| Balmoral Intersects 1,138 g/t (33 oz/ton) Gold Over 4.87 Metres, Bug Lake Footwall Zone, Detour Gold Trend Project, Quebec Posted: 12 May 2014 10:22 AM PDT VANCOUVER, BC–(Marketwired – May 12, 2014) - Balmoral Resources Ltd. (TSX: BAR) (OTCQX: BALMF) - Extends Bug Lake Zone to 400 metres vertical depth, high grade intercept of 8.25 g/t gold over 14.53 metres

- Intersects 9.35 g/t over 5.17 metres — new high-grade “steep” section, south extension

Balmoral Resources Ltd. (“Balmoral” or the “Company”) (TSX: BAR) (OTCQX: BALMF) today reported the results of the winter 2014 drill program on the Company’s wholly owned Martiniere Property. Results are highlighted by an intercept of 1,138 g/t (33 oz/ton) gold over 4.87 metres from the Bug Lake Footwall Zone, which includes a property record intercept of 9,710 g/t (312 oz/ton) over 0.57 metres. This intercepts sits within a 71.05 metre wide gold mineralized interval cutting the Footwall and Bug Lake Gold Zones. This high-grade intercept and others in today’s release continue to emphasize the high to bonanza-grade nature of the Bug Lake Footwall Zone. Holes MDE-14-143 and -144 also successfully extended the Bug Lake and related gold zones to a vertical depth of 400 metres, including an intercept of 8.25 g/t gold over 14.53 metres associated with the lower steep (see Figure 1 – Cross Section 1+62.5 North and “Steeps and Flats” below). The Zones remain open below this depth for potential expansion. Testing of the southern extension of the Bug Lake Gold Trend, (see Figure 2 – Plan Map and Figure 3 – Cross Section 3+25 South) 500 metres to the south of MDE-13-143, has identified high-grade gold mineralization associated with a newly identified “steep” section of the Bug Lake Fault Zone. Hole MDE-14-142 returned intercepts of 9.35 g/t gold over 5.17 metres and 4.78 g/t gold over 2.65 metres from the upper and lower contacts of the Bug Lake porphyry in the deepest hole to date along the southern extension. “As impressive as the bonanza grades continue to be at Bug Lake, the confirmation of continued high-grade intercepts at depth and the discovery of another high-grade “steep” along the southern extension of the Bug Lake Gold Trend emphatically demonstrate the continued up side and expansion potential of this system” said Darin Wagner, President and CEO of Balmoral. “With excellent results from Martiniere and a very exciting new nickel-PGE discovery at Grasset our exploration team is firing on all cylinders and unlocking numerous opportunities for Balmoral and its shareholders.” Northern Segment – Bug Lake Gold Trend During the winter 2014 program Balmoral completed fifteen holes along the northern segment of the Bug Lake Gold Trend. Drilling was successful on multiple fronts, extending open ended portions of the Bug Lake and related gold zones in the near surface, extending the zones to depth beyond the limits of previous drilling, confirming the current exploration model, intersecting high-grade gold mineralization from the second, down-dip, “steep” along the Bug Lake structure and returning the single highest grade intercept to date from the Detour Gold Trend Project. Table 1 – Significant Intercepts from the Northern Segment of the Bug Lake Gold Trend | Hole | | North | | Easting | | Dip | | From | | To | Interval* | Gold | Zone | | Number | | | | | | | | (Metres) | | (Metres) | (Metres) | (g/t) | | | MDE-14-124 | | 0+40 N | | 1+85 W | | -45 | | 82.96 | | 91.34 | 8.38 | 5.71 | Hanging Wall | | including | | | | | | | | 82.96 | | 83.52 | 0.56 | 52.90 | “ | | | | | | | | | 163.04 | | 175.15 | 12.11 | 0.76 | Bug Lake | | including | | | | | | | | 164.34 | | 166.02 | 1.68 | 3.02 | “ | | MDE-14-125 | | 0+40 N | | 1+85 W | | -52 | | 81.28 | | 100.77 | 19.49 | 1.59 | Hanging Wall | | including | | | | | | | | 84.32 | | 85.00 | 0.68 | 30.20 | “ | | MDE-14-126 | | 0+40 N | | 2+50 W | | -45 | | 104.33 | | 110.12 | 5.79 | 4.65 | Hanging Wall | | including | | | | | | | | 105.98 | | 107.27 | 1.29 | 17.65 | “ | | MDE-14-127 | | 0+40 N | | 2+50 W | | -58 | | 46.80 | | 53.96 | 7.16 | 0.77 | Upper Vein | | including | | | | | | | | 48.93 | | 49.40 | 0.47 | 4.14 | “ | | MDE-14-128 | | 0+40 N | | 1+15 W | | -45 | | 50.77 | | 51.34 | 0.57 | 16.20 | Upper Vein | | | | | | | | | 143.93 | | 148.49 | 4.56 | 1.35 | Hanging Wall | | including | | | | | | | | 144.98 | | 145.64 | 0.66 | 7.50 | “ | | | | | | | | | 228.60 | | 247.00 | 18.40 | 0.53 | Bug Lake | | | | | | | | | 260.20 | | 273.60** | 13.40 | 3.98 | Footwall | | including | | | | | | | | 262.54 | | 264.15 | 1.61 | 30.12 | “ | | MDE-14-129 | | 1+35 N | | 1+95 W | | -47 | | 148.00 | | 203.20 | 55.20 | 0.89 | Bug Lake | | including | | | | | | | | 164.06 | | 181.26 | 17.20 | 1.69 | “ | | which includes | | | | | | | | 170.56 | | 172.23 | 1.67 | 3.51 | “ | | and | | | | | | | | 174.62 | | 175.01 | 0.39 | 7.50 | “ | | and | | | | | | | | 199.95 | | 201.56 | 1.61 | 3.29 | Footwall | | MDE-14-130 | | 1+15 N | | 2+40 W | | -53 | | 49.15 | | 56.04 | 6.89 | 2.54 | Hanging Wall | | including | | | | | | | | 55.60 | | 56.04 | 0.44 | 29.60 | “ | | | | | | | | | 88.07 | | 132.44 | 44.37 | 0.96 | Bug Lake | | including | | | | | | | | 88.07 | | 90.52 | 2.45 | 6.77 | “ | | MDE-14-131 | | 1+15 N | | 2+40 W | | -64 | | 119.90 | | 181.50 | 61.60 | 1.08 | Bug Lake | | including | | | | | | | | 147.15 | | 148.09 | 0.94 | 40.40 | | | MDE-14-132 | | 0+75 N | | 2+45 W | | -47 | | 53.24 | | 54.50 | 1.26 | 3.17 | Hanging Wall | | | | | | | | | 78.93 | | 91.40 | 12.47 | 0.46 | Bug Lake | | MDE-14-133 | | 0+75 N | | 2+45 W | | -60 | | 33.00 | | 40.80 | 7.80 | 1.07 | Hanging Wall | | including | | | | | | | | 37.85 | | 38.95 | 1.10 | 5.90 | | | | | | | | | | 111.95 | | 141.00 | 29.05 | 0.35 | Bug Lake | | including | | | | | | | | 140.00 | | 141.00 | 1.00 | 4.72 | | | MDE-14-134 | | 0+75 N | | 1+95 W | | -55 | | 132.13 | | 210.35 | 78.22 | 1.40 | Bug Lake | | including | | | | | | | | 147.42 | | 162.27 | 14.85 | 3.02 | “ | | which includes | | | | | | | | 148.42 | | 149.84 | 1.42 | 6.12 | “ | | and | | | | | | | | 156.12 | | 162.27 | 6.15 | 5.03 | “ | | which includes | | | | | | | | 159.59 | | 160.05 | 0.46 | 17.90 | “ | | and | | | | | | | | 176.15 | | 176.65 | 0.50 | 17.40 | “ | | and | | | | | | | | 181.76 | | 182.48 | 0.72 | 21.10 | “ | | and | | | | | | | | 198.32 | | 206.25 | 7.93 | 2.12 | Footwall | | MDE-14-135 | | 0+75 N | | 1+95 W | | -61 | | 95.82 | | 111.00 | 15.18 | 3.01 | Bug Lake | | including | | | | | | | | 95.82 | | 96.50 | 0.68 | 50.30 | “ | | Gold Makes 3rd Large Outside Up Day Since 4/24 Posted: 12 May 2014 10:11 AM PDT | | Gold Chart Posted: 12 May 2014 10:05 AM PDT A quick update for those interested in observing the price chart... the metal bounced from support near $1280 on continued Ukranian unrest. That continues to reinforce the significance of the level. If it goes ( on a closing basis ) watch for a significant round of speculative long side liquidation.One thing I am noticing is the series of LOWER HIGHS being made in this market. Each time it manages a pop from Ukraine events, the high is made at a lower level. That tells me that the events there are losing significance in the mind of many traders and that it is going to take a much more severe flare up in tensions to enable the bulls to push past chart resistance levels. The region near $1320 should hold any bounce to keep the picture bearish. A push through that level, particularly if it can breach $1330 or so, would spook a lot more bears. If not, they will use the rallies to sell.I am watching to see if gold can manage to sustain any sort of closing price above the $1300 level. The HUI is stronger today holding above support between 218-215 but remains well off any resistance levels. | | Gold advances as Ukraine tension spurs demand for haven assets Posted: 12 May 2014 09:54 AM PDT Gold futures headed for the first gain in five sessions as the crisis over Ukraine spurred demand for the metal as a haven.  | | India's BJP Win to Boost Gold Prices? Posted: 12 May 2014 09:30 AM PDT Gold prices might pop short-term. But 3 facts say Western guesswork will likely be disappointed... FOR A NATION where gold investment and ownership matters so very much, politicians in India have gone awful quiet about its de facto ban on gold imports during the current national elections, writes Adrian Ash at BullionVault. Finally ending in Varanasi on Monday after four weeks touring the country, India's elections are widely expected to land BJP leader Narendra Modi the prime minister's job. The gold and jewelry industry in India – former world No.1 consumer nation, but with barely an ounce of domestic mine output – last year sided with Modi, and Modi sided with the two-million or so gold industry workers. The incumbent Congress Party, in contrast, has faced down India's deeply-rooted culture, history and savings habits to try and curb gold inflows, making a hot topic of the Current Account Deficit (CAD) and making enemies of the jewellery business and plenty of other voters meantime. Victory for the BJP might therefore boost global gold prices. Or so you might think. But there are three problems with guessing that a more gold-friendly administration in India will automatically mean gold rising. First, the BJP's manifesto makes no mention of gold. Not a word on bullion or jewelry either, despite previously saying the anti-import rules would be reviewed inside 3 months of taking power. Instead, the manifesto vows that "CAD will be brought down aggressively, by focusing on exports and reducing the dependency on imports." So far, so vague and so what? Whatever Modi's apparent support for ending India's ban on gold imports, he's never stated clearly how the BJP plans to address the issue. Any action on gold " should take into account the interests of the public and traders," Modi is quoted today by BusinessWorld magazine, "not just economics and policy." If ever a lobby group looked set for disappointment, this would be it. The 10% import duty looks set to be trimmed anyway if Congress did somehow win re-election, if only as a way of claiming the anti-import policy is working and a little more gold can now be allowed. Instead the kicker remains India's 80:20 rule, under which 20% of all new shipments must be re-exported before the rest can clear customs. Causing such confusion last summer that India's monthly gold imports sank from record highs to zero, that rule was imposed by the independent Reserve Bank. So it's not actually in government's gift to repeal immediately. And like shaving the top off the high rate of duty, tweaking that ratio would now embed the policy, making it a more permanent part of India's gold regulation. Second, India hasn't been short of gold anyway. "We see reports of gold smuggling reappearing," as Modi said this January. "In the 1960s and 70s, when gold smuggling was big, it created the underworld, which troubles us even now." India was still the world's No.1 consumer before imports were deregulated in the early 1990s. Today's heavy import duties offer fat margins to so-called "grey market" inflows and the gangsters who run them. So despite the anti-import rules, India's private gold demand rose more than 12% to 975 tonnes last year, according to data compiled by market-development organization the World Gold Council. Its full-year 2013 Gold Demand Trends put India's gold smuggling " closer to the top end" of 150-200 tonnes – a figure which would widen India's official CAD by some 20% from the government's earlier fiscal-year forecast of $45 billion, or even 25% if the newly revised $35bn forecast is to be believed. Third, whatever happens to India's gold policy in the coming weeks and months, it's highly unlikely to boost prices either way. Because people who buy gold because it's gold – led by Indian and Chinese households – don't push gold higher. What counts for a bull market are not consumers, but people who buy gold because it isn't anything else, meaning investors. Just look at 2013's price action. Imports to India hit all-time highs last spring. Chinese demand was also off the charts. Yet prices were meantime falling at the fastest pace on record. Anyone scratching their head needs simply to swap the horse and cart around to see how this rolled forwards, with Western money managers reducing their gold holdings to buy the equities, credit and real-estate exposure they'd fled five years before. By the time India slammed the shutters with the 80:20 rule in July, gold had already completed its 30% drop for 2013. The back-half of last year saw Dollar prices go sideways even as the subcontinent's legal, visible demand vanished. Its return would by no means suggest a strong rise from current levels. The root cause of India's huge gold demand meanwhile remains unaddressed. According to Modi's rhetoric, some Congress Party leaders think it stems from financial ignorance and ill-education amongst the rural poor. Certainly they have cast buying gold as anti-social, a waste of resources in a "useless" asset which should be put to public use instead. But in truth, people choose to buy gold with their own money when that money loses value, and for Indian households, that's been the case pretty much every year since WWII. Like the US Fed or Bank of England at the start of the 1980s then, the Reserve Bank of India could curb all gold demand – legal and grey – overnight if it wished. But strong real rates of interest aren't politically popular anywhere here in 2014. So Western traders and investors watching the heaviest buyers for some kind of direction might expect the floor which Indian, Chinese and Western retail demand put beneath gold prices last year to stay firm in 2014. No, India's gold buyers didn't spur a surge in prices. But they plainly like a bargain in gold, and they have – over the last 14 years – stepped up their demand at ever-higher prices both in Dollar and Rupee terms. | | Ted Butler: Is the GAO Investigating the CFTC Over Silver Manipulation Cover-Up? Posted: 12 May 2014 09:15 AM PDT | | Gold proves safe haven status Posted: 12 May 2014 09:11 AM PDT Safe haven demand from escalating geopolitical tensions in Ukraine is supporting gold.  | | Silver Shield Uncle Slave Available Now at SDBullion! Posted: 12 May 2014 09:00 AM PDT | | Incredible chart shows a RARE opportunity in silver right now Posted: 12 May 2014 08:24 AM PDT From Kimble Charting Solutions:

Three years ago this month silver was hitting it’s 1980′s high, reflected in the chart below. Around the same time, gold was becoming a crowded trade, so crowded the gold ETF (GLD) became the largest ETF in the world! Over the past past three years, silver has now lost 61% of its value.

The top chart reflects that silver has had its worst 18-month performance in the past 30-years. The top chart also reflects that silver’s decline has it testing a 10-year rising support line. The “Power of the Pattern” had been long the metals during the bull run, then it suggested to harvest metals positions at the peak. The Pattern even suggested three years ago – two weeks from golds highs – that gold could be flat to down for years to come! (see here) One of our goals at Kimble Charting Solutions is to find “Tops & Bottoms“ in a variety of key assets. Almost the polar opposite of three years ago, we are now finding some unique things taking place at this time in the metals complex. Too many might have fallen in love with both gold & silver back in 2011… not so much now after this 61% decline in silver (28% bulls). As mentioned above, the rate of change is at 30-year lows and silver is hitting a 10-year rising support line… this doesn’t happen very often! If you would like a complimentary copy of our metals report, email us at services@kimblechartingsolutions.com. If you would like to stay updated on my “Power of the Pattern” thoughts in the metals complex on a weekly basis and receive special reports when opportunities arise, I would be honored to have you as a member. More on silver: Casey Research: What you need to know about the bear market in silver

This chart shows why you should buy silver right now

Master trader Clark: A must-see update on silver  | | The Solution to the Declining Middle Class: Destroy Fixed Costs and Debt Posted: 12 May 2014 08:07 AM PDT The solution to the erosion of the middle class lifestyle is to destroy debt and other fixed costs and eliminate self-sabotaging discretionary consumption. Last week I covered the structural dynamics causing the decline of the middle class. In general, the costs of untradable services (healthcare, higher education, government) and the rot of financialization have increased while wages have stagnated. The Federal Reserve’s “solution” was to make everyone who owned a house a speculator who could only keep even with rising costs by riding the asset bubbles higher and then extracting the “free money” generated by these bubbles before they popped.

Let’s take two representative households to understand the decline of the middle class and the solution. Let’s say both households earn $81,000 annually, virtually all from wages and salaries. This puts the family at around the 70% mark of U.S. households, just within the top 30%. (For context, the 2011 median household income was $50,054.) This income is solidly middle class: not low enough to qualify for much in the way of government subsidies but not high enough to avoid prioritizing and trade-offs. Household A has a big mortgage on a house they bought near the top of the market with a minimal down payment, student loans, two auto loans and credit card balances. After making the loan payments and paying for utilities, transportation, groceries, employees’ share of healthcare costs, eating out, mobile phone/broadband/TV service plans, there is little money left to save for emergencies, travel, college for the kids, home maintenance, etc. How do we describe this family: middle class or debt-serfs? Actually, they’re both:measured by what they superficially own (home, two vehicles, communication and entertainment devices, college degrees, etc.), this household is solidly middle class. But measured by how much income is spent servicing debt, how much is left to accumulate or invest, the family’s net worth (their assets’ market value minus debt) and generational wealth, this household is mired in debt-serfdom: their debts will never be paid off. The mortgage will never be paid off, and by the time the parents’ student loan debt is reduced, the next generation’s student loans are piling up. The auto loans may eventually be paid off, but it will look cheaper to buy a new vehicle with a modest monthly payment than to pay costly auto maintenance with scarce cash. Debt anchors this household’s fealty to the state and financial sector as securely as any medieval peasant household’s bond to the noble’s manor house. This is the basis of my characterization of the U.S. economy as a neofeudal arrangement based on debt. Household B shares the family home that is owned free and clear (mortgage has been paid off) with other family members, owns debt-free vehicles and maintains the cars themselves, rarely eats out, has no student loans (either paid cash for college, used scholarships and grants or paid their loans off), buys cheap catastrophic medical insurance and invests money in staying healthy/preventative care, i.e. eating and preparing real food and enjoying regular fitness, lives close to work, invests some of the ample family savings in enrichment (lessons for the kids, etc.), occasional frugal travel and income-producing assets and retains the rest for emergencies such as vehicle breakdown, medical emergency, etc. If this scenario seems “impossible,” recall that 1/3 of all homes (roughly 26 million houses) in the U.S. are owned free and clear, i.e. there is no mortgage. How do we describe this family: middle class or wealthy? Actually, they’re both:this household has a solidly middle class income, but because they’ve eradicated fixed costs (most importantly, debt, costly “gold-plated” healthcare insurance, etc.) and discretionary luxuries such as eating out, costly entertainment plans, etc., but measured by their values, behaviors and net income saved and invested, this household is upper-middle class or wealthy, having achieved a level of prosperity that eludes free-spending households with double their annual income. The solution to the erosion of the middle class lifestyle is to destroy debt and other fixed costs and eliminate self-sabotaging discretionary consumption that cripples the household’s ability to accumulate capital that generates income. There is nothing magical about the values and behaviors that enable this; it boils down to choosing to leave the permanent adolescence of debt-based consumerism behind and move up to a more prosperous, productive way of living: doing more with less. I am indebted to Paul C. for this graphic depiction of how instant-gratification consumption that appears “cheap” is actually horrendously expensive when the consequential costs and alternatives are considered:

This is but one example of many in which the lower-cost alternative is the better choice, not just in value but in opportunity costs. We assess the opportunity costs of every purchase or loan by asking one simple question: what else could we have done with this money? It’s a question that is scale-invariant, that is, it works as well for a nation as it does for an individual, and every organization between these two ends of the economic spectrum. In the case of the debt-serf “middle class” household, the answer to the question, “what else could we have done with our money?” is slowly build productive assets and prosperity that is within your own control.

Want to give an enduringly practical graduation gift? Then give my new book Get a Job, Build a Real Career and Defy a Bewildering Economy, a mere $9.95 for the Kindle ebook edition and $17.76 for the print edition. | | It's Yo-Yo Time Posted: 12 May 2014 08:01 AM PDT Up and Down; Back and Forth; Where she stops, nobody knows. That pretty much sums up trading in the precious metals. Both silver and gold continue range trading with the metals bouncing off of their respective support zones but unable to break free to the upside. For silver that support is near the $19 level and for gold it is our old friend, $1280. The result is a stalemate between bulls and bears.

Bulls are holding the metals where they need to hold them to prevent a strong sell signal and the start of a fresh leg lower but they are unable to kick the price out of the range either. The result is a big, giant, "Yawn" for most traders except for those who are quick on the draw and want to trade the range. Those who do should use a one hour chart combined with a 4 hour.

Gold initially was sold down sharply as there was not much, if any, violence associated with the vote over the weekend. Traders' first inclination was to dump the metal. However, the results, overwhelmingly in favor of separating, sparked a united condemnation by European foreign ministers. One of them, the Swedish Foreign Minister, Carl Bildt, dubbed them, fake figures from a fake referendum". He was echoed by his German counterpart who graced the vote by saying that, "it cannot be taken seriously".

Well, someone took it seriously there because the talk rapidly shifted into how to ratchet up the sanctions and how to go after those Crimean-based companies who might stand to benefit from a Moscow-annexation of the area in question.

With that, back up went the gold price as shorts once again ran for cover. This will more than likely continue to be the pattern at least until we get to the big presidential vote in Ukraine, which is now less than two weeks away. As I have stated many times now - as long as tensions continue to simmer over there, gold will garner buying support. Depending on how this issue is finally resolved, once those tensions are removed, gold is more than likely headed lower especially if US economic data improves. We just have to wait and see and react accordingly.

In the meantime, this is a trader's market. Do not form any long term opinions based off these day to day gyrations being induced by the ebb and flow of geopolitical events. One never knows how events will play out. Again, and this is a strong bit of advice - do not take too large of a position, either long or short unless you have some sort of masochistic streak and enjoy pain. Stay flexible and nimble or stay out altogether until the situation is resolved. There are lots of better markets to trade right now.

Shifting therefore to something more interesting, the grains are getting hammered today. It started last night as follow through from last Friday's bearish USDA reports ( for new crop - old crop bean report was considered bullish) continued. Aiding the negative sentiment was rather widespread rains through some key growing regions in the Plains. That brought about strong selling pressure in wheat, which has been supported by hot and dry weather injuring the crop. The rains are a welcome relief and traders are thus taking some of the risk premium out as they look for some improvement in the crop's prospects.

This afternoon we will get the planting progress numbers and traders will get another look at how things stand in relation to last year and to the 5 year averages.

The Dow scored yet another all time high today while the S&P 500 is approaching its all-time high today as equity traders are pretty much dismissing Ukraine as having any impact whatsoever on anything OUTSIDE of the immediate region. Only if events were to take some sort of serious turn for the worse, would we see stocks impacted by that situation. For now, stock traders are of the view that it will be a non-factor in most global equity markets as it is now firmly viewed as purely a regional matter. The consensus for now is that the economy continues to slowly improve.

Copper moved higher today after comments out of China that authorities there are committed to reforming its money market. Traders took those remarks as signs that the leadership remains desirous of economic growth and with that, PRESTO, gone were last week's losses. This is just more evidence of how the conflicting cross currents in many markets are whipsawing hedge fund computers back and forth. "If you snooze, you lose" is an apt adage to describe certain markets right now. Again, be careful with large positions or be prepared to get skinned. Hedge funds are losing money left and right in the commodity markets - don't follow suit.

WTI crude is hanging around the $100 mark. The Dollar is a tad weaker and the yield on the Ten Year is up a bit to 2.65%.

More later...

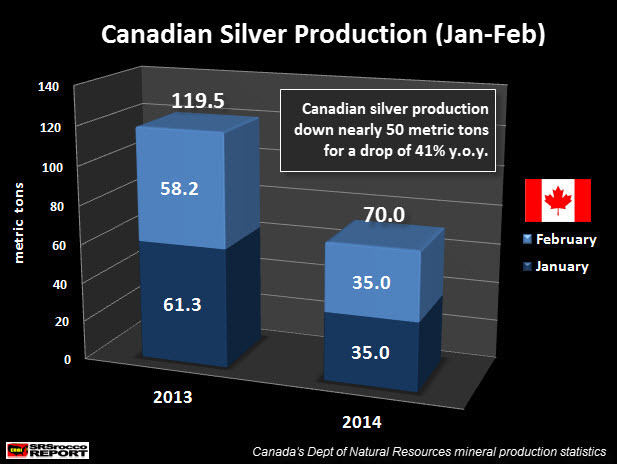

| | BIG Move Coming: Silver Is More Oversold Than At Any Time In The Last 20 Years! Posted: 12 May 2014 08:01 AM PDT Everyone in the precious metals community is scratching their heads over the recent behavior of the price of silver. At the end of the day, the severely depressed price level can only be attributed to the extreme degree of manipulation and price containment activities of the Federal Reserve and the U.S. Treasury's Exchange Stabilization [...] The post BIG Move Coming: Silver Is More Oversold Than At Any Time In The Last 20 Years! appeared first on Silver Doctors. | | Canadia Loses 2/3rds of Silver Production in Just 12 Years! Posted: 12 May 2014 08:00 AM PDT Canadian silver production declined significantly in the first two months of 2014 compared to last year. The huge drop off in production was due to the closure of two base metal mines and one primary silver mine in 2013. Canada has lost two-thirds of its silver production in just twelve years. While Canada isn't a [...] The post Canadia Loses 2/3rds of Silver Production in Just 12 Years! appeared first on Silver Doctors. | | Steve Sjuggerud: This is the best way to buy gold today Posted: 12 May 2014 07:21 AM PDT From Steve Sjuggerud in DailyWealth: It’s the best legal way to BUY and SELL gold that I’ve ever seen… Right now, we have an incredible window of opportunity… There’s a way you can buy gold at roughly $70 off melt value – a 6% discount. It’s the best way to buy gold right now. This investment is also the best way to sell gold… because when you sell this investment, you will NOT pay the usual taxes that you would normally pay on gold. Even better, chances are good that you will not only be able to buy at a discount to melt value, but you will be able to sell it at a premium as well. Lastly, it’s easy to do… This investment trades in the U.S., just like a stock. Let me give you the full story… In 1961, the Central Fund of Canada (CEF) was born… and in 1983, it re-defined its mandate to become the “Sound Monetary Fund.” The Central Fund of Canada made a commitment to hold gold and silver… nothing else. Gold makes up 59% of the fund, and silver is 41% of the fund. It primarily holds gold and silver bullion in a bank vault in Canada. It doesn’t buy, sell, or trade. It simply sits on its precious metals in Canada. Importantly, the Central Fund of Canada is organized as a closed-end fund, which means that it has a fixed amount of shares outstanding. This gives us an opportunity to buy gold at a discount today… You see, when gold is “hot,” investors pile into gold investments like this fund. And because the Central Fund of Canada has a fixed number of shares, increased demand forces it to trade for a premium above the melt value of gold. Gold was “hot” for over a decade recently… Since investors loved gold – and the security and simplicity of buying bullion in a Canadian vault through the stock market – the Central Fund of Canada traded for an average premium of 7% over the last 12 years. But lately, gold has been out of favor… Sentiment is so negative toward gold that the Central Fund of Canada – which usually trades at a 7% premium to its liquidation value – is now trading at a 6% discount to its liquidation value. That’s a remarkable change. And remember, it only holds precious metals in bullion form in bank vaults in Canada. So you are buying gold at a discount to melt value. Take a look:

Today, you can buy it at a 6% discount… At today’s gold price, that’s like buying gold for about $70 off – that’s crazy! I expect that when gold gets “hot” again, this fund will return to trading at a premium. If CEF goes from 6% discount to a 5% premium, you will have gained 11 percentage points. That’s sort of like “free” income – a hidden high yield! There’s another big benefit here, too… When it comes time to pay income taxes on this, you won’t have to pay what you would normally pay on gold… Generally with gold investing, you pay a flat 28% “collectibles” tax. However, the Central Fund of Canada is unique. So you’ll pay taxes at your normal, long-term capital-gains rate (15% for most people). (You will have to fill out one extra, but simple, form at tax time.) In sum, the Central Fund of Canada is the absolute best way to BUY and SELL gold. You can buy gold and silver at a 6% discount to liquidation value through this fund… with the potential to sell at a premium in the future. And instead of paying the usual 28% tax on gold, you will instead pay your long-term capital-gains tax rate (which is 15% for many people). If you’re interested in gold, you have to check out this fund. It’s the best way to own gold today. More on gold: There could be a HUGE shift happening in gold right now

Master trader Clark: The next major gold rally is starting now

Is the gold bull market over? Read this and decide for yourself.

| | Alasdair Macleod: On the Threshold of a New Downturn Posted: 12 May 2014 07:00 AM PDT Bond yields are falling yet again, confirming western economies are most likely on the edge of a new downturn. With all the money-printing going on it appears the financial system is awash with the stuff, for which there is little appetite from the real economy. By way of confirmation, Mr Draghi of the ECB has [...] The post Alasdair Macleod: On the Threshold of a New Downturn appeared first on Silver Doctors. | | Technical Trading: Gold Bulls Swoop In To Buy On Dip Posted: 12 May 2014 06:50 AM PDT forbes | | Gold Bounces Off Key Support Posted: 12 May 2014 06:45 AM PDT dailyfx | | US Silver jewellers report increased sales in 2013 Posted: 12 May 2014 05:09 AM PDT A large majority of retailers, 92%, said that they are optimistic that the current silver boom will continue for the next several years. | | Bank Account Raid Powers Needed Or Taxes Will Rise - Cameron Posted: 12 May 2014 05:02 AM PDT gold.ie | | Andrew Ross Sorkin, Timothy Geithner, and the Three Card Monte Model of Propaganda Posted: 12 May 2014 04:08 AM PDT Truth be told, I had really wanted to ignore Andrew Ross Sorkin’s artfully packaged Timothy Geithner puff piece in the Sunday New York Times magazine. It’s is a major element in the pre-publication public relations push for Monday’s release of Geithner’s rewriting of history book, Stress Test. I’ve described the Geithner’s repeated claim that the TARP made money as three card monte, since looking at the TARP in isolation from the hidden tax on savers of ZIRP and QE was misleading. ZIRP alone is estimated to have cost US savers over $300 billion a year, more than 10x in a single year of the total “profit” attributed to TARP. And as we’ll discuss shortly, even that claim does not stand up to scrutiny. Lambert astutely pointed out that this technique wasn’t just a device used relative to TARP, but applied more broadly to Sorkin’s and Geithner’s messaging. And upon inspecting the Sorkin article, Lambert is even more on target than he realized. Separately, I think it’s important to identify this propaganda technique, since it is distinct from other types of dishonest communication or rhetorical tricks, such as cherry picking. It’s critical to remember that three card monte is a three person con. The roles are the dealer, who throws the cards in a way so as to mislead, a mark, who is the intended victim, and a shill who helps instill overconfidence in the mark’s level of insight to encourage him to play the game. So what distinguishes three card monte as a narrative trick is deception and misdirection. As indicated above, it is different than cherry picking, in that it is not merely expunging unflattering elements so as to present an unduly rosy picture, but engaging in deliberate deception. But it is also distinct from the Big Lie, where something that is clearly untrue is stated repeated with the understanding that dint of repetition will sway quite a few people. Here’s a classic three card monte example from the article: This criticism that he was too close to Wall Street was also fueled by the fact that Geithner, with his English spread-collar shirts and his perfectly coifed hair, just looks like a banker. He often tells a story about how Emanuel's wife, Amy Rule, once told him at a dinner party, "You must be looking forward to going back to that nice spot you have waiting for you at Goldman." During an April 2009 hearing about the financial-bailout program, Damon A. Silvers, a panel member, seemed almost incredulous that Geithner had never worked on Wall Street. "You have been in banking — ” Silvers said. "I have never actually been in banking," Geithner interrupted. "I have only been in public service." "Well, a long time ago. A long time — " "Actually, never." "Investment banking, I meant — " "Never investment banking." "Well, all right," Silvers conceded. "Very well then."

Did you catch it? Geithner was the president of the New York Fed. The Fed is a bank. The fact that it is a central bank, as in a banker’s bank and also happens to have an awkward public-private status does not make it any less a bank. Let us turn to the authoritative Palgrave Dictionary of Money and Finance (no online version), in an entry written by Richard Sylla: The Federal Reserve System, or “Fed” in common parlance, is the central bank of the USA. It was founded explicitly as a central bank in 1913. In this respect the Fed differed from the central banks of the leading European nations of the last [19th] century. These central banks evolved gradually over decades into bankers’ banks, holders of the nation’s ultimate monetary and banking reserves, lenders of the last resort, sole issuers of banknote currency, and supervisors and regulators of ordinary banks. This was after earlier phases in which they had served primarily as agents of government finance and, in most cases, as as ordinary banks of discount, deposit, and note issue. From its inception, the Fed took on all these functions save one. It never carried on an ordinary commercial banking business; it was an exclusively a bankers’ bank.

In addition, the New York Fed, the most powerful of the Fed’s member banks, has interest rate and currency trading desks, which are important activities to large banks. He was considered to be sufficiently experienced as a banker to be asked in 2007 by Sandy Weill to become CEO of Citigroup. But see the misdirection? Even Damon Silvers, who is widely considered to be very sharp, fell for it. Americans are so deeply acculturated to see banks as private, profit-making entities that the “public servant” palaver threw him off track. And Andrew Ross Sorkin uncritically parrots Geithner’s ruse. That isn’t to say that all of the three card monte in this article originated with Geithner. The entire edifice of the piece is a sleight of hand. Sorkin starts out depicting Geithner as having to defend his record, showing Geithner fieldinh questions from not-terribly-friendly economics undergraduates in Larry Summers’ economics class: On this morning, as was the case many times before, his responses generally coalesced around the plan that defined his tenure: the wildly unpopular authorization of $700 billion in taxpayer money, known as the Troubled Asset Relief Program, to bail out Wall Street's biggest banks. "To oversimplify it, and I think this was Jon Stewart's framing," Geithner told the students, "why would you give a dollar to a bank when you can give it to an American? Why not give them a dollar to help them pay their mortgage?"

Sorkin uses this device to make the story of Geithner’s (by implication) unfairly hostile reception as due to his association with the unpopular TARP. Huh? The TARP was designed by Hank Paulson’s Treasury and depended on Obama, as leading Presidential candidate, whipping for it aggressively in Congress after its initial defeat to secure its passage. It was most decidedly not Geithner’s baby. The focus on TARP (and to a lesser degree, Lehman) allows Sorkin to omit mention of actions that were clearly Geithner’s doing, including: his fighting Sheila Bair tooth and nail on resolving the clearly insolvent Citigroup; his decision to pay AIG credit default swaps counterparties 100 cents on the dollar; his defense of the failure to haircut AIG employees’ pay; Treasury’s acceptance of intransigence by AIG’s CEO, Robert Benmosche; his refusal to use $75 billion in TARP that Paulson’s Treasury had courteously left aside for homeowner relief; the clearly too permissive “stress tests,”; Geithner’s Treasury allowing banks to repay TARP funds early rather than rebuild their balance sheets (get this: because they were eager to escape very limited restrictions on executive pay); Treasury letting banks repay TARP warrants at an unduly cheap price until Elizabeth Warren’s Congressional Oversight Panel caught them out; his cynical policy of “foaming the runway,” as in using what were billed as homeowner relief programs merely to attenuate foreclosures and thus spread out bank losses, which had the secondary effect of wringing more money out of already stressed borrowers before they were turfed out of their homes. And this is far from a complete list of Geithner’s actions that favored banks over the public at large. Sorkin instead tries to use the TARP to epitomize that Geithner has been treated unfairly. After all, the TARP was a success! The first paragraph is from Geithner’s Harvard talk; after the ellipsis is Sorkin, much later in the article: "People think we gave the banks this free gift of hundreds and hundreds of billions of dollars, using the taxpayers' money that we would never see again," he said. "People thought we would lose $2 trillion on our financial rescues."…. Geithner is confident that the empirical data has already vindicated his decision. And while there is some debate over how to calculate the proceeds from the various bailouts — TARP, the auto companies, the F.D.I.C. programs and Fannie and Freddie, among others — the evidence is persuasive. ProPublica, the nonprofit investigative organization, which keeps a tally of the bailout, puts the current profit at $32 billion. The White House Office of Management and Budget estimates that Fannie and Freddie will turn a profit of $179 billion over the next decade. (Critics might contend that these figures don't include the costs of the stimulus or the Federal Reserve's quantitative-easing programs.)

Notice how we’ve shifted terrain again, another three card monte trick. If we are going to make Geithner responsible for the TARP, then Sorkin should follow through with that framing. Paulson, and not Geithner, was responsible for putting Fannie and Freddie into conservatorship, as Sorkin knows full well, having written up that decision in detail in his book Too Big to Fail. Geithner has no business taking credit for that. Nor does he get points for the various alphabet-soup lending programs, which are widely credited to Bernanke (not that I think they deserve praise, mind you. They violated the Bagehot rule of “lend freely, against good collateral, at a penalty rate” and thus created a terrible precedent. And their “success” depended in large measure on ZIRP, which goosed collateral values, particularly of weak credits). Moreover, the Geithner claim of “$2 trillion in losses” was a straw man, as Sorkin knew full well. Neil Barofsky sent me his e-mail to Sorkin in response to some questions: [Sorkin] You have been critical of TARP. Should the public, in determining a view about TARP, measure the proceeds returned to taxpayers? You suggested in your book – I think– that the government could lose money. Do you think that stands? To the extent that I’ve seen estimates of profits, are those real? Or do you think govt is playing games? [Barofsky] I believe that TARP should and will be measured, historically, by the moral hazard it created and what that means when the next financial crisis hits, as well as the millions of people that it could have helped (and were supposed to help) but did not. As to costs, I defer to CBO, which recently indicated a loss. It is of course good news that the losses will be far less than originally anticipated. I can only hope, Andrew, that you do not repeat the rather stark misrepresentation that you did last time, which is to attribute a quote in my book about potential losses in the PPIP program on page 136 (regarding potentially catastrophic losses which did not occur after the programs were trimmed significantly based on our recommendations) to AIG or the program as a whole. It was unfair then, and it would be even more so now.

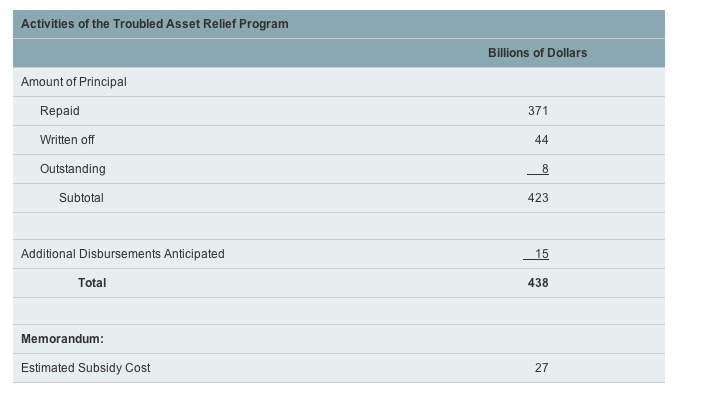

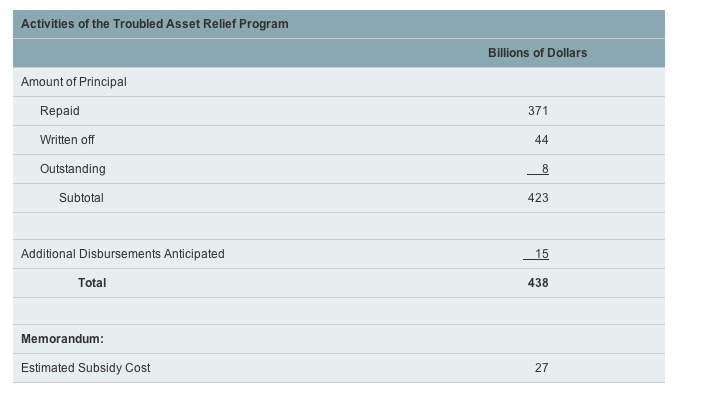

In fact, Barofsky is correct on the CBO’s tally on the TARP as of April 2014:

Amusingly, Tim Cavanaugh in the National Review, which really does not want to like Barofsky, since he’s a “liberal,” can barely contain his antipathy for Geithner: But Barofsky (who became SIGTARP shortly before Obama's inauguration and left in 2011) was notably if not uniquely honest in the Obama brain trust. He correctly pointed out in 2010 that the design of federal housing efforts was to re-inflate the housing bubble — not exactly a Newtonian discovery, but something few people in government were willing to say outright. He consistently threw water on bogus claims that the TARP was on the verge of turning a profit. Despite or because of his soft spot for bad mortgage borrowers, he was unusually willing to admit [pdf] that the whole federal apparatus of trial loan modifications was a form of cruelty, dragging out the pain and false hope for people who would have been better off just getting foreclosed and moving on with their lives. He made an earnest effort to perform an essentially impossible task: safeguarding the taxpayers' interest in a program that was designed to rip off the taxpayers… Barofsky's commitment to getting at the truth is in fact the source of the hatred between the two men.

Some other examples of three card monte in the story: Sorkin offers a weak defense of Geither’s “Turbo Timmie” tax problems as being due to fact that he was a modestly paid public servant and couldn’t afford big ticket tax advice. Please try that excuse with the IRS the next time you have a tax problem and tell me how well it goes. Similarly, Sorkin plays the modesty card again” “Last month, Geithner officially began a new job as president of a modestly sized private-equity firm, Warburg Pincus.” He does concede that Geithner is “likely to make millions if not tens of millions of dollars over the next decade if he stays in the business.” Is this the Andrew Ross Sorkin who is a finance maven? Top players in PE have pay packages that make bank CEOs look like pikers. And Warburg Pincus “modestly sized”? It’s the fifth largest player. These are far from the only misdirections by Geithner and his loyal water-carrier Sorkin, although many of them are more conventional rhetorical devices, such as straw manning or false dichotomies. For instance, Geithner repeatedly presents the alternative as bailing out the banks versus letting the system collapse, as opposed to preventing a meltdown and making sure that bankers and bank investors shared in the pain along with ordinary citizens. The idea of restructuring (as opposed to collapse) appears to be utter anathema to Geithner. Similarly, Geithner uses the straw man of half-hearted British measures to direct more credit to the real economy as proof that other approaches would have failed. And par for the course, Geithner deems ending “too big to fail” as ” not just quixotic, it's misguided." The one bit of good news here is that for three card monte to succeed, it takes a gullible mark. But Geithner is too well known to the American public for his efforts at record-burnishing to have much effect. The comments in the New York Times section were overwhelmingly critical of Geithner and often Sorkin, and the defenses were far shorter and less articulate, generally of the “if he hadn’t done what he did, you wouldn’t have been able to get cash from your ATM.” Honestly, even that as a worst case scenario is overdone.

Americans would have accepted a week long bank holiday if they knew the system was being restructured. And the bigger point, which is not lost on the public, was there were plenty of other options for saving the system. The one chosen, that left the banks largely unreformed and no one of any consequence punished, was clearly just about the worst of the available options, unless, of course, you are, like Geithner, a banker.  | | Links 5/12/14 Posted: 12 May 2014 03:55 AM PDT A Magnificent Orangutan Experienced the Best and Worst of Zoos Slate Plastic material imitates veins to heal itself Nature Marijuana May Heal Health Problems That Come With Old Age: How Can People Living in Senior Homes Get It? San Diego Free Press UMaine student who slept in car to save money will graduate same weekend as mother, sister Bangor Daily News. Slept in car. Over the Maine winter. For four years. Exclusive: The Cameron crony, the private jet company, and a crash landing that cost taxpayers £100m Independent (RS) London tops super-rich city list, survey shows AFP 'It was the point where the eurozone could have exploded' FT. Part I of “How the Euro was saved.” There seems to be a boomlet in pre-election FIRE sector crash retrospectives. Banking on Shaky Ground: Australia's big four banks and Land Grabs Oxfam Lockhart Expects Fed to Use Reverse Repos During Stimulus Exit Bloomberg UberX Drivers Protest Outside Uber Headquarters Time. Uber should “share” more. Class Warfare

How Finance Gutted Manufacturing Boston Review (fresno dan). Finance crapifiers are why your washing machine falls apart in two years. The problem with Thomas Piketty: "Capital" destroys right-wing lies, but there's one solution it forgets Thomas Frank, Salon More on Piketty History Unfolding (Mel) Hedge fund titans are testing the quality of US democracy Edward Luce, FT Fallen support frame mistaken for gunshots at mall AP. The way we live now. Democrats struggle to win over skeptical Americans on Obamacare Reuters. Story on NH (2016). Monopoly insurer and narrow network: Paragraph 23. US failed to inspect thousands of at-risk oil and gas wells, report finds Guardian Big Brother Is Watching You Watch

'We Kill People Based on Metadata' NYRB Edward Snowden statement at Munk Debate on State Surveillance (transcript) Corrente Retail Spy Services for Business Relationships Another Word for It. The technology was presaged by Neal Stephenson’s Snow Crash (just Google “Y.T.’s mom pulls up the new memo”), although given Stephenson’s libertarian focus, the State deploys it, not corporate HR types. The CIA’s Bro Culture Is Doing Yemen No Favors Vice. This article shows the strengths and limits of Vice. We’ve got hip (“bros”), sharp contextualization on gendered markers: During my time covering Yemen's 2011 youth [Vice demographic] uprising against former president Ali Abdullah Saleh, it was more difficult to identify quality qat than to finger American spooks. Their out-of-uniform uniform, ubiquitous and often including 5-11 cargo pants, a pair of Oakley sunglasses and full beards, functioned as a caricature that could be plucked right out of the latest installment of the Call of Duty franchise.

Coupled with policy recommendation like this: The cavalier bravado of the IC's bro culture in Yemen crops up regularly amidst the daily lives of the individuals that live there … A more robust counter-terrorism policy in Yemen would include more direct assistance to Yemen military on the ground, engaging AQAP militants face-to-face. …. Dollar for dollar, spotting Yemeni soldiers a few bucks to get their APC gas tanks filled up is a lot more effective than paying the salary of spooks that appear to be more concerned with looking like bad asses than keeping a low profile. … If the super spies are going to emulate a video game, perhaps they should look towards Metal Gear Solid instead of Call of Duty.

So, after the street reporting, the writer (note the Beltway tell, “robust”) shifts gears, or not, into the policy recommendation that we Americans run our empire more like those clever Brits did, back when they had one: With native troops and compradors. Alrighty then. Anybody who wants non-trivial change yet views political economy primarily through a generational lens should include material like this in their account. Ukraine

Q&A: What now after eastern Ukraine's referendum? FT Controversial independence votes add to Ukrainian instability Globe and Mail Armed men in eastern Ukraine open fire on crowd AP Has Blackwater been deployed to Ukraine? Notorious U.S. mercenaries ‘seen on the streets of flashpoint city’ as Russia claims 300 hired guns have arrived in country Daily Mail. Donetsk, don’t tell. Ukraine security forces riven by mistrust, wrangle over prisoners Reuters Ukraine: Another German “Leak” Against U.S. Policy Moon of Alabama Late payers squeezing Europe's businesses FT Fast Destruction and Slow Reconstruction Oilprice.com Behind the rise of Boko Haram – ecological disaster, oil crisis, spy games Guardian Saudi Arabia warns of MERS risk from camels as cases rise Reuters Is This the ‘Gujarat Model’ India Needs? The Diplomat Masala Dosa to Die For Times India’s new government set to inherit wobbly economy Reuters Likhit Dhiravegin Interview – Part 3: On Article 7 and appointing a new PM Asian Correspondent Government House lost, Thailand’s frustrated red shirts in a waiting game Straits Times Top brass reject Sect 7 step : Source Bangkok Post. Coup coming off the burner? Xi Says China Must Adapt to 'New Normal' of Slower Growth Bloomberg Weak Japan exports, not tax hike, could shake BOJ Reuters The Atlas of Economic Complexity Center for International Development, Harvard The Toxic Brew in Our Yards Times. The author confuses “yard” with “lawn.” How your ancestors’ farms shaped your thinking New Scientist. I’ve seen the same argument from the odious Malcolm Gladwell, so readers may wish to critique the study.

By reader request, bonus alligators! Is that you, Tim? [waves]

See yesterday’s Links and Antidote du Jour here.  | | Has America’s Use of Finance as a Foreign Policy Tool Backfired? Posted: 12 May 2014 03:30 AM PDT From the 1980s onward, one of the major aims of American foreign policy has been to make the world safer for US investment bankers. That might seem like an exaggeration until you look at the priorities of American economic policy as well as the actions of US-dominated international institutions like the World Bank and the IMF. The World Bank, though its International Finance Corporations, pushed emerging economies to set up capital markets. The posture was that more open markets were always better. Now that we’ve had repeated tsunamis of hot money flows in and out of small economies wreak havoc with them, conventional wisdom among development economists is more along the lines of “protectionism in emerging economies is desirable so they can develop companies and/or export sectors that are capable of competing internationally, and also serve domestic markets, so that the economy isn’t too export dependent. Open capital markets produce too much volatility in interest and foreign exchange rates and thus undermine internal development.” Similarly, the US has pressed advanced economies for more open financial markets. America’s insistence that Japan deregulate its banking system was a prime driver of its 1980s bubble (I had a bird’s eye view of how the Japanese banks went full bore into all sorts of products and markets they didn’t understand and incurred huge losses as a result). A cynic might point out that Japan’s speculative boom and bust put a decisive end to Japan’s status as serious challenger to American economic dominance. The Chinese, the poster children of successful development, have made a close study of the Japanese experience. Among other things, the Chinese decided to maintain tight control over the banking system and have restricted international capital flows. Note these curbs have become less effective over time, perhaps due to neglect. Regional governments have helped spawn a large shadow banking system and wealthy company owners have been able to evade capital controls through over-invoicing. Nevertheless, the Chinese financial system is a long way away from being deregulated. As a result, the consensus among Western securities analysts is that China will be able to engineer a soft landing despite the scary size of its credit bubble. Now of course, there has been pushback against the American model of open capital markets since they can and do upend the real economy. After the Asian financial crisis of the 1997, when the IMF put in place “shock doctrine” style reform programs, countries throughout Asia concluded that they never wanted to suffer through that again. They pegged their currencies low relative to the dollar to build up foreign exchange reserve warchests. Economists have argued that this use of currency pricing to increase exports to the US has been a major culprit in the decline of US manufacturing and job losses. So to the extent that this strategy might have produced foreign policy advantages, it has come at considerable domestic cost. But has this use of “open markets/’free markets’” as an ideological and policy tool really been a plus for the US, even in its own terms? A thorough analysis is well beyond what can be accomplished in a mere post, but let’s look at some recent evidence. One can argue that the effectiveness of economic sanctions is evidence that America’s dominant role in international finance has translated into policy gains. Witness the pain inflicted on Iran and more recently, on Russia (although Russia’s European energy trump card has imposed restrictions on how aggressive a sanctions game the US can play). But dial the clock back in Russia to the early 1990s, and you see a different picture. The US lost Russia thanks to full bore implementation of neoliberal policies, and its finance-centricity was a major component. We’ve chronicled this sorry chapter in part due to the prominent role that Harvard played. It bears repeating long form, since it is not as well known in the US as it ought to be. From a 2013 post: Summers’ second big problem is the scandal that led to his ouster at Harvard, which was NOT his infamous “women suck at elite math and sciences” remarks. The university has conveniently let that be assumed to be the proximate cause. In fact, it was Summers’ long-standing relationship with and protection of Andrei Shleifer, a Harvard economics professor, who was at the heart of a corruption scandal where he used his influential role on a Harvard contract advising on Russian privatization to enrich himself and his wife, his chief lieutenant Jonathan Hay, and other cronies. The US government sued Harvard for breach of contract and Shleifer and Hay for fraud and won. This section comes from a terrifically well reported account in Institutional Investor by David McClintick: The judge determined that Shleifer and Hay were subject to the conflict-of-interest rules and had tried to circumvent them; that Shleifer engaged in apparent self-dealing; that Hay attempted to "launder" $400,000 through his father and girlfriend; that Hay knew the claims he caused to be submitted to AID were false; and that Shleifer and Hay conspired to defraud the U.S. government by submitting false claims. On August 3, 2005, the parties announced a settlement under which Harvard was required to pay $26.5 million to the U.S. government, Shleifer $2 million and Hay between $1 million and $2 million, depending on his earnings over the next decade. Shleifer was barred from participating in any AID project for two years and Hay for five years. Shleifer and Zimmerman were required by terms of the settlement to take out a $2 million mortgage on their Newton house. None of the defendants acknowledged any liability under the settlement. (Forum Financial also settled its lawsuit against Harvard, Shleifer and Hay under undisclosed terms.

And while Harvard can’t be held singularly responsible for the plutocratic land-grab in Russia, the fact that its project leaders decided to feed at the trough sure didn’t help: Reinventing Russia was never going to be easy, but Harvard botched a historic opportunity. The failure to reform Russia’s legal system, one of the aid program’s chief goals, left a vacuum that has yet to be filled and impedes the country’s ability to confront economic and financial challenges today.

And while Summers was not responsible for Shleifer getting the contract, he was a booster and later protector of Shleifer: Summers wasn’t president of Harvard when Shleifer’s mission to Moscow was coming apart. But as a Harvard economics professor in the 1980s, a World Bank and Treasury official in the 1990s, and Harvard’s president since 2001, Summers was positioned uniquely to influence Shleifer’s career path, to shape US aid to Russia and Shleifer’s role in it and even to shield Shleifer after the scandal broke. Though Summers, as Harvard president, recused himself from the school’s handling of the case, he made a point of taking aside Jeremy Knowles, then the dean of the faculty of arts and sciences, and asking him to protect Shleifer.

And the protection Shleifer got was considerable: Knowles tells Institutional Investor that he does not remember Summers' approaching him about Shleifer… However, not long after Summers says he intervened on the professor's behalf, Knowles promoted Shleifer from professor of economics to a named chair, the Whipple V.N. Jones professorship. Shleifer's legal position changed on June 28, 2004, when Judge Woodlock ruled that he and Hay had conspired to defraud the U.S. government and had violated conflict-of-interest regulations. Still, there was no indication that the Summers administration had initiated disciplinary proceedings. To the contrary, efforts were seemingly made to divert attention from the growing scandal. The message from the top at Harvard was, "No problem — Andrei Shleifer is a star," says one senior Harvard figure… One instance was a meeting early in the academic year that began in September 2004, less than two months after the federal court formally adjudicated Shleifer's liability for conspiring to defraud the U.S. government. A faculty member asked [Dean] Kirby why Harvard should defend a professor who had been found liable for conspiring to commit fraud. The second confrontation came early in the current academic year when another professor asked Kirby why Harvard should pay a settlement of $26.5 million and legal fees estimated at between $10 million and $15 million for legal violations by a single professor and his employee, about which it was unaware. On both occasions Kirby is said to have turned red in the face and angrily cut off discussion. On at least one other occasion, Summers himself told members of the faculty of arts and sciences that the millions of dollars that Harvard paid in damages did not come from the budget of the faculty of arts and sciences, but didn't say where the money came from. Those listening inferred he meant that the matter shouldn't be of concern to the faculty and that they shouldn't raise it, a curious notion, given that Shleifer was one of their own… Shleifer has never acknowledged doing anything wrong. Summers has said nothing. And so far as is known, there has been no internal investigation or sanction. "An observer trying to make sense of the University's position on Shleifer, Ogletree and Tribe is driven to an unhappy conclusion. Defiance seems to be a better way to escape institutional opprobrium than confession and apology. . . . And most of all being a close personal friend of the president probably does one no harm."

And before you think this sorry performance of US AID was a mistake, the only part that appears to have been unintended was the hand-over-fist looting by Shleifer and Hay. Mark Ames, who witnessed the plundering of Russia by its elites and their Western allies at close range, pointed out that US AID has used its humanitarian image as a cover for covert operations for decades. Russia saw the expansion of US AID’s role from helping “train” foreign police forces to a vehicle for having CIA operatives infiltrate every possible foreign power nexus of interest, be it governmental, religious, or social programs. Naturally, finance and financial flows would become recognized as being on the list. And we can see how well this mission creep worked. From Ames: There were many ways to transform Russia in the 1990s, but thanks to funding from USAID, the path chosen was the most brutal and disastrous of all: Shock therapy, mass privatization, and the mass impoverishment of 150 million people. As Janine Wedel and my former eXile partner Matt Taibbi documented, USAID funding and support empowered a single "clan" from St. Petersburg led by Anatoly Chubais, who oversaw the complete destruction of Russia's social welfare system, and the handing over of lucrative assets to a tiny handful of oligarchs. Under Chubais' stewardship, Russia's economic output declined some 60% in the 1990s, while the average Russian male life expectancy plummeted from 68 years to 56 years. Russia's population went into a freefall, Russia's worst death-to-birth ratio at any time in the 20th Century — which is amazing when you think that USAID's privatization program had to compete with the ravages Hitler, Dzerzhinsky and Stalin wreaked on Russia. USAID funded Chubais through public-private organizations and a Harvard program that was so patently corrupt, Harvard and its program directors including economist Andrei Shleifer were sued by the US Department of Justice for "conspiring to defraud" the US government (not to mention Russians). USAID also paid public relations giant Burson-Marsteller to sell the disastrous voucher program to the Russian public, in a mass media advertising blitz that promoted Chubais' political party on the eve of parliamentary elections. It was this USAID funded privatization, and the USAID-backed Russia "democrats," which soured Russians on market capitalism and democracy (renamed "dermokratsia" or "shitocracy" in Russian).

So while the West likes to decry the popularity of Russia’s strongman Putin, it’s the result of its citizens getting a taste of an American effort to impose democracy, except imposing “free markets” was the real aim of this project. And as experience in Latin America, starting with Pinochet, has shown, rapid deregulation leads to plutocratic land grabs. There was no reason to think Russia would be any different. Putin’s high approval ratings rest in no small measure on his having imposed some curbs on the oligarchs and improving living conditions for ordinary Russians. And one big reason that Russian oligarchs remain powerful is that they have been able to put their plunder in the safekeeping of US and UK tax havens. Reuters reports tonight that London has more billionaires per capita than any city, followed by Moscow. A new article at American Interest by Ben Judah titled How Offshore Finance Sank Western Soft Power makes a forceful case that unbridled finance, specifically, the nexus between tax havens and looting plutocrats, has undermined one of the West’s most important assets, its claim to have a more virtuous political and economic model. I strongly suggest you read the article in full. Key extracts: When most people think about offshore finance, they don't think about the future of Europe: They think about palm trees, about shell corporations headquartered in a P.O. Box, and about secret Swiss bank accounts. But this is not what people in Eastern Europe think. When Russians, Ukrainian, Azerbaijanis—I will spare the reader from a roll call of the 15 fraternal republics—when these countries think offshore finance, they think about their stolen futures. But isn't that a good thing? Won't that make them realize that West is best? Not so fast. First, a few figures. The offshore economy has grown into a gargantuan parallel financial system. There may be more than $20 trillion hidden in more than fifty tax havens. The colossal treasure hidden in British tax havens alone is more than $7 trillion. And a disproportionately large share of that money is Eastern European. Take Russia's missing $211.5 billion: That's the conservative estimate for illicit financial flows out of Russia alone between 1994–2011… East European corruption fighters are discovering that Western countries and their systems of offshore economies have enabled the colossal theft of their countries' resources. Bubbling up from beneath the surface of both the Russian opposition and the Ukrainian Maidan is a new sense of disdain for the West… This is what happened to Daria Kaleniuk at Kiev's Anti-Corruption Action Centre. The director of one Ukraine's most important NGOs battling corruption spent years investigating how corruption actually works. But the more she learned, the more she viewed both America and the European Union as hypocrites. Kaleniuk explains: What we found was that the money stolen in Ukraine was heading into British and European tax havens and hidden using shell companies inside the European Union. This was very uncomfortable to find out. What we felt is the Western elites were being hypocritical to us—preaching anti-corruption but allowing this offshore world to flourish.

…..Ukrainian MP Lesya Orobets is running for Mayor of Kiev on a platform that flirts with nationalist outrage. She is enraged by Western complicity with the offshore black hole into which Ukraine's national wealth has long disappeared: What you need to understand is that Western tax havens have resulted in Ukrainian deaths. Take for example the theft of Ukraine's HIV budget. The national budget for fighting HIV was stolen and hidden in tax havens and in Great Britain. But this has consequences—we are now approaching a 2 percent HIV infection rate in Ukraine, which is near the no-return point of pandemic. This corruption will kill British men too. I hear they come to Ukraine. But they also return home. What will happen if the British do not close down their tax havens? I will be deeply, negatively, impressed.

….The West has gotten used to enjoying a hero's reputation amongst Eastern European democrats. But get to know the Moscow opposition or the Maidan and you soon learn that London is now a byword for corruption, and the names of whole European countries—Luxemburg, Cyprus, Switzerland, Andorra, and even the Netherlands—are synonymous with "theft."

As I stressed, please read this important article in its entirety. Despite America’s record of CIA thuggery and undeclared wars, we used to be clean enough internally and involved in enough of the right sort of international activities so as to be able to maintain the appearance of being a reluctant imperialist (this from the imperialism enthusiast Niall Ferguson, who hectored America for its lack of enthusiasm in his 1990s book The Cash Nexus), and on balance, to be a useful ally. The rapid rise of open corruption and the power of America’s new oligarchs has laid waste to what little was left of America’s good name. The tacit assumption seems to be that with no credible competitor for superpower role, the US position remains secure despite increasingly reckless and destructive behavior. But as Ed Luce of the Financial Times has pointed out, the alternative to the weakening of US power isn’t to accelerate the rise of a replacement, but to usher in more instability. Yet even commentators like Luce are constitutionally unable to see how rank corruption is playing into this process, not doubt because far too many well-placed people benefit directly or indirectly. This road to hell is not paved with good intentions, but with willful blindness.  | | Copper Soars Ahead Of China Data, Gold Bounces Off Key Support Posted: 12 May 2014 03:20 AM PDT dailyfx | | Yanis Varoufakis: Sleep-Deprived in Europe Posted: 12 May 2014 01:55 AM PDT Lambert here: Yanis raises a very interesting point. The literature shows that sleep-deprived people make very bad decisions; at Three Mile Island and Chernobyl, for example. And Yves has spoken, as Yanis does below, of how drained Paulson, Bernanke, and other key figures were during the financial meltdown that began with the collapse of Lehman. So if when the finance guys crash the economy again, let’s pay attention to the time of day the decisions come down from on high. Generally, I’m not very sympathetic to body language stories, but visibly exhausted decision makers might be an exception to that rule. By Yanis Varoufakis, a professor of economics at the University of Athens. Cross posted from his blog The thoughts below were inspired by a talk Arianna Huffington gave at the Headliners' Club, Austin TX in April 2014. She spoke of sleep deprivation and the terrible decisions that it leads to. This made me recall that all the awful decisions of our European leaders (and there were so many of them) were reached at around 4.00am. At the height of her political dominance, Mrs. Margaret Thatcher famously portrayed sleep as another form of inefficiency. Given that her political ideology turned on combating inefficiency with the same venom that the Catholic Church had previously reserved for mortal sin, her remark that “sleep is for wimps” possessed the hallmarks of a major political and cultural intervention. Indeed, it did much to establish the “hamsters-on-a-treadmill” environment in government, in the City of London, in the corporations; everywhere men and women strove to prove that they were part of her Brave New Economy and not, to coin another of Mrs. Thatcher's expressions, “moaning minnies.” Thus, from eager interns to the heads of government departments and the CEOs, the race to prove one's capacity for burning the midnight oil was on. Quantity came to trump quality on every turn. It would not stretch credulity too far to say that the vast pyramids of bad quality assets, which crashed and burned in 2008, had their origins, at least in some small part, in this cultural shift. Mrs. Thatcher left her mark not only as a prodigious insomniac but also as a committed Eurosceptic. It is, in this sense, a delicious irony that her attitude to sleep seems to have been adopted and pressed into service by the European Union's leaders during their inane handling of the inevitable Euro Crisis. Once Greece ignited the haystack (with its early 2010 insolvency), a cascading financial and economic crisis engulfed Europe like a vicious bushfire, scorching one proud nation after the other. In a bid to stem it, Europe's great and good were forced to convene more than thirty emergency summits. These summits will undoubtedly go down in history as a comedy of errors. Indeed, for those of us who have been observing our leaders' decision making closely, it feels a lot like watching Othello – wondering how our leaders can be so deluded. One explanation, that is intimately linked to Europe's political economy, has to do with the time of day when they finalized their decisions: invariably in the early hours of the morning, between 4am and 5am. Deadline effects are important to all of us. Alas, European leaders seem to have neglected consciously to set time limits for their negotiations. Instead, they allowed deliberations to last for days and nights until a de facto deadline presented itself in the form of the physical exhaustion that usually hits just before sunrise. At that point, in a fog of fatigue, desperate minds settled on the most immediately available position. Would Europe be a better place today had sleeplessness had not been a major determining factor of our leaders' accords? While the root causes of Europe's troubles are deep, some of Europe's shenanigans might have been avoided. If "sleep is for wimps," as Mrs. Thatcher said, and a form of inefficiency, Europe should today be the land of efficiency and heroic leadership. It is, of course, neither. Powerful Europeans get less sleep than ever, as the crisis continues to fill their mind with intense worry, while a multitude of Europeans are kept awake at night fearing for their jobs, wondering what they must do to get one, agonizing on how they will succeed in putting food on the table after the sun rises.  | | Technical analysis of Gold for May 12, 2014 Posted: 12 May 2014 01:20 AM PDT forex | | GOLD - Faces Bear Threats Posted: 12 May 2014 01:20 AM PDT actionforex | | Technical Picture: Gold Neutral, Silver Fragile, Palladium Breakout Posted: 12 May 2014 01:15 AM PDT goldsilverworlds | | Gold attempts to recover – Analysis - 12/05/2014 Posted: 12 May 2014 01:15 AM PDT economies | | US Dollar Trying to Set a Bottom, SPX 500 Stuck in Familiar Territory Posted: 12 May 2014 01:05 AM PDT dailyfx | | Gold Falls Further Away From Key $1300 Level Posted: 11 May 2014 11:35 PM PDT investing | | Making Silver Coins Posted: 11 May 2014 10:30 PM PDT 24hgold | | Sunday Night Gold Action Posted: 11 May 2014 09:33 PM PDT Le Cafe Américain | | US dollar comes under unexpected pressure this year as recovery falters and money printing winds down so what next? Posted: 11 May 2014 09:10 PM PDT The expected recovery in the US economy has not materialized this year with 0.1 per cent GDP growth in the first quarter which many economists think will be revised down to a negative figure, while at the same time the Fed’s balance sheet is only exceeded by the Bank of Japan as a percentage of GDP. That’s depressed the dollar with prospects in Europe and the UK looking up, at least in comparison with the gloom of the past five years. The demand for US treasuries and equities from foreign buyers has tailed off as the S&P 500 has struggled to maintain all-time highs against mounting tailwinds that include a topping in the profit cycle, a cyclically high price-to-earnings ratio and recently the geopolitical crisis in the Ukraine. Euro-pull On the other hand with the risk of defaults seemingly over there has been a rush into European debt, particularly in the once despised periphery nations like Spain, Italy and even Greece. As yields have fallen investors have been counting their profits. That’s money being transfered from dollars to euros. At the same time yields on US treasuries remain low despite the winding down of QE money printing. Cheap money and a low exchange rate is actually a bonus for the US economy and its recovery. The Japanese, Europeans and British now have the burden of overvalued currencies to contend with as their economies battle to emerge from years of low growth. Is this perhaps what the Fed has in mind? A low dollar makes the US more competitive in global markets and should stoke up inflation to devalue nominal debt. Of course that assumes that there is not a rush towards the exit door for the dollar. A currency collapse would be a nightmare of unimaginable proportions. Yet that is what some predict as a consequence of money printing on the unimaginable scale that has followed the global financial crisis. Hyperinflation? In short, a hyperinflation in which money becomes worthless unless it happens to be in the form of monetary metals that have no central bank controlling them. Maybe the currency collapse is too extreme as a scenario but a return to the very high inflation levels of the late 1970s and a bubble in gold and silver prices is certainly not a wild prediction. Current dollar weakness could therefore be more than a symptom of what has happened and more a sign of days to come. It’s also most likely flagging up an imminent stock market crash which is a panic to exit US assets. | | T. Ferguson on The Curious Case of the GLD Posted: 11 May 2014 07:28 PM PDT TFMetalsReport’s T. Ferguson joins the show this week to discuss: The Vaults Are NEARLY EMPTY- why claims of a physical gold shortage is not stacker hysteria, but rather the COLD HARD TRUTH! PM Sentiment sucks by design: Cartel fears Western investment demand with vaults vastly depleted- vigorously capping any and all price rallies Big picture outlook: Summer stock [...] The post T. Ferguson on The Curious Case of the GLD appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now | | All the Presidents’ Bankers: Ex Goldman Managing Director Nomi Prins on the Coming Market Crash Posted: 11 May 2014 07:01 PM PDT | | Stocks on the Brink of a Sharp Correction? And, The Inflation has Begun Posted: 11 May 2014 05:31 PM PDT Gold Scents | | Gold Prices Vulnerable as USD Regains Footing- All Eyes on US CPI Posted: 11 May 2014 02:50 PM PDT dailyfx |

|

No comments:

Post a Comment