Gold World News Flash |

- ECB Planning a Corporate QE?

- Russian Central Bank Continues Gold Buying Spree

- China’s Plan For $100 Silver, $2,000 Gold & The Oil Market

- Gold & Silver: Wealth of The Rich… And Nations

- MUST READ: JIM WILLIE’S Rebuttals to Jim Rickards’ Recent USA Watchdog Interview Rant

- How To Start A War, And Lose An Empire

- The Gold Price Rose $7.00 Closing at $1,241.00

- The Hedge Fund Industry's 25 Favorite ETFs

- 19 Surprising Facts About The Messed Up State Of The US Economy

- Is China the Next Sub-Prime Event?

- James G. Rickards: In the year 2024

- Kinross to sell halted Ecuador gold project to Lundin company

- Von Greyerz: Swiss gold referendum aims squarely at market manipulation

- How Much Gold is on Loan Worldwide

- In the Year 2024

- Forex-rigging fines against banks could reach $41 billion worldwide, Citi report says

- Gold Daily and Silver Weekly Charts - Slowly Higher, More Gold Withdrawals

- Russia Adds A Record 1.2 Mio Ounces Gold To Its Reserves

- Gold Is Extending Its October Run

- How Will We Know That the Gold & Silver Price Bottom Is In?

- Is Gold as Dead as Florida Hurricanes?

- First Swiss Gold Poll Shows Pro-Gold Side In Lead At 45%

- Why We Hold Hard Assets II

- Rate Hikes & Gold

- First Poll In Swiss Gold Referendum Shows Tight Race

- Goldbroker puts French subtitles on GATA secretary's interview with Larry Parks

- Peter Schiff - Ending QE Will Plunge US Into Severe Recession

- Poll finds support for Swiss gold repatriation referendum proposal

- The Crash of 2014: A Special Briefing for All Casey Subscribers

- Gold & Silver Show Mixed Signals While Bitcoin Shows Relative Strength

- Fed Emergency - Fabricated Recovery Is Stalling

- Swiss Gold Vote: Should You Be Worried?

- Stefan Ioannou: Copper, Nickel and Zinc Won't Be Cheap for Long

- Oil Deflation, the Saudi’s Muslim Frankenstein, and the Colder War

| Posted: 22 Oct 2014 01:00 AM PDT from Dan Norcini:

Copper, silver and gold are all higher and even crude oil has firmed. Equities of course love that news. Even the grains are moving higher. More volatility, more uncertainty and more factors for traders/investors to now digest. | ||||||||||||||||||||||||||||||||

| Russian Central Bank Continues Gold Buying Spree Posted: 22 Oct 2014 12:30 AM PDT by Lawrence Williams, MineWeb.com

The graph below from Australian gold chart supremo Nick Laird, from www.goldchartsrus.com shows the Russian gold build-up from 2006 and there has been hardly a month since then, as the month-on-month figures show, that the country has not increased its gold reserve. | ||||||||||||||||||||||||||||||||

| China’s Plan For $100 Silver, $2,000 Gold & The Oil Market Posted: 21 Oct 2014 09:01 PM PDT  Today an acclaimed money manager spoke with King World News about China's plan for $100 silver, $2,000 gold, and the oil market. Stephen Leeb also spoke about the big picture for resource wars, fracking, Russia, the United States, and Saudi Arabia. Today an acclaimed money manager spoke with King World News about China's plan for $100 silver, $2,000 gold, and the oil market. Stephen Leeb also spoke about the big picture for resource wars, fracking, Russia, the United States, and Saudi Arabia.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||

| Gold & Silver: Wealth of The Rich… And Nations Posted: 21 Oct 2014 08:20 PM PDT from PastorDowell: First published in 1776, The Wealth of Nations is generally regarded as the foundation of contemporary economic thought. | ||||||||||||||||||||||||||||||||

| MUST READ: JIM WILLIE’S Rebuttals to Jim Rickards’ Recent USA Watchdog Interview Rant Posted: 21 Oct 2014 08:02 PM PDT [Ed. Note: We have long argued that Jim Rickards is a gatekeeper and a mouthpiece for the establishment. Case in point: Jim Rickards Exposes Himself as an Establishment Shill Covering Up CIA Involvement in 9/11 Insider Trading -- Calling It "IRRELEVANT."] from Jim Willie, via Perpetual Assets: Some people in our community have wondered exactly whose side Jim Rickards is on. Many have recently argued he is nothing more than a mouthpiece for the globalists. Perhaps we should question anyone who is purporting that an SDR currency could be the solution. That is the solution for the globalist thieves. Meet the new boss, same as the old boss. Mr. Rickards was interviewed by Greg Hunter recently. The below are comments from our friend Jim Willie, whom we believe to be one of the best sources of information that doesn't work for the parasitic cartel of banking thieves. First we give you the interview here, with commentary and Dr. Willie's rebuttals below The Chinese are hedging against not only the USDollar risk inherent to their vast reserves, but the entire global USD-based financial structure. ◄$$$ RICKARDS ON HUNTER WATCHDOG SHOW SPOUTED ABOUT MANY TOPICS… HE DOES NOT EXPECT CHINA TO BE IN POSITION FOR YUAN TO ACT AS RESERVE CURRENCY… HE EXPECTS THE INTL MONETARY FUND TO BAIL OUT THE CENTRAL BANKS WITH OVER $4 TRILLION IN SDR BASKETS OFF THE PRINTING PRESS… RICKARDS DOES NOT FORESEE THE CHINESE LAYING THE GROUNDWORK FOR A RETURN TO THE GOLD STANDARD (WITH YUAN IN PRIMARY ROLE), AS HE ONLY SEES A USDOLLAR HEDGE. $$$ Jim Rickards is an interesting figure, author of a new book entitled ‘Death of Money‘ that has been well received. He is a culpable system wonk and serves a purpose while appearing as a maverick and friend of gold. The following are his thoughts put to prose, with my rebuttals in bold parentheses. The Islamic State, the emerging caliphate, is not a new concept, but rather an old fixture for centuries, now awakened. The USGovt has been caught off guard (nonsense, the USGovt actively revived it for their destabilization purposes after exiting Iraq, to use the wild card).

Their guerrillas have captured equipment, and been supplied possibly by diverted Saudi arms. A risk of spectacular terror attack exists, including a risk from disruption of oil transport. The United States depends little on Gulf oil supply, but China and Europe depend heavily on the Gulf region for their oil, suddenly at risk. The crude oil market has 3 main factors currently working to provoke a price decline. 1) supply & demand equation slowing down, 2) geopolitical wild card not seen yet, 3) monetary policy giving us deflation. Rickards dislikes the black swan metaphor, and prefers the snowflake and avalanche, which signifies the accumulated risk. The Ebola virus presents a pandemic risk, but still is just a snowflake. It could grow to become a pile of snow, or to become an avalanche. The financial markets can be taken down by unforeseen events. However, the many blunders to date are built into the system, already recognized, having happened, and factored in. Rickards cannot anticipate the timing of calamity, but the magnitude of the collapse can be foreseen. Rickards accuses Russia as having responded asymmetrically with cyber warfare, an example at Nasdaq in 2010. (But Russian virus traces could easily have been planted by Langley software experts. Langley has been improperly painting Iran and China for many years, to take blame for Langley's own extensive work in cyber attacks.) People must realize that securities and assets are not money. People do not know what money is, which is cash or precious metals. If restrictions or market shutdowns occur, then they learn fast what is money and what are stuck assets. Rickards suggests to have 10% in gold & silver, as one asset class. Gold is not digitalized, has no counter-party, has no limitations like cash limits on withdrawal. Notice all the Too Big To Fail banks have even greater concentration of assets than in 2008. It is therefore easier to lock down the few big banks if the goal is to limit withdrawals and access. The non-directional volatility in stock market is evident, big up and down moves on successive days. Rickards is certain of no rate hike by the USFed, as he is more afraid of deflation taking fast root. (Total agreement on ZIRP Forever.) Notice how Buffet bought several hard assets and sits on record level of cash (20%). A calamity is coming as certainty, but when it hits, it will be exponentially larger than any collapse in past. A progression is crystal clear. The 1998 LTCM failure was big, the 2008 Wall Street failure bigger, maybe in 2016-2018 the USFed will be in trouble with other major central banks for the biggest calamity. (USFed has been in deep trouble, near catastrophic trouble since the start of QE bond purchases.) Each crash is bigger, and each bailout bigger than the previous. The central banks are set to fail, but some entity must be ready and have huge potential to bail out the central banks. The Intl Monetary Fund is big enough to bail out central banks, so Rickards believes. (The Jackass believes such a notion is preposterous and delusional, since the IMF is a hollowed out defunct pillar.) The IMF could produce $4 to $5 trillion in SDR basket units in a short period of time. Its offices contain a trading desk. (Huh? The IMF operates on member pledges, and currently is broke. If various high weight nations pledge $trillions, the entire FOREX currency system would quickly collapse, and might force a sudden double or triple in the Gold price, leading to sudden implosion.) All roads lead to hyper-inflation, the clear signal. The USDollar is going to fall versus the SDR basket of currencies, Rickards expects. (Such a notion is again errant, since the USD is the biggest component to the SDR. So the USD cannot fall versus itself in dominant team basket.) The IMF could conduct a rescue based upon a hyper-inflation exercise since it is a faceless edifice that can man the printing press, with offices on 19th Street in Washington DC. (The IMF will be converted into a Chinese tool for its purposes, likely to grease the ramp for a BRICS gold currency launch.) | ||||||||||||||||||||||||||||||||

| How To Start A War, And Lose An Empire Posted: 21 Oct 2014 07:30 PM PDT Submitted by Dmitry Orlov via Club Orlov blog, A year and a half I wrote an essay on how the US chooses to view Russia, titled The Image of the Enemy. I was living in Russia at the time, and, after observing the American anti-Russian rhetoric and the Russian reaction to it, I made some observations that seemed important at the time. It turns out that I managed to spot an important trend, but given the quick pace of developments since then, these observations are now woefully out of date, and so here is an update. At that time the stakes weren't very high yet. There was much noise around a fellow named Magnitsky, a corporate lawyer-crook who got caught and died in pretrial custody. He had been holding items for some bigger Western crooks, who were, of course, never apprehended. The Americans chose to treat this as a human rights violation and responded with the so-called “Magnitsky Act” which sanctioned certain Russian individuals who were labeled as human rights violators. Russian legislators responded with the “Dima Yakovlev Bill,” named after a Russian orphan adopted by Americans who killed him by leaving him in a locked car for nine hours. This bill banned American orphan-killing fiends from adopting any more Russian orphans. It all amounted to a silly bit of melodrama. But what a difference a year and a half has made! Ukraine, which was at that time collapsing at about the same steady pace as it had been ever since its independence two decades ago, is now truly a defunct state, with its economy in free-fall, one region gone and two more in open rebellion, much of the country terrorized by oligarch-funded death squads, and some American-anointed puppets nominally in charge but quaking in their boots about what's coming next. Syria and Iraq, which were then at a low simmer, have since erupted into full-blown war, with large parts of both now under the control of the Islamic Caliphate, which was formed with help from the US, was armed with US-made weapons via the Iraqis. Post-Qaddafi Libya seems to be working on establishing an Islamic Caliphate of its own. Against this backdrop of profound foreign US foreign policy failure, the US recently saw it fit to accuse Russia of having troops “on NATO's doorstep,” as if this had nothing to do with the fact that NATO has expanded east, all the way to Russia's borders. Unsurprisingly, US–Russia relations have now reached a point where the Russians saw it fit to issue a stern warning: further Western attempts at blackmailing them may result in a nuclear confrontation. The American behavior throughout this succession of defeats has been remarkably consistent, with the constant element being their flat refusal to deal with reality in any way, shape or form. Just as before, in Syria the Americans are ever looking for moderate, pro-Western Islamists, who want to do what the Americans want (topple the government of Bashar al Assad) but will stop short of going on to destroy all the infidel invaders they can get their hands on. The fact that such moderate, pro-Western Islamists do not seem to exist does not affect American strategy in the region in any way. Similarly, in Ukraine, the fact that the heavy American investment in “freedom and democracy,” or “open society,” or what have you, has produced a government dominated by fascists and a civil war is, according to the Americans, just some Russian propaganda. Parading under the banner of Hitler's Ukrainian SS division and anointing Nazi collaborators as national heroes is just not convincing enough for them. What do these Nazis have to do to prove that they are Nazis, build some ovens and roast some Jews? Just massacring people by setting fire to a building, as they did in Odessa, or shooting unarmed civilians in the back and tossing them into mass graves, as they did in Donetsk, doesn't seem to work. The fact that many people have refused to be ruled by Nazi thugs and have successfully resisted them has caused the Americans to label them as “pro-Russian separatists.” This, in turn, was used to blame the troubles in Ukraine on Russia, and to impose sanctions on Russia. The sanctions would be reviewed if Russia were to withdraw its troops from Ukraine. Trouble is, there are no Russian troops in Ukraine. Note that this sort of behavior is nothing new. The Americans invaded Afghanistan because the Taleban would not relinquish Osama Bin Laden (who was a CIA operative) unless Americans produced evidence implicating him in 9/11—which did not exist. Americans invaded Iraq because Saddam Hussein would not relinquish his weapons of mass destruction—which did not exist. They invaded Libya because Muammar Qaddafi would not relinquish official positions—which he did not hold. They were ready to invade Syria because Bashar al Assad had used chemical weapons against his own people—which he did not do. And now they imposed sanctions on Russia because Russia had destabilized and invaded Ukraine—which it did not do either. (The US did that.) The sanctions against Russia have an additional sort of unreality to them, because they “boomerang” and hurt the West while giving the Russian government the impetus to do what it wanted to do all along. The sanctions infringed on the rights of a number of Russian businessmen and officials, who promptly yanked their money out of Western banks, pulled their children out of Western schools and universities, and did everything else they could to demonstrate that they are good patriotic Russians, not American lackeys. The sanctions affected a number of Russian energy companies, cutting them off from Western sources of technology and financing, but this will primarily hurt the earnings of Western energy companies while helping their Chinese competitors. There were even some threats to cut Russia off from the SWIFT system, which would have made it quite difficult to transfer funds between Russia and the West, but what these threats did instead was to give Russia the impetus to introduce its own RUSSWIFT system, which will include even Iran, neutralizing future American efforts at imposing financial restrictions. The sanctions were meant to cause economic damage, but Western efforts at inflicting short-term economic damage on Russia are failing. Coupled with a significant drop in the price of oil, all of this was supposed to hurt Russia fiscally, but since the sanctions caused the Ruble to drop in tandem, the net result on Russia's state finances is a wash. Oil prices are lower, but then, thanks in part to the sanctions, so is the Ruble, and since oil revenues are still largely in dollars, this means that Russia's tax receipts are at roughly the same level at before. And since Russian oil companies earn dollars abroad but spend rubles domestically, their production budgets remain unaffected. The Russians also responded by imposing some counter-sanctions, and to take some quick steps to neutralize the effect of the sanctions on them. Russia banned the import of produce from the European Union—to the horror of farmers there. Especially hurt were those EU members who are especially anti-Russian: the Baltic states, which swiftly lost a large fraction of their GDP, along with Poland. An exception is being made for Serbia, which refused to join in the sanctions. Here, the message is simple: friendships that have lasted many centuries matter; what the Americans want is not what the Americans get; and the EU is a mere piece of paper. Thus, the counter-sanctions are driving wedges between the US and the EU, and, within the EU, between Eastern Europe (which the sanctions are hurting the most) and Western Europe, and, most importantly, they drive home the simple message that the US is not Europe's friend. There is something else going on that is going to become more significant in the long run: Russia has taken the hint and is turning away from the West and toward the East. It is parlaying its open defiance of American attempts at world domination into trade relationships throughout the world, much of which is sick and tired of paying tribute to Washington. Russia is playing a key role in putting together an international banking system that circumvents the US dollar and the US Federal Reserve. In these efforts, over half the world's territory and population is squarely on Russia's side and cheering loudly. Thus, the effort to isolate Russia has produced the opposite of the intended result: it is isolating the West from the rest of the world instead. In other ways, the sanctions are actually being helpful. The import ban on foodstuffs from EU is a positive boon to domestic agriculture while driving home a politically important point: don't take food from the hands of those who bite you. Russia is already one of the world's largest grain exporters, and there is no reason why it can't become entirely self-sufficient in food. The impetus to rearm in the face of NATO encroachment on Russian borders (there are now US troops stationed in Estonia, just a short drive from Russia's second-largest city, St. Petersburg) is providing some needed stimulus for industrial redevelopment. This round of military spending is being planned a bit more intelligently than in the Soviet days, with eventual civilian conversion being part of the plan from the very outset. Thus, along with the world's best jet fighters, Russia is likely to start building civilian aircraft for export and competing with Airbus and Boeing. But this is only the beginning. The Russians seem to have finally realized to what extent the playing field has been slanted against them. They have been forced to play by Washington's rules in two key ways: by bending to Washington's will in order to keep their credit ratings high with the three key Western credit rating agencies, in order to secure access to Western credit; and by playing by the Western rule-book when issuing credit of their own, thus keeping domestic interest rates artificially high. The result was that US companies were able to finance their operations more cheaply, artificially making them more competitive. But now, as Russia works quickly to get out from under the US dollar, shifting trade to bilateral currency arrangements (backed by some amount of gold should trade imbalances develop) it is also looking for ways to turn the printing press to its advantage. To date, the dictat handed down from Washington has been: “We can print money all we like, but you can't, or we will destroy you.” But this threat is ringing increasingly hollow, and Russia will no longer be using its dollar revenues to buy up US debt. One proposal currently on the table is to make it impossible to pay for Russian oil exports with anything other than rubles, by establishing two oil brokerages, one in St. Petersburg, the other, seven time zones away, in Vladivostok. Foreign oil buyers would then have to earn their petro-rubles the honest way—through bilateral trade—or, if they can't make enough stuff that the Russians want to import, they could pay for oil with gold (while supplies last). Or the Russians could simply print rubles, and, to make sure such printing does not cause domestic inflation, they could export some inflation by playing with the oil spigot and the oil export tariffs. And if the likes of George Soros decides to attack the ruble in an effort to devalue it, Russia could defend its currency simply by printing fewer rubles for a while—no need to stockpile dollar reserves. So far, this all seems like typical economic warfare: the Americans want to get everything they want by printing money while bombing into submission or sanctioning anyone who disobeys them, while the rest of the world attempts to resist them. But early in 2014 the situation changed. There was a US-instigated coup in Kiev, and instead of rolling over and playing dead like they were supposed to, the Russians mounted a fast and brilliantly successful campaign to regain Crimea, then successfully checkmated the junta in Kiev, preventing it from consolidating control over the remaining former Ukrainian territory by letting volunteers, weapons, equipment and humanitarian aid enter—and hundreds of thousands of refugees exit—through the strictly notional Russian-Ukrainian border, all the while avoiding direct military confrontation with NATO. Seeing all of this happening on the nightly news has awakened the Russian population from its political slumber, making it sit up and pay attention, and sending Putin's approval rating through the roof. The “optics” of all this, as they like to say at the White House, are rather ominous. We are coming up on the 70th anniversary of victory in World War II—a momentous occasion for Russians, who pride themselves on defeating Hitler almost single-handedly. At the same time, the US (Russia's self-appointed arch-enemy) has taken this opportunity to reawaken and feed the monster of Nazism right on Russia's border (inside Russia's borders, some Russians/Ukrainians would say). This, in turn, makes the Russians remember Russia's unique historical mission is among the nations of the world: it is to thwart all other nations' attempts at world domination, be it Napoleonic France or Hitleresque Germany or Obamaniac America. Every century or so some nation forgets its history lessons and attacks Russia. The result is always the same: lots of corpse-studded snowdrifts, and then Russian cavalry galloping into Paris, or Russian tanks rolling into Berlin. Who knows how it will end this time around? Perhaps it will involve polite, well-armed men in green uniforms without insignia patrolling the streets of Brussels and Washington, DC. Only time will tell. You'd think that Obama has already overplayed his hand, and should behave accordingly. His popularity at home is roughly the inverse of Putin's, which is to say, Obama is still more popular than Ebola, but not by much. He can't get anything at all done, no matter how pointless or futile, and his efforts to date, at home and abroad, have been pretty much a disaster. So what does this social worker turned national mascot decide to do? Well, the way the Russians see it, he has decided to declare war on Russia! In case you missed it, look up his speech before the UN General Assembly. It's up on the White House web site. He placed Russia directly between Ebola and ISIS among the three topmost threats facing the world. Through Russian eyes his speech reads as a declaration of war. It's a new, mixed-mode sort of war. It's not a total war to the death, although the US is being rather incautious by the old Cold War standards in avoiding a nuclear confrontation. It's an information war—based on lies and unjust vilification; it's a financial and economic war—using sanctions; it's a political war—featuring violent overthrow of elected governments and support for hostile regimes on Russia's borders; and it's a military war—using ineffectual but nevertheless insulting moves such as stationing a handful of US troops in Estonia. And the goals of this war are clear: it is to undermine Russia economically, destroy it politically, dismember it geographically, and turn it into a pliant vassal state that furnishes natural resources to the West practically free of charge (with a few hand-outs to a handful of Russian oligarchs and criminal thugs who play ball). But it doesn't look like any of that is going to happen because, you see, a lot of Russians actually get all that, and will choose leaders who will not win any popularity contests in the West but who will lead them to victory. Given the realization that the US and Russia are, like it or not, in a state of war, no matter how opaque or muddled, people in Russia are trying to understand why this is and what it means. Obviously, the US has seen Russia as the enemy since about the time of the Revolution of 1917, if not earlier. For example, it is known that after the end of World War II America's military planners were thinking of launching a nuclear strike against the USSR, and the only thing that held them back was the fact that they didn't have enough bombs, meaning that Russia would have taken over all of Europe before the effects of the nuclear strikes could have deterred them from doing so (Russia had no nuclear weapons at the time, but lots of conventional forces right in the heart of Europe). But why has war been declared now, and why was it declared by this social worker turned national misleader? Some keen observers mentioned his slogan “the audacity of hope,” and ventured to guess that this sort of “audaciousness” (which in Russian sounds a lot like “folly”) might be a key part of his character which makes him want to be the leader of the universe, like Napoleon or Hitler. Others looked up the campaign gibberish from his first presidential election (which got silly young Americans so fired up) and discovered that he had nice things to say about various cold warriors. Do you think Obama might perhaps be a scholar of history and a shrewd geopolitician in his own right? (That question usually gets a laugh, because most people know that he is just a chucklehead and repeats whatever his advisers tell him to say.) Hugo Chavez once called him “a hostage in the White House,” and he wasn't too far off. So, why are his advisers so eager to go to war with Russia, right now, this year? Is it because the US is collapsing more rapidly than most people can imagine? This line of reasoning goes like this: the American scheme of world domination through military aggression and unlimited money-printing is failing before our eyes. The public has no interest in any more “boots on the ground,” bombing campaigns do nothing to reign in militants that Americans themselves helped organize and equip, dollar hegemony is slipping away with each passing day, and the Federal Reserve is fresh out of magic bullets and faces a choice between crashing the stock market and crashing the bond market. In order to stop, or at least forestall this downward slide into financial/economic/political oblivion, the US must move quickly to undermine every competing economy in the world through whatever means it has left at its disposal, be it a bombing campaign, a revolution or a pandemic (although this last one can be a bit hard to keep under control). Russia is an obvious target, because it is the only country in the world that has had the gumption to actually show international leadership in confronting the US and wrestling it down; therefore, Russia must be punished first, to keep the others in line. I don't disagree with this line of reasoning, but I do want to add something to it. First, the American offensive against Russia, along with most of the rest of the world, is about things Americans like to call “facts on the ground,” and these take time to create. The world wasn't made in a day, and it can't be destroyed in a day (unless you use nuclear weapons, but then there is no winning strategy for anyone, the US included). But the entire financial house of cards can be destroyed rather quickly, and here Russia can achieve a lot while risking little. Financially, Russia's position is so solid that even the three Western credit ratings agencies don't have the gall to downgrade Russia's rating, sanctions notwithstanding. This is a country that is aggressively paying down its foreign debt, is running a record-high budget surplus, has a positive balance of payments, is piling up physical gold reserves, and not a month goes by that it doesn't sign a major international trade deal (that circumvents the US dollar). In comparison, the US is a dead man walking: unless it can continue rolling over trillions of dollars in short-term debt every month at record-low interest rates, it won't be able to pay the interest on its debt or its bills. Good-bye, welfare state, hello riots. Good-bye military contractors and federal law enforcement, hello mayhem and open borders. Now, changing “facts on the ground” requires physical actions, whereas causing a financial stampede to the exits just requires somebody to yell “Boo!” loudly and frighteningly enough. Second, it must be understood that at this point the American ruling elite is almost entirely senile. The older ones seem actually senile in the medical sense. Take Leon Panetta, the former Defense Secretary: he's been out flogging his new book, and he is still blaming Syria's Bashar al Assad for gassing his own people! By now everybody else knows that that was a false flag attack, carried out by some clueless Syrian rebels with Saudi help, to | ||||||||||||||||||||||||||||||||

| The Gold Price Rose $7.00 Closing at $1,241.00 Posted: 21 Oct 2014 07:23 PM PDT

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||

| The Hedge Fund Industry's 25 Favorite ETFs Posted: 21 Oct 2014 07:15 PM PDT Exchange Traded Funds are becoming an important market for hedge funds as BofAML notes, they have shifted their profiles from shorting single stocks to more actively using ETFs as a hedge. On aggregate, BofAML reports that hedge funds owned $36.9bn worth of ETFs at the beginning of 3Q 2014, up notably from $33.8bn in the previous quarter, and these are the top 25 by market value. Notably, hedge funds bought Agricultural business (MOO) along with Emerging Markets (EEM, VWO), while selling gold (GDX and GLD) and Italy index (EWI).

Our universe consists of 758 ETFs listed in the US with market caps of at least $100mn as of June 30, 2014. Source: BofAML | ||||||||||||||||||||||||||||||||

| 19 Surprising Facts About The Messed Up State Of The US Economy Posted: 21 Oct 2014 05:31 PM PDT Submitted by Michael Snyder of The Economic Collapse blog, Barack Obama and the Federal Reserve are lying to you. The "economic recovery" that we all keep hearing about is mostly just a mirage. The percentage of Americans that are employed has barely budged since the depths of the last recession, the labor force participation rate is at a 36 year low, the overall rate of homeownership is the lowest that it has been in nearly 20 years and approximately 49 percent of all Americans are financially dependent on the government at this point. In a recent article, I shared 12 charts that clearly demonstrate the permanent damage that has been done to our economy over the last decade. The response to that article was very strong. Many people were quite upset to learn that they were not being told the truth by our politicians and by the mainstream media. Sadly, the vast majority of Americans still have absolutely no idea what is being done to our economy. For those out there that still believe that we are doing "just fine", here are 19 more facts about the messed up state of the U.S. economy... #1 After accounting for inflation, median household income in the United States is 8 percent lower than it was when the last recession started in 2007. #2 The number of part-time workers in America has increased by 54 percent since the last recession began in December 2007. Meanwhile, the number of full-time jobs has dropped by more than a million over that same time period. #3 More than 7 million Americans that are currently working part-time jobs would actually like to have full-time jobs. #4 The jobs gained during this "recovery" pay an average of 23 percent less than the jobs that were lost during the last recession. #5 The number of unemployed workers that have completely given up looking for work is twice as high now as it was when the last recession began in December 2007. #6 When the last recession began, about 17 percent of all unemployed workers had been out of work for six months or longer. Today, that number sits at just above 34 percent. #7 Due to a lack of decent jobs, half of all college graduates are still relying on their parents financially when they are two years out of school. #8 According to a new method of calculating poverty devised by the U.S. Census Bureau, the state of California currently has a poverty rate of 23.4 percent. #9 According to the New York Times, the "typical American household" is now worth 36 percent less than it was worth a decade ago. #10 In 2007, the average household in the top 5 percent had 16.5 times as much wealth as the average household overall. But now the average household in the top 5 percent has 24 times as much wealth as the average household overall. #11 In an absolutely stunning development, the rate of small business ownership in the United States has plunged to an all-time low. #12 Subprime loans now make up 31 percent of all auto loans in America. Didn't that end up really badly when the housing industry tried the same thing? #13 The average cost of producing a barrel of shale oil in the United States is approximately 85 dollars. Now that the price of oil is starting to slip under that number, the "shale boom" in America could turn into a bust very rapidly. #14 On a purchasing power basis, China now actually has a larger economy than the United States does. #15 It is hard to believe, but there are 49 million people that are dealing with food insecurity in America today. #16 There are six banks in the United States that pretty much everyone agrees fit into the "too big to fail" category. Five of them have more than 40 trillion dollars of exposure to derivatives. #17 The 113 top earning employees at the Federal Reserve headquarters in Washington D.C. make an average of $246,506 a year. It turns out that ruining the U.S. economy is a very lucrative profession. #18 We are told that the federal deficit is under control, but the truth is that the U.S. national debt increased by more than a trillion dollars during fiscal year 2014. #19 An astounding 40 million dollars has been spent just on vacations for Barack Obama and his family. Perhaps he figures that if we are going down as a nation anyway, he might as well enjoy the ride. If our economy truly was "recovering", there would be lots of good paying middle class jobs available. But that is not the case at all. I know so many people in their prime working years that spend day after day searching for a job. Most of them never seem to get anywhere. It isn't because they don't have anything to offer. It is just that the labor market is absolutely saturated with qualified job seekers. For example, USA Today recently shared the story of 42-year-old Alex Gomez...

Does Alex Gomez have gifts and abilities to share with our society? Of course he does. So why can't he find a job? It is because we have a broken economy. We are in the midst of a long-term economic decline and the system simply does not work properly anymore. And thanks to decades of very foolish decisions, this is only the start of our problems. Things are only going to get worse from here. | ||||||||||||||||||||||||||||||||

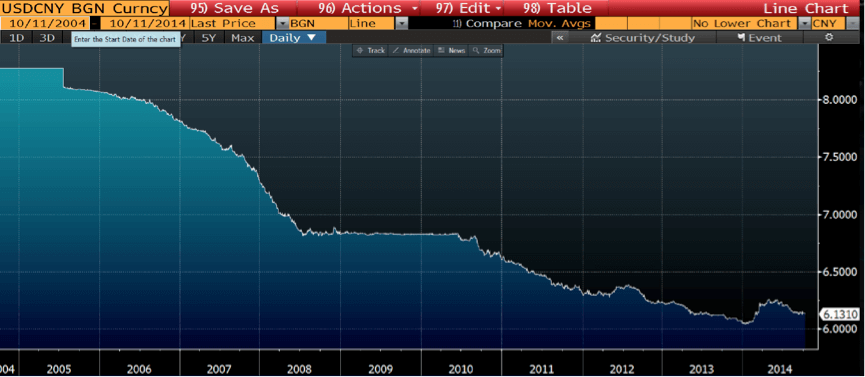

| Is China the Next Sub-Prime Event? Posted: 21 Oct 2014 05:18 PM PDT By: Brad Thomas at http://capitalistexploits.at/ As mentioned in my writing on the Singapore dollar, the most dangerous thing in finance is the "thing" that never moves. This stability creates an illusion of control around which many positions are built, the greater the perceived stability the greater the positions, and the more other assumptions and forecasts are made. The stability (or lack of volatility) in the Renminbi has been the one of the foundations that has made so many other variables more forecastable. No one can imagine the Renminbi being a highly volatile currency, let alone coming remotely close to repeating what happened during the Asian Tiger crisis of 1997! If this foundation of stability suddenly disappears then there will be a great increase in uncertainty and volatility in many markets across the globe. I don't know exactly how a breakdown in the Renminbi will play out. However, it is a sure bet that all those markets that prospered over the last 15 years or so on the back of a China will do badly. Where things become shady is the collateral damage to other markets that have had nothing to do with the Chinese economic miracle. I think a reasonable bearish position on the Renminbi will be a great way to hedge out the uncertainty of outcomes with respect to how the Chinese economic miracle "unwinds". For a long time I have been highly skeptical on the Chinese "economic miracle". Every contrarian bone in my body has been telling me that there is something not quite right with China's meteoric rise from an economy that was seemingly insignificant some 15 years ago to the economic powerhouse that we are led to believe it is today. The Chinese economy has risen to prominence too quickly too soon. What has been the driver of this rise? Why did commodity prices explode skywards in 2002 having gone nowhere for the previous 30 years? I find it hard to believe that commodities became scarcer all of a sudden!

The CRB Commodity Index (the CCI) Well, no one has been able to give me a straight down the line answer - at least one that an ordinary average trader like myself could understand. That is until I came across the following discussion with Mark Hart. Hart came to prominence together with Kyle Bass after shorting the "sub-prime thing" in 2007. Hart's discussion on China starts at about the 55 minute mark. Note what Hart says about how he is applying his view on China (via options on the Renminbi). The interview was conducted in September but note that he has been "bearish" on China at least since 2011! For more on the issues facing China you might like to read the writings of Gordon Chang and Michael Pettis. I think both present very objective views on China. I am not going to pretend to offer anything more than what these gentlemen offer with respect to the view on China. Hart talks about buying "puts" on the Renminbi. What makes the trade so attractive is the extreme low level of volatility. Below is an index of implied volatility for 12 months to expiry at the money (ATM) calls on the USD/CNY.

So we can buy calls on the USD/Renminbi for about 2.5% volatility. For comparison purposes - implied volatility on the AUD/USD is about 10%! Hart talks about buying the CNY 7 strike call on the USD/Renminbi. To give you an idea of the leverage offered on a 12-month option at the CNY 7 strike – about $1,100 will get you a notional position of $1,000,000! To achieve a payoff of 10x all the USD/CNY would have to close at is 7.07, and at 7.15 a 20x payoff is achieved! One can now appreciate what Mark Hart is on about - the gearing offered by options on the Renminbi is huge because volatility is grossly underpriced. Is it so crazy to think that the Renminbi can get to a "tick or two" above 7 within 12 months?

Well, let's not forget what happened to currencies in the past. Note what happened to the Mexican Peso during the "Tequila" crisis:

...the Thai baht during the Asian Tiger crisis:

...or to the Russian Ruble during the LTCM crisis:

Currencies can move and they move significantly when they have been sailing in calm waters for extended periods of time - just like the Chinese Renminbi now. Position for the unexpected. It is why Hart and Bass made so much money during the Subprime crisis. - Brad

"Never think that lack of variability is stability. Don't confuse lack of volatility with stability, ever." - Nassim Nicholas Taleb | ||||||||||||||||||||||||||||||||

| James G. Rickards: In the year 2024 Posted: 21 Oct 2014 05:08 PM PDT 7:06p CT Tuesday, October 21, 2014 Dear Friend of GATA and Gold: Writing for The Daily Reckoning, fund manager, author, and geopolitical strategist James G. Rickards imagines life in the year 2024 as being under the totalitarian control of a world central bank that has outlawed not only gold but also markets and money itself. While Rickards' nightmare scenario is the perfectly logical consequence of the trend of central banking, we still have a few years to push the world toward a different future. Rickards' essay is headlined "In the Year 2024" and it's posted at The Daily Reckoning here: http://dailyreckoning.com/a-glimpse-into-the-year-2024/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 BullionStar is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. BullionStar's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in BullionStar's bullion vault, which is integrated with BullionStar's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||

| Kinross to sell halted Ecuador gold project to Lundin company Posted: 21 Oct 2014 04:51 PM PDT By Nicole Mordant Kinross Gold Corp has agreed to sell its halted Fruta del Norte gold project in Ecuador to a company belonging to the Swedish-Canadian Lundin family for $240 million, Kinross and the company, Fortress Minerals Corp., said today. Toronto-based Kinross acquired the project in 2008 with its $1.2 billion friendly takeover of Aurelian Resources, and once called it "one of the most exciting gold discoveries of the past 15 years." But last year it suspended work on the gold project, Ecuador's largest, saying the government had refused to compromise over a 70 percent windfall tax. Last June Kinross took a $720 million charge on the project and has been looking to sell it. The government of Ecuador has indicated its support for the transaction, Kinross said. ... ... For the remainder of the report: http://www.reuters.com/article/2014/10/21/kinross-fortress-ecuador-idUSL... ADVERTISEMENT Own Allocated -- and Most Importantly -- Zurich, Switzerland, remains an extremely safe location for storing coins and bars of the monetary metals. If you do not own segregated physical coins and bars that you can visit, inspect, and take delivery of, you are vulnerable. International diversification remains vital to investors. GoldCore can accomplish this for you. Read GoldCore's "Essential Guide to Gold Storage In Switzerland" here: http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44 (0)203 086 9200 -- U.S.: +1-302-635-1160 -- International: +353 (0)1 632 5010 Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||

| Von Greyerz: Swiss gold referendum aims squarely at market manipulation Posted: 21 Oct 2014 04:26 PM PDT 6:24p CT Tuesday, October 21, 2014 Dear Friend of GATA and Gold: Swiss gold fund manager Egon von Greyerz today comments to King World News about the opinion poll showing strong support for the Swiss gold repatriation referendum proposal. Von Greyerz says: "The yes campaign starts this Thursday with a press conference. This is when it will put forward its arguments for this initiative. The Swiss government is against this initiative, as all governments are, because it takes away the government's ability to manipulate the currency and gold markets. Switzerland sold 50 percent of its gold at the bottom of the market between 2000 and 2005. This has already cost the Swiss government 29 billion Swiss francs." Von Greyerz's interview is excerpted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/10/21_T... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers. (http://www.gata.org/node/173) To invest or learn more, please visit: Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||

| How Much Gold is on Loan Worldwide Posted: 21 Oct 2014 04:00 PM PDT GoldBroker | ||||||||||||||||||||||||||||||||

| Posted: 21 Oct 2014 02:01 PM PDT [Editor's Note from Jim Rickards: The following article describes a fictional dystopia in the spirit of Brave New World or 1984. It is not a firm forecast or prediction in the usual analytic sense. Instead, it's intended to provide warning, and encourage readers to be alert to dangerous trends in society, some of which are already in place. Thank you.] As I awoke this morning, Sunday, Oct. 13, 2024, from restless dreams, I found the insect-sized sensor implanted in my arm was already awake. We call it a "bug." U.S. citizens have been required to have them since 2022 to access government health care. The bug knew from its biometric monitoring of my brain wave frequencies and rapid eye movement that I would awake momentarily. It was already at work launching systems, including the coffee maker. I could smell the coffee brewing in the kitchen. The information screens on the inside of my panopticon goggles were already flashing before my eyes. Images of world leaders were on the screen. They were issuing proclamations about the fine health of their economies and the advent of world peace. Citizens, they explained, needed to work in accordance with the New World Order Growth Plan to maximize wealth for all. I knew this was propaganda, but I couldn't ignore it. Removing your panopticon goggles is viewed with suspicion by the neighborhood watch committees. Your "bug" controls all the channels. I'm mostly interested in economics and finance, as I have been for decades. I've told the central authorities that I'm an economic historian, so they've given me access to archives and information denied to most citizens in the name of national economic security. My work now is only historical, because markets were abolished after the Panic of 2018. That was not the original intent of the authorities. They meant to close markets "temporarily" to stop the panic, but once the markets were shut, there was no way to reopen them without the panic starting again. My work now is only historical, because markets were abolished after the Panic of 2018. Today, trust in markets is completely gone. All investors want is their money back. Authorities started printing money after the Panic of 2008, but that solution stopped working by 2018. Probably because so much had been printed in 2017 under QE7. When the panic hit, money was viewed as worthless. So markets were simply closed. Between 2018–20, the Group of 20 major powers, the G-20, abolished all currencies except for the dollar, the euro and the ruasia. The dollar became the local currency in North and South America. Europe, Africa and Australia used the euro. The ruasia was the only new currency — a combination of the old Russian ruble, Chinese yuan and Japanese yen — and was adopted as the local currency in Asia. There is also new world money called special drawing rights, or SDRs for short. They're used only for settlements between countries, however. Everyday citizens use the dollar, euro or ruasia for daily transactions. The SDR is also used to set energy prices and as a benchmark for the value of the three local currencies. The World Central Bank, formerly the IMF, administers the SDR system under the direction of the G-20. As a result of the fixed exchange rates, there's no currency trading. All of the gold in the world was confiscated in 2020 and placed in a nuclear bomb-proof vault dug into the Swiss Alps. The mountain vault had been vacated by the Swiss army and made available to the World Central Bank for this purpose. All G-20 nations contributed their national gold to the vault. All private gold was forcibly confiscated and added to the Swiss vault as well. All gold mining had been nationalized and suspended on environmental grounds. The purpose of the Swiss vault was not to have gold backing for currencies, but rather to remove gold from the financial system entirely so it could never be used as money again. Thus, gold trading ceased because its production, use and possession were banned. By these means, the G-20 and the World Central Bank control the only forms of money. Some lucky ones had purchased gold in 2014 and sold it when it reached $40,000 per ounce in 2019. By then, inflation was out of control and the power elites knew that all confidence in paper currencies had been lost. The only way to re-establish control of money was to confiscate gold. But those who sold near the top were able to purchase land or art, which the authorities did not confiscate. Those who never owned gold in the first place saw their savings, retirement incomes, pensions and insurance policies turn to dust once the hyperinflation began. Now it seems so obvious. The only way to preserve wealth through the Panic of 2018 was to have gold, land and fine art. But investors not only needed to have the foresight to buy it… they also had to be nimble enough to sell the gold before the confiscation in 2020, and then buy more land and art and hang onto it. For that reason, many lost everything. Land and personal property were not confiscated, because much of it was needed for living arrangements and agriculture. Personal property was too difficult to confiscate and of little use to the state. Fine art was lumped in with cheap art and mundane personal property and ignored. Stock and bond trading were halted when the markets closed. During the panic selling after the crash of 2018, stocks were wiped out. Too, the value of all bonds were wiped out in the hyperinflation of 2019. Governments closed stock and bond markets, nationalized all corporations and declared a moratorium on all debts. World leaders initially explained it as an effort to "buy time" to come up with a plan to unfreeze the markets, but over time, they realized that trust and confidence had been permanently destroyed, and there was no point in trying. Wiped-out savers broke out in money riots soon after but were quickly suppressed by militarized police who used drones, night vision technology, body armor and electronic surveillance. Highway tollbooth digital scanners were used to spot and interdict those who tried to flee by car. By 2017, the U.S. government required sensors on all cars. It was all too easy for officials to turn off the engines of those who were government targets, spot their locations and arrest them on the side of the road. In compensation for citizens' wealth destroyed by inflation and confiscation, governments distributed digital Social Units called Social Shares and Social Donations. These were based on a person's previous wealth. Americans below a certain level of wealth got Social Shares that entitled them to a guaranteed income. Those above a certain level of wealth got Social Donation units that required them to give their wealth to the state. Over time, the result was a redistribution of wealth so that everyone had about the same net worth and the same standard of living. The French economist Thomas Piketty was the principal consultant to the G-20 and World Central Bank on this project. By 2017, the U.S. government required sensors on all cars. To facilitate the gradual freezing of markets, confiscation of wealth and creation of Social Units, world governments coordinated the elimination of cash in 2016. The "cashless society" was sold to citizens as a convenience. No more dirty, grubby coins and bills to carry around! Instead, you could pay with smart cards and mobile phones and could transfer funds online. Only when the elimination of cash was complete did citizens realize that digital money meant total control by government. This made it easy to adopt former Treasury Secretary Larry Summers' idea of negative interest rates. Governments simply deducted amounts from its citizens' bank accounts every month. Without cash, there was no way to prevent the digital deductions. The government could also monitor all of your transactions and digitally freeze your account if you disagreed with their tax or monetary policy. In fact, a new category of hate crime for "thoughts against monetary policy" was enacted by executive order. The penalty was digital elimination of the wealth of those guilty of dissent. The entire process unfolded in small stages so that investors and citizens barely noticed before it was too late. Gold had been the best way to preserve wealth from 2014–18, but in the end, it was confiscated because the power elites knew it could not be allowed. First, they eliminated cash in 2016. Then they eliminated diverse currencies and stocks in 2018. Finally came the hyperinflation of 2019, which wiped out most wealth, followed by gold confiscation and the digital socialism of 2020. By last year, 2023, free markets, private property and entrepreneurship were things of the past. All that remains of wealth is land, fine art and some (illegal) gold. The only other valuable assets are individual talents, provided you can deploy them outside the system of state-approved jobs. Regards, Jim Rickards P.S. Sign up to receive the Daily Reckoning email edition for free. It’s now the official way to stay up to date on Jim’s new writings and any developments in his newsletter, Strategic Intelligence. Sign up for FREE, right here. | ||||||||||||||||||||||||||||||||

| Forex-rigging fines against banks could reach $41 billion worldwide, Citi report says Posted: 21 Oct 2014 01:37 PM PDT By Richard Partington http://www.bloomberg.com/news/2014-10-20/forex-rigging-fines-could-hit-4... LONDON -- Probes into allegations that traders rigged foreign-exchange benchmarks could cost banks as much as $41 billion to settle, Citigroup Inc. analysts said. Deutsche Bank is seen as probably the "most impacted" with a fine of as much as 5.1 billion euros ($6.5 billion), Citigroup analysts led by Kinner Lakhani said yesterday, estimating that the Frankfurt-based bank's settlements could reach 10 percent of its tangible book value, or its assets' worth. Using similar calculations, Barclays could face as much as 3 billion pounds ($4.8 billion) in fines and UBS penalties of 4.3 billion Swiss francs ($4.6 billion), they wrote in a note first sent to clients on Oct. 3. ... Dispatch continues below ... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: "Extrapolating European and, more importantly, U.S. penalties from a previous global settlement suggests to us a total potential global settlement on this key issue," they said in the note. Authorities around the world are scrutinizing allegations that dealers traded ahead of their clients and colluded to rig currency benchmarks. Regulators in the U.K. and U.S. could reach settlements with some banks as soon as next month, and prosecutors at the U.S. Justice Department plan to charge one by the end of the year, people with knowledge of the matter have said. Spokesmen for Deutsche Bank, Barclays and UBS declined to comment on the Citigroup estimates. The Citigroup analysts made their calculations using a Sept. 26 Reuters report that the U.K. Financial Conduct Authority settlements could include fines totaling about 1.8 billion pounds. They derived their estimates for how high fines could go in other investigations from that baseline, using banks' settlements in the London interbank offered rate manipulation cases as a guide. "The discussion around a potential U.K. settlement as well as certain U.S. banks taking related provisions in their recent results suggests a kick-start toward overall FX litigation settlement," Lakhani said by e-mail. Citigroup is the biggest player in the $5.3 trillion-a-day foreign-exchange market, according to a Euromoney Institutional Investor Plc survey published May 9. The New York-based bank's 16.04 percent market share topped Deutsche Bank's 15.67 percent and Barclays's 10.91 percent. UBS controlled 10.88 percent. Citigroup's potential fine in the currency manipulation investigations wasn't mentioned in the analysts' report, in line with bank policy. The firm is among those in talks with regulators in the U.S. and U.K. to settle probes, people with knowledge of the matter have said. The Euromoney rankings are drawn from a survey of traders in the foreign-exchange markets. The 2013 results were based on 14,050 responses, representing $225 trillion of turnover, London-based Euromoney said. U.K. authorities will probably account for about $6.7 billion of fines across all banks, according to the Citigroup analysts. Other European investigations will account for $6.5 billion. Penalties in the U.S. cases could be about four times greater, hitting $28.2 billion. The Citigroup analysts didn't take into account the possible effect of banks' collaboration with investigators. That can have a big impact on the size of the fines, lowering and even wiping out a penalty in some cases. UBS and Barclays saw $4.3 billion worth of antitrust fines waived by European Union authorities in December in exchange for their early and full cooperation. Six others were fined 1.7 billion euros in that case, which involved rigging euro and yen interest rate derivatives. UBS has sought leniency in exchange for handing over evidence of misconduct to U.S. antitrust investigators in the foreign-exchange probes, and was the first to step forward to cooperate with the EU, people with knowledge of the matter have said. Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Slowly Higher, More Gold Withdrawals Posted: 21 Oct 2014 01:19 PM PDT | ||||||||||||||||||||||||||||||||

| Russia Adds A Record 1.2 Mio Ounces Gold To Its Reserves Posted: 21 Oct 2014 12:57 PM PDT As evidenced by the Russian central bank, it appears that Russia has added another 1,200,000 ounces of physical gold to their reserves. Total Russian gold reserves now stand at 37,000,000 ounces, or 1049 tonnes. The following chart, courtesy Sharelynx, shows the increase of Russian gold reserves over the last 8 years. The latter part of the chart shows the monthly change. It is very interesting to note how September 2014 attributed to the biggest month-on-month increase ever. Only in May 2010 was there an increase which came close to the one of last month with an addition of 1.1 million ounces. As we said in March of this year in our article Russia Touches U.S. Achilles Heel: Petrogold instead of Petrodollar, we believe gold equals strength. It is no coincidence that the petrodollar system is losing ground and that countries like Russia and China keep on hoarding large amounts of gold. This trend could end up in a lost of trust in the US dollar leading the world reserve to collapse. That is the also unspoken Achilles heel of the US.

Ed Steer notes in his daily newsletter that the 1.2 million troy ounces is considerably more gold than Russia digs out of the ground in one month. “I get the impression from this big deposit in September that they have gold stashed away somewhere that doesn’t show up in the books of the central bank, as a deposit that size can’t be explained any other way.” | ||||||||||||||||||||||||||||||||

| Gold Is Extending Its October Run Posted: 21 Oct 2014 12:07 PM PDT This is an excerpt from the daily StockCharts.com newsletter to premium subscribers, which offers daily a detailed market analysis (recommended service).

The correction in the Dollar helped gold as the Gold SPDR GLD advanced over 5% from its early October low. The first chart shows GLD breaking the August trend line and moving back above the support break. In an interesting twist, gold is ignoring weakness in the Euro today and moving higher. While I am not sure if this will last, I would mark first support at 118 and stay positive on gold as long as this level holds. All bets are off if the Dollar breaks out to the upside. The second chart shows the Gold Miners ETF GDX forming a pennant within a downtrend. Pennants are typically continuation patterns and a break below 20.5 would signal a continuation lower. However, gold is on the rise this month and GDX did form a harami on Friday-Monday. A move above 22 would break pennant resistance and be bullish.

| ||||||||||||||||||||||||||||||||

| How Will We Know That the Gold & Silver Price Bottom Is In? Posted: 21 Oct 2014 11:55 AM PDT Briefly: In our opinion speculative long positions (half) in gold, silver and mining stocks are justified from the risk/reward perspective. Yesterday, gold closed higher than it did in the previous several weeks, which seems like a very bullish development for the entire precious metals market until one realizes that miners are still close to their most recent lows. In short, in our opinion, the answer to the title question is that miners could rally some more in the short term, but we don’t expect the rally to be significant. We expect to see significant rallies after the final bottom is reached (in a few weeks – months), but not before that – at least not based on the information that we have available today. Furthermore, it seems that the next local top will be reached shortly, but that it’s not in just yet. | ||||||||||||||||||||||||||||||||

| Is Gold as Dead as Florida Hurricanes? Posted: 21 Oct 2014 11:36 AM PDT It’s been over 3,280 days since a hurricane hit Florida. As hurricane season comes to a close next month, only Mother Nature knows how long the streak will last. Like many Floridians, my wife and I stayed home and rode out a hurricaneâ€"once! We’d built a home on Perdido Key, a barrier island west of Pensacola. It was engineered to withstand 150-plus mph winds, and it was a beautiful home with a master bedroom spanning the entire third floor, looking out across the Gulf of Mexico. | ||||||||||||||||||||||||||||||||

| First Swiss Gold Poll Shows Pro-Gold Side In Lead At 45% Posted: 21 Oct 2014 11:15 AM PDT The first poll of how the Swiss people will vote in the “Save Our Swiss Gold” initiative on November 30th shows that the Swiss are leaning towards voting for the pro-gold initiative. | ||||||||||||||||||||||||||||||||