saveyourassetsfirst3 |

- China gold accumulation and macro-economic gold trends – Rickards

- Silver cautiously waiting for gold to move higher

- Total gold holdings in stark contrast to past decades and should change - WGC

- You may not believe what Obama just said about Russia and Ukraine

- JIM RICKARDS SHOCKER: CHINA IS IMPORTING GOLD SECRETLY USING MILITARY CHANNELS, Will Announce Over 5k Tons of Gold in 2015!

- HPEV, Inc.: Small Cap Growth With Big IP

- 29-Year-Old Welfare Parasite Would Not Accept An $80,000 A Year Job

- Potash Power Plays: Rio Tinto's Big Blunder Puts Spotlight On Western Potash

- Another Voice On The Dollar Vs. Yen And Euro Discussion

- Welcome to the Currency War, Part 14: Russia, China, India Bypass the Petrodollar

- A COMEX GOLD MANIPULATED HIT VISUALIZED

- A Comex Gold Manipulated Hit Visualized

- ECB Chatter Weakens Euro; Dollar Rises

- Chinese Gold Demand Hits 488 tons YTD, Up 29 %!

- CalPERS’ Private Equity Scandals and the Steptoe & Johnson Report Whitewash

- Be Right & Sit Tight!

- Jim Sinclair: Yellen To Get A Shock Of A Lifetime, Will Respond With Hyper QE of $4 Trillion!

- Eric Holder Has Spent Millions of Taxpayer Dollars on Unreported Personal Travel

- Steve Sjuggerud: This was the worst mistake of my career... and it's happening again right now

- 10 oz Silver Bars As Low As 59 Cents Over Spot at SDBullion!

- Russia to launch its payment system in months, as disruption fears mount

- Russia Raises Gold Holdings By 7.247 Tonnes To Over 1,040 Tonnes In February

- Pakistan Gold imports up 59.26% in Jul Feb: PBS

- India flush with gold smugglers

- Russia raises gold holdings

- Gold demand surge in China

- Russia Raises Gold Holdings By 7.247 Tonnes To Over 1,040 Tonnes In February

- The crisis in Ukraine could have a silver lining for these investors

- China’s Monthly Gold Imports Through Hong Kong Jump 30% to 109.2 Tonnes in February

- Four King World News Blogs

- Kinross Asks Canada for ‘Balanced Approach’ on Russia

- Iraq Buys Massive 36 Tonnes of Gold in March

- China’s monthly gold imports jump 30% to 109.2 tonnes in February

- Lawrence Williams: China/Hong Kong gold imports accelerating - 109 tonnes in February

- Chris Powell: Gold market manipulation update, March 2014

- Jeff Killeen: A Picky Player's Guide to a Cautiously Optimistic Mining Market

- Invasion of the Data Snatchers, Big Data and the Internet of Things Means the Surveillance of Everything

- Yanis Varoufakis: Think Big, Think Bold – A Green New Deal

- Gold?s Macro Fundamentals

- Silver Update: Debt Destruction

- US budget deficit and debts still factors that could lift gold prices much higher

- As Predicted, IRS Deems Bitcoin to be Property, Limiting Its Usefulness in Commercial Transactions

- Gold advances on technical support as investors weigh Ukraine

- Gold Testing the Medium Term Key Moving Averages on This Pullback

- Gold Carnage Takes a Break

- Five Reasons Gold Has Been Dropping and The Most Likely Reason of All is # 5

- Marshall Swing: MASSIVE Short Buying in Gold As Cartel Getting Very Ready to do Something Big!

- march 25/GLD drops by 2.7 tonnes of gold/SLV constant/gold holds/silver falls a bit/Anarchy in the Ukraine/

- Gold’s Macro Fundamentals

- Gold Daily and Silver Weekly Charts - Option Expiration Tomorrow

| China gold accumulation and macro-economic gold trends – Rickards Posted: 26 Mar 2014 06:58 PM PDT Interview with Jim Rickards who believes China is accumulating substantial gold reserves – some through military channels – and notes that gold protects against both inflation and deflation. | ||||||||||||||||||||||||

| Silver cautiously waiting for gold to move higher Posted: 26 Mar 2014 02:52 PM PDT Julian Phillips says the gold price appears to have found a 'bottom' but a few more days are needed to see if this is so. | ||||||||||||||||||||||||

| Total gold holdings in stark contrast to past decades and should change - WGC Posted: 26 Mar 2014 01:34 PM PDT The World Gold Council says that the ballooning of financial assets over the last 20 years and the current market environment should have investors reviewing the advantages of gold in their portfolios. | ||||||||||||||||||||||||

| You may not believe what Obama just said about Russia and Ukraine Posted: 26 Mar 2014 01:09 PM PDT From Bloomberg: President Barack Obama said indifference to Russia's attempt to unilaterally redraw the boundaries of Ukraine would ignore the lessons that are written in the cemeteries for the dead in two world wars. The U.S. and Europe are at "a moment of testing," as Russia challenges the ideals of democracy, free markets and international law that have spread peace and prosperity, Obama said in a speech at Palais des Beaux-Arts in Brussels. "Once again, we are confronted with the belief that bigger nations can bully smaller ones to get their way, that recycled maxim that might makes right," he said."So I come here today to insist that we must never take for granted the progress that has been won here in Europe." Obama is in Europe to rally allies in opposition to Russia's annexation of Crimea and troop buildup along the Ukrainian border, the most tense standoff involving the NATO alliance since the collapse of the Soviet Union. He cast the confrontation as a battle between 21st Century ideals and "the old way of doing things." The situation in Ukraine has neither an easy answer nor a military solution, Obama said. Even so, he said, every member of the North Atlantic Treaty Organization "must step up and carry its share of the burden" of the alliance's defense and its role in maintaining international security. "We must meet the challenge to our ideals – to our very international order – with strength and conviction," Obama said in the speech. Sending Message Failure "would allow the old way of doing things to gain a foothold in this young century. And that message would be heard – not just in Europe – but in Asia and the Americas; in Africa and the Middle East," he said. Obama rejected Russia's assertion that the invasion of Iraq and military intervention in the former Yugoslavia show NATO's hypocrisy. He noted his own opposition to the Iraq war and said the U.S. sought to work within the international system. "We did not claim or annex Iraq's territory, nor did we grab its resources for our own gain," he said. "Instead, we ended our war and left Iraq to its people and a fully sovereign Iraqi state could make decisions about its own future." The U.S. and European Union have imposed financial sanctions on Russian and Ukrainian officials as well associates of Russian President Vladimir Putin, leaving open the threat of broader sanctions targeting the Russian economy. Market Reaction As Obama spoke, U.S. stocks fell, erasing earlier gains, on investor concern that the conflict may escalate. The Standard & Poor's 500 lost 0.3 percent to 1,859.63 at 1:49 p.m. in New York, after earlier climbing to within three points of its record closing level reached March 7. Before the speech, Russian markets rebounded to levels seen before Putin's decision to annex Ukraine's Crimea region. The benchmark Russian Micex Index climbed 1.9 percent to 1,349.39, the highest since March 5 by the close, though it is down 10 percent this year. European governments, faced with youth unemployment rates above 50 percent in some southern-tier countries, are debating the costs. Banking curbs would hurt Britain, an arms embargo would bar France from selling Mistral-class helicopter carriers to the Kremlin, and cutbacks in purchases of Russian gas would harm a swathe of EU countries, starting with Germany. More on the crisis in Ukraine: Ukraine BOMBSHELL: Leaked conversation could set off a full-blown war Emerging markets insider: In a way, the U.S. just declared sanctions on all Russian stocks Cold War 2.0? Obama just "ordered" a huge new list of sanctions on Russia | ||||||||||||||||||||||||

| Posted: 26 Mar 2014 01:00 PM PDT

There are many estimates of official and non-official accumulation of gold in China. The truth is that no one knows the exact number because China is non-transparent about the total amount of gold coming into the country and its own mining output, and it is not-transparent about how much of that gold goes for personal [...] The post JIM RICKARDS SHOCKER: CHINA IS IMPORTING GOLD SECRETLY USING MILITARY CHANNELS, Will Announce Over 5k Tons of Gold in 2015! appeared first on Silver Doctors. | ||||||||||||||||||||||||

| HPEV, Inc.: Small Cap Growth With Big IP Posted: 26 Mar 2014 12:00 PM PDT Great things appear to be happening at HPEV, Inc. (OTCQB: OTCQB:WARM). The stock started to move in late November after publishing favorable, third party test results of their patented thermal dispersion technology. The stock was steadily accumulated for three months before breaking out in March on repeated record volume sessions. The expected retracement was short lived as the stock bounced hard after falling below a dollar intraday. It has been trending upward with a steady increase in both price and volume as investors begin to grasp the potential of this company. Their recently filed investor presentation implies good things may be in store for investors in this relatively unknown company. (click to enlarge) Why HPEV? Three Paths to Revenue with a Common Theme HPEV currently lists three main paths to revenue:

| ||||||||||||||||||||||||

| 29-Year-Old Welfare Parasite Would Not Accept An $80,000 A Year Job Posted: 26 Mar 2014 12:00 PM PDT

What should be done with a 29-year-old welfare parasite that believes that in addition to practicing with his rock band, his main job in life is to “make sure the sun’s up and the girls are out”? Most people that receive government assistance truly need the help and do not abuse the system, but there [...] The post 29-Year-Old Welfare Parasite Would Not Accept An $80,000 A Year Job appeared first on Silver Doctors. | ||||||||||||||||||||||||

| Potash Power Plays: Rio Tinto's Big Blunder Puts Spotlight On Western Potash Posted: 26 Mar 2014 11:39 AM PDT

The vaulting ambition of Rio Tinto to become a global potash producing powerhouse has been thrown an unexpected curveball. And it's one that could prove hugely embarrassing for one of the world's biggest and most successful mining companies. I'm talking about a serious strategic blunder that may also prove to be an absolute godsend to its tiniest rival. While recently investigating potential M&A synergies between several aspiring new market entrants in Saskatchewan's multi-billion dollar potash mining business, I made a startling discovery. And unfortunately for Rio Tinto (RIO) and its Russian joint venture partner, JSC Acron, it's a shocking oversight. In fact, it's one that may seriously complicate plans to commercialize what's being hailed by the Russian fertilizer giant | ||||||||||||||||||||||||

| Another Voice On The Dollar Vs. Yen And Euro Discussion Posted: 26 Mar 2014 11:30 AM PDT By Jeremy Schwartz Recently, I spoke with Ray Farris, Head of Asia Pacific Macro Products Research at Credit Suisse, about his outlook for the major currencies against the U.S. dollar. Here are some highlights of our discussion:

Ray, what do you think will be the main drivers of the U.S. dollar against the yen and euro over the coming months? Historically, we are not yet at a part of the Fed cycle which would generally argue for a strong | ||||||||||||||||||||||||

| Welcome to the Currency War, Part 14: Russia, China, India Bypass the Petrodollar Posted: 26 Mar 2014 10:58 AM PDT As it tries to punish Russia for the latter’s dismemberment of Ukraine, the West is discovering that the balance of power isn’t what it used to be. Russia is a huge supplier of oil and gas — traded in US dollars — which gives it both leverage over near-term energy flows and, far more ominous for the US, the ability to threaten the dollar’s rein as the world’s reserve currency. And it’s taking some big, active steps towards that goal. As Zero Hedge noted on Tuesday:

To understand why trade deals between Russia, China and India are potentially huge, a little history is useful: Back in the 1970s, the US cut a deal with Saudi Arabia — at the time the world’s biggest oil producer — calling for the US to prop up the kingdom’s corrupt monarchy in return for a Saudi pledge that it would accept only dollars in return for oil. The “petrodollar” became the currency in which oil and most other goods were traded internationally, requiring every central bank and major corporation to hold a lot of dollars and cementing the greenback’s status as the world’s reserve currency. This in turn has allowed the US to build a global military empire, a cradle-to-grave entitlement system, and a credit-based consumer culture, without having to worry about where to find the funds. We just borrow from a world voracious for dollars. But if Russia, China and India decide to start trading oil in their own currencies — or, as Zero Hedge speculates, in gold — then the petrodollar becomes just one of several major currencies. Central banks and trading firms that now hold 60% of their reserves in dollar-denominated bonds would have to rebalance by converting dollars to those other currencies. Trillions of dollars would be dumped on the global market in a very short time, which would lower the dollar’s foreign exchange value in a disruptive rather than advantageous way, raise domestic US interest rates and make it vastly harder for us to bully the rest of the world economically or militarily. For Russia, China and India this looks like a win/win. Their own currencies gain prestige, giving their governments more political and military muscle. The US, their nemesis in the Great Game, is diminished. And the gold and silver they’ve vacuumed up in recent years rise in value more than enough to offset their depreciating Treasury bonds. The West seems not to have grasped just how vulnerable it was when it got involved in this latest backyard squabble. But it may be about to find out. | ||||||||||||||||||||||||

| A COMEX GOLD MANIPULATED HIT VISUALIZED Posted: 26 Mar 2014 10:39 AM PDT

| ||||||||||||||||||||||||

| A Comex Gold Manipulated Hit Visualized Posted: 26 Mar 2014 10:25 AM PDT

The primary reason the U.S. Government and Federal Reserve intervene actively in the gold market is to keep to keep the price from moving higher in order the protect the reserve status of the U.S. dollar. Given that we know Russia and China are actively disabusing their foreign reserve holdings of Treasuries – quietly and [...] The post A Comex Gold Manipulated Hit Visualized appeared first on Silver Doctors. | ||||||||||||||||||||||||

| ECB Chatter Weakens Euro; Dollar Rises Posted: 26 Mar 2014 10:08 AM PDT The chatter in the Forex markets today centered around the comments of Bundesbank President Weidman who seemed to be concerned about the low level of inflation in the Euro Zone. Throw in the comments of some other major European Central Bankers and that hit the Euro as talk grew that the ECB was moving in the direction of its own version of Quantitative Easing. Over here in the US Fed Governor Charles Plosser (head of the Phillie Fed) commented that the hurdle to change course on the Fed's plan to taper was "pretty high". By the way, he was concerned that inflation was currently a little low and that he would actually like to see it creep up a bit! How's that for some candid talk? This sort of stuff, coming from Central Bankers in the West, along with further weakness in the mining shares, was enough to pull the rug out from underneath those buying gold out of any Dollar weakness concerns. If rates in Europe are not going up anytime soon and if the Fed is continuing its current tapering plans, then Gold has those headwinds to contend with. if that were not enough, copper prices continued to fall lower today out of worries over the health of the Chinese economy. What really has the market roiled however is that persistent weakness in the Yuan. That makes copper more expensive to purchase for Chinese buyers. In a market already experiencing demand issues, that is not helpful. There is a bit of chatter however that the economy over there is weakening to the point where the Chinese authorities may soon try to do something to generate some growth. Who knows exactly what that might be but it was enough, at this point, to prevent copper from falling any lower. Copper is holding about last week's spike low near 2.87 for now. I would be concerned if it broke down below there as the odds would increase that silver is not going to hold support down near $19 if that were the case. Silver has become a teenager once again. Here is the chart of gold. As you can see, the bears have regained control of the market on the short term chart. Notice how the price consolidated the last couple of days near the 38.2% Fibonacci retracement level indicated. Then today, it fell below that and as of now, has not yet recovered. It did manage to hold above psychological chart support at the $1300 level. Bulls would not want to lose that as it would further shift the sentiment in the market in favor of the bears. If $1300 goes, then look for a test of the 50% retracement level near $1287. Bulls need to recapture $1340 to gain any sort of traction right now. They certainly need some help from the miners which are down over 2% as I type these comments ( basis HUI). The US Dollar Index needs to clear 80.50 to run out some of the recent shorts. If it does, gold will more than likely be unable to hold support on the downside. We will have to monitor developments in the currency markets to get a sense of whether or not that is going to be the case. | ||||||||||||||||||||||||

| Chinese Gold Demand Hits 488 tons YTD, Up 29 %! Posted: 26 Mar 2014 09:00 AM PDT

Although last week only 34 metric tonnes of gold were withdrawn from the vaults of the Shanghai Gold Exchange (SGE), down 6.52 % from the prior week, year to date there has been a staggering 48 8 metric tonnes withdrawn, up 29 % to compared to 2013. Silver Buffalo Rounds As Low As 77 Cents Over Spot at [...] The post Chinese Gold Demand Hits 488 tons YTD, Up 29 %! appeared first on Silver Doctors. | ||||||||||||||||||||||||

| CalPERS’ Private Equity Scandals and the Steptoe & Johnson Report Whitewash Posted: 26 Mar 2014 08:40 AM PDT Readers may recall that we published a letter that a beneficiary of the nation’s largest public pension fund, CalPERS, wrote in support of our effort to have CalPERS provide us with data that it has finally admitted it gave to Oxford academics in 2009. In his letter, our advocate, Tony Butka, stated:

This bit of history is germane, particularly since, as Butka noted, CalPERS promised to become more transparent as a result of this scandal and in particular, to “improve the timeliness and responsiveness to Public Records Act requests” like mine. But if you understand what went on, CalPERS conduct should come as no surprise. Overview of the “Pay to Play” Scandal at CalPERS CalPERS’ investments have been controversy-ridden since the early 2000s, but the “pay to play” scandal that Butka alludes to directly implicated the CEO and some board members. The former CEO, Fred Buenrostro, as well as the placement agent, Alfred Villalobos, were indicted in 2011. This is how Matt Taibbi summarized the case:

$48 million wasn’t the total Villalobos got; it was $58 million because he was pushing deals to CalPERS on behalf of four additional clients: Relational, CIM Ares, and Aurora Capital. And the part that has been curiously airbrushed out of every media account of this scandal is Villalobos was engaged in improper conduct, even if he had managed to get the needed sign-offs from CalPERS. He wasn’t a registered broker-dealer, as he was required to be when marketing deals on a regular basis. As we’ll explain in due course, this omission appears to be deliberate, to protect the hides of Apollo and the other fund managers (referred to in the trade as general partners or GPs) who hired a placement agent they knew, or should have known, shouldn’t be in that business at all. And it also obscures the fact that CalPERS had tremendous leverage in dealing with these GPs. One of the remedies available under the securities laws when party who is not licensed engages in securities transactions is rescission, as in demanding that the deal be unwound and the funds returned. To make a very short story of how this process worked, as Taibbi does state correctly, placement agents had to get written acknowledgments from fiduciaries like CalPERS of the fees paid by general partners. Indeed, many GPs insist on having the documentation in hand before paying the fees. Villalobos used his personal relationships with Buenrostro and a CalPERS board member, Charles Valdes, who got improper political donations from Villalobos’ firm, to get them to lean on the investment team on behalf of his clients. It was also Buenrostro who signed the waivers without notifying the board as required. In two cases, the waivers were on crudely doctored-up CalPERS letterhead and dated after Buenrostro was no longer with the giant pension fund. There were other sordid chapters, like improper gifts and flights on private jets, but the real juice was in the coverup of the massive fees paid to Villalobos. Why the Choice of a Law Firm and Private-Equity Connected Partner Say that CalPERS Wanted a Cover Up When the scandal broke in late 2009, CalPERS hired a Los Angeles law firm, Steptoe & Johnson, to investigate. This is absolutely standard practice, but the question whenever these “investigations” are launched is whether the firm really intends to turn over a new leaf or whether the “investigation” is an effort in damage control and perception management. There are plenty of reasons for skepticism. First, CalPERS has such a well-established pattern of pay-to-play abuses that the legislature barred those payments in 1997. Astonishingly, a CalPERS board member got the law overturned. But second is the decision to hire a law firm. Generally speaking, corporations will elect to pay the higher price tag of law firms for this sort of investigation precisely because they want to take advantage of attorney-client privilege; otherwise, you’d use a consultant or accounting firm for this sort of work. For instance, former Comptroller of the Currency Gene Ludwig built his reputation and top-level relationships by becoming the preferred provider of investigations on rogue trader scandals. Remember, when a bank has suffered billion dollar losses, they need to be seen to have done a credible investigation, to understand exactly how the fiasco happened and to be putting proper controls and other remedies in place. They have not merely their reputations but their stock prices, funding costs, and counterparty relationships at stake. I’m not overstatig the stakes: remember that Barings failed due to rogue trader Nick Leeson. So parties with economic exposure need to know the deficiencies are being remedied, pronto. And since most of them also run trading operations, they have a finely honed radar for bullshit. The third reason to be skeptical is CalPERS is perfectly positioned to do accountability theater. Their beneficiaries have little ability to influence the organization. Seven of the thirteen member of the board are selected by the state government or are members of it:

So even more so than with a public company, the incentives of the board are to make problems go away rather than get to the bottom of them. The one possible source of real pressure on them is the state legislature, but they tend to be more sensitive to press coverage than occasional letters from upset CalPERS beneficiaries. Now let us finally turn to the Steptoe & Johnson report proper and see if it bears out our concerns. Our first step is to look at the choice of law firm and partner. Here CalPERS was likely to have been constrained in its options, since Apollo and the other firms use a large number of law firms, so most of the top candidates would be conflicted out. Philip Khinda was the Steptoe partner that ran the investigation and prepared the report. If you look at his bio at Steptoe, you can discern what the real priorities were. This is what he lists immediately after his work for CalPERS, and shows what his calling card was prior to that engagement:

Notice how this description emphasizes that Khinda smoothes problems over and often succeeds in making them invisible to the public. Khinda also has important prior experience in investment fund kickback scandals. But another critical element is that CalPERS hired someone who has worked heavily for the sell side of the financial services industry. This almost guaranteed that Khinda would at a minimum be sympathetic to their point of view. CalPERS appears either to have been insufficiently sensitive to this issue or have resigned itself to the fact that anyone with a big firm who had heavyweight investigation experience would have similar conflicts (and big companies feel the need to hire other big firms; it’s doubtful that CalPERS considered hiring a scrappy boutique like Boies Schiller). The Peculiar “Steptoe Report” Despite its length, the public version of the Steptoe report reads as thin and temporizing, particularly when you contrast it to other reports on questionable conduct, such as the so-called Ludwig report issued by Wachtell Lipton and Promontory Group on the Allied Irish Bank currency trading scandal, or the UBS report on its crisis-related losses. If you look at either one, you can see how dramatic the contrast is in the level of detail provided. And here is why the lack of detail is troubling: the real reason for this sort of investigation is to look into whether anyone at CalPERS got kickbacks from Villalobos. That’s why Steptoe brought in Daylight Forensic & Advisory, which specializes in financial fraud and money-laundering investigations, so that they could examine transactions and activities and see if they looked to be payoffs for helping Villalobos. And trust me, it’s a near certainty that kickbacks were offered. Why? There is absolutely no reason for Apollo to have hired a placement agent for CalPERS, much the less paid one so lavishly. Staff with CalPERS at the time in question confirm that the head of Apollo, Leon Black, could get the Chief Investment Officer and the head of alternative investments (known in CalPERS-speak as the SIO, or senior investment officer) on the phone or in a meeting in Sacramento at any time. So far and away the most plausible scenario is that Apollo and the other private equity firms were told that they had to hire Villalobos as a condition of doing business with CalPERS. The report does provide evidence that Buenrostro got inducements from Villalobos: an offer of a Lake Tahoe condo, payment for wedding expenses, and his plan to go straight from CalPERS to Villalobos’ firm, which would have allowed him to have a cut of the CalPERS fees laundered to him via compensation for his then-current work. But what about others at CalPERS? There’s reason to wonder about the conduct of certain board members, particularly given the discussion of Villolobos’ role in getting a pharmacy benefits contract awarded to Medco. The brief version is that Villalobos convened a meeting at his house with the CEO of Medco and Buenrostro, which led to Villalobos being retained by Medco for $4 million. Shortly thereafter, Villalobos met with the Medco CEO, Buenrostro, and three other board members, Chuck Valdes, Kurato Shimada, and Bob Carlson. Various members of that group continued to meet. Medco mysteriously got its hands on useful CalPERS internal documents. Medco came to the Health Committee meeting as the preferred candidate; Valdes moved to recommend that Medco be awarded the contract and Carlson, another committee member, voted for it. And apparently, to leave nothing to chance, Shimada, who was not a member of the committee, attended the meeting and asked questions. And it gets even better: Shimada had taken a three year leave from CalPERS in 1999, and had worked as a placement agent with Villalobos. And remember, Valdes was head of the investment committee of the board, and thus well positioned to be useful to Villalobos. Now the report does unearth a lot of penny-ante payoffs from Villalobos to Valdes (hundreds of dollars’ worth of casino chips, possible large advances for travel that were never repaid) and Shimada (help in paying for his trip to attend the Academy Awards). But the report simply finesses the question of whether this might have been the tip of the payoffs iceberg. And troubling, we see no discussion of the scope and limitations of Daylight Forensic & Advisory’s investigation. You would expect a report of this sort to be far more crisp on the matter of “Here is what we looked into. Here is what we found. These particular issues (stated specifically) remain open because the individuals were not cooperative and we lacked the authority to compel the production of documents.” Given the failure to say in sufficient detail what was and was not done, the second striking element is the cost of the report, which the Los Angeles Times revealed to be $11 million. As Butka indicates, there was a great deal of consternation over the price tag, and experts were stunned too. From the Times:

Let’s do some back-of-the-envelope math. The article reports that Steptoe’s rates were capped at $400 an hour. Let’s charitably assume Steptoe had $500,000 in expenses. Take $10.5 million and divide it by the maximum rate, $400 an hour, for an 8 hour billable day (trust me, 8 billed hours is more like a 10 to 12 hour work day) and 250 working days a year. You get 13.125 man years. Divide that by the year and a half the study took. That says they had at a minimum of 8.75 very senior people working on this full time for the full 18 months, or a bigger team of some senior people and lower-rate attorneys and staff. This for a study where a total of 140 people were interviewed, some of them more than once, plus (as we will see) some pretty limp-wristed negotiations with four funds.* You can see why eyebrows were raised. Unfortunately, clients are hostage in situations like this, since the steps needed to dispute a bill run the risk of breaching attorney-client privilege, and we suspect having attorney-client privilege was one of the top objectives of this exercise. A third striking element of the report is how deferential, indeed, fawning, it is to Apollo and three of the other four implicated funds: Relational, CIM, and Ares. CalPERS evidently decided that its interests were best served by making common cause with them. It is critical to understand that there is no reason, ex ante, to assume these relationships should be preserved. However, CalPERS, like many other public pension funds, is cognitively captured and terrified of alienating private equity funds. And in this case, it’s not hard to imagine that Khinda advised them that they would only lose if they went to war with Apollo, so they’d be better off turing him into an ally. Now let’s look at the report in more detail. The writing style of the Steptoe report is patronizing, as if a parent has been forced to explain a hopefully past affair to his children. However, the report is up front about not being complete: two section headers contain the phrase “illustrative conduct”. Yet the report tries to assuage concerns by saying how cooperative everyone was, except, not surprisingly, Villalobos and Buenrostro. Its very first paragraph tries to present the use of placement agents as common and by implication, not necessarily a cause for alarm. And we have an explicit “everyone is doing it” statement:

Ahem, the whole point of hiring a placement agent is to try, first, to make sure your fund gets an audience, if you might not normally get access to the pension funds investors (known in the trade as “limited parters” or “LPs”), and second, to try to get a bigger share of the total pot than you’d get otherwise. But the fact is, as Khinda stresses, that Apollo already an well-established relationship (“one of CalPERS’ largest and most trusted private equity managers”). Yet the notion that Apollo and the other funds were seeking to get a large piece of the CalPERS pie, and presumably did, seems to have been completely neglected in the Steptoe analysis of harm. In fact, the report acknowledged that this in fact probably happened in a back-handed way, in the recommendations section (as in while this presumably refers to Medco, one has to wonder if this was also an aim of the private equity payoffs): Notice how this question ties into the scope of Steptoe’s assignment:

Yet the Special Report fails to contemplate the possibility that CalPERS was harmed by the five managers having received larger allocations than they would have otherwise. You’d expect a declaration that an analysis was performed and either no harm resulted or “It’s too soon to tell, given the long time frame of these commitments; we’ll give you an update in five years.” Moreover, the only outside expert mentioned in the report is Daylight Forensic & Advisory. Daylight has a great deal of experience in fraud investigations, anti-money laundering and regulatory compliance, which would be helpful in pinning down the financial dealings and movements of the key figures under scrutiny. However, they do not appear to have expertise in the valuation of illiquid assets like private equity funds or leveraged loan parti | ||||||||||||||||||||||||

| Posted: 26 Mar 2014 08:30 AM PDT

Because of the severe drawdowns that many gold market investors have experienced over the past few years, emotions can run very high on any disappointing sell-off, like the current one. It's important for investors to fight those emotions and maintain their focus on the big picture. <iframe id=”1dedb65f9d” name=”1dedb65f9d” src=”http://us-ads.openx.net/w/1.0/afr?auid=541857&cb=INSERT_RANDOM_NUMBER_HERE” frameborder=”0″ scrolling=”no” width=”300″ height=”250″><a href=”http://us-ads.openx.net/w/1.0/rc?cs=1dedb65f9d&cb=INSERT_RANDOM_NUMBER_HERE” [...] The post Be Right & Sit Tight! appeared first on Silver Doctors. | ||||||||||||||||||||||||

| Jim Sinclair: Yellen To Get A Shock Of A Lifetime, Will Respond With Hyper QE of $4 Trillion! Posted: 26 Mar 2014 08:01 AM PDT

Legendary gold expert Jim Sinclair has sent an email alert to subscribers warning that new Fed Chairwoman Janet Yellen will soon get the shock of a lifetime as the economy collapses in response to her convoluted forward guidance at the March FOMC meeting, resulting in the Fed being forced to kick quantitative easing into hyper [...] The post Jim Sinclair: Yellen To Get A Shock Of A Lifetime, Will Respond With Hyper QE of $4 Trillion! appeared first on Silver Doctors. | ||||||||||||||||||||||||

| Eric Holder Has Spent Millions of Taxpayer Dollars on Unreported Personal Travel Posted: 26 Mar 2014 08:00 AM PDT

As the Attorney General of these United States, Eric Holder is the top legal advisor for the entire nation. As such, he has been in a position to help punish financial criminals and the mega-banks for the crimes they committed in the run-up to the financial crisis, and the egregious looting thereafter. Despite his unique [...] The post Eric Holder Has Spent Millions of Taxpayer Dollars on Unreported Personal Travel appeared first on Silver Doctors. | ||||||||||||||||||||||||

| Steve Sjuggerud: This was the worst mistake of my career... and it's happening again right now Posted: 26 Mar 2014 06:58 AM PDT From Dr. Steve Sjuggerud in DailyWealth: My friend, I fully admit it... I make mistakes investing, just like everyone else. People get the impression that because I'm a well-known investment writer I somehow don't make mistakes in the markets. That's crazy! Everyone makes investment mistakes... The more important factor is how you handle them. You must do two things: 1. Learn from your mistakes (so you don't make them again). 2. Limit the pain (the losses) from your mistakes as soon as you recognize the mistake. Sounds easy... But it's harder than it sounds. Today, I'll share with you my biggest mistake, and what I learned from it. It's important today because what happened then is happening again today. I want you to learn from my mistake, so you won't make it too. Here's the story... On June 17, 2004, Vladimir Putin said "[We] aren't interested in seeing Yukos go bankrupt," My big mistake was I believed him! I recommended the stock! I wrote: "Until Putin claimed he didn't want to push Yukos into bankruptcy, the oil giant was either a zero or a home run. Now the prospect of a zero has been taken away." Yukos, if you don't know, was the Russian oil company that – at the time I wrote the story – had more oil than Exxon or BP. But it was dirt – I mean DIRT – cheap... trading like it was going out of business. Our upside potential was easily hundreds of percent. And our downside risk had been taken away. I said "we know what we need to know... Putin won't send the company into bankruptcy." What a fool I was! I took a politician at his word. That was the crux of my investment thesis. Putin forced Yukos to go bankrupt not long after. The assets owned by Yukos were sold for next-to-nothing to oil companies controlled by the Russian government. The only silver lining here is that I used a trailing stop when I entered the trade – a 50% trailing stop! I don't remember exactly what we ended up losing on the trade – but I'm sure it was darn close to 50%! It was the worst trade of my career, in my opinion. I say this because this trade really sticks with me as the one where I failed my readers the most. (This isn't the biggest loser of my career... I recommended a basket of three tiny gold stocks once. I said buy all three. One of the three crashed more than Yukos, but the other two went up by triple-digits. One went up 995%. I don't feel I failed my readers on that one.) This week, Vladimir Putin said "I have no intention of invading other regions of Ukraine." The casual observer might think, "That's nice of him – he's done with his invading for now." But what do you think? Isn't Putin's statement similar to what he said about Yukos in 2004? The most-likely goal back in 2004 for Putin was to get the international community off his back. I'm guessing he has the same goal today. The general lesson today is simple. 1. Never base your investment on a promise from a politician! 2. Use those trailing stops! They can and will save you! Will Putin invade "other regions of Ukraine"? I don't know... But I do know enough – after getting stung badly – to not take him at his word. Trust me on this one... Please, be extremely careful if you're going to use a promise from a politician as the crux of your investment thesis. And learn from your investment mistakes! This one was from 10 years ago... And it still stings today... Crux note: To help ensure our readers never make the same mistake, Steve has put together an incredible offer... For a limited time, you can try the world's most powerful and easy-to-use system for tracking your trailing stops – the same one Steve uses himself – completely risk-free... AND get access to Steve's subscriber-only investment research absolutely FREE. Click here for all the details.

More from Steve Sjuggerud: Steve Sjuggerud: It's official... the gold crash is over Steve Sjuggerud: This is what happens after a stock market crash Steve Sjuggerud: What to do right now if you missed last year's rally in stocks | ||||||||||||||||||||||||

| 10 oz Silver Bars As Low As 59 Cents Over Spot at SDBullion! Posted: 26 Mar 2014 06:47 AM PDT

Doc’s Deal of the Day: 10 oz Silver Bars As Low As 59 Cents Over Spot at SDBullion! Click or call 800-294-8732 to place your order! The post 10 oz Silver Bars As Low As 59 Cents Over Spot at SDBullion! appeared first on Silver Doctors. | ||||||||||||||||||||||||

| Russia to launch its payment system in months, as disruption fears mount Posted: 26 Mar 2014 06:36 AM PDT Stacy Summary: I figured from the day that SWIFT cut off Iran, this sort of thing would eventually happen (and notice that this new payment system in Russia was first piloted in 2010). And when Visa/MC later cut off Wikileaks and now Russia, over relatively minor spats in the history of geopolitics, it was only a matter of time before alternative payment systems started to emerge (as well, of course, as old ones as Russia bought over 7 tons of gold in February).  Financial war games.

| ||||||||||||||||||||||||

| Russia Raises Gold Holdings By 7.247 Tonnes To Over 1,040 Tonnes In February Posted: 26 Mar 2014 06:33 AM PDT gold.ie | ||||||||||||||||||||||||

| Pakistan Gold imports up 59.26% in Jul Feb: PBS Posted: 26 Mar 2014 06:29 AM PDT On value basis, gold imports advanced by 20.40% to $17.601 million in July-February FY 2013-14 compared to $13.828 million in the same period in FY 2012-13. | ||||||||||||||||||||||||

| India flush with gold smugglers Posted: 26 Mar 2014 06:14 AM PDT Officers are reported to have spoiled four separate attempts of gold smuggling at the country's busiest airport | ||||||||||||||||||||||||

| Posted: 26 Mar 2014 06:11 AM PDT Where will Russian demand end up in the coming months? | ||||||||||||||||||||||||

| Posted: 26 Mar 2014 06:03 AM PDT World Gold Council report shows that the Chinese consumption reached a record of 1,066 tons last year as the gold demand in the form of coins, bars and jewelry climbed 32% in February. | ||||||||||||||||||||||||

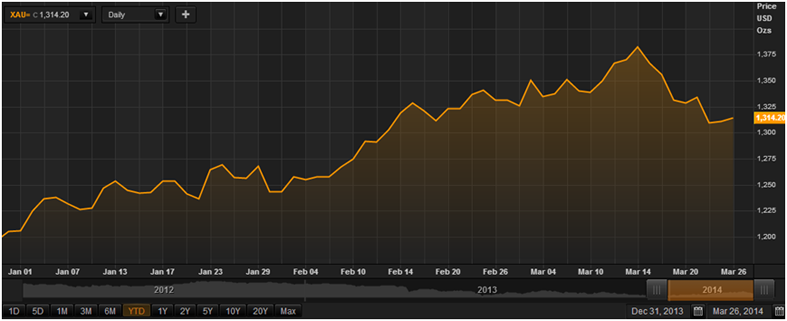

| Russia Raises Gold Holdings By 7.247 Tonnes To Over 1,040 Tonnes In February Posted: 26 Mar 2014 04:41 AM PDT Many analysts are ignoring the important context of today’s new geopolitical backdrop. Russia alone has some $400 billion in foreign exchange reserves – mostly in U.S. dollars. If they were to diversify just 5%, worth some $20 billion, of those reserves into gold – it would be equal to nearly 500 tonnes of gold or nearly 25% of global annual production. Today's AM fix was USD 1,314.50, EUR 952.74 and GBP 794.98 per ounce. Gold climbed $2.30 or 0.18% yesterday to $1,311.80/oz. Silver rose $0.02 or 0.1% at $20.00/oz.

Gold traded above a five week low today as investors weighed the crisis over Ukraine. Gold reached a six-month high on March 17th near $1,400/oz as brinkmanship and tensions between Russia and the West intensified and the worst geo-political crisis since the Cold War escalated. Yesterday U.S. President Barack Obama warned Russian President Vladimir Putin that Russia would face more sanctions if it moved further into eastern Ukraine after its annexation of Crimea. Worryingly for residents of New York and for financial markets, Obama also warned that he was more worried about the risk of a nuclear bomb going off in Manhattan then he was about Russia. Geopolitical risk in the form of terrorism, financial and economic war and actual war remains high and should support gold.

Russia has increased its gold holdings by 7.247 tonnes to 1,042 tonnes in February. Turkey and Kazakhstan also raised their bullion reserves, data from the International Monetary Fund showed today. Many analysts are ignoring the important context of today’s new geopolitical backdrop. Russia alone has some $400 billion in foreign exchange reserves – mostly in U.S. dollars. If they were to diversify just 5%, worth some $20 billion, of those reserves into gold – it would be equal to nearly 500 tonnes of gold or nearly 25% of global annual production.

Russia bought another 7.247 tonnes of gold in February. It will be interesting to see what Russian demand is in March and indeed in the coming months. Sanctions could lead to materially higher demand from the Russian central bank, Bank Rossii. This would cause a material strain on the already fragile supply demand dynamics of the physical gold market. The possibility of a default on the COMEX gold exchange would become more likely, with a consequent surge in the cost of gold coins and bars and a difficulty of securing physical gold either in Hong Kong’s net gold exports to China jumped 25% in February after a small drop in the previous month, data showed overnight. Net gold exports to China from Hong Kong rose to 112.31 tonnes from 89.75 tonnes in January. Total gold exports rose to 125 tonnes in February from 102.64 tonnes in the previous month. China imported about 1,158.16 tonnes from Hong Kong alone in 2013, more than double its 557.48 tonnes in 2012, according to data from the Hong Kong government. China, the world’s biggest gold buyer, does not publish trade data for gold and there is the possibility that demand was even higher.Official sector demand from the People's Bank of China is not declared and is not reflected in these figures. Nor are direct imports into other cities such as Shanghai from gold producing nations and countries that have seen rising gold exports in recent months such as the UK and Switzerland. This has been due to large London good delivery bars (400 oz) being shipped to Switzerland from bullion banks in London to be refined and cast into smaller kilo bars for the Chinese and Asian market. The numbers from Hong Kong, a main conduit for gold into China, give an indication of Chinese demand for gold but should not be relied on solely as there is clandestine importation of gold into China in recent months and years. The People’s Bank of China is widely believed to have engineered a sudden and sharp fall in the yuan in recent weeks to punish speculators who have seen the currency as a one way appreciation bet. The yuan gained some 30% since 2005. Thus, Chinese retail buyers have pulled back and demand has fallen in the short term. However, it is important to realise that there is more to Chinese demand than the so called "Chinese aunties". Ignore noise regarding fluctuations in short term demand for gold and focus on the big picture quarterly and annual Chinese gold demand data which we believe will continue to be very positive. This is especially the case given the increasing risks emanating from the Chinese shadow banking system, the Chinese property market and indeed the Chinese banking system with localised bank runs being seen in recent days. The financial and economic system remains vulnerable with much unappreciated technological , systemic and geo-political risk. Owning non digital, physical bullion coins and bars in segregated, allocated accounts in Switzerland, Hong Kong and Singapore are some of the safest ways to own precious metals. Protect and grow your wealth by reading The Essential Guide To Storing Gold In Singapore. | ||||||||||||||||||||||||

| The crisis in Ukraine could have a silver lining for these investors Posted: 26 Mar 2014 04:00 AM PDT From Matt Badiali, editor, S&A Resource Report: The Russia/Ukraine situation is about to give U.S. refiners another big payday. Unless you were backpacking off the grid for the past month (a real possibility for some of you, I know), you probably know that Russia just annexed Crimea. Suddenly, a major world crisis has broken out somewhere other than the Middle East... and it has big implications for oil markets. Outside of the U.S., oil is expensive. The benchmark crude oil for Europe is called Brent, which is produced in the North Sea above England. Since the 1970s, the U.S. crude oil benchmark price, called West Texas Intermediate (WTI), has been more expensive than Brent. However, starting in 2011, WTI has traded at a discount to Brent. It hit an all-time high near $30 per barrel in September 2011. The table below shows the average price difference per barrel between Brent and WTI. As you can see, they were nearly equal in 2010, but gapped apart in 2011 and 2012.

Data compiled from the U.S. Energy Information Administration.

As you can imagine, companies that can buy oil for $16 or $17 per barrel cheaper can make a much larger profit margin than competitors that must pay more. That's the advantage U.S. refiners enjoyed in 2011 and 2012. It showed up dramatically in their profit margins. Take ExxonMobil, the largest energy producer in the U.S. In 2012, its refining arm propelled the company to a five-year high. ExxonMobil raked in $9.95 billion in the fourth quarter of 2012 alone. Another giant refiner, Chevron, also hit a five-year high that quarter... thanks to cheap U.S. crude. U.S. refining companies, like those two majors, spent the last eight years pulling an end run around the law against exporting crude oil. They bought cheap oil here in the U.S., ran it through their refineries, then shipped it to... well, just about anywhere else. You can see that refiners benefit from cheap U.S. crude and expensive Brent crude. In the past year or so, the price difference narrowed. But right now, the Brent-WTI differential is about to widen again... Demand for both oil and gasoline is down in the United States. Domestic production continues to rise as well. That means falling WTI prices. Add to that political pressure to push oil prices lower too, and we could see WTI fall far below Brent again. How is Russia involved? As the world's second largest producer of oil, Russia has a lot at stake in its oil prices. It produces roughly 10.4 million barrels per day (mmbd) of crude oil, and exports about 7.2 mmbd. If we use fourth quarter 2013 prices for oil, Russia's annual oil and gas exports total $362.2 billion, or about 14.5% of the nation's gross domestic product. Even more important, Russian oil prices and Brent pricing influence each other... So if Brent prices are pushed up due to this conflict, and the U.S. continues to push WTI prices down, the Russian economy will feel the pinch. Cue March 12, 2014, when the U.S. actually sold crude oil from the strategic reserve for the first time since 1990. It was just 5 million barrels, a drop in the global bucket. But WTI prices fell from more than $104 per barrel in late February to less than $100 today. That's not a huge fall, about 4% in three weeks. However, it could be a sign of things to come... and a clear indication that oil prices will be a target if Russia continues its aggression in Ukraine. More on Ukraine: Ukraine BOMBSHELL: Leaked conversation could set off a full-blown war What the media's not saying as the top two nuclear powers square off in Ukraine Know what's really going on in Ukraine? If you're buying the media's account, you don't. | ||||||||||||||||||||||||

| China’s Monthly Gold Imports Through Hong Kong Jump 30% to 109.2 Tonnes in February Posted: 26 Mar 2014 02:25 AM PDT "Mining executives should carry little bells, like lepers in the Middle Ages" ¤ Yesterday In Gold & SilverThere wasn't much in the way of price action in either Far or East or early London trading on their Tuesday. Gold was up a bit more than five bucks by 11:30 a.m. GMT in London. Then it got sold down a bit over ten bucks in the next hour, with the low of the day coming at 8:30 a.m. EDT in New York. The high tick in New York during the subsequent rally came at the London p.m. gold fix, which was 11 a.m. EDT, as London is still not on British Summer Time as of yet. By noon, the gold price gave up five dollars of its prior gain, before trading flat into the 5:15 p.m. EDT close. The high and low ticks, such as they were, were recorded as $1,318.00 and $1,306.00 in the April contract. Gold closed in New York on Tuesday at $1,311.70 spot, up $2.10 from Monday's close. Gross volume was over 200,000 contracts once again, but once the heavy roll-over volume was subtracted out, the real volume was only around 102,000 contracts, which wasn't particularly heavy. Silver got sold off a bit in early Far East trading, but finally made it back to the $20 spot price mark by noon Hong Kong time. A bit of a rally commenced around 3 p.m.---and ran into a not-for-profit seller two hours later at 9 a.m. in London. From there it traded in a 25 cent range for the rest of the day, but once noon arrived in New York, the price didn't do much after that. The CME Group recorded the low and high ticks as $19.905 and $20.215 in the May contract. The silver price closed in New York yesterday at $20 right on the button. Volume, net of March and April, was 42,500 contracts. The platinum price didn't do much in Far East or early London trading---and once the high tick was in shortly after 11 a.m. GMT, it was all downhill to the absolute low, which came minutes after 4 p.m in New York. After that, it recovered a few bucks, but still finished down a few bucks on the day. Palladium traded pretty flat until shortly before 2 p.m. Hong Kong time---and then it rolled over, hitting its low of the day at 9 a.m. EDT in New York. Then, like platinum, the palladium price rallied a few dollars into the close, but still finished down on the day. The dollar index closed in New York late on Monday afternoon at 79.94. From there it didn't do much until a rally began shortly after 9 a.m. in London on their Tuesday morning. The index topped out at 80.18 shortly after 12 o'clock noon in New York before getting hit for a 30 basis point decline, with the 79.87 low coming shortly before 2 p.m. EDT. The index then rallied ten points before trading sideways from 2:30 p.m. onwards. The index closed back at 79.94---right where it started the day. The gold stocks opened in positive territory and manged to stay there for the remainder of the day, although they did sell off into the close. The HUI finished up 0.61%. It was the same price pattern for the silver equities as well---and Nick Laird's Intraday Silver Sentiment Index closed up 0.91%. The CME's Daily Delivery Report showed that 3 gold and 23 silver contracts were posted for delivery within the Comex-approved depositories on Monday. JPMorgan was involved as the main short/issuer in both metals. The link to yesterday's Issuers and Stoppers Report is here. After a decent deposit in GLD on Monday, there was withdrawal yesterday. An authorized participant took out 86,720 troy ounces. And as of 9:24 p.m. EDT yesterday evening, there were no reported changes in SLV. The good folks over at the shortsqueeze.com Internet site updated the short positions up to mid-March for both SLV and GLD yesterday. There was a tiny decrease in SLV's short position of 2.52%. The short position now stands at 13.29 million shares/troy ounces, which works out to more than six days of world silver production, or stated in other terms---410 metric tonnes of the stuff. The short position in GLD blew out by 12.24% during the first two weeks of March---and it's entirely possible that some of the gold added after that cut-off date was used to cover part of that increase in the short position, but we won't know that for sure until the next report from shortsqueeze.com---and that won't be posted for another two weeks or so. The short position in GLD increased from 1.23 million ounces, to 1.38 million ounces up until mid-March. The U.S. Mint had another sales report yesterday. They sold 2,000 troy ounces of gold eagles---500 one-ounce 24K gold buffaloes---and another 392,000 silver eagles. They also sold 200 one-ounce platinum eagles as well. Over at the Comex-approved depositories on Monday, they reported shipping out 53,216 troy ounces of gold. Most of it came out of the HSBC USA depository---and the link to that activity is here. And, like Friday, there was monstrous in/out movement in silver once again on Monday. They reported receiving 1,003,021 troy ounces---and shipped out 1,837,730 troy ounces of the stuff. In the last two business days [Friday and Monday combined] five million ounces has been shipped in and shipped out. The link to that action is here---and it's definitely worth a look. Here's what Ted Butler had to say about this in the quote I used in yesterday's column. Keep in mind that the 5 million ounces I spoke of in the previous paragraph are over and above the amounts Ted speaks of here. Turnover or physical movement of metal into and out from the Comex-approved silver warehouses moderated to under 2.5 million oz. this week, as total inventories fell 250,000 oz to 182.5 million oz. Over the last three weeks, 10 million oz. have come in or departed the Comex warehouses as total levels have barely fluctuated on a weekly basis. There must be a reason for this activity---and at the core of that reason must include the fact that most of the existing inventory is not available for sale at current prices, which necessitates the bringing in of new supply to meet demand. This certainly would not seem to be in keeping with silver’s rotten price performance, both absolutely and relative to gold. - Silver analyst Ted Butler: 22 March 2014 I have a decent number of stories today---and a lot less than in Monday's column, so I hope you have the time to read the ones that interest you. ¤ Critical ReadsWal-Mart: Food Stamps Spending by Customers Key to Its Profits For the first time, Wal-Mart Stores Inc. is citing its dependence on customers using food stamps in order to maintain its revenues and profits. Can Americans Retire in a Decade of Financial Repression?Twelve years after retiring as a telephone repairman, Roger Wood clocks 12 to 15 hours a week at a Lowe’s Cos. hardware store near Glen Allen, Virginia. “About the same amount I made 30 years ago,” Wood, 69, says of his $12 hourly wage. “I’m worried about my portfolio because of low interest rates, even to the point of considering full-time again.” Feeble returns on the safest investments such as bank deposits and fixed-income securities represent a “financial repression” transferring money from savers to borrowers, says Bill Gross, manager of the world’s biggest bond fund. Workers 65 and older, struggling with years of depressed yields, are the only group of Americans who are increasingly employed or looking for jobs, according to Labor Department participation-rate data. This right-on-the-money article was posted on the Bloomberg website early yesterday morning MDT---and it's the second contribution in a row to today's column from Elliot Simon. Hosting Obama costs Belgium 20 times as much as hosting E.U. Summit The American presidency has become grotesquely imperial, and when a president travels overseas, the contrast between the entourage and security measures commanded by a president versus an ordinary head of government of a major nation is downright embarrassing to citizens of a democratic republic. The left wing U.K. Guardian reports: Monks recant: Bundesbank opens the door to Q.E. blitzThe last bastion is tumbling. Even the venerable Bundesbank is edging crablike towards quantitative easing. It seems that tumbling inflation in Germany itself has at last shaken the monetary priesthood out of its ideological certainties. Or put another way, the Pfennig has dropped that euroland is just one Chinese shock away from a deflation trap, an outcome that would play havoc with the debt dynamics of southern Europe, render the euro unworkable, and ultimately inflict massive damage on Germany. Bundesbank chief Jens Weidmann was not exactly panting for QE in comments to Market News published this morning, it has to be said, but the tone marks a clear shift in policy. This Ambrose Evans-Pritchard blog was posted on the telegraph.co.uk Internet site yesterday---and it's the first contribution of the day from Roy Stephens. It's definitely worth reading. European Central Bank now considering even negative interest ratesEuropean Central Bank officials sent strong signals Tuesday that they are willing to consider dramatic steps to guard against dangerously low inflation, suggesting that the bank is prepared to shed some of its traditionally cautious approach. The possible tools, cited by some top policy makers from different parts of the euro zone, include effective negative interest rates -- meaning rates so low that commercial banks would essentially pay the ECB to park their extra cash overnight. They also include purchases of government or private-sector debt to hold down long-term rates and spur lending. "We haven't exhausted our maneuvering room" on interest rates, Bank of Finland Governor Erkki Liikanen, told The Wall Street Journal in an interview in Helsinki. Mr. Liikanen is on the ECB's 24-member governing council. Asked what tools the ECB has remaining, Mr. Liikanen cited a negative deposit rate as well as additional loans to banks and asset purchases. Only the part of this Wall Street Journal story [from yesterday] that is posted in the clear, is shown above---and the rest is available from their website---and the link to that is in this GATA release that Chris Powell filed from Hong Kong late in the afternoon local time earlier today. Murderous Ukrainian ultra-nationalist dead – after 2 decades of violent thuggeryNotorious ultra-nationalist leader Aleksandr Muzychko has been shot dead by Ukrainian special forces after going on the rampage amid Ukraine's current turmoil. Muzychko’s death followed many years of unpunished militant activity in neo-Nazi organizations. Born in Russia’s Urals in 1962, Muzychko served his military duty in Tbilisi, Georgia, and then got his first experience of warfare in Afghanistan as he served side-by-side with fellow Soviet troops. As the Soviet Union fell, Muzychko joined the militant wing of the radical nationalist Ukrainian UNA-UNSO organization to fight against his former fellow citizens. This very ugly story showed up on the Russia Today website late yesterday afternoon Moscow time---and I thank Roy Stephens for sending it our way. Russia's New Ability to Evade NSA Surveillance is Either a Crazy Coincidence or Something Much WorseU.S. officials think that Russia may have recently obtained the ability to evade U.S. eavesdropping equipment while commandeering Crimea and amassing troops near Ukraine's border. The revelation reportedly has the White House "very nervous," especially because it's unclear how the Kremlin hid its plans from the National Security Agency's snooping on digital and electronic communications. One interesting parallel is the presence of Edward Snowden in Russia, where he has been living since flying to Moscow from Hong Kong on June 23. This short, but very interesting article showed up on the businessinsider.com Internet site late Monday morning EDT---and I thank reader "Goodsport from Massahusetts" for sending it our way. 'Dear to Our Hearts': The Crimean Crisis from the Kremlin's Perspective The E.U. and U.S. have come down hard on Russia for its annexation of the Crimean Peninsula. But from the perspective of the Kremlin, it is the West that has painted Putin into a corner. And the Russian president will do what it takes to free himself. Capital controls feared in Russia after $70 billion flightCapital flight from Russia has spiked dramatically since President Vladimir Putin first sent troops into Crimea and may reach $70bn (£42bn) over the first quarter of the year, prompting fears that the country may soon have to impose capital controls to stem the loss. Andrei Klepach, the deputy economy minister, admitted in Moscow that the outflows are likely to reach $65-70bn, far higher than originally expected and a clear sign that investors are extremely nervous of escalating sanctions. “It is shocking,” said Bartosz Pawlowski from BNP Paribas. “Markets have been extremely complacent, fooling themselves that Russia is invulnerable because it has almost half a trillion in foreign reserves. But reserves can become almost irrelevant in this sort of crisis.” This Ambrose Evans-Pritcha | ||||||||||||||||||||||||

| Posted: 26 Mar 2014 02:25 AM PDT 1. Art Cashin: "Jeremy Grantham's Major Prediction" 2. Dr. Stephen Leeb: "There is a Conspiracy in the Silver Market" 3. Rick Rule: "We're Going to See 300% to 400% Gains From Here" 4. Ben Davies: "One of the Greatest Market Calls in History Happened in Silver" | ||||||||||||||||||||||||

| Kinross Asks Canada for ‘Balanced Approach’ on Russia Posted: 26 Mar 2014 02:25 AM PDT Kinross Gold Corp., the largest foreign gold miner operating in Russia, told Canada it wants a “balanced approach” in resolving a standoff with Russia after the annexation of Crimea earlier this month. “We have communicated to the government of Canada our desire to see a balanced approach to resolving this situation in a way that considers Canadian interests in Russia,” Andrea Mandel-Campbell, a spokeswoman for Toronto-based Kinross, said yesterday in an e-mail. Kinross operates the Kupol and Dvoinoye mines in Russia’s far east, which Mandel-Campbell said haven’t been affected by the political situation. About 27 percent of Kinross’s 2014 gold-equivalent production, which includes silver, may come from Russia, the Toronto-based company said Feb. 12. This Bloomberg story, filed from Toronto, was posted on their website early yesterday afternoon Denver time---and I thank reader Ken Hurt for sending it along. | ||||||||||||||||||||||||

| Iraq Buys Massive 36 Tonnes of Gold in March Posted: 26 Mar 2014 02:25 AM PDT The Central Bank of Iraq said it bought 36 tons of gold this month to help stabilise the Iraqi dinar against foreign currencies, according to a statement from the bank that was emailed this morning. It is very large in tonnage terms and Iraq’s purchases this month alone surpasses the entire demand of many large industrial nations in all of 2013. It surpasses the entire demand of large countries such as France, Taiwan, South Korea, Malaysia, Singapore, Italy, Japan, the UK, Brazil and Mexico. Indeed, it is just below the entire gold demand of voracious Hong Kong for all of 2013 according to GFMS data. The first question I have is---where the heck did they get the money to buy it? The other questions that comes to mind are---is it in allocated or unallocated form---and did they take delivery, or is it stored for 'safekeeping' in London? This very interesting news item showed up on the goldcore.com Internet site yesterday morning---and found a home over at Zero Hedge. It's definitely worth reading---and I thank U.A.E. reader Laurent-Patrick Gally for being the first one through the door with it yesterday. | ||||||||||||||||||||||||

| China’s monthly gold imports jump 30% to 109.2 tonnes in February Posted: 26 Mar 2014 02:25 AM PDT According to new data from Hong Kong Census and Statistics Department mainland China's net imports of gold totaled 109.2 tonnes in February. That's up more than 30% over the 83.6 tonnes in January and up a whopping 79.3% compared to the same month last year when Chinese imported 60.9 tonnes from the financial and trading hub. China overtook India to become the world's top importer of gold bars, coins and jewelry last year with 2013 imports soaring to 1,065 tonnes, up from 807 tonnes the year before. Here's another must read story. This one was posted on the mining.com Internet site yesterday sometime---and it's the final offering of the day from reader M.A. | ||||||||||||||||||||||||

| Lawrence Williams: China/Hong Kong gold imports accelerating - 109 tonnes in February Posted: 26 Mar 2014 02:25 AM PDT Gold bulls should be heartened by the latest official figures for Chinese gold imports through Hong Kong for February. Not only were net imports some 30% higher than in the previous month, but fully 79% higher than in February 2013 according to calculations from Bloomberg based on the latest Hong Kong official data. The latest figures out of Hong Kong suggest that far from Chinese gold demand slowing down this year it could even be accelerating. Indeed for the first two months of the year net imports through Hong Kong totalled 192.8 tonnes as compared with 80.6 tonnes in the first two months of 2013 suggesting that imports over the 2 month period have actually risen by just under 140%. Some demand slowdown!! The very fact that China imported more than 100 tonnes in February – normally a weak month for gold imports because of the Chinese New Year holiday – has to be highly significant as a guide to likely ongoing Chinese demand. Indeed the 109 tonnes imported was a comfortable new record for the month. This commentary by Lawrie was posted on the mineweb.com Internet site yesterday sometime---and it's worth reading as well. | ||||||||||||||||||||||||

| Chris Powell: Gold market manipulation update, March 2014 Posted: 26 Mar 2014 02:25 AM PDT Here's the speech that Chris presented at the Mines and Money Hong Kong Conference earlier today. It's your long read of the day---but a must read in my opinion. Chris slid it into my in-box in the wee hours of this morning EDT. | ||||||||||||||||||||||||

| Jeff Killeen: A Picky Player's Guide to a Cautiously Optimistic Mining Market Posted: 26 Mar 2014 01:00 AM PDT | ||||||||||||||||||||||||

| Posted: 26 Mar 2014 12:57 AM PDT By Catherine Crump and Matthew Harwood. Crump is a staff attorney with the ACLU’s Speech, Privacy, and Technology Project and a non-residential fellow with the Stanford Center for Internet and Society and an adjunct professor of clinical law at NYU. Her principle focus is representing individuals challenging the lawfulness of government surveillance programs. Follow her on Twitter at @CatherineNCrump. Harwood is senior writer/editor with the ACLU and his work has been published by Al-Jazeera America, Guardian, Guernica, Reason, Salon, Truthout, and the Washington Monthly. Follow him on Twitter at @mharwood31. Cross posted from TomDispatch Estimates vary, but by 2020 there could be over 30 billion devices connected to the Internet. Once dumb, they will have smartened up thanks to sensors and other technologies embedded in them and, thanks to your machines, your life will quite literally have gone online. The implications are revolutionary. Your smart refrigerator will keep an inventory of food items, noting when they go bad. Your smart thermostat will learn your habits and adjust the temperature to your liking. Smart lights will illuminate dangerous parking garages, even as they keep an “eye” out for suspicious activity. Techno-evangelists have a nice catchphrase for this future utopia of machines and the never-ending stream of information, known as Big Data, it produces: the Internet of Things. So abstract. So inoffensive. Ultimately, so meaningless. A future Internet of Things does have the potential to offer real benefits, but the dark side of that seemingly shiny coin is this: companies will increasingly know all there is to know about you. Most people are already aware that virtually everything a typical person does on the Internet is tracked. In the not-too-distant future, however, real space will be increasingly like cyberspace, thanks to our headlong rush toward that Internet of Things. With the rise of the networked device, what people do in their homes, in their cars, in stores, and within their communities will be monitored and analyzed in ever more intrusive ways by corporations and, by extension, the government. And one more thing: in cyberspace it is at least theoretically possible to log off. In your own well-wired home, there will be no “opt out.” You can almost hear the ominous narrator’s voice from an old “Twilight Zone” episode saying, “Soon the net will close around all of us. There will be no escape.” Except it’s no longer science fiction. It’s our barely distant present. Home Invasion “[W]e estimate that only one percent of things that could have an IP address do have an IP address today, so we like to say that ninety-nine percent of the world is still asleep,” Padmasree Warrior, Cisco’s Chief Technology and Strategy Officer, told the Silicon Valley Summit in December. “It’s up to our imaginations to figure out what will happen when the ninety-nine percent wakes up.” Yes, imagine it. Welcome to a world where everything you do is collected, stored, analyzed, and, more often than not, packaged and sold to strangers — including government agencies. In January, Google announced its $3.2 billion purchase of Nest, a company that manufactures intelligent smoke detectors and thermostats. The signal couldn’t be clearer. Google believes Nest’s vision of the “conscious home” will prove profitable indeed. And there’s no denying how cool the technology is. Nest’s smoke detector, for instance, can differentiate between burnt toast and true danger. In the wee hours, it will conveniently shine its nightlight as you groggily shuffle to the toilet. It speaks rather than beeps. If there’s a problem, it can contact the fire department. The fact that these technologies are so cool and potentially useful shouldn’t, however, blind us to their invasiveness as they operate 24/7, silently gathering data on everything we do. Will companies even tell consumers what information they’re gathering? Will consumers have the ability to determine what they’re comfortable with? Will companies sell or share data gathered from your home to third parties? And how will companies protect that data from hackers and other miscreants? The dangers aren’t theoretical. In November, the British tech blogger Doctorbeet discovered that his new LG Smart TV was snooping on him. Every time he changed the channel, his activity was logged and transmitted unencrypted to LG. Doctorbeet checked the TV’s option screen and found that the setting “collection of watching info” was turned on by default. Being a techie, he turned it off, but it didn’t matter. The information continued to flow to the company anyway. As more and more household devices — your television, your thermostat, your refrigerator — connect to the Internet, device manufacturers will undoubtedly follow a model of comprehensive data collection and possibly infinite storage. (And don’t count on them offering you an opt-out either.) They have seen the giants of the online world — the Googles, the Facebooks — make money off their users’ personal data and they want a cut of the spoils. Your home will know your secrets, and chances are it will have loose lips. The result: more and more of what happens behind closed doors will be open to scrutiny by parties you would never invite into your home. After all, the Drug Enforcement Administration already subpoenas utility company records to determine if electricity consumption in specific homes is consistent with a marijuana-growing operation. What will come next? Will eating habits collected by smart fridges be repackaged and sold to healthcare or insurance companies as predictors of obesity or other health problems — and so a reasonable basis for determining premiums? Will smart lights inform drug companies of insomniac owners? Keep in mind that when such data flows are being scrutinized, you’ll no longer be able to pull down the shades, not when the Peeping Toms of the twenty-first century come packaged in glossy, alluring boxes. Many people will just be doing what Americans have always done — upgrading their appliances. It may not initially dawn on them that they are also installing surveillance equipment targeted at them. And companies have obvious incentives to obscure this fact as much as possible. As the “conscious home” becomes a reality, we will all have to make a crucial and conscious decision for ourselves: Will I let this device into my home? Renters may not have that option. And eventually there may only be internet-enabled appliances. Commercial Stalking The minute you leave your home, the ability to avoid surveillance technologies masquerading as something else will, if anything, lessen.