Gold World News Flash |

- One More Correction For Gold Before ‘Substantial Rally’

- Is The Demise Of The PetroDollar Coming? -- John Rubino

- Gold Daily and Silver Weekly Charts – Flight To Safety

- You Can’t Eat Gold… But It’s Portable, Easy To Trade and Confiscation-Proof

- All The Presidents' Bankers: The World Bank And The IMF

- Guest Post: Oil Limits and Climate Change – How They Fit Together

- YELLOWSTONE SUPERVOLCANO ERUPTION IN 2014? Truth & Secrets of Super Volcanoes

- Putting The "Bank Loans Are Rising & Animal Spirits Are Reviving" Meme In Context

- Economic Collapse 2014 -- Current Economic Collapse News Brief

- Gold Investors Weekly Review – April 11th

- The Super Rich are Literally Wiping Their Asses With Gold Now

- Paul Craig Roberts - Why This Collapse Will Be So Horrific

- 2014 Coud Be A Yawner For Gold And Silver; Be Prepared For A Weekend Surprise

- Trading oil outside of dollar might break gold price suppression, Roberts says

- Tocqueville's Hathaway on why gold is likely to rise

- Gold And Silver – 2014 Coud Be A Yawner; Be Prepared For A Surprise

- Gold Preparing to Launch as U.S. Dollar Drops to Key Support

- Doctor Doom on the Fiat Money Empire Coming Financial Crisis

| One More Correction For Gold Before ‘Substantial Rally’ Posted: 12 Apr 2014 11:00 PM PDT from KitcoNews: |

| Is The Demise Of The PetroDollar Coming? -- John Rubino Posted: 12 Apr 2014 10:48 PM PDT John Rubino sees big risks for the Dollar ahead. As it tries to punish Russia for the latter's dismemberment of Ukraine, the West is discovering that the balance of power isn't what it used to be. Russia is a huge supplier of oil and gas — traded in US dollars — which gives it both leverage... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Daily and Silver Weekly Charts – Flight To Safety Posted: 12 Apr 2014 08:30 PM PDT from Jesse's Café Américain:

Gold is still outperforming silver, and has the taste of a minor ‘flight to safety’ in the price action. The Comex warehouses continue to be a foggy snoozer, and stopped contracts are a formidable percentage of the deliverable gold category. But the Comex is a shell game, and so I am not looking for things to start there, but to perhaps surface there once they start overseas with a break in the physical deliveries chain, despite the continuing assurances from the team of Shill & Troll that it is all in your mind, and that such a thing could never happen. |

| You Can’t Eat Gold… But It’s Portable, Easy To Trade and Confiscation-Proof Posted: 12 Apr 2014 06:30 PM PDT by Mac Slavo, SHTFPlan:

|

| All The Presidents' Bankers: The World Bank And The IMF Posted: 12 Apr 2014 06:02 PM PDT The following is an excerpt from ALL THE PRESIDENTS' BANKERS: The Hidden Alliances that Drive American Power by Nomi Prins (on sale April 8, 2014). Reprinted with permission from Nation Books. Nomi Prins is a former managing director at Goldman Sachs. The World Bank and the IMF: Expanding Wall Street's Reach Worldwide Just after the United States entered World War II, two simultaneous initiatives unfolded that would dictate elements of financing after the war, through the joint initiatives of foreign policy measures and private banking whims. Plans were already being formulated to navigate the postwar peace, especially its international power implications for finance and politics, in the background. American political leaders and scholars began considering the concept of "one world" from an economic perspective, void of divisions and imbalances. Or so the theory went. The original plans to create a set of multinational entities that would finance one-world reconstruction and development (and ostensibly balance the world's various economies) were conceived by two academics: John Maynard Keynes, an adviser for the British Treasury, and Harry Dexter White, an economist in the Division of Monetary Research of the US Treasury under Treasury Secretary Henry Morgenthau. By the spring of 1942, White had drafted plans for a "stabilization fund" and a "Bank for Reconstruction and Development." His concept for the fund became the seed for the International Monetary Fund. The other idea became the World Bank. But before those entities would come to life through the Bretton Woods conferences, many arguments about their makeup would take place, and millions of lives would be lost. Keynes, White, and Power Transfer to the United States By early 1944, nearly two-thirds of the European GNP had been devoted to war; millions of people had been slaughtered. But six months after the complete liberation of Leningrad, it was the international financial aspects of the coming peace that exercised the imagination of the policy elites. In July 1944, 730 delegates representing the forty-four Allied nations convened at the Mount Washington Hotel in Bretton Woods, New Hampshire. Amid picturesque mountains, hiking trails, and oppressive heat, they sat to determine the postwar economic system. For three weeks, they debated the charter for the International Monetary Fund and discussed how the International Bank for Reconstruction and Development, or the "World Bank," would operate. White and Keynes had competed for influence over this final result for the past two years. To a large extent, the personal vehemence of each man aside, they did so as an extension of the jockeying for position between the United States and Britain as the incoming and outgoing financial superpowers. At first, virtually every American banker and politician opposed the main aspects of Keynes's plans, particularly his idea about creating a new global currency—the unitas—that would supersede gold and the dollar. Many subsequent histories of the Bretton Woods Conference consider the final doctrines for the IMF and World Bank as representing a clear compromise between White and Keynes. But they leaned far more toward White's model and vision. From the bankers' standpoint, White's model was more tolerable because it preserved the supremacy of the dollar. Former President James A. Garfield once said, "He who controls the money supply of a nation controls the nation." But in the negotiations surrounding those Bretton Woods meetings, the mantra was more "Those who control the banks backed by the currency that dominates the world control world finance." While final drafts snaked through Congress after the July 1944 meetings, one key US banker maintained his public opposition to Bretton Woods. Even after it became clear that the multinational entities would be dollar-based, Chase chairman Winthrop Aldrich remained opposed to the idea. Mostly, he feared the slightest amount of competition from any uncontrollable source. Though Aldrich favored removing trade barriers, which would provide the US banks a wider field for cross-border financing, he didn't want some supranational entity getting in the way of private lending to facilitate that trade. In his "Proposed Currency Plan" of September 16, 1944, Aldrich slammed the accords, which he saw as a distinct challenge to the power of private banks. "The IMF," he said, "would become a mechanism for instability rather than stability since it would encourage exchange-rate alterations." Like most bankers, Aldrich was fine with the World Bank taking responsibility for exchange-stabilization lending. That element would aid bankers; a supranational entity providing monies to struggling countries would bolster them sufficiently to be able to borrow more through private banks. But bankers didn't want a fund constructed as a competing lending mechanism that could possibly take business away from them, operating in the guise of economic security. Aldrich warned, "We shall have the shadow of stability without the substance. . . . Perhaps the most dangerous aspect of the Bretton Woods proposals is that they serve as an obstacle to the immediate consideration and solution of these basic problems." Aldrich's public outcry was unsettling to President Roosevelt and Treasury Secretary Robert Morgenthau, who knew that it was politically important to get all the main bankers' support. Not only did they hold a solid proportion of US Treasury debt; they had become the distribution mechanisms of that debt to more and more citizens and countries. There couldn't be an IMF without the support of private lenders, and if the US was going to be in command of such an entity from a global perspective, US bankers had to be on board. Concession to the bankers wasn't a matter of empty appeasement but of economic supremacy. The American Bankers Association, on which Aldrich was a board member, also wanted to restrict the IMF's powers. Burgess, who served as chairman of the American Bankers Association and National City Bank vice chairman, was unwilling to back the Bretton Woods proposals unless White made more concessions to reinforce the supremacy of the US banks and the dollar. He would play hardball and get Morgenthau involved if he had to. Though White refused to bow to Burgess's requests, Congress incorporated them into the final documents. To make the bankers happy, a compromise was fashioned that restricted the IMF funds to loans offsetting short-term exchange rate fluctuations, such as when one country has a sharp and sudden shift in the value of its currency relative to another. That loophole left plenty of room for banks to supply aggressive financing to developing nations over the loosely defined longer-term. It also meant that all nations receiving short- term assistance from the IMF would likely be on the hook for more expensive debt at the hands of the bankers in tandem, or later. But in the scheme of White's plan, this alteration was more cosmetic than substantial. The Bretton Woods Agreement Congress approved the Bretton Woods agreement on July 20, 1945. Twenty- seven other countries joined as well. The Soviet Union did not. It was a portent of how rapidly the world was falling into the Cold War and how rapidly the United States was forging its own foreign alliances in the postwar economy. By the time the Bretton Woods delegates reconvened to settle the final details of the agreement at Savannah, Georgia, in March 1946, Churchill had already coined the term "the Iron Curtain" to describe the line between Communist Soviet Union and the West in his famous "Sinews of Peace" speech at Westminster College. In addition to the growing Cold War mentality, or perhaps because of it, expectations that White would lead the IMF were squashed when the FBI alerted President Truman that White and other senior civil servants had passed secret intelligence to the Soviet Union. It's doubtful that Truman believed the allegations; though he took White out of the bidding for the head position, White remained an executive director. The incident served as a precedent for how the top positions at the World Bank and the IMF would be allocated along political-geographical lines. The post was offered instead to Belgian economist Camille Gutt, establishing the protocol whereby the IMF would be headed by a Western European and the World Bank by an American. But while politics dictated the initial leadership choices, private bankers' behavior would soon overshadow the functions of both bodies. Despite their "international" monikers, the World Bank and the IMF disproportionately served the interests of the Western European nations that were most important to the United States from the get-go. The bankers could exert their influence over both entities to expand their own enterprises. Later, another element that reinforced this dynamic was added. Thanks to a minor technicality introduced by Truman's Treasury secretary, John Snyder, "aid monies" to "friendly" (or large and friendly) countries would be considered "grants," which would not show up as national debt, thereby providing the illusion of better economic health. Money granted for military operations or the friendly countries would not show up as debt either. This presented a foreign business opportunity whereby banks could provide loans at better terms to larger countries and make more money off higher interest loans to developing ones because of the disparity in their perceived debt loads. In addition, as Martin Mayer observed in his classic book The Bankers, "the growing and unregulated Eurodollar market would become a cauldron of out-of-control debt and heady profits for US banks." Through this market, many of the major midcentury postwar loans would be made. Making the World Bank Work for Wall Street Congress had established the National Advisory Council to be the "coordinating agency for United States international financial policy" and as a mechanism to direct that policy through the international financial organizations. In particular, the council dealt with the settlement of lend-lease and other wartime arrangements, including the terms of foreign loans, details of assistance programs, and the evolving policies of the IMF and World Bank. As chairman of the National Advisory Council, U.S Treasury secretary John Snyder carried a vast amount of influence over those entities, as many major decisions were discussed privately at the council meetings and decided upon there. There was one ambitious lawyer who understood the significance of Snyder's role. That was John McCloy, an outspoken Republican whose career would traverse many public service and private roles (including the chairmanship of Chase in the 1950s), and who had just served as assistant secretary of war under FDR's war secretary, Henry Stimson. McCloy and Snyder would form an alliance that would alter the way the World Bank operated, and the influence that private bankers would have over it. It was Snyder who made the final decision to appoint McCloy as head of the World Bank. McCloy, a stocky Irishman with steely eyes, had been raised by his mother in Philadelphia. He went on to become the most influential banker of the mid-twentieth century. He had been a partner at Cravath, Henderson, and de Gersdorff, a powerful Wall Street law firm, for a decade before he was tapped to enter FDR's advisory circle. After the war, McCloy returned to his old law firm, but his public service didn't translate into the career trajectory that he had hoped for. Letting his impatience be known, he received many offers elsewhere, including an ambassadorship to Moscow; the presidency of his alma mater, Amherst College; and the presidency of Standard Oil. At that point, none other than Nelson Rockefeller swooped in with an enticing proposition that would allow McCloy to stay in New York and get paid well—as a partner at the family's law firm, Milbank, Tweed, Hope, and Hadley. The job brought McCloy the status he sought. He began a new stage of his private career at Milbank, Tweed on January 1, 1946. The firm's most import- ant client was Chase, the Rockefeller's family bank. But McCloy would soon return to Washington. Truman had appointed Eugene Meyer, the seventy-year-old veteran banker and publisher of the Washington Post, to be the first head of the World Bank. But after just six months, Meyer abruptly announced his resignation on December 4, 1946. Officially, he explained he had only intended to be there for the kick-off. But privately, he admitted that his disagreements with the other directors' more liberal views about lending had made things untenable for him. His position remained vacant for three months. When Snyder first approached McCloy for the role in January 1947, he rejected it. But Snyder was adamant. After inviting McCloy to Washington for several meetings and traveling to New York to discuss how to accommodate his stipulations about the job—conditions that included more control over the direction of the World Bank and the right to appoint two of his friends— Snyder agreed to his terms. Not only did Snyder approve of McCloy's colleagues, but he also approved McCloy's condition that World Bank bonds would be sold through Wall Street banks. This seemingly minor acquiescence would forever transform the World Bank into a securities vending machine for private banks that would profit from distributing these bonds globally and augment World Bank loans with their private ones. McCloy had effectively privatized the World Bank. The bankers would decide which bonds they could sell, which meant they would have control over which countries the World Bank would support, and for what amounts. With that deal made, McCloy officially became president of the World Bank on March 17, 1947. His Wall Street supporters, who wanted the World Bank to lean away from the liberal views of the New Dealers, were a powerful lot. They included Harold Stanley of Morgan Stanley; Baxter Johnson of Chemical Bank; W. Randolph Burgess, vice chairman of National City Bank; and George Whitney, president of J. P. Morgan. McCloy delivered for all of them. A compelling but overlooked aspect of McCloy's appointment reflected the postwar elitism of the body itself. The bank's lending program was based on a supply of funds from the countries enjoying surpluses, particularly those holding dollars. It so happened that "the only countries [with] dollars to spare [were] the United States and Canada." As a result, all loans made would largely stem from money raised by selling the World Bank's securities in the United States. This gave the United States the ultimate power by providing the most initial capital, and thus obtaining control over the future direction of World Bank financial initiatives—all directives for which would, in turn, be predicated on how bankers could distribute the bonds backing those loans to investors. The World Bank would do more to expand US banking globally than any other treaty, agreement, or entity that came before it. To solidify private banking control, McCloy continued to emphasize that "a large part of the Bank capital be raised by the sale of securities to the investment public." McCloy's like-minded colleagues at the World Bank—vice president Robert Garner, vice president of General Foods and former treasurer of Guaranty Trust; and Chase vice president Eugene Black, who replaced the "liberal" US director Emilio Collado—concurred with the plan that would make the World Bank an extension of Wall Street. McCloy stressed Garner and Black's wide experience in the "distribution of securities." In other words, they were skilled in the art of the sale, which meant getting private investors to back the whole enterprise. The World Bank triumvirate was supported by other powerful men as well. After expressing his delight over their appointments to Snyder on March 1, 1947, Nelson Rockefeller offered the three American directors his Georgetown mansion, plus drinks, food, and servants, for a three-month period while they hammered out strategies. No wives were allowed. Neither were the other directors. This was to be an exclusive rendezvous. It is important to note here that the original plan as agreed upon at Bretton Woods did not include handing the management and organization of the World Bank over to Wall Street. But the new World Bankers seemed almost contemptuous of the more idealistic aspects of the original intent behind Bretton Woods, that quaint old notion of balancing economic benefits across nations for the betterment of the world. Armed with a flourish of media fanfare from the main newspapers, they set about constructing a bond-manufacturing machine. With the Cold War hanging heavily in the political atmosphere, the World Bank also became a political mechanism to thwart Communism, with funding provided only to non-Communist countries. Politics drove loan decisions: Western allies got the most money and on the best terms. |

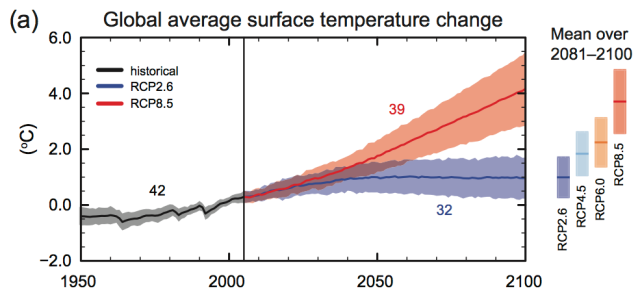

| Guest Post: Oil Limits and Climate Change – How They Fit Together Posted: 12 Apr 2014 04:48 PM PDT Submitted by Gail Tverberg via Our Finite World blog, We hear a lot about climate change, especially now that the Intergovernmental Panel on Climate Change (IPCC) has recently published another report. At the same time, oil is reaching limits, and this has an effect as well. How do the two issues fit together? In simplest terms, what the situation means to me is that the “low scenario,” which the IPCC calls “RCP2.6,” is closest to what we can expect in terms of man-made carbon emissions. Thus, the most reasonable scenario, based on their modeling, would seem to be the purple bar that continues to rise for the next twenty years or so and then is close to horizontal. I come to this conclusion by looking at the tables of anthropogenic carbon emission shown in Annex II of the report. According to IPCC data, the four modeled scenarios have emissions indicated in Figure 2.  Figure 2. Total anthropogenic carbon emissions modeled for in the scenarios selected by the IPCC, based on data from Table All 2.a in Annex II.

The Likely Effect of Oil Limits The likely effect of oil limits–one way or the other–is to bring down the economy, and because of this bring an end to pretty much all carbon emissions (not just oil) very quickly. There are several ways this could happen:

If any of these scenarios takes place and snowballs to a collapse of today’s economy, I expect that a rapid decline in fossil fuel consumption of all kinds will take place. This decline is likely to be more rapid than modeled in the RCP2.6 Scenario. The RCP2.6 Scenario assumes that anthropogenic carbon emissions will still be at 84% of 2010 levels in 2030. In comparison, my expectation (Figure 3, below) is that fossil fuel use (and thus anthropogenic carbon emissions) will be at a little less than 40% of 2010 levels in 2030.  Figure 3. Estimate of future energy production by author. Historical data based on BP adjusted to IEA groupings. After 2070, the RCP2.6 Scenario indicates negative carbon emissions, presumably from geo-engineering. In my view of the future, such an approach seems unlikely if oil limits are a major problem, because without fossil fuels, we will not have the ability to use engineering approaches. It is also doubtful that there would be as much need for these engineered carbon-take-downs at the end of the period. Population would likely be much lower by then, so current anthropogenic carbon emissions would be less of a problem. The Climate Change Scenario Not Modeled We really don’t know what future climate change will look like because no one has tried to model what a collapse situation would look like. Presumably there will be a lot of tree-cutting and burning of biomass for fuel. This will change land use besides adding emissions from the burned biomass to the atmosphere. At the same time, emissions associated with fossil fuels will likely drop very rapidly. Clearly the climate has been changing and will continue to change. At least part of our problem is that we have assumed that it is possible to have an unchanging world and have made huge investments assuming that climate would go along with our plans. Unfortunately, the way nature “works” is by repeatedly replacing one system with another system. The new systems that survive tend to be better adapted to recent changes in conditions. If we think of humans, other animals, and plants as “systems,” this is true of them as well. No living being can expect to survive forever. Unfortunately economies are not permanent either. Just as the Roman Empire failed, our economy cannot last forever. In physics, economies seem to be examples of dissipative structures, just as plants and animals and hurricanes are. Dissipative structures are formed in the presence of flows of energy and matter in open thermodynamic systems–that is, systems that are constantly receiving a new flow of energy, as we on earth do from the sun. Unfortunately, dissipative structures don’t last forever. Dissipative structures temporarily dissipate energy that is available. At the same time, they affect their surroundings. In the case of an economy, the use of energy permits the extraction of the most accessible, easy-to-extract resources, such as fossil fuels, metals, and fresh water. At the same time, population tends to grow. The combination of growing extraction and rising population leads to economic stresses. At some point the economy becomes overly stressed because of limits of various types. Some of these limits are pollution-related, such as climate change. Other limits present themselves as higher costs, such as the need for deeper wells or desalination to provide water for a growing population, and the need for greater food productivity per acre because of more mouths to feed. The extraction of oil and other fossil fuels also provides a cost limit, as resource extraction becomes more complex, requiring a larger share of the output of the economy. When limits hit, governments are especially likely to suffer from inadequate funding and excessive debt, because tax revenue suffers if wages and profits drop. People who haven’t thought much about the situation often believe that we can simply get along without our current economy. If we think about the situation, we would lose a great deal if we lost the connections that our current economy, and the financial system underlying it, offers. We as humans cannot “do it alone”–pull out metals and refine them with our bare hands, dig deeper wells, or keep up fossil fuel extraction. Re-establishing needed connections in a totally new economy would be a massive undertaking. Such connections are normally built up over decades or longer, as new businesses are formed, governments make laws, and consumers adapt to changing situations. Without oil, we cannot easily go back to horse and buggy! Unfortunately, much of the writing related to dissipative structures and the economy is in French. François Roddier wrote a book called Thermodynamique de l’évolution on topics related to this subject. Matthieu Auzanneau writes about the issue on his blog. Roddier has a presentation available in French. One paper on a related topic in English is Energy Rate Density as a Complexity Metric and Evolutionary Driver by E. Chaisson. Causal Entropic Forces by Wissner-Gross and Freer provides evidence regarding how societies self-organize in ways that maximize entropy. The IPCC’s Message Isn’t Really Right We are bumping up against limits in many ways not modeled in the IPCC report. The RCP2.6 Scenario comes closest of the scenarios shown in providing an indication of our future situation. Clearly the climate is changing and will continue to change in ways that our planners never considered when they built cities and took out long-term loans. This is a problem not easily solved. One of the big issues is that energy supplies seem to be leaving us, indirectly through economic changes that we have little control over. The IPCC report is written from the opposite viewpoint: we humans are in charge and need to decide to leave energy supplies. The view is that the economy, despite our energy problems, will return to robust growth. With this robust growth, our big problem will be climate change because of the huge amount of carbon emissions coming from fossil fuel burning. Unfortunately, the real situation is that the laws of physics, rather than humans, are in charge. Basically, as economies grow, it takes increasing complexity to fix problems, as Joseph Tainter explained in his book, The Collapse of Complex Societies. Dissipative structures provide this ever-increasing complexity through higher “energy rate density” (explained in the Chaisson article linked above). Now we are reaching limits in many ways, but we can’t–or dare not–model how all of these limits are hitting. We can, in theory, add more complexity to fix our problems–electric cars, renewable energy, higher city density, better education of women. These things would require more energy rate density. Ultimately, they seem to depend on the availability of more inexpensive energy–something that is increasingly unavailable. The real issue is the danger that our economy will collapse in the near term. From the earth’s point of view, this is not a problem–it will create new dissipative structures in the future, and the best-adapted of these will survive. Climate will adapt to changing conditions, and different species will be favored as the climate changes. But from the point of view of those of us living on the planet earth, there is a distinct advantage to keeping business as usual going for as long as possible. A collapsed economy cannot support 7.2 billion people. We need to understand what are really up against, if we are to think rationally about the future. It would be helpful if more people tried to understand the physics of the situation, even if it is a difficult subject. While we can’t really expect to “fix” the situation, we can perhaps better understand what “solutions” are likely to make the situation worse. Such knowledge will also provide a better context for understanding how climate change fits in with other limits we are reaching. Climate change is certainly not the whole problem, but it may still play a significant role. |

| YELLOWSTONE SUPERVOLCANO ERUPTION IN 2014? Truth & Secrets of Super Volcanoes Posted: 12 Apr 2014 03:56 PM PDT Stan Deyo, a globetrotting researcher and an advanced propulsion engineer who has held "Above Top Secret" security clearance on government projects, also joins the broadcast to discuss the coming global economic collapse, the knowledge of the potential of a super volcano and many other topics.... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Putting The "Bank Loans Are Rising & Animal Spirits Are Reviving" Meme In Context Posted: 12 Apr 2014 03:22 PM PDT Much has been made of the "sharp acceleration" in bank lending in the last few months promulgated by the status quo huggers that 'animal spirits are reviving' and, despite a collapse in equity market valuations for 'growth' stocks, that escape velocity growth and that so-longed-for surge in Capex is just around the corner. However, when put in context... when looked at over more than a few months, and when considered against the typical economic cycle... this is anything but sustainable and merely reflects on the inventory-stacking mal-investment debacle of Q4 that is now unwinding en masse as hoped for 'aggregate demand' shows no signs of appearing. Submitted by Lance Roberts of STA Wealth Management, In a recent posting on Business Insider, reference was made to a chart by Liz Ann Sonders discussing a recent surge in bank loans and leases as a sign of impending economic recovery.

The problem is that the chart is completely out of context. Is this spurt in activity historically relevant? Have such increases previously led to surges in economic activity or inflation? Or, is this activity just an anomaly that will rectify itself in the months ahead? While Ms. Sonders certainly presents an interesting point, by taking the data out of context it potentially leads to a misdiagnosis of the issue. The chart below is a long term view of the bank loan and lease data as compared to both the economy and the velocity of money as an indicator of potential inflationary pressures. What we see is, as would be expected, that businesses respond to changes in the economy on a lagged basis. Business owners, and individuals, do not generally jump out to take on credit until they are sure the economy is recovering and vice-versa. The recent uptick corresponds with the economic push in the last quarter of 2013. It is very likely, given the recent economic weakness both domestically and internationally, that the recent surge in activity may well be very short lived.

|

| Economic Collapse 2014 -- Current Economic Collapse News Brief Posted: 12 Apr 2014 02:14 PM PDT In this news brief we will discuss the latest news on the economic collapse. We look to see if things are really that different. The central bank will not stop at just confiscating your wealth they will want your life. They want to enslave the people. [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Investors Weekly Review – April 11th Posted: 12 Apr 2014 11:57 AM PDT In his weekly market review, Frank Holmes of the USFunds.com nicely summarizes for gold investors this week's strengths, weaknesses, opportunities and threats in the gold market. Gold closed the week at $1,318.42, up $14.77 per ounce (1.13%). The NYSE Arca Gold Miners Index rose 0.06% on the week. This was the gold investors review of past week. Gold Market StrengthsGold rose to a two-week high following the release of the Federal Reserve minutes, which showed that projections for an interest-rate increase may be overstated. According to the Fed, several participants expressed concerns that the rate forecast could be misconstrued, indicating a move to a less-accommodative function. Founder of INK Research, Ted Dixon, commented during an interview on current insider buying trends in the gold space, stating that insider buying in U.S. stocks has been languishing for a long time. But the indicator for the TSX Gold Sector shows a ratio of insider buying to insider selling of 2.5:1. This is one of the most bullish readings ever. Gold Market WeaknessesCentamin reported that for the first quarter of 2014, total gold production from its Sukari mine in Egypt fell 19 percent quarter-on-quarter to 74,241 ounces. The result is certainly disappointing given that the company has been implementing a major plant expansion and was thought to be in a position where higher-grade, underground sections were being accessed, thus providing more ore to the mill. The production shortfall is attributed to poor mining fleet availability, with the company stating that underground mining equipment issues have been rectified by the end of the quarter. In a Mineweb article, author Lawrence Williams details that Former Assistant Treasury Secretary Paul Craig Roberts stated categorically that the gold price is indeed manipulated by the U.S. Fed. The Fed has had to resort to this practice in order to protect the value of the U.S. dollar and its reserve currency status from its effective reduction in value through its quantitative easing (QE) policy. According to Roberts, intervention in the gold market has been occurring for a long time, but has become more and more blatant and desperate recently. Roberts says that the Fed accomplishes it through a series of gold price flash crashes by short selling huge amounts of gold futures into the COMEX market, usually at times when trading is thin. Gold Market OpportunitiesOn Monday night, Philippe Couillard's Liberals won a formidable majority in the province of Quebec. The implication for the resources sector is the imminent acceleration of the Plan Nord, a massive mining development plan that when first introduced, called for $80 billion in investment over 25 years. This included $47 billion towards renewable energy and $33 billion towards mining and infrastructure. The following day Stornoway Diamond Corp. announced its entry into a $944 million binding financing agreement with a syndicate of Quebec funds and lenders for the construction of the Renard Project in north central Quebec. The opportunity for Quebec-domiciled names and operators such as Virginia Mines is tremendous. Barry Bannister, Chief Equity Strategist at Stifel, published a report highlighting that U.S. real interest rates are set to decline, which bodes well for gold in 2014 and may bring the yellow metal to $1,600 per ounce. His analysis partly reflects the opinion of Jefferies Strategist David Zervos, who argues the Fed will continue to punish cash hoarders, mainly by allowing real interest rates to go negative. Negative real interest rates force investors to deploy their cash as cash-hoarding comes with a cost in the form of inflation exceeding the nominal return on cash. Gold Market ThreatsGold is Morgan Stanley's least-preferred commodity among the metals on the outlook for rising U.S. interest rates and low inflation expectations. Analyst Joel Crane states that the factors that boosted bullion in the first quarter, including Ukraine tensions, are set to weaken. As a result, Crane expects prices to drop for the next four quarters. Gold is set to drop as the U.S. economic recovery picks up, according to UBS analysts. The Swiss bank's analysts believe gold will trade between $1,300 and $1,350 per ounce at the end of the year, arguing that any price rally will prove short lived. On May 13, the SEC's Dodd-Frank-mandated conflict minerals reports are due, and a significant number of public companies risk falling behind, according to PwC. According to Mineweb, the conflict minerals rule requires companies registered with the SEC to determine or disclose if any of their minerals, including gold, may have originated in the Democratic Republic of the Congo. If so, the companies must determine whether these minerals in the products are conflict-free. |

| The Super Rich are Literally Wiping Their Asses With Gold Now Posted: 12 Apr 2014 11:00 AM PDT Anonymous Presents: Life of the Uncaring Rich "Snob's" The Super Rich are Literally Wiping Their Asses With Gold Now.Class Warfare Exists:It was recently revealed that the world's richest 85 people hold as much wealth between them as the poorest 3.5 billion -- so what are they going to spend... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Paul Craig Roberts - Why This Collapse Will Be So Horrific Posted: 12 Apr 2014 10:59 AM PDT  Today former US Treasury official, Dr. Paul Craig Roberts, spoke with King World News about why the coming collapse will be so horrific. Dr. Roberts also warned about the lies and corruption which are now engulfing the U.S., as well as how this is beginning to impact the way other countries around the world view Washington. Below is what Dr. Roberts had to say in this powerful interview. Today former US Treasury official, Dr. Paul Craig Roberts, spoke with King World News about why the coming collapse will be so horrific. Dr. Roberts also warned about the lies and corruption which are now engulfing the U.S., as well as how this is beginning to impact the way other countries around the world view Washington. Below is what Dr. Roberts had to say in this powerful interview.This posting includes an audio/video/photo media file: Download Now |

| 2014 Coud Be A Yawner For Gold And Silver; Be Prepared For A Weekend Surprise Posted: 12 Apr 2014 09:48 AM PDT For the past year, we have been saying that the charts for gold and silver are likely bottoming in a normal manner, and it takes time for a this kind of formation to complete itself. It remains the case, to date. What is likely to cause a sharp price reversal to the upside for gold and silver? If both were allowed to simply adjust to inflation, you would see a fairly substantial rally. Given that will not be the case, what will be a/the catalyst for a precious metal [PM] change in trend? Could it be enormous purchases of whatever-is-available physical gold by countries like China and India? No. That has been in the works and a known fact for a few years now, and gold continues to languish near recent lows. How about prospects for a U S-prompted breakout of war? [No other country seems interested in starting one.] No. Libya failed to ignite anything, nor did the Arab Spring or the ongoing Syrian situation where the US sees chemicals everywhere, except in rebel hands. What about Iran and its "nuclear proliferation" that needs to be stopped? No. Pakistan and North Korea have nuclear capabilities well beyond that of Iran, so a nuclear threat from a country that does not have nuclear capability is another US false flag. What Iran does have that neither Pakistan nor North Korea have is oil. Wait. Are not all contracts for trade in oil based on use of the petrodollar? The first "yes!" How about the US-sponsored coup d'etat in Ukraine as an instigation for war? No. It has been well-checked by Putin, so far. Wait. Are not all contracts for natural gas trade based on use of the petrodollar? A second "yes." What about the loss of the petrodollar as a world reserve currency? Would that cause the prices for gold and silver to rise dramatically? A huge yes for that one. Come to think of it, the reason for the US-led invasion of Iraq was due to Saddam's cache of Weapons of Mass Destruction. Turns out, there were none, but Iraq did have oil, just like Iran, and both countries were selling their oil for gold, by-passing the use of the US fiat-issue petrodollar. The elites have consequences for when their rules are ignored. Iraq was invaded, and partially ruined, and Iran has been economically sanctioned Syria is not known as an oil-producing nation. True. That is not the threat to the US. What is a threat is the strategic location of a Syrian port used as an integral part for sending Russian natural gas to Europe. A successful pipeline that is not run by the US is a huge concern, especially because the natural gas coming from Russia will not use the petrodollar. Without the petrodollar standard, the US cannot export its inflationary fiat to the rest of the world. Countries that use the petrodollar hold large quantities of US treasury bonds to facilitate trade agreements. If countries, let us say like Iraq and Iran, stop basing oil trade on the petrodollar, other countries will follow suit. The elites cannot allow this to happen. Both countries are relatively small compared to the BRICS alliance, of which China is fast- becoming the world's biggest energy user. All of the BRICS nations,[Brazil, Russia, India, China, South Africa], and a host of other countries are starting their own trade agreements, and guess which country is "odd man out?" The elite's own United States. The elites cannot allow this to happen, but they cannot stop it, either. This is a problem for them. While everyone is focused on the demand side for gold, doing all kinds of calculations, trying to figure out the real number of tonnes China has purchased. Our simple answer: a lot, and the real number is of no consequence. All of the charts depicting countries purchasing gold, graphs showing the depletion of COMEX, LBMA, GLD, et al, are well done and nice to look at, but none address why the price of gold and silver are at relatively low levels, these days. Gold, more so than silver, has been purposefully suppressed to keep the fiat petrodollar propped up. The elites will stop at nothing to prevent gold from being recognized as an alternative to their Western world fiat Ponzi scheme. Why has the elite-puppet Obama been continually enabling and prompting the illegally sponsored coup in Ukraine? The US is fighting to keep the Wizard behind the curtain from being exposed for the fraud that it is. The fraud is the fiat Ponzi scheme and the utter insolvency of the entire Western central banking system. What keeps it alive, actually more on a respirator, at this stage, is the grip over the entire Western world political system which is designed to keep the masses enslaved to the debt system from which there is little hope of escape. There is a reason why there has been such a militarized build-up in the United States, used against certain countries to keep all other countries in line, lest they be next. The militarization of local police forces, with their highly armed swat teams, former military vehicles being "donated" to cities and towns. This is by elite design to have the means of keeping the masses under control, no match for the excessively armed police. This is why elite-kisser Michael Bloomberg, who has turned the NY police into a virtual private military, and why he has been busy campaigning for national gun control. A population with no means to defend itself is an easy target to keep under control. Chicago has some of the strictest gun-control laws in the nation, yet crime and death by gun is amongst the highest in this country. What will more gun controls accomplish? Nothing. Not a thing. All that needs be done is to enforce the gun laws on the books, but that would not solve the disarming of the people, which is what the corporate federal government wants in order to eliminate all forms of civil resistance. We got a little off topic re the threat of dismantling of the petrodollar, and with it the rapid fall of the United States into a third-rate country drowning in debt with no way out. The elites can ill afford to lose its primary ATM machine that feeds the top .0001% who profit by controlling all the money. All of these seemingly extraneous events are really tied into the control of the powerful and power-hungry elites. The Rothschild crowd. As was stated last week, we know of no sentence that has had a more profound effect on the people of the world than the one uttered by Mayer Amschel Rothschild, "Give me control of a nation's money, and I care not who makes the laws." [See Power Of Elites More Important Than China's Gold, 5th paragraph and the ones following as explanation.] Why is it that 2014 may be like a repeat of 2013 in failed expectations for gold and silver to reach new highs and beyond? For as long as the elites maintain their monetary power to destroy countries via their imposition of financial terrorism, [Greece, Cyprus, Ireland, Spain, et al, and now trying to gain financial control over Ukraine, in desperation. The utter inability of Germany to repatriate its own gold, to which one should ask, why is Germany not in an uproar over this? Hint: Power of the elites to keep Germany in line.], the price of gold and silver will take time to turn around. The catalyst will not be how much gold China owns. The catalyst will be the fall of the petrodollar. Once that happens, checkmate elites. Game over US. Gold and silver, rise to your natural relationship between supply and demand, no longer being artificially suppressed. The problem for now? There is no viable alternative to replace the broken fiat petrodollar scam. The Chinese have already made clear that they do not want their Yuan tied to the price of gold, and China is not really equipped yet to have their currency be a substitute world reserve, emphasis on the adverb "yet." Russia's ruble is not sufficiently held by other countries to make the ruble a reserve currency. It is in a position to grow into that status, but not in the near future. Which country has the ability to replace the petrodollar? None of which we are aware. The BRICS nations are successfully building an alternative to trade that eliminates the fiat petrodollar, and that, more than anything else in the interim, poses the biggest threat to its demise. We could see a marking of time during which all of this continues to unfold. No one has a clue as to the how or to the when, which is why 2014 could be an extension of 2013. The way in which Obama keeps prodding Russia could precipitate an event that escalates out of control, just possibly, as an example. This is why we say to watch out for weekend surprises. When people least expect, and/or are in a position to least react, some kind of announcement could be made that devalues the fiat Federal Reserve Note, still wrongly called the "dollar." A few paragraphs back, we said the there is little hope of escape. For as long as the fiat monetary Ponzi scheme exists and people remain tethered to it though debt, dependent upon government through assistance/subsistence, there is no exit. The only means, or perhaps the best means is through the buying and personally holding physical gold and silver. Both PMs represent a form of wealth that leads to independence from control of any government. This is why the Rothschilds took over this country via the Federal Reserve Act, ["Give me control of a nation's money, and I care not who makes the laws."], gained control of the money, and then once in control, had FDR make the Executive Order to have "all persons" turn in their gold under penalty of $10,000 and/or confiscation. This was also another sham that fooled people into believing an Executive Order applied to them, which it did not. But that is how the Rothschild formula works, through total deception. [We keep repeating the Rothschild sentence about control over the money supply because once you comprehend how it is the genesis for all what ails people in their own country. Governments are nothing more than instruments for elite control over the people.] These are the reasons why we keep exhorting everyone to buy gold and silver. Price is immaterial, having it is all that matters. Having gold and/or silver is what will keep you financially viable when this country falls apart, and fall apart it will. The US has been hollowed out since the Rothschild central bankers took over in 1913, in a financial coup d'etat. On a final note, before reviewing the charts, a second interview conducted by SGTReport has been posted on the site. Here is the link for anyone interested. The Rothschild IMF Bankster Fiat Death Machine. The title was selected by Sean of SGTReport, and it gives a clue to some of the content discussed. There is not a shred of evidence that the price of gold is about to embark upon a much higher trajectory. This is the value of reading developing market activity within the context of all the world news and events that potentially impact price. What the market is saying is that nothing in the news is disturbing the bottoming process. What people are saying about the market may be a different "story," but it is the market that has the final say. Pay attention to it. |

| Trading oil outside of dollar might break gold price suppression, Roberts says Posted: 12 Apr 2014 06:06 AM PDT 9:07a ET Saturday, April 12, 2014 Dear Friend of GATA and Gold: Acceptance by energy producers of currencies other than the U.S. dollar well might destroy the Federal Reserve's ability to suppress the price of gold, former Assistant U.S. Treasury Secretary Paul Craig Roberts tells King World News: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/4/11_Pa... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. |

| Tocqueville's Hathaway on why gold is likely to rise Posted: 12 Apr 2014 06:02 AM PDT 9a ET Saturday, April 12, 2014 Dear Friend of GATA and Gold: In commentary posted at King World News, the Tocqueville Gold Fund's John Hathaway makes a comprehensive case for higher gold prices. "No mining company management in its right mind would commit to a program of mine construction at current prices," Hathaway writes. "Therefore, we believe that mine supply will shrink in the years ahead, especially after 2015. Given the lead times involved in new mine construction and even with a moderately rising trend in gold prices, supply could be constrained through the end of the current decade. The demand picture, especially from Asian consumers and possible central banks, looks robust. "The flow of gold into China continues to set records and the all-important consumption by the Indian subcontinent remains solid. The Chinese government, acutely aware to the downside risks of its $4 trillion exposure to the U.S. currency, has almost certainly been surreptitiously accumulating physical gold as a hedge. There has been no update from official sources on central bank holdings since 2009, and if China is still in an accumulation mode, one can be certain that they have taken full advantage of the two year price decline and that their future intentions remain a well-guarded secret." Hathaway covers market manipulation as well: "We believe that the architecture of the gold market is set to undergo significant change in the current year and that these changes, which have little to do with macroeconomic considerations, will result in attracting capital flows. These changes begin with inquiries by regulatory authorities in Germany and the United Kingdom into possible price manipulation by bullion banks in connection with the London fix mechanism for gold. These inquiries have been followed by lawsuits seeking damages for plaintiffs possibly injured by price manipulation. We believe many other lawsuits could follow." Hathaway's commentary is posted at KWN here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/4/12_Re... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. |

| Gold And Silver – 2014 Coud Be A Yawner; Be Prepared For A Surprise Posted: 12 Apr 2014 05:13 AM PDT For the past year, we have been saying that the charts for gold and silver are likely bottoming in a normal manner, and it takes time for a this kind of formation to complete itself. It remains the case, to date. What is likely to cause a sharp price reversal to the upside for gold and silver? If both were allowed to simply adjust to inflation, you would see a fairly substantial rally. Given that will not be the case, what will be a/the catalyst for a precious metal [PM] change in trend? |

| Gold Preparing to Launch as U.S. Dollar Drops to Key Support Posted: 12 Apr 2014 01:51 AM PDT Gold bugs have been forecasting a dollar collapse for years. They have been correct about the gold price, which has advanced nearly 400% in the past 12 years versus a gain of just 64% for the S&P 500. They were also correct about the dollar during the first phase of the gold bull market (2001-2008), when the USD index fell from 120 to around 72. |

| Doctor Doom on the Fiat Money Empire Coming Financial Crisis Posted: 12 Apr 2014 01:05 AM PDT Save The Threatened Empire Almost openly now, the long-running attempt to kick the price of gold down, and keep it down to Save the Money and stoke further frenzied and unreal price growth of equities has overreached. The fiat money empire is more threatened, today, than for decades and the train has hit the buffers. Speaking on CNBC this week, the veteran market expert Marc Faber – often ridiculed by business media as a Doctor Doom who always exaggerates – was given more respect than he normally gets. There were no you-said-it-before jibes when he said a 1987-style “pure financial” market crash is coming. Leading the way, he said, the insanely-overpriced Internet and Biotech stocks will be the first to go. Apart from what he called “cloud cuckoo” stock and asset prices, the basic upstream trigger are the antics of the US Fed, which like other central banks has upped the ante to the point where, Faber said, anybody can see the Fed is a “clueless organization”. Global monetary overreach went viral years ago. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The miners continued to get pounded along with tech momentum stocks as this week turned out badly for equities overall.

The miners continued to get pounded along with tech momentum stocks as this week turned out badly for equities overall. If you've conducted even a preliminary investigation into the global economic situation you've likely concluded that something isn't right. As noted previously, all of the evidence points to

If you've conducted even a preliminary investigation into the global economic situation you've likely concluded that something isn't right. As noted previously, all of the evidence points to

No comments:

Post a Comment