Gold World News Flash |

- End of QE3 and First Signs of PANIC

- More GLD Drawdowns

- Richard Russell - Expect An Avalanche Of Fiat Money Creation

- Nationalize The Federal Reserve

- 14 California communities now on verge of waterless-ness; mass migration out of California seems imminent

- Leading Contrarian Economist: “We Are Coming In On The End Game Here”

- How Much Gold Is On Loan Worldwide?

- Goodbye War On Drugs, Hello Libertarian Utopia. Dominic Frisby’s Bitcoin: The Future of Money?

- Top Scientist Warns This Version Of Ebola Looks Like "A Very Different Bug"

- "Either You're The Butcher... Or The Cattle"

- The Gold Price Rose Back to $1,244 Up $5.70 on the Comex

- "Anti-Petrodollar" CEO Of French Energy Giant Total Dies In Freak Plane Crash In Moscow

- What The Strong Dollar Does With The Price Of Gold

- Gold or Crushing Paper Debt

- Why the Fed Will Continue to Print Money in 2015

- Gold Daily and Silver Weekly Charts - Post Stock Option Expiration Rally

- Despite Struggle, Gold & Shares Coiled For Upside Explosion

- Lower Gold Prices Prompt Large BRIC Purchases

- The Seven Sins Of Obama- 1. The Rot From Within

- Ebola Armageddon Could Trigger a Rebirth in Gold and Silver Prices

- Challenge to Keynesians 'Prove Rising Prices Provide an Overall Economic Benefit'

- Koos Jansen: The Chinese precious metals market is on fire

- Gold vs Euro Risk Due To Possible Return of Italian Lira - Drachmas, Escudos, Pesetas and Punts?

- Blood in the Streets to Create the Opportunity of the Decade

- An Ebola Armageddon Could Trigger a Rebirth in Gold and Silver Prices: Eric Sprott

| End of QE3 and First Signs of PANIC Posted: 21 Oct 2014 01:30 AM PDT by Léonard Sartoni , Gold Broker:

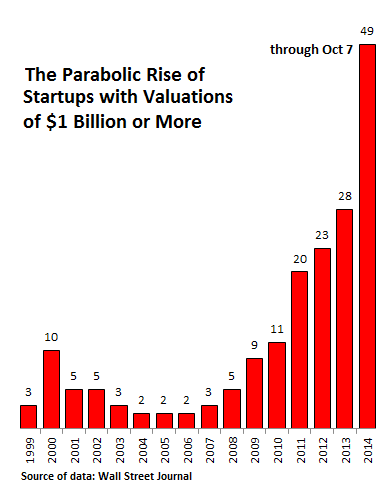

The wind of speculation, brought about by much too low interest rates fixed by the Fed and the other central banks, is such that even turkeys have started to fly! In 2014, stock market euphoria and multi-billion dollar IPOs have reached new heights. Money has flown into all kinds of assets, including crypto-currencies. When the tide recedes we'll be able to better see who was swimming naked. | ||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 Oct 2014 11:00 PM PDT from TF Metals Report:

Longtime readers will recall that we’ve been covering the ongoing depletion of the GLD since early 2013. After today’s massive withdrawal, the total alleged “inventory” of the GLD now stands at a multi-year low of just 751.96 metric tonnes and down 5.8% on the year. This while the paper price of gold is actually up on the year by nearly 4%. In case you’re new to this site and need a refresher, here are just a few of the articles we’ve posted in the past: http://www.tfmetalsreport.com/blog/4517/raiding-gld http://www.tfmetalsreport.com/blog/4633/enencumbered-gold http://www.tfmetalsreport.com/blog/4684/bear-market-gold http://www.tfmetalsreport.com/blog/5167/pillaging-gld http://www.tfmetalsreport.com/blog/5505/gld-two-step The alleged “inventory” of the GLD began 2013 at 1,349.92 metric tonnes of “gold”. Over the course of the year, while paper price declined from $1650 to $1200 or 27%, the “inventory” of the GLD declined to 798.22 mts or about 41%. | ||||||||||||||||||||||||||||||||||||||||||||

| Richard Russell - Expect An Avalanche Of Fiat Money Creation Posted: 20 Oct 2014 09:01 PM PDT  Today the Godfather of newsletter writers, 90-year old Richard Russell, warned that the world should now brace itself for the creation of a veritable avalanche of fiat currencies. The 60-year market veteran also covered gold, silver, stocks, China, the U.S. dollar and more. Today the Godfather of newsletter writers, 90-year old Richard Russell, warned that the world should now brace itself for the creation of a veritable avalanche of fiat currencies. The 60-year market veteran also covered gold, silver, stocks, China, the U.S. dollar and more.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||

| Nationalize The Federal Reserve Posted: 20 Oct 2014 08:40 PM PDT by Dean Henderson, Henderson Left Hook:

At their core they are Nazis, so the black Obama provides the perfect fall guy. There is but one rabbit which Obama can pull out of the hat which will prevent both his and our demise. He must nationalize the Federal Reserve. And he must do it now. | ||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 Oct 2014 08:00 PM PDT by Jonathan Benson, Natural News:

A few months ago, the official count was 28 communities bordering on complete waterless-ness, according to the Water Resources Control Board. Those that have since dropped off the list were able to come up with a fix, at least for now. The other 14, though, face an unprecedented resource collapse that could leave thousands of Californians with no other choice but to pack their bags and head to greener pastures. “It’s a sign of how severe this drought is,” verbalized Bruce Burton, an assistant deputy director for the board, to the Los Angeles Times about some of the drastic measures being taken. For the first time ever, the water board has begun tracking communities throughout the state that are bordering on complete water loss, a situation that has never before occurred. | ||||||||||||||||||||||||||||||||||||||||||||

| Leading Contrarian Economist: “We Are Coming In On The End Game Here” Posted: 20 Oct 2014 07:40 PM PDT by Mac Slavo, SHTFPlan:

A loss of confidence in America's ability to manage its fiscal, economic and monetary policy coupled with a continued slowdown in growth could soon reveal what Williams calls "the end game." It's coming sooner rather than later suggests Williams in a recent interview with Greg Hunter's USA Watchdog: | ||||||||||||||||||||||||||||||||||||||||||||

| How Much Gold Is On Loan Worldwide? Posted: 20 Oct 2014 07:21 PM PDT by Dan Popescu , SRS Rocco:

The two diagrams bellow show an approximation of the size of the derivatives market supported by the real market but not its increased complexity and opacity. | ||||||||||||||||||||||||||||||||||||||||||||

| Goodbye War On Drugs, Hello Libertarian Utopia. Dominic Frisby’s Bitcoin: The Future of Money? Posted: 20 Oct 2014 07:19 PM PDT Now that bitcoin has subsided from speculative bubble to functioning currency (see the price chart below), it’s safe for non-speculators to explore the whole “cryptocurrency” thing. So…is bitcoin or one of its growing list of competitors a useful addition to the average person’s array of bank accounts and credit cards — or is it a replacement for most of those things? And how does one make this transition? With his usual excellent timing, London-based financial writer/actor/stand-up comic Dominic Frisby has just released Bitcoin: The Future of Money? in which he explains all this in terms most readers will have no trouble following. As you’d expect from someone who uses words to amuse as well as educate, Frisby’s prose is informal and fluid and occasionally very funny, with lots of first-person anecdotes. The message, however, is fairly serious: Bitcon is, just maybe, a new and better form of money, an emerging homo sapiens to the dollar’s Neanderthal. As such it’s potentially transformational. So let’s start with a little background: Bitcoins are created (or mined) when computers solve certain kinds of mathematical puzzles. The number of bitcoins outstanding is designed to grow at a predetermined rate for a predetermined period, making its supply both limited and predictable (in contrast to fiat currencies that multiply at the whim of central bankers and politicians). And the currency can be transferred online quickly and cheaply, bypassing the traditional banking/credit card nexus.

He also profiles some of the early players in the bitcoin ecosystem. Silk Road, for instance, was briefly the Amazon.com of online drug sales until it was shut down by the authorities — and then subsequently reemerged in various forms around the world. Meanwhile, a lot of early adopters made and lost some serious money during bitcoin’s initial price spike:

Here’s the promised chart of bitcoin’s explosive rise and subsequent decline to what looks like a stable valuation: The second half of the book covers the impact of cryptocurrencies on the old, corrupt financial order. Frisby concludes, rightly, that today’s fiat currencies are pale, dysfunctional shadows of yesterday’s sound money and that this corruption is the main cause of our descent into debt-driven chaos. Cryptocurrencies, meanwhile, have the potential to usher in an age of high-tech sound money that puts future governments and mega-banks in their (much more humble) place. From the chapter titled “Why Bitcoin is a libertarian Utopia”:

From Why “Bitcoin will end the war on drugs”:

These are of course controversial predictions and before they come true lots of questions will have to be answered. For instance: When the empire inevitably strikes back, what will the world’s central banks and intelligence services do to squash and/or co-opt cryptocurrencies, and how will these actions affect the functioning and value of bitcoin and its peers? Which cryptocurrency will win out? Besides bitcoin there are hundreds in existence already and several, including Litecoin and Dogecoin, are gaining traction. What would the emergence of one or two winners do to the utility and monetary value of the others? By decade’s end we’ll know the answers. In the meantime this is a great place to start. | ||||||||||||||||||||||||||||||||||||||||||||

| Top Scientist Warns This Version Of Ebola Looks Like "A Very Different Bug" Posted: 20 Oct 2014 05:56 PM PDT Submitted by Michael Snyder via The Economic Collapse blog, Barack Obama and the head of the CDC need to quit saying that we know exactly how Ebola spreads. Because the truth is that there is much about this virus that we simply do not know. For example, a top Ebola scientist that is working in the heart of the outbreak in Liberia says that this version of Ebola looks like it could be "a very different bug" from past versions. Other leading scientists are echoing his concerns. And yet Barack Obama and Thomas Frieden continue to publicly proclaim that we know precisely how this virus behaves. Not only is that bad science, but it could also potentially result in the unnecessary deaths of a very large number of people. For example, Obama has refused to implement an Ebola travel ban because he is greatly underestimating the seriousness of this virus. This decision could turn out to be incredibly costly. If what you will read about below is true, we could be dealing with some sort of "super Ebola" that nobody has ever seen before. Peter Jahrling of the National Institute of Allergy and Infectious Disease is on the front lines fighting this disease in Liberia. He is one of the top authorities in the world on Ebola, and what his team has been seeing under the microscope is incredibly sobering...

Other top scientists are making similar observations. The following comes from a recent article posted on Washington's Blog...

I have posted video of that talk on C-Span below... But even if we were dealing with the exact same strain of Ebola, that does not mean that our leaders are telling us the truth when they say that it is not an airborne virus. Just check out the following quotes from top scientists about the spread of Ebola from a recent Los Angeles Times article…

And I have written about this before, but so many people don't know about this that it bears repeating. The following is an excerpt from a news story about a study that was conducted back in 2012 that demonstrated that the Ebola virus can be transferred from one animal to another animal without any physical contact whatsoever...

So when Barack Obama and Thomas Frieden get up and tell us that they know with 100% certainty that Ebola is not airborne, they are lying to you. There is so much about this outbreak that we simply do not know. Our public officials should be honest about that. Instead, it seems like they are flying by the seats of their pants and just saying whatever they think will keep everyone calm. We are potentially facing the greatest health crisis of this generation, and bad science and false assurances are not going to help anyone. Sadly, Barack Obama just continues to make bad decision after bad decision. This includes his very foolish decision to send thousands of U.S. troops right into the heart of the Ebola death zone. It is being reported that these troops are only going to get just four hours of Ebola training, and the Pentagon is saying that they "will only need gloves and masks" to protect themselves...

Who is going to be held accountable when these young men and women start coming home sick? So far the federal response to this Ebola crisis has been a parade of incompetence. And yet we continue to be told that "everything is under control". I don't know about you, but I have a bad feeling about all of this. | ||||||||||||||||||||||||||||||||||||||||||||

| "Either You're The Butcher... Or The Cattle" Posted: 20 Oct 2014 04:44 PM PDT Submitted by Jim Quinn via The Burning Platform blog, The Walking Dead reflect the darkening mood of this intensifying Fourth Turning. I wrote one of my more pessimistic articles called Welcome to Terminus in April regarding the season four finale of the Walking Dead series. I essentially argued we are approaching the end of the line and the world is going to get real nasty.

In the six short months since I wrote that depressing article, we’ve seen men beheaded on Youtube videos by terrorists no one had ever heard of at the beginning of this year. Somehow a ragtag band of 30,000 Muslim terrorists, using American military equipment supplied to fight Assad in Syria and taken from the Iraqi Army when they turned tail and ran away, have been able to defeat 600,000 Iraqi and Kurd fighters with air support from the vaunted U.S. Air Force. Syria, Iraq, Libya, and Afghanistan descend into never ending religious based warfare. We’ve even had passenger planes mysteriously disappear in Asia with no trace. Crimea seceded from Ukraine and rejoined Russia, initiating a plan to punish Russia by the western powers. America supported and planned the overthrow of a democratically elected government in the Ukraine, with a predictable push back response by Russia, leading to a bloody civil war in the Eastern Ukraine. We’ve had a false flag shooting down of an airliner over the Ukraine by the Ukrainian government, blamed on Russia and Putin by Obama and his EU co-conspirators. The American corporate media mouthpieces have ignored the cover-up of missing controller transmissions, black box recordings, and physical evidence regarding the murder of hundreds of innocent people by western politicians. Israel and Hamas resumed their endless religious war in Gaza, with thousands of casualties and destruction. UK fear mongering and financial threats barely averted the secession of Scotland from the UK. Cantalonia continues to push for a secession vote to leave Spain. Violent protests have broken out in Spain, Italy, France and even Sweden. Turmoil, protests and riots in Brazil, Venezuela, Argentina and Mexico have been driven by anger at political corruption, high inflation, and general economic dysfunction. Saber rattling between China and Japan has increased and young people in Hong Kong have been protesting the lack of democratic elections being permitted by China. The world economy, undergoing central bank monetary stimulus withdraw, is headed back into recession as Germany, China and the U.S. join the rest of the world in economic decline. And now the Western Africa outbreak of ebola has gone worldwide, with predictions of an epidemic potentially causing worldwide economic chaos. What’s happening in the real world makes the dystopian zombie world of Walking Dead seem almost quaint. The writers of this show brilliant use of symbolism and imagery captures the violent, chaotic, inhumane, darkening, brutal world we inhabit as the Fourth Turning crisis period we entered in 2008 deepens on a daily basis. There is a good reason why the first episode of their fifth season drew the biggest cable TV audience in history. The show is clearly tapping into the mood of the masses. Early in the latest episode you realize Terminus has become a processing center run by cannibals. The line between victim and criminal, killer and prey, good and evil, madness and sanity, and moral and immoral is blurred. Everything is relative in the post-pandemic world of the Walking Dead.

Seeing Wall Street cannibals walk away unscathed after devouring the worldwide economic system in 2008 with their fraudulent financial schemes, corrupt politicians enriched by throwing taxpayers under the bus, militarized police forces trampling the Fourth Amendment, the NSA spying on every American, a private central bank enriching their owners by funneling trillions into their bank vaults, a president trampling on the Constitution by issuing executive orders to bypass the other branches of government, and billions of welfare and tax fraud from the urban ghettos to the penthouse suites in NYC, has convinced a large swath of Americans that everything is relative and nothing matters in our warped dystopian world. Right and wrong no longer matter. Morality is an antiquated concept. Adhering to the Constitution is an outmoded notion. Our society celebrates and condones our dog eat dog economic paradigm. Or zombie eats anything world in the case of Walking Dead. The Terminus complex is reminiscent of the concentration camp in Schindler’s List. It is complete with railroad cars to hold the prisoners, gates with barbed wire, armed guards, and extermination facilities to “process” the prisoners. Thick black smoke belches into the air. There is a room stacked full of booty, teddy bears, watches, clothes – everything except the gold fillings.The Nazi like precision and attention to detail is reflected in the almost business-like method in which the Terminus administrators go about gutting their prey. The bone chilling efficiency and antiseptic processing facility evoke memories of the holocaust gas chambers. The opening sequence when Rick, Daryl, Glenn and Bob are among a group of men lined up to be gutted like pigs over a trough in place to collect their spilled blood, might have been the most brutal scene ever put on non-premium cable TV. The callous and dispassionate way in which the prisoners (cattle) are lined up in front of a stainless steel trough is disconcerting and bone chilling. The victims are hit with a baseball bat and then their throats are slit over the trough by men in protective suits. They have become nothing but cattle to be butchered and consumed by the Terminus cannibals. You see another part of the processing plant where human remains are hanging from hooks like sides of beef. Gareth, the leader of Terminus, supervises the operation like a CEO, berating the butchers for not meeting quotas and following standard operating procedures. Not much different than how our mega-corporations are run today.

The other fascinating similarity between the dystopian “nightmare of want” setting of Terminus and our modern day dystopian “empire of excess” is the use of false advertising and propaganda to lure “customers” into their web. Their version of billboard advertising has plywood with the hand written messages of “Sanctuary for All”, “Community for All”, and “Those Who Arrive Survive”. The Terminus cannibals would have fit in well on Madison Avenue with the highly paid spin artists, propagandists, and whores for the corporate oligarchs. The signs along train tracks and radio transmissions from a call center like facility showed the calculated business-like efficiency of the cannibals in systematically and methodically luring victims to their slaughterhouse. It is the same techniques used by the apostles of Edward Bernays to consciously and intelligently manipulate the habits, opinions, tastes, ideas and actions of the masses, in order to control and influence their buying habits, voting decisions, and support of their rulers. The unseen men who constitute the “invisible government” use these techniques to keep the cattle docile, fed, and ignorant, as they are led to slaughter. The government and lack thereof is always lurking in the murky background of how and why the United States has devolved into an infected world of the walking dead. This episode provided some clues about government labs producing viruses as weapons to be used against some unexplained enemy. The insinuation is that the government somehow lost control of the virus and the ensuing pandemic destroyed our modern world and left the survivors to battle the biters and each other for the remaining scraps. The Federal government caused the societal collapse and is nowhere to be found in rebuilding the nation. It is unclear how the apocalypse went down, but you can assume it began with fear, which led to panic, chaos, economic collapse, violent upheaval, war, and total breakdown of governmental authority and control. It is ironic that today fear of a worldwide ebola pandemic is coinciding with an inevitable economic implosion, wars raging in te Middle East, violent protests raging around the globe, and trust in governmental authority plunging to all-time lows. The Walking Dead has wittingly or unwittingly captured the ambiance of our turbulent times. When you are faced with desperate circumstances you can either do whatever you need to survive or you can submissively accept your fate and die. Gareth and his cannibalistic cohorts had been in the same situation as Rick and his posse, but they had somehow turned the tables on their captors. Gareth’s survival of the fittest creed was “either you’re the butcher or you’re the cattle”. Human beings react to intense pressure and life threatening situations in different ways. Some people snap and turn into monsters, like Gareth. Some people snap and lose their minds. Others, like Rick and Carol, summon an inner strength to do whatever it takes to survive while barely maintaining their humanity. Others turn into blind followers of a strong forceful leader, not questioning the morality, legality or humanity of what they are ordered to do. The line between right and wrong, necessary versus unnecessary, vengeance versus justice, and butcher versus cattle is blurred in a world without rules, government or accepted norms. I believe the “butcher or cattle” analogy is sadly a valid meme for the world we currently inhabit. In the Walking Dead world, individuals must choose to be butcher or cattle. It’s a Darwinian world of kill or be killed. Like minded individuals with common values and goals form communities to protect themselves, provide for themselves, and attempt to bring a semblance of order in a chaotic world. The community of Westbury, led by the governor and the community of Terminus, led by Gareth, are founded upon a foundation of evil and ultimately destroyed. Rick’s community of liberty minded freedom fighters do whatever is necessary to survive, but retain their humanity, decency and desire to create a better world. Our present day world may not be as brutish as the Walking Dead world, though the line between reality and fiction is often indistinguishable when you turn on the news, but the distinction between butchers and cattle is clear. The elected and non-elected rulers of the deep state are the butchers, sending young men off to die for oil companies and arms dealers, impoverishing the masses through inflation and their control of the currency, and enriching themselves through their complete control of the political, financial, judicial, and economic systems. This establishment, or invisible government as Bernays described, is committed to its own enrichment and perpetuation. Its scope, financial resources, and global reach put it in a predator class all by itself. The common people are the cattle being led to slaughter. We are kept docile with incessant propaganda from the mainstream media; marketing messages to consume from Madison Avenue; filtered, adjusted, manipulated economic data fed to us by government agencies; an endless supply of iGadgets and other electronic distractions; government education designed to keep us ignorant; 24/7 reality TV on six hundred stations to keep us entertained; corporate toxic processed food to keep us obese and tame; and an endless supply of Wall Street supplied debt to keep us caged in our pens with no hope of escape. The butchers of the deep state have maintained control for decades, but we’re entering a new era. Fourth Turnings result in the tables being turned on the butchers. Some cattle are awakening from their stupor. They can see the bloody writing on the slaughterhouse wall. Anyone who isn’t sensing a dramatic mood change in this country is either a mindless zombie or a functionary of the deep state. The financial shenanigans of the ruling class are again being revealed as nothing but a Ponzi scheme built on a foundation of debt and propped up by delusions and ignorance. When the house of cards collapses in the near future, the tables will turn. When people have nothing left to lose, they will lose it. The butchers will become the cattle. There will be no sanctuary for these evil men. Their reign of terror will be swept away in a whirlwind of retribution, death and destruction. It might even make the Walking Dead look like a walk in the park.

| ||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Rose Back to $1,244 Up $5.70 on the Comex Posted: 20 Oct 2014 04:26 PM PDT

Anyway, the GOLD PRICE rose back to $1,244, up $5.70 on the Comex. The SILVER PRICE rose 2.2 cents to $17.304 on Comex, but is now trading at $17.39. When the GOLD PRICE breaks through $1,250, it will run. Stocks have another huge fall coming. Stocks rose cosmetically, but technically they remain in a bull-strangling downtrend. Dow closed up 19.26 (0.12%) to 16,399.67 while the S&P500 gained 0.91% (17.260 to 1,904.02. All this changeth nothing, althought he S&P500 looks a little stornger than the Dow. Both will make this dead-cayt bounce, then resume their plunge. US dollar index fell 24 basis points (0.29%) renewing its downtrend. Increasing premium on US 90% silver coin suggests buying pressure is a-building in silver. I have to travel the rest of this week, but will try to comment on Wednesday. If you are waiting to buy silver or gold, stop. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||

| "Anti-Petrodollar" CEO Of French Energy Giant Total Dies In Freak Plane Crash In Moscow Posted: 20 Oct 2014 04:10 PM PDT Three months ago, the CEO of Total, Christophe de Margerie, dared utter the phrase heard around the petrodollar world, "There is no reason to pay for oil in dollars," as we noted here. Today, RT reports the dreadful news that he was killed in a business jet crash at Vnukovo Airport in Moscow after the aircraft hit a snow-plough on take-off. The airport issued a statement confirming "a criminal investigation has been opened into the violation of safety regulations," adding that along with 3 crewmembers on the plane, the snow-plough driver was also killed.

De Margerie, 63, joined Total in 1974 after graduating from the École Supérieure de Commerce in Paris. He served in several positions in the Finance Department and Exploration & Production division. In 1995, he became President of Total Middle East before joining the Total's Executive Committee as the President of the Exploration & Production division in May 1999. In May 2006, he was appointed a member of the Board of Directors. He was appointed Chairman and Chief Executive Officer of Total on May 21, 2010. * * *

* * * The plane he was aboard... * * * Of course this could merely be a desparately sad accident... aside from the coincidence of this so recently... Christophe de Margerie, the CEO of Total (the world's 13th biggest oil producer and Europe's 2nd largest), believes "There is no reason to pay for oil in dollars." Clearly, based onhis comments, that we have passed peak Petrodollar.

So even a major beneficiary of the status quo appears to see the end in sight for the Petrodollar. * * * Furthermore, despite Western-imposed sanctions on Russia that prohibit western financing and technology transfer to some Russian energy projects, Total is continuing to pursue a natural gas project in Yamal, a joint venture with Russia's Novatek and China's CNPC.

* * * And of course, it had to happen in Russia! | ||||||||||||||||||||||||||||||||||||||||||||

| What The Strong Dollar Does With The Price Of Gold Posted: 20 Oct 2014 02:54 PM PDT The United States is doing better than it has in years. Jobs growth is up, unemployment is down, our manufacturing sector carries the rest of the world on its shoulders like a wounded soldier and the World Economic Forum named the U.S. the third-most competitive nation, our highest ranking since before the recession. As heretical as it sounds, there's a downside to America's success, and that's a stronger dollar. For the 12-month period, our currency has seen a 1.1-standard deviation move, which has put pressure on two commodities that we consider our lifeblood at U.S. Global Investors: gold and oil. September Was the Cruelest Month On the left side of the chart below, you can see 45 years' worth of data that show fairly subdued fluctuations in gold prices in relation to the dollar. On the right side, by contrast, you can see that the strong dollar pushed bullion prices down 6 percent in September, historically gold's strongest month. This move is unusual also because gold has had a monthly standard deviation of ±5.5 percent based on the last 10 years' worth of data. Here's another way of looking at it. On October 3, bullion fell below $1,200 to prices we haven't seen since 2010, but it quickly rebounded to the $1,240 range as the dollar index receded from its peak the same day. There's no need to worry just yet. This isn't 2013, when the metal gave back 28 percent. And despite the correction, would it surprise you to learn that gold has actually outperformed several of the major stock indices this year? As for gold stocks, there's no denying the facts: With few exceptions, they've been taken to the woodshed. September was demonstrably cruel. Based on the last five years' worth of data, the NYSE Arca Gold BUGS Index has had a monthly standard deviation of ±9.4, but last month it plunged 20 percent. We haven't seen such a one-month dip since April 2013. This volatility exemplifies why we always advocate for no more than a 10 percent combined allocation to gold and gold stocks in investor portfolios.

This article appeared on the website of USFunds.com.

| ||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 Oct 2014 02:25 PM PDT A Yahoo headline: Pentagon Readying For Long War in Iraq, Syria. More war means more debt and higher inflation. Increasing national debt is as certain as death and taxes. Increasing consumer prices follow.

Then the "something for nothing" crowd adds to the trauma.

Governments respond to problems with more spending (stimulus), central banks support the bond and stock markets (QE), and we pretend debt and deficit spending can increase forever (delusional). The U.S. official national debt is nearly $18,000,000,000,000. Occasionally a 1987 or 2000 stock market crash occurs, a 9-11 event changes the world as we know it, a housing bubble deflates, and major wars are created. What could dramatically change our world – again – like 9-11 did?

Our financial world seems more unstable and more dangerous than usual. Which has been safer under difficult economic and political conditions during the past 3,000 years – gold or debt based paper? Consider the following graph of gold (log scale) since 1968. Note the rally into the mid 1970s and the subsequent correction. Is that pattern similar to the rally into 2011 and the correction since then? Our financial world is dangerous and volatile. It is possible that:

But I doubt it! I think gold will survive as a store of value far longer than any government, fiat currency, or debt-based paper investment.

Additional reading: Gary Christenson | The Deviant Investor | GEChristenson.com

| ||||||||||||||||||||||||||||||||||||||||||||

| Why the Fed Will Continue to Print Money in 2015 Posted: 20 Oct 2014 01:54 PM PDT Editor’s. Note: On Oct. 6, 2014, Jim Rickards was interviewed by Bloomberg TV for his thoughts on gold, currency manipulation and the overall strength of the global economy. You can watch the entire interview by clicking on the video, or read the transcript below… Bloomberg TV: I wonder, Jim, how you… First your reaction to that statement that the economy is stable… at least relatively. Are you encouraged by, for example, the jobs numbers that we saw last week? Jim Rickards: No, not at all. Look… Labor force participation is going down. What Janet Yellen is looking at is real wages. Forget about the unemployment rate, that's almost an artifact at this point because labor force participation is declining. She's concerned about inflation. She wants to have easy money, to create jobs until she's right about inflation. What is she looking at? She's looking at real wages. When real wages go up that means people can get a raise. When people start to get a raise that's when inflation alarms start to go up. Real wages are flat to down. They're actually down, lately. So she's not concerned at all. She's got so much slack because of the labor force participation. Real wages are going nowhere. She has no inflation concerns at all. That means… I don't see them raising rates in 2015. Bloomberg TV: Is the real wages number a demographic issue? I mean, do you see people who get paid more retiring and moving out, while people who are starting at a lower wage coming into the labor force? Jim Rickards: Well, there could be a lot of causes behind it. Some of them are demographic, some of them are structural. That's one of the debates. Is it demographic or is it structural? The answer is it's a little bit of both. But the important thing is regardless of the cause, [real wages] are on her dashboard, that's what she's looking at. So, that continues to be weak. You know, we've got 50 million Americans on food stamps… 26 million Americans unemployed or underemployed… 11 million on disability which is kind of a new form of unemployment in some cases and that's going up. Our fundamental economy is very weak… for structural reasons. Yellen is trying to address a structural problem with a liquidity solution. It doesn't work, it won't work, that's why the Fed forecasts have been wrong by orders of magnitude for five years in a row. Interestingly Madame Lagarde the other day, because the IMF meeting is coming up… The IMF forecast has been wrong five years in a row also — they lowered their forecasts. She was actually candid about it, she said "you know, this is getting a little boring we're wrong every year." But that's because we're in a depression not a cyclical recovery. Bloomberg TV: You know we had several guests on Bloomberg Surveillance this morning, though, saying that we were actually returning to Alan Greenspan's Oasis of Prosperity here in the U.S. And the big theme at those big IMF/World Bank meetings will actually be this divergence. The U.S. economy nearing escape velocity while the rest of the world slows down. And since Jim says we're in a Depression, I'm going to say he disagrees with that… Jim Rickards: Here's the thing… First of all the rest of the world is slowing down. Japan fell off a cliff in the second quarter, China is slowing down — that's actually contributing to these demonstrations [in Hong Kong]. Bloomberg TV: And look at the numbers out of Germany overnight! Jim Rickards: So, it's obvious the world is slowing down. But the idea that U.S. is going to pull the world up? Now, what's been happening lately is we have this strong dollar… That, by the way is why… See gold hasn't changed much in real value in 5,000 years. When people say gold's up or gold's down — if the dollar is your numeraire then yeah, the dollar price of gold is up or down. But the way I think about it, gold's the constant, so when I see a low dollar price of gold, what I say is the dollar's strong, and that's exactly [the way I think of it]. What's happening to gold is no different than what's happening to the euro, the yen and all the other currencies. So what we have is a strong dollar right now. But the U.S. is bearing the entire cost of global structural adjustment. We can't afford it. We threw Japan and Europe a lifeline through the strong dollar, but we're going have to pull the lifeline back in and use it ourselves. Bloomberg TV: The United States and Germany, though, are the only two developed countries that have actually reduced, since the financial crisis, their level of debt — total debt-to-GDP. There's also the fact that manufacturing… What about the great American revival of manufacturing? We've seen companies, even Lenovo, moving back to the U.S. to manufacture here, because the labor market here is becoming more competitive. Jim Rickards: Sure, a couple things, though first… Everyone in Washington is high-fiving because we cut the deficit in half in the last couple of years. It went from 1.4 trillion to $700 billion, that's true. But the debt-to-GDP ratio is still going up and that's the one that matters. The reason it's going up… you have the numerator is going up but the denominator is going down faster — in other words, we still have deficits. The debt is growing fast than the economy's growing. So the deficit has come down but the debt-to-GDP ratio is still going up. And this Geneva report that came out a couple of weeks ago showed that. That there's more debt… more leverage… more, basically, piling on of debt… globally than ever before. Bloomberg TV: I would be most concerned about household debt, though… If I were looking at… You know, you want to see how the people are doing in the country… Jim Rickards: Well, the only reason the economy got a little bit of lift in the second quarter was partly because people were willing to take on a little bit more debt. But they seem to be kind of moving the other way lately. So that's not sustainable. Bloomberg TV: Alright, so… The price of gold, you're saying, is stable, it's the dollar that moves… I mean… How does gold look, then, when you value it in terms of euros or in terms of yen? Jim Rickards: Well actually in euros it's been performing better because the euro itself is going down. But, you know, just kind of taking the dollar price of gold as our benchmark… Here's how the world is set up… The taper's going to end either this month or next month. Everyone expects the Fed to raise interest rates in 2015. The big debate is will it be March, will it be July… That's nonsense. They can't possibly raise rates because the economy's weak. Janet Yellen is not seeing anything on her dashboard that tells her to raise rates. I expect it may actually come to QE4 in the middle of 2015. Remember… Bloomberg TV: So we'll continue to grow the balance sheet. Because this is the one thing I think about… The commercials that you hear on radio telling you to go and buy gold because the Fed's printing presses are running nonstop… Makes sense… But when the Fed's printing presses stop, does that trade turnaround? You're saying that those printing presses are only on hold? Jim Rickards: Right… But they're going to have to keep printing… they have no other way. But the reason is, they're using a liquidity solution to a structural problem. It won't work, but they think it works, so they're going to keep trying. That's the bottom line. And remember, everything changes January first. We have the most hawkish FOMC you can imagine. There have been vacancies on the Board of Governors, so you're overweight presidents and you got two "super-hawks" Fisher and Plosser. January 1st the President has filled the vacancies. You got Brainerd and Sam Fisher who are doves. Let's see, one more vacancy probably get another dove, and then two more presidents coming on, Evans and Kocherlakota are doves. And Janet Yellen, you know, it took her a while to get her feet on the ground… Remember she didn't start the taper, Bernanke did. He tied her hands. And you know, she's the new kid on the block — you're not going to blow up policy in your first meeting. But by January, the governors are going to be at full strength, the presidents are going to be dovish, Yellen's gonna have her feet on the ground, and her dashboard is still not blinking red… So they'll, at best, not raise rates, and probably go to QE4. Bloomberg TV: So you're saying no rate raise for all of 2015. Jim Rickards: Not in my lifetime unless they make structural changes. Seriously we're in a depression… You can't solve a depression by printing money. You can only solve it with structural changes. Look at the Great Depression… At the beginning of WWII, we completely restructured the economy. I'm not rooting for war, I'm just saying that's the kind of drastic structural… And what does it mean today… fiscal policy, keystone pipeline, Obamacare, regulation, break up the banks… These are the things that will get the economy moving, not printing money. Bloomberg TV: Just finally… Gold, obviously you're saying it trades inversely to the dollar, but it also trades in other things such as central banks buying, retail demand… at these levels it wouldn't be surprising to see some of, in particular, the Asian retail customers coming back to the market… Central banks manipulate, even some would say… Why isn't that activity moving the price of gold? Jim Rickards: Well, because you've got two things going on at once. You've got the physical market and the paper market. Now the prices are not wildly different or else you'd be in arbitrage. But look at the physical demand in China coming out of the Shanghai Gold Exchange. I talk to people in Hong Kong and the Chinese are bringing gold in through central Asia using People's Liberation Army assets — armored cars, basically off the books… mining output, Hong Kong inputs… China has acquired 3-4 thousand tons in the last five years. That's almost 10% of all the official gold in the world. These are enormous acquisitions. Here's the thing… People say, "Oh… It goes from the GLD warehouse in London to a… safe warehouse in Shanghai… What difference does it make? The total supply of gold is unchanged." That's true, but the floating supply drops. The London gold is in the floating supply. The Shanghai gold is not. So the gold available to support the paper market is shrinking. Bloomberg TV: Alright, Jim Rickards, author of The Death of Money… Also not a proponent of Bitcoin… Right? We've talked about this… Jim Rickards: I think the technology's cool. The currency I have my doubts about, but the technology will be around. | ||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Post Stock Option Expiration Rally Posted: 20 Oct 2014 01:22 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||

| Despite Struggle, Gold & Shares Coiled For Upside Explosion Posted: 20 Oct 2014 12:42 PM PDT  Today KWN is putting out a special piece which features an incredible chart showing that despite the recent weakness, gold and the gold shares may be coiled for a major upside explosion. These are charts that the big banks follow closely, as well as big money and savvy professionals. David P. out of Europe sent us the key chart that all KWN readers around the world need to see. Today KWN is putting out a special piece which features an incredible chart showing that despite the recent weakness, gold and the gold shares may be coiled for a major upside explosion. These are charts that the big banks follow closely, as well as big money and savvy professionals. David P. out of Europe sent us the key chart that all KWN readers around the world need to see.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||

| Lower Gold Prices Prompt Large BRIC Purchases Posted: 20 Oct 2014 09:24 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||

| The Seven Sins Of Obama- 1. The Rot From Within Posted: 20 Oct 2014 08:58 AM PDT One cannot deny the similarities of the collapse of the Roman and American Empires. Individuals need to protect themselves from this collective fate by getting their fiat, intangible wealth out of the rigged and now doomed system and into real tangible assets like silver. [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||

| Ebola Armageddon Could Trigger a Rebirth in Gold and Silver Prices Posted: 20 Oct 2014 08:08 AM PDT Could an infectious disease kill the monster that has been choking gold and silver prices for more than a year? On the heels of a lively Sprott Precious Metals Roundtable discussion, The Gold Report caught up with investor Eric Sprott to ask how a tragedy in Africa could impact the price of precious metals and mining stocks. We also spoke to his Executive Vice President of Corporate Development John Ciampaglia about a new way to gain exposure to gold. | ||||||||||||||||||||||||||||||||||||||||||||

| Challenge to Keynesians 'Prove Rising Prices Provide an Overall Economic Benefit' Posted: 20 Oct 2014 07:59 AM PDT The ECB has been concerned about falling consumer prices. I propose that's 100% stupid, yet that's the concern. When the euro declined vs. the US dollar, the ECB was happy that inflation would inch back up. The fear now is that falling oil prices will take away the alleged gain of a falling euro. | ||||||||||||||||||||||||||||||||||||||||||||

| Koos Jansen: The Chinese precious metals market is on fire Posted: 20 Oct 2014 07:08 AM PDT 9:11a CT Monday, October 20, 2014 Dear Friend of GATA and Gold: China's gold demand, as signified by offtake from the Shanghai Gold Exchange, has reached "extraordinary" levels in recent days, while silver is growing shorter in supply as well, according to gold researcher and GATA consultant Koos Jansen, market analyst for Bullion Star in Singapore. Jansen's analysis is headlined "The Chinese Precious Metals Market Is on Fire" and it's posted at Bullion Star here: https://www.bullionstar.com/article/the%20chinese%20precious%20metals%20... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||

| Gold vs Euro Risk Due To Possible Return of Italian Lira - Drachmas, Escudos, Pesetas and Punts? Posted: 20 Oct 2014 04:58 AM PDT The European status quo and EU elites are becoming increasingly concerned by popular calls in Italy for Italy to leave the European Monetary Union and the euro "as soon as possible" and return to the lira. | ||||||||||||||||||||||||||||||||||||||||||||

| Blood in the Streets to Create the Opportunity of the Decade Posted: 20 Oct 2014 04:35 AM PDT Dear Reader, Two weeks ago, gold dropped almost back to where it was last December. The resulting negative sentiment gripping the precious metals market and indeed the whole metals and mining sector is profound and far reaching—as bad as last December, or worse. Which is odd, because the better stocks have not returned to their December lows. Producers have cut costs, explorers and developers with quality assets have been able to raise the money needed to advance, and we’ve actually been able to book some profits this year. But that’s typical; markets tend to overreact, and that, of course, creates opportunities. That said, the Casey consensus is now that broader markets are set for a major correction—much greater than the $1,000 slide the Dow has seen over the last month. We may at along last be on the verge of leaving the eye of the global economic storm, as we’ve called it. Our colleagues at The Casey Report are preparing a special report on this subject, which we will send to all paying subscribers. But whether or not a “waterfall event” is about to hit Wall Street and beyond, if we’re facing the possibility of another 2008-type downturn, it’s only prudent to rig for stormy weather. What does that mean? It means rebalancing more toward cash and culling underperformers to that end—especially companies low on funds or losing money. Being contrarians, however, we also want to prepare to go bargain hunting. It’s in this context that I want to share some price-to-book-value research we’ve done, as you’ll see below. It’s important to keep the difference between price and value in mind when the two diverge. And they already have. Things could start moving very quickly in the weeks ahead. We’ll do our best to keep you appraised and advise you on how to proceed. Subscribers should check our portfolio pages frequently this month. Before we get to today's article, however, I’m pleased to announce our new documentary-style film on the only way for Americans to legally minimize their taxes without leaving the US. It’s called America’s Tax-Free Zone, and you can watch it for free. As I’m sure longtime readers can guess, the focus is on Puerto Rico’s new tax incentives. Doug Casey, Peter Schiff, and other experts walk viewers through the facts and what to do. I hope you enjoy the video; I’d love to have more of you become my neighbors here in the US Caribbean. Now, on to the main event. More next week, Sincerely, Louis James

Blood in the Streets to Create the Opportunity of the DecadeLaurynas Vegys, Research Analyst Gold stocks staged spring and summer rallies this year, but haven’t able to sustain the momentum. Many have sold off sharply in recent weeks, along with gold. That makes this a good time to examine the book value of gold equities; are they objectively cheap now, or not? By way of reminder, a price-to-book-value ratio (P/BV) shows the stock price in relation to the company’s book value, which is the theoretical value of a company’s assets minus liabilities. A stock is considered cheap when it’s trading at a historically low P/BV, and undervalued when it’s trading below book value. From the perspective of an investor, low price-to-book multiples imply opportunity and a margin of safety from potential declines in price. We analyzed the book values of all publicly traded primary gold producers with a market cap of $1 billion or more. The final list comprised 32 companies. We then charted book values from January 2, 2007 through last Thursday, October 15. Here’s what we found. At the current 1.20 times book value, gold stocks aren’t as cheap as they were when we ran the numbers in June, 2013, successfully pinpointing the all-time low of 0.91 (the turning point before the period in gray). Of course, that P/BV is hard to beat: it was one of the lowest values ever. And while the stocks not quite as cheap now, the valuation multiple still lingers close to its historical bottom. Remember, we’re talking about senior mining companies here—producers with real assets and cash flow selling for close to their book values. In short, yes, gold stocks are objectively selling cheaply. The juniors, of course, have been hit harder. It’s hard to put a meaningful book value on many of these “burning matches” with little more than hopes and geologists’ dreams, but valuations on many are scraping the bottom, making them even better bargains, albeit substantially riskier ones. What does this mean for us investors? It’s no surprise to see that every contraction in the ratio was followed by a major rally. In other words, the cure for low prices is low prices:

Stocks have been on a long slide since the ratio last peaked at 3.24 in October, 2010, with the downturn in 2013 pushing multiples to previously unseen lows. No one—us included—has a crystal ball, and so it’s impossible to tell if the bottom is behind us. We can, however, gauge with certainty when an asset is cheap—and cash-generating companies selling for little more than book value are extraordinary values for big-picture investors. Now let’s see how these valuations look against the S&P 500. Stocks listed in the S&P500 are currently more than twice as expensive as the gold producers. That’s not surprising given how volatile metals prices can be and how unloved mining is—but is it rational? Note that despite the downtrend in the last month, the multiple for the S&P500 remains close to a multiyear high. In other words, yes, the S&P 500 is expensive. This contrast points to an obvious opportunity in our sector. So is now the time to buy gold stocks? Answer: our stocks are good values now, and, if there is a larger correction ahead, they may well become fantastic values, briefly. Either way, value is value, on sale. As the most successful resource speculators have repeatedly said: you have to be a contrarian in this sector to be successful, buying low and selling high, and that takes courage based on solid convictions. Yes, it’s possible that valuations could fall further. However: The difference between prices and clear-cut value argue for going long and staying that way until multiples return to lofty levels again—which they’ve done every time, as the historical record shows. With a long-term time frame in mind, whatever happens in the short term is less of a concern. Building substantial positions at good prices in great companies in advance of what must transpire sooner or later is what successful speculation is all about. This is how Doug Casey, Rick Rule, and others have made their fortunes, and it’s why they’re buying in the market now, seeing market capitulation as one of the prime opportunities of the decade. That’s worth remembering, especially during a downturn that has even die-hard gold bugs giving up. Bottom line: “Blood in the streets” isn't pretty, but it’s a good thing for those with the liquidity and courage to act. What to buy? That’s what we cover in BIG GOLD and the International Speculator. Thanks to our 3-month full money-back guarantee, you have nothing to lose and the potential for gains that only a true contrarian can expect. | ||||||||||||||||||||||||||||||||||||||||||||

| An Ebola Armageddon Could Trigger a Rebirth in Gold and Silver Prices: Eric Sprott Posted: 20 Oct 2014 01:00 AM PDT Could an infectious disease kill the monster that has been choking gold and silver prices for more than a year? On the heels of a lively Sprott Precious Metals Roundtable discussion, The Gold Report caught up with investor Eric Sprott to ask how a tragedy in Africa could impact the price of precious metals and mining stocks. We also spoke to his Executive Vice President of Corporate Development John Ciampaglia about a new way to gain exposure to gold. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

The Fed bankers must be really upset: They haven't even started to raise their base rate and markets are already in panic mode with the expected end to QE 3, just like junkies being told they might have to go into detox. The truth is that economic recovery is so fragile that it can't go without monetary fixes.

The Fed bankers must be really upset: They haven't even started to raise their base rate and markets are already in panic mode with the expected end to QE 3, just like junkies being told they might have to go into detox. The truth is that economic recovery is so fragile that it can't go without monetary fixes.

It's clear that the gold-hoarding, ISIS-funding, Ebola-creating international bankers are bent on destroying America. Their current flurry of wars and interventions is a desperate attempt to both stave off a deflationary depression and to shut down the giant spotlight increasingly being shown upon them.

It's clear that the gold-hoarding, ISIS-funding, Ebola-creating international bankers are bent on destroying America. Their current flurry of wars and interventions is a desperate attempt to both stave off a deflationary depression and to shut down the giant spotlight increasingly being shown upon them. Unless California gets some heavy rain, and soon, the state’s roughly 38 million residents will eventually be up a creek without a paddle — or without a creek, for that matter. The latest media reports indicate that some 14 communities throughout the state are now on the verge of running completely dry, and many more could join them in the coming year if conditions remain as they are.

Unless California gets some heavy rain, and soon, the state’s roughly 38 million residents will eventually be up a creek without a paddle — or without a creek, for that matter. The latest media reports indicate that some 14 communities throughout the state are now on the verge of running completely dry, and many more could join them in the coming year if conditions remain as they are. To say that the U.S. economy is in trouble would be an understatement. According to

To say that the U.S. economy is in trouble would be an understatement. According to  We can't speak about the manipulation of the gold price today without understanding the derivatives market. Right after the crash of 2000 in the stock market I became alarmed by the exponential increase of derivative products but especially by the complexity of those products. I am sure that if I asked one of those financial engineers who has designed those products to explain their functioning and consequences in a bear market or, better yet, in a crash, he would be incapable. We are familiar with derivatives in real life through cars. When we speak of the speed of a car we talk of a first derivative, while acceleration, an increase of the speed, is a second derivative. But in finance we have gone well belong that to third, fourth and even higher derivatives. Those products have never been tested in the real world and especially in adverse conditions as a major crash. I concluded then that the next financial crisis will have derivatives at its core. The 2008 crisis confirmed it to some extent. The next crisis will be much worse and it will also have derivatives at its core. In the gold market derivatives are presently dictating to the physical market what the price should be whereas by definition, as derivatives, they should be derived from prices set in the physical market.

We can't speak about the manipulation of the gold price today without understanding the derivatives market. Right after the crash of 2000 in the stock market I became alarmed by the exponential increase of derivative products but especially by the complexity of those products. I am sure that if I asked one of those financial engineers who has designed those products to explain their functioning and consequences in a bear market or, better yet, in a crash, he would be incapable. We are familiar with derivatives in real life through cars. When we speak of the speed of a car we talk of a first derivative, while acceleration, an increase of the speed, is a second derivative. But in finance we have gone well belong that to third, fourth and even higher derivatives. Those products have never been tested in the real world and especially in adverse conditions as a major crash. I concluded then that the next financial crisis will have derivatives at its core. The 2008 crisis confirmed it to some extent. The next crisis will be much worse and it will also have derivatives at its core. In the gold market derivatives are presently dictating to the physical market what the price should be whereas by definition, as derivatives, they should be derived from prices set in the physical market.

Special Note

Special Note

No comments:

Post a Comment