Gold World News Flash |

- The US Atlantic Coastline Goes On High Alert To Cover Up The Economic Collapse

- Gerald Celente : A Front Row Seat to Economic Hell

- Ferguson: We’re Past the Point of NO RETURN — Inflationary Collapse Ahead

- Alasdair McLeod – The US Blew It In The Ukraine

- Doug Casey & Chris Waltzek

- Gold market manipulation update, March 2014

- Preparing for Economic Instability: Six Ways to Ready Yourself For the Inevitable

- Economic Inequality In The USA (In One Comprehensive Chart)

- The Gold Price Reached $1,286.10, 50 Percent Correction Target

- The Gold Price Reached $1,286.10, 50 Percent Correction Target

- Gold Daily And Silver Weekly Charts - Here Comes April

- Gold Daily And Silver Weekly Charts - Here Comes April

- The Real Reason the U.S. Dollar Has Value

- People Have No Idea A Terrifying Global Meltdown Is Coming

- Study Will Show That Gold Is Being Manipulated on the Comex

- Gold as a Currency in Your Portfolio

- Gold as a Currency in Your Portfolio

- Gold Mid-Tier Stocks Set for Growth

- Man Who Made Legendary Call In Silver Tells KWN What’s Next

- Jim Rickards: Study Will Show That Gold Is Being Manipulated on the Comex (Again)

- Jim Rickards: Study Will Show That Gold Is Being Manipulated on the Comex (Again)

- Is Putin Quietly Dumping Russia’s US Treasuries?

- Gold, Debt and Gold Reserves

- The Accidental End to Silver Price Manipulation

- Gold Bullion Drops for 2nd Week After Near-Record Run, Shanghai Discount "Says China Demand Slowing"

- Golden Opportunity Coming in Silver

- Silver, Buffett & the Hunt Brothers

- Max Keiser: The Dollar is Done!

- 3 Pieces to China’s Gold Puzzle

- Silver, Buffett & the Hunt Brothers

- Silver, Buffett & the Hunt Brothers

- Silver, Buffett & the Hunt Brothers

- Market Needs a Hero

- Market Needs a Hero

- China's New Electricity Grid

- China's New Electricity Grid

- Silver Prices Heading Lower As the Bears Tighten Their Grip

- Stocks and Gold Simply Cannot Get it Up!

- JPMorgan defeats appeal in U.S. silver price-fixing lawsuit

| The US Atlantic Coastline Goes On High Alert To Cover Up The Economic Collapse Posted: 29 Mar 2014 12:04 AM PDT Cyprus has voted to remove the capital controls for the people of Cyprus. The Greek government has voted confiscation of deposits are unconstitutional. Countries are worried about the economy and are now buying more gold. Obama is considering sending advanced weapons to Syria to help the paid... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gerald Celente : A Front Row Seat to Economic Hell Posted: 28 Mar 2014 11:03 PM PDT David Knight and financial trend analyst Gerald Celente finish the Friday broadcast covering the Japanese rush on physical gold, banker suicides across the world and why the banking system is aging that there is nothing to the bankers deaths. [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Ferguson: We’re Past the Point of NO RETURN — Inflationary Collapse Ahead Posted: 28 Mar 2014 09:00 PM PDT from FinanceAndLiberty.com: |

| Alasdair McLeod – The US Blew It In The Ukraine Posted: 28 Mar 2014 08:00 PM PDT from FinancialSurvivalNetwork.com:

Click Here to Listen |

| Posted: 28 Mar 2014 07:20 PM PDT from GoldSeekRadiodotcom:

Click Here to Listen |

| Gold market manipulation update, March 2014 Posted: 28 Mar 2014 07:00 PM PDT by Chris Powell, GATA:

Dear Friend of GATA and Gold: For 15 years the Gold Anti-Trust Action Committee has been documenting and publicizing the largely surreptitious manipulation of the gold market by Western central banks, a longstanding policy of gold price suppression aimed at controlling the currency markets and interest rates. While GATA is a research, educational, and civil rights organization, those who object to examination of our topic call us a “conspiracy theory” organization. There is much conspiracy here, but it is easily ascertainable as fact rather than mere theory, conspiracy occurring whenever people gather in secret to plan or implement some undertaking or policy. Meeting in secret to plan or implement policy is, of course, the very definition of modern central banking. After all, when is the last time you were invited to a meeting of the G-10 Committee on Gold and Foreign Exchange or were even told that such a committee exists and meets secretly? When is the last time you were allowed to learn the results of the committee’s work without having to bring a lawsuit against the participants, as GATA did a few years ago? |

| Preparing for Economic Instability: Six Ways to Ready Yourself For the Inevitable Posted: 28 Mar 2014 06:40 PM PDT by Tess Pennington, Ready Nutrition:

For several years now, many economic forecasters and trenders have warned the general public of a looming economic collapse – all we needed was a catalyst as a kick start. It seems that this year's active winter season coupled with the west coast's extreme droughts could be the straw that will break the camel's back. According to www.zerohedge.com, 2014 food prices are up 19%. In fact, "U.S. foodstuffs is the best performing asset this year." Due to the crippling drought that swept the west coast, a significant amount of our food supply could not be grown. Consequently, our food prices are increasing because of the demand for food. The more events that cause instability in our economy, the harder it will be for households to provide for themselves. Start Insulating Yourself from an Unstable Economy Those who have taken steps to insulate themselves from the instability of the markets have made prudent choices to invest in their future through lucrative investments. Dry goods, precious metals, land and skills are some of the hard assets that many economist such as Gerald Celente and Marc Faber stress. |

| Economic Inequality In The USA (In One Comprehensive Chart) Posted: 28 Mar 2014 03:59 PM PDT Inequality – long ignored – is now centre stage in debate about economic policy around the globe. As Tony Atkinson and Salvatore Morelli note, the 2007-2008 collapse of the global financial system and the subsequent economic downturn/debt crises have acted as a catalyst for growing anxiety around the increasing dispersion of incomes within most advanced economies. In an effort to show that "we are not 'all in it together'", the two professors have created The Chartbook of Income Inequality. As the chart below shows, the acute loss of job prospects, especially among the young, the credit crunch and the austerity measures implemented by governments to contain the sovereign debt crisis have all put extra burden on the shoulders of the lower and middle classes.

Income Inequality In The US...

Summed up

And the huge interactive version...

|

| The Gold Price Reached $1,286.10, 50 Percent Correction Target Posted: 28 Mar 2014 03:05 PM PDT Gold Price Close Today : 1,293.80 Gold Price Close 21-Mar-14 : 1,336.00 Change : -42.20 or -3.2% Silver Price Close Today : 19.772 Silver Price Close 21-Mar-14 : 20.286 Change : -0.514 or -2.5% Gold Silver Ratio Today : 65.436 Gold Silver Ratio 21-Mar-14 : 65.858 Change : -0.422 or -0.6% Silver Gold Ratio : 0.01528 Silver Gold Ratio 21-Mar-14 : 0.01518 Change : 0.00010 or 0.6% Dow in Gold Dollars : $ 260.80 Dow in Gold Dollars 21-Mar-14 : $ 252.25 Change : 8.55 or 3.4% Dow in Gold Ounces : 12.616 Dow in Gold Ounces 21-Mar-14 : 12.203 Change : 0.41 or 3.4% Dow in Silver Ounces : 825.56 Dow in Silver Ounces 21-Mar-14 : 803.65 Change : 21.92 or 2.7% Dow Industrial : 16,323.06 Dow Industrial 21-Mar-14 : 16,302.77 Change : 20.29 or 0.1% S&P 500 : 1,857.32 S&P 500 21-Mar-14 : 1,866.72 Change : -9.40 or -0.5% US Dollar Index : 80.330 US Dollar Index 21-Mar-14 : 80.250 Change : 0.08 or 0.1% Platinum Price Close Today : 1,404.70 Platinum Price Close 21-Mar-14 : 1,435.50 Change : -30.80 or -2.1% Palladium Price Close Today : 774.10 Palladium Price Close 21-Mar-14 : 788.75 Change : -14.65 or -1.9% Silver and GOLD PRICES argued with each other today. Gold lost 90 cents to $1,293.80 on Comex. Silver rose 8.2 cents to 1977.2 cents. Ratio fell to 65.436 from yesterday's 65.754. Both metals are riding their bottom Bollinger Bands, which increases likelihood of a turnaround. The GOLD PRICE today reached $1,286.10, my target for this move and a 50% correction. The SILVER PRICE hit 1958c yesterday and 1962c today, close enough to call my 1950c target met. After Monday both should turn up and leave y'all scratching your heads and twisting your necks around 180 degrees for that perfect hindsight and saying to yourselves, "I KNEW I should have bought some last week." Bad week for metals, middlin' mediocre week for stocks, might have been a good week for the US dollar. Stocks have been treading water this week, up and down in the same spot, over and under the 20 DMA without being above to make up their mind. S&P500 broke the bottom boundary of an even-sided triangle yesterday, but that breakdown proved false when it reversed today and closed up within the triangle. Dow added 58.83 (0.36%) to close 16,323.06. S&P500 rose 8.58 (0.46%) to 1,857.62. Dow in metals has that feeling of a fly ball reaching the height of its arc. Dow in Gold rose 0.13% to 12.61 oz ($260.67 gold dollars) but leveled off. I am anticipating a turn, since it stands above its 50 DMA (12.36) which means momentum is up. Dow in silver dipped barely down, down 0.09% to 824.81 oz (S$1,066.42 silver dollars. I may be no better than that ox on his way to slaughter who don't know enough to be afraid, but for some reason these rallying Dow in metals don't disturb me. I expected a sharp rally after that long fall, but don't expect this will last much longer. Nasty, filthy, noxious, vile, beastly, foul, loathsome, lousy, mephitic, noisome, odious, scrofulous, scurvy, parasitic -- yea, all these describe fiat dollars, yen, and euros. And I'm just warming up my thesaurus here. US Dollar index is glacially trying to rise. It did manage to stand up off the floor this week, and rose six basis points (0.07%) to 80.33 today. Technically it's trending up, but without any enthusiasm. Euro broke down sure enough this week. Bounced 0.08% today to $1.3753, but it's plumb broken. Next week should cross below its bunched 20, 50, and 62 day moving averages. Yen busted its 50 DMA today, falling to 97.27 cents/y100. Still range-bound, trending sideways. Y'all enjoy your weekend! Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| The Gold Price Reached $1,286.10, 50 Percent Correction Target Posted: 28 Mar 2014 03:05 PM PDT Gold Price Close Today : 1,293.80 Gold Price Close 21-Mar-14 : 1,336.00 Change : -42.20 or -3.2% Silver Price Close Today : 19.772 Silver Price Close 21-Mar-14 : 20.286 Change : -0.514 or -2.5% Gold Silver Ratio Today : 65.436 Gold Silver Ratio 21-Mar-14 : 65.858 Change : -0.422 or -0.6% Silver Gold Ratio : 0.01528 Silver Gold Ratio 21-Mar-14 : 0.01518 Change : 0.00010 or 0.6% Dow in Gold Dollars : $ 260.80 Dow in Gold Dollars 21-Mar-14 : $ 252.25 Change : 8.55 or 3.4% Dow in Gold Ounces : 12.616 Dow in Gold Ounces 21-Mar-14 : 12.203 Change : 0.41 or 3.4% Dow in Silver Ounces : 825.56 Dow in Silver Ounces 21-Mar-14 : 803.65 Change : 21.92 or 2.7% Dow Industrial : 16,323.06 Dow Industrial 21-Mar-14 : 16,302.77 Change : 20.29 or 0.1% S&P 500 : 1,857.32 S&P 500 21-Mar-14 : 1,866.72 Change : -9.40 or -0.5% US Dollar Index : 80.330 US Dollar Index 21-Mar-14 : 80.250 Change : 0.08 or 0.1% Platinum Price Close Today : 1,404.70 Platinum Price Close 21-Mar-14 : 1,435.50 Change : -30.80 or -2.1% Palladium Price Close Today : 774.10 Palladium Price Close 21-Mar-14 : 788.75 Change : -14.65 or -1.9% Silver and GOLD PRICES argued with each other today. Gold lost 90 cents to $1,293.80 on Comex. Silver rose 8.2 cents to 1977.2 cents. Ratio fell to 65.436 from yesterday's 65.754. Both metals are riding their bottom Bollinger Bands, which increases likelihood of a turnaround. The GOLD PRICE today reached $1,286.10, my target for this move and a 50% correction. The SILVER PRICE hit 1958c yesterday and 1962c today, close enough to call my 1950c target met. After Monday both should turn up and leave y'all scratching your heads and twisting your necks around 180 degrees for that perfect hindsight and saying to yourselves, "I KNEW I should have bought some last week." Bad week for metals, middlin' mediocre week for stocks, might have been a good week for the US dollar. Stocks have been treading water this week, up and down in the same spot, over and under the 20 DMA without being above to make up their mind. S&P500 broke the bottom boundary of an even-sided triangle yesterday, but that breakdown proved false when it reversed today and closed up within the triangle. Dow added 58.83 (0.36%) to close 16,323.06. S&P500 rose 8.58 (0.46%) to 1,857.62. Dow in metals has that feeling of a fly ball reaching the height of its arc. Dow in Gold rose 0.13% to 12.61 oz ($260.67 gold dollars) but leveled off. I am anticipating a turn, since it stands above its 50 DMA (12.36) which means momentum is up. Dow in silver dipped barely down, down 0.09% to 824.81 oz (S$1,066.42 silver dollars. I may be no better than that ox on his way to slaughter who don't know enough to be afraid, but for some reason these rallying Dow in metals don't disturb me. I expected a sharp rally after that long fall, but don't expect this will last much longer. Nasty, filthy, noxious, vile, beastly, foul, loathsome, lousy, mephitic, noisome, odious, scrofulous, scurvy, parasitic -- yea, all these describe fiat dollars, yen, and euros. And I'm just warming up my thesaurus here. US Dollar index is glacially trying to rise. It did manage to stand up off the floor this week, and rose six basis points (0.07%) to 80.33 today. Technically it's trending up, but without any enthusiasm. Euro broke down sure enough this week. Bounced 0.08% today to $1.3753, but it's plumb broken. Next week should cross below its bunched 20, 50, and 62 day moving averages. Yen busted its 50 DMA today, falling to 97.27 cents/y100. Still range-bound, trending sideways. Y'all enjoy your weekend! Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Gold Daily And Silver Weekly Charts - Here Comes April Posted: 28 Mar 2014 01:24 PM PDT |

| Gold Daily And Silver Weekly Charts - Here Comes April Posted: 28 Mar 2014 01:24 PM PDT |

| The Real Reason the U.S. Dollar Has Value Posted: 28 Mar 2014 12:48 PM PDT I was at a conference when I took out a dollar bill and waved it in front of the audience. I asked, "Why does this piece of paper have value?" It's interesting the range of answers I got. One person said "gold," which has nothing to do with it. There was a time when you could demand a fixed weight in gold in exchange for a dollar, but those days are gone. Another said, "You can buy things with it" — an answer that only begs the question why that it so. "Faith," said yet a third. Not quite. The answer is one that (some) economists have known about for a long time. I'll tell you about it below along with three other counterintuitive and seemingly bizarre conclusions about the twisted world of modern money. I don't think you would draw it up this way if you had the chance — but it's the way the system works. Government debt… is a form of savings for the private sector. Tax liabilities give otherwise worthless paper value. The U.S. dollar has value because the government levies $3 trillion in tax liabilities annually and accepts only U.S. dollars in payment — which only it issues. And there is the credible threat of penalties if you don't settle up with dollars. In so doing, the government turns all of us into dollar chasers. It's how a state, any state, can turn worthless pieces of paper into valued currency. "The modern state can make anything it chooses generally acceptable as money," economist Abba Lerner wrote in 1947. "If the state is willing to accept the proposed money in the payment of taxes and other obligations to itself, the trick is done." Brilliantly devious, isn't it? A dollar is, essentially, a tax credit. Economists call this the tax-driven view of money, and it is at least as old as Adam Smith. It is also one of the core principles of Modern Monetary Theory, or MMT. (This is a macroeconomic school of thought that has taken the deep dive into the plumbing of how modern money works.) The principles of MMT have a certain forceful logic. And they can lead to some shocking and uncomfortable conclusions… One example is that government deficits increase financial savings. It sounds outrageous. How can government deficits increase savings? Well, how else is the nongovernment sector supposed to get dollars? The only way is for the government to spend more than it collects — thereby leaving money in the economy. Or think of it this way, as economist Warren Mosler puts it: "When the government spends, only two things can happen to that money… the money can be used to pay taxes, or it isn't used to pay taxes. In which case, somebody out there still has it." So deficit spending equals financial savings at the macro level. Government debt, then, is a form of savings for the private sector. Everywhere there is a Treasury security there is someone who owns it. For that holder, it is a part of his financial wealth, or savings. But aren't government deficits and debt too large? They can be too large, which then causes the dollar to lose value. However, in a fiat currency system, it is natural for the government to be in deficit, because the private sector usually wants to save something. In fact, there is a good argument that any attempt to balance the budget is futile. It will simply lead people to cut spending in an effort to get back to a desired savings level. This also has the effect of contracting the economy and driving tax receipts lower, thereby putting the government back into deficit. The trouble with budget surpluses is they take money out of the economy. That puts pressure on private-sector balance sheets. It may not be so surprising to learn, then, that economic depressions have followed every major surplus in U.S. history. Another conclusion is that Government doesn't need taxes and bond sales to finance spending. Most people think that the government collects taxes and sells bonds to finance its spending. But remember, the government issues dollars. It can't run out. This sounds scary, but it's the naked truth of a fiat currency system. The U.S. government faces zero solvency risk. It can always meet all of its bills. Of course, there are consequences when government spends. If it spends "too much" relative to what dollars can buy and the desire to save, then the dollar can lose value. (Which is what's happened over the last century. I see no reason why this trend will end.) But the government clearly doesn't need to borrow or collect something it issues in order to spend. That's the point. Further, think about it from the beginning: What must a government do before it collects its own money in taxes? It has to spend the money first. That's how people get the dollars to meet the tax. So logically, spending precedes tax collection. There is a classic paper by Stephanie Bell (now Kelton) that demonstrates that "proceeds from taxation and bond sales are technically incapable of financing government spending" and that governments actually finance their spending by creating money directly. (See "Can Taxes and Bonds Finance Government Spending?"). It's a bit technical, but I believe it is correct and I mention it here in case you want to hunt it down. It's free online. There is another key insight that follows from this. The U.S. government never borrows from the Chinese to "finance" its budget deficit. The U.S. government is not at the mercy of foreign creditors. You've surely heard that the U.S. is in debt to China, because China holds some large amount of U.S. Treasury debt. Politicians even used this rhetoric around election time, saying how we are borrowing from the thrifty Chinese to pay for our lavish lifestyle. It's not true. And in fact, it can't be true. Let me cite economist L. Randall Wray, who put it in no uncertain terms: Those who claim that the U.S. government must borrow dollars from thrifty Chinese don't understand basic accounting. The Chinese do not issue dollars — the United States does. Every dollar the Chinese "lend" to the United States came from the United States…. The U.S. government never borrows from the Chinese to "finance" its budget deficit. Again, think through how the Chinese got the dollars. They sold stuff to Americans. Presumably, they did this because they wanted to acquire dollars. That can change, and the foreign exchange value of the dollar will change, too, to reflect the desire of foreigners to hold dollars. But the point I want to make is simply that the U.S. issues dollars; China and other foreign governments do not. Therefore, the U.S. doesn't rely on foreign creditors to finance its spending. As I told you, the world of modern money is a seemingly bizarre world, but it does have its own logic and principles. I've only touched on a few of the most surprising conclusions here. (I would humbly suggest that the best introductory guide to this monetary maze is Wray's Modern Money Theory: A Primer on Macroeconomics for Sovereign Money Systems.) At least you have a good answer why the U.S. dollar has value — albeit, a value that bleeds out over time. It's a currency, not an investment vehicle. Regards, Chris Mayer Ed. Note: As it stands, the US dollar is still incredibly valuable within global financial system. But eventually, that value will drop to zero. It might be 10, 100 or 1,000 years from now. But eventually, the dollar’s dominance will come to an end. Sign up for the FREE Daily Reckoning email edition, right here, to learn how to combat any future decline in the almighty dollar… and what to do in the meantime. |

| People Have No Idea A Terrifying Global Meltdown Is Coming Posted: 28 Mar 2014 12:33 PM PDT  Today Egon von Greyerz told King World News that unsuspecting people around the world have no idea that a terrifying global meltdown is coming, because if they did, there would be panic like we are seeing right now in Japan. Below is what Egon von Greyerz, who is founder of Matterhorn Asset Management out of Switzerland, had to say in this extraordinary interview. Today Egon von Greyerz told King World News that unsuspecting people around the world have no idea that a terrifying global meltdown is coming, because if they did, there would be panic like we are seeing right now in Japan. Below is what Egon von Greyerz, who is founder of Matterhorn Asset Management out of Switzerland, had to say in this extraordinary interview.This posting includes an audio/video/photo media file: Download Now |

| Study Will Show That Gold Is Being Manipulated on the Comex Posted: 28 Mar 2014 09:48 AM PDT "If I were running the manipulation I would be embarrassed at this point, it is so blatant...The regulators have been asleep at the switch." Jim Rickards As an aside, and in case you wondered, I do not take Rickards at face value. I sift what he says, carefully. And that is enough said about that, except that it is good advice in general especially when it comes to money and investments. |

| Gold as a Currency in Your Portfolio Posted: 28 Mar 2014 09:45 AM PDT Director of Investment Research for World Gold Council speaks on gold as currency... JUAN-CARLOS ARTIGAS manages the Global Investment Research team at the World Gold Council, the global authority on gold-related research. Providing oversight of research initiatives related to investor portfolios, he is a regular presenter at industry conferences and is a sought-after speaker for institutional and private investors who seek his expertise on the strategic case for gold. Speaking with me this week in my regular podcast interview, Juan-Carlos and I discussed:

Looking at the size and liquidity of the gold market, "Understanding gold as a currency is easier," said Juan Carlos Artigas. Discover Business Internet Radio with New York Markets Live on BlogTalkRadio "It makes more sense in portfolios when you consider it a currency. We do think that gold stands completely apart from commodities. The gold market is extremely liquid. According to the London Bullion Market Association, gold trades $240 billion a day. To put it in perspective, all of the Dow Jones combined trades at $20 billion a day. Gold trades more than 10 x the Dow in a day. It is not officially a currency but it is treated as such in many cases." Going on, Juan Carlos Artigas of the World Gold Council said that "We don't look at gold in isolation, rather we look at the benefits that gold brings to all investments, stocks, bonds, real estate or other alternatives. We have found through our research that holding 2-10% of gold in a portfolio reduces volatility and losses in times of systemic failure of equity and fixed income markets. "We found that investors holding gold in times of systemic losses alone reduced losses 7.5%..." |

| Gold as a Currency in Your Portfolio Posted: 28 Mar 2014 09:45 AM PDT Director of Investment Research for World Gold Council speaks on gold as currency... JUAN-CARLOS ARTIGAS manages the Global Investment Research team at the World Gold Council, the global authority on gold-related research. Providing oversight of research initiatives related to investor portfolios, he is a regular presenter at industry conferences and is a sought-after speaker for institutional and private investors who seek his expertise on the strategic case for gold. Speaking with me this week in my regular podcast interview, Juan-Carlos and I discussed:

Looking at the size and liquidity of the gold market, "Understanding gold as a currency is easier," said Juan Carlos Artigas. Discover Business Internet Radio with New York Markets Live on BlogTalkRadio "It makes more sense in portfolios when you consider it a currency. We do think that gold stands completely apart from commodities. The gold market is extremely liquid. According to the London Bullion Market Association, gold trades $240 billion a day. To put it in perspective, all of the Dow Jones combined trades at $20 billion a day. Gold trades more than 10 x the Dow in a day. It is not officially a currency but it is treated as such in many cases." Going on, Juan Carlos Artigas of the World Gold Council said that "We don't look at gold in isolation, rather we look at the benefits that gold brings to all investments, stocks, bonds, real estate or other alternatives. We have found through our research that holding 2-10% of gold in a portfolio reduces volatility and losses in times of systemic failure of equity and fixed income markets. "We found that investors holding gold in times of systemic losses alone reduced losses 7.5%..." |

| Gold Mid-Tier Stocks Set for Growth Posted: 28 Mar 2014 09:31 AM PDT In 2014 B2Gold is targeting gold production of 410k ounces from three different mines. This would be record output for this new mid-tier, a whopping 159% increase in volume over just a couple years ago. And with its fourth mine on schedule to pour its first gold in Q4, B2Gold is looking at an annual production rate of 550k+ ounces by this time next year. |

| Man Who Made Legendary Call In Silver Tells KWN What’s Next Posted: 28 Mar 2014 09:17 AM PDT  Two days ago KWN published a piece titled One Of The Greatest Market Calls In History Happened In Silver. This piece received a great deal of attention from readers around the world because it featured the astonishing market calls made by the CEO of Hinde Capital, Ben Davies, in the silver market. The first call was for an upside explosion in the price of silver in August of 2010. The price of silver then soared $32 in a matter of months. Two days ago KWN published a piece titled One Of The Greatest Market Calls In History Happened In Silver. This piece received a great deal of attention from readers around the world because it featured the astonishing market calls made by the CEO of Hinde Capital, Ben Davies, in the silver market. The first call was for an upside explosion in the price of silver in August of 2010. The price of silver then soared $32 in a matter of months.This posting includes an audio/video/photo media file: Download Now |

| Jim Rickards: Study Will Show That Gold Is Being Manipulated on the Comex (Again) Posted: 28 Mar 2014 09:09 AM PDT |

| Jim Rickards: Study Will Show That Gold Is Being Manipulated on the Comex (Again) Posted: 28 Mar 2014 09:09 AM PDT |

| Is Putin Quietly Dumping Russia’s US Treasuries? Posted: 28 Mar 2014 08:20 AM PDT Dear Reader, Because this edition of The Room is bursting at its digital seams, I’ll quickly introduce my three coauthors, then step out of the way. First up is Doug French with a brief history of how Putin has been outmaneuvering the US for longer than you think. Then, Kevin Brekke does some impressive sleuthing to figure out which country just dumped over $100 billion in US debt in one week. Might it be Putin’s doing? And last but not least, I’m happy to announce that Gerald Simmons of California is the winner of the Casey Research Storytelling Contest. You’ll find his winning story—a fine piece of short fiction—below. And don’t forget to check out the Friday Funnies. Let’s get to it… Putin and Obama Play ChessDoug French, Contributing Editor President Obama may have just turned the G8 into the G7 and dismissed Russia as a “regional power,” but this is no Bobby Fischer vs. Boris Spassky. In this geopolitical chess match, the Russian is outmaneuvering the American at every turn. Putin’s antics are nothing new—he’s been quietly undermining the US for over a decade. Let’s examine some of his more successful gambits from the past, and see what they can tell us about the present. Dropping Financial Bombs In 1998, Russia defaulted on $40 billion of domestic debt, forcing the Federal Reserve to engineer a bailout of hedge fund Long Term Capital Management. Three years later, Putin used the distraction of the Olympics to invade US ally Georgia. While the world was focused on the Beijing games, the Russian leader told George W. Bush, “War has started.” But the Georgia invasion was nothing compared to the bomb Russia was dropping on US markets. Treasury Secretary Hank Paulson was in Beijing for a family trip to see the games, but he worried about Fannie and Freddie the whole time, as he was told the Russians had approached the Chinese to work together to dump their Fannie Mae and Freddie Mac shares. In his book On the Brink, Paulson wrote the motivation was “to force the US to use its emergency authorities to prop up these companies.” He went on, “The report was deeply troubling—heavy selling could create a sudden loss of confidence in the GSEs and shake the capital markets. I waited till I was back home and in a secure environment to inform the president.” Of course, Putin spokesman Dmitry Peskov denied the bear raid conspiracy. To this day, the former Treasury secretary claims the two countries never carried out the plan. However, Russia did unload all $65.6 billion of its Fannie and Freddie debt that year. As for the Chinese, Aaron Back reported for the Wall Street Journal in 2011, “China’s selloff of Fannie and Freddie securities in 2008 was widely credited with pushing up mortgage rates in the US at a time Washington was struggling to revive housing sales.” He cited US Treasury data, writing, “China has been steadily selling its holdings of agency securities since mid-2008. It sold a net $24.67 billion worth of agency securities in 2009, and $27.35 billion in the first 11 months of 2010, according to the data.” In the end, less than a month after Paulson was given that information in Beijing, the US government took over Fannie and Freddie and placed them into conservatorship. Putin the Loan Shark How many of the world’s leaders would have the foresight to structure a loan as a private-sector eurobond? One sovereign-debt expert called the structure of Russia’s $3 billion loan to Ukraine “clever.” Here’s why: instead of handing aid money directly to Ukraine, Russia had the Ukrainian government float $3 billion in bonds denominated in euros. Russia then bought the bonds. But that’s not all—the Russians had a provision written into the bond that if the Ukraine’s debt-to-GDP level reached 60%, Russia could call the bonds for immediate payment. Such a qualification in government bonds is very unusual. Mitu Gulati, a sovereign-bond expert, says he has never seen a government bond with a similar debt-to-GDP provision. Most sovereign debt is ‘covenant-lite.’” Today, Ukraine has eurobonds outstanding to several countries, so stiffing only Russia isn’t an option, because it would hurt the price of all their debt. America’s beltway pundits agitating for a large aid package to Ukraine should realize that Putin’s foresight ensures that any US aid money will find its way to Moscow. More Smart Than Lucky After being out of office four years, Putin took over again in 2012. A year later, the Russian president didn’t just say the US was endangering the global economy with its dollar monopoly—he put Russia’s money where his mouth was. Putin made sure the world’s largest oil producer would become the biggest gold buyer as well, adding 570 tonnes in the last ten years, much of it on his watch. “The more gold a country has, the more sovereignty it will have if there’s a cataclysm with the dollar, the euro, the pound, or any other reserve currency,” Evgeny Fedorov, a lawmaker for Putin’s United Russia, said in a telephone interview with Bloomberg. Putin had his central bank start loading up on the yellow metal when the price was just $495 an ounce. This makes him either smarter or luckier than, say, former UK finance minister Gordon Brown, who sold 400 tonnes of the metal when gold traded under $300. It’s safe to say Putin is smarter than your average politician. For instance, Saudi Arabia’s influential intelligence chief, Prince Bandar bin Sultan, met with Putin last year and offered to buy $15 billion worth of arms from Russia in return for Putin abandoning his support of Syria. Bandar even assured Putin that the Saudis would never sign an agreement allowing a gulf state to ship gas through Syria. Putin just laughed. He knows a pipeline through Syria would mean Russia’s Gazprom would lose its European gas business to Qatar. Zero Hedge pointed out last August, “What is shocking in all of this is that Saudi Arabia was so stupid and/or naïve to believe that Putin would voluntarily cede geopolitical control over the insolvent Eurozone, where he has more influence, according to some, than even the ECB or Bernanke. Especially in the winter.” Saudi promises or not, Putin’s no dummy. Europe obtains 30% of its natural gas from Russia and half of that runs through Ukrainian pipelines. Putin’s energy stranglehold is strongest in Eastern Europe, where several individual countries are at Russia’s mercy: Slovakia relies on Russia for 93% of its gas; Poland (83%), Hungary (81%), the Czech Republic (66%), and Austria (61%) are captive customers of Russia, too. Ukraine’s prime minister, Arse Yatsenyuk, says Russia could use energy as a “new nuclear weapon.” As it is, Ukraine is $1.89 billion behind in payments to Russian company Gazprom for gas. Shunned by the West, Putin Looks East Putin has been a laughingstock in the West for spending a reported $60 billion on the Sochi winter games. But while the world was focusing on curling and ice dancing, he was amassing troops at the Crimea border and managed to engineer a bloodless annexation before the Paralympics were over. In response, the most powerful country in the world sanctioned a few Russian individuals and a mid-size bank Putin does business with. This toothless action gave Putin another laugh, and he responded by imposing some sanctions of his own on John Boehner, Harry Reid, and others, as well as 13 Canadians. While Obama and Angela Merkel make nasty noises in Russia’s direction, Reuters reports, “The Holy Grail for Moscow is a natural gas supply deal with China that is apparently now close after years of negotiations. If it can be signed when Putin visits China in May, he will be able to hold it up to show that global power has shifted eastwards and he does not need the West.” “The worse Russia’s relations are with the West, the closer Russia will want to be to China. If China supports you, no one can say you’re isolated,” said Vasily Kashin, a China expert at the Analysis of Strategies and Technologies (CAST) think tank. Russia is also looking to redirect the flow of its oil. “Russia is trying to diversify its energy flows away from its core European markets,” according to Reuters, “with Rosneft leading the race with plans to triple oil flows to China to over 1 million barrels per day in coming years.” Rosneft is the top oil producer in the world and is run by Putin ally Igor Sechin. Sechin wrapped up a recent Asian trip by meeting with the folks at India’s state-run Oil and Natural Gas Corp ONGC, Reliance Industries, an Indian conglomerate, and India’s biggest refiner Indian Oil Corporation. China and India’s combined population is over 2.5 billion. That’s a lot of potential customers. Experience Matters Vladimir Putin worked as a KGB officer stationed in East Germany from 1975 to 1989. While the future Russian president worked the front lines of the Cold War, the future US president was going to high school in Hawaii, followed by college in Los Angeles and New York, before heading to Chicago to become a community organizer. When Putin was instructing his central bank to buy gold, Barack Obama was learning to navigate Capitol Hill as a freshly minted US senator. Obama was on the presidential campaign trail spouting empty campaign slogans when Russia orchestrated the meltdown of Fannie and Freddie. Today, Obama is waging multiple wars around the globe while gumming up the US economy with increased regulation and the highest corporate taxes in the world. Putin? He’s busy selling oil and gas and buying gold. It doesn’t seem like a fair fight. Besides having gold, oil, natural gas, palladium, and any number of other critical natural assets, Russia has improved its government’s finances manyfold while the United States has been borrowing its way to insolvency. Russia’s current debt-to-GDP ratio is 8.4%, after being a reported 57% when it defaulted on its debt. Uncle Sam is going in the opposite direction. US debt to GDP was 60% when Russia defaulted in 1998—now it is over 100%. The bottom line is that Russia is anything but “regional.” Obama should realize Putin’s ground troops are the least of America’s worries. The Russian president’s financial moves are what affect us all. And he’s running circles around Obama in the places it counts—from forging relationships with China and India to his accumulation of gold. You’re probably wondering how to make money while Putin schools the teleprompter-in-chief. Casey Research Chief Economist Bud Conrad penned an excellent piece on Ukraine and Putin in last week’s Dispatch, and it was just an appetizer for his in-depth report coming in the April Casey Report. Click here to take The Casey Report for a risk-free spin, and to get Bud’s upcoming in-depth analysis hot off the digital press. A Few Bumps on the Way to the DumpKevin Brekke, Managing Editor “Fed-watching.” With the emergence of hyper-interventionist US Federal Reserve monetary policy, keeping watch over the Fed’s every move has become a spectator sport within much of the financial community. The vast data universe of statistics published by the Fed is now monitored with near Sherlock Holmes-like scrutiny. The Fed’s menagerie of asset purchases and bond buying programs has launched its balance sheet on a moon shot. By now, most of us are familiar with the story, but to save a thousand words, here’s the picture: In December 2002, the Fed’s holdings totaled US$719 billion. By March 2014, they have grown to US$4.18 trillion. That’s an increase of 480%, the bulk of which has occurred since 2008. The value of the Fed’s assets now exceeds the annual budget of the US federal government. As the balance sheet has continued to balloon, so has unease about how the Fed will eventually unwind and exit its holdings. Even Ben Bernanke expressed concern. “As the balance sheet of the Federal Reserve gets large, managing that balance sheet, exiting from that balance sheet become more difficult,” he said at a Washington press conference last December. Treasury Ownership: Who’s Buying and Selling Aside from the size and fate of the assets on the Fed’s balance sheet, unease also grows about another issue: who will continue to buy all that government paper? The central cog in the series of quantitative easing machinery is the outright purchase of bonds by the Federal Reserve. The purchases were made with the intent to drive down, and keep down, interest rates. That, in turn, meant rates on US Treasury bonds would be suppressed and lower the finance cost of US borrowing. Seemed fine and dandy. But someone has to buy the US debt, and a large slice of debt is held by foreign investors. More to the point, trillions of dollars of US debt is in the hands of foreign governments. The US’s reliance on the kindness of strangers to finance its deficits has alarmed Fed watchers for years. If foreign buyers begin to buy less US debt—commonly referred to as the “dumping” of US debt—that could drive up yields on Treasury paper and seriously impact the US budget and the government’s ability to finance chronic deficit spending. So, investors pay particular attention to the Federal Reserve’s custody holdings. The Federal Reserve summarizes its balance sheet in weekly Statistical Release H.4.1. Within the release is a line item labeled “Marketable US Treasury securities held in custody for foreign official and international accounts.” These are basically US Treasury securities held at the Fed on behalf of foreign central banks. The Statistical Release for the week ending March 12, 2014 sent Fed watchers into speculation overdrive. The release showed that custody holdings fell US$104.5 billion from the prior week. This was the largest weekly decline on record by a wide margin: Speculation is that Russia sold, or “dumped,” billions of dollars in Treasury holdings in response to the sanctions imposed by Western governments over Russian actions in Crimea. Although the wholesale dumping of US debt is possible, it does not look likely on this scale. For one thing, the repatriation of billions of US dollars would require the Central Bank of Russia (CBR) to enter the foreign exchange markets and buy rubles. Not much point for Russia to sell its US bonds, then keep the proceeds in US dollars. The CBR releases its foreign exchange activity with only a two-day lag. For the week prior to the Fed’s Statistical Release that revealed the big drop in foreign holdings, the CBR only bought US$11.1 billion of rubles. That doesn’t even come close to smoking-gun type of evidence. We’ll Gladly Pay You Tuesday for Custodial Services Today Another line of inquiry leads us to the Treasury International Capital (TIC) statistics. Here, too, like the custody holdings stats from the Fed, we can find data on foreign holders of US Treasury securities. The bonus is that the TIC data is further sorted into Treasury holdings by country. The downside is that TIC data is published with a six-week lag. Nevertheless, the TIC data are instructive. And by that, I mean they will reveal the hazards in an attempt to use either the Fed’s custody holdings or TIC data to draw conclusions about who’s dumping or accumulating US debt. Let’s take a look. The latest TIC data is for the period that ends January 2014. Of particular interest is that it shows a US$30.7 billion month-on-month rise in foreign holdings of Treasury securities from December 2013 to January 2014. In contrast, the Fed’s custody holdings data show a fall of US34.5 billion over the same time frame. That is a not-so-insignificant discrepancy of US$65.2 billion that roughly equals the total Treasury holdings of Germany. There are two simple explanations for this. The first is that the two data sets use different criteria to calculate the holdings. The Treasury website explains the difference quite well, and you can explore the details here. The express version is summed up nicely in this excerpt under Questions on foreign holdings of US Treasury Securities and Foreign Official holdings: “Differences in coverage: The most important reason for differences between holdings reported in the TIC and the FRBNY custody accounts is that reporting coverage differs. First, not all foreign official holdings of Treasury securities as reported by the TIC system are held at FRBNY. In particular, Treasury securities held by private custodians on behalf of foreign official institutions are included in the TIC but not in the FRBNY figures. In this sense, the coverage of the TIC system is broader than that of the FRBNY custody holdings. Second, the custody holdings at FRBNY include securities held for some international organizations as well as for foreign official institutions. In this sense, the coverage of the FRBNY custody holdings is broader than the foreign official designation in the TIC system.” The Putin Punt The second and most probable cause of a discrepancy is the nature of the custody system. Both the TIC and Fed custody holdings only measure Treasuries held in US custody. A foreign government can opt to hold its US Treasury securities with the central bank of a foreign government other than the US. An arrangement like this can mean that the foreign holding may not appear on either the TIC or Fed custody holdings. Further, a foreign government can acquire Treasury securities from a private foreign entity where the transaction occurs on a foreign securities exchange, and the security is held outside the US. Here again, the foreign holding may not appear in US data, or it could appear as a holding by the custodial government. Either way, it skews or corrupts the US data. The first example is what might have happened with any presumed Russia “selling.” Russia could have moved its Treasury holdings out of the US and into foreign custody. This would account for the large drop in the March US data. And there is evidence that suggests where the securities may have gone. Belgium is a small country. Its GDP and foreign-currency reserves are about US$420 billion and US$29 billion, respectively. Yet, its Treasury holdings are reported at US$310 billion as of January 2014—and the size of its holdings has nearly doubled since August 2013. That positions it as the world’s third-largest holder of US debt, right behind China and Japan. This lopsided Treasury-holdings-to-GDP ratio strongly suggests that Belgium is in the custodial business. Again, this is a “may have” scenario. But what we do know for sure is that wherever the Russian securities may be, Russia had ample incentive to move its stash out of the US. Coincidentally, the US Department of the Treasury also houses the Office of Foreign Assets Control that administers the Posted: 28 Mar 2014 08:04 AM PDT |

| The Accidental End to Silver Price Manipulation Posted: 28 Mar 2014 07:15 AM PDT It should be clear now to most precious metals observers that gold and silver price manipulation is just as common to the metals as it is to every other asset class. And equally evident should be the realization that resolution will not come from organized efforts. Be it regulation or legal class action, market forces will more than likely assert themselves. With silver (and gold to less of a degree), it's strictly "look the other way" from a regulatory stand point. The greater market and public don’t seem to care, and are not at all aware that they should. |

| Gold Bullion Drops for 2nd Week After Near-Record Run, Shanghai Discount "Says China Demand Slowing" Posted: 28 Mar 2014 07:15 AM PDT GOLD BULLION prices bounced from new 6-week lows beneath $1290 per ounce Friday lunchtime in London, heading for a second weekly drop after rising 6 weeks running – a feat seen only 65 times since 1968. The Dollar price of gold has beaten that stretch of week-on-week gains only 10 times in the last 46 years. US Treasury bonds also fell for a second week Friday, nearing as did gold bullion the first monthly loss of 2014. World stock markets ticked higher together with crude oil and copper prices. A near-record UK current account deficit for end-2013 failed to dent the British Pound on the currency markets, helping the Sterling price of gold bullion drop to last June's crash low of £774 per ounce. Silver prices meantime whipped around $19.80 per ounce, losing some 2.5% for the week. "We may be looking at extended consolidation above $1274" in gold bullion, Reuters quotes Phillip Futures analyst Joyce Liu. Calling it "a key technical level that offered strong resistance when prices were on the ascent in January," that $1274 level "may prove strong support now as prices decline" Liu says. But the gap between London and Shanghai gold prices – "an important indicator" according to ANZ analyst Victor Thianpiriya of demand in China, the world's heaviest consumer market – held at a discount for the fourth day running. Closing $4.50 per ounce below the international benchmark of London settlement, spot prices on the Shanghai Gold Exchange "suggest that the demand in China is slowing," says Thianpiriya, "and we have certainly see that through our physical volumes as well.'' New data meantime showed fresh deflationary pressures across the 18-nation Eurozone, with import prices to Germany falling in February and consumer inflation turning negative in Spain this month But consumer confidence on the European Central Bank's survey has jumped to its strongest level since mid-2011, separate data showed Friday, "strengthen[ing] the hands of the hawks," reckons ING Bank analyst Martin van Vliet, ahead of next week's ECB policy vote. US central bank policymaker Charles Evans of the Chicago Fed said in a speech in Hong Kong Friday that low inflation and high unemployment should delay any Dollar rate-rise until mid-2015 But St.Louis Fed president James Bullard calls for rates as high as 4.25% by end-2016 speaking to Reuters. "You have to keep in mind I tend to be a more optimistic member of the committee," Bullard told Reuters Insider TV. Meantime in Ankara, the government of Turkey – the world's 4th heaviest gold bullion buying nation – called yesterday's leak of video showing senior officials discussing possible military action in neighboring Syria "villainous" and a "declaration of war" by opposition politicians, and added YouTube to its block on Twitter. |

| Golden Opportunity Coming in Silver Posted: 28 Mar 2014 07:02 AM PDT Silver has been in a bear market for almost three years and the recent lack of strength suggests the metal could be headed for new lows. New lows are always bearish until the last one. Our technical work suggests that we should watch for a final low and end to the bear market in the coming months. |

| Silver, Buffett & the Hunt Brothers Posted: 28 Mar 2014 06:46 AM PDT Bullion Vault |

| Max Keiser: The Dollar is Done! Posted: 28 Mar 2014 06:39 AM PDT Max Keiser breaks down the days of the american dollar and how bad it will get when it does fully collapse. The banks need money to fund their covert wars - after all, these wars are all about making more money on their Beast stockless market - which they seem to live for. The dead bankers either... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

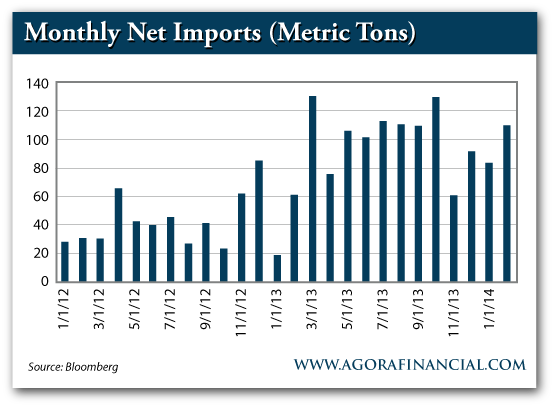

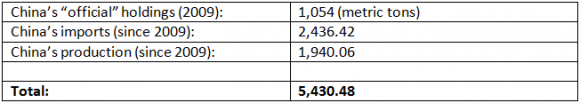

| 3 Pieces to China’s Gold Puzzle Posted: 28 Mar 2014 06:00 AM PDT 5,430.48… That's the number you should concentrate on today, and for the next nine months. It's a specific number, to be sure. But it's as important a number as you'll see in today's gold market. And if you've been waiting for the next leg higher in precious metals, you'll want to keep an eye on those all-important digits — especially in the next nine months. Here's why… "China's gold imports from Hong Kong rose in February," Bloomberg reported this week. Net imports calculated by Bloomberg are a roundabout way of following the gold trail to China. Since the Middle Kingdom doesn't report its gold total officially, the Hong Kong numbers are our best guess of the gold flowing into China's borders. According to the most recent monthly data, "Net imports totaled 109.2 metric tons [in February], compared with 83.6 tons in January and 60.9 tons a year earlier." The big takeaway here is that China is continuing to steadily accumulate gold. It's something we've covered in these pages a bunch — in fact, I'm on record telling you that this will be the biggest gold story of the decade. Simply put, if you're interested in gold, you MUST be interested in the story developing out of China. The numbers revealed in the chart above are huge. Just in that graphic alone — a two-year snapshot — China has more than doubled its gold holdings. But the more important number is 5,430.48. By my calculation, China is now "officially" holding 5,430.48 metric tons of gold. Beyond the 1,054 metric tons that China owns up to holding, that's an added 4,376 metric tons! That total easily places China as the second largest gold holder in the world (second only to the U.S. — if you believe Fort Knox has gold and not a stack of IOUs). China isn't slowing down, either. And as I'll show you in a moment, this could be the next big catalyst to spur gold prices higher. How soon? I believe we're going to see this come to a point less than nine months from today. First, though, let's clear up some math — because we know the Chinese won't do it for us!

So there you have it: "But Matt, why do you keep referencing 2009?" you may ask. Good question! The last time China announced its official gold holding was back in 2009 (April, I believe). And the time before that was 2003, when they announced they had 600 metric tons. If you follow the pattern, the next six-year gold announcement is due in 2015. Coincidentally, that's the same year that China wants to have its currency (the yuan) fully convertible. (Fully convertible in this sense means their currency will be liquid and tradable just like all other major currencies, including the dollar.) So 2015 is your huckleberry. That's the year I believe China will splash the gold world with a huge announcement. An announcement that could light a fire under gold prices. And regardless of the precise date we think they'll announce their holdings, the real importance is the fact that the Chinese are HOARDING GOLD in a strategic concerted effort to strengthen their currency and put it on the world market to compete with other major currencies, including the U.S. dollar. To sum it up, here's a great comment I received from David H. on a past article about China's gold: "The Chinese have a 100-year plan; the U.S. has a 100-day plan." I couldn't have said it better. China is a strategic nation, much like Russia. Only instead of getting into a "hot" war with the U.S., they may go for a currency war. While the U.S. continues to rack up debt and print U.S. dollars, keep an eye out for China's big announcement. And in the next nine months, keep any eye on your favorite gold investments. Keep your boots muddy, Matt Insley P.S. Now may be a good time to check out your favorite gold investments — the big miners and some of the small guys. For a look back at some of our favorites, simply sign up for the FREE Daily Resource Hunter, right here. This article originally appeared in Daily Resource Hunter. |

| Silver, Buffett & the Hunt Brothers Posted: 28 Mar 2014 03:36 AM PDT Warren Buffett took a shine to silver. So did the Hunt brother oil barons... WHY have there been two major corners of the silver market in recent history? asks Miguel Perez-Santalla at BullionVault. In 1980, the year I started working in the marketplace, the price of silver had reached $50 per ounce, only to collapse a few days later. The Hunt brothers, two oil baron brothers with powerful financial means, were behind much of the rise in the market at that time. In a book by Stephen Fay, entitled Beyond Greed, the author writes the story of this incident. According to the evidence, Nelson Bunker led his brother Herbert Hunt – along with friends from the Middle East – in conspiring to make the price of silver rise by purchasing over 280 million ounces, estimated by Fay as 80% of 1979's entire global mine output, worth some $14 billion at that peak price. The Hunts made business arrangements to hide their activity under other names. They believed in the value of silver, and they desired to accumulate as much as possible and by any means. In my eyes they did so without regard of others. Yet this was at a significant risk to them, because they were buying both the futures and physicals. So was their attempted corner unjust? After all, they were trading within the market rules of the time. But they got greedy and used any resources to extend their reach. Once the gig was up, and it was known that the Hunts were heavily leveraged through their structured business alliances, the bankers joined forces with the commodities exchange, the Comex, and the Federal Reserve to change the rules. Once the rules were changed the calamitous collapse of the silver price and the destruction of the Hunt brother's' corner ensued. Since every loser on a futures contract must be matched by a winner, Bunker Hunt was convinced that the bankers and regulators involved with ending the corner profited greatly. But whatever the truth there, the Hunts would have been much more successful had they taken their profit sooner, before the price they demanded reached levels that affected industry and the average consumer. At that point authorities get involved to correct the distortion. Because the silver market is much smaller than the gold market, the corner is a temptation that is almost irresistible to a big player. Even if cornering the silver market is not the intent. In the late 1990s renewed buying of physical silver ensued. It began through a large trading firm by a major investor, Warren Buffett's Berkshire Hathaway (ticker: BRK), which accumulated nearly 130 million ounces from 1997 to early 1998. The market price rose sharply as this news broke, however it did not make the kind of price moves that would shock the public as the Hunts corner had. Though the quantity purchased was large, silver production had increased since 1980 and the price had not reacted to the same extent. Additionally, the economic reality at that time was of a booming US economy, where people felt less need of silver as a safe haven investment. In general, market participants were surprised by the price moves in silver. It did not break any records; it just broke other investor's trades. Silver moved from slightly above the $4 level to nearly a $7 price tag. Bad for industries that use silver, and because it did have an adverse effect on other investment manager's financial positions, this price rise was brought to the attention of the authorities. One of these investment managers was Martin Armstrong of Princeton Economics International, who apparently had been selling short the silver market. His business became unraveled by the constant buying and rising price that he did not foresee. At the request of investigators the large participants were asked to reveal their intentions. It became clear that no crime was committed unless buying silver was made illegal. But unfortunately for Mr. Armstrong he had opened a can of worms. In the process of the investigation it was discovered that the money he used to sell short leveraged silver futures was from an alleged Ponzi scheme, perpetrated through his company's business. Armstrong was convicted for fraud and imprisoned for many years. He is currently a free man, and claims his innocence and that bigger fish who should have been prosecuted were left unscathed. Did Berkshire Hathaway manipulate the silver market, or were they just investors looking for a long term stake in this hard asset? A common point given to prove the benign intent of their position was its small size compared to the rest of BRK's portfolio – only 2% of the company's entire holdings. It was said that if the price of Coca Cola shares had dropped $5 at the time, it would have been a more significant loss to them than if silver went to zero dollar value. The point is that silver is more at risk of volatility, and attempted corners or squeezes, than its big brother gold. The principal reason is the volume of money ordinarily in the market place. Latest data from the London bullion market, where Warren Buffett took delivery of physical silver bars for Berkshire Hathaway's late 1990s' investment, says gold trading outdoes silver trading more than 9-fold by Dollar value on average. In the US Comex futures market, where the Hunt brothers got burnt having leveraged their position with borrowed money, the value of open interest – the amount of outstanding contracts – ended February 3 times greater in gold than in silver. Liquidity is a reference to this actual market size. The more people or businesses putting more money through a market, the easier and faster it is to buy and sell larger volumes without affecting the market price. Because the silver market is so small there are participants that will take the risk that they can make a big win in this game by taking a rather large stake whether by selling it short or buying the metal. Some win and some lose and some are big enough to cause the move. But in the end the real reason we see someone take a big shot in the silver market every so often is because they think they can make money doing it. |

| Silver, Buffett & the Hunt Brothers Posted: 28 Mar 2014 03:36 AM PDT Warren Buffett took a shine to silver. So did the Hunt brother oil barons... WHY have there been two major corners of the silver market in recent history? asks Miguel Perez-Santalla at BullionVault. In 1980, the year I started working in the marketplace, the price of silver had reached $50 per ounce, only to collapse a few days later. The Hunt brothers, two oil baron brothers with powerful financial means, were behind much of the rise in the market at that time. In a book by Stephen Fay, entitled Beyond Greed, the author writes the story of this incident. According to the evidence, Nelson Bunker led his brother Herbert Hunt – along with friends from the Middle East – in conspiring to make the price of silver rise by purchasing over 280 million ounces, estimated by Fay as 80% of 1979's entire global mine output, worth some $14 billion at that peak price. The Hunts made business arrangements to hide their activity under other names. They believed in the value of silver, and they desired to accumulate as much as possible and by any means. In my eyes they did so without regard of others. Yet this was at a significant risk to them, because they were buying both the futures and physicals. So was their attempted corner unjust? After all, they were trading within the market rules of the time. But they got greedy and used any resources to extend their reach. Once the gig was up, and it was known that the Hunts were heavily leveraged through their structured business alliances, the bankers joined forces with the commodities exchange, the Comex, and the Federal Reserve to change the rules. Once the rules were changed the calamitous collapse of the silver price and the destruction of the Hunt brother's' corner ensued. Since every loser on a futures contract must be matched by a winner, Bunker Hunt was convinced that the bankers and regulators involved with ending the corner profited greatly. But whatever the truth there, the Hunts would have been much more successful had they taken their profit sooner, before the price they demanded reached levels that affected industry and the average consumer. At that point authorities get involved to correct the distortion. Because the silver market is much smaller than the gold market, the corner is a temptation that is almost irresistible to a big player. Even if cornering the silver market is not the intent. In the late 1990s renewed buying of physical silver ensued. It began through a large trading firm by a major investor, Warren Buffett's Berkshire Hathaway (ticker: BRK), which accumulated nearly 130 million ounces from 1997 to early 1998. The market price rose sharply as this news broke, however it did not make the kind of price moves that would shock the public as the Hunts corner had. Though the quantity purchased was large, silver production had increased since 1980 and the price had not reacted to the same extent. Additionally, the economic reality at that time was of a booming US economy, where people felt less need of silver as a safe haven investment. In general, market participants were surprised by the price moves in silver. It did not break any records; it just broke other investor's trades. Silver moved from slightly above the $4 level to nearly a $7 price tag. Bad for industries that use silver, and because it did have an adverse effect on other investment manager's financial positions, this price rise was brought to the attention of the authorities. One of these investment managers was Martin Armstrong of Princeton Economics International, who apparently had been selling short the silver market. His business became unraveled by the constant buying and rising price that he did not foresee. At the request of investigators the large participants were asked to reveal their intentions. It became clear that no crime was committed unless buying silver was made illegal. But unfortunately for Mr. Armstrong he had opened a can of worms. In the process of the investigation it was discovered that the money he used to sell short leveraged silver futures was from an alleged Ponzi scheme, perpetrated through his company's business. Armstrong was convicted for fraud and imprisoned for many years. He is currently a free man, and claims his innocence and that bigger fish who should have been prosecuted were left unscathed. Did Berkshire Hathaway manipulate the silver market, or were they just investors looking for a long term stake in this hard asset? A common point given to prove the benign intent of their position was its small size compared to the rest of BRK's portfolio – only 2% of the company's entire holdings. It was said that if the price of Coca Cola shares had dropped $5 at the time, it would have been a more significant loss to them than if silver went to zero dollar value. The point is that silver is more at risk of volatility, and attempted corners or squeezes, than its big brother gold. The principal reason is the volume of money ordinarily in the market place. Latest data from the London bullion market, where Warren Buffett took delivery of physical silver bars for Berkshire Hathaway's late 1990s' investment, says gold trading outdoes silver trading more than 9-fold by Dollar value on average. In the US Comex futures market, where the Hunt brothers got burnt having leveraged their position with borrowed money, the value of open interest – the amount of outstanding contracts – ended February 3 times greater in gold than in silver. Liquidity is a reference to this actual market size. The more people or businesses putting more money through a market, the easier and faster it is to buy and sell larger volumes without affecting the market price. Because the silver market is so small there are participants that will take the risk that they can make a big win in this game by taking a rather large stake whether by selling it short or buying the metal. Some win and some lose and some are big enough to cause the move. But in the end the real reason we see someone take a big shot in the silver market every so often is because they think they can make money doing it. |

| Silver, Buffett & the Hunt Brothers Posted: 28 Mar 2014 03:36 AM PDT Warren Buffett took a shine to silver. So did the Hunt brother oil barons... WHY have there been two major corners of the silver market in recent history? asks Miguel Perez-Santalla at BullionVault. In 1980, the year I started working in the marketplace, the price of silver had reached $50 per ounce, only to collapse a few days later. The Hunt brothers, two oil baron brothers with powerful financial means, were behind much of the rise in the market at that time. In a book by Stephen Fay, entitled Beyond Greed, the author writes the story of this incident. According to the evidence, Nelson Bunker led his brother Herbert Hunt – along with friends from the Middle East – in conspiring to make the price of silver rise by purchasing over 280 million ounces, estimated by Fay as 80% of 1979's entire global mine output, worth some $14 billion at that peak price. The Hunts made business arrangements to hide their activity under other names. They believed in the value of silver, and they desired to accumulate as much as possible and by any means. In my eyes they did so without regard of others. Yet this was at a significant risk to them, because they were buying both the futures and physicals. So was their attempted corner unjust? After all, they were trading within the market rules of the time. But they got greedy and used any resources to extend their reach. Once the gig was up, and it was known that the Hunts were heavily leveraged through their structured business alliances, the bankers joined forces with the commodities exchange, the Comex, and the Federal Reserve to change the rules. Once the rules were changed the calamitous collapse of the silver price and the destruction of the Hunt brother's' corner ensued. Since every loser on a futures contract must be matched by a winner, Bunker Hunt was convinced that the bankers and regulators involved with ending the corner profited greatly. But whatever the truth there, the Hunts would have been much more successful had they taken their profit sooner, before the price they demanded reached levels that affected industry and the average consumer. At that point authorities get involved to correct the distortion. Because the silver market is much smaller than the gold market, the corner is a temptation that is almost irresistible to a big player. Even if cornering the silver market is not the intent. In the late 1990s renewed buying of physical silver ensued. It began through a large trading firm by a major investor, Warren Buffett's Berkshire Hathaway (ticker: BRK), which accumulated nearly 130 million ounces from 1997 to early 1998. The market price rose sharply as this news broke, however it did not make the kind of price moves that would shock the public as the Hunts corner had. Though the quantity purchased was large, silver production had increased since 1980 and the price had not reacted to the same extent. Additionally, the economic reality at that time was of a booming US economy, where people felt less need of silver as a safe haven investment. In general, market participants were surprised by the price moves in silver. It did not break any records; it just broke other investor's trades. Silver moved from slightly above the $4 level to nearly a $7 price tag. Bad for industries that use silver, and because it did have an adverse effect on other investment manager's financial positions, this price rise was brought to the attention of the authorities. One of these investment managers was Martin Armstrong of Princeton Economics International, who apparently had been selling short the silver market. His business became unraveled by the constant buying and rising price that he did not foresee. At the request of investigators the large participants were asked to reveal their intentions. It became clear that no crime was committed unless buying silver was made illegal. But unfortunately for Mr. Armstrong he had opened a can of worms. In the process of the investigation it was discovered that the money he used to sell short leveraged silver futures was from an alleged Ponzi scheme, perpetrated through his company's business. Armstrong was convicted for fraud and imprisoned for many years. He is currently a free man, and claims his innocence and that bigger fish who should have been prosecuted were left unscathed. Did Berkshire Hathaway manipulate the silver market, or were they just investors looking for a long term stake in this hard asset? A common point given to prove the benign intent of their position was its small size compared to the rest of BRK's portfolio – only 2% of the company's entire holdings. It was said that if the price of Coca Cola shares had dropped $5 at the time, it would have been a more significant loss to them than if silver went to zero dollar value. The point is that silver is more at risk of volatility, and attempted corners or squeezes, than its big brother gold. The principal reason is the volume of money ordinarily in the market place. Latest data from the London bullion market, where Warren Buffett took delivery of physical silver bars for Berkshire Hathaway's late 1990s' investment, says gold trading outdoes silver trading more than 9-fold by Dollar value on average. In the US Comex futures market, where the Hunt brothers got burnt having leveraged their position with borrowed money, the value of open interest – the amount of outstanding contracts – ended February 3 times greater in gold than in silver. Liquidity is a reference to this actual market size. The more people or businesses putting more money through a market, the easier and faster it is to buy and sell larger volumes without affecting the market price. Because the silver market is so small there are participants that will take the risk that they can make a big win in this game by taking a rather large stake whether by selling it short or buying the metal. Some win and some lose and some are big enough to cause the move. But in the end the real reason we see someone take a big shot in the silver market every so often is because they think they can make money doing it. |