Gold World News Flash |

- Limits to Employment Participation, and Societal Change

- Prepare For Dollar Collapse With 33% Allocation To Gold - Rickards

- DHS Is Preparing For The Next Disaster Which Will Cover Up The Economic Collapse

- The Secret That Has U.S. & Western Leaders Truly Terrified

- Gold Price Marks Crash Anniversary by Rising to April '13 Low as US Tech Slump Spreads

- Gold Price Marks Crash Anniversary by Rising to April '13 Low as US Tech Slump Spreads

- Great Depression II

- Weekly News Wrap-Up U.S. & Russia at Odds over Ukraine, GOP wants IRS Chief Prosecuted, Sebelius, Out over Obama Care

- The Truth About the Nevada Rancher’s Standoff

- Koos Jansen: New physical gold exchange in Singapore

- HFT in Comex gold is like the old London Gold Pool, Kaye tells KWN

- Prepare For Dollar Collapse With 10% To 33% Allocation To Gold – Rickards

- Alasdair Macleod: Gold and bail-ins

- Large Decline Of Shanghai & Comex Silver Stocks

- China Gold Imports Through Hong Kong

- U.S. Gold Gone & What 52 Years In This Business Taught Me

- The Truth About the Nevada Rancher's Standoff

- Chris Martenson and Alasdair Macleod discuss China's corner on gold

- Shocking Charts Show Silver Set For A Staggering $70 Surge

- Pat Heller: U.S. has rigged precious metals markets for 80 years

- The Gold Price Gained $14.6 or 1.1 Percent Today to Close Comex at $1,320.10

- The Gold Price Gained $14.6 or 1.1 Percent Today to Close Comex at $1,320.10

- Another smashing of gold unlikely because it would unleash demand, Kaye says

- Gold Price Holding Up Well But Next Catalyst Unclear

- Shocking Gold Bull Ahead

- Shocking Gold Bull Ahead

- Gold Daily and Silver Weekly Charts - Gold Continues Higher

- Gold Daily and Silver Weekly Charts - Gold Continues Higher

- Gold Delivery Strains Reappear & What Might Destroy COMEX

- Trade of the decade

- Gold and Silver Speculation

- Critical Metric Is Now Over 1,000 Times Higher Than Normal!

- Chinese Checkers with Gold Prices

- Gold Traders Resolve Tested

- Crude to the Rescue: How $100 Oil Helps the Market

- All the Gold in China

- THE ROTHSCHILD IMF BANKSTER FIAT DEATH MACHINE - Michael Noonan

- Gold Price Slips from 2-Week High on US Jobs Data, Rising Comex Warehouse Stocks "Suggest China Slowdown"

- Precious Metals Market Report with Franklin Sanders

- Mainstream Gold and Silver Analysis Out of Touch, Out of Context and Off the Mark

- Gold Supply & Demand: Shocking Numbers

- Gold Supply & Demand: Shocking Numbers

- Financial War: Chances & Impact

- Financial War: Chances & Impact

- Interest Rate Hikes on the Horizon? Not Likely

- Puerto Rico's Tax Benefits—More than 'The Better Florida'

| Limits to Employment Participation, and Societal Change Posted: 11 Apr 2014 07:44 AM PDT Raymond Matison writes: Ever since the calamitous financial meltdown in 2008, economists, market analysts, and media pundits persistently have envisioned an economic recovery, with an attendant increase in employment. However, critics maintain that such a recovery has never really occurred – prompting the pundit response that ours is a jobless recovery. Recently, President Obama promoted raising the minimum wage, and increasing payment for overtime work, as a means to help provide a higher wage for workers. This effort is good politics, but is not really a sound bureaucratic practice. The direction and future of unemployment is easy to see, as is the future employment participation rate, and the resulting direction of national income. Globally embedded, strategic economic trends are more powerful than presidential edict and the Federal Reserve Bank, and so economics will trump central planning. This article discusses a possible outcome of these trends. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prepare For Dollar Collapse With 33% Allocation To Gold - Rickards Posted: 11 Apr 2014 07:15 AM PDT Today's AM fix was USD 1,317.25, EUR 948.62 & GBP 785.71 per ounce. Yesterday's AM fix was USD 1,321.50, EUR 953.19 & GBP 787.73 per ounce.

Spot gold was steady at $1,322.10 an ounce by 1137 GMT, after three straight days of gains. The precious metal is up 1.4% for the week, having hit a high of $1,324.40 on Thursday - its highest since March 24.

These anomalies would appear to more than coincidental. They may be due to traders painting the tape or manipulation through HFT and computer trading. Goldman Sachs have been very vocal in their bearishness on gold at quarter ends. It is worth considering whether there is an attempt to "jaw bone" gold prices lower.

DEFLATION AND THE RISK OF COLLAPSE "The system is now larger than 2008 — make the system bigger and you're going to have a bigger collapse … we are further down the timeline," Rickards warns. "Are you going to believe me or the IMF? I have a little better track record."

"The world wants to deflate but central banks and governments cannot have deflation – it increases the Debt-to-GDP ratio, destroys tax collection, creates bad debts and hurts the banks." "So central banks will do anything to avoid deflation. The way they do this is to print money. But if you print too much money then you'll collapse confidence in the U.S. dollar." "The U.S. dollar is ultimately backed by confidence, as also said by Paul Volcker." "The FED is insolvent on a mark to market basis. I came to this conclusion himself, but insiders have also told me this privately … they won't say it publicly." "Money is a perpetual non-interest-bearing note issued by an insolvent central bank. DEPRESSION Rickards questions the consensus mantra of recovery and asserts that "we are in a depression and we have been in one since 2007." He admits that "if the FED had not done everything they've done, then things would have been much worse than they were in 2010. No question about that — unemployment would have been higher and growth would have been lower. "But we should have been much stronger today. We should be having 7% growth now. We can't have 7% for a long time, but we can for a short time while people come back into the workforce. Instead we're Japan — we've got 1.9% growth as far as the eye can see. DHS Is Preparing For The Next Disaster Which Will Cover Up The Economic Collapse Posted: 11 Apr 2014 07:10 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Secret That Has U.S. & Western Leaders Truly Terrified Posted: 11 Apr 2014 07:00 AM PDT from KingWorldNews:

Kaye: "I think that's the likely outcome, whether it's on purpose or not. I have to assume the end game that's being played out is bigger than the COMEX. In other words what is at stake here, and the agenda itself, has to be viewed as bigger than the COMEX and the COMEX's position in trading and controlling the price of precious metals…. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Marks Crash Anniversary by Rising to April '13 Low as US Tech Slump Spreads Posted: 11 Apr 2014 06:41 AM PDT GOLD PRICES slipped again from near 3-week highs above $1324 per ounce in London trade Friday lunchtime, as world stock markets fell after yesterday's slump in US tech stocks. Dropping $6 per ounce after spiking from $1314 as the US Dollar rose on the currency market, gold prices were heading for their 12th weekly gain in 15 so far in 2014. Twelve months ago tomorrow, the gold began a 15% crash which took it through what analysts called strong support at $1535, bottoming on Monday 15 April at $1322. "The gold price is continuing to find support from the unexpectedly dovish Fed minutes from mid-week," says Germany's Commerzbank, citing earlier Dollar weakness. Sterling and Euro gold prices rose Friday, but held flat from last week's finish vs. the Dollar price's 1.2% gain. "Precious metals prices have proven resilient," says London market-maker Deutsche Bank, again pointing to Dollar weakness and Wednesday's release of US Federal Reserve meeting notes. The Fed "indicated unease with overly hawkish interpretations" of last month's statements on raising rates in 2015, says Deutsche, warning that a Dollar rally is likely this quarter. "Without the dovish [Fed] minutes," says Swiss bullion bank UBS, "we expect that gold would have traded lower. But gold has been wrong-footing many this week." The Chinese Yuan meantime fell to a 1-week low today, while the Shanghai stock market bucked the global trend to end 3.7% higher from last Friday. Tracking US biotech stocks drop, however, "the average fall for Asian internet stocks in the past month has now topped 20%," reports the Financial Times. Despite the falling Yuan, the Shanghai gold price – typically at a premium to world benchmarks – reduced its discount to $2.50 per ounce below London quotes by the close of Chinese trade. The Shanghai Gold Exchange said Friday it will launch "a rudimentary version" of the gold lending contracts used in London, heart of the world's physical gold market. Gold borrowing costs rose again in London again Friday, as lower GOFO rates reduced the incentive offered to would-be borrowers, who must pay storage and lose cash interest for the period of a gold loan. Two-month GOFO today went negative for the first time since late February, meaning that lenders are asking for payment on top of the interest they earn during a gold-cash swap. One-month GOFO has now been negative, albeit at 0.05% annualized at the most, for 38 of 72 gold trading days in London so far in 2014. That suggests what analysts have called some "tightness" in London's wholesale market, contrasted with the plentiful supply in Shanghai suggested by its discount to world prices. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Marks Crash Anniversary by Rising to April '13 Low as US Tech Slump Spreads Posted: 11 Apr 2014 06:41 AM PDT GOLD PRICES slipped again from near 3-week highs above $1324 per ounce in London trade Friday lunchtime, as world stock markets fell after yesterday's slump in US tech stocks. Dropping $6 per ounce after spiking from $1314 as the US Dollar rose on the currency market, gold prices were heading for their 12th weekly gain in 15 so far in 2014. Twelve months ago tomorrow, the gold began a 15% crash which took it through what analysts called strong support at $1535, bottoming on Monday 15 April at $1322. "The gold price is continuing to find support from the unexpectedly dovish Fed minutes from mid-week," says Germany's Commerzbank, citing earlier Dollar weakness. Sterling and Euro gold prices rose Friday, but held flat from last week's finish vs. the Dollar price's 1.2% gain. "Precious metals prices have proven resilient," says London market-maker Deutsche Bank, again pointing to Dollar weakness and Wednesday's release of US Federal Reserve meeting notes. The Fed "indicated unease with overly hawkish interpretations" of last month's statements on raising rates in 2015, says Deutsche, warning that a Dollar rally is likely this quarter. "Without the dovish [Fed] minutes," says Swiss bullion bank UBS, "we expect that gold would have traded lower. But gold has been wrong-footing many this week." The Chinese Yuan meantime fell to a 1-week low today, while the Shanghai stock market bucked the global trend to end 3.7% higher from last Friday. Tracking US biotech stocks drop, however, "the average fall for Asian internet stocks in the past month has now topped 20%," reports the Financial Times. Despite the falling Yuan, the Shanghai gold price – typically at a premium to world benchmarks – reduced its discount to $2.50 per ounce below London quotes by the close of Chinese trade. The Shanghai Gold Exchange said Friday it will launch "a rudimentary version" of the gold lending contracts used in London, heart of the world's physical gold market. Gold borrowing costs rose again in London again Friday, as lower GOFO rates reduced the incentive offered to would-be borrowers, who must pay storage and lose cash interest for the period of a gold loan. Two-month GOFO today went negative for the first time since late February, meaning that lenders are asking for payment on top of the interest they earn during a gold-cash swap. One-month GOFO has now been negative, albeit at 0.05% annualized at the most, for 38 of 72 gold trading days in London so far in 2014. That suggests what analysts have called some "tightness" in London's wholesale market, contrasted with the plentiful supply in Shanghai suggested by its discount to world prices. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 11 Apr 2014 06:20 AM PDT from Ameria Again:

