saveyourassetsfirst3 |

- Gold Rebounds Near Huge 1206 Level; 1240 is Resistance

- Fund Manager On ALIBABA.CON: The New Poster Child of Bankster Corruption

- Banksters Trying to Get Their Dirty Claws Back on Venezuela’s Repatriated Gold Reserves

- Copper hit by China News

- Richard Karn's Advice for Avoiding the Walking Dead

- On the Breakdown of Nations

- Gold Divergences Are Everywhere

- We will see a 'bank run' on silver

- Gold holding on to key support channel line

- You know your country is broke when the cops have to call 911…

- Pressure on gold market as dollar strengthens

- Wow, There's A Lot Going On!

- Russia, former Soviet states amp up gold reserves

- Stock Market Weakness Brings Safe Haven buying into Gold, Bonds

- New BOMBSHELL Development in PM Manipulation Story

- When a surge isn’t a surge

- Metals market update for September 25

- Airport staff apprehended in India for helping gold smugglers

- Currency Wars Deepen - Russia, Kazakhstan Buy Very Large 30 Tons Of Gold In August

- SA gold stocks down

- Currency Wars Deepen – Russia, Kazakhstan Buy Very Large 30 Tons Of Gold In August

- Gold demand in India 'now at record levels' - Phillips

- Gold drops to 9-month low as dollar hits 4-year peak

- Gold traders: This is your next move

- $1180 - Is This A Triple Bottom In Gold?

- Gold Sentiment – How Bad Is It?

- Gold declines calmly – Analysis - 25/09/2014

- Gold – is there no end to the pain?

- Crude Oil Hits 26-Month Low, US Dollar at Risk of a Reversal

- What the Charts Are Saying About Gold, Precious Metals

- Rickards Tells Anglo Far-East the Methods, Objectives, and Perps of Gold Market Rigging

- Three King World News Blogs

- Gold price seen near tipping point for mine cuts, closures

- Royal Canadian Mint Introduces One Gram Size Gold Maple Leaf Bullion Coins

- Rickards tells Anglo Far-East the methods, objectives, and perps of gold market rigging

- Australian economy faces major challenge from iron ore slump

- The “Five M’s” For Picking Gold Stocks

- GLD gold holdings hit new Yearly Low

- New BOMBSHELL Development in PM Manipulation Story

- Does gold always gain during crises?

- Protected: COT Analysis & More

- Bumps, Dips, Bubbles, and Storms - Part 2

- Computer Models Predict Ebola Pandemic Could Kill Millions “In the Next 6 Months”

- Jim Willie: The Crash Heard Round the World- Saudis to Reject USD for Oil Payments

- Is This A Triple Bottom In Gold?

- sept 24/no change in gold inventory at the GLD/No change in silver inventory at SLV/Ned Naylor's important commentary on the suppression of news regarding silver/gold rigging/gold and silver fall on raid/

- Is Gold Correcting Or In A Downtrend?

- Silver Eagles & the SLV: The Chart Every Silver Investor Should See

- 5 U.S. Banks Each Have More Than 40 Trillion Dollars In Exposure To Derivatives

- Precious Metals Video Market Update

| Gold Rebounds Near Huge 1206 Level; 1240 is Resistance Posted: 25 Sep 2014 12:45 PM PDT |

| Fund Manager On ALIBABA.CON: The New Poster Child of Bankster Corruption Posted: 25 Sep 2014 12:30 PM PDT Alibaba is now the poster child example of how corrupt and controlled by the bankers our entire system is. Any professional money managers/fund managers who bought this stock for anything more than a quick flip should be strung up from an oak tree by the neck for breach of fiduciary duty. It is completely inconceivable that […] The post Fund Manager On ALIBABA.CON: The New Poster Child of Bankster Corruption appeared first on Silver Doctors. |

| Banksters Trying to Get Their Dirty Claws Back on Venezuela’s Repatriated Gold Reserves Posted: 25 Sep 2014 11:15 AM PDT In August 2011, the Venezuelan government surprised the gold market when it announced that it would seek to repatriate, at short notice, 160 tonnes of its foreign held gold reserves back to Venezuela for safekeeping. The government also revealed at that time where its gold was located and in what form it was held. The […] The post Banksters Trying to Get Their Dirty Claws Back on Venezuela’s Repatriated Gold Reserves appeared first on Silver Doctors. |

| Posted: 25 Sep 2014 11:11 AM PDT Do any of the readers remember not that long ago when the talk in the copper market ( and the metals market) was about those fraudulent financing deals that were being investigated in China. To refresh your memory, it appeared that the same stash of metal was being used to secure financing multiple times. That made a big splash at the time but then seems to have been largely forgotten until overnight news surfaced that the amount involved in those less-than-upright deals was in the vicinity of $10 billon! The metals were stored in two port cities, Qingdao and Penglai. Reports noted that potential losses for foreign banks and commodities firms could be close to $1billion. Worse however was estimates that exposure for Chinese banks could potentially be in the billions ( yes, with an "S") of dollars. That send copper lower - as if it did not already need any help moving in that direction. The red metal has pushed down into an important chart support zone. Failure to hold here and copper is going to change handles to a "2". It will, as it always has, take its cues from economic data. As a way of reminder - that certain website out there, which goes by the name, "We never saw a news article that we could not interpret and spin to be bullish for gold", was pushing that story as one more perma bullish gold theory not that long ago when this thing was in the news. Talk about another one biting the dust! Their bizarre claim was that somehow double-counted metal was bullish for gold because all of that gold that was hedged was going to have to be covered resulting in a huge rally in the yellow metal. Whoops! By the way, gold is still holding onto its gains as the equity markets are not as of yet showing any signs of serious buying. The yen remains higher as does the bond market which is up over a full point now. Safe haven buying is definitely keeping gold aloft at the moment. On the moo-moo front, they simply will not break down even as the beef weakens. Packer margins are already deep in the red but that is not fazing the cattle bulls. I thought that perhaps, just maybe, we might see the cattle sell off with the lower equity markets today, but no dice. Those who think gold is volatile should try their hands at the hogs. The blasted things fell to practically limit down earlier today and then cut those losses in half as there was what might best be described as a "panic buying" short covering binge that hit the pit 15 minutes before the close of the pit. With the big Quarterly Hogs and Pigs report due out tomorrow, no one knows what to expect. My view at this point is that regardless of what the report might or might not say, the industry is going to ramp up in a big way. It might not be reflected in that report since many hog producers have gotten wise to telling USDA their breeding plans in advance, but nonetheless, with two vaccines now approved and with dirt cheap corn prices, I expect to see significant efforts to enlarge herds. We shall see. I have been wrong on these wildly unpredictable reports before so it will not be the first time if I am. What matters more than the report however is the reaction to it and that we will not get until next Monday morning. One last thing- those corn/wheat spreads are coming right back on again. Amazing. |

| Richard Karn's Advice for Avoiding the Walking Dead Posted: 25 Sep 2014 10:44 AM PDT Starved of cash, nearly 150 mining companies listed on the Australian Stock Exchange went into bankruptcy during the fiscal year that ended June 30. In this interview with The Gold Report, Karn shares a handful of names with the wherewithal to survive the onslaught. |

| Posted: 25 Sep 2014 10:15 AM PDT "A building is too big when it can no longer provide its dwellers with the services they expect – running water, waste disposal, heat, electricity, elevators and the like – without these taking up so much room that there is not enough left over for living space, a phenomenon that actually begins to happen in […] The post On the Breakdown of Nations appeared first on Silver Doctors. |

| Gold Divergences Are Everywhere Posted: 25 Sep 2014 09:50 AM PDT inthemoneystocks |

| We will see a 'bank run' on silver Posted: 25 Sep 2014 09:25 AM PDT I am convinced that because of supply/demand and low price causing less production, we will see a "bank run" in the silver market, writes Bill Holter, of Miles Franklin. |

| Gold holding on to key support channel line Posted: 25 Sep 2014 09:20 AM PDT Commodity Trader |

| You know your country is broke when the cops have to call 911… Posted: 25 Sep 2014 09:00 AM PDT Recently in [bankrupt] Argentina, a single police officer was left in charge of an entire jail in the Buenos Aires area which was housing several dozen prisoners. The lone officer, who was clearly in over her head and poorly trained, heard suspicious noises somewhere in the building. So what did she do? She (a police […] The post You know your country is broke when the cops have to call 911… appeared first on Silver Doctors. |

| Pressure on gold market as dollar strengthens Posted: 25 Sep 2014 08:59 AM PDT Gold continues to have a number of headwinds that are keeping the selling pressure on the yellow metal. |

| Posted: 25 Sep 2014 08:30 AM PDT Very, very interesting day today. Gold has spiked a little while the S&P has broken key support at 1980. The dollar is down but bonds are up, with yields at the lowest level in over two weeks. This begs the question: Have the metals seen the latest bottom? |

| Russia, former Soviet states amp up gold reserves Posted: 25 Sep 2014 08:06 AM PDT Russia and ex-Soviet states Kazakhstan, Kyrgyz Republic and Azerbaijan continued to accumulate significant gold reserves in August. |

| Stock Market Weakness Brings Safe Haven buying into Gold, Bonds Posted: 25 Sep 2014 07:49 AM PDT One look at the Japanese Yen is all that one needs to know that the safe haven trade was being plied today. As the stock market moved lower ( surrendering its gains from yesterday), the Yen moved higher. Bonds moved up a full point and up came gold from the grave. This is why trading the Yen in the current environment can cause one to invest heavily in a supply of Tums or Rolaids. The infernal currency has somehow over the years morphed into a safe haven. In effect, one ends up trading risk or no risk when trading the yen. It looked as if gold was about to run down and test $1200 as it traded below Monday's low but that safe haven buying popped it back up. The bulls are certainly putting in a good faith effort to prevent it from breaking down and changing handles. Very quickly on the grains... so much for the wheat rally from yesterday. Strength in the Dollar is proving to be a big lead weight for wheat. I will try to get some more up later... it is a busy morning in trading land. |

| New BOMBSHELL Development in PM Manipulation Story Posted: 25 Sep 2014 07:35 AM PDT

Click here for more on the new BOMBSHELL development in the PM Manipulation story: |

| Posted: 25 Sep 2014 07:22 AM PDT Stacy Summary: I do appreciate a little context. |

| Metals market update for September 25 Posted: 25 Sep 2014 07:12 AM PDT Gold fell $5.70 or 0.47% to $1,217.20 per ounce and silver slipped $0.10 or 0.56% to $17.70 per ounce yesterday. |

| Airport staff apprehended in India for helping gold smugglers Posted: 25 Sep 2014 06:59 AM PDT The Directorate of Revenue Intelligence officials at the Chennai International Airport in India foiled two gold smuggling attempts involving airport staff. |

| Currency Wars Deepen - Russia, Kazakhstan Buy Very Large 30 Tons Of Gold In August Posted: 25 Sep 2014 06:02 AM PDT gold.ie |

| Posted: 25 Sep 2014 05:33 AM PDT Spot gold price nears nine-month low; platinum falls to lowest since June 2013. |

| Currency Wars Deepen – Russia, Kazakhstan Buy Very Large 30 Tons Of Gold In August Posted: 25 Sep 2014 05:32 AM PDT Kazakhstan now has the world’s 23rd largest holdings, just behind the Philippines which has 194.4 tonnes of gold reserves. Currency Wars: Bye, Bye Petrodollar – Buy, Buy Gold

Russia and ex Soviet States Kazakhstan, Kyrgyz Republic and Azerbaijan continued to accumulate significant gold reserves in August in a trend that we highlighted last month: Russia Coordinating Gold Reserve Accumulation With Ex Soviet States?

Likewise, the National Bank of Kazakhstan purchased a massive 795,213 ozs or 24.7 tonnes in August bringing its total gold reserves to 5.848 million ozs (181.9 tonnes). Turkey was also a gold buyer in August and the Turkish central bank adding 96,783 ozs (3 tonnes) to bring its total official gold reserves to 16.45 million ozs (511.6 tonnes), which is the world’s 12th largest official gold holding. According to the IMF data, other countries which added to their gold reserves in August included the central banks of Azerbaijan and Ukraine. With the ongoing conflict in Ukraine, its not clear where the official Ukrainian are now stored. There had been reports in March that the Ukrainian gold was flown out of Kiev to the Federal Reserve Bank of New York, but neither central bank would comment on this issue at the time. Kazakhstan now has the world’s 23rd largest holdings, just behind the Philippines which has 194.4 tonnes of gold reserves. With 1,112.5 tonnes, Russia remains the world’s 6th largest official gold holder, ahead of China (1,054.1 tonnes) and Switzerland (1,040 tonnes). The Swiss National Bank (SNB) has not been a gold buyer recently but this may change if a Swiss gold referendum to be held in November goes through, which would force the SNB to maintain 20% of its reserves in gold and to repatriate all gold held abroad back to Switzerland. It is widely believed that China’s gold reserves are understated and as David Marsh of the Official Monetary and Financial Institutions Forum (OMFIF) said last week “over the past six or seven years the Chinese authorities probably have been adding to their holdings in different ways.” As we pointed out last month, as well as being a reserve diversification strategy, the ongoing gold accumulation trend by both Russia and Kazakhstan could be part of a coordinated monetary policy since the two countries are members of the Eurasian Customs Union along with Belarus. Next year the three countries plan to turn this Eurasian Customs Union into a more formal Eurasian Economic Union. Coordinated accumulation of gold reserves would make sense in this context. Russia, Kazakhstan and Belarus are also members of larger regional cooperation organisations, namely the Eurasian Economic Community and the Shanghai Cooperation Organisation (SCO). It will be interesting to see what a pooled gold holdings total for Russia, China, Kazakhstan, and other SCO members will look like when China finally does provide the world with an update on its official gold holdings. UK Treasury plans to criminalise benchmark manipulation Yesterday, the UK Treasury announced a consultation review into widening UK financial benchmark legislation and make manipulation of key currency, precious metals, and interest rate benchmarks a criminal offence. The only benchmark that is currently regulated is the interest rate LIBOR benchmark. HM Treasury plan to add a further seven key benchmarks to the legislation. These benchmarks are the WM/Reuters 4pm London fix (currency), ISDAFix (interest rate), the London Gold Fixing benchmark, the new LBMA Silver Price benchmark, the ICE Brent futures contract (crude oil), and two index swap benchmarks called the Sterling Overnight Index Average (SONIA) and the Repurchase Overnight Index Average (RONIA). The London Gold Fixing process is in disarray after multiple claims of manipulation and the prosecution of Barclays by the Financial Conduct Authority (FCA) last May for manipulating the gold price in the fixing auction. The London Gold Market Fixing Company (LGMFL) and the London Bullion Market Association (LBMA) are now attempting to ‘circle the wagons’ on regulatory compliance and investor litigation by moving to a new LBMA Gold Price process modelled on the recently introduced LBMA Silver Price. The LBMA Silver Price auction has not really evolved in any way since being introduced on August 15, and its current ‘phase 2′ stage, by design, only allows bullion banks and brokers to participate due to the lack of a central clearing counterparty and limitations on bi-lateral credit lines for auction participants. However, this has not stopped the LBMA ploughing ahead with a similar plan for the gold fixing process which still has the CME Group and Thomson Reuters as the leading contender. Following up today on the news of the Treasury’s benchmark consultation, Bloomberg contacted the four London Gold Fixing banks and the LBMA seeking comment, but reported this morning that “Representatives of the banks that contribute to the London gold fixing declined to comment or didn’t immediately return calls and emails seeking comment. The LBMA wasn’t immediately available.” With the London gold fixing process being so central to the determination of the world gold price, any moves by the UK authorities to criminalise manipulation of the gold fixing price are welcome. MARKET UPDATE Gold fell $5.70 or 0.47% to $1,217.20 per ounce and silver slipped $0.10 or 0.56% to $17.70 per ounce yesterday. Spot bullion in Singapore slipped 0.3% to $1,213.60 an ounce by 0043 GMT, after losing 0.5% in the earlier session. Gold is close to an 8 1/2 month low of $1,208.36 reached earlier in the week. U.S. Mint September American Eagle gold coin sales are almost 50,000 ounces, nearly twice its sales in August, with heightened geopolitical risk and a cheaper bullion price contributing to the interest from investors. If further bullish U.S. economic data comes out this week it will strengthen the U.S. dollar and weaken gold's appeal, as investors think the U.S. Fed will react with an earlier than expected interest rate hike. by Ronan Manly , Edited by Mark O'Byrne Currency Wars: Bye, Bye Petrodollar – Buy, Buy Gold See ‘How to Buy Gold and When to Sell’ Webinar Here Sign Up For Breaking News And Research Here |

| Gold demand in India 'now at record levels' - Phillips Posted: 25 Sep 2014 04:33 AM PDT Julian Phillips of the Gold Forecaster takes a quick look at signs of strong Asian gold demand as prices drop. |

| Gold drops to 9-month low as dollar hits 4-year peak Posted: 25 Sep 2014 04:06 AM PDT U.S. policy and currency moves are the 'one and only driver' of the gold market at present, says a VTB Capital analyst. |

| Gold traders: This is your next move Posted: 25 Sep 2014 04:00 AM PDT From Jeff Clark, editor, S&A Short Report: There’s no way to cushion the punch… After a strong rally in June, and two months consolidating and building up energy for its next move… gold tumbled last week. The price of gold fell more than 1%. And the benchmark gold-stocks fund, the Market Vectors Gold Miners Fund (GDX), pulled back more than 5%. Now, a lot of folks are wondering what’s next for gold stocks… Take a look at this chart of GDX…

On Friday, GDX closed 12.3% below its 50-day moving average (DMA). That’s an extreme move. GDX rarely strays more than 10% from its 50-DMA before reversing and then coming back toward its 50-DMA. Extreme moves, like we’re seeing right now, often mark significant bottoms. But bottoming is a process, not a one-day event. It takes time to recover from a sledgehammer hit on the head. For example, after falling 20% in one month, GDX closed 15% below its 50-DMA last December. That was the most oversold GDX had been since the gold sector bottomed in October 2008. GDX then bounced more than 5% higher over the next few trading sessions. But it was too much too soon. The gold-stock bounce failed and GDX dropped to a slightly lower low later in the month. That’s when we got the real gold-stock bottom. And that’s what I’m looking for this time as well. Friday’s extreme oversold condition should lead to a sharp, short-term bounce in the gold sector. But that bounce is likely to fail… And GDX is likely to come back down and retest Friday’s low. That’s when traders should start looking for an intermediate-term rally in gold stocks. The action back in December kicked off a 34% rally in GDX in just 10 weeks. We could see something similar this time around. |

| $1180 - Is This A Triple Bottom In Gold? Posted: 25 Sep 2014 01:20 AM PDT goldsilverworlds |

| Gold Sentiment – How Bad Is It? Posted: 25 Sep 2014 12:35 AM PDT gotgoldreport |

| Gold declines calmly – Analysis - 25/09/2014 Posted: 25 Sep 2014 12:35 AM PDT economies |

| Gold – is there no end to the pain? Posted: 25 Sep 2014 12:30 AM PDT macrobusiness |

| Crude Oil Hits 26-Month Low, US Dollar at Risk of a Reversal Posted: 25 Sep 2014 12:30 AM PDT dailyfx |

| What the Charts Are Saying About Gold, Precious Metals Posted: 25 Sep 2014 12:30 AM PDT investorplace |

| Rickards Tells Anglo Far-East the Methods, Objectives, and Perps of Gold Market Rigging Posted: 24 Sep 2014 11:11 PM PDT "The powers-that-be are pulling out all the stops" ¤ Yesterday In Gold & SilverThe gold price didn't do a lot during the Wednesday trading session---and the high, if you wish to dignify it with that name, appeared to come shortly after the London open. The 'low' came around 11:30 a.m. EDT---and the price didn't do much after that. The high and low ticks are barely worth the effort of looking up, but they were reported as $1,226.70 and $1,216.20 in the December contract. Gold ended the Wednesday session in New York at $1,216.60 spot, down $6.30 from Tuesday's close. Net volume checked in at around 123,000 contracts. The silver price didn't have much direction yesterday. The 'high' came about forty minutes before London opened---and the 'low' was at the 3 p.m. BST London p.m. golf fix---and the subsequent 'rally' didn't get far. The CME Group reported the high and low ticks as $17.87 and $17.51 in the December contract, which is the current front month---and the next big delivery month. It's the same for gold as well. Silver closed on Wednesday at $17.675 spot, down 10.5 cents from yesterday---and net volume was very brisk at 47,000 contracts. Platinum rallied up until shortly after Zurich opened---and that was pretty much it for the day, as that white metal got closed virtually on its low tick of the day---as da boyz took a $12 gain and turned it into a $12 loss. Palladium's high tick, which came at the same moment as platinum's high tick, had that metal up ten bucks. But JPMorgan et al showed up once again---and the gain ended up being only two dollars by the end of the Wednesday session in New York. The dollar index closed late yesterday afternoon EDT at 84.70---and then didn't do much until just before noon in London. At that point a rally began that topped out at the 85.07 mark. It fell back to 84.95 by 11:00 a.m. EDT---and then rallied weakly, closing the Wednesday session at 85.06---up another 36 basis points. The dollar index is up 6.5 percent since July 1. Here's the 3-year dollar index chart once again to put this current rally in some sort of historical perspective. The gold stocks opened in the red, but by just after 10:30 a.m. EDT were back in the black. That lasted for less than twenty minutes---and they never got a sniff of positive territory after that. The HUI finished down 1.21%---erasing half of Wednesday's gain. The silver stocks were down 2 percent by shortly after 10 a.m. EDT---and the subsequent rally only got a whiff of unchanged before it got sold down once again. The absolute low came at 2:30 p.m. in New York---and they rallied a bit into the close, as Nick Laird's Intraday Silver Sentiment Index closed down 1.74%. The CME Daily Delivery Report showed that zero gold and 10 silver contracts were posted for delivery within the Comex-approved depositories on Friday. The CME Preliminary Report for the Wednesday trading session showed that there are just 13 gold and 70 silver contracts left open in the September contract. There were no reported changes in GLD yesterday, but that can hardly be said about SLV, as another 2,397,420 troy ounces of silver were reported deposited by an authorized participant. When I typed the above number, it seems strangely familiar, so I checked the deposit of about that size that was made into SLV on Tuesday---and that worked out to 2,397,570 troy ounces, so I'm wondering out loud if there was an error of some kind, such as double counting. I'll find out today---and then report on this tomorrow, so stay tuned. The good folks over at the shortsqueeze.com Internet site updated their website with the short positions in both SLV and GLD as of the close of trading on September 15. In SLV, the short position declined from 14,299,000 shares/troy ounces down to 13,729,200 troy ounces, a decrease of only 570,000 shares/troy ounces, or 3.98%. During the reporting period, a hair over 8.0 million troy ounces of silver was deposited, so it's obvious that the remaining short position in SLV is of the 'plain vanilla' type---and JPMorgan, along with any other authorized participant, are no longer short the metal in SLV---and 'value investors' have been depositing the metal and taking shares in lieu of the physical, which is a rather strange way to do things. GLD went the other way, as the short position increased from 1,339,090 troy ounces up to 1,551,990 troy ounces, an increase of 212,900 ounces, or 15.90%. This sounds like a lot, but in the grand scheme of things it really isn't---and all of it would of the 'plain vanilla' variety as well. In some respects I'm surprised it was as low as that considering the price action in gold during the reporting period. The folks over at Switzerland's Zürcher Kantonalbank updated their website with the current data from both their gold and silver ETFs for the week ending on Sept 19. Once again both ETFs declined during the reporting week, as their gold ETF sold off 31,200 troy ounces---and their silver ETF was lower by 132,814 troy ounces. There was another sales report from the U.S. Mint yesterday. They sold 2,500 troy ounces of gold eagles---500 one-ounce 24K gold buffaloes---and 35,000 silver eagles. There was no gold deposited over at the Comex-approved depositories on Tuesday, but 35,497 troy ounces were shipped out. Virtually all of it came out of Canada's Scotiabank---and the link to that activity is here. And, for a change, there was virtually no action in silver, as nothing was reported received---and a tiny 17,443 troy ounces were shipped out. I have the usual number of stories for a mid-week column---and here's hoping that you'll find the odd one that interests you. ¤ Critical ReadsNYSE Margin Debt Is Drifting Higher AgainThe New York Stock Exchange publishes end-of-month data for margin debt on the NYXdata website, where we can also find historical data back to 1959. Let's examine the numbers and study the relationship between margin debt and the market, using the S&P 500 as the surrogate for the latter. Unfortunately, the NYSE margin debt data is about a month old when it is published. Following its February peak, real margin declined sharply for two months, -3.9% in March -3.2% in April and was flat in May. It then jumped 5.7% in June, its largest gain in 17 months. June saw a 0.9% decline, but the August number has drifted higher, up 0.6%, and is now only is 1.9% below the February peak. This article, with three excellent charts, appeared on the businessinsider.com Internet site at 3:37 p.m. EDT on Wednesday afternoon---and today's first story is courtesy of reader U.D. Hussman: The U.S. Economy Is Becoming a Ponzi SchemeThe United States has evolved into a nation with a Ponzi economy, in which the continuous expansion of debt is the only thing that keeps prosperity alive, according to Federal Reserve critic John Hussman. In his weekly commentary, Hussman, founder of the eponymous Hussman Funds family of mutual funds, said the U.S. economy appears fine on the surface, but that capital accumulation and labor force participation have buckled below – with dire prospects for the American future. "Over time, growth in the standard of living is chained to and limited by growth in productivity," he wrote. "When the most persistent, most aggressive and most sizable actions of policymakers are those that discourage saving, promote debt-financed consumption and encourage the diversion of scarce savings to yield-seeking financial speculation rather than productive investment, the backbone that supports a rising standard of living is broken." This excellent article showed up on the moneynews.com Internet site at 7:01 a.m. EDT yesterday---and I thank West Virginia reader Elliot Simon for sharing it with us. Kyle Bass on CNBCThis 1:07 minute CNBC video clip with Kyle has obviously been heavily edited, but it's certainly worth your time---and I thank reader Ken Hurt for sending it our way. David Stockman: The Fed's Credit Channel is Broken and Its Bathtub Economics Has FailedAmong the many evils of monetary central planning is the conceit that 12 members of the FOMC can tweak the performance of a $17 trillion economy on virtually a month to month basis—using the crude tools of interest rate pegging and word cloud emissions (i.e. “verbal guidance”). Read the FOMC meeting minutes or the actual transcripts (with a five-year release lag) and they sound like an economic weather report. Unlike the TV weathermen, however, our monetary politburo actually endeavors to control the economic climate for the period immediately ahead. Accordingly, the Fed is preoccupied with utterly transient and frequently revised-away monthly release data on retail sales, housing starts, auto production, business investment, employment, inflation and the like. But its always about the latest ticks in the data—never about the larger patterns and the deeper longer-term trends. And of course that’s the essence of the Keynesian affliction. The denizens of the Eccles Building—-overwhelmingly academics and policy apparatchiks—-rarely venture into the blooming, buzzing messiness of the real economic world. They simplistically believe, therefore, that the US economy is just a giant bathtub that must the filled to the brim with “aggregate demand” and all will be well. This longish essay by David appeared on this Internet site yesterday sometime---and I thank Roy Stephens for his first offering of the day. Joesph Stiglitz — "The U.S. will always pay its debt. Because it just prints the dollars.""Let me assure you the U.S. will always pay its debt. How do I know that? If you borrow money from the United States you get a piece of paper, a bond. And what does the paper say? We promise to pay, say a thousand dollars. How do I know the United States could always pay that? Because they just print those dollars. You know, you can imagine a temporary shortage of electricity and the printing press didn't work but apart from that it is inconceivable that we would not... we promise to pay you these little pieces of paper, you were foolish enough to accept that promise, and we will deliver those pieces of paper. But Greece can't deliver those pieces of paper. When it borrowed in drachma it could deliver those pieces of paper called drachma. But now it promises to pay in euros and it doesn't control the printing of the euros. That's done from Frankfurt. And so they can't get access to those euros. So in essence the euro created the potential for sovereign debt crises in Europe. A problem that had not been there before." - Joseph Stiglitz, The Future of Europe, UBS International Center of Economics in Society, University of Zurich, Basel, January 27, 2014 The arrogance of this little twerp is evident in the contempt he holds the audience as he says these words---and the link to that video, along with a few other choice quotes of his, were posted at the mikenormaneconomics.blogspot.de Internet site on Tuesday---and my thanks go out to Michael Cheverton for bringing it to our attention. It's worth your time. Don't Be a Freedom Wimp: Live from the Casey Research Summit in San AntonioOn Day Two of the Casey Research Summit in San Antonio, the emphasis was decidedly on the “deep state,” as Doug Casey termed it: what it is, what it’s doing, and how to thrive despite its ubiquitous reach. The deep state begins with government, an institution Doug describes as intrinsically evil and destructive. That’s because it’s empowered by enforced coercion—one of only two ways in which humans interact with one another (the alternative being voluntary co-operation). But the deep state is more. It’s not only the massive, prying, regulating apparatus of the federal government, but also the corporate structure that depends on government largess, and the lapdogs in the media and academic community that serve to perpetuate its message. All of these elements are held together with money and propaganda, and they combine to deny the vast majority of citizens true freedom. Doug described America’s “top dogs”—a few thousand elites who all know each other. They went to the same schools, belong to the same clubs, socialize amongst themselves, and scratch each other’s backs. No conspiracy needed. They all know exactly what to do to maintain their position without being told. It’s a closed party, and as Doug said, “We ain’t invited.” This short commentary on Doug's speech was written by Doug Hornig---and was posted on the Casey Research website yesterday---and is worth reading. Barclays Fined Twice in One Day for Compliance FailuresBarclays Plc was fined twice in one day for client account failures in the U.K. and the U.S., hurting the bank’s effort to rehabilitate a tarnished image. It agreed to pay a total of $77 million in penalties. The bank will pay $15 million to the Securities and Exchange Commission to settle claims that its U.S. wealth-management business failed to maintain an adequate internal compliance system and made trades and charged commissions without client approval. In the U.K., Barclays agreed to pay 38 million pounds ($62 million) to Britain’s market regulator for failing to properly protect 16.5 billion pounds of client assets between 2007 and 2012. Flaws in account naming or data suggested assets belonged to Barclays instead of its clients, which could have caused customers to lose money if the bank became insolvent, the Financial Conduct Authority said. Once a crook---always a crook! This Bloomberg news item appeared on their website at 5 p.m. Denver time on Tuesday afternoon---and it's the second contribution of the day from Elliot Simon. French business leaders target minimum wage, public holidaysFrance’s famously generous employment rights could be a thing of the past if radical new proposals unveiled by business leaders are adopted, though fierce opposition from politicians and trade unions are likely to prevent that from happening. Employers’ association Medef announced its proposals, which it said will help create one million new jobs over five years, in a 100-page document on Wednesday, though details had already been leaked to the press earlier this month. They include plans to reduce the number of public holidays, relax minimum wage laws and alter France’s historic 35-hour working week law to allow employees at certain companies to work longer hours without receiving overtime payments. These drastic changes are needed if France is to revive its flagging economy and tackle its pressing unemployment problem, the report says – the latest figures put the number of jobless in France at a record high of almost 3.5 million as of July, an 0.8 percent increase on the month before and the ninth consecutive monthly rise. This article appeared on the france24.com Internet site yesterday yesterday---and I thank South African reader B.V. for finding it for us. Germany's Ukip threatens to paralyse eurozone rescue effortsThe stunning rise of Germany’s anti-euro party threatens to paralyse efforts to hold the eurozone together and may undermine any quantitative easing by the European Central Bank, Standard & Poor’s has warned. Alternative für Deutschland (AfD) has swept through Germany like a tornado, winning 12.6pc of the vote in Brandenburg and 10.6pc in Thuringia a week ago. The party has broken into three regional assemblies, after gaining its first platform in Strasbourg with seven euro-MPs. The rating agency said AfD’s sudden surge has become a credit headache for the whole eurozone, forcing Chancellor Angela Merkel to take a tougher line in European politics and risking an entirely new phase of the crisis. “Until recently, no openly Eurosceptic party in Germany has been able to galvanise opponents of European 'bail-outs’. But this comfortable position now appears to have come to an end,” it said. This Ambrose Evans-Pritchard story showed up on the telegraph.co.uk Internet site at 9:50 p.m. BST on their Tuesday evening---and the first reader through the door with this story yesterday was Roy Stephens. |

| Posted: 24 Sep 2014 11:11 PM PDT 1. Gerald Celente: "Increased Worldwide Danger to Rock Gold Market" 2. David P: "Despite Drop, Gold Coiled to Break $2,000 and Silver Above $70" 3. Jeffrey Saut: "Quote of the Week---and a Chart That Will Stun Global Readers" [Please direct any questions or comments about what is said in these interviews by either Eric King or his guests to them, and not to me. Thank you. - Ed] |

| Gold price seen near tipping point for mine cuts, closures Posted: 24 Sep 2014 11:11 PM PDT The price of gold, down more than a third in three years, is approaching the tipping point where the mining industry would see a spike in the number of producers reducing output or even shutting down operations. Several mines globally have already suspended output in the past 18 months, but not as many as industry watchers expected as producers focused on slashing costs and reworking mine plans to extract more profitable, higher-grade ounces. But with bullion's slide this week to a nine-month low of $1,208.36 an ounce, those defenses may not be enough. "$1,200 is a critical level. The industry has geared itself around $1,200," said Joseph Foster, portfolio manager at institutional investor Van Eck Global. "If it falls below that level, then there are a lot of mines around the world that are really going to struggle." This Reuters article, filed from Vancouver, showed up on their website at 1:07 a.m. EDT this morning---and I thank reader Harry Grant for sliding it into my in-box just before midnight MDT last night. |

| Royal Canadian Mint Introduces One Gram Size Gold Maple Leaf Bullion Coins Posted: 24 Sep 2014 11:11 PM PDT The Royal Canadian Mint’s Gold Maple Leaf bullion coin is now available in a new one gram size. The coins are packaged into sets of 25 and referred to as the “Maplegram 25″ product. “The Royal Canadian Mint always strives to innovate and diversify its products to offer customers new ways to own high-quality precious metals which set new standards for the global bullion industry,” said Marc Brûlé, Interim President and CEO of the Royal Canadian Mint. “The Mint’s new Maplegram25 product gives investors a novel way to purchase Gold Maple Leaf bullion coins in a highly liquid format that preserves and celebrates all the trademark qualities of the Maple Leaf brand.” Because of their tiny size, I'm sure the premium over spot will be quite hefty. This is no way to buy gold bullion for investment purposes, so stay miles away from this product unless you just have to own one for its novelty value. This story appeared on the mintnewsblog.com Internet site yesterday sometime---and it's the final offering of the day from Elliot Simon. |

| Rickards tells Anglo Far-East the methods, objectives, and perps of gold market rigging Posted: 24 Sep 2014 11:11 PM PDT *Cease fire in Ukraine holding, Putin is getting what he wants John Ward interviews Jim in this audio podcast done on September 17 that was posted on the physicalgoldfund.com Internet site yesterday---and it's courtesy of Harold Jacobsen. It runs for just under 45 minutes, so it may be a good idea to pop the top off a cold one before you dig in. I borrowed the headline from the GATA release on this interview---and Chris Powell's introduction is worth the read as well. The link to that is here. |

| Australian economy faces major challenge from iron ore slump Posted: 24 Sep 2014 10:58 PM PDT Il-timed investment in new capacity at the top of the market cycle and crumbling Chinese demand have left the huge Australian iron ore industry in a right pickle. ArabianMoney predicted as much back in April on our visit down under, but we also saw this as eventually opening up investment opportunities for bargain hunters as the Australian dollar and local asset prices fall. Mike Harrowell, Director, Resources Research at BBY, discusses the impact of falling iron ore prices on major miners like BHP Billiton… |

| The “Five M’s” For Picking Gold Stocks Posted: 24 Sep 2014 10:45 PM PDT Goldseek |

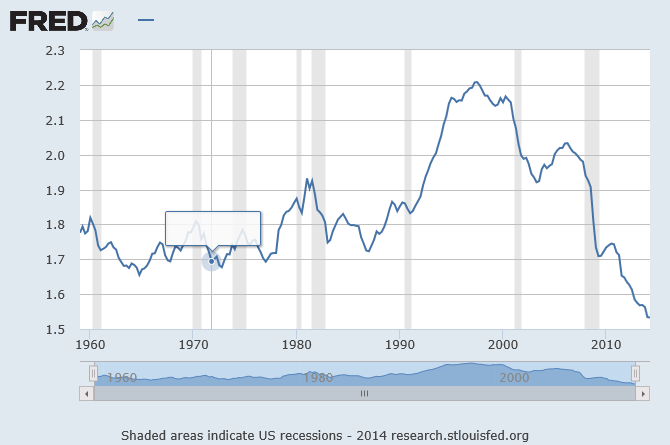

| GLD gold holdings hit new Yearly Low Posted: 24 Sep 2014 10:15 PM PDT Western-based gold investment demand continues to plummet as gold is being sold in order to buy equities. It is a continuation of the theme that has been in place for the majority of 2014. The surging stock market, coupled with a strong Dollar, is undercutting interest in the zero-interest paying asset. Add to this recipe falling inflation expectations, and it is looking more and more likely that, barring some sort of unforeseen geopolitical event, gold is not going to be able to stay above the $1200 level. Take a look at the following two charts which I post very regularly here. The first is the reported holdings of the giant gold ETF, GLD. Holdings are now at 773.45 tons, the lowest reading of the year thus far and down some 24.77 tons from the starting point at the beginning of this year. One must go all the way back to December 2008 to find that amount of gold in the ETF! That is nearly six years ago. My oh my, how the mighty have fallen! Here is the TIPS Spread chart and the price of gold overlaid upon it. Notice the near perfect relationship between the TIPS spread line and the price of gold. As inflation expectations in the market fall, so too is the price of the yellow metal There is nothing in either of these charts that would suggest some sort of coordinated assault on the gold price as some still want to argue. The simple facts are that for now, the fundamentals favoring a higher gold price are not present. That could change at some point as all markets are indeed subject to shifts in sentiment, but to argue that gold would be multiples higher were it not for some sort of constant price manipulation scheme by the powers that be, is a colossal waste of time, energy and intellect. Here is the most current Velocity of Money ( note I am using the M2 money measure ) through the end of the first quarter of this year. As long as this line continues to move lower, inflation pressures are going to be rather elusive. I maintain that the jobs situation in this nation, especially wages, is going to have to change for this line to turn higher. |

| New BOMBSHELL Development in PM Manipulation Story Posted: 24 Sep 2014 08:51 PM PDT In September 2013, just 24 hours after Andrew Maguire went public with revelations of two actual JP Morgan whistle-blowers in the silver manipulation case, the CFTC quickly and summarily closed what had been an ongoing, 5-year silver market investigation. In a curious development, just two days later the chief investigative officer of the CFTC, David […] The post New BOMBSHELL Development in PM Manipulation Story appeared first on Silver Doctors. |

| Does gold always gain during crises? Posted: 24 Sep 2014 08:00 PM PDT SunshineProfits |

| Protected: COT Analysis & More Posted: 24 Sep 2014 07:02 PM PDT The post Protected: COT Analysis & More appeared first on The Daily Gold. |

| Bumps, Dips, Bubbles, and Storms - Part 2 Posted: 24 Sep 2014 06:22 PM PDT Bumps, Dips, Bubbles, and Storms - Part 2

The Return To Gold Throughout the 1920s most of the world returned to gold because the Classical Gold Standard had worked so marvelously well before WWI. It was the greatest period of international trade and stability the world had ever seen and the world longed for the good old days. But the standard they chose wasn't the classical gold standard of the prewar period. It was a pseudo gold standard called the Gold-Exchange Standard. "The classical gold standard of the prewar period functioned reasonably smoothly and without a major convertibility crisis for more than thirty years." - "…the prewar gold standards was a hegemonic system, with Great Britain the unquestioned center. In contrast, in the interwar period the relative decline of Britain, the inexperience and insularity of the new potential hegemon (the United States), and ineffective cooperation among central banks left no one able to take responsibility for the system as a whole." Ben S. Bernanke |

| Computer Models Predict Ebola Pandemic Could Kill Millions “In the Next 6 Months” Posted: 24 Sep 2014 04:30 PM PDT We could potentially be on the verge of the greatest health crisis that any of us have ever seen. The number of Ebola cases in Africa has approximately doubled over the past three weeks, and scientific computer models tell us that this Ebola pandemic could ultimately end up killing millions of us – especially if […] The post Computer Models Predict Ebola Pandemic Could Kill Millions “In the Next 6 Months” appeared first on Silver Doctors. |

| Jim Willie: The Crash Heard Round the World- Saudis to Reject USD for Oil Payments Posted: 24 Sep 2014 03:00 PM PDT Putin kicked out the Rothschild bankers from his country. Putin interrupted the USGovt heroin trade supply routes out of Afghanistan. Like Abraham Lincoln 150 years ago, the elite banker chambers wish to remove Putin and to suppress Russia, but the sprawling nation has joined at the hip with China. Thus Russia cannot be isolated any more […] The post Jim Willie: The Crash Heard Round the World- Saudis to Reject USD for Oil Payments appeared first on Silver Doctors. |

| Is This A Triple Bottom In Gold? Posted: 24 Sep 2014 02:58 PM PDT This is an excerpt from the daily StockCharts.com newsletter to premium subscribers, which offers daily a detailed market analysis (recommended service). It shows the ongoing inter-market effect of a rising dollar, which proves to be weighing on precious metals prices so far. Gold has been performing badly for some time, but especially since August 21st when our Trend Model changed from a BUY to a SELL. The chart is completely negative with price below the 20EMA, which is below the 50EMA, which is below the 200EMA. Recent support at 1240 failed quickly, but more important support at 1180 may soon be in play. The weekly chart, however, is ever so much more revealing. We can see that the 1180 support has held twice before, so there is a good chance that it will hold upon another retest. I don’t wish to be overly optimistic because the triangle that has formed over the last year is technically a continuation pattern, meaning it is expected to resolve downward. Also note that during the consolidation, price has made progressively lower highs, showing that the bulls are losing strength. Nevertheless, a triple bottom which forms the base for a new, longer-term up leg is a distinct possibility. As for how to exploit that possibility, we would suggest that it would be best to await a clear bounce off the support area.

A major cause of gold’s weakness is the strength of the dollar, but the weekly chart of the dollar ETF (UUP) shows that the dollar has been in a long-term trading range and is currently approaching the top of that range. So the recent strength of the dollar may be about to come to an end, with price reversing and heading to the bottom of the range. That would be very positive for gold.

Conclusion: We do not intend these observations to imply a recommendation to buy gold, but as chartists we wait and watch for promising setups. In this case we can see something developing that may prove to be relief for long-suffering gold bulls. Those with interest in the yellow metal should watch it closely over the next few weeks.

|

| Posted: 24 Sep 2014 02:56 PM PDT |

| Is Gold Correcting Or In A Downtrend? Posted: 24 Sep 2014 02:50 PM PDT Submitted by GoldBroker.com: Is gold in a a correction, or is it taking a breather within a move that will retrace the whole move since 2009? What does sentiment tell us? The gold market is a very opaque one and very hard to analyse. The amount of gold exchanging hands outside the markets is enormous. China seems to continue buying in a very discrete way and shows regularly, through speaches but also actions, that it considers gold at the core of its currency war, mainly with the United States. It's interesting to notice that, recently, on every attack on the gold price to push it down, once the original move stops, almost every time momentum fails to take gold lower. This pattern doesn't look to me as a correction into a bear market but more as a bottoming formation. Check GoldBroker’s website for accompanying charts. If we also look at the sentiment in the gold mining stocks we can observe that the price of gold mining stocks measured in hard money (gold) has hit a 71-year low. Today, you can't even mention gold stocks to portfolio managers or investors, even less tell them to buy. The only thing missing is those ready to predict that gold is valueless and its price will go to zero, as some predicted when gold hit $250 in the '90s. A recent Reuters article was even indicating a possible end to India’s historical love affair with gold. If we also look at the gold sentiment composite index as calculated by Nick Laird, we can also see it has hit the low reached in 2009, and is bottoming out. The index is compiled from datasets of precious metals, gold indices, gold stocks and gold mutual funds and these datasets have been collated from four primary gold producing regions: America, Australia, Canada and South Africa. Gold’s price acceleration hit a low close to the 35-year low recently and reversed, even moving in positive territory. This comparison with the '70s is important for me because I strongly believe we will have an international monetary reset and gold will be part of the new system. With tensions rising in the world and the beginning of a new Cold War, I suspect this triangle pattern is more of a bottoming formation than just a correction within a bear market. The new Cold War is pushing the world more and more, if not into a military World war at least into a trade war. We are already into a currency and gold war. We already see it with the trade and travel restrictions imposed on Russia and the counter actions taken. I expect the sanctions against Russia to fail just as the US sanctions against Cuba have failed, but they will have a major impact on the world economy. In a recent article in the London Financial Times, John Dizard mentioned that gold's "popularity as a medium of exchange for international transactions has been soaring, particularly in the past few months, as the impact of US government sanctions on non-compliant banks has become severe." And that is despite gold being "the most expensive and least convenient of all of the monetary alternatives to the dollar." I am surprised this article has not attracted more attention, as I think it deserves. Smart money worldwide is already taking action, just as sovereigns like Russia and China are, by slowly, but also very discreetly, accumulating gold. All this makes me believe we are not in a corrective triangle within a bear market but rather in a bottoming formation. Gold sentiment is not just negative, it is extremely negative, while all the bears in US stocks and the dollar have capitulated. However the breakout from this triangle formation has to be watched very closely. Any move below US$1,200 and, more specifically, $1,180, to which I give a low probability, would require a new look. I have to caution you that a false breakout from a triangle formation to the downside is still possible, as it happened in 2012 (see chart #1) at the top, followed by a reversal. In manipulated markets, traditional instruments, either technical or fundamental, have to be looked at with caution and gold is, in my view, one of the most manipulated. |

| Silver Eagles & the SLV: The Chart Every Silver Investor Should See Posted: 24 Sep 2014 02:30 PM PDT There is a chart that every silver investor needs to see. Especially now, as the Fed and Central Banks continue to manipulate the precious metals lower while propping up the broader stock and bond markets. Even though precious metals sentiment is at record lows, this normally represents a turning point in the gold and silver […] The post Silver Eagles & the SLV: The Chart Every Silver Investor Should See appeared first on Silver Doctors. |

| 5 U.S. Banks Each Have More Than 40 Trillion Dollars In Exposure To Derivatives Posted: 24 Sep 2014 01:58 PM PDT

If derivatives trading is so risky, then why do our big banks do it? The answer to that question comes down to just one thing. Greed. The "too big to fail" banks run up enormous profits from their derivatives trading. According to the New York Times, U.S. banks "have nearly $280 trillion of derivatives on their books" even though the financial crisis of 2008 demonstrated how dangerous they could be...

The big banks have sophisticated computer models which are supposed to keep the system stable and help them manage these risks. But all computer models are based on assumptions. And all of those assumptions were originally made by flesh and blood people. When a "black swan event" comes along such as a war, a major pandemic, an apocalyptic natural disaster or a collapse of a very large financial institution, these models can often break down very rapidly. For example, the following is a brief excerpt from a Forbes article that describes what happened to the derivatives market when Lehman Brothers collapsed back in 2008...

After the last financial crisis, we were promised that this would be fixed. But instead the problem has become much larger. When the housing bubble burst back in 2007, the total notional value of derivatives contracts around the world had risen to about 500 trillion dollars. According to the Bank for International Settlements, today the total notional value of derivatives contracts around the world has ballooned to a staggering 710 trillion dollars ($710,000,000,000,000). And of course the heart of this derivatives bubble can be found on Wall Street. What I am about to share with you is very troubling information. I have shared similar numbers in the past, but for this article I went and got the very latest numbers from the OCC's most recent quarterly report. As I mentioned above, there are now five "too big to fail" banks that each have more than 40 trillion dollars in exposure to derivatives... JPMorgan Chase Total Assets: $2,476,986,000,000 (about 2.5 trillion dollars) Total Exposure To Derivatives: $67,951,190,000,000 (more than 67 trillion dollars) Citibank Total Assets: $1,894,736,000,000 (almost 1.9 trillion dollars) Total Exposure To Derivatives: $59,944,502,000,000 (nearly 60 trillion dollars) Goldman Sachs Total Assets: $915,705,000,000 (less than a trillion dollars) Total Exposure To Derivatives: $54,564,516,000,000 (more than 54 trillion dollars) Bank Of America Total Assets: $2,152,533,000,000 (a bit more than 2.1 trillion dollars) Total Exposure To Derivatives: $54,457,605,000,000 (more than 54 trillion dollars) Morgan Stanley Total Assets: $831,381,000,000 (less than a trillion dollars) Total Exposure To Derivatives: $44,946,153,000,000 (more than 44 trillion dollars) And it isn't just U.S. banks that are engaged in this type of behavior. As Zero Hedge recently detailed, German banking giant Deutsche Bank has more exposure to derivatives than any of the American banks listed above...

For those looking forward to the day when these mammoth banks will collapse, you need to keep in mind that when they do go down the entire system is going to utterly fall apart. At this point our economic system is so completely dependent on these banks that there is no way that it can function without them. It is like a patient with an extremely advanced case of cancer. Doctors can try to kill the cancer, but it is almost inevitable that the patient will die in the process. The same thing could be said about our relationship with the "too big to fail" banks. If they fail, so do the rest of us. We were told that something would be done about the "too big to fail" problem after the last crisis, but it never happened. In fact, as I have written about previously, the "too big to fail" banks have collectively gotten 37 percent larger since the last recession. At this point, the five largest banks in the country account for 42 percent of all loans in the United States, and the six largest banks control 67 percent of all banking assets. If those banks were to disappear tomorrow, we would not have much of an economy left. But as you have just read about in this article, they are being more reckless than ever before. We are steamrolling toward the greatest financial disaster in world history, and nobody is doing much of anything to stop it. Things could have turned out very differently, but now we will reap the consequences for the very foolish decisions that we have made. |

| Precious Metals Video Market Update Posted: 24 Sep 2014 01:35 PM PDT We discuss short-term thoughts on Gold, Silver and the mining stocks. One additional note, Hulbert’s Gold Sentiment Indicator reached its second lowest level in 30 years.

The post Precious Metals Video Market Update appeared first on The Daily Gold. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment