saveyourassetsfirst3 |

- Nevsun Resources: Think Zinc

- Financial Times Adviser reviews Dimitri Specks The Gold Cartel

- Weekend Gold Analysis

- It’s A Precarious Time For Gold

- Jim Rickards: Study Will Show That Gold Is Being Manipulated on the Comex (Again)

- Dollar Tree's Buyback Is A Gem In Plain Sight

- Taseko: The Silver Lining With New Prosperity

- Gold Investors Weekly Review – March 28th

- Alasdair Macleod: China regulates gold too tightly for shadow banking system to play with it

- Dollar Mixed To Start Q2

- Three King World News Blogs

- Barclays sees a steady growth in Chinese Gold jewellery demand in medium term

- Jim Rickards: Russia, China signposting dollar’s demise and gold’s rise

- Sprott's Thoughts: South Africa---Platinum, Gold Miners and Workers are Stuck :: Nick Holland, Gold Fields

- Japanese Prepare For "Abenomics Failure", Scramble to Buy Physical Gold

- Japanese Prepare For “Abenomics Failure”, Scramble to Buy Physical Gold

- Gold And Silver Are Money

- NYSE Margin Debt Hits All-Time High Of $465.72 Billion In February, With Risk Rank At No. 2

- Peak Gold, easier to model than Peak Oil ? Part II

- Peak Gold, easier to model than Peak Oil ? Part II

- Authorized Purchasers Rebel Against US Mint- Halt Gold Eagle Purchases!

- Rates up, gold down? Recall 2004-06

- Campaign to Debase U.S. Coins Alive and Well in Obama Budget

- March 28/No change in gold inventory at GLD and no change in silver inventory at SLV/gold and silver hold their own today/

- Gold Tests the channel line at the cycle turn means best chance for short term low

- The Guardian’s Deputy Editor Claims the UK Gov’t Threatened the Paper with Shutdown Over Snowden

- Bitcoin won't replace the U.S. dollar... but it could soon break into the mainstream in a completely different way

- A First Look at a New Report on Crony Capitalism – Trillions in Corporate Welfare

- A lost album was found in Johnny Cash's vault. Listen to it here.

- Oil And Gold Analysis : March 28, 2014

- Elliott Wave Review: Gold, crude, S&P 500

- CHART - Gold, Debt and Gold Reserves

- A gold forecast you may not like

- The Doc: Loss of Reserve Currency Status Will Be The Death of The Dollar

| Posted: 29 Mar 2014 10:54 AM PDT When we last reported on Nevsun Resources (NSU) it was under the pre-text of Nevsun being a gold miner outperforming all other companies included in the Market Vectors Gold Miners ETF (GDX). Since then Nevsun has finished mining the top gold-bearing oxide zone and has transitioned to mining the supergene layer at its Bisha mine in Eritrea which contains predominantly copper (accompanied by gold and silver by-products). And in its new incarnation as a copper miner the company has just filed its financial statements for the fourth quarter and full year 2013. A concise summary of these statements can be found here. In a year that was characterized by the transition from gold miner to copper miner, including several months of down-time at the processing plant, Nevsun Resources recorded a profit for the year. Not surprisingly, and evidenced by the chart below, Nevsun has continued to outperform |

| Financial Times Adviser reviews Dimitri Specks The Gold Cartel Posted: 29 Mar 2014 10:03 AM PDT GATA |

| Posted: 29 Mar 2014 10:01 AM PDT To begin these comments, let's take a look at the hedge fund positioning in the Comex gold futures through Tuesday of this past week. April gold closed at $1311.40 that day having closed at $1359 a week earlier ( Tuesday, March 18). That is a loss of $48 over the reporting period that the CFTC employs. In looking at the chart ( a comparison of the hedge fund NET positions against the price of the metal ) you can see what happened. A combination of LONG LIQUIDATION and NEW SHORTING produced a drop of some 18,000 contracts ( futures and options combined ) in the overall net long positioning of the group of traders. The Blue Line is the hedge fund net position while the red line is the gold price. The result? - Gold moved lower as this group of large traders was selling. Through the end of the week, gold dropped another $17 to settle at $1294 in the April contract, which by the way goes into its delivery period next week. Here is the Daily or short-term chart. There are several things to note. First, Bears are back in control of this market on this time frame. Negative Directional Movement is above Positive Directional Movement and the ADX has turned lower and is continuing to move down indicating the break in the uptrend. The recent uptrend that began in January has halted with the market having given up over $100 off its best level of this year. Second - the "golden cross" which some were touting as sign of a new bull market beginning has been negated as price has fallen below that level of the cross ( the 50 day moving average crossed up and above the 200 day moving average from beneath). Third - the sloping uptrend line drawn off the late December low has been violated to the downside. These are all bearish signals. The one bullish signal on this chart is that the important 50% Fibonacci retracement level of the entire rally from that same December low near $1180 to the recent high near $1392 has thus far held. That level is near $1287. Bulls managed to keep price from penetrating that level for long before it recovered. On the short term chart, the bears have the clear advantage. Let's shift to the weekly or intermediate chart. I have included another old, but reliable technical indicator, the Stochastics, because of the nature of the price action on this time frame. Let's first look at the Directional Movement Indicator. Notice that the ADX line ( the dark line ) continues to move lower indicating a TRENDLESS MARKET. If a market is trendless, that means it is moving sideways. That is exactly what gold has been doing on this time frame. It is essentially meandering back and forth in a very broad range as noted in that green rectangle I have shown. Support down near $1200 and below is intact while resistance near $1400 is also intact. We have what amounts to a $200 range within which gold is working. What one usually experiences with a market moving within a broad trading range is the perma bulls begin coming out with their "to the moon" price predictions and all manner of wildly bullish scenarios as price works its way up towards the top of the range. The perma bears on the other hand, begin talking their "price is going to collapse" scenario as the price works it way down towards the bottom of the range. In other words, the bulls get noisier as price moves higher while the bears get noisier as the price moves lower. The Directional Movement lines indicate that while the bulls have seized control of the market ( +DMI (blue line) crossed above the -DMI ( red line), they are in danger of surrendering their mild advantage if they do not quickly assert themselves. I have also noted the Stochastics indicator because this is designed for trendless markets. Note the area within the rectangle on the price chart and look at the action of the stochastic indicator. It has been moving higher generating buy signals as price has bounced off of support at the bottom of the range and generating sell signals as price has stalled out at the top of the range. It is currently in a sell mode . Lastly here is the monthly or long term chart. The Directional Movement Indicator shows that the market is moving sideways as well with no clear trend although bears currently have a slight advantage in that -DMI remains above +DMI. Those lines are converging however so the bears will need to reassert themselves sooner rather than later if they are to retain control on this long term frame. Also, the MACD indicator, while still in a bearish mode, is working on putting together an upside bullish crossover which would generate a buy signal based on that indicator. Lastly, the sloping uptrend line drawn in red has thus far held. One can see that the $1280 level is a pivot with price working around it on both sides. The chart is inconclusive at this point. The long term uptrend is still intact near the 38.2% Fibonacci retracement level although both indicators show bearish forces still in control. Bulls are attempting to wrest control of the market from them but have not as of yet managed to do so. A push through this week's high near $1400 will be required to tip the scales in their favor in my opinion. Before that can occur however, $1300 will have to be captured. We'll see how the battle goes. |

| It’s A Precarious Time For Gold Posted: 29 Mar 2014 09:50 AM PDT Past weekend, I remained "on the fence" with regards to which direction gold was headed. Without clear evidence that the weekly (Investor) Cycle had topped, I had discussed how I was warming up to the possibility of this being a late stage 2nd DC, instead of the failed 3rd Daily Cycle scenario I had followed exclusively up to that point. Whatever the outcome, I maintain the position that it's just too difficult to trade gold on the Long side anymore. I'm glad we're out of positions because this just does not feel or look like an Investor Cycle that is headed higher again. Normally, in an uptrend, sharp drops into DCL's are quickly reversed, as the new Cycle powers higher. But this one has lingered for too long without catching a new Cycle bid and is almost $100 lower.

