $17.35 and $16.93 in the December contract. Silver closed yesterday afternoon in New York at $17.095 spot, down 8 cents from Wednesday. Net volume was 39,500 contracts. The high in platinum also occurred minutes after 11 a.m. Hong Kong time---and it was all down hill into its low that came around 10:20 a.m. EDT. After that, the price didn't do much. Platinum was closed lower by 12 bucks. It was the same for palladium, except the down hill slide ended at the 1:30 p.m. EDT Comex close---and it traded flat from there, down 8 dollars from Wednesday. Thursday was the first day in many weeks that there hasn't been a new low tick set in any of the precious metals. The dollar index closed late on Wednesday afternoon in New York at 85.91---and then headed sharply lower starting around 6:30 p.m. in New York Wednesday evening. As I mentioned before, someone with deep pockets was there to catch the proverbial falling knife shortly after 11 a.m. in Hong Kong as the dollar index was about to take out 85.50 to the downside---and that's when the rallies in all four precious metals got capped---and their respective declines commenced. From there, the dollar index rallied back to almost unchanged by the London open, but at that point it chopped lower for the remainder of the Thursday session, finishing the trading day at 85.61---down 30 basis points. Despite the decent decline in the dollar index, JPMorgan et al made sure that all four precious metals closed lower on the day regardless of that fact. Here's the 3-day chart that shows all the action, starting right at the 6 p.m. open on Thursday evening. The gold stocks opened slightly in the black, but began to chop lower immediately, with their lows of the day coming at precisely 1:00 p.m. EDT. From there they shot higher---and back into positive territory, but stopping just short of breaking through the 200 mark on the HUI for second time in as many days, as the rally topped out minutes after 2 p.m. EDT. They chopped lower until 3:40 p.m.---and then rallied sharply into the close. The HUI finished the day up 1.19%. The silver equities barely opened in positive territory---but then headed lower with a vengeance. By 1 p.m. EDT, they were down more than 2 percent, but rallied sharply back into positive territory, with the high of the day coming around 2:15 p.m. They slid back into the red from there---and Nick Laird's Intraday Silver Sentiment Index closed down another 0.66%. The CME Daily Delivery Report for Day 3 of the October delivery month showed that zero gold and 42 silver contracts were posted for delivery within the Comex-approved depositories on Monday. Jefferies was the short/issuer on all 42 contracts---and Canada's Scotiabank stopped 24 of them. The link to yesterday's Issuers and Stoppers Report is here. The CME Preliminary Report for the Thursday trading session showed that there are 2,240 gold contracts still open in October, down 70 contracts from Wednesday. In silver, there are 213 contracts [minus the 42 contract mentioned above] still left in October, unchanged from Wednesday's report. There was another withdrawal from GLD yesterday. This time it was 38,461 troy ounces. There was a smallish withdrawal from SLV as well---151,464 troy ounces---which certainly looked like it could have been a fee payment of some type. Joshua Gibbons, the "Guru of the SLV Bar List" updated his website with the weekly report from the iShares.com Internet site for their week ending at the close of trading on Wednesday---and this is what he had to say: "Analysis of the 01 October 2014 bar list---and comparison to the previous week's list :: 3,164,464.4 troy ounces were added (all to Brinks London). No bars were removed or had a serial number change." "The bars added were from: Solar Applied Materials (1.6M oz), Yunnan Copper (0.5M oz), Kazakhmys (0.4M oz)---and 5 others." "As of the time that the bar list was produced, it was overallocated 78.9 oz." "All daily changes are reflected on the bar list, except a 4,075,207.6 oz deposit on Tuesday night. Again, about 2.8M oz of the deposits appear to be fresh bars (never in SLV before)." The link to Joshua's website is here. The U.S. Mint had another sales report yesterday. They sold 2,000 troy ounces of gold eagles---and another 500,000 silver eagles. During the last three business days, the U.S. Mint has sold 2,415,000 silver eagles---and as Ted Butler pointed it, it's pretty much a given that the 'big buyer' is back---and it remains to be seen how much more they purchase during the the remainder of the month. It's also an excellent bet that they're vacuuming up every silver maple leaf that the Royal Canadian Mint has been producing for the last few months as well. Third quarter Canadian mint sales won't be posted on their website until late this month, or early next month. The Perth Mint also had a monster September in precious metal sales---and there's a story about that in the Critical Reads section below. It was a pretty quiet day in both gold and silver over at the Comex-approved depositories on Wednesday. In gold, there was 13,568 troy ounces reported received---and 16,135 troy ounces shipped out. The link to that activity is here. In silver, only 1,978 ounces were received---and 144,805 troy ounces shipped out the door. The link to that activity is here. Here's a photo that Australian reader Wesley Legrand sent my way last night. It shows some of the gold items that were on display at the Gold Congress in Beijing about a month ago. I stole the photo from a gold commentary that will appear in this column tomorrow. Once again I don't have all that many stories for you today---and the final edit is yours. ¤ Critical ReadsSEC's Gallagher: Bond Bubble Puts Small Investors at RiskThe $10 trillion U.S. corporate bond market has been inflated by companies taking advantage of record low interest rates for the last five years, Securities and Exchange Commission member Daniel M. Gallagher said Wednesday. “It clearly looks like a bubble,” Gallagher said at a market structure conference sponsored by the Security Traders Association. “You have a buildup of assets and you have to think about the downside if the bubble gets pricked.” Retail investors would be most vulnerable to a sell-off that could result after the Federal Reserve raises interest rates and prices of outstanding bonds fall, Gallagher said at the conference in Washington. Banks have curtailed their fixed-income holdings as they seek to comply with new capital rules and Volcker Rule restrictions on risky bets. About a quarter of corporate debt is owned directly by retail investors, and 73 percent of the $3.2 trillion of outstanding municipal debt is owned by small investors, he said. Today's first story showed up on the moneynews.com Internet site at 5:47 p.m. EDT on Wednesday afternoon---and it's courtesy of West Virginia reader Elliot Simon. Is the New York Fed a Pushover for Big Banks? Dudley Fires BackWilliam C. Dudley, president of the Federal Reserve Bank of New York, defended his bank-supervision staff following allegations that they had been too deferential to large financial firms. “I completely stand behind the integrity and work of our supervision staff,” he said after a speech today in New York. “They are operating completely in the public interest.” Dudley’s remarks, his first addressing allegations of lax supervision aired last week by former employee Carmen Segarra, highlight the New York Fed’s difficulties in overcoming perceptions that it’s too close to Wall Street. “This is a zero-credibility era for big banks and their regulators,” said Karen Shaw Petrou, managing partner of Federal Financial Analytics, a research firm in Washington. As a result, stories like Segarra’s “have a lot of resonance regardless of their truth,” she added. That's a real classy thing to when all else fails---and that's trash the messenger, along with the message. But what else can one expect from the top whores in the banking system---and on Wall Street? This Bloomberg news item appeared on their website at 3:52 p.m. Denver time yesterday afternoon---and I thank reader U.D. for sharing it with us. Ask the Expert – Dr. Paul Craig Robert: The U.S. Economy in TurmoilIn this exclusive interview, Dr. Paul Craig Roberts answers our followers’ questions on the U.S. financial crisis, manipulation, hyper-inflation, unemployment and more. This interview with Paul was recorded on September 25---and posted on the sprottmoney.com Internet site yesterday. Global growth and job creation 'simply not good enough', IMF chief saysChristine Lagarde, the managing director of the IMF, warned that the global economy risked having mediocre growth for some time to come as she announced that her Washington-based organisation would next week trim its forecasts for activity. Ahead of the Fund’s annual meeting, Lagarde urged action – including an easing of austerity, job creation programmes and higher spending on infrastructure – to boost growth. “Our main job now is to help the global economy shift gears and overcome what has been so far a disappointing recovery: one that is brittle, uneven, and beset by risks”, Lagarde said in a speech. “Yes, there is a recovery but as we all know – and can all feel it – the level of growth and jobs is simply not good enough.” This article appeared on theguardian.com Internet site at 4:46 p.m. BST on Thursday afternoon---and I thank South African reader B.V. for sending it along. Gas war escalates as Russia halves Slovakia suppliesRussia has cut gas deliveries to Slovakia by half in a bad sign for E.U. efforts to broker a deal on Ukraine. Prime minister Robert Fico told press after a cabinet meeting in Bratislava on Wednesday (1 October) that the drop came without any warning. He said his national distributor, SPP, can still "fulfill its commitments" on “reverse flow” to Ukraine and supply customers in Slovakia and the Czech Republic by buying extra volumes on the spot market. But he criticised Russia, saying: "Gas has become a tool in a political fight … This isn't about a lack of gas, it’s about playing with gas supplies as an instrument of political posturing”. This news item was posted on the euobserver.com Internet site at 9:30 a.m. Europe time on Thursday---and it's the first offering of the day from Roy Stephens. Turkey to get more Russian natural gasThe Turkish government said it reached a deal with Russian energy company Gazprom to receive nearly 20 percent more gas per year from the Blue Stream pipeline. Turkish Energy Minister Taner Yildiz met with Gazprom officials in Moscow to discuss bilateral relations. Turkey consumes about 1.5 trillion cubic feet of natural gas annually and more than half of that comes from Russia. During meetings with Russian Energy Minister Alexander Novak and Gazprom Chief Executive Alexei Miller, the Turkish government said the amount of gas sent from Russia though the Blue Stream pipeline would increase by about 18 percent to 670 billion cubic feet per year. Turkey aims to exploit its geographical position to serve as an energy bridge between Middle Eastern and Asian suppliers to the Middle East. This UPI article, filed from Moscow, appeared on their website at 6:04 a.m. EDT yesterday---and it's the second story in a row from Roy Stephens. Iran mulling oil swap with RussiaA trade official in Iran said the issue of oil swaps may be on the table along with refinery construction during possible talks with Russian investors. Hassan Khosrowjerdi, head of the Iranian Oil, Gas and Petrochemical Products Exporters Association, said he plans to lead a delegation to Moscow to discuss trade relations in the energy sector. "Iranian companies have good experience in swap and transit, particularly under the conditions of sanctions," he said Wednesday. "These experiences should be exported to other countries." Western governments had expressed concern over the possibility that Iran was working on an oil-for-goods swap deal with Russia. Iranian Oil Minister Bijan Zanganeh has said the Iranian government endorsed such a deal, but nothing was formalized. This is the second UPI article in a row, this one filed from Tehran---and it was posted on their Internet site at 10:02 a.m. EDT on Thursday morning. That makes it three in a row from Roy Stephens, for which I thank him. Turkey steels for action as Islamic State advances on Syrian border townTurkey's parliament authorized the government to order military action against Islamic State on Thursday as the insurgents tightened their grip on a Syrian border town, sending thousands more Kurdish refugees into Turkey. The vote gives the government powers to order incursions into Syria and Iraq to counter the threat of attack "from all terrorist groups", although there was little sign that any such action was imminent. The mandate also allows foreign troops to launch operations from Turkey, a NATO member which hosts a U.S. air base in its southern town of Incirlik, but which has so far resisted a front line role in the military campaign against the insurgents. This Reuters article, co-filed from Suruç, Turkey and Beirut, put in an appearance on their Internet site at 7:43 p.m. EDT yesterday evening---and once again it's courtesy of Roy Stephens. African Bank just the start of loan delugeThe August collapse of African Bank Investments Ltd. as its loans soured was only the beginning of South Africa’s bad-debt cycle. The country’s four-biggest lenders are preparing for a flood of bad debts as the economy sputters and markets bet the central bank will keep raising interest rates after 75 basis points of increases since January. A gauge showing the percentage of bank loans that might not be fully repaid rose to the highest level in at least four years, according to PricewaterhouseCoopers LLP research last month. “Impairments in the unsecured portfolios have been increasing,” David Hodnett, Barclays Africa Group Ltd.’s chief financial officer, said in an e-mailed response to questions on Oct. 1. “We don’t expect the improvements of the current year to continue next year, because the consumers remain under pressure. We have increased our general provisions.” The nation’s unsecured lending market is being squeezed between growth at the weakest level since the 2009 recession and rising rates as inflation feeds off a 6.3 percent drop in the rand |

| Crude Oil, Gold Await Direction Cues as SPX 500 Hits 2-Month Low Posted: 02 Oct 2014 11:10 PM PDT dailyfx |

| Gold Will Surprise In More Ways Than One Posted: 02 Oct 2014 10:45 PM PDT marketoracle |

| Gold – Remains Steady Around $1215 Posted: 02 Oct 2014 10:20 PM PDT marketpulse |

| Gold Braces For A Bumpy Ride On NFP, Natural Gas Dives On Storage Data Posted: 02 Oct 2014 10:05 PM PDT dailyfx |

| Gold Extends Weekly Decline as Platinum Slumps to Five-Year Low Posted: 02 Oct 2014 10:05 PM PDT bloomberg |