Gold World News Flash |

- Webbot 07-Mar-2014 : Dollar Hyperinflation & Death of Federal Reserve

- Jeffrey Lewis: The mainstream grapples with the last manipulated asset class

- Market Report: Gold challenges $1350

- RETAIL CRE: 225 Staple Store Closures – The Forecast Tsunami Now on the Horizon

- Five years of daylight robbery

- Chinese Exports Collapse Leading To 2nd Largest Trade Deficit On Record

- Gold industry must rebuild credibility and refine focus

- Guest Post: Obama And Putin Are Trapped In A Macho Game Of "Chicken"

- The Gold Price Lost 1 Percent or $13.60 Today in a Steep Drop to $1,338.10

- The Gold Price Lost 1 Percent or $13.60 Today in a Steep Drop to $1,338.10

- Meet The Mysterious Firm That Is About To Leave Blythe Masters Without A Job

- China Is Crashing … As Predicted

- South Africa notices gold fix controversy; GATA consultant Speck cited

- Gold Daily and Silver Weekly Charts - This Must Have Been a Non-Farm Payrolls Friday

- Gold Daily and Silver Weekly Charts - This Must Have Been a Non-Farm Payrolls Friday

- On a Manhunt for Newly Created Currency

- “Bitcoin is Gold 2.0″

- BITCOIN CRASH : HACKS, Suicides, and Ponzi Schemes. Is it Really Safe?

- The U.S. Government Is One Big Lie

- The U.S. Government Is One Big Lie

- The London Gold Fix, Manipulation & the Quantum

- The London Gold Fix, Manipulation & the Quantum

- The London Gold Fix, Manipulation & the Quantum

- Gold ETF Stocks Inflows Return

- Gold and Silver and the Paradox of Over-Optimization

- Gold Prices Drop Weekly Gain as US Jobs Data "Defy Cold Weather", Moscow Rebukes EU Over Ukraine, Shanghai Premium Ends Negative

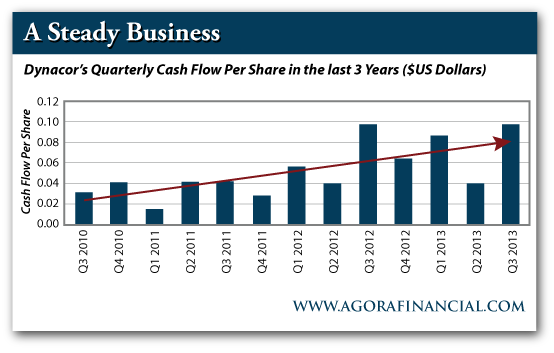

- Surprise! A Profitable, Low-Risk Gold Company

- Koos Jansen: China's road to secret gold accumulation

- Paulson, the Ultimate Financial Meltdown Insider Is Worried… About Another One

- Friday Morning Links

- Alasdair Macleod: Elevating markets: A signal of reviving bank lending?

- Gold Price Challenges $1350

- Stock Market Top - 2014 The Year of Gold, Silver and Commodities

- Gold and Silver Stocks Interesting Developments in the Charts

- 10 Ways to Screw Up Your Retirement

| Webbot 07-Mar-2014 : Dollar Hyperinflation & Death of Federal Reserve Posted: 07 Mar 2014 10:51 PM PST 07-Mar-2014 Clif High Wujo, Silver Gold, Bitcoin, US Dollar Hyperinflation, Death of Federal Reserve Title: 07-Mar-2014 Clif High Wujo, Silver Gold, Bitcoin, US Dollar Hyperinflation, Death of Federal Reserve Recording Date (start): 07-Mar-2014, 02:16 PM Pacific Coast of North America... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Jeffrey Lewis: The mainstream grapples with the last manipulated asset class Posted: 07 Mar 2014 09:25 PM PST 12:20a ET Saturday, March 8, 2014 Dear Friend of GATA and Gold: A well-trained financial journalist would require no more than 15 minutes to grasp the facts of manipulation of the monetary metals markets, Silver Coin Investor proprietor Jeffrey Lewis writes, marveling at the off-kilter reports about such manipulation that have begun creeping into mainstream financial publications. The documentation, such as that collected by GATA, is, Lewis notes, overwhelming. His commentary is headlined "The Mainstream Grapples with the Last Manipulated Asset Class" and it's posted at Silver Coin Investor here: http://www.silver-coin-investor.com/The-Mainstream-Grapples-with-the-Las... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair plans seminars in Los Angeles and San Diego Gold advocate Jim Sinclair's next market analysis seminars will be held in Los Angeles from 11 a.m. to 2 p.m. on Saturday, March 8, and in San Diego from 2 to 6 p.m. the following day, Sunday, March 9. Details, including registration information, are posted at Sinclair's Internet site, JSMinset.com, here: http://www.jsmineset.com/qa-session-tickets/ Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1 302 635 1160 in the United States. Or email them at info@goldcore.com. |

| Market Report: Gold challenges $1350 Posted: 07 Mar 2014 09:00 PM PST by Alasdair Macleod, Gold Money:

The change in sentiment over the last eight weeks has encouraged small traders to go long on gold. Normally, market-makers would be able to mark prices down aggressively to shake out these short-term speculators, but it has not recently happened. This suggests that the underlying market is robust. |

| RETAIL CRE: 225 Staple Store Closures – The Forecast Tsunami Now on the Horizon Posted: 07 Mar 2014 08:00 PM PST by Gordon T Long, Gold Seek:

Staples, the largest US office supplies retailer just announced:

|

| Five years of daylight robbery Posted: 07 Mar 2014 07:40 PM PST by Jan Skoyles, TheRealAsset.co.uk

Gold may not pay interest but neither, it seems do the banks. Today the Bank of England's MPC met for their monthly bank-rate setting meeting. This was the 60th meeting since they first set rates at the record low of 0.5%, five years ago. Savers' campaign group Save Our Savers estimates that since the first rate cut to 0.5% on the 5th March 2009, savers have lost 'a staggering £326 billion.' |

| Chinese Exports Collapse Leading To 2nd Largest Trade Deficit On Record Posted: 07 Mar 2014 07:20 PM PST Plenty of excuses out there for this evening's collosal miss in Chinese exports (-18.1% YoY vs an expectation of a 7.5% rise) mainly based on timing issues over the Lunar New Year (but didn't the 45 economists who forecast this data know the dates before they forecast?) This is a 6-sigma miss and plunges China's trade balance to its biggest miss on record and 2nd largest deficit on record. Combining Jan and Feb data (i.e. smoothing over the holiday), exports are still down 1.6% YoY - not good for the much-heralded global recovery. Exports to the rest of the BRICs were all down over 20% but no there is no contagion from an emerging market crisis.

Even when the trade deficit was last this large, economists were more accurate - this is the biggest miss on record...

Seasonally-adjusted the data is stunningly bad...

and non-seaonally-adjusted

The excuse...

