Gold World News Flash |

- New York Sun: Audit the New York Fed

- The DEATH of the Derivatives Monster & Its Impact on the Precious Metals

- Putin adviser suggests Russia knows all about West's gold price suppression

- "Hope Is Not Good Policy" - Saxo Bank Warns The Entire World Is Headed For A Minsky Moment

- Weekend Update September 26

- Syria, Neo-Cons, And The Attempted Infiltration Of The Liberty Movement

- Michael Pento Warns Global Markets Set To Collapse

- Russia War Against Global Economic "Parasite" & U.S. Dollar Monopoly!

- Central banks don't need Barrick much if they secretly spend and repurchase their gold

- Conspiracy fact: The European Central Bank Gold Agreement is renewed

- Gold And Silver - PetroDollar On Its Deathbed? PMs About To Rally? No

- Maguire tells KWN he expects a derivatives blowup in gold, silver by year-end

- Gold Investors Weekly Review – September 26th

- Truthseeking: How The Elites Are Running The World, The Dollar And Metals

- The Financial Crisis is mainly an Energy problem

- Gold Not A Safe Haven On Terrorism, Middle East Bombing, Russia ... Yet

- Valuing Gold and Turkey Farming

- Gold $1200 Underpinned by Physical Demand

- Selling the Family Silver

- Inflate or Die! When Leverage Fails and Market Hope Turns to Fear

- Market Forecasts for Stocks, Gold, Silver, Commodities, Financials and Currencies

- Gold and Silver Bear Phase III Dead Ahead

| New York Sun: Audit the New York Fed Posted: 27 Sep 2014 08:31 PM PDT 11:30p ET Saturday, September 27, 2014 Dear Friend of GATA and Gold: With Massachusetts' freshman liberal Democratic senator, Elizabeth Warren, calling for hearings on the Federal Reserve's subservience to big investment banks, the New York Sun muses that Kentucky's libertarian-leading freshman Republican senator, Rand Paul, could join her in a coalition to pass legislation to audit the central bank, and particularly its New York office. The Sun's editorial is headlined "Audit the New York Fed" and it's posted here: http://www.nysun.com/editorials/audit-the-new-york-fed/88856/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| The DEATH of the Derivatives Monster & Its Impact on the Precious Metals Posted: 27 Sep 2014 07:45 PM PDT from SRS Rocco Report:

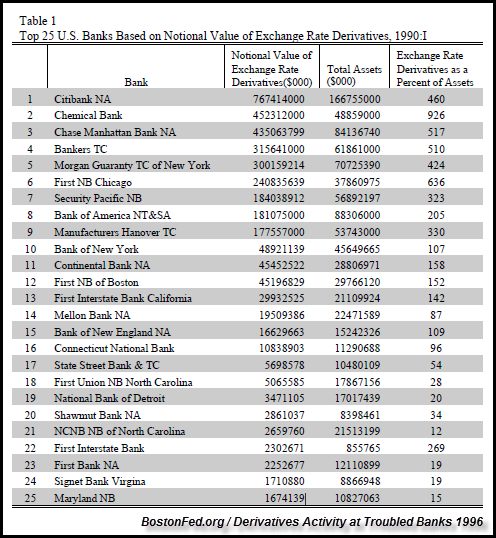

I would imagine very few people could state the total value of derivatives in the U.S. Banking Industry in 1990. Actually, I had no idea until I did the research. Of course, I knew it was much lower than hundreds of trillions in Dollars held by the banks today. If we look at the table below, we can see the total notional value of derivatives in the top 25 U.S. Banks. This data came from a paper by the BostonFed.org in 1996 titled Derivatives Activity At Troubled Banks:

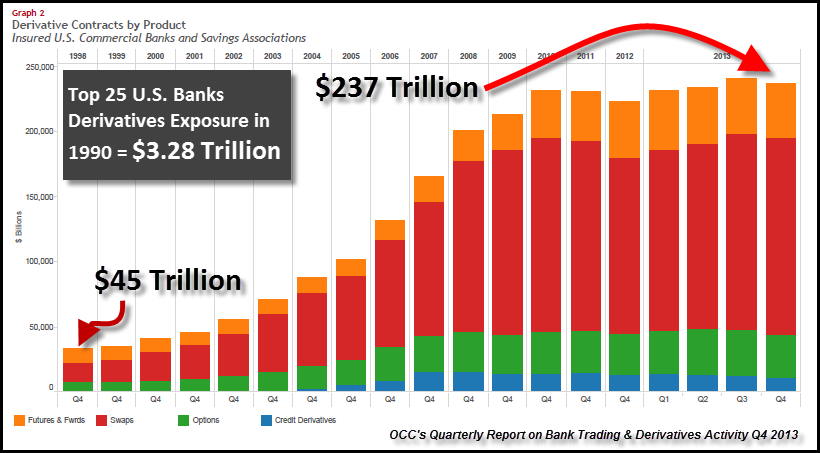

Adding up these 25 U.S. Banks derivatives holdings, we arrive at a paltry $3.28 Trillion in 1990. The bank with the largest derivatives holdings during the first quarter of 1990 was Citibank with $767 billion. Amazing aye? The number one bank in 1990 didn’t even hold a $trillion of derivatives. Let’s compare this table to the Office of the Comptroller of the Currency Q4 2013 Report on U.S. Bank Trading and Derivatives Activity: So, from 1990 total derivatives at the top 25 banks increased from $3.28 trillion to $45 trillion in 1998. As we can see, total derivatives picked up significantly to reach a total $237 million by the end of 2013. The majority of these derivatives (in red) are interest rate swaps. Thus, the U.S. Banking industry utilized the Interest Rate Swap Market to destroy the REAL MARKET RATE OF INTEREST. By the banks artificially controlling the market rate of interest, they also manipulate the REAL VALUE of goods, services, commodities and yes… the precious metals. Let’s go back to 1980, when derivatives had a negligible impact on the market. In 1980, the price of gold and silver hit new highs. In January of 1980, silver hit a high of $49 and gold reached $873, while the Dow Jones Average topped 893. The chart below shows the Dow-Gold Ratio from this same time period. You will notice that in Jan 1980, the Dow-Gold Ratio was nearly 1/1. The price of gold hit $873 and the Dow Jones was 893. |

| Putin adviser suggests Russia knows all about West's gold price suppression Posted: 27 Sep 2014 07:38 PM PDT Note particularly the reference to standards for the issuers of reserve currencies. * * * The Threat of War and the Russian Response By Sergey Glazyev http://eng.globalaffairs.ru/number/The-Threat-of-War-and-the-Russian-Res... U.S. actions in Ukraine should be classified not only as hostile with regard to Russia, but also as targeting global destabilization. The U.S. is essentially provoking an international conflict to salvage its geopolitical, financial, and economic authority. The response must be systemic and comprehensive, aimed at exposing and ending U.S. political domination, and, most importantly, at undermining U.S. military-political power based on the printing of dollars as a global currency. The world needs a coalition of sound forces advocating stability -- in essence, a global anti-war coalition with a positive plan for rearranging the international financial and economic architecture on the principles of mutual benefit, fairness, and respect for national sovereignty. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Curbing the Arbitrariness of Reserve Currency Issuers This coalition could be comprised of large independent states (BRICS); the developing world (most of Asia, Africa, and Latin America), which has been discriminated against in the current global financial and economic system; CIS countries interested in balanced development without conflicts; and those European nations not prepared to obey the disparaging U.S. diktat. The coalition should take measures to eliminate the fundamental causes of the global crisis, including: -- the uncontrolled issuance of global reserve currencies, which allows issuers to abuse their dominant position, thus increasing disproportions and destructive tendencies in the global financial and economic system; -- the inability of existing mechanisms regulating banking and financial institutions to ward off excessive risks and financial bubbles; -- an exhausted potential for growth within the prevailing technology-based economic system and lack of conditions for creating a new one, including insufficient investment for the broad use of basic technological solutions. Conditions must be created to allow the national fiscal authorities to lend money for building an economy based on new technologies and carrying out economic modernization, and to encourage innovation and business activities in areas of potential growth. The issuers of reserve currencies must guarantee their stability by capping the national debt and payment and trade balance deficits. Also, they will have to use transparent mechanisms for issuing currencies and ensure free exchange for all assets trading in their countries. [EMPHASIS ADDED.] Another important requirement issuers of global reserve currencies should meet is compliance with fair rules of competition and non-discriminatory access to financial markets. Other countries observing similar restrictions should be able to use their national currencies as an instrument of foreign trade and currency and financial exchanges, and allow their use as reserve currencies by partner countries. It would be advisable to group national currencies seeking the status of global or regional reserves into several categories depending on the issuers' compliance with certain standards. In addition to introducing rules for issuers of global reserve currencies, measures should be taken to strengthen control over capital flows to prevent speculative attacks that destabilize international and national currency and financial systems. Members of the coalition will need to forbid transactions with offshore jurisdictions and make refinancing inaccessible to banks and corporations created with offshore residents. The currencies of countries that fail to follow these rules should not be used in international settlements. A major overhaul of international financial institutions is necessary to ensure control over the issuers of global reserve currencies. Participating countries must be represented fairly, on objective criteria, such as their share in global production, trade, and finances; their natural resources; and population. The same criteria should be applied to an emerging basket of currencies for new SDRs (Special Drawing Rights) that can be used as a yardstick for determining the value of national currencies, including reserve currencies. Initially, the basket could contain the currencies of those coalition members that agree to observe these rules. Such ambitious reforms will require proper legal and institutional support. To this end, the coalition's decisions should be given the status of international commitments; and UN institutions, relevant international organizations, and all countries interested in reforms should be broadly involved. In order to encourage application of socially important achievements of a new technological mode globally, countries will have to devise an international strategic planning system of socio-economic development. It should provide long-term forecasts for scientific and technological development; define prospects for the global economy, regional associations and leading countries; look for ways to overcome disproportions, including development gaps between industrialized and emerging economies; and set development priorities and indicative targets for international organizations. The U.S. and other G7 countries will most likely reject the above proposals for reforming the international currency and financial system without discussion out of fear that they could undermine their monopoly, which allows them to issue world currencies uncontrollably. While reaping enormous benefits from this system, leading Western countries limit access to their own assets, technologies, and labor by imposing more and more restrictions. If the G7 refuses to "make room" in the governing agencies of international financial organizations for the anti-war coalition, the latter should master enough synergy to create alternative global regulators. The BRICS could serve as a prototype and take the following measures to maintain economic security: -- create a universal payment system for BRICS countries and issue a common payment card that would incorporate China's UnionPay, Brazil's ELO, India's RuPay, and Russian payment systems; -- build an interbank information exchange system similar to SWIFT and which is independent from the United States and the European Union; -- establish its own rating agencies. Russia as Unwilling Leader Russia will have a leading role in building a coalition against the U.S. since it is most vulnerable and will not succeed in the ongoing confrontation without such an alliance. If Russia fails to show initiative, the anti-Russian bloc currently being created by the U.S. will absorb or neutralize Russia's potential allies. The war against Russia the U.S. is inciting in Europe may benefit China, because the weakening of the U.S., the European Union, and Russia will make it easier for Beijing to achieve global leadership. Also, Brazil could give in to U.S. pressure and India may focus on solving its own domestic problems. Russia has as much experience of leadership in world politics as the U.S. It has the necessary moral and cultural authority and sufficient military-technical capabilities. But Russian public opinion needs to overcome its inferiority complex, regain a sense of historical pride for the centuries of efforts to create a civilization that brought together numerous nations and cultures and which many times saved Europe and humanity from self-extermination. It needs to bring back an understanding of the historical role the Russian world played in creating a universal culture from Kievan Rus, the spiritual heir to the Byzantine Empire, to the Russian Federation, the successor state of the Soviet Union and the Russian Empire. Eurasian integration processes should be presented as a global project to restore and develop the common space of nations from Lisbon to Vladivostok, and from St. Petersburg to Colombo, which for centuries lived and worked together. A Social-Conservative Synthesis A new world order could be based on a concept of social-conservative synthesis as an ideology that combines the values of world religions with the achievements of the welfare state and the scientific paradigm of sustainable development. This concept should be used as a positive program for building an anti-war coalition and establishing universally understandable principles for streamlining and harmonizing social, cultural, and economic relations worldwide. International relations can be harmonized only on the basis of fundamental values shared by all major cultures and civilizations. These values include non-discrimination (equality) and mutual acceptance, a concept declared by all confessions without dividing people into "us" and "them." These values can be expressed in notions of justice and responsibility, and in the legal forms of human rights and freedoms. The fundamental value of an individual and equality of all people irrespective of their religious, ethnic, class, or other background must be recognized by all confessions. This stems, at least in monotheistic religions, from the perception of the unity of God and the fact that every faith offers its own path to salvation. This outlook can eliminate violent religious and ethnic conflicts and permit every individual to make a free choice. But there must be legal mechanisms in place to enable confessions to participate in public life and resolve social conflicts. This approach will help neutralize one of the most destructive means of chaotic global warfare employed by the U.S. -- the use of religious strife to incite religious and ethnic conflicts that develop into civil and regional wars. The role of religion in molding international politics will provide the moral and ideological basis for preventing ethnic conflicts and resolving ethnic contradictions using national social policy instruments. Various religions can also be engaged in charting social policy, thus providing a moral framework for government decisions, restraining the attitude of permissiveness and laxity that dominates the minds of the ruling elites in developed countries, and bringing back an understanding of the authorities' social responsibility to society. As the shaken values of the welfare state gain strong ideological support, political parties will have to acknowledge the importance of moral restrictions that protect the basic principles of human life. The concept of social-conservative synthesis will lay the ideological groundwork for reforming international currency, financial, and economic relations on the principles of fairness, mutual respect for national sovereignty, and mutually advantageous exchanges. This will require certain restrictions on the freedom of market forces that constantly discriminate against most people and countries by limiting their access to wealth. Liberal globalization has undermined the ability of countries to influence the distribution of national income and wealth. Transnational corporations uncontrollably move resources that were previously controlled by national governments. The latter have to trim back social security in order to keep their economies attractive to investors. State social investments, the recipients of which no longer have a national identity, have lost their potency. As the U.S.-centered oligarchy gets hold of an increasingly greater part of income generated by the global economy, the quality of life is dwindling in open economies and the gap in access to public wealth is widening. In order to overcome these destructive tendencies, it will be necessary to change the entire architecture of financial and economic relations and restrict the free movement of capital. This should be done in order to prevent transnationals from evading social responsibility, on the one hand, and to even out social policy costs shared by national states, on the other. The former means eliminating offshore jurisdictions, which help evade tax obligations, and recognizing the nation states' right to regulate transborder movement of capital. The latter would mean establishing minimal social criteria to ensure accelerated improvement of social security in relatively poor countries. This can be done by creating international mechanisms for balancing out living standards, which, in turn, will require proper funding. Acting along the concept of a social-conservative synthesis, the anti-war coalition could move to reform the global social security system. A fee of 0.01 percent of currency exchange operations could provide funding for international mechanisms designed to even out living standards. This fee (of up to $15 trillion a year) could be charged under an international agreement and national tax legislation, and transferred to the authorized international organizations which include the Red Cross (prevention of and response to humanitarian catastrophes caused by natural disasters, wars, epidemics, etc.); the World Health Organization (prevention of epidemics, reduction of infantile mortality, vaccination, etc.); International Labor Organization (global monitoring of compliance with safety regulations and labor legislation, including wages not less than the subsistence level and a ban on the use of child and compulsory labor; labor migration); the World Bank (construction of social infrastructure facilities -- water supply networks, roads, waste water disposal systems, etc.); UNIDO (transfer of technologies to developing countries); and UNESCO (support of international cooperation in science, education and culture, cultural heritage protection). Spending should be made according to the budgets approved by the UN General Assembly. Another task to tackle is the creation of a global environmental protection system financed by polluters. This can be done by signing an international agreement establishing across-the-board fines for pollution and earmark them for environmental protection under national legislation and under the supervision of an authorized international organization. Part of this money should be committed to global environmental activities and monitoring. An alternative mechanism can be based on trade in pollution quotas under the Kyoto Protocol. An important aspect is the creation of a global system for eliminating illiteracy and ensuring public access to information and modern education throughout the world. This will require standardizing minimum requirements for comprehensive primary and secondary education and subsidizing underdeveloped countries with revenue generated by the tax mentioned above. There must be a universally accessible system of higher education services provided by leading universities in major industrialized countries. The latter could assign admission quotas for foreign students selected through international contests and paid for from the same source. Simultaneously, the participating universities could set up a global system of free distance learning for all individuals with secondary education. UNESCO and the World Bank could commit themselves to creating and supporting the necessary information infrastructure, while drawing funds from the same source. Anti-Crisis Harmonization of the World Order The growing gap between rich and poor countries is threatening the development and the very existence of humanity. The gap is created and sustained by national institutions in the U.S. and allied countries that arrogate certain international economic exchange functions proceeding from their own interests. They have monopolized the right to issue the world's currency and use the revenue for their own benefit, giving their banks and corporations unlimited access to loans. They have monopolized the right to establish technical standards, thus maintaining technological supremacy of their industry. They have imposed upon the world their own international trade rules that require all other countries to open up their markets and limit substantially their own ability to influence the competitiveness of their national economies. Finally, they have forced the majority of countries to open up their capital markets, thus ensuring the domination of their own financial tycoons, who keep multiplying their wealth by exercising a currency monopoly. It is impossible to ensure a sustainable and successful socio-economic development without eliminating the monopoly on international economic exchange used for private or national interests. Global and national restrictions can be imposed to support sustainable development, harmonizing global public affairs, and eliminating discrimination in international economic relations. In order to ward off a global financial catastrophe, urgent measures need to be taken to create both a new, safe, and efficient currency and a financial system based on the mutually advantageous exchange of national currencies. This new system would exclude the appropriation of global seniority in private or national interests. To level out socio-economic development opportunities, emerging economies need free access to new technologies, conditioned on their promise not to use them for military purposes. Countries that agree to such restrictions and open up information about their defense budgets will be exempted from international export control constraints and receive assistance in acquiring new developmental technologies. An international mechanism to prevent multinational companies from abusing their monopoly power on the market could ensure fair competition. The World Trade Organization could exercise anti-trust control under a special agreement binding for all member states. This would allow economic entities to demand elimination of monopoly power abuses by transnational corporations and seek compensation for losses from such abuses by imposing sanctions against the entities at fault. Apart from overstated or understated prices, quality falsifications, and other typical examples of unfair competition, the payment of wages below the ILO-defined minimum regional subsistence level should also be regarded as an abuse. In addition, there should be reasonable price regulation for the products and services of global and regional natural monopolies. Because of unequal economic exchanges, countries should be allowed to retain the right to regulate their national economies in order to equalize socio-economic development levels. In addition to WTO mechanisms protecting domestic markets from unfair foreign competition, such equalizing measures could also be achieved by encouraging scientific and technological progress and providing state support to innovation and investment activities; establishing a state monopoly on the use of natural resources; introducing currency controls to limit capital flight and prevent speculative attacks on national currencies; retaining government control over strategic industries; and using other mechanisms to boost competitiveness. Fair competition in the IT sector is essential. Access to the global information networks must be guaranteed to all people throughout the world as both information consumers and suppliers. This market can be kept open by using stringent antitrust restrictions that will not allow any one country or group of countries to become dominant. To ensure that all parties to the global economic exchange observe international and national rules, there must be penalties for violators under an international agreement that would enforce court rulings regardless of their national jurisdiction. However, one should be able to appeal a ruling in an international court whose judgment will be binding on all states. Binding rules and penalties for non-compliance (alongside penalties for breaking national laws) would give international agreements priority over national legislation. Countries that break this principle should be restricted from participating in international economic activities by excluding their national currencies from international settlements, imposing economic sanctions against residents, and limiting those operations on international markets. In order to enforce all of these fu |