As we have described in past articles, Washington D.C. has been operating organized crime for 152 years. A counterfeiting operation always ends when it is exposed; yet this one was exposed over 20 years ago, and still continues. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 11 Apr 2014 06:00 AM PDT from USA Watchdog: This headline is only half right–"Putin turns up the heat in Ukraine." It should read, Obama and Putin turn up the heat. I think this is the big story, and it is being underreported. It has both financial and real war implications. Let's start with what Russia is doing. It is now going to issue a new bond based in the yuan. Are you getting that? This is yet another move away from using the U.S. dollar to settle international trade. Russia is also hiking the price of natural gas to Ukraine by at least 50% in May. The Russian's are going to want the cash for natural gas up front. Russia is warning of the dire debt crisis in Ukraine and how this could threaten Russian natural gas deliveries to the EU. I said it's game on for financial war, and this is proof. Meanwhile, the U.S. is threatening more sanctions on Russia over the growing Ukraine crisis. On top of that, it is being reported by the AP, NATO's top commander says he could start deploying U.S. troops in Eastern Europe to counter Russian military pressure put on Ukraine. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Truth About the Nevada Rancher’s Standoff Posted: 11 Apr 2014 05:30 AM PDT from Stefan Molyneux: Nevada Rancher Cliven Bundy is locked in a standoff with the federal Bureau of Land Management over illegal cattle grazing, endangered tortoises and property rights. It gets even better… The fight involves a 600,000-acre area under BLM control called Gold Butte, near the Utah border. The is the habitat of the protected desert tortoise, and the land has been off-limits for cattle since 1998. Five years before that, when grazing was legal, Bundy stopped paying federal fees for the right. Bundy stopped paying grazing fees in 1993. He said he didn’t have to because his Mormon ancestors worked the land since the 1880s, giving him rights to the land. “We own this land,” he said, not the feds. He said he is willing to pay grazing fees but only to Clark County, not BLM. Years ago, I used to have 52 neighboring ranchers,” he said. “I’m the last man standing. How come? Because BLM regulated these people off the land and out of business.” Nevada, where various federal agencies manage or control more than 80 percent of the land, is among several Western states where ranchers have challenged federal land ownership. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Koos Jansen: New physical gold exchange in Singapore Posted: 11 Apr 2014 05:26 AM PDT 8:26a ET Friday, April 11, 2014 Dear Friend of GATA and Gold: Gold researcher and GATA consultant Koos Jansen today reports on a new physical gold exchange starting in Singapore: http://www.ingoldwetrust.ch/new-physical-gold-exchange-singapore CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair to hold gold market seminar in Toronto on April 26 Mining entrepreneur and gold advocate Jim Sinclair's next gold market seminar will be held from 1 to 5 p.m. Saturday, April 26, at the Pearson Hotel & Conference Centre at Toronto's Pearson International Airport, 240 Belfield Road, Toronto. For details on tickets, please visit Sinclair's Internet site, JSMineSet.com, here: http://www.jsmineset.com/2014/04/01/toronto-qa-session-announced/ Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| HFT in Comex gold is like the old London Gold Pool, Kaye tells KWN Posted: 11 Apr 2014 05:13 AM PDT 8:10a ET Friday, April 11, 2014 Dear Friend of GATA and Gold: Hong Kong fund manager William Kaye tells King World News that high-frequency trading in gold on the New York Commodities Exchange is a variant of the London Gold Pool of the 1960s, another mechanism of gold price suppression. Kaye concurs with your secretary/treasurer that "controlling gold is the primary mechanism of controlling the world." An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/4/11_Th... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prepare For Dollar Collapse With 10% To 33% Allocation To Gold – Rickards Posted: 11 Apr 2014 05:07 AM PDT from Gold Core:

"Are you going to believe me or the IMF? I have a little better track record." "The ultimate thesis is that deflation is the biggest problem in the world." "The world wants to deflate but central banks and governments cannot have deflation – it increases the debt-to-GDP ratio, destroys tax collection, creates bad debts and hurts the banks." | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alasdair Macleod: Gold and bail-ins Posted: 11 Apr 2014 05:05 AM PDT 8a ET Friday, April 11, 2014 Dear Friend of GATA and Gold: Even allocated gold probably isn't safe in an insolvent bank being restructured under government supervision, GoldMoney research director Alasdair Macleod writes today, especially since Western central banks may no longer have the gold they long have used to rescue bullion banks in trouble. Macleod's commentary is headlined "Gold and Bail-Ins" and it's posted at GoldMoney's Internet site here: http://www.goldmoney.com/research/analysis/gold-and-bail-ins?gmrefcode=g... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Large Decline Of Shanghai & Comex Silver Stocks Posted: 11 Apr 2014 05:00 AM PDT from SRS Rocco:

In the chart below, we can see that total silver inventories at the Comex grew from 160 million ounces in September of 2013, to 183.3 million ounces on March 11th. This was a 23 million oz build in seven months. In just one month after the Comex inventories peaked (March 11th), 6.1 million oz of silver were withdrawn. This is the largest one month decline in over a year. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Gold Imports Through Hong Kong Posted: 11 Apr 2014 12:28 AM PDT Le Cafe Américain | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Gold Gone & What 52 Years In This Business Taught Me Posted: 10 Apr 2014 09:01 PM PDT  Today a legendary value investor spoke with King World News about what he has learned over 52 years in this business, and the tragedy of the massive gold hoard leaving the United States. Below is what the legendary investor, Jean-Marie Eveillard, who oversees more than $65 billion, had to say in this fascinating interview. Today a legendary value investor spoke with King World News about what he has learned over 52 years in this business, and the tragedy of the massive gold hoard leaving the United States. Below is what the legendary investor, Jean-Marie Eveillard, who oversees more than $65 billion, had to say in this fascinating interview.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Truth About the Nevada Rancher's Standoff Posted: 10 Apr 2014 06:54 PM PDT Nevada Rancher Cliven Bundy is locked in a standoff with the federal Bureau of Land Management over illegal cattle grazing, endangered tortoises and property rights. It gets even better...The fight involves a 600,000-acre area under BLM control called Gold Butte, near the Utah border. The is the... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chris Martenson and Alasdair Macleod discuss China's corner on gold Posted: 10 Apr 2014 06:50 PM PDT 9:50p Thursday, April 10, 2014 Dear Friend of GATA and Gold: Market analyst Chris Martenson and GoldMoney's Alasdair Macleod discuss China's increasing control of the gold market, anti-gold propaganda in the Western financial news media, the likelihood that Western governments will comandeer the gold of private investors, and other provocative topics in an interview posted this week in audio and text versions at Martenson's Internet site, Peak Prosperity, here: http://www.peakprosperity.com/insider/85192/chinas-demand-gold-has-trapp... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shocking Charts Show Silver Set For A Staggering $70 Surge Posted: 10 Apr 2014 06:24 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pat Heller: U.S. has rigged precious metals markets for 80 years Posted: 10 Apr 2014 06:19 PM PDT 9:20p ET Thursday, April 10, 2014 Dear Friend of GATA and Gold: Writing for Coin Week, Patrick Heller of Liberty Coin Service in Lansing, Michigan, provides a brief history of the U.S. government's mechanisms of surreptitious market intervention and headlines his commentary, "The U.S. Government Has Rigged Precious Metals Markets For 80 Years": http://www.coinweek.com/bullion-report/rigged-precious-metals-markets/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Gained $14.6 or 1.1 Percent Today to Close Comex at $1,320.10 Posted: 10 Apr 2014 03:24 PM PDT

The GOLD PRICE gained $14.6 or 1.1% today to close Comex at $1,320.10. Silver jumped 1.6% or 32.3 cents to 2007.8 cents. Ratio dropped to 65.749 The GOLD PRICE is behaving as it should, climbing today through the next resistance level, about $1,318. The SILVER PRICE, frankly, stank. It rose to 2040c (above the magic 2015c) and poked its head through the downtrend line, then fell back to close below the 20 DMA (2015c). What giveth? MACD just shouted "BUY!" for both today. Proving once again there the world holds even BIGGER fools than a nacheral born durned fool from Tennessee, the Greek government's bond auction today raised about $4 billion, $500 more than the original target, and bids for $23.6 billion were received. I reckon they sold it at the 5.3% they wanted to pay, but didn't see that reported. Buying these bonds nearly equals, but is not nearly as good as, loaning a clubhouse full of drunks money to buy cases of whiskey. Blood flowed on Wall Street today, spurting in bright red arterial bursts. Russell 2000 plunged 2.78%, Nasdaq tumbled 3.1%, Nasdaq-100 sank 3.13%, Dow dropped 1.62% and S&P500 lost 2.1%. Dow closed at 16,170.22, 266.96 points lighter than yesterday and turning decisively down. Not up, down. S&P500 lost 39.1, a massive 2.1%. This is moving past puking in the wastebasket and on to contemplating diving out a window. Dow closed a gnat's whisker above the 50 DMA (16,168.79) and not far from the long term uptrend line it threw over in November. S&P500 closed below its 50 DMA (1,843.34). This could easily reach 1,800. Dow measured in precious metals today resumed its downward plunge. Closing at 12.25 oz (G$253.23 gold dollars), the Dow in Gold capsized beneath its 20 and 50 DMAs (12.43 and 12.32 oz), locking in its downtrend. Ending at 804.85 oz (S$1,040.21 silver dollars), the Dow in Silver tripped its 20 DMA (811.21 oz). Both have signaled SELL in their MACDs. The US dollar index has gushed over the cliff with a five (5) day cascade. Closed today down another 0.14% to 79.47. A close below 79 sends it much lower. Dollar's weakness most likely comes from the market's apprehension interest rates will stay low. Euro has shot back nearly to its last peak ($1.3958), and today closed up another 0.25% at $1.3888. Shows you don't have to be healthy at all to be rented if you're the only horse in the livery stable able to stand. Yen continues to gain, up another 0.45% today to 98.52 c/Y100, but needs to gain a tadge more to break out upside Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Gained $14.6 or 1.1 Percent Today to Close Comex at $1,320.10 Posted: 10 Apr 2014 03:24 PM PDT

The GOLD PRICE gained $14.6 or 1.1% today to close Comex at $1,320.10. Silver jumped 1.6% or 32.3 cents to 2007.8 cents. Ratio dropped to 65.749 The GOLD PRICE is behaving as it should, climbing today through the next resistance level, about $1,318. The SILVER PRICE, frankly, stank. It rose to 2040c (above the magic 2015c) and poked its head through the downtrend line, then fell back to close below the 20 DMA (2015c). What giveth? MACD just shouted "BUY!" for both today. Proving once again there the world holds even BIGGER fools than a nacheral born durned fool from Tennessee, the Greek government's bond auction today raised about $4 billion, $500 more than the original target, and bids for $23.6 billion were received. I reckon they sold it at the 5.3% they wanted to pay, but didn't see that reported. Buying these bonds nearly equals, but is not nearly as good as, loaning a clubhouse full of drunks money to buy cases of whiskey. Blood flowed on Wall Street today, spurting in bright red arterial bursts. Russell 2000 plunged 2.78%, Nasdaq tumbled 3.1%, Nasdaq-100 sank 3.13%, Dow dropped 1.62% and S&P500 lost 2.1%. Dow closed at 16,170.22, 266.96 points lighter than yesterday and turning decisively down. Not up, down. S&P500 lost 39.1, a massive 2.1%. This is moving past puking in the wastebasket and on to contemplating diving out a window. Dow closed a gnat's whisker above the 50 DMA (16,168.79) and not far from the long term uptrend line it threw over in November. S&P500 closed below its 50 DMA (1,843.34). This could easily reach 1,800. Dow measured in precious metals today resumed its downward plunge. Closing at 12.25 oz (G$253.23 gold dollars), the Dow in Gold capsized beneath its 20 and 50 DMAs (12.43 and 12.32 oz), locking in its downtrend. Ending at 804.85 oz (S$1,040.21 silver dollars), the Dow in Silver tripped its 20 DMA (811.21 oz). Both have signaled SELL in their MACDs. The US dollar index has gushed over the cliff with a five (5) day cascade. Closed today down another 0.14% to 79.47. A close below 79 sends it much lower. Dollar's weakness most likely comes from the market's apprehension interest rates will stay low. Euro has shot back nearly to its last peak ($1.3958), and today closed up another 0.25% at $1.3888. Shows you don't have to be healthy at all to be rented if you're the only horse in the livery stable able to stand. Yen continues to gain, up another 0.45% today to 98.52 c/Y100, but needs to gain a tadge more to break out upside Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Another smashing of gold unlikely because it would unleash demand, Kaye says Posted: 10 Apr 2014 02:43 PM PDT 5:42p ET Thursday, April 10, 2014 Dear Friend of GATA and Gold: Hong Kong-based fund manager William Kaye today tells King World News that more smashing of the gold price seems unlikely because it would unleash unquenchable demand for real metal that isn't available: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/4/10_Go... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair to hold gold market seminar in Toronto on April 26 Mining entrepreneur and gold advocate Jim Sinclair's next gold market seminar will be held from 1 to 5 p.m. Saturday, April 26, at the Pearson Hotel & Conference Centre at Toronto's Pearson International Airport, 240 Belfield Road, Toronto. For details on tickets, please visit Sinclair's Internet site, JSMineSet.com, here: http://www.jsmineset.com/2014/04/01/toronto-qa-session-announced/ Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Holding Up Well But Next Catalyst Unclear Posted: 10 Apr 2014 01:51 PM PDT Gold has shown strength in today’s trading session. Last week, the yellow metal was trading near $1280, a huge support zone and key inflection point which has held very well. Now, it seems that $1300 is holding as well, a sign of strength, at least short term. Dan Norcini discusses the technical picture in more detail. He explains the current state of the gold price based on the charts and his expectations going forward. Yesterday’s FOMC minutes continue to put pressure on the US Dollar, but even more importantly, acted to depress US interest rates. That is the key driver for gold in my view at this time. Gold seems to struggle when interest rates here in the US rise as investors see little threat of inflation and seek out assets that will throw off some sort of yield rather than the yellow metal which only provides gains if it continues to rise in price. In a benign inflation environment, many do not believe gold will continue to rise. From a chart perspective, gold continues to remain within the broad trading range outlined for some time now. It will need a catalyst of some sort to kick it higher or send it lower. What that might be remains unclear to me. The chart shows that gold has run into some selling near the resistance level noted near the $1320 region. Above that, resistance is layered in approximately $20 increments, first near $1340 and then again near $1360. Downside support comes in near and just above $1300 followed by our old friend near $1280. On the ADX, which indicates a trendless market, the bulls have regained the short term advantage. Stochastics are rising as price moves up in the range showing the near term friendly picture. How this market handles this $1320 level today and tomorrow, will be a key as to how to approach it. The trading range is pretty broad (up near $1400 on the top and $1280 on the bottom). I cannot see what would cause this market to break out of its current range at this time. The Dollar would either have to drop off sharply breaking down below 79 on the USDX or interest rates would have to plummet sharply here in the US, along with perhaps a larger selloff in the broader equity markets to take it up out of the top end of the range. On the downside, we would need to see a sharp rally higher in the US Dollar and a surge in interest rates above the 3% level in the Ten Year to take it down below $1280 in my view. Take a look at Eurogold. Notice how it too is essentially rangebound. The ADX reveals the lack of a clearly defined trend. The top of the range is up near the 1000 euro region; the bottom down near 880 – 860. If gold could clear the 1000 euro level, we might finally have something to write about. If the ECB were to actually proceed with their chatter about their own version of QE and forcing banks to pay interest on reserves held there at the ECB, then we might finally see the Euro weaken sharply enough to send gold higher and through that 1000 level. Apparently Europe is having the same problems over there as we are over here – a lack of inflation and in their case, an excessively strong currency, which no one over there wants. The gold mining shares are providing little if any support to gold judging from their mediocre performance today. One gets the impression that they do not know whether to follow the broader market lower or the metal higher. Either way, it is not exactly a ringing endorsement of further strong gains in the actual metal. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 10 Apr 2014 01:22 PM PDT That's what this "big picture" gold bull says... JAY TAYLOR began publishing North American Gold Mining Stocks in 1981, and launched his current weekly, J.Taylor's Gold, Energy & Tech Stocks, in 1997. Also now hosting a radio program, "Turning Hard Times into Good Times", Jay Taylor understands why investors in gold and gold equities are consumed with caution after 2013. But as he explains in this interview with The Gold Report, Jay Taylor still believes in the big picture – the big, bull-market picture which yet leaves junior gold mining stocks with cash and good projects trading at tiny fractions of their worth right now... The Gold Report: Janet Yellen's about-face on quantitative easing makes two panicked pullbacks so far by the Federal Reserve from the end of QE. Is it fair to say we now have QE forever? Jay Taylor: I don't know about forever because nothing lasts forever. Your premise is largely correct, however, because the discontinuation of quantitative easing would be so painful it's a pretty good assumption that it will continue for a long time to come. It will probably end only when the system breaks down, which is inevitable because it is becoming increasingly insolvent. TGR: We've been hearing for three years about the end of QE and the zero interest-rate policy. It has been argued that this is unlikely for several reasons. QE is the only thing responsible for whatever recovery we've had since 2008, and if ZIRP ended, the US government couldn't pay the interest on its debt, and trillions of Dollars in derivatives would go south. Jay Taylor: That's exactly right. Not to mention that the private sector too is dependent on the narcotic of easy money. As I say, QE and ZIRP won't end until the system breaks down and forces the creation of a different monetary regime. What we call "the economy" is really more of a casino. The money that is created isn't getting into the real economy. The Wall Street guys with the PhDs in mathematics have built pick-pocketing machines that misallocate capital into their wallets, into endlessly bigger government and further military action on the part of the United States. It's going to end very badly. All we can do is try to prepare as best we can to protect ourselves and our families. TGR: How does the system break down? Jay Taylor: We saw the first hint of that with the Lehman Brothers bankruptcy in 2008. Generally, the banking system goes first. They can pretend that they've fixed it, but I see that Citicorp just failed its stress test. After the banking system fails, the commercial system fails because you can't stock the shelves in stores. Then you can't pay the fire and police departments. Then you have chaos. TGR: You've agreed with Jim Rickards that attempts by the US to "get tough" with Russia will fail. Can you explain why? Jay Taylor: Russia has its own interests to protect, but so does Europe. I'm not so sure that the Europeans will necessarily side with the United States. There could be a real crack in the NATO alliance. The Germans need natural gas, and the Russians have it. I see that the French helping Russia increase its gas and oil production through fracking. Many German companies are very much involved in Russia, as well. TGR: You've talked about the petroDollar being replaced by "petrogold". Jay Taylor: An enormous amount of gold is flowing into China. And China has established a second gold exchange that will allow non-Chinese to buy and sell it. Not paper gold, which is fantasy gold, but real, physical gold. The gold price is being manipulated by the futures markets, by the very people we were just talking about, the bankers, the bullion guys, the people that really can't afford to lose the Dollar confidence game. The Chinese want no part of this. They have enough Dollars and don't want more. Moreover, they don't want to finance America's military-industrial offensive, which is paid for by Dollar manipulation. TGR: How would petrogold work in practice? Jay Taylor: Russia would provide China with much of its energy needs and would be paid in renminbi. The Russians would then take their renminbi to the Chinese exchange and get gold for it, if they so desire. I think the infrastructure is being set up, both with petroleum exchanges and gold exchanges, in Russia and China and other countries in Asia. We would have a much more balanced world right now if Nixon hadn't taken us off the gold standard. That allowed the elite and the military-industrial complex to pull the whole of the world into the American orbit and saddle them with American debt and American power. Now there's blowback against American power, the currency wars and the US Dollar as reserve currency. Russia and China and other countries are saying, "enough already." TGR: Gold and gold equities had an excellent winter, but spring has not at all been kind to them. Why? Jay Taylor: I think what we've seen recently is just part of the natural ebb and flow. This is probably the last good buying opportunity for many junior mining stocks. I am more excited now than I have been at any time since 1981 when I first started writing my newsletter. I think we're going to see a bull market that's going to shock even the most ardent gold investment bugs. TGR: Final thoughts? Jay Taylor: Investors are still shell-shocked. And the mainstream is convinced that gold isn't going anywhere because they've been sold on the idea that the PhD standard is much better than the gold standard. And if you believe that, why would you buy gold stocks? I'd say that 99% of American investors aren't in the least bit interested. Canadians are a little different because mining is a big Canadian industry. But I think we're on the verge of a secular bull market for the ages, something greater than I've seen in my lifetime. TGR: Jay, thank you for your time and your insights. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 10 Apr 2014 01:22 PM PDT That's what this "big picture" gold bull says... JAY TAYLOR began publishing North American Gold Mining Stocks in 1981, and launched his current weekly, J.Taylor's Gold, Energy & Tech Stocks, in 1997. Also now hosting a radio program, "Turning Hard Times into Good Times", Jay Taylor understands why investors in gold and gold equities are consumed with caution after 2013. But as he explains in this interview with The Gold Report, Jay Taylor still believes in the big picture – the big, bull-market picture which yet leaves junior gold mining stocks with cash and good projects trading at tiny fractions of their worth right now... The Gold Report: Janet Yellen's about-face on quantitative easing makes two panicked pullbacks so far by the Federal Reserve from the end of QE. Is it fair to say we now have QE forever? Jay Taylor: I don't know about forever because nothing lasts forever. Your premise is largely correct, however, because the discontinuation of quantitative easing would be so painful it's a pretty good assumption that it will continue for a long time to come. It will probably end only when the system breaks down, which is inevitable because it is becoming increasingly insolvent. TGR: We've been hearing for three years about the end of QE and the zero interest-rate policy. It has been argued that this is unlikely for several reasons. QE is the only thing responsible for whatever recovery we've had since 2008, and if ZIRP ended, the US government couldn't pay the interest on its debt, and trillions of Dollars in derivatives would go south. Jay Taylor: That's exactly right. Not to mention that the private sector too is dependent on the narcotic of easy money. As I say, QE and ZIRP won't end until the system breaks down and forces the creation of a different monetary regime. What we call "the economy" is really more of a casino. The money that is created isn't getting into the real economy. The Wall Street guys with the PhDs in mathematics have built pick-pocketing machines that misallocate capital into their wallets, into endlessly bigger government and further military action on the part of the United States. It's going to end very badly. All we can do is try to prepare as best we can to protect ourselves and our families. TGR: How does the system break down? Jay Taylor: We saw the first hint of that with the Lehman Brothers bankruptcy in 2008. Generally, the banking system goes first. They can pretend that they've fixed it, but I see that Citicorp just failed its stress test. After the banking system fails, the commercial system fails because you can't stock the shelves in stores. Then you can't pay the fire and police departments. Then you have chaos. TGR: You've agreed with Jim Rickards that attempts by the US to "get tough" with Russia will fail. Can you explain why? Jay Taylor: Russia has its own interests to protect, but so does Europe. I'm not so sure that the Europeans will necessarily side with the United States. There could be a real crack in the NATO alliance. The Germans need natural gas, and the Russians have it. I see that the French helping Russia increase its gas and oil production through fracking. Many German companies are very much involved in Russia, as well. TGR: You've talked about the petroDollar being replaced by "petrogold". Jay Taylor: An enormous amount of gold is flowing into China. And China has established a second gold exchange that will allow non-Chinese to buy and sell it. Not paper gold, which is fantasy gold, but real, physical gold. The gold price is being manipulated by the futures markets, by the very people we were just talking about, the bankers, the bullion guys, the people that really can't afford to lose the Dollar confidence game. The Chinese want no part of this. They have enough Dollars and don't want more. Moreover, they don't want to finance America's military-industrial offensive, which is paid for by Dollar manipulation. TGR: How would petrogold work in practice? Jay Taylor: Russia would provide China with much of its energy needs and would be paid in renminbi. The Russians would then take their renminbi to the Chinese exchange and get gold for it, if they so desire. I think the infrastructure is being set up, both with petroleum exchanges and gold exchanges, in Russia and China and other countries in Asia. We would have a much more balanced world right now if Nixon hadn't taken us off the gold standard. That allowed the elite and the military-industrial complex to pull the whole of the world into the American orbit and saddle them with American debt and American power. Now there's blowback against American power, the currency wars and the US Dollar as reserve currency. Russia and China and other countries are saying, "enough already." TGR: Gold and gold equities had an excellent winter, but spring has not at all been kind to them. Why? Jay Taylor: I think what we've seen recently is just part of the natural ebb and flow. This is probably the last good buying opportunity for many junior mining stocks. I am more excited now than I have been at any time since 1981 when I first started writing my newsletter. I think we're going to see a bull market that's going to shock even the most ardent gold investment bugs. TGR: Final thoughts? Jay Taylor: Investors are still shell-shocked. And the mainstream is convinced that gold isn't going anywhere because they've been sold on the idea that the PhD standard is much better than the gold standard. And if you believe that, why would you buy gold stocks? I'd say that 99% of American investors aren't in the least bit interested. Canadians are a little different because mining is a big Canadian industry. But I think we're on the verge of a secular bull market for the ages, something greater than I've seen in my lifetime. TGR: Jay, thank you for your time and your insights. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Gold Continues Higher Posted: 10 Apr 2014 01:20 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Gold Continues Higher Posted: 10 Apr 2014 01:20 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Delivery Strains Reappear & What Might Destroy COMEX Posted: 10 Apr 2014 10:22 AM PDT  Today an outspoken hedge fund manager out of Hong Kong spoke with King World News about delivery strains in the gold market reappearing and what might destroy the COMEX. William Kaye, who 25 years ago worked for Goldman Sachs in mergers and acquisitions, also discussed the major problems the entities managing the gold market are now facing. Below is what Kaye had to say in this timely interview. Today an outspoken hedge fund manager out of Hong Kong spoke with King World News about delivery strains in the gold market reappearing and what might destroy the COMEX. William Kaye, who 25 years ago worked for Goldman Sachs in mergers and acquisitions, also discussed the major problems the entities managing the gold market are now facing. Below is what Kaye had to say in this timely interview.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 10 Apr 2014 09:08 AM PDT Trade of the decade

The US in now slowly entering its hyperinflationary phase. Food prices are already up 19% in the first three months of 2014. On an annualised … Read the rest | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 10 Apr 2014 08:41 AM PDT Monetary Metals | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Critical Metric Is Now Over 1,000 Times Higher Than Normal! Posted: 10 Apr 2014 08:34 AM PDT  Today one of the legends in the business writes that an all-important metric is now over 1,000 times higher than normal. 50-year veteran Art Cashin, who is Director of Floor Operations at UBS ($650 billion under management), warned about this development: "the mind boggles -- at least mine does." Cashin also discussed everything from Napoleon to gold, and included a guest commentary covering the dramatic increase in the all-important metric. Today one of the legends in the business writes that an all-important metric is now over 1,000 times higher than normal. 50-year veteran Art Cashin, who is Director of Floor Operations at UBS ($650 billion under management), warned about this development: "the mind boggles -- at least mine does." Cashin also discussed everything from Napoleon to gold, and included a guest commentary covering the dramatic increase in the all-important metric. This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chinese Checkers with Gold Prices Posted: 10 Apr 2014 08:18 AM PDT For decades many of us in the hard money world have speculated that cloak and dagger activity by large financial interests has played a large role in determining performance in the gold market. The focus of this alleged manipulation is believed to be in the London market, and has been widely referred to as "The London Fix." However those who have blown the whistle have been dismissed as alarmists, gold bugs, conspiracy theorists or worse. But recent revelations should bring us closer to the truth. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 10 Apr 2014 08:11 AM PDT Just when you thought it was safe to go back into the market the gold price and junior resource stocks drop and nervous traders declare the sky is falling yet again. I’m not thrilled by the market action of the past two or three weeks but I also don’t think the basic narrative has changed. The gold price has corrected but I don’t think its rolled over unless it gets quite a bit lower. Likewise, the correction in the Venture Index is not large compared to some of its larger brethren and well within the bounds of what one would see as part of a larger bullish advance. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Crude to the Rescue: How $100 Oil Helps the Market Posted: 10 Apr 2014 07:53 AM PDT While fears of a market meltdown ripple across Wall Street, commodities continue to outperform. In the commodities world, most folks are focused on the big weather plays that continue to rip higher. Coffee, corn and orange juice are all working well this year. But what about oil? Crude crossed into triple digits again this week. This morning, a barrel of black gold trades for about $103. And that's good news for the markets… "We can look at crude oil as a market barometer," explains our own Matt Insley. "The point is simple: If people and foreign governments alike can afford $100-plus oil, the global market is not in dire straits. On the other hand, if the crude market starts to fall, it represents a leading indicator that the economy isn't spinning the cash it needs to survive." Here's a look at the 10-year price of West Texas Intermediate (WTI) crude oil: "As you can see from this long-term chart, prices for crude oil have seen a lot of support since the 2009 market fallout. You can also see that we're smack-dab in the middle of crude's long-term trading channel," Matt explains. "In that sense — and the sense that we're still looking at $103 oil at last check — the global market still has plenty of wind in its sails… "Closer to home, there's even more reason to like an uptrending oil chart. You see, now that the U.S. is producing more crude oil by the day, the country's trade balance is moving in our favor," Matt says. "Along with that, more crude and natural gas production is providing real-world benefits to U.S. manufacturers." While we're keeping an eye out for a market correction, if crude continues to hold $100 and move higher, Matt sees no reason to fear a major market pullback here… Regards, Greg Guenthner P.S. Do you know what the best part about $100 oil is? It’s the fact that the U.S. is producing a massive amount of crude these days. There’s a huge story brewing here. Sign up for the Rude Awakening for FREE today to learn how you can play this powerful trend… | ||||||||||||||||||||||||||||||||||||||||||||||||||||

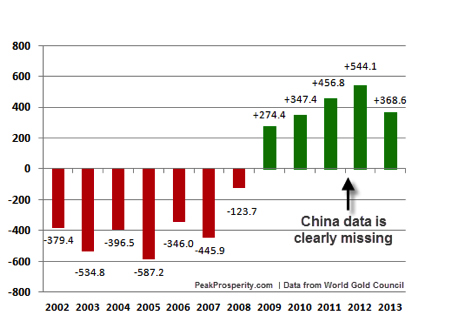

| Posted: 10 Apr 2014 07:02 AM PDT This chart depicting the dramatic rise in China gold demand from Sharelynx appears to be making the rounds this morning and it really is stunning. Note that the 2013 demand total of nearly 1,600 tonnes shown below is considerably higher than the World Gold Council figure, but also considerably lower than some of the more [...] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE ROTHSCHILD IMF BANKSTER FIAT DEATH MACHINE - Michael Noonan Posted: 10 Apr 2014 06:57 AM PDT A 2014 precious metals discussion with researcher Michael Noonan from Edge Trader Plus. Michael reminds us the Gold and Silver ARE MONEY. He also reminds us that all the gold in Fort Knox is gone, and the elite's don't want to call attention to what's NOT there. The elite - the ROTHSCHILDS and... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 10 Apr 2014 05:58 AM PDT GOLD PRICE gains of 1.6% for this week so far were trimmed lunchtime Thursday in London, with spot quotes dropping $5 per ounce after better-than-forecast US jobs data. Retreating from $1324, the gold price had also touched 2-week highs for Euro and Sterling investors, after the Bank of England kept UK interest rates unchanged at 0.5% for the 60th month running. Initial claims for US jobless benefits fell last week to 300,000 vs. analyst forecasts of 320,000, the Department of Labor said. US import prices meantime rose faster-than-expected last month, separate data showed, cutting the 1-year drop to minus 0.6%. China's domestic gold price earlier closed at its highest level since March 24 in Yuan terms on the Shanghai Gold Exchange. But in Dollar terms, the gold bullion price in China – now the world's No.1 consumer market – returned Thursday to a discount to the global benchmark of London settlement, trading $3.50 per ounce below spot. Shanghai gold typically trades at a premium to the London price, but has now closed at a discount on all but 3 trading days in the last 7 weeks, by far the longest stretch in at least years. "We should not lose sight of what has been a strong Chinese market so far this year," said London-based consultancy Metals Focus in its latest weekly report Tuesday, "still on course to post its second highest level for gold demand on record." But noting a 2-week rise of 15 tonnes in Comex warehouse stockpiles in the United States, "The US [gold industry] has become increasingly reliant on shipments to China," the report adds, "reflect[ing] field research that suggests flows into the country slowed considerably last month." Comex warehouse gold stockpiles track prices higher and lower in the main, showing a strong correlation of 89% over the last 18 years according to Bullionvault analysis of weekly data. Total Comex warehouse gold stockpiles edged back Wednesday from the largest level since June 2013 at 245 tonnes. "There is certainly no physical tightness in gold," Reuters quotes Bill O'Neill at LOGIC Advisors in New Jersey. "Why would you scramble for any physical gold stocks when the market appears to be going nowhere at this point?" Growing availability of gold in Comex warehouses "represents the end of the drawdown in stocks seen last year," says the newswire, "when gold's record two-day drop in prices unleashed years of pent-up buying by Asian investors who spotted a bargain for coins and small bars." New data released overnight showed China returning to a trade surplus in March, even though total trade fell sharply. Exports fell 6.6% by value as imports fell 11.3%. Bullion held to back shares in the giant SPDR Gold Trust (NYSE:GLD) meantime ended Wednesday unchanged having edged back to 806 tonnes Tuesday, the lowest level in a month. The world's largest exchange-traded trust fund at its peaks in 2011 and 2012, the GLD began 2013 with a near-record 1,350 tonnes, dropping nearly 60% by value as the gold price fell 30%. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Precious Metals Market Report with Franklin Sanders Posted: 10 Apr 2014 05:00 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mainstream Gold and Silver Analysis Out of Touch, Out of Context and Off the Mark Posted: 10 Apr 2014 03:09 AM PDT On average, every quarter we are exposed to yet another price guidance by a mainstream analyst. Such analysts usually reside within a large investment bank. These calls become focal points for a sector and often seem to carry with them some form of self fulfilling prophecy. What makes them qualified? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

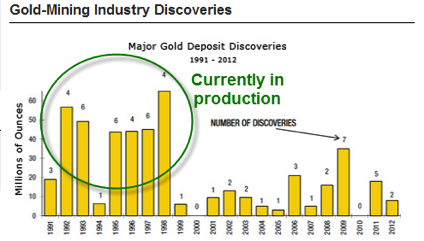

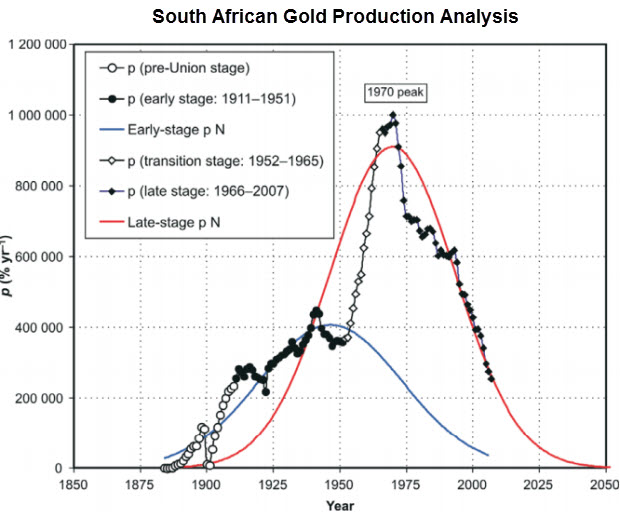

| Gold Supply & Demand: Shocking Numbers Posted: 10 Apr 2014 02:56 AM PDT One calculation puts China's 2013 demand nearly equal to global gold-mine output entirely... GOLD DEMAND went up from 3,200 tonnes in 2003 to 4,400 tonnes in 2013, writes Chris Martenson at Peak Prosperity, citing World Gold Council data. That's even with a massive 800 tonnes being disgorged from the GLD tracking fund over 2013 (purple circle, below): Note the dotted red line in this chart: it shows the current level of mine production. World demand has been higher than mine production for a number of years. Where has the additional supply come from to meet demand? We'll get to that soon, but the quick answer is: it had to come from somewhere, and that place was 'the West.' A really big story in play here is the truly historic and massive flows of gold from the West to the East, with China being the largest driver of those gold flows. Alasdair McLeod of GoldMoney.com has assembled the public figures on China's cumulative gold demand which, notably, do not include whatever the People's Bank of China may have bought. Those are presumably additive to these figures unless we are to believe that the PBoC now purchases its gold over the counter and in full view (which they almost certainly do not). Using publicly available statistics only, it's possible to calculate that in 2013 China alone accounted for more than 2,600 tonnes of demand, or more than 60% of total demand or, as we'll soon see, almost all of the world's total gold mine production: Of course the big risk in all that Chinese demand for gold is that China may stop buying that much gold in the future for a variety of reasons. One could be that the Chinese bubble economy finally bursts and people there no longer feel wealthy and so they stop buying gold. Another could be that the Chinese government reverses course and makes future gold purchases illegal for some reason. Perhaps they are experiencing too much capital flight, or they want to limit imports of what they consider non-essential items. Who knows? I do know that Chinese demand has been simply incredible and, keeping all things equal, I expect that to continue, if not increase. India, long a steady and traditional buyer of gold, saw so much buying activity as a consequence of the lower gold prices that the government had to impose controls on the amount of gold imported into the country, even banning imports for a while: Another factor driving demand has been the reemergence of central banks as net acquirers of gold. This is actually a pretty big deal. Over the past few decades, central banks have been actively reducing their gold holdings, preferring paper assets over the 'barbarous relic.' Famously, Canada and Switzerland vastly reduced their official gold holdings during this period (to effectively zero in the case of Canada), a decision that many citizens of those countries have openly and actively questioned. The UK-based World Gold Council is the primary firm that aggregates and reports on gold supply-and-demand statistics. Here's their most recent data on official (i.e., central bank) gold holdings: Note that the 2009 data is lowered by slightly more than 450 tonnes in this chart to remove the one-time announcement by China that it had secretly acquired 454 tonnes over the prior six years, so this data may differ from other representations you might see. I thought it best to remove that blip from the data. Also, the data for 2012 and 2013 must also be lacking official China data because the last time they announced an increase in their official gold holdings was in 2009. In just 2013 alone, the gap between China's apparent and reported gold consumption was over 500 tonnes and the Chinese central bank, for a variety of reasons, is the most likely candidate to have absorbed such a quantity. If true, then China alone increased its official reserves by more than the rest of the world combined in 2013. The World Gold Council puts out what is considered by many to be the definitive source of gold statistics, which are the source data for the above chart. I do not consider the WGC to be definitive since their statistics do not comport well with other well reported data, but let's first take a look at what the WGC had to say about gold demand in 2013: The big story there, obviously is that investment demand absolutely cratered even as jewelry and coins and bars rose to new heights. And nearly all of that investment drop was driven by flows out of the GLD investment vehicle. That is, gold was chased out of the weak hands of mainly western investors and into the strong hands of Asian buyers who wanted physical bullion and jewelry. This huge drop in total demand, led by plummeting investment demand, fits quite well with the 15% price drop recorded in 2013. So the WGC tells a nice coherent story so far. But the problem with this tidy story is that it simply does not fit with the above data about China's voracious appetite for gold, let along India's steady demand and rising demand in Europe, the Middle East, Turkey, Vietnam or Russia. The summary of the fundamental analysis of gold demand is:

Now about that supply... Not surprisingly, the high prices for gold and silver in 2010 and 2011 stimulated quite a bit of exploration and new mine production. Conversely, the bear market from 2012 to 2014 has done the opposite. However, the odd part of the story for those with a pure economic view is that with more than a decade of steadily rising prices, there has been relatively little incremental new mine production. For those of us with an understanding of depletion it's not surprising at all. In 2011 the analytical firm Standard Chartered calculated a rather subdued 3.6% rate of gold production growth over the next five years based on lowered ore grades and very high cash operating costs: