Gold World News Flash |

- April Fools’ drop dead date for the Volcker Rule – what it might mean for gold

- ECB Chatter Weakens Euro; Dollar Rises

- Diamonds Are A Chinese Smuggler's Best Friend

- Mike Kosares: Volcker Rule starts April 1 and might push big banks out of gold

- Koos Jansen: A first glance at U.S. official gold reserves audits

- China's Credit Pipeline Slams Shut: Companies Scramble For The Last Drops Of Liquidity

- Evans-Pritchard sees Russia as loser in Crimea, Roberts as winner

- Intervention is killing commodity hedge funds, Turk tells KWN

- UBS said to suspend FX traders in New York, Zurich, and Singapore

- How The BRICs (Thanks To Russia) Just Kicked The G-7 Out Of The G-20

- Geoengineering & Collapse of Civilization -- Dane Wigington

- The Gold Price Has Corrected, Time To Buy

- The Gold Price Has Corrected, Time To Buy

- Gold And Silver Excellent Store Of Wealth In Last 60 Years

- Gold Price Projection by the Golden Ratio

- Rick Rule: Ownership Of Gold Is Critical To Your Wealth Next Years

- Gold Daily And Silver Weekly Charts - Option Expiration

- Gold Daily And Silver Weekly Charts - Option Expiration

- April Fools’ drop dead date for the Volcker Rule – what it might mean for Gold

- U.S. Dollar Value Could Suffer Instant Change

- Unsustainable?

- Gold Price vs. "Flattening" Yield Curve

- Gold Price vs. "Flattening" Yield Curve

- Gold Juniors? Choose Carefully, If At All

- Gold Juniors? Choose Carefully, If At All

- The Way the World Ends

- The Way the World Ends

- China Stimulus: Hope Against Hope?

- China Stimulus: Hope Against Hope?

- Go Gold! Got Gold?

- Go Gold! Got Gold?

- Welcome to the Currency War, Part 14: Russia, China, India Bypass the Petrodollar

- Gold Prices Drop Near $1300, Seen "Struggling" as US Rates Slip After Data, Options Expire

- In The News Today

- The West’s War On Gold Is Raging & There Are New Casualties

- Evil Entrepreneurs: How the Feds Spin Price Inflation

- Gold Prices Test $1308 Again as China Bank Run Hits Headlines, Bundesbank Says Euro QE "Not Out of Question"

- Extrapolation Fever

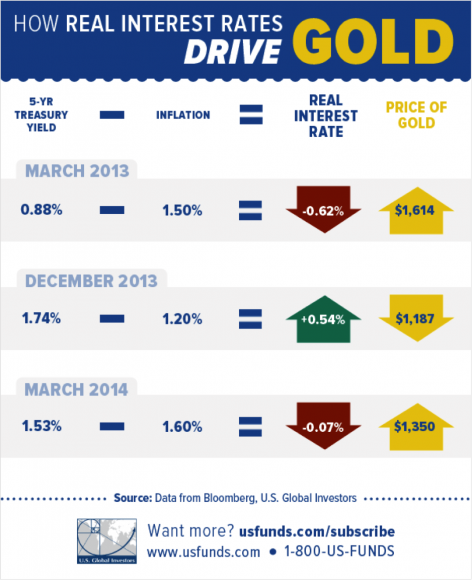

- One Match that Reliably Sparks a Rising Gold Price

- Gold Price Projection by the Golden Ratio

- U.S. Dollar Bottom - Third Time’s a Charm?

| April Fools’ drop dead date for the Volcker Rule – what it might mean for gold Posted: 26 Mar 2014 11:44 PM PDT USAGold |

| ECB Chatter Weakens Euro; Dollar Rises Posted: 26 Mar 2014 08:00 PM PDT from Dan Norcini:

Over here in the US Fed Governor Charles Plosser (head of the Phillie Fed) commented that the hurdle to change course on the Fed’s plan to taper was “pretty high”. By the way, he was concerned that inflation was currently a little low and that he would actually like to see it creep up a bit! How’s that for some candid talk? |

| Diamonds Are A Chinese Smuggler's Best Friend Posted: 26 Mar 2014 07:33 PM PDT With copper, iron-ore, soybeans, and nickel all tough to carry when you need liquidity from your commodity-financing deals; it appears the Chinese people have turned to more spectaculr methods of moving 'wealth'. As The South China Morning Post reports, just week after a man was stopped at the China-Hong-Kong border with 4 kilograms of gold in his shoes, customs officers caught a man smuggling more than 7000 diamonds in plastic bags in his underwear. The tell, officers noticed he was walking in a pculair manner.

Via The South China Morning Post,

Maybe he would have made it if he wore the diamonds like this?

However, this Chinese gentleman has nothing on a female smuggler entering Toronto (from Trinidad):

Seems diamonds are a smuggler's best friend, as the Shanghaiist notes, as undesirable as diamonds in your underpants seem...

|

| Mike Kosares: Volcker Rule starts April 1 and might push big banks out of gold Posted: 26 Mar 2014 06:50 PM PDT 9:48a HKT Thursday, March 27, 2014 Dear Friend of GATA and Gold: Speculative trading by banks is to end in the United States on April 1 upon implementation of the "Volcker Rule," Mike Kosares of Centennial Precious Metals in Denver notes today, with implications for the gold market. "The big trading banks traditionally have occupied the short side of the paper gold market," Kosares writes. "Some analysts feel that those positions will be handed off to the hedge fund business so things won't change much. On the other hand, hedge funds are not considered too big to fail, so their bets could be placed more evenly on either side of the market." Kosares' commentary is headlined "April Fools Drop-Dead Date for the Volcker Rule -- What It Might Mean for Gold" and it's posted at Centennial's Internet site, USAGold.com, here: http://www.usagold.com/cpmforum/2014/03/26/volcker-rule-goes-into-effect... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: |

| Koos Jansen: A first glance at U.S. official gold reserves audits Posted: 26 Mar 2014 06:28 PM PDT 9:35a HKT Thursday, March 27, 2014 Dear Friend of GATA and Gold: Gold researcher and GATA consultant Koos Jansen today begins to examine in detail what have passed for audits of U.S. gold reserves in recent decades. The problem with these audits is that they don't extend past assertions that there is gold in the various vaults -- don't address whether the gold is oversubscribed, as through gold swaps with foreign central banks, arrangements for which the Federal Reserve has admitted to GATA, if inadvertently: Jansen's commentary is headlined "A First Glance at U.S. Official Gold Reserves Audits" and it's posted at his Internet site, In Gold We Trust, here: http://www.ingoldwetrust.ch/a-first-glance-on-us-official-gold-reserves-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata |

| China's Credit Pipeline Slams Shut: Companies Scramble For The Last Drops Of Liquidity Posted: 26 Mar 2014 06:26 PM PDT One of our favorite charts summarizing perfectly the Chinese credit bubble, better than any other, is the following which compares bank asset (i.e., loan) creation in China vs the US.

It goes without saying that while the blue line has troubles of its own (namely finding the proper rate of liquidity lubrication to keep over $600 trillion in derivatives from collapsing into an epic gross=net garbage heap), it is the red one, that of China, where $1 trillion in credit was created in the fourth quarter alone, that is clearly unsustainable for the simple reasons that i) China will quickly run out of encumbrable assets and ii) the bad, non-performing loan accumulation has hit an exponential phase, which incidentally is why Beijing is scrambling to slow down the "flow" from the current unprecedented pace of $3.5 trillion per year. It is also because of this wanton and mindblowing capital misallocation (the de novo created debt goes not into profitable, cash flow generating ventures, but into fixed asset investments which create zero and potentially negative cash flow, due to China's already epic overinvestment resulting in ghost cities, and building that fall down weeks after their erection) that China has finally decided to provide lenders with the other much needed component of the return equation: risk. This, in the form of debt defaults, something unheard of in China for two decades. Which brings us to today, when we find that China's credit formation, until now proceeding at a breakneck speed, has suddenly ground to a halt. Reuters explains:

Here's why PKU Healthcare will likely be among the first to experience what happens when the liquidity runs out:

That's the kind of leverage that not even Jefferies would sign a "highly confident letter" it can raise a B2/B- debt deal at 10% or less. It is also a huge problem for Chinese corporates which suddenly realize they have just a tad too much debt on their books.

So with increasingly more uber-levered companies suddenly blacklisted by the banks, what do they do? Why go to the shadow banking system for last ditch liquidity of course, where it will cost them orders of magnitude more to stay viable for a few more weeks or months.

How do you spell re-re-rehypothecation again... while selling the collateral.... again? Remember this: it really does explain all one needs to know about China.

Anyway, continuing:

Unfortunately, for most the can kicking is now over. Which brings us to the second part of this story - China's housing bubble, and specifically how its foundations - China's own property developer firms - just imploded as a result of all the above. Also from Reuters:

CMBS, senior perpetuals, preferreds: what is the common theme? This is last ditch capital, far more dilutive of equity, and one which always appears just before the final can kick. As such, it means that the credit game in China is over. And now the only question is how long before the market realizes the jig is up. Some already have. As we reported last week, "Cash-strapped Chinese are scrambling to sell their luxury homes in Hong Kong, and some are knocking up to a fifth off the price for a quick sale, as a liquidity crunch looms on the mainland." In other words, those who sense which way the wind is blowing have already entered liquidation mode. Because they know that those who sell first, sell best. Soon everyone else will follow in their shoes, unfortunately they will be selling into a bidless market. Until then, we will greatly enjoy as finally, after many years of delays, the dominoes start falling.

The fun is about to start. |

| Evans-Pritchard sees Russia as loser in Crimea, Roberts as winner Posted: 26 Mar 2014 06:04 PM PDT 9a HKT Thursday, March 27, 2014 Dear Friend of GATA and Gold: The London Telegraph's Ambrose Evans-Pritchard argues today that Russia's Crimean adventure will inflict a devastating cost on the country and that China, far from being in league with Russia, is actually clawing away at its neighbor's interests in central Asia: http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/107256... Former Assistant U.S. Treasury Secretary Paul Craig Roberts disagrees. In an interview with King World News, Roberts says China remains on Russia's side and the aggressiveness of the United States will push those two nations and developing nations closer together: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/3/26_Pa... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Intervention is killing commodity hedge funds, Turk tells KWN Posted: 26 Mar 2014 05:55 PM PDT 8:50a HKT Thursday, March 26, 2014 Dear Friend of GATA and Gold: Blasted by government intervention in the markets, commodity hedge funds are closing all over the place, GoldMoney founder and GATA consultant James Turk tells King World News today. Professional traders may profit by trading with these interventions, Turk says, but ordinary investors may do best simply to acquire the monetary metals on a regular basis. Turk's interview is posted at KWN here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/3/26_Th... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| UBS said to suspend FX traders in New York, Zurich, and Singapore Posted: 26 Mar 2014 05:48 PM PDT By Liam Vaughan, Ambereen Choudhury, and Gavin Finch LONDON -- UBS suspended foreign-exchange traders in the United States, Singapore, and Switzerland as its investigation into the alleged rigging of currency markets widened, according to a person with knowledge of the matter. They include Onur Sert, an emerging-markets spot trader based in New York, and at least three more worldwide, said the person, who asked not to be identified because of the probe. Sert and Dominik von Arx, a spokesman for UBS in London, both declined to comment on the suspensions. Switzerland's largest bank opened a review of its currency operations last year after Bloomberg News reported in June that traders in the industry had colluded to rig the WM/Reuters rates, a benchmark used by investors and companies around the world. ... ... For the full story: http://www.bloomberg.com/news/2014-03-26/ubs-said-to-suspend-fx-traders-... ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| How The BRICs (Thanks To Russia) Just Kicked The G-7 Out Of The G-20 Posted: 26 Mar 2014 05:31 PM PDT By Paul Mylchreest of Monument Securities A critical juncture Over the course of the last century, the US Congress has been blamed for much that has gone wrong in international relations. The unwillingness of Congressional leaders in 1919 to support US participation in the League of Nations doomed from the outset that quixotic attempt to put global relations on a rational basis. Renewed world war was the eventual outcome. Then in 1930, Congressional passage of the Tariff Act, widely known as Smoot-Hawley, marked the break-out of beggar-thy-neighbour trade practices that no less an authority on that period than Mr Bernanke has maintained contributed to the length and depth of the global depression. It is no matter that some historians argue that Smoot-Hawley merely built on the Fordney-McCumber Tariff Act of 1922; that had been Congress's doing as well. More recently, the US Congress has resisted presidential demands for 'fast-track' authority to tie up international trade deals. The lack of faith of the USA's counterparties in Washington's ability to ratify trade agreements was an important factor in the collapse of the Doha Round, which has put a brake on the development of the World Trade Organisation. Now, the US Congress is acting in a way which could have consequences at least as serious as those that followed these past examples of obduracy. This week the US Congress is considering a bill to provide financial aid to Ukraine. President Obama had appended clauses to this bill to ratify the IMF's 2010 decision to increase the quotas, and hence voting power, of emerging countries, chiefly at the expense of European members, and to boost the IMF's capacity to lend. The USA enjoys a blocking minority in IMF decision-making under current quotas, and would continue to do so after the changes; it is essential, therefore, that US ratification be secured if the reform is to go ahead. However, many members of the US Congress, especially on the Republican side, are suspicious of the IMF and its activities. Specifically, that element of the reform package which would convert countries' temporary lending to the IMF during the global financial crisis into a permanent increase in IMF resources has roused fierce opposition. For more than three years, congressional leaders have thought better of exacerbating party tensions by bringing forward proposals to approve the IMF changes. However, the G20 meeting in February 'deeply regretted' that the reform was still held up and urged the USA to ratify 'before our next meeting in April'. Mr Siluanov, Russia's finance minister, then suggested that the IMF should move ahead with the reforms without US approval, a suggestion sympathetically received by other BRICS leaders but which would threaten to split the IMF. Mr Obama's concern to avoid this outcome is understandable and he has argued that, since the IMF will play the lead role in supporting Ukraine's economy, approval of the new quotas is relevant to the Ukraine legislation. All the same, Mr Reid, the Democrat Majority Leader in the Senate, yesterday stripped the IMF provisions from the text, taking the view that the bill would be given a rough ride through the Senate and no chance of passage through the House of Representatives if it retained them. It now seems unlikely that the USA will complete (or, indeed, begin) legislative action on the IMF reform by the 10 April deadline the BRICS have set. The odds are moving in favour of a showdown at the G20 finance ministers' and central bank governors' meeting due in Washington on that date. International discord over Ukraine does not bode well for the settlement of differences over the IMF's future. Though the G7 is excluding Russia from its number, in retaliation for its action in Crimea, this does not amount to isolating Russia. There has been no suggestion that Russia be excluded from the G20. The USA and its allies have suspected that several other G20 members would not stand for it. This suspicion was confirmed yesterday when the BRICS foreign ministers, assembled at the international conference in The Hague, issued a statement condemning 'the escalation of hostile language, sanctions and counter-sanctions'. They affirmed that the custodianship of the G20 belongs to all member-states equally and no one member-state can unilaterally determine its nature and character. In short, their statement read like a manifesto for a pluralist world in which no one nation, bloc or set of values would predominate. Meanwhile, Mr Obama has also been active at The Hague fostering warmer relations between South Korea and Japan. His aim seems to be to contain China's expansionism in the Asian region. But US worries in this regard may be exaggerated to judge by a recent article in the PLA Daily, the official media outlet of China's military. This urged China's leaders to study the history of the 1894-95 war with Japan, which China lost decisively despite being at least as well equipped. The concern in Beijing seems to be that problems of corruption and nepotism in the PLA today are no less serious than they were in China's forces in 1894. That may well deter China from taking military action. However, to the extent that China lacks confidence to use military force, it may be all the more intent on wielding financial weapons in pursuing its geopolitical aims. Beijing leaders have long dreamt of displacing, or at least dethroning, the US dollar from its reserve currency role. US dominance of the IMF is one of several effective bars to the achievement of such a goal. The kind of action Russia is advocating, the BRICS wresting control of the IMF in despite of US veto power, might have some appeal. That would mark the end of the unified global monetary system that has developed since the IMF was founded in 1945, to be replaced by a bloc of fiat currencies in the developed countries and a system in the emerging sector where currencies were linked to drawing rights in some new international fund, possibly with some material backing. It seems unlikely that convertibility between these monetary systems could be maintained for long. Consequently, the 10 April meeting is shaping up as a potentially critical juncture in world economic history. |