Specifically, today the equity markets suffered another sharp reversal and bonds soared, both in response to comments made by president Obama and European leaders in response to Russia's actions in Crimea. These flight to safety moves are supposed to be in gold's "wheelhouse", especially so late (Day 34) in a Cycle. A bullish leaning asset would have taken that as a catalyst for a strong rally in a new Cycle. Instead, gold was muted and remained depressed. Yes, the Cycle count still supports the possibility of a (bullish) Day 34 – 2nd DCL here. But in all honesty, it's not a position one should be taking seriously here because it requires taking a considerable amount of risk. And as I outlined this past weekend, even a DCL right here is no guarantee of strong performance. A 3rd Daily Cycle would need to rally almost $100 just to break new highs and the risk of it falling well short and topping early is very real.

In addition, we have an interesting development within the miners which should have all gold Longs concerned. With a fairly consistent track record of correlating to market tops, the precious metals miners' bullish percent chart has decisively turned lower. Once the charts of precious metals miners start breaking down like this, then it's almost always associated with Investor Cycle tops.

This is an excerpt from this week’s premium update from the The Financial Tap, which is dedicated to helping people learn to grow into successful investors by providing cycle research on multiple markets delivered twice weekly. Now offering monthly & quarterly subscriptions with 30 day refund. Promo code ZEN saves 10%. |

| Jim Rickards: Study Will Show That Gold Is Being Manipulated on the Comex (Again) Posted: 29 Mar 2014 08:03 AM PDT Le Cafe Américain |

| Dollar Tree's Buyback Is A Gem In Plain Sight Posted: 29 Mar 2014 07:20 AM PDT Since March of 2004, Dollar Tree (DLTR) has offered investors annual returns of 18.35%, turning every $1,000 invested in Dollar Tree into $5,427. Over that time period, Dollar Tree increased its total profits from $180 million to $615 million. If profits only grew by 341%, why did Dollar Tree shareholders receive a 542% return on their investment? It's not due to valuation changes: Dollar Tree traded at 18x profits in 2004, and trades at 18x profits now. The answer is this: 2004 marked the year that Dollar Tree management decided "we are going to do what Autozone did and use our very large amounts of free cash flow to systematically destroy giant blocks of stock to boost earnings per share for our owners." Since that time, Dollar Tree has been buying back between 15 million and 30 million shares annually (an exception was the year 2008 when the company had |

| Taseko: The Silver Lining With New Prosperity Posted: 29 Mar 2014 06:57 AM PDT Taseko Mines (TGB) has been affected by a couple of negative items recently. The Canadian government rejected its New Prosperity copper and gold mine proposal for a second time in late February. Taseko is appealing that decision, but there is a significant chance that Taseko may be forced to develop a third proposal. As well, the price of copper has gone down to around $3.00 per pound recently, falling from around $3.25 per pound when I wrote about Taseko a couple of months ago. Although it would have benefited Taseko to have New Prosperity approved, there is a silver lining in the rejection in that Taseko can continue to strengthen its balance sheet before New Prosperity begins development. Taseko's previous expansion projects at its Gibraltar mine have helped to significantly reduce its cost of production and increase its output. It doesn't have any major capital outlays in |

| Gold Investors Weekly Review – March 28th Posted: 29 Mar 2014 06:29 AM PDT In his weekly market review, Frank Holmes of the USFunds.com nicely summarizes for gold investors this week's strengths, weaknesses, opportunities and threats in the gold market. Gold closed the week at $1,295.27, down $39.43 per ounce (2.95%). The NYSE Arca Gold Miners Index lost 5.23% on the week. This was the gold investors review of past week. Gold Market StrengthsThe Singapore exchange is looking to start a gold trading market that allows for physical delivery into the island nation. The news coincides with reports of gold ETF holdings rising; the SPDR Gold Trust announced an increase in holdings to the highest in three months. With gold prices back near the $1,300 level, an important threshold for price sensitive buyers, there is encouragement for sidelined physical buyers in emerging markets to resume buying. China's gold imports from Hong Kong rose in February amid increasing demand resulting from the country allowing more banks to import the yellow metal. Net imports for February totaled 109.2 metric tons, which added to the 83.6 tons in January, account for a 140 percent rise relative to the same period in 2013. Similarly, demand in Indonesia, Thailand and Vietnam totaled 300 tons in 2013, a 42 percent increase from 2012. Lastly, the Iraqi Central Bank purchased 36 tons of gold to prop up its reserves, marking the single largest purchase in three years. Gold Market WeaknessesGold traders are bearish as they expect the Fed to keep cutting its stimulus and raising interest rates as the economy strengthens. According to a Bloomberg poll, nine traders expect gold to trade higher next week, while 15 have said they expect gold to trade lower. The reason most frequently cited in the poll related to Fed Chair Yanet Jellen's comments last week which suggested rates would rise in the U.S six months after the end of the bond buying program this fall. Platinum and palladium fell as striking miners in South Africa eased their pay demands. Despite this advance, a resolution to the work stoppage is not yet in sight as miners continue to demand onerous raises of nearly 100 percent over a four year period. It is estimated workers have forgone more than $403 million in wages since the beginning of the strike action. Gold Market OpportunitiesDuring a presentation in San Antonio this week, Jefferies Chief Strategist David Zervos commented on gold and the equity market's reaction to Yellen's press conference last week. In his opinion, the Fed's focus on driving real interest rates negative will continue, simply because high real rates deter investments. Just ask Japan which lost two decades while experimenting with high real rates. The Fed will likely raise nominal interest rates, but only when existing inflation can justify them; thus keeping real interest rates flat or negative. Yellen may have brought up the subject at this time because the Fed can see inflation in the horizon. Loan growth, as shown on the loan to deposit ratio below, drives money velocity. Velocity is one of the key components of inflation and was on a downtrend since 2008. This spike in velocity will act as a detonator to the unprecedented $4 trillion monetary base, thus spurring rising inflation. If the threat of imminent inflation hasn't hit home for you, David Rosenberg, Chief Economist at Gluskin Sheff, brings a cascade of money supply indicators that will have you thinking. According to Rosenberg, since the beginning of the year, M1 money supply has exploded at a 23 percent annual rate, 45 percent over the past four weeks. M2 has risen at 7.3 percent pace, while the M1 multiplier bottomed a month ago, boding well for velocity to pick up. In terms of loan growth, which has accounted for velocity missing in action since 2008, commercial paper and industrial exploded 19 percent. These are crazy numbers according to Rosenberg. The quantity theory of money says that based on the statistics above, inflation may not yet be present, but it is in your future. Indian gold imports will rebound in the second half of 2014 as a new government eases trade curbs and festivals and weddings spur demand, according to billionaire Indian jeweler T.S. Kalyanaram. Despite the curbs, India accounted for 25 percent of global demand in 2013 according to the World Gold Council, being surpassed by China as the largest gold consumer. According to Kalyanaram, India's demand is nearly 50 percent greater than China's, once you take into consideration the gold smuggling. Gold Market ThreatsABN AMRO, the largest Dutch bank by assets, raised its 2014 gold forecast to $1,100 from $1,000 arguing changes in in currency forecasts and current market dynamics. The bank, however, left its 2015 forecast for gold at $800 as it believes the U.S. economy will accelerate and yields climb. This is the same bank that issued paper IOUs to investors holding physical gold in its vaults, claiming it was unable to deliver physical gold to clients any longer. Hedge funds may hesitate from buying more gold after boosting their bets on the metal ahead of the Fed meeting that speculated rates may rise in 2015. A Bloomberg report shows that speculators and other money managers increased their net-long position to the highest level since 2012 ahead of the Fed meeting on March 19. |

| Alasdair Macleod: China regulates gold too tightly for shadow banking system to play with it Posted: 29 Mar 2014 06:02 AM PDT GATA |

| Posted: 29 Mar 2014 05:36 AM PDT There have been four notable price action developments in the foreign exchange market:

Euro: The combination of the dovish comments from ECB officials, where even the Bundesbank appears to have warmed to the idea of QE, and the somewhat more hawkish FOMC, has prompted some profit-taking on long euro positions. The euro peaked just shy of the $1.40 level on March 13. While Draghi's comments helped put the euro's top in, it was Yellen's comments that exposed the downside. The euro was briefly pushed through the $1.3720 area, the 50% retracement of the euro's rally from early February lows, just |

| Posted: 29 Mar 2014 04:59 AM PDT 1. Ben Davies: "Man Who Made Legendary Call in Silver Tells KWN What's Next" 2. Egon von Greyerz: "People Have No Idea a Terrifying Global Meltdown is Coming" 3. Michael Pento: "Shocking - What Pento Said to Get Him Erased From CNBC" |

| Barclays sees a steady growth in Chinese Gold jewellery demand in medium term Posted: 29 Mar 2014 04:59 AM PDT British banking giant Barclays expects a steady growth in Chinese gold jewellery demand in the medium term. Chinese jewellery demand was strong in 2013, largely on the back of strong demand in H1 13 (April and June). Likewise, Chinese jewellery fabrication has defied world jewellery fabrication trends, increasing steadily since around the early 2000s. In fact, 2013 proved to be strong year for gold jewellery demand in China, as despite heavy buying in H1, demand resumed during the last two months of 2013 in advance of Lunar New Year, closing the year at a new sales record of RMB187bn (WGC). In 2014, according to the latest Gold Demand Trends report from the World Gold Council, almost 80% of Chinese consumers plan on spending the same or more (35% and 44%, respectively) on gold jewellery in 2014. This story has been through a couple of websites already---metal.com via Scrap Register---and I found it posted on the Sharps Pixley website yesterday. It's worth reading. |

| Jim Rickards: Russia, China signposting dollar’s demise and gold’s rise Posted: 29 Mar 2014 04:59 AM PDT "Our budget deficit in the U.S. is coming down, but our debt to GDP ratio is still going up. Policy-makers are saying they have cut the deficit from 10 percent of GDP to about three or four percent, but growth is only at two percent, so the debt to GDP ratio is still going up - we are still on the path to Greece." |

| Posted: 29 Mar 2014 04:59 AM PDT An eight-week strike by the South African Association of Mineworkers and Construction Union (AMCU) mining union has blocked operations at platinum producers Anglo American Platinum Ltd. (Amplats), Lonmin Plc., and Impala Platinum Holdings Ltd. (Implats). As of March 21, losses to these companies’ revenues were 9.4 Billion South African Rand, or around $865 million, because of the strikes. “Unfortunately, I believe the miners will not be able to get what they want from the big mining companies,” said Mr. Holland. “The real issue in South Africa is that there is a very big gap in incomes,” he continued. “You have a situation where unions are now becoming much more aggressive in terms of what they want as base wages. “This comes against a backdrop in the platinum industry where the price of platinum has come down and costs are escalating rapidly. Producers are not in a position to give more – otherwise, they will roll over.” This edition of Sprott's Thoughts was posted on the sprottglobal.com Internet site on Thursday. |

| Japanese Prepare For "Abenomics Failure", Scramble to Buy Physical Gold Posted: 29 Mar 2014 04:59 AM PDT As we reported on Thursday, the world's most clueless prime minister, Japan's Shinzo Abe, has suddenly found himself in a "no way out" situation, with inflation for most items suddenly soaring (courtesy of exported deflation slamming Europe), without a matched increase in wages as reflected in the "surprising" tumble in household spending, which dropped 2.5% on expectations of a 0.1% increase in the month ahead of Japan's infamous sales tax hike. How does one explain this unwillingness by the public to buy worthless trinkets and non-durable goods and services ahead of an imminent price surge? Simple - while the government may have no options now, the same can not be said of its citizens who have lived next to China long enough to know precisely what to do when faced with runaway inflation, and enjoying the added benefit of a collapsing currency courtesy of Kuroda's "wealth effect." That something is to buy gold, of course, lots of it. According to the Financial Times, "Tanaka Kikinzoku Jewelry, a precious metals specialist, reported that sales of gold ingots across seven of its shops are up more than 500% this month. At the company’s flagship store in Ginza on Thursday, people queued for up to three hours to buy 500g bars worth about ¥2.3m ($22,500). March has been the busiest month in Tanaka’s 120-year history." This must read commentary showed up on the Zero Hedge website late on Thursday morning EDT---and my thanks go out to reader M.A. for today's last story. |

| Japanese Prepare For “Abenomics Failure”, Scramble to Buy Physical Gold Posted: 29 Mar 2014 04:59 AM PDT "Can we rally strongly from here? You betcha" ¤ Yesterday In Gold & SilverIt was another day where very little of anything happened in the gold price in the Far East. The high tick on Friday came at the 8 a.m. GMT London open---and it was all down hill until the low was set at 9:45 a.m. in New York. The price rallied sharply back to the $1,295 spot mark in less than 20 minutes---and then chopped sideways into the 5:15 p.m. EDT close. The high and low ticks were recorded as $1,299.40 and $1,286.10 in the new front month, which is June. Gold closed in New York at $1,294.90 spot, up $3.20 on the day. Gross volume was around 238,000 contracts, but net volume was only 75,000 contracts---and most of the activity was in the new front month. Silver rallied a bit right from the open in the Far East but, like gold, ran into not-for-profit sellers at the London open. The low tick came about five minutes before the Comex open---and the subsequent rally ended at the same time as gold as well, shortly after 10 a.m. EDT. From there, the price got sold down a dime before trading sideways for the remainder of the New York session. The high and low, such as they were, were recorded at $19.92 and $19.62 in the May contract. Silver closed the Friday session at $19.82 spot, up 13 cents from Thursday. Volume, net of roll-overs, was only 30,000 contracts. Platinum rallied about ten bucks during the Far East trading session---and then began to edge lower once London opened. That 'sell-off' ended around 9 a.m. in New York---and from there, the platinum price rallied quietly into the close, finishing up 13 bucks on the day. The palladium price didn't do much in Far East trading, but began to rally starting moments before London opened. That lasted until shortly after the 1:30 p.m. EDT Comex close in New York---and from there traded flat. Platinum finished the Friday session up $15---gaining back a large chunk of what it 'lost' on Thursday. The dollar index closed late on Thursday afternoon in New York at 80.13---and then chopped basically sideways in a 10 point range either side of unchanged. The index closed on Friday afternoon at 80.17. Nothing to see here---please move along. The gold stocks sold off few points at the open on Friday, but quickly rallied until 10:30 a.m. EDT. After that, they didn't do much---and the HUI closed up 1.59%. The silver equities followed a similar pattern---but Nick Laird's Intraday Silver Sentiment Index closed up only 0.88%. The CME Daily Delivery Report for 'Day 1' of the April delivery month showed that 2,642 gold and 189 silver contracts were posted for delivery within the Comex-approved depositories on Tuesday. In gold, JPMorgan was the only short/issuer of note, as they delivered 2,470 contract out of their in-house [proprietary] trading account---and another 170 of their client account. The biggest long/stopper was also JPMorgan, with 505 in its client account. In silver, JPMorgan was the short/issuer of 128 contracts out of its in-house [proprietary] trading account---and Jefferies came in second with 50 contracts. The only long/stopper of note was Canada's Scotiabank with 164 contracts. There were at least a couple of dozen stoppers involved in April's First Day Notice deliveries in gold---and yesterday's Issuers and Stoppers Report is worth studying for a minute or so---and the link is here. March deliveries in the Comex-approved depositories ended the month as follows---84 gold and 2,113 silver contracts. Of those amounts, JPMorgan Chase out of it's in-house [proprietary] trading account, issued 4 contracts and stopped 72 contract in gold. In silver, they issued 74 contracts and stopped/took delivery of 1,313 contracts. Those 1,313 contracts represents 62% of the total March deliveries. Just for fun, I thought I'd check out palladium, as March was the latest delivery month for that metal as well. There were 1,083 contracts issued and stopped. Of those, JPMorgan Chase [out of both accounts] issued 839 contracts---and Goldman Sachs was a distant second with 102 contracts issued. The big long/stopper was Barclays with 935 contracts. Here's the year-to-date delivery report, current to the end of March, from the CME Group for all four precious metals [plus copper] so you can see for yourself who the most active bullion banks are. There were no reported changes in GLD---and as of 9:40 a.m. EDT there were no changes in SLV, either. There was a sales report from the U.S. Mint to end the week. They sold 500 troy ounces of gold eagles---500 one-ounce 24K gold buffaloes---and 121,000 silver eagles. Month-to-date the mint has sold 20,000 troy ounces of gold eagles---12,000 one-ounce 24K gold buffaloes---and 4,476,000 silver eagles. Based on March's sales data to date, the silver/gold sales ratio checks in at a hair under 140 to 1. Year-to-date that ratio stands at 62 to 1. And, as matter of interest, the number of silver eagles sold year-to-date stands at 13,001,000. It was a very busy day over at the Comex-approved depositories on Thursday. In gold, they reported receiving 61,882 troy ounces of the stuff---and shipped out 29,957 troy ounces. But in reality, the 29,957 troy ounces shipped out of Canada's Scotiabank warehouse, ended up as a deposit at HSBC USA. So the real movement on Thursday was only 32,150 troy ounces [precisely one metric tonne] shipped into Scotiabank. The link to that activity is here. It was another breath-taking day of in/out movement in silver, as 605,679 troy ounces were reported received---and a very large 1,764,190 troy ounces were shipped out the door for parts unknown. Almost all the silver shipped out came out of Scotia Mocatta's vault. The link to that action is here. Ted Butler mentioned that this past week was the biggest week of Comex silver activity that he can remember---and I just know that he'll have much more to say about it in his commentary to paying subscribers later today. The Commitment of Traders showed improvement in the Commercial net short position in both silver and gold, but I was hoping for a bigger improvement than we got. In silver, the Commercial net short position declined by 4,145 contracts, or 20.7 million troy ounces. The Commercial net short position is now down to 159 million troy ounces. The raptors, the Commercial traders other than the Big 8, bought 5,700 long contracts, but Ted said that the '5 through 8' largest short holders actually increased their short position by 2,200 contracts during the reporting week. JPMorgan covered about 700 contracts of their short-side corner in the Comex silver market---and Ted says that their short-side corner is down to about 19,000 contracts, or 95 million troy ounces. JPM's short position represents 60% of the total net short position in silver---which is preposterous. In gold, the Commercial net short position declined by 18,313 contracts, or 1.83 million troy ounces. The Commercial net short position is now down to 12.76 million troy ounces. As the technical funds puked up their longs and/or went short---the raptors bought about 15,000 of these long contracts---and the Big 8 short holders covered about 3,500 contracts of their short position. Ted said that JPMorgan added about 500 contracts to their long-side corner in the Comex gold market---and he pegs their current long-side corner at 40,000 contracts, or 4.0 million ounces. As I said at the start, I was expecting/hoping for a bigger improvement than the numbers showed above. It's obvious that we've had further improvement since the Tuesday afternoon cut-off for the above report, especially now that gold has closed below it's 50 and 200-day moving averages for two days in a row. Ted pointed out the obvious on the phone yesterday, but he put my concern in concrete numbers. He said that compared to the Commitment of Traders Report at the very lows in late December 2013, both gold and silver have miles to go [in number of contracts---and therefore price] before we get back to that level. In contracts, it's around 15,000 in silver---and about 100,000 in gold. How that translates in price is unknown, but it's a lot lower than it is now. Don't forget that it was, as Ted Butler said, all technical fund buying that drove the price up---and it's now technical fund selling that's taking it back down again as JPMorgan et al game the tech funds for fun, profit---and price management. However, a decent chunk of those contracts in both gold and silver have been covered since the Tuesday cut-off, but the sad truth of it is that if "da boyz" wish it, we have a along way to go to the downside. But that may not be in the cards, however I just don't know how this is going to play out going forward. I was expecting much more aggressive down-side price movements going into the April delivery month---and it just never materialized. Will it materialize next month, or are we done to the downside? Only JPM, the BIS et al, know where we're going from here---and they aren't talking. And as Jim Rickards said in that Sprott interview posted in my column yesterday---"If I were running the manipulation, I would actually be embarrassed at this point because it's so blatant." He would be right about that---and the three charts below are just another brick in the wall for the three big U.S. bullion banks. Yesterday, the Office of the Comptroller of the Currency [OCC] updated their website with the 4th quarter 2013 derivatives report for all U.S. banks. Of course it's only the precious metals that concern us---and it's the data from Table 9 on page 38 of this pdf file that all three charts below, are derived. Except for a handful of readers, these charts are going to be difficult to grasp in their entirety---and to tell you the truth, even though I've been looking at these charts [or similar ones] for over a decade now---and understand them in the broad strokes, trying to describe them in layman's terms is tough. The first chart shows the total derivatives positions held by all U.S. banks in dollars going back about 17 years. There are only a handful of U.S. banks out of the 6,000 plus registered banks in the U.S.---a half-dozen at most---that hold 100% of all these gold derivatives---and well over 95% of them are held by JPMorgan Chase, Citigroup and HSBC USA. Over 90% of the "Others" category on all three charts is composed of positions held by HSBC USA. As the price of gold has risen, the dollar value of the derivatives written has also risen, which is why chart #1 and chart #3 have the left-to-right shape they do. As interesting as that chart is, the dollar figures don't tell you a lot. But if you convert the dollars to tonnes of gold that the amounts represent, then you get a chart that looks like the one below---and it's much more meaningful. It shows the monstrous derivatives positions held by the banks when gold hedging/forward selling was at its peak---and as the gold miner's hedge book has been closed out over the years, the derivatives written against what left of the gold hedge book has declined as well. And, as Nick Laird just mentioned---"With the hedge book basically unwound, what's left are the derivatives that are not involved in hedging". Remember that it cost Barrick Gold $10 billion to extricate itself from its hedge book loses. Virtually all of the $10 billion went to JPMorgan Chase, as they were Barrick's bullion bank. Back on June 27, 1999---when gold hedging/forward selling was at its peak, silver analyst Ted Butler wrote an essay entitled "The Death of Hedging". It falls into the must read category---and I urge you to read it now before continuing, as it will help you understand these OCC charts a little better. The third chart is similar to the first one. The OCC doesn't provide a break-down of derivatives held for silver, platinum and palladium separately, but just puts them all in one category---and for that reason you can't have a tonnage chart like the one for gold above, as all these metals are at different prices---and tonnages mined. The take-away on all this, at least in the broad strokes, is that '3 or less' U.S. bullion banks control every aspect of the precious metal markets, with JPMorgan firmly in charge. They run the show on the Comex---and in the OTC derivative market that these charts represent. Yes, there are derivatives written by other foreign banks and probably some large brokerage firms as well [Morgan Stanley comes to mind], but they are spread out over such a large number of players that they're overall impact is minimal. It's JPMorgan et al all the way, both at home and abroad. I have very few stories for you today, which suits me just fine as I'm at least two hours behind where I normally am at this time of morning. ¤ Critical ReadsFebruary Pending Home Sales Continue SlidePending home sales declined for the eighth straight month in February, according to the National Association of Realtors. Modest increases in the Midwest and West were offset by declines in the Northeast and South; all regions are below a year ago. The Pending Home Sales Index, a forward-looking indicator based on contract signings, dipped 0.8 percent to 93.9 from a downwardly revised 94.7 in January, and is 10.5 percent below February 2013 when it was 104.9. The February reading was the lowest since October 2011, when it was 92.2. Lawrence Yun, NAR chief economist, said the recent slowdown in home sales may be behind us, while home prices continue to rise. “Contract signings for the past three months have been little changed, implying the market appears to be stabilizing,” he said. “Moreover, buyer traffic information from our monthly Realtor® survey shows a modest turnaround, and some weather delayed transactions should close in the spring.” It will take more than the usual spring market in housing to turn things around in the U.S. this year, but hope springs eternal. Today's first story showed up on the realtor.org Internet site on Thursday---and I found it in yesterday's edition of the King Report. Could terrorists really black out the power grid in the U.S.?The possibility of a terrorist attack knocking out the power grid makes for a good headline, but could it really happen? The U.S. Federal Energy Regulatory Commission (FERC) says yes. If terrorists are ever able to knock out nine of the nation's 55,000 substations, the U.S. power grid could suffer coast-to-coast blackouts lasting 18 months or more, according to leaked excerpts from a FERC report. There are 30 substations in the U.S. that play a critical role in the nation's grid operations, the report said. If any nine of them were taken offline, there could be widespread blackouts for weeks — or far longer. Just because a crippling grid attack is possible, doesn't mean it's going to happen. But terrorist attacks on the power grid don't just make for good headlines — they're already happening. This very interesting story was posted on the utilitydive.com Internet site on Monday---and it's courtesy of reader "Geoff from Melbourne". Doug Noland: Q.E., Uncertainty---and CPI As much as it is reminiscent of the late-nineties, the more apt comparison is to the Roaring Twenties. Major technological innovation throughout the 1920’s had unappreciated consequences on the economic structure and price dynamics more generally. Misunderstanding the forces behind the downward pressure on many prices, the Federal Reserve remained too highly accommodative for too long. In the process, the Fed harbored a prolonged period of deep economic maladjustment, while fostering a historic speculative financial Bubble. Putin orders Ukrainian weapons returned from CrimeaPresident Vladimir Putin has ordered all weapons and hardware left by the Ukrainian military after Crimea’s accession to Russia to be returned to Ukraine. The Russian President, who is also the commander-in-chief of the military forces, gave the order to Defense Minister Sergey Shoigu at a rank-conferring ceremony in Moscow on Friday. The order concerns weapons, an |

| Posted: 29 Mar 2014 04:11 AM PDT Almost all who read our commentaries know that we place the greatest importance on reading the developing market activity, as best seen in charts, in order to have the closest pulse on what is going on in the market[s]. The reason is because the activity found in price and volume behavior reflects the decisions of all market participants. Smart money leads, the rest follow. What constitutes smart money? Those with the most knowledge and deepest pockets that control what goes on. In the US stock market, it used to be institutional money that drove stocks. For the past few years, it has been the Federal Reserve, through Permanent Open Market Operations, [POMO], and the all of the QEs that have unsustainably propped up stocks. In the Precious Metals, [PM], it has been the US and London central banks colluding to suppress primarily gold but also the silver market, and with gold, the active suppression has been going on for at least the last 50 years, just more blatantly in the past few. It is for these reasons we have turned our focus toward the elites, all related to the Rothschild dynasty, because they control all of the money. All Western money is worthless fiat, but for as long as the masses continue to believe the "emperor is wearing clothes," the elites rely on people turning a blind eye and will get by with their massive Ponzi scheme. Let us be clear about one thing, and the most important of all to never forget: gold and silver are money, and the truest form of money. Everything else, the fiat Federal Reserve Note, erroneously referred to as the "dollar," the Euro, the Yen, the Swiss Franc, and every other Western form of what passes for a country's currency is worthless paper money, backed by nothing but more worthless paper money. Actually, it is not even paper anymore. Almost all fiat currencies are digitalized, paper being a small percentage. If you ask most people if they know that fiat currency has no value, they will agree. Yet, those very same people continue to use the intrinsically worthless paper as though it actually had value! In other words, people are willing to imagine the worthless fiat has the [lack of]value the issuing central bank says it does. The kicker is, everyone who uses fiat-with-no-intrinsic-value is a smart person. Can anyone explain to their 8-year-old son or daughter what fiat currency means? Parent: "It is paper money used to buy and sell goods and services, but it is not really worth anything." Son/Daughter: "If it is not worth anything, why use it, and why do other people accept it?" We cannot justify a worthwhile response without it begging the question, "If everybody else jumped off a cliff, would you, too?" Parent: "Where is your new bicycle?" Son/Daughter: "I sold it for $100. See! This man gave me a piece of paper and wrote $100 on it." Parent: "Are you crazy! Just because someone tells you a piece of paper is worth $100 does not make it true." This would be a good time to stay away from a mirror. Living in America, prior to the 1930s, if you went into a bank with a US Treasury Note of any denomination, you could exchange it for gold or silver, for all currency was specie-backed, even the Federal Reserve issue, which circulated side-by-side with US Treasury Notes, [those issued by the US government and not the private corporation known as the Federal Reserve]. After the elites forced the US into bankruptcy in 1933, when FDR declared a bank holiday and shut the system down for several days, when the banks reopened, it was the foreign-owned Federal Reserve that was in charge of the entire banking system, finally. [We add "finally," because that was the objective of the Rothschilds for over 50 years even before 1933, actually longer, but it gets too complicated to explain.] A man goes into a bank, prior to 1933, and hands over a $100 US Treasury Note, or even a Federal Reserve Note, which also was specie-backed, at the time, and asks for $50 in gold and $50 in silver. No problem. Sometime after 1933, a man goes into a bank with a $100 Federal Reserve Note and asks for $50 in gold and $50 in silver. Banker: "Sorry, sir. There is no gold or silver backing for your $100. Would you like two $50 Federal Reserve Notes, instead?" What happened? When the Federal Reserve Act was passed, two days before Christmas in 1913, when most politicians were home on holiday, the Act was passed with no opposition by the remaining chosen politicians who stayed on, and were well paid to do so by the Rothschild-backed bankers. And so the most treasonous act against the Constitution was passed. Here is how the rest of the plan was carried out: The Federal Reserve issued its own currency, also specie-backed, to circulate along with the US specie-backed Treasury Notes. This went on for a few decades, which is a short period of time for the Rothschilds. What happened was, people saw the new Federal Reserve Notes, along with Treasury Notes, but it made no difference because both were equally backed by, and could be exchanged for gold and silver on demand, at any bank. After 1933, when the Federal Reserve took over control of the money supply, it began to slowly withdraw all US specie-backed Treasury Notes and had them destroyed! Nobody paid attention to the disappearance of the US Treasury Notes because Federal Reserve Notes were the same thing, in their minds, and in reality. This was all planned, decades in advance. It was a part of the Rothschild formula for well over a hundred years even before that. Something else happened very gradually, over time, and almost immediately after 1933. All Federal Reserve Notes that were specie-backed were also withdrawn from circulation. All of the US Treasury currency issued by the United States government had already been removed and destroyed. All that was left were Federal Reserve Notes, backed by the full faith and credit of the United States. Fiat. Again, people had come to accept Federal Reserve Notes in circulation at the same as Treasury Notes, so when all that was left were the Federal Reserve Notes, it did not matter because people could still buy and sell whatever they wanted and did as in times prior to the financial bait-and-switch. All the gold and silver owned by the United States government was stolen, taken by the elite-owned Federal Reserve central bank. The central bank controlled the government and the media. The public was fed the kind of news that never let on to what happened during those decades, and the public has since been dumbed down even further in all the other decades to date. In the 1940s, '50s, and '60s, one often heard the expression, "The dollar is as good as gold." That was another Rothschild-inspired idea to implant in the minds of the people, and it worked. Another popular expression related to the gold stored in Fort Knox. No one ever talks about Fort Knox, anymore, and hasn't for many decades. Why not? All the gold is gone, and the elites do not want to draw attention to what is not there. Does the US own any gold, at all? Absolutely! But only on paper, if you believe the paper on which it is written. Has anyone seen any hard evidence of gold stored at Fort Knox? "Here it is, right here on this paper." Can we see the actual physical gold? "That would be inconvenient, but here it all is, and our ledgers are audited every year." Hello, Germany, can you hear us now? A bit of irony that the same people who hold and control Germany's gold got their start in Frankfort, where the wooden"red shield" sign used to hang over the door of Mayer Amshel Bauer, he who changed his last name from Bauer to "Red Sign," or Rotschild. If a group, not just any group, but one that controls all of the money in existence in the Western world, and also controls all of the governments in the Western World, [almost], is it that far a stretch of one's imagination, [especially for those who believe in paper fiat], to believe that this group of elites can just as easily control the price of gold and silver? They have for many, many decades, and do so to this day. It may well be that they have had to sell all their holdings to rising Eastern countries, but their grip on nations, and certainly on the powerless people who inhabit those nations is stronger than ever. It will take more time and much more effort to ever get those in power to give up that power. When we look at the charts, despite the gold community pundits declaring the shortages of and the unprecedented demand for both gold and silver, tell us where in the charts there are any indications of the fundamentals reflecting what so many assert as the "true" value for gold to be in the $5,000 – $10,000 the ounce range, or silver in the $100 – $300 range? Here are the charts, once again, and our comments. If you see extraordinary bullish signs within them, let us know. We certainly keep looking, but cannot find any needle in these "haystack" charts. For every valid reason that so many others are advocating the purchase of physical gold and silver, demand, shortages, Chinese buying, exchange disappearing physical, etc, etc, we echo those sentiments and suggest/advise to keep on buying, but hold it personally. However, for more salient reasons, such as discussed in our last several commentaries, as well as this one, there are far more important reasons to buy and hold gold and silver. They are money. At some point in the future, and no one knows when, no one, but eventually the unsustainable debt generated by the United States, BIS, IMF, and other central banks, [all of which are insolvent], will collapse. The elites will fight the collapse to the bitter end, likely forcing war to cover their duplicity, and it will get real ugly, maybe even downright dangerous for daily living, not to sound alarmist. One can hope for the best and be prepared for the worst. Thee is one more trading day left for the monthly charts, but we do not expect there will be any material change, either way, that will alter what is showing right now. The monthly chart reflects the makings for change, but the trend is still down. Forget about $5000 or higher gold, for now. It ain't going to happen any time soon. The breaking of a down sloping TL does not mean the trend has changed. All it means is that the trend has weakened. Price may have stopped declining, but it could spend many more months moving sideways, and not up, at all. Do not place much emphasis on such an event as a broken TL. The bearish spacing has not been challenged. The current swing high rally failed to reach, the $1420 -$1430 area, but developing market activity is showing a few clues that may prove more bullish than the market appears. Within the down channel, the December low stayed above the June low, and price did not even come close to the lower channel line. Instead, price held firmly within the channel and above the 50% portion of it, a sign of strength. From the December low, gold had a persistent rally for several days straight. March, last bar on the chart, has the look of a key reversal. A key reversal is when price makes a new recent high and then reverses to close lower than the previous bar. It can often be a red flag for longs. However, note the volume for March. It is the highest in 8 months, and it produced a lower close, ostensibly negative. |

| NYSE Margin Debt Hits All-Time High Of $465.72 Billion In February, With Risk Rank At No. 2 Posted: 29 Mar 2014 02:58 AM PDT Margin debt at the New York Stock Exchange hit an all-time high of about $465.72 billion in February, as it reached a nominal record level for the sixth month in a row. The increase in NYSE margin debt came as the SPDR S&P 500 ETF's (SPY) adjusted monthly closing value also hit an all-time high of $185.47 during the same period. NYSE has reported monthly data on securities market credit in three discrete series (Margin Debt, Free Credit Cash Accounts and Credit Balances in Margin Accounts) since 2003 and on margin debt itself since 1959. NYSE margin debt is the aggregated dollar value of issues bought on margin (i.e., borrowed money) across the exchange. Many equity-market participants consider it a gauge of speculation in the stock market. The U.S. Federal Reserve currently has the initial margin requirement set at 50 percent. There is a |

| Peak Gold, easier to model than Peak Oil ? Part II Posted: 29 Mar 2014 02:30 AM PDT The Oil Drum |

| Peak Gold, easier to model than Peak Oil ? Part II Posted: 29 Mar 2014 02:30 AM PDT The Oil Drum |

| Authorized Purchasers Rebel Against US Mint- Halt Gold Eagle Purchases! Posted: 28 Mar 2014 09:00 PM PDT

The Doc & Eric Dubin break down the action in the markets this week, & discuss: Gold completes a golden cross last Friday, the cartel promptly smashes gold & silver under $1300 & $20 to dampen sentiment Shortage developing in US Gold Eagles as the Authorized Purchasers collectively rebel against the US Mint & halt [...] The post Authorized Purchasers Rebel Against US Mint- Halt Gold Eagle Purchases! appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Rates up, gold down? Recall 2004-06 Posted: 28 Mar 2014 08:11 PM PDT Gold must fall if rates rise. Except when it doesn't...Adrian Ash opines. |

| Campaign to Debase U.S. Coins Alive and Well in Obama Budget Posted: 28 Mar 2014 04:52 PM PDT U.S. President Barack Obama's recently submitted budget proposal for 2015 revisits against U.S. coinage, its composition and cost. The President has shown an interest in updating and streamlining U.S. currency by cutting costs to production or eliminating altogether the smallest denominations since at least 2010, "in order to efficiently promote commerce in the 21st Century." Both pennies and nickels cost some twice their face value to produce, despite the fact that the amount of copper and nickel contained within has been dramatically reduced. Canada is now a year into the apparently seamless and successful elimination of its penny coin. But the real significance of debasing or eliminating coins is an implicit acknowledgement that the dollar continues to fall in value, as do all fiat currencies in the world, and that no one has any intention of restoring that lost value. |

| Posted: 28 Mar 2014 03:26 PM PDT |

| Gold Tests the channel line at the cycle turn means best chance for short term low Posted: 28 Mar 2014 02:56 PM PDT Commodity Trader |

| The Guardian’s Deputy Editor Claims the UK Gov’t Threatened the Paper with Shutdown Over Snowden Posted: 28 Mar 2014 01:45 PM PDT

Mr Johnson said the whole attitude in the UK was that national security trumped press freedom and that the newspaper should not publish a word…We were threatened that we would be closed down. We were accused of endangering national security and people's lives. It left us in a very difficult position. - Paul Johnson, deputy [...] The post The Guardian's Deputy Editor Claims the UK Gov’t Threatened the Paper with Shutdown Over Snowden appeared first on Silver Doctors. |

| Posted: 28 Mar 2014 01:07 PM PDT From Bloomberg: Bitcoin isn't just for buying and selling cupcakes and cameras anymore. A crop of entrepreneurs, backed by investors such as Andreessen Horowitz and BitAngels, are betting that the technology behind the virtual currency can be used for a range of financial tasks now handled by banks, exchanges, e-commerce providers and other middlemen. Invictus Innovations Inc., Ripple Labs Inc. and other startups are harnessing Bitcoin's underlying code for such tasks as authentication, which means making sure that a buyer isn't posing as someone else, and verification of payments to ensure that a transaction is valid. If successful, the new tools could reduce the fees shouldered by buyers and sellers in the $1.22 trillion global electronic-commerce market, as well in financial services, cloud computing and other areas. "People are just starting to realize that Bitcoin isn't a currency and a payment system, it's the Internet of Money," David Johnston, co-founder of BitAngels, a group of investors in Bitcoin-related startups, said in an interview. "It's a really exciting time." BitAngels is currently considering more than 30 projects in the Internet-of-Money category, Johnston said. There's growing recognition, even among financial firms, that Bitcoin's underlying design can be used for any transaction requiring some degree of verification. In a report this month, Goldman Sachs Group Inc. said while Bitcoins probably won't be viable as a currency, the basic technology "could hold promise." Bitcoin's future as the Internet of Money was one of the hottest topics at the CoinSummit conference in San Francisco this week. Digital Money Bitcoin captured the attention of investors and innovators last year, fueling a rally that drove the value of the digital money to about $1,200 from $12. More recently, scrutiny from governments, bans in China and India, and the collapse of online exchange Mt. Gox have cast doubt on the viability of Bitcoin as credible replacement for fiat currencies. The price of Bitcoin plunged almost 10 percent yesterday after China's central bank ordered banks and payment companies to close the trading accounts of more than 10 Bitcoin exchanges. Bitcoin was valued at about $500 yesterday, according to the CoinDesk Bitcoin Price Index. The software behind Bitcoin relies on a public record of every transaction that's ever made. When someone spends all or part of a Bitcoin, the change in ownership is recorded by a global network of computers and posted to a public register, ensuring that the same unit of money can't be used twice. The owners of computers solving and verifying these transactions are rewarded with new Bitcoins for their work. Building Blocks Bitcoin's building blocks, designed to validate each transaction, are adaptable for any type of exchange, regardless of whether they are attached to a currency or not. Called a blockchain, the currency's underlying design opens up possibilities for the technology to be used in other industries, according to Marc Andreessen, a partner at Andreessen Horowitz who is looking to fund startups focused on this new category. "The blockchain is the core innovation," Andreessen said at CoinSummit. "We want a whole sequence of companies: digital title, digital media assets, digital stocks, and bonds, digital crowdfunding, digital insurance. If you have online trust like the blockchain provides, you can reinvent field after field after field." Bloomberg LP, the parent of Bloomberg News, is an investor in Andreessen Horowitz. Buyers, Sellers BitShares X, a decentralized bank and exchange, is among the first Internet of Money services. Developed by Blacksburg, Virginia-based Invictus, BitShares X will debut in the second quarter and will offer users the ability to save, trade, borrow, and lend financial securities, from dollars to derivatives, without an intermediary like a bank or brokerage. Transactions are handled by users' computers, and verified publicly, making theft or fraud impossible. "With a traditional exchange, you send your dollars, and they record an IOU for so many dollars," Dan Larimer, chief executive officer of Invictus, said. "The exchange can default on their IOUs to you – Mt. Gox is an example. In our case, no one can steal the balance from your account." The technology can potentially eliminate fees, which pay for the cost of accounting systems, banking services and verification of account holders, according to Chris Dixon, a partner at Andreessen Horowitz. By eliminating most of those expenses, financial services such as escrows and dispute resolution based on the Internet of Money could represent a significant business opportunity, he said in an interview. "What Bitcoin does, it removes the need for trust in the system," Dixon said. "It's very brilliantly designed." Real Things People buying and selling physical goods, especially expensive items such as cars and houses, can also benefit from Bitcoin's technology. EBay Inc. and real estate brokers stand in the middle of transactions, ensuring each party's identity and making sure everyone gets paid, for a fee. While this doesn't rule out person-to-person deals, many opt to pay a commission to a middleman to minimize risk. Ownership of goods could be tied to a verified digital token that can be transferred to the buyer from the seller, simultaneously with a payment. "There's a potential for at least 10 percent of the world's e-commerce to be done over the blockchain," Michael Terpin, co-founder of BitAngels, said in an interview. Keybase, another nascent idea, works as a virtual identity card, verifying people using the same underlying Bitcoin technology. In addition to confirming people for messages or e-mail, it can also be used to as a certificate of authenticity for files or online video streams. Open Markets In another scenario, Bitcoin Tangible Trust lets people buy and trade gold using Bitcoin technology to validate transactions and show ownership. Ripple Gateway Pte's RippleSingapore offers a similar service for trading gold, silver, platinum, and currencies. Some 200 people are using the system, which is backed by bullion reserves, and currency deposits at Singapore's Oversea-Chinese Banking Corp. Digital media, such as music and video can also benefit from the same technology. Invictus is planning a service that lets users buy shares in sound tracks, for example. "It's a way for fans to buy into a song when it's new, and if it becomes popular, you can make money," Larimer said. Since digital content ownership will be verified, such a service will be a natural defense against piracy, he said. Voting Tools Using Bitcoin technology and cars connected to wireless networks, package courier services could evolve into a self-organizing industry. Anyone who is part of the service with a car could become a courier, picking up and delivering packages as they commute or run errands. While still a conceptual idea, the system would collect fees from senders and pay deliverers. MaidSafe has developed a service that lets consumers share storage or processing power with others, an alternative to cloud-computing providers such as Amazon Web Services. David Irvine, MaidSafe's founder, said he's working with about 20 companies that are creating Web applications. The Internet of Money isn't all about cash and software, said Dave Cohen, a 45-year-old programmer in San Francisco who is working on a way to let users cast votes using Bitcoin-based verification. "I would like to see voting for the voters to be convenient, and for the vote counting to be almost instantaneous," Cohen said. New Coins JPMorgan Chase & Co. and EBay have filed patents that mention digital currencies such as Bitcoin and underlying technologies. "We know for a fact that many financial companies are thinking about adopting it," Balaji Srinivasan, a partner at Andreessen Horowitz, said in an interview. "We see banks all the time that are evaluating this for internal operations." While some of the Bitcoin 2.0 startups are using the existing Bitcoin network, many are creating alternate versions that work in the same way to provide verification. The most well-known projects are Mastercoin, Ethereum, Colored Coins, Counterparty, Ripple, and BitShares. BitAngels' Johnston said the majority of his group's funding and deals will be related to Internet of Money this year. After evaluating 200 investments last year, the venture-capital group invested more than 60 percent of its funds in Mastercoin, he said. "Right now, Bitcoin is in the lead," Brock Pierce, an investor in Mastercoin, said. "And usually, the technology that gets the most adopters wins."

More on Bitcoin: Escape the bankers... This is the real reason Bitcoin is surging Porter Stansberry: What you should know about Bitcoin and gold The IRS just made a "ruling" on Bitcoin. Here's what they said. |

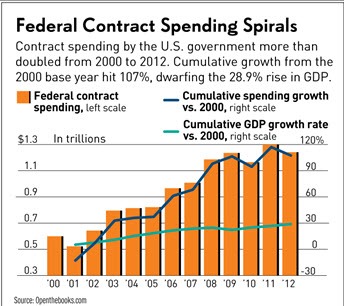

| A First Look at a New Report on Crony Capitalism – Trillions in Corporate Welfare Posted: 28 Mar 2014 12:00 PM PDT

One of the primary topics on this website since it was launched has been the extremely destructive and explosive rise of crony capitalism throughout the USA. It is crony capitalism, as opposed to free markets, that has led to the gross inequality in American society we have today. Cronyism for the super wealthy starts at [...] The post A First Look at a New Report on Crony Capitalism – Trillions in Corporate Welfare appeared first on Silver Doctors. |

| A lost album was found in Johnny Cash's vault. Listen to it here. Posted: 28 Mar 2014 12:00 PM PDT The Man in Black is back. Johnny Cash is one of the most iconic singer-songwriters of all time. He had a voice like freight train. His words could touch the deepest parts of your soul. He sang and toured with other greats such as Elvis Presley, Bob Dylan, and Jerry Lee Lewis. His music was rooted in country… but it was so much more. There is no doubt his music took part in the origins of rock and roll. Johnny Cash's music transcends genres… only to be classified as great American music. It's for this reason, famed producer, Rick Rubin, started working with Johnny in the 1990s. Rick Rubin co-founded rap empire, Def Jam. Rubin is eclectic and works with top performers. He is a production genius. Johnny and Rubin worked a lot together. They created a lot of songs. Rubin released two Johnny Cash albums posthumously. There are still four to five albums that haven't been released… and may not even see the light of day. Even if these albums never get released… there is still good news. Another new album was found. Johnny died in 2003… months after his wife, June Carter Cash died. After his death, their son, John Carter Cash, cleaned up their home. This is when he found a treasure... In a vault, John found a never-before-released album called Out Among the Stars. The majority of the production happened in 1984. Johnny had battled drug addiction throughout his life. He had fallen back into his drug addiction in 1983. In 1984, he went through recovery. It's at this point in his life… when he was true… when he was aware… when his voice was perfect. Listen to the full newly released album from Johnny Cash's album Out Among Stars right here...

More Cruxellaneous: Ukraine BOMBSHELL: Leaked conversation could set off a full-blown war Why Jim Rickards says buy gold now... before it's too late This 59-second video explains how the gov't tricked us all into paying income taxes |

| Oil And Gold Analysis : March 28, 2014 Posted: 28 Mar 2014 11:50 AM PDT investing |

| Elliott Wave Review: Gold, crude, S&P 500 Posted: 28 Mar 2014 11:45 AM PDT futuresmag |

| CHART - Gold, Debt and Gold Reserves Posted: 28 Mar 2014 11:45 AM PDT goldseek |

| A gold forecast you may not like Posted: 28 Mar 2014 10:56 AM PDT The bitter truth about what may happen to gold is not all that exciting and likely don't want to know, but you need to understand what is unfolding as we speak. |

| The Doc: Loss of Reserve Currency Status Will Be The Death of The Dollar Posted: 28 Mar 2014 10:30 AM PDT

The Doc joined the Prepper Recon Podcast this week for a discussion on the end game for the US dollar and the Western financial system, and how investors and Americans in general should prepare for what is ahead. Doc discusses his outlook for the remaining lifespan of the US dollar as reserve currency, the risks [...] The post The Doc: Loss of Reserve Currency Status Will Be The Death of The Dollar appeared first on Silver Doctors. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment