saveyourassetsfirst3 |

- If A Few Ebola Cases Can Make The Stock Market Crash This Much, Imagine A Full-Blown Pandemic

- PM Fund Manager Warns Another Banking Crisis May Be Imminent- “Something Nasty is Going on Behind the Scenes”

- 12 Charts That Show The Permanent Damage That Has Been Done To The U.S. Economy

- Silver Myths Smashed, Pt. 3: The Silliest Question You Could Possibly Ask about Silver

- Gold Trades Around Significant Resistance Level

- From Mayberry to Martial Law

- Stocks get slammed, propelling gold

- Jewelers set up for Indian festive season

- The Current Cap

- Metals market update for October 16

- Asian demand for gold falters

- Things That Make You Go Hmm…US Banks’ Financial Leverage Ratios Go Parabolic

- Polyus Gold Q3 production up 5 percent y/y

- South Africa seeks to revamp disused gold mines

- PM Fund Manager Warns Another Banking Crisis May Be Imminent- “Something Nasty is Going on Behind the Scenes”

- Stocks plunge, Treasuries gain, oil tumbles

- Platinum drops below gold for first time since April 2013

- What you should know about the "epic decline" in oil

- The Rules of the Game

- Saudi and Dubai stocks crash 5% in panic selling as oil price plunge and IPOs hit sentiment

- Flight To Safety – Gold Rises As Stocks, European Bonds See Sharp Falls … Again

- GEAB N°88 ist angekommen! Umfassende weltweite Krise - 2015: Die Koordinaten der Weltordnung verschieben sich nach Osten

- Flight To Safety - Gold Rises As Stocks, European Bonds Again See Sharp Falls

- Don’t wait for deflation to buy gold and silver as price gains stick and US dollar slips

- What Has The Gold Price Done Since 9-11

- Balmoral Resources to Raise $10M

- Dollar claws back ground against yen, helped by importers

- India’s Gold Imports Soar 450% in September

- A Former SWIFT Insider on Financial Warfare, the Fate of the Dollar, and Bitcoin

- Miner Fresnillo looks to hedge some gold output

- Jeff Deist/Claudio Grass: The Upcoming Swiss Gold Referendum

- Gold Imports by India Seen Rising More Than Fourfold Last Month

- Gold imports soar 450% in India

- The History of Money: Georgia

- Miner Spotlight: Crocodile Gold On Track to Produce 225,000 Ounces in 2014

- XLE Rebounds

- Harvey Organ’s Gold & Silver Update: PM’s Rebuff All Attempts of Containment!

- 9 Ominous Signals Coming From The Financial Markets That We Have Not Seen In Years

- If A Few Ebola Cases Can Make The Stock Market Crash This Much, What Would A Full-Blown Pandemic Mean?

- What Hitler and the Nazis copied from America

- Silver Myths Smashed, Pt. 2: The Surprising Lie that some Gold Lovers Repeat

- The Correlation Between The Gold Price and Bitcoins

- Gold Bullion Producers Offer A Great Buying Opportunity

| If A Few Ebola Cases Can Make The Stock Market Crash This Much, Imagine A Full-Blown Pandemic Posted: 16 Oct 2014 12:15 PM PDT Is Ebola going to cause another of the massive October stock market crashes that Wall Street is famous for? At one point on Wednesday, the Dow was down a staggering 460 points. It ultimately closed down just 173 points, but this was the fifth day in a row that the Dow has declined. And of course […] The post If A Few Ebola Cases Can Make The Stock Market Crash This Much, Imagine A Full-Blown Pandemic appeared first on Silver Doctors. |

| Posted: 16 Oct 2014 10:45 AM PDT Something nasty is going on behind the scenes in the financial system that is not yet apparent. Treasury futures opened in the early evening and the 10-yr traded down to 2.25%. Something has the market incredibly spooked and I find it interesting that the U.S. Treasury Secretary and the UK's equivalent will be running a big […] The post PM Fund Manager Warns Another Banking Crisis May Be Imminent- “Something Nasty is Going on Behind the Scenes” appeared first on Silver Doctors. |

| 12 Charts That Show The Permanent Damage That Has Been Done To The U.S. Economy Posted: 16 Oct 2014 10:45 AM PDT Most people that discuss the “economic collapse” focus on what is coming in the future. And without a doubt, we are on the verge of some incredibly hard times. But what often gets neglected is the immense permanent damage that has been done to the U.S. economy by the long-term economic collapse that we are already […] The post 12 Charts That Show The Permanent Damage That Has Been Done To The U.S. Economy appeared first on Silver Doctors. |

| Silver Myths Smashed, Pt. 3: The Silliest Question You Could Possibly Ask about Silver Posted: 16 Oct 2014 10:15 AM PDT Wondering what is the most ridiculous question one could possibly ask about silver? Submitted by The Wealth Watchman: So Many Myths, So Little Time Do ya wanna know the hardest part of about writing a "Silver myth-Smashing series"? It certainly hasn't been figuring out how to dispel the lies, that's for sure! Silver lies are all brittle […] The post Silver Myths Smashed, Pt. 3: The Silliest Question You Could Possibly Ask about Silver appeared first on Silver Doctors. |

| Gold Trades Around Significant Resistance Level Posted: 16 Oct 2014 09:39 AM PDT |

| Posted: 16 Oct 2014 09:30 AM PDT From Mayberry to Martial Law. The militarization of the police is happening right before our eyes. But if the founding fathers were so worried about the threat of domestic tyranny, how did we get here? The post From Mayberry to Martial Law appeared first on Silver Doctors. |

| Stocks get slammed, propelling gold Posted: 16 Oct 2014 09:13 AM PDT Gold caught a bid today as stocks got hit hard. At one point today, the Dow Jones Industrial Average was down over 400 points as growth fears, concerns over the Eurozone and Ebola took its toll. |

| Jewelers set up for Indian festive season Posted: 16 Oct 2014 08:42 AM PDT The jewelers in India are seen gearing up for the big gold sale on Dhanteras and Diwali - considered to be the most auspicious occasions for purchasing gold. |

| Posted: 16 Oct 2014 08:31 AM PDT Less than two weeks ago, gold again bounced from the same $1180 level which had supported it in the past. The "safe haven" bid has pushed gold higher since but now it seems stuck and capped at/near $1245. Why would this be? Regular readers know the answer...for the same reason gold has been capped all year! |

| Metals market update for October 16 Posted: 16 Oct 2014 08:22 AM PDT Gold climbed $4.40 or 0.36% to $1,237.80 per ounce and silver slipped $0.03 or 0.17% to $17.43 per ounce yesterday. |

| Posted: 16 Oct 2014 08:12 AM PDT The research note published by Standard Bank states that the Chinese physical gold demand continues to remain weak, despite sharp fall in gold prices. |

| Things That Make You Go Hmm…US Banks’ Financial Leverage Ratios Go Parabolic Posted: 16 Oct 2014 07:00 AM PDT "Hyperinflation and hyper-deflation are just two different forms of the same phenomenon: credit collapse. Arguing which of the two forms will dominate is futile: it blurs the focus of inquiry and frustrates efforts to avoid disaster." The Fed's leverage ratio (total assets to capital) now stands at just under 80x. That compares with Lehman Brothers' […] The post Things That Make You Go Hmm…US Banks’ Financial Leverage Ratios Go Parabolic appeared first on Silver Doctors. |

| Polyus Gold Q3 production up 5 percent y/y Posted: 16 Oct 2014 06:37 AM PDT Sales during the quarter reached $603 million, up from $527 million in the previous quarter. |

| South Africa seeks to revamp disused gold mines Posted: 16 Oct 2014 06:35 AM PDT South Africa's gold mining sector has been contracting as ore grades decline and shafts plunge to hard-to-reach depths. |

| Posted: 16 Oct 2014 06:25 AM PDT

|

| Stocks plunge, Treasuries gain, oil tumbles Posted: 16 Oct 2014 06:20 AM PDT Stacy Summary: More turmoil. Has Jim Cramer started yelling at Janet Yellen that “it’s no time to be an academic” blah blah blah. Treasuries Gain as Oil Drops Below $80 While Stocks Slide

To put the European disaster into context:

Paris's 'Squalor Pit' Gare du Nord Becomes French Decline Symbol

|

| Platinum drops below gold for first time since April 2013 Posted: 16 Oct 2014 06:12 AM PDT Platinum for immediate delivery fell as much as 1.8% to $1,239.13 an ounce, the lowest since October 6. |

| What you should know about the "epic decline" in oil Posted: 16 Oct 2014 06:00 AM PDT From Jeff Clark, editor, S&A Short Report: Oil has suffered an epic decline. Since peaking above $107 per barrel at the end of June, the price of West Texas Intermediate (WTI) crude oil recently collapsed to less than $82. That’s a 23% decline in less than three months. Oil is now trading at its lowest price in two years. And a lot of folks think it’s going to fall even further. I disagree. It’s likely the bottom is almost in for oil prices. And the sector looks like it’s setting up for a short-term rally. Let me explain… As regular readers know, assets like oil typically trade opposite of the U.S. dollar. So oil rallies when the dollar falls… And oil falls when the dollar rallies. That’s what we’ve seen recently. As I told you two weeks ago, the dollar has been in a parabolic rally. The U.S. Dollar Index is up more than 6% since June. Meanwhile, the price of oil has plunged 23%. But parabolic moves never last. And it looks like the dollar just peaked. Take a look at this chart of the U.S. Dollar Index…

As you can see, the dollar has started to pull back. It’s likely it will fall further from here. And that’s great for oil. As I said earlier, oil rallies when the dollar falls. The red circles on the chart show past short-term peaks in the dollar index. And as you can see in the chart of WTI crude oil below, these peaks tend to correlate with short-term bottoms in the price of oil.

It’s also worthwhile to note that in each of the past three years, the price of oil has bottomed sometime in October. Oil then rallied sharply through the end of the year. So the stage is set for a strong rally in oil to get started sometime soon. That doesn’t mean traders should go out and put their entire portfolios into oil right now. As my colleague Amber Lee Mason wrote yesterday, there are four rules to trading during a crisis… 1. Wait for the price to stop falling. 2. Use a tight stop. 3. Keep your position size small. 4. Give the trade a few chances to work out. These rules apply to oil right now. With the topping action in the dollar, and with the normal seasonal strength in oil this time of year, an excellent contrarian trade is setting up here. But first, we have to wait for the price of oil to stop falling… and we probably don’t have to wait too long. Best regards and good trading, Jeff Clark P.S. With the recent market volatility, a lot of folks are starting to get nervous about their investments. That’s why I’ll be hosting a free live question-and-answer session about the coming market collapse today at 2 p.m. EST. If you want to learn how to prepare and profit during the next bear market, be sure to join me here. |

| Posted: 16 Oct 2014 05:32 AM PDT Do you have a copy of The Rules of the Global Game by Ken Dam aka Mr. SDR? It has been out of print for many years. You can still buy a used hardcover copy, including shipping, for well under $10 on Amazon. The Fed is leveraged more than Lehman before its bankruptcy. What will be the next move to inflate the market if this goes south? The IMF’s special drawing rights. It may not work, but it will be the next Hail Mary play when the time comes. Depression in the USAJim Rickards was in Chicago last week talking about his books Currency Wars and the Death of Money. He reminded the audience that the United States is in a depression as defined by years of substandard growth. Yes, we have anemic growth, but it's well below our capabilities. There are no policy changes in sight to change that. If that’s true, then where are the soup lines? Our soup lines are more efficient this time around. The 53 million Americans on food stamps now swipe a card. Out of sight, out of mind. See also: "Hidden Bank Risks Drive Investors to Productive Assets, U.S. Treasuries, and Gold", Coming Soon: Unveiled Threat: A Personal Experience of Fundamentalist Islam and the Roots of Terrorism, Janet M. Tavakoli, Lyons McNamara LLC, December 2014. |

| Saudi and Dubai stocks crash 5% in panic selling as oil price plunge and IPOs hit sentiment Posted: 16 Oct 2014 05:25 AM PDT There were signs of panic selling on the Saudi and Dubai bourses on the last day of the trading week with both markets down around five per cent. The 25 per cent fall in crude oil prices since the high of the summer has investors worried and $6 billion initial public offering for the National Commercial Bank next week threatens a liquidity squeeze. Is it really sensible to allow such IPOs to go ahead when markets are in steep decline? Anywhere else in the world and the issue would be pulled to safeguard the rest of the market whose value will be in jeopardy as investors sell shares to buy the new IPO. Oil prices down Falling crude oil prices are not a complete disaster for producer nations like Saudi Arabia and the UAE whose GDP comes 90 and 30 per cent respectively from black gold. Neither country has any net sovereign debt to worry about and budget deficits could be easily financed for years. However, both Gulf States have been enjoying something of a boom over the past couple of years and this could now be in trouble. Oil price falls generally take about six months to be reflected in lower orders for other sectors of the economy but it is fairly automatic as cash flows contract. Earlier this year Saudi stocks hit a post-global financial crisis high on news that the bourse would be making some concessions to foreign ownership, albeit you need to be an institution managing $5 billion in funds to do so and five per cent is the upper limit. But equities have now lost all their gains since that announcement. Probable cause Our sister publication the monthly ArabianMoney investment newsletter (subscribe here) correctly predicted the downturn in the last issue and pointed to the liquidity squeezed from the $1.6 billion Emaar Malls Group IPO as the probable cause. Today news that another IPO would be going ahead in Dubai next week likely speeded up the sell-off as we commented in an article before the market opened. Increasing the supply of equities when a market is falling can only accelerate its descent and probably leave the IPO buyers with an instant loss too. Global stock markets continued to sell-off again today and Gulf investors likely also thought it best to get out before the weekend. |

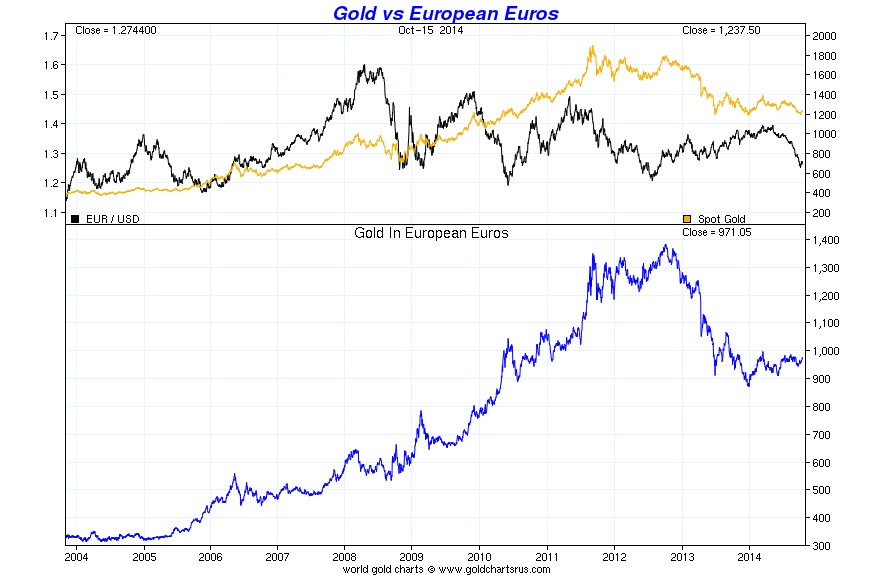

| Flight To Safety – Gold Rises As Stocks, European Bonds See Sharp Falls … Again Posted: 16 Oct 2014 05:14 AM PDT There is huge volatility in stock markets and European bonds have seen sharp selling again, with Greek 10-year interest rates surging to nearly 9% and Irish bonds rising over 20 basis points to over 1.9%. Spanish 10-year government bond yields rose 26 basis points to 2.37 percent, while equivalent Italian yields were 28 bps up at 2.68 percent. Portuguese yields rose 27 bps to 3.57 percent.

As we have warned for many months now, the Eurozone and indeed global financial crisis is far from over. We had a brief interlude after the starter but the main course is soon to commence.

Today's AM fix was USD 1,241.00, EUR 969.38 and GBP 775.87 per ounce. Gold climbed $4.40 or 0.36% to $1,237.80 per ounce and silver slipped $0.03 or 0.17% to $17.43 per ounce yesterday. Gold s now nearly 5% above its recent lows and is again acting as a hedging instrument in investment portfolios after sharp falls in stock and many bond markets.

Gold retained sharp overnight gains today to trade near its highest in over a month as investors sought safety amid increasing concerns over a slump in the global economy. Gold rose to its highest since September 11 at $1,249.30 yesterday. This morning gold for Swiss storage or for immediate delivery rose 0.2% to $1,244 an ounce by 12:00 in London, according to Bloomberg generic pricing. Futures trading volume was 64% above the average for the past 100 days for this time of day. Global stocks plummeted yesterday and again today, on investor concern that U.S. and Chinese inflation data are signalling a global slowdown in economic activity. U.S. retail sales fell in September and producer prices declined for the first time in a year. S&P 500 Stock Index – 10 Years (Thomson Reuters) The MSCI All-Country World Index of equities slumped to an eight month low yesterday and the Bloomberg Commodity Index has retreated to the lowest level since July 2009. The risks of a stock market crash are quite high and the complacency of recent months has inevitably come to a shuddering halt. Weak U.S. data and global growth concerns will likely prompt the Federal Reserve to delay a hike in interest rates, a potential boost for non-interest-bearing gold – as we have warned of for some time. Europe and the debt laden world risks falling into a downward spiral of falling wages, prices and deflation. Investors fled into safe haven gold bullion, bonds and Japanese yen as the dollar and oil declined. Yesterday's, stampede into non risky assets resulted in a massive rally in U.S. Treasury bonds, moving the benchmark 10-year note’s yield as low as 1.865%, its lowest since May 2013. Today, markets are in a panic. Greek stocks, which collapsed yesterday, are down another 2% today. The FTSE and DAX are down nearly 2% and France is down nearly 3%. Irish 10 Year Bonds (Thomson Reuters) There is huge volatility in stock markets and European bonds have seen sharp selling again, with Greek 10-year interest rates surging to nearly 9% and Irish bonds rising over 20 basis points to over 1.9%. Spanish 10-year government bond yields rose 26 basis points to 2.37 percent, while equivalent Italian yields were 28 bps up at 2.68 percent. Portuguese yields rose 27 bps to 3.57 percent. As we have warned for many months now, the Eurozone and indeed global financial crisis is far from over. We had a brief interlude after the starter but the main course is soon to commence. Get Breaking News and Updates On Gold and Markets Here See Essential Guide To Gold and Silver Storage In Switzerland |

| Posted: 16 Oct 2014 05:03 AM PDT - Pressemitteilung des GEAB vom 15. Oktober 2014 (GEAB N°88) -  In den letzten Wochen ist zweierlei geschehen, was zusammen genommen in seiner Bedeutung nicht unterschätzt werden kann: Zum einen hat China nun die amerikanische Produktion überholt und ist nun ganz offiziell die größte Wirtschaftsmacht der Welt; nach den Zahlen des IWF beläuft sich die chinesische Wirtschaftsleistung auf 17,61 Milliarden Dollar, die der USA auf 17,4. Auch wenn die Mainstream- Medien dieser Nachricht kaum Beachtung geschenkt haben, so halten wir hingegen diesen Stabwechsel für ein Ereignis von historischer Bedeutung. Zum ersten Mal seit dem frühen 20. Jahrhundert sind die USA nicht mehr die weltweit größte Wirtschaftsmacht (1)!  Schaubild 1: Chinas (blau) und USAs BIP (rot), entsprechend der jeweiligen Kaufkraft, in Milliarden Dollar, 2002 – 2019. Quelle: Financial Times Zum anderen scheitern die USA in ihren Bemühungen, das überbordende Chaos im Irak einigermaßen unter Kontrolle zu halten, kläglich. Es ist gerade einmal ein paar Monate her, dass die USA in der Ukrainekrise so taten, als wären sie militärisch stark genug, einen Krieg mit Russland riskieren zu können. Und nun zeigt sich, dass sie nicht einmal in der Lage sind, einer Terrorbande Herr zu werden. Rückblickend wirken nun ihre Versuche, sich als Militärsupermacht aufzuspielen, schlichtweg lächerlich. Heute weiß alle Welt, dass die USA die berühmten Hunde sind, die bellen, aber nicht beißen. Die Politik der militärischen Einschüchterung, mit der die USA der Welt ihre Dominanz aufzwangen, verfehlt von nun an ihre Wirkung. An diesen beiden Geschehnissen lässt sich ablesen, dass nun eine wichtige Etappe im Ablauf der umfassenden weltweiten Krise absolviert ist. Heute ist China die neue Supermacht. Die neue Weltordnung wird von der chinesischen Dominanz geprägt. Europa, Russland – Ein chinesischer Marshallplan Der Aufstieg Chinas zum wichtigsten Akteur auf der Bühne der Weltwirtschaft und der internationalen Politik wurde durch die Ukrainekrise überstürzt. Obwohl China versuchte, still und leise in diese Rolle hineinzuwachsen, obwohl Russland um Abstand zu einem zu aufdringlichen China bemüht war, obwohl die Europäer eigentlich auch Interesse daran hätten haben sollen, dass sich der Aufstieg Chinas diskret und allmählich vollzieht, beschleunigte die Ukrainekrise den Wandel und ließ die Akteure die Kontrolle über den Prozess verlieren. Wir haben bereits darauf hingewiesen, dass die Ukrainekrise und die folgende Sanktionspolitik die Russen dazu gebracht haben, einen Gaslieferungsvertrag mit China zu unterzeichnen, der für sie weniger gewinnbringend als geplant ist. Die Ukrainekrise hat Russland zu einem Schritt gezwungen, den sie sonst so nicht gemacht hätten. Zurzeit ist der chinesische Premierminister zum Staatsbesuch in Europa und Russland (2). Und er bringt einiges an Verträgen, an Investitionsprojekten und Geschäftsmöglichkeiten (3) im Handgepäck mit. Es ist geradezu ein Marshallplan für den Wiederaufbau der europäischen und der russischen Wirtschaft, die teilweise von den Kämpfen in der Ukraine massiv in Mitleidenschaft gezogen waren (4). Da können Russland und Europa natürlich nicht nein sagen. Aber können wir gegenwärtig sicher sein, dass Europa auf diese Weise nicht in eine Abhängigkeit zu China schlittert, so wie es bisher von den USA abhängig war? Schließlich war auch Ziel des US- Marshallplans nach dem 2. Weltkrieg, die europäische Wirtschaft an die amerikanische zu binden. China hat bereits die Londoner City vor dem Konkurs gerettet, weil die City als erster Finanzplatz außerhalb Chinas chinesische Staatsanleihen herausgeben darf (5). Kein Wunder, dass nun England mit Verve dafür eintritt, den Yuan in das System der IWF- Sonderziehungsrechte zu integrieren. Auch heißt es, die EZB denke darüber nach, Währungsreserven in Yuan vorzuhalten (6). Und Europa findet sich in der Rolle, die ihm auf den Leib geschneidert ist, nämlich als Steigbügelhalter der neuen Weltordnung, die die alte Weltordnung ablöst. Aber es wäre schön gewesen, wenn Europa diese Rolle aktiv, als Ausfluss seiner Vision von einer wünschenswerten Entwicklung, angenommen hätte (7), statt ausschließlich von Geschäfts– bzw. Überlebensinteressen zu dieser Politik gezwungen zu sein. All diese Aktivitäten zwischen Europa, Russland und China werden in den nächsten Tagen ihren Höhepunkt im ASEM- Gipfel in Mailand vom 16./17. Oktober finden. Dieses Treffen von Staats- und Regierungschefs aus Asien und Europa könnte sehr wohl Einzug in den Geschichtsbüchern finden, wenn es dort gelingt, die europäischen und asiatischen Interessen zu koordinieren; im Rahmen von ASEM könnten Asien und Europa gemeinsam die Instrumente für die Lösung der Euro-Krise, der Ukrainekrise, der europäisch-russischen Krise sowie der umfassenden weltweiten Krise liefern. Das Treffen wäre damit der Moment, an dem man den endgültigen Übergang von der alten in die neue Weltordnung verorten könnte. Sicherlich wäre ein Euro-BRICS-Gipfel (8) geeigneter gewesen, um die neue Weltordnung aus der Taufe zu heben, da er die neue Realitäten der kommenden multipolaren Weltordnung exakter abgebildet hätte; aber die Zeit drängt und immerhin werden drei der fünf BRICS vor Ort sein (Russland, Indien, China). ASEM wird, was zumindest Wirtschaftskraft, Bevölkerung und Anteil am Welthandel anbelangt, weitgehend repräsentativ für die neuen globalen Kräfteverhältnisse sein. Und vor allen Dingen werden die USA außen vor bleiben. Dies ist unabdingbar, da die USA keine Gelegenheit versäumen, die Anpassung der Weltordnung an die neuen Realitäten zu hintertreiben und zu sabotieren. Der Erfolg dieses Treffens wird allen europäischen Entscheidern vor Augen halten, welch immenser Unterschied zwischen den Zukunftsaussichten eines weiteren Bündnisses mit den USA (was immer auf Kriegsbeteiligungen hinausläuft) und den Perspektiven einer strategischen Annäherung an Asien (was einen wirtschaftlichen Aufschwung verheißt) besteht (9). Wir gehen davon aus, dass die Hoffnungen, die mit diesem Treffen genährt werden, insbesondere zur Folge haben werden, dass der schon heute so sehr in der Kritik stehende transatlantische Freihandelsvertrag TTIP endgültig beerdigt wird (10). Unsere Leser wissen, dass wir dem unaufhaltbaren Aufstieg Chinas nicht mit Sorge begegnen. Aber Politische Antizipation muss auch berücksichtigen, dass das politische System in China sich wandeln, dass die neu errungene Weltmachtposition Versuchungen, die neue Stärke zu missbrauchen, wecken, dass die wirtschaftliche Lage sich ändern kann. Europa muss daher den notwendigen Aufwand treiben, auch gegenüber einer neuen Supermacht in der Lage zu sein, seine Unabhängigkeit zu bewahren. Insoweit sehen wir in einem weiteren Punkt Anlass für Optimismus. In Europa sind die ersten Studentengenerationen, für die Europa dank des Erasmus- Programms und der gesamteuropäischen Ausrichtung der Universitätsausbildungen zur Lebensrealität geworden ist, inzwischen 40 bis 50 Jahre alt und haben in ihren Arbeitsbereichen Positionen erreicht, auf denen sie Einfluss ausüben können. Ihre Fähigkeit, sich auf eine multipolare Welt einzustellen, ist unvergleichlich stärker ausgeprägt als die der Eliten der früheren Generationen, die nur national oder in den USA ausgebildet waren und die im besten Fall gerade einmal Englisch als Fremdsprache beherrschten. Dank Erasmus hat Europa alle Trümpfe in der Hand, um trotz seiner relativ geringen Größe auch weltweit von Bedeutung zu sein: Europäische sprachliche und kulturelle Vielfalt machen es diesen Generationen leichter, offen für die Welt zu sein und ihre Komplexität zu verstehen. Wir können also abschließend festhalten, dass die Entstehung der multipolaren Welt sich wieder entlang der von LEAP vorhergesagten Linien vollzieht. Lediglich war ihre Genese schwieriger und verworrener als sie hätte sein müssen, wenn der Übergang aktiv betrieben worden wäre . Und die neue Welt wird auch stärker von China dominiert werden, als dies wünschenswert ist. --------------------- Notes: (1) Weniger Aufsehen erregend, aber dennoch bezeichnend für einen Paradigmenwechsel: China hat bekannt gegeben, dass es nunmehr sein BIP anders berechnen und neben der Wirtschaftsleistung andere Parameter berücksichtigen wird. Wenn die nun wichtigste Wirtschaftsmacht der Welt diese objektiv schon lange überfällige Entscheidung trifft, ist davon auszugehen, dass die alte Methode der Berechnung des BIP bald auf dem wirtschaftspolitischen Friedhof landen wird. Der statistische Nebel wird sich bald lichten und die sichtbar werdende Landschaft wird ganz anders aussehen als die, in der wir bisher zu leben glaubten. Quelle : Europe Solidaire (2) Quellen : China Daily, 08/10/2014 (3) Quellen : Business Insider, 14/10/2014 ; China Daily, 09/10/2014 (4) Die russisch-europäische Krise und die gegenseitigen Sanktionen sind natürlich der Hauptgrund der wirtschaftlichen Abkühlung in Russland und Europa in den letzten Monaten. Überraschend, dass diese Tatsache in den großen Medien keinerlei Beachtung findet. Aber sie wurde nun durch die katastrophalen neuesten Zahlen für die deutsche Wirtschaft bestätigt, deren Aussichten sich gerade in den letzten sechs Monaten eingetrübt haben – sicherlich nur einem Zufall geschuldet: Quelle : The Telegraph, 06/10/2014 ; International Business Times, 09/10/2014 (5) Quelle : Wall Street Journal, 09/10/2014 (6) Quelle : Malay Mail, 11/10/2014 (7) Indem es sich aktiv für das Enstehen einer multipolaren Welt eingesetzt hätte, wofür sich Franck Biancheri und LEAP schon seit Jahren eingesetzt haben. (8) Für dessen Abhaltung wir uns schon seit 2009 einsetzen. Vgl. das Euro-BRICS – Projekt von LEAP. (9) Der GlobalEurometer bestätigt seit einigen Monaten diese Auffassung. Viele Europäer sind sich inzwischen sehr wohl bewusst, dass die für die Zukunft entscheidenden Dynamiken sich eher in den BRICS als in den USA abspielen. (10) Wir hatten immer vorhergesagt, dass TTIP scheitern werde. Aber die Ereignisse der letzten Monate, in der Europa wieder voll auf Kurs des westlichen, amerikadominierten Lagers gebracht wurde, brachten auch die reale Gefahr mit sich, dass TTIP den Menschen in Europa von ihren amerikahörigen Eliten aufgezwungen würde. |

| Flight To Safety - Gold Rises As Stocks, European Bonds Again See Sharp Falls Posted: 16 Oct 2014 05:02 AM PDT gold.ie |

| Don’t wait for deflation to buy gold and silver as price gains stick and US dollar slips Posted: 16 Oct 2014 03:08 AM PDT Is this all about a weaker US dollar? Or are gold and silver just acting as natural safe havens in troubled markets? Those awaiting deflation before buying the precious metals may just be missing the boat that is now leaving port. Peter Akerley, president and CEO of Erdene Resource Development, outlines the factors that are fueling the rally in gold prices on Thursday… |

| What Has The Gold Price Done Since 9-11 Posted: 16 Oct 2014 02:39 AM PDT The world as we knew it changed after the dot-com crash of 2000 and especially after 9-11.

What do the charts show? Since 9-11 national debt (official) has increased from $5.773 Trillion to $17.858 Trillion, an increase of $12.08 Trillion. Note the increasing ratio of gold prices to national debt after adjusting for increased population. We can reasonably assume that National Debt will continue increasing a $Trillion or so per year. I think gold will rise even faster, with notable corrections along the way, for the next several years, as it has since 9-11. Note the graph of the ratio of gold to the S&P 500 Index. Both are rising together and gold is now inexpensive (again) compared to the S&P 500 Index, like it was on 9-11. Since 9-11 crude oil prices have gone much higher and crashed lower but on average they have increased with gold prices.

Gold and silver increased dramatically since 9-11, but they corrected after mid-2011. They are now inexpensive, per the graphs, compared to the national debt, the S&P, and crude oil. Note the ratio of gold to silver where peaks in the ratio have been a good indicator of bottoms in the prices for gold and silver

Read Christenson’s newest book “Gold Value and Gold Prices – From 1971 to 2021“

|

| Balmoral Resources to Raise $10M Posted: 16 Oct 2014 12:32 AM PDT Balmoral Resources will raise $10M in a flow through financing from 5.9M shares. According to the company’s latest presentation, it had $8.5M in working capital. Accounting for the exercise of 1.2M options and this financing results in an estimated 110M shares outstanding and working capital of ~$19.4M for the company. The proceeds raised from the Offering will be used by the Company for further exploration of its Detour Gold Trend Project and other properties located in the Province of Quebec. “The financing announced today will allow us to accelerate on-going exploration and delineation of our Grasset Ni-Cu-PGE discovery and Martiniere gold system in Quebec” said Darin Wagner, President and CEO of Balmoral. “We will also be positioned to continue our aggressive exploration of the entire, 700+ square kilometre Detour Trend Project throughout 2015.” The post Balmoral Resources to Raise $10M appeared first on The Daily Gold. |

| Dollar claws back ground against yen, helped by importers Posted: 16 Oct 2014 12:21 AM PDT With worries about global economic growth prompting investors to rush into relatively safe assets such as the Japanese currency, the dollar slid to ¥105.19 overnight -- its lowest since Sept. 8... Read |

| India’s Gold Imports Soar 450% in September Posted: 15 Oct 2014 11:35 PM PDT "The Plunge Protection Team is not only alive and well, but was at battle stations" ¤ Yesterday In Gold & SilverAs has been the case recently, gold got sold down a few bucks right at the open of Globex trading at 6 p.m. EDT in New York on their Tuesday evening. From that point it chopped lower in fits and starts, hitting its low tick shortly after 9 a.m. BST in London on their Wednesday morning. The price didn't do much until the London silver fix was done at noon BST---and then away went the price to the upside. The rally gathered more momentum at the Comex open, but at 9:40 a.m. EST, the powers-that-be hit the 'Sell Precious Metals/Buy the Dollar Index' as the gold price was about to go 'no ask', at the same moment as the dollar index was going 'no bid'. At that moment, the Dow was already down 370 points. 'Da boyz' had the gold price back in the box within 30 minutes. However once the London p.m. gold 'fix' was in, the price rallied anew, but began to get sold down starting just before the 1:30 p.m. Comex close---and from about 2:45 p.m. EDT onwards, the gold price traded flat into the close of electronic trading. The low and high ticks were reported by the CME Group as $1,222.00 and $1,250.30 in the December contract. Gold finished the Wednesday trading session at $1,241.10 spot, up $8.90 from Tuesday---an well off its high. Net volume was over the moon at 243,000 contracts, so it should be obvious to all and sundry that JPMorgan et al threw whatever Comex paper was necessary at this rally to make it go away. Here's the 5-minute tick gold chart courtesy of Brad Robertson---and you can see the volume explode at the 8:30 a.m. EDT Comex open---and that high volume level lasted for a bit over two hours. After that, the volume settled down nicely. Don't forget to add 2 hours to this chart for EDT. The 'click to enlarge' feature works well here. The silver price action, with the odd minor exception, was almost the same as the gold rally, so I shall spare you the play-by-play. The low and high ticks were recorded as $17.02 and $17.82 in the December contract---an intraday move of just under 5 percent. Silver closed yesterday at $17.445 spot, up 5.5 cents. Volume was enormous as well---62,500 contracts, as the technical funds covered some of their short positions---and JPMorgan et al were more than willing sellers in order to stop the rally in its tracks. The chart for platinum looks suspiciously familiar as well---and the 'da boyz' even managed to close platinum down 9 dollars on the day. The palladium chart, up until the powers-that-be hit the "Sell Precious Metals/Buy Dollar Index" button, looked the same as the other three precious metals. But at that point the HFT boyz and their algorithms went to work---and palladium got pounded for 26 bucks, finishing the day a few dollars off its low tick. The dollar index closed late on Tuesday afternoon at 85.88---and then didn't do much until it began to fade a little starting just before noon in London. The roof caved in at the Comex open, with the 84.62 low tick coming at 9:40 a.m. EDT. 'Da boyz' pumped it back up to around 85.25 by the London p.m. gold fix---and from there it chopped lower into the close, finishing the Wednesday session at 84.87---down 101 basis points. As I said yesterday---and will repeat myself again today---it should be obvious to anyone with two synapse to rub together that the dollar would have crashed---and taken the stock market with it, if the Plunge Protection Team hadn't intervened when they did. But all they're doing is delaying the inevitable. I guess one should be thankful that the gold stocks opened in the black, hitting their highs of the day at the point where the Dow was down 370 points, which was ten minutes after the markets opened. They stayed in positive territory until the gold price got turned over starting about 10 minutes before the Comex close. They rallied off their lows during the last forty-five minutes of trading---and the HUI closed down only 0.19%. The silver equities traded in a similar pattern, but the rally at the end of the day took their shares back into positive territory, as Nick Laird's Intraday Silver Sentiment Index closed up 1.09%. The CME Daily Delivery Report showed that 1 lonely gold contract, along with 14 silver contracts were posted for delivery within the Comex-approved depositories on Thursday. Jefferies was the short/issuer for the second day running. The link to yesterday's Issuers and Stoppers Report is here. The CME Preliminary Report for the Wednesday trading session showed that October open interest in gold declined another 20 contracts---and is now down to 967 contracts. Silver's October o.i. increased by 5 contracts up to 188 contracts, from which one must subtract the 14 contracts mentioned in the previous paragraph. Over at GLD yesterday, an authorized participant withdrew 67,298 troy ounces, which was about 9,000 more ounces than was deposited on Tuesday. And as of 9:59 p.m. EDT yesterday evening, there were no reported changes in SLV. There was no sales report from the U.S. Mint. Over at the Comex-approved depositories on Tuesday, they reported receiving 19,933 troy ounces of gold, most of which went into JPMorgan's vault. Nothing was reported shipped out. The link to that activity is here. In silver, nothing was reported received, but a very chunky 1,564,962 troy ounces were shipped out, with almost all the activity coming at the Brink's, Inc. and Scotiabank's vaults. The link to that action is here. Here are a couple of charts from yesterday. First is the Dow which, as I pointed out earlier, was down 370 points within ten minutes of the open---and that's where the PPT showed up. The low [down about 450 points] was at the 1:30 p.m. EDT close of Comex trading---and from there 'da boyz' made sure that the equity markets closed well off that mark. And here's the 6-month VIX chart. I have the usual number of stories for you today---and I'll happily leave the final edit up to you. ¤ Critical ReadsThe Depressing Signals the Markets Are Sending About the Global EconomyIt wasn’t very long ago that the dread hovering over global financial markets was that things were getting too calm. Just this summer, Federal Reserve officials were fretting over markets being so stable that it might create complacency, and we were writing about a global boom in asset prices. Even if many Americans don’t fully realize it yet—though an unnerving drop in a wide range of global markets Wednesday may have gotten our collective attention—the autumn has brought a rather darker set of worries with a series of dives in financial markets across the globe. On Wednesday alone, the Standard & Poor's 500 briefly fell into negative territory for the year and the interest rate investors were willing to accept on 10 year U.S. Treasury bonds edged below 2 percent for the first time since June 2013. (As of late morning, the S&P was down 1.4 percent for the day and narrowly up for the year, and the 10 year Treasury bond was back up to 2.05 percent). But those moves underlie a bigger story: Many crucial indicators in markets for international bonds, currency and commodities are pointing toward a heightened risk of a worldwide economic slowdown that may be beyond the ability of policy makers to halt. It would inevitably have ripple effects even on the relatively strong American economy. This commentary/opinion piece was posted on The New York Times website yesterday sometime---and I thank Phil Barlett for today's first news item. BIS warns on 'violent' reversal of global marketsThe global financial markets are dangerously stretched and may unwind with shock force as liquidity dries up, the Bank of International Settlements has warned. Guy Debelle, head of the BIS’s market committee, said investors have become far too complacent, wrongly believing that central banks can protect them, many staking bets that are bound to “blow up” as the first sign of stress. In a speech in Sydney, Mr Debelle said: “The sell-off, particularly in fixed income, could be relatively violent when it comes. There are a number of investors buying assets on the presumption of a level of liquidity which is not there. This is not evident when positions are being put on, but will become readily apparent when investors attempt to exit their positions. “The exits tend to get jammed unexpectedly and rapidly.” This commentary by Ambrose Evans-Pritchard appeared on the telegraph.co.uk Internet site at 9:00 p.m. BST on their Tuesday evening---and I thank Roy Stephens for his first contribution of the day. World economy so damaged it may need permanent Q.E.Combined tightening by the United States and China has done its worst. Global liquidity is evaporating. What looked liked a gentle tap on the brakes by the two monetary superpowers has proved too much for a fragile world economy, still locked in "secular stagnation". The latest investor survey by Bank of America shows that fund managers no longer believe the European Central Bank will step into the breach with quantitative easing of its own, at least on a worthwhile scale. Markets are suddenly prey to the disturbing thought that the five-and-a-half year expansion since the Lehman crisis may already be over, before Europe has regained its prior level of output. That is the chief reason why the price of Brent crude has crashed by 25pc since June. It is why yields on 10-year US Treasuries have fallen to 1.96pc, and why German Bunds are pricing in perma-slump at historic lows of 0.81pc this week. We will find out soon whether or not this a replay of 1937 when the authorities drained stimulus too early, and set off the second leg of the Great Depression. This is the second commentary in a row from Ambrose, but this one showed up on The Telegraph's website at 9:36 p.m. BST yesterday evening---and I found it embedded in a GATA release. It's definitely worth reading. Bank of America moves past worst legal costs, posts lossBank of America Corp said on Wednesday that it has moved past the worst of its legal settlements linked to the financial crisis, after its latest big legal charge brought the bank's common shareholders a net loss for the third quarter. Since 2010, the second-largest U.S. bank has agreed to pay at least $70 billion to resolve disputes linked to home loans, mortgage bonds and other problems stemming from before and during the crisis. In the most recent settlement, the bank paid $16.65 billion to resolve Department of Justice charges that it misled investors in its mortgage bonds. Money was already set aside to cover most of that, but the bank took a $5.6 billion charge in the third quarter to cover the rest. "The DoJ settlement from everything we can see was the most significant matter that’s out there," Chief Financial Officer Bruce Thompson told reporters, signaling that investors can stop fearing outsized legal settlements every quarter. This Reuters story appeared on their website at 2:40 p.m. EDT on Wednesday afternoon---and I thank West Virginia reader Elliot Simon for sharing it with us. For Bank of America, Crime is Now an Ordinary Course of BusinessOnce upon a time banks made money in one of two ways: either by borrowing short and lending long, aka the conventional banking way, or through investment banking, which includes advisory, underwriting and trading with the backstop of billions in deposits, aka the proto-hedge fund way. Then things changed. How does this nearly $30 billion in legal "add-backs" over the past three years compared to the so-called Net Income Bank of America generated over the same time period? Between Q4 2011 and Q3 2014 Bank of America produced "Net Income" of $15.9 billion. However, the amount of added back "one-time, non-recurring" legal expenses is a stunning $28.9 billion: two of every three dollars, non-GAAP as they may be, comes from Bank of America engaging in criminal activity... and that's just the stuff it got caught for. So perhaps an even more relevant question than how long will the EPS "add-back" bulls hit continue, is how long will the regulators and enforcers allow Bank of America to exist as an organization for which two-thirds of its "ordinary course business" is, for lack of a better word, crime? Ditto for JPMorgan. This must read article appeared on the Zero Hedge Internet site at 7:11 p.m. EDT yesterday evening---and I thank reader Harry Grant for sliding it into my in-box just before midnight last night MDT. U.S. bid for oil supremacy shakes crude marketPropelled by surging shale output, the United States is fighting for supremacy in the global oil market even as a pullback in crude prices threatens to challenge the boom. The U.S., which only a few years ago seemed to be in the midst of an inexorable decline in domestic petroleum production, may have already overtaken other petroleum giants. In terms of crude alone, the US pumped 8.8 million barrels a day in September, still a distance from Russia's 10.6 million barrels and Saudi Arabia's 9.7 million, according to official sources. But when natural gas liquids are included, the U.S. extracted 11.5 million barrels in August, essentially level with OPEC kingpin Saudi Arabia, according to data from the International Energy Agency. As you already know, dear reader, current crude oil prices are 100 percent caused by game-playing between the technical funds and Commercial traders on the Comex---just like the precious metals. This AFP story showed up on the france24.com Internet site at 5:05 p.m. Europe time yesterday---and I thank South African reader B.V. for sending it our way. It's worth reading. A Former SWIFT Insider on Financial Warfare, the Fate of the Dollar, and BitcoinOne of the great things about Casey Summits is that you get to meet some truly fascinating people among the attendees. The opportunity to network with successful, like-minded people is one that should not be missed. And this year’s Summit was no different. I had the pleasure of meeting many interesting people. Among them was Tjerk Veenstra. Tjerk spent nearly 30 years with SWIFT (Society for Worldwide Interbank Financial Telecommunication) as one of its most senior managers. SWIFT is truly integral to the international financial system, specifically in transferring money from a bank in country A to a bank in country B. More than 10,500 financial institutions and corporations in 215 countries use SWIFT millions of times every day. We’ll get into more detail below. Suffice to say, it behooves you to appreciate how SWIFT works to better understand some of the big-picture trends in the world today—like the decline of the dollar as the world’s premier currency, financial warfare, geopolitics, and the emergence of game-changing technologies like Bitcoin and cryptocurrencies. Tjerk and I will discuss all of these things. This interview by Nick Giambruno, Senior Editor of the International Man, appeared on his website yesterday---and it's definitely worth reading. Dublin to scrap 'double Irish' tax loopholeIreland will scrap a controversial tax instrument which allows companies to legally shift huge profits from Ireland to countries with low taxes, the country's budget minister has announced. Speaking in the Irish parliament on Tuesday (14 October), Michael Noonan told deputies that the scheme, known as "double Irish" would be closed to new entrants in 2015 and gradually phased out between now and 2020. He added that in the future all companies registered in Ireland would have to pay tax there. The double Irish enables companies to make royalty payments to separate Irish-registered subsidiaries whose parent company is based in another country, allowing them to avoid paying corporate tax. This story, filed from Brussels, showed up on the euobserver.com Internet site at 9:26 a.m. Europe time on their Wednesday morning---and it's courtesy of Roy Stephens. Bumper French wine grape harvest clouded by threat of wood decayThe French grape harvest has produced a bumper crop for 2014 after two years of adverse weather conditions. But the smiles could be wiped off winegrowers’ faces if wood decay disease, which now affects 12 per cent of vines in all of France’s wine-growing re |

| A Former SWIFT Insider on Financial Warfare, the Fate of the Dollar, and Bitcoin Posted: 15 Oct 2014 11:35 PM PDT One of the great things about Casey Summits is that you get to meet some truly fascinating people among the attendees. The opportunity to network with successful, like-minded people is one that should not be missed. And this year’s Summit was no different. I had the pleasure of meeting many interesting people. Among them was Tjerk Veenstra. Tjerk spent nearly 30 years with SWIFT (Society for Worldwide Interbank Financial Telecommunication) as one of its most senior managers. SWIFT is truly integral to the international financial system, specifically in transferring money from a bank in country A to a bank in country B. More than 10,500 financial institutions and corporations in 215 countries use SWIFT millions of times every day. We’ll get into more detail below. Suffice to say, it behooves you to appreciate how SWIFT works to better understand some of the big-picture trends in the world today—like the decline of the dollar as the world’s premier currency, financial warfare, geopolitics, and the emergence of game-changing technologies like Bitcoin and cryptocurrencies. Tjerk and I will discuss all of these things. This interview by Nick Giambruno, Senior Editor of the International Man, appeared on his website yesterday---and it's definitely worth reading. |

| Miner Fresnillo looks to hedge some gold output Posted: 15 Oct 2014 11:35 PM PDT Mexican miner Fresnillo Plc reported a small drop in quarterly silver production and said it could hedge a part of its gold output to protect its recent investment in the Herradura corridor in northern Mexico. Shares in the miner fell as much as 3.4 percent on Wednesday morning, making the stock one of the top percentage losers on the FTSE 100 index. An increasing numbers of precious metals miners, battered by last year's steep drop in prices, are selling planned output forward to better control their cash flow. "This is going to be discretionary to the management ... This is going to be done very slowly. So we are not going to immediately hedge all the production," Gabriela Mayor, head of investor relations, said on a media call. The media can make news out of any rumour these days---and this is a case in point. It will be a real news story if/when it happens. The Reuters article was posted on their website at 11:45 a.m. BST on Wednesday morning---and it's another story that I found posted on the gata.org Internet site. |

| Jeff Deist/Claudio Grass: The Upcoming Swiss Gold Referendum Posted: 15 Oct 2014 11:35 PM PDT Jeff Deist, the president of the Mises Institute, and Claudio Grass discuss the uniquely Swiss mindset behind the upcoming Swiss gold referendum, and how decentralization of political power is part of Swiss DNA; the tremendous geopolitical aftershocks that would occur if the referendum passes — including the physical repatriation of gold to Switzerland; and how the Swiss people may be waking up to the sellout of their country by the Swiss National Bank and the IMF. This 17:42 minute audio interview showed up on the mountainvision.com Internet site yesterday---and I thank Casey Research's own Dennis Miller for finding it for us. |

| Gold Imports by India Seen Rising More Than Fourfold Last Month Posted: 15 Oct 2014 11:35 PM PDT Gold imports by India, the largest user after China, probably surged more than fourfold last month on expectations declining prices would boost festival demand. Purchases are estimated at about 95 metric tons compared with 15 tons to 20 tons in September last year, said Bachhraj Bamalwa, a director at the All India Gems & Jewellery Trade Federation. The government raised import taxes for a third time in August last year after a month earlier obliging importers to set aside 20 percent of purchases for re-export as jewelry. India represented 25 percent of global demand in 2013. Imports of gold were valued at $3.75 billion in September, 450 percent more than a year earlier, the Commerce Ministry estimates. Buying and gifting of gold is considered auspicious and the most favorable time is the festival of Dhanteras, two days before Diwali which occurs on Oct. 23. Festivals run through November and the wedding season follows to early May. “These are normal imports before Diwali,” Bamalwa said in a phone interview from Kolkata today. “There is no abnormal feature. Prices have fallen in the international market and this is good for Indian consumers.” This gold-related news item, filed from New Delhi, appeared on the Bloomberg Internet site at 3:53 a.m. Denver time on Wednesday morning---and I found it embedded in a GATA release. Reader U.M. sent us another story on this. This one is headlined "Country's gold imports rising on price slide & festive demand"---and it showed up on Economic Times of India website at 7:02 p.m. IST on their Wednesday evening. |

| Gold imports soar 450% in India Posted: 15 Oct 2014 11:35 PM PDT The Indian government has been proved right once again in not lifting its curbs on gold. Trade deficit has widened the most in 18 months, as imports of the precious metal have surged. Gold imports jumped about 450% to a new high of $3.75 billion in September (versus $682.5 million y/y). In August 2014, gold imports stood at $2.04 billion. This as the trade deficit widened to $14.25 billion in September, from $10.84 billion a month before. Falling inflation might just not be enough, say trade experts. With a muted export performance in September, the trade figures have raised concerns of worsening external account, especially if the global economy continues to remain sluggish. I know that the headline is similar, as is part of the story, but this article goes into far more depth. It was filed from Mumbai yesterday as well---and showed up on the mineweb.com Internet site. It's the final offering of the day from Manitoba reader U.M., for which I thank her. It's worth reading. |

| Posted: 15 Oct 2014 07:00 PM PDT Dollar Daze |

| Miner Spotlight: Crocodile Gold On Track to Produce 225,000 Ounces in 2014 Posted: 15 Oct 2014 06:30 PM PDT Crocodile Gold soared 10% today after announcing they produced 55,909 ounces of gold in the third quarter 2014, bringing year-to-date production to 163,516 ounces. The Company is raising its production guidance by 10% for 2014 to 220,000 to 225,000 ounces. The Company has recorded improvements in average grade and recoveries, on a consolidated basis, over three consecutive quarters, […] |

| Posted: 15 Oct 2014 05:04 PM PDT As you all know, crude oil and its products have been hammered of late. One has to wonder if the Saudis' decision to not reduce output was a deliberate attempt to go after the US fracking industry. Either way, the energy complex has been hit extremely hard over the last six weeks. Just look at the following chart! The XLE had lost 22% over that time frame before some decent buying finally showed up today which enabled it to close up on a day in which the entirety of the US equity markets were getting clobbered. Maybe the worst is over for crude? I don't know for sure but I am definitely going to be keeping an eye out on the XLE to see if it shows any upside follow through tomorrow and certainly on Friday. As I type these comments, crude is down another full dollar to $80.73 in the early overnight trading. Yet another thing I felt the need to point out and that is related to the reported holdings in GLD. It showed a DROP in the tonnage this afternoon which is really disconcerting if one is a bull. It lends credence to the idea that some are selling gold to keep the margin clerks happy with the equity positions. Total tonnage fell 2.09 tons from the last reported number and currently sits at 759.14 tons, down 39.08 tons on the year and the lowest level since early December 2008. Lastly, this is the updated TIPS spread/Gold chart from yesterday. Since then interest rates have fallen sharply (* today ) so it will be interesting to see what numbers we get tomorrow when the update is complete. Notice that gold has been moving in the opposite direction of the spread the last few days, something which is out of the more normal behavior, indicating the metal is functioning as a safe haven for some. |

| Harvey Organ’s Gold & Silver Update: PM’s Rebuff All Attempts of Containment! Posted: 15 Oct 2014 04:59 PM PDT The bankers were all over gold and silver today but both metals rebuffed all attempts of containment. The huge volatility is not too good for our banker derivative friends. Let’s head immediately to see what the data has in store for us today: Submitted by Harvey Organ: Gold: 1244.10 up $10.50 […] The post Harvey Organ’s Gold & Silver Update: PM’s Rebuff All Attempts of Containment! appeared first on Silver Doctors. |

| 9 Ominous Signals Coming From The Financial Markets That We Have Not Seen In Years Posted: 15 Oct 2014 04:00 PM PDT Is the stock market about to crash? Without a doubt we have been living through one of the greatest financial bubbles in U.S. history, and the markets are absolutely primed for a full-blown crash. We are starting to see some ominous things happen in the financial world that we have not seen happen in a very […] The post 9 Ominous Signals Coming From The Financial Markets That We Have Not Seen In Years appeared first on Silver Doctors. |

| Posted: 15 Oct 2014 03:07 PM PDT

Of course Ebola is not the only reason why stocks are declining. Just look at what is happening over in Europe. The European Stoxx 600 index is already down a whopping 11.4 percent from the high that it hit just 18 days ago. That is officially considered to be "correction" territory. And Greece experienced a full-blown stock market collapse on Wednesday...

In general, markets tend to fall faster than they rise. When there is a sudden downturn, the price action can be violent. And just like we saw back in 2008, financial stocks are leading the way. Just check out what happened to some of the biggest banks in America before the final bell sounded...

And thanks to Ebola fears, airline stocks plummeted as well...

An increasing number of voices are concerned that we could be on the verge of a repeat of what happened back in 2008. For example, Professor Steve Keen, the head of Economics, History & Politics at Kingston University in London, wrote the following in a piece for CNN entitled "Brace yourself for another financial crash"...

Others are even more pessimistic. For example, just check out what Daniel Ameduri of Future Money Trends recently told his readers...

However, keep in mind that not that much has really changed from a month or two ago. Yes, we now have had three confirmed cases of Ebola in the United States, but this could be just the beginning. At first, the fear of Ebola will be worse than the disease. But if a worst-case scenario does develop in the United States where hundreds of thousands of people are getting the virus, the fear such a pandemic will create will be off the charts. In the midst of a full-blown Ebola pandemic, we wouldn't just be talking about a 10 percent, 20 percent or 30 percent stock market decline. Rather, we would be talking about the greatest stock market collapse in the history of stock market collapses. In essence, there would not be much of a market at all at that point. And if Ebola does start spreading wildly in this country, we would have a credit crunch that would make 2008 look like a Sunday picnic. During times of extraordinary fear, financial institutions do not want to lend money to each other or to consumers. But our economy is entirely based on debt. If credit were to stop flowing, we would essentially not have an economy. That is why we need to pray that this Ebola crisis stops here. But thanks to the incompetence of Barack Obama and the CDC, there has been a series of very grave errors in trying to contain this disease. This display of incompetence would be absolutely hilarious if we weren't talking about a disease that could potentially kill millions of us. Let us hope for the best, but let us also prepare for the worst. That means stocking up on the food and supplies that you will need to stay isolated for an extended period of time. As we have seen so many times in the past, basic essentials fly off of store shelves during any type of an emergency. During an extended Ebola pandemic, those essentials would be in very short supply and prices on the basics would absolutely skyrocket. Those that have taken the time to get prepared now will be way ahead of the game. And if there were dozens or hundreds of people in your community that were contagious, you would definitely not want to go to a grocery store or anywhere else where large numbers of people circulate. The key during any major pandemic is to keep yourself and your family isolated from the virus. This is basic common sense, but it is something that Barack Obama does not seem to understand. As I write this, he still has not done anything to restrict air travel between the United States and West Africa. Hopefully this very foolish decision will not result in scores of dead Americans. |

| What Hitler and the Nazis copied from America Posted: 15 Oct 2014 02:00 PM PDT The Nazi salute and the indoctrination of children? Yep, that was the US's idea first. Submitted by Simon Black, Sovereign Man: A man in a uniform dashes up to you with a badge pinned to his chest and says "that man over there is a thief! Quick, help me get him!" What do you do? […] The post What Hitler and the Nazis copied from America appeared first on Silver Doctors. |

| Silver Myths Smashed, Pt. 2: The Surprising Lie that some Gold Lovers Repeat Posted: 15 Oct 2014 02:00 PM PDT Silver investment demand has rocketed from less than 10% of industrial silver demand's size, to nearly 50% of its size in just 6 short years. This is historic. And it spells biiiiiiiig problems for the "biiiiiiig players". Submitted by The Wealth Watchman: Truth Gives You Such a High! Well, that was fun! In fact, smashing silver myths […] The post Silver Myths Smashed, Pt. 2: The Surprising Lie that some Gold Lovers Repeat appeared first on Silver Doctors. |

| The Correlation Between The Gold Price and Bitcoins Posted: 15 Oct 2014 01:58 PM PDT We recently noticed in an analysis that gold and bitcoin prices were highly correlated (now at +0.80), and were curious to see how we could take this a step further. To begin, we have a limited set of variables, so we must make our own. Something I thought interesting to look at the vector of price changes of gold and bitcoin: the direction and magnitude. However it goes one step forward and we examine the correlation of these newly created variables. This could provide us with further insight into the bitcoin-gold relationship. Defintions Let's start with defining what our output will mean:

We chose to look at data from after March 2014 considering that information from before this period is skewed from the massive run up and decline caused by the MtGox exchange hacking. That period is not representative of bitcoin's true nature. We also note that the analyzed data was looked at with a 30-day moving period to generate the values. Without doing this, our output look look erratic and we are more concerned with the general trend. Our Observations In mid-September, there seems to be a sudden change to a positive correlation. Our magnitudes of change appear to become more alike in size and direction. There are 30 days of data calculated in generating the correlation. Therefore, the speed of this change suggests a significant shift in the that calculates the correlation value. What does this mean? We think that it may show that gold and bitcoin have been making large price movements together. Possible Causes Given the recent macroeconomic announcements and news, from the slowing global economy to the Fed's monetary policy stance, both these assets seem to be responding in a similar fashion to exogenous variables. It has gained more legitimacy, attention, and is being invested in by seasoned investors like hedge funds. All this could suggest that bitcoin is maturing into a commodity asset, like gold.

|

| Gold Bullion Producers Offer A Great Buying Opportunity Posted: 15 Oct 2014 01:56 PM PDT Submitted by Michael Lombardi from ProfitConfidential: The fundamentals for higher gold bullion prices continue to impress. The table below illustrates the output from U.S. mines in the first six months of 2014 compared to the first six months of 2013. In the below chart, we quickly see that since March of 2014, production of the precious metal has been quickly declining. Meanwhile, on the demand side of the equation, we see increased demand for gold bullion from the East—especially from China. China recently launched a gold bullion market on the Shanghai Gold Exchange (SGE) for international investors. The goal of this exchange is to gain more control over the price of the precious metal in yuan (the official currency of China). China wants to have price control over gold bullion, just like the West does with their daily settings in New York and London.

For seven years in a row, the SGE has been the top spot for gold bullion trading in the global economy. In 2013, the volume at the exchange reached 11,600 tons. Quality gold bullion mining companies continue to offer significant value. Some of the most well-known miners are selling for pennies on the dollar. Goldcorp Inc. (NYSE/GG), selling for $23.00 a share for a market cap of just over $18.5 billion, is a great example. If we just look at the proven and probable reserves of the company, it had 54.38 million ounces as of December 31, 2013. (Source: Goldcorp Inc. web site, last accessed October 7, 2014.) These reserves alone amount to $65.2 billion at a price of $1,200 an ounce of gold. And the company has massive silver reserves, too. In respect to gold bullion, I would like to offer you these words from my esteemed colleague and gold guru, Robert Appel, BA, BBA, LLB: "Wasn't it just late 2011, three years ago, when gold bullion was selling at $1,900 an ounce and almost every advisory on the planet was bullish on gold? What's happened since then? Well, the economic recovery has failed, if we take out the fake numbers. The number of people who have left the workforce is at levels not seen for 30 years. There is food and medical inflation, but few talk about it, and there has been a massive transfer of wealth from the middle class to the elites. Europe and Japan have collapsed and ditto for Argentina and Venezuela. We have a potential world war in Ukraine and ISIS has taken back Iraq. It seems the U.S. president has recently preferred Iran over the Saudis, which jeopardizes the petro-dollar. Russia and China are taking active, ongoing steps to bypass the greenback, and Ebola is loose. Against all this unpleasant backdrop, gold bullion is down almost 40%, sentiment is at depths never before seen, and the only two remaining bulls on the planet may be myself and Michael Lombardi. The shares of quality gold bullion producers, which have been severely oversold, offer investors a great opportunity to buy low before they sell high. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment