saveyourassetsfirst3 |

- The Bullion Banks are Literally Arming Stackers with Greater Firepower

- Junior gold producer under the radar

- Gold at ideal day for medium term cycle turn (Sept 23rd)

- Must-see: The UNBELIEVABLE reason your health insurance plan could be cancelled

- Gold Resistance at 1240; Support at 1206

- Pinion Uncovered: The Next Open-Pit in Nevada?

- PM Fund Manager: When Manipulation Ends, Gold Will Snap Higher Than Anyone Can Imagine

- Indian authorities set up airport intelligence wing to tackle gold smuggling

- Metals market update for September 23

- Gold American eagle coins soar

- Indian gold retail group focuses on international markets

- Preparing for the Full Force of Reality

- Zeal: Cheap Gold Stocks’ Upleg Intact

- Gold Bounces on Syrian Air Strike News

- BO POLNY: Treasure the Moment as Summer Ends!

- The Collapse Of U.S. Silver Stocks As Public Debt Skyrockets

- Jim Willie: The Crash Heard Round the World- Saudis to Reject USD for Oil Payments

- Gold, Silver Bullion Coin Sales Robust Despite Sell Off

- Gold, Silver Bullion Coin Sales Robust Despite Sell Off

- BO POLNY: Treasure the Moment as Summer Ends!

- Sneaking it anyway: When it's taboo to buy gold in India

- Silver to $14/oz, but discounting QE end - analysts

- Technical picture for gold remains weak - Phillips

- Silver prices near a floor, attractive to investors: ETFS

- Gold reaching blast off position for new highs

- Has The Gold Price Drop Ran Its Course?

- Eight King World New Blogs/Audio Interviews

- Koos Jansen: Chinese gold demand rises 5 percent as international exchange opens

- Is World Gold Council's CEO angling for a tin-foil hat?

- Russia central bank buys more gold and builds bilateral trade with China

- Hugo Salinas Price: The tribute the world pays to the empire

- Established rivals may keep Shanghai trade zone's gold exchange in check

- New Gold Fix Planned By LBMA In Desperate Attempt to Maintain Status Quo

- U.K.'s Royal Mint's Tip for Investors: Go for Gold

- Gold price suppression covered fully by GATA secretary treasurer Chris Powell on 'The Larry Parks Show'

- Is the World Gold Council’s CEO Angling For a Tin-Foil Hat?

- Crude Oil Recovers On China PMI Beat, Gold Firmer Ahead Of US Data

- sept 22/record level of Open Interest on silver (176,501 contracts)/Gold rises/silver falls/ GLD falls by 1.79 tonnes to 774.65 tonnes/Shanghai brings in another huge 41 tonnes/silver still in backwardation

- This Is About As Good As Things Are Going To Get For The Middle Class – And It’s Not That Good

- Polar Vortex to Return This Winter Thanks to Massive Volcanic Eruptions?

- Has The Gold Price Drop Run Its Course?

- Gold and Silver vs Debt and Taxes

- Corn Conditions Hold Steady; Beans Dip Ever so Slightly

- Can gold act as a safe haven again?

- Alasdair Macleod Breaks Down The End of Tapering and Government Funding

- Why Isn’t Housing A Bubble?

- The Geopolitics of World War III

- What resource “superstar” Frank Giustra is thinking today

- Top 5 Buys at the Bottom

| The Bullion Banks are Literally Arming Stackers with Greater Firepower Posted: 23 Sep 2014 01:00 PM PDT The Banks are Literally Arming us with Greater Firepower Remember all the way back in April 2011, when price action was getting really fun, and stackers were feeling all-powerful? Silver was literally moving up $1 a day, for crying out loud! For weeks! JP Morgan was running for the hills, we were literally unbeatable, right? […] The post The Bullion Banks are Literally Arming Stackers with Greater Firepower appeared first on Silver Doctors. |

| Junior gold producer under the radar Posted: 23 Sep 2014 12:41 PM PDT A profitable TSX-V junior gold producer with an operating gold mine in Botswana that has been largely off the radar for a couple of years as has had no need to raise capital. |

| Gold at ideal day for medium term cycle turn (Sept 23rd) Posted: 23 Sep 2014 11:45 AM PDT Commodity Trader |

| Must-see: The UNBELIEVABLE reason your health insurance plan could be cancelled Posted: 23 Sep 2014 11:37 AM PDT From Mike “Mish” Shedlock at Global Economic Trend Analysis: There are lots of reasons why your health care plan may have been cancelled but this one is arguably the most bizarre. Please play the video or the following discussion will not make much sense. I am automatically skeptical of such videos and articles. So I did some digging. It appears the video has it right. “De Minimis Variation“ PDF page 36 of 40 of Federal Register, Vol. 78, No. 37 / Monday, February 25, 2013 / Rules and Regulations, spells things out nicely. § 156.140 Levels of coverage. (a) General requirement for levels of coverage. AV, calculated as described in § 156.135 of this subpart, and within a de minimis variation as defined in paragraph (c) of this section, determines whether a health plan offers a bronze, silver, gold, or platinum level of coverage. (b) The levels of coverage are: (1) A bronze health plan is a health plan that has an AV of 60 percent. (2) A silver health plan is a health plan that has an AV of 70 percent. (3) A gold health plan is a health plan that has an AV of 80 percent. (4) A platinum health plan is a health plan that has as an AV of 90 percent. (c) De minimis variation. The allowable variation in the AV of a health plan that does not result in a material difference in the true dollar value of the health plan is +- 2 percentage points. Outside of the video, the above obscure government doc was the only place I found an accurate discussion of bronze, silver, gold, and platinum ranges. Since I did not have the term “de minimis variation” in my search, it took me a while to find that doc. As Typically Presented Most sites offer woefully inadequate explanations. For example, Medical Mutual accurately defines Actuarial Value (AV) as “the percentage of total spending on Essential Health Benefits (EHBs) that is paid by the health plan,” yet, falls woefully short in describing the various metals as follows.

That is what we have come to believe, and similar explanations appear on numerous healthcare sites. Ten percent ranges seem reasonable, but they are against the law. Health Insurance AVs

Range Analysis

Competition Not If for any reason, health care providers do not want to modify pre-existing plans that are just outside the acceptable ranges, their only option under the law is cancellation. The legislation guarantees “If you like your plan, you may not be able to keep it.” What reason might insurers have to cancel plans? Thanks to ACA, the providers all have captive audiences. They all understand that no other provider can offer a plan in anything but the 16 of the 100 possible ranges. If a plan outside one of the allowed ranges makes a smaller percentage profit than something inside one of the ranges, there is a huge incentive for providers to simply dump the plan. And Obamacare was supposed to increase competition! |

| Gold Resistance at 1240; Support at 1206 Posted: 23 Sep 2014 10:39 AM PDT |

| Pinion Uncovered: The Next Open-Pit in Nevada? Posted: 23 Sep 2014 10:10 AM PDT Gold Standard Ventures Corp. published its eagerly awaited maiden NI43-101 resource estimate for its 100% owned Pinion Deposit, which is located on the prolific Carlin Trend in Nevada. The results exceeded expectations of management and the market, |

| PM Fund Manager: When Manipulation Ends, Gold Will Snap Higher Than Anyone Can Imagine Posted: 23 Sep 2014 10:00 AM PDT I honestly do not know the extent to which the western Sicilian Mafia-like elitists can continue their manipulation of the gold and silver markets using unbacked paper gold/silver. No one really knows. I do truly believe that the action we're seeing now reflects extreme desperation by the Fed/DC to keep a lid on the price […] The post PM Fund Manager: When Manipulation Ends, Gold Will Snap Higher Than Anyone Can Imagine appeared first on Silver Doctors. |

| Indian authorities set up airport intelligence wing to tackle gold smuggling Posted: 23 Sep 2014 09:40 AM PDT The Indian Customs authorities have set up special security wing at Ahmedabad City Airport to curb the rising incidents of gold smuggling. |

| Metals market update for September 23 Posted: 23 Sep 2014 09:13 AM PDT Gold fell $2.30 or 0.19% to $1,215.30 per ounce and silver slipped $0.09 or 0.5% to $17.81 per ounce yesterday. |

| Gold American eagle coins soar Posted: 23 Sep 2014 09:12 AM PDT Despite the recent bout of price weakness, gold American eagle coin sales from the U.S. Mint have picked up significantly from last month. |

| Indian gold retail group focuses on international markets Posted: 23 Sep 2014 09:04 AM PDT Tara Jewels, the renowned jewelry brand in India, expressed the hope that the upcoming festive season demand would give significant boost to domestic sales. |

| Preparing for the Full Force of Reality Posted: 23 Sep 2014 09:00 AM PDT It's always about preparing – especially when the writing is on the wall… It’s not about hoping for some worst case scenario. It's always about preparing – especially when the writing is on the wall and we are far past the point where further intervention can bring us back. When reality comes in, it arrives […] The post Preparing for the Full Force of Reality appeared first on Silver Doctors. |

| Zeal: Cheap Gold Stocks’ Upleg Intact Posted: 23 Sep 2014 08:00 AM PDT Gold stocks have plunged in September, crushed by the withering selling pressure from heavy futures shorting hammering gold. As usual, these falling prices have kindled extreme bearishness on this left-for-dead sector. But despite this rotten sentiment, gold stocks' young upleg remains very much intact technically. This impressive resiliency is fueled by these miners' incredibly-cheap fundamental […] The post Zeal: Cheap Gold Stocks’ Upleg Intact appeared first on Silver Doctors. |

| Gold Bounces on Syrian Air Strike News Posted: 23 Sep 2014 07:45 AM PDT Looks like the news of air attacks in portions of ISIS-controlled Syria has been enough to spook some of the shorts in gold. After a ferocious wave of short-covering, gold has given back most of its gains for now. After a near relentless decline, it was perhaps to be expected that any sort of news which might generate some safe-haven buying would run some shorts out of the market. However, in watching the price action at this point, it does seem that any rallies are going to be viewed as selling opportunities. Geopolitical events are always good ( generally speaking ) for bounces in gold but tend to flame out as quickly as they begin. We'll watch for now but even the Dollar is barely moving lower. Traders ( except those with the most shortest time frame ) are looking past the current geopolitical concerns and focused almost exclusively on the strong Dollar and interest rate differential advantage it possesses. |

| BO POLNY: Treasure the Moment as Summer Ends! Posted: 23 Sep 2014 07:29 AM PDT

Click here for more from Bo Polny on the gold/silver BOTTOM in progress: |

| The Collapse Of U.S. Silver Stocks As Public Debt Skyrockets Posted: 23 Sep 2014 07:00 AM PDT The U.S. Empire is in real trouble. While it's true that the gold and silver market have taken a lot of punishment over the past several years, there's a good reason China, India and Russia continue to add to their gold hoards. The day will come when an AVALANCHE of countries exiting the Dollar will […] The post The Collapse Of U.S. Silver Stocks As Public Debt Skyrockets appeared first on Silver Doctors. |

| Jim Willie: The Crash Heard Round the World- Saudis to Reject USD for Oil Payments Posted: 23 Sep 2014 06:00 AM PDT Putin kicked out the Rothschild bankers from his country. Putin interrupted the USGovt heroin trade supply routes out of Afghanistan. Like Abraham Lincoln 150 years ago, the elite banker chambers wish to remove Putin and to suppress Russia, but the sprawling nation has joined at the hip with China. Thus Russia cannot be isolated any more […] The post Jim Willie: The Crash Heard Round the World- Saudis to Reject USD for Oil Payments appeared first on Silver Doctors. |

| Gold, Silver Bullion Coin Sales Robust Despite Sell Off Posted: 23 Sep 2014 05:12 AM PDT The U.S. Mint is unusual in that its gold and bullion coin sales figures are updated very frequently and, as far as possible, the figures include sales activity in the most recent week or previous week.

Other government mints such as the Royal Canadian Mint and the Royal Mint in Britain do not have such real time bullion sales reporting. Publically available bullion coin sales data from these institutions has to be sourced from their quarterly, half yearly and annual report updates. However, in Australia, the Perth Mint does release monthly data on gold and silver coin and bar sales with a one month lag. Data for August shows gold sales stronger at 36,369 ozs compared to 25,103 ozs in July, with silver sales also up strongly at 818,856 ozs compared to 577,988 ozs in July.

Despite the recent bout of price weakness, gold American eagle coin sales from the U.S. Mint have picked up significantly from last month. The latest bullion coin sales figures from the U.S. Mint show a tentative pickup and robust retail bullion demand, with September sales stronger for both the American Eagle and American Buffalo gold coins as well as for the American Eagle silver 1oz coins. U.S. Mint Gold Buffalo Bullion Coin (1 oz) Month-to-date for September, gold Eagle sales across all coin sizes have already reached 43,200 oz compared to total gold Eagle sales of 25,000 oz in August. This is also well ahead of September 2013, when total gold Eagle sales for the month only touched 13,000 oz. Year-to-date American Eagle sales have now reached 364,200 oz. Gold American Buffalo 1 oz sales so far this month have reached 10,500 oz, up from 8,000 oz in August, and 5,500 oz in July. With a strong first quarter, year-to-date American Buffalo sales are now running at a cumulative 135,500 oz for 2014. Taken together, U.S. Mint gold Eagle and Buffalo sales for 2014 have now reached 500,000 troy oz, or 15.5 tonnes. While this gold total falls short of the 1.1 million ozs of gold coins sold by the US Mint in 2013, if Q4 of 2014 continues the trend seen in Q3, then total gold sales by the Mint could reach just shy of 700,000 oz for all of 2014, which demonstrates an element of resilience in the face of the ongoing gold price weakness.

U.S. Mint Silver Eagle (1 oz) Silver American Eagle 1 oz sales are also stronger for the month-to-date, at 2.42 million ozs compared to 2.0075 million ozs for the full month of August. While these monthly totals are weaker than the monthly sales in August and September 2013, which came in at 3.625 million ozs and 3.103 million ozs respectively, the year-to-date silver total for 2014 is running at a relatively strong 30.53 million ozs, and if the trend continues, silver sales may finish 2014 in the region of 40 million ozs which compares well with the 2013 silver sales total of 42.675 million ozs. This is because although 2013 silver sales has a very strong start compared to 2014, this year has seen relatively strong sales across most months. The U.S. Mint is unusual in that its gold and bullion coin sales figures are updated very frequently and, as far as possible, the figures include sales activity in the most recent week or previous week.

Other government mints such as the Royal Canadian Mint and the Royal Mint in Britain do not have such real time bullion sales reporting. Publically available bullion coin sales data from these institutions has to be sourced from their quarterly, half yearly and annual report updates. However, in Australia, the Perth Mint does release monthly data on gold and silver coin and bar sales with a one month lag. Data for August shows gold sales stronger at 36,369 ozs compared to 25,103 ozs in July, with silver sales also up strongly at 818,856 ozs compared to 577,988 ozs in July. Overall, the U.S. Mint bullion sales figures, due to their real-time nature, are used extensively in the industry as a proxy for retail gold and silver investor sentiment, and are even included in a number of well known bullion bank commodity and precious metals research reports. While extrapolating the U.S. Mint figures to other Mint bullion sales requires caution, the sales trends of the U.S. Mint tend to be confirmed when quarterly data from the Mint’s main competitors is put into the public domain. MARKET UPDATE Gold fell $2.30 or 0.19% to $1,215.30 per ounce and silver slipped $0.09 or 0.5% to $17.81 per ounce yesterday. Spot gold in Singapore was 1,215.56 per ounce and Asian stocks finished mixed on Tuesday following the release Chinese factory data (PMI). Trading was quiet as Japan was closed for a holiday but in London, gold rallied from an eight-month low as investors digested the news of air-strikes in Syria. Silver gained from the lowest price in four years. The U.S. and its Arab allies launched a strategic air strikes against Islamic State positions in Syria. Heightened geopolitical risk was highlighted when Israel shot down a Syrian fighter jet. The U.S. dollar’s recent bullish run has added to the pressure on commodity prices. As has concerns about the debt laden, global economy. Market sentiment that the U.S. Federal Reserve would increase interest rates sooner than expected is also hurting the gold price. COMEX gold and silver contracts are the most active they have been in months. Gold will be driven by demand from China and India, which seasonally ramps up from September ahead of festive periods and the wedding season. Gold's recent price decline kept its 14 day relative strength index (RSI) under 30 for 8 days, which to technical chartists would signal as a possible rebound. by Ronan Manly , Edited by Mark O'Byrne Sign Up For Breaking News And Research Here |

| Gold, Silver Bullion Coin Sales Robust Despite Sell Off Posted: 23 Sep 2014 05:02 AM PDT gold.ie |

| BO POLNY: Treasure the Moment as Summer Ends! Posted: 23 Sep 2014 05:00 AM PDT Is there anything SPECIAL about this week? Summer officially ends September 21, 2014 and September 22, 2014 is the First Day of Fall — In More Ways than One! Sept. 22 is known among aficionados of various and arcane market indicators as the day pinpointed by the late technical analyst, W. D. Gann, when markets […] The post BO POLNY: Treasure the Moment as Summer Ends! appeared first on Silver Doctors. |

| Sneaking it anyway: When it's taboo to buy gold in India Posted: 23 Sep 2014 04:57 AM PDT Pitru Paksha is upon us, a time when it is considered bad form to make deals of any sort. But times are changing. |

| Silver to $14/oz, but discounting QE end - analysts Posted: 23 Sep 2014 04:54 AM PDT Analysts weigh in on the direction of silver with some pointing to lower prices, possibly over-accounting for the predicted end of QE by the U.S. Fed. |

| Technical picture for gold remains weak - Phillips Posted: 23 Sep 2014 04:53 AM PDT Julian Phillips says the technical picture for gold still remains weak, but is now starting to bounce off support above $1,200. |

| Silver prices near a floor, attractive to investors: ETFS Posted: 23 Sep 2014 02:57 AM PDT Precious metals remains under pressure on strong US dollar and the US FOMC meeting shifted the foucs to the timing and scale of future US interest rate hikes. |

| Gold reaching blast off position for new highs Posted: 22 Sep 2014 11:10 PM PDT The time to buy is when a price is low in its cycle and not when it is high. Gold is in that position now. Joe Foster, portfolio manager at Van Eck Global, says now is the time to buy into the gold market and explains why he believes further gains are in store for the precious metal… |

| Has The Gold Price Drop Ran Its Course? Posted: 22 Sep 2014 11:10 PM PDT goldsilverworlds |

| Eight King World New Blogs/Audio Interviews Posted: 22 Sep 2014 11:10 PM PDT 1. John Embry: "The Wild Action in Gold, Silver and Other Markets" 2. Michael Pento: "It's Terrifying to Look at What's Really Happen in the U.S." 3. David P: "Despite Pressure, is Silver Ready to Turn Mega-Bullish?" 4. Robert Fitzwilson: "Western Vampire Machine Waging War Against Russia and China" 5. James Turk: "Two Shocking Charts Expose the Stunning Collapse in the U.S." 6. Richard Russell: "The Grim and Devastating Tragedy of America" 7. The first audio interview is with Bill Fleckenstein----and the second audio interview is with Nigel Farage. [Please direct any questions or comments about what is said in these interviews by either Eric King or his guests to them, and not to me. Thank you. - Ed] |

| Koos Jansen: Chinese gold demand rises 5 percent as international exchange opens Posted: 22 Sep 2014 11:10 PM PDT China's gold demand, the off take from the Shanghai Gold Exchange for the most recent week reported, rose nearly 5 percent as China bought the dip, gold researcher and GATA consultant Koos Jansen writes. Jansen also reports the comments made at the opening ceremony of the exchange's international subsidiary, where the governor of the People's Bank of China said that China wants to become a major force in gold pricing. This article appeared on the bullionstar.com Internet site early on Saturday morning Singapore time---and I found it embedded in a GATA release. |

| Is World Gold Council's CEO angling for a tin-foil hat? Posted: 22 Sep 2014 11:10 PM PDT MineWeb's Lawrence Williams reports an interesting comment by the World Gold Council's chief executive, Aram Shishmanian, about the opening of the international subsidiary of the Shanghai Gold Exchange. "The growth of the Shanghai Gold Exchange to become the world's largest physical gold exchange provides compelling evidence that the future for gold is physical," Shishmanian said. "As the market shifts from west to east, the expansion of strong gold trading hubs in Asia will improve price discovery, liquidity, transparency, and efficiency, all of which will transform the landscape of the global gold market." So, then, does the World Gold Council believe after all that the present gold market is not really physical and transparent at all but rather shadowy and highly manipulated by derivatives and that, as a result, price discovery needs to be improved? That kind of talk could sound like an application for a tin-foil hat. Williams should ask Shishmanian whether he wants one. We here at GATA's tin-foil hat factory would be delighted to oblige. The rest of this commentary by Chris Powell, along with the mineweb.com story from Lawrie, falls into the must read category---and it was posted on the gata.org Internet site on Saturday. |

| Russia central bank buys more gold and builds bilateral trade with China Posted: 22 Sep 2014 11:10 PM PDT While we will probably have to wait another few days until the IMF publishes its latest statistics for the global picture, the Russian central bank has announced that it has added another 9.3 tonnes of gold to its official gold reserves. This is as tensions now seem to be diminishing in Ukraine which could, if the latest agreement holds, lead to Western sanctions against Russia being gradually withdrawn. Russian gold reserves now stand at 1,113.5 tonnes, the world’s fifth largest national holding, thus climbing even further above China’s 'official' 1,054 tonnes. However few out there seem to believe that China doesn’t have more gold than it announces to the IMF, but is holding considerable amounts in some other government controlled accounts. Overall Russia has just about doubled its gold reserves since the 2007/2008 financial crisis and its central bank has been a net buyer almost every month since. The figures suggest that that the monthly increases have primarily come from the central bank taking in a significant proportion of the country’s domestic gold output which averaged around 20 tonnes a month in 2013; last year Russia was the world’s third largest producer of gold and this year could surpass Australia and move into the No. 2 position behind China. Russia, like China, perhaps somewhat belatedly, has come to see its gold holdings as a significant positive in any new world financial order that may develop over the next decade. American financial policy has dominated world trade for almost a century but there are powerful economic forces out there – notably involving various countries, including China and Russia, building trade ties in their own domestic currencies and thus starting to bypass the dollar. Energy trade is particularly significant in this respect as the U.S. dominance in setting the terms of world trade has been very much down to the virtually total dominance of the dollar in global oil and gas transactions. Historically the country with the most gold has been able to dominate global trade – barbarous relic or no – and while the West may see this coming to an end there is an enormous, and ever wealthier, part of the world’s population which still believes in gold as the key global monetary asset. China and Russia are both strong believers in gold and the potential negotiating position it enables. At some stage soon the validity of their belief is going to be put to the test. Here's another commentary from Lawrie. This one was posted on the mineweb.com Internet site on Monday sometime---and I thank West Virginia reader Elliot Simon for pointing it out. It's certainly worth reading as well. |

| Hugo Salinas Price: The tribute the world pays to the empire Posted: 22 Sep 2014 11:10 PM PDT In his latest commentary Hugo Salinas Price, president of the Mexican Civic Association for Silver, explains how foreign exchange surpluses kept in the bonds of countries that issue reserve currencies are actually the tax or tribute lesser countries pay to the empires that dominate them. Countries that hold such bonds in exchange for their exports have not really been paid and never will be paid, Salinas Price writes. In the old days, he adds, exporting nations could be paid by exchanging fiat currencies for gold. His commentary is headlined "The Tribute the World Pays to the Empire" and it's posted at the civic association's Internet site, plata.com.mx---and I found all of the above in a GATA release on Sunday. I can't get this website to load on either my home computer, or my laptop. So if it doesn't work for you, there's nothing I can do to help. |

| Established rivals may keep Shanghai trade zone's gold exchange in check Posted: 22 Sep 2014 11:10 PM PDT China's launch of an international gold exchange in the Shanghai Free-Trade Zone 11 days ahead of schedule last week, may not be much help as it seeks to compete with established gold markets such as New York, London or Singapore. While China is the largest physical gold consumer in the world, the financial infrastructure may lag that of Singapore and Hong Kong in handling a gold market. Gold traders believe the gold market in the FTZ would attract domestic and foreign investors to trade, but catching up with the major international players will not come quickly. This gold-related news item showed up on the South China Morning Post website in the wee hours of Monday morning local time---and it's another item I found on the gata.org Internet site. |

| New Gold Fix Planned By LBMA In Desperate Attempt to Maintain Status Quo Posted: 22 Sep 2014 11:10 PM PDT The London Bullion Market Association (LBMA) is quietly planning its new gold fix in a desperate attempt to maintain the status quo. Reuters reported Friday that according to the LBMA, there are at least 15 companies interested in running the upcoming replacement to the London ‘Gold Fixing’ auction. Like the recently introduced replacement to the ‘Silver Fixing’ which is now being run by the CME Group and Thomson Reuters, the LBMA has appointed itself as the coordinator for a new London Gold Price auction and is currently soliciting Requests for Proposals (RfPs) from interested parties. When the new silver fixing auction was being debated in the summer, the World Gold Council (WGC) took the initiative and organised a conference of gold market participants including miners and refiners to work out the key features of a new gold price auction. This WGC initiative appears to have been shot down by the LBMA who felt threatened that a gold mining representative organisation was muscling in on the London gold ‘price discovery’ mechanism. In advance of the LBMA choosing the winning bid, which may well be CME Group/Thomson Reuters again, the LBMA will be holding another seminar for ‘market participants’ that will feature presentations from the short-listed candidates. This article appeared on the Zero Hedge website at 4:15 p.m. Sunday afternoon---and I thank reader Harry Grant for sending it our way. |

| U.K.'s Royal Mint's Tip for Investors: Go for Gold Posted: 22 Sep 2014 11:10 PM PDT It has provided gold coins for kings, queens, and governments for hundreds of years, but the Royal Mint is opening its services to the public with a new trading website. It is encouraging members of the public to become gold investors, claiming that the precious metal is now "relatively affordable." It is hoped that the website will convince everyday investors to buy bullion coins struck in gold or silver directly from the Royal Mint, after previously being put off by the complexity of investing. This article put in an appearance on the telegraph.co.uk Internet site at 11:33 p.m. BST on their Sunday evening---and this is another gold-related item I found in a GATA release. |

| Posted: 22 Sep 2014 11:10 PM PDT Thanks to the interviewer's knowledge of the issue and willingness to spend time on it, your secretary/treasurer got to cover many aspects of the Western gold price suppression scheme last week on "The Larry Parks Show," broadcast on the Manhattan Neighborhood Network in New York. Parks was so adept because he is executive director of the Foundation for the Advancement of Monetary Education. Among the aspects discussed were the U.S. government's having authorized itself to rig all markets secretly, the U.S. government documents recently disclosed showing that central banks are trading secretly in all major U.S. futures markets, the other documents GATA has compiled proving the gold price suppression scheme, why the gold mining industry refuses to do anything about it, why the scheme will keep succeeding until gold investors shun "paper gold," and the treason of the central bankers in developing countries. The interview being so comprehensive, it would be an especially good one for gold investors and anti-imperialists to recommend to government officials, financial journalists, and gold and silver company executives. The interview is 30 minutes long---and can be viewed at the Vimeo Internet site. This GATA release and embedded video easily falls into the absolute must watch category---and should be given the widest possible distribution. |

| Is the World Gold Council’s CEO Angling For a Tin-Foil Hat? Posted: 22 Sep 2014 11:10 PM PDT "Da boyz are after silver in a big way" ¤ Yesterday In Gold & SilverThe gold price rallied a hair in Far East trading on their Monday morning, but that all ended at 9 a.m. Hong Kong time as the HFT boyz and their algorithms took an eight or nine dollar slice off the golden salami. After that, the price didn't do much until shortly after 11 a.m. EDT---and the rally that began at that time got dealt with in the usual manner at one minute before noon, before it got too far into positive territory---and it wasn't allowed to close there. The low and high tick were reported as $1,208.80 and $1,221.00 in the December contract. Gold closed in New York on Monday at $1,214.80 spot, down $1.40 from Friday's close. Net volume was 131,000 contracts. Silver opened flat on Monday morning in the Far East but, like gold, the HFT traders and their algorithms showed up at 9 a.m. Hong Kong time as well---and within an hour had silver down over 50 cents. From there it rallied in fits and starts back to just above unchanged by noon in New York---and at that time met the same fate as the gold price---getting closed down on the day. The low and highs were reported by the CME Group as $17.865 and $17.325 in the December contract. Silver finished the trading session on Monday at $17.73 spot, down 6 cents from Friday's close. Net volume was a stunning 74,000 contracts. Platinum and palladium had charts very similar to the gold charts, but mini versions---and both metals, like gold and silver, were closed at a new low for this move down. Platinum was closed down 12 bucks---and palladium was closed down 9 bucks, but was briefly below $800 during the day. Here are the charts. The dollar index close late on Friday afternoon in New York at 84.78---and then climbed to its 85.85 'high' tick of the day around 11:20 a.m. EDT. From there it slid lower---and closed at 84.70, which was down 8 basis points from Friday. The gold stocks gapped down---and then stayed down for the remainder of the day, except for a small rally around noon when gold rallied as well. Even though gold made it into positive territory for a bit---and only closed down a dollar or so, the HUI closed down another 2.89%. The silver equities headed for the basement the moment that trading began in New York. The noon rally didn't last---and the stocks continued lower---and Nick Laird's Intraday Silver Sentiment Index closed down a chunky 3.64%. The CME Daily Delivery Report showed that zero gold and 220 silver contracts were posted for delivery on Wednesday. The biggest short/issuer was Jefferies by far with 188 contracts. There were about 10 long/stoppers, none which really stood out---and the link to yesterday's Issuers and Stoppers Report is here if you wish to check it out. The CME Preliminary Report for the Monday trading session showed that there are 16 gold and 387 silver contracts still open in September, from which you can subtract the 220 silver contracts in the prior paragraph. There was 57,698 troy ounces of gold withdrawn from GLD yesterday---but it was totally different over at SLV, as there was another monster deposit. This time there was 2,397,570 troy ounces were added by an authorized participant. I forgot all about Joshua Gibbons, the "Guru of the SLV Bar List" while was in San Antonio, so I'll make amends here. As of the close of trading last Wednesday, this is what he had to say: "Analysis of the 17 September 2014 bar list, and comparison to the previous week's list---4,844,010.2 troy ounces were added (all to Brinks London). No bars were removed or had a serial number change. The bars added were from: Solar Applied Materials (2.8M oz), Henan Yuguang (1.4M oz), Nordeutsche (0.3M oz), and 4 others. As of the time that the bar list was produced, it was over-allocated 594.3 oz. All daily changes are reflected on the bar list, except the 959,072.0 oz deposit last night (17 September 2014). About 2.5M oz of the deposits were bars that had been in SLV before, with another 2.3M oz of fresh bars." There was a decent sales report from the U.S. Mint. They sold 3,700 troy ounces of gold eagles---500 one-ounce 24K gold buffaloes---660,000 silver eagles---and 100 platinum eagles. There wasn't much activity in gold at the Comex-approved depositories on Friday, as only 3,407 troy ounces were shipped out---and nothing was reported received. The silver activity was off the charts once again, as 2,656,293 troy ounces were reported received, with all the action at Brink's, Inc.---CNT---and Canada's Scotiabank. Only 165,152 troy ounces were shipped out. The link to that activity is here---and it's worth a look. Nick Laird sent us this chart on the weekend. It's the weekly deliveries from the Shanghai Gold Exchange right up until September 12, 2014---and as you can tell, the chart is doing what it's supposed to, moving from lower left to upper right. I've kept the stories down to as few as possible, but there's still a lot. The final edit is yours. ¤ Critical ReadsFalling used-car prices roil the auto marketUsed-car prices are sliding, a boon to penny-pinchers, but troubling for new-car sales. The auto industry sales recovery in recent years means millions of used cars, many coming off lease, are starting to flood the market. The result is a decline in used-car prices that zoomed sky-high after the recession. And the decline is leading to talk that new-car auto sales growth may be peaking. "We're going to see a tremendous increase in used-car supply over the next couple of years," says Larry Dominique, an executive vice president of auto-pricing site TrueCar. That used-car cascade could dampen new-car sales in three ways. This is very interesting story showed up on the usatoday.com Internet site on Sunday---and the first story of the day is courtesy of reader Ward Pace. 'I had no choice,' says Sarkozy of political comebackFormer French president Nicolas Sarkozy said Sunday that he "had had no choice" but to return to politics, stating that he had never seen such "despair" in France. In a 45-minute prime time television interview on France 2, Sarkozy outlined his bid to lead the opposition UMP party and launched a scathing attack on Socialist President François Hollande.“I don’t want my country to be condemned to the humiliating state of affairs that we have today or the perspective of total isolation'' that he predicts will happen if France's far-right National Front party continues its rise. This news item appeared on the france24.com Internet site on Sunday---and it's the first offering of the day from Roy Stephens. 'Europe getting fed up with the U.S. business influence'Europeans’ anger with their governments over US-led sanctions against Russia can go “quite far” as they are fed up with US business influence helping arms exporters and NATO, but not average Europeans, former British diplomat William Mallinson told RT. RT: On Friday, French farmers in the city of Brest in Brittany set local tax office on fire, in protest against tit-for-tat sanctions with Russia. Is the Russian food ban hitting European businesses that bad, making people that desperate? William Mallinson: Yes. What we have to remember is that the EU is originally founded on the livelihood for farmers and for supplying food to Europeans. Despite the fact that there is a very large number of huge farms, in France, in particular, [there are] still a lot of small farmers. The French agriculturalists are one of the most powerful political forces in France. I remember the Poujadists in 1960-70s [a movement named after Pierre Poujade that articulated the economic interests and grievances of shopkeepers and other proprietor-managers of small businesses facing economic and social change - RT]; they are quite capable of causing major problems for the government. This article showed up on the Russia Today website at 1:32 p.m. Moscow time on their Monday afternoon---and it's the second contribution of the day from Roy Stephens. Russian sanctions 'de facto against European business' – Alstom chiefRussia has become a strategic market for thousands of European companies, and sanctions put E.U. business at risk, Philippe Pegorier, President of Alstom Russia , told RT at a Sochi Investment Forum. “Sanctions against Russia are de facto sanctions against European business,” Philippe Pegorier, President of Alstom Russia, and Chairman of the Association of European Business in Russia (AEB), the largest foreign business association in the country, told RT over the weekend at an international business forum in Sochi . “We don’t need the government or the E.U. to decide where our priorities are, for us, for many European companies, Russia is a strategy partner and we will remain a strategy partner,” he said. Pegorier has warned that sanctions against Russia could cause 300,000 layoffs in Germany and at least 100,000 in France. This is another article from the Russia Today website. This one was posted there at 3:39 p.m. Moscow time yesterday afternoon---and it's also courtesy of Roy Stephens. Moscow warns 'circles in Washington' over hindering peace process in UkraineMoscow is bewildered by Washington’s warmongering rhetoric, which accompanied President Petro Poroshenko’s visit to the U.S. Russia has also noted all the Russia-unfriendly opinions voiced recently by hawkish American politicians. “We’ll keep in mind all signals, including those unfriendly towards Russia, that were heard during the visit of the Ukrainian president to Washington,” commented Russia’s Deputy Foreign Minister Sergey Ryabkov. “We do regret that there are quite influential circles [within the American establishment] that are unambiguously working against the emerging stabilization [in Ukraine],” Ryabkov said. In short, U.S. senators urged to supply Ukraine with arms to fight against Russia and President Putin. Senator Robert Mendez, a Democrat who runs the Foreign Relations Committee told CNN, "We should provide the Ukrainians with the type of defensive weapons that will impose a cost upon Putin for further aggression." This story was also posted on the Russia Today website yesterday, just before lunch Moscow time---and my thanks go out to Roy Stephens once more. Turkish security troops clash with Kurds, as thousands flee ISISTurkey's security forces closed the border with Syria through which thousands of Kurds are trying to flee IS, after clashes between Kurds and soldiers on the Turkish side of the divide. The separatist Turkey-based Kurdistan Workers Party (PKK), which is classed as a terrorist organization by Istanbul, called for a solidarity demonstration on Sunday, after 70,000 Kurds crossed from Syria in just 24 hours. Hundreds of Kurds duly showed up near the barbed wire border fence - some volunteering to join the struggle against IS, others asking to bring over aid to the refugees on the other side of the border. This Russia Today story, filed from Moscow at 12:43 p.m. Moscow time on the their Sunday afternoon is also courtesy of Roy Stephens. Lavrov tells U.S. to respect Syria's sovereignty while tackling ISISWashington should respect the sovereignty of Syria in its attempts to deal with the Islamic state, Russia’s Foreign Minister Sergey Lavrov said in a phone call with his US counterpart, John Kerry. Lavrov and Kerry talked on Sunday at the initiative of the US Secretary of State, Russia’s Foreign Ministry said in a statement. During the conversation, the Russian FM stressed “the importance of coordinated action... by the international community aimed at countering the threat” coming from the Islamic State (IS, formerly ISIS). However, he warned against “double standards” and “distortion of facts” during the battle against the terrorist group, which has declared a caliphate in the occupied territories of Syria and Iraq. This is the final story from the Russia Today website---and the final offering of the day from Roy Stephens as well. South Africa in '$50m deal' for Russian nuclear reactorsRussia's atomic energy agency said Monday it will provide up to eight nuclear reactors to South Africa by 2023 in a $50m strategic partnership between the two countries. The delivery of the reactors will enable the foundation of the first nuclear power plant based on Russian technology on the African continent, the Rosatom agency said in a statement. Director general Sergey Kirienko estimated the value of the deal at between $40 to $50 billion, given that one reactor costs around $5 billion, according to the Itar-Tass news agency. This news item was posted on the france24.com Internet site at 7:25 p.m. Europe time on Monday evening---and I thank South African reader B.V. for sharing it with us. Eight King World New Blogs/Audio Interviews1. John Embry: "The Wild Action in Gold, Silver and Other Markets" 2. Michael Pento: "It's Terrifying to Look at What's Really Happen in the U.S." 3. David P: "Despite Pressure, is Silver Ready to Turn Mega-Bullish?" 4. Robert Fitzwilson: "Western Vampire Machine Waging War Against Russia and China" 5. James Turk: "Two Shocking Charts Expose the Stunning Collapse in the U.S." 6. Richard Russell: "The Grim and Devastating Tragedy of America" 7. The first audio interview is with Bill Fleckenstein----and the second audio interview is with Nigel Farage. [Please direct any questions or comments about what is said in these interviews by either Eric King or his guests to them, and not to me. Thank you. - Ed] Koos Jansen: Chinese gold demand rises 5 percent as international exchange opensChina's gold demand, the off take from the Shanghai Gold Exchange for the most recent week reported, rose nearly 5 percent as China |

| Crude Oil Recovers On China PMI Beat, Gold Firmer Ahead Of US Data Posted: 22 Sep 2014 11:05 PM PDT dailyfx |

| Posted: 22 Sep 2014 04:21 PM PDT |

| This Is About As Good As Things Are Going To Get For The Middle Class – And It’s Not That Good Posted: 22 Sep 2014 04:20 PM PDT

The U.S. Census Bureau has just released some brand new numbers, and they are quite sobering. For example, after accounting for inflation median household income in the United States has declined a total of 8 percent from where it was back in 2007. That means that middle class families have significantly less purchasing power than they did just prior to the last major financial crisis. And one research firm is projecting that it is going to take until 2019 for median household income to return to the level that we witnessed in 2007...

Of course that projection assumes that the economy will continue to "recover", which is a very questionable assumption at best. Meanwhile, total household wealth has been declining for middle class families as well. According to the New York Times, the "typical American household" is now worth 36 percent less than it was worth a decade ago. That is a pretty substantial drop. But you never hear our politicians (especially the Democrats) bring up numbers like that because they want us to feel good about things. So why is all of this happening? The biggest reason why the middle class is struggling so much is the lack of good jobs. As the chart posted below demonstrates, the percentage of the working age population that is actually employed is still way, way below where it was prior to the last recession... The "employment recovery" (the tiny little bump at the end of the chart) has been so miniscule that it is hardly even worth mentioning. At the moment, we still have 1.4 million fewer full-time jobs than we did in 2008 even though more than 100,000 people are added to the U.S. population each month. And a lot of the workers that have lost jobs since the start of the last recession have never been able to find a new one. According to a brand new survey conducted by Rutgers University, more than 20 percent of all workers that have been laid off in the past five years still have not found a new job. Meanwhile, the control freak bureaucrats that run this country continue to kill off small businesses. In recent years we have seen large numbers of small businesses fail, and at this point the rate of small business ownership in the United States is at an all-time low. As a result of everything that you have just read, the middle class is shrinking and dependence on the government is soaring. Today, there are 49 million Americans that are dealing with food insecurity, and Americans received more than 2 trillion dollars in benefits from the federal government last year alone. For many more statistics just like this, please see my previous article entitled "30 stats to show to anyone that does not believe the middle class is being destroyed". Without a doubt, things are not that good for the middle class in America these days. Unfortunately, the next great wave of financial trouble is rapidly approaching, and once it strikes things are going to get substantially worse for the middle class. Yes, the stock market set record high after record high this summer. But what we have observed is classic bubble behavior. So many of the exact same patterns that occurred just prior to previous stock market crashes are happening once again. And it is interesting to note that September 22nd has marked important market peaks at various times throughout history...

Could the coming months be the beginning of the next major stock market decline? Small-cap stocks are already starting to show signs of real weakness. In fact, the Russell 2000 just hit a "death cross" for the first time in more than 2 years...

None of us knows what the market is going to do tomorrow, but a lot of the "smart money" is getting out of the market right now while the getting is good. So where is the "smart money" putting their assets? In a previous article, I discussed how sales of gold bars to wealthy clients is way up so far this year. And CNBC has just reported that the ultra-wealthy "are holding mountains of cash" right now...

Why are they doing this? Are they concerned about the potential of a market crash? And if we do see another market crash like we witnessed back in 2008, what is that going to mean for the rest of us? 2008 certainly did not destroy our economy. But it did cause an immense amount of damage that we have never recovered from. Now the next wave is approaching, and most people don't even see it coming. |

| Polar Vortex to Return This Winter Thanks to Massive Volcanic Eruptions? Posted: 22 Sep 2014 03:30 PM PDT The number of volcanoes that are erupting continues to rise, and scientists cannot seem to explain why this is happening. In 2013, we witnessed the most volcanic eruptions worldwide that we have ever seen in a single year, and this increased activity has carried over into 2014. In recent months, we have seen major volcanoes roar […] The post Polar Vortex to Return This Winter Thanks to Massive Volcanic Eruptions? appeared first on Silver Doctors. |

| Has The Gold Price Drop Run Its Course? Posted: 22 Sep 2014 02:58 PM PDT The gold price dropped on Monday September 22nd to USD 1212 and EUR 942. Dollar gold is close to retest its bottom for the third time since mid-2013, a price level which was seen only in the summer of 2010. For readers seeking to understand what is going on, we are providing a comprehensive view on the gold market. We take all perspectives into account: price and chart patterns, the technical picture, sentiment, the fuures market, physical demand, gold miners, the influence of the dollar, correlation with commodities, monetary policy and inflation/deflation. We also compare several indicators with the low price points in April, June and December 2013. With 20 different charts, it should be clear that we have only used market data in our analysis. In other words, this article contains the necessary information for readers to put the current gold price decline in its right context and explain the most likely scenarios going forward. Gold price patternThe daily USD gold chart clearly shows a downtrend since its top in September 2011, with two large trading ranges. The current trading range, between USD 1180 and 1450, is about to undergo a serious test: the bottom of the trading range is being tested. In case the USD 1200 to 1180 price level does not hold, the gold market is heading (significantly) lower.

In case the gold price would trade in a lower trading range than the current one, would it mean that the bull market is over? The answer to that question primarily lies in the gold price chart of a larger timeframe. As the following chart shows, there are three long term trend uptrend lines at play, which primarily found their origin in the period between 2001 and 2004. The first of the three lines provides support at USD 1100. The price point at USD 1000 provides major support as it coincides with a local top in 2008 which was retested several times in 2009. It implies that USD 1000 – 1100 is a major support area within the secular bull market. It goes without saying that, if that area would be violated, it could invalidate the long term gold bull market.

Technical pictureFrom a technical point of view, it is quite obvious that the selling pressure is not over. Dan Norcini, professional trader for more than two decades, uses the average directional index (ADX) as a measure of a trend’s strength. The rising red ADX line and declining blue line point to a clear and strong trend. Norcini sees little in the way of further support until one gets back down to the former double bottom low near $1180. From his personal blog: “I suspect that will not hold if the Dollar index runs past 85.50. If gold does manage to get down to near $1200, Asian buying will no doubt be active but it will be insufficient to sustain the metal if Western interests become aggressive sellers. Along that line I am closing watching reported GLD holdings and to some extent, the action in the gold mining shares, which incidentally, look very heavy at the moment.” We will come back to the Dollar and the physical market later on.

As evidence on the next chart, gold’s move down to $1210/12 coincides with a couple of Fibonacci extension levels, based on gold’s rally from December 27th till the end of February. Gold’s momentum indicator shows a significantly oversold reading. However, “oversold” is not a valid timing indicator, as an asset can remain for several days or weeks oversold.

The bearish outlook would be invalidated with a closing break above USD 1240, the 78% Fibonacci level, according to Matthew Weller. Sentiment readingsAccording to Sentimentrader‘s analysis, gold has a reading of 20 on a scale to 100 and silver 30. That is low, but not as extreme as it possibly can get. Compare these readings with the bottoms of the last 18 months:

What we are trying to say is that this situation could become much worse than it is today. The gold sentiment (light blue line) over the last ten years which is shown on the following chart makes that point.

Along the same lines, is the newsletter sentiment index by Hulbert which measures gold sentiment. The red line shows that sentiment reading stands at minus 40.6%, which means that the typical gold timer is recommending that clients allocate nearly half their gold-oriented portfolios to going short the market. Marketwatch notes: “That's a particularly aggressive bet that gold will keep declining, and — at least according to contrarian analysis — these timers are unlikely to be right. As recently as last week, the HGNSI had not fallen below minus 21.9%. That was less than the lows to which this sentiment index fell last December (minus 36.7%) and in the summer of 2013 (minus 56.7%). And that, in turn, led me to conclude that contrarians were not yet ready to bet on even a short-term rally.”

Physical gold marketThe demand for physical gold is not the root cause for the drop in the gold price. We like to use the total physical gold holdings of the major gold ETF’s in the West as a proxy for the Western physical gold market. As the chart below shows, the total holdings are rather stable in 2014, even slightly increasing in Q2 of this year. So this is clearly not a catalyst for a gold price decline. Note that the GLD ETF is making up almost 40% of the holdings on the chart. Courtesy of Sharelynx.

Similar to the gold price drop of last year, the recent decline has attracted an increased number of buyers in Asia. Koos Jansen, analyst of the physical gold market in China, wrote this week: "The SGE 1 Kg Au9999 physical contract closed at 0.52 % above London spot; premiums are in an uptrend since July. This underlines strong demand for gold in China, in contrast to what western media report based on gold export from Hong Kong to the mainland, data that has lost its significance as China imports more gold directly, bypassing Hong Kong, since April."

In India, the former biggest consumer of physical gold in the world, gold demand is expected to pick up as the wedding season starts. Reuters reported that “gold demand is improving gradually and is expected to rise further in the coming months ahead of Diwali,” according to a Mumbai-based jeweller. “Sales during the first six months were weak but now it is likely to pick up,” he said. Meantime, according to Goldcore on Zerohedge, trade statistics for the month of August have shown a huge surge in gold imports compared to August of 2013. The value of gold officially imported into India in August totalled $2.04 billion, which was nearly three times more than the August 2013 figure of $739 million. The conclusion is that the ongoing gold transfer from the West to the East continues. Also, the West is not dumping its physical gold to the extent that it causes prices to decline. An equally important segment of the physical market is the wholesale gold market (think kilobars gold). As Bron Suchecki notes, premiums have come up off the floor and are moving up nicely. It caused Suchecki to have a look at the kilobar movements in COMEX warehouses which he documented in the chart below.

What the charts shows is “that deposits seem to line up with future price weakness, as bullion banks stockpile them when Asian demand is weak. The withdrawals of kilobars, certainly in January this year, foretold price strength but it is not as strong an indicator considering the late 2012/early 2013 ones. You can see that on the 2nd of September 5 tonnes came out of JP Morgan’s warehouse and that doesn’t surprise me considering the renewed interest we are seeing. Worth keeping an eye on the COMEX movements to see if more of the 26 tonnes that was deposited in August is pulled out.” COMEX gold futures market structureWithout any doubt, the most important driver of the gold price is the gold futures market at the COMEX. The volumes traded every day, calculated in ounces of gold, are huge compared to the real world of demand and supply. The latest COT report figures are displayed below, courtesy of GoldSeek.

Ted Butler is the anlaysts who has brought the manipulation in the COMEX futures market to the surface. He is a student of the gold and silver futures markets for 4 decades. In his latest market commentary, Butler explains that “the total commercial net short position has declined by 21,700 contracts, to 76,200 contracts, the lowest (most bullish) level since June 10 (when gold began a $100 rally). All three commercial categories participated in the $35 orchestrated decline in the price of gold … Somewhat surprisingly, JPMorgan stood pat with 25,000 contracts net long. Interestingly, the concentrated short position of the 4 and 8 largest COMEX gold shorts is now lower than any time since May 2013 and may now be lower (since the cut-off) than any point in years. In time, good things always seem to happen to the price of gold when the largest COMEX commercial shorts hold record low short positions.” The technical funds hold more than 73,000 contracts in gross shorts, which coincides with the June extremes. After the sharp gold price decline of the last days, technical fund shorts in gold now may exceed the all-time managed money extreme short position of almost 83,000 contracts on Dec 24, 2013. On the short turn, new lows in gold are still possible if the technical funds continue to pile on new shorts; but these positions are considered as fundamentally bullish for the medium term by Ted Butler. Butler concludes: “A perfect COT set up must be defined as being comprised of the least amount of commercial shorts and the maximum amount of technical fund shorts. Unfortunately but realistically, it would be impossible to achieve such a perfect COT set up on anything other than a pronounced and persistent sell-off of the kind we've just experienced. There is simply no way for the commercials to reduce their overall net short position or for the technical funds to increase their gross short position on anything other than successively lower prices.” Another veteran of the gold futures market, Dan Norcini, points out that the hedge fund community (see “large speculators” in the COT report above) is still net long, even with the current price drop. It implies that there is still some room left to cut long positions, resulting in a continuation of declining prices. The key question for Norcini is what is the hedge funds’ threshold for tolerance of pain is. “Some will hold on until or unless $1180 is broken. Some will exit if psychological support near $1200 collapses and gold then changes handles once more from “12” to “11”.” The light blue line on the chart shows that hedge funds have been shorting more heavily on similar low prices in the last 18 months. Gold in other currenciesAnother way to look at the gold price is the strength or weakness in various currencies. Dollar gold is testing for the third time the lows of its 18-months old trading range. Gold in Brititsh Pounds and in Chinese Yuan is showing a similar picture. However, Euro gold and Yen gold are relatively better off, as evidenced by the first two charts in the collection below. This is not a huge strength, but it is a positive aspect in the overall picture. Gold minersThe gold miners are mostly leading the yellow metal higher or lower. When miners are accelerating in the same direction as the metal, it is proof of a strong trend. Up until Thursday September 18th, the miners were holding up remarkably well. Unfortunately, in the last two trading sessions they have accelerated their downward move. This is not a sign of (short term) strength for the metals.

On a more positive note, the chart at the bottom right shows the Gold Miner’s Bullish Percentage Index. Although the miners are heading south in the last two days, the Gold Miner’s Bullish Percentage Index has not broken down. Also, the GDX and GDXJ indexes are still above their lowest point of the year (first days of 2014). One should pay close attention to the evolution of these indexes. Intermarket analysis: commoditiesIt is not only the metals trading at long term support, at the bottom of a long term trading range. The commodities index is also under severe pressure and at a point where it could break down. The following chart, courtesy of Dan Norcini, makes clear how commodities have been trending down since their peak in 2011. Metals and commodities are highly correlated, for sure in the last years. Their price pattern is comparable. Clearly, deflationary pressure is present in the economy. Is the commodities index about to break down and are we about to experience a deflationary collapse? Or will inflation pick up from here? The jury is out, and we have to monitor the market data very closely. Whichever direction it goes, the consequences can be significant. Dan Norcini sees this environment with low inflation and slow economic growth. In such market conditions, traders and investors have a preference for stocks; gold is expected to fall out of favor even further, and commodities are expected to move lower.

US Dollar strength and monetary policyUndoubtedly, the main catalyst of recent weakness in commodities and metals is US Dollar strength.

Gold and Silver vs Debt and Taxes Posted: 22 Sep 2014 02:20 PM PDT I'm convinced – we can't escape debt and taxes. Essentially all currency is created as debt, and our financial system creates more debt and more currency into circulation every day. Taxes are insufficient to pay the massive expenditures that our politicians deem essential, so our national, state and local governments fall deeper into debt every year. I think we can all agree – expect more debt and more taxes. What About Silver and Gold? National debt has increased from $3 Billion in 1913, to $398 Billion in 1971 to about $17,700 Billion ($17.7 Trillion). Debt and taxes – much more debt – are in our future. Plan on it. The population of the US slowly increases (203,984,000 in 1970, about 322,500,000 today). Take the national debt and divide by the population to calculate a per capita national debt. Now divide the annual price of gold (annual price is the average daily price for the year) by per capita national debt and graph it. The gold to population adjusted national debt ratio has increased, on average, for about the last 25 years. You can see the gold bear market (1981 – 2000) and the bull market (2001 – 2011) and the correction (some will call it a bear market) since 2011. But the point is:

Summary Population adjusted national debt is increasing – inexorably. The gold to population adjusted national debt ratio will decline only if gold falls more rapidly than the national debt grows. Will that ratio decline? It would take a further large decline in the price of gold to make the ratio decline. But will gold prices collapse even further? Look at the following graph of the ratio calculated back to 1971. Does the bubble in the gold to national debt ratio in 1980 look similar to the increase in the ratio into 2011? Clearly not! Gold bubbled up from about $100 to over $800 in about 3.5 years back in 1976 – 1980. The rally from the October 2008 lows in gold to the August 2011 high was impressive but not similar to the 1980 rally. You can see from the graph of the ratio that the 2011 high was barely a "blip" on the graph compared to the spike upward in 1980.

CONCLUSION

Alternatively, congress could pass a budget that drastically cuts spending, reduces the military, slashes spending on Social Security, Medicare, presidential golf excursions, White House staff, congressional staff, CIA spending, and 1001 other governmental expenses. If you find that scenario unlikely, consider buying gold and silver while the prices have been smashed down by our favorite High Frequency Traders. For more information on gold, read my book: "Gold Value and Gold Prices From 1971 – 2021." It is available here and here.

Gary Christenson | The Deviant Investor

|

| Corn Conditions Hold Steady; Beans Dip Ever so Slightly Posted: 22 Sep 2014 02:19 PM PDT The weekly USDA Crop Conditions and Progress reports were released this afternoon as they always are on Mondays' during the growing season. The results show the percentage of the corn crop rated Good/Excellent unchanged at 74% but even that masks the fact that the percentage rated Excellent jumped by 1% with the 1% drop coming from the Good category. A whopping 23% of the corn crop is rated Excellent. Think about that for a moment - nearly a full quarter of the crop has the highest rating possible! As far as corn maturity goes, this recent weather has been ideal for the crop to begin catching up to its more usual maturity ratings at this time of the year. Remember, I have been maintaining that the reason for the lag in the crop maturity rate has everything to do with the exceptionally perfect weather and moisture levels for the plants which kept the plant from shutting down as it usually does when the weather tends to turn to its more seasonal dry period at this time of the year. My view is that while it keeps the plant from shutting down it also results in bigger kernels and even better ear fill. As long as that plant can put energy into those kernels, it will. That translates to bigger overall yields which I believe is going to be confirmed as the harvest results start multiplying. However, to provide the numbers - 90% of the crop is now dented compared to 82% last week and 90% at the same time last year. The 5 year average is 92% so for all practical purposes, the crop is now catching up. 42% of the crop is mature versus 27% last week and 37% last year! Compared to last year, the crop is now ahead slightly in that regard. The 5-year average stands at 54%. Harvest is at 7% compared to 7% last year ( dead even ) and the 5-year average of 15%. Good weather will help farmers make tremendous progress in areas where the crop is ready to go to the bin. On the soybean front - there was a slight bit of deterioration this week with the percentage rated Good/Excellent dropping 1% to 71% from 72% last week. In going through the data state by state, it looks as if the minor decline came from Minnesota and Michigan ( northern tier states ) so perhaps some of that is indicative of some very mild frost damaged that occurred very early just ahead of the previous weekend and was reflected a bit later in the week when the surveyors had a chance to get out into the fields and take a look-see. That being said, the Wisconsin crop actually improved to 49% Good from 48% last week and held steady at 24% Excellent from the previous week. North Dakota lost 1% in the Excellent category to 16% but it moved to the Good category which is now at 59% compared to last week's reading at 58%. Still when you consider that Minnesota has 65% of its crop rated Good/Excellent with 27% rated fair, while Michigan has 61% rated at Good/Excellent and 26% Fair, it is quite a stretch to try to talk up prices by referring to frost damage with those kinds of ratings. More important in my view is the fact that 45% of the crop is dropping leaves compared to 24% last week ( the number nearly doubled!) and 44% the same week last year. That is good news. The 5-year average is 53%. On the harvest front - 3% of the crop is in the bin compared to 3% last year at this time and the 5-year average of 8%. One can definitely see the progress in the Delta which is running ahead of not only last year at this time but also ahead of the 5-year average. The harvesters are coming north! Based on what I can see of the forecasts at this stage, they look very good on out into the first week of October. We should see some very good harvest progress in some areas. The warmth should also speed along those crops in the northern tier states. We'll see how the Board reacts to this tomorrow but I find any bullishness in it missing. Incidentally, changing gears a bit here to look at the mining shares as evidenced by the HUI, the index has fallen to support at the late May/early June lows of this year and looks very precarious. Also, that happens to nicely coincide with the top of the gap made on the chart to start the year when the shares jumped sharply to start of the new year. The index is very close to surrendering the entirety of this year's gains. The way things stand at the moment, the gold shares are not exactly sending out a ringing endorsement of higher gold prices. The longer gold remains below $1220, the more the odds grow that it will revisit psychological round number support at $1200. If it changes handles, a test of the major low near $1180 will be coming shortly thereafter. Note that the HUI/Gold ratio continues to plummet: On the US Dollar front, traders seem a bit unwilling the take the greenback up through the 85 level basis USDX. If they do, gold will more than likely not hold $1200. |

| Can gold act as a safe haven again? Posted: 22 Sep 2014 02:12 PM PDT PI Financial mining analyst Christos Doulis says six years ago when the financial crisis was in full swing, safe-haven buying made gold skyrocket. Today, the fear component is down, as is the price of gold. |

| Alasdair Macleod Breaks Down The End of Tapering and Government Funding Posted: 22 Sep 2014 01:45 PM PDT Thanks to the Fed’s monetary policies, which have encouraged an increase in demand for US Treasuries, the Federal government no longer has a problem funding its deficit. QE is therefore redundant, and has been since tapering was first mooted. This does not mean that QE is going to be abandoned forever: its re-introduction will depend […] The post Alasdair Macleod Breaks Down The End of Tapering and Government Funding appeared first on Silver Doctors. |

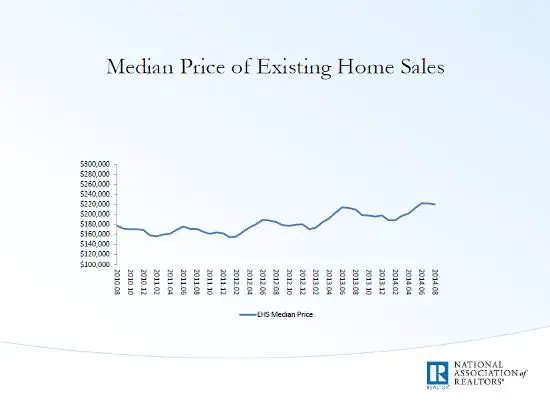

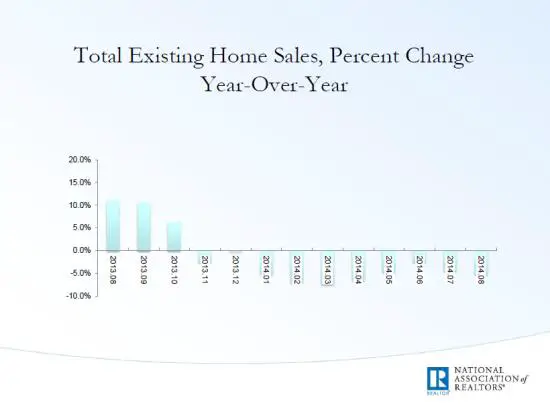

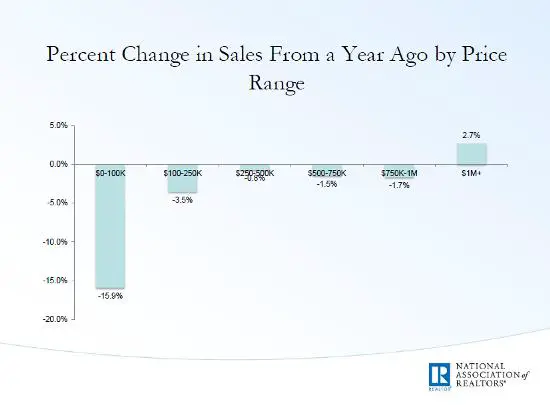

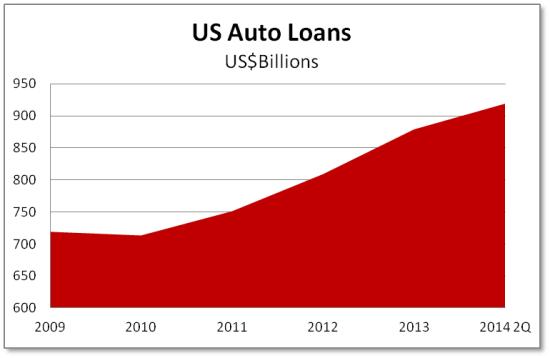

| Posted: 22 Sep 2014 01:31 PM PDT In his book The Postcatastrophe Economy, iTulip’s Eric Janszen notes that financial bubbles don’t repeat. That is, yesterday’s bubble is never tomorrow’s because hot money likes to chase the next big thing, not the last big thing. Which explains how US equities, government bonds, fine art, and trophy properties like London penthouses can all be sizzling while US houses, the epicenter of the previous decade’s financial orgy, just sit there. Some charts from the National Association of Realtors illustrate just how boring the US housing market has become: To summarize the first three charts, overall sales have declined year-over-year for ten straight months, prices are barely up from a year ago, and near-term trends imply more of the same. The fourth chart explains why: All the positive action is in high-end properties while the entry level part of the market is imploding. There are several reasons for this: 1) Today’s college students are graduating with so much debt that many can’t even conceive of buying a house. Instead, their choice is between a cheap apartment or a bedroom in their parents’ home. 2) US consumers, after a few years of deleveraging, are once again borrowing, but in large part this is to pay for necessities like gas and food. When they buy something discretionary, it’s now likely to be a new car. Auto loans are rapidly approaching the $1 trillion milestone achieved by student loans a couple of years back. 3) Back in 2004-2007, banks handed out home equity lines of credit (HELOCs) to pretty much anyone with a house and a heartbeat (heartbeat frequently optional). Those loans generally require only interest payments for the first ten years and then begin demanding repayment of principal. So the loans made during the housing bubble are now starting to step up, hitting their owners with hundreds of dollars of extra monthly payments at a time when they’re already strapped. For more see Why the Real Estate Market Remains Fragile. Rich folks, meanwhile, own the stocks and bonds that have soared lately, so they’re ready and able to diversify out of financial assets and into real stuff like million-dollar houses. Take these extravagant buyers out of the equation and the housing market for the rest of us is contracting at what looks like a steady 5% per year, with no end in sight. So what does this mean for the overall economy? Specifically, can a country as dependent on consumer spending as the US generate sustained growth when the one major asset owned by most families isn’t participating? The answer is probably not. For the wealth effect (rising asset prices leading people to spend more) to really get going, all the pressure is now on the narrow shoulders of the stock market. And so is all the risk. If stock prices were to correct from their current record levels, the impact would be directly painful for the 1% who are now buying those mansions, and at least scary for the 99% who aren’t losing on the stocks they were never able to buy, but can’t escape the ubiquitous headlines about “crashes” and “crises” and such. The net effect would be to snuff out the recovery and leave a desperate government with only one remaining weapon: a high-profile monetary shock designed to replace the scary headlines with a perception that our bold, innovative leaders once again have our backs. Japan has already reached this point (see Abenomics Approaches Moment of Reckoning), Europe is getting there (Pressure Builds on ECB Chief) and the US, unless housing turns around or stocks double from here, will be there soon. Welcome to the brave new world of global coordinated monetary debasement. |

| The Geopolitics of World War III Posted: 22 Sep 2014 01:30 PM PDT The real reason Russia and Syria are being targeted right now by the US war machine… We are on a road that leads straight to the World War 3, but in order to see that and to fully understand what is at stake you have to look at the big picture and connect the dots. […] The post The Geopolitics of World War III appeared first on Silver Doctors. |