Gold World News Flash |

- The Criteria For Investing

- Russia FinMin Calls For Shift Away From US Treasurys Into BRIC Bonds, Settlement In Non-Dollar Currencies

- A Plan to Convert the US Dollar to Gold as Money

- The Big Picture For Gold And Silver

- The Black Mass and Our Future Feral Society

- Russia FinMin Calls For Shift Away From US Treasurys Into BRIC Bonds, Settlement In Non-Dollar Currencies

- It’s Terrifying To Look At What’s Really Happening In The U.S.

- Greenspan's "Irrational Exuberance" Warning In Context

- Economic Collapse 2014 News Brief

- Meanwhile, Here's What The "Super-Rich" Are Rushing To Buy

- Technical Outlook for the Dollar

- GDP Watch: Summer 2014 Was World's Warmest Ever

- Rafapal: Iraqi Dinar reset; Fed Dollar out, US Treasury Dollar & BRICS in; Collateral Gold coming

- Gold Price: Open Suppression in Action

- Gold Miners Bear Market Worsens

- We Are Headed Into World War III and Economic Collapse Imminent! - Gerald Celente

- Weekend Update September 19

- Gold And Silver - Current Price Is The Story

- Is World Gold Council's CEO angling for a tin-foil hat?

- Koos Jansen: Chinese gold demand rises 5 percent as international exchange opens

- Live From San Antonio

- The Alibaba IPO May Shine, But Gold is Glistening

- Cheap Gold Stocks Upleg Intact

- The London Gold Pool - 1961 to 1968

| Posted: 21 Sep 2014 12:00 AM PDT from silver investor.com: |

| Posted: 20 Sep 2014 09:20 PM PDT from ZeroHedge:

It is the same BRICs that, Russia’s Prime Minister Dmitry Medvedev, told Rossiya TV in an interview earlier today, should conduct transactions in national currencies, bypassing cross-rates with the US Dollar, adding that “we can easily make mutual settlements directly,” and the mechanism should be beneficial to both sides of transactions. |

| A Plan to Convert the US Dollar to Gold as Money Posted: 20 Sep 2014 08:30 PM PDT by David Redick, Activist Post:

Two more benefits of using commodity money are to; 1. Limit excessive expansion of the money supply (inflation; loss of value) by the government, and 2. Provide a market-based, and stable, store and measure of value, with coins and paper notes produced by private mints (including banks). Mints would not require a license, and there would be no legal tender laws, since that would put the government in control. The only government function would be inspections (which could also be done by a private org) to verify that the mints indeed have the gold reserves they claim to have for redeeming paper notes. The commodity used as money could be (and has been) wheat, iron, diamonds, notched sticks, or pearls, but the market (users of money) usually chooses gold because it works best. |

| The Big Picture For Gold And Silver Posted: 20 Sep 2014 07:32 PM PDT With precious metals back at 4-year lows against a backdrop of gold migration from west to east, paper vs physical divergences, 'disappearing' Comex positions, dark pools in London, collateral grabs, and massive monetary policy extremist actions; we thought the following two presentations worth considering. Tocqueville's John Hathaway delves into the darker corners of today's gold markets while Mike Maloney reminds us of the big picture behind gold and silver as wealth insurance. The failure of a monetary system is never a smooth road - it is rocky and undulating, with twists and turns that don't appear on any map. But the destination is always without question, despite suppression efforts: Gold will inevitably respond to an expanding fiat currency supply. That simple.

Tocqueville's John Hathaway asks (and answers) "Do You Know Where YOUR Gold Is" as he explains how counterparty and systemic risk will converge and the various dark and murky corners of the precious metals markets in which manipulation grows unchecked...

John Hathaway Tocqueville Keynote

* * * And Mike Maloney explains the big picture for gold and silver in the clip below...

* * * Simply put,

|

| The Black Mass and Our Future Feral Society Posted: 20 Sep 2014 07:30 PM PDT by stephanie, TF Metals Report:

Let’s set aside the supernatural dynamite you are playing with when you call upon dark forces. (I’ll just comment that you are really stupid if you do so, and I myself suffered greatly after playing around with a Ouija board in high school.) One of my biggest fears isn’t that we are going to have a financial collapse today that will render everyone in ruins. It’s what our world is going to look like in 40 years – and who is going to be running it. I’m going to be America-centric here, so apologies to our foreign readers. But I believe these observations apply to most people in the Western world – or what we might have to start calling the “Post-Western World.” |

| Posted: 20 Sep 2014 06:43 PM PDT It is no secret that Russia has had enough of the Petrodollar, and in light of ongoing western sanctions - which many view not so much as a reaction to events in Ukraine bur merely as an attempt to halt the Russian revolution against the Petrodollar status quo, crushing its economy before the momentum grows and more countries join Moscow - is constantly thinking of ways it can ditch the dollar as a medium of exchange as fast as possible. The problem is that when it comes to retaliating against the West, Russia - short of declaring an embargo on USD payments for its commodities - has little control over what currency its western trading partners will pay in. So instead it is focusing on its net exporting peers, aka the BRICS, with whom as previously reported, Russia had launched a "bank" alternative to the IMF when it comes to backstop and bailout funding, one that avoids reliance on the SDR, the USD, and on Western empathy. It is the same BRICs that, Russia's Prime Minister Dmitry Medvedev, told Rossiya TV in an interview earlier today, should conduct transactions in national currencies, bypassing cross-rates with the US Dollar, adding that "we can easily make mutual settlements directly," and the mechanism should be beneficial to both sides of transactions. And if it wasn't clear by now, Russia pivot away from the west and toward China is pretty much complete. Medvedev also said that "our collaboration with China is of strategic importance. We have great, brilliant political contacts, we have excellent economic relations. [China] is our strategic partner, and we are interested in expanding the volume of cooperation. We are not afraid of collaborating because we are confident that this is equal, friendly and mutually beneficial collaboration in all areas." Meanwhile, regarding escalating Western tensions, the PM said that sanctions have created a bad situation for Russian banks on financial markets, all sources of liquidity are frozen. "We regard this as a senseless and ugly decision toward Russia, but we'll manage without it." So does that mean that China will step in to provide the required FX reserves as Russia minimizes its USD exposure? Perhaps, but not entirely: Medvedev did add that "Asia, other markets "unlikely fully" to compensate for frozen European financing." The PM also said that Russia passed through similar squeeze in 2008-2009 and can manage with central bank resources, adding that Europe is still important market for Russia, if EU members "make no absurd decisions to squeeze us out of this market, we'll stay there, it's interesting for us." But while Medvedev was the good cop today, it was Russia's finance minister Anton Siluanov who was the designated "bad guy", and as the WSJ reported, Russia is considering diversifying its debt portfolio away from countries that have imposed sanctions on Moscow and into the papers of its BRICS partners.

The good news for the US, now that Russia appears set on either rapidly or slowly selling off its US Treasury exposure, is that Kremlin has possession of only $115 billion in US paper, which happens to be more than the $100 billion it reported in May when the first shock of a Russian bond sell off hit the market, and both of which happen to be amounts the Fed can easily monetize into its record big balance sheet (which, taper or no taper, just grew by $28 billion in the past week alone) in just over a month. But at the end of the day it is not what Russia does, but what its other BRIC peers and US Treasury holders do. Because while Moscow may be in possession of just over $114.5 billion in US paper, China, Brazil and India share among them some $1.6 trillion in US Treasurys, better known as "leverage" in every sense of the word, or an amount that not even the Fed could monetize on short notice without sending a massive shockwave through the global capital markets. In other words, while the US pushes Russia hard, it may be careful not to push it too hard, and in the process start an avalanche that leads to a BRIC bond avalanche, which may well be one possible endgame as the world is forced to transition from the US Dollar as a reserve currency in the coming years. Never gonna happen? Considering that none other than Obama's own former chief economic advisor, Jared Bernstein, is advocating dropping the USD as the global reserve currency, we would be careful with using the word "never" in this specific case...

|

| It’s Terrifying To Look At What’s Really Happening In The U.S. Posted: 20 Sep 2014 06:30 PM PDT from KingWorldNews:

We are nearing the end of 2014, and to the debt markets it is almost as if the 2008 economic collapse never happened. It appears that borrowers and lenders are suffering from a severe case of collective amnesia. Yes, consumer debt levels took a slight breather in 2009-10. But today total consumer credit in the United States has risen by 22 percent over the past three years, and at this point 56 percent of all Americans have a subprime credit rating. |

| Greenspan's "Irrational Exuberance" Warning In Context Posted: 20 Sep 2014 03:33 PM PDT As the marginal investing bot continues to invest his marginal leveraged dollar-on-the-sideline on an equity market that, as Janet Yellen has explained to the poor, will create a "wealth effect" to sustain everyone through rainy days and retirement, we thought some context worthwhile. On December 5th 1996, Alan Greenspan - upon the recognition that equity market capitalization has bubbled to over 100% of nominal GDP - opined that investors had succumbed to "irrational exuberance." Since then, that 'exuberance' has become increasingly rational as the Fed pulls all its monetary-base expanding, deficit-funding, asset-purchases to keep the American Dream alive for a select (and shrinking) few...

Irational-er and Irrational-er...

But adjusted for the reality of a fiat world, things look a little different since the dot-com collapse inspired The Fed...

As is clear - since the financial crisis, stocks have become completely dependent upon The Fed

As The Monetary stock and flow indicate...

And relative to debt... stocks have gone nowherefor 90 years... * * * "Clearly, sustained low inflation implies less uncertainty about the future, and lower risk premiums imply higher prices of stocks and other earning assets. We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade..." "How" indeed, Alan, how indeed? |

| Economic Collapse 2014 News Brief Posted: 20 Sep 2014 03:10 PM PDT Economic Collapse 2014 News Brief Current Economic Collapse News Brief , In this news brief we will discuss the latest news on the economic collapse. We look to see if things are really that different. The central bank will not stop at just confiscating your wealth they will want your life.... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Meanwhile, Here's What The "Super-Rich" Are Rushing To Buy Posted: 20 Sep 2014 02:44 PM PDT If you said shares of BABA, you'd be wrong. According to the Telegraph, the exodus out of paper wealth and into hard assets is reaching a fever pitch as the "super-rich are looking to protect their wealth through buying record numbers of "Italian job" style gold bars, according to bullion experts." The numbers cited by the paper are impressive: the number of 12.5kg gold bars being bought by wealthy customers has increased 243% so far this year, when compared to the same period last year, said Rob Halliday-Stein founder of BullionByPost. "These gold bars are usually stored in the vaults of central banks and are the same ones you see in the film 'The Italian Job'," added David Cousins, bullion executive from London based ATS Bullion. The sales of 1kg gold bars, worth about £25,000 each, have doubled during the three months ended August, when compared to the same period last year, Telegraph reports according to ATS Bullion sales figures. As a reminder, these are not some dinky, 1 oz coins that are being bought hand over fist: the bars which are made from pure gold and are worth more than £300,000 each at today's prices of $1,223 (£760) an ounce. That said, sales of the more popular, and far cheaper gold coins such as the quarter ounce sovereign and one ounce Krugerrand have also doubled this year, according to figures from BullionByPost. Mr Halliday-Stein said that while most customers arrange for secure storage of the larger bars in secret vaults operated by Brinks, some customers have taken physical delivery of the 12.5kg bars. Would they be... Chinese customers? But, how is it possible that as the "super rich" are supposedly rushing to buy gold that gold prices are at 2014 lows? Simple: as the chart below shows, there is no better way to continue masking the demand for physical gold than to keep selling paper gold, in this case via its most liquid manifestation, the GLD ETF. It is this ETF that just saw the notional value of gold "holdings" backing the paper manifestation of its "goldness", drop to just 776 tons, the lowest since 2008 and nearly half the maximum "holdings" of 1,353 tons reached in December 2012. In fact, as if to punctuate what we said early yesterday about the liquidation of precious metals in order to fund BABA purchases, here is the percentage change in GLD holdings on a daily basis: yesterday's 1% drop in which some 8 paper tons of gold were firesold was a 1% drop in GLD holdings, and the second biggest daily drop in all of 2014... ... a drop which also pushed the price of paper gold to its lowest for 2014. And, a drop, which all those who are buying physical gold instead of paper, are thankful for. |

| Technical Outlook for the Dollar Posted: 20 Sep 2014 02:02 PM PDT Technically, the dollar is finishing the quarter on strong footing. It has risen against all the major currencies. The New Zealand dollar has eclipsed the yen as the weakest of the major currencies. It is off 7% since end of June. The Canadian dollar is strongest of the majors, losing only 2.7%, and that is after this week's leading 1.2% advance.

Neither the euro nor the yen have been able to sustain even modest upticks. Despite extended positioning, the bears do not appear to have had their fill. Into the weekend G20 meeting, there has been no official resistance to the euro and yen's depreciation. The poor participation in the ECB's new four-year lending facility (TLTRO) has boosted speculation that more aggressive measures will be needed to 1) revive lending and 2) bolster the ECB's balance sheet by the trillion euros Draghi mentioned.

In Japan, BOJ Governor Kuroda welcomed the yen's decline, and pledged to provide more stimulus if needed. This is in the context in which the Federal Reserve's forecasts appear to have increased the risk of an earlier rate hike, and a US economy that is running a bit faster than appreciated. Q2 GDP will likely be revised (September 26) to something closer to 5% than 4% (from 4.2%) and estimates for Q3 GDP are creeping up as well.

A note of caution may be in order for the euro. The multi-month lows set at the end last week were not confirmed by the RSI or MACD. This could be an early signal of a market losing momentum. However, the upside is not compelling, with new selling anticipated in the $1.3000-20 area. On the downside, the next key target is near $1.2750.

The dollar reached almost JPY109.50 before the weekend. It has gone almost straight up since the JPY101-JPY103 four-month range was broken in late August. We had suggested potential toward JPY110. The market may grow cautious as this level is neared. A pullback would be seen as a new buying opportunity for dollar bulls. Downside support is near JPY107.80 to JPY108.00.

The weakness in the yen will likely continue to help lift the Nikkei, which finally turned positive for the year just before the weekend. Since the dollar broke out of the range against the yen on August 20, the Nikkei has advanced by 6.2% to new multi-year highs.

In an almost classic case of "buy the rumor, sell the fact", sterling fell two cents after initially rallying on new that Scotland will remain part of the Kingdom. It appears to have posted a shoot star pattern, a bearish candlestick formation. Recall sterling had rallied from the $1.6050 low on September 10 to $1.6525 shortly after it became clear that the unionists would win. It then proceeded to reverse lower. Initial support is seen a little below $1.6300, and there is a daily trend line that comes in just below $1.6250, in front of a retracement objective near $1.6235.

The Canadian dollar looks interesting from a technical perspective. For those US dollar bulls looking for a currency to diversify into, the Canadian dollar may be attractive. The US dollar was turned back from CAD1.11 at the start of last week, and with the help of a stronger core inflation print, it dipped below CAD1.09 before the weekend. Trend line support, drawn off the mid-July and the early September lows comes in near CAD1.0875 at the start of the new week, which is just north of the 100-day moving average (~CAD1.0855). There are US dollar bearish divergences in the MACD, but that does not rule out some modest upticks toward CAD1.0980-CAD1.1020 The bottom of the range is CAD1.08.

Since it tested the $0.9400 area on September 5, the Australian dollar has slumped 4.3% or nearly five cents. Immediate resistance is seen near $0.9000. Given Australia's interest rates it is expensive to be short when the downside momentum stalls. Weaker commodity prices and the China slowdown are often cited as factors that have sparked the dramatic drop in the Aussie. The Australian dollar appears to have carved out a large head and should pattern from April through early-September. The neckline was broken on September 9 near $0.9220. The minimum objective is just above $0.8900, and below there is $0.8850. Further a field, the 2014 low near $0.8660 from late-January beckons.

Technical indicators are not generating strong signals in the Mexican peso. The US dollar appears in a new broader range of MXN13.00 to MXN13.30. We have a slight bias toward a stronger peso, and see that local stocks have performed better than the MSCI EM index recently, perhaps aided by strength of the US economy and somewhat better Mexican data.

US 10-year yields edged single basis point higher last week. While the near-term risk extends toward 2.70%, many are talking about 2.65%, which corresponds to the 200-day moving average. Perhaps a sharp drop in the headline of August durable goods orders (September 25), as the July surge in Boeing orders is unwound, may encourage some backing off of the yield, but 2.55% may be the most that can reasonably be hoped for now.

Observations based on the speculative positioning in the futures market:

1. There was an unusually high number of significant position adjustments, which we have defined as a change of 10k of more contract in the gross position. This increase in activity has been observed in the spot market as well.

2. The gross long euro position increased by 20.2k contracts to 79.6k. This seems to be a case of bottom picking. The net short position fell as a result of new longs entering the market rather than a bout of short covering. The gross short position fell by 200 contracts to 216.7k.

3. The gross long yen position jumped by 20.3k contracts to 37.6k. This was the principle cause of the decline in the net short position to 83.2k contracts from 101k. The gross short position actually increased by 2.8k contracts to 120.8k.

4. The gross long sterling position was cut by a 25.7k contracts to 55.6k. The gross short position grew by 7.6k contracts. This was sufficient to switch the net position to the short side (6.6k contracts) for the first time since last November.

5. The gross long Australian dollar position was culled by 17.7k contracts to 55.6k. The gross short position increased by almost 1.5k contracts. The net long position was essentially halved to 22.1k contracts (from 41.2k).

6. The gross short Mexican peso position rose by almost 15k contracts to 47.4k. The gross long position was trimmed by 1.6k to stand at 69.4k contracts.

7. Speculators generally added to gross short currency futures positions, with the euro the main exception. The adjustment to the gross long position were more mixed.

8. The net short US 10-year Treasury bond futures position fell to 6.8k contracts from 33.3k. This was mostly a product of 23.2k gross short positions being covered. The bulls added 3.3k contracts, which lifted the gross long position to 443.5k contracts.  |

| GDP Watch: Summer 2014 Was World's Warmest Ever Posted: 20 Sep 2014 02:01 PM PDT Since weather has become the most crucial factor in forecasting economic growth, we thought it crucial to the future of central bank policy to note that Summer 2014 was officially the hottest one ever, according to NOAA. This of course means there is "pent-up" cold weather, which may explain the collapse in global growth expectations. However, this chatter about heat may surprise Americans (aside from those that live in the Western States) as the Mid-Atlantic and Northeast U.S. were running cooler than normal (thus concerns about growth). According to NOAA's records, this is the 38th consecutive August and 354th consecutive month with a global average temperature above the 20th century average.

As The Washington Post reports,

Which explains this... (as meteoreconomists downgrade growth expectations on the basis that hot summer means cold winter in the Keynesian mean-reverting world of weather prognostication)

Global GDP growth plunged to cycle lows as the "hot" summer swept across the world. But...

* * * |

| Rafapal: Iraqi Dinar reset; Fed Dollar out, US Treasury Dollar & BRICS in; Collateral Gold coming Posted: 20 Sep 2014 11:36 AM PDT Rafapal: Global reset & Iraqi Dinar revaluation starting; End of Fed Dollar & return to U.S. Treasury dollar, BRICS currency; Wanta Gold (collateral accounts) coming . http://exopolitics.blogs.com/breaking... In this ExopoliticsTV interview from Madrid with Alfred Lambremont Webre, Spanish... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Price: Open Suppression in Action Posted: 20 Sep 2014 11:00 AM PDT A short history of 1960s' London Gold Pool, and its failure to suppress gold prices... By the BEGINNING of the 1960s, the US Dollar peg of 35 to 1 ounce of gold was becoming more and more difficult to sustain, writes Julian Phillips at The GoldForecaster. Gold demand was rising and US gold reserves were falling, both as a result of the ever increasing trade deficits which the US continued to run with the rest of the world. Shortly after President Kennedy was inaugurated in January 1961, and to combat this situation, newly-appointed Undersecretary of the Treasury Robert Roosa suggested that the US and Europe should pool their gold resources to prevent the private market price for gold from exceeding the mandated rate of US$35 per ounce. Acting on this suggestion, the central banks of the US, Britain, West Germany, France, Switzerland, Italy, Belgium, the Netherlands, and Luxembourg set up the "London Gold Pool" in early 1961. One wonders why they were so cooperative with the US. Granted the gold that left these nations ahead of the war was still in the US and slowly but surely they felt it necessary to get it back. What happened in occupied Europe was that US Dollars became more abundant there and a market in 'Eurodollars' sprang up derived in part from US soldiers still in Europe. But the volumes grew more and more as the US established a perpetual Trade deficit feeding the rest of the world with them. The 'Pool' came apart as Europe, under Charles de Gaulle, decided enough was enough and began to send the Dollars earned by Europe back to the US back and exchanged these for their gold. Then they were unwilling to continue accepting US Treasury Bills & Bonds in return. Under the terms of the 'Bretton Woods Agreement' signed in 1944, Europe was legally entitled to do this. It would appear that by the time the gold sent to the US before the war had returned to Europe, the US pulled the plug on exchanging gold for Dollars letting the London Gold Pool fold in April 1968. But the demand for gold from Europe did not abate. By the end of the 1960s, the US once again (as with the 1935 Dollar devaluation against gold) faced the stark choice of eliminating their trade deficits or revaluing the Dollar downwards against gold to reflect the actual situation. President Nixon decided to do neither. Instead, he repudiated the international obligation of the US to redeem its Dollar in gold just as President Roosevelt had repudiated the domestic obligation in 1933. On August 15, 1971, President Nixon closed the "gold window" at the New York Fed. In other words the US defaulted on its agreement with Europe and once again Europe tolerated it. We have to ask why? How could a currency with, what was to become perpetually undermined by being printed and exported, continue to stand and become the world's sole reserve currency and not collapse? Military might, might add some pressure, but not among the allies. No, the key lay in the then established fact that you could only buy oil with US Dollars. Nearly everything modern needed oil to work. Most nations import bills comprised 25% of so of oil. The US controlled Opec. and provided their political and military security. In turn the US had a firm grip on all their allies and secured their financial 'empire'. The last link between gold and the Dollar was gone. The result was inevitable. One of the prices paid by the US was to permit the oil producers to 'nationalize' their oilfield, production and the US and British companies that ran them, the 'seven sisters'. The oil price began to run up from $8 a barrel to $35 a barrel vastly increasing the demand for Dollars and US Dollar liquidity. The US in turn permitted this, provided that the oil producers reinvested the capital they earned into the US Treasury market and US equities and US products (including military hardware). They were allowed to keep the interest income in their own hands under these conditions. This prevented the oil producers posing any financial challenge to the US The Persian Gulf was defined as part of the US' 'vital interests', as a result. So if the allies in Europe wanted their economies to function properly they had to accept this fact. Quietly they accepted more and more US Dollars into their foreign exchange reserves. As the oil price rose the pressure on all currencies climbed too. In February 1973, the world's currencies were "floated". They were allowed to move to levels that reflected the state of their Balance of Payments. The US was excused all such value measurements because it was so needed by all. By the end of 1974, gold had soared from $35 to $195 an ounce in an almost mathematically neat progression. This did not make the US happy at all, as it highlighted the real weakening of the US Dollar and the sagacious investor was fully aware of this. So a war on gold was begun. This was not just manipulation but a transparent bullying attack on real money. At first the tactics used underestimated the power of gold and the trust placed in it. Nevertheless the common theme to this manipulation was to suppress the gold price. |

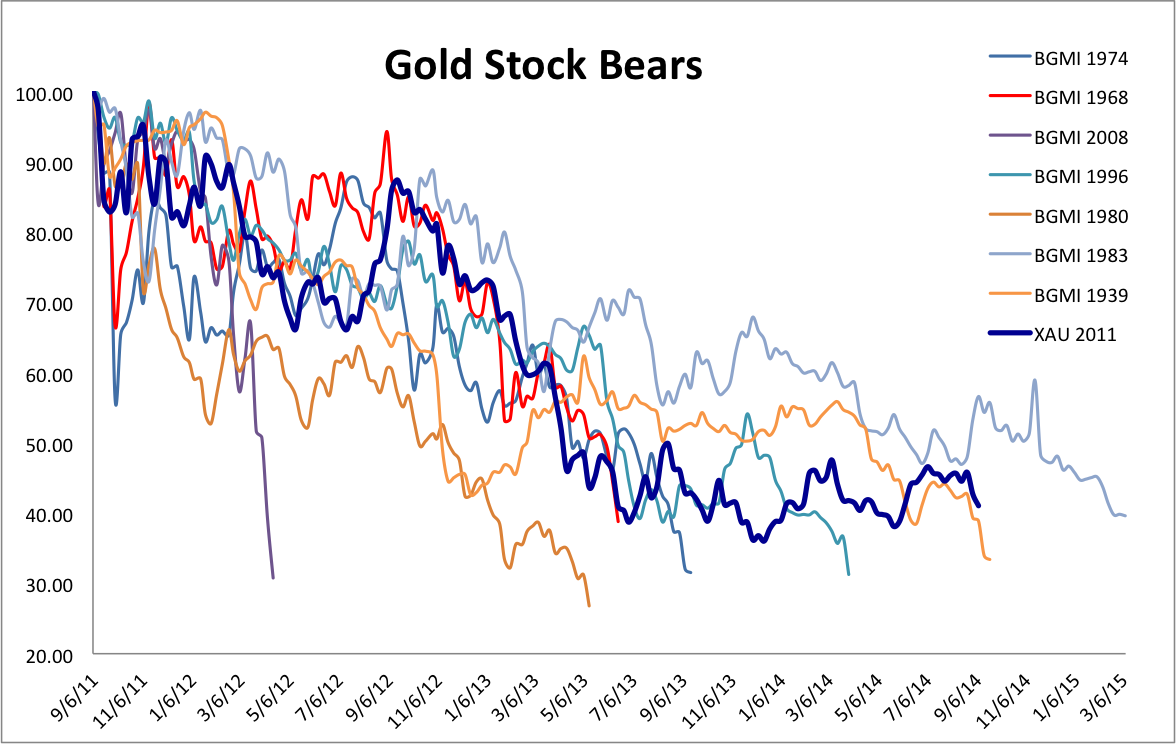

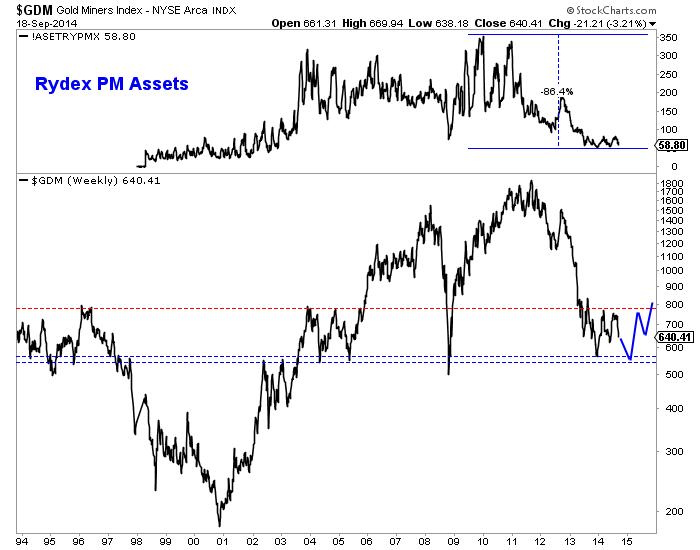

| Gold Miners Bear Market Worsens Posted: 20 Sep 2014 10:50 AM PDT Mining stock charts are getting uglier as the gold price falls... SINCE last summer, writes Jordan Roy-Byrne at TheDailyGold, investing in the mining sector has been akin to riding a mini-roller coaster. Gold mining stocks have seen two huge rallies, plus two sudden and sharp declines. More than a handful of individual stocks have rebounded over 200% from their lows. But nevertheless, the weakness of the metal price itself won out and is dictating the terms. A look at the bear market analog chart illustrates the coming risks and opportunities.  This updated chart compares the current bear market for gold stocks with previous declines. The Philly Gold & Silver miners index (IndexNasdaq:XAU) is used for the current bear market. This chart helped identify the opportunity at the June 2013 and December 2013 lows. If you believe the gold stocks have not yet bottomed, then this is the second worst bear in terms of time. There has been only one bear market worse than 70%. The chart argues that if the December low is taken out, it would be so only marginally. A 65% loss at the December 2013 low could become 67% or 68% but probably not anything worse. Below is a weekly line chart of the Amex Gold Miner index (IndexNYSEGIS:GDM). This is one of the broadest indices for miners.  GDM has two levels of strong support which date back 20 years. GDM would have to decline 13% and 17% to test those supports. At the top, we plot the assets in the Rydex Precious Metals Fund, which have dwindled 86%. We plot in blue a rough projection only for consideration purposes. In looking at long-term charts of miners, I find that a double bottom (seen above) is definitely possible. The risk is quite clear. Failed moves produce fast moves. The miners failed to breakout and have tumbled. The late May lows mark the next support but these points do not amount to much beyond the daily charts. Furthermore, after $1200 per ounce, the gold price's next strong support isn't until $1080, the 50% retracement of the entire bull market. Hence, there is a growing risk of the miners falling to their December lows. Therein lies the opportunity. Only time will tell but that point could immediately mark a shift from risk to amazing opportunity. |

| We Are Headed Into World War III and Economic Collapse Imminent! - Gerald Celente Posted: 20 Sep 2014 10:31 AM PDT http://usawatchdog.com/economy-will-c... - Gerald Celente, Publisher of The Trends Journal says, "We are looking at destabilization in the Middle East with no end in sight. It's only going to get worse unless this killing and excuse for the murders from both sides stops." On the crisis in Israel... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Posted: 20 Sep 2014 09:54 AM PDT By Everett Millman, head content writer at Gainesville Coins, a leading gold and silver distributor. ABSTRACT: Markets were cautiously optimistic ahead of Fed Chair Janet Yellen's press... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} |

| Gold And Silver - Current Price Is The Story Posted: 20 Sep 2014 06:49 AM PDT Forget all the news, all the fundamentals, all the [mostly errant] price projections. There is a reason why a picture is worth more than 1,000 words, and this is one of those times where it is best to focus on pictures of the market, over various time frames, to get a better handle on what to expect moving forward. Put to rest every so-called PMs pundit or blogger that has persistently been calling for higher prices or saying the low is in. We keep saying that the best and most reliable indicators come from the market. Time to stop listening about what others have been saying about the market and pay closer attention to what the market is saying about others. Several months ago, we expressed the thought that 2014 would likely be more like 2013 and to not expect a dramatic increase in gold and silver prices. Even that was optimistic as silver just reached recent 4 year lows. |

| Is World Gold Council's CEO angling for a tin-foil hat? Posted: 20 Sep 2014 06:40 AM PDT 9:41a ET Saturday, September 20, 2014 Dear Friend of GATA and Gold: MineWeb's Lawrence Williams reports today an interesting comment by the World Gold Council's chief executive, Aram Shishmanian, about the opening of the international subsidiary of the Shanghai Gold Exchange "The growth of the Shanghai Gold Exchange to become the world's largest physical gold exchange provides compelling evidence that the future for gold is physical," Shishmanian said. "As the market shifts from west to east, the expansion of strong gold trading hubs in Asia will improve price discovery, liquidity, transparency, and efficiency, all of which will transform the landscape of the global gold market." So, then, does the World Gold Council believe after all that the present gold market is not really physical and transparent at all but rather shadowy and highly manipulated by derivatives and that, as a result, price discovery needs to be improved? That kind of talk could sound like an application for a tin-foil hat. Williams should ask Shishmanian whether he wants one. We here at GATA's tin-foil hat factory would be delighted to oblige. Williams' commentary is headlined "The Future for Gold Is Physical" and it's posted at MineWeb here: http://www.mineweb.com/mineweb/content/en/mineweb-gold-news?oid=253679&s... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Canadian Investor Conference http://cambridgehouse.com/event/31/canadian-investor-conference-toronto-... New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Koos Jansen: Chinese gold demand rises 5 percent as international exchange opens Posted: 20 Sep 2014 06:05 AM PDT 9:03a ET Saturday, September 20, 2014 Dear Friend of GATA and Gold: China's gold demand, the offtake from the Shanghai Gold Exchange for the most recent week reported, rose nearly 5 percent as China bought the dip, gold researcher and GATA consultant Koos Jansen writes today. Jansen also reports the comments made at the opening ceremony of the exchange's international subsidiary, where the governor of the People's Bank of China said that China wants to become a major force in gold pricing. Jansen's commentary is posted at Bullion Star here: https://www.bullionstar.com/article/chinese%20gold%20demand%20continuous... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 BullionStar is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. BullionStar's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in BullionStar's bullion vault, which is integrated with BullionStar's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: Canadian Investor Conference http://cambridgehouse.com/event/31/canadian-investor-conference-toronto-... New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 20 Sep 2014 02:05 AM PDT Live from the Casey Research Summit in San AntonioThe day dawned hot here in San Antonio—again—and the topic most on the minds of the day’s featured speakers was the hottest one of all: war. War, as we all know from the writings of early 20th century progressive Randolph Bourne, “is the health of the state.” That famous quote is often misconstrued to mean that war is a healthy thing for a country to engage in. But Bourne actually made an important distinction between society—in which individuals interact in peace—and the state, which seeks continual accretion to its power. Society, Bourne wrote, “is a concept of peace, tolerance, of living and letting live. But State is essentially a concept of power, of competition; it signifies a group in its aggressive aspects.” And nothing allows the state to assume ever greater power to itself and to act as an oppressor, than war. Or, as Summit speaker Justin Raimondo, editorial director of Antiwar.com, put it this morning, “War is inevitably good for expansion of government power and bad for citizens.” How close is the US to engaging in yet another war? Pretty close, most of the speakers would agree, with any number of flash points to be found in the world: the Middle East, Ukraine, Africa, and many more. Grant Williams—managing editor of Things that Make You Go Hmmm…—noted that the worse things get economically, the more likely war becomes, especially at times of economic dislocation and when most people consider a major conflict unthinkable. As in 1914. As today, on the hundredth anniversary of the war to end wars. Others spoke of alternatives to a hot, shooting war. Jim Rickards, senior managing director of Tangent Capital Partners, talked about a financial war game he participated in in 2009. Back then, he posited a war in which China and Russia cooperated in the creation of a gold-backed currency of their own, in which they would demand that other nations pay in this currency if they wanted Russian or Chinese goods and services. His team in the game was ridiculed for this idea; yet today, something very like that is beginning to play out. Casey Research’s own Marin Katusa offered a preview of his new book, The Colder War, due out in early November. Vladimir Putin, Marin asserts, is winning this new cold war at the expense of an ineffectual President Obama. Putin laughs at US sanctions. They have no real teeth, Marin explained. They will mean nothing until the president proposes something that would actually hurt Americans—such as cutting off Russian exports of uranium to the US. Don’t expect to see that any time soon. Williams—who wowed the audience with a dynamic presentation that included a sound bite from Richard Nixon and an image of Ben Bernanke in a Hannibal Lecter serial killer mask—also noted that the news is full of stories about the wars in Syria, Ukraine, and Gaza, and about domestic wars on poverty, drugs, and Christmas (yes, Christmas). Yet the war that directly affects the most people in the US is never mentioned in the media. That’s the war on savers, waged through the debasement of the currency in which citizens have saved. While the prospects of various kinds of wars were clearly on many minds, this is not to say that day one of the Summit was wall-to-wall doom and gloom. Stephen Moore, chief economist at the Heritage Foundation, is very optimistic. He believes that bad times are coming to an end and that the prosperity on the way will be driven by America attaining energy independence, which should happen within five years or so. US companies have streamlined themselves over the past few years, and are now the best run in the world. And Moore ended with a message for Washington: if you really want to see the economy take off, cut the corporate tax rate to zero. Rick Rule—chairman of Sprott US Holdings and always a popular speaker at Casey Research Summits—lived up to his self-proclaimed role as the ray of sunshine in the room. The way to make money, Rick said, is to buy quality companies when they’re extremely undervalued. After a brutal three-year bear market, that’s currently the case with junior resource companies. Thus this is the time to position yourself for the inevitable rebound. Five years from now, Rick predicted, we’re going to look back on the present and say: “Those were the good old days.” Hedge fund manager Mark Yusko provided an even more positive outlook... for those who invest outside of North America. He sees the developing world stock markets dramatically outperforming US and European stocks and is himself heavily investing there, including having been a venture investor in yesterday's smash IPO for Chinese ecommerce giant Alibaba. Mark and the others were joined on stage by economist Mike "Mish" Shedlock, who the NY Times named one of the prescient voices ahead of the 2007 market crash. Mish also correctly called the current deflation and inflation tug-of-war, and the debt crises that have plagued the EU system. Now he's another big market change headed our way. If you’d like to hear what the next event to rock our markets is shaping up to be, and all the other the great presentations given here at the Summit, be sure to preorder the complete audio collection and get every presentation on CD or in MP3 format. They’re still available at a significant discount, so don’t hesitate to take advantage of this great offer to receive all presentations and associated slides. Doug Hornig |

| The Alibaba IPO May Shine, But Gold is Glistening Posted: 20 Sep 2014 12:58 AM PDT Scotland voted to remain part of the United Kingdom, Alibaba (BABA) is going to become the United States largest initial public offering (IPO), U.S. stock market indexes are up nearly 2% this week, Treasury yields are near lows, and gold and silver prices are getting bludgeoned in the paper market. |

| Cheap Gold Stocks Upleg Intact Posted: 20 Sep 2014 12:44 AM PDT Gold stocks have plunged in September, crushed by the withering selling pressure from heavy futures shorting hammering gold. As usual, these falling prices have kindled extreme bearishness on this left-for-dead sector. But despite this rotten sentiment, gold stocks’ young upleg remains very much intact technically. This impressive resiliency is fueled by these miners’ incredibly-cheap fundamental valuations. Gold stocks are without a doubt the most despised sector in all the stock markets. Thanks to the Fed’s brazen debt monetizations and manipulations of interest rates, the global markets are distorted beyond belief. Stock markets have soared to extreme valuations on the Fed’s implied backstopping, leading to epic complacency, greed, and hubris. That artificial levitation sucked vast capital out of alternative investments. |

| The London Gold Pool - 1961 to 1968 Posted: 20 Sep 2014 12:17 AM PDT Of course the Gold Price is manipulated, that's the point! By the beginning of the 1960s, the U.S.$ 35 = 1 oz. Gold price was becoming more and more difficult to sustain. Gold demand was rising and U.S. Gold reserves were falling, both as a result of the ever increasing trade deficits which the U.S. continued to run with the rest of the world. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

It is no secret that Russia has had enough of the Petrodollar, and in light of ongoing western sanctions – which many view not so much as a reaction to events in Ukraine bur merely as an attempt to halt the Russian revolution against the Petrodollar status quo, crushing its economy before the momentum grows and more countries join Moscow – is constantly thinking of ways it can ditch the dollar as a medium of exchange as fast as possible. The problem is that when it comes to retaliating against the West, Russia – short of declaring an embargo on USD payments for its commodities – has little control over what currency its western trading partners will pay in. So instead it is focusing on its net exporting peers, aka the BRICS, with whom as previously reported,

It is no secret that Russia has had enough of the Petrodollar, and in light of ongoing western sanctions – which many view not so much as a reaction to events in Ukraine bur merely as an attempt to halt the Russian revolution against the Petrodollar status quo, crushing its economy before the momentum grows and more countries join Moscow – is constantly thinking of ways it can ditch the dollar as a medium of exchange as fast as possible. The problem is that when it comes to retaliating against the West, Russia – short of declaring an embargo on USD payments for its commodities – has little control over what currency its western trading partners will pay in. So instead it is focusing on its net exporting peers, aka the BRICS, with whom as previously reported,  Why Gold? All forms of money serve as a 'medium of exchange', and 'unit of account' and 'store of value', which is convenient and flexible compared to barter. Key Point: Note that when a valuable commodity (such as gold) is used as money ('monetization of gold'), the money is worth as much as the goods or services in the transaction. It is not just a 'symbol' or 'measuring device'. This is also true of barter, but with gold's high value per weight and volume, etc., using gold is more convenient, and thus helps improve commerce.

Why Gold? All forms of money serve as a 'medium of exchange', and 'unit of account' and 'store of value', which is convenient and flexible compared to barter. Key Point: Note that when a valuable commodity (such as gold) is used as money ('monetization of gold'), the money is worth as much as the goods or services in the transaction. It is not just a 'symbol' or 'measuring device'. This is also true of barter, but with gold's high value per weight and volume, etc., using gold is more convenient, and thus helps improve commerce.

Many of us who are of a spiritual bent are rightfully concerned about the

Many of us who are of a spiritual bent are rightfully concerned about the

A wise saying goes like this; "Those who do not remember history are condemned to repeat it." So ask yourself: What is the fate of those who seem to have no recollection of events just a few years ago?

A wise saying goes like this; "Those who do not remember history are condemned to repeat it." So ask yourself: What is the fate of those who seem to have no recollection of events just a few years ago?

No comments:

Post a Comment