Gold World News Flash |

- Gold, Silver, Hindenburg Omens & Full-Blown Global Collapse

- This is truly a wide-open multi-billion dollar opportunity

- Venezuela opens gold vault to impromptu inspection -- So how about it, central banks?

- JIM WILLIE: The Crash Heard Round the World — Saudis to Reject USD for Oil Payments

- COPPER vs SILVER MANIPULATION: The Tale Of Two Metals

- Bread, Circuses, & Bombs - Decline Of The American Empire

- The Fed Kills Emerging Markets For Profit

- The Gold Price Rose $4.20 to $1,221.00 on Comex

- Gold Price Outlook For 2014 And 2015

- Royal Mint Stimulating Gold Investing

- Germany's UKIP threatens to paralyze eurozone rescue efforts

- Gold Daily and Silver Weekly Charts - The Prisoner's Dilemma, Bureaucrats Agonistes

- U.S. Stock Market Fear of MELTDOWN as Billionaires Hoard Cash!

- Strong Accumulation May Follow Selling Capitulation in Junior Gold Miners

- China, Russia, Germany, India & A Roadmap To $10,000 Gold

- Kaye sees 'desperation' in gold and silver price suppression efforts

- To Rob a country, own a Bank -- William Black

- Silver, Gold, Debt and Taxes

- Has The Gold Price Drop Run Its Course?

- Sovereign Buy Orders In Gold, But Watch Silver For Price Gains

- Gold Prices Leap to 1-Week on "Short Covering" as Stock Markets Fall, Shanghai's New FTZ Contracts Show Zero Volume as Silver Spikes 3.8% from 4-Year Low

- China will take control of gold pricing, Sprott's Charles Oliver says

- Arbitration awards $740 million to Gold Reserve for expropriation by Venezuela

- The Macro View and the Stock Market

- Gold, the Fed and the Looming Stock Market Correction Q&A

- Can Gold Act as a Safe Haven Again?

- Destroying the U.S. Dollar a Penny at a Time

- How (Not) to Corner a Market

- Silver, Gold, Debt & Taxes

- How Much Further Can Gold Fall?

| Gold, Silver, Hindenburg Omens & Full-Blown Global Collapse Posted: 23 Sep 2014 09:01 PM PDT  Today an outspoken hedge fund manager out of Hong Kong spoke with King World News about gold, silver, Hindenbug Omens, and a full-blown global collapse. William Kaye, who 25 years ago worked for Goldman Sachs in mergers and acquisitions, also discussed what investors really to know -- what does it all mean and how will this all end? Below is what Kaye had to say in his outstanding interview. Today an outspoken hedge fund manager out of Hong Kong spoke with King World News about gold, silver, Hindenbug Omens, and a full-blown global collapse. William Kaye, who 25 years ago worked for Goldman Sachs in mergers and acquisitions, also discussed what investors really to know -- what does it all mean and how will this all end? Below is what Kaye had to say in his outstanding interview.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This is truly a wide-open multi-billion dollar opportunity Posted: 23 Sep 2014 08:00 PM PDT from Sovereign Man:

Years back I remember the first time I came across the stereotypical busload of Chinese tourists. It was in Paris, and I was somewhere near the obelisk, when a bus pulled up and out popped a Chinese tour guide leading the charge with a flag and loud speaker, and closely followed by a stream of very conspicuous tourists. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Venezuela opens gold vault to impromptu inspection -- So how about it, central banks? Posted: 23 Sep 2014 07:23 PM PDT By Isabella Cota http://www.bloomberg.com/news/2014-09-24/bofa-peeks-inside-venezuela-s-g... Francisco Rodriguez, an economist with Bank of America Corp., was at a routine meeting with Venezuelan central bank officials last week when he sprung an unusual question on them: Can you show me your gold? He'd been itching to take a peek for years and now was the time to ask. With the government's bonds sinking toward prices that indicate investors are bracing for the possibility of default, the country's $15 billion of gold bars are crucial to ensuring debt payments are met. His first impression once inside the vaults? Those bars don't take up a lot of room. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata "You picture that amount of money requiring a lot of space when, in reality, it all fits in five small cells that were not even full to the top," Rodriguez, a Venezuela native who covers Andean economies for Bank of America Corp. in New York, said in a telephone interview yesterday. He said he started counting frantically in his head, summing up figures scrawled out on signs near each pile of the metal. By his quick math, the gold was all there. Rodriguez said that while he has remained optimistic about Venezuela's ability to keep servicing its debts, he has been getting nervous phone calls from investors amid the rout that sent the country's benchmark bonds to as low as 67 cents on the dollar last week. One client was even worried that the gold might have vanished from the vaults, a concern that Rodriguez said helped push him to ask to see the stockpile last week. Gold accounts for about 71 percent of Venezuela's $21.4 billion of foreign reserves, according to the World Gold Council. About $13 billion of the gold is held at the central bank in downtown Caracas, with another $2 billion at the Bank of England, according to Rodriguez. The total value of its reserves have dropped 34 percent over the past five years. As the bond rout deepened earlier this month, President Nicolas Maduro sought to reassure creditors, saying Sept. 10 that the government will pay back its debt "down to the last dollar." Investors aren't convinced. The cost to insure Venezuela's bonds against default for five years with credit default swaps is the highest in the world, at 15.47 percent. Standard & Poor's cut the rating on Venezuela's debt on Sept. 16 to CCC+, a level that indicates a 50 percent chance of non-payment within two years. Rodriguez got his glimpse at the gold on Sept. 17, when, he said, he and four other people who attended the meetings at the central bank were led by an official in a white lab coat to a set of elevators with reinforced doors. Once it opened, some two or three floors underground, the vault was open for inspection under the watchful eye of security guards. Inside were about five compartments, similar to jail cells but smaller, where different types of gold bars were stacked, Rodriguez said. Signs indicated how much gold was stored in each cell in ounces. The central bank didn't reply to an e-mail seeking comment on the meeting with Rodriguez. In a Sept. 23 note to clients, Rodriguez said the "rare" visit was "largely symbolic yet reassuring." "It's not that the majority of the people doubt that the gold is there," he said over the telephone. "But it's one of these things that linger, something that's nagging you and makes you wonder: What if it's not?" Join GATA here: Canadian Investor Conference http://cambridgehouse.com/event/31/canadian-investor-conference-toronto-... New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JIM WILLIE: The Crash Heard Round the World — Saudis to Reject USD for Oil Payments Posted: 23 Sep 2014 07:03 PM PDT by Jim Willie, via Silver Doctors:

The marriage between the Saudis and Chinese is a process well along, with each month featuring yet another high level conference. The Saudis will make the announcement in the coming weeks or months, as a genuflection before the Chinese, with a hat tip to the Russians. Soon the crude oil price will be set by the Russia-China tag team, priced in Yuan. When the Gold Trade Standard is entrenched, the diversification away from USTreasurys in the global banking system will become a torrent. Bank system practices will follow trade payment practices. When installed, it will cause prosperity in the East and havoc in the West. The Crash Heard Round the World is coming. The USDollar will be rejected, and replaced by the Gold Trade Standard. By Jim Willie, GoldenJackass.com, The USFed monetary policy is killing the system, simply and boldly put. They call it stimulus, when the extreme accommodation is actually just a backdoor Wall Street bailout combined with a pass on the USGovt debt discipline. No debt limit is enforced anymore, a travesty. The United States is looking more like a Third World nation with each passing month, with colossal fraud, economic decay, war and sanctions, and no leadership. The US Federal Reserve has ventured into very dangerous ground, putting hyper monetary inflation as the installed policy, while making money free for the Interest Rate Swap machinery that operates the derivative for maintaining the easy policy. So foreign creditors have largely exited the room, with no great entities to finance the yawning annual $trillion debt. So derivative machinery is relied upon to maintain the absurd 10-year USTreasury (TNX) yield at 2.60% without buyers. So asset markets like the US Stock Market go to monthly new high levels, despite the USEconomy mired in the worst recession since the Great Depression. The visible piece is shopping malls with one third of stores shuttered, and the jobless rate over 22% in the real world without rose colored glasses. These conditions cannot be sustained, especially since the credit machinery is all jammed. The big US banks are insolvent structures dedicated to the bond carry trade, where that same cheap money is used to invest, often with leverage, in the long-dated maturity USTreasury Bonds. The banks serve the casino, not the business sector. STUCK MONETARY POLICY In no way can the current easy money policy be reversed, and put into a normal mode. In no way can the accommodation be tapered. The entire Taper Talk is a lie, and always has been a lie. The Jackass called out the USFed last June and July, and was proved correct by September. Since that time, the USFed has been lying vigorously and creatively. The Belgium Bulge showed itself as a $400+ billion abscess visible to the world, hardly a real savings account by the small nation. It was either a Hidey Hole for USTBonds or else a loading depot for BRICS sourcing of Gold bullion for their upcoming central bank. In no way can the enormous bond carry trades be stopped. They are the only source of actual income for the big US banks. Their other source of narco funds money laundering. Doing so would put the carry trade engines into reverse, forcing an unwanted Bond Convexity episode of leveraged selling of USTreasury Bonds by the same large corrupted banks which are so clearly involved in the derivatives game. In no way can the USFed hike rates, since their own outsized bond portfolio would register huge losses, only to gain ugly publicity. They after all bought the top in bonds, and continue to buy the top in bonds every month that QE continues. They are the fools buying the asset bubble at the top. See a parallel in Japan. Red light warning signals are all over the place. The biggest in the Jackass view is the Failures to Deliver. We are told that the demand for USTreasurys is huge by the market players. It might be moderate, but surely not huge, since savings is in shortage. When the Interest Rate Swaps are applied, using 0% money into the machinery tubes, the result is an artificial demand produced to purchase the same USTreasurys. The big US banks are required to follow through, or else to expose the entire sham game, a veritable Ponzi Scheme. The banks are growing in resentment.However, not enough USTBonds exist in the operating bond market to satisfy such outsized contrived demand out of machinery. The result is Failures to Deliver, the warning signal of a fabricated rigged market. This Third World nation has fancy machinery indeed. SMOKING GUN GRAPHS IN CONTRAST The answer to the US bond riddle lies in corrosive ruinous effect of monetary policy, now in its fourth year. They said the 0% ZIRP would be just for a few months, but they lied. The Jackass said in 2009 that it would be permanent. They said QE bond monetization would be just for a few months, but they lied. The Jackass said in 2011 that it would be permanent. We were taught by central bank mouthpieces for years that a little inflation is good, but a lot is bad. We were taught in economics classes that hyper inflation destroys the entire system eventually, like in Third World nations. Yet QE (hyper monetary inflation) and ZIRP (free money) respectively cause capital destruction with retired equipment and distorted asset prices with no reward to savers. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

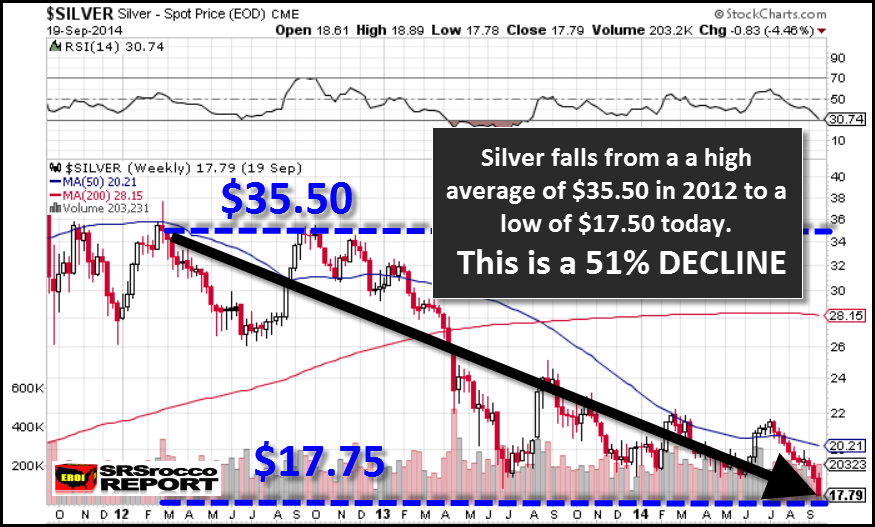

| COPPER vs SILVER MANIPULATION: The Tale Of Two Metals Posted: 23 Sep 2014 06:59 PM PDT by Steven St. Angelo, SRS Rocco:

Especially, when the overwhelming majority of the public's funds have been siphoned into the biggest Ponzi Scheme in history. You see, the manipulation isn't just HAMMERING the paper price of silver during the slimmest trading periods of the day.. that's just a small part of it. The largest area of manipulation is in the WHOLESALE PACKAGING OF LIES* by the Fed, Cartel Banks and MSM stating that paper assets such as 401k's, Retirement-Insurance Funds, Stocks, U.S. Treasuries are wealth, when in fact they are huge liabilities. (* term coined by James Howard Kunstler).

If the public realized they had invested in the biggest ponzi scheme in history, there would be a stampede out of paper assets and into anything tangible. This would create a SHOCK-WAVE around the world as fiat currencies would implode and the value of commodities and physical assets would skyrocket. Getting back to the metals, if we look at the two charts below, we can see just how much more of a beating silver has taken compared to copper: Copper hit a peak of around $3.90 in March 2012, a decline into the summer months and then another peak in October getting ready for the Fed's QE3. However, After the majority of QE3 monetary liquidity was siphoned into that BLACK HOLE of the Wall Street Stock & Bond Markets via the Fed's most favorite Banks, copper missed all the fun as it was hit hard, declining 22% to a low of $3.04 today. Poor Copper…. Well, if you think copper was hit hard, let's look at silver. Silver went from an average high of $35.50 in March 2012 to a staggering low of $17.50 today. A whopping 51% DECLINE…. If you thought the primary miners were losing money at $19-$20… how bad is the hemorrhaging at $17? As you can imagine, I get a handful of readers who send me emails stating that silver is a garbage metal and it's only worth a lousy $10 bucks because that is the average CASH COST of the primary silver miners. If I had a Silver Dollar for every time I came across that nonsense…. I could retire. The world has been BAMBOOZLED to believe in a FAIRY TALE, a DELUSION, and a PONZI SCHEME that will all end badly. The real value is found by holding investments that store wealth. Paper assets today are mostly future liabilities with a BIG SUCKER stamped across each one. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bread, Circuses, & Bombs - Decline Of The American Empire Posted: 23 Sep 2014 06:01 PM PDT Submitted by Jim Quinn via The Burning Platform blog, “Already long ago, from when we sold our vote to no man, the People have abdicated our duties; for the People who once upon a time handed out military command, high civil office, legions — everything, now restrains itself and anxiously hopes for just two things: Bread and Circuses.” – Juvenal – Satire (100 A.D.) Roman satirist and poet Juvenal was displaying contempt for a degraded Roman citizenry that had shunned civic responsibility, shirked their duties of citizenship within a republic, and had chosen to sell their votes to feckless politicians for assurances of bread and circuses. Rather than govern according to noble principles based upon reason, striving for public policies that led to long term sustainability and benefitting the majority of citizens, politicians chose superficial displays and appeasing the masses utilizing the lowest common denominator of "free' food and bountiful spectacles, pageants, and ceremonies in order to retain power. The Roman Empire’s decline stretched across centuries as the gradual loss of civic virtue among its citizenry allowed demagogues to gain power and barbarians to eventually overrun the weakened empire. While the peasants were distracted with shallow exhibitions of palliative pleasures, those in power were debasing the currency, enriching themselves, and living pampered lives of luxury. The Roman leaders bought public approval and support, not through exemplary public service, but through diversion, distraction, and the satisfaction of base immediate needs and desires of the populace. Satisfying the crude motivations of the ignorant peasants (cheap food and entertainment) is how Roman politicians bought votes and retained power. Free wheat, circus games, and feeding Christians to lions kept the commoners from focusing on politicians pillaging and wasting the empire’s wealth. History may not repeat exactly because technology, resource discoveries, and political dynamics change the nature of society, but it does rhyme because the human foibles of greed, lust for power, arrogance, and desire for conquest do not vary across the ages. The corruption, arrogance, hubris, currency debasement, materialism, imperialism, and civic decay that led to the ultimate downfall of the Roman Empire is being repeated on an even far greater scale today as the American Empire flames out after only two centuries. The pillars of western society are crumbling under the sustained pressure of an immense mountain of debt, created by crooked bankers and utilized by corrupt politicians to sustain and expand their welfare/warfare state. Recklessness, myopia, greed, willful ignorance, and selfish disregard for unborn generations are the earmarks of decline in this modern day empire of debt, delusion and decay. “Armaments, universal debt, and planned obsolescence – those are the three pillars of Western prosperity. If war, waste, and moneylenders were abolished, you’d collapse. And while you people are over-consuming the rest of the world sinks more and more deeply into chronic disaster.” – Aldous Huxley – Island Rome was eight and a half centuries old when Juvenal scornfully described the degenerative spiral of the Roman populace. Still, the Western Empire lasted another three centuries before finally succumbing to the Visigoths and Vandals. The far slower pace of history and lack of other equally matched competing nation states allowed Rome to exist for centuries beyond its Pax Romana period of unprecedented political stability and prosperity, which lasted for two centuries. Prior to becoming an empire, the Roman Republic was a network of towns left to rule themselves with varying degrees of independence from the Roman Senate and provinces administered by military commanders. It was ruled, not by Emperors, but by annually elected magistrates known as Roman Consuls. The Roman citizens were a proud people who had a strong sense of civic duty and made government work for the people. During the 1st century B.C. Rome suffered a long series of internal conflicts, conspiracies and civil wars, while greatly extending their imperial power beyond Italy through military conquest. After the assassination of Julius Caesar and the ascension of Augustus to emperor in 27 BC, after a century of civil wars, Rome experienced an unprecedented period of peace and prosperity. During this era, the solidity of the Empire was furthered by a degree of societal stability and economic prosperity. But it didn’t last. The successors to Augustus contributed to the progressive ruination of the empire. The repugnant reigns of Tiberius, Caligula, Claudius, and Nero reflected the true nature of the Roman people, who had relinquished their sovereignty to government administrators to whom they had granted absolute powers, in return for food and entertainment. It was the beginning of the end. The American Republic began as a loose confederation of states who ruled themselves, with little or no direction from a central authority. The Articles of Confederation, ratified in 1781 by all 13 States, limited the powers of the central government. The Confederation Congress could make decisions, but lacked enforcement powers. Implementation of most decisions, including modifications to the Articles, required unanimous approval of all thirteen state legislatures. After winning the war for independence from England, the U.S. Constitution, which shifted power to a central authority, was ratified in 1789. The Bill of Rights, the first ten amendments to the Constitution, was passed in 1791 with the purpose of protecting individual liberties and insuring justice for all. Their function was to safeguard the citizens from an authoritarian federal government. These imperfect documents would benefit and protect the rights of the American people only if applied by moral, just, incorruptible, noble, honorable leaders and enforced by an educated, concerned, vigilant citizenry. As with the Roman Empire, the quality of leadership has rapidly deteriorated over the last two centuries and now wallows at disgustingly low levels. These leaders are a reflection of a people who have abandoned their desire for knowledge, responsibility for their lives, work ethic, belief in freedom and the U.S. Constitution. The Juvenal of our times was H.L. Mencken who aptly and scornfully described the citizenry in 1920 as an ignorant mob who would eventually elect a downright moron to the presidency. He was right. “The larger the mob, the harder the test. In small areas, before small electorates, a first-rate man occasionally fights his way through, carrying even the mob with him by force of his personality. But when the field is nationwide, and the fight must be waged chiefly at second and third hand, and the force of personality cannot so readily make itself felt, then all the odds are on the man who is, intrinsically, the most devious and mediocre—the man who can most easily adeptly disperse the notion that his mind is a virtual vacuum. The Presidency tends, year by year, to go to such men. As democracy is perfected, the office represents, more and more closely, the inner soul of the people. We move toward a lofty ideal. On some great and glorious day the plain folks of the land will reach their heart’s desire at last, and the White House will be adorned by a downright moron.” – H.L. Mencken A Republic was formed 225 years ago, as opposed to a monarchy, by men of good intentions. They weren’t perfect, but their goals for the new nation were honorable and decent. Ben Franklin had his doubts regarding whether we could keep a republic. He had good reason to doubt the long-term sustainability of this experiment. Freedom is not something bestowed on us by men of higher caste. We are born into this world free, with the liberty to live our lives as we see fit, the opportunity to educate oneself and the freedom to succeed as far as our capabilities and efforts allow. Only a self-reliant, virtuous, moral, civic minded people are capable of enjoying the fruits of freedom. Once corruption, self-interest, greed, and dependency upon government bureaucrats for sustenance become prevalent, the populace seeks masters who promise safety and security in return for sacrificing essential liberty and basic freedoms. The country has defeated foreign invaders, withstood financial calamities, endured a bloody civil war, benefitted immensely from the discovery of oil under its soil, became an industrial power, fought on the winning side of two world wars, and since 1946 has become the greatest imperial empire since Rome fell to the barbarians. Over the course of our 225 year journey there has been a gradual relinquishment of the citizens’ sovereignty and autonomy to an ever more overbearing central government. Lincoln’s unprecedented expansion of Federal government authority during thwe Civil War marked a turning point, as state and local rights became subservient to an all-powerful central authority. Individual liberty has been surrendered and freedoms forfeited over a decades long insidious regression of a once courageous, independent, self-sufficient citizenry into a mob of cowering, willfully ignorant dependents of the deep state. From the inception of the country there has been a constant battle between the banking interests and the common people. Bankers have used fraudulent fractional reserve banking to speculate for their own benefit, made risky loans, and created every financial crisis in the country’s history. The profits from excessive risk taking are retained by the bankers. The inevitable losses are borne by taxpayers with the excuse that the financial system must be saved and preserved. The storyline never changes. The beginning of the end of the American Empire can be pinpointed to the year 1913, only 124 years after its inception. Private banking interests captured the monetary system of the empire with the secretive creation of the Federal Reserve. The power of the central state was solidified with the implementation of the personal income tax, allowing politicians to bribe their constituents with modern day “bread and circuses”, paid for with money taken at gunpoint from them by the central state. We are now nothing but the hollowed out shell of a once noble Republic. A century of central banking and heavy taxation of the people by bought off politician puppets has coincided with a century of war, depressions, currency debasement, overconsumption, obscene levels of consumer debt, trillions of excessive debt financed government spending, hundreds of trillions in unfunded entitlement liabilities, and a persistent decline in standard of living for the masses due to Federal Reserve manufactured inflation. We have failed to heed the lessons of history. We have repeated the blunders committed by the Romans. The American Empire will not be murdered by an external force because it is too busy committing suicide. The moneyed interests, corporate oligarchs and their hand-picked politician front men see themselves as conquering heroes. Their colossal hubris and arrogance is only matched by the ignorance, gullibility, quivering fear of bogeymen, and susceptibility to propaganda of the general populace. The Wall Street bankers and feckless politicians are not gods, they are only men. Death is the great equalizer for emperors and peasants alike. The only thing that remains is your legacy and whether you positively impacted the world. It can be unequivocally stated that those in power today are leaving a legacy of despair, destruction, and debt.

Empires are born and empires die. The American Empire will not be sustained for eight centuries, as the swiftness of modern civilization, nuclear proliferation, religious zealotry, and sociopathic leadership ensures we will flame out in a blaze of glory before reaching our third century. The spirit of independence, idealism, self-reliance, entrepreneurship, knowledge seeking, advancement, and goodwill towards our fellow citizens that marked the height of our fledgling country has succumbed to a malaise of government dependency, cynicism, living on the dole, financial Ponzi schemes, willful ignorance, materialism, delusion, and myopic self-interest. The moral decline of the American populace has been reflected in the deteriorating quality of leaders we have chosen over the last century. Prosperity was taken for granted and no longer earned. We abdicated our civic responsibility to corrupt financiers and power seeking politicians. As time has passed, the ruling elite have grown ever more powerful and wealthy, at the expense of the peasantry. These sociopaths see themselves as god-like emperors, on par with the vilest of the Roman emperors. Historians will mark 1980 as another turning point, when the nation capitulated to the financiers and ceded control of our destiny to Wall Street bankers, the military industrial complex, and globalist billionaires. The final deformation from a productive society built upon savings, capital investment, and goods production to a borrowing, gambling, and consumption society built upon debt and profiteering by powerful corporate and banking interests had commenced. The peak of this warfare/welfare state insanity was reached in 2000 and the road to decline and decay is now littered with the figurative corpses of a gutted middle class and the literal corpses of men, women and children across the globe, killed during our never ending imperial conquests. The ruling elite sense the futility and foolishness of their folly, but their insatiable appetite for wealth, power, triumph and glory blind them to the destructive consequences of their actions upon the nation and their fellow man. Power and dominion over others is a powerful aphrodisiac for our current day emperors and self-preservation at all costs is their mantra. While they bask in their perceived triumph and glory, achieved through rigging the financial and political systems in their favor, they should heed the faint whisper in their ear that all glory is fleeting. “For over a thousand years Roman conquerors returning from the wars enjoyed the honor of triumph, a tumultuous parade. In the procession came trumpeteers, musicians and strange animals from conquered territories, together with carts laden with treasure and captured armaments. The conquerors rode in a triumphal chariot, the dazed prisoners walking in chains before him. Sometimes his children robed in white stood with him in the chariot or rode the trace horses. A slave stood behind the conqueror holding a golden crown and whispering in his ear a warning: that all glory is fleeting.” – George S. Patton, Jr. The decline of the Roman Empire can be attributed to a number of supportable hypotheses, which have been documented by historians over time. They include:

In Part Two of this tale of two empires, I’ll document the parallels between mistakes made, eternal human foibles, military misfortunes, financial misconduct, and moral decay, that denote the decline of the Roman and American Empires. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fed Kills Emerging Markets For Profit Posted: 23 Sep 2014 05:10 PM PDT Submitted by Raul Ilargi Meijer via The Automatic Earth blog,  DPC Herald Square, New York 1903 Emerging markets are about to get hit by a whopper of a double whammy. And if I were you, I wouldn’t be too surprised if it takes on epic proportions. The exposure that emerging markets, countries in the less wealthy parts of the globe, Asia, Eastern Europe, Africa, Latin America, have to the west has grown at a very rapid clip since, let’s say, Lehman. These countries were hit hard by the western crisis, but found what looked like a sugar mountain afterward when western interest rates plunged to zero and beyond, which provided them with both of the seemingly beneficial sides of what will now become their double whammy. First, western money flowed, make that flooded, into their economies at unparalleled levels, driven by a chase for yield instigated by the difference between ultra low interest rates in the west and much higher rates beyond. For emerging countries, this has been a boon beyond belief. No matter how corrupt or poorly organized they may have been or still are, most showed nice growth numbers for a few years. It wasn’t really a carry trade in the literal sense of the word, but it was close. And it’s now coming to an end.  Second, and likely to work out even much worse, the ‘emerging governments’ borrowed those cheap US dollars using anything not bolted down, including their national treasures, as collateral, and they now face a doubling, tripling, quadrupling etc. of the interest rates they have to pay on those loans. Which looks about like this (and something tells me this could well underestimate reality by a considerable margin):  Janet Yellen is about to announce rising rates, and whether it’s tomorrow or in 6 months is not that relevant in all this, it’s expectations that rule the day. Emerging markets will first be hit by outflows of western investment – or rather casino – capital, just because of the fear in the markets of what Yellen will do, and then get the second whammy when rates move from 0.25% to 1.25% and then some. We see the initial jitters today. Or rather, they’re not the initial ones, just the first ones to come from people other than western investors. What sticks out that the western press has very little attention for the ‘other side’s’ point of view. Still, here’s the Indonesian FM with a pretty clear message for someone who sees his country being suspended by its balls: Asia May Need to Sacrifice Growth to Cope With Fed Rate Hike

Not that all investors will leave. If only because the emerging market countries need to raise their base rates even higher. Investors Bet on Asia Despite U.S. Rate Threat

Still, the world’s smaller economies are plenty afraid. Wary of Another ‘Tantrum,’ Emerging Economies Prep for Fed Rate Hike

One more then, because you enjoy it so much: Fed Dims Emerging Markets’ Allure

The Fed, by raising its rates and relinquishing its downward pressure on the US dollar, is about to kill off most of the emerging markets. That’s a whole lot of misery in one pen stroke. That’s a whole lot of millions of people who will see their dreams of better lives shattered, just as they were beginning to think they had a chance. It’s how the game is played. The weak must be sacrificed so the strong be stronger. It’s like a law of nature. From some point of view, at least. For me, it looks more like ‘we’ have found another way, and another victim, to keep ‘our’ game going a bit longer. There is no way this just happens, in some accidental kind of way. There is a reason the Fed raises both interest rates and the US dollar inside the same timeframe. Short emerging markets. Play it well and their misery can make you a fortune. Isn’t that what life is all about? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Rose $4.20 to $1,221.00 on Comex Posted: 23 Sep 2014 04:24 PM PDT

The GOLD PRICE rose $4.20 to $1,221.00 on Comex. Silver rose a piddling 1.4 cents to $17.713. Both closes belie today's underlying strength. On a five day chart gold has made a rounding bottom. Today it came up out of that bowl about 5:30 a.m. with a break through $1,225 and rose in steps to $1,237 by 8:30. Rest of the day it backed off, down to $1,220 again at noon. Rest of the day it oscillated between $1,220 and $1.225. The GOLD PRICE today pierced but did not quite close above its downtrend line in place since September began. It has barely moved up from grotesquely oversold, and other indicators appear to be turning up. Today's gains were confirmed by rising volume. The SILVER PRICE made a V-bottom at $17.33 before Monday's market opened in the US. Since then it hasn't traded below $17.60. Today I opened strong and ran to $17.99 about 8:30 a.,. It fell off that rise and spent the rest of the day riding $17.75 - $17.80. As long as silver holds above $17.60 we can presume it has reversed upward. Unlike the gold price, the silver price has not yet crossed above its downtrend line that began late in August. It needs a price above $18.25 to accomplish that. I got to thinking about that GOLD/SILVER RATIO. It gapped up three days ago, and today rose once more to 68.932. That corrects 70.8% of its rise from the April 2011 low. A 75% correction would lift it to 71.06. A drop in that ratio below 67.5 would help confirm a reversal upward for metals. I may be foolish, but I bought both silver and gold today. Considerable amount. Friend of mine called today to point out that the premiums on some storage scheme silver has reached the point where you can swap that for physical and roughly break even. If you are in one of those schemes and your silver has a 5 or 6% premium, you can almost break even swapping to physicals. Oddly, the 5 day US dollar chart shows highs above 84.80 on Wednesday 17 September and Monday 22 September, with a big drop until noon today and a high lower than yesterday's. That leaves behind what looks like a double top and beginning of a reversal. Needs to close below 84 to confirm that reversal. Today it closed unchanged at 84.79. Japanese Yen tried to rise today but was slapped back. Lost 0.06% to 91.83 cents/Y100. Euro played by the same script, rising strongly early but closing near the bottom of its range for a 0.01% loss to $1.2846. Stocks had a rough day, following through downward after that nose cone top. S&P500 lost 11.52 (0.68%) to 1,982.77. Dow sank a hefty 116.87 (0.68%) to 17,055.87. S&P500 is all negative today. It dropped way below its 20 DMA (1,998.04) and isn't too far from its 50 DMA below that (1,976). RSI has turned negative, along with MACD and full stochastics. Dow today closed below its 20 DMA (17,104.21). RSI at 50.45 didn't quite close below 50, but the MACD and Full Stochastics turned down. Gravity will control of the next big move, and that right soon. Both the Dow in Gold and Dow in silver have plunged sharply. Dow in gold shrank today by 1.33% to 13.94 (G$288.16 gold dollars). RSI has moved down from grotesquely overbought to merely overbought. Must close below that December high at 13.80 (G$285.27) and then the 20 DMA at 13.68 (G$282.79) to confirm a downturn. Dow in silver dropped 0.9% to 959.81 oz (S$1,240.97 silver dollars). 20 DMA awaits at 909.03 oz (S$1,171.43). Remains grotesquely overbought. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Outlook For 2014 And 2015 Posted: 23 Sep 2014 02:58 PM PDT In a recent presentation, Dundee’s Martin Murenbeeld explained the bullish and bearish forces at work in the gold market with some 50 charts. The slideshow is available below. Looking back to 2013, it appeared that investors went heavily into equities which resulted in a massive negative correlation between stocks and gold. On the other hand, Chinese net imports from Hong Kong set record volumes. More importantly, however, Murenbeeld looks into the gold price expectations for 2014 and 2015. Bearish factors for 2014 and 2015Basically, in sum, Murenbeeld sees the following bearish factors for gold’s price in the coming 18 months:

This is only the summary of this view. Readers are recommended to study the accompanying charts which are available in the presentation below. Bullish factors for 2014 and 2015As for the bullish forces at play, this is what Murenbeeld expects in the coming 18 months:

Gold price scenarios for 2014 and 2015On the last slide, Dundee provides price targets, as evidenced in the following table:

Clearly, the targets are rather defensive but for sure not bearish. The full presentation | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Royal Mint Stimulating Gold Investing Posted: 23 Sep 2014 02:31 PM PDT With gold sentiment standing at 20 on a scale to 100, according to Sentimentrader, it is clear that the precious metals sector needs some sort of stimulus which is visibly not coming from higher prices in the short run. The Royal Mint is taking steps in that direction by launching a new trading website. By doing so, The Royal Mint is opening its services to a broader public. The website is running at royalmintbullion.com; one could compare it with the well known names like GoldMoney and BullionVault, but specialized in gold coin investing. The flagship coin of royalmintbullion.com is The Sovereign, struck in 22 carat gold. Britannia coins are available in either 999.9 fine gold (24 carat) or 999 fine silver, and the UK's newest Bullion coin, the Lunar coin, is also struck in either 999.9 fine gold (24 carat) or 999 fine silver. Customers can have the coins delivered to their home. They can also opt to store them in "the vault", the Royal Mint's on-site storage facility, which is protected by the Ministry of Defence. From Telegraph:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Germany's UKIP threatens to paralyze eurozone rescue efforts Posted: 23 Sep 2014 02:06 PM PDT By Ambrose Evans-Pritchard The stunning rise of Germany's anti-euro party threatens to paralyze efforts to hold the eurozone together and may undermine any quantitative easing by the European Central Bank, Standard & Poor's has warned. Alternative für Deutschland (AfD) has swept through Germany like a tornado, winning 12.6 percent of the vote in Brandenburg and 10.6 percent in Thuringia a week ago. The party has broken into three regional assemblies, after gaining its first platform in Strasbourg with seven euro-MPs. The rating agency said AfD's sudden surge has become a credit headache for the whole eurozone, forcing Chancellor Angela Merkel to take a tougher line in European politics and risking an entirely new phase of the crisis. "Until recently, no openly Euroskeptic party in Germany has been able to galvanize opponents of European 'bailouts.' But this comfortable position now appears to have come to an end," it said. ... ... For the remainder of the report: http://www.telegraph.co.uk/finance/financialcrisis/11117482/Germanys-Uki... ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 BullionStar is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. BullionStar's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in BullionStar's bullion vault, which is integrated with BullionStar's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: Canadian Investor Conference http://cambridgehouse.com/event/31/canadian-investor-conference-toronto-... New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - The Prisoner's Dilemma, Bureaucrats Agonistes Posted: 23 Sep 2014 01:49 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Stock Market Fear of MELTDOWN as Billionaires Hoard Cash! Posted: 23 Sep 2014 01:29 PM PDT The U.S. stock market has been propped up by the Federal Reserve and it's scheme of perpetual low interest rates and excessive Quantitative Easing, (a.k.a. printing money and giving it to bankers). Now that the Fed has claimed they are winding down QE3 and will soon raise interest rates, the market... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

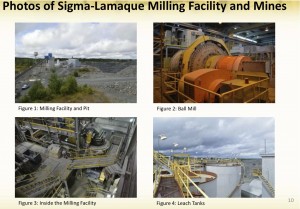

| Strong Accumulation May Follow Selling Capitulation in Junior Gold Miners Posted: 23 Sep 2014 01:24 PM PDT Gold and silver prices have been declining as the US dollar begins to test multi-year highs. The US dollar is very overbought as investors fear that the US will raise interest rates while other countries continue to print money like the ECB and China. This rally in the US dollar should not last long as it may be a dead cat bounce before the next downturn. This may actually be a great time to transfer cash into real assets such as gold and silver bullion, base metals and energy trading at multi year lows. The US deficit is continuing to increase especially as new wars are announced in Europe and the Middle East. The Fed will continue to support inflationary policies and prevent deflations at all costs. I doubt the US dollar will strengthen for much longer. Rising deficits and war are usually quite bullish for gold and bearish for the dollar. Silver is already in new four year lows trading below $18. Gold has not yet violated the $1200 mark but may soon bounce off that level. The GDXJ is continuing to hold its 2013 lows. Meanwhile, the US dollar is strong at new six year highs despite billions of dollars of bailout and quantitative easing. The Fed is running the risk of deflation and may actually be forced into more easing to prevent deflation. The U.S. must pay back its record debts with cheaper dollars. Right now, the bottles of champagne are popping in the US as real estate and equity markets continue to hit new highs. However, the piper must be paid. Don’t be surprised to see the Fed eventually make a reverse move to devalue the dollar to pay down debts. Expect more bubbles to pop up not just in 3d printing, but in social media stocks and get rich quick real estate scams. There is a huge cash position waiting on the sidelines to buy real money such gold and silver especially from China which just announced a new Shanghai Gold Exchange. China is sitting on large amounts of US dollars/bonds and must transfer that into the form of real money. Look for huge volume and accumulation in gold and silver over the next few weeks and in some high quality junior mining stocks. Negative capitulation followed by strong accumulation could be the indicator that the smart money expects gold and silver to bottom. The question for many is when this will occur. Stay tuned to my premium report for signs of a potential bottom. Do not forget we are seeing increased interest into the junior miners such as Integra Gold (ICG.V or ICGQF) which announced an oversubscribed financing over the summer. What is driving this investor demand for junior gold miners such as Integra Gold (ICG.V)? Integra recently announced the acquisition of a 2200 tpd mill. With the acquisition Integra has access to the underground infrastructure which is located next to their project. Integra was able to pay pennies on the dollar for this asset as it was in bankruptcy. Integra paid $7.55 million in cash and shares for an asset valued at close to $100 million by some engineering firms. The recent mill acquisition should improve project economics as Integra’s costlier plan to toll mill the ore is no longer necessary. With this mill, Integra becomes one of the only junior gold mining companies developing a new high grade gold operation with a permitted mill in one of the richest, stable and lowest cost mining jurisdictions in the world in Val d’Or, Quebec. I expect the shares to lead the junior gold market when the sector turns as there are very few advanced high grade economic projects with a mill in a well known stable jurisdictions. Don’t forget Osisko received top dollar from the majors Agnico and Yamana. I wouldn’t be surprised if Integra Gold (ICG.V or ICGQF) is next. If not already at the top of the list of the majors, I expect that the updated economic study which includes the mill scheduled to be released in the 2nd quarter of 2015 could catapult them to the top of the list as a potential takeout target. Integra has just come onto the OTCQX under the symbol ICGQF and plans to be active this fourth quarter meeting with retail investors and institutions in the US as they now have a permitted mill. I recently met with management in Denver where they were one of the most talked about companies at the Precious Metals Summit. For many months, I have written that Integra’s Lamaque Project could be Quebec’s next major gold mine to come into production. With the recent acquisition of the mill, my prediction could be coming closer to reality. Listen to my recent interview with Integra's (ICG.V or ICGQF) Stephen De Jong by clicking here. Mr. De Jong continues to prove his ability to finance Integra through periods of weak metal prices and low investor sentiment having raised over $25 million in the past two years. For more information on Integra Gold contact Josh Serfass josh@integragold.com 604-629-0891 Disclosure: I am a shareholder and Integra is a website sponsor. Conflicts of interest apply. ___________________________________________________________________________ Sign up for my free newsletter by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… Accredited investors looking for relevant news click here… To send feedback or to contact me click here… Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China, Russia, Germany, India & A Roadmap To $10,000 Gold Posted: 23 Sep 2014 12:34 PM PDT  Today an acclaimed money manager spoke with King World News about China, Russia, Germany, India, and the roadmap to $10,000 gold. Stephen Leeb also spoke about the major inflection point for the world and the greatest wealth transfer in history that lies ahead for investors. Today an acclaimed money manager spoke with King World News about China, Russia, Germany, India, and the roadmap to $10,000 gold. Stephen Leeb also spoke about the major inflection point for the world and the greatest wealth transfer in history that lies ahead for investors.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Kaye sees 'desperation' in gold and silver price suppression efforts Posted: 23 Sep 2014 11:32 AM PDT 2:30p ET Tuesday, September 23, 2014 Dear Friend of GATA and Gold: Sentiment in the monetary metals markets has never been worse, Hong Kong fund manager William Kaye tells King World News today, adding, however, that there are elements of "desperation" in the efforts of Western governments to keep gold and silver prices down: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/9/23_So... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: Canadian Investor Conference http://cambridgehouse.com/event/31/canadian-investor-conference-toronto-... New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| To Rob a country, own a Bank -- William Black Posted: 23 Sep 2014 10:21 AM PDT William Black, author of "Best way to rob a bank is to own one" talks about deliberate fraud on Wall St. An explanation is - - who has the power? The golden rule. He who owns the gold, makes the rules! And correct, the U.S. government doesn't have the gold. The Federal Reserve does. The... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 23 Sep 2014 10:08 AM PDT I’m convinced – we can’t escape debt and taxes. Essentially all currency is created as debt, and our financial system creates more debt and more currency into circulation every day. Taxes are insufficient to pay the massive expenditures that our politicians deem essential, so our national, state and local governments fall deeper into debt every year. I think we can all agree – expect more debt and more taxes. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Has The Gold Price Drop Run Its Course? Posted: 23 Sep 2014 09:31 AM PDT The gold price dropped in the last weeks, to close on Monday September 22nd at USD 1212 and EUR 942. Dollar gold is close to retest its bottom for the third time since mid-2013, a price level which was seen only in the summer of 2010. For readers seeking to understand what is going on, we are providing a comprehensive view on the gold market. We take all perspectives into account: price and chart patterns, the technical picture, sentiment, the fuures market, physical demand, gold miners, the influence of the dollar, correlation with commodities, monetary policy and inflation/deflation. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sovereign Buy Orders In Gold, But Watch Silver For Price Gains Posted: 23 Sep 2014 09:08 AM PDT  Today an outspoken hedge fund manager out of Hong Kong told King World News that we are now seeing aggressive sovereign buy orders in the gold market taking place at the LBMA. William Kaye, who 25 years ago worked for Goldman Sachs in mergers and acquisitions, also discussed the physical markets for both gold and silver, and said that silver will be the one to watch in the future. Today an outspoken hedge fund manager out of Hong Kong told King World News that we are now seeing aggressive sovereign buy orders in the gold market taking place at the LBMA. William Kaye, who 25 years ago worked for Goldman Sachs in mergers and acquisitions, also discussed the physical markets for both gold and silver, and said that silver will be the one to watch in the future.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 23 Sep 2014 06:53 AM PDT GOLD PRICES retraced half of the morning's 1.4% jump Tuesday lunchtime in London, trading at $1225 per ounce after touching 1-week highs near $1234 as world stock markets fell. Chinese manufacturing activity was reported better-than-forecast on the HSBC PMI survey, but Eurozone factory growth has slowed hard according to the Markit data agency. US air-strikes meantime hit Islamic State targets inside Syria for a second day, joined by allied warplanes from five Arab nations. Commodity prices bounced from new 5-year lows and major government bonds also rose, nudging long-term interest rates lower again. Silver followed and extended the rally in gold prices, rising 3.8% at one point from Monday's new 4-year lows before easing back to unchanged on the week so far. "Geopolitical tensions are on the rise again," Bloomberg quotes a fixed-income strategist based in Edinburgh, "prompting some renewed safe-haven flows into US Treasuries." "Gold seems to have been supported by some safe-haven buying," adds a Mumbai commodities analyst. But while "Mid-East headlines of Israel shooting down Syrian warplane supposedly added the bid to gold," says one London bullion desk's trading note, "technical [chart patterns] played a larger part." Latest data showed hedge funds and other speculators holding more bearish bets against gold prices than any time since end-2013 last week, while money managers as a group turned bearish overall on silver futures and options. Such a "net short" position in silver this June was followed by a 15% jump in bullion prices as bears were forced to close their bets at a loss. "Stops were triggered [this morning]," says today's trading note, "and scale up selling [by bearish traders] ran into very firm bids." Earlier in Shanghai, trading volume in Shanghai's domestic gold contract was again well above recent averages on Tuesday. But trading in the city's new free-trade zone contracts for international players fell once more. Recording zero volume on Monday, the new iAu995 wholesale gold bar contract was joined by the 100 gram contract in failing to show volume or price on today's Shanghai Gold Exchange's report. "There's no major support until $1182...the December 2013 low," says a chart analysis by Swiss bank UBS today. "Any upside moves in the interim would be viewed as recoveries within a downtrend, providing fresh selling opportunities." "We've no interest whatsoever," adds trading tipster Dennis Gartman, "in [trading] gold in US dollar terms, either bullishly or bearishly. "With most commodities clearly moving from the upper left to the lower right on the charts, any attempts or wishes to own gold in Dollar terms is abruptly rendered ill-advised." "With broader conditions in the US continuing to improve, we expect the Dollar to maintain a firm tone," agrees an Indian bullion analyst, advising against buying gold. But on the contrary, says Societe Generale strategist Albert Edwards, the Dollar's recent strength is in fact due to a "rapidly weakening Japanese Yen" which "spell[s] trouble for the global economy. "The Chinese economy will see a further rise in its already strong real exchange rate [denting exports]...[meaning] a wave of deflation washes in from the rapidly devaluing east. This reverses a decade long trend." With Philadelphia Fed president Charles Plosser announcing his retirement on Monday, "Two dissenters" against the US central bank's zero-rate and QE policies will stand down next year, notes the New York Times, as Dallas Fed chief Richard Fisher is required to quit in spring. "We need to be very cautious and careful about starting to raise rates," said Minneapolis Fed president Narayana Kocherlakota – a voting member this year – in a speech, "because we do want to be sure that inflation is on the path back to 2%." | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China will take control of gold pricing, Sprott's Charles Oliver says Posted: 23 Sep 2014 05:47 AM PDT 8:45a ET Tuesday, September 23, 2014 Dear Friend of GATA and Gold: Sprott Asset Management gold portfolio manager Charles Oliver tells the Sprott Money News' Jeff Rutherford that China is well on its way to taking control of the monetary metal's price-determination mechanisms and building its gold reserves to a much higher level. The interview is 9 minutes long and can be heard at Sprott Money News here: http://www.sprottmoney.com/sprott-money-weekly-wrap-up CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Canadian Investor Conference http://cambridgehouse.com/event/31/canadian-investor-conference-toronto-... New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Arbitration awards $740 million to Gold Reserve for expropriation by Venezuela Posted: 23 Sep 2014 05:27 AM PDT By Alexandra Ulmer CARACAS, Venezuela -- The International Centre for Settlement of Investment Disputes determined Venezuela must pay U.S.-based miner Gold Reserve $740.3 million for terminating its Las Brisas gold concession, the company said on Monday. Socialist-run Venezuela in 2009 formally ended the concession in one of Latin America's largest gold deposits as part of a strategy to increase state control of key economic sectors. Gold Reserve then sought $2.1 billion in damages at the World Bank's ICSID for what it deemed an expropriation. ... ... For the remainder of the report: http://www.reuters.com/article/2014/09/23/venezuela-arbitration-idUSL3N0... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Canadian Investor Conference http://cambridgehouse.com/event/31/canadian-investor-conference-toronto-... New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Macro View and the Stock Market Posted: 23 Sep 2014 01:06 AM PDT Last week we noted that Uncle Buck would be front and center in the analysis, not because the strength in the (anti-market) currency was not expected (it was), but because our big picture theme of an ongoing economic contraction had remained intact (ref: gold vs. commodities ratio) over the long-term. It is important here to remember that NFTRH would only be on its big picture macro themes as long as indictors implied they are still viable. I will be damned if I will let us follow a Pied Piper off an ideological cliff, no matter what readers (including me) might want to hear. We must dedicate to know what is happening, not what our hopes, dreams, egos, etc. think or worse, hope will happen. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold, the Fed and the Looming Stock Market Correction Q&A Posted: 23 Sep 2014 12:49 AM PDT Shah Gilani writes: My mailbox is still bulging with all your questions about everything I’ve been writing about recently. So I’m delving back in today to answer a few more. Last week, I took on your “looming catastrophes” and “what-if” scenarios and told you what I would do – and what I hope our leaders in Washington and Wall Street will do. (Don’t hold your breath…) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Can Gold Act as a Safe Haven Again? Posted: 23 Sep 2014 12:46 AM PDT PI Financial mining analyst Christos Doulis says six years ago when the financial crisis was in full swing, safe-haven buying made gold skyrocket. Today, the fear component is down, as is the price of gold. That is why Doulis believes investors need to own bulletproof, low-cost names that can survive this environment. In this interview with The Gold Report, Doulis discusses some M&A possibilities and points to management teams getting the most out of their low-cost precious metals assets. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Destroying the U.S. Dollar a Penny at a Time Posted: 23 Sep 2014 12:33 AM PDT Mike Finger writes: A recent article on the Wall Street Journal's blog draws attention to the high cost of producing a single penny - 1.6 cents each, to be exact. They blame this unsustainable price on the high cost of zinc, which makes up 97.5% of every American penny. The online publication Quartz ran with this story, giving it a new headline: "It costs 1.6 cents to make one penny because of the rising price of zinc". Time for a short economics lesson. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Sep 2014 11:14 PM PDT When someone tries to corner a commodity, he makes use the anonymous nature of futures trading. The person accumulates a large position that calls for delivery in a particular month and waits until the delivery date. The person on the other side of the futures trade has the contractual obligation for delivery, but most of the time the contracts are settled beforehand. This is not the case when someone tries to corner the market. The buyer of the contracts waits until very close to the delivery date and states that he wishes to take delivery. The party who is committed to make the delivery must now choose to either pay the charges for delivery or buy back the contracts at a large premium. This can be a sleazy move. Probably one of the most famous stories of cornering a market gone wrong is the Hunt Brothers and their quest for silver dominance. In 1979, Nelson Bunker Hunt and William Herbert Hunt, sons of Texas billionaire H.L. Hunt, attempted to corner the silver market. By 1980, they amassed half of the world’s deliverable silver supply, causing the price to rise from $1.95 per ounce to $49.50 per ounce. This brought everyone out of the woodwork. Old mines were revived, silver coins were being melted down, and Grandma’s silverware was being peddled. Things were still going well for the Hunts… until “Silver Thursday.” On Thursday, March 27, 1980, a sharp fall in silver prices caused worldwide panic, and the Hunts were hit with a $100 million margin call. Silver prices dropped by 50%, and the Hunts were unable to come up with the dough. Nelson was forced to declare bankruptcy and was subsequently convicted for manipulating the market. He famously told his sister, “I was just trying to make some money.” You would think cornering markets is something of the past, considering how large and global the commodities market is. But this hasn’t stopped traders in their crazy quest. Not surprisingly, those who have tried have failed spectacularly. One trade that comes to mind is that of Brian Hunter, who went from small-time Albertan to one of the most envied traders on Wall Street. In 2005, Brian Hunter was on top of his game and one of the world’s top traders, ranking 29th out of 100 on a list published by the now defunct Trader Monthly. Hunter, 32 at the time, was paid out in an estimated $100 million and generated over $1 billion in profits for his fund, Amaranth Advisors, betting on natural gas futures. Just one year later, Brian Hunter made the news again, this time for losing a staggering $6.5 billion and earning the honor of having the greatest trading loss of all time (it has since been topped twice over during the 2008 financial crisis). He rocked the financial world and earned himself a permanent spot in the history books. As it happens, Brian Hunter can teach us some lessons to apply to our investment strategy. Lesson 1: The natural gas markets are unpredictable. A host of factors can move natural gas prices, and these factors can work in concert or alone. One is seasonality: demand for gas typically peaks during cold winter months, with another, smaller peak in summer when air conditioners are working hard. Another factor, particularly in the United States, has traditionally been hurricane season. In fact, hurricane season is largely how Brian Hunter made such a killing in 2005—specifically, Hurricanes Katrina and Rita, the epic one-two punch that knocked down gas production in the Gulf of Mexico from about 10 to 4 billion cubic feet per day (bcf/d). Ironically, the hurricane season is also what brought Hunter down. In May 2006, US meteorologists predicted another “very active” season, with eight to ten hurricanes. The trader figured he could reprise his performance the previous year, and he was confident enough to leverage his positions heavily—that is, he used a lot of borrowed money to place his bets. As the summer wore on, however, the hurricane season was proving to be an unusually quiet one, and storage levels of natural gas—another factor that influences price—were rising. By late September, the price had plummeted, nearly halving its value in three months. Amaranth was bleeding money, as the fund’s margin requirements—the money its lenders could ask to back its positions—ballooned with every stumble in price. Lesson 2: Choose carefully the data on which you base your investment decisions. Depending on some numbers is a gamble. Take Hunter’s bet that the 2006 hurricane season would generate the storms to boost natural gas prices: he based his position on data he couldn’t analyze directly—the meteorological prediction of eight to ten hurricanes, with at least a few of Category 3 or higher. As it turned out, not a single hurricane that year blew ashore in the United States. Before we recommend a company to invest in, we put it through the analytical wringer based on the Casey 8 Ps: People, Property, Phinancing, Paper, Promotion, Politics, Push, and Price. Instead of just tracking how the stock has performed in past and current market conditions, we dig deep into what makes it move, what could make it move, and why. If a company makes it through this kind of direct, nuts-and-bolts analysis, we’re confident that we’ve gleaned the best insights possible into its prospects as a moneymaker for us. One company has done just that, and made it past all our investment filters. We know the management team very well, and everything they told us was confirmed through our research and analysis. On September 5, 2014, we recommended a company in the Casey Energy Report, and we’re now sitting on a 100% gain (those who follow the world of energy will remember that it was a 75% gain just last week). There is a reason why this company is Doug Casey’s biggest bet of the year… and why we’re still pounding the table. From our numbers, there is significantly more room for the stock to run up. To find out what stock this is, sign up for the Casey Energy Report at no risk with our full money-back trial guarantee. If you don’t like the portfolio or don’t make money on it—or our superstar pick—over the first three months, just cancel your subscription and we’ll issue a prompt refund, no questions asked. We’re that confident. Sign up today to start getting outsized profits in the energy sector. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Sep 2014 11:00 PM PDT I'm convinced – we can't escape debt and taxes. Essentially all currency is created as debt, and our financial system creates more debt and more currency into circulation every day. Taxes are... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Much Further Can Gold Fall? Posted: 22 Sep 2014 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

When I landed at Addis Ababa airport in Ethiopia again last month, the first thing that struck me was how much everything was… Chinese. Far and away, most of the passengers at the airport arriving from various destinations were Chinese. Many of the signs were in Chinese. There were even some Mandarin-speaking hotel operators standing by to assist travelers. Granted, Chinese investment plays a very dominant role in Africa, and those countries are adapting. But more importantly, it's a sign of the times. China's growing influence cannot be ignored. The country is coming to dominate international finance. Geopolitics. Oil. Consumer items. And now travel.

When I landed at Addis Ababa airport in Ethiopia again last month, the first thing that struck me was how much everything was… Chinese. Far and away, most of the passengers at the airport arriving from various destinations were Chinese. Many of the signs were in Chinese. There were even some Mandarin-speaking hotel operators standing by to assist travelers. Granted, Chinese investment plays a very dominant role in Africa, and those countries are adapting. But more importantly, it's a sign of the times. China's growing influence cannot be ignored. The country is coming to dominate international finance. Geopolitics. Oil. Consumer items. And now travel. Putin kicked out the Rothschild bankers from his country. Putin interrupted the USGovt heroin trade supply routes out of Afghanistan. Like Abraham Lincoln 150 years ago, the elite banker chambers wish to remove Putin and to suppress Russia, but the sprawling nation has joined at the hip with China. Thus Russia cannot be isolated any more than a bear can be bear hugged. The nation spans 12 time zones and is a top supplier of numerous important commodities. The Russia & China bond is growing and will result in a marriage, the consummation being a baby called the Gold Trade Standard.

Putin kicked out the Rothschild bankers from his country. Putin interrupted the USGovt heroin trade supply routes out of Afghanistan. Like Abraham Lincoln 150 years ago, the elite banker chambers wish to remove Putin and to suppress Russia, but the sprawling nation has joined at the hip with China. Thus Russia cannot be isolated any more than a bear can be bear hugged. The nation spans 12 time zones and is a top supplier of numerous important commodities. The Russia & China bond is growing and will result in a marriage, the consummation being a baby called the Gold Trade Standard. While it's true that the entire financial system is rigged today, some markets are manipulated more than others. This is certainly true for the precious metals… particularly SILVER. This metal is the whipping boy of the Fed and Cartel Bullion Banks. Most would believe manipulation of a metal for decades is impossible.. it isn't.