But, our simple question is - didn't they already know this when applying their forecasts? If so - then why a 6-standard-deviation miss? At least they didn't blame the weather?!! It seems the massive imports of copper - to act as collateral for all the shadow banking loans - also did not help as imports surged... *CHINA JAN.-FEB. COPPER, PRODUCT IMPORTS 915,000 TONS

All that apparent demand and yet the price is collapsing - not good for the credit unwind And what does it say about the US that our trade balance with China collapsed MoM...

|

| Gold industry must rebuild credibility and refine focus Posted: 07 Mar 2014 07:00 PM PST by Dorothy Kosich, MineWeb.com

What incurred the managers' wrath was a February 28th letter Tumazos sent to the CEOs of gold mining companies, Barrick, Newmont, Goldcorp, AngloGold Ashanti, Agnico-Eagle and Kinross, urging them "to renounce construction of complex large mines, whether in this hemisphere or remote locations." |

| Guest Post: Obama And Putin Are Trapped In A Macho Game Of "Chicken" Posted: 07 Mar 2014 05:25 PM PST Submitted by Michael Snyder of The Economic Collapse blog, The U.S. government and the Russian government have both been forced into positions where neither one of them can afford to back down. If Barack Obama backs down, he will be greatly criticized for being "weak" and for having been beaten by Vladimir Putin once again. If Putin backs down, he will be greatly criticized for being "weak" and for abandoning the Russians that live in Crimea. In essence, Obama and Putin find themselves trapped in a macho game of "chicken" and critics on both sides stand ready to pounce on the one who backs down. But this is not just an innocent game of "chicken" from a fifties movie. This is the real deal, and if nobody backs down the entire world will pay the price. Leaving aside who is to blame for a moment, it is really frightening to think that we may be approaching the tensest moment in U.S.-Russian relations since the Cuban missile crisis. There has been much talk about Obama's "red lines", but the truth is that Crimea (and in particular the naval base at Sevastopol) is a "red line" for Russia. There is nothing that Obama could ever do that could force the Russians out of Sevastopol. They will never, ever willingly give up that naval base. So what in the world does Obama expect to accomplish by imposing sanctions on Russia? By treaty, Russia is allowed to have 25,000 troops in Crimea and Russia has not sent troops into the rest of Ukraine. Economic sanctions are not going to cause Putin to back down. Instead, they will just cause the Russians to retaliate. In a letter that he sent to Congress this week, Obama claimed that the Ukrainian crisis is an "unusual and extraordinary threat to the national security and foreign policy of the United States." Language like that is going to make it even more difficult for Obama to back down. On Thursday, Obama announced "visa restrictions" on "those Russians and Ukrainians responsible for the Russian move into Ukraine's Crimean Peninsula", and a House panel passed a "symbolic resolution" that condemned Russia for its "occupation" of Crimea. But those moves are fairly meaningless. Leaders from both political parties are now pushing for very strong economic sanctions against Russia, and there does not appear to be many members of Congress that intend to stand in the way. If the U.S. does hit Russia with harsh economic sanctions, what is going to happen? Is Russia going to back down? No way. So let's just play out the coming moves like a game of chess for a moment... -The U.S. slaps economic sanctions on Russia. -Russia seizes the assets of U.S. companies that are doing business in Russia. -The U.S. seizes Russian assets. -The Russians refuse to pay their debts to U.S. banks. -The U.S. government hits Russia with even stronger sanctions. -Russia starts dumping U.S. debt and encourages other nations to start doing the same. -The U.S. gets Europe to also hit Russia with economic sanctions. -Russia cuts off the natural gas to Europe. As I noted the other day, Russia supplies more than half the natural gas to a bunch of countries in Europe. -The United States moves troops into western Ukraine. -Russia starts selling oil for gold or for Russian rubles and encourages other nations to start abandoning the U.S. dollar in international trade. Of course the order of many of these moves could ultimately turn out to be different, but I think that you can see the nightmare that this game of "chicken" could turn out to be. And what would be the final result? Nothing would be resolved, but the global economy would greatly suffer. What makes all of this even more complicated is that about 60 percent of the people living in Crimea are actually ethnic Russians, and a majority of the population appears to want to leave Ukraine and be reunited with Russia. The following comes from a Reuters article...

The Obama administration is calling the upcoming referendum "illegal" and says that it will not respect the will of the Crimean people no matter how the vote turns out. But the people of Crimea are very serious about this, and of course they never would be pushing for reunification with Russia if they had not gotten approval from Putin...

There is no way that the U.S. government is going to accept Crimea becoming part of Russia, and there is no way in the world that Russia is going to back down at this point. Just consider what geopolitical expert Ian Bremmer of the Eurasia Group recently had to say...

What we need is someone with extraordinary diplomatic skills to defuse this situation before it spirals out of control. Unfortunately, we have Barack Obama, Valerie Jarrett and John Kerry running things. What a mess. So why is Ukraine such a big deal anyway? In a recent article, Peter Farmer explained succinctly why Ukraine is so incredibly important...

If the U.S. insists on playing a game of brinksmanship over Ukraine, the consequences could be disastrous. For one thing, as I mentioned above, the status of the petrodollar could be greatly threatened. The following is how Jim Willie is analyzing the situation...

In addition, if Russia starts dumping U.S. debt and gets other nations (such as China) to start doing the same, that could create a nightmare scenario for the U.S. financial system very rapidly. So let us hope and pray that cooler heads prevail.... But if the United States and Russia do declare "economic war" on each other, all hell could start breaking loose. Unfortunately, there does not appear to be much hope of anyone backing down at this point. In an editorial for the Washington Post, Henry Kissinger stated that it "is incompatible with the rules of the existing world order for Russia to annex Crimea." Very interesting word choice. So this is the situation we are facing... -The U.S. government seems absolutely determined to "punish" Russia until it leaves Crimea. -Russia is never going to leave Crimea, and has promised to "respond" harshly to any sanctions. Most Americans are not paying much attention to what is going on in Ukraine, but this is a very, very big deal. In the end, it could potentially affect the lives of virtually every man, woman and child on the planet. |

| The Gold Price Lost 1 Percent or $13.60 Today in a Steep Drop to $1,338.10 Posted: 07 Mar 2014 04:56 PM PST Gold Price Close Today : 1,338.10 Gold Price Close 27-Feb-14 : 1,331.60 Change : 6.50 or 0.5% Silver Price Close Today : 20.897 Silver Price Close 27-Feb-14 : 21.314 Change : -0.417 or -2.0% Gold Silver Ratio Today : 64.033 Gold Silver Ratio 27-Feb-14 : 62.475 Change : 1.558 or 2.5% Silver Gold Ratio : 0.01562 Silver Gold Ratio 27-Feb-14 : 0.01601 Change : -0.00039 or -2.4% Dow in Gold Dollars : $ 254.17 Dow in Gold Dollars 27-Feb-14 : $ 252.62 Change : 1.55 or 0.6% Dow in Gold Ounces : 12.296 Dow in Gold Ounces 27-Feb-14 : 12.220 Change : 0.08 or 0.6% Dow in Silver Ounces : 787.32 Dow in Silver Ounces 27-Feb-14 : 763.47 Change : 23.85 or 3.1% Dow Industrial : 16,452.72 Dow Industrial 27-Feb-14 : 16,272.65 Change : 180.07 or 1.1% S&P 500 : 1,878.04 S&P 500 27-Feb-14 : 1,854.29 Change : 23.75 or 1.3% US Dollar Index : 79.730 US Dollar Index 27-Feb-14 : 80.320 Change : -0.59 or -0.7% Platinum Price Close Today : 1,483.00 Platinum Price Close 27-Feb-14 : 1,452.15 Change : 30.85 or 2.1% Palladium Price Close Today : 781.60 Palladium Price Close 27-Feb-14 : 742.25 Change : 39.35 or 5.3% The GOLD PRICE lost 1% or $13.60 today in a steep drop to $1,338.10 while silver tumbled 3% (64.5 cents) to 2089.7c. Owch! Below 2100c. Right now it appears that the GOLD PRICE is entering a correction that will fall to the bottom of the trading channel, right now about $1,320 and rising, or even to the 200 DMA at $1,303.14. Conceivable is a drop to the neckline of the upside down head and shoulders it broke down in February, now about $1,280. I find gold corrections almost as much fun as rubbing down my feet with broken glass and salt, but we've got to live through them. I expect this one to be minor, and to offer an opportunity to buy a bushel at a sale price. On the monthly chart the gold price has three months' running rise. On the weekly chart the gold price just this week closed ABOVE the downtrend line from the August 2011 high. That's a milestone. The SILVER PRICE today at last dropped below its 200 DMA (2100c) to the upper border of the trading range that contained it form November's end through February's middle. First target for a reversal is 2036c, the 50 day moving average. Get your money can down off the shelf and get ready. Very soon silver and gold prices will offer you a buying opportunity. Watch closely. I was expecting that last week put a little cap on silver and gold for a while, and another week makes that look accurate, even though gold gained this week. Stocks continue to rise, probing how much air hot government money can blow into a balloon. Unrest in southern Africa and Russia, home to most of the world's platinum and palladium, pushed up the white metals. Their piper often plays a different tune than gold and silver's. US dollar index set itself up for a trip to 79. S&P500 made another new high this week, but the Dow laggeth still. Oddly, most indices (Nasdaq, Nasdaq 100, Russell 2000) dropped but the Dow rose 30.83 (0.2%) today to 16,452.72. S&P500 climbed 1.01 (0.05%) to end up at 1,878.04. Is the Dow making up its mind to play catch-up? If so, stocks can go higher into May. Dow in Gold rose 0.97% to 12.28 oz (G$253.85 gold dollars), and punched a little hole in the downtrend line and the 20 DMA (12.24). This whisper and today's gold drop tends to confirm my suspicion that the DiG is ripe for a rally to correct briefly its long fall from December. Dow in silver rose 3% to 787.40 oz, but unlike DiG remains below its downtrend line. Right now that coincides with the 50 DMA (795.56 oz). Both the DiS and DiG will move higher for a while. US Dollar Index rose an embarrassing five basis points (0.06%) today, just enough to avoid classification with the Zimbabwean dollar. It's a bad week indeed when a Russian invasion of Ukraine can't raise the dollar index. Dollar Index has formed a falling wedge. Wedges usually resolve with a breakout in the opposite direction they point, so that suggests the dollar should soon begin some rally, but perhaps not before visiting 79. The euro settled questions about its short term future by rising 0.15% to $1.3882. Well, really I am anticipating because the Euro closed smack on its old upper trend line, but I think a two day close above the last high ($1.3847) will probably carry it higher. Technically it could run to $1.4000 or $1.4200, but 'tis hard to picture how the eurocrats could stand that much downward pressure on their exports. Maybe the Fed is strong-arming them? The yen, on the other hand, has tanked this week, and today lost another 0.14% to 96.84, below its 50 DMA (96.97). Wait to buy your Japanese dinner china, as it will be cheaper next week. Y'all enjoy your weekend! Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| The Gold Price Lost 1 Percent or $13.60 Today in a Steep Drop to $1,338.10 Posted: 07 Mar 2014 04:56 PM PST Gold Price Close Today : 1,338.10 Gold Price Close 27-Feb-14 : 1,331.60 Change : 6.50 or 0.5% Silver Price Close Today : 20.897 Silver Price Close 27-Feb-14 : 21.314 Change : -0.417 or -2.0% Gold Silver Ratio Today : 64.033 Gold Silver Ratio 27-Feb-14 : 62.475 Change : 1.558 or 2.5% Silver Gold Ratio : 0.01562 Silver Gold Ratio 27-Feb-14 : 0.01601 Change : -0.00039 or -2.4% Dow in Gold Dollars : $ 254.17 Dow in Gold Dollars 27-Feb-14 : $ 252.62 Change : 1.55 or 0.6% Dow in Gold Ounces : 12.296 Dow in Gold Ounces 27-Feb-14 : 12.220 Change : 0.08 or 0.6% Dow in Silver Ounces : 787.32 Dow in Silver Ounces 27-Feb-14 : 763.47 Change : 23.85 or 3.1% Dow Industrial : 16,452.72 Dow Industrial 27-Feb-14 : 16,272.65 Change : 180.07 or 1.1% S&P 500 : 1,878.04 S&P 500 27-Feb-14 : 1,854.29 Change : 23.75 or 1.3% US Dollar Index : 79.730 US Dollar Index 27-Feb-14 : 80.320 Change : -0.59 or -0.7% Platinum Price Close Today : 1,483.00 Platinum Price Close 27-Feb-14 : 1,452.15 Change : 30.85 or 2.1% Palladium Price Close Today : 781.60 Palladium Price Close 27-Feb-14 : 742.25 Change : 39.35 or 5.3% The GOLD PRICE lost 1% or $13.60 today in a steep drop to $1,338.10 while silver tumbled 3% (64.5 cents) to 2089.7c. Owch! Below 2100c. Right now it appears that the GOLD PRICE is entering a correction that will fall to the bottom of the trading channel, right now about $1,320 and rising, or even to the 200 DMA at $1,303.14. Conceivable is a drop to the neckline of the upside down head and shoulders it broke down in February, now about $1,280. I find gold corrections almost as much fun as rubbing down my feet with broken glass and salt, but we've got to live through them. I expect this one to be minor, and to offer an opportunity to buy a bushel at a sale price. On the monthly chart the gold price has three months' running rise. On the weekly chart the gold price just this week closed ABOVE the downtrend line from the August 2011 high. That's a milestone. The SILVER PRICE today at last dropped below its 200 DMA (2100c) to the upper border of the trading range that contained it form November's end through February's middle. First target for a reversal is 2036c, the 50 day moving average. Get your money can down off the shelf and get ready. Very soon silver and gold prices will offer you a buying opportunity. Watch closely. I was expecting that last week put a little cap on silver and gold for a while, and another week makes that look accurate, even though gold gained this week. Stocks continue to rise, probing how much air hot government money can blow into a balloon. Unrest in southern Africa and Russia, home to most of the world's platinum and palladium, pushed up the white metals. Their piper often plays a different tune than gold and silver's. US dollar index set itself up for a trip to 79. S&P500 made another new high this week, but the Dow laggeth still. Oddly, most indices (Nasdaq, Nasdaq 100, Russell 2000) dropped but the Dow rose 30.83 (0.2%) today to 16,452.72. S&P500 climbed 1.01 (0.05%) to end up at 1,878.04. Is the Dow making up its mind to play catch-up? If so, stocks can go higher into May. Dow in Gold rose 0.97% to 12.28 oz (G$253.85 gold dollars), and punched a little hole in the downtrend line and the 20 DMA (12.24). This whisper and today's gold drop tends to confirm my suspicion that the DiG is ripe for a rally to correct briefly its long fall from December. Dow in silver rose 3% to 787.40 oz, but unlike DiG remains below its downtrend line. Right now that coincides with the 50 DMA (795.56 oz). Both the DiS and DiG will move higher for a while. US Dollar Index rose an embarrassing five basis points (0.06%) today, just enough to avoid classification with the Zimbabwean dollar. It's a bad week indeed when a Russian invasion of Ukraine can't raise the dollar index. Dollar Index has formed a falling wedge. Wedges usually resolve with a breakout in the opposite direction they point, so that suggests the dollar should soon begin some rally, but perhaps not before visiting 79. The euro settled questions about its short term future by rising 0.15% to $1.3882. Well, really I am anticipating because the Euro closed smack on its old upper trend line, but I think a two day close above the last high ($1.3847) will probably carry it higher. Technically it could run to $1.4000 or $1.4200, but 'tis hard to picture how the eurocrats could stand that much downward pressure on their exports. Maybe the Fed is strong-arming them? The yen, on the other hand, has tanked this week, and today lost another 0.14% to 96.84, below its 50 DMA (96.97). Wait to buy your Japanese dinner china, as it will be cheaper next week. Y'all enjoy your weekend! Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Meet The Mysterious Firm That Is About To Leave Blythe Masters Without A Job Posted: 07 Mar 2014 04:44 PM PST It was about a month ago when it was revealed that the infamous JPMorgan physical commodities group, plagued by both perpetual accusations of precious metal manipulation and legal charges most recently with FERC for $410 million that it had manipulated electricity markets, was in exclusive talks to be sold to Geneva-based Marcuria Group. It was also revealed that Blythe Masters, JPMorgan's commodities chief, "probably won't join Mercuria as part of the deal." Of course, we all learned the very next day that Ms. Masters - an affirmed commodities market manipulator - and soon to be out of a job, had shockingly intended to join the CFTC trading commission as an advisor, a decisions which was promptly reversed following an epic outcry on the internet. This is all great news, but one thing remained unclear: just who is this mysterious Swiss-based company that is about to leave Blythe without a job? Today, courtesy of Bloomberg we have the answer: Mercuria is a massive independent trading behemoth, with revenue surpassing a stunning $100 billion last year, which was started less than ten years ago by Marco Dunand and Daniel Jaeggi, who each own 15% of the firm's equity. And it probably should come as no surprise that the company where the two traders honed their trading skill is, drumroll, Goldman Sachs.

Not surprisingly, some of the key hires in the past couple of years as the firm expanded at a breakneck pace and added some 570 people, bringing its total headcount to 1,200, were from Goldman: "The hires include Houston-based Shameek Konar, a former managing director with Goldman Sachs Group Inc. who is chief investment officer overseeing Mercuria's corporate development, including the JPMorgan negotiations. Victoria Attwood Scott, Mercuria's head of compliance, also joined from Goldman Sachs." We find it not at all surprising that the Goldman diaspora is once again showing JPMorgan just how it's done. So just how big is Mercuria now? Well, it is almost one of the biggest independent commodities traders in the world:

In other words, the old boys' club is about to get reassembled, only this time even further away from the supervision of the clueless, corrupt and incompetent US regulators. And with the physical commodity monopoly of the big banks finally being unwound, long overdue following its exposure here and elsewhere over two years ago, it only makes sense that former traders from JPM and Goldman reincarnate just the same monopoly in a jurisdiction as far away from the US and Fed "supervision" as possible. Which also means that anyone hoping that the great physical commodity warehousing scam is about to end, should not hold their breath. As for the main question of what happens to everyone's favorite commodity manipulator, "It hasn't been determined whether Blythe Masters, who has led the JPMorgan unit since 2006 and orchestrated the buying spree, would join Mercuria, a senior executive at Mercuria said." Which means the answer is a resounding no: after all who needs the excess baggage of having a manipulator on board who got caught (because in the commodity space everyone manipulates, the trick, however, is not to get caught). Finally, with "trading" of physical commodities, which of course include gold and silver, set to be handed over from midtown Manhattan to sleep Geneva, what, if any, is the endgame?

But they will be promptly resumed once JPM's physical commodities unit has been sold, giving China a foothold into this most important of spaces. Because recall what other link there is between China and JPM? One may almost see the connection here. |

| China Is Crashing … As Predicted Posted: 07 Mar 2014 03:27 PM PST The head of China’s sovereign wealth fund noted in 2009: “both China and America are addressing bubbles by creating more bubbles”. He’s right … Global credit excess is worse than before the 2008 crash. The U.S. and Japan have been easing like crazy, but – as Zero Hedge notes [if you missed it when Tyler Durden first posted this] – China has been much worse:

And here: So what’s the problem? Well, the world’s most prestigious financial agency – the central banks’ central bank, called the Bank of International Settlements or “BIS” – has long criticized the Fed and other central banks for blowing bubbles. The World Bank and top economists agree. So do many others. As such, it was easy for us to predict a crash in China when the bubble collapses. We argued in 2009 that China’s period of easy credit was analogous to America’s monetary easing starting in 2001 … and Rome’s in 11 B.C. We noted in 2009 and against in 2011 that China is suffering from a lot of the same malaises as the American economy, including corruption, crony capitalism, and failure to disclose bad debt. In 2010, we asked “When Will China’s Bubble Burst?” China’s $23 Trillion Dollar Credit Bubble Is BurstingInternational Business Times noted last year that China’s debt-laden steel industry was on the verge of bankruptcy. Quartz reported in December that a huge coal company called Liansheng Resources Group declared bankruptcy with 30 billion yuan ($5 billion) in debt. Chinese Business Wisdom argues (via China Gaze) that waves of bankruptcies are striking in 10 Chinese industries: (1) shipbuilding; (2) iron and steel: (3) LED lighting; (4) furniture; (5) real estate development; (6) cargo shipping; (7) trust and financial institutions; (8) financial management; (9) private equity; and (10) group buying. AP notes today:

Time asks whether China has reached its “Bear Stearns moment”:

The Financial Post reported in January:

The big picture: the $23 trillion dollar Chinese credit bubble is starting to collapse. As Michael Snyder wrote in January:

|

| South Africa notices gold fix controversy; GATA consultant Speck cited Posted: 07 Mar 2014 02:33 PM PST Banks Bear Brunt of Gold-Fix Blame By Chantelle Benjamin http://mg.co.za/article/2014-03-06-banks-bear-brunt-of-gold-fix-blame Evidence emerging in the United Kingdom about the possible manipulation of the gold price for a decade could have major implications for South African investors and mining companies who might be able to sue for damages in terms of South African law. The London gold fix benchmark, set by five banks twice a day, is used worldwide by mining companies, central banks, and jewellers to value gold. A similar process, involving three banks, is used to value silver. This week a New York resident, Kevin Maher, lodged a case in U.S. District Court for the Southern District of New York seeking unspecified damages against Barclays, HSBC Holdings, Bank of Nova Scotia, Societe Generale SA, and Deutsche Bank, on the grounds that they worked together and manipulated the benchmark. ... Dispatch continues below ... ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1 302 635 1160 in the United States. Or email them at info@goldcore.com. He has based his case on a draft study by a renowned researcher, Rosa Abrantes-Metz, that was published by Bloomberg last week and said "it as likely that co-operation between participants had been occurring." Her work is supported by research by Dimitri Speck, a commodity analyst. Abrantes-Metz, a professor at New York University's Stern School of Business, is credited with helping to expose the London interbank offered rate (Libor) scandal. Her 2008 paper uncovered the rigging of the rate, which led to Barclays and UBS being fined about $6-billion. Stanlib's Kobus Nell said there had been rumours for many years about the possible manipulation of the gold price but this is the first time that a study has been conducted by someone of her calibre. In terms of the Competition Act, criminal or civil action can be taken against any company found guilty of collusion or price fixing, provided the activity took place in South Africa. That means any buying or selling in South Africa based on the gold fix price and undertaken with or by one of the five banks is covered by the act. ENS attorney Theuns Steyn, who specialises in the mining sector, said this could have "huge" implications. "If trade is here and the branches of the banks are here, it could be possible to prove jurisdiction," he said. "The difficult part would be proving and quantifying damages." The fix is calculated twice a day via a phone conference at 10.30 a.m. and 3 p.m. London time. The banks declare how many bars of gold they want to buy or sell at the current spot price, based on orders from their clients and themselves. The price is increased or reduced until the buy and sell amounts are within 50 bars of each other, at which point the fix is set. An issue for many is that the bank traders can communicate with their clients and each other during the process. Traders can tell clients about shifts in supply and demand and take fresh orders during their conference call and can buy or sell as the price changes, according to the website of London Gold Market Fixing. And the process is unregulated. The Libor is seen as the most important benchmark for setting short-term interest rates and, since 2000, has been calculated in 10 currencies. It was revealed in 2012, after an investigation, that some banks were falsely inflating or deflating their rates in order to profit from trades. The Libor is a central cog in global financial markets against which financial products worth about $450 trillion are pegged. Allegations about the rigging of the gold price, like those about the Libor, have been circulating for some time, although some analysts believe rigging would not have a big influence on the market because of the wide varieties of gold trading, from spot trading to gold exchange-traded funds. Abrantes-Metz said in an 2013 Bloomberg article that, like the Libor manipulation, the gold fix is "controlled by a handful of firms with a direct financial interest in where it is set and there is virtually no oversight -- it's based on information exchanged" among themselves. Nell said: "Gold is not a small market and there are tonnes being bought and sold every day, but it is possible that, over time, manipulation by the banks would have an impact. "Of course, the problem is, with all the other information emerging about the banks, it does raise the question, if they could get involved in currency rigging, was it possible that other collusion was going on that we do not know about?" Abrantes-Metz and some traders noticed "trading surges" after the 3 p.m. meeting and began writing about it about two years ago. Abrantes-Metz, when approached by the Mail & Guardian, said: "The structure of the benchmark is certainly conducive to collusion and manipulation and the empirical data are consistent with price artificiality." Her research, conducted with Albert Metz, the managing director of Moody's Investor Service, found there were frequent spikes in the gold price from 2004 after the 3 p.m. The study has been looking at the market from 2001. But the large price moves were overwhelmingly down. For example, in 2010, large moves during the fix were negative 92 percent of the time. She said that in the end it would be up to the regulators to establish why these movements began in 2004 and why prices tended to be downward. In January this year Deutsche Bank announced that it was pulling out of the process for setting gold and silver benchmarks because of a decision to scale back its commodities business. But it emerged this week that it might have hired a consultancy to review the bank's role in the gold fix benchmark. There has been market speculation that Standard Bank would be a good candidate to replace Deutsche Bank, particularly since it is selling its United Kingdom-based markets division to the Industrial and Commercial Bank of China and China last year became the biggest consumer of gold. In reply to questions posed by the M&G, Deutsche Bank said: "Deutsche Bank is withdrawing its participation in the gold and silver benchmark setting process following the significant scaling back of our commodities business. We remain fully committed to our precious metals business." Researcher Rosa Abrantes-Metz says that when it comes to the gold fix, "one needn't look to far for a motive. The participating banks all stand to gain both from using the privileged knowledge they glean during the fixing process and from influencing the fixing itself," she told Bloomberg last year. Research by commodity analyst Dimitri Speck found that gold prices tend to drop sharply in the London afternoon fixing, with a less pronounced drop in London morning fixes. It also drops during the trading session of the Commodity Exchange (Comex) in New York. Research by economist Paul Craig Roberts and analyst Dave Kranzler found that, in times of financial crisis, the price of gold is manipulated by central banks to calm or manipulate markets. They said that the U.S. Federal Reserve has a vested interest in influencing the gold price, actively keeping it low. "When gold hit $1 900 per ounce in 2011, the Federal Reserve realised that $2 000 an ounce would have a psychological impact that would spread into the dollar's exchange rate with other currencies, resulting in a run on the dollar as both foreign and domestic holders sold dollars to avoid the fall in value." They said the Fed began using "bullion banks as its agents to sell naked gold shorts in the New York Commodity Exchange [Comex] future market". "Short selling drives down the price, triggers stop-loss orders and margin calls, and scares participants out of gold trusts. The bullion banks purchase the deserted shares and present them to the trusts for redemption in bullion." They said the bullion could then be sold in the London physical gold market. But Ross Norman, CEO of bullion brokers Sharps Pixley, believes that the large moves in price at the time of the fixings is because large selling and buying orders collide, and that there is more activity at 3 p.m. because that is when the US market opens. Join GATA here: Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Jim Sinclair plans seminars in Los Angeles and San Diego Gold advocate Jim Sinclair's next market analysis seminars will be held in Los Angeles from 11 a.m. to 2 p.m. on Saturday, March 8, and in San Diego from 2 to 6 p.m. the following day, Sunday, March 9. Details, including registration information, are posted at Sinclair's Internet site, JSMinset.com, here: http://www.jsmineset.com/qa-session-tickets/ |

| Gold Daily and Silver Weekly Charts - This Must Have Been a Non-Farm Payrolls Friday Posted: 07 Mar 2014 01:41 PM PST |

| Gold Daily and Silver Weekly Charts - This Must Have Been a Non-Farm Payrolls Friday Posted: 07 Mar 2014 01:41 PM PST |

| On a Manhunt for Newly Created Currency Posted: 07 Mar 2014 01:32 PM PST My poor back was aching from playing golf, I was bored with TV, and, in desperation for something to do other than taking an interest in the kids, doing some desperately-needed chores around the house, or even faking the slightest interest in ANY of that crap, I was casually looking at, you know, economic stuff. As usual, I was registering the usual shock and awe (we're freaking doomed!) at such continuing monetary and fiscal insanity, such as Total Fed Credit increasing another hefty $35.4 billion last week, with the Fed itself buying up $36.9 billion in US government securities, committing yet another blatant, brazen fraud in a long series of Quantitative Easing frauds to monetize government debt to the tune of, according to these new figures, an annualized $1.84 trillion a freaking year, for which the Federal Reserve creates $1.820 trillion out of thin freaking air! In case you missed it at the beginning of this paragraph, we're freaking doomed! Interestingly, comically segueing from "freaked out" to "interestingly," Currency in Circulation, namely dollar bills and coins, went up $ 9.6 billion last week, which is $31 in cash for every man, woman and child in America. In one week! In fact, in looking at the figures, Currency in Circulation is up $72.5 billion in the last year, which is enough NEW cash floating around for EACH of the abovementioned men, women and children in the country to get $234! Personally being a man, woman or child in America, imagine my disgruntlement and dismay when I impatiently waited until my wife finally went into the kitchen, and then sneaked a look into her purse so that I could claim MY personal $234. I figured maybe I could sneak out to go have a few refreshing brewskis and, you know, maybe see who and what's new in the marvelous, magical world of pole-dancing, only to find her purse empty! And so I casually and politely asked her about it ("Hey! You in the kitchen! Where's my damned 234 dollars?"), emphasizing how she had better cough it up because I had plans for that cash, and I mean BIG plans, but she insisted SHE didn't have hers, either! I'm investigating. Meanwhile, swerving back, tires squealing, to the topic at hand, the Monetary Base itself just jumped up $82 billion to $3.839 trillion from $3.757 trillion and (according to Barron's) is up an astounding $2.841 trillion in the last year! So, hey! You! You wanna talk about inflation in the money supply that always leads to inflation in consumer prices? No? You say you've heard it all from me so many, many times before, and you are so damned bored with hearing about it that you are deliberately NOT reading this? Well, if you are out blithely gallivanting around, instead of reading this Mogambo Dire Warning (MDW) because of your petty, spiteful nature, then OK! Fine with me! The cruel part of me is glad — GLAD, do you hear me? — that you are not going to let me tell you, for the thousandth time, how you should be buying gold, silver and oil right now, which you still wouldn't do, which means you are going to lose out on fabulous capital gains when their prices explode, thanks to the monetary idiocy of the evil Federal Reserve and the other dirtbag central banks around the world creating so much excess cash and credit. As a result, you will spend the rest of your life in pitiful poverty, mired in misery, eating weed salads and bug burgers to survive, perhaps watching me drive by in my big, shiny new car, stereo blasting, fancy hubcaps glinting in the sunlight. Perhaps, too, you will hear me laugh at you, "Hahaha! Now who's too busy to read a MDW? Hahaha!" And since you are still ignoring me, you won't hear the chilling news that the evil government cabal that calls itself the G-20 is proposing to "stimulus spend" $2 trillion in the next year, or that the Obama 2015 federal budget proposal is an astounding $3.9 trillion! Yikes! Sadly, the Butt Ugly Truth (TBUT) is that this monetary and fiscal insanity is to desperately try and save the banks for a little while longer, as the banks have lent out, and borrowed for themselves with which to speculate, all the depositors' money, dozens of times over. So, sadly, all your money in a bank is, actually, gone, according to the accounting ledgers at the banks, and the only way to get it back is if all those borrowers who borrowed money paid back the money they borrowed, which they can't do, because they don't have the money to pay back the money. But not paying back the money they borrowed is paradoxically a good thing, because everybody selling assets to raise cash to pay off debt is what makes the money supply go down, asset prices go down, things collapse, bankruptcy all around, and everybody is grumpy at being devastated. And probably a LOT sooner than expected, too, since so many assets are leveraged so unbelievably highly that any significant move downward in prices would quickly overwhelm all the investor's capital, immediately bankrupting the deal and handing their creditors a big loss, who are, ultimately, the banks, which causes a fall in the money supply. Yikes again! Perhaps fortunately, in light of the above, not only are consumers NOT paying back the money they owe, but they are borrowing more! Consumer Installment Debt was up almost $20 billion in December, rising to $3.106 trillion, which seems staggering because of it being up almost $327 billion (almost 12 percent!) in the past year, or, perhaps more meaningfully, $3,114 more debt for every one of America's 105 million credit-card holders, and coming, as it does, at a terrible time when interest rates are rising, prices are rising, but incomes are falling. It is usually at this point where I find that you WERE actually reading this Mogambo Dire Warning (MDW), you wily devil, betraying yourself with your pent-up verbal assault at me to "Shut the hell up, Mogambo! Just shut up, shut up, shut up!", which I deftly party and riposte with the powerful, "If you are NOT buying gold, silver and oil with everything you have, then you are making a huge, huge, HUGE mistake!" And then, in keeping with the sudden fencing theme, I end the refrain "thrusting home" like Cyrano de Bergerac, saying with all the deadly contempt and venom I can muster, "Moron!" Beyond that powerful closing scene, starring me as Cyrano, the handsome and brave master swordsman and lyrical wordsmith, there is nothing to add: You know what to do and why you must do it. Truthfully, the Cyrano de Bergerac reference is a bit of spontaneous whimsy that I just threw in, I don't know why. Perhaps we'll never know why. Or even care why. But we know why to buy gold, silver and oil, and that's the important thing. And the fact that it is spectacularly easy, too, only makes it more and more blindingly obvious that, "Whee! This investing stuff is easy!" Regards, The Mogambo Guru Ed. Note: The Mogambo’s sage wisdom has been a fixture in The Daily Reckoning for several years. And after a brief hiatus, he is back to his old tricks. To make sure you’re clue in to his most recent musings, sign up for The Daily Reckoning, for FREE, right here. |

| Posted: 07 Mar 2014 01:25 PM PST This video has been making the rounds and it’s pretty amusing in many ways, most of which are not likely to be appreciated by Bitcoin advocates. See also: The Face Behind Bitcoin – Newsweek Did Newsweek just validate Bitcoin conspiracy theory? – CNN/Money Bitcoin's Mysterious Creator Is Said to Be Identified – Dealbook The Satoshi [...] |

| BITCOIN CRASH : HACKS, Suicides, and Ponzi Schemes. Is it Really Safe? Posted: 07 Mar 2014 11:35 AM PST Bitcoin has been hacked repeatedly. Is it really trustworthy? I believe in alternate currencies to the US dollar because the dollar is clearly a HUGE failure.Bitcoin is a great concept and is a good method of online transaction. I don't advise people use it to store their life savings in it... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| The U.S. Government Is One Big Lie Posted: 07 Mar 2014 11:09 AM PST As I discussed yesterday, we know the Government is lying through its teeth to us about the Ukraine situation. It's amazing how quickly CNN and Fox News seem to have misplaced the Victoria Nuland phone tape discussing the $5 billion the U.S. has "invested" to foment the unrest over there. You know, the one in which she says "F_CK the EU." Both CNN and Fox are disseminating nothing but the lies being promoted by Obama/Kerry etc without researching or reporting on the actual facts. Kind of ironic that CNN backs the Obama regime's backing of the neo-Nazis who have taken control of western Ukraine (I'm not surprised that Fox News supports this). The Government also lies about the employment situation in this country. We saw the most recent example today with the Bureau of Labor Statistics monthly employment report claiming that the economy generated 175,000 jobs in February. I don't want to go through a detailed analysis of the data as reported and the obvious statistical manipulation implemented on that data. The real issue is the legitimacy of the data itself. This requires thinking about the data as presented in the context of every other business data report that was released during February, especially the reports from the private sector. As one example, the BLS claims that the construction industry added a total of 55,000 jobs in January and February. Yet, we know from homebuilder reports that housing starts have been tanking. And what about the "bad weather" narrative. If housing starts declined over the period and bad weather prevented this, how on earth is it possible that profit-seeking businesses hired workers? Does anyone really think that a homebuilder executive, who is trying to keep his stock price elevated so he can unload as many shares as possible (see the recent S-4 SEC stock transaction filings - homebuilder execs dumped shares in February), would spend money hiring workers who don't have to work? That's just one line item example. There are several. The point here is that if you look at the numbers being reported - regardless of how they are manipulated to paint a positive picture - in the context of everything else that has been reported about the economy, there's no possible way that the economy generated job growth in February. In fact, the ill-reputed "birth/death" model, which everyone understands is used as "plug" number the Government uses to pad the employment data, explains 125,000 of the 175,000 jobs reported. The birth/death model has been dissected and shown to be a complete fraud ad nauseum. The smart money must understand this, because the S&P 500 futures gapped up nearly 10 points when the number hit the tape. It's currently trading down 3 points, 13 points lower than the initial buying orgy. The real damage was inflicted by the banks who manipulate the gold and silver market. Instantaneously as the report hit the newswires, gold was demolished for a total of $25 before recovering some of the manipulated damage. Right at the time the report was released, nearly 8,000 gold contracts were unloaded on the Comex.. To put this into context, in the 14 hours and 20 minutes of Comex gold futures trading that occurred from 6 p.m. the previous evening until the 8:30 a.m. Comex open today, the total volume was roughly 45 contracts per minute. You decide if the 8,000 contracts dumped at 8:30 a.m. was legitimate selling or motivated Fed/Govt manipulation The most frightening part about all of this the fact that the Government finds it acceptable to lie to us about everything. The U.S. Government has become as corrupted and self-serving as was the old U.S.S.R Government that many of us grew up fearing. The lack of fear about what has happened in our own backyard is truly stunning. |

| The U.S. Government Is One Big Lie Posted: 07 Mar 2014 11:09 AM PST As I discussed yesterday, we know the Government is lying through its teeth to us about the Ukraine situation. It's amazing how quickly CNN and Fox News seem to have misplaced the Victoria Nuland phone tape discussing the $5 billion the U.S. has "invested" to foment the unrest over there. You know, the one in which she says "F_CK the EU." Both CNN and Fox are disseminating nothing but the lies being promoted by Obama/Kerry etc without researching or reporting on the actual facts. Kind of ironic that CNN backs the Obama regime's backing of the neo-Nazis who have taken control of western Ukraine (I'm not surprised that Fox News supports this). The Government also lies about the employment situation in this country. We saw the most recent example today with the Bureau of Labor Statistics monthly employment report claiming that the economy generated 175,000 jobs in February. I don't want to go through a detailed analysis of the data as reported and the obvious statistical manipulation implemented on that data. The real issue is the legitimacy of the data itself. This requires thinking about the data as presented in the context of every other business data report that was released during February, especially the reports from the private sector. As one example, the BLS claims that the construction industry added a total of 55,000 jobs in January and February. Yet, we know from homebuilder reports that housing starts have been tanking. And what about the "bad weather" narrative. If housing starts declined over the period and bad weather prevented this, how on earth is it possible that profit-seeking businesses hired workers? Does anyone really think that a homebuilder executive, who is trying to keep his stock price elevated so he can unload as many shares as possible (see the recent S-4 SEC stock transaction filings - homebuilder execs dumped shares in February), would spend money hiring workers who don't have to work? That's just one line item example. There are several. The point here is that if you look at the numbers being reported - regardless of how they are manipulated to paint a positive picture - in the context of everything else that has been reported about the economy, there's no possible way that the economy generated job growth in February. In fact, the ill-reputed "birth/death" model, which everyone understands is used as "plug" number the Government uses to pad the employment data, explains 125,000 of the 175,000 jobs reported. The birth/death model has been dissected and shown to be a complete fraud ad nauseum. The smart money must understand this, because the S&P 500 futures gapped up nearly 10 points when the number hit the tape. It's currently trading down 3 points, 13 points lower than the initial buying orgy. The real damage was inflicted by the banks who manipulate the gold and silver market. Instantaneously as the report hit the newswires, gold was demolished for a total of $25 before recovering some of the manipulated damage. Right at the time the report was released, nearly 8,000 gold contracts were unloaded on the Comex.. To put this into context, in the 14 hours and 20 minutes of Comex gold futures trading that occurred from 6 p.m. the previous evening until the 8:30 a.m. Comex open today, the total volume was roughly 45 contracts per minute. You decide if the 8,000 contracts dumped at 8:30 a.m. was legitimate selling or motivated Fed/Govt manipulation The most frightening part about all of this the fact that the Government finds it acceptable to lie to us about everything. The U.S. Government has become as corrupted and self-serving as was the old U.S.S.R Government that many of us grew up fearing. The lack of fear about what has happened in our own backyard is truly stunning. |

| The London Gold Fix, Manipulation & the Quantum Posted: 07 Mar 2014 10:27 AM PST Does Heisenberg's uncertainty principle shed light on "manipulation" of the London Gold Fix? Or is it the other way around? WHEN Werner Heisenberg looked at his brand new quantum formulae in 1927, writes Paul Tustain, founder and CEO of BullionVault, he noticed something weird. The world of very small spaces and particles is ruled by matrix mechanics, but as you may remember from your school mathematics, in matrix multiplication (A * B) * C is not the same as A * (B * C). What Heisenberg saw was that because of the difference in the two matrix products there would always be uncertainty as to key physical properties of a particle. His discovery forbids a particle from having both precisely defined motion and precisely defined position at the same time. Spotting this earned Heisenberg a Nobel prize, and a lifetime of being widely misunderstood. The rest of us have a very deep seated 'common-sense' view of spacetime and particles, and almost all of us reject the subtle complexity of the 'Uncertainty Principle'. Indeed I am prepared to bet that if you are here reading about it for the first time you are mentally rejecting it. "Of course", you will be thinking, "whether we can measure it or not, a particle obviously has a particular position and a particular speed." Alas you would be wrong. But don't beat yourself up about it because you are in good company. Even Albert Einstein was on your side for a while. In physics you can pin down individual quantities very precisely, but by knowing one quantity exactly you will automatically give the particle freedom to be uncertain in another. Woe betide any physicist who interpolates between observations to state as fact something he didn't specifically measure, because physical particles do not do predictable things when they are unmeasured; they appear to spend their unobserved lives weighing up the choices of where physics allows them to be found next, and then pressing the hyperspace button to get there whenever somebody looks. If you took to examining particle paths between observations the best route map you could draw to describe the motion of an unmeasured particle would look something like this :-  The diagram shows how we located the particle precisely at point A, and again at point B. But in being so precise about its location at an instant of time we made its motion uncertain. At time A, it might have been going up, or down, there is no answer. In making our precise measurement of position at instant A (and B) we actually denied the particle a definitive up/down motion. It's weird, but that is how particles work in spacetime – it really is. Nevertheless a good physicist will be able to perform certain quantum calculations, and she will be able to give us a sense of where our particle might have been found, if we had looked. She will be able to calculate that if we were to set everything up the same way and make hundreds of additional measurements at Time T, then the particle would be found in the various ranges shown on the blue dotted line on the picture, with the various probabilities shown. Even many physicists find it unsatisfactory that the most nature allows us to say about where the particle was when we weren't looking is basically "probably about here". But there it is. Without an observation there was no single explicit position at Time T, because the phenomenon of unmeasured position did not properly exist except in our own mental models. Unmeasured position is smoothed out into a fuzzy realm of possibilities. The Gold Fix The situation of a particle's motion and position bears a striking similarity to price. Let's have a look at another picture.  The blue dots are 'quotes' from a market. Someone from Bloomberg has tracked bankers' gold price quotes, each of which is here represented as a blue spot. Bloomberg decided to be helpful to the rest of us, and they filled in the gaps between the points with a solid line. Then they sold it to us as a gold price chart – a track of the position of price, through time. A few years ago, before derivatives were invented, the rest of us would have taken that plotted line with a pinch of salt. We always knew it was an approximation, and not a very good one either, because when we waited to see the price reporting at the end of the day we could see a whole load of real gold deals (here the green dots) obstinately refusing to position themselves on Bloomberg's line. We did not care much, because none of us who worked in real markets ever thought for one moment that anyone would start to treat the lines interpolated by Bloomberg as something real. They were a useful visualisation – that was all. It was only later, when financial engineers started building products that were valued by reference to that line, and when people started making profits, or losing, depending on where Bloomberg drew their line, that investors started attaching significantly more weight to the line itself than to the reality of the reported deal prices. Is the gold price uncertain too? Okay, so I am clearly drawing a parallel. Price charts and particle route maps are doing something quite similar. But let's take it a stage further. Let's try doing what Heisenberg did, and make the bold assertion that there is no price between the data points of trades, just a realm of possibilities. The derivatives engineers, and even a few of the gold bugs are going to go nuts with this, but it stands up to some pretty detailed scrutiny. For a start the price that gets printed by Bloomberg is without size. If the bullion banker were to be asked a real price, by a real trader, the banker's first question would be "what is the size?" He has to know if he is quoting for a $200 deal or a $200 million dollar deal, because the prices are completely different!  This gives a third dimension to the price, one which any spot price chart always ignores. At any given point in time the price of anything is a function of the amount of it you want to buy or sell. Unlike quantum particles this is not difficult concept to grasp. If I were a greengrocer, and you asked me for one banana, I'd probably charge you 20 pence. If you asked me for 10, I might give you a discount, and sell for £1.90 (19p each). If you asked me for 500 I might charge you a premium, because I'd have to get in the van and go and purchase a lot more bananas – so maybe £110 (22p each). But if you asked me for 1,000,000 there is no price. I don't want to sell you 1,000,000 bananas because I wouldn't know where to get them, and I certainly don't want to spend my week in the van hunting them down and paying ever larger prices for the diminishing stock! As you can see the price varies according to size. Once you introduce this extra dimension to the price chart, so as to get the real feel for where the trading price is, the single line of Bloomberg starts to look like a gross over-simplification. Because not only is there uncertainty in the vertical momentum of the price between two measured points (trades) but also there is a completely different answer depending on the size. So instead of a line progressing from last quote to next quote the reality is that there is a very large volume of three dimensional economic space between the points, and, with different probabilities, the next trading price could be any point within that volume. All in all it seems to me that there is a very good case for saying that in the absence of a trade there is no such thing as price. Anyone who seeks to know a price without the hard experiment of executing a trade is deluding themselves into creating a phenomenon which does not really exist. Price is an attribute of a specific trade. It occurs meaningfully only at points in the economic continuum where an exchange happens, and it depends on the individual circumstances, reasons and emotional states of two experimenters (sorry, traders) who each foresee the price subsequently moving in opposite directions. So price is not smoothly variable, but point-like, quantised, and a generator of uncertainty; and everything between real trades is probabilistic guesswork. Is Gold fixed? If I were to criticise the Gold Fix I would certainly concede that it is rather stupidly named. Also in the era of Chinese walls – rules which insist colleagues do not tell each other what their common clients are doing – there is something unusual in allowing bank principals to know their own internal customer order book. However in my opinion this oddity is rather elegantly offset by the fact that the Gold Fix allows another bank principal to steal those orders simply by offering a better price during the auction. I believe this system is much more robust than Chinese walls, because it relies on natural competition rather than self-imposed discipline. Also two other powerful points jump out for comment:-

Besides, if the sellers thought they were getting a bad deal day after day wouldn't they simply deal on the spot market? Or on Comex? There is nothing stopping them. Forgive me, but I don't really care much in any case. There remain quite a large number of people who are wedded to gold price conspiracy theories. Many of them buy paper gold (gold futures) and then grumble that sellers of paper gold exist. In my opinion they perfectly match each other's requirement! Meanwhile not one person who has bought gold, to take delivery, has only got paper. All the sellers were able to deliver real gold. That makes a concerted price suppression story – through shorting – very difficult to swallow. More interesting than the Gold Fix But there is still unfinished business here, because the physics element of this story is far more interesting than the gold element. Could it be that a run-of-the-mill financial spat begins to show us a route to solving the central riddle of quantum physics? Now that really would be something. Since quantum physics first arrived 87 years ago its application has been stupendously successful, but no-one has been able to explain its results in a way we can grasp and call 'reality'. Physicists remain stumped when it comes to describing the weird world they see through their simplest experiments. In the absence of anything better we all fall back, a bit lazily, into the default human mental model of thinking of stuff as being somewhere and moving somewhere smoothly, rather than in jerks from point to point. We have taken to thinking – much as conspiracy theorists do when they look at price charts – that unmeasured particles have real position and real motion, even when they are isolated from the rest of our universe and no-one is looking. But this perfectly natural, common sense interpretation leaves science at an impasse. Our mental model and the experimental facts are in fundamental disagreement with each other about how stuff really is. Physicists have been wringing their hands trying to solve this. They want to explain a reality under quantum physics in a way which does not make the act of measurement special. They want reality to be permanent, whether or not they are looking, and they have come up with some truly zany models ranging from 'there is no reality' to 'there are countless zillions of realities, and entire universes are created every nano-second to cope with all the quantum possibilities'. I am not kidding. These are both pretty standard models of quantum reality which physicists are clinging to. Yet – and this is the amazing thing – through analysing price at the Gold Fix we can actually see a workable metaphor for quantum experiments, and that really excites me. It's as if the quantum world is an incredibly fast moving market, heaving with tiny exchanges, where each exchange produces an instant of perfect precision in some physical attribute or other, enabling the countless trillions of particle events in the observable universe to map themselves, with respect to each other, into the unambiguous history of our spacetime. I have read lots of physics books, and not understood many of them, but by sitting in my office and thinking about gold prices I can for the first time start to see how something which appears to be deeply real and continuous is in fact point-like, and fuzzy between the points. I can explain, and in an understandable way to anyone who knows markets, that between one trade and the next price is undefined, uncertain and unreal. We don't know exactly where it is, or if it's moving up or down. All we can do is copy the quantum physicists and make probabilistic guesses until the next trade. Is there something here the physicists could learn from us? After all, so many physics laboratories have lost their brightest research stars to the quant funds. Perhaps it's time the London bullion market offered the labs some of our Gold Fix dealers, on sabbatical, of course. |