| "Hope Is Not Good Policy" - Saxo Bank Warns The Entire World Is Headed For A Minsky Moment Posted: 27 Sep 2014 05:03 PM PDT Surely not this old chestnut – again? 'Interest on debt grows without rain' – Yiddish proverb This proverb explains most of what goes on in policy circles these days. We are now watching Extend-and-Pretend, Episode VI: Promises for improvement amid ever growing debt levels. In brief, we're still working with the same dog-eared script we were introduced to all of five years ago, when markets had stabilised in the wake of the financial crisis: maintain sufficiently low interest rates to service the debt burden. In other words, pretend to have a credible plan, but never address the structural problems and simply buy more time. But while we were able to get away with this theme for an awfully long time, the dynamic is now changing as the risk of low inflation (and even deflation) is a brick wall for the extend-and-pretend meme. Yes, interest does grow without rain, and the cost of maintaining and servicing debt grows especially fast in a deflationary regime. Mads Koefoed, Saxo Bank's macro economist, projects US growth at around 2.0% for all of 2014. That will be the sixth year with US growth near 2.0%, so despite lower unemployment and a record high S&P500, the economy has a hard time escaping that 2.0% level.

Any talk of higher interest rates is hard to take seriously when US growth is going nowhere and world growth is considerable weaker than was expected back in January (or as recently as July, for that matter). It seems everyone has forgotten that even the US is a part of the global economy. The fourth quarter is always the most politically interesting time of year. Countries need to get their new budgets in order. The EU, IMF and World Bank will need to pretend they agree or accept the weaker data, which has to mean bigger deficits. It's a tiresome exercise to watch denial-in-action as EU governments and other policymakers try to make something so obviously unpalatable go down easy in their internal reporting. ' It's obvious that buying more time (extending) is always the number one priority, followed by projecting (pretending) that forward looking growth will reach an ever-higher trajectory in order to make the budget fit within the supposed constraints. Or in France's case, the recent unilateral abandonment of meeting budget targets for the next two years is already a fait accompli. Who's next? Such behaviour would cost you your job in the private sector, but in the economic model of 2014, which reminds us more of the Soviet Union than a market based economy, it's par for the course. But, many would protest, it would be even worse if we hadn't done so much to "save the system", right? Well maybe, except for the fact that those economies where the belief in State Capitalism is strongest – Russia, China and France – are all at the end of the line. Time has caught up. Negative productivity, capital flight and a system built on protecting the elite is failing. France is now moving from recession to depression. China is moving quickly from denial towards a mandate for change, Russia's future has not looked this bleak since the late 1990s. Meanwhile, the US continues at a sluggish 2.0% rate of growth. Investors and pundits seem to have forgotten that we were promised 2014 would be the end of the crisis.

Instead, we are speeding towards the inflection point at which debt becomes harder to service because pretend-and-extend policy making has created a depression in investment and consumption. The public debt loads continue to inflate across Europe: Portugal's public debt has ramped up to a staggering 130% of GDP, up from about 70% in 2007. Greece's public debt load, even after the restructuring of Greek debt a few years ago, has swelled to 175% of GDP. The EU now has far more systemic risk than it did at the beginning of the crisis. With zero growth or as our economist Mads sees it, 0.6% with the arrow pointing down, debt levels continue to rise relative to GDP. And most importantly, the current flirt with deflation will make servicing the growing debt even more expensive. The nightmare for both the European Central Bank and the world is deflation, as it's a tax on debtors and a boon to net savers. The new reality is that we currently stand face-to-face with the very deflation risk that just about everyone denied could ever happen when Q1 outlooks were written. Two other global threats (or time bombs, if you will) outside of the EU are risks from the growing costs of servicing debt in China and the US. In China, the governments – national and local – have piled up considerable debt, but it is the overall debt service costs in all of China that are the real concern, which have only grown so large with the dangerous assumption by Chinese banks, companies and citizens that they can count on a public bailout. According to a Societe Generale analyst, total debt service costs (including maturing debt and roll overs) in China are at nearly 39% of GDP. Compare that with the closer to 25% of GDP for the US in 2007. In the US, interest on US government debt cost over 6% of budget outlays in 2013. This is relatively down from its worst levels when interest rates were much higher, but only because the Federal Open Market Committee has so drastically lowered the costs for the US government to issue debt with a zero interest rate policy. And now the debt load is vastly larger than it was before the financial crisis, at 80% of GDP (net debt according to IMF) versus 45% of GDP a mere 10 years ago. So are we actually to believe that the Federal Reserve can lift the entire front-end of the curve from 0-1% (current rates out to three years) to 2-4% over the next two years without adding massive further stress onto the deficit, and only adding to the debt? Servicing 2% interest when growth is 2% means you are doing worse than standing in place if you also have a budget deficit. Whatever the timing, the US, China and Europe are all headed for another Minsky moment: the point in debt inflation where the cash generated by assets is insufficient to service the debt taken on to acquire the asset. Productivity growth in the US last year was +0.36%. The real growth per capita was about 1.5%. Anything which is not productivity is consumption of capital. So, the only way to grow an economy without productivity growth is to do so temporarily through the use of debt – about 75% debt and 25% productivity growth, in this case. Since the 1970s, US productivity growth rates have fallen by 81% – the move onto the internet has ironically made us bigger consumers and less productive. Had we remained at pre-1970s productivity, the US GDP would have been 55% higher and the outstanding debt to GDP would be easily fundable. * * * Anecdotally, and by way of conclusion, I just returned from Singapore on business. Singapore, to me, used to be the most rational business model around. Its founder Lee Kuan Yew was one of the greatest statesmen in history. Now, productivity is collapsing in Singapore. They are, like us, becoming the Monaco of the world — an economy based on consumption and not on productivity and growth. The developed economies are growing old in demographic terms, but we're still not wise enough to realise that our current model is a Ponzi scheme rushing toward its inevitable Minsky moment. No serious policymaker or central banker is talking about the truth told by simple maths and hoping that things turn out well. Hope is not good policy and it belongs in church, not in the real economy.

|

| Posted: 27 Sep 2014 03:18 PM PDT By Everett Millman, head content writer at Gainesville Coins, a leading gold and silver distributor. ABSTRACT: A rising dollar had the greatest effect on the markets this week, driving most... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} |

| Syria, Neo-Cons, And The Attempted Infiltration Of The Liberty Movement Posted: 27 Sep 2014 12:21 PM PDT Submitted by Brandon Smith of Alt-Market.com, There is nothing worse than a die-hard neoconservative. Of all the socialist horrors wrought against the American public by the Obama administration and its small but impressively insane group of followers, the neoliberals are at least relatively open about their disdain for the Constitution as well as their intentions to reduce our country to a Third World communist enclave. Neoconservatives, on the other hand, have the audacity to pretend as if they adore the Bill of Rights, posing as freedom fighters and champions of liberty while working intently to administer the same exact despotic policies and socialist infrastructure. As most readers are aware, the false left/right paradigm has been the primary control mechanism used against the American people for decades. The idea being that in order for establishment elites to maintain control of a population with a heritage of independence, a facade of choice must be created to placate the dim-witted masses while the system itself is dominated from behind the scenes. The people of a republic must be conned into participating in the process of their own enslavement, at least until the oligarchs are ready to unleash full-blown totalitarianism. The concept of free elections becomes a grand theatrical display when most candidates, regardless of party affiliation, are bought, bribed, blackmailed or philosophically allied with the elite. The actions of these candidates speak far louder than their rhetoric for those with the sense to pay attention. But for many people, the attachment to the sports team mentality of politics is just too much to resist. For them, the circus is reality. The birth of neoconservatism is clouded by what some claim to be the “incidental” relationship between neocon adherents like Irving and William Kristol, Abram Shulsky, Paul Wolfowitz, John Ashcroft, Donald Rumsfeld and George W. Bush, among others, and a little-known political science professor by the name of Leo Strauss. Strauss’ work culminated in the University Of Chicago as many of his students and followers went on to engineer the rise of an insidious bureaucratic machine that gave us the Patriot Acts, the fake War on Terror, rationalized torture procedures and numerous other constitutional disgraces. Strauss was at least publicly opposed to the formation of communism; but at the same time, he held a reverence for a pre-Weimar Germany brand of authoritarian oligarchy. To fight the rise of “liberalism,” Strauss maintained that the use of “noble lies” was preferable to surrender. That is to say, the left was so devilish that an “any means necessary” approach became acceptable. This approach, interpreted by Strauss’ students, was meant to include the creation of false unity in the face of a fabricated enemy. Strauss himself argued that enemies were vital in the unification of man:

It is important to note that the “noble lie” concept was also a primary pillar in the philosophical methods of another political gatekeeper by the name of Saul Alinsky, a gatekeeper who just happened to become prominent during the same era as Strauss and who influenced the same generation, but on the left end of the spectrum, giving birth to what we now call neoliberalism. Much in the way internationalists simultaneously funded the rise of fascism in Europe and communism in Russia during the 20th Century, I do not believe it is simple coincidence that these gatekeepers would both go on to successfully galvanize two sides of American society against each other based on false premises while both of them were promoting nearly identical forms of moral relativism. Both ideologies argue in speech for either “liberal values” or “conservative values.” But the tactics they use can end only one way, regardless of which side wins out: with despotism being the ultimate result. The identical policy measures taken by the administrations of both George W. Bush and Barack Obama in terms of war, executive powers, personal privacy (FISA and NSA domestic surveillance), torture, indefinite detention (including U.S. citizens as per the NDAA), assassination (including U.S. citizens), etc., clearly illustrate that there is truly no discernible concrete difference between Republican leadership and Democratic leadership. The brilliance of the false left/right paradigm is that it mesmerizes the public with two cosmetically separate but inherently identical political movements, and it distracts Americans away from the more plausible third option: namely, personal liberty and responsibility, also known as classical liberalism, practiced by the Founding Fathers. Neoconservatism in particular is highly destructive to our constitutional heritage, because it poses as constitutionalism while seeking to erode liberty from within. The neoliberal side of the paradigm uses the stark viciousness of neocons to convince the public that socialization is a necessary measure to humanize government. The neoconservative side of the paradigm uses the foreign policy “weakness” of neoliberals to then argue for a return to greater militarization and force of law. Both methods result in a perpetually growing government and inevitable tyranny. In the near term, I believe it is possible that we are about to see the left/right game switch gears once again. The rise of ISIS and the increased threat of economic war with Russia have highlighted the old “weak liberal” talking points in conservative circles, while conveniently ignoring the fact that all our current problems were created by elites on both sides of the aisle. What I see simmering under the surface of the geopolitical cinema conjured to distract us is a burgeoning trend toward a return of the neoconservative narrative. With the sudden and apparently "inexplicable" rise of the ISIS caliphate, not to mention the debut of a new cartoon villian, Khorasan, it is only a matter of time before America is smattered with terror attacks. The anger of the general public towards the Obama Administration is already at a peak; with war at our doorstep, people may demand immediate changes. In my last article, 'When War Erupts Patriots Will Be Accused Of Aiding "The Enemy"', I warned of the underlying propaganda trend used by the establishment to falsely associate the Liberty Movement with foreign aggression. A clear tactic is being developed to hijack the Liberty Movement's identity by labeling patriot dissension as treason, and marginalizing our efforts as merely a mercenary extension of Russian and/or ISIS subversion. This is not the only dangerous method threatening liberty activism, however. Co-option of the movement by elements of the neoconservative side of the globalist coin is also ever present... While it is true that America has been made weaker with each passing year, both defensively and economically, it is important that we question what exactly our response should be. Is the solution to swing the pendulum right back to the neoconservative standards of centralized military-industrial might and trading freedom for security? Or how about a military coup to unseat Obama and put the country "back on track"? Would the removal of a middle-management puppet like Obama by a group of patriot-posers among the military brass really change anything in the long run? The coup idea is being floated everywhere the past two years, in some cases by neocon talking heads presenting themselves as liberty movement leaders. There are always the old standby neocon peddlers like John McCain and Lindsay Graham, who are both avid supporters of greater executive power, including the defense of torture, indefinite detention, and assassination of American citizens. But when such politicians use ISIS as a villainous prop to frighten the citizenry with visions of masked gunman and mushroom clouds, liberty proponents remember that ghouls like McCain were involved in the funding and training of the same extremists that now make up the core of the ISIS threat. The so-called “moderate” Free Syrian Army, a group entirely created by Western covert intelligence agencies, has been interweaving with the Islamic State (aka ISIS or ISIL) for some time. Meanwhile, neocons like Sen. John McCain (R-Ariz.) argue that FSA members are the “good guys.” Once again, I have to go back to the neoconservative ideology, which holds that unification requires the creation of enemies in order to galvanize peoples and nations around a centralized leadership. We have seen mounting evidence that ISIS is a fully fabricated monstrosity. We see fake Republicans like McCain involved from the very beginning of the process, admonishing President Obama for his participation while HELPING Obama with his mission. And now we see these same instigators coming to the American people with promises of utter terror if we do not rally around their governance. An important point to grasp here is that all political leaders are ultimately expendable in the view of the internationalists. A shift to the left, or a shift to the right, makes no difference to them, as long as they control the momentum. Obama is a puppet whose public image could easily be sacrificed in order to gain a power advantage. It is important to understand that if the Liberty Movement cannot be destroyed, the elites may attempt to insert it's own "leaders" into our midst in classic Cointelpro fashion and rally us in a misguided battle to unseat Obama and replace him with yet another globalist stooge. We do have infiltrators who, in my view, are seeking to co-opt our initiative and divert the efforts of constitutional proponents away from the true enemies of our republic (namely, internationalist financiers calling for total globalization) using the looming threat of an extremist Islamic terror campaign. One such example (one of many) is Fox News contributor Maj. Gen. Paul Vallely, who has been skulking around my neck of the woods in Montana, attempting to sell his version of the final liberty “solution” to the large community of patriots in the region. Vallely’s answer to the problem appears to be an extension of the Operation American Spring project, which he has been promoting every year for as long as I can remember and has been relabeled over and over, and which has failed every year to produce the million-man armed march on Washington, D.C., that it calls for. The strategy has now evolved into what essentially amounts to a military coup led by neoconservative brass. Vallely’s suggestions are certainly enticing to some, and his rhetoric sounds rather similar to what many in organizations like Oath Keepers believe. However, there is a distinct difference. Oath Keepers and other legitimate patriot groups do not focus only on middlemen like Obama, and any organization that claims Obama is the source of all our ills is either rife with ignorance, or is controlled opposition. By extension, a military coup led by politicized generals who may very well be controlled by the same globalist interests as Obama is not an expression of constitutional revolution. It is, in fact, a warped and twisted facsimile of revolution. The idea is alluring because many Americans want to take direct action to remove corrupt government, but they do not want to risk their lives to do it. That is to say, they would much rather the "professionals" handle their rebellion for them. Military coup takes the responsibility of constitutional revolution away from the people and places it the hands of a select few. What this means is that a military coup led by Washington-bred generals is actually advantageous to the elites because it allows them to undermine legitimate rebellion without directly confronting it at the risk of energizing it. Two birds are thus killed with one stone: The revolutionary momentum is derailed, and the establishment maintains control through military puppets who have more room to impose greater totalitarianism through overt force. But what if those generals were rock-solid constitutionalists, some might ask? We can only guess at the result, but I can say with certainty that pretenders like Vallely are NOT constitutionalists. Before Vallely settled in Montana to become a “freedom fighter” he was most famous for co-authoring a Department of Defense white paper called “From Psyop To Mind War,” published in 1980. The paper devises fourth-generation warfare methods to paralyze entire nations with complex propaganda, turning the population against itself and its own interests so that controllers do not have to expend vast military resources to defeat them conventionally. This strategy was deemed preferable, as it would reduce destruction of resources while still establishing dominance and/or destabilization. It is also a strategy that was recommended for use against the American people (not to mention the utilization of “ESP” as a weapon, but we don’t have time to get into that garbage). The Arab Spring, funded and directed by covert intelligence agencies, is a perfect example of Mind War in action. And in light of this, I find it interesting that Vallely would champion a project labeled "Operation American Spring", as if the joke on us is right out in the open. The other author of “From Psyop To Mind War” is a man by the name of Michael Aquino, who has a foggy career history beyond his status as a lieutenant colonel in the U.S. military and allegedly an employee of the NSA. What is not a mystery is Aquino’s religious orientation. The man is an open Satanist, a former member of the Church of Satan, and a current member of his own Temple of Set. (Aquino founded the Temple of Set five years before working with Vallely, meaning his darker theological leanings were well known to any of his peers). Whether or not one has a Christian orientation, one should still be compelled to question the moral intentions of a man who curls his eyebrows to look like horns, worships either the myth or the actual embodiment of the prince of darkness, and tries to present such activities as a mere expression of rationalism. One should also be compelled to question the moral and mental compass of anyone who would willingly maintain a working relationship with such a person and then suddenly fight the good fight as a "Christian patriot". I have not found a single instance in which Vallely has stood in public opposition to Aquino or denounced the methods of “From Psyop to Mind War.” And to this day, Aquino thanks Vallely for his efforts on the white paper. After retiring from the military, Vallely became a client of Benedor Associates, a neoconservative public relations firm. And he continues to ally closely with neoconservative political elites. It should come as no surprise then that just like McCain, Vallely also took a trip to Syria, on the same day as the infamous sarin gas attack — the same gas attack that was most likely perpetrated by Muslim extremist groups as a false flag against the Syrian government, and which almost led America into World War III. In response, Valley called for increased U.S. government support for the FSA insurgents, the same insurgents that are joining ISIS in droves. So why is a retired neoconservative U.S. general who wrote a psychological warfare paper with a DoD Satanist supporting extremist insurgency in the Middle East while suggesting military coup in the United States? I can only suggest that the Hegelian dialectic is in full force. The elites conjure a frightening enemy in the form of ISIS, attacks occur that distract the masses away from the internationalists, and the chaos that follows — whether it results in revolution or military coup — is then sold to the world as a natural by-product of a crumbling Western world due to the misguided zealotry of “conservatives.” After the dust settles, the men who made the collapse possible move forward with the global centralization they always wanted, using America as a horror story to teach future generations of children in Common Core-style classrooms about the barbaric attachments to national sovereignty and individualism. A fanciful conspiracy theory? Perhaps. Or perhaps it’s a very real possibility if the liberty movement and conservatives in general are suckered into the neocon fold once again. The U.S. is back in Syria, this time to commit air strikes on the same terror groups OUR GOVERNMENT created to fight Assad. ISIS elements have called for attacks on U.S. citizens in response. The Neocon sharks are in a frenzy, ready to offer false leadership once again. The only question left is, will the citizenry follow, will they stick with establishment muppet, Barack Obama, or, will they finally cast off the false left/right paradigm, and choose to lead themselves? |

| Michael Pento Warns Global Markets Set To Collapse Posted: 27 Sep 2014 10:30 AM PDT  On the heels of another wild week of trading in global markets, today Michael Pento warned that global markets are now set for total collapse. Pento takes KWN readers around the world on a trip down the rabbit hole which takes a sobering look at what is really taking place in the United States. On the heels of another wild week of trading in global markets, today Michael Pento warned that global markets are now set for total collapse. Pento takes KWN readers around the world on a trip down the rabbit hole which takes a sobering look at what is really taking place in the United States. This posting includes an audio/video/photo media file: Download Now |

| Russia War Against Global Economic "Parasite" & U.S. Dollar Monopoly! Posted: 27 Sep 2014 08:27 AM PDT Russia and China have been partnering up year over year with greater stability and friendship. This has been going on as the Western nation impose sanctions on Russia. The result has simply been a divide in between the two sides, causing volatility and uncertainty about the future. Russia has... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Central banks don't need Barrick much if they secretly spend and repurchase their gold Posted: 27 Sep 2014 08:02 AM PDT 11:28a ET Saturday, September 27, 2014 Dear Friend of GATA and Gold: Our friend D.K. writes: "Former Goldman Sachs partner John Thornton is now running Barrick Gold. I'm wondering if Thornton has given the big bullion banks direct supply contracts for enough of Barrick's gold output so that they can have it refined into bars and shipped to wherever they need it. It's the only thing that makes sense to me that would be enabling the bullion banks to deliver physical gold right now." Your secretary/treasurer has no idea whether Barrick is working any particular deals with bullion banks at the moment, but the company must have some arrangements with them, if only because the company is carrying a hedge position. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Further, during the Blanchard & Co. antitrust litigation in U.S. District Court in New Orleans in 2003, Barrick claimed to be the gold market agent not of the bullion banks but of the central banks: But here's a different possibility: That it's not Barrick but the Federal Reserve that is providing all the metal the bullion banks need for maintaining the central bank gold price suppression scheme, using the foreign official reserves held in custody by the United States and secret gold swap arrangements the Fed has with allied central banks, swaps confirmed by the Fed during GATA's freedom-of-information litigation against it in 2009: While Venezuela got most of its gold back from the Bank of England and other depositories in 2011, Germany's Bundesbank has yet to recover much of its foreign-vaulted gold, and most countries vaulting their gold in the U.S. haven't asked for anything to be returned. If all that needs to be done is to pretend that the foreign gold is still safely in the New York Fed's vault in Manhattan, its shipment elsewhere will never be a problem. The price-suppression system of the London Gold Pool collapsed in March 1968 because the metal available to it was depleting so fast that the exhaustion of the gold reserves of the participating central banks was in sight: http://en.wikipedia.org/wiki/London_Gold_Pool I suspect that only something like that will end the current round of price suppression. The central banks suppressing the gold price drained their official reserves for price suppression before, so why wouldn't they do it again? After all, if the central banks want to recover their reserves, they can always create infinite money with which to repurchase the gold and start the price suppression scheme all over again at a higher level. Indeed, the Bank for International Settlements says it trades gold and gold derivatives for its members all the time: http://www.gata.org/node/12717 The BIS even advertises its gold market intervention services to prospective central bank members: http://www.gata.org/node/11012 The French central bank also says it trades gold for its own account and for the accounts of other central banks nearly every day: http://www.gata.org/node/13373 This trading needn't be and certainly isn't all selling; a central bank couldn't be repurchasing after having knocked the price way down with huge paper sales. After all, with infinite money -- which central banks have the power to create -- one can control any market, at least until the commodity being traded runs out. There's a reason why the United States does not charge any fee to foreign governments for vaulting their gold over here, and that reason is almost certainly so the United States can control that gold -- which means using it secretly as necessary. If, as Barrick itself asserted back in 2003, it remains merely an agent of the central banks, they have accessible in their own vaults far more gold than the mining company can scratch out of the ground over many years, and if they never have to account honestly for it, as the secret March 1999 report of the International Monetary Fund says they don't -- http://www.gata.org/node/12016 -- there is no obstacle to their using it for market rigging. Nothing prevents the Federal Reserve from putting into play all the foreign official gold reserves vaulted in New York. As the old joke goes, if all the gold of a Western central bank was depleted through market rigging, the central bank would double the guard to keep up appearances. It would be more than enough to convince the Financial Times that everything was still all right. CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Conspiracy fact: The European Central Bank Gold Agreement is renewed Posted: 27 Sep 2014 07:05 AM PDT 10:11a ET Saturday, September 27, 2014 Dear Friend of GATA and Gold: Bullion Vault research director Adrian Ash notes that the fourth European Central Bank Gold Agreement takes effect today, extends for five years, and removes any limits on gold sales by the 21 signatories while acknowledging that "they do not have any plans to sell significant amounts of gold," because the limits contained in predecessor agreements had come to look silly, such sales having ended long ago. Ash's commentary is headlined "End of the Central Bank Gold Agreement" and it is posted at Bullion Vault here -- https://www.bullionvault.com/gold-news/central-bank-gold-092620143 -- but from GATA's perspective the agreement's latest incarnation, announced in May, remains significant for two other reasons. That is, the agreement, posted at the European Central Bank's Internet site here -- http://www.ecb.europa.eu/press/pr/date/2014/html/pr140519.en.html -- renews the proclamation of conspiracy that Western financial news organizations and most purported gold market analysts refuse to see. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata "The signatories," the renewed agreement says, "will continue to coordinate their gold transactions so as to avoid market disturbances." That is, first, the participating central banks will continue to meet secretly to consider manipulating the gold market, which is disguised as a matter of avoiding market disturbances -- or at least avoiding disturbances the central banks don't like. Financial journalists and market analysts will not be invited to these meetings, nor will any mere member of the public be allowed to attend -- not even CPM Group's Jeff Christian or Doug Casey of Casey Research, who purport to know everything central banks do in regard to gold. And second, the U.S. Federal Reserve and the U.S. Treasury Department continue not to be signatories to the agreement and thus do not even pretend to want to avoid disturbing the gold market. The latest European Central Bank Gold Agreement is not "conspiracy theory" but conspiracy fact, not so much hiding in plain sight as residing in the open with the participants having full confidence that financial news organizations and purported market analysts will never dare to explore what it really means, the first rule of mainstream financial journalism being that no critical questions about gold may ever be put to a central bank and that a central bank's refusal to answer critical questions about gold may never be reported. CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold And Silver - PetroDollar On Its Deathbed? PMs About To Rally? No Posted: 27 Sep 2014 06:37 AM PDT As we near the end of the 3rd Q for 2014, time is running out for all the 2014 enthusiasts that are calling for higher prices by year-end. The lessons learned from 2013 have been forgotten as not only are not prices beginning to move higher, they are making new recent lows. Incredibly enough, many of these prognosticators are paid pretty well by their subscribers. Lesson to be learned? Absolutely no one can divine the future. |

| Maguire tells KWN he expects a derivatives blowup in gold, silver by year-end Posted: 27 Sep 2014 06:16 AM PDT 9:16a ET Saturday, September 27, 2014 Dear Friend of GATA and Gold: In the second part of his new interview with King World News, London metals trader Andrew Maguire reports that the big bullion banks are unwinding their monetary metals positions on the Comex and that he expects a derivatives failure in the monetary metals by the end of the year. An excerpt from his interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/9/27_Ma... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold Investors Weekly Review – September 26th Posted: 27 Sep 2014 04:18 AM PDT In his weekly market review, Frank Holmes of the USFunds.com nicely summarizes for gold investors this week's strengths, weaknesses, opportunities and threats in the gold market. Gold closed the week at $1,218.07 up $2.37 per ounce (0.19%). Gold stocks, as measured by the NYSE Arca Gold Miners Index, fell 2.74%. The U.S. Trade-Weighted Dollar Index rose 1.04% for the week. Gold Market StrengthsCentral banks remain attracted to gold. Russia announced that its central bank has added another 9.3 tonnes of gold to its reserves. Russia has almost doubled its gold reserves since the financial crisis, being a net buyer every month since. Furthermore, European central banks have retained much more gold than they expected, unloading just 1.7 percent of the gold allowed in their agreement to limit sales.

Gold mint sales are on the rise. This week, the United Kingdom’s Royal Mint launched an online bullion trading website for the first time. The move is aimed at accessing unsatisfied gold demand in the UK. The Mint’s gold coin sales have increased after being granted value-added-tax-free status in the UK. In the United States, gold coin sales are on the rise as well. Thus far in September, sales of American Eagle bullion gold coins have increased 84 percent from August. Roughly 50 tonnes of gold have been smuggled into India over the past ten days according to the Hindustan Times. The substantial inflows into the country stem from the seasonal demand for gold and highlight the resilient demand for the precious metal in India. Premiums for gold in India are anticipated to double to $20 per ounce over the London cash price going into October. Gold Market WeaknessesThe ETF that tracks the Market Vectors Junior Gold Miners Index, the GDXJ, is reportedly too large to match the benchmark. Most of the fund’s holdings have exceeded 10 percent of the outstanding shares, causing the need for the ETF to rebalance to an asset mix that departs from its benchmark. Down 12% this quarter, commodities are poised for the biggest decline since the financial crisis. Weak global growth data from Europe and China as well as a strong dollar have created severe headwinds for the asset class.

Gold Market OpportunitiesThe World Gold Council says that gold will rebound by the end of 2014. The confidence in gold expressed by the council is due to the strong demand from India during the current wedding season. The council is forecasting demand figures in the range of 850 to 950 tonnes. A recent report issued by McKinsey and Company argued that the diamond industry will likely continue to be a strong and profitable one. In the near future, demand growth will outstrip supply.

Gold Market ThreatsAccording to Goldman Sachs Group’s Jeffrey Currie, gold is set to continue its decline. He argues that gold has been supported recently by geopolitical tensions in Ukraine, which are now fading. Investors are also shying away from gold as the dollar continues to appreciate and commodities as a whole suffer. Despite gold being unable to find many buyers during its recent slump, Mohamed El-Erian, Chief Economic Adviser at Allianz, noted today in an editorial that “only brave investors would omit it from their investment portfolio given the fluid world we live in.” The Central Bank of Japan (BOJ) has reportedly purchased a record amount of Japanese equities. Holding 1.5 percent of the entire Japanese equity market, the BOJ’s aggressive purchasing leads one to speculate as to whether or not the U.S. Federal Reserve is doing the same. Since higher equity prices would directly enhance the wealth effect, thus raising consumer confidence, it is not beyond reason to consider. Norilsk Nickel is looking at buying palladium from the Russian Central Bank. Uncertainty surrounding the deal, which is expected to amount to 2.4 million oz., may push palladium prices lower. Furthermore, whereas it was uncertain to what degree the Russian Central bank was holding palladium, this deal now reveals that the bank holds a substantial position in the metal.

|