| Geoengineering & Collapse of Civilization -- Dane Wigington Posted: 26 Mar 2014 05:30 PM PDT Red Ice Radio - Dane Wigington -- Geoengineering & Collapse of Civilization Dane Wigington has an extensive background in solar energy. He is a former employee of Bechtel Power Corp. and was a licensed contractor in California and Arizona. His personal residence was featured in a cover... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The Gold Price Has Corrected, Time To Buy Posted: 26 Mar 2014 04:07 PM PDT Gold Price Close Today : 1303.40 Change : -8.02 or -0.61% Silver Price Close Today : 19.759 Change : -0.196 or -0.98% Gold Silver Ratio Today : 65.965 Change : 0.246 or 0.37% Silver Gold Ratio Today : 0.01516 Change : -0.000057 or -0.37% Platinum Price Close Today : 1406.50 Change : -14.40 or -1.01% Palladium Price Close Today : 781.15 Change : -8.25 or -1.05% S&P 500 : 1,852.56 Change : -13.06 or -0.70% Dow In GOLD$ : $258.02 Change : $ 0.02 or 0.01% Dow in GOLD oz : 12.482 Change : 0.001 or 0.01% Dow in SILVER oz : 823.37 Change : 3.13 or 0.38% Dow Industrial : 16,268.99 Change : -98.89 or -0.60% US Dollar Index : 80.110 Change : 0.030 or 0.04% Today the GOLD PRICE fell $8.02 (0.6%) to close Comex at $1,303.40. Silver fell 19.6 cents (1%) to 1975.9 cents. Today's action pretty well fulfills my targets for the correction, i.e., $1,300 and 1950c. Lows came at $1,299.30 and 1968c. Y'all can stand around waiting for perfection, but I'm not. Both metals fell off about noon, but without any more drama than a short waterfall. Little V-bottoms near day's end might mark the lows. Believe it or not I had a customer today who bought 60 cents off the day's lows. Good shooting! What's the downside risk? With the GOLD PRICE, possible drop to $1,287. the SILVER PRICE could -- but might not, drop as far as 1950 - 1945c. Not much from here, unless some surprise ariseth. Time to buy silver and gold. A reader wrote asking, "Many people are predicting a depression which will take down the price of almost everything. You feel that real estate and other tangible assets will also depreciate. Why don't you feel that precious metals and other commodities won't also take a big hit?" Because silver and gold are not commodities. Silver and gold prices are driven by MONETARY not economic demand as commodities are (copper, lumber, tin). They rise when inflation is eating out the dollar's value. So regardless of economic conditions, inflation will drive silver and gold higher, because people seeing their dollars lose value will seek refuge in silver and gold. Everything of value will NOT tank in the future, only those items whose value depends on economic demand, and that doesn't include silver and gold. It doesn't overstate much to say we are already in a depression, and that will over time lower most assets' value. However, the Fed and yankee government have shown that they will respond to every crisis by printing more money, so an inflationary depression will result. The underlying economic condition will be a depression (shrinking economic activity) while the monetary condition will be inflation resulting in rising prices. Although asset prices may rise, they will in fact be losing value or purchasing power, unless they rise faster than the dollar falls. Purchasing power is all that counts. You can see this in the Dow yesterday at 16,367.88, which appears much higher than its 2000 peak at 11,722. However, corrected for inflation (even using the government's understated and jimmied numbers), that 11,722 in 2000 equals only 15,982 today. Turn that around: 2014's 16,367.88 would equal only 12,005 in 2000. The Dow has not gained (16,367.88/11,722 = 40%, but 12,005/11,722 = 2.4% in purchasing power. Adjusted for real inflation loss, the Dow is lower now than it was in 2000. If I could teach y'all just one thing, it would be FORGET NOMINAL GAINS and LOOK ONLY AT PURCHASING POWER GAIN OR LOSS. Y'all remember this, too: inflation does not stimulate the economy, any more than illegal counterfeiting would. Inflation always creates booms that go bust, and disrupts the economy in thousands of other ways. Inflation benefits only those near the source of the inflation, i.e., Wall Street, and the bureaucrats and politicians who produce inflation while it robs all others. Now that I've hawked that bone out of my throat, let's look at markets. Stocks see-sawed back the other way today, losing more than they gained yesterday. Dow got near its upper downtrend line and looked like Dracula smelling garlic -- wilted. S&P500 bounced from top of its even-sided triangle to the bottom, and closed there for good measure. Dow lost 98.89 (0.6%) and closed 16,268.99. S&P500 coughed up 13.06 (0.7%) to roost at 1,852.56. Both of them perched below their 20 day moving averages. I have no opinion, triangles can surprise, but all this carries with it the scent of weakness. Silver is supposed to be strong relative to gold when stocks are strong and vice versa, but it hasn't been following that script lately. Dow in gold dropped slightly today, down 0.15% to 12.46 oz (G$257.57 gold dollars). It stands barely above the 50 DMA (12.39 oz or G$256.12), which might be a splendid place to turn down. But no indication of that yet. I'm anticipating. Dow in silver rose 0.63% to 824.37 oz (S$1,065.85 silver dollars). Unless stocks break down soon, it's liable to return to that December high at 853.1 oz. It has already fulfilled a 75% correction of the Dec - Feb drop. Last five days the US dollar index has established a downtrend with lower lows and lower highs. Now it's sort of bunching up, with a small range today, 80.29 - 80.06. Rose a less-than-gigantic three basis points today to 80.11. This sort of "stability" smacks of the strong hand of Nice Government Men. Euro back appears to have been broken. Closed again today beneath its 20 DMA, and lost another 0.3% to end at $1.3785. This comes after a breakout it could not cash in on. Yen rose 0.24% but that is sound and fury, signifying nothing, even with a close at 98.01 cents/Y100. Gold in euros and in British pounds looks like a buy here. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| The Gold Price Has Corrected, Time To Buy Posted: 26 Mar 2014 04:07 PM PDT Gold Price Close Today : 1303.40 Change : -8.02 or -0.61% Silver Price Close Today : 19.759 Change : -0.196 or -0.98% Gold Silver Ratio Today : 65.965 Change : 0.246 or 0.37% Silver Gold Ratio Today : 0.01516 Change : -0.000057 or -0.37% Platinum Price Close Today : 1406.50 Change : -14.40 or -1.01% Palladium Price Close Today : 781.15 Change : -8.25 or -1.05% S&P 500 : 1,852.56 Change : -13.06 or -0.70% Dow In GOLD$ : $258.02 Change : $ 0.02 or 0.01% Dow in GOLD oz : 12.482 Change : 0.001 or 0.01% Dow in SILVER oz : 823.37 Change : 3.13 or 0.38% Dow Industrial : 16,268.99 Change : -98.89 or -0.60% US Dollar Index : 80.110 Change : 0.030 or 0.04% Today the GOLD PRICE fell $8.02 (0.6%) to close Comex at $1,303.40. Silver fell 19.6 cents (1%) to 1975.9 cents. Today's action pretty well fulfills my targets for the correction, i.e., $1,300 and 1950c. Lows came at $1,299.30 and 1968c. Y'all can stand around waiting for perfection, but I'm not. Both metals fell off about noon, but without any more drama than a short waterfall. Little V-bottoms near day's end might mark the lows. Believe it or not I had a customer today who bought 60 cents off the day's lows. Good shooting! What's the downside risk? With the GOLD PRICE, possible drop to $1,287. the SILVER PRICE could -- but might not, drop as far as 1950 - 1945c. Not much from here, unless some surprise ariseth. Time to buy silver and gold. A reader wrote asking, "Many people are predicting a depression which will take down the price of almost everything. You feel that real estate and other tangible assets will also depreciate. Why don't you feel that precious metals and other commodities won't also take a big hit?" Because silver and gold are not commodities. Silver and gold prices are driven by MONETARY not economic demand as commodities are (copper, lumber, tin). They rise when inflation is eating out the dollar's value. So regardless of economic conditions, inflation will drive silver and gold higher, because people seeing their dollars lose value will seek refuge in silver and gold. Everything of value will NOT tank in the future, only those items whose value depends on economic demand, and that doesn't include silver and gold. It doesn't overstate much to say we are already in a depression, and that will over time lower most assets' value. However, the Fed and yankee government have shown that they will respond to every crisis by printing more money, so an inflationary depression will result. The underlying economic condition will be a depression (shrinking economic activity) while the monetary condition will be inflation resulting in rising prices. Although asset prices may rise, they will in fact be losing value or purchasing power, unless they rise faster than the dollar falls. Purchasing power is all that counts. You can see this in the Dow yesterday at 16,367.88, which appears much higher than its 2000 peak at 11,722. However, corrected for inflation (even using the government's understated and jimmied numbers), that 11,722 in 2000 equals only 15,982 today. Turn that around: 2014's 16,367.88 would equal only 12,005 in 2000. The Dow has not gained (16,367.88/11,722 = 40%, but 12,005/11,722 = 2.4% in purchasing power. Adjusted for real inflation loss, the Dow is lower now than it was in 2000. If I could teach y'all just one thing, it would be FORGET NOMINAL GAINS and LOOK ONLY AT PURCHASING POWER GAIN OR LOSS. Y'all remember this, too: inflation does not stimulate the economy, any more than illegal counterfeiting would. Inflation always creates booms that go bust, and disrupts the economy in thousands of other ways. Inflation benefits only those near the source of the inflation, i.e., Wall Street, and the bureaucrats and politicians who produce inflation while it robs all others. Now that I've hawked that bone out of my throat, let's look at markets. Stocks see-sawed back the other way today, losing more than they gained yesterday. Dow got near its upper downtrend line and looked like Dracula smelling garlic -- wilted. S&P500 bounced from top of its even-sided triangle to the bottom, and closed there for good measure. Dow lost 98.89 (0.6%) and closed 16,268.99. S&P500 coughed up 13.06 (0.7%) to roost at 1,852.56. Both of them perched below their 20 day moving averages. I have no opinion, triangles can surprise, but all this carries with it the scent of weakness. Silver is supposed to be strong relative to gold when stocks are strong and vice versa, but it hasn't been following that script lately. Dow in gold dropped slightly today, down 0.15% to 12.46 oz (G$257.57 gold dollars). It stands barely above the 50 DMA (12.39 oz or G$256.12), which might be a splendid place to turn down. But no indication of that yet. I'm anticipating. Dow in silver rose 0.63% to 824.37 oz (S$1,065.85 silver dollars). Unless stocks break down soon, it's liable to return to that December high at 853.1 oz. It has already fulfilled a 75% correction of the Dec - Feb drop. Last five days the US dollar index has established a downtrend with lower lows and lower highs. Now it's sort of bunching up, with a small range today, 80.29 - 80.06. Rose a less-than-gigantic three basis points today to 80.11. This sort of "stability" smacks of the strong hand of Nice Government Men. Euro back appears to have been broken. Closed again today beneath its 20 DMA, and lost another 0.3% to end at $1.3785. This comes after a breakout it could not cash in on. Yen rose 0.24% but that is sound and fury, signifying nothing, even with a close at 98.01 cents/Y100. Gold in euros and in British pounds looks like a buy here. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Gold And Silver Excellent Store Of Wealth In Last 60 Years Posted: 26 Mar 2014 03:06 PM PDT We are told that money is safe. Likewise, our bank is a trusted partner, so is the bank account where you hold your savings. While that could be true in normal circumstances, during times of stress nothing is further from the truth. Gold and silver in physical form outside the banking system are the ultimate stores of value. But readers of this site knew that for a long time. What is a much more interesting question, though, is how gold and silver preserve wealth over a long period of time. Consider, for instance, the last several decades … to which extent have the metals proven their “unique selling proposition” (to use some marketing jargon)? And how does this relate to the price change in a basket of goods that people are using in their daily lives? Or how does it compare to other regular investment alternatives? This article, written by contributor Gary Christenson, provides answers to those questions. The author looks back 60 years and comes with a very insightful set of findings. 2014 is the 60th anniversary of nothing special. A quick review and comparison to 1954 seems appropriate.

Some approximate numbers

Summary The value of the dollar has declined over 60 years so prices for most items have increased. Gold and Silver are still a store of value. Politics and government are … well, the same as always. For the Future 1) Politicians will borrow and spend, the national debt will increase, and more promises will be forthcoming. 2) Deflation is a problem for the industries and governments that depend upon ever increasing prices and ever increasing debt. There are few in power that would benefit from deflation. Expect inflation. 3) The Federal Reserve is committed to "printing dollars," increasing debt, expanding the money supply, and creating inflation. Expect the Fed to succeed. 4) The gold and silver bears will be disappointed. Both precious metals will go much higher as all currencies weaken. 5) A financial crash will demonstrate that debt based paper assets can plummet in value. Gold will increasingly be seen as a store of value. 6) Even without a crash, continued inflation in the money supply will demonstrate that debt based fiat currencies are not a store of value. 7) A hot war in the Middle East, Asia, or Eastern Europe will be expensive. Remember the Vietnam War. The consequences will include more debt, more inflation, and higher prices. Gold prices rose by over a factor of 20 between 1970 and 1980. The cost of living increased substantially during that same decade. It could happen again. 8) Even a cold war or a currency war will be expensive, but less so than a hot war. The consequences of either a hot or cold war will be similar. 9) From Milton Friedman: "Only government can take perfectly good paper, cover it with perfectly good ink and make the combination worthless." Delusions die hard! The delusions regarding the value of paper currency, usefulness of the Fed, government entitlements, the welfare and warfare state, and continual growth are weakening. The ultimate reckoning may be sudden or slow, but it will not be pretty for the unprepared. Gold and silver will remain valuable and a store of value over the next 60 years.

GE Christenson | The Deviant Investor |

| Gold Price Projection by the Golden Ratio Posted: 26 Mar 2014 02:46 PM PDT Submitted by Trader MC, Cycles Expert & Market Timer (more about Trader MC): This article shows how Gold has been following the Golden Ratio which predicted all the major turning points with a high degree of accuracy for the past thirty years, and reveals the next possible major turning points. The Golden Ratio 1.618034… (also called the Golden Number, the Golden Section or the Golden Mean) can be found everywhere around us from mathematics to architecture, from nature to our own anatomy. But as you can see in the following analysis, it can also be found in the Gold Metal Charts. The first chart presents the Secular Bear Market from 1980 to 1999 and the Cyclical Bull Market from 1999 to 2011 and shows how they are connected to the Golden Ratio 1.618. Firstly, you can see that the three most important turning points (1980 top – 1999 low – 2011 top) had a time duration which is accurately connected to the Golden Ratio. It is also interesting to note that the Golden Ratio has an inverse correlation with the previous turning point (high-low-high). Secondly, the first leg up of the Cyclical Bull Market from the low on August 25, 1999 to the top of March 17, 2008 predicted exactly the low on June 28, 2013. Here again, the Golden Ratio has an inverse correlation with the previous turning point (low-high-low). Thirdly, the second leg up of the Cyclical Bull Market – from the low on October 24, 2008, to the top on September 6, 2011 – pinpointed also the low on June 28, 2013 and once again, the correlation is inverted (low-high-low). The next chart shows the Cyclical Bear Market from the 2011 top to the 2013 low. A look at the time duration of the tops and lows of this bear market reveals that it has an inverse correlation with the Golden Ratio. Contrary to the bull market, the bear market follows the 0.62 ratio which is the inverse of the Golden Ratio (1/1.618=0.62). We can also notice that the alternate relation between highs and lows is broken (high-low-low). As we can see, every turning point has been predicted by the Golden Ratio for the last thirty years. The charts are showing that these turning points did not happen by coincidence but followed a precise Golden Ratio road map. This ratio can therefore also be used to project the next important market turning points. On the following charts you can see a projection upon studying the tops and lows of the previous bull and bear markets. The entire leg up of the Cyclical Bull Market from the low on August 25, 1999 to the top on September 6, 2011, is pinpointing an important market turn date during the last week of January 2019. As history has shown, the Golden Number had an inverse correlation with the previous tops or lows, so odds favor that the last week of January 2019 could be a major low which will be reversed by the September 6, 2011 high. As for the Cyclical Bear Market from the 2011 high to the 2013 low, two possible turning points could be forecast, since I also take into account the Inverse Golden Ratio which pinpointed the highs and lows of the previous bear market. We can see that the first turning point could happen during the first week of August 2014 (Golden Ratio) and the second one during the third week of May 2016 (Inverse Golden Ratio). Based on the Golden Ratio study, the first week of August 2014 could be a top, as the Golden Ratio sequence has usually an inverse correlation with the previous turning point (the low on June 28, 2013). As for the third week of May 2016, history has shown that the Inverse Golden Ratio 0.62 keeps the same characteristic of the previous turning point. In that case the third week of May 2016 could be a low, as the previous turning point on 28 June, 2013 was a low. However, it is important to note that the history also reveals that turning point sequences can be broken whether we are in a cyclical bull or a cyclical bear market. Therefore I think that the most important is to watch how the price action will approach these turning points (in an uptrend or in a downtrend) and be prepared for a trend change. If the Golden Ratio has an important role for the time period, my analyses on Gold prices also reveals that prices of both legs up of the Cyclical Bull Market and of both legs down of the Cyclical Bear Market are connected to the Golden Ratio 1.618. The Correlation of Price is a little less accurate than the one for Time Duration but it is still very relevant. A measure move with round numbers of the first leg up and the second leg up of the Cyclical Bull Market presents that both legs up have a price ratio of 1.59 which is very close to 1.618. The two legs down of the bear market are also very close to the Golden Ratio (7 points less than 1.62). As far as Gold prices are holding above the Symmetry Guideline and Silver holds above its thirty years Base Pattern Neckline (as shown on the two charts below, also published in "2014 – The Year of Commodities"), the Secular Bull Market is still intact. In that case we could expect another leg up with a measure move between (the Golden Number) X (measure move of the Cyclical Bull Market) and (the Inverse Golden Number) X (measure move of the Cyclical Bull Market): 1.618 X (1921-252) = 2700 This leg up could therefore send prices to a range between $2215 and $3880 from the low at $1180. For the moment we need to see further development in the price action to confirm a new leg up.

As all the major turning points were predicted by the Golden Ratio both in terms of Price and Time, we can also note that Gold Time Duration is well balanced. The second leg up of the bull market lasted three times less that the first leg up, whereas the second correction lasted three times longer than the first one. The dynamic symmetry is therefore completed. The geometry of Time Dimension has an important role in the market structure, as the market likes geometry both in Price and Time. The Golden Ratio has accurately predicted all the Gold major turning points these last thirty years and it seems reliable for making future projections. It is one of the techniques that can be used but the most important is to understand the structure and the rhythm of the market to forecast future developments not only in terms of the dimension of Price but also of the dimension of Time. In order to gain superior returns, it is essential to study the history of the market and to follow the price action. Cycles and market timing research > more info. |

| Rick Rule: Ownership Of Gold Is Critical To Your Wealth Next Years Posted: 26 Mar 2014 02:30 PM PDT Rick Rule, Chairman of Sprott Global Resource Investments Ltd., answered 10 questions on precious metals investing and gold miners. Read Rick Rule’s previous interview “Gold Is A Store Of Wealth In A Mechanism Other Than Fiat Currency.” Gold price expectations for the next one-to-five years? "I believe that the gold price bottomed in 2013," Rick begins. "Between 2011 and 2013, traders drove the gold price down, unwinding leveraged bets on gold. For most of that period, there were forced sellers and not much buying. "In the middle part of 2013, we saw a stalemate between exhausted sellers and buyers. As the forced selling by leveraged traders passed, gold began to find a bid, taking the price higher so far in 2014. "The gold price rally will not necessarily continue through 2014. But as an investor with an outlook of three-to-five years, I believe ownership of gold will be critical to maintaining your wealth in the next few years." What about silver? "We often joke that 'silver bugs' are 'gold bugs on steroids,'" says Rick. "Moves in the price of silver tend to be more dramatic than in gold. So if gold moves up, silver can move up even more – and fall by a lot more too. "The problem with silver is that a lot of it comes as a by-product of producing some other metal. So in order to predict the silver production from mining you need to understand the economics of the other metals, where silver is mined as a by-product. "Another hitch is that estimates vary widely on how much silver really exists in circulation today – especially in places like India, Sri Lanka, Bangladesh, or Pakistan." Where are platinum and palladium headed? "We have recently seen an increasing popularity of platinum group metals among financial institutions, who are now speculating in the price of the metal. I believe they could now begin to unwind these positions now, which could drive the price lower in the short term. "But in the longer-term, I see them going higher," he adds. "Mining companies are losing money on their platinum production, which could force them to shut down. But platinum and palladium are extremely useful to modern society – primarily because they help prevent smog. "For these reasons, the price has to go up," he believes. Will there be a 'meltdown' in the metals sector before a new bull market takes off? "I don't think that we will see another move down like the one from 2011 to 2013, where gold dropped 30 percent and mining stocks fell by over 50 percent. But this is still the most volatile sector in the world. Just as gold went up by over 1,000 in only a few months, we could see it return to around 1,150 at some point before the year is over. "In fact, I believe the market will mostly move sideways over the next 18 months with intermittent rallies and subsequent sell-offs. Once this period is passed, we could see a major bull market truly take off." Are institutions intentionally driving down prices by shorting the metals? "The situation is different depending on the metal you are talking about," says Rick. "In platinum and palladium, for instance, there are almost no short-sellers of the metals. "On the gold side, traders are now covering their short positions, which could indicate that downwards momentum has subsided." Was there a concerted effort to drive down the metals? "I believe that any potential manipulation is disappearing," said Rick. "The banks' and other major institutions' ability to manipulate metals prices is under increasing regulatory scrutiny." Is there any store of wealth that cannot be manipulated? "The biggest threat to your wealth is not the government, the banks or market manipulators," says Rick. "It is almost always your own lack of conviction, courage, or knowledge. "Everyone wants to be a contrarian, but only when it's popular. That is why lots of people wanted to invest in 2011 when precious metals had enjoyed an unprecedented rise. Meanwhile, nobody wanted to invest in 2012 and 2013, when both the precious metals and the mining stocks were much cheaper. "If you believe in the precious metals in the long term, then manipulation by financial or government institutions to drive the price lower is an opportunity. You can buy the assets you want at an artificially low price. "So don't fear manipulation. Fear your own mistakes due to emotional decision-making and prejudices set by your experience in the immediate past." How long will the Fed keep interest rates low? "As long as they can get away with it," says Rick. "Suppressed interest rates take money from savers, who receive an artificially low return, and rewards spenders with the ability to borrow more at lower rates. "Because spenders outnumber savers, elections and political powers tend to favor low-interest-rate policies like the current ZIRP (zero-interest-rate policy) in the United States." So far, a weak recovery has prevented low interest rates from causing high inflation, he adds. "We are in a very strange situation – a jobless recovery with little new investment in production. The demand for capital has been muted as a result, which has prevented easy money from translating into greater inflation. "Because the economy remains anemic, interest rates could stay low for the next two or three years. But markets always win in the end. Eventually, I would expect inflation and higher interest rates to arise." Is the general stock market in for another crash? "It seems the general stock market has been driven by artificially low interest rates. If interest rates were to rise, as I believe they will eventually, it could severely adversely impact most stocks. "There is no real economic recovery going on to justify higher stock prices today. Few jobs are being created and there is little capital investment. It looks like a recovery 'on paper' – but it is a confidence recovery driven by low interest rates. "If confidence wears off and interest rates start to rise, I believe it could be extremely damaging to the overall stock market," he concludes. If the resource sector recovers, how will we know when to get out? "Remember back to 2010 and 2011 – and how well your portfolio was performing. Many investors were seeing their portfolios rise by double-digits each month. That is when we felt the smartest and the most aggressive. "As the height of a bull market, investors confuse a bull market with brains. So when we become most fearlessly bullish it is time to begin to sell stocks. The easiest sign of a top is really that you begin to see solicitations everywhere to invest in that sector – from the media and publishing companies. "In contrast, publishers begin to cancel their publications that have to do with natural resources when we are in a bear market. It is a harbinger of a bottom." What impact will the Mexican mining tax have on the industry? "Politicians and governments frequently turn to mining and oil and gas to increase their tax revenues because the assets are fixed. They cannot be moved elsewhere. "I believe the new tax will not be beneficial to Mexico. State ownership of the oil industry has severely impeded the oil and gas industry there. Now, they are turning their attention to mining, which is certainly not a positive development. "The mining industry has been a stellar contributor of revenues for the government and jobs for the Mexican people. It will only be weighed down by this tax, which is very unfortunate." More on the Mexican mining tax here. Where should an investor in natural resources put their money today? "Personalized investment advice is only available to clients. The full depth of our research and expertise at analyzing natural resource stocks is available through your Sprott Global broker. "The best investments for your portfolio will depend on your individual situations and willingness to tolerate risk. If you would like to know what are favorite companies are today, I urge you to either contact your Sprott Global broker or become a client of Sprott Global. Rick concludes: "Investing in natural resources and precious metals is attractive today because the sector is so much cheaper than it was three years ago. Many of the stocks are trading at a 90 percent discount to their prices in 2011. For a contrarian investor, I believe that we are seeing a historic opportunity now." Rick Rule is the Chairman and Founder of Sprott Global Resource Investments Ltd., a full-service brokerage firm located in Carlsbad, CA. Sprott Global is an affiliate of Sprott Inc., a public company based in Toronto, Canada. Mr. Rule leads a team of earth science and finance professionals who form an intellectual pool for resource investment management. He and his team have experience in many resource sectors including mining, oil and gas, water, agriculture, forestry, and alternative energy. |

| Gold Daily And Silver Weekly Charts - Option Expiration Posted: 26 Mar 2014 01:27 PM PDT |

| Gold Daily And Silver Weekly Charts - Option Expiration Posted: 26 Mar 2014 01:27 PM PDT |

| April Fools’ drop dead date for the Volcker Rule – what it might mean for Gold Posted: 26 Mar 2014 01:22 PM PDT It could get to be interesting as we move into the end of the month. The Volcker Rule which limits banks’ speculative investments (including gold) goes into effect April 1, 2014. There has probably already been quite a bit of adjustment to bank portfolios, but those who have held out will need to make their moves before the deadline. |

| U.S. Dollar Value Could Suffer Instant Change Posted: 26 Mar 2014 01:20 PM PDT span style="color:#000000; ">Silver expert David Morgan is warning of coming financial changes that may be forced on the U.S. during the next G20 meeting. Morgan says, “The impetus here is the U.S. has had too much financial power backed by the military for far too long, and they (G20) are going to implement change one way or the other. The IMF is basically an extension of the United States. Even though it’s called the International Monetary Fund, it is really U.S. based. With what’s been proposed here, the IMF is not going to have the clout that it once did because the G-20 is going to be able to overrule the IMF vote. This is a point in history, monetary history and global economic politics that could set a precedent . . . where it’s official that the U.S. dollar has lost its primary status as world reserve currency.” |

| Posted: 26 Mar 2014 01:05 PM PDT Via this item at Mining.com where someone took the time to read through this report from the World Gold Council on the subject of risk management and capital preservation comes the chart below where, clearly, they’ve got the correct caption. I’d read about gold’s share of financial assets then and now (i.e., back in 1980 as [...] |

| Gold Price vs. "Flattening" Yield Curve Posted: 26 Mar 2014 12:37 PM PDT Why you should care about the yield curve. Really... THERE is a lot of talk now about a flattening of the yield curve, writes Gary Tanashian in his Notes from the Rabbit Hole. A flattening curve is commonly viewed as bad for gold prices, and according to Mark Hulbert, is an indicator of a coming recession. But is the curve really flattening or is this all hype based on Janet Yellen's press conference comments? Here is a chart the likes of which we have been using in NFTRH for many months now, the 30 year vs. the 5 year yield.  MarketWatch shows a similar chart in its article. So here we should lend some perspective. I ask you what is different this time from the last flattening?  I am not going to pretend to sit here like some genius blogger and post all the conclusions so that we all know exactly what is going on (according to one guy's imperfect world view). But what we do know is...

There is a distortion built into the system. This is not opinion, it is a fact presented by the chart above. Now, how it will resolve is up for debate among various eggheads. But there is a running distortion on the fly and not you or I know how it will resolve. It is not normal and it (in my opinion) belies desperation on the part of those promoting it. To me, it looks like the latter stages of an 'all or nothing' operation that was put in play years ago. 'All or nothing' implies all in and totally committed. Otherwise, why has ZIRP not already (and long ago) begun to be incrementally phased out? One conclusion that can be made is that this alignment continues to be favorable to whomever it is that borrows from the Fed Funds window exclusively. That is of course due to the beneficial (and again in my opinion, immoral) ZIRP. They can lend out at any other point on the curve for a favorable spread. The curve is not flattening when ZIRP is used as the short term measurement point, as it is when the 5, 3 or 2 year yields are measured. And people wonder why the rich get richer. They should stop looking at politics and start looking at finance. |

| Gold Price vs. "Flattening" Yield Curve Posted: 26 Mar 2014 12:37 PM PDT Why you should care about the yield curve. Really... THERE is a lot of talk now about a flattening of the yield curve, writes Gary Tanashian in his Notes from the Rabbit Hole. A flattening curve is commonly viewed as bad for gold prices, and according to Mark Hulbert, is an indicator of a coming recession. But is the curve really flattening or is this all hype based on Janet Yellen's press conference comments? Here is a chart the likes of which we have been using in NFTRH for many months now, the 30 year vs. the 5 year yield.  MarketWatch shows a similar chart in its article. So here we should lend some perspective. I ask you what is different this time from the last flattening?  I am not going to pretend to sit here like some genius blogger and post all the conclusions so that we all know exactly what is going on (according to one guy's imperfect world view). But what we do know is...

There is a distortion built into the system. This is not opinion, it is a fact presented by the chart above. Now, how it will resolve is up for debate among various eggheads. But there is a running distortion on the fly and not you or I know how it will resolve. It is not normal and it (in my opinion) belies desperation on the part of those promoting it. To me, it looks like the latter stages of an 'all or nothing' operation that was put in play years ago. 'All or nothing' implies all in and totally committed. Otherwise, why has ZIRP not already (and long ago) begun to be incrementally phased out? One conclusion that can be made is that this alignment continues to be favorable to whomever it is that borrows from the Fed Funds window exclusively. That is of course due to the beneficial (and again in my opinion, immoral) ZIRP. They can lend out at any other point on the curve for a favorable spread. The curve is not flattening when ZIRP is used as the short term measurement point, as it is when the 5, 3 or 2 year yields are measured. And people wonder why the rich get richer. They should stop looking at politics and start looking at finance. |

| Gold Juniors? Choose Carefully, If At All Posted: 26 Mar 2014 12:27 PM PDT You could just plunge x 3 with $JNUG. Or actually study gold miners first... JEFF KILLEEN has been with the CIBC Mining research team since early 2011, providing technical assessment of junior exploration and mining companies worldwide. Previously, Killeen worked as an exploration and mine geologist in several major mining camps, including the Sudbury basin and the Kirkland Lake region. Here he tells The Gold Report how, while the gold price may be enjoying a double-digit increase so far this year, it's not time to jump into metals with both feet. Especially not junior miners. Be selective, Killeen says... The Gold Report: The price of gold has increased 10% this year. Is that due to gold's safe haven status? Jeff Killeen: The safe-haven mentality is one element that's supporting the gold price. There is uncertainty in the market about the strength of the US economy. A number of economic indicators reported during the last two months have not met forecasts. The rebound may be slower than expected. Buyers are coming back to bullion. Unrest in the Ukraine is also helping to support the gold price, however, to a lesser extent than US economic data. If weaker-than-expected indicators persist – and severe weather in the US results in soft data – such a scenario could be positive for gold in the near term. Even before this rebound, there was very strong physical buying around the $1200 per ounce level from Asia. The investment community believed that there was a base established and started putting money back into the space with much less risk of a downside move. TGR: It's now six years since the economic crisis of 2008. Is it possible that a consensus could form that a traditional economic recovery is not going to occur? And if this consensus does form, would it be a big boost for gold? Jeff Killeen: Certainly. However, I think that that consensus may take a little while to form because most of the US economic indicators started moving in the right direction in 2013. In the next three to six months the impact from severe weather last winter will obscure the data picture. TGR: The mood at this year's Prospectors and Developers Association of Canada (PDAC) conference has been described as "cautious optimism." Would you agree? Jeff Killeen: I'd say the tone was divergent – some senior management teams were feeling very cautious about commodity prices and general market appetite for mining equities, whereas a lot of the junior management teams had a much greater conviction that 2014 would be a strong year for the metals and equities. TGR: If you look at the juniors and mid-caps, a lot of these stocks have gone up 25%, 50% and even 100% this year. I would have thought you would've seen a lot of smiling faces at PDAC as a result of that. Jeff Killeen: Very true, but even a 100% uptick still leaves some share prices below where they may have been at better points in 2012. There is still that rearward-looking view to where the stock prices have come from, and a lot of them are a long way from there. TGR: As capital returns to the mining sector, would it be correct to say that it will return first to the producers, second to companies with late-development assets and then, third and finally, to explorers? Jeff Killeen: That succession sounds reasonable; however, new capital investment will certainly be selective. I would expect to see capital flowing into the space across the market-cap spectrum, but those companies or projects that are marginal at the current gold price or require further appreciation in the price to generate acceptable returns are likely to find it difficult to attract any new investments in 2014. TGR: How can smaller companies, specifically explorers, demonstrate that they are worthy of financing? Jeff Killeen: The first question anyone should ask when looking at the explorer space concerns the management team. Pick a solid team, especially in a market where accessing capital can be difficult. Spending Dollars wisely is important. Beyond that, a project with strong grades can give a comfort level to the buy side that a project could be profitable in the future, considering it's very difficult to assess where gold prices might be four, five or seven years from now. Other benefits – geographic or logistic – such as being in the right region for having a smooth permitting process and having good roadways, rail or power, can add value. TGR: Given the recent increase in the price of gold and the significant uptick in a lot of equities, do you think that investors are embracing the sea change? Jeff Killeen: There is a belief within the investment community that we're finding a bottom for the commodities. We do know that equities underperformed to the down side of the gold and silver price. Even just to revalue based on current spot prices means that there is probably still some upside to be had in a lot of the equities. With that in mind, investors are feeling better, but not excited to the point where there's going to be broad-scale investment across the mining space. It's going to be selective. It's going to be higher-quality names or those that have a higher prospect for development. It's not going to be widespread just yet. TGR: Jeff, thank you for your time and your insights. |

| Gold Juniors? Choose Carefully, If At All Posted: 26 Mar 2014 12:27 PM PDT You could just plunge x 3 with $JNUG. Or actually study gold miners first... JEFF KILLEEN has been with the CIBC Mining research team since early 2011, providing technical assessment of junior exploration and mining companies worldwide. Previously, Killeen worked as an exploration and mine geologist in several major mining camps, including the Sudbury basin and the Kirkland Lake region. Here he tells The Gold Report how, while the gold price may be enjoying a double-digit increase so far this year, it's not time to jump into metals with both feet. Especially not junior miners. Be selective, Killeen says... The Gold Report: The price of gold has increased 10% this year. Is that due to gold's safe haven status? Jeff Killeen: The safe-haven mentality is one element that's supporting the gold price. There is uncertainty in the market about the strength of the US economy. A number of economic indicators reported during the last two months have not met forecasts. The rebound may be slower than expected. Buyers are coming back to bullion. Unrest in the Ukraine is also helping to support the gold price, however, to a lesser extent than US economic data. If weaker-than-expected indicators persist – and severe weather in the US results in soft data – such a scenario could be positive for gold in the near term. Even before this rebound, there was very strong physical buying around the $1200 per ounce level from Asia. The investment community believed that there was a base established and started putting money back into the space with much less risk of a downside move. TGR: It's now six years since the economic crisis of 2008. Is it possible that a consensus could form that a traditional economic recovery is not going to occur? And if this consensus does form, would it be a big boost for gold? Jeff Killeen: Certainly. However, I think that that consensus may take a little while to form because most of the US economic indicators started moving in the right direction in 2013. In the next three to six months the impact from severe weather last winter will obscure the data picture. TGR: The mood at this year's Prospectors and Developers Association of Canada (PDAC) conference has been described as "cautious optimism." Would you agree? Jeff Killeen: I'd say the tone was divergent – some senior management teams were feeling very cautious about commodity prices and general market appetite for mining equities, whereas a lot of the junior management teams had a much greater conviction that 2014 would be a strong year for the metals and equities. TGR: If you look at the juniors and mid-caps, a lot of these stocks have gone up 25%, 50% and even 100% this year. I would have thought you would've seen a lot of smiling faces at PDAC as a result of that. Jeff Killeen: Very true, but even a 100% uptick still leaves some share prices below where they may have been at better points in 2012. There is still that rearward-looking view to where the stock prices have come from, and a lot of them are a long way from there. TGR: As capital returns to the mining sector, would it be correct to say that it will return first to the producers, second to companies with late-development assets and then, third and finally, to explorers? Jeff Killeen: That succession sounds reasonable; however, new capital investment will certainly be selective. I would expect to see capital flowing into the space across the market-cap spectrum, but those companies or projects that are marginal at the current gold price or require further appreciation in the price to generate acceptable returns are likely to find it difficult to attract any new investments in 2014. TGR: How can smaller companies, specifically explorers, demonstrate that they are worthy of financing? Jeff Killeen: The first question anyone should ask when looking at the explorer space concerns the management team. Pick a solid team, especially in a market where accessing capital can be difficult. Spending Dollars wisely is important. Beyond that, a project with strong grades can give a comfort level to the buy side that a project could be profitable in the future, considering it's very difficult to assess where gold prices might be four, five or seven years from now. Other benefits – geographic or logistic – such as being in the right region for having a smooth permitting process and having good roadways, rail or power, can add value. TGR: Given the recent increase in the price of gold and the significant uptick in a lot of equities, do you think that investors are embracing the sea change? Jeff Killeen: There is a belief within the investment community that we're finding a bottom for the commodities. We do know that equities underperformed to the down side of the gold and silver price. Even just to revalue based on current spot prices means that there is probably still some upside to be had in a lot of the equities. With that in mind, investors are feeling better, but not excited to the point where there's going to be broad-scale investment across the mining space. It's going to be selective. It's going to be higher-quality names or those that have a higher prospect for development. It's not going to be widespread just yet. TGR: Jeff, thank you for your time and your insights. |