saveyourassetsfirst3 |

- Government pressure on miners to avoid Russia muddies the waters

- Will central banks need to buy gold back from the market?

- Detour Gold beginning to perform, but will it stay independent?

- Silver remains inclined to rise in line with gold

- Trader alert: This chart says gold is about to make a BIG move

- Is The Mainstream Media Dying?

- FOMC Minutes Day

- A massive bull market could be starting in one of the last places you'd guess

- Is The Loonie Swoon Really Over?

- Fractional-Reserve Banking: From Goldsmiths To Hedge Funds To…Chaos

- Geopolitical Changes Keeping Investors’ Interest in Gold

- Report: Chinese “Exchanging Gold for Cars, Silver for Houses”

- ‘The Birth of a New Bull Market’

- Russia buys $1.17 billion worth of gold in April

- India's silver bar imports plunge in April

- India Gold jewellery demand declines to 145.6 tons in Q1

- U.S. Exports 128 Metric Tons Of Gold Jan & Feb 2014… Supply Deficit Increases

- Peru expects gold output to recover in coming years

- Perspective

- Barclays’ head of spot gold trading leaves bank - sources

- The Return of Indian Gold Demand!

- Bye Bye Petro-dollar: $400 B China-Russia Gas Deal is Official!

- After Dumping UST Bonds, Russia Buys 900,000 Ounces Of Gold Worth $1.17 Billion In April

- Russia Buys 900,000 Ounces Of Gold Worth $1.17 Billion In April

- I’m a Fiat Slave, And So Are You

- Who needs gold really?

- European central banks Gold agreement renewal may boost Gold prices

- Russia Buys 900,000 Ounces Of Gold Worth $1.17 Billion In April

- Links 5/21/14

- Russia’s Central Bank Buys 28 Tonnes of Gold in April

- Financial Times: Currency Wars Heat Up Again

- European Commission Presidency Contenders Campaign Amid Indifference

- China Signs Non-Dollar Settlement Deal With Russia's Largest Bank

- Gold Slammed As 'Panic-Seller' Dumps $520 Million In Futures

- Barclays head of spot gold trading leaves bank - sources

- Eric Sprott: Chinese Gold Demand Falls, Indian Gold Demand May Increase, and More

- Gold demand in India to rise, Modi seen easing import curbs

- Jewellers, bullion traders jubilant with election results

- AngloGold’s new game-changing technology churns out 1,600 oz

- Lawrence Williams: Latest ECB gold sales agreement raises questions

- German TV network broadcasts long program on gold market manipulation

- Double Bottom In For Gold Prices?

- Silver Forecast May 21, 2014, Technical Analysis

- CHARTS : Critical Support in Silver

- Pierre Lassonde: Mining Cycles Are Good for Royalty Companies and Investors

- Gold Standard Ventures Consolidates Southern Carlin Trend District

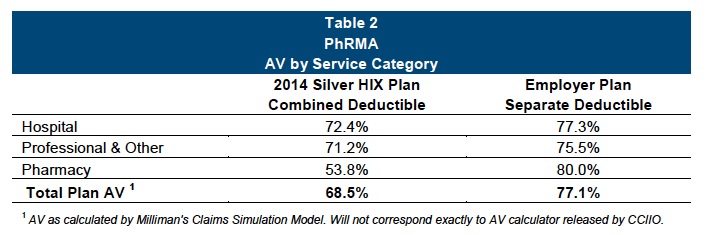

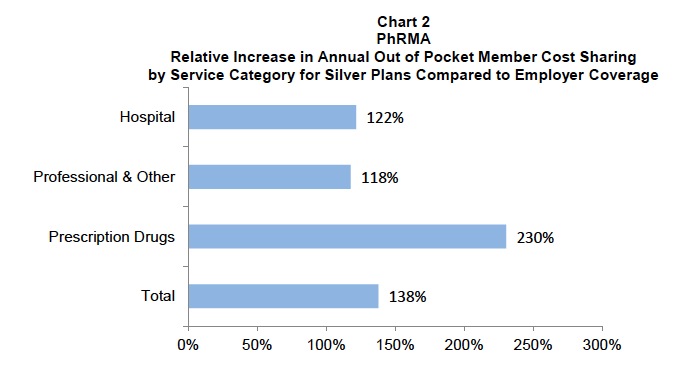

- How Obamacare Policy Holders and Big Pharma Lose Out from Insurers Gaming Plan Designs

- US Dollar Trend May Have Reversed, SPX 500 Slumps to Monthly Support

- Gold Trading Without Direction Or Conviction

- Gold Price Bearish Reversal Ahead

| Government pressure on miners to avoid Russia muddies the waters Posted: 21 May 2014 01:45 PM PDT Notably Kinross Gold ducks Canadian government pressure to avoid Russian events, underscoring what's wrong with the policy in the first. |

| Will central banks need to buy gold back from the market? Posted: 21 May 2014 01:13 PM PDT Julian Phillips outlines his view on gold leasing, and why, for instance, the Bundesbank has been slow to repatriate. |

| Detour Gold beginning to perform, but will it stay independent? Posted: 21 May 2014 12:50 PM PDT Detour Gold's size and long term production potential make it a takeover target for a gold major. |

| Silver remains inclined to rise in line with gold Posted: 21 May 2014 12:44 PM PDT The gold price will continue in a tight trading range before a strong move either way in New York, says Julian Phillips. |

| Trader alert: This chart says gold is about to make a BIG move Posted: 21 May 2014 12:01 PM PDT From InvesTRAC:

This is an alert. The gold price has formed a triangle type pattern and is dropping out of it, plus the moving averages have converged with price. This type of action invariably precedes a sharp move.

More on gold: How you can buy gold at a BIG discount today Is the gold bull market over? Read this and decide for yourself. What history says about gold and silver prices now |

| Is The Mainstream Media Dying? Posted: 21 May 2014 12:00 PM PDT

Ratings at CNN, MSNBC and Fox News have all been plummeting in recent years, and newspaper ad revenues are about a third of what they were back in the year 2000. That is not just a “shift” – that is a massive tsunami. So is the mainstream media dying? From The Economic Collapse Blog: Despite [...] The post Is The Mainstream Media Dying? appeared first on Silver Doctors. |

| Posted: 21 May 2014 11:56 AM PDT Today was the day on which we get the release of the minutes from the April FOMC meeting. Traders were not expecting much out of these that was not already in the market. In spite of that, the focus seemed to shift to a paragraph: "In their discussion of the economic situation and the outlook, meeting participants generally indicated that their assessment of the economic outlook had not changed materially since the March meeting. Severe winter weather had contributed to a sharp slowing in activity during the first quarter, but recent indicators pointed to a rebound and suggested that the economy had returned to a trajectory of moderate growth." It has always been a mystery to me how markets manage to focus on certain aspects of reports, whether from here in the FOMC minutes, the Labor Department or the USDA, and ignore other aspects which are equally important. You could definitely make the case that the Fed is viewing the economy in friendlier terms yet the minutes contained plenty of caveats and concerns. The initial kneejerk reaction however was to ignore the caveats with market players scrutinizing talk about the Fed's exit strategy from low interest rates. In an economy that has become so utterly dependent on these low rates, any talk, any discussion, any focus by the Fed on this topic, is going to create some nervousness. The first reaction for gold was to sharply plunge scoring a new low back to May 12. That however was quickly erased as players seemed to actually take the time to read through the minutes. Doing so shows nothing especially new from the March meeting in my view. Yes, at some point they are going to raise rates, but the economy is going to have to be strong enough for them to consider doing that and for now, it is not there yet. Also seeming to help gold recover were lingering concerns dealing with geopolitical risks. While Ukraine seems to have faded somewhat from the minds of traders, some are still buying gold ahead of this weekend's election. I would be a bit surprised to see gold lose chart support before that vote is held and traders get a chance to see the reaction and responses. The result of all this up and down, go nowhere price movement is to contain gold in its range trade. Once again it should be noted that the pattern of lower highs is continuing. Support remains intact. Nearly the same pattern can be seen in the HUI and the GDXJ, however both of those indices look quite heavy compared to the Comex gold chart. Eventually this constriction is going to be resolved in one direction or the other. Here is the deal - gold could actually break through chart support and drop to $1260 and yet set up another range trade with a lower top and a lower bottom. In other words, the possibility exists that gold could go nowhere for quite some time with the metal being content to just meander back and forth in a prolonged period of sideways price movement. Much will depend upon traders' assessment of the broader equity markets. If the bulk of them are looking past the current period of hesitancy and caution to better times ahead then risk appetite will stay strong for equities and that will keep gold off the radar screen for most here in the West. It throws off no yield and locks up scarce trading capital and money managers do not get paid to produce nothing. They will put capital to work where it can garner the most returns. If the environment shifts to one of caution for the majority, then gold will find support and hold up as money managers will be more interested in return OF capital rather than return ON capital. Some interesting news today out of India, the world's second largest gold buyer. The consensus has been that the election of a new government would be considered friendly for gold prices as it would eliminate the tariff or import taxes on the metal which the previous government had established. That tax was raised to 10% from 2%. It had also ruled that "20% of all gold imports must be re-exported as jewelry, coins or other finished products" according to a story that appeared on Dow Jones this AM. However, thus far it seems it is having the opposite effect. According to that same story from Dow Jones, premiums have come down and more gold is actually being sold for the time being. The reason? - Indian dealers are reporting that many fear the relaxation of the taxes will result in more gold coming into the country. That will have the effect of causing prices to actually fall as supply increases. Some are selling out ahead of this. They quote a large dealer in recycled gold in "the western Indian city of Mumbai's Zaveri Bazaar, the country's largest gold market as saying: ' We are getting more sellers than buyers these day. Most of these sellers are coming to offload their bars and coins, which they purchased a few months back". The big question that many are having, is after this initial response over fears of increased supply, will demand then actually rise as the prices move lower with the premiums coming down. Of course that is the question that we all have. The World Gold Council projects Indian gold demand for 2014 to range between 900 and 1,000 metric tons. Last year it was 975 tons. That is a fairly wide range. We are certainly going to find out. Gold bulls need Indian demand to stay very strong to help offset reduced Western investment interest. Along that same line, GLD reported yet another reduction in its gold holdings. They are now down to 780.19 tons, the lowest reading since late December 2008. Here is a funny thing - shortly after looking over the story mentioned above, more news broke from out of India which sent gold higher almost immediately. India's Central Bank slightly relaxed their gold import rules. I suspect traders were thinking that it would help gold demand when the period for peak buying in India emerges later this year. However, the short term impact might be negative as the previous story indicated. That took the market right back down. Hard to say - we'll just watch and see how things shake out and go from there. One thing that I can say with some certainty, which is becoming harder and harder to do in these goofy markets anymore, is that the mining shares, basis the HUI continue to perform quite poorly. Same goes for the GDXJ, which is hovering above a recent low near 33.75. Buyers seem scarce at the moment. Maybe they will come back before the close of trading today. Gold, and anything gold related right now seems to be an enormously BORING sector. By the way, this is the reason that CME recently cut margin requirements to trade it. Markets that go nowhere lose speculative interest. They are also enormously frustrating for many traders because of the random price movements up and down without rhyme or reason. Most of the time that is caused by speculators just getting out, whether long or short and saying, "the hell with this useless market". Gold seems to fit this description very well right now. By the way, I am sure that we are going to get more breathless commentary from the GIAMATT crowd how gold "was attacked in a brutal takedown" as soon as the FOMC minutes were released. We will not however get any comments on the equally goofy spike back up in price which erased all those losses in minutes. Of course we all know here that evil manipulators are at work in the gold market attempting to manipulate prices higher and giving the appearance to the masses that inflation is ramping up proving that the Fed's policies are working and that they are achieving their goal of an inflation rate of 2%. Why just today several Fed governors were out congratulating themselves about this increase in inflation. Actually what happened was the exact opposite - several of them were bewailing the lack of inflation and were telling us that is could be several years before it returns to their target rate of 2%. However, these Fed-sponsored buyers were buying huge, obscene amounts of gold contracts, without any attention to finesse or the impact that such indiscriminate buying will have on those hoping to obtain the best possible buying price for their metal. They drove the price higher and well up from session lows, punishing the bears who dared to short this key metal that the Fed obviously now wants to stop going lower. Those of you who read here regularly know by now that I enjoy using sarcasm and hyperbole to illustrate absurdity. Can you see the folly in this never-ending, day in and day out dissecting of every move lower and higher in gold? It is such a waste of time, energy and talent. Just call it what it is - markets are confused - traders are unsure of much - data is conflicting and the Fed itself is uncertain. One moment they focus on one thing - the next moment they are looking at something else. Pick your daisy, pluck the pedals off, repeat the phrase, " She love me; she loves me not" and you have a pretty good description of what takes place on some days in these confused markets. Speaking of confused markets - Jack had his magic beans but the soybean pit has its magic word, "CHINA". it was old news but China reported huge demand for US beans. That sent visions of empty bins here in the US and up they went. Yesterday they went flying high only to implode lower. Today they went sharply higher yet again ( for now). For the sake of illustration, here is a one hour chart of the old crop bean contract. And these gold guys think they have seen price volatility. Soybeans make gold trading look like it is similar to watching paint dry. Observe the huge swings in price, soaring rallies followed by steep plunges only to reverse sharply at move higher again followed by another steep drop. Behold what wonders hedge fund computers have wrought! Moving to touch on the currencies a bit - The Draghi verbal takedown of the Euro that began back when it was near the 1.400 level, has been most effective in undercutting that currency. It has fallen about 2.5% against the greenback since the second week of May and is now perched above a major chart support zone. If you notice the ADX, it is rising and above 25 indicating the presence of a trending move lower. Bears are currently in control. Bulls have a shot at holding the Euro near current levels but if they do not, we should see it drop initially to slightly below the 1.36 level. Failure there and 1.35 is in store. Since the Euro makes up such a large portion of the basket of currencies that comprise the US Dollar Index ( USDX), any sharp fall in the Euro will tend to magnify any upward movements in the Dollar. This will need to be watched closely for if the Dollar begins to gain some additional tailwinds pushing it up, gold is going to test that key chart support region near $1280 yet again. Keep in mind that these currencies have been extremely volatile due to the ebb and flow of safe haven plays of late ( ask any Yen traders about this if you are doubters). Currencies are always sensitive to anything their respective Central Bankers might say but given the current environment, they are even more so at the current time. That being said, I am especially on alert for interest rate movements here in the US or in the Euro Zone. Current thinking is that while the market does not expect any rate hikes here in the US until at least next year, odds favor higher rates here much sooner than in the Euro Zone. Some are talking interest rate reductions in the Euro zone if it does not show some more increased growth by the time the next ECB meeting occurs next month. Either that or some form of QE coming from the ECB. We shall see but this type of talk tends to pressure the Euro at the expense of the Dollar. I am also noticing on the crosses that the British Pound is gaining on the Euro as well. UK retail sales were very strong in April according to data released today over there. That fed talk of a higher rates there in the UK as well. Another bit of foreign news - Moody's Investor Service released a report noting concerns over China's housing market. They lowered the sector rating outlook from stable to negative. " A significant slowdown in residential property sales growth, high inventory levels and weakening liquidity over the coming 12 months" was the key phrase. Copper seemed to take it cues from that as it put in its lowest close since May 9. On the energy front, can anyone say "Soaring Crude Oil Prices". Crude is working its way back higher again after only the briefest of forays beneath the $100 level early this month. In looking at the price action of this key market, I have to wonder if it is telling us something about the health of the US economy. Like just about everyone else out there, I am unclear on the exact picture when it comes to US growth. Some data looks promising when it comes out; some data looks negative. Obviously, in the face of big supply coming from domestic shale production, demand is staying quite strong. Is the US economy driving this alone? The chart shows some heavy overhead resistance near and around the $105 zone. Thus far that level has capped the price rise. If crude clears that, it should trade to $108 in short order. Can it? I have no idea but am watching. On a different note - check out the following link when you can: http://www.hollywoodreporter.com/news/fast-furious-7-insurance-claim-706037 It concerns the wildly successful "Fast and Furious" franchise. Many of you are no doubt familiar with the very sad passing of Paul Walker, one of the main stars in this series of movies. Apparently, they are planning on some technological tricks to keep his character going in the planned 7th installment. This is similar to what they did with the movie, "Tron - Legacy" where they used the same technology to overlay a younger face of the actor Jeff Bridges on a different actor. I guess it is "progress" but the whole thing strikes me as pretty weird, almost morbid, when it comes to replacing an actor that has passed away with a computerized image. If I were a Hollywood actor, I would be a bit nervous about this. Before long, they will not need any actors - they will be able to do the whole thing with computer generated characters. That should lower the cost of making the movie which I am sure will be passed on to us, the consumer, in the form of lower theater ticket costs. ( note this is sarcasm here) Have any of you out there been to the movies lately and grabbed some pop corn and a drink? Yikes! I mentioned just recently having some fun with the movie "Godzilla" but I can report that another thing that the monsters savaged besides Honolulu, Las Vegas and San Francisco was my wallet. |

| A massive bull market could be starting in one of the last places you'd guess Posted: 21 May 2014 11:34 AM PDT From J. Clark, Senior Precious Metals Analyst, Casey Research: If I asked you why you think I'm bullish on platinum and palladium, you'd probably point to the strikes in South Africa, the world's largest producer of platinum. Or maybe the geopolitical conflicts with Russia, the largest supplier of palladium. Maybe you'd even mention that some technical analysts say the palladium price has "broken out" of its trading range. These are all valid points—but they're reasons why a trader might be bullish. When the strikes end, or Russia ends its aggression, or short-term price momentum eases, they'll sell. And that will be a mistake. Because underneath the headlines lies an irreparable situation with the PGM (Platinum Group Metals) market, one that will last at least several years and probably more like a decade. This market is teetering on the edge of a supply crunch, one more perilous than many investors realize. As the issues outlined below play out, prices will be forced higher—which signals that we should diversify into the "other" precious metals now. The basic problem is that platinum and palladium supply is in a structural deficit. It won't be resolved when the strikes end or Russia simmers down. Here are six reasons why… #1. Producers Won't Meet the Cost of Production The central issue of the striking workers in South Africa is wages. In spite of company executives offering to double wages over the next five years, workers remain on the picket line. Regardless of the final pay package, wages will clearly be higher. And worker pay is one of the biggest costs of production. And the two largest South African producers (Anglo American and Impala), which supply 69% of the world's platinum, are already operating at a loss.

Once the strike settles, costs will rise further. Throw in ongoing problems with electric power supply, high regulations, and past labor agreements, and there is virtually no chance costs will come down. This dilemma means that platinum prices would need to move higher for production to be maintained anywhere near "normal" levels. Morgan Stanley predicts it will take at least four years for that to occur. And if the price of the metal doesn't rise? Companies will have no choice but to curtail production, making the supply crunch worse. #2. Inventories Are Near the Bottom of the Barrel One reason platinum price moves have been muted during the work stoppage is because there have been adequate stockpiles. But those are getting low. Impala, the world's second-largest platinum producer, said the company is now supplying customers from its inventories. In March, Switzerland's platinum imports from strike-hit South Africa plummeted to their lowest level in five-and-a-half years, according to the Swiss customs bureau. Since producers can't currently meet demand, some customers are now obtaining metal from other sources, including buying it in the open market. As inventories decline, supply from producing companies will need to make up the shortfall—and they'll have little ability to do that. #3. The Strikes Will Make Recovery Difficult and Prolonged Companies are already strategizing how to deal with the fallout from the worst work stoppage since the end of apartheid in 1994…

#4. Russian Palladium Is Already in a Supply Crunch When it comes to palladium, Russia matters more than South Africa, since it provides 42% of global supply. Remember: palladium demand is expected to rise more than platinum, due to new auto emissions control regulations in Asia. But Russia's mines are also in trouble…

Take a look at reserve sales today:

Many analysts believe that since palladium reserve sales have shrunk, Russia has sold almost all its inventory. As unofficial confirmation, the government announced last week that it is now purchasing palladium from local producers. This paints a sobering picture for the world's largest supplier of palladium—and is very bullish for the metal's price. #5. Demand for Auto Catalysts Cannot Be Met The greatest use of PGMs is in auto catalysts, which help reduce pollution. Platinum has long been the primary metal used for this purpose and has no widely used substitute—except palladium. But that market is already upside down.

Palladium is cheaper than platinum, but replacing platinum with palladium requires some retooling and, on a large scale, would worsen the supply deficit. As for platinum (which does work better than palladium in higher-temperature diesel engines), auto parts manufacturers are expected to use more of it than is mined this year, for the third straight year. Some investors may shy away from PGMs because they believe demand will decline if the economy enters a recession. That could happen, but tighter emissions controls and increasing car sales in Asia could negate the effects of declining sales in weakening Western economies. For example, China is now the world's top auto-producing country. According to IHS Global, auto sales in China are projected to grow 5% annually over the next three years. PricewaterhouseCoopers forecasts that sales of automobiles and light trucks in China will double by 2019. That will take a lot of catalytic converters. This trend largely applies to other Asian countries as well. It's important to think globally when considering demand. The key, however, is that supply is likely to fall much further than demand. #6. Investment Demand Has Erupted Investment demand for platinum rose 9.1% last year. The increase comes largely from the new South African ETF, NewPlat. At the end of April, all platinum ETFs held nearly 89,000 ounces—a huge amount when you consider it was zero as recently as 2007. Palladium investment fell 84% last year—but demand is up sharply year-to-date due to the launch of two South African palladium ETFs, pushing global palladium holdings to record levels. And like platinum, there was no investment demand for palladium seven years ago. Growing investment demand adds to the deficit of these metals. The Birth of a 10-Year Bull Market Add it all up and the message is clear: by any reasonable measure, the supply problems for the PGM market cannot be fixed in the foreseeable future. We have a rare opportunity to invest in metals that are at the beginning of a potential 10-year bull run. Platinum and palladium prices may drop when the strikes end, but if so, that will be a buying opportunity. This market is so tenuous, however, that an announcement of employees returning to work may be too little, too late. We thus wouldn't wait to start building a position in PGMs. GFMS, a reputable independent precious metals consultancy, predicts the palladium price will hit $930 by year-end and that platinum will go as high as $1,700. But that will just be the beginning; the forces outlined above could easily push prices to double over the next few years. At that point, stranded supplies might start coming back online—but not until after major, sustained price increases make it possible. The RIGHT Way to Invest In my newsletter, BIG GOLD, we cover the best ways to invest in the metals themselves (funds and bullion), but for the added leverage of investing in a profitable platinum/palladium producer, I have to hand the baton over to Louis James, editor of Casey International Speculator. You see, most PGM stocks are not worth holding, so you have to be very diligent in making the right picks. Remember, the dire problems of the PGM miners are one reason we're so bullish on these metals. However, Louis has found one company in a very strong position to benefit from rising prices—and its assets are not located in either South Africa or Russia. It's the only platinum mining stock we recommend, and you can get its name, our full analysis, and our specific buy guidance with a risk-free trial subscription to Casey International Speculator today. If you give it a try today, you'll get three investments for the price of one: Your Casey International Speculator subscription comes with a free subscription to BIG GOLD, where you'll find two additional ideas on how to invest in the PGMs. If you're not 100% satisfied with our newsletters, simply cancel during the 3-month trial period for a full refund—but whatever you do, make sure you don't miss out on the next 10-year bull market. Click here to get started right now.

More on precious metals: This could be your last great chance to buy one precious metal before it SOARS Incredible chart shows a RARE opportunity in silver right now This could be the gold discovery of the decade… And it's "on sale" right now

|

| Is The Loonie Swoon Really Over? Posted: 21 May 2014 11:29 AM PDT At the beginning of 2014, Canadian dollar speculators were heavily positioned for the loonie to lose to the USD. According to the COT report from December 31st, 2013, speculators had a net short of 74,495 contracts. As the new year rolled in, the USDCAD was valued around 1.06. The spec had this trade right, as the USD appreciated to the topside of 1.1220 at the end of January. Sadly for the Canadian dollar bears, the trend has ended for the C$ versus the USD, and the trade has been flailing over a 460 pip range, redistributing wealth in the process. Recently David Rosenberg, the well respected economist with Gluskin Sheff and Associates in Toronto had some insightful observations courtesy if the Globe and Mail. He contends:

|

| Fractional-Reserve Banking: From Goldsmiths To Hedge Funds To…Chaos Posted: 21 May 2014 10:39 AM PDT From Chapter 15 of The Money Bubble, by James Turk and John Rubino: Banking didn't start out as a reckless, parasitical plaything of a moneyed and politically-connected aristocracy. In the beginning, in fact, bankers weren't even bankers. They were jewelers and goldsmiths who had to maintain their inventory with vaults, guards etc., and offered storage services to others with valuables to protect. So the original banks were, in effect, very safe warehouses. Eventually some goldsmiths noticed that the paper receipts they gave to their customers to evidence the valuables left in storage began to circulate as currency alongside their countries' coins. A shopkeeper accepting these receipts in payment knew that he could go to the goldsmith to redeem them for gold and silver, and also recognized that a paper receipt was more convenient to use as currency than were pieces of metal. Gradually these receipts became a widely-accepted form of payment, circulating among buyers to sellers and saved like other forms of wealth. The goldsmiths then noticed something else about their new paper-money invention: Only a tiny fraction of their clients asked for the return of their valuables in any given period, which led to a bright – but legally and morally-dubious – idea. Why not start issuing receipts in excess of the gold and silver on hand? The goldsmiths could spend this currency themselves or lend it to others – thus inventing the business/consumer loan. Henceforth the total gold and silver in the vault (the goldsmith's reserves) would equal only a fraction of the receipts circulating as currency. "Fractional reserve banking" was thus born of deception if not outright fraud, because for the receipts to retain their value the goldsmiths had to pretend that those paper claims to gold and silver were backed by an equal amount of metal and were therefore of equivalent value. They were not, of course, because a tangible asset is more valuable than a promise to pay a tangible asset, particularly when the latter outnumbers the former. The goldsmiths, having evolved into more-or-less recognizable bankers, then realized that more deposits equaled more profits. So they began paying people for deposits of gold and silver rather than charging for their storage, thus inventing the interest-bearing account. The resulting system had some inherent dangers, most obviously that it tempted bankers to lend out ever-greater multiples of deposits, increasing the odds that they would be unable to meet withdrawal requests and collapse. This happened frequently early-on, eventually leading governments to regulate the amount that a given bank could lend against its capital. For a sense of how this works, imagine a bank with $100 in capital that is required to hold a reserve equal to 20 percent of its loans outstanding – which based on experience is usually more than enough to satisfy a typical day's withdrawal requests. In our example, the bank can lend 4/5ths of its depositors' money, or $80, while 1/5th, or $20, remains in reserve. Now here's where it gets interesting: When our hypothetical bank makes a loan, the recipient deposits the proceeds in another bank, which can lend out 4/5ths of that deposit. The recipients of those loans make deposits in other banks, and so on, until a huge multiple of the original deposit base has been turned into circulating currency. The result is an "elastic" money supply. When borrowers are optimistic and want to increase their borrowing, banks in a fractional reserve system can in the aggregate offer them immense amounts of new credit. So the money supply, instead of being determined by the amount of gold, silver or other bank capital in the system, can expand dramatically to accommodate an energetic society's demands. But it can also contract dramatically. If an economy that has greatly increased its money supply through bank lending suddenly takes a downturn or is unnerved by an unexpected crisis, borrowers will pay off their loans or default on them and banks won't replace them, while depositors seek the return of their cash. These actions cause the money supply to collapse, potentially all the way back to the level of base money in the system. The result of this fluctuation in the supply of circulating currency is a recurring series of booms and busts that wipe out businesses, individuals, and banks and frequently send the general economy into recession or depression. Fractional reserve banking was, in fact, a major cause of the Great Depression. To condense a long, complex story into a single paragraph, the extra currency that was printed by the belligerents during World War I (which ended in 1918) was recycled through the fractional reserve banking system and massively amplified via the process we've just described. This tsunami of new credit caused the Roaring Twenties boom in asset prices – especially global equities – that popped in 1929, destroying the pseudo-wealth created in the previous decade. The collateral supposedly guaranteeing bank loans evaporated and sentiment turned negative, sending the fractional reserve credit machinery into reverse and collapsing both the banking system and the real economy. Today’s situation is much, much worse. To see how, click here: |

| Geopolitical Changes Keeping Investors’ Interest in Gold Posted: 21 May 2014 10:33 AM PDT According to the World Gold Council (WGC), the gold demand in Q1 2014 was 1,074 tonnes, lower than in Q1 2013. |

| Report: Chinese “Exchanging Gold for Cars, Silver for Houses” Posted: 21 May 2014 10:30 AM PDT

He Jun turned to precious metals because of the ban. "I believe gold and silver, which have high market liquidity, are suitable for settling debts," he noted, adding that "gold can be exchanged for cars and silver for houses." …For example, He uses silver objects worth of 500,000 yuan (US$80,000) to pay off at least [...] The post Report: Chinese “Exchanging Gold for Cars, Silver for Houses” appeared first on Silver Doctors. |

| ‘The Birth of a New Bull Market’ Posted: 21 May 2014 10:25 AM PDT The Birth of a New Bull Market |

| Russia buys $1.17 billion worth of gold in April Posted: 21 May 2014 10:07 AM PDT Gold is marginally lower today at $1,293.50/oz and remains in lock down in an unusually tight range. |

| India's silver bar imports plunge in April Posted: 21 May 2014 09:30 AM PDT The Gems and Jewellery Export Promotion Council suggests a huge drop in the country's silver bar imports during April. |

| India Gold jewellery demand declines to 145.6 tons in Q1 Posted: 21 May 2014 09:02 AM PDT India gold jewellery demand declined by 9% year-on-year to 145.6 tons during the first three months of this year, said London based World Gold Council (WGC). |

| U.S. Exports 128 Metric Tons Of Gold Jan & Feb 2014… Supply Deficit Increases Posted: 21 May 2014 09:00 AM PDT

As Russia, China and the other BRIC countries work towards a system that doesn't include the TURD called the U.S. Dollar, Americans have less and less time to prepare for the GREATEST TRANSFER OF WEALTH…. in history. Not only did the U.S. export 128 metric tons of gold in the first two months of the [...] The post U.S. Exports 128 Metric Tons Of Gold Jan & Feb 2014… Supply Deficit Increases appeared first on Silver Doctors. |

| Peru expects gold output to recover in coming years Posted: 21 May 2014 08:52 AM PDT Peru's output has declined in recent years as deposits dwindle at large mines and local opposition and red tape hold up new projects. |

| Posted: 21 May 2014 08:52 AM PDT Today, a stake was driven through the heart of U.S. dollar hegemony. You could tell, right? I mean, seriously. Look at the doll---, OK it's up. And stock mar---, OK it's up, too. No, seriously though, this is a VERY BIG DEAL though, of course, the Status Quotians couldn't care less. |

| Barclays’ head of spot gold trading leaves bank - sources Posted: 21 May 2014 08:31 AM PDT Sources familiar with the situation say Marc Booker is leaving as part of the bank's restructuring and its exit from the commodity business. |

| The Return of Indian Gold Demand! Posted: 21 May 2014 08:00 AM PDT

The landslide win of Narendra Modi just days ago is viewed by Indian economists as the catalyst that will raise Indian GDP growth to 8%. The bottom line is that India's gargantuan population is young, vibrant, and hungry for gold! The only way for Indians to get the enormous amount of gold they will demand [...] The post The Return of Indian Gold Demand! appeared first on Silver Doctors. |

| Bye Bye Petro-dollar: $400 B China-Russia Gas Deal is Official! Posted: 21 May 2014 06:24 AM PDT

Led by Vladimir Putin negotiating in Shanghai himself, the Russia-China “Holy Grail” Gas Deal of the Century- $400 billion over 30 years, is official. Bye-bye Petro-dollar! Originally posted at RT.com: After 10 years of negotiations, Russia’s Gazprom and China’s CNPC have finally signed a historic gas deal which will provide the world’s fastest growing economy [...] The post Bye Bye Petro-dollar: $400 B China-Russia Gas Deal is Official! appeared first on Silver Doctors. |

| After Dumping UST Bonds, Russia Buys 900,000 Ounces Of Gold Worth $1.17 Billion In April Posted: 21 May 2014 06:12 AM PDT

For anyone who wondered what Russia was doing with the $21 billion in US Treasury bonds it dumped in March alone, we now have the definitive answer. From Goldcore: Today's AM fix was USD 1,292.00, EUR 942.65 and GBP 764.81 per ounce. Yesterday's AM fix was USD 1,291.50, EUR 943.46 and GBP 767.56 per ounce. [...] The post After Dumping UST Bonds, Russia Buys 900,000 Ounces Of Gold Worth $1.17 Billion In April appeared first on Silver Doctors. |

| Russia Buys 900,000 Ounces Of Gold Worth $1.17 Billion In April Posted: 21 May 2014 05:31 AM PDT gold.ie |

| I’m a Fiat Slave, And So Are You Posted: 21 May 2014 05:26 AM PDT Fiat money is at base a form of indirect wealth transfer from those forced to hold the money to those issuing the money. I describe the pernicious servitude created by debt as debt serfdom, as serfdom implies a neofeudal arrangement that requires serfs’ acceptance of this financial yoke of servitude. In other words, debt is freely accepted as the line of least resistance in a system that incentivizes debt and places high barriers to debt-free independence from a Status Quo operated to benefit the owners and issuers of debt, not the debtors.

Correspondent Jeff W. has identified an even more insidious form of monetary servitude that he calls fiat slavery, as the servitude is enforced by fiat (unbacked government-issued) money. In other words, being forced to use state-issued fiat currency is a form of servitude, as fiat money is at base a form of indirect wealth transfer from those forced to hold the money to those issuing the money. Beyond this state-enforced wealth transfer from citizens to the state, there is a secondary wealth transfer going on in any fiat-money system: the neofeudal financial nobility who are closest to the money spigot get to buy whatever real-world assets and income streams offer the best return before the money trickles down to the debt-serfs paying interest and taxes. For example, the financial nobility can borrow billions of dollars at near-zero interest from the Federal Reserve, and use this nearly-free fiat money to buy student loans that pay 7+% annually. They can also snap up houses for cash that the nobility then rents to debt-serfs who have been outbid by those with the extraordinary advantage of unlimited access to the Fed’s nearly-free fiat money. Here is Jeff’s commentary:

Almost everyone understands what it means to be a tax slave. It means that people must work several months of the year for the benefit of the taxing authorities. Taxes in the U.S. today are several times higher than they were 100 years ago, and at present-day tax levels, today's Americans are rightly called tax slaves. What it means to be a debt slave is also easy to understand. It means that one must spend a large fraction of one's time to earn money to pay creditors. Millions of Americans today are mired deeply in debt, but today's America is also a country where if you personally stay out of debt, the government will go into debt for you. Each American taxpayer is on the hook for his or her share of over $17 trillion in debt that government admits to; the real debt total is much higher. Government leaders are eagerly plunging us ever deeper into debt each year. Most Americans also have personal experience of being a wage slave. It means that a person has no way to make a living except by selling his labor into a glutted market. Thomas Jefferson hoped that most Americans could own their own farms and thereby profit from capital improvements that they made through their own efforts. Such Americans could be their own bosses and escape wage slavery. But today we live in an age of huge factory farms, and it is more difficult than ever to establish or run any small business. Thus wage slavery is the norm for Americans today. But few people understand what it means to be a fiat slave. Being a fiat slave means that one lives in a country where the machinery of money printing is used to maximize wealth extraction from its citizens. How do they maximize the wealth they can extract through money printing? First of all, it is done by increasing of the volume of transactions that take place in a given fiat currency. Each newly-printed unit of fiat is a drop in the bucket in terms of the inflation it creates, and more fiat can be printed without causing serious inflation if a country has a bigger bucket. For example, Canada's GDP is about 11% the size of America's. At first glance this might be taken to mean that Americans can print nine times more dollars than Canadians. But we must also remember that U.S. dollars circulate throughout the world, and Eurodollars and petrodollars also add to the total of U.S. dollar transactions. Because of extraterritorial dollar circulation, the U.S. might actually be able to print 20 times more than Canada without causing serious (in terms of causing political problems for the money printers) inflation. From this we see why money printers may want to fight wars to protect America's dollar circulation areas in the Middle East or in Afghanistan, where much of the opium trade is transacted in dollars. But a country's fiat transaction volume is only part of the equation. A more important part of the equation is the inflation level. Imagine two countries: Country A with an annual fiat transaction volume of 100 trillion units per year and Country B with a volume of 50 trillion. Everything else being equal, Country B can only print half as much fiat each year to give to its government and its banking elite. But suppose further that the inflation rate in Country A is 5% absent any money printing, and the inflation rate in Country B is negative 2% due to global wage arbitrage, regulatory suppression of small businesses, and high unemployment. Suppose further that a real inflation rate of 5% is the money printers' upper limit because it is the maximum asset erosion that wealthy bondholders will tolerate. Now we see that potential money printing in Country A is reduced to zero, while potential money printing in Country B is 3.5 trillion units (50 trillion times seven percent). American money printers thus have trillions of dollars in incentive to support deflationary policies, which may include global wage arbitrage (sending work to the country where labor is cheapest), suppression of job creation by small businesses, suppression of private-sector labor unions, support for open borders immigration, commodity price suppression through market interventions, support for genetically modified seeds so as to push agricultural prices down, support for owners taking a larger share of corporate revenues so as to reduce labor's share, and support for high levels of consumer debt so as to dampen inflationary pressure in a nation of demoralized debt slaves. All of these oppressive policies enrich the money printers at the citizens’ expense. Tax slavery, debt slavery, wage slavery, and fiat slavery are four methods that elites employ to extract wealth from the people. To this list we should also add their encouragement of Ponzi gambling. Ponzi asset bubbles are constantly being created and citizens are encouraged to go into debt to "cash in" on bubble profits (or get wiped out in bubble crashes). Those five methods are the major wealth extraction methods they use. Those who support the cause of human freedom must resist tax slavery by insisting on a government that keeps its spending down to the bare basics. Free people must also support a culture that discourages people from getting into debt and encourages them to get out of debt and stay out. They must demand that government debt be rolled back to zero. Policies that favor capital accumulation in families and a supportive legal environment for small businesses are the antidotes to wage slavery, and free people must also demand that there be zero wealth extraction from the citizens through money printing. That can best be done by requiring 100% gold backing for currency and eliminating fractional reserve banking. Eliminating the inflation that comes from money printing will also go a long way toward eliminating asset bubbles and Ponzi gambling on asset bubbles. Older Americans have watched as a once-free people have been reduced to slave-like conditions. Not only has wealth been ruthlessly extracted from the people, but today's surveillance state is more intrusive than ever, and the police are increasingly insolent and imperious. What are we going to do? A necessary first step is to take the blinders off and to see clearly how elites are victimizing you. A second step is to figure out what practical steps you can take as an American to secure the blessings of liberty for yourself and your posterity. Freedom is not free, as the saying goes, and the price of freedom is not only eternal vigilance, but also intelligent action. We should begin this work today. Thank you, Jeff, for describing our fiat bondage. Awareness of the sources of wealth transfer and monetary servitude is the first step forward. Of related interest: Bernanke the Sophist: The Deception Behind QE. Want to give an enduringly practical graduation gift? Then give my new book Get a Job, Build a Real Career and Defy a Bewildering Economy, a mere $9.95 for the Kindle ebook edition and $17.76 for the print edition. |

| Posted: 21 May 2014 04:23 AM PDT Four reasons to waste your time with the deeply historic, deeply human value ascribed to gold... |

| European central banks Gold agreement renewal may boost Gold prices Posted: 21 May 2014 04:15 AM PDT The European Central Bank and other central banks announced the fourth Central Bank Gold Agreement on Monday, and bullion's importance as part of the global monetary reserve system is reinforced, said HSBC in a research note. |

| Russia Buys 900,000 Ounces Of Gold Worth $1.17 Billion In April Posted: 21 May 2014 03:57 AM PDT Gold in Singapore, which often sets the price trend in Asia, traded at $1,292.23/oz prior to a bounce to just over $1,295/oz. The Russian central bank has been gradually increasing the Russian reserves since 2006 (see chart). On average they have been accumulating 0.5 million troy ounces every month. Therefore, the near 1 million ounce purchase in April is a definite increase in demand. This was to be expected given the very pronounced geopolitical tension with the U.S. and west over Ukraine. Indeed the TIC data shows that Russia has been aggressively divesting themselves of U.S. Treasuries.

Today's AM fix was USD 1,292.00, EUR 942.65 and GBP 764.81 per ounce. Gold climbed $1.10 or 0.08% yesterday to $1,294.70/oz. Silver rose $0.03 or 0.15% to $19.42/oz. Gold is marginally lower today at $1,293.50/oz and remains in lock down in an unusually tight range between $1,287/oz and $1,306/oz this week. Gold in Singapore, which often sets the price trend in Asia, traded at $1,292.23/oz prior to a bounce to just over $1,295/oz.

Gold has been in a very narrow range between $1,283/oz and $1,310/oz for a month now. There are a lot of things going on underneath the surface of the calm gold market this month. That superficial calm is likely to give way in the coming days as we appear on the verge of a sharp move to the upside or downside once gold breaks out of the recent range. A break below $1,283/oz is possible and this could see gold quickly fall to test longer term support at $1,200/oz. This is likely if the technical traders and computer manipulations continue to dominate. However, should physical demand pick up on rising geopolitical tensions and the return of Indian demand with the easing of import duties, gold should quickly challenge resistance at $1,385/oz and $1,418/oz. Russia Buys 900,000 Ounces Of Gold Worth $1.17 Billion In April Russia’s gold reserves rose to 34.4 million troy ounces in April, from 33.5 million troy ounces in March, the Russian central bank announced on its website yesterday. The value of its gold holdings rose to $44.30 billion as of May 1, compared with $43.36 billion a month earlier, it added. The following is a summary from Bloomberg of the April data template on international reserves and foreign currency liquidity from the Central Bank of Russia in Moscow: Russia’s gold & foreign exchange reserves remained virtually unchanged at USD 471.1billion in the week ending May 9. Russia's reserves have fallen since the crisis began but remain very sizeable. The reserves include monetary gold, special drawing rights, reserve position at the IMF and foreign exchange. The 900,000 ounce purchase is a lot of physical gold in ounce or tonnage terms but as a percentage of Russian foreign exchange reserves it is a very small 0.24%. Gold as a percentage of the overall Russian reserves is now nearly 10%. This remains well below the average gold holding as a percentage of foreign exchange reserves of major central banks such as the Bundesbank, Bank of France and the Federal Reserve which is over 65%. The Russian central bank has been gradually increasing the Russian reserves since 2006 (see chart above). On average they have been accumulating 0.5 million troy ounces every month. Therefore, the near 1 million ounce purchase in April is a definite increase in demand. This was to be expected given the very pronounced geopolitical tension with the U.S. and west over Ukraine. Indeed the TIC data shows that Russia has been aggressively divesting themselves of U.S. Treasuries. Russian holdings of U.S. Treasuries fell very sharp, by nearly $50 billion, between October and March 2014 or nearly a third of Russia's total holdings. Over half of the plunge came in March, when $26 billion was liquidated as western sanctions were imposed. TIC Data for April won't be available until June and will make for very interesting reading. Especially given the mysterious huge U.S. Treasury buying that is being done by little Belgium. This has analysts scratching their heads and has aroused suspicions that the Fed and or the ECB may be behind the huge Belgian purchases.

Russia has already made their intentions regarding gold very clear. Numerous high ranking officials have affirmed how they view gold as an important monetary asset and Putin himself has had many publicised photos in which he very enthusiastically holds large gold bars. On May 25th 2012, the deputy chairman of Russia’s central bank, Sergey Shvetsov, said that the Bank of Russia plans to keep buying gold in order to diversify their foreign exchange reserves. “Last year we bought about 100 tonnes. This year it will be less but still a considerable figure,” Shvetsov told Reuters at the time. The World Gold Council reported yesterday that central bank purchases were 70% above their 5-year quarterly average, led by Iraq and Russia. The Eurozone actually became a net buyer thanks to Latvia joining the single currency union, adding its gold to the Eurozone reserves as part of the Euro treaty. Russia may be planning to give the ruble some form of gold backing in order to protect the ruble from devaluations and protect Russia from an international monetary crisis and the soon to return currency wars. Russian central bank demand and indeed global central banks demand is set to continue as macroeconomic, monetary and geopolitical uncertainty is unlikely to abate any time soon. Indeed, it may escalate substantially in the coming months as we move into the next phase of the global debt crisis. Follow GoldCore and GoldCore’s Head of Research Mark O’Byrne on Twitter. |

| Posted: 21 May 2014 03:55 AM PDT Catipal: Piketteh in the 21st Century (Nikki) Tornado hunter films black bear saving cub KVUE Thousands of dogs, and 3 people, sickened by jerky pet treats, FDA says CBS :-( Study: Mice Actually Enjoy Running On Their Spinning Sisyphus Wheels Gawker. This still reminded me of a study done by the University of Maine which concluded that lobsters didn’t mind being steamed to death. Fucked Dr. David Healy. How an effort to make clinical trial data was designed to be a headfake and is working out as planned. Russian lawmakers want to impose criminal liability for GMO-related activities ITAR-TASS Antibiotics Are Becoming Ineffective All Over the World, Why? Triple Crisis In Landmark Class Action, Farmers Insurance Sues Local Governments for Ignoring Climate Change Nation of Change A Mathematical Proof That The Universe Could Have Formed Spontaneously From Nothing Physics arXiv (furzy mouse) Rogoff on negative rates, paper currency and Bitcoin Izabella Kaminska, FT Alphaville. Kaminska has pointed out that Bitcoin is likely to have the unintended effect of legitimating electronic-only state currencies, something central banks would have found doing on their own. One of Rogoff’s conclusions:

Japan Fukushima operator releases groundwater into sea BBC China calls for new Asian security structure Associated Press Citi: China property bust risks growing MacroBusiness Martial law in Thailand Economist US: Thailand martial law will not trigger sanctions Associated Press Modi's Role Model: Margaret Thatcher or Lee Kuan Yew? New Yorker European Central Bank 'unlikely to fire the big bazooka' Financial Times Ukraine

Big Brother is Watching You Watch

Obamacare Launch

V.A. Accusations Aggravate Woes of White House New York Times Sign the Petition Opposing Investor-State Dispute Settlement in Trade Agreements Public Citizen. This is the single worst element of the TransPacific Partnership and the Transatlantic Trade and Investment Partnership. Please sign! Tea Party candidate falls in Idaho The Hill (furzy mouse) Wyoming Is First State To Reject Science Standards Time America dumbs down Macleans. Not exactly news… Millennials Spurning Silicon Valley for Dallas Oil Patch Bloomberg Debate Over Fed’s Exit Strategy Continues: Bernanke vs. Dudley vs. Yellen Michael Shedlock CREDIT SUISSE GOT OFF LIGHTLY John Cassidy, New Yorker Class Warfare

Antidote du jour (mark w): See yesterday’s Links and Antidote du Jour here. |

| Russia’s Central Bank Buys 28 Tonnes of Gold in April Posted: 21 May 2014 02:23 AM PDT "It was another day of marking time" ¤ Yesterday In Gold & SilverNot much happened with the gold price until about 30 minutes before the London open. It got sold down a bit---and then didn't do a lot until until the 8:20 a.m. New York open. Then the usual suspects showed up with their computer algorithms---and gold was down five bucks in seconds. The same thing happened at the 9:30 a.m. EDT open of the equity markets, except it was in the other direction. Once that rally was capped, the gold price traded sideways in a tiny range for the remainder of the day. The low and high ticks, such as they were, were recorded by the CME Group as $1,286.00 and $1,297.20 in the June contract. The gold price closed in New York on Tuesday at $1,294.30 spot, up $1.70 on the day. Volume, net of roll-overs, was only 102,000 contracts---only 7,000 more than the volume on Monday. The silver price was under light selling pressure during most of the Far East and morning trading session in London. There was no sign of "da boyz" at the New York open, but the price also popped at the 9:30 a.m. open of the New York equity markets. Once the high was in minutes after the London p.m. gold fix, silver also traded basically ruler flat for the remainder of the day. The low and highs weren't much to write home about, either---$19.225 and $19.465. Silver finished the day at $19.385 spot, up a nickel form Monday. Volume was 31,500 contracts. The platinum price chart was similar to the gold and silver chart, at least up until the London p.m. gold fix. But by the close the sellers of last resort had platinum back almost down where it ended the Monday session---and for the second day in a row all the gains of the day had disappeared by the close. They allowed platinum to close up a whole two bucks. After the low of the day, which came moments before the London open, palladium was in rally mode---and made it up to its high of the day around 11 a.m. EDT. After that, the rally gt capped---and the metal traded sideways for the rest of the Tuesday session. The dollar index, which closed the Monday session at 80.01, didn't do much of anything during the Tuesday session---and it closed at 80.04. The gold stocks started in negative territory, but rallied into the black in the first five minutes of trading. That didn't last, of course---and the stocks traded in slightly negative territory for the remainder of the Tuesday session. The HUI finished down 0.11%---which wasn't bad considering the flat performance of the gold price and the lousy action of the general equity markets. The silver equities started off in negative territory---and the subsequent rally hadn't cracked the unchanged mark by 9:40 a.m. EDT. After that, this silver stocks slid lower, but finally caught a bit of a bid shortly after 2:30 p.m. ---and Nick Laird's Intraday Silver Sentiment Index cut its loss to only 1.13%. The CME Daily Delivery Report showed that 1 gold and 121 silver contracts were posted for delivery within the Comex approved depositories on Thursday. ABN Amro was the short/issuer on all but one of the contracts---and it should come as no surprise that the two largest long/stoppers were Canada's Scotiabank and JPMorgan Chase. Scotiabank stopped only 10 contracts---but JPMorgan stopped 94 contracts---72 for its in-house [proprietary] trading account---and 22 for its clients account. The link to yesterday's Issuers and Stoppers Report is here. There was another withdrawal from GLD yesterday. This time it was 57,778 troy ounces. Since the start of 2014, the GLD ETF has had net withdrawals of a hair under 580,000 troy ounces. And as of 9:40 p.m. EDT yesterday evening, there were no reported changes in SLV. However, since the 2014 year began, there has been net additions into the SLV ETF of 11,626,263 troy ounces. Over at Switzerland's Zürcher Kantonalbank for the period ending Friday, May 16---they reported that their gold ETF had declined by 32,390 troy ounces---and their silver ETF had dropped by 65,909 troy ounces from the prior Friday report. The U.S. Mint had a sales report yesterday. They sold 5,500 troy ounces of gold eagles---2,500 one-ounce 24K gold buffaloes---300,000 silver eagles---and 300 platinum eagles. Ted Butler was expecting way more silver eagle sales than that---and so was I. Let's see what today brings. Over at the Comex-approved depositories in gold on Monday, they reported receiving 32,292 troy ounces---and shipped out 24,701 troy ounces. Virtually all of the activity was at HSBC USA. The link to that action is here. For a change, there wasn't big activity in silver. They didn't report receiving any, but they did ship out 229,287 troy ounces and, like gold, almost all the activity was confined to the HSBC USA warehouse. The link to that action is here. Since yesterday was the 20th of the month---and it fell on a weekday---The Central Bank of the Russian Federation updated their website with their April numbers. What they showed was that they had purchased 900,000 troy ounces of gold during the reporting month. That, along with their purchase in January 2010, represents the second-largest monthly Russian Central Bank purchase ever---and only the 1.1 million troy ounces added in May 2010 was larger. Nick Laird's most excellent chart below tells all. Once again I have a lot of stories for you today---and the final edit is up to you. ¤ Critical ReadsHousing Debt Still Traps 10 Million AmericansNearly 10 million Americans remain financially trapped by homes worth less than their mortgage debts, an enduring drag on the U.S. economy almost seven years after the housing bust triggered the Great Recession. During the first three months of this year, 18.8 percent of homeowners with a mortgage, 9.7 million, owed more on their loans than their properties would sell for, according to online real estate database Zillow. Though that was an improvement from the 25.4 percent figure of a year ago, the share of such "underwater" homeowners is about four times the historic average. An additional 18.1 percent of mortgage holders were "effectively" underwater: They had equity, but the proceeds from selling their home would be too low to recoup the sales costs and also put a down payment on a new property. The consequence is that few Americans are putting their homes on the market, thereby limiting the economic growth made possible by sales. Because of the shortage of homes being listed, bidding wars have inflated prices in parts of the country to levels that squeeze out many first-time and middle class buyers. Today's first new item, which is a must read, was posted on the moneynews.com Internet site early yesterday afternoon EDT---and my thanks go out to West Virginia reader Elliot Simon for sending it our way. Charles Plosser thinks there's a ticking time bomb at the FedThe way Charles Plosser sees it, the Federal Reserve is sitting on a ticking time bomb that could severely damage the economy unless the central bank reacts quickly to defuse the looming threat. The Philadelphia Fed president, viewed as one of the bank’s leading hawks, is worried about some $2.5 trillion in “excess” reserves. That is, loanable funds available to individual or corporate borrowers through the nation’s banks. The Fed has created these reserves through unprecedented purchases of U.S. Treasurys and mortgage-backed securities, a strategy known as quantitative easing. This news item, also courtesy of Elliot Simon---and also worth reading---was posted on the marketwatch.com Internet site later in the afternoon EDT. WikiLeaks threatens to name NSA-targeted country despite warnings it may lead to deathsDespite warnings that doing so “could lead to increased violence” and potentially deaths, anti-secrecy group WikiLeaks says it plans to publish the name of a country targeted by a massive United States surveillance operation. On Monday this week, journalists at The Intercept published a report based off of leaked U.S. National Security Agency documents supplied by former contractor Edward Snowden which suggested that the NSA has been collecting in bulk the contents of all phone conversations made or received in two countries abroad. This very interesting Russia Today story appeared on their Internet site very early Tuesday evening Moscow time---and it's the first offering of the day from Roy Stephens. U.S. Cites End to C.I.A. Ruses Using VaccinesThree years after the Central Intelligence Agency set up a phony hepatitis vaccination program in Pakistan as part of the hunt for Osama bin Laden, the Obama administration told a group of American health educators last week that the agency no longer uses immunization programs as a cover for spying operations. In a letter to leaders at a dozen schools of public health, President Obama’s senior counter-terrorism adviser said the C.I.A. had banned the practice of making “operational use” of vaccination programs, adding that the agency would not seek to “obtain or exploit DNA or other genetic material acquired through such programs.” The letter from the adviser, Lisa O. Monaco, comes more than a year after public health officials wrote to Mr. Obama expressing anger that the United States had used immunization programs as a front for espionage. The educators were protesting the C.I.A.’s employment of a Pakistani doctor, Shakil Afridi, to set up a hepatitis B vaccination program in Abbottabad to gain access to a compound where Bin Laden was believed to be hiding. You couldn't make this stuff up. Here's another interesting news item. This one was posted on The New York Times website yesterday sometime---and it's the second offering in a row from Roy Stephens. JPMorgan, HSBC and Credit Agricole accused of euro rate-fixesThe European Commission has accused JPMorgan, HSBC and Credit Agricole of colluding to fix a key euro benchmark borrowing rate - Euribor. JP Morgan and HSBC will fight the charges. Credit Agricole will study the European Commission's findings. Euribor is a cousin to Libor, which is used to set trillions of dollars of financial contracts from complex financial transactions to car loans. In December, the Commission imposed fines totalling 1.04bn on Barclays, Deutsche Bank, RBS and Société Générale as part of the same investigation. This news item showed up on the bbc.com Internet site late yesterday morning EDT---and I thank South African reader B.V. for bringing it to our attention. Deutsche Bank: "Perhaps the Fed and Other Central Banks Are Controlling the Market Too Much These Days" On Monday we showed what happens when the Fed takes central-planning a bit too far and leads to a market in which even Fed members say is too manipulated. Tuesday, it's Deutsche Bank's turn to voice a lament on the topic of uber-manipulated, rigged markets. Financial Times: Currency Wars Heat Up Again A year after G-20 finance ministers agreed to end their currency wars, competitive devaluations are back in style. European Commission Presidency Contenders Campaign Amid IndifferenceMartin Schulz, 58, and Jean-Claude Juncker, 59, are going head-to-head in the 28 countries of the E.U., drumming up support and cooperation everywhere from Estonia to Portugal, from Ireland to Greece. But will this experiment be successful? Can an election campaign underway in so many different countries actually work? After all, the elections are taking place at a time when the Brussels is looking to the general public more than ever like a bubble. The last five years have seen the economies of many Southern European nations collapse, debts spiral and in some regions, unemployment among the younger generation has reached 50 percent. The euro crisis catapulted the bloc into an identity crisis. Voter indifference was a problem even in the last European elections, five years ago. Putting faces to the parties is intended to jolt the electorate out of their E.U. fatigue -- but are the candidates for the EPP and the PES different enough to make the vote interesting? This commentary was posted on the German website spiegel.de very early yesterday evening Europe time. It now sports a more 'upbeat' headline..."A Distinct Lack of Excitement: Battle for Brussels Less Than Tense". It's courtesy of Roy Stephens. Netherlands' Geert Wilders cuts up E.U. flagScissors in hand, anti-E.U. nationalist Geert Wilders of the Netherlands on Tuesday vandalised the European Union flag in front of the European Parliament in Brussels. In a publicity stunt amid the dozen or so cafes at Place Luxembourg, overlooked by the parliament’s tall glass structures, Wilders cut out a yellow star before unfolding the Dutch flag in its place. The nationalist, who runs the Dutch Freedom Party, is convinced he will be able to form a new group of eurosceptic MEPs following the upcoming European Parliament elections. He wants the Netherlands to leave the Union, regain its sovereignty, and shut down its borders to asylum seekers. His other goal - to pull apart the EU from within by forming the anti-EU faction in parliament - will require at least 25 MEPs from seven EU member states. This interesting news item showed up on the euobserver.com Internet site very early yesterday evening---and it's another contribution from Roy Stephens. Who will benefit from the IMF's $17bn bailout of Ukraine? Not its peopleIn return for the latest $17bn bailout of Ukraine the IMF insists on dramatic measures in five main areas of the economy: a sharp currency devaluation, which will increase the cost of all imported goods, a government-funded bailout for domestic banks, government spending cuts, measures to regulate money laundering and a sharp increase in energy prices. The latter are particularly ironic, since the widespread story in the west is that it is the Russian oil giant Gazprom that is t |

| Financial Times: Currency Wars Heat Up Again Posted: 21 May 2014 02:23 AM PDT A year after G-20 finance ministers agreed to end their currency wars, competitive devaluations are back in style. |

| European Commission Presidency Contenders Campaign Amid Indifference Posted: 21 May 2014 02:23 AM PDT Martin Schulz, 58, and Jean-Claude Juncker, 59, are going head-to-head in the 28 countries of the E.U., drumming up support and cooperation everywhere from Estonia to Portugal, from Ireland to Greece. But will this experiment be successful? Can an election campaign underway in so many different countries actually work? After all, the elections are taking place at a time when the Brussels is looking to the general public more than ever like a bubble. The last five years have seen the economies of many Southern European nations collapse, debts spiral and in some regions, unemployment among the younger generation has reached 50 percent. The euro crisis catapulted the bloc into an identity crisis. Voter indifference was a problem even in the last European elections, five years ago. Putting faces to the parties is intended to jolt the electorate out of their E.U. fatigue -- but are the candidates for the EPP and the PES different enough to make the vote interesting? This commentary was posted on the German website spiegel.de very early yesterday evening Europe time. It now sports a more 'upbeat' headline..."A Distinct Lack of Excitement: Battle for Brussels Less Than Tense". It's courtesy of Roy Stephens. |

| China Signs Non-Dollar Settlement Deal With Russia's Largest Bank Posted: 21 May 2014 02:23 AM PDT Slowly - but surely - the USD's hegemony is being chipped away whether by foreign policy faux pas, crossed red-lines, or economic fragility. However, on Day 1 of Vladimir Putin's trip to China it is clear that the two nations are as close as ever. VTB - among Russia's largest banks - has signed a deal with Bank of China to pay each other in domestic currencies, bypassing the need for US Dollars for "investment banking, inter-bank lending, trade finance and capital-markets transactions." Kirill Dmitriyev the head of Russia’s Direct Investment Fund notes, "together it’ll be possible to discuss investment in various projects much more efficiently and clearly," as Russia's pivot to Asia continues to gather steam. |

| Gold Slammed As 'Panic-Seller' Dumps $520 Million In Futures Posted: 21 May 2014 02:23 AM PDT You can't make this up. An initial dump in gold happened when Europe was getting going late last night but as the US wakes up and markets get active, someone (panic-seller) decided it was an entirely optimal time to sell $520 million notional gold futures - sending the price of the precious metal down $7. Intriguingly, though the notional size was large, the actual move is not as large as we have become used to with the ubiquitous slamdowns (and it's a Tuesday). At the same time, USD/JPY was ramped... because we must maintain the appearance that stock markets are operating normally despite civil wars, coups, global growth slowdowns, and de-dollarization growing. No surprises here. It's the same old, same old---and only the willfully blind won't admit it. That's all there is to this brief Zero Hedge article from yesterday---but the embedded graph is worth a look. I thank U.A.E. reader Laurent-Patrick Gally for bringing this story to my attention---and now to yours. |

| Barclays head of spot gold trading leaves bank - sources Posted: 21 May 2014 02:23 AM PDT Barclays' head of spot gold trading is leaving as part of the bank's restructuring and its exit from the commodity business, sources familiar with the situation told Reuters on Tuesday. Marc Booker's exit leaves Martyn Whitehead, Barclays' global head of metals and mining sales, as the bank's only representative listed with the London Gold Market Fixing company. Barclays is one of the four banks that contributes to the twice-a-day price setting process for the globally recognised benchmark. But there has also been speculation about Whitehead's future at the bank. This Reuters story, filed from London, was posted on their website just after 12 o'clock noon EDT yesterday---and I thank reader Brad Robertson for sharing it with us. |

| Eric Sprott: Chinese Gold Demand Falls, Indian Gold Demand May Increase, and More Posted: 21 May 2014 02:23 AM PDT Eric's 4:12 weekly broadcast was posted on the sprottmoney.com Internet site yesterday. I haven't had the time to listen to it myself, but would suggest it's worth listening to. |

| Gold demand in India to rise, Modi seen easing import curbs Posted: 21 May 2014 02:23 AM PDT India's gold demand is likely to pick up in the second half of the year as curbs on bullion imports are expected to be eased by the country's new government, the World Gold Council (WGC) and other industry officials said on Tuesday. Gold imports by India, the world's No. 2 bullion consumer after China, could double from current levels if the restrictions are eased, according to an industry estimate. This would help global prices that slumped 28 percent last year - the first drop in 13 years - partly due to India's curbs. Struggling with a ballooning trade deficit, India in 2013 imposed a record high duty of 10 percent on overseas purchases of gold, the second-biggest expense in its import bill, and introduced a rule tying import quantities to export levels. This Reuters story, co-filed from Mumbai and Singapore, was posted on their Internet site mid-afternoon yesterday India Standard Time---and I thank Ulrike Marx for sending it. |

| Jewellers, bullion traders jubilant with election results Posted: 21 May 2014 02:23 AM PDT Bullion traders and jewellers are ecstatic about Narendra Modi gearing up to take over as the Prime Minister of India. As election results starting trickling in on Friday last, the afternoon heat seemed to matter little to those milling around south Mumbai’s busy Zaveri Bazaar, an area dominated by diamond traders and jewellers who distributed sweets and burst firecrackers to celebrate the BJP victory. It helps hugely that the trade is dominated by Gujaratis who have never hidden their unequivocal support for Narendra Modi. “He understands the problems we have been facing over the last twelve months,” Haresh Soni, Chairman, All India Gem & Jewellery Traders’ Federation, told this correspondent. “We are sure he will solve our issues.” This gold-related news item put in an appearance on thehindu.com Internet site early yesterday evening IST---and I thank reader Joe Nordgaard for sending it our way. |

| AngloGold’s new game-changing technology churns out 1,600 oz Posted: 21 May 2014 02:23 AM PDT South Africa’s largest gold miner AngloGold Ashanti has now produced 1 600 oz of gold using its exciting new technology, which mines “all of the gold, only the gold, all the time, safely”. AngloGold’s Tau Tona gold mine, near Carletonville, has become the first pukka production site of the “game-changing” technology, which leaps over mechanisation into automation (Also watch attached video). The technology is referred to as the South African Technology Project because of the company’s big-hearted decision to allow it to be migrated to all of South Africa’s hard-rock narrow-reef non-group mines, including the hard-pressed platinum mines. Despite widespread cost cutting in the latest quarter to March 31, which saw AngloGold reduce its all-in sustaining costs (AISC) by 22% to $993/oz, the project budget was one of the few that remained untouched because of the “bang” the company expects to get from every “buck” it spends on it. This very interesting news item appeared on the miningweekly.com Internet site yesterday sometime---and it's the final offering of the day from reader B.V. |