Gold World News Flash |

- Mr.Fat Head Returns to the HUI

- October 2/no change in silver inventory at the SLV./ another drop of 1.19 tonnes from the GLD/ gold and silver rise/Updates on Ebola in the USA

- Despite Drop, Gold Getting Set To Reenter Monetary System

- China is ENJOYING the Gold Manipulation

- Truth, Consequences, and Confiscations

- Man Who Executed QE1 Warns Of Total Systemic Collapse

- Precious Metals : Silver Collection Update, The Current Market, & AG Solutions

- U.S. Government & CDC Are Not Disclosing Everything About Ebola

- Europe COLLAPSE as Germany Prepares BAIL-IN to Save Banks!

- Swiss Gold Initiative – 30 November 2014 – Volksinitiative — (English Subtitles)

- What will Cause a Breakout for Gold?

- Europe's Losing Battle For Recovery

- The Gold Price Lost 40 Cents to Close at $1,214.20

- Egon von Greyerz: Will gold referendum save the Swiss financial system?

- Von Greyerz, Kaye interviewed at KWN

- High-speed trader accused of commodity market 'spoofing'

- High-Frequency Trader Indicted for Manipulating Commodities Futures Markets in First Federal Prosecution for Spoofing

- Gold Daily and Silver Weekly Charts - The Ritual of Our Existence

- High-Frequency Trader Indicted for Manipulating Commodities Futures Markets in First Federal Prosecution for Spoofing

- 4 Ways to Make a Fortune With One Precious Metal

- Why There Is Still Hope For Gold Bulls

- Despite Drop, Gold Getting Set To Reenter Monetary System

- Gold to Silver Ratio - Sentiment

- Why a CIA Insider is Spilling His Secrets to Protect You

- Gold Silver Ratio and Some Thoughts On Markets

- Will this save the Swiss financial system?

- This Is Why All Hell Is Breaking Loose & Fear Is Taking Hold

- Gold Investing "Negative" as Crude Oil Slumps, "Ice Age Thesis" Gains Appeal

- Will Algae Help Manufacture the Delicious Foods of the Future?

- The End of The Dollar wont be the Apocalypse. it will be worse

- Asian demand for gold blunts West's price suppression, Kaye tells KWN

- Trading Impulse Moves in Gold and Silver Stocks

- Gold sales at Perth Mint reach 11-month high as prices retreat

- 3rd Quarter Wrap Up

- US Dollar is the Last Stop Before Gold and Silver Price Spike

- Gold To Silver Ratio – Sentiment

- Gold Investing “Negative” as Crude Oil Slumps, “Ice Age Thesis” Gains Appeal

| Mr.Fat Head Returns to the HUI Posted: 03 Oct 2014 01:02 AM PDT Gold and silver mining stocks are setting up for a big fall. Maybe... BACK in February of 2013 we noted the big fat head on the HUI Gold Gugs miner stock index's massive head and shoulders pattern, writes Gary Tanashian in his Notes from the Rabbit Hole. It was reviewed again in April of 2013 after it broke the neckline in a very bearish move. Mr.Fat Head's technical objective was and is 100 on the HUI (IndexNYSEGIS:HUI). Why is this being revisited? Because I have gotten a couple emails noting that it is showing up again out there amidst the very bearish backdrop. If anything, if every gold bug on the planet is planning for 100, the ingredient is in place for this final indignity that they are so well prepared for, to maybe not happen. But a target is a target and it is there for a reason; namely that its source – Mr.Fat Head in this case – has not been eliminated from the picture. Here he is updated...  There are other considerations...

A lot of people think technical analysis sucks because a lot of TA's try to baffle people with b/s, ascribing greater power to charting than it deserves. Still, it is a handy tool as it irrefutably gave warning signals on the bear market. Signals 1, 2 (which is when NFTRH went into full-risk management mode on gold and silver miners as HUI lost 460 in November of 2012) and 3. Dial ahead to today. A final and terrible drop may indeed come about. But here again I remind you not to take anyone with just a chart and an overly bullish or overly bearish thesis too seriously. It stimulates the greed and fear response and right now everyone in the gold sector is well gripped in fear. There is much more to any given narrative. For reference on why charting in a vacuum is not good, I trot out to you my one time 888 projection for HUI (I just love owning this one) based on a pattern that was every bit as bullish as Mr.Fat Head is bearish. Just as I ask you now to take 100 for what it's worth, I noted the same thing for the 3 Snowmen (888) back then. Targets are just targets/measurements, not directives. For reference I offer my own screw up and the S&P 500's target off a very similar pattern that has happily gotten most of the way to target.  TA is a guide (subject to ongoing revision), not a director. HUI has a target of 100 and so many other potentials in play. Only week to week management of not only the technicals, but especially the macro fundamentals will see us through. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 02 Oct 2014 11:30 PM PDT by Harvey Organ, HarveyOrgan.Blogspot.ca:

In the access market tonight at 5:15 pm GLD : we lost 1.19 tonnes of gold inventory at the GLD (inventory now at 767.47 tonnes) SLV : as of 6 pm tonight we have no change in inventory. However we have Fred checking throughout the evening to see if these guys update their data. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Despite Drop, Gold Getting Set To Reenter Monetary System Posted: 02 Oct 2014 10:30 PM PDT from KingWorldNews:

But in that era he was publicly a disciple of Ayn Rand and an apostle of gold. Of course he then got his official position working at the Fed and was elevated to Fed chairman and eventually knighted by the queen of England. At the Fed Greenspan changed his tune on gold altogether. Like Ben Bernanke, his successor, Greenspan acted publicly as if he was clueless about the role of gold in the world's financial architecture. When asked about gold he would say something along the lines of, 'Well, gold is a legacy of a prior era.' Of course he was referring to the time when gold and, to some extent, silver were used as money or at least a benchmark for monetary transactions. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China is ENJOYING the Gold Manipulation Posted: 02 Oct 2014 09:40 PM PDT from Cambridge House: China is enjoying the gold manipulation! – John Kaiser | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Truth, Consequences, and Confiscations Posted: 02 Oct 2014 09:20 PM PDT by Dr, Jeffrey Lewis, Silver-coin-investor:

Commenting on these markets over the last decade, I often wonder how long they can keep it all together. The entire house of cards has stood up much longer than anyone has expected. The next wave of investors will likely go through the almost reflexive reach for derivatives first. New investors, or would be long term holders, simply have an aversion and are well versed in the worlds of ETFs. Overall, I think we have to keep in mind that each and every move for the time being occurs by the will of those who control it. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Man Who Executed QE1 Warns Of Total Systemic Collapse Posted: 02 Oct 2014 09:02 PM PDT  In the aftermath of the release of the controversial Goldman Sachs tapes, today King World News spoke with the man the Fed called on to execute QE1 and who also set up the Fed's massive trading room, former Fed member and former Managing Director at Morgan Stanley, Andrew Huszar. What he had to say will stun KWN readers around the world. He warned that people's careful savings of a lifetime could be wiped out in the blink of an eye if we go into another 2008-style meltdown and the Fed once again stands ready to "create money without limit." Below is what Huszard had to say in this remarkable interview. In the aftermath of the release of the controversial Goldman Sachs tapes, today King World News spoke with the man the Fed called on to execute QE1 and who also set up the Fed's massive trading room, former Fed member and former Managing Director at Morgan Stanley, Andrew Huszar. What he had to say will stun KWN readers around the world. He warned that people's careful savings of a lifetime could be wiped out in the blink of an eye if we go into another 2008-style meltdown and the Fed once again stands ready to "create money without limit." Below is what Huszard had to say in this remarkable interview.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Precious Metals : Silver Collection Update, The Current Market, & AG Solutions Posted: 02 Oct 2014 08:20 PM PDT from cutlerylover: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Government & CDC Are Not Disclosing Everything About Ebola Posted: 02 Oct 2014 08:09 PM PDT August factory order plunge most on record. President Obama reports that the economy is recovering and looking good. Chinese renminbi is now directly tradeable with the Euro. Russian and Iran decide to use their own currencies and bypass the dollar. CDC not giving all information regarding Ebola.... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe COLLAPSE as Germany Prepares BAIL-IN to Save Banks! Posted: 02 Oct 2014 07:44 PM PDT As the economic conditions worsen in Europe, the unelected technocrats need to put their heads together in order to figure this out. Previously, they attempted austerity measures which has now resulted in high levels of poverty and an increasing unemployment rate. Meanwhile the banks are making... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Swiss Gold Initiative – 30 November 2014 – Volksinitiative — (English Subtitles) Posted: 02 Oct 2014 07:40 PM PDT from GoldSwitzerland: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What will Cause a Breakout for Gold? Posted: 02 Oct 2014 07:00 PM PDT from cambridgehouseintl: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Europe's Losing Battle For Recovery Posted: 02 Oct 2014 06:59 PM PDT Via Nick Andrews via Evergreen Gavekal, The wobble in world markets continues, with stock indices across all time zones down steeply in recent sessions. Investors are not only realigning their exposure in anticipation of tighter liquidity conditions as the US Federal Reserve finally brings its asset purchases to a close later this month. After today's European Central Bank (ECB) meeting they are also looking nervously at the magnitude of the task facing eurozone policymakers. And they appear to be coming to the conclusion that generating a rebound in growth may be too tough a job for Europe's leaders to accomplish in the near term. With France and Italy - the eurozone's second and third biggest economies - either stagnating or contracting, to achieve a convincing recovery will require policymakers to press home their attack on three fronts: structural reform to increase economic flexibility, fiscal easing to stimulate activity, and monetary expansion to support credit growth. On all three fronts they face determined opposition.

With efforts to procure a European recovery belabored on all three fronts, and prospects for eurozone corporate earnings set to disappoint, it should be no surprise that investors are jittery. The only bright spot for Europe at the moment is the weakness of the euro, which has fallen nearly 10% against the US dollar since May; a decline that will both help to support eurozone exporters and to ease disinflationary pressure. As the US moves closer to tightening monetary policy and with European policymakers facing an uphill struggle in their efforts to generate a recovery, the decline in the euro looks set to continue. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Lost 40 Cents to Close at $1,214.20 Posted: 02 Oct 2014 05:59 PM PDT

The GOLD PRICE jiggled fiercely today in a range from $1,209 to $1,221.50 without accomplishing anything but burning rubber off its tires. There stands a double bottom from Tuesday and Wednesday, but today built little on that -- unless that move that topped in overnight trading and fell today is only a correction of that first little leg up. If so, tomorrow gold will close above $1,225 tomorrow. Yea, the SILVER PRICE did about the same today, just jiggling back and forth with no progress, but losing all the previous day's gains. Silver must close above $17.50 or drop further. What's the big picture? Tentatively I answer that the Dow in Gold and Dow in Silver have pinpointed (again) a top in stocks, which implies also a bottom in silver and gold. But that theory requires much more confirmation. Is it even possible to talk about gold and silver reversing? Well, gold's MACD has turned up, along with the full stochastic and the rate of change. It has pulled out of grotesquely oversold mode. All that's surely a start. Silver has yet has none of that in its favor, but at this sort of turnaround it's to be expected that silver would lag. We wait patiently. Ain't them open borders great? Looks like to me one clear job the yankee government does have is the very one they don't bother themselves with, namely, controlling who comes into the country. And now the want of the most minimal public health precautions at the border have brought the ebola virus into the US. Great job, Yankee government, sorry, Texas. And an epidemic, or fear of an epidemic, can wreak havoc on an economy. First it was the airline stocks, hit by the threat of waning travel. Now its your gas tank. Ebola in West Arica is disrupting drilling plans for Exxon. For reasons unclear, very little is taught in history about the impact of plagues. The Black Death, for instance, hit Europe about 1346, spreading north. In some places 90% died, and 30% to 60% of the entire population perished. Alive in the morning, they were dead by dusk. Imagine what effect this had on social mood! And England was roiled by labor unrest for the next 100 years and more because the much reduced population made labor more valuable, but landowners didn't want to pay up. Two fascinating books about theplagues' impact are Rats, Lice, and History: the Biography of a Bacillus by Hans Zinsser (1935) and Plagues and Peoples by William H. McNeil (1976). Sounds ridiculous, but Zinsser's book is a charming adventure. You can't put down Plagues and Peoples, either. Aside from all that, does it seem to y'all that Our Masters are pulling out all the stops on their media organ to play Ebola. It's been around since the 1970s, but suddenly -- after 3000 deaths -- it's gonna carry us all away, and our dogs, too. When the media all sing that sweetly together, I know they're working hard to sell us something. Me, I ain't buying. I don't even buy the germ theory of disease. If the germ really caused the disease, rather than a failure of the immune system, then every disease should cause 100% fatalities. But I ain't nothing but a nat'ral born durned fool from Tennessee. All I know about medicine is putting cobwebs on bleeders. On to markets: Stocks skidded to a stop today. Dow lost only 3.66 points to close at 16,801.05. S&P500 actually gained 1/100th point. That's probably not the end of the first leg of this tumble, but only the beginning. Bull markets die hard, in particular stock bull markets. Dow in gold fell further below its 20 DMA (13.89) and lost 0.13% to close at 13.83 oz (G$285.89 gold dollars). Dow in Silver fish-hooked up 0.45% to 983.38 oz (S$1271.44 silver dollars). Dow in Gold has surely turned down, the Dow in silver presumptively. US dollar index dropped 29.7 basis points (0.38%) to 85.614, but the Internet waves are filled with speculation that at least a year long dollar bull market has begun. Yeah, maybe, but not without some correction first. That may have begun today. Over in Euro-land the Head Felon at the ECB, Super Mario Draghi, revealed new measures today to fight off the evil spirit of deflation. His nostrums will do about the same good as a witch doctor's rattle dance, only making the economy worse, and creating more bubbles. Maybe the Europeans would be better off with a witch doctor. Euro rose 0.41% to $1.2670, about what the US dollar index fell. It rose to close a gap in the chart, but that doesn't say it will rise again tomorrow. In the past two days the Yen has staged a rally from its 90.93 low for the move to 92.24 today, up 0.43%. It actually reached its 20 DMA today! Clearly the yen has begun a rally, and has escaped grotesquely oversold conditions so far as to bring its RSI up to 36.8 today. Other indicators have turned up, too. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Egon von Greyerz: Will gold referendum save the Swiss financial system? Posted: 02 Oct 2014 03:36 PM PDT 6:35p ET Thursday, October 2, 2014 Dear Friend of GATA and Gold: Swiss gold fund manager Egon von Greyerz of Matterhorn Asset Management today explains the objectives of Switzerland's gold referendum proposal, which will go to Swiss voters on November 30, and argues that repatriating the country's gold reserves and keeping in gold 20 percent of the country's total foreign exchange reserves will be good for the country as well as for gold. Von Greyerz's commentary is headlined "Will This Save the Swiss Financial System?" and it's posted at Matterhorn's Internet site, Gold Switzerland, here: http://goldswitzerland.com/will-this-save-the-swiss-financial-system/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Von Greyerz, Kaye interviewed at KWN Posted: 02 Oct 2014 03:25 PM PDT 6:24p ET Thursday, October 2, 2014 Dear Friend of GATA and Gold: Swiss gold fund manager Egon von Greyerz tells King World News today that all news was good news during the bull market in equities and now all news will be bad news in a bear market: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/10/2_Th... And Hong Kong fund manager William Kaye tells KWN that former Federal Reserve Chairman Alan Greenspan's commentary in the new issue of Foreign Affairs, affirming gold's monetary function, is an indication that gold is returning to the world monetary system: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/10/2_De... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Join the Sprott Precious Metals Roundtable on Tuesday, Oct. 7 Sprott Asset Management's Eric Sprott, Rick Rule, and John Embry will get together for an hour at 2 p.m. ET Tuesday, October 7, to discuss the prospects for the precious metals, and you can join them via the Internet. Just register here: https://event.on24.com/eventRegistration/EventLobbyServlet?target=reg20.... Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| High-speed trader accused of commodity market 'spoofing' Posted: 02 Oct 2014 02:52 PM PDT By Andrew Harris and Matthew Leising http://www.bloomberg.com/news/2014-10-02/high-speed-trader-accused-of-co... A high-frequency trader has been indicted for "spoofing," the placing and immediate canceling of orders to manipulate commodities markets, in what the U.S. Justice Department says is the first criminal case of its kind. Michael Coscia, 52, of Rumson, New Jersey, the principal of Panther Energy Trading LLC, was indicted by a federal grand jury in Chicago and charged with six counts of commodities fraud and six of spoofing. He's accused of illegally reaping nearly $1.6 million as a result of orders placed through CME Group Inc. and European futures markets in 2011. Coscia last year settled civil case accusations by the U.S Commodity Futures Trading Commission by paying a $2.8 million fine and consenting to a one-year trading ban. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata The anti-spoofing statute is part of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act. Some trading firms have found the definition too vague and have pressed CME to be more specific, two people familiar with the matter said last month. Coscia's indictment was returned by the grand jury yesterday and announced today by the office of U.S. Attorney Zachary Fardon in Chicago. Each spoofing count carries a maximum sentence of 10 years in prison and a fine of as much as $1 million. Each commodities-fraud charge is punishable by as long as 25 years in prison and a $250,000 fine. No arraignment date has been set, according to Fardon. Coscia's attorney, Richard Reibman, didn't immediately reply to a voice-mail message seeking comment on the charges. It's against the law to spoof, or post requests to buy or sell futures, stocks, and other products in financial markets without intending to follow through on those orders. Spoofers try to make money by feigning interest in trading at a certain price, creating the illusion of demand in an attempt to get other traders to move prices in a way they can profit from. The spoofer cancels the original trade before it's executed, and buys or sells at the new price. The CFTC yesterday won a consent order from a federal court requiring another trader, Eric Moncada, to pay $1.56 million to settle allegations that he entered noncompetitive trades and engaged in spoofing in wheat futures markets. Moncada, who was barred from trading any wheat contract for five years, neither admitted nor denied wrongdoing, according to the order. CME Group, operator of the world's largest futures market, instituted a rule against the practice on Sept. 15. "No person shall enter or cause to be entered an order with the intent, at the time of order entry, to cancel the order before execution or to modify the order to avoid execution" in an effort to prohibit "the type of activity identified by the Commission as 'spoofing,'" CME told the CFTC in a letter. The case is U.S. v. Coscia, 14-cr-551, U.S. District Court, Northern District of Illinois (Chicago). Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 02 Oct 2014 02:33 PM PDT Jim Sinclair My Dear Extended Family, This is done every day in paper gold and silver and is the main tool of bearish manipulation. There may be some hope that payback is pending. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - The Ritual of Our Existence Posted: 02 Oct 2014 02:22 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 02 Oct 2014 01:44 PM PDT Jim Sinclair’s Commentary This is done every day in paper gold and silver and is the main tool of bearish manipulation. There may be some hope that payback is pending. High-Frequency Trader Indicted for Manipulating Commodities Futures Markets in First Federal Prosecution for Spoofing U.S. Attorney's Office October 02, 2014 Northern District of Illinois(312) 353-5300... Read more » The post High-Frequency Trader Indicted for Manipulating Commodities Futures Markets in First Federal Prosecution for Spoofing appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

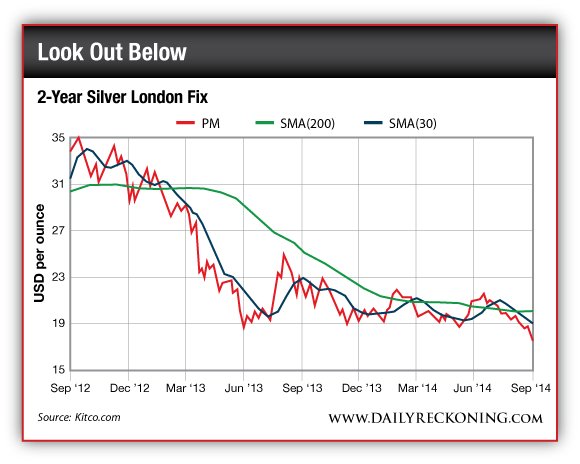

| 4 Ways to Make a Fortune With One Precious Metal Posted: 02 Oct 2014 01:34 PM PDT The "metal of the moon," as ancient Egyptians called it, has had a tough two years. Another way to look at it, though, is that there's strong evidence we're in the midst of a phenomenal buying opportunity. What to do? Buy or wait? Let's think it through, and start with the silver price chart… As you can see from the chart, silver has fallen from near $35 per ounce, two years ago, to its current level in the $17.50 range; a 50% haircut. Ugh. Yet the chart also shows the 200-day moving average for silver is flattening out in the $20 range. That's a hopeful sign. Still, the fact is that recent price actions have been downward for silver. In recent weeks, prices cracked the $19 level; and then dipped under $18. How low can silver go? To answer that question, I went to Toronto, earlier this week. I had the pleasure of spending a day with Eric Sprott, his associates and a small group of "metal guys" from across a spectrum of newsletters and research groups. To most policymakers, bankers and investors, "gold is the antichrist to their precious dollar." The Sprott organization is one of the savviest of savvy metal-investors. At the mast-head of the ship, you'll look long and hard to find any captain with more encyclopedic knowledge of silver than Eric Sprott; and his knowledge is reflected amongst those with whom he works day to day. One participant, at the get-together, was Sprott's well-regarded John Embry, Chief Investment Strategist at Sprott Asset Management and Sprott Gold and Precious Minerals Fund. Mr. Embry has been following gold and silver markets for over 45 years — indeed, as he told me during a conversation over one of the breaks, he's been "doing gold and silver" since before Pres. Nixon took the U.S. off the gold standard in August 1971. Mr. Embry has seen every kind of market — up, down and sideways. Right off the bat, Mr. Embry stated that the average cost per ounce of new silver is in the range of $22 to $25 per ounce, delivered from the mine. "At current prices, I cannot see how miners can keep delivering product at a loss." He noted, to be sure, that some silver comes as a by-product of lead, zinc and copper production; and those mining groups may not be as sensitive to pricing. "But at some stage," he said, "economics will return to the driver's seat, and production will have to tighten." Right now, Mr. Embry explained, he has "never seen more negative sentiment towards precious metals." In other words, it's as bad as it has ever been. In fact, one of the worst, compounding issues is that three generations of people — especially in Western economies — have grown up and now live blissfully under the "dollar standard." "People are invested backwards," declared Mr. Embry. To most policymakers, bankers and investors, "gold is the antichrist to their precious dollar." Indeed, the great mass of people simply cannot wrap their brains around the idea that currency in their pocket or bank account needs any sort of "backing." Yet, declared Mr. Embry, "If the dollar gives way against precious metals, U.S. living standards will collapse." According to Mr. Embry, economically, "the world has reached a hopeless situation." That is, the great mass of people — certainly voters — live comfortably with bottomless levels of government debt, endless growth of government indebtedness and fiscal and monetary chicanery cannot end well. Mr. Embry expects silver and gold to reach "unimaginable prices" when the big crisis hits, but until then he said, "I look like a dope." So what's Mr. Embry's defense mechanism? Some portion of your portfolio must be invested in precious metals, especially silver. "This is the finest opportunity I've seen in my career," he said. "Silver is a potential 10-bagger from here… Eric thinks we'll see 30- and 40-baggers with silver." Mr. Embry believes that investors' wealth will be protected by owning physical silver; and fortunes will be made in silver miners. "Silver is a potential 10-bagger from here," he noted; then quickly nodded to Eric Sprott, sitting in a corner, and reminded everyone that "Eric thinks we'll see 30- and 40-baggers with silver." Some of the best ways to play for those gains are with the well-run metals funds Sprott operates — the Sprott Physical Gold Trust ETF (NYSE:PHYS), the Sprott Physical Silver Trust ETF (NYSE:PSLV) and the Sprott Physical Platinum and Palladium Trust ETF (NYSE:SPPP). Among the great virtues of these funds, they're tightly regulated and audited; plus they store physical metal in the Canadian Mint, a government facility with ZERO chance of ever going bankrupt or being seized by someone else's judicial process. If you don't own physical metal, get some. Accumulate over time; don't blow all of your seed corn in one fell swoop. Then, for investors who don't want to hold "too much" physical metal in their home, safe, local bank, secure storage or such, these Sprott funds are all excellent ways to "buy physical" without actually holding the bars in your hand. Over the course of the day at Sprott, we went over a number of silver mining plays as well; I'm reviewing those names by my own standards. I'll have more to say soon… For now, though, the mining and investment landscape is littered with the corpses of ideas that have had the dog-gone tar kicked out of them. Yet some of these ideas hold strong assets, and are well-capitalized. Opportunities are there, if you know where to look. Regards, Byron King P.S. In addition to buying PHYS and PSLV, I strongly encourage reading my newest colleague, Jim Rickards' dire forecast. He agrees that you should own some silver plays — especially when America's "spooky" new money is adopted. I gave readers of The Daily Reckoning email edition a chance to discover this new money for themselves in today’s issue. It was part of our larger discussion about the looming panic in the currency markets — a valuable conversation if you were lucky enough to be a part of it. If not, we suggest you click here and sign up for the Daily Reckoning, for FREE, right away. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why There Is Still Hope For Gold Bulls Posted: 02 Oct 2014 12:26 PM PDT Gold is approaching a critical price point, i.e. $1,180. That is the lowest price of the last years. It has been tested twice, so this third retest is a crucial one for the short and medium term. Although the sentiment is extremely negative, there are some indications which could provide some help for the yellow metal. The first set of charts shows the precious metals complex: gold, silver, gold miners and the bullish percentage index of gold miners (BPGDM). The key insight from this set of charts is that silver has broken below the lows of December 31st 2013 gold and the miners are holding up much better, in particular junior miners. Also, the BPGDM is nowhere near the same extreme levels as December 2013. It should be noted that the miners have been hit hard a week ago, not a sign of strength.

The second set of charts shows the gold ratios. Gold has held up much better than commodities, especially when compared to the lows of the ratio at the end of 2013. The Dow Jones to gold ratio (INDU:GOLD) is a multi-year high, which could spell a correction of that ratio. Interestingly, the TIP:GOLD ratio looks much better than at gold’s lows in December 2013 (TIP is an indicator of inflation expectation). In other words, gold has held up better than TIP.

By zooming on the TIP chart (Treasury Inflation Protected securities), an inflation hedging tool , it looks like it is coming off extreme oversold readings, bouncing from its 200 day moving average. Whether this is a “dead cat bounce” or not, remains to be seen. Nevertheless, the extreme reading could be a positive for gold. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Despite Drop, Gold Getting Set To Reenter Monetary System Posted: 02 Oct 2014 12:24 PM PDT  Today an outspoken hedge fund manager out of Hong Kong spoke with King World News about the recent comments from former Fed Chairman Alan Greenspan concerning the prominence of gold in the global financial architecture. William Kaye, who 25 years ago worked for Goldman Sachs in mergers and acquisitions, also spoke about the remarkable U-turn by Greenspan regarding gold as well as what this means for gold in the future. Today an outspoken hedge fund manager out of Hong Kong spoke with King World News about the recent comments from former Fed Chairman Alan Greenspan concerning the prominence of gold in the global financial architecture. William Kaye, who 25 years ago worked for Goldman Sachs in mergers and acquisitions, also spoke about the remarkable U-turn by Greenspan regarding gold as well as what this means for gold in the future.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold to Silver Ratio - Sentiment Posted: 02 Oct 2014 12:06 PM PDT The gold to silver ratio (GSR) acts like a sentiment indicator. When the GSR is low both gold and silver are usually running upward and strong. When the ratio is high, like now (Sept. 30, 2014), gold and especially silver are priced low and disinterest is nearly universal. This is my anecdotal interpretation of silver & gold sentiment from a high of 10 to a low of 1: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why a CIA Insider is Spilling His Secrets to Protect You Posted: 02 Oct 2014 11:01 AM PDT Imagine you're standing on a peaceful snow-covered hill… Birds are chirping. The powder is fresh and untouched. What a beautiful day, you think. Then you hear a rumble. And then another. "Oh, sh*t," you say. "That's an avalanche!" Hunker down, my friend. You're not going to outrun this one… As you dig your way out, think about how this happened… Everything was so calm. So peaceful. All it took was one teeny-tiny snowflake to land the wrong way… And BOOM. Several years of built-up snow collapsed all at once. And all hell broke loose on everything in its path. Alright. You might be wondering… Why are we talking about avalanches? Well, it has to do with the newest addition to the editorial team here at Agora Financial… He’s a former CIA insider who, as our colleague Dave Gonigam said yesterday, "knows people high up in the power structure and is willing to call BS on them when he sees it. Do you have any idea how rare that is?" His name is Jim Rickards. And if you’re a Daily Reckoning subscriber — or even if you’ve just visited The Daily Reckoning website before — you’re probably aware of him… Of course, we're naturally skeptical of anything the establishment spits out… But this guy is an outlier. He's been called "one of the world's brightest minds in finance and geopolitics…" "The smartest man in the room." And "probably the world's baddest of the bad-asses in understanding and explaining the modern monetary theory." Up until now, he's given personal attention only to private investment funds, investment banks, the CIA, the Pentagon, the NSA and 14 other U.S. intelligence agencies. He's been hired by many of these organizations to help them prepare for the brewing financial catastrophe. Moreover, he's helped the Pentagon develop a predictive model to protect the U.S. from another Sept. 11. But that doesn't mean he's beholden to any of them. In fact, quite the opposite. And to prove it, he's devoting all his attention to you. "My mission," he told us, "is to help everyday Americans not be ripped off by people who know better who won't be honest with the American people. "Bankers, government — both parties. There are enough people in positions of real power who see what I see and won't be honest with people about it. "And they're perfectly prepared for all those people to lose all their money. I think that's despicable." If they're not tight-lipped, then they're in complete denial. Or worse, clueless. Like the wingnuts at the Federal Reserve… In Jim's words, the Fed staff "misapprehends the statistical probabilities of risk." Or simply put, they're ignoramuses when it comes to understanding how the markets actually work. "They are using Keynesianism, they are using monetarism, they are using modern financial economics," Jim told the CFA Institute. "Most of this stuff is deeply flawed, if not completely junk science." In other words, they may as well be reading tea leaves. "This is why I say the Fed is playing with a nuclear reactor," he warns. "Fortunately, economic science has not stood entirely still. A new paradigm has emerged in the past 20 years from several schools of thought… The most promising school of thought, says Rickards, is what's called "complexity theory." Only a handful of people in the world have mastered this future field of deliberation. And Jim is the only one thus far to apply it to the economy at large. "Despite the name, complexity theory rests on straightforward foundations," Jim explains. "In a nutshell, complex systems arise spontaneously, behave unpredictably, exhaust resources, and collapse catastrophically." The latter is a feature called "critical state dynamics." With it, he says, "minute changes in initial conditions can result in catastrophically different outcomes." And when that occurs, "you end up in a very different place [than] where you started." And it can happen in the blink of an eye. "When you start looking at things that way," Jim makes clear, "you will see that this is a system that is bordering on the critical state and potentially prone to collapse." Which brings us back to our discussion of avalanches and snowflakes… Earlier, we went through one avalanche scenario. "…instability is already baked into the pie… At any moment, it could come crumbling down." Let's rewind to before the avalanche happened… Rickards is going to walk you through the scenario once more. This time, in lieu of sauntering casually through the snow, you're aware of the danger before it happens. First, Jim describes, you notice "a snowpack building up on the ridge line while it continues snowing. You can tell just by looking at the scene that there's danger of an avalanche. "It's windswept… it's unstable… and if you're an expert, you know it's going to collapse and kill skiers and wipe out the village below. "You see a snowflake fall from the sky onto the snowpack. "It disturbs a few other snowflakes that lay there. Then, the snow starts to spread… then it starts to slide… then it gets momentum, until, finally, it comes loose and the whole mountain comes down and buries the village. "Question: Whom do you blame? Do you blame the snowflakes, or do you blame the unstable pack of snow? "I say the snowflake's irrelevant. If it wasn't one snowflake that caused the avalanche, it could have been the one before or the one after or the one tomorrow. "The instability of the system as a whole was a problem." That unstable system is all around us, says Jim. Burping and creaking like an old wooden ship on the brink of capsizing. "You and I are just waiting for that 'snowflake' that will finally cause the crisis. It will come very suddenly, too. What you need to be concerned about is that instability is already baked into the pie. "At any moment, it could come crumbling down." Regards, Chris Campbell P.S. Just for our Baltimore HQ, Rickards drafted THREE reality-shattering reports on the coming crisis. Readers of my FREE Laissez Faire Today e-letter are the only ones to receive all three leaks. If you're not yet a member, you can click here right now to sign up for FREE. Once signed up, email Chris@lfb.org, and he'll send you the full, uncensored issue. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Silver Ratio and Some Thoughts On Markets Posted: 02 Oct 2014 11:00 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will this save the Swiss financial system? Posted: 02 Oct 2014 10:00 AM PDT Will this save the Swiss financial system?by Egon von Greyerz – October 2014

The "Gold Initiative" referendum November 30, 2014On November … Read the rest | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Is Why All Hell Is Breaking Loose & Fear Is Taking Hold Posted: 02 Oct 2014 09:09 AM PDT  Today a 42-year market veteran spoke with King World News about why all hell is breaking loose in the global markets and fear is taking hold. He also discussed the gold market. Below is what Egon von Greyerz, who is founder of Matterhorn Asset Management out of Switzerland, had to say in this extraordinary interview. Today a 42-year market veteran spoke with King World News about why all hell is breaking loose in the global markets and fear is taking hold. He also discussed the gold market. Below is what Egon von Greyerz, who is founder of Matterhorn Asset Management out of Switzerland, had to say in this extraordinary interview.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Investing "Negative" as Crude Oil Slumps, "Ice Age Thesis" Gains Appeal Posted: 02 Oct 2014 08:07 AM PDT GOLD INVESTING bids pushed prices up to $1222 per ounce in quiet Asian trade Thursday morning, but the metal retreated as European stock markets fell again and crude oil sank 2% to multi-year lows. Silver followed gold's pop and fall, slipping for the second time this week below $17 per ounce – a level last seen in March 2010. Put options – bets that prices will fall – "remain in strong demand for silver much more than gold," says one bullion bank's trading desk. "Investors have become negative on precious metals as a whole," says Dutch bank ABN Amro. "With outstanding positions [in future and options] still being net-long, liquidation of investing positions has still further to go resulting in more price weakness." "It is too soon to discount further gold ETF liquidation," says another bank's commodities team, remarking on 2014's continued but slower pace of investment selling through exchange-traded trust funds compared with 2013. Over on the currency market, the Euro steadied above this week's new 2-year lows after the European Central Bank failed to back any new stimulus measures at its monthly meeting. "We [did] decide," said ECB president Mario Draghi in his monthly press conference, "on the key operational details" of the bond-purchase schemes announced in September, stressing again their "sizeable impact" the central bank's balance sheet – currently one third smaller from its 2012 peak. Wholesalers in India – the world's No.1 gold buying nation until 2013 – meantime reported a rise in imports ahead of next month's Diwali festival. But "the absense of [Chinese] demand" thanks to the Golden Week holidays, says Swiss refining group MKS – plus "strong expected [US jobs data Friday] and general bear bias" – means gold prices "could be testing $1180-1200 in the coming days. "Another factor" are the continued pro-democracy protests in Hong Kong, MKS adds, "which could dramatically" dent that "prominent source of physical demand." With Opec meeting next month, notes French investment bank Natixis, the cartel of oil-producing nations "faces an oversupplied market [and] must now also face up to the prospect of rising US exports of crude" from shale output. World No.6 oil producer Nigeria made zero imports to US last month for the first time in 40 years. But slower economic growth is also a key factor, says the Financial Times, with oil analysts cutting 2014 forecasts for additional world demand in half. "I've had a lot of requests of late to resend our Ice Age [investing] thesis," says French bank Societe Generale strategist Albert Edwards, reprising his long-term call for Japan-style deflation worldwide, pushing equity markets into a major and protracted bear market. "This is usually a good indication that we have again reached that point in the cycle where investors are willing to start valuing risk properly again." Silver investing through exchange-traded trust funds rose sharply throughout the third quarter, notes Australia's Macquarie Bank, giving "continuing evidence of the remarkable confidence of investors in that metal despite its poor price performance." | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will Algae Help Manufacture the Delicious Foods of the Future? Posted: 02 Oct 2014 06:33 AM PDT When we hear the word “biotechnology,” we tend to think about new and exciting drugs… and for good reason. According to FiercePharma, four of the top five best-selling drugs worldwide in 2013 were biologics (as opposed to other drugs like small molecules). These four drugs (Humira, Enbrel, Remicade, and Rituxan) alone generated sales of nearly $36 billion last year. That’s compared to just $7 billion in worldwide sales for all biologics in 1997. But in addition to healing the world, biotechnology also promises to help fuel the world and help feed the world. It’s that third promise that we’re going to focus on today. A technology in general is just a means to fulfill some purpose or goal. When we talk about biotechnology in the broadest sense, we’re referring to the use of biological organisms—or their systems or components—to develop new products or processes in an attempt to solve a problem or improve our lives in some way. You may or may not have heard the term “industrial biotechnology,” which simply refers to applying biotechnology to industry—creating biobased products for sectors such as chemicals, food, plastics, and energy. Rudimentary industrial biotechnology dates back thousands of years, to the time when our ancestors first started to make beer and wine through fermentation—and then cheeses and yogurts as knowledge of the fermentation process grew. The basic idea is the same today, though the science is a bit more complex. For example, let’s take Solazyme (SZYM), a company that’s poised to become a major player in the industrial biotech space. Solazyme synthesizes renewable oils using a proprietary microalgae process; it started with the singular goal of producing biofuels. But it has since broadened its reach into higher-margin, less price-sensitive markets, including chemicals, skin and personal care, and most important for our purposes here, nutritionals (i.e., food). Solazyme’s process for making the oils goes like this: Depending on what the company wants to make, it first selects one of its microalgae strains—either native or genetically enhanced, but in either case capable of flourishing without light—and puts it into a large fermentation tank. It then adds a renewable feedstock (like sugarcane or switchgrass) and through the magic of fermentation, the microalgae convert the sugars into the desired oil. Here’s an illustration from Solazyme’s investor presentation: The basic process by which Solazyme’s microalgae produce oil is nothing special; the organisms themselves are some of the world’s original oil producers. The difference with Solazyme is that its process has improved on the technique on every conceivable front: it’s much faster; produces much higher concentrations of oil per unit of input; is more easily scalable; and allows the company to produce higher-value products due to its ability to tailor oils to customer specifications. Some of those higher-value oil products are poised to make a big impact on the global food market. The world’s population is about 7 billion, and it’s growing by about 80 million per year. At the same time, in developing economies such as China, India, parts of South America, and Africa, there’s an expanding middle class with rising disposable incomes. This has led to a rapidly increasing demand for numerous plant oils important to the food industry, and that has translated into much higher prices for those oils because the supply side of the equation is basically fixed. Over the last decade, the price of rapeseed oil has increased by 45%, while palm oil and sunflower oil have increased by 77% and 71% respectively. Solazyme’s algal oils, tailored to food industry needs, could have a big impact here. That the company is on the right track was evident when it was honored at the 2014 Institute of Food Technologists (IFT) Annual Meeting & Food Expo as the recipient of an innovation award for its high-stability, high-oleic oil. The oil can replace partially hydrogenated vegetable oils (which are often high in trans and saturated fats), substitute for unstable oils in frying or baking applications, or be used as an ingredient in dressings and sauces. It was singled out because it “delivers superior performance and healthful attributes for a wide variety of foods without compromising on critical taste metrics. It has the lowest level of polyunsaturated fatty acids compared to any oil on the market and provides excellent stability with zero transfats. Additionally, it is rich in healthy omega-9 fatty acids, low in saturated fats, and high in monounsaturated fats.” The company is currently producing only small quantities of its oils for a limited number of clients, but we should see big things over the next year or two as it increases capacity and ramps production at its new Moema facility in Brazil and transitions from a development-stage company to an operating company. Sounds rather compelling, doesn’t it? But it doesn’t stop there. As with palm oil, the spot price of butter has been surging, up 71% this year to about $2.50 per pound by late July and hitting $2.96 this past Monday. Again, it’s still pretty early stage, but Solazyme has a possible “fix” here too. In addition to optimizing the composition of oils, it has also developed new ways of preparing powdered forms of triglyceride oils for the food industry. The company’s Whole Algal Flour is rich in healthy lipids with a profile similar to olive oil and can be used to replace or reduce milk, cream, butter, or eggs in ice cream, soups, and baking applications like breads. The Whole Algal Flour product is vegan, gluten-free, trans-fat free, free of known allergens, and low in saturated fat and cholesterol. If it’s that good for you, it must taste like crap, right? Apparently not. I haven’t gotten my hands on the stuff yet, but the author of an article in Scientific American, David Biello, said that on its own it “tastes like pancake mix, minus the salt and baking soda but with the addition of olive oil.” He also confirmed that cooking with it yielded ice cream and caramels that were “delicious” and that bread made from the stuff was outstanding. A comparison between the nutritional stats of chocolate ice cream and chocolate frozen dessert with Solazyme’s ingredient revealed that the Solazyme product appeared to be a much healthier alternative, with 38% fewer calories, 70% less saturated fat, 90% less cholesterol, and two additional grams of dietary fiber per half-cup serving. From what we’ve seen so far, industrial biotechnology in general could have far-reaching implications for global food markets; and Solazyme in particular looks well positioned to capitalize on this multibillion-dollar opportunity. But what remains to be seen is how consumers will respond. Such products probably carry a significant risk of consumer rejection, especially early the game. Even so, companies in this space still look compelling from an investor’s standpoint. As a kicker, consider that not only is everything Solazyme does highly regulated, its products are technically not genetically modified organisms. The GMO label is not applied to fermented ingredients, since the organisms used to make them are not present in the final products. At least that’s the distinction for now. And carrying a “non-GMO” tag could be a big plus for the company’s products going forward. The ability to produce valuable oils for numerous end markets from algae and sugarcane augurs a bright future for cutting-edge companies in the field, like Solazyme. But it’s only one among many new technologies that are changing our world on a daily basis. At Casey Extraordinary Technology, we follow all the latest developments and winnow them to find the best investment opportunities. Set yourself up to profit from their visionary work and our due diligence by starting a 90-day risk-free trial subscription today. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The End of The Dollar wont be the Apocalypse. it will be worse Posted: 02 Oct 2014 06:04 AM PDT This is not America's economic policy it is Rotscild's economic policy. The entire Federal Reserve Board, the Congress, the Council on Foreign relation, the military & the NSA has been infiltrated and ran by them, the mossad & AIPAC. We will never regain control of our government or our... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asian demand for gold blunts West's price suppression, Kaye tells KWN Posted: 02 Oct 2014 05:42 AM PDT 8:40a ET Thursday, October 2, 2014 Dear Friend of GATA and Gold: Hong Kong trader William Kaye today tells King World News today that demand for gold is high in Asia, contrary to some reports in the West, and this offtake will blunt the paper trading of the gold price suppression policy in the West: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/10/2_St... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading Impulse Moves in Gold and Silver Stocks Posted: 02 Oct 2014 05:31 AM PDT For the last two months, and especially the month of September, I've been trying to prep you for the impulse move that we currently find ourselves in right now. You don't have to wait any longer wondering when it's going to begin. We've been in this impulse move down since the last high was made on August 14th, which is the 4th reversal point in that blue triangle consolidation pattern, we've been following so close. I've been showing you countless H&S top patterns in all the big cap precious metals stocks a long with smaller consolidation patterns that are breaking out. I've shown you how the Japanese Yen and the eruo that have been collapsing and how closely gold and precious metals stock indexes are following the Yen lower. I don't know how I can make it any more clearer that the move we've been waiting for, for 15 months or so, is already six weeks old. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold sales at Perth Mint reach 11-month high as prices retreat Posted: 02 Oct 2014 05:26 AM PDT By Phoebe Sedgman MELBOURNE, Australia -- Gold sales from Australia's Perth Mint, which refines all the bullion output in the world's second-biggest producer, climbed 89 percent in September to the highest level in almost a year as prices declined. Sales of gold coins and minted bars rose to 68,781 ounces from 36,369 ounces in August and the most since October 2013, according to data from the mint compiled by Bloomberg News. Sales were about 68,487 ounces in September 2013, data show. ... ... For the remainder of the report: http://www.bloomberg.com/news/2014-10-02/gold-sales-at-perth-mint-reach-... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 02 Oct 2014 05:00 AM PDT “The future is here – it's just not evenly distributed.” ~ William Gibson By Catherine Austin Fitts The US dollar index moved above 85 last week while the US stock market continued to levitate. This caused hundreds of pundits to scratch their heads looking for fashionable ways of explaining why managed markets [...] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Dollar is the Last Stop Before Gold and Silver Price Spike Posted: 02 Oct 2014 03:00 AM PDT David Morgan is interviewed by Butler On Business Alan: Silver has been under pressure. We saw a little bit of a pop when Mario Draghi did his thing last week. This is an environment where precious metals should be off to the races and yet it's been down for gold... they are taking gold out to the woodshed. David: As far as I'm concerned, and this is not about being right, or being stubborn, this is about my analysis, right or wrong. I really think this is the month where we are going to turn around, meaning that the bottoms for both metals could be tested. Silver broke below the $18.17 low that I have been talking about for a long time. The next level of support is the $17.50 area. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold To Silver Ratio – Sentiment Posted: 01 Oct 2014 11:01 PM PDT The gold to silver ratio (GSR) acts like a sentiment indicator. When the GSR is low both gold and silver are usually running upward and strong. When the ratio is high, like now (Sept. 30, 2014),... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Investing “Negative” as Crude Oil Slumps, “Ice Age Thesis” Gains Appeal Posted: 01 Oct 2014 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Gold closed down $0.40 at $1214.20 (comex to comex closing time ). Silver was down 21 cents at $17.00

Gold closed down $0.40 at $1214.20 (comex to comex closing time ). Silver was down 21 cents at $17.00

I think it’s normal to have doubts – especially in rigged markets like this. Stockholm Syndrome creeps in and we begin questioning everything.

I think it’s normal to have doubts – especially in rigged markets like this. Stockholm Syndrome creeps in and we begin questioning everything.

On 30 November 2014 the Swiss People has the opportunity to determine not just the fate of their own financial system but also to be the catalyst for the return to sound money in the Western World.

On 30 November 2014 the Swiss People has the opportunity to determine not just the fate of their own financial system but also to be the catalyst for the return to sound money in the Western World.

No comments:

Post a Comment