saveyourassetsfirst3 |

- Is Eric Sprott Giving Up on Silver?

- Resource guru Sprott: What Ebola could mean for gold and silver now

- Could an Ebola Armageddon revitalize gold and silver prices?

- Forget about Ebola – here’s why US banks (and your savings) are now EXTREMELY vulnerable

- Gold and Real Interest Rate

- Troy signs minerals agreement for the Karouni Gold Project in Guyana

- Silver Myths Smashed, Pt. 4: The Coming Silver Lie You Simply Must Be Ready For

- Prolonged gold curbs hit the Current Account Deficit

- Craig Hemke: NO FREE MARKETS – ONLY MANIPULATION

- So What Will This Week Bring?

- India enacts import tariff hike on gold

- Welcome To Arcadia – The California Suburb Where Rich Chinese Stash Cash In McMansions

- Marshall Swing: This Bottom May Be the Longest Yet!

- Gold can shield against euro risk

- Indian exchanges extend trading sessions for gold ETFs

- Metals market update for October 20

- Alasdair Macleod’s Market Report: Gold Benefits from Market Uncertainty

- Indian Finance Ministry to tighten gold import curbs

- Why do foreign investors remain so sure London property is risk-free?

- The gold price still looks robust - Phillips

- India's Diwali festivities could push Gold higher

- Euro Risk Due To Possible Return of Italy To Lira - Drachmas, Escudos, Pesetas and Punts?

- Euro Risk Due To Possible Return Of Italy To Lira – Drachmas, Escudos, Pesetas and Punts?

- Picking gold tops and bottoms

- Gold market update

- Gold market update

- Gold bulls lured back for first time in two months

- An Ebola Armageddon Could Trigger a Rebirth in Gold and Silver Prices: Eric Sprott

- Gold Weekly Report---the Consumer price index report on Wednesday should be key this week

- Gold and Silver

| Is Eric Sprott Giving Up on Silver? Posted: 20 Oct 2014 12:45 PM PDT As part of our weekly webinar series, it was a distinct pleasure and honor to welcome Eric Sprott. In this wide-ranging, 47-minute discussion, Eric offers his comments and analysis on: Chinese gold demand and the continuing drawdown of the GLD. Market conditions needed to facilitate an expansion of the PHYS and/or PSLV. The mining stocks. […] The post Is Eric Sprott Giving Up on Silver? appeared first on Silver Doctors. |

| Resource guru Sprott: What Ebola could mean for gold and silver now Posted: 20 Oct 2014 12:16 PM PDT From The Gold Report: Could an infectious disease kill the monster that has been choking gold and silver prices for more than a year? On the heels of a lively Sprott Precious Metals Roundtable discussion, The Gold Report caught up with investor Eric Sprott to ask how a tragedy in Africa could impact the price of precious metals and mining stocks. We also spoke to his Executive Vice President of Corporate Development John Ciampaglia about a new way to gain exposure to gold. The Gold Report: Deutsche Bank warned in a recent note that the Ebola virus could impact commodity markets, including gold and cocoa, as it spreads to producing countries in West Africa, particularly Ghana and Mali. In a recent article titled “Ebola, The Tipping Point,” you mourned the unnecessary loss of life and predicted 5% less global production next year than this year. Could a lack of supply due to Ebola-related closures really cause the price of gold to rise? Eric Sprott: There is already a shortage of gold and silver in the markets without a corresponding increase in the price. I wrote an open letter to the World Gold Council questioning its data on China. If you believe the Shanghai Gold Exchange data, China consumes more than 2,000 tons (2 Kt). In 2011, it consumed only about 1 Kt. In the last two years, China has bought an extra 1 Kt gold—25% of a 4 Kt market. If any country came in and bought 25% of the oil market, the wheat market or the orange juice market, the commodity price would not go down. Obviously, the physical gold market is not manifesting itself in the price changes. We also see that in silver. Last year, Indians bought an extra 18% of the silver market, yet the silver price declined. That’s because the price is being run by someone who has avoided the physicality of the market. I hope the U.S. Mint will announce that it has to stop selling 2014 silver because the demand has picked up so much. That’s what I expect the Mint to do if it’s running out of silver. It would be interesting if some of these futures players were to stand up and demand delivery, because I don’t think the Mint could deliver. Closing mines in Africa would just exacerbate the supply problem and cause things to finally change dramatically to the upside in prices as people publicly acknowledge the fundamentals. I’m really focusing on the impact of Ebola on the demand side. The numbers suggest that Ebola will be difficult to contain. The death rate is incredibly high and it is highly contagious. It has already spread to Spain and the U.S. Unfortunately, the powers that be at the Centers for Disease Control (CDC) and the World Health Organization (WHO) have totally misunderstood and understated what’s going on. Four weeks ago the U.S. government magnanimously announced it will spend $22 million to build a 25-bed facility in Liberia. What would 25 beds possibly do in Liberia? Sierra Leone has already given up trying to treat people in hospitals. The country could have 100,000 cases in just a few months. The CDC estimated that we could see between 550,000 and 1.4 million cases by Jan. 20 in just those two countries. There aren’t enough hospitals or healthcare workers there to deal with those numbers. TGR: You called the world’s response to the crisis “nothing short of underwhelming.” Do you think now that there have been cases in the U.S. that the world health community will take it more seriously? ES: Unfortunately, recent events have suggested that travel protocols, monitoring programs and hospital procedures are not working. It’s a mess of incompetence, and it goes back to central planners focusing on the economy and the stock markets and bond yields. They forget about people and their response is wholly ineffective. When Doctors Without Borders was screaming months ago that it needed more help, nothing happened. No one understood the simple equation of numbers that if you let this thing go, you’ve lost control. We have certainly lost control in Sierra Leone and Liberia. The Ebola virus doesn’t know where the border is and the likelihood of it spreading to Ivory Coast and Ghana is very high. The jury is still out on how the developed counties will do. TGR: How will an explosion in the number of Ebola cases impact the global economy? ES: Fear of travel and business disruption is definitely going to have an impact on a fragile economy already weakened by recessions in Europe and Japan. An event like this could have serious negative repercussions because it changes people’s behaviors. If people worried about the security of bank deposits start pulling their money out, they would logically want to shift to gold and silver. All of a sudden, investors would come back into these markets and push the price up. No one is considering that. The natural Armageddon of disease could cause a financial Armageddon and precious metals are the natural comfort play. TGR: Do you think that the commodity markets have already baked that into the precious metals prices? The Index also uses long-term debt to equity as a factor because companies with higher debt levels tend to have weaker balance sheets, and interest payments erode profitability. A high level of debt can also make a company more vulnerable in a downturn. For this reason, a company like Barrick Gold Corp. (ABX:NYSE), which has a high debt ratio, is currently underrepresented in the Index. Conversely, a company like Franco-Nevada Corp. (FNV:TSX; FNV:NYSE) is currently overweighted because it has zero debt. The process is dynamic, which means that every quarter the Index rebalances its holdings to incorporate the latest company results into its screening process. This ensures that companies with the highest factor scores are represented in the Index on a quarterly basis. TGR: The Sprott Gold Miners ETF currently holds a mixture of company types at various stages of development. It includes royalty companies like Silver Wheaton Corp. (SLW:TSX; SLW:NYSE), large caps like Goldcorp Inc. (G:TSX; GG:NYSE), along with intermediate producers like Primero Mining Corp. (PPP:NYSE; P:TSX) and New Gold Inc. (NGD:TSX; NGD:NYSE.MKT). Then you have the near-term producers like NOVAGOLD (NG:TSX; NG:NYSE.MKT). What role does each of those company types play in the Index? ES: You obviously want a cross-section. In this environment, the royalty companies seem to have done the best. They essentially have almost zero cost. All they have is revenue. Now, the revenue goes down because the price of gold and silver goes down, but you’re not going to go broke. However people invest in precious metals I would like to stress what I said in the roundtable: People need to stay the course. I think the returns can be very large if what should happen is allowed to happen in the physical market. I think it will happen very shortly. TGR: Thank you for your time, Eric and John. Eric Sprott has more than 40 years of experience in the investment industry. In 1981, he founded Sprott Securities (now called Cormark Securities Inc.), which today is one of Canada’s largest independently owned securities firms. After establishing Sprott Asset Management Inc. in December 2001 as a separate entity, Sprott divested his entire ownership of Sprott Securities to its employees. Sprott’s predictions on the state of the North American financial markets have been captured throughout the last several years in an investment strategy article that he authors titled “Markets At A Glance.” Sprott has been widely recognized for his strategic insights and his accurate market predictions over the years. John Ciampaglia joined Sprott in April 2010 as chief operating officer. Ciampaglia has 18 years of experience in the investment industry. Previously, he was a senior executive at Invesco Trimark; Ciampaglia was an active member of the firm’s Executive Committee and held the position of senior vice president, product development. Prior to joining Invesco Trimark, Ciampaglia spent more than four years at TD Asset Management, where he held progressively senior product management and research roles. He earned a Bachelor of Arts in economics from York University, holds the Chartered Financial Analyst designation and is a Fellow of the Canadian Securities Institute. |

| Could an Ebola Armageddon revitalize gold and silver prices? Posted: 20 Oct 2014 12:16 PM PDT Could an infectious disease kill the monster that has been choking gold and silver prices for more than a year? |

| Forget about Ebola – here’s why US banks (and your savings) are now EXTREMELY vulnerable Posted: 20 Oct 2014 11:15 AM PDT With a combined position of nearly $2 trillion in US government debt, against which they hold little or no capital buffer, US banks are now EXTREMELY vulnerable to a bond market sell-off. The global economy shivered when the consequences of lending to subprime homebuyers came to fruition. Just imagine how it will quake when the US […] The post Forget about Ebola – here's why US banks (and your savings) are now EXTREMELY vulnerable appeared first on Silver Doctors. |

| Posted: 20 Oct 2014 10:18 AM PDT SunshineProfits |

| Troy signs minerals agreement for the Karouni Gold Project in Guyana Posted: 20 Oct 2014 10:09 AM PDT The Minerals Agreement details all fiscal, property, import-export procedures, taxation and other related conditions for the development and operation of Karouni. |

| Silver Myths Smashed, Pt. 4: The Coming Silver Lie You Simply Must Be Ready For Posted: 20 Oct 2014 10:00 AM PDT The Federal Reserve and bullion banks, through decades of body-slamming the silver "market", have actually removed silver so far from "Bubble" status, that you couldn't see it with the Hubble telescope! Instead of expanding upward and outward, it has been forced inward and downward, through the numerous crimes of these crooked institutions. In fact, silver has […] The post Silver Myths Smashed, Pt. 4: The Coming Silver Lie You Simply Must Be Ready For appeared first on Silver Doctors. |

| Prolonged gold curbs hit the Current Account Deficit Posted: 20 Oct 2014 09:17 AM PDT The U.S.-based Citi said on Thursday that it expects the country's Current Account Deficit (CAD) to remain under 2% for the current fiscal year. |

| Craig Hemke: NO FREE MARKETS – ONLY MANIPULATION Posted: 20 Oct 2014 09:00 AM PDT TFMetalsReport’s Craig Hemke joins Finance & Liberty for an in-depth interview discussing: QE- Will the Federal Reserve stop printing money? Latest PM takedown- Why did precious metals prices crash? Outlook for gold & silver- Will precious metals stay low? Who is responsible- Are China and India manipulating precious metals? What will the first sign be for the […] The post Craig Hemke: NO FREE MARKETS – ONLY MANIPULATION appeared first on Silver Doctors. |

| Posted: 20 Oct 2014 09:00 AM PDT Last week saw tremendous volatility in the equity and bond markets. It also saw a strong rebound on gold, right back up to the primary trendline we've been following all year. Holy moly, where do we go from here? |

| India enacts import tariff hike on gold Posted: 20 Oct 2014 08:47 AM PDT The Indian government today announced marginal hike in import tariff value for gold. |

| Welcome To Arcadia – The California Suburb Where Rich Chinese Stash Cash In McMansions Posted: 20 Oct 2014 08:45 AM PDT The surge in foreigners buying up U.S. real estate has been well documented in recent years. Of all this buying, no nation has demonstrated a bigger increase in purchases than China. In fact, it is estimated that 24% of all foreign purchases of domestic real estate this year have come from China, up 72% from last year. In some California communities, 90% […] The post Welcome To Arcadia – The California Suburb Where Rich Chinese Stash Cash In McMansions appeared first on Silver Doctors. |

| Marshall Swing: This Bottom May Be the Longest Yet! Posted: 20 Oct 2014 08:30 AM PDT This bottom may be the longest yet. This is psychological warfare and does not resemble the true PM physical market at all but it is contrived through manipulation to depress speculation so that physical buyers will stay away from PMs and trust bonds and equities while Ebola and ISIS rip up the daily headlines. The […] The post Marshall Swing: This Bottom May Be the Longest Yet! appeared first on Silver Doctors. |

| Gold can shield against euro risk Posted: 20 Oct 2014 08:10 AM PDT The European status quo and EU elites are becoming increasingly concerned by popular calls in Italy for Italy to leave the European Monetary Union. |

| Indian exchanges extend trading sessions for gold ETFs Posted: 20 Oct 2014 07:39 AM PDT The two Indian stock exchanges have announced their decision to conduct extended trading sessions for gold Exchange Traded Funds on account of Dhanteras. |

| Metals market update for October 20 Posted: 20 Oct 2014 07:28 AM PDT On Friday, gold fell $1.70 or 0.14% to $1,237.80 per ounce. Silver slipped $0.10 or 0.58% to $17.28 per ounce Friday. |

| Alasdair Macleod’s Market Report: Gold Benefits from Market Uncertainty Posted: 20 Oct 2014 07:00 AM PDT The outlook for gold is now more positive than it has been for some time. After a prolonged period of low volatility as funds invested in ever-greater risk, markets have snapped and volatility has jumped. In short, we are swinging very suddenly from complacency to reality. Submitted by Alasdair Macleod, GoldMoney: Financial markets hit a […] The post Alasdair Macleod’s Market Report: Gold Benefits from Market Uncertainty appeared first on Silver Doctors. |

| Indian Finance Ministry to tighten gold import curbs Posted: 20 Oct 2014 06:53 AM PDT The Indian Finance Ministry has called for re-imposition of the gold import curbs which were earlier relaxed on May 21 this year. |

| Why do foreign investors remain so sure London property is risk-free? Posted: 20 Oct 2014 06:31 AM PDT Property can make or break a market. One of the world's strongest is London. But as the UK capital's most valuable real estate gets snapped up, where does it leave Londoners? Is selling off the family silver such a good idea? Where is everybody going to live? Will locals buy the property back when the market finally goes bust? Rental yields already make deflation a clear and present danger. Bloomberg’s Tom Gibson reports… |

| The gold price still looks robust - Phillips Posted: 20 Oct 2014 06:06 AM PDT In his daily commentary, Julian Phillips reckons this could be a big week for gold. |

| India's Diwali festivities could push Gold higher Posted: 20 Oct 2014 05:27 AM PDT The gold-supportive macro environment has seen gold extend its gains above the $1200/Oz mark as the dollar has weakened, the St. Louis Fed discussed the possibility of further stimulus, and importantly, demand picked up amid the seasonally strong period of consumption. |

| Euro Risk Due To Possible Return of Italy To Lira - Drachmas, Escudos, Pesetas and Punts? Posted: 20 Oct 2014 05:18 AM PDT gold.ie |

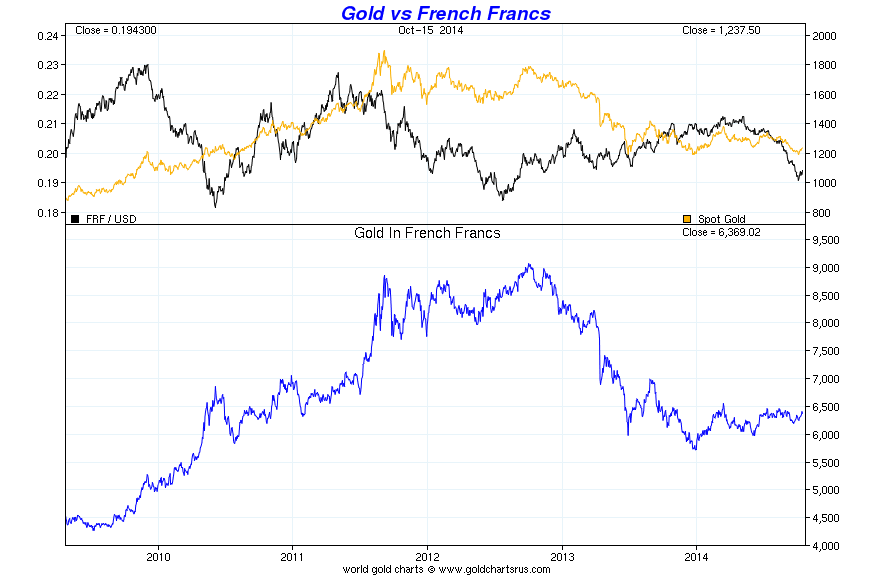

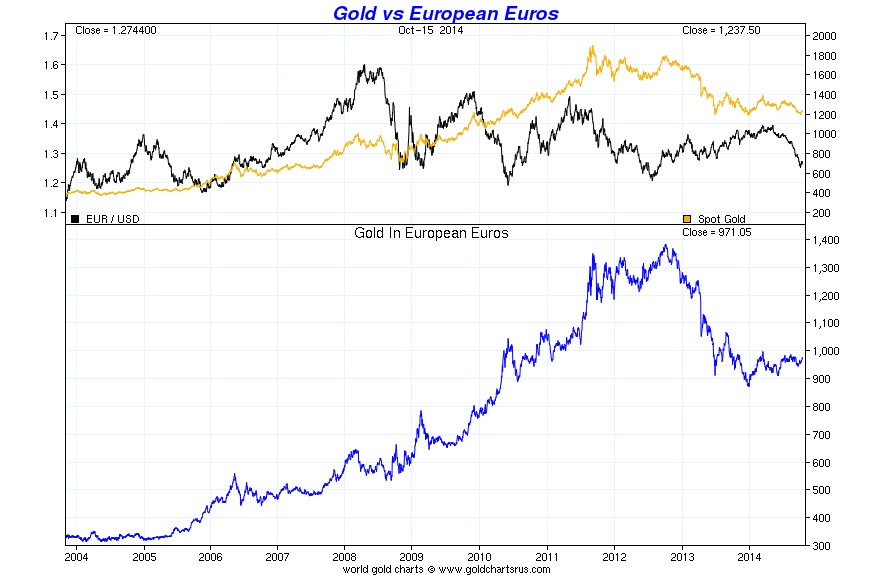

| Euro Risk Due To Possible Return Of Italy To Lira – Drachmas, Escudos, Pesetas and Punts? Posted: 20 Oct 2014 04:10 AM PDT Euro Risk Due To Possible Return of Italy To Lira – Drachmas, Escudos, Pesetas and Punts?The European status quo and EU elites are becoming increasingly concerned by popular calls in Italy for Italy to leave the European Monetary Union and the euro “as soon as possible” and return to the lira.

Beppe Grillo, the leader of Italy’s Five Star Movement has shocked EU elites by launching of a non-binding consultative referendum on the matter which will be put before the parliament. “We will collect half a million signatures in six months – a million signatures – and we will take our case to parliament, and this time thanks to our 150 legislators, they will have to talk to us" the Telegraph reports Grillo, the popular comedian and increasing popular politician as having said. The movement, for whom 25% of Italians voted in last year’s general election, and a further 21% in this years European elections, appear to be upping the ante following the failure of the the EU bureaucracy and the ECB to acknowledge demands, last May, for the creation of Eurobonds to support the Euro and the abolition of the EU fiscal compact. Both measures are staunchly opposed in Germany. They see the creation of Eurobonds as a means to make Germany responsible for the borrowing of struggling peripheral nations. Peripheral nations such as Italy, Greece, Spain, Portugal and Ireland argue that they should not be made carry the entire burden of a problem caused, at least in part, by their participation in the monetary union. The customary method of devaluing a sovereign currency in order to make their exports more competitive is not open to them. The fiscal compact requires that Eurozone states keep a balanced budget. According to Ambrose Evans Pritchard, the respected International Business Editor of the Telegraph, the "Fiscal Compact is economic insanity. It would force Italy to run massive fiscal surpluses for decades. These would cause an even deeper depression, pushing the debt ratio even higher, and would therefore be scientifically self-defeating.” While it is still early to speculate on the outcome of this process, it is worth considering the implications of the fifth largest economy in Europe jettisoning the Euro. At the height of the Euro crisis in early 2012 it looked possible that the entire monetary union project might rupture as the interest yielded on the bonds issued by the more vulnerable states began to soar. This has begun to happen again in recent days and Greek bonds have seen a new vicious sell off and 10 year yields have soared to nearly 9% (see below). That is, investors in the bond markets had come to regard the bonds of Italy, Greece, Spain and others as high risk investments and required a much higher rate of return to compensate for this risk. At that time, talk of the creation of a Eurobond was rife but the Germans held fast. It was looking as though these struggling countries would be forced to leave the euro until, at the eleventh hour, ECB governor Draghi stepped in, in July 2012, and announced that the ECB “is ready to do whatever it takes to preserve the euro.” This was interpreted to mean, among other things, that the ECB would buy bonds of struggling countries if necessary. Without Draghi having to actually do anything, risk was regarded as having been removed, at least temporarily, from the system and there has been a relative calm and confidence in the viability of the single currency since then. But crisis seems to be surfacing again as seen in the sharp increase in volatility and decline in stock markets and certain bond markets in recent days and again today. For many Italians, the slow grind of depression has tested their patience beyond endurance. Youth unemployment is at an incredible 46% and industrial production has fallen 25%. Many note that, since joining the euro, Italy – once an industrial powerhouse of Europe – has been unable to compete with Germany due to an overvalued currency. In Greece the effects of Draghi’s pronouncements appear to have run their course and now actions may be required. The stock market has retraced around 50% of its gains since the “Draghi put.” It is down a sharp 23.65% this year alone. There are increasing calls in Greece for a return to the drachma – polls show 33% in favour of a return to the Greek drachma at this time. The fact that it is impossible for Greece to regain competitiveness and recover from depression while clinging to the euro is becoming increasingly evident. Prominent economists such as Nouriel Roubini, as well as investor George Soros have said as much and influential voices in Greece are now questioning the wisdom of clinging to the euro. Even uber Keynesians and money printing advocates such as Paul Krugman have previously warned of the euro breaking up and Italy returning to the Italian lira and France returning the French franc. In Ireland, dissatisfaction is not being expressed through euro skepticism. However, there is certainly a sense that enough austerity is enough. Up to 100,000 people took to the streets the weekend before last, to protest the introduction of water meters and privatisation of the water supply. This was a very large turnout by Irish standards and may be the start of the Irish public awakening from their recent apathetic slumber. Criticism of the EU and ECB remains muted in Ireland. Although, the recent revelations by former central bank head, Patrick Honohan, regarding the manner in which the losses of reckless European banks were foisted onto the Irish taxpayer, is making even the most hardened euro phile somewhat skeptical. Not skeptical of the EU per se but of a policy of blindly accepting unfair and damaging policies foisted on Ireland. In Spain and Portugal none of the structural problems that led to the crisis have been solved. And with data from Germany suggesting it is entering recession it may be only a matter of time before the eurozone is in crisis mode once again. Debt levels remains very high throughout the EU. In this environment, the ECB is in a much more difficult, some would say impossible position, as the panacea of ultra low interest rates can no longer be administered. In the fifteen years since the introduction of the euro, we have had six years of austerity and monetary hardship. If Europeans are faced with more of the same it is likely that disillusionment with the euro project will be inflamed. It is hard to envisage an orderly breakup of the EMU. Like Cortez – who burned all but one of his ships before marching inland to take on the Aztec empire – turning back was not factored into the architecture of the monetary union. There are now three real scenarios that could play out in the coming months. First, is that the German people, politicians and Bundesbank manage to prevent the ECB from embarking on the 'bazooka' of Euro QE. Given huge deflationary pressures, this would likely lead to deflation and an economic depression in Europe and globally. The second scenario is that Draghi and the ECB manage to overcome German opposition to euro QE or euro debt monetisation and printing. This would lead to the euro being debased and devalued and falling in value versus major currencies and especially gold. The third scenario is that Italy or Greece opt to leave the monetary union and revert to their national currency. Their new liras and drachmas see sharp devaluations. There is also the possibility that we see the deflation first and then the euro or national currency devaluations. It is worth remembering that gold is both a hedge against currency devaluation and inflation and also gold is a hedge against deflation. Gold has no counterparty risk and cannot go default or go bankrupt , unlike companies and governments. Conclusion The answer remains obvious and can be seen in the charts above. Gold is an important hedging instrument and financial insurance that will protect people from the potential return to liras, drachmas, escudos, pesetas and punts. These are the types of scenarios where gold comes into it’s own as financial insurance and a store of value. Get Breaking News and Updates On Gold and Markets Here

GOLDCORE MARKET UPDATE On Friday, gold fell $1.70 or 0.14% to $1,237.80 per ounce. Silver slipped $0.10 or 0.58% to $17.28 per ounce Friday. Gold had a second week of gains and rose 1.2% last week, while silver fell 0.40% after the selling on Friday pushed silver lower for the week. Gold in British Pounds – 2 Years (Thomson Reuters) Gold in Singapore fell initially prior to rising in later trade prior to London opening when prices were capped again. Silver for Swiss storage or immediate delivery gained 0.5% to $17.40 an ounce. Spot platinum rose 1.1% to $1,272.75 an ounce after ending last week little changed. Palladium rose 0.6% to $761 an ounce, after falling 3.6% last week. Gold has rallied almost 4% in the past two weeks and reached one month high of $1,249.30 last Wednesday. Futures climbed to $1,250.30 on October 15, the highest price September 11. The net long position in futures and options jumped 39% in the week to October 14, snapping the longest run of reductions since 2010, according to CFTC data. While Asian shares rose today, European stocks fell again, following their longest streak of weekly losses in more than a year. Worse than estimated financial results from large companies added to concerns over the region's recovery. European equities have led a global rout that erased as much as $5.5 trillion from the value of shares worldwide as concern over the region's economic recovery re-emerged, amid speculation that the ECB's stimulus measures would not be enough to spur growth. Stocks pared losses today, due to rumours that the European Central Bank bought short dated French covered bonds. Gold in Euros – 2 Years (Thomson Reuters) Government bonds from Italy and Spain fell, extending a selloff from last week. Italy's 10-year rate climbed another four basis points to 2.54% after increasing 17 basis points last week. Spain's rose three basis points today to 2.19%. The S&P 500 rallied on Friday, but it still locked in its fourth straight weekly decline. Its longest bearish run in over 3 years, as investors are becoming wary about the fragile global economy, another European debt crisis and the risks posed by the ebola virus and possible contagion. See Essential Guide To Gold and Silver Storage In Switzerland |

| Posted: 20 Oct 2014 04:01 AM PDT Fans of gold have been following announcements for any sign of relief, but Jeff Wright says change may be a long time coming. |

| Posted: 20 Oct 2014 03:18 AM PDT Perth Mint |

| Posted: 20 Oct 2014 02:42 AM PDT At the launch of our Perth Mint Certificate Program Approved Dealer GoldSilver Central today the journalists were interested in the views of Raphael Scherer of Degussa and myself on the gold market. I made a bottom/buy call on 18 September and the price subsequently held above $1180 and has strengthened since then. It is worth noting that not long ago the narrative around gold was quite negative, even in respect of China demand (see here for an example). In that article a dealer was quoted as saying that Chinese buyers "could come back to the market if prices fall below $1,200 an ounce." This has proven to be the case, as the Perth Mint saw kilobar premiums rise once the price breached $1200 on the downside (see here) as interest returned and volumes were up. I would note that since my September 18th post there has been many more tonnes of kilobars withdrawn out of Comex warehouses (don't have the figures or charts to hand here in Singapore, but will update when I get back into the office). However, while the $1200 level has proved to draw out interest and gives me confidence that the $1180 level is a firm support point, I would have to agree with this comment that "Asian physical demand doesn't look strong enough to act as a major catalyst to drive the gold prices higher" at least at this time, as the Perth Mint did see premiums reduce a bit as the price moved up above $1220. Indian demand is still being throttled, as we saw with calls to retighten import rules in response to the surge in gold imports in September. Smuggling is making up some of the shortfall, but increased policing is making an impact, with courier fees increasing from $245 to $470 a kilo (approx 1.2% "risk premium") as this Reuters article explains. FYI, I have heard reports that some importers are getting around the 80:20 rule by making cheap value added product and then after exporting it, just melting it down as this gives them the right to then import 80% (part of which is the melted gold). This "arbitrage" is unlikely to last, given the Indian government's anti-gold stance and I'm sure we will see a crackdown on this in the future. So I don't think we can rely on India to save to day, so to speak. On the positive side, I have seen more articles discussing the fact that current prices are around mine cost. This from Saxobank's CIO "there is growing belief that the "narrative of the central banks" is failing" - it seems Ben Hunt's work is getting more exposure - is positive as I think mainstream investors are not buying gold because they believe the government can fix the economy's problems. If that narrative is challenged, then we will see a renewed interest in gold. While Ben Hunt feels that we are "on the precipice of that breakdown in confidence. A cold wind of change is starting to blow" I think such a change in the belief in the power of central bankers will take some time to unwind, as Ben himself says, noting that the "collective solipsism of modern markets is a much bigger game still, and will require a much larger shock and external social structure to unwind the Common Knowledge structure at the heart of all this". In summary I think we have a formed a firm bottom but gold needs another catalyst to drive it higher and is mostly relying on US dollar/economic weakness at this time. Maybe it is just a case of gold needing to consolidate at these levels: the longer it holds above $1180 the more the bearish calls for $1050 or whatever begin to lose their credibility and then we have the "space" for a more positive narrative about higher gold prices to form. |

| Gold bulls lured back for first time in two months Posted: 20 Oct 2014 02:19 AM PDT The gain in the net-long position in New York gold futures and options snapped the longest run of reductions since 2010. |

| An Ebola Armageddon Could Trigger a Rebirth in Gold and Silver Prices: Eric Sprott Posted: 20 Oct 2014 01:00 AM PDT |

| Gold Weekly Report---the Consumer price index report on Wednesday should be key this week Posted: 19 Oct 2014 05:18 PM PDT Commodity Trader |

| Posted: 19 Oct 2014 05:06 PM PDT The Silver GoldSpot